Overview

The article examines "10 Automated Collections Process Optimization Strategies for Financial Institutions," underscoring how financial organizations can enhance their debt recovery operations through automation. A key point is the utilization of advanced tools like Equabli's EQ Suite, which leverages data analytics and automated workflows. This approach not only improves operational efficiency but also enhances borrower engagement and compliance. The result is a significant boost in recovery rates and streamlined processes, positioning financial institutions to navigate the complexities of debt collection more effectively.

Introduction

Financial institutions are increasingly facing the complexities of debt recovery, where efficiency and compliance are critical. The emergence of automated collections process optimization strategies presents a significant opportunity for these organizations to enhance their recovery efforts and operational effectiveness. However, as they navigate this evolving landscape, it is essential to consider how automation initiatives can meet regulatory standards while also improving borrower engagement and recovery rates.

This article explores ten innovative strategies that financial institutions can implement to optimize their automated collections processes, offering insights into the tools and methodologies that can drive success in this vital area.

Equabli's EQ Suite: Intelligent Solutions for Automated Collections Optimization

Equabli's EQ Suite represents a pivotal advancement in the payment recovery process. This suite, which includes the EQ Engine, EQ Engage, and EQ Collect, is meticulously designed to improve operational efficiency and borrower engagement. By leveraging advanced analytics and customizable scoring models, financial institutions can implement automated collections process optimization strategies for financial institutions to accurately forecast repayment behaviors, thereby refining their recovery strategies.

The data-driven approach of the EQ Suite not only reduces operational costs but also enhances compliance and borrower satisfaction. By facilitating communication through preferred channels, it addresses the critical need for effective engagement in debt recovery. Successful implementations of the EQ Suite have demonstrated significant improvements in retrieval outcomes, underscoring its role in modernizing debt recovery practices.

From a compliance perspective, the EQ Suite aligns with regulatory requirements, ensuring that financial institutions can navigate the complexities of debt collection effectively. The integration of advanced analytics supports strategic decision-making and informs automated collections process optimization strategies for financial institutions, enabling lenders to adapt their workflows to minimize risk exposure. This positions the EQ Suite as a vital tool for enterprises aiming to enhance their debt recovery operations while maintaining compliance.

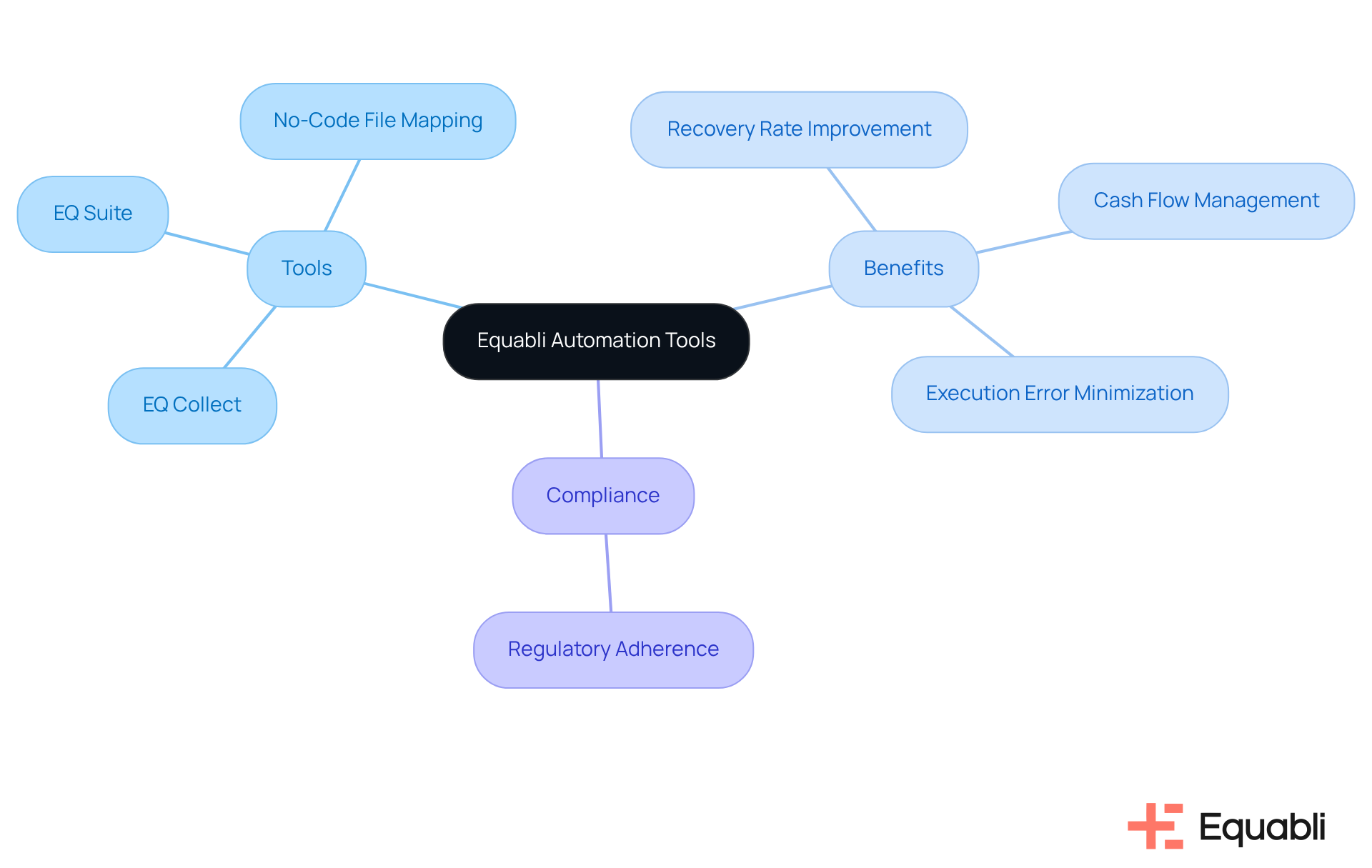

Gaviti: Automation Tools for Streamlining Accounts Receivable Processes

Equabli automates accounts receivable procedures, enhancing recovery efforts through its EQ Collect and EQ Suite. This platform features a no-code file-mapping tool, automated workflows, and real-time reporting, which collectively reduce vendor onboarding timelines and improve cash flow management. By minimizing execution errors and reliance on manual resources, financial institutions can implement automated collections process optimization strategies, which will allow them to focus on strategic decision-making and significantly boost their recovery rates.

Moreover, Equabli offers robust compliance management alongside an intuitive, scalable cloud-native interface. This facilitates a seamless transition to modern, data-driven processes that transform recovery methods. From a compliance perspective, the platform ensures adherence to regulatory standards, which is crucial for maintaining operational integrity in debt collection.

In summary, Equabli's solutions incorporate automated collections process optimization strategies for financial institutions, streamlining recovery processes and empowering organizations to navigate the complexities of compliance and operational efficiency. By leveraging these advanced tools, executives can enhance their strategic initiatives and drive improved financial outcomes.

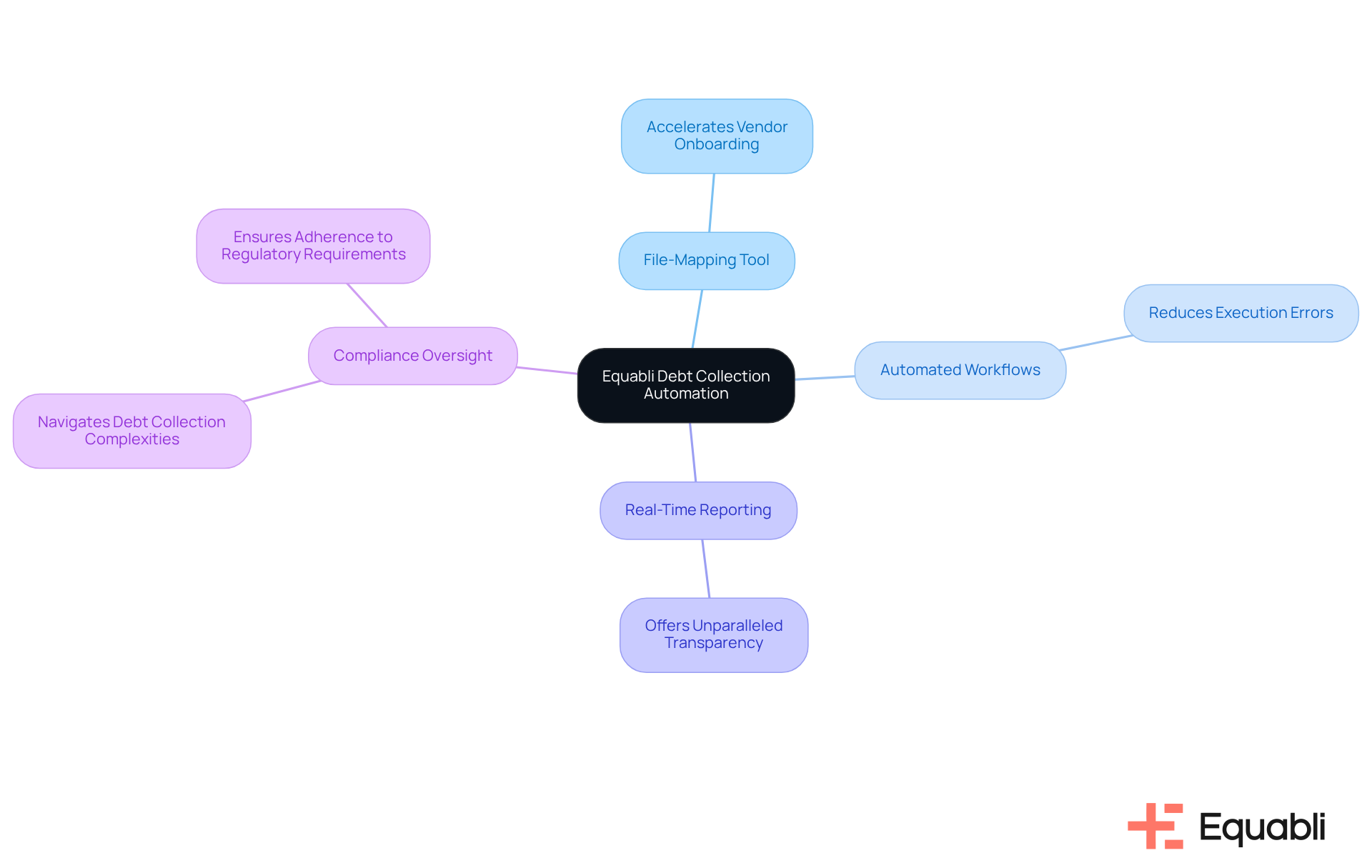

Creatio: Data-Driven Automation for Debt Collection Efficiency

Equabli provides a no-code platform that empowers organizations to use automated collections process optimization strategies for financial institutions to enhance their receivables management processes through data-driven insights. By integrating customer data and analytics, Equabli allows organizations to tailor their retrieval strategies based on borrower behavior. This method not only boosts efficiency but also guarantees that communication remains timely and relevant, ultimately resulting in improved recovery rates.

Key features of Equabli’s platform include:

- A straightforward file-mapping tool that accelerates vendor onboarding

- Automated workflows that reduce execution errors

- Real-time reporting that offers unparalleled transparency

- Top-tier compliance oversight

These solutions are meticulously designed to implement automated collections process optimization strategies for financial institutions to optimize operations and enhance performance in receivables management, all while providing a user-friendly and scalable interface.

From a compliance perspective, organizations can leverage Equabli’s capabilities to navigate the complexities of debt collection more effectively. By utilizing data analytics, they can identify trends and adjust strategies proactively, ensuring adherence to regulatory requirements while maximizing recovery efforts. This strategic approach not only mitigates risk but also positions organizations to respond swiftly to changing market dynamics.

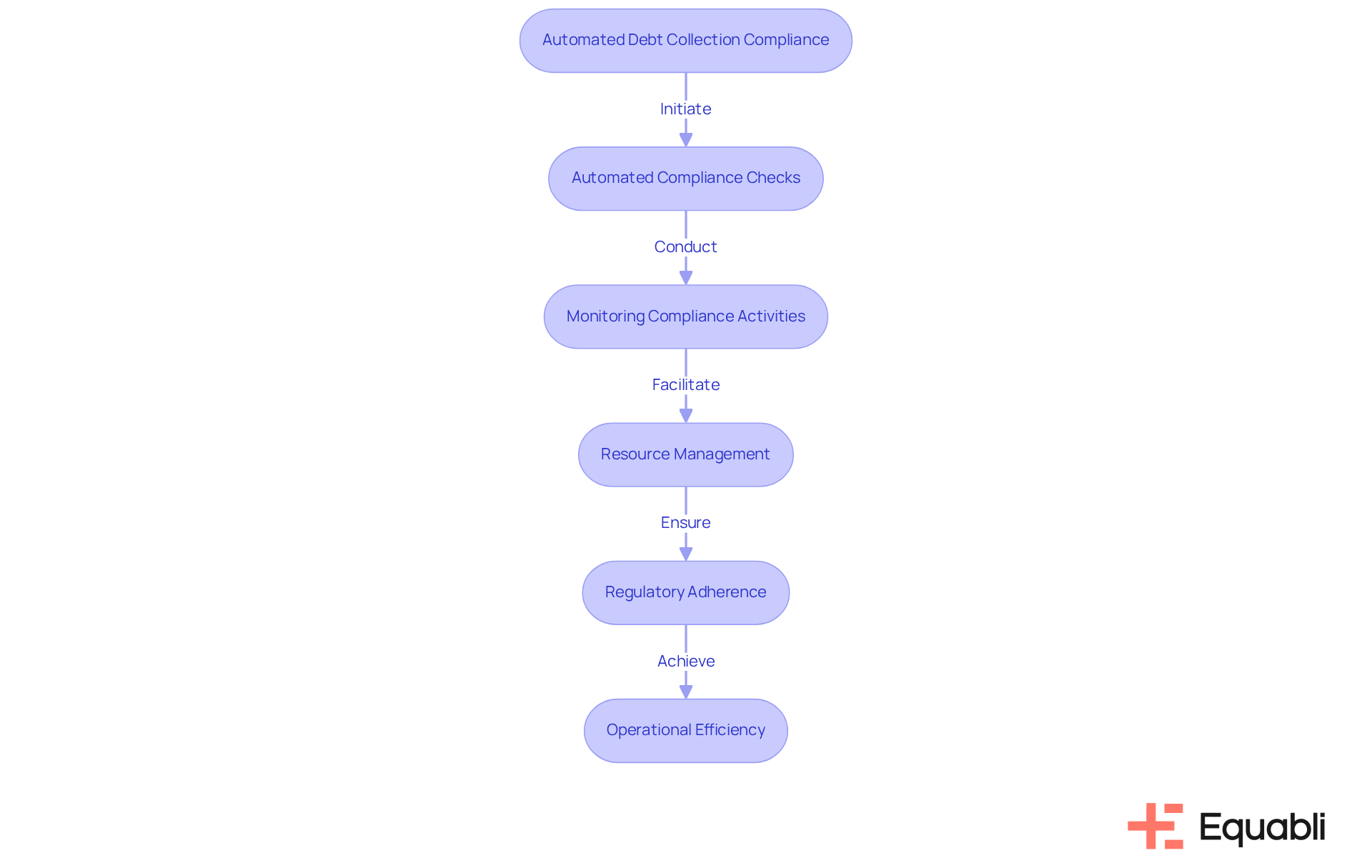

ComplianceMax: Ensuring Regulatory Compliance in Automated Debt Collection

ComplianceMax empowers financial institutions to enhance their debt recovery processes by utilizing automated collections process optimization strategies for financial institutions through automated compliance checks. By ensuring strict adherence to regulations such as the Fair Debt Collection Practices Act (FDCPA), it significantly mitigates the risk of legal complications while improving operational efficiency. This innovative tool automates the monitoring of compliance-related activities, allowing organizations to concentrate on effective retrievals without compromising regulatory standards.

The integration of automated compliance reviews not only safeguards against potential infractions but also streamlines workflows. This enables teams to manage resources more effectively, instilling greater confidence in their compliance posture. In an environment where regulatory scrutiny is paramount, utilizing automated collections process optimization strategies for financial institutions is not just advantageous; it is essential for maintaining operational integrity and minimizing risk exposure.

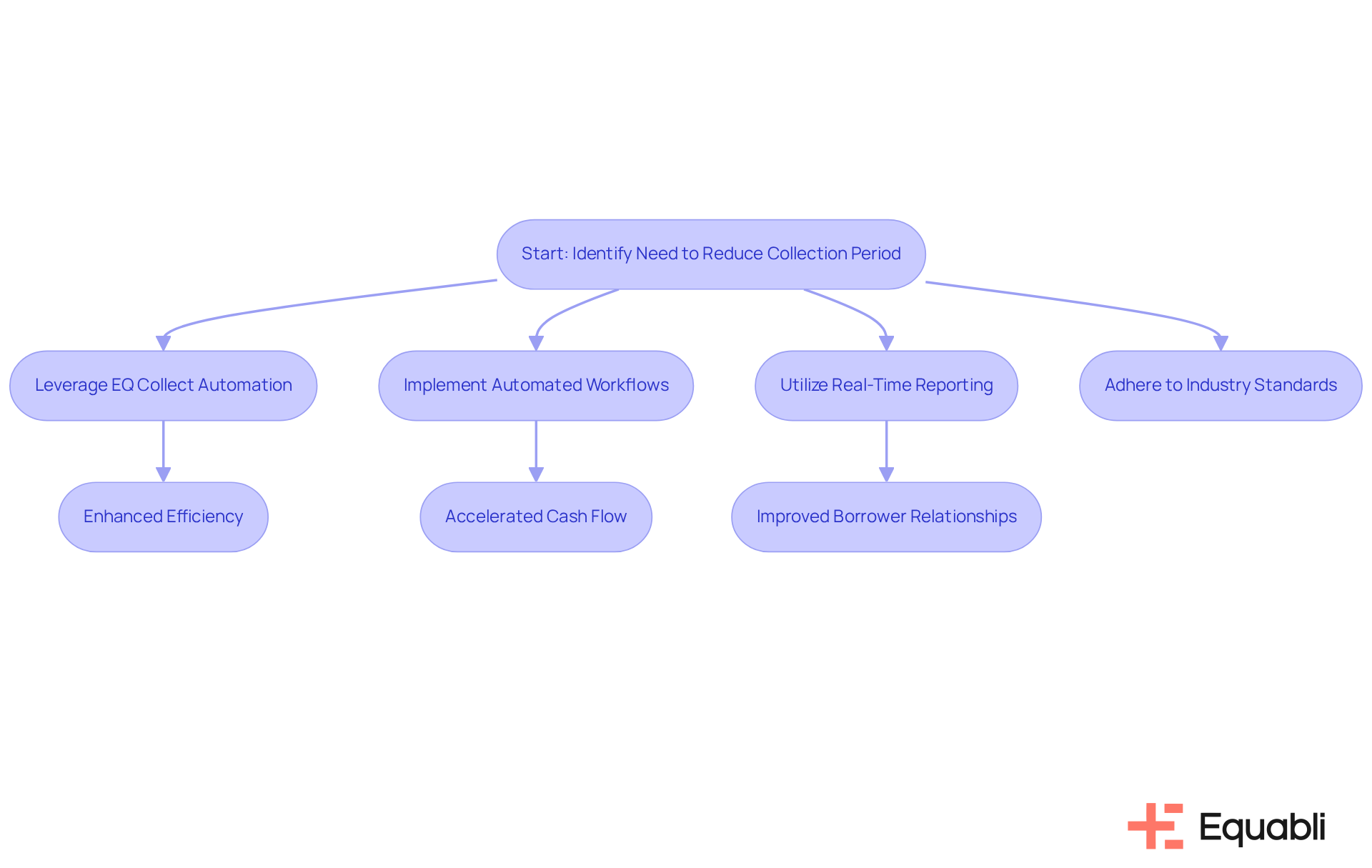

Aptitude: Solutions for Reducing Average Collection Periods

Equabli provides innovative solutions aimed at reducing the average retrieval period for monetary organizations. By leveraging EQ Collect's automation capabilities—such as a no-code file-mapping tool and automated workflows—organizations can implement automated collections process optimization strategies for financial institutions, thereby markedly enhancing efficiency in their retrieval processes. This strategic approach not only accelerates cash flow and reduces outstanding receivables but also employs automated collections process optimization strategies for financial institutions to ensure adherence to industry standards through automated monitoring.

Furthermore, real-time reporting offers unparalleled clarity, empowering banks to strengthen their relationships with borrowers by facilitating timely communication and support. With an intuitive, adaptable, cloud-based interface and data-driven strategies, EQ Collect supports automated collections process optimization strategies for financial institutions, enabling organizations to streamline operations and improve their retrieval processes effectively. This positions them to navigate the complexities of debt collection while maintaining compliance and operational excellence.

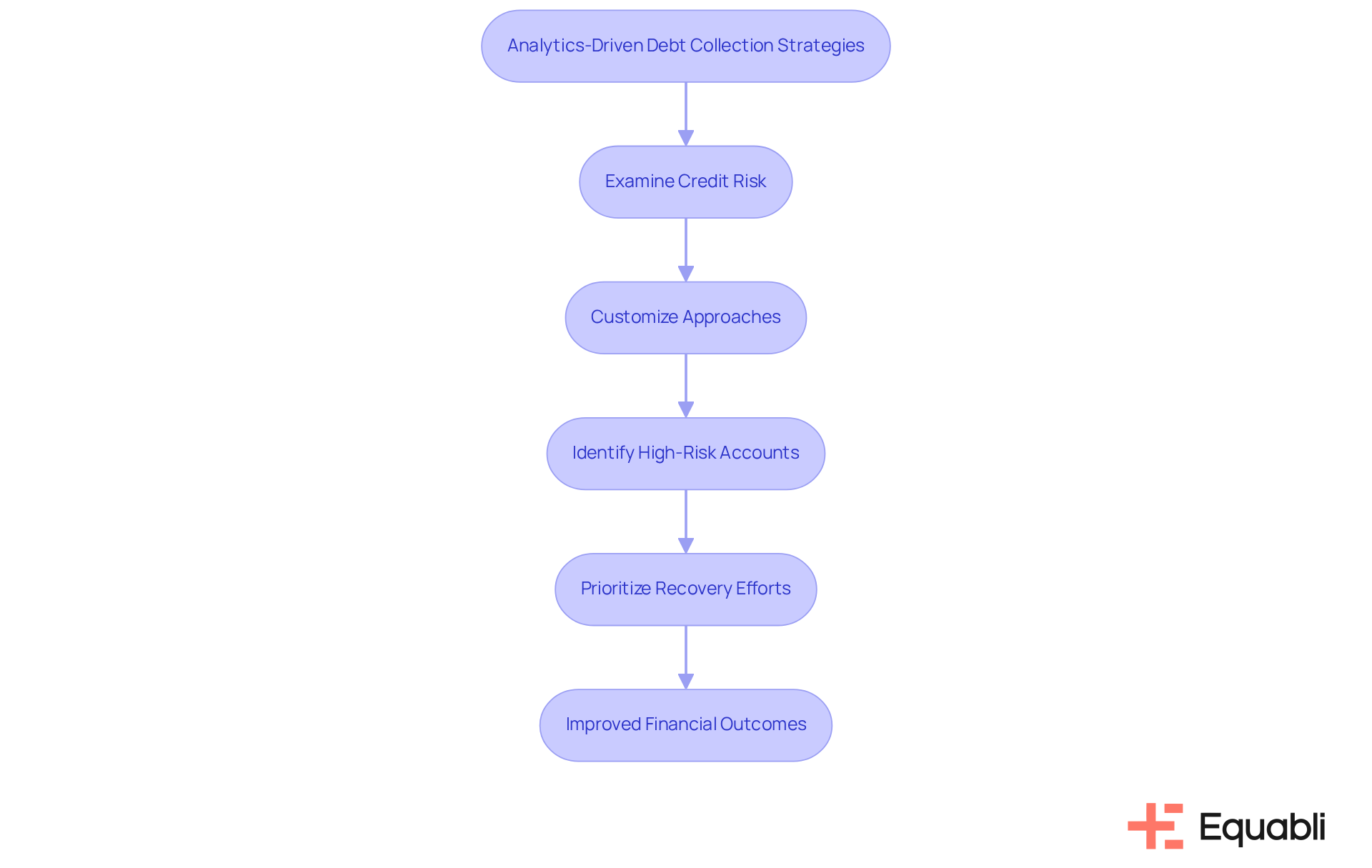

Dun & Bradstreet: Analytics-Driven Insights for Debt Collection Strategies

Dun & Bradstreet provides analytics-driven insights that empower organizations to refine their automated collections process optimization strategies for financial institutions. By examining credit risk and borrower behavior, organizations can customize their approaches to optimize recovery rates. This data-centric methodology enables the identification of high-risk accounts, allowing for prioritized recovery efforts that lead to improved financial outcomes.

The significance of informed strategies in managing credit risk is underscored by the overall default rate for private counterparts, which stands at 3.54%. Notably, 67.6% of defaults are resolved within four years. Furthermore, over half of defaulted contracts achieve recovery rates exceeding 90%, while the average recovery rate for private contracts is 72.9%. These statistics highlight the critical need for strategic insights in debt recovery.

As World Bank Group President Ajay Banga articulated, "We believe our proprietary information should be a global public good and sharing it will provide transparency and inspire investor confidence." By integrating analytics-driven methods with EQ Collect's features—such as automated workflows, real-time reporting, and compliance oversight—organizations can adopt automated collections process optimization strategies for financial institutions to effectively mitigate risks and enhance operational efficiency in receivables management.

Collectly: Enhancing Debtor Engagement Through Automated Communication

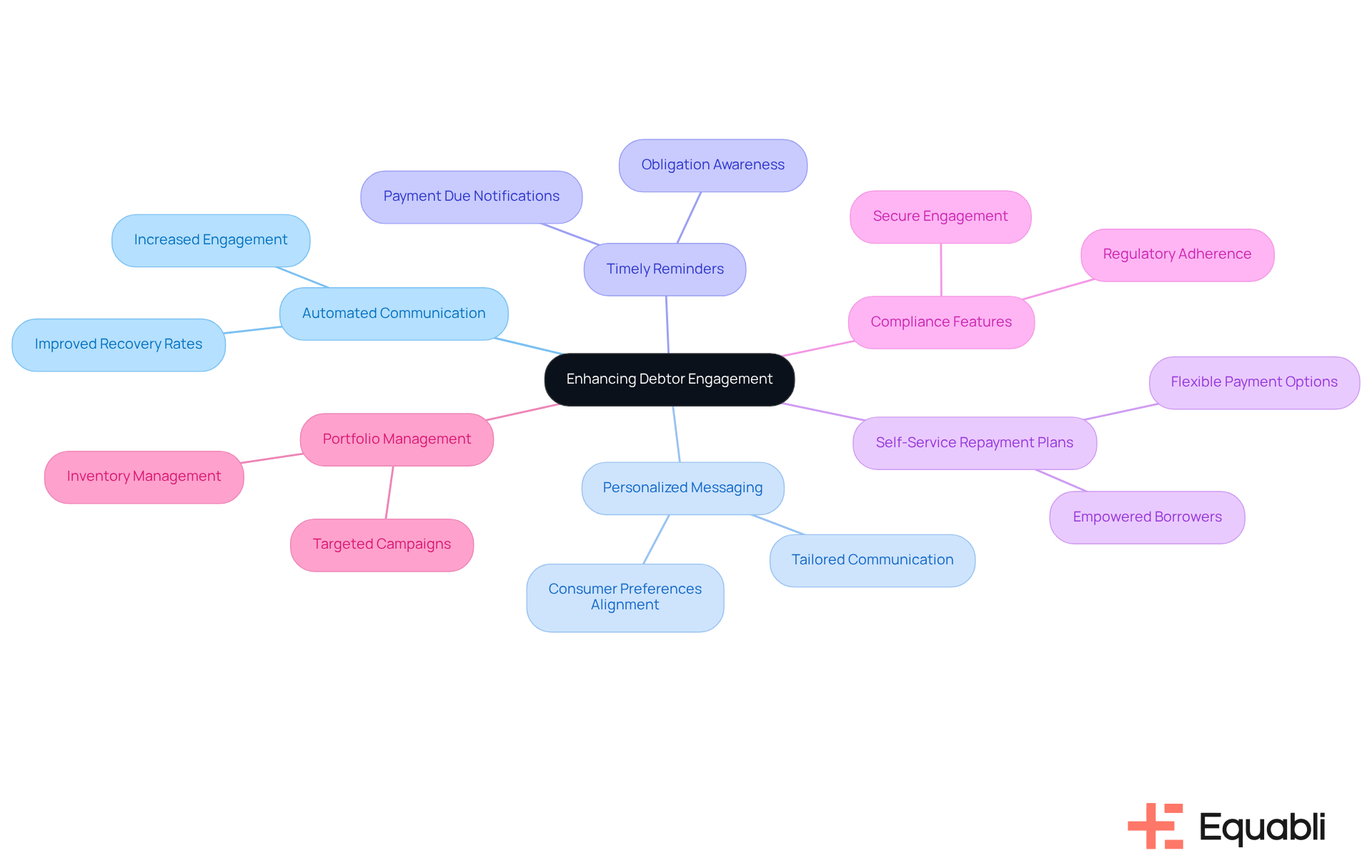

Equabli significantly enhances debtor engagement through its automated communication strategies. By leveraging personalized messaging and timely reminders, the EQ Engage platform ensures borrowers remain informed about their obligations. This proactive communication not only increases the likelihood of timely payments but also fosters a positive relationship between lenders and borrowers. As a result, financial organizations experience improved recovery rates, underscoring the critical role of automated collections process optimization strategies for financial institutions in enhancing retrieval processes.

Moreover, EQ Engage empowers borrowers to self-service with tailored repayment plans, facilitating smarter payment options that align with consumer preferences. The platform's compliance features guarantee that communication adheres to regulatory standards, thereby enhancing secure engagement. Additionally, EQ Engage offers robust portfolio management capabilities, enabling organizations to manage inventory, establish engagement rules, and execute targeted campaigns.

Given the anticipated decline in global business bankruptcies, it is imperative for financial organizations to prioritize automated collections process optimization strategies for financial institutions as part of their innovative financial recovery strategies. This approach will enable them to effectively navigate the evolving landscape of debt collection and risk management.

TaskRay: Workflow Automation for Efficient Debt Collection Management

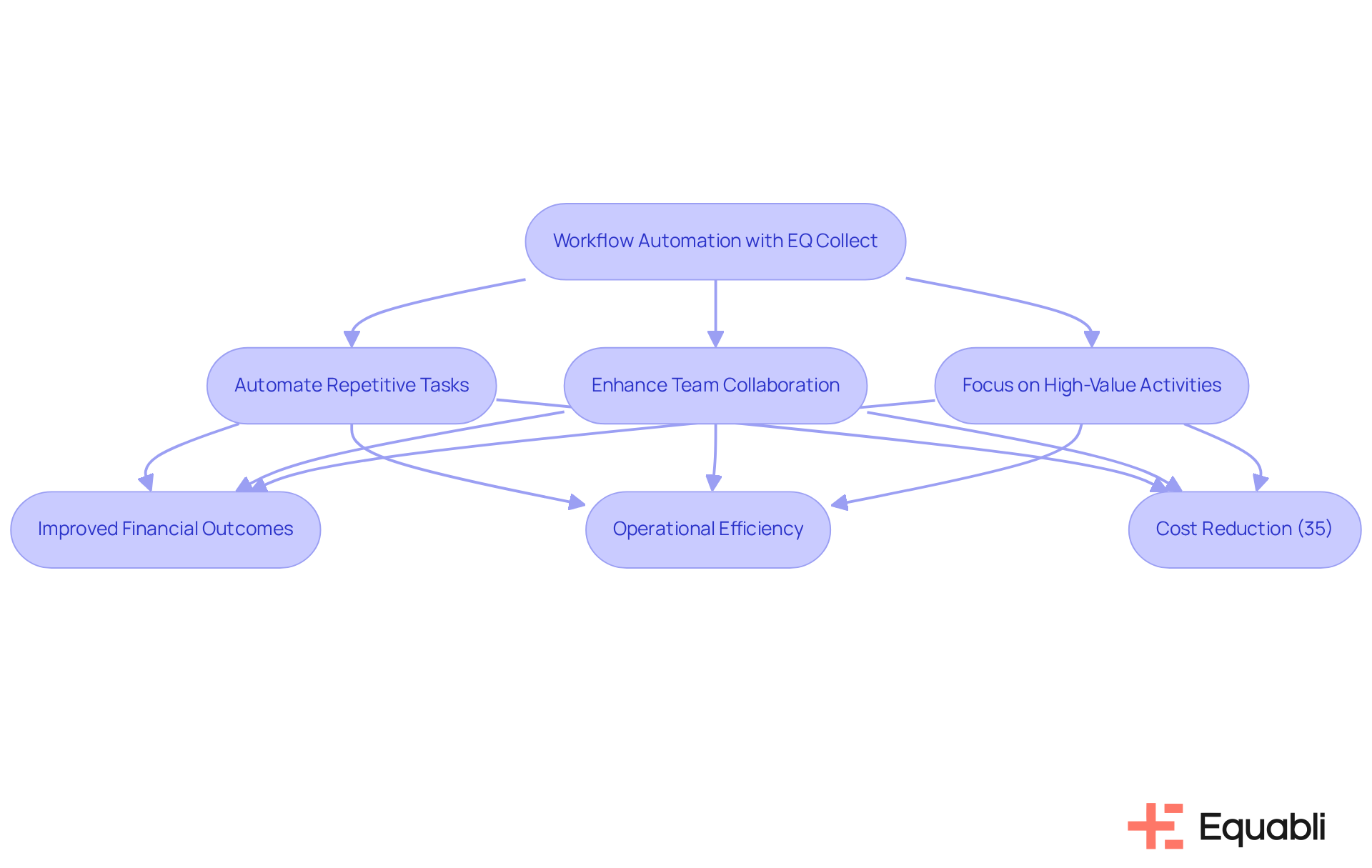

Equabli revolutionizes debt management through its advanced workflow automation solutions, particularly with EQ Collect. By automating repetitive tasks, EQ Collect streamlines processes and enhances collaboration among team members. This shift allows teams to focus on high-value activities, such as negotiating with debtors and developing strategic recovery plans. Consequently, organizations can achieve improved financial outcomes and enhanced operational efficiency.

Current trends indicate that debt recovery teams must implement automated collections process optimization strategies for financial institutions, enabling them to swiftly adapt to evolving market demands while ensuring compliance and boosting performance. With features like an intuitive, scalable, cloud-based interface, a no-code file-mapping tool, data-driven methodologies, and real-time reporting, organizations utilizing EQ Collect can realize a 35% reduction in costs per account and a 75% decrease in time-to-market for new strategies.

Moreover, selecting the right vendors and partners, such as Equabli, is crucial for successful automation initiatives. This strategic choice helps organizations effectively mitigate burnout and enhance work-life balance among their teams, ultimately fostering a more resilient operational environment.

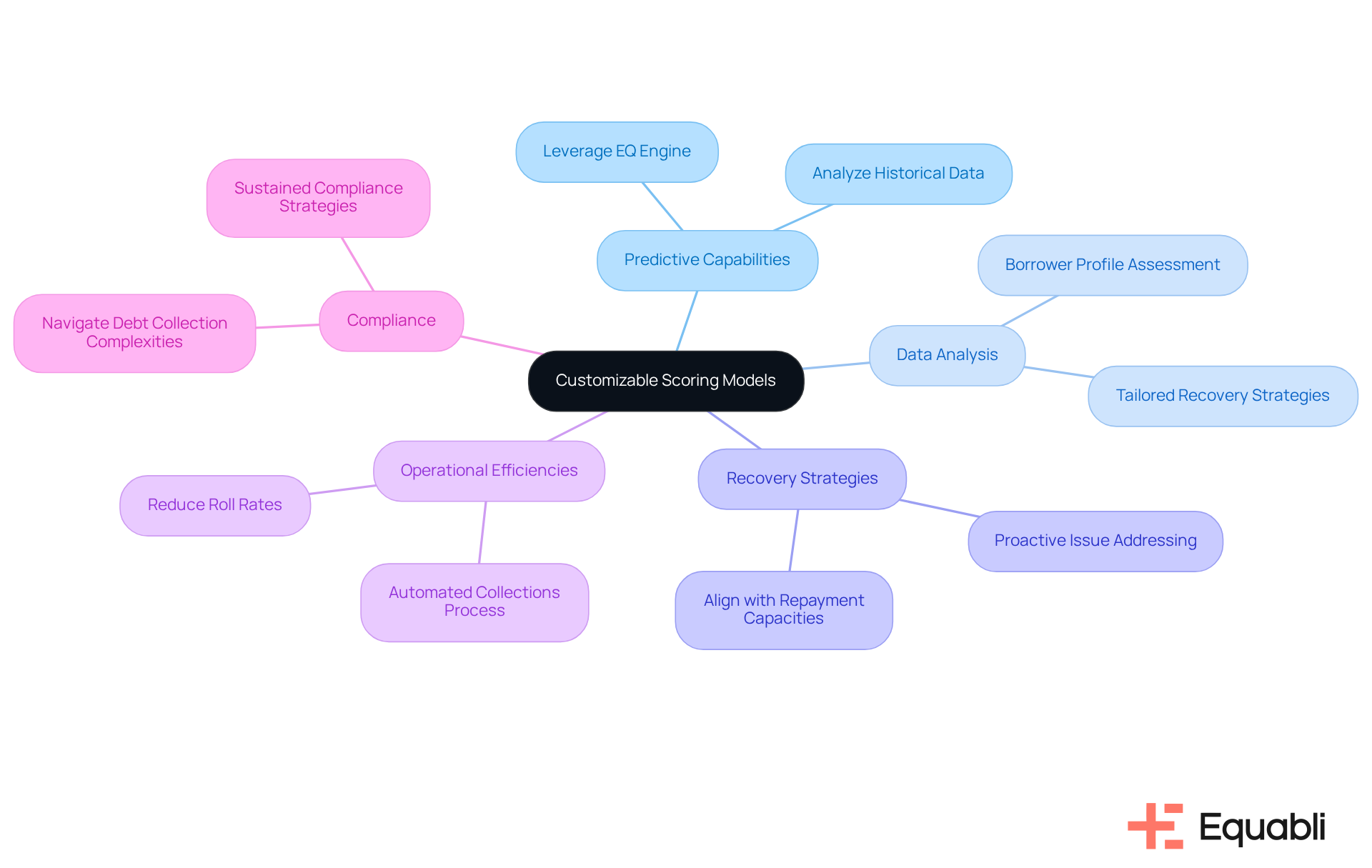

Scorecard: Customizable Scoring Models for Predicting Repayment Behaviors

Scorecard offers adaptable scoring frameworks that empower lenders to accurately forecast borrower repayment patterns. By leveraging the EQ Engine’s predictive capabilities across various communication channels, organizations can analyze historical data and borrower profiles. This analysis enables the development of tailored recovery strategies that align with individual repayment capacities.

This integration not only improves recovery rates but also mitigates the risk of default by proactively addressing potential issues. By implementing automated collections process optimization strategies for financial institutions based on anticipated default risks, organizations can enhance operational efficiencies and reduce roll rates in their recovery processes.

In an environment where compliance and risk management are paramount, lenders can utilize automated collections process optimization strategies for financial institutions to navigate the complexities of debt collection effectively. How can organizations further refine these approaches to ensure sustained compliance and operational excellence?

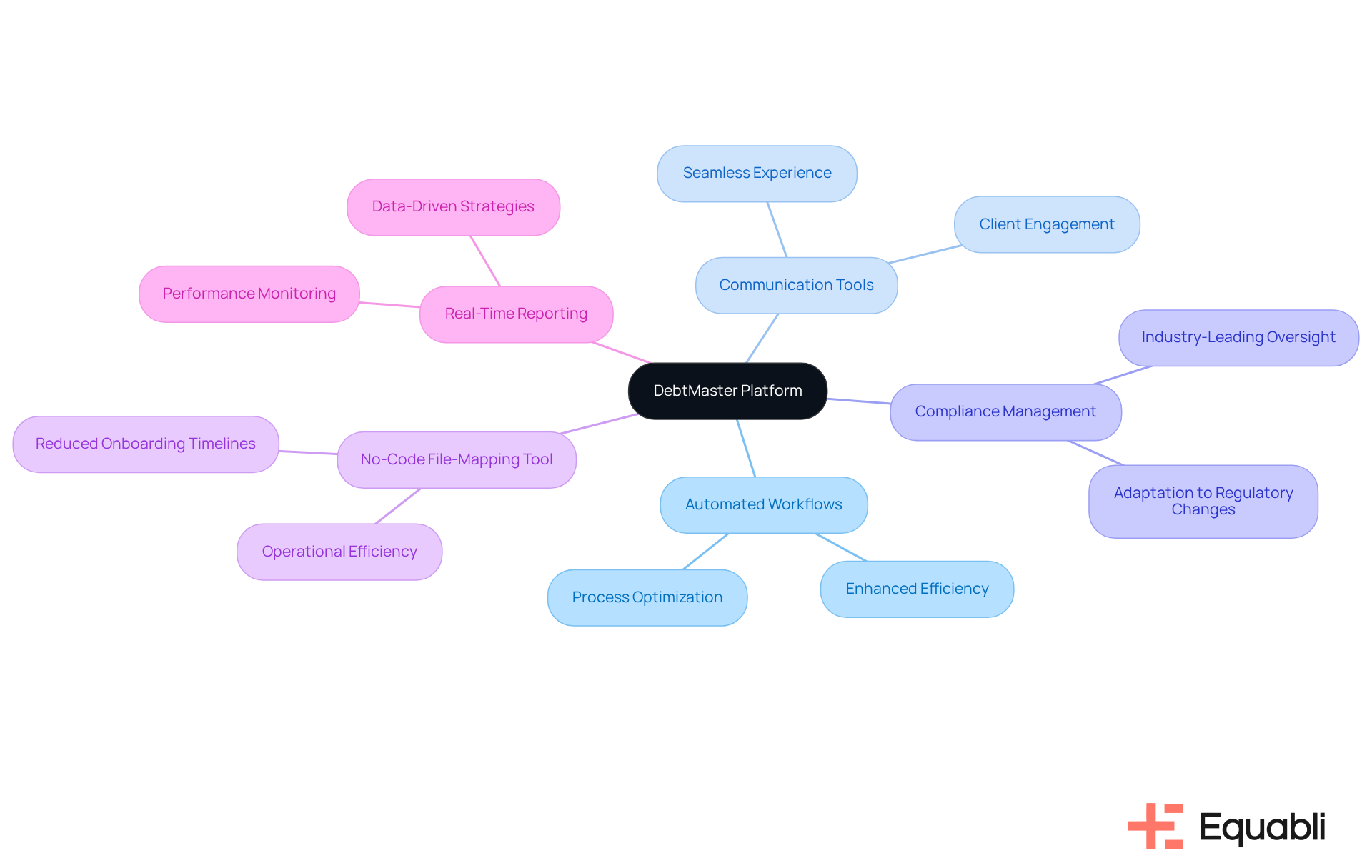

DebtMaster: Comprehensive Platform for Modern Debt Collection Solutions

DebtMaster serves as a pivotal platform for modern financial recovery solutions, integrating essential functionalities such as automated workflows, communication tools, and compliance management into a cohesive ecosystem. This comprehensive approach allows financial institutions to utilize automated collections process optimization strategies for financial institutions, enabling them to manage their receivables with enhanced efficiency and ensuring that every aspect of the recovery process is streamlined and optimized for maximum effectiveness.

The platform features a no-code file-mapping tool and data-driven strategies, which significantly reduce vendor onboarding timelines and bolster operational efficiency. By providing real-time reporting and industry-leading compliance oversight, DebtMaster empowers client engagement and facilitates product adoption. These capabilities are crucial for organizations aiming to navigate the complexities of debt recovery in a regulatory landscape.

Furthermore, by leveraging intelligent automation and machine learning solutions, DebtMaster utilizes automated collections process optimization strategies for financial institutions to transform the debt recovery process, maximizing collection performance while ensuring a seamless experience for both clients and their customers. This strategic integration of technology not only enhances operational workflows but also positions organizations to adapt to evolving compliance requirements effectively.

Conclusion

The optimization of automated collections processes is crucial for financial institutions aiming to enhance their debt recovery capabilities. By implementing advanced solutions like Equabli’s EQ Suite, organizations can significantly boost operational efficiency, borrower engagement, and compliance, ultimately leading to improved financial outcomes. This strategic shift modernizes debt recovery practices and equips institutions to navigate the complexities of regulatory requirements with greater confidence.

Key insights emphasize the necessity of leveraging data-driven approaches and automation tools to streamline accounts receivable processes. Solutions such as Gaviti, Creatio, and ComplianceMax illustrate how automation can lower operational costs, enhance communication with borrowers, and ensure adherence to regulatory standards. Moreover, integrating analytics-driven insights enables organizations to customize their recovery strategies, thereby maximizing their success in debt collection.

As financial institutions confront evolving market dynamics, prioritizing automated collections process optimization strategies becomes increasingly critical. Embracing these innovative tools and methodologies not only improves recovery rates but also cultivates stronger relationships with borrowers. By investing in automation and analytics, organizations can elevate their operational excellence and ensure sustained compliance in a constantly changing regulatory landscape.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is an advanced solution designed to optimize the payment recovery process for financial institutions. It includes the EQ Engine, EQ Engage, and EQ Collect, focusing on improving operational efficiency and borrower engagement through advanced analytics and customizable scoring models.

How does the EQ Suite enhance operational efficiency?

The EQ Suite enhances operational efficiency by implementing automated collections process optimization strategies, allowing financial institutions to accurately forecast repayment behaviors and refine their recovery strategies, ultimately reducing operational costs.

What benefits does the EQ Suite provide for borrower engagement?

The EQ Suite improves borrower engagement by facilitating communication through preferred channels, which addresses the critical need for effective engagement in debt recovery and enhances borrower satisfaction.

How does the EQ Suite ensure compliance with regulatory requirements?

The EQ Suite aligns with regulatory requirements, helping financial institutions navigate the complexities of debt collection effectively while maintaining compliance through its data-driven approach and advanced analytics.

What tools does Equabli offer to streamline accounts receivable processes?

Equabli offers tools like a no-code file-mapping tool, automated workflows, and real-time reporting to enhance recovery efforts, reduce vendor onboarding timelines, and improve cash flow management.

How does Equabli's platform minimize execution errors?

By automating workflows and reducing reliance on manual resources, Equabli's platform minimizes execution errors, allowing financial institutions to focus on strategic decision-making and improve recovery rates.

What features contribute to compliance management in Equabli's solutions?

Equabli's solutions include robust compliance management features that ensure adherence to regulatory standards, which is crucial for maintaining operational integrity in debt collection.

How does Equabli utilize data-driven insights in debt collection?

Equabli integrates customer data and analytics to allow organizations to tailor their retrieval strategies based on borrower behavior, ensuring timely and relevant communication that improves recovery rates.

What advantages does the no-code platform offer to organizations?

The no-code platform allows organizations to easily implement automated collections process optimization strategies without requiring extensive technical knowledge, making it user-friendly and scalable.

How does Equabli help organizations respond to changing market dynamics?

By utilizing data analytics to identify trends and adjust strategies proactively, Equabli positions organizations to mitigate risk and respond swiftly to changing market dynamics, enhancing their overall recovery efforts.