Overview

The article examines various accounts receivable management solutions tailored for financial institutions, underscoring the effectiveness of diverse tools and strategies in optimizing collection processes. It highlights the critical role of automation, data-driven insights, and effective communication in enhancing cash flow and minimizing disputes. Notably, solutions such as Equabli's EQ Suite exemplify how these strategies can significantly bolster operational efficiency and improve borrower engagement.

Introduction

In the rapidly changing landscape of financial management, optimizing accounts receivable processes has become a critical focus for institutions seeking to enhance cash flow and operational efficiency. This article examines ten innovative solutions tailored for accounts receivable management, illustrating how these tools can convert traditional practices into streamlined, automated workflows.

However, as organizations endeavor to implement these advanced strategies, they confront a pressing question: how can they effectively navigate the complexities of digital transformation while ensuring compliance and preserving strong customer relationships?

Equabli's EQ Suite: Intelligent Solutions for Accounts Receivable Management

Equabli's EQ Suite serves as a vital toolset for optimizing accounts receivable management collection agency solutions for financial institutions. The suite's key components include:

- EQ Engine: Utilizes custom scoring models to predict repayment behaviors.

- EQ Engage: Designed to enhance recovery strategies.

- EQ Collect: Facilitates digital retrievals through self-service repayment plans.

Notably, EQ Collect:

- Streamlines vendor onboarding with a no-code file-mapping tool.

- Boosts efficiency through data-driven strategies.

- Reduces execution errors via automated workflows.

- Offers real-time reporting, ensuring unparalleled transparency and compliance oversight.

In addition, EQ Engage enhances borrower experiences by providing personalized communication journeys and self-service repayment options, thereby increasing engagement and lowering collection costs.

With the automation market for outstanding payments projected to reach USD 5.32 billion by 2029, growing at an 11.84% CAGR, it is imperative for organizations to adopt digital-first engagement strategies. Adam Parks underscores this necessity, asserting, 'AI is no longer an option—it’s a necessity for agencies that want to stay ahead.'

Moreover, the integration of compliance AI is essential for addressing communication-related grievances, allowing financial institutions to update their practices effectively. Importantly, accounts receivable management collection agency solutions for financial institutions driven by AI have been demonstrated to decrease dispute resolution times by three weeks, highlighting the efficiency gains achievable through Equabli's innovative solutions.

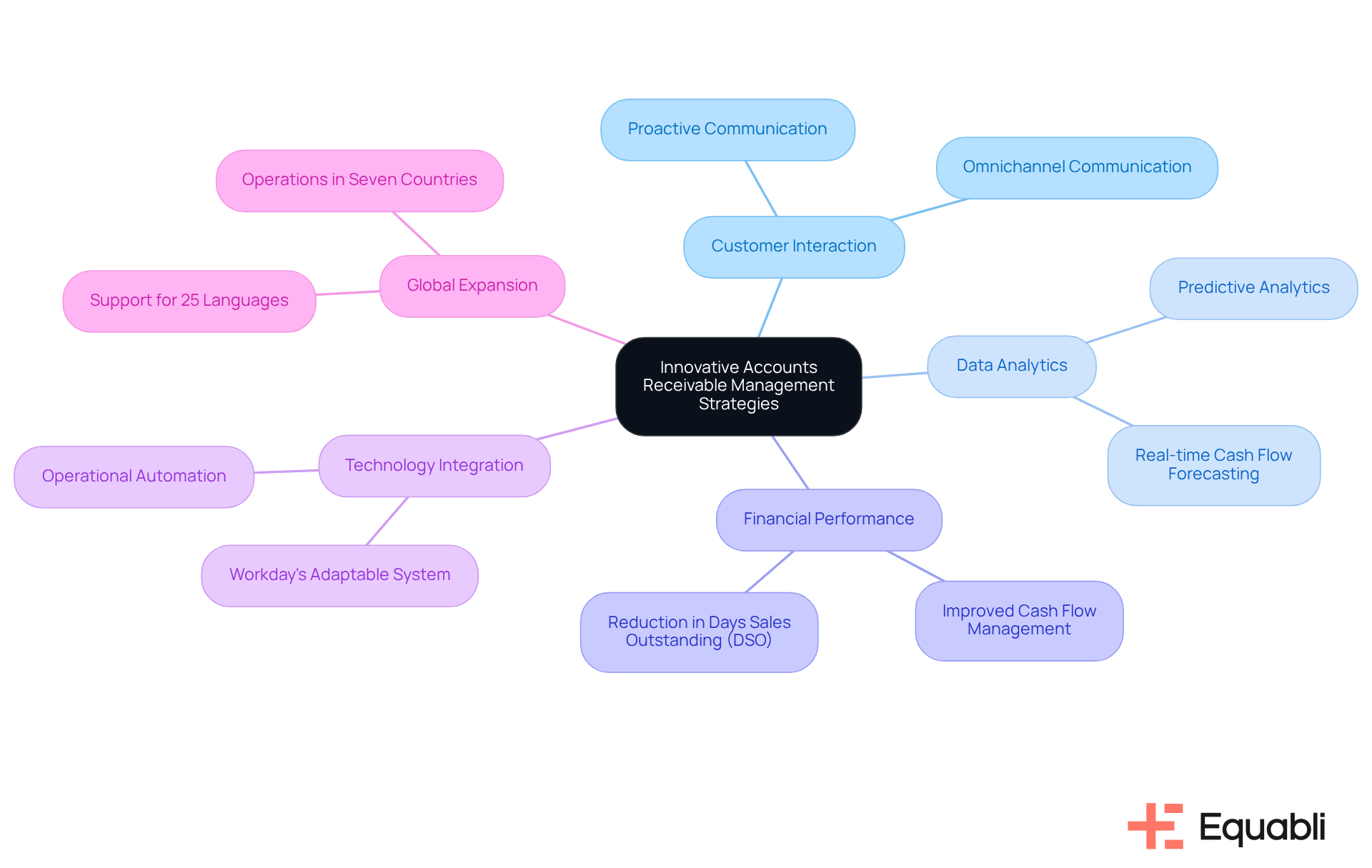

Bill Gosling: Innovative Accounts Receivable Management Strategies

Bill Gosling Outsourcing adopts innovative strategies to enhance financial management. By leveraging omnichannel communication, they improve customer interactions and utilize data analytics to refine retrieval processes. Recognized as one of Canada’s Best Managed Companies, their commitment to excellence is evident in their outstanding business performance. This focus on customer experience, combined with technology integration, enables businesses to optimize cash flow and reduce days sales outstanding (DSO) by utilizing accounts receivable management collection agency solutions for financial institutions.

The implementation of predictive analytics within accounts receivable management collection agency solutions for financial institutions significantly enhances cash flow forecasting accuracy, facilitating improved financial planning. Furthermore, their expansion into seven countries, supported by Workday's adaptable system, underscores their operational capabilities on a global scale. Their commitment to transparency and proactive communication ensures clients are informed throughout the retrieval process, while operational automation enhances efficiency in financial management.

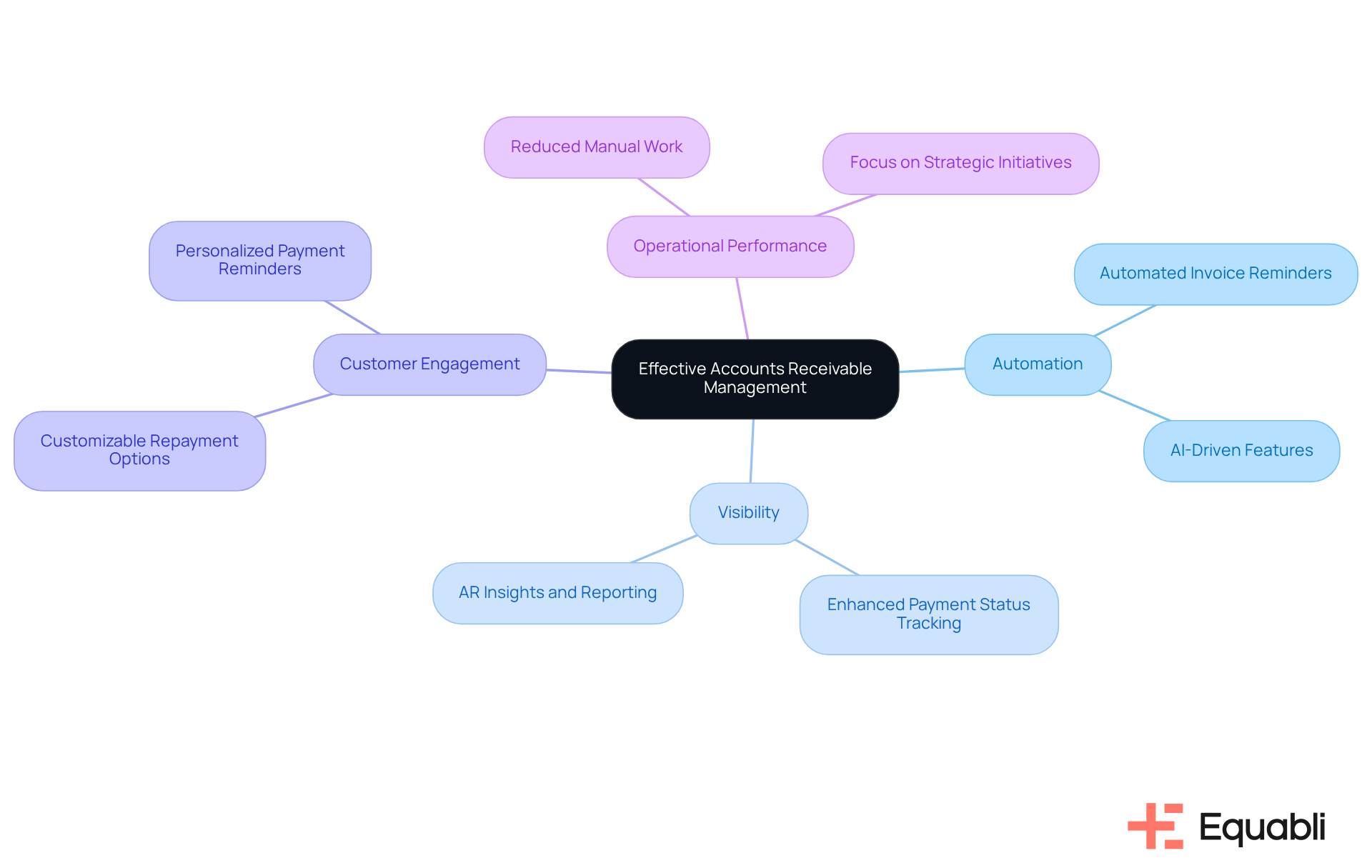

Chaser: Comprehensive Guide to Effective Accounts Receivable Management

Equabli specializes in providing accounts receivable management collection agency solutions for financial institutions, enabling businesses to automate their processes, expedite payments, and foster robust customer relationships. Their EQ Suite modernizes traditional debt recovery methods, transforming them into intelligent and intuitive solutions.

By automating invoice reminders and enhancing visibility into payment statuses, Equabli offers accounts receivable management collection agency solutions for financial institutions, empowering organizations to manage their receivables with greater efficacy. This transition from manual to data-driven processes not only reduces the time spent on follow-ups but also enhances borrower engagement through customizable repayment options and compliance oversight.

Consequently, finance teams can concentrate on strategic initiatives that drive revenue growth while simultaneously improving overall operational performance.

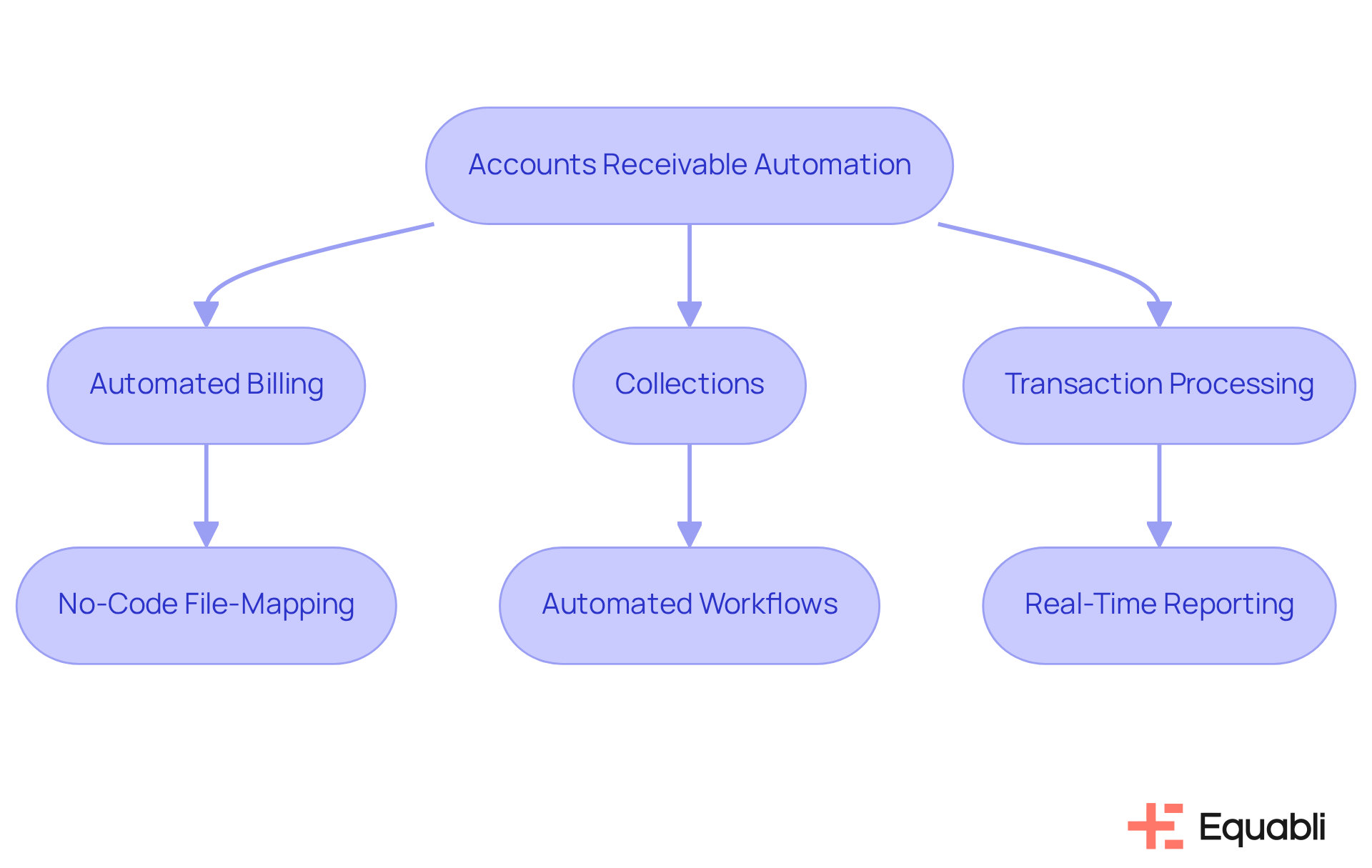

Invoiced: Automation for Streamlined Accounts Receivable Processes

Equabli offers accounts receivable management collection agency solutions for financial institutions that provide a comprehensive automation solution to enhance the invoice-to-cash process. By automating billing, collections, and transaction processing, this platform significantly reduces the administrative burden on finance teams. Key features—such as a no-code file-mapping tool for vendor onboarding, automated workflows to decrease execution errors, and real-time reporting for unparalleled transparency—enable businesses to accelerate cash flow and minimize inaccuracies. This streamlined approach not only boosts financial performance but also fosters stronger customer relationships through prompt transactions.

The ability to automate repetitive tasks allows organizations to concentrate on strategic initiatives, effectively transforming their finance teams from reactive to proactive. As Carey O’Connor Kolaja, CEO of Versapay, observes, "digitizing and automating payments is essential for companies in 2025 due to rising capital costs and customer expectations." Furthermore, with $497 billion locked in accounts receivable management collection agency solutions for financial institutions among median-performing companies globally, it is crucial to integrate automation into accounts receivable to sustain financial agility and resilience in today's competitive environment.

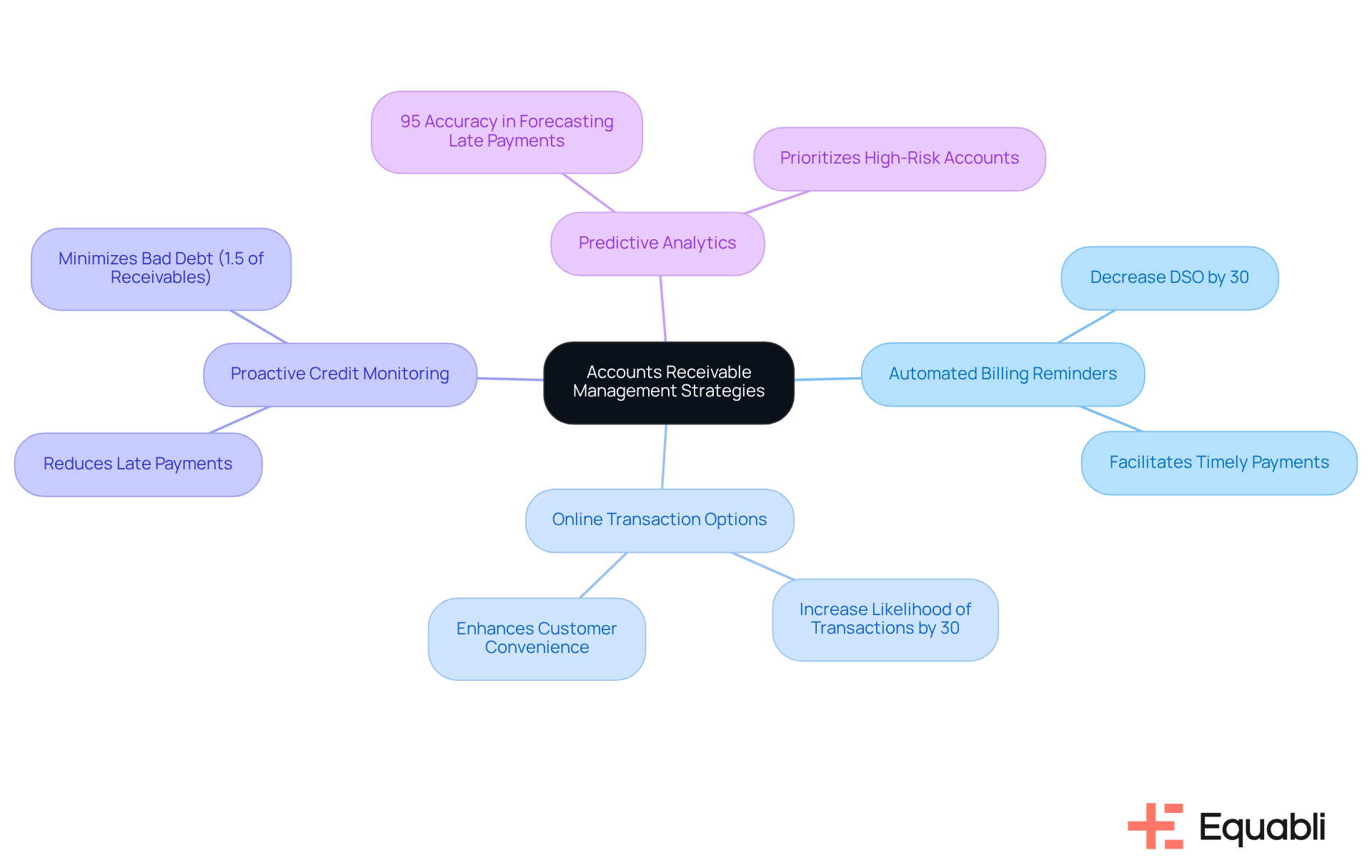

Quadient: Accounts Receivable Collections Playbook for Financial Institutions

Quadient's accounts receivable management collection agency solutions for financial institutions offer actionable strategies to enhance their recovery processes. It underscores the importance of leveraging customer information, automating billing reminders, and maintaining consistent communication with clients. By adopting these best practices, organizations can enhance their accounts receivable management collection agency solutions for financial institutions, improve retrieval rates, and reduce Days Sales Outstanding (DSO), ultimately leading to better cash flow management.

-

Automated billing reminders have been shown to decrease DSO by up to 30%, facilitating timely payments and keeping clients informed of their obligations.

-

Additionally, offering online transaction options can increase the likelihood of transactions by 30%, demonstrating the effectiveness of digital platforms in improving recovery rates.

-

Proactive credit monitoring and AI insights are also essential, particularly in light of the fact that 47% of credit sales are paid late, resulting in 1.5% of receivables being written off as bad debt each year.

-

Financial institutions can enhance their resource allocation by effectively utilizing customer data to prioritize high-risk accounts, leveraging accounts receivable management collection agency solutions for financial institutions.

-

For instance, organizations using predictive analytics tools, which boast a 95% accuracy rate in forecasting late payments, can refine their recovery strategies, leading to improved financial outcomes.

As highlighted in industry discussions, "utilizing customer data can significantly enhance recovery rates," reinforcing the need for these best practices. By implementing these strategies, organizations not only elevate their retrieval rates but also foster stronger relationships with their clients, paving the way for sustainable growth.

Paystand: Digital Transformation for Accounts Receivable Management

Paystand is transforming accounts receivable management through digital innovation. Their platform automates the entire AR process, from invoicing to revenue collection, allowing businesses to streamline operations and reduce costs. Evidence shows that features like automated transaction processing and real-time cash flow visibility enhance financial management and improve customer satisfaction.

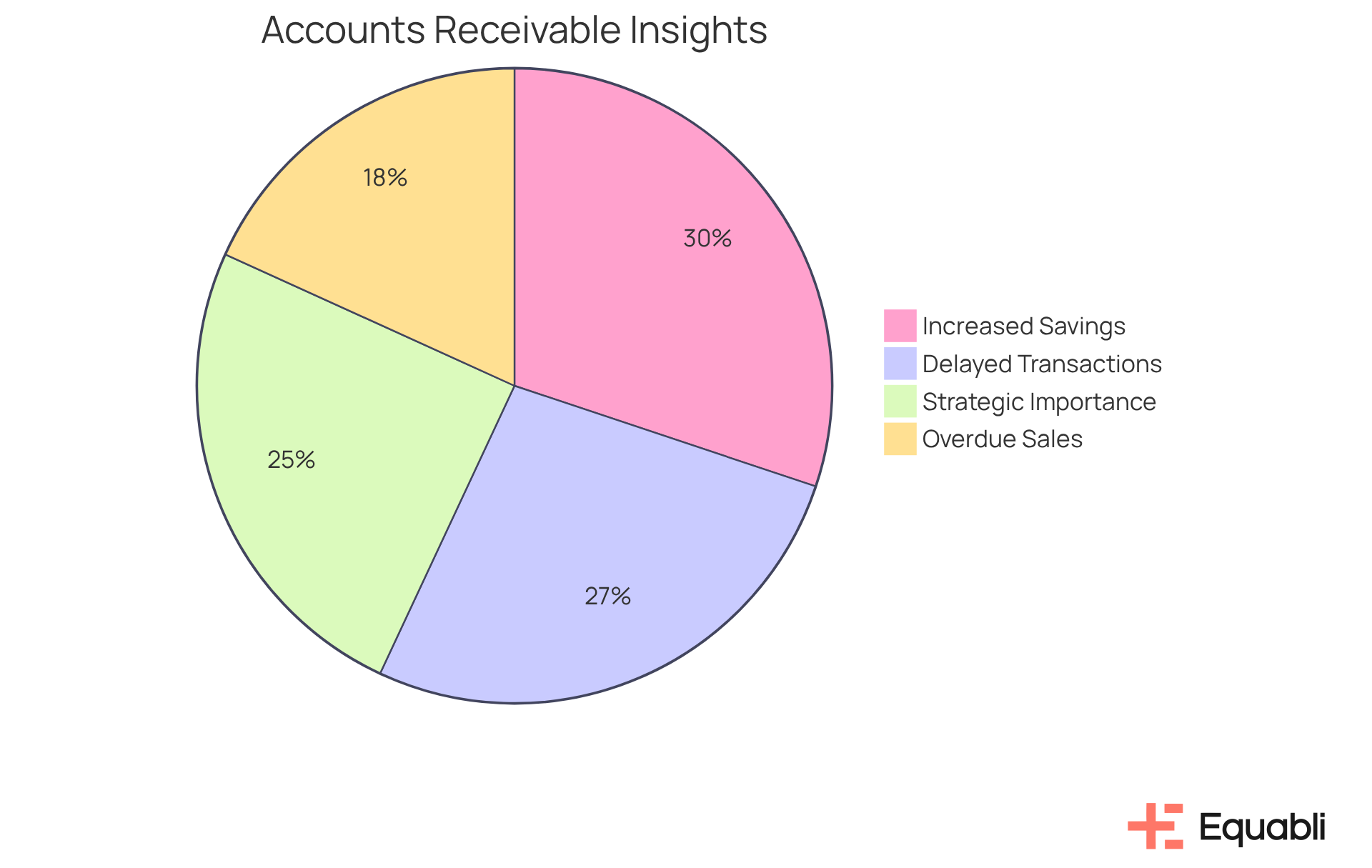

A recent study by PYMNTS indicates that:

- 91% of mid-sized firms with fully automated AR systems report increased savings and enhanced cash flow.

- 81% of businesses are experiencing a rise in delayed transactions, highlighting the importance of timely dealings in strengthening customer relationships.

- 55% of all B2B invoiced sales are overdue, underscoring the urgency of addressing AR challenges.

As financial institutions increasingly acknowledge the strategic significance of efficient accounts receivable management, collection agency solutions for financial institutions—75% of finance leaders believe it has gained strategic importance over the past 12-24 months—Paystand's innovative solutions position them for sustainable growth and enhanced financial health.

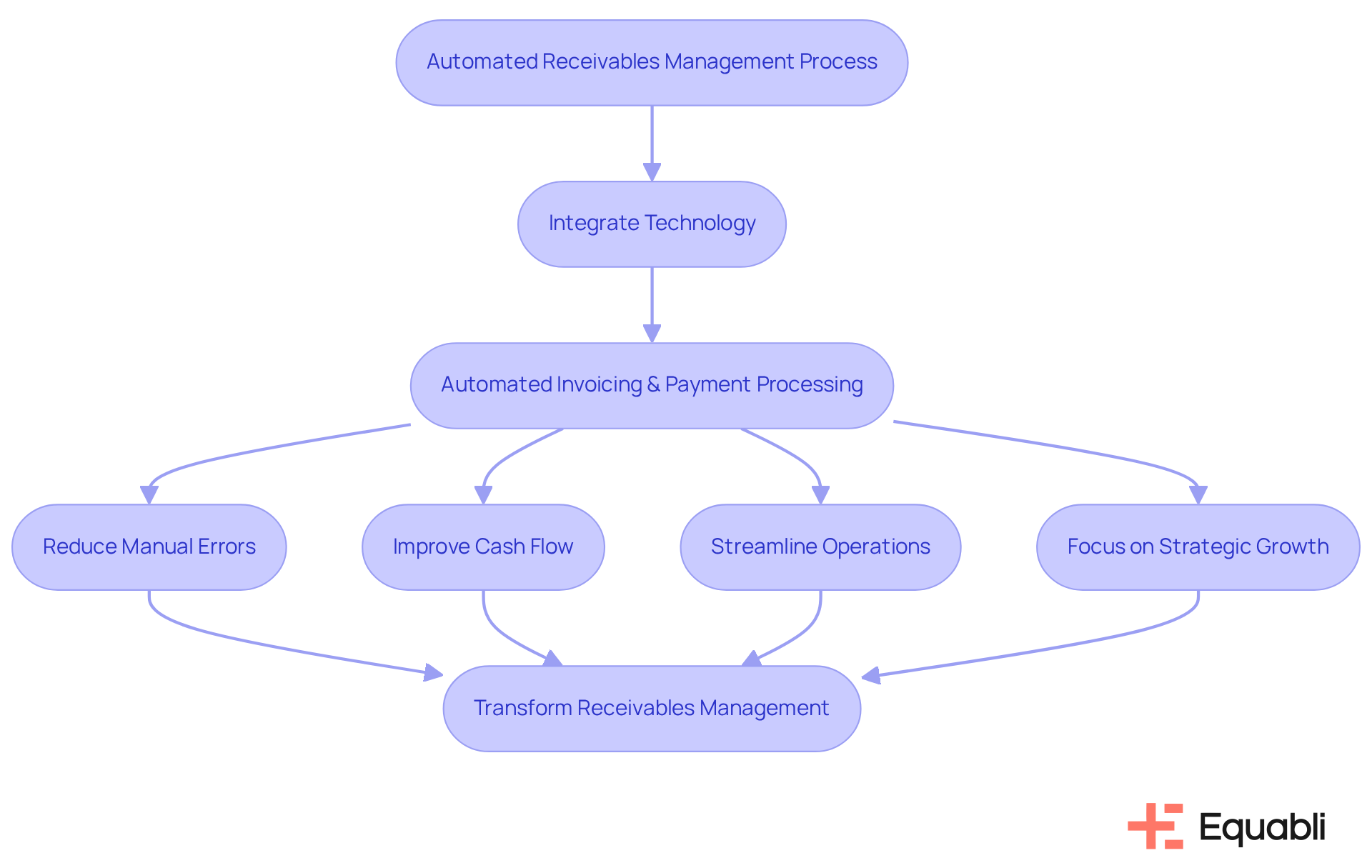

JPMorgan: Automated Receivables Management Insights

Equabli offers accounts receivable management collection agency solutions for financial institutions that provide a suite of automated receivables management solutions aimed at enhancing operational efficiency for businesses. Evidence indicates that integrating technology into the receivables process significantly reduces manual errors and improves cash flow. By automating invoicing and payment processing, Equabli empowers clients to streamline their operations and concentrate on strategic growth initiatives.

A key feature of EQ Collect is its no-code file-mapping tool, which dramatically reduces vendor onboarding timelines, facilitating quicker integration with minimal disruption. Data-driven strategies enhance efficiency and boost collections by delivering actionable insights that foster improved decision-making. Automated workflows curtail execution errors and lessen the reliance on manual resources, allowing staff to focus on higher-value tasks.

Furthermore, users gain access to real-time reporting, providing unparalleled transparency and insights that enable proactive management of receivables. Industry-leading compliance oversight is assured through automated monitoring, effectively safeguarding against potential risks. With a user-friendly, scalable, cloud-native interface, Equabli promotes smarter orchestration, enhanced performance, and integrated operations, providing accounts receivable management collection agency solutions for financial institutions and revolutionizing debt recovery. Embrace a more efficient future with EQ Collect and transform your receivables management.

BDC: Entrepreneur Toolkit for Effective Accounts Receivable Management

BDC's Entrepreneur Toolkit serves as a pivotal resource for businesses aiming to optimize their accounts receivable management collection agency solutions for financial institutions. This toolkit encompasses a variety of invoicing templates and guidelines that clarify financial terms, which are essential for maintaining robust cash flow. Effective invoicing practices can substantially decrease Days Sales Outstanding (DSO), with 55% of businesses projecting an increase in DSO in 2024, highlighting the necessity for strategic collection methodologies.

Utilizing these templates enables entrepreneurs to refine their invoicing processes, resulting in enhanced cash flow and diminished occurrences of bad debt, which currently impacts an average of 9% of all credit-based B2B sales in the US. Successful case studies from small businesses illustrate that implementing structured invoicing not only improves customer relationships but also accelerates timely payments; indeed, 21% of companies reported heightened customer satisfaction following the cessation of manual invoice chasing.

In addition, BDC offers supplementary resources designed to bolster cash flow, including comprehensive guides on invoicing best practices and late fee regulations. These tools are instrumental in the accounts receivable management collection agency solutions for financial institutions and contribute significantly to the overall financial health of businesses. With the accounts receivable automation market projected to expand at a CAGR of 12.9% over the next five years, leveraging such resources is increasingly critical for businesses striving to excel in a competitive environment.

For financial institutions looking to modernize their recovery processes, Equabli's EQ Suite offers accounts receivable management collection agency solutions for financial institutions that provide cloud-based support to address the challenges associated with manual debt retrieval. Featuring EQ Collect for efficient debt recovery and EQ Engage for personalized communication and self-service repayment options, Equabli equips businesses with essential tools to revolutionize their debt recovery strategies and enhance borrower engagement. The EQ Suite encompasses the entire recovery lifecycle, facilitating a seamless and efficient transition to data-driven management.

Versapay: Effective Accounts Receivable Management Software Solutions

Equabli provides a comprehensive suite of accounts receivable management collection agency solutions for financial institutions, specifically designed to optimize the invoicing and receivables process. The EQ Collect platform enables financial institutions to streamline vendor onboarding with a straightforward, no-code file-mapping tool, thereby enhancing operational efficiency. By automating payment processing and facilitating real-time transaction reconciliation, EQ Collect minimizes execution errors and supports organizations in maintaining precise financial records, which are essential for effective cash flow management.

The integration of data-driven methodologies and automated processes not only improves retrieval rates but also provides unparalleled clarity through real-time reporting. EQ Collect's user-friendly, scalable, cloud-native interface enhances usability, making it accessible to all users. Furthermore, the platform includes automated compliance monitoring, ensuring robust oversight both internally and externally.

Given that 75% of finance leaders recognize the strategic importance of managing outstanding payments, Equabli's intelligent automation and machine learning solutions are critical for navigating the complexities of modern payment management. Despite the challenges associated with delayed payments—81% of financial institutions have reported an increase in this issue—Equabli's accounts receivable management collection agency solutions for financial institutions equip organizations to effectively address these obstacles. The impact of delayed transactions is significant; for instance, UK SMBs are currently owed an average of £27,214, highlighting how EQ Collect's features can enhance recovery performance and ensure compliance.

Allianz Trade: Insights into Accounts Receivable Collection Techniques

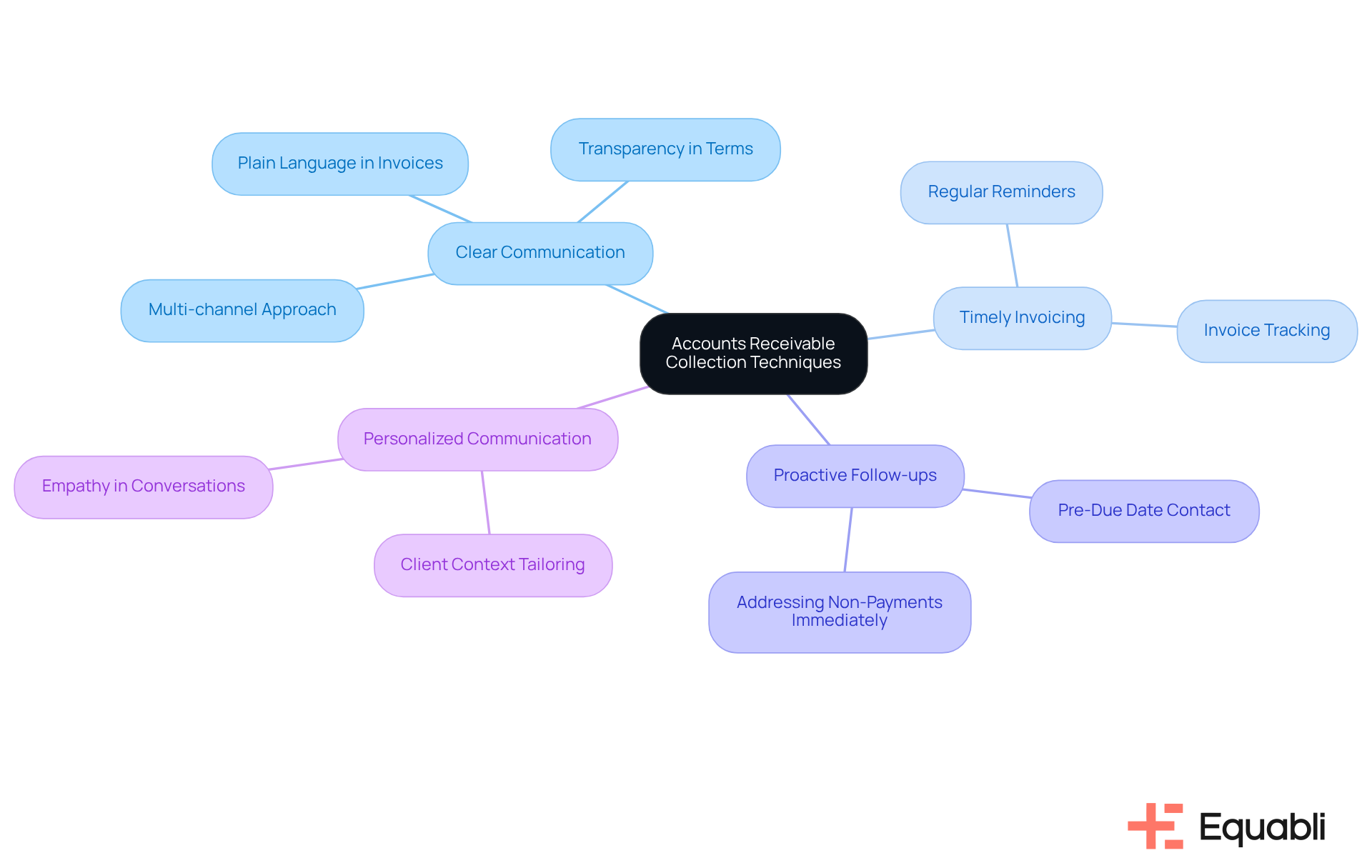

Efficient accounts receivable management collection agency solutions for financial institutions hinge on clear communication, a principle underscored by Allianz Trade's insights into recovery techniques. Timely invoicing and proactive follow-ups are essential strategies that facilitate swift transactions and mitigate the risk of bad debt. Evidence indicates that utilizing clients' preferred communication channels significantly enhances the likelihood of timely responses, thereby improving overall collection efforts. For instance, businesses employing a multi-channel approach can increase customer engagement by up to 230%, illustrating the vital role of clear communication in effectively reaching borrowers at the appropriate moment.

Numerous successful instances demonstrate how clear communication has directly improved transaction timeliness. By explicitly outlining financial terms and expectations, organizations can avert misunderstandings that often precipitate disputes. Furthermore, personalized communication tailored to individual client contexts fosters cooperation, reflecting attentiveness and consideration from debt recovery agents. As highlighted in a pertinent case study, businesses that adopt personalized communication strategies experience a notable enhancement in client responses, further affirming the significance of clear communication.

As Ryan Howard aptly states, 'Clear and honest communication helps to demystify the debt recovery process, reducing any anxiety or confusion the client may have.' This perspective emphasizes the importance of transparency in cultivating trust, which is critical in the debt recovery process. When clients are well-informed about their options and the collections process, they are more inclined to engage positively, ultimately leading to improved payment outcomes.

Conclusion

The landscape of accounts receivable management for financial institutions is undergoing significant transformation, primarily driven by the imperative for efficiency and improved customer engagement. By leveraging innovative solutions such as Equabli's EQ Suite, organizations can convert their debt recovery processes into intelligent, data-driven operations. This not only streamlines workflows but also enhances borrower experiences. Embracing these modern strategies is essential for financial institutions that seek to maintain a competitive edge and remain responsive to evolving market demands.

Throughout the article, various solutions and strategies have been examined, underscoring the critical role of automation, predictive analytics, and effective communication in optimizing accounts receivable management. From Equabli's comprehensive suite of tools to Bill Gosling's innovative methodologies, each solution presents distinct advantages that contribute to enhanced cash flow and reduced days sales outstanding (DSO). The focus on personalized communication and multi-channel engagement further highlights the vital importance of customer relationships in successful receivables management.

As the accounts receivable automation market continues to expand, it is imperative for financial institutions to prioritize the integration of these advanced solutions to cultivate agility and resilience. The insights presented herein serve as a call to action for organizations to reassess their current practices and invest in technologies that bolster operational efficiency and customer satisfaction. By adopting these best practices, financial institutions can not only mitigate risks associated with late payments but also lay the groundwork for sustainable growth and improved financial health.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a toolset designed for optimizing accounts receivable management and collection agency solutions for financial institutions. It includes components like EQ Engine, EQ Engage, and EQ Collect.

What does the EQ Engine do?

The EQ Engine utilizes custom scoring models to predict repayment behaviors, helping organizations assess the likelihood of repayment from borrowers.

How does EQ Engage enhance borrower experiences?

EQ Engage enhances borrower experiences by providing personalized communication journeys and self-service repayment options, which increase engagement and lower collection costs.

What are the features of EQ Collect?

EQ Collect streamlines vendor onboarding with a no-code file-mapping tool, boosts efficiency through data-driven strategies, reduces execution errors via automated workflows, and offers real-time reporting for transparency and compliance oversight.

Why is automation important in accounts receivable management?

The automation market for outstanding payments is projected to grow significantly, making it essential for organizations to adopt digital-first engagement strategies to stay competitive. Automation can also decrease dispute resolution times and improve overall efficiency.

How does Bill Gosling Outsourcing enhance financial management?

Bill Gosling Outsourcing enhances financial management by leveraging omnichannel communication and data analytics to improve customer interactions and refine retrieval processes, ultimately optimizing cash flow and reducing days sales outstanding (DSO).

What role does predictive analytics play in accounts receivable management?

Predictive analytics significantly enhances cash flow forecasting accuracy, facilitating improved financial planning within accounts receivable management solutions.

How does Equabli's approach to accounts receivable management differ from traditional methods?

Equabli modernizes traditional debt recovery methods by automating processes, expediting payments, and fostering robust customer relationships, transitioning from manual to data-driven approaches for greater efficacy.

What benefits do automated invoice reminders provide?

Automated invoice reminders enhance visibility into payment statuses and reduce the time spent on follow-ups, allowing finance teams to focus on strategic initiatives that drive revenue growth.