Overview

The article provides a detailed overview of advanced payments and receivables solutions that enhance operational efficiency for finance teams. Notable tools include Equabli's EQ Suite, HighRadius, and SAP S/4HANA. These solutions leverage automation, predictive analytics, and real-time insights to streamline processes such as invoicing and collections. Consequently, they significantly improve cash flow and compliance management within the contemporary financial landscape.

Introduction

In an era where financial efficiency is paramount, organizations are increasingly turning to advanced payments and receivables solutions to streamline their operations. These innovative tools promise to enhance cash flow management while addressing the complexities of compliance and operational challenges faced by finance teams.

However, with a myriad of options available, finance professionals must critically evaluate which solutions will truly optimize their processes and drive sustainable growth.

Equabli EQ Suite: Intelligent Solutions for Receivables Management

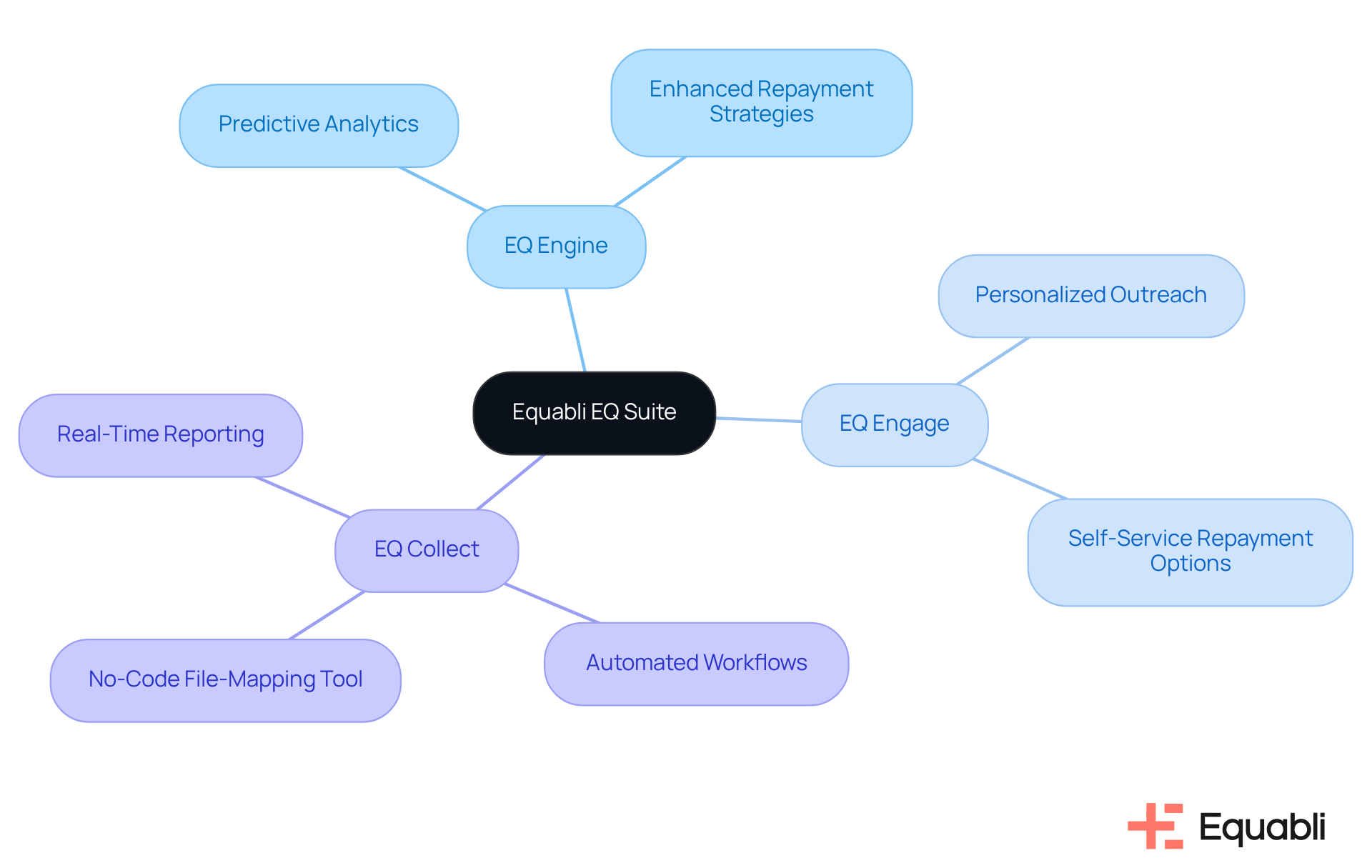

Equabli's EQ Suite is a pivotal advancement in advanced payments and receivables management solutions for corporate finance teams, focusing on optimizing operations while ensuring robust data protection. The suite includes critical components such as the EQ Engine, EQ Engage, and EQ Collect, which leverage predictive analytics to enhance repayment strategies, automate communication, and streamline collections. For instance, EQ Collect significantly minimizes manual tasks, thereby increasing efficiency through its no-code file-mapping tool, automated workflows, and real-time reporting capabilities.

This comprehensive suite not only drives down operational costs but also strengthens compliance oversight. By enhancing borrower engagement through personalized outreach and self-service repayment options, Equabli positions itself as a leader in debt recovery. The integration of smart automation and machine learning solutions further underscores the EQ Suite's relevance in today’s financial landscape, establishing it as an essential resource for contemporary financial institutions seeking advanced payments and receivables management solutions for corporate finance teams to navigate complex compliance and operational challenges.

HighRadius Integrated Receivables: Streamline Your Accounts Receivable Processes

The HighRadius Integrated Receivables platform serves as a pivotal tool in automating essential processes, including invoicing, transaction tracking, and credit management. Evidence shows that by consolidating these functions into a single platform, businesses can significantly streamline their accounts receivable processes. This integration not only reduces manual errors but also accelerates cash flow, enhancing overall operational efficiency.

Furthermore, the platform’s AI-driven insights empower finance teams to make informed decisions, which is crucial in today’s fast-paced financial landscape. This capability leads to improved financial performance, underscoring the importance of leveraging technology in enterprise-level debt collection and risk management. In conclusion, adopting advanced payments and receivables management solutions for corporate finance teams positions organizations to effectively navigate compliance challenges while optimizing their financial operations.

![]()

Versapay Accounts Receivable Management: Optimize Payment Processes

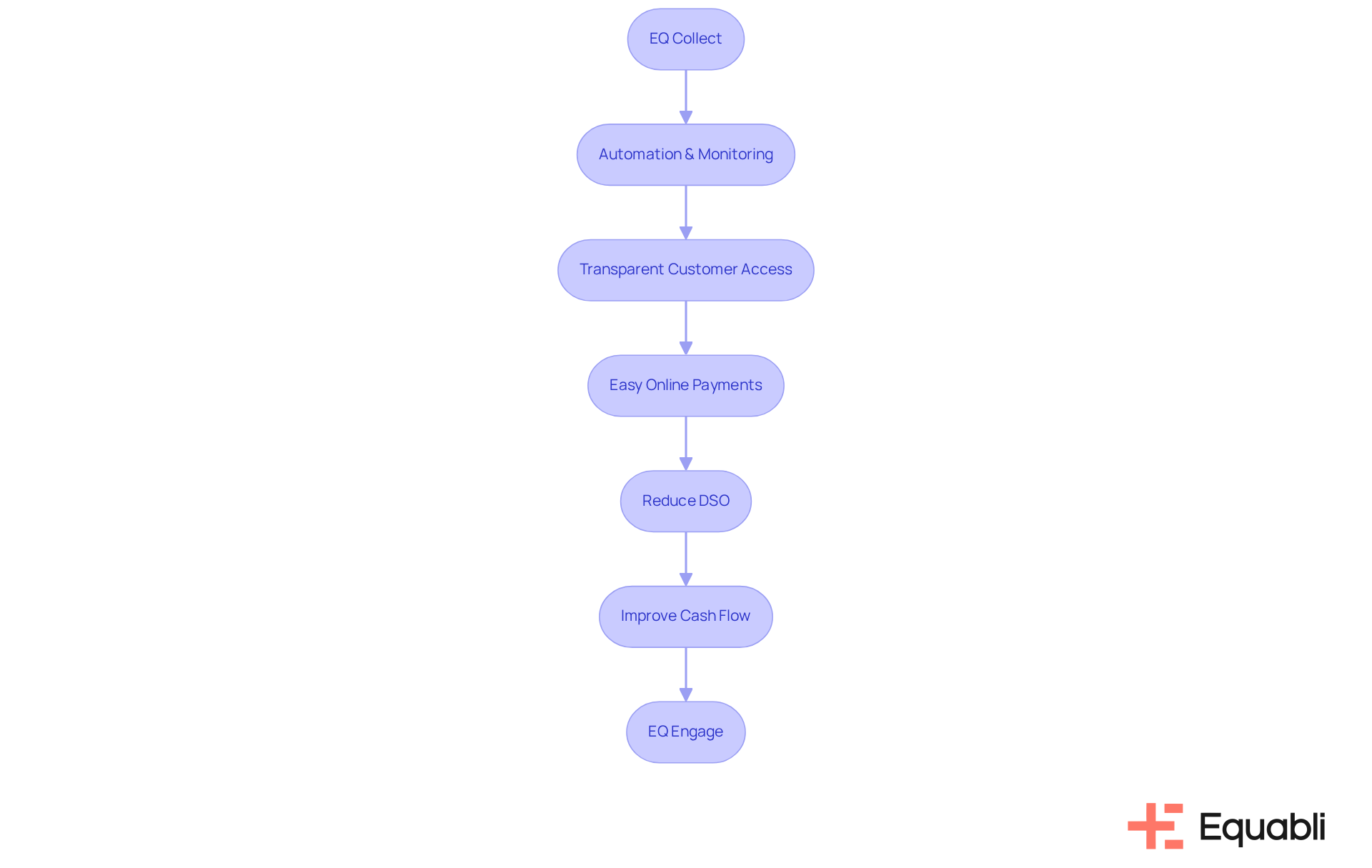

Equabli's Accounts Receivable Management system enhances transaction processes through automation and real-time monitoring. This system provides customers with transparent access to their accounts and facilitates easy online payments, which in turn helps businesses reduce days sales outstanding (DSO) and improve cash flow. The transition from inefficient to integrated operations is initiated with EQ Collect, ensuring smarter orchestration and enhanced performance.

Moreover, EQ Engage enables financial institutions to revolutionize digital collections by offering personalized communication and self-service repayment options, thereby increasing borrower engagement. The platform's ability to integrate with existing systems further amplifies its utility, establishing it as a valuable asset for financial organizations. This strategic capability not only streamlines operations but also positions institutions to meet evolving compliance demands effectively.

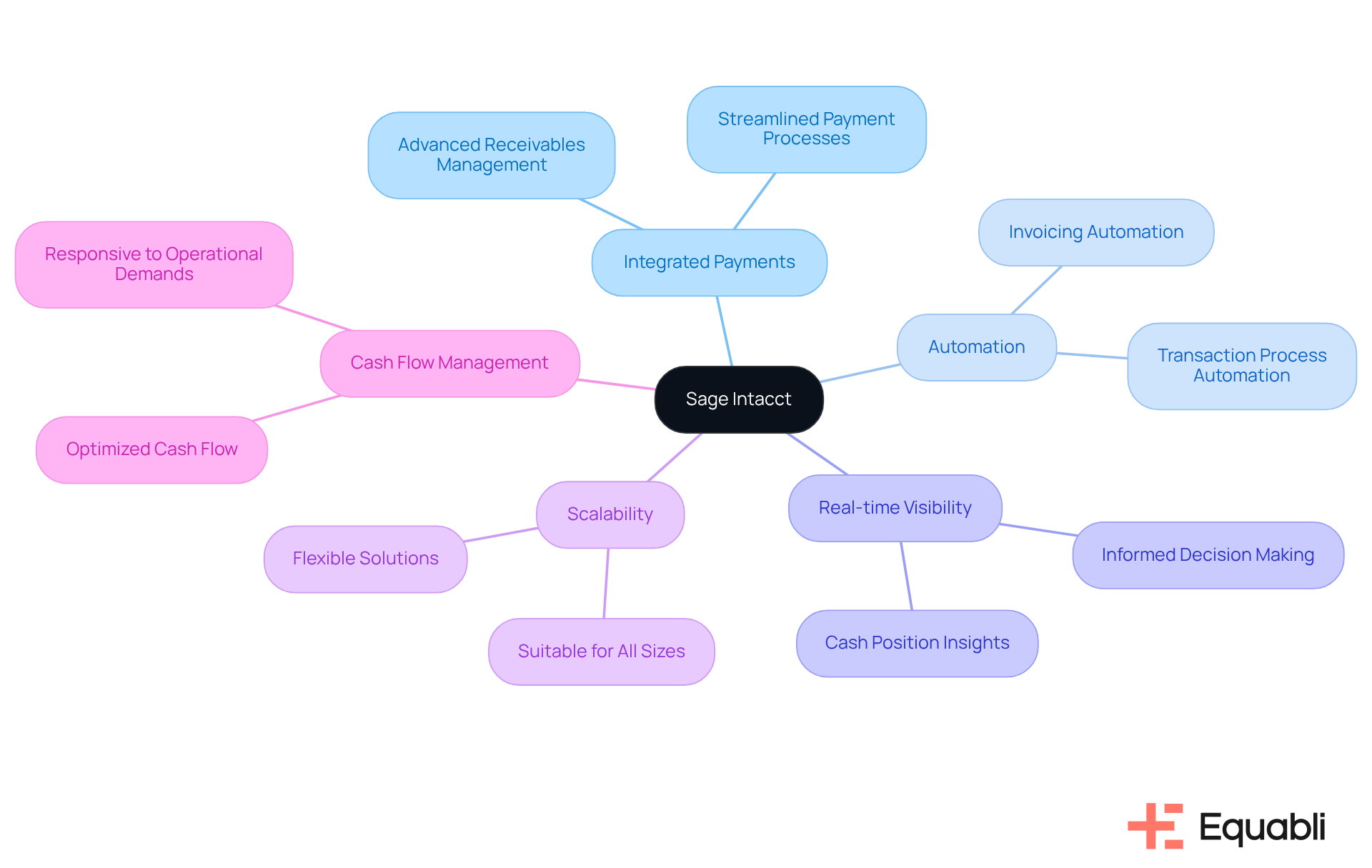

Sage Intacct: Integrated Payments for Enhanced Cash Flow Management

Sage Intacct delivers integrated transaction solutions that significantly enhance cash flow management through the automation of invoicing and transaction processes. This platform provides advanced payments and receivables management solutions for corporate finance teams, offering real-time visibility into cash positions and streamlined reconciliation to enable swift, informed decisions. The inherent flexibility and scalability of Sage Intacct position it as a suitable solution for enterprises of all sizes, ensuring that cash flow remains optimized and responsive to operational demands.

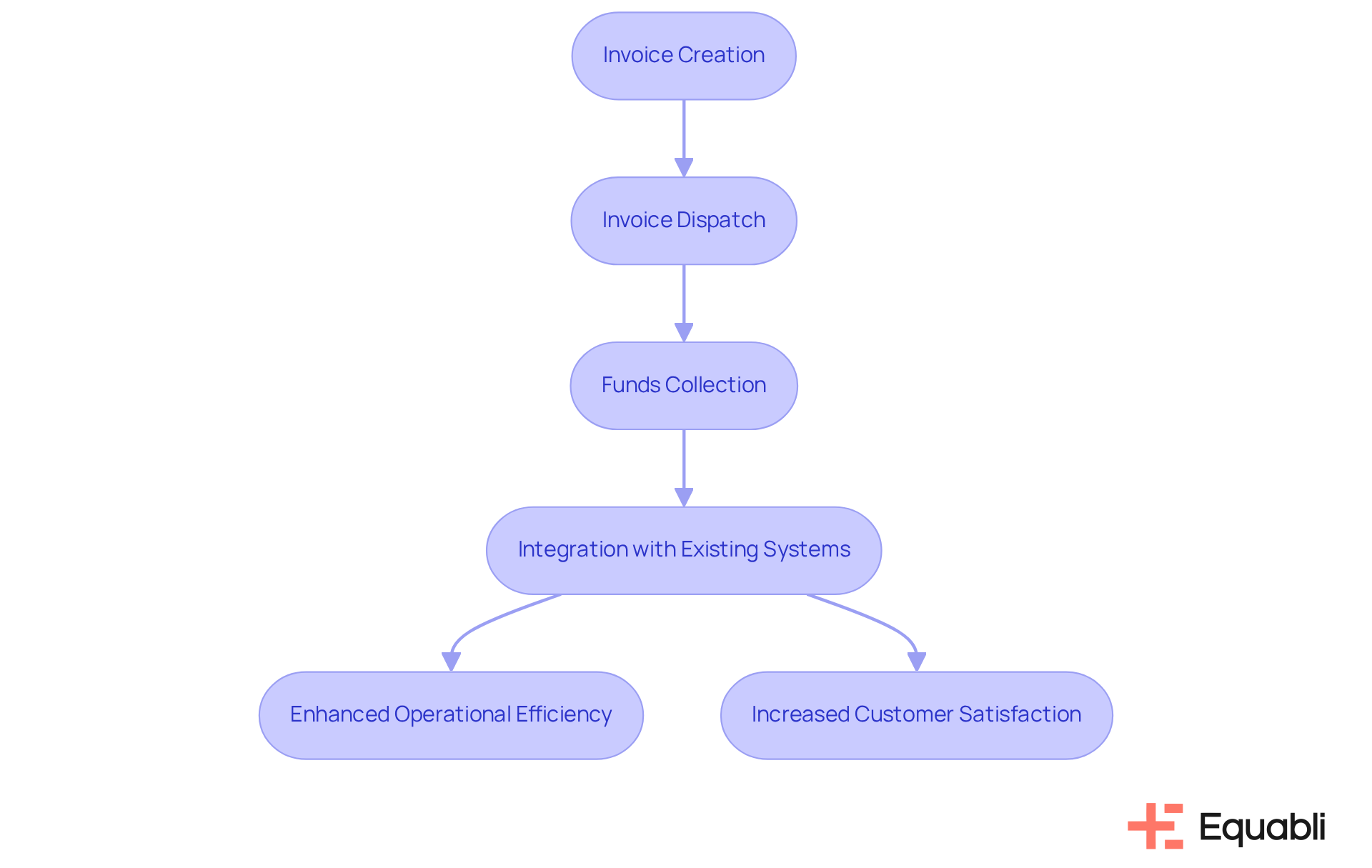

Paystand Accounts Receivable Management: Transform Cash Flow Dynamics

Paystand's Accounts Receivable Management platform fundamentally transforms cash flow dynamics by automating the entire AR process, from invoice creation to funds collection. This is evidenced by the provision of zero-fee transaction options and seamless integration with existing systems, which enables businesses to accelerate their cash cycles and reduce Days Sales Outstanding (DSO). The impact of this innovative approach is twofold:

- It enhances operational efficiency

- It simultaneously increases customer satisfaction through adaptable financial options.

Consequently, organizations can leverage advanced payments and receivables management solutions for corporate finance teams to optimize their financial operations and strengthen their market position.

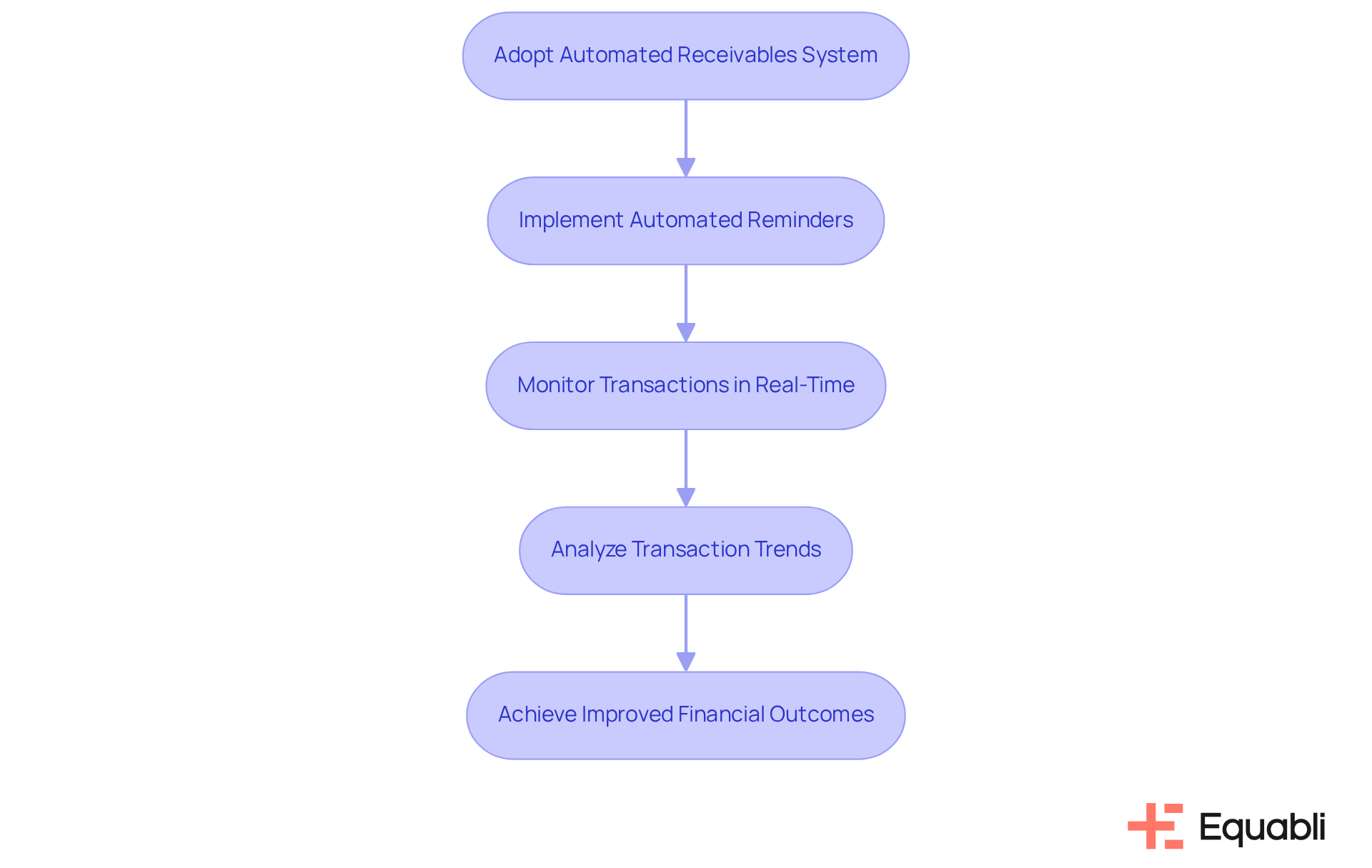

J.P. Morgan Automated Receivables: Overcome Payment Management Challenges

Automated receivables systems are essential for organizations navigating the complexities of transaction oversight when they implement advanced payments and receivables management solutions for corporate finance teams. These advanced payments and receivables management solutions for corporate finance teams significantly enhance operational efficiency by streamlining invoicing and collections processes. Evidence shows that automated reminders can reduce the likelihood of late transactions, with research indicating that consumers receiving such reminders are 21% less likely to experience severe defaults. Furthermore, these reminders contribute to a 10.5-point increase in credit scores for consumers, underscoring their effectiveness in fostering improved financial behavior. Real-time transaction tracking further empowers finance teams to utilize advanced payments and receivables management solutions for corporate finance teams, allowing them to monitor transactions closely, ensure timely follow-ups, and enhance cash flow.

The platform's robust analytics capabilities deliver critical insights into transaction trends, enabling organizations to make informed, data-driven decisions. For instance, companies utilizing automated reminders have reported a notable increase in collection rates, with average savings balances rising by 81 percentage points among clients engaged in these programs. This data illustrates the value of integrating technology into financial management strategies, ultimately promoting enhanced financial discipline and reduced operational costs.

As financial teams continue to face challenges in managing receivables, the adoption of advanced payments and receivables management solutions for corporate finance teams not only addresses these issues but also positions organizations for sustainable growth in an increasingly competitive landscape. To operationalize these strategies effectively, financial groups should consider incorporating automated reminders into their workflows to improve transaction tracking and overall economic outcomes.

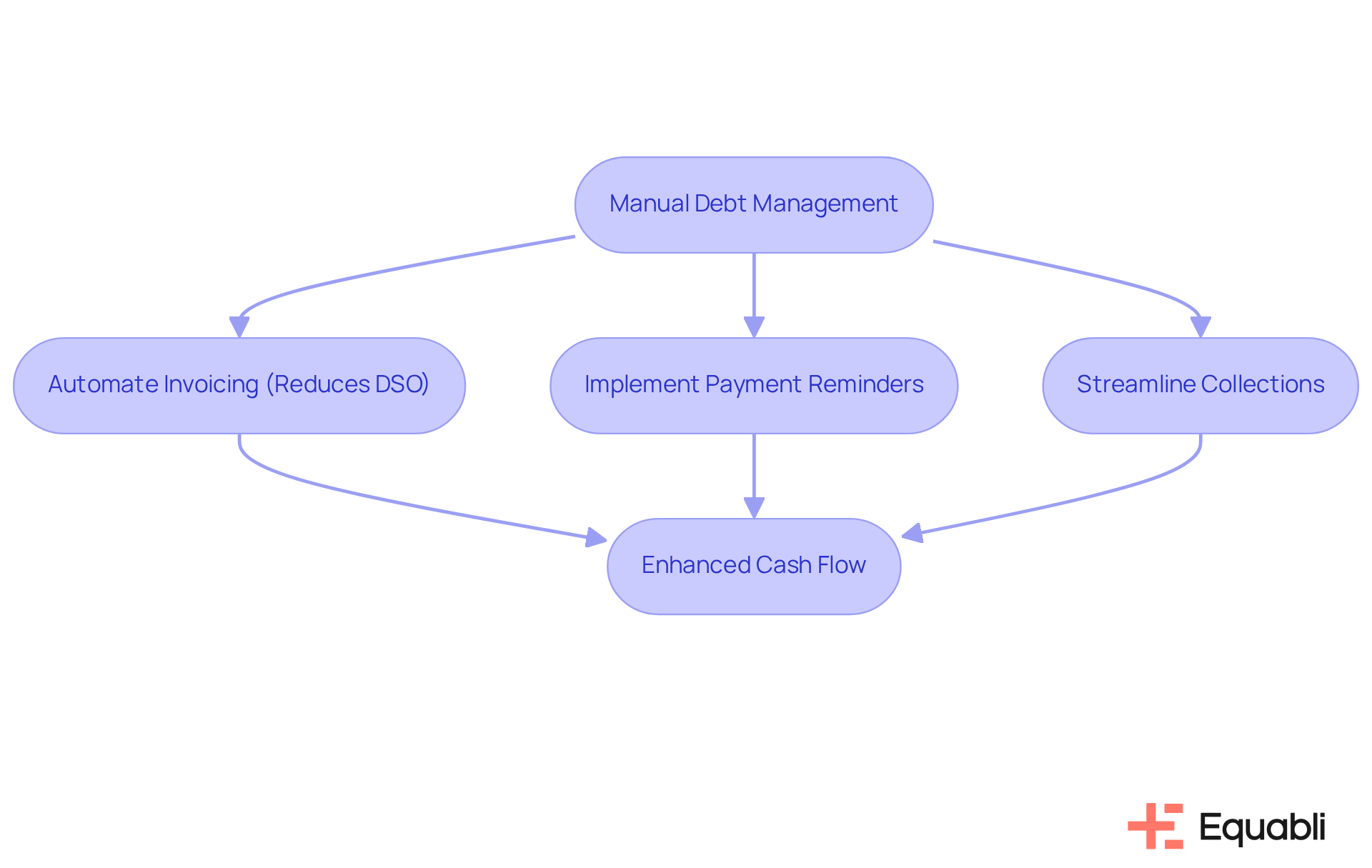

Tabs Receivables Management: Practical Strategies for SaaS Companies

Equabli's Receivables Management platform offers strategic solutions tailored for SaaS financial institutions. By automating invoicing, payment reminders, and collections, it effectively reduces Days Sales Outstanding (DSO) and enhances cash flow, addressing the prevalent challenges of manual debt collection that can result in lost time and revenue.

The platform's capability to navigate complex billing scenarios, such as subscription models and usage-based pricing, positions it as an essential asset for finance teams seeking advanced payments and receivables management solutions for corporate finance teams to refine their revenue cycles.

Transitioning from manual debt management to Equabli's EQ Suite not only modernizes the collections process but also significantly boosts operational efficiency throughout the recovery lifecycle. This enables financial institutions to remain competitive and responsive to the evolving needs of borrowers.

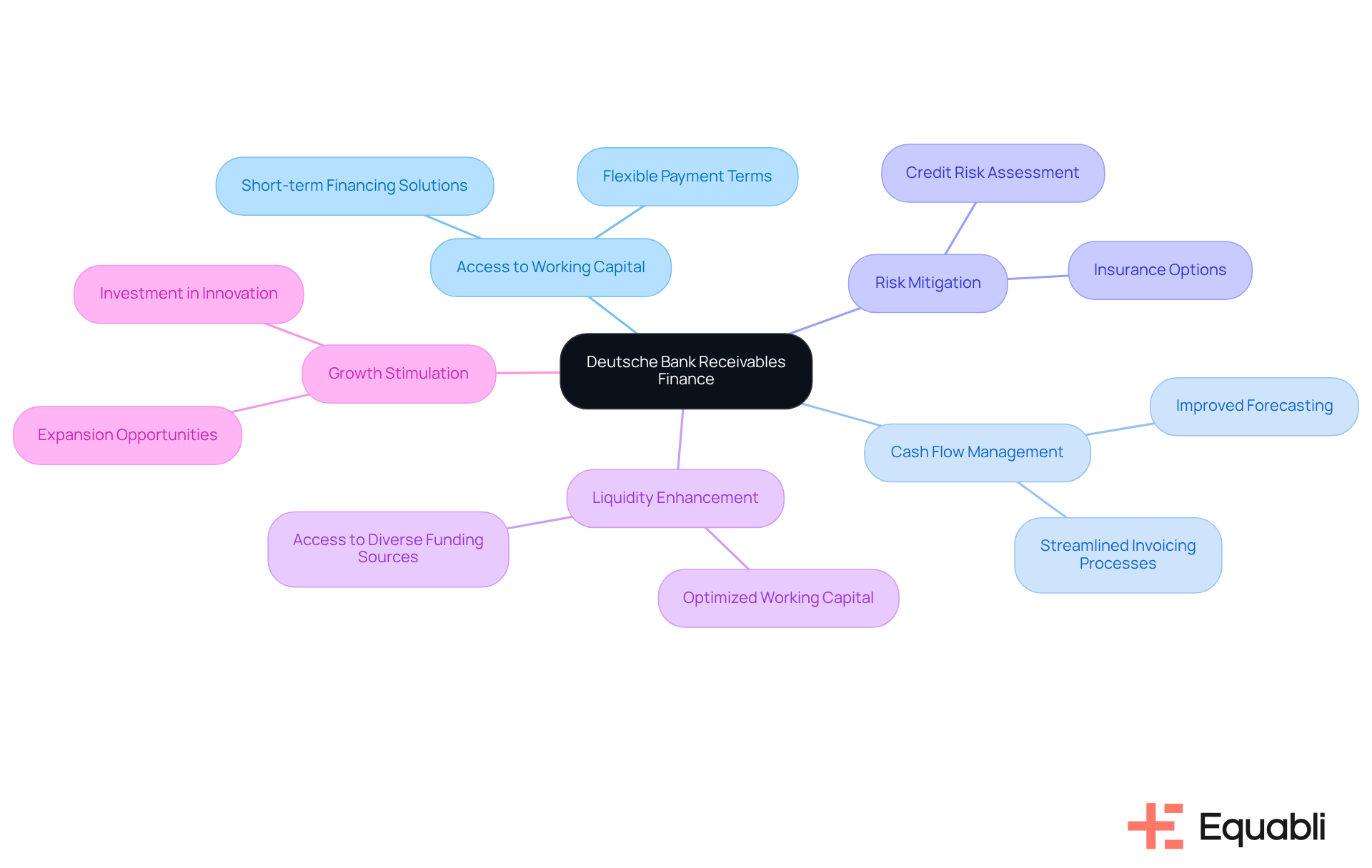

Deutsche Bank Receivables Finance: Optimize Your Financial Operations

Deutsche Bank's Receivables Finance offerings empower organizations to optimize their financial operations by providing access to essential working capital through receivables. This capability is bolstered by Deutsche Bank's extensive network and expertise, which assist companies in refining their cash flow management and mitigating risks associated with delayed transactions. The strategic approaches employed are designed to enhance liquidity and stimulate growth, thereby establishing Deutsche Bank as a critical partner for financial entities.

SAP S/4HANA: Master Receivables Management for Financial Success

SAP S/4HANA represents a pivotal solution for optimizing receivables management by providing advanced payments and receivables management solutions for corporate finance teams, characterized by advanced automation in invoicing, payment processing, and collections. This platform provides advanced payments and receivables management solutions for corporate finance teams, offering financial groups real-time insights into monetary data, enabling efficient cash flow tracking and facilitating rapid, informed decision-making.

Its robust integration capabilities streamline financial processes by offering advanced payments and receivables management solutions for corporate finance teams, significantly enhancing operational efficiency and driving financial success. As organizations increasingly adopt automation, they report improvements such as up to 90% faster invoice processing times, underscoring the critical role of technology in modern financial operations.

Automated processes present numerous advantages over manual methods, notably reducing the risk of human error and ensuring tasks are executed correctly and consistently. Furthermore, the integration of EQ Collect can amplify these capabilities by minimizing vendor onboarding timelines through a no-code file-mapping tool, enhancing efficiency via data-driven strategies, and delivering real-time reporting for unparalleled transparency.

With automated workflows that mitigate execution errors and superior compliance oversight achieved through automated monitoring, EQ Collect empowers financial professionals to refine recovery strategies and optimize account-level lifetime value analysis.

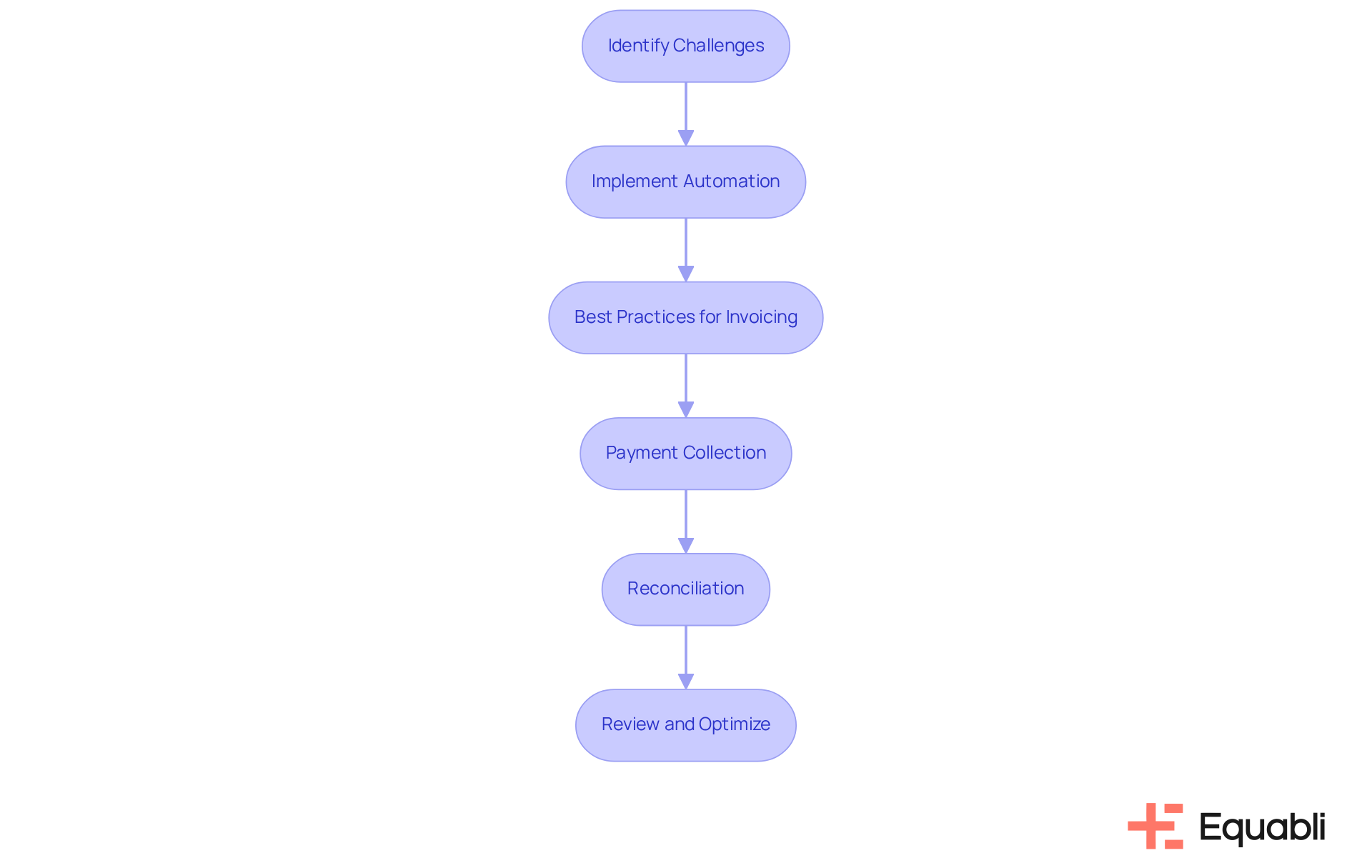

BillingPlatform Accounts Receivable Guide: Step-by-Step Process Improvement

Equabli's Accounts Receivable Guide offers a structured approach to process improvement, emphasizing automation and efficiency in debt collection. It highlights the challenges associated with manual debt collection, particularly the time and financial losses incurred due to outdated processes. By detailing best practices for invoicing, payment collection, and reconciliation, the guide aids financial institutions in streamlining operations and reducing errors by implementing advanced payments and receivables management solutions for corporate finance teams.

The EQ Suite, a cloud-based solution, modernizes these manual processes, transforming collections into an intelligent and intuitive experience. It encompasses the entire recovery lifecycle, enabling financial institutions to adapt to evolving market conditions and customer demands while ensuring compliance. Equabli empowers finance teams with advanced payments and receivables management solutions for corporate finance teams through customizable repayment options and enhanced borrower engagement to improve their operational efficiency. This strategic approach not only addresses immediate challenges but also positions organizations for sustained success in a dynamic financial landscape.

Conclusion

The landscape of advanced payments and receivables management solutions is rapidly evolving, driven by innovative technologies and strategies that support corporate finance teams. By embracing these solutions, financial institutions can significantly enhance their operational efficiency, streamline processes, and improve cash flow management. This underscores the importance of integrating advanced tools like Equabli's EQ Suite and HighRadius Integrated Receivables, which collectively empower finance teams to navigate the complexities of today's financial environment.

Key insights from the discussion highlight the transformative impact of automation on accounts receivable processes, the role of predictive analytics in enhancing repayment strategies, and the necessity of personalized borrower engagement. Solutions such as Sage Intacct and Paystand not only reduce Days Sales Outstanding (DSO) but also foster a more responsive approach to cash flow management. Furthermore, platforms like J.P. Morgan’s automated receivables provide essential support in overcoming payment management challenges, ensuring timely follow-ups and improved collection rates.

As organizations strive for excellence in financial operations, the adoption of advanced payments and receivables management solutions becomes imperative. The integration of these technologies is not merely a trend but a strategic necessity for finance teams aiming to achieve sustainable growth and maintain a competitive edge. Embracing these innovative solutions positions organizations to adapt to evolving market demands, enhance compliance, and ultimately drive financial success in an increasingly complex landscape.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is an advanced payments and receivables management solution designed for corporate finance teams, focusing on optimizing operations and ensuring robust data protection. It includes components like the EQ Engine, EQ Engage, and EQ Collect, which utilize predictive analytics to enhance repayment strategies and streamline collections.

How does EQ Collect improve efficiency in receivables management?

EQ Collect minimizes manual tasks through its no-code file-mapping tool, automated workflows, and real-time reporting capabilities, significantly increasing operational efficiency.

What are the benefits of using the EQ Suite for financial institutions?

The EQ Suite drives down operational costs, strengthens compliance oversight, enhances borrower engagement through personalized outreach, and offers self-service repayment options, making it essential for debt recovery.

How does HighRadius Integrated Receivables streamline accounts receivable processes?

HighRadius Integrated Receivables automates essential processes like invoicing, transaction tracking, and credit management, which reduces manual errors and accelerates cash flow, thus enhancing overall operational efficiency.

What role do AI-driven insights play in HighRadius Integrated Receivables?

AI-driven insights empower finance teams to make informed decisions, which improves financial performance and is crucial for effective debt collection and risk management in a fast-paced financial landscape.

What features does Equabli's Accounts Receivable Management system offer?

Equabli's Accounts Receivable Management system enhances transaction processes through automation and real-time monitoring, providing customers with transparent access to their accounts and facilitating easy online payments.

How does EQ Engage enhance borrower engagement?

EQ Engage revolutionizes digital collections by offering personalized communication and self-service repayment options, which increases borrower engagement and helps financial institutions better meet compliance demands.

Why is it important for organizations to adopt advanced payments and receivables management solutions?

Adopting these solutions allows organizations to effectively navigate compliance challenges while optimizing their financial operations, leading to improved cash flow and operational efficiency.