Overview

The article examines advanced credit risk technology solutions for financial institutions, underscoring various tools that enhance debt recovery and risk management processes. It points to the significance of data-driven strategies, automation, and predictive analytics in bolstering borrower engagement, minimizing default rates, and optimizing operational efficiency. These advancements position financial organizations for success within a competitive landscape, ultimately reinforcing the necessity for strategic implementation in enterprise-level debt collection and risk management.

Introduction

In an era where financial institutions confront mounting pressure to mitigate risks while optimizing operations, the integration of advanced credit risk technology solutions has emerged as a critical necessity. This article examines ten innovative tools that not only enhance risk assessment but also streamline debt recovery processes, thereby providing organizations with a competitive advantage. However, with a plethora of options available, how can institutions effectively identify which technologies will genuinely transform their credit management strategies and foster improved borrower relationships?

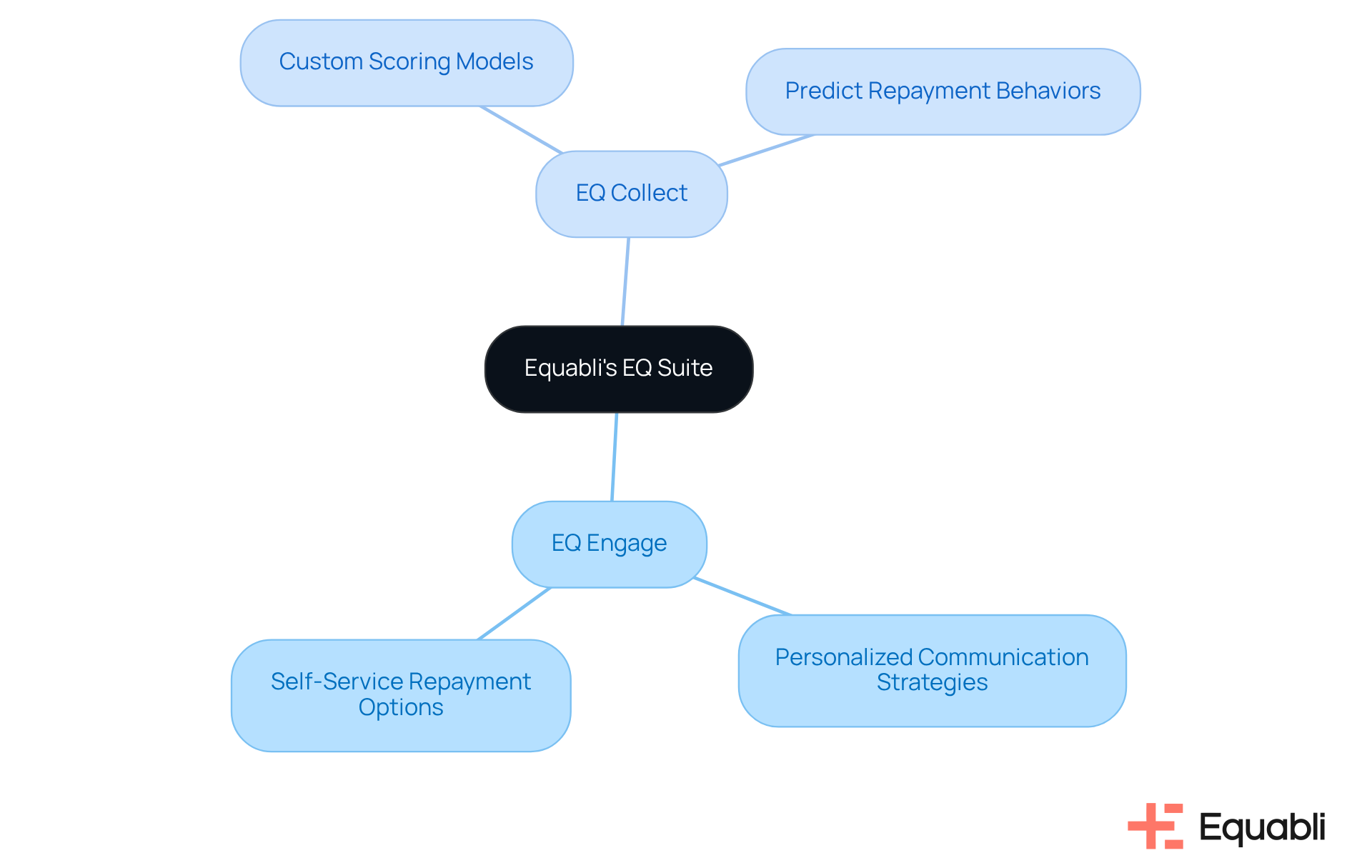

Equabli's EQ Suite: Intelligent Solutions for Data-Driven Recovery

Equabli's EQ Suite represents a strategic advancement in optimizing debt recovery through intelligent, data-driven solutions. Central to this suite are tools such as EQ Engage and EQ Collect, which empower banks to implement personalized communication strategies and offer self-service repayment options. By leveraging custom scoring models, organizations can accurately predict repayment behaviors, thereby enhancing collection strategies and significantly improving borrower engagement. This suite not only streamlines operational processes but also ensures compliance with regulatory standards, establishing it as a vital asset for modern lenders and agencies navigating the complexities of debt recovery.

Gaviti: Top Credit Risk Management Tools for Enhanced Assessment

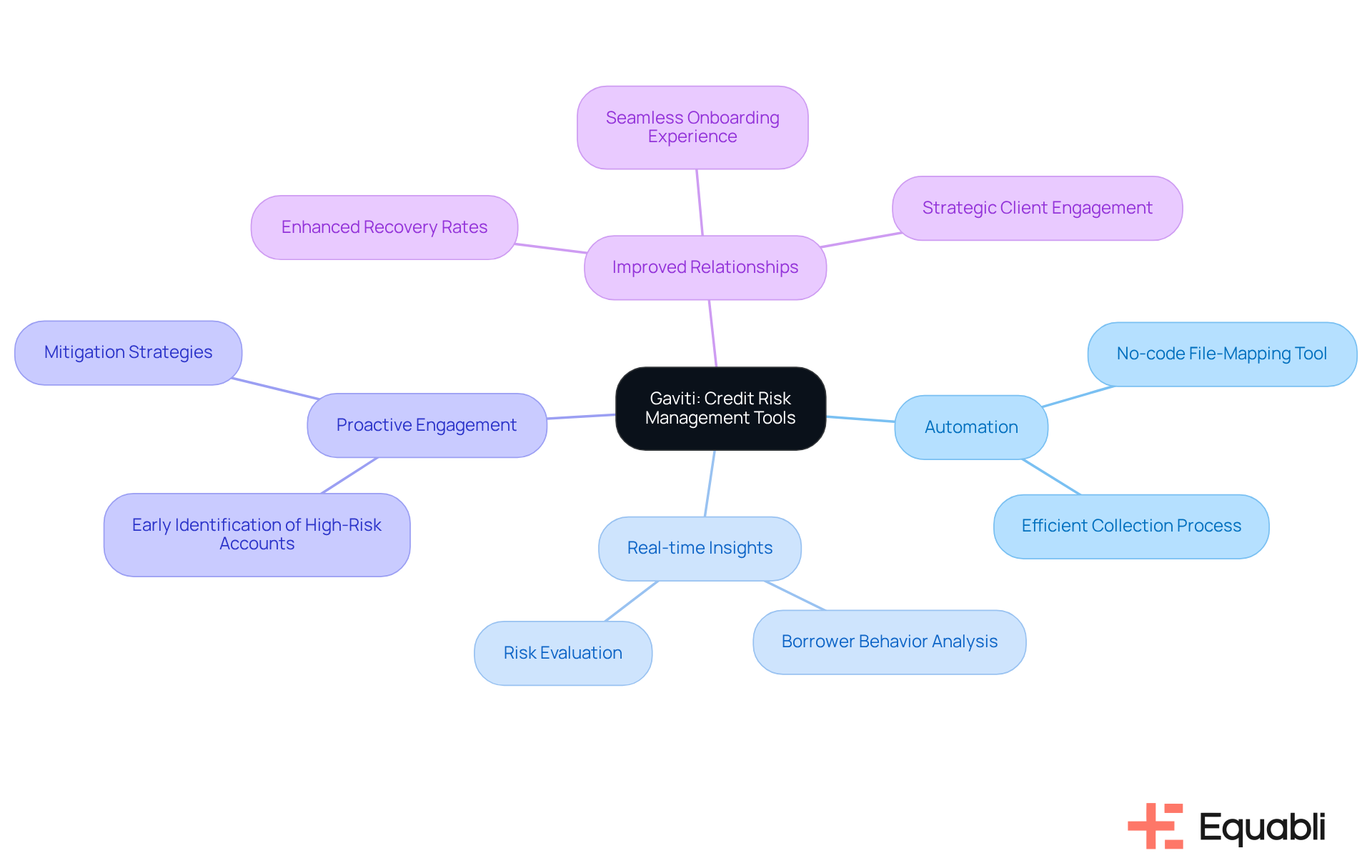

Equabli provides advanced credit risk technology solutions for financial institutions that offer a suite of tools designed for managing loan hazards, enabling organizations to evaluate and control uncertainties with greater efficiency. Their solutions emphasize automation in the collection process, delivering real-time insights into borrower behavior.

By utilizing advanced credit risk technology solutions for financial institutions alongside the EQ Collect platform—characterized by its user-friendly, scalable, cloud-native interface and a no-code file-mapping tool—Equabli empowers organizations to identify high-risk accounts early. This proactive approach facilitates engagement strategies that effectively mitigate potential losses.

Furthermore, the platform not only enhances recovery rates but also fosters improved relationships with borrowers, ensuring a seamless onboarding experience and promoting product adoption through strategic client engagement.

ACTICO: Automation Solutions for Efficient Credit Risk Management

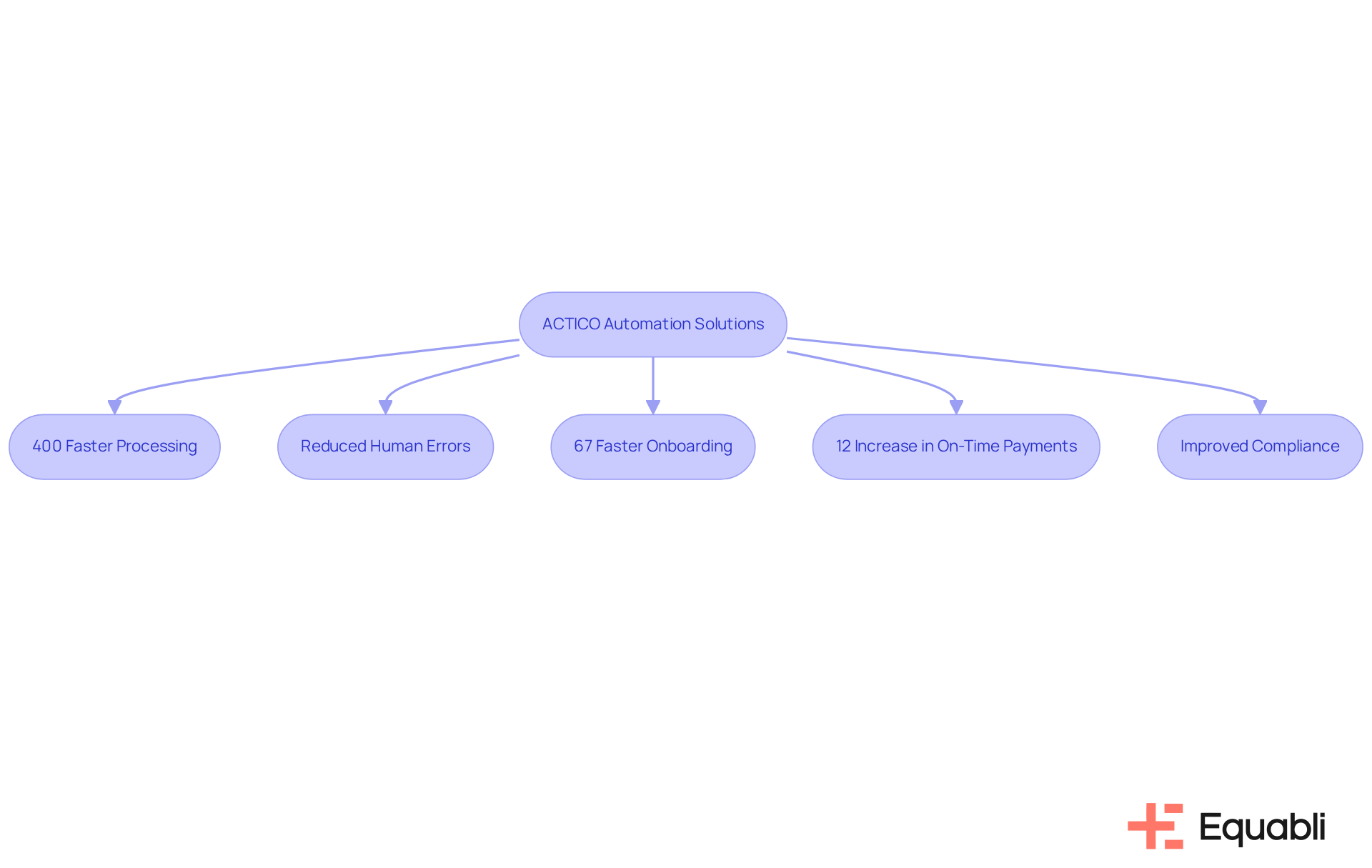

ACTICO provides advanced credit risk technology solutions for financial institutions that significantly enhance risk management processes. By leveraging ACTICO's platform, organizations can automate decision-making, drastically reducing the time and resources traditionally allocated to manual assessments. This transformation accelerates the evaluation process—automated systems can process applications 400% faster than traditional methods—while ensuring consistent application of lending policies, thus improving compliance and operational efficiency.

For instance, organizations utilizing ACTICO's tools have reported processing loan applications in minutes rather than days, which leads to a notable increase in responsiveness to market demands. Furthermore, automation minimizes human errors, resulting in more accurate assessments, as these systems are designed to ensure fairness through regular algorithm evaluations and audits.

Industry leaders have observed that advancements in automation can facilitate a 67% faster customer onboarding experience, with one source asserting, "Their customer onboarding is 67% faster, and they make decisions in half the time," along with a 12% increase in on-time first payments. By adopting ACTICO's offerings, organizations in the finance sector not only streamline their lending evaluation procedures but also position themselves for utilizing advanced credit risk technology solutions for financial institutions in a competitive landscape.

Additionally, regulatory compliance becomes more traceable with automation compared to manual processes, further reinforcing the advantages of ACTICO's solutions. The platform's modular capabilities can be customized and expanded to address the specific operational needs of various financial institutions.

Pega: AI-Driven Analytics for Smarter Credit Risk Decisions

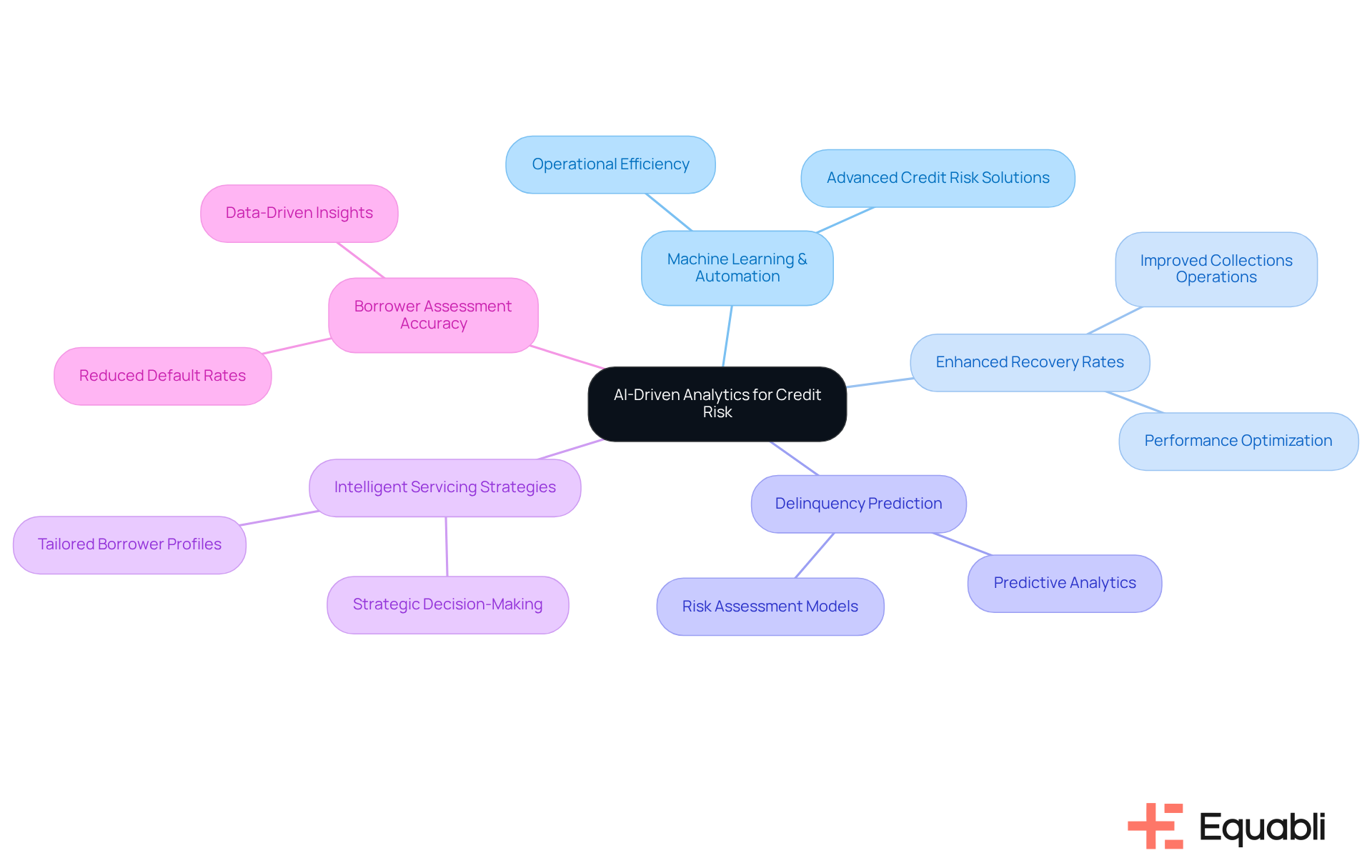

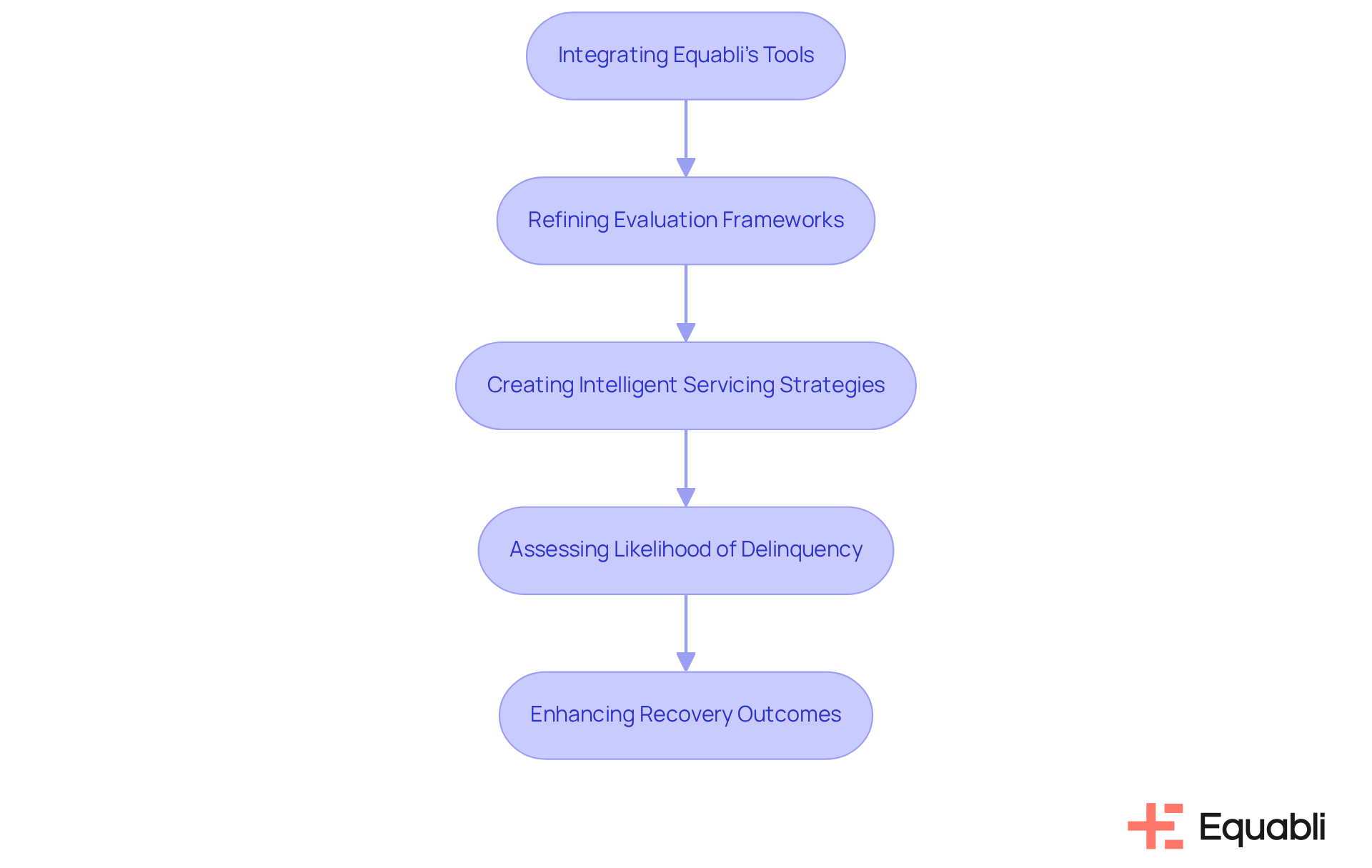

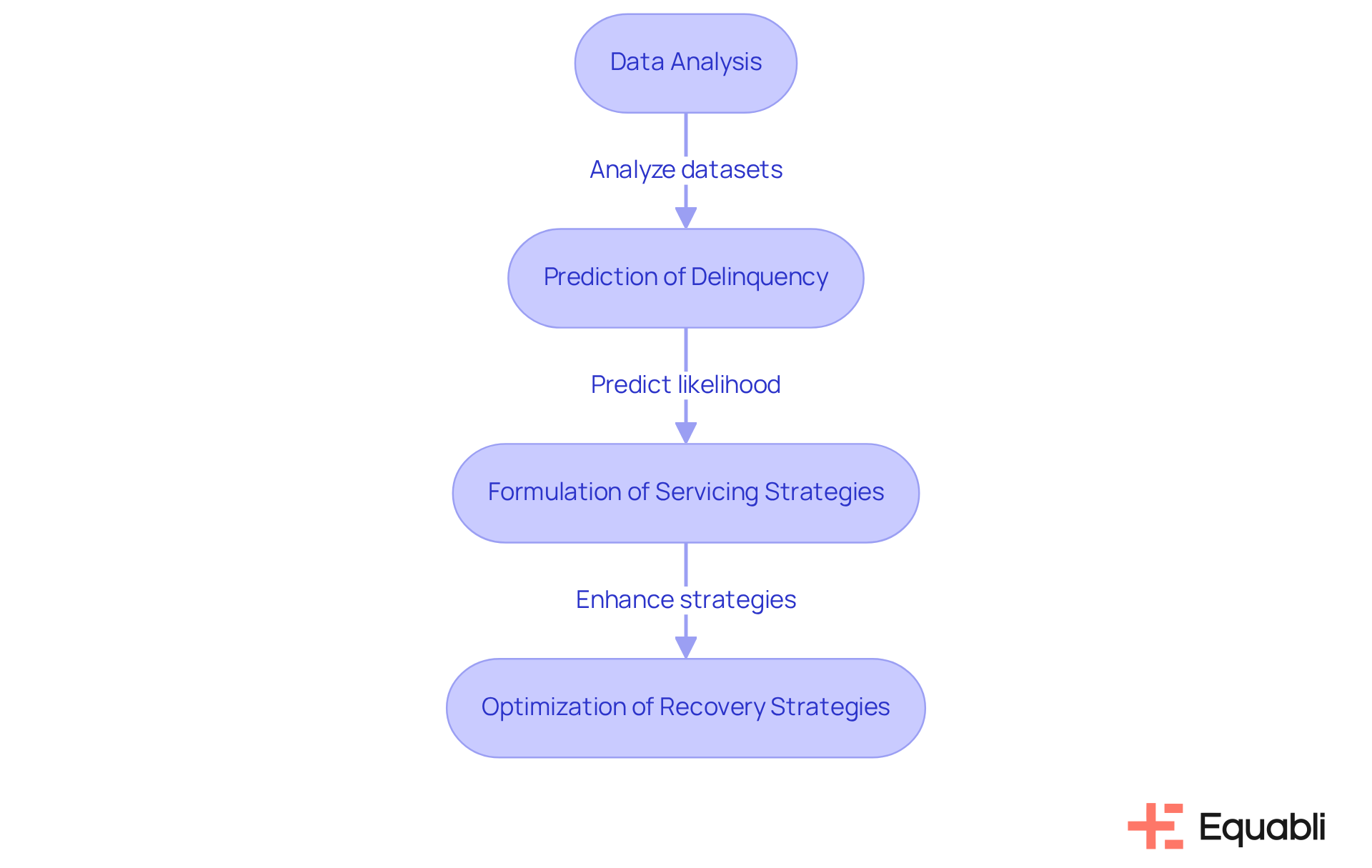

Equabli harnesses machine learning and automation to deliver profound insights into credit management by implementing advanced credit risk technology solutions for financial institutions, thereby enhancing operational efficiency throughout the debt recovery process.

By rapidly improving recovery rates and expanding collections operations without sacrificing performance, Equabli's solutions empower organizations to predict the likelihood of delinquency in active accounts.

This predictive capability enables the development of intelligent servicing strategies tailored to the unique profiles of individual borrowers.

The integration of such advanced technologies significantly enhances the accuracy of borrower assessments, leading to better decision-making and reduced default rates.

Financial organizations are encouraged to leverage Equabli's features alongside advanced credit risk technology solutions for financial institutions to stay ahead in a dynamic landscape, ensuring they meet the diverse needs of their borrowers while refining their management strategies.

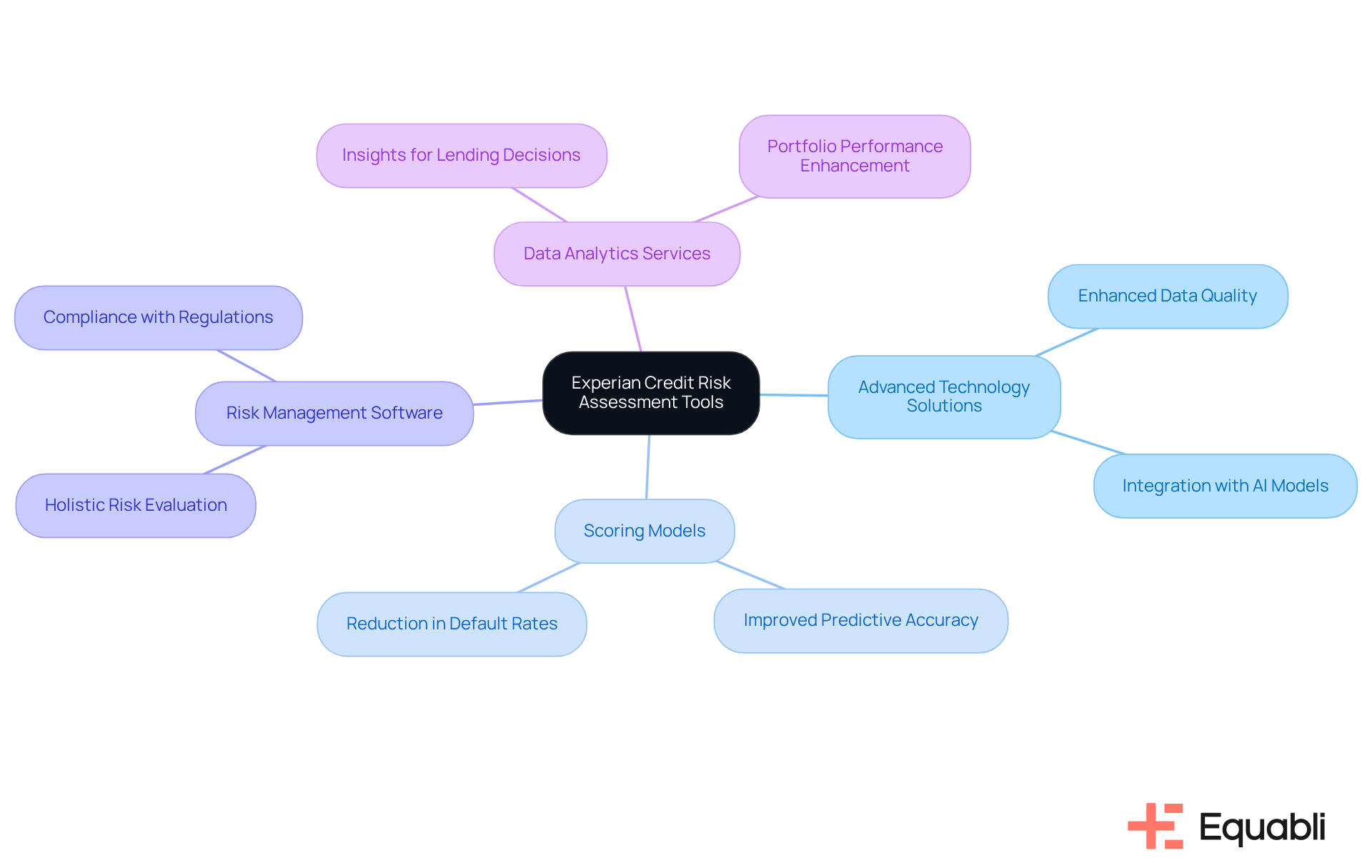

Experian: Comprehensive Tools for Informed Credit Risk Assessment

Experian offers a comprehensive suite of tools tailored for effective risk evaluations, which includes advanced credit risk technology solutions for financial institutions, advanced scoring models, risk management software, and data analytics services.

These advanced credit risk technology solutions for financial institutions empower financial organizations to accurately assess borrower creditworthiness by leveraging reliable data that informs lending decisions.

Evidence suggests that integrating Experian's tools can lead to a substantial reduction in default rates, thereby enhancing overall portfolio performance.

Organizations utilizing Experian's scoring models have reported significant decreases in default rates, underscoring the critical role of data-driven insights in refining lending strategies.

As financial institutions increasingly adopt advanced credit risk technology solutions for financial institutions, the emphasis on reliable data becomes paramount.

Industry experts indicate that sound lending decisions hinge on the quality of available information.

This holistic approach equips organizations with the insights necessary to navigate the complexities of financial exposure effectively.

Numerix: Quantitative Analytics for Accurate Credit Risk Modeling

Equabli demonstrates a strong capability in quantitative analytics, offering advanced credit risk technology solutions for financial institutions to develop precise lending assessment models. The EQ Engine leverages advanced predictive features to assess the likelihood of delinquency in active accounts. This capability facilitates the creation of intelligent servicing strategies that enhance operational efficiency and reduce roll-rates.

By integrating Equabli's tools, organizations can refine their evaluation frameworks with advanced credit risk technology solutions for financial institutions, resulting in more reliable credit assessments and informed decision-making. This emphasis on predictive threat evaluation is vital for organizations seeking to mitigate exposure and optimize returns within their lending portfolios.

Current trends reveal an increasing dependence on data-driven strategies, highlighting the essential role of predictive analytics in comprehending borrower behavior and enhancing recovery outcomes. Financial organizations can implement these strategies by systematically assessing the effectiveness of communication channels and adjusting servicing methods accordingly.

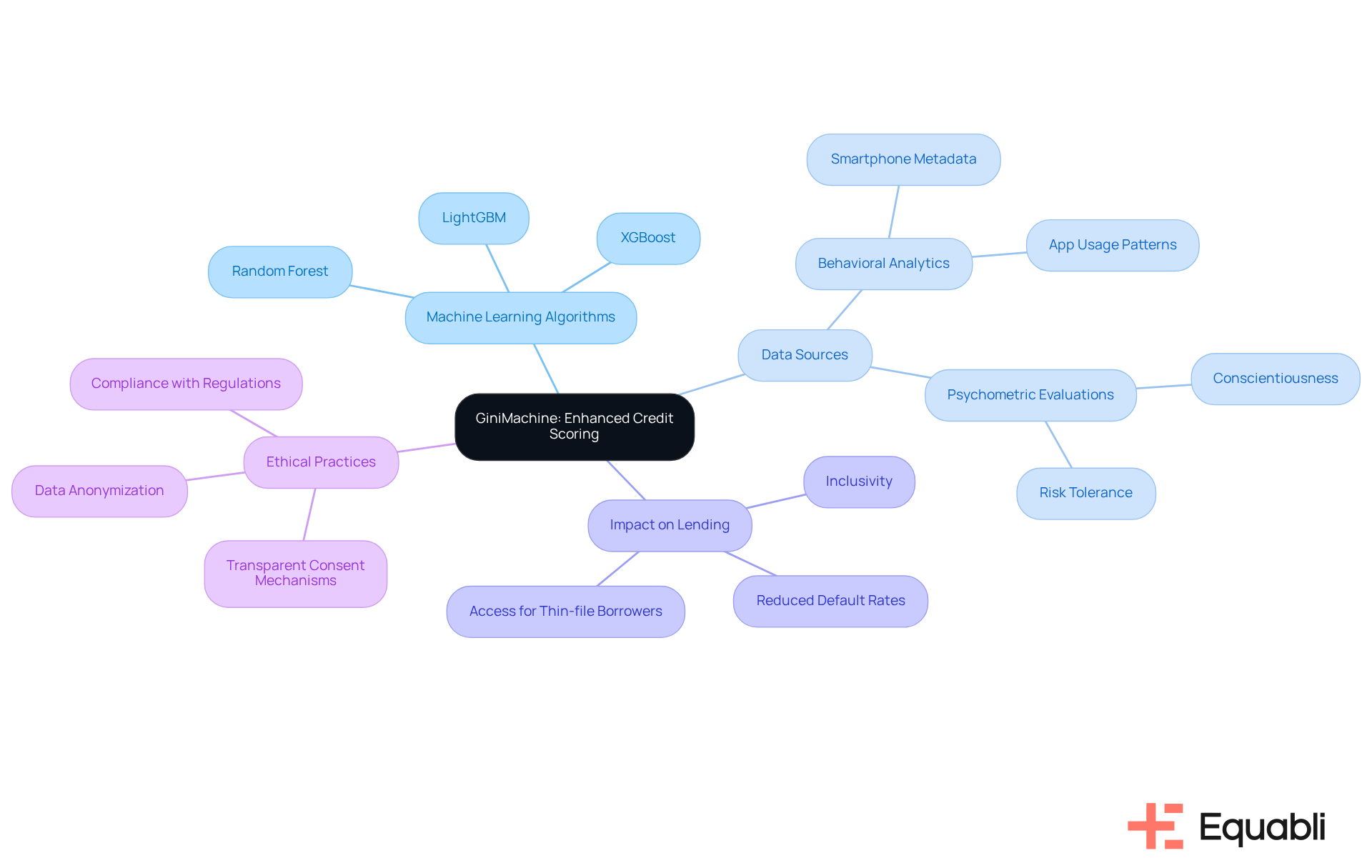

GiniMachine: Machine Learning for Enhanced Credit Scoring Models

GiniMachine leverages advanced machine learning algorithms to revolutionize scoring models, enabling financial entities to achieve a more precise assessment of borrower uncertainty. By scrutinizing a broad array of data points—including behavioral analytics and non-traditional data sources—GiniMachine's technology reveals patterns frequently overlooked by traditional scoring methods. This innovative methodology empowers organizations to make informed lending decisions, thereby significantly lowering default rates and improving overall portfolio performance.

Furthermore, GiniMachine facilitates more equitable and customized lending conditions for thin-file and first-time borrowers, expanding access to financing while mitigating risk. The integration of behavioral data and psychometric evaluations highlights the critical importance of ethical data practices in contemporary lending.

As industry leaders assert, the implementation of advanced credit risk technology solutions for financial institutions in scoring signifies a pivotal transformation for organizations aiming to modernize their evaluation processes, fostering inclusivity and enhancing financing access for underserved communities.

Defi Solutions: Automation for Streamlined Credit Risk Management

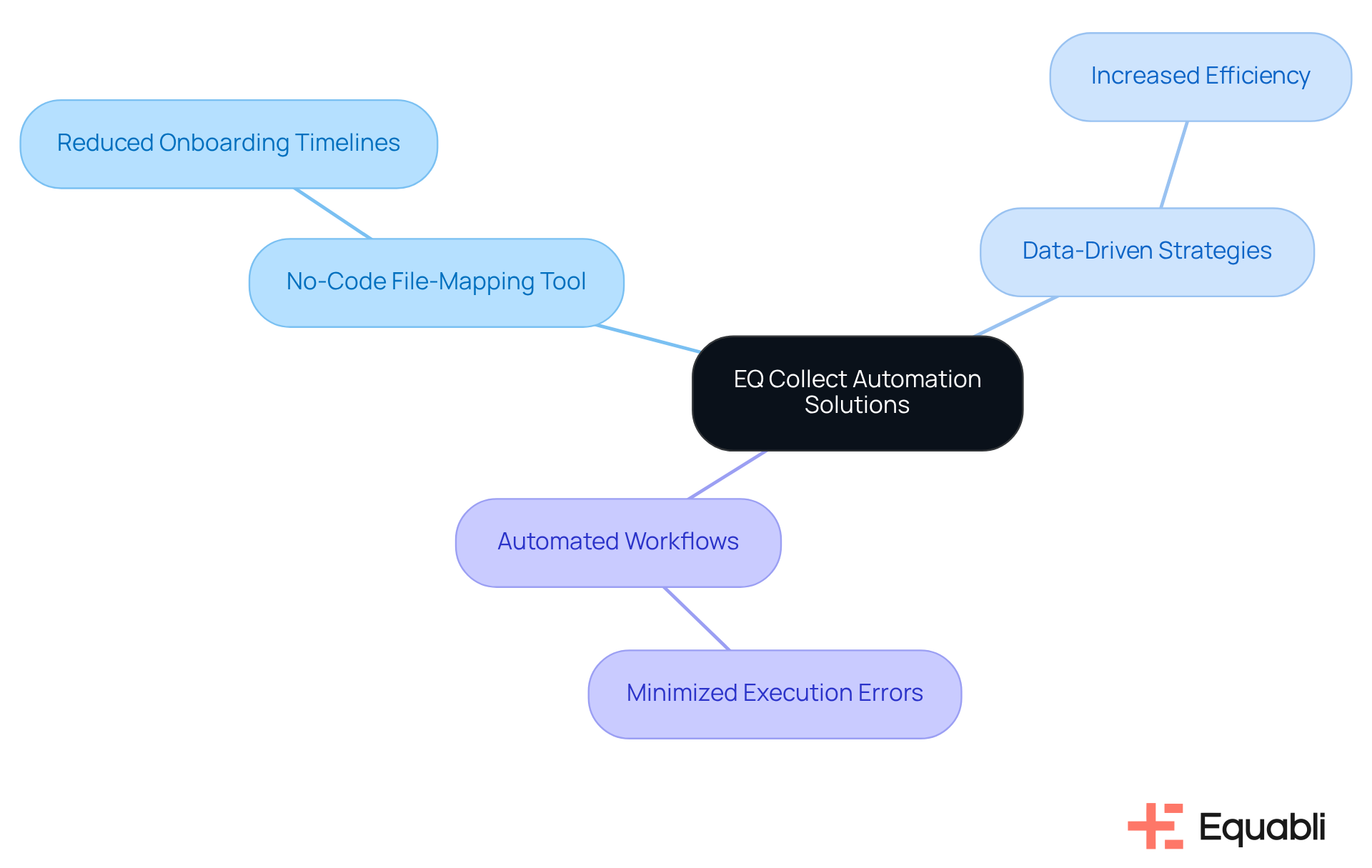

Equabli provides advanced automation solutions that significantly enhance financial management processes for organizations. The EQ Collect platform automates routine tasks, enabling organizations to redirect their focus from manual data entry to strategic decision-making. Notable features include:

- A no-code file-mapping tool that reduces vendor onboarding timelines

- Data-driven strategies that increase efficiency

- Automated workflows that minimize execution errors

These capabilities empower organizations to enhance the accuracy of their credit assessments, reduce costs, and improve operational effectiveness by utilizing advanced credit risk technology solutions for financial institutions. This automation accelerates the risk evaluation process while ensuring compliance with regulatory standards through industry-leading oversight and automated monitoring, thereby providing advanced credit risk technology solutions for financial institutions.

Furthermore, the user-friendly, scalable, cloud-native interface of EQ Collect facilitates seamless operations for banks. Financial experts assert that leveraging technology is essential for achieving comprehensive, end-to-end financing solutions. Recent data reveals that financial organizations utilizing EQ Collect are realizing significant improvements in their operational efficiency, thereby positioning themselves favorably in a competitive marketplace.

Squirro: AI and Data Analytics for Improved Credit Risk Insights

Equabli utilizes AI and data analysis to provide advanced credit risk technology solutions for financial institutions, enabling them to gain a deeper understanding of credit challenges. Their EQ Engine analyzes extensive datasets to predict the likelihood of delinquency in active accounts. This capability enables organizations to formulate effective servicing strategies that enhance operational efficiency and reduce roll rates.

By harnessing Equabli's predictive insights across various communication channels, organizations can refine their risk assessment processes using advanced credit risk technology solutions for financial institutions, leading to more accurate evaluations and informed lending strategies. This focus on AI-driven insights is critical for organizations striving to optimize recovery strategies through net present value (NPV) optimization and account-level lifetime value analysis, particularly in a rapidly evolving economic landscape.

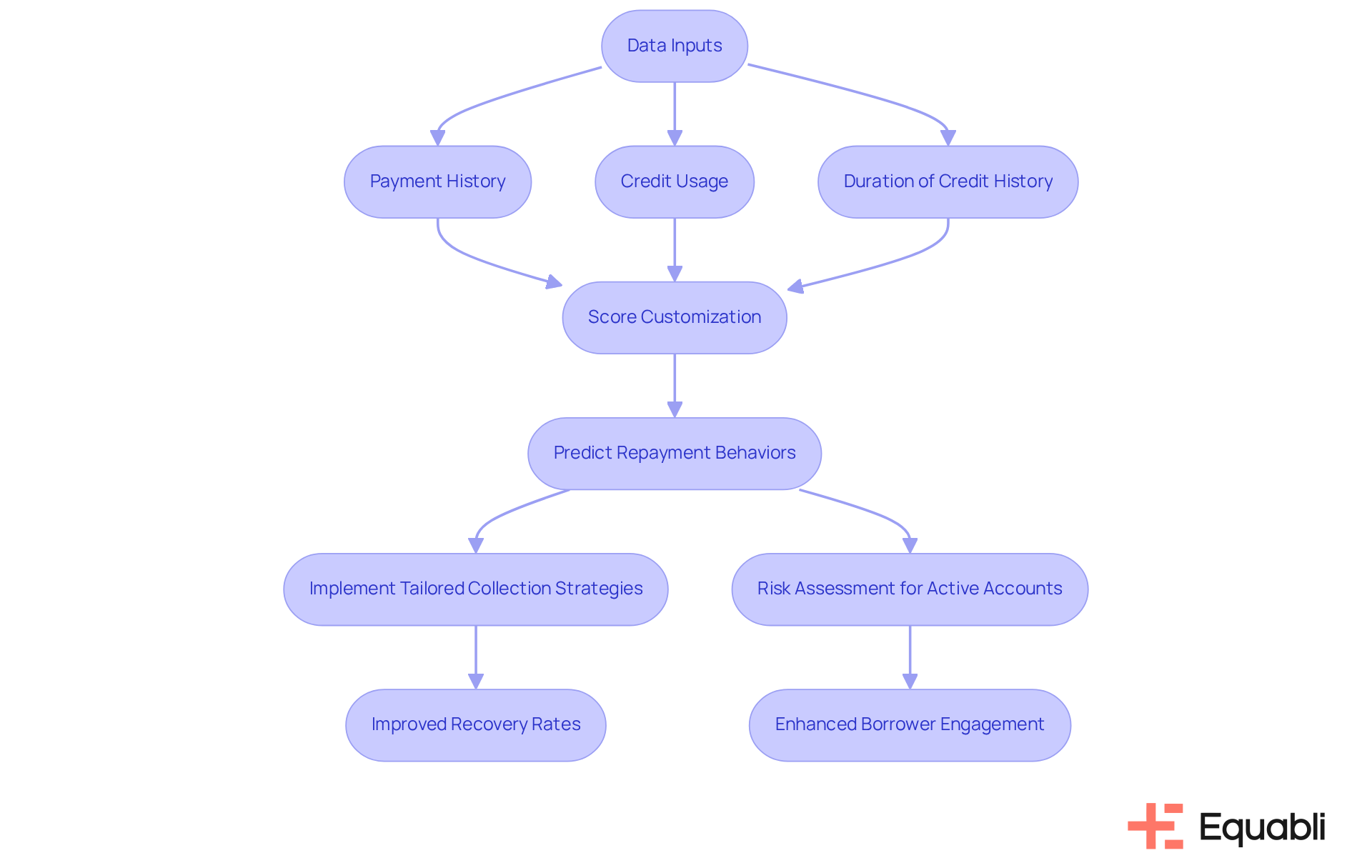

EQ Engine: Customizable Scoring Models for Predicting Repayment Behaviors

The EQ Engine represents a significant advancement for financial institutions, facilitating the creation of customizable scoring models that effectively predict repayment behaviors. By analyzing a comprehensive range of data inputs—such as payment history, credit usage, and the duration of credit history—the EQ Engine identifies borrowers with the highest likelihood of repayment. This capability allows organizations to implement tailored collection strategies. The predictive analytics not only improve recovery rates but also foster enhanced borrower engagement through personalized repayment plans. Additionally, the EQ Engine conducts risk assessments for active accounts, which is crucial for developing intelligent servicing strategies. As financial institutions increasingly embrace advanced credit risk technology solutions for financial institutions, the EQ Engine emerges as a critical tool in transforming debt collection processes, ultimately yielding improved outcomes for both lenders and borrowers.

Conclusion

The landscape of credit risk management is rapidly evolving, propelled by advanced technology solutions that enable financial institutions to navigate complexities with enhanced precision. By adopting these innovations, organizations can significantly improve their assessment processes, elevate borrower engagement, and effectively mitigate risks associated with lending.

This article has explored various advanced credit risk technology solutions, such as Equabli's EQ Suite, Gaviti's management tools, and ACTICO's automation capabilities. Each solution presents unique features, including:

- Predictive analytics

- Customized scoring models

- AI-driven insights

These features are all designed to streamline operations and enhance decision-making. These tools not only bolster recovery rates but also cultivate stronger relationships between lenders and borrowers, paving the way for more informed lending strategies.

As financial institutions increasingly embrace these cutting-edge technologies, the significance of data-driven decision-making becomes paramount. Organizations are urged to leverage these advanced credit risk solutions to maintain competitiveness and responsiveness in a dynamic market. By prioritizing innovation and adopting a proactive approach to credit risk management, financial entities can solidify their position in the industry while ensuring equitable access to financing for all borrowers.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a strategic advancement in optimizing debt recovery through intelligent, data-driven solutions, featuring tools like EQ Engage and EQ Collect that enable personalized communication strategies and self-service repayment options for banks.

How does EQ Suite enhance debt recovery?

The EQ Suite enhances debt recovery by leveraging custom scoring models to accurately predict repayment behaviors, improving collection strategies and borrower engagement while streamlining operational processes and ensuring regulatory compliance.

What tools does Equabli provide for credit risk management?

Equabli provides advanced credit risk technology solutions that include a suite of tools designed for managing loan hazards, allowing organizations to evaluate and control uncertainties more efficiently, with an emphasis on automation and real-time insights into borrower behavior.

How does the EQ Collect platform assist organizations?

The EQ Collect platform offers a user-friendly, scalable, cloud-native interface and a no-code file-mapping tool, empowering organizations to identify high-risk accounts early and implement effective engagement strategies to mitigate potential losses.

What benefits does ACTICO offer for credit risk management?

ACTICO provides advanced credit risk technology solutions that automate decision-making, significantly reducing the time and resources needed for manual assessments, and accelerating the evaluation process by processing applications up to 400% faster.

How does automation with ACTICO improve compliance and efficiency?

Automation with ACTICO ensures consistent application of lending policies, minimizes human errors, and enhances regulatory compliance, making the process more traceable compared to manual methods.

What impact does ACTICO's automation have on customer onboarding?

Organizations using ACTICO's tools have reported a 67% faster customer onboarding experience and a 12% increase in on-time first payments, significantly improving responsiveness to market demands.

Can ACTICO's solutions be customized for different financial institutions?

Yes, ACTICO's platform features modular capabilities that can be customized and expanded to meet the specific operational needs of various financial institutions.