Overview

The article examines ten accounts receivable management collection solutions that can significantly enhance enterprise financial operations. It underscores the critical role of integrating advanced technologies such as automation, AI, and cloud services. These innovations are vital for improving operational efficiency, reducing costs, and increasing recovery rates. Consequently, they empower businesses to adapt to evolving financial challenges and maintain their competitive edge in the marketplace.

Introduction

In today's rapidly evolving financial landscape, effective accounts receivable management has become increasingly critical for enterprises aiming to sustain competitiveness and drive growth. This article explores ten innovative technological solutions—from automation and AI to blockchain and cloud services—specifically designed to enhance debt collection processes and improve recovery rates.

However, as organizations adopt these advancements, they encounter the pressing challenge of integrating these sophisticated tools into their existing frameworks.

How can enterprises navigate this transformation to streamline operations while simultaneously fostering stronger relationships with their clients?

Equabli EQ Suite: Intelligent Solutions for Streamlined Debt Collection

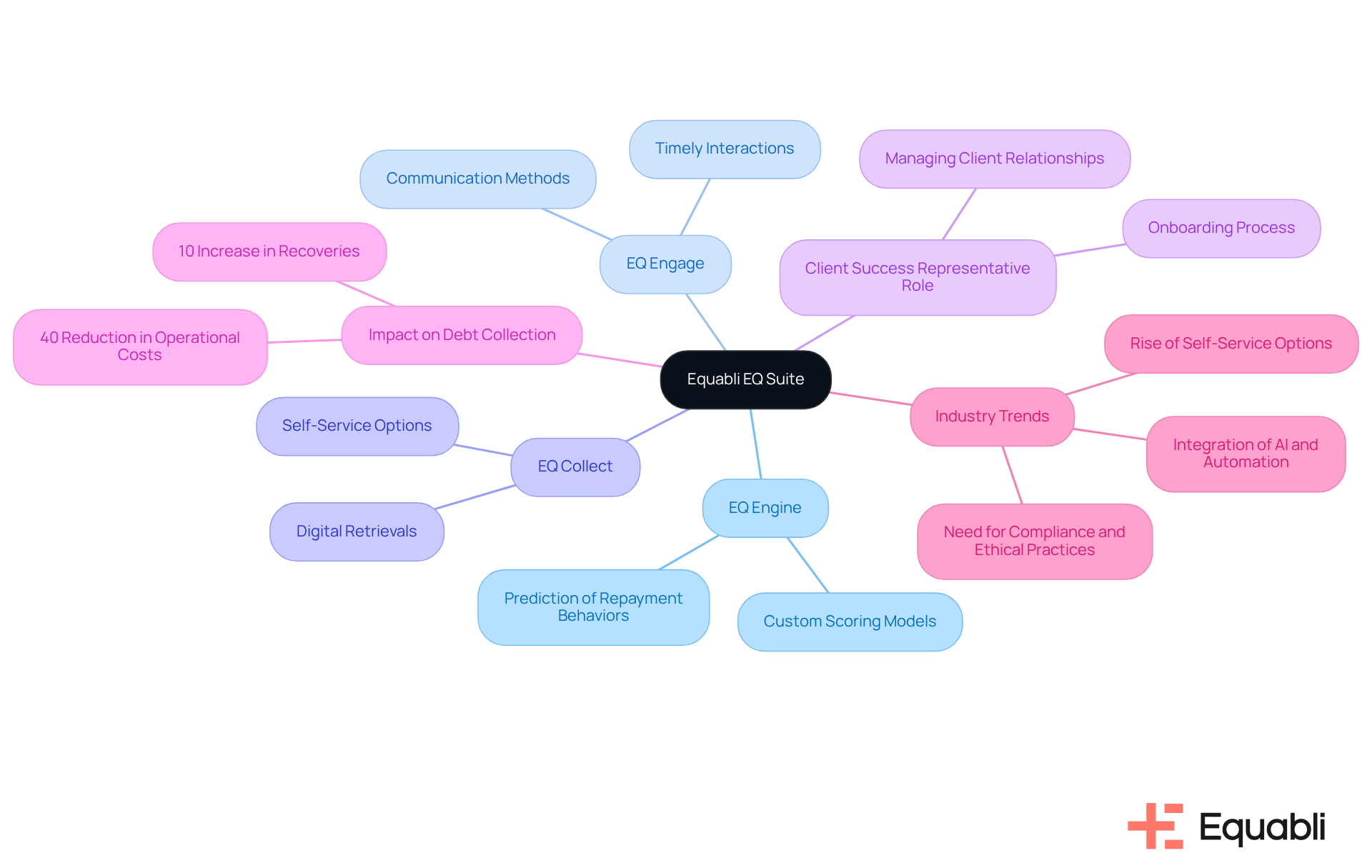

The Equabli EQ Suite offers a comprehensive array of tools designed to enhance debt collection processes. Central to this suite is the EQ Engine, which employs custom scoring models to accurately predict repayment behaviors, allowing enterprises to tailor their strategies effectively. Supporting this is EQ Engage, which enhances communication methods through preferred channels, ensuring interactions are both timely and relevant. Additionally, EQ Collect facilitates seamless digital retrievals, empowering borrowers with self-service repayment options that align with their preferences, including a no-code file-mapping tool and automated workflows that minimize execution errors.

The Client Success Representative at Equabli plays a crucial role in driving product adoption and fostering client engagement. By overseeing the onboarding process and managing client relationships, they ensure that financial institutions can fully utilize the capabilities of the EQ Suite. This proactive approach not only builds trust but also encourages the effective use of tools like EQ Collect and EQ Engage, essential for enhancing borrower engagement and streamlining loan recovery strategies.

These intelligent solutions for accounts receivable management collection solutions for enterprise financial operations not only enhance recovery rates but also significantly lower operational costs. For instance, organizations utilizing the EQ Suite have reported a 40% decrease in operational costs and a 10% increase in recoveries, underscoring the transformative impact of integrating advanced technology into financial recovery practices. As the industry evolves, the adoption of accounts receivable management collection solutions for enterprise financial operations becomes vital for maintaining competitiveness and achieving sustainable growth amid increasing consumer financial pressures and rising operational challenges. As Cody Owens, co-founder and CEO of Equabli, noted, "Most debt recovery teams understand the necessity for a contemporary method, but they lack clarity on where to begin, how to incorporate new tactics, and how to transition ongoing projects." This highlights the urgent need for financial institutions to embrace these advancements.

Automation and AI: Revolutionizing Accounts Receivable Management

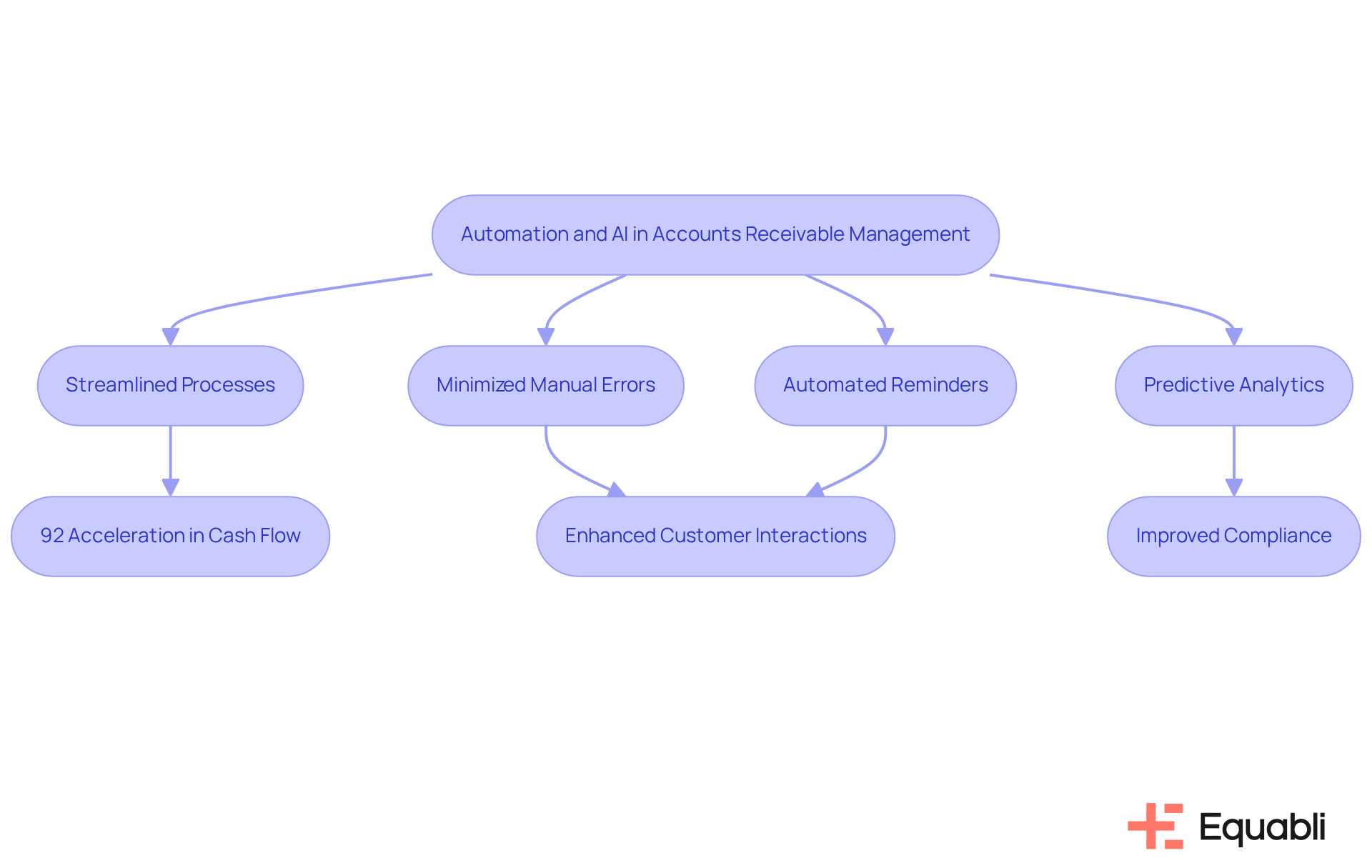

Automation and AI technologies are fundamentally transforming accounts receivable management collection solutions for enterprise financial operations by streamlining processes and minimizing manual errors. Evidence of this transformation is seen in the implementation of automated reminders and AI-driven predictive analytics, which are essential for improving operational efficiency. Enterprises utilizing accounts receivable management collection solutions for enterprise financial operations can foresee payment behaviors and refine retrieval methods, with organizations reporting a 92% acceleration in cash flow, underscoring the tangible benefits of these innovations. Furthermore, chatbots enhance customer interactions, ensuring timely follow-ups and improved borrower engagement.

Equabli's EQ Collect exemplifies this transformation by shortening vendor onboarding timelines through an easy, no-code file-mapping tool. This approach enhances efficiency via data-informed strategies, significantly reducing execution mistakes and reliance on manual resources through automated workflows. Additionally, it offers unrivaled transparency and insights with real-time reporting while ensuring secure, industry-leading compliance oversight.

As enterprises embrace these technologies, they can redirect their focus towards strategic decision-making, ultimately driving better financial outcomes and enhancing client relationships through accounts receivable management collection solutions for enterprise financial operations. This shift not only enhances operational effectiveness but also positions organizations to navigate compliance challenges more adeptly, reinforcing their commitment to risk management in an evolving financial landscape.

B2B Debt Collection Solutions: Tailored Strategies for Business Clients

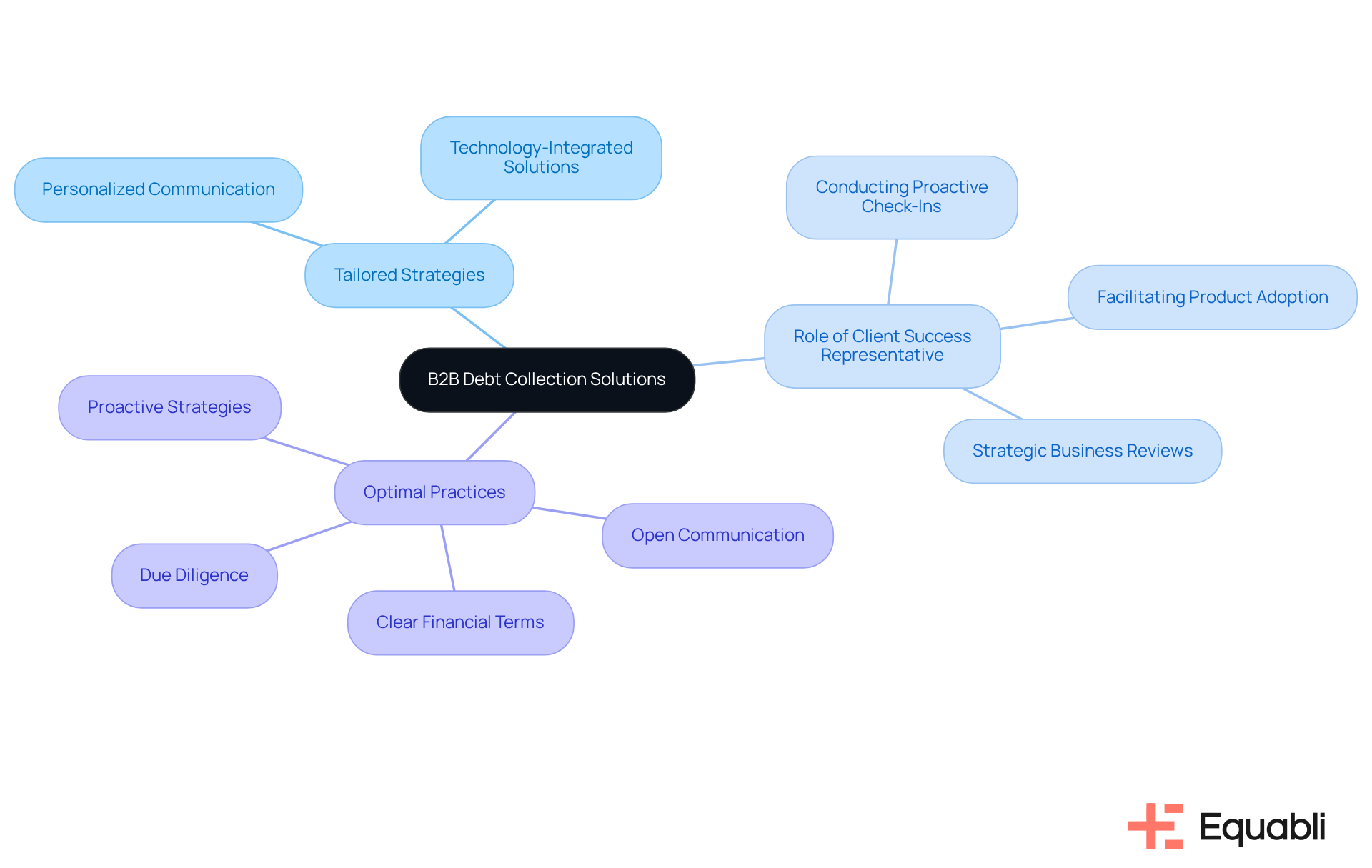

B2B accounts receivable management collection solutions for enterprise financial operations require a sophisticated approach that acknowledges the complexities inherent in business relationships. Tailored strategies, particularly personalized communication, can significantly enhance recovery rates. Evidence indicates that businesses employing technology-integrated debt recovery solutions have improved their recovery rates by up to 80% compared to traditional methods, especially when these solutions are complemented by personalized communication efforts.

The role of a Client Success Representative at Equabli is crucial in this context; they facilitate product adoption and client engagement by aligning with business goals and ensuring the platform meets those objectives. This includes conducting proactive check-ins and strategic business reviews to share insights and identify expansion opportunities.

Adaptable financial conditions and effective negotiation strategies not only expedite transactions but also foster enduring collaborations. By recognizing and addressing the unique needs of business clients, organizations can enhance their collection efforts while maintaining positive relationships.

Optimal practices in accounts receivable management collection solutions for enterprise financial operations involve:

- Establishing clear financial terms

- Ensuring open communication channels

- Conducting due diligence on clients' financial situations

- Employing proactive strategies to mitigate late transactions

As noted by Marcus Williams, a commercial lawyer, "Standard terms of payment need to be agreed upfront," highlighting the necessity for clarity in financial agreements.

Ultimately, a balanced approach that respects legal frameworks while prioritizing client relationships is essential for successful B2B financial recovery.

Blockchain Technology: Enhancing Security and Transparency in Collections

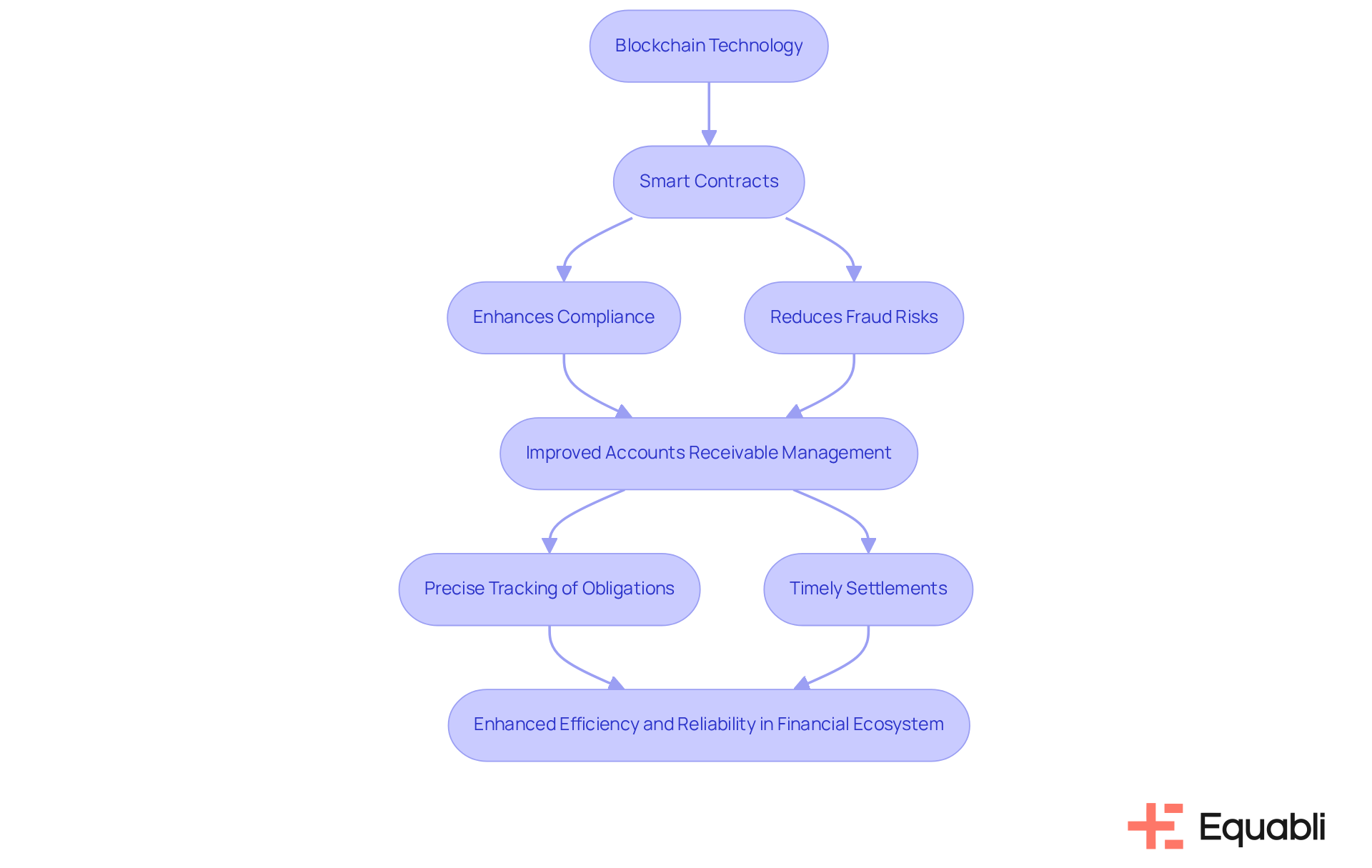

Blockchain technology is revolutionizing money recovery through the implementation of smart contracts, which automate agreements and ensure compliance with established terms. This decentralized framework not only enhances transparency but also significantly reduces fraud risks, thereby fostering trust between creditors and debtors.

The deployment of smart contracts enhances accounts receivable management collection solutions for enterprise financial operations by facilitating precise tracking of obligations and transactions. Consequently, enterprises can anticipate enhanced debt recovery processes, with automated systems promoting timely settlements and lowering operational costs.

By harnessing accounts receivable management collection solutions for enterprise financial operations, organizations can bolster their overall efficiency and effectiveness in managing receivables, ultimately contributing to a more secure and reliable financial ecosystem.

Cloud Services: Flexible Solutions for Modern Accounts Receivable Management

Cloud services empower enterprises to utilize accounts receivable management collection solutions for enterprise financial operations from any location, significantly enhancing remote work capabilities and collaboration. These solutions are inherently scalable, enabling businesses to adjust resources in response to fluctuating demand. With built-in security features, cloud-based platforms safeguard sensitive data, reflecting Equabli's commitment to data protection and compliance with local and international regulations, as outlined in our Privacy Policy. This focus on security is crucial for financial institutions that handle sensitive consumer information.

Companies leveraging cloud technology report a 40% increase in accuracy and a 50% reduction in bookkeeping time, both of which are attributed to the use of cloud-based accounting solutions, underscoring the efficiency gains associated with these tools. Furthermore, automated processes free collectors to focus on high-value cases, improving overall recovery rates and customer satisfaction. As organizations transition to cloud solutions, they not only streamline operations but also enhance client engagement through dedicated support roles, such as Equabli's Client Success Representatives, who drive product adoption and ensure that clients achieve their business goals, directly contributing to the reported efficiency gains.

This makes cloud adoption a strategic necessity for competitiveness in 2025 and beyond.

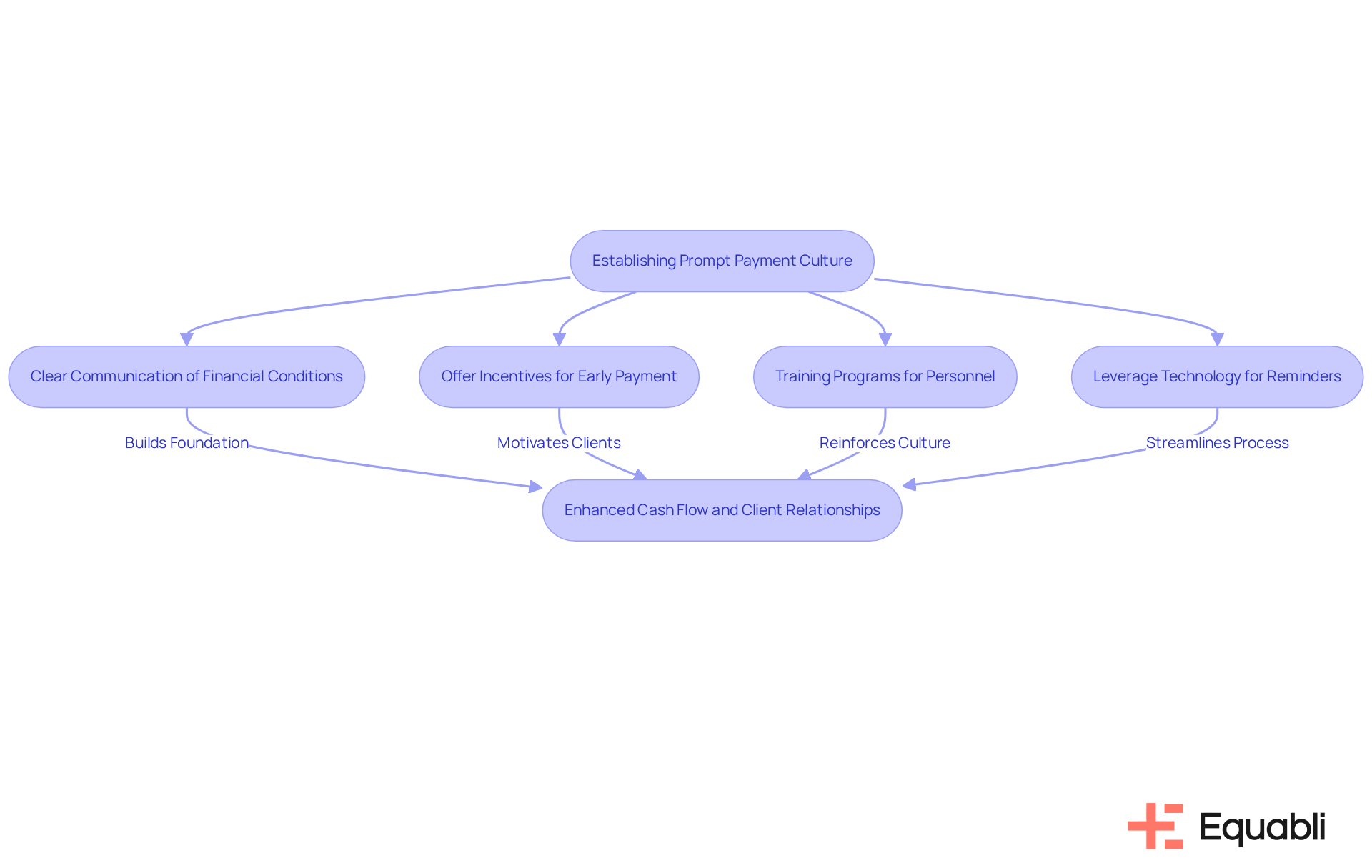

Prompt Payment Culture: Strategies to Encourage Timely Payments

Establishing a timely settlement culture is essential for businesses aiming to enhance cash flow and minimize collection efforts. This initiative begins with the clear communication of financial conditions, ensuring that clients fully understand deadlines, accepted payment methods, and any penalties associated with late submissions. Evidence suggests that offering incentives for early transactions, such as discounts or loyalty rewards, can significantly motivate clients to settle invoices promptly. Research indicates that businesses implementing early payment incentives often experience improved cash flow and reduced debtor days, thereby fostering stronger financial health.

To reinforce this culture, organizations should consider training programs for personnel that highlight the importance of prompt collections. Leveraging technology, such as Equabli's EQ Suite, to automate reminders and alerts can streamline the follow-up process, ensuring that clients receive timely notifications regarding upcoming due dates. By integrating these strategies and utilizing modern, data-driven tools, enterprises can adopt a proactive approach to accounts receivable management collection solutions for enterprise financial operations, which ultimately leads to enhanced financial outcomes and improved client relationships.

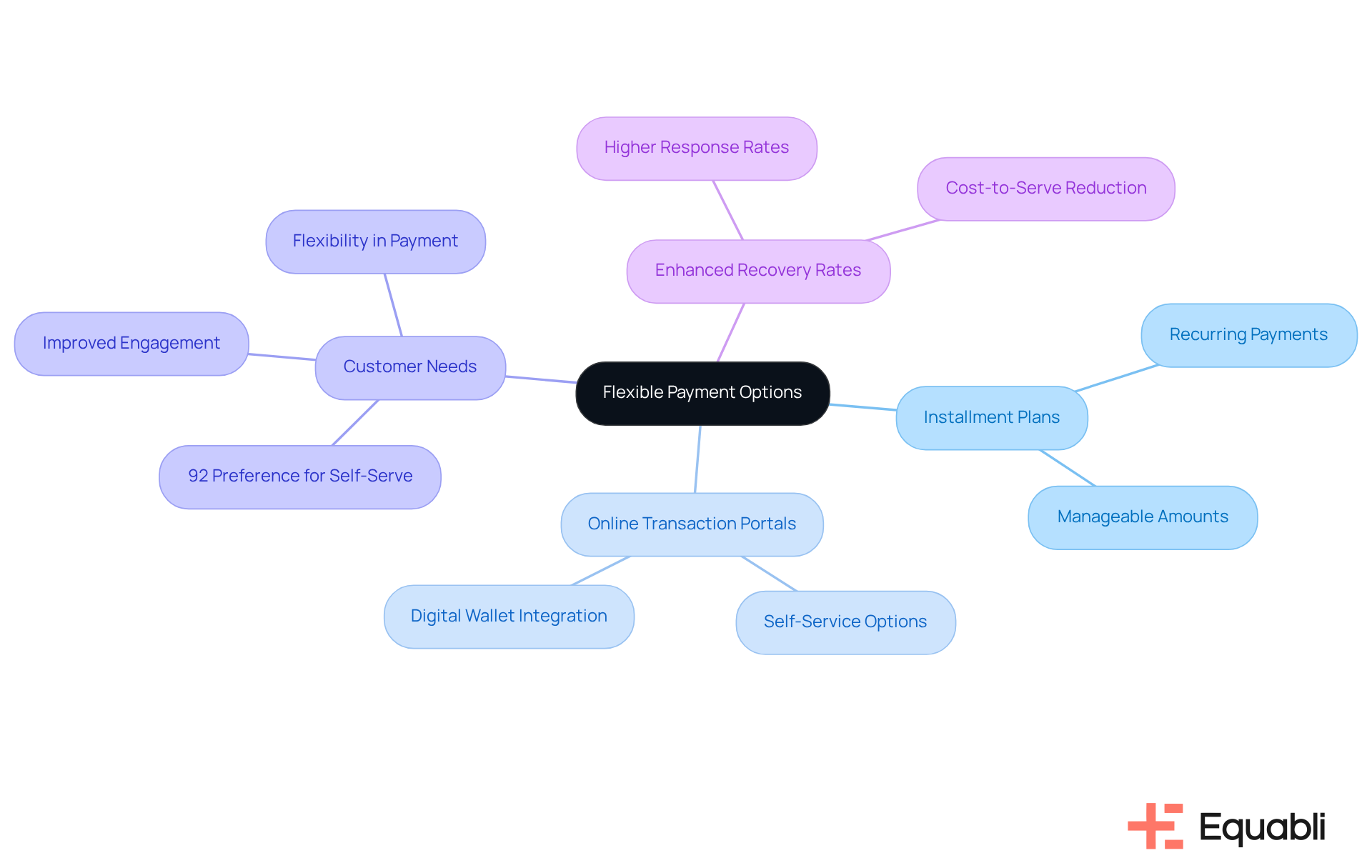

Flexible Payment Options: Meeting Diverse Customer Needs

Implementing flexible financial options, such as installment plans and online transaction portals, is crucial for addressing the diverse needs of customers. Evidence shows that these solutions enhance customer satisfaction and facilitate prompt transactions. Research indicates that 92% of customers prefer self-serve options for resolving balances, underscoring the demand for digital solutions that empower consumers.

By offering a variety of transaction methods and ensuring clear communication regarding these choices, enterprises can foster a sense of control among customers in their repayment processes. This strategy not only improves engagement but also significantly increases recovery rates, as customers are more inclined to respond positively when granted the flexibility to choose how and when to pay.

Furthermore, the integration of online payment platforms, alongside EQ Collect's no-code file-mapping tool and intuitive interface, has proven to reduce cost-to-serve by up to 75%. This positions them as a valuable asset in modern recovery strategies. The real-time reporting and compliance oversight provided by EQ Collect ensure that enterprises can manage their processes effectively while adhering to industry standards.

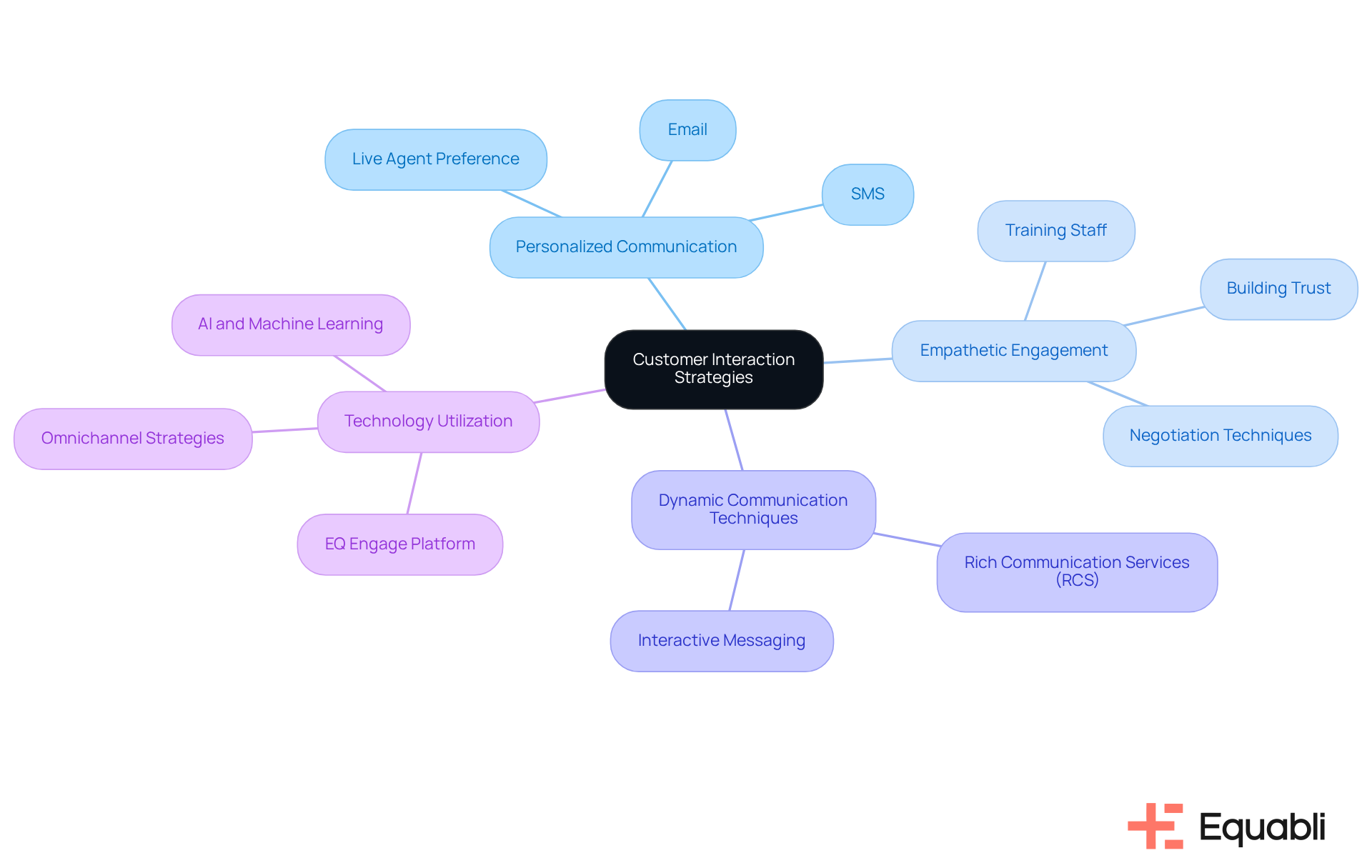

Customer Interaction: Enhancing Engagement for Better Collections

Effective customer interaction is critical for successful accounts receivable management collection solutions for enterprise financial operations. Enterprises must prioritize personalized communication by leveraging preferred channels such as email, SMS, and phone calls. Research indicates that 50% of consumers prefer speaking to a live agent for customer service, underscoring the importance of a human touch in collections.

Training staff to engage with empathy and understanding can significantly enhance customer relations; empathetic interactions are essential for building trust and rapport. Organizations that implement tailored approaches have observed a 25% rise in recovery rates, according to The Kaplan Group. By fostering a more positive experience for borrowers, companies can utilize accounts receivable management collection solutions for enterprise financial operations to improve engagement, leading to higher recovery rates and reduced disputes.

Utilizing dynamic communication techniques, such as Rich Communication Services (RCS), facilitates interactive, two-way discussions that enhance borrower involvement and satisfaction, transforming consumer engagement with collectors. Furthermore, Equabli's EQ Engage platform allows organizations to design, automate, and execute tailored borrower contact strategies that empower self-service repayment options. This ensures compliance while enhancing the overall borrower experience.

This innovative method not only increases engagement but also serves as accounts receivable management collection solutions for enterprise financial operations by reducing operational costs.

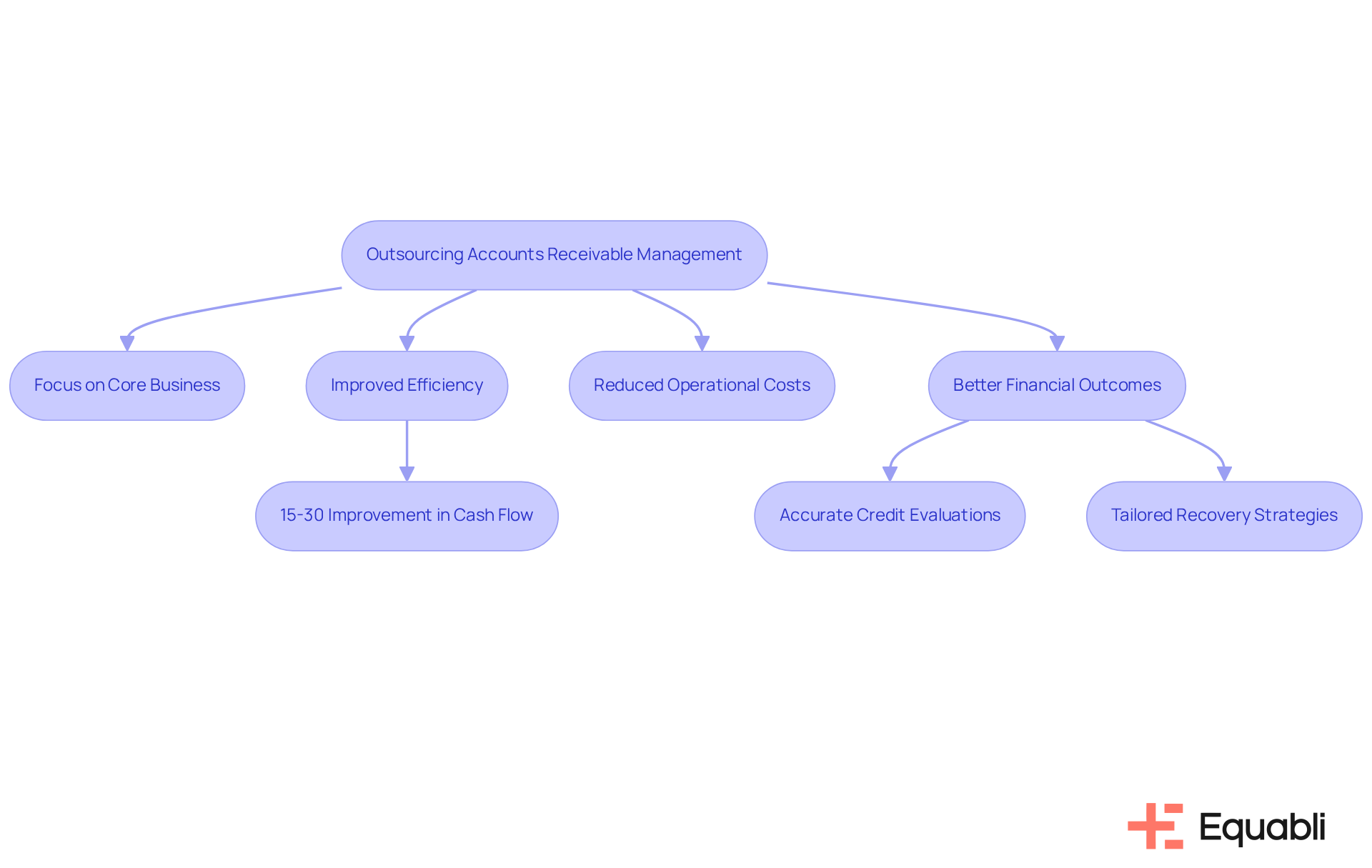

Outsourcing Accounts Receivable Management: Leveraging Expertise for Efficiency

Outsourcing accounts receivable management collection solutions for enterprise financial operations enables enterprises to focus on their core business functions while leveraging the specialized expertise of dedicated firms. These firms employ advanced technologies and extensive experience to enhance retrieval efforts significantly. By outsourcing, organizations can streamline processes, resulting in improved efficiency and reduced operational costs—often by as much as 50%. This strategic decision not only ensures compliance with industry regulations but also promotes better financial outcomes by utilizing accounts receivable management collection solutions for enterprise financial operations.

For instance, companies utilizing specialized AR services typically experience a 15-30% improvement in cash flow due to expedited receipt of funds. Furthermore, the integration of real-time payment technologies and predictive analytics within accounts receivable management collection solutions for enterprise financial operations facilitates more accurate credit evaluations and tailored recovery strategies, ultimately mitigating risks associated with late payments.

As Radius Global Solutions articulates, 'Outsourcing your AR is like bringing a super-efficient assistant into your financial team,' allowing organizations to concentrate on growth and innovation while sustaining robust financial health. Establishing clear service level agreements (SLAs) with AR outsourcing providers is essential for defining success metrics and expectations, thereby ensuring effective communication throughout the transition process.

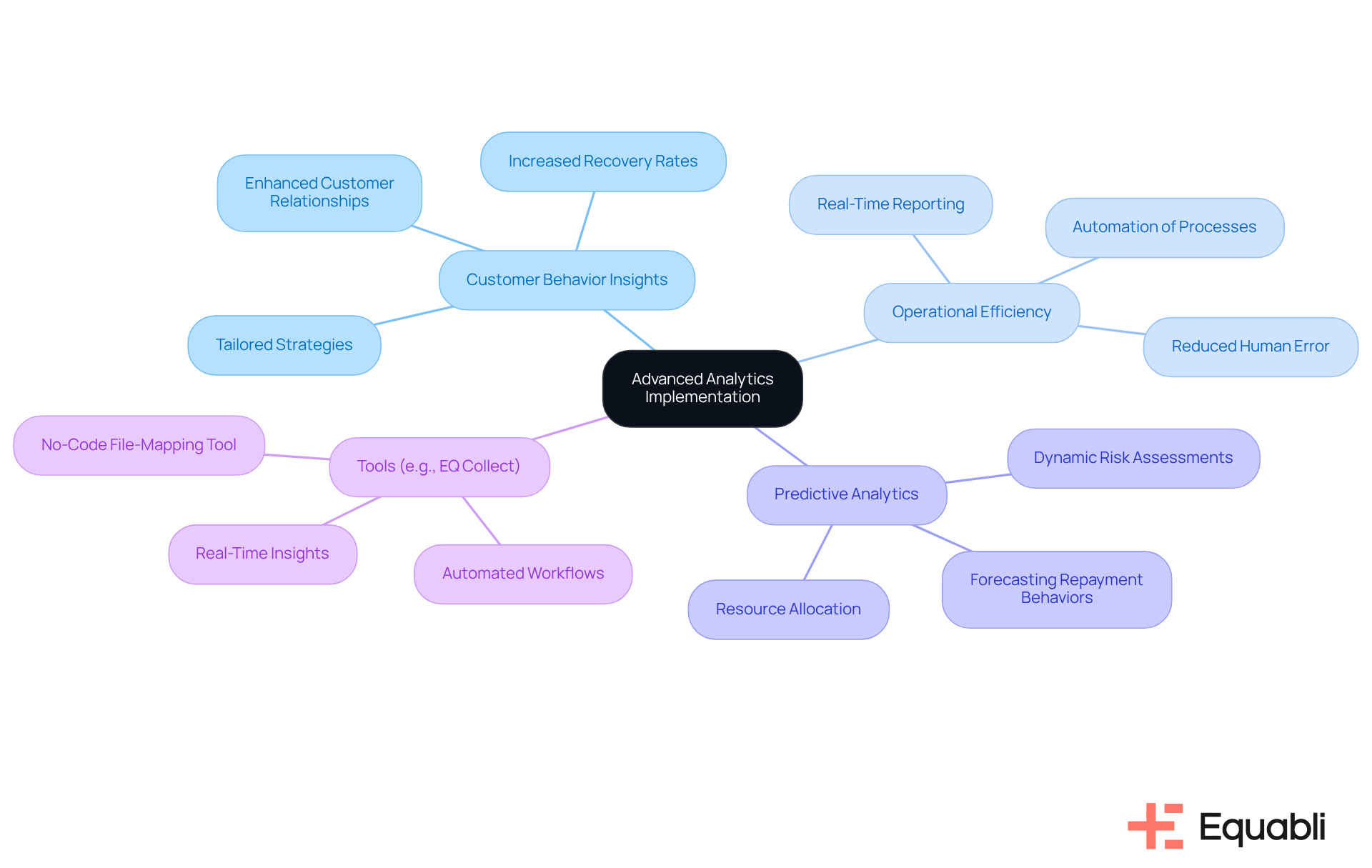

Advanced Analytics Implementation: Data-Driven Insights for Improved Collections

Implementing advanced analytics in accounts receivable management collection solutions for enterprise financial operations provides critical insights into customer behavior and repayment patterns for enterprises. Evidence suggests that organizations utilizing data analysis can identify trends, categorize customers, and tailor their strategies accordingly. This data-driven approach not only enhances efficiency in collections but also facilitates accurate forecasting of future repayment behaviors, which is crucial for implementing accounts receivable management collection solutions for enterprise financial operations.

For instance, agencies that adopt data-driven digital retrieval techniques have reported recovery rates increasing by up to 25% compared to traditional methods. Furthermore, businesses that invest in refining their data infrastructure can transform raw data into strategic actions, significantly improving operational efficiency and compliance.

Equabli's EQ Collect delivers unparalleled transparency and insights through real-time reporting, complemented by a no-code file-mapping tool that shortens vendor onboarding timelines and reduces execution errors via automated workflows, ensuring smarter orchestration and enhanced performance.

Organizations are increasingly recognizing the transformative potential of integrating AI-driven insights into their accounts receivable management collection solutions for enterprise financial operations. This shift has proven to be a game-changer, with predictive analytics emerging as a core component of modern debt collection strategies. Financial institution executives are urged to leverage these insights and invest in their data infrastructure to optimize recovery strategies and foster stronger customer relationships, capitalizing on the compliance oversight offered by EQ Collect.

Conclusion

The landscape of accounts receivable management is rapidly evolving, driven by the integration of advanced technologies and tailored strategies. By adopting intelligent solutions such as the Equabli EQ Suite, enterprises can enhance their debt collection processes, improve recovery rates, and significantly reduce operational costs. The emphasis on automation, AI, and data-driven insights showcases a transformative shift that empowers organizations to navigate the complexities of financial recovery more efficiently.

Key insights from the article underscore the importance of personalized communication, flexible payment options, and the role of advanced analytics in optimizing collections. Strategies that foster a prompt payment culture and leverage cloud services further illustrate how modern enterprises can meet diverse customer needs while maintaining robust financial health. The impact of outsourcing accounts receivable management also highlights the value of specialized expertise in enhancing efficiency and compliance.

In conclusion, embracing these innovative approaches is not merely an option but a necessity for enterprises aiming to thrive in a competitive financial landscape. As the industry continues to evolve, organizations are encouraged to invest in these cutting-edge solutions to enhance their accounts receivable management strategies. By doing so, they will not only improve their recovery outcomes but also strengthen client relationships, ensuring long-term sustainability and growth in an increasingly challenging environment.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a comprehensive set of tools designed to enhance debt collection processes, featuring the EQ Engine for predicting repayment behaviors, EQ Engage for improved communication, and EQ Collect for seamless digital retrievals and self-service repayment options.

How does the EQ Engine work?

The EQ Engine employs custom scoring models to accurately predict repayment behaviors, allowing enterprises to tailor their debt collection strategies effectively.

What role does EQ Engage play in the EQ Suite?

EQ Engage enhances communication methods by utilizing preferred channels, ensuring that interactions with borrowers are timely and relevant.

What features does EQ Collect offer?

EQ Collect facilitates seamless digital retrievals, offers self-service repayment options, includes a no-code file-mapping tool, and automates workflows to minimize execution errors.

What is the role of a Client Success Representative at Equabli?

The Client Success Representative oversees the onboarding process, manages client relationships, drives product adoption, and ensures that financial institutions fully utilize the capabilities of the EQ Suite.

What operational improvements have organizations experienced using the EQ Suite?

Organizations using the EQ Suite have reported a 40% decrease in operational costs and a 10% increase in recovery rates, highlighting the suite's transformative impact on financial recovery practices.

How are automation and AI changing accounts receivable management?

Automation and AI streamline processes, minimize manual errors, and improve operational efficiency through automated reminders and AI-driven predictive analytics, resulting in a 92% acceleration in cash flow.

What is the significance of personalized communication in B2B debt collection?

Personalized communication significantly enhances recovery rates, with businesses using technology-integrated debt recovery solutions improving their recovery rates by up to 80% compared to traditional methods.

What practices are recommended for effective accounts receivable management in B2B settings?

Recommended practices include establishing clear financial terms, ensuring open communication channels, conducting due diligence on clients' financial situations, and employing proactive strategies to mitigate late transactions.

Why is it important to have clarity in financial agreements?

Clarity in financial agreements is essential for successful B2B financial recovery, as it helps to establish clear expectations and fosters positive relationships between organizations and their clients.