Overview

The article presents an authoritative overview of advanced credit scoring platform solutions tailored for financial institutions, emphasizing ten innovative tools that significantly enhance decision-making and risk management in lending. Each solution, including Equabli's EQ Suite and Dataiku, leverages sophisticated data analysis and machine learning techniques, which improve scoring accuracy, operational efficiency, and borrower engagement. This strategic approach effectively addresses the evolving needs of the financial sector, ensuring compliance and operational excellence.

Introduction

The landscape of credit scoring is undergoing significant transformation, propelled by advancements in technology and data analytics. Financial institutions now have access to a multitude of innovative solutions aimed at enhancing their credit assessment processes and improving lending outcomes. This article examines ten cutting-edge credit scoring platform solutions that enable organizations to refine their strategies, mitigate risks, and foster greater borrower engagement. As the demand for more accurate and inclusive credit evaluations intensifies, it is imperative to consider how these advanced tools can reshape the future of lending and ensure that no potential borrower is overlooked.

Equabli's EQ Suite: Intelligent Solutions for Data-Driven Credit Scoring

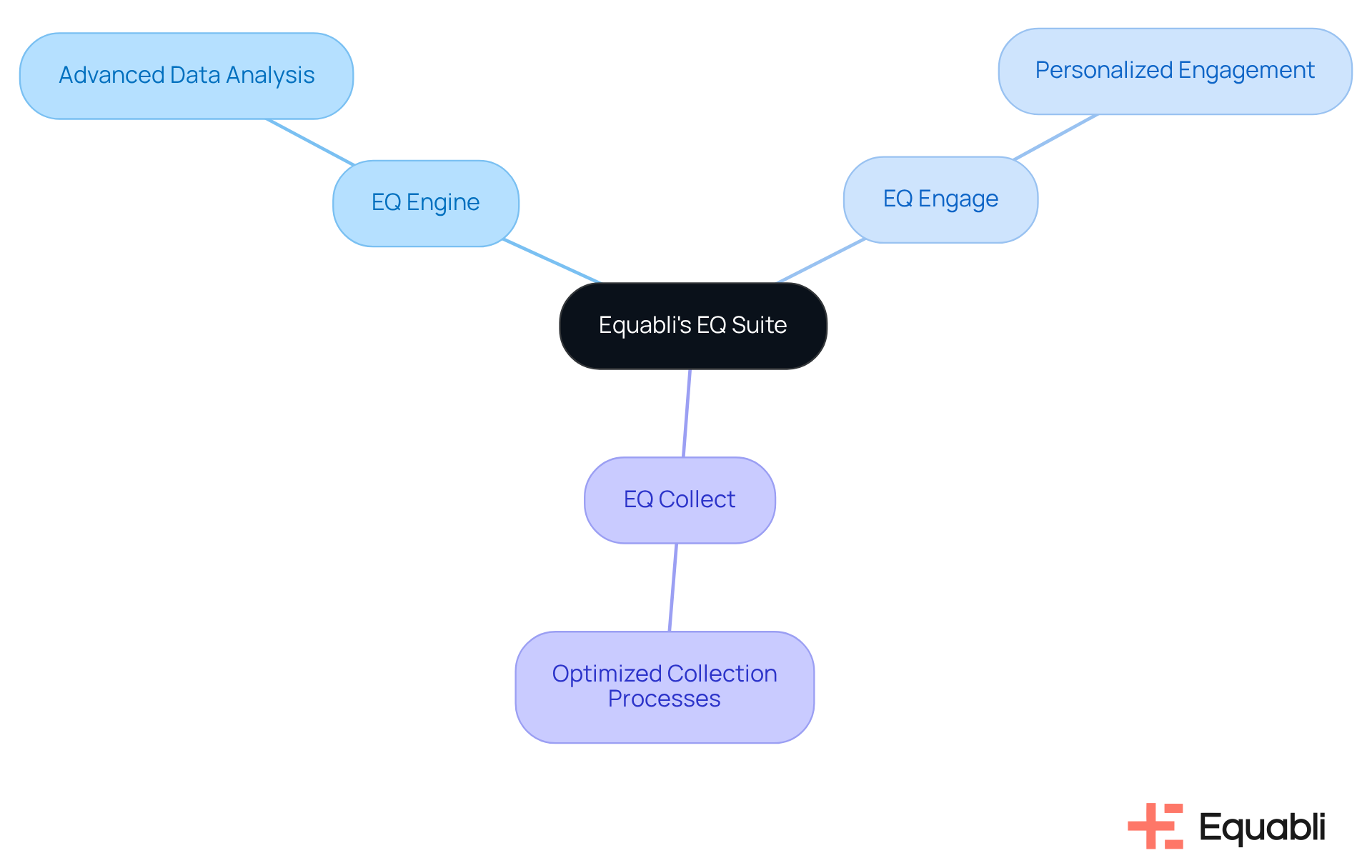

Equabli's EQ Suite offers advanced credit scoring platform solutions for financial institutions, representing a significant advancement through intelligent data analysis. This suite includes components such as:

- EQ Engine

- EQ Engage

- EQ Collect

These components provide advanced credit scoring platform solutions for financial institutions that enable monetary organizations to create tailored scoring models which accurately forecast repayment behaviors. By optimizing the collection process, the suite enhances operational efficiency and fosters greater borrower engagement.

It utilizes preferred communication channels, promoting a personalized debt management approach that aligns with consumers' expectations for convenience and responsiveness. As the debt collection landscape evolves, the adoption of advanced credit scoring platform solutions for financial institutions becomes critical for organizations seeking to refine their strategies and achieve improved outcomes.

Dataiku: Advanced Analytics for Enhanced Credit Scoring Decision-Making

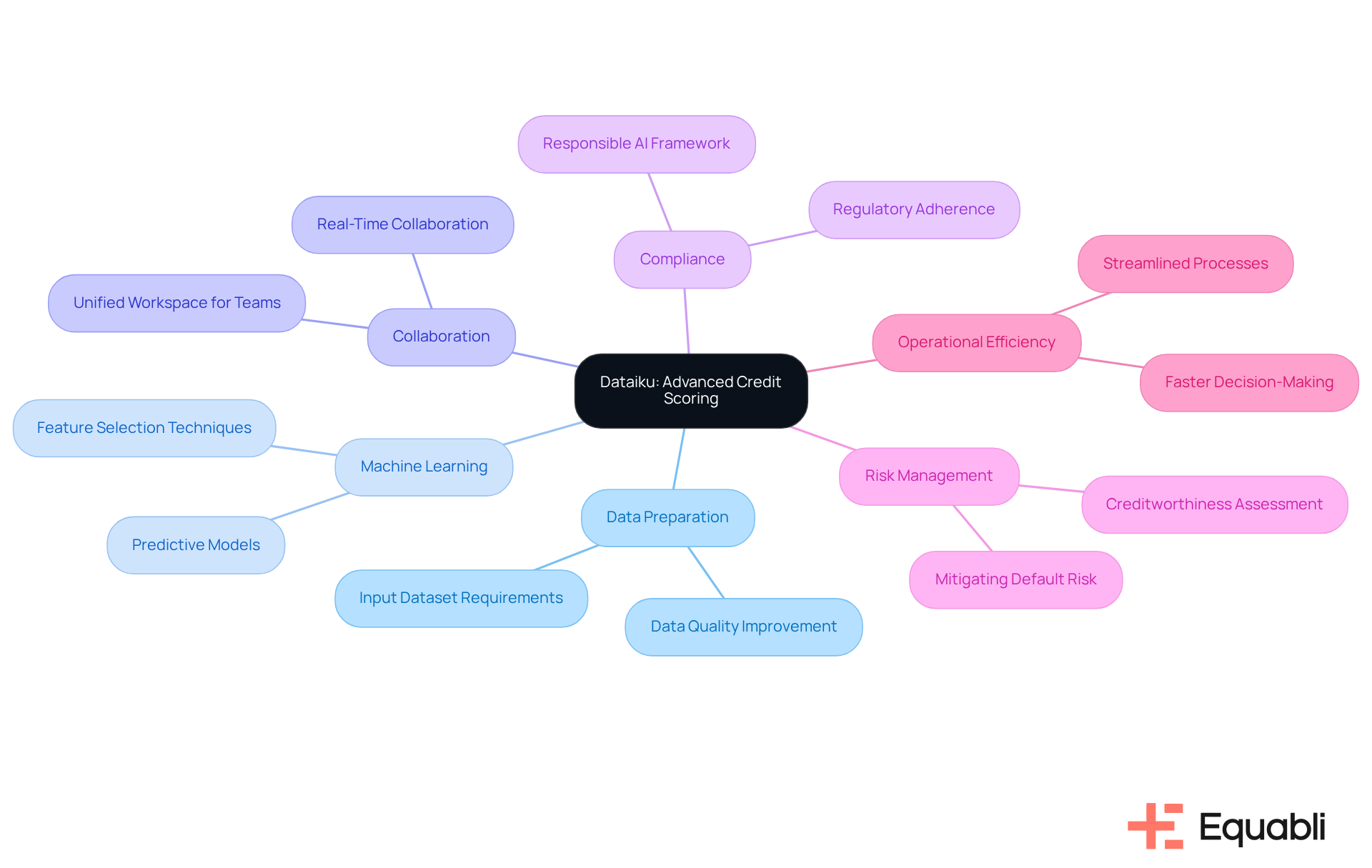

Dataiku serves as one of the advanced credit scoring platform solutions for financial institutions, enabling them to leverage their data for improved loan scoring. By offering comprehensive tools for data preparation, machine learning, and collaboration, Dataiku empowers organizations to develop predictive models that significantly enhance decision-making. This capability is particularly beneficial for institutions aiming to harness big data to refine their scoring methodologies and mitigate risk.

The platform's robust features align with the growing need for compliance and risk management in the financial sector. For instance, organizations utilizing Dataiku can streamline their processes to ensure adherence to regulatory standards while optimizing operational efficiency. By integrating advanced credit scoring platform solutions for financial institutions into their workflows, banks can better assess creditworthiness and reduce exposure to default, ultimately leading to more informed lending decisions.

In conclusion, Dataiku not only enhances scoring processes but also positions organizations to navigate the complexities of the financial landscape effectively. As the industry continues to evolve, leveraging such analytics platforms will be crucial for maintaining a competitive edge and ensuring compliance with regulatory requirements.

Experian: Comprehensive Credit Decisioning Engine for Actionable Insights

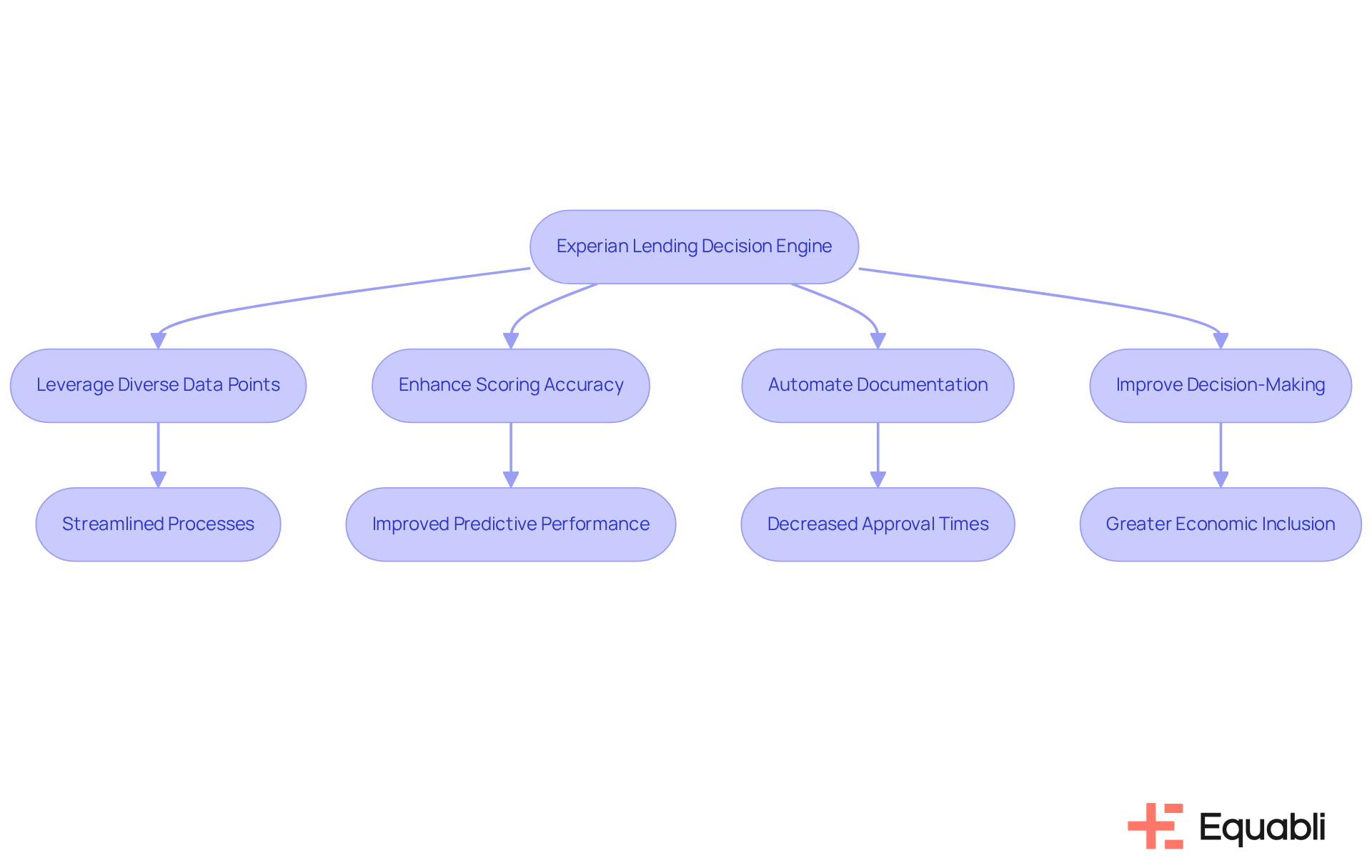

Experian's lending decision engine delivers comprehensive insights that empower organizations to make informed borrowing decisions. By leveraging a diverse array of data points, this engine enhances scoring accuracy, enabling organizations to streamline their decision-making processes while ensuring compliance with regulatory standards. For instance, Experian's Cashflow Score can yield up to a 25% improvement in predictive performance compared to traditional scoring methods, allowing lenders to more effectively assess borrower financial behavior.

Furthermore, the integration of advanced AI tools within the Experian Ascend platform automates documentation and monitoring, significantly decreasing internal approval times by as much as 70%. This advancement not only enhances auditability and transparency but also mitigates the risk of regulatory penalties, aiding organizations in meeting U.S. and U.K. regulatory requirements. Practical applications of these innovations illustrate their effectiveness; for example, the provision of free access to VantageScore 4.0 aims to broaden financing availability and facilitate homeownership opportunities for millions of consumers.

Current trends indicate a shift towards utilizing extensive data analysis to improve scoring precision, with institutions increasingly recognizing the importance of integrating cashflow insights with traditional data. As Scott Brown articulates, "We envision a future where the strength of loan information can be enhanced with cashflow insights to improve choices and ultimately include more consumers — especially those who are typically underserved — into the economic ecosystem." This holistic approach not only enhances decision-making but also fosters greater economic inclusion, ultimately benefiting both lenders and borrowers alike.

FICO: Predictive Scoring Solutions for Effective Credit Risk Management

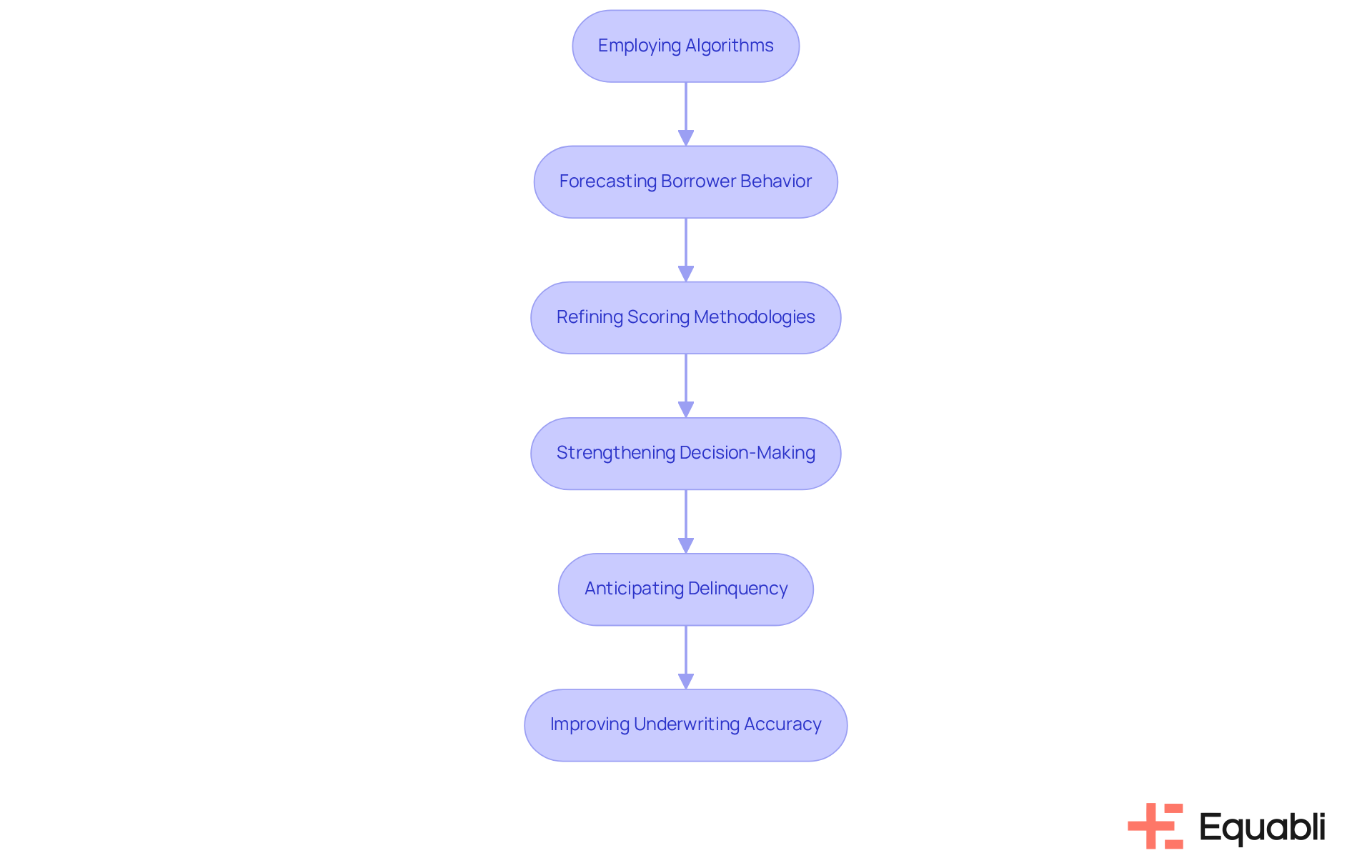

Equabli's advanced credit scoring platform solutions for financial institutions empower financial organizations to navigate lending uncertainties with precision. By employing advanced algorithms and machine learning techniques, Equabli delivers advanced credit scoring platform solutions for financial institutions to accurately forecast borrower behavior and assess associated challenges. This approach not only refines scoring methodologies but also strengthens decision-making processes in lending practices through advanced credit scoring platform solutions for financial institutions.

Financial institutions leveraging Equabli's EQ Engine can utilize advanced credit scoring platform solutions for financial institutions to anticipate the likelihood of delinquency among active accounts, allowing for the development of strategic servicing strategies that enhance operational efficiency and reduce roll-rates. Such capabilities are crucial for effectively managing the complexities of an evolving financial landscape.

Furthermore, the integration of advanced forecasting and safety management tools has significantly improved underwriting accuracy, leading to expedited lending decisions and enhanced borrower evaluations. As the economic environment continues to transform, Equabli's commitment to innovation in advanced credit scoring platform solutions for financial institutions serves as a vital resource for organizations aiming to refine their lending management strategies.

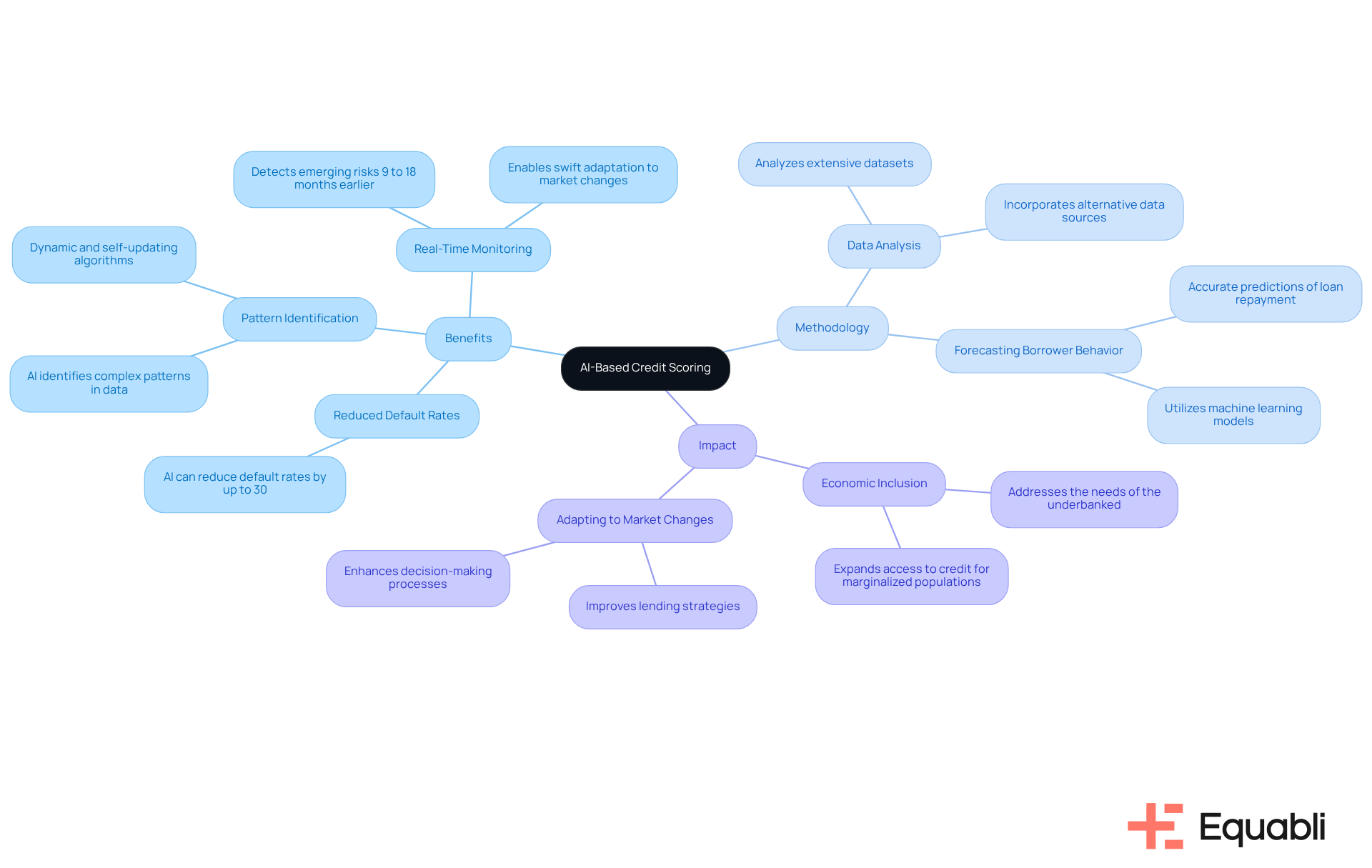

LeewayHertz: AI-Based Credit Scoring for Enhanced Risk Assessment

LeewayHertz leverages artificial intelligence to revolutionize advanced credit scoring platform solutions for financial institutions, thereby enhancing risk evaluation capabilities. Research indicates that AI-driven lending assessments can reduce overall default rates by as much as 30%, as demonstrated in a study by Lyzr. This evidences the efficacy of AI in improving financial outcomes.

By analyzing extensive datasets, their AI models identify complex patterns and accurately forecast borrower behavior. This innovative methodology empowers banking institutions to utilize advanced credit scoring platform solutions for financial institutions, enabling them to make informed lending decisions and leading to a significant reduction in default rates.

Furthermore, the integration of AI in credit evaluation allows for real-time monitoring and the timely detection of emerging threats, enabling lenders to swiftly adapt to changing market conditions. For instance, Deloitte highlights that AI systems can detect emerging risks 9 to 18 months earlier than traditional systems.

As financial organizations increasingly adopt AI technologies, they are poised to refine their lending strategies through advanced credit scoring platform solutions for financial institutions, fostering greater economic inclusion, particularly for marginalized populations.

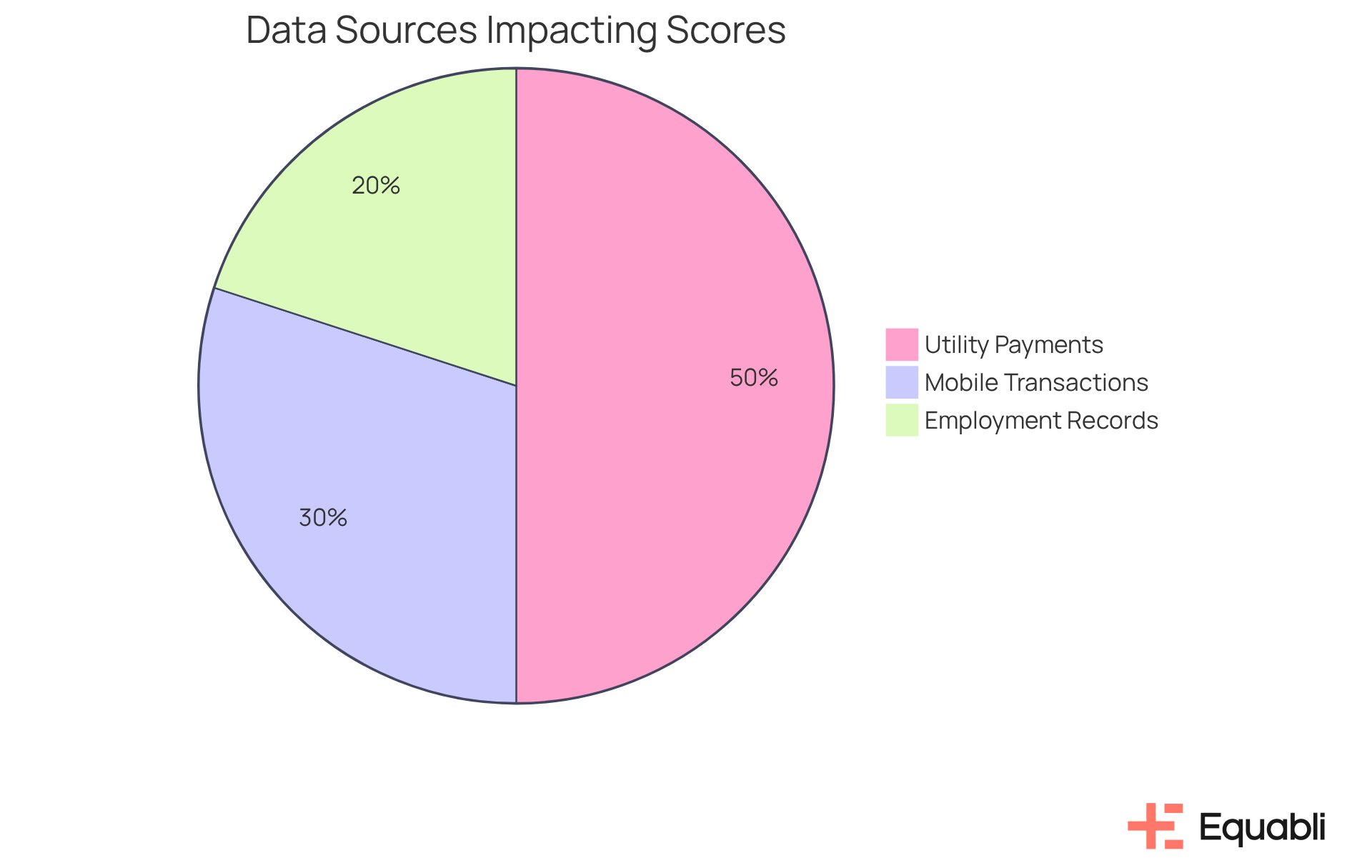

LendFoundry: Alternative Credit Scoring Solutions for Broader Borrower Access

LendFoundry offers advanced credit scoring platform solutions for financial institutions that empower lenders to evaluate borrowers without relying on conventional credit histories. By utilizing non-traditional data sources—such as utility payments, mobile transaction histories, and employment records—LendFoundry offers advanced credit scoring platform solutions for financial institutions to broaden their lending criteria.

This strategic approach enhances borrower access and fosters economic inclusion, allowing previously underserved groups to secure funding. For example, integrating utility payment histories can convert approximately 6.5 million U.S. customers from unscorable to scorable, significantly increasing their likelihood of obtaining loans. Furthermore, around 9% of unscorable consumers transitioned to scorable status, achieving an average score of 631, which underscores the effectiveness of these assessment methods.

Additionally, financial institutions that leverage alternative data and adopt advanced credit scoring platform solutions for financial institutions report an average scoring increase of 40 points, further validating the impact of LendFoundry's solutions. LendFoundry's commitment to expanding borrower access aligns with the evolving landscape of loan assessments, ensuring that more individuals can participate in the economic system.

U.S. Senator Tim Scott has noted that the Credit Access and Inclusion Act aims to amend the Fair Credit Reporting Act, enabling bureaus to collect payment information for rent, phone, electricity, and other ongoing obligations, thereby further enhancing access to financing through alternative data.

Moody's: Integrated Decision Tools for Effective Credit Risk Management

Moody's integrated decision tools provide financial organizations with essential resources for effective loan assessment management. By seamlessly combining quantitative analysis with qualitative insights, these tools facilitate well-informed lending decisions. This integration is vital for organizations aiming to enhance their scoring methods and effectively mitigate exposure using advanced credit scoring platform solutions for financial institutions. Advanced machine learning models, such as Gradient Boosting Machines, serve as compelling evidence of this approach, demonstrating exceptional performance in forecasting defaults. This illustrates how quantitative methods can be enriched by qualitative evaluations, forming a comprehensive profile of potential challenges.

Furthermore, Moody's Lending Suite exemplifies this synergy by optimizing underwriting procedures. This enhancement enables lenders to process a greater volume of loans while maintaining robust management practices. Clients report that processes which previously required hours now take mere minutes, underscoring the efficiency achieved through these tools. The profound impact of these integrated decision tools extends beyond operational efficiency; they significantly enhance the accuracy of financial assessments and integrate advanced credit scoring platform solutions for financial institutions, fostering a more agile response to evolving market conditions. Ultimately, this drives profitability and ensures compliance with regulatory frameworks such as Basel, IFRS 9, and CECL in lending operations.

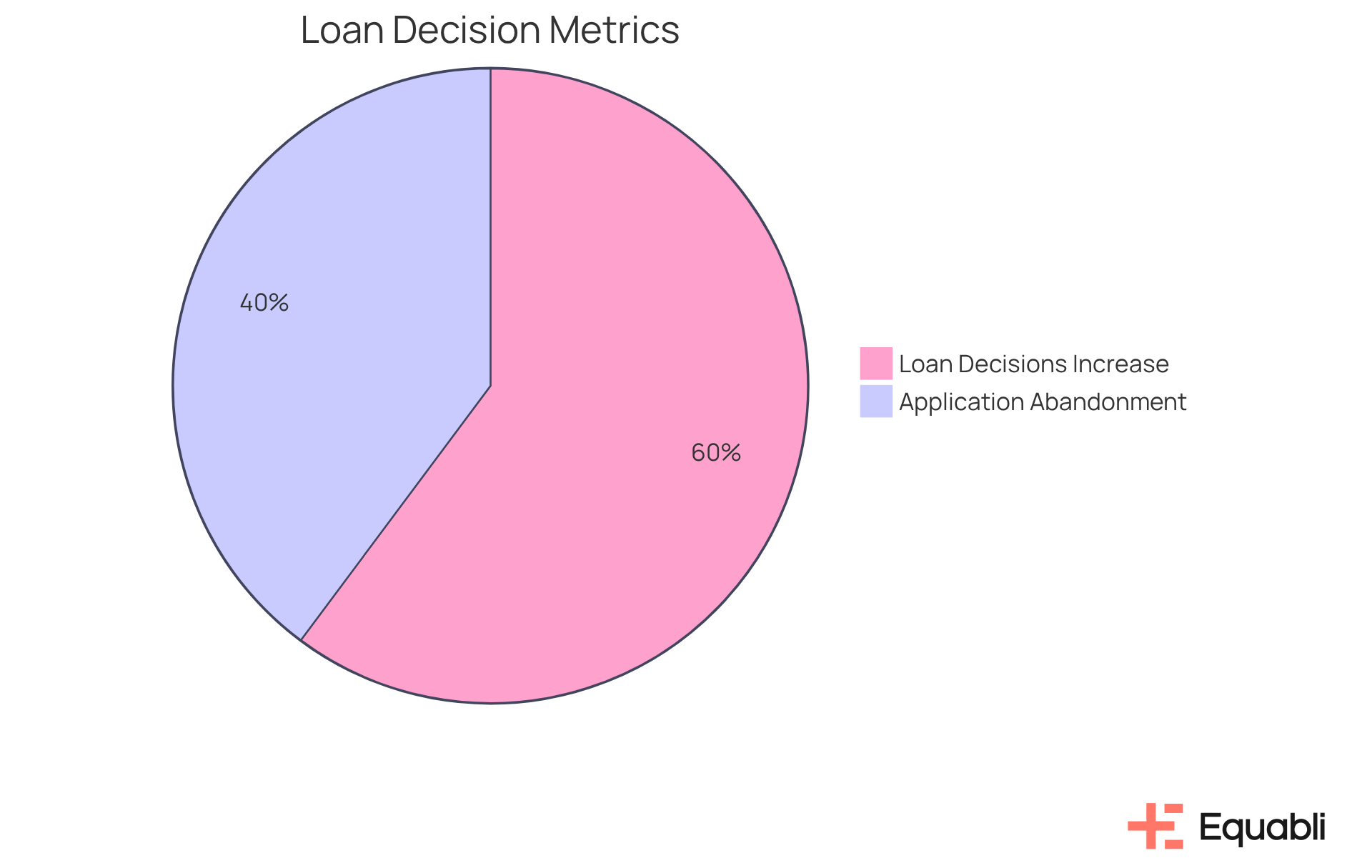

nCino: Automated Credit Risk Management Solutions for Financial Institutions

nCino provides automated loan management solutions that incorporate advanced credit scoring platform solutions for financial institutions, significantly streamlining the lending process. By automating critical tasks, nCino not only enhances operational efficiency but also reduces the risk of human error in advanced credit scoring platform solutions for financial institutions.

Evidence shows that organizations leveraging nCino's platform have experienced a:

- 62% increase in loan decisions for small businesses

- 41% decrease in application abandonment rates

This level of automation allows financial organizations to concentrate on strategic decision-making while ensuring compliance and precision in their lending practices through advanced credit scoring platform solutions for financial institutions.

Furthermore, nCino's Continuous Credit Monitoring solution proactively alerts organizations to at-risk relationships, enabling early intervention and improved risk management. As 73% of lenders are now adopting AI to boost operational efficiency, the integration of automation into scoring processes is reshaping the lending landscape, rendering it more efficient and reliable.

Financial organization executives should contemplate implementing similar automation strategies to maintain competitiveness in this evolving market.

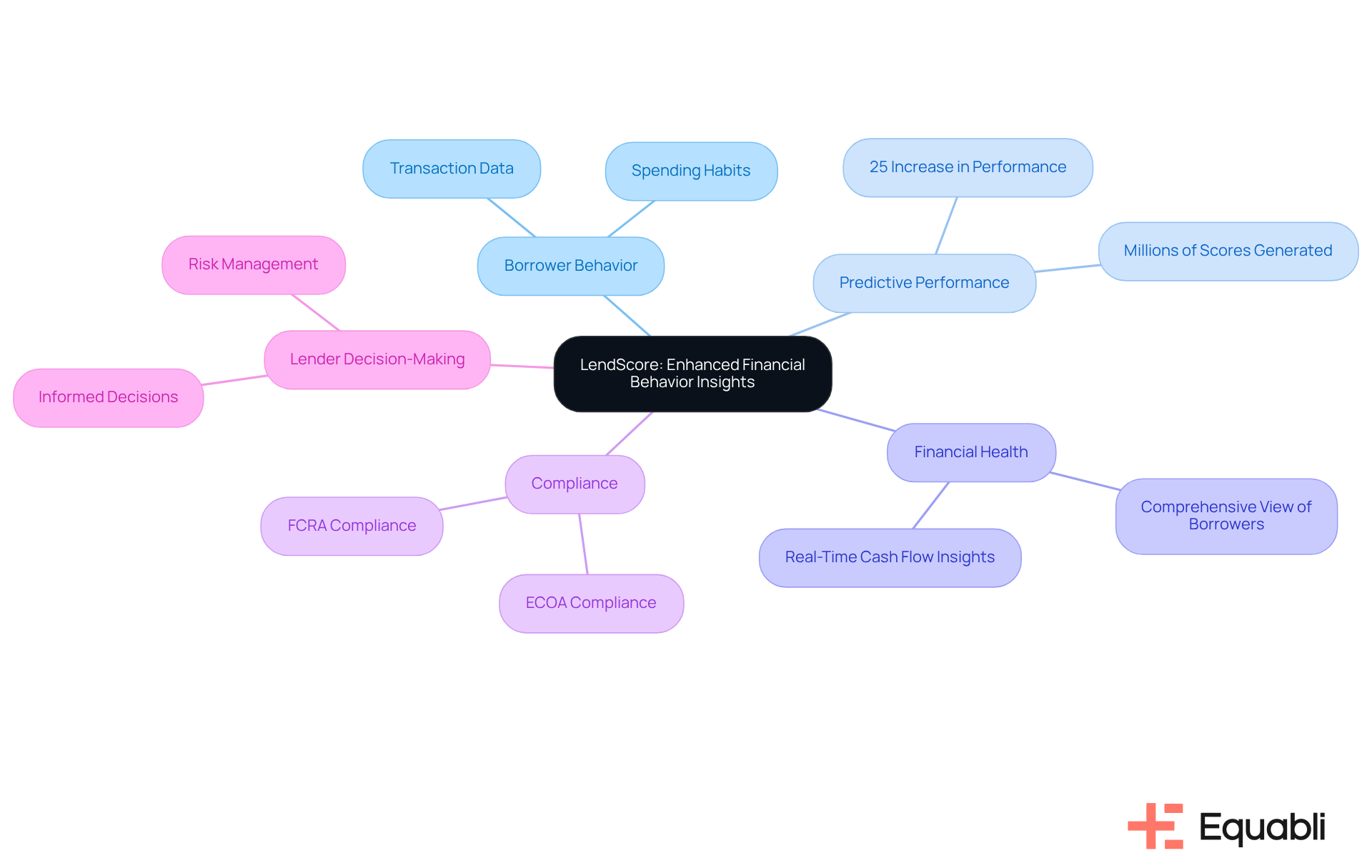

Plaid: LendScore for Enhanced Financial Behavior Insights in Credit Scoring

Plaid's LendScore provides lending organizations with enhanced insights into borrower behavior, thereby significantly improving scoring accuracy. By meticulously analyzing transaction data and spending habits, LendScore constructs a comprehensive view of a borrower's financial health. As Michelle Young, Plaid’s product lead, noted, "In testing, we produced millions of scores and achieved a 25% increase in predictive performance for lenders, relative to conventional data alone." This rigorous analysis is crucial for organizations seeking to refine their advanced credit scoring platform solutions for financial institutions and enhance borrower engagement.

The ability to leverage real-time cash flow insights empowers lenders to make informed decisions, ultimately leading to better management of uncertainty and a more nuanced understanding of borrower behavior. Furthermore, LendScore adheres to the Fair Credit Reporting Act (FCRA) and Equal Credit Opportunity Act (ECOA), ensuring that financial institutions can confidently integrate advanced credit scoring platform solutions for financial institutions into their operations. This compliance not only mitigates risk but also positions lenders to capitalize on advanced analytics for strategic advantage.

ProSight: Expert Judgment-Based Risk Rating Solutions for Credit Risk Management

ProSight revolutionizes credit management by integrating expert judgment into rating solutions, thereby enhancing traditional data-driven scoring methods. This innovative approach leverages insights from seasoned professionals alongside the predictive capabilities of Equabli's EQ Engine, which significantly elevates the accuracy of evaluations.

By predicting the likelihood of delinquency for active accounts, financial institutions can develop intelligent servicing strategies that improve efficiency and reduce roll-rates. The fusion of quantitative data with qualitative insights facilitates more nuanced lending decisions.

Institutions employing ProSight have reported enhanced risk assessments, which empower them to more effectively gauge potential borrowers' creditworthiness. This dual strategy not only sharpens the evaluation process but also cultivates a deeper understanding of borrower behavior, ultimately leading to more informed and strategic lending practices.

Conclusion

The landscape of credit scoring is experiencing a significant transformation, driven by advanced platform solutions that empower financial institutions to make informed lending decisions. Evidence of this shift is seen in the integration of innovative technologies and data-driven methodologies, which enhance accuracy and efficiency while fostering greater economic inclusion. This ensures that a wider array of borrowers can access essential financial services.

Key insights have emerged from the exploration of various advanced credit scoring platforms. Solutions such as Equabli's EQ Suite, Dataiku's analytics tools, and Experian's decisioning engine underscore the importance of leveraging sophisticated data analysis and machine learning to refine scoring models. Additionally, platforms like LendFoundry and LeewayHertz demonstrate the necessity of incorporating alternative data sources and AI-driven assessments to broaden borrower access and minimize default rates. The emphasis on compliance and risk management remains paramount, as organizations navigate the complexities of the financial landscape.

As financial institutions adapt to changing market dynamics, embracing these advanced credit scoring solutions is crucial for maintaining competitiveness. By investing in innovative technologies and methodologies, organizations can enhance their lending practices, improve borrower engagement, and ultimately contribute to a more inclusive economic ecosystem. The future of credit scoring lies in the ability to harness data intelligently, paving the way for smarter, more equitable lending decisions.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is an advanced credit scoring platform designed for financial institutions, featuring intelligent data analysis to create tailored scoring models that accurately forecast repayment behaviors.

What are the components of Equabli's EQ Suite?

The components of Equabli's EQ Suite include EQ Engine, EQ Engage, and EQ Collect, which together enhance operational efficiency and borrower engagement in the credit scoring process.

How does Equabli's EQ Suite improve borrower engagement?

The suite promotes personalized debt management by utilizing preferred communication channels, aligning with consumers' expectations for convenience and responsiveness.

What role does Dataiku play in credit scoring?

Dataiku is an advanced credit scoring platform that enables financial institutions to leverage their data for improved loan scoring through tools for data preparation, machine learning, and collaboration.

How does Dataiku enhance decision-making in credit scoring?

Dataiku empowers organizations to develop predictive models that refine scoring methodologies and mitigate risk, thus enhancing decision-making processes in credit scoring.

What compliance benefits does Dataiku offer?

Dataiku helps organizations streamline processes to ensure adherence to regulatory standards, optimizing operational efficiency while managing compliance and risk in the financial sector.

What features does Experian's lending decision engine provide?

Experian's lending decision engine offers comprehensive insights and utilizes a diverse array of data points to enhance scoring accuracy and streamline decision-making processes.

How does Experian's Cashflow Score improve predictive performance?

Experian's Cashflow Score can yield up to a 25% improvement in predictive performance compared to traditional scoring methods, allowing lenders to better assess borrower financial behavior.

What advancements does the Experian Ascend platform offer?

The Experian Ascend platform integrates advanced AI tools that automate documentation and monitoring, decreasing internal approval times by as much as 70% and enhancing auditability and transparency.

How does the trend towards extensive data analysis impact credit scoring?

There is a growing recognition of the importance of integrating cashflow insights with traditional data to improve scoring precision, which helps include more underserved consumers in the economic ecosystem.