Overview

This article identifies automated collections software solutions that significantly enhance enterprise risk management within debt recovery processes. It emphasizes platforms such as Equabli's EQ Suite and EQ Collect, which utilize advanced technology and data analytics to improve recovery rates, ensure compliance, and optimize operational efficiency. These solutions effectively address the complexities associated with financial risk management in enterprises.

From a compliance perspective, leveraging such technology is crucial. Evidence shows that organizations employing these platforms experience higher recovery rates and reduced compliance risks. For instance, data analytics capabilities allow for better tracking of regulatory changes, ensuring that enterprises remain compliant with evolving standards.

The impact of these automated solutions on enterprise-level operations is profound. By streamlining debt recovery processes, organizations can allocate resources more effectively, thereby enhancing overall operational efficiency. This not only mitigates financial risks but also positions enterprises to respond proactively to market changes.

To operationalize this strategy, executives must consider integrating these advanced software solutions into their existing frameworks. The strategic adoption of such technologies can lead to significant improvements in both compliance and recovery outcomes, ultimately driving better financial performance.

Introduction

The landscape of debt collection is evolving rapidly, influenced by technological advancements and increasing regulatory demands. Organizations are striving to enhance their financial recovery processes, making automated collections software solutions essential for effective enterprise risk management. This article examines ten innovative software solutions that not only streamline operations but also ensure compliance and enhance borrower engagement. As enterprises navigate a multitude of options, the critical question arises: which tools will best address their unique challenges and drive optimal results in 2025?

Equabli EQ Suite: Comprehensive Debt Collection Solutions for Enterprises

The Equabli EQ Suite serves as a pivotal platform tailored to meet the diverse needs of businesses engaged in debt recovery. It offers advanced tools for custom scoring models, optimized retrieval strategies, and digital acquisitions. By leveraging cloud-based technology, the EQ Suite enhances both efficiency and effectiveness in managing delinquent accounts, positioning itself as an essential solution for organizations seeking to modernize their recovery processes.

With features such as automated workflows, real-time reporting, and stringent compliance oversight, the EQ Suite not only streamlines financial recovery but also prioritizes data protection throughout the process. This commitment to safeguarding client information, coupled with data-informed strategies, empowers financial institutions to improve their retrieval performance while ensuring transparency and adherence to regulatory standards.

In an era where compliance is paramount, the EQ Suite stands out by incorporating automated collections software solutions for enterprise financial risk management, alongside robust security measures and operational efficiencies that tackle the complexities of enterprise-level debt collection. Organizations can leverage these capabilities to navigate the evolving landscape of financial recovery, ultimately enhancing their strategic positioning in the market.

Finvi Debt Collection Software: Tailored Solutions for Diverse Industries

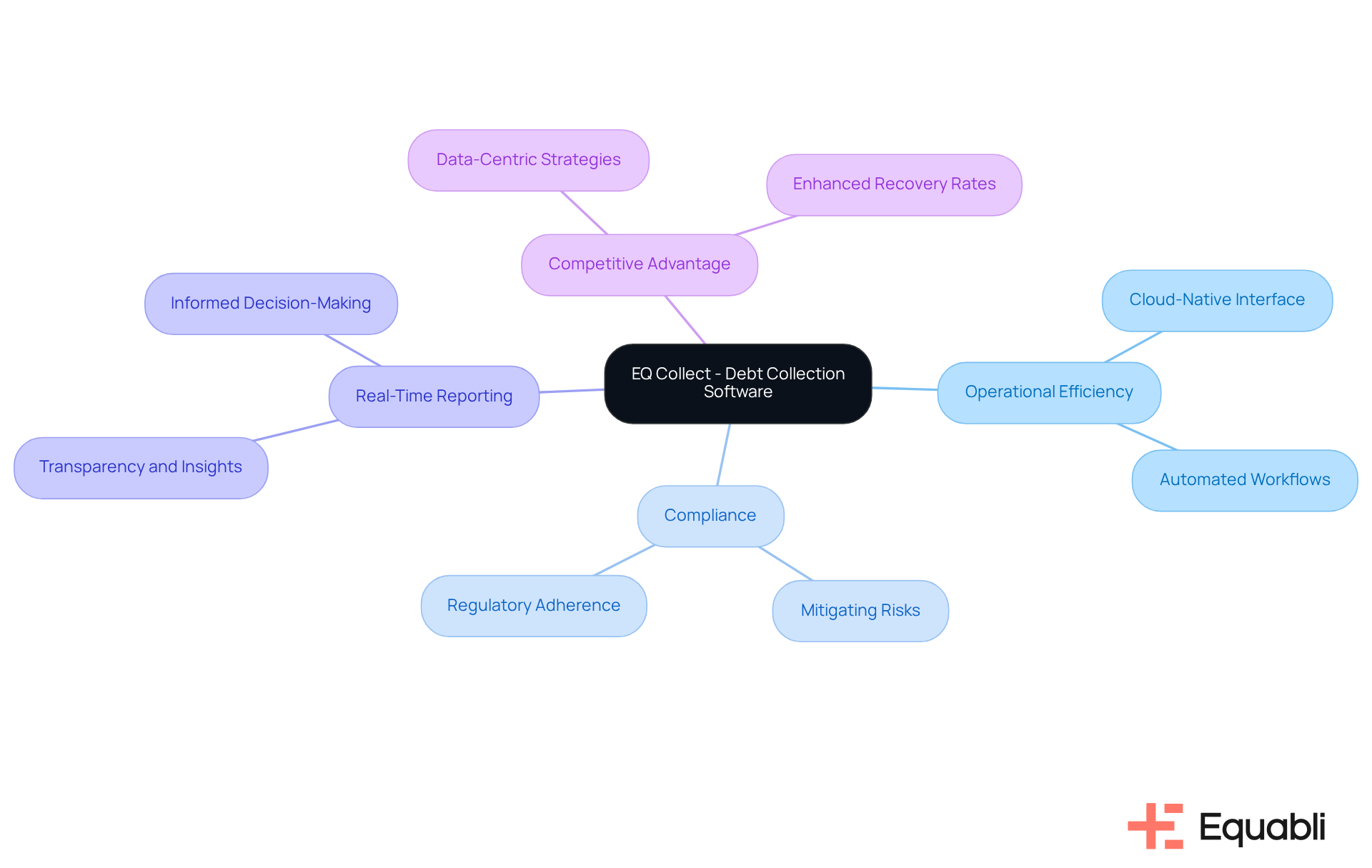

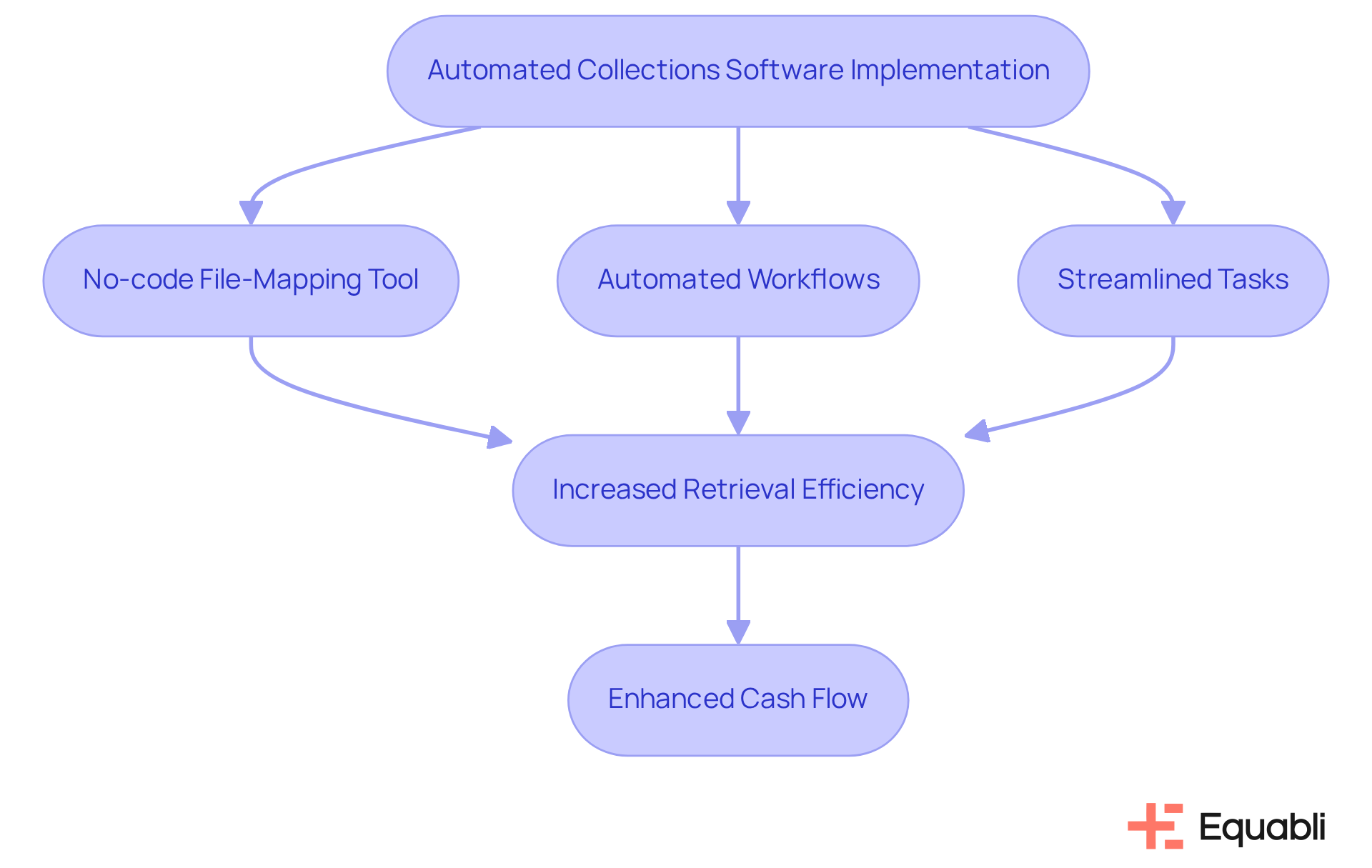

Equabli provides automated collections software solutions for enterprise financial risk management through EQ Collect, specifically designed to enhance operational efficiency for large financial organizations. This platform features a user-friendly, scalable, cloud-native interface and a no-code file-mapping tool that significantly reduces vendor onboarding timelines. Such capabilities streamline processes and minimize execution errors via automated workflows, which not only improve retrieval performance but also ensure compliance with industry standards through automated collections software solutions for enterprise financial risk management.

Moreover, real-time reporting delivers unparalleled transparency and insights, empowering financial executives to make informed decisions. Compared to competitors like Finvi, EQ Collect's data-centric strategies and comprehensive features position it as a compelling choice in the automated recovery landscape, fundamentally transforming debt retrieval for financial institutions.

From a compliance perspective, the integration of automated collections software solutions for enterprise financial risk management within EQ Collect not only enhances operational workflows but also mitigates risks associated with regulatory adherence. This strategic alignment with industry standards is crucial for organizations aiming to navigate the complexities of debt recovery effectively.

In conclusion, EQ Collect stands out as a strategic partner for financial organizations seeking to optimize their receivables recovery processes while maintaining compliance and operational excellence.

Equabli EQ Engine: Predictive Scoring for Enhanced Repayment Strategies

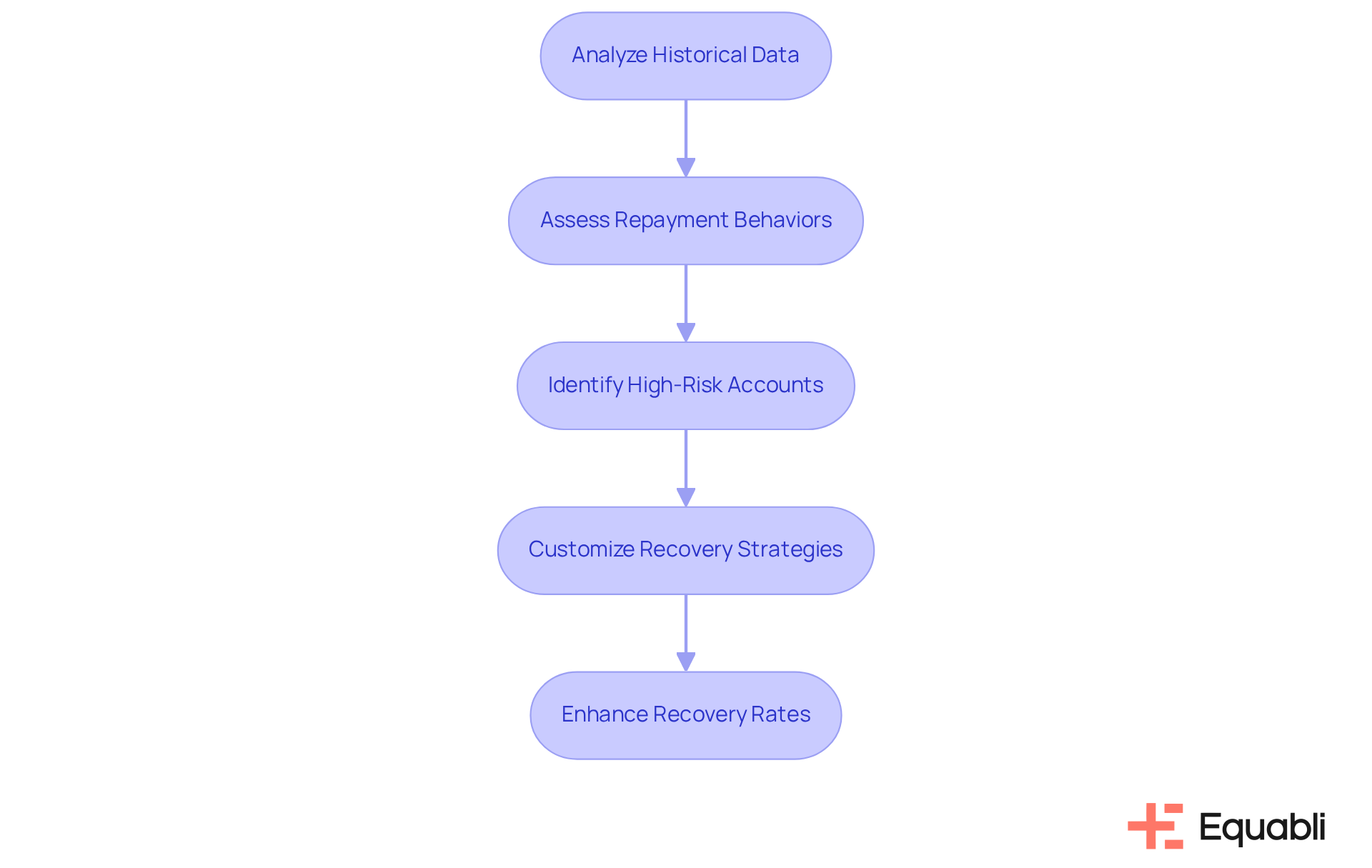

The EQ Engine serves as a pivotal component of the EQ Suite, utilizing advanced predictive scoring models to assess repayment behaviors across diverse communication channels. By meticulously analyzing historical data and loan applicant profiles, the EQ Engine utilizes automated collections software solutions for enterprise financial risk management to empower organizations to pinpoint high-risk accounts and customize their recovery strategies. This proactive approach not only enhances recovery rates but also cultivates stronger relationships with borrowers by addressing their specific financial circumstances.

Financial analysts emphasize that understanding repayment behavior through predictive analytics, supported by automated collections software solutions for enterprise financial risk management, leads to more informed decision-making and ultimately boosts the efficiency of recovery efforts. As we approach 2025, the role of predictive analytics in shaping repayment behaviors is expected to grow, with organizations increasingly relying on data-driven insights to refine their strategies. The EQ Engine exemplifies this evolution by offering automated collections software solutions for enterprise financial risk management, providing a robust framework for identifying potential risks and implementing effective repayment plans that resonate with clients, thereby improving collection efforts and enhancing recovery outcomes.

Equabli EQ Engage: Boosting Borrower Engagement for Better Collection Outcomes

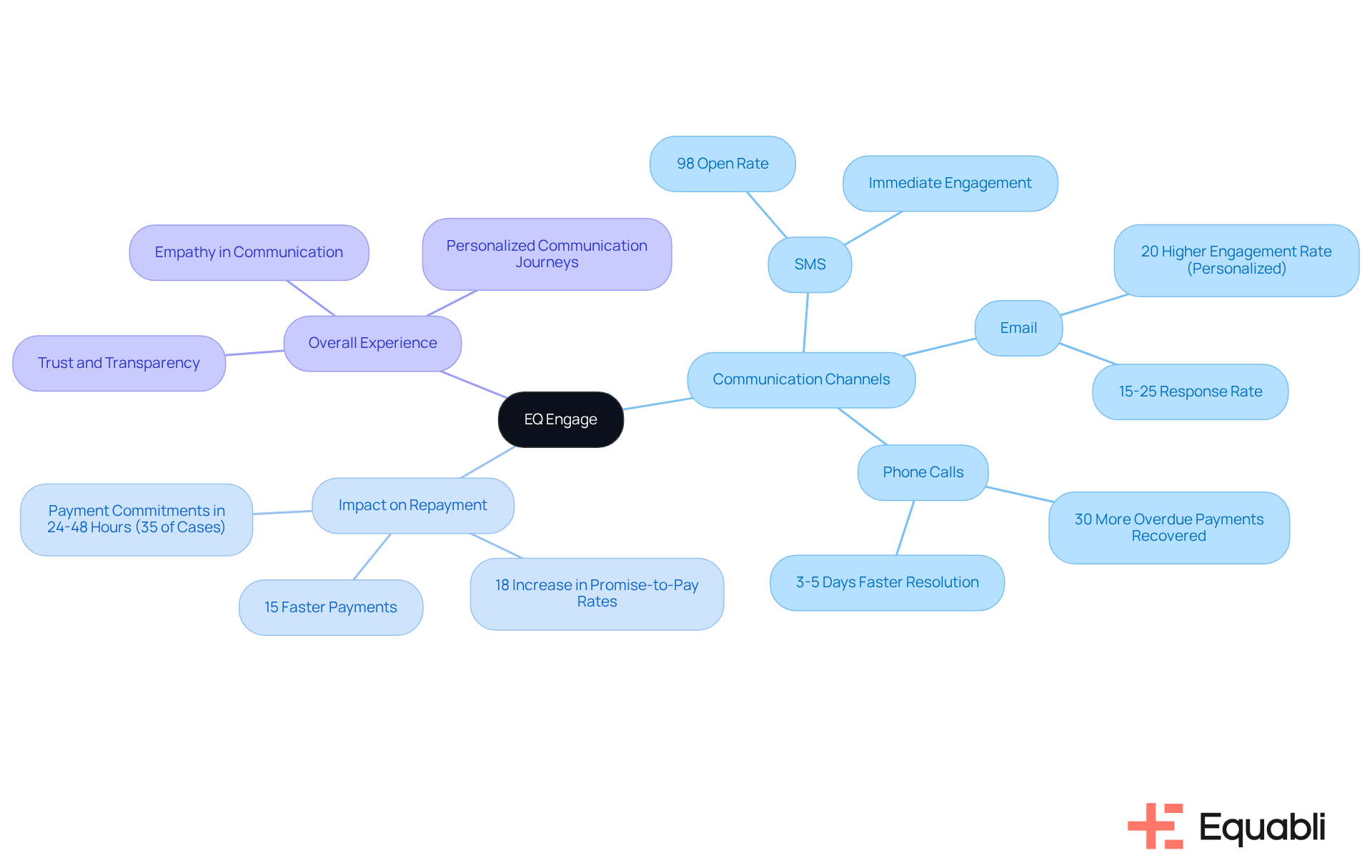

EQ Engage enhances participant involvement through tailored communication strategies that leverage preferred channels such as SMS, email, and phone calls. This tool ensures borrowers receive timely and relevant information regarding their debts, fostering trust and transparency between lenders and borrowers. By personalizing communication journeys, EQ Engage significantly boosts engagement, thereby increasing the likelihood of repayment.

Research indicates that customers contacted via their preferred channel pay 15% faster on average, highlighting the effectiveness of personalized outreach. Furthermore, text messaging achieves an impressive 98% open rate within five minutes, establishing it as a powerful tool for immediate engagement. Effective communication methods, such as integrating phone calls with follow-up texts, can enhance promise-to-pay rates by 18%, underscoring the importance of a multi-channel approach.

Additionally, text messaging generates payment commitments within 24-48 hours in 35% of cases, further illustrating the impact of personalized communication strategies. As the financial recovery landscape evolves, the emphasis on individualized communication becomes increasingly critical. Industry leaders recognize that empathy and understanding can bridge the gap between collectors and consumers. This approach not only aids in debt recovery but also transforms the overall experience for individuals seeking loans, positioning it as a cornerstone of effective debt management.

Equabli EQ Collect: Streamlined Digital Collections for Modern Enterprises

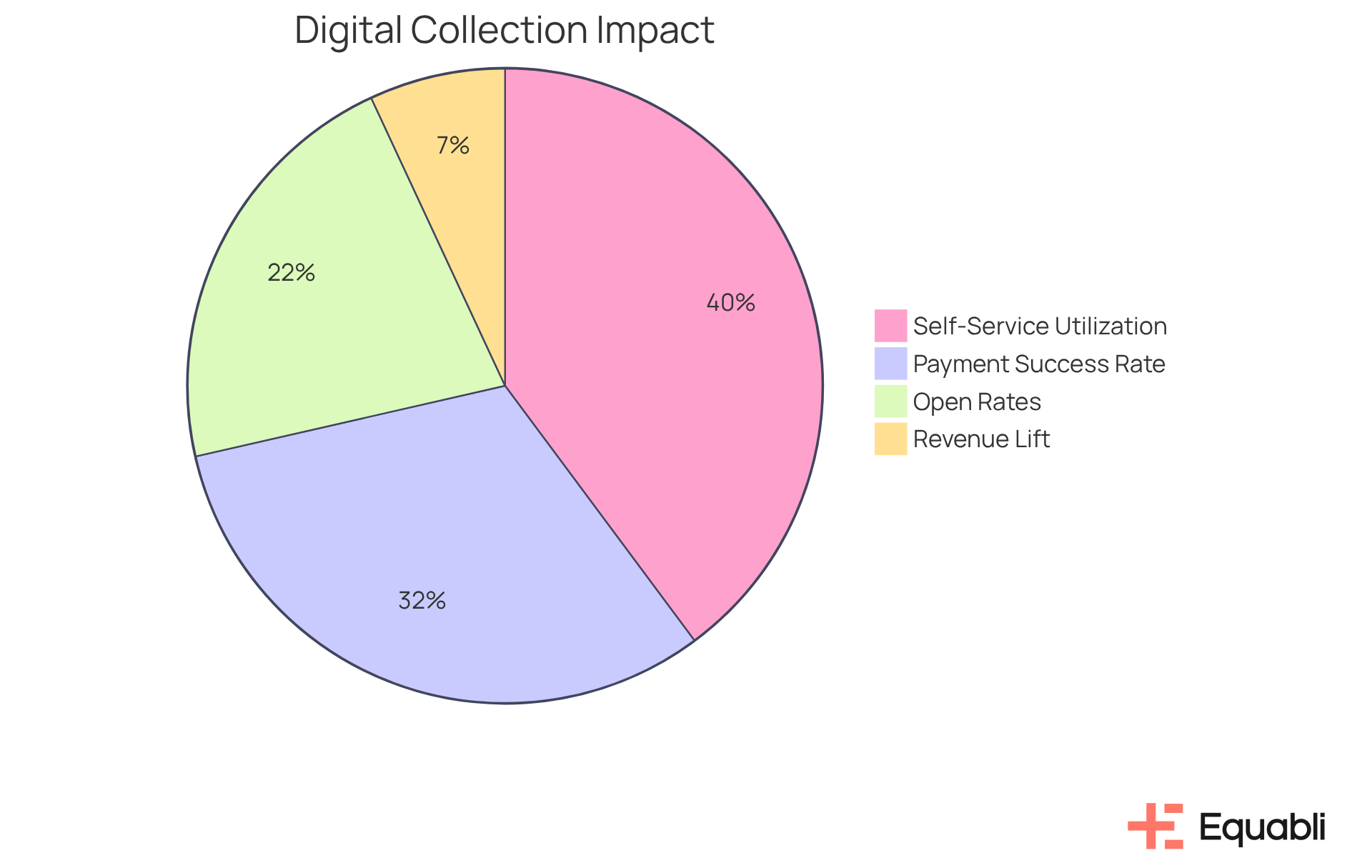

EQ Collect transforms digital assets by enabling businesses to establish self-service repayment plans and automate payment processing. This tool not only reduces operational expenses but also enhances user experience through flexible repayment options tailored to individual needs. The Client Success Representative at Equabli plays a pivotal role in this process, leading the setup and implementation during client onboarding. This ensures a seamless transition and a robust start to the client relationship. Proactive check-ins and strategic business reviews allow them to identify upsell opportunities and share insights on product usage trends.

Research indicates that:

- 73% of customers in late delinquency made payments when contacted through digital channels, underscoring the effectiveness of these approaches.

- Self-service payment alternatives significantly boost revenue outcomes and customer satisfaction, with 92% of clients utilizing them when available.

By promoting product use and understanding client business objectives, the Client Success Representative helps organizations enhance retrieval efficiency and adapt to the evolving preferences of borrowers.

Successful implementations have demonstrated that self-service portals can lead to a 16% revenue lift and improved collection rates, showcasing the tangible benefits of using automated collections software solutions for enterprise financial risk management in payment processes. As Tim Smith, Senior Vice President - Collections, notes, "Digital communications can achieve open rates of 50% or greater," emphasizing the importance of effective outreach methods. As financial institutions increasingly adopt these modern strategies, they can anticipate enhanced customer satisfaction and operational efficiency.

Finvi Compliance Features: Ensuring Regulatory Adherence in Debt Collection

Equabli's EQ Collect software offers robust compliance features that empower organizations to navigate the intricate regulatory landscape effectively. These features ensure adherence to federal and state laws, significantly mitigating the risk of legal complications. By prioritizing compliance, EQ Collect allows users to focus on efficient recoveries without the looming threat of regulatory repercussions.

Moreover, EQ Collect enhances payment recovery effectiveness through automated collections software solutions for enterprise financial risk management, along with automated workflows, real-time reporting, and an intuitive, scalable interface. The inclusion of a no-code file-mapping tool and data-driven approaches further streamlines operations, enabling financial institutions to optimize their receivables management while maintaining industry-leading oversight. This strategic alignment not only improves operational efficiency but also reinforces compliance integrity, positioning organizations to thrive in a complex regulatory environment.

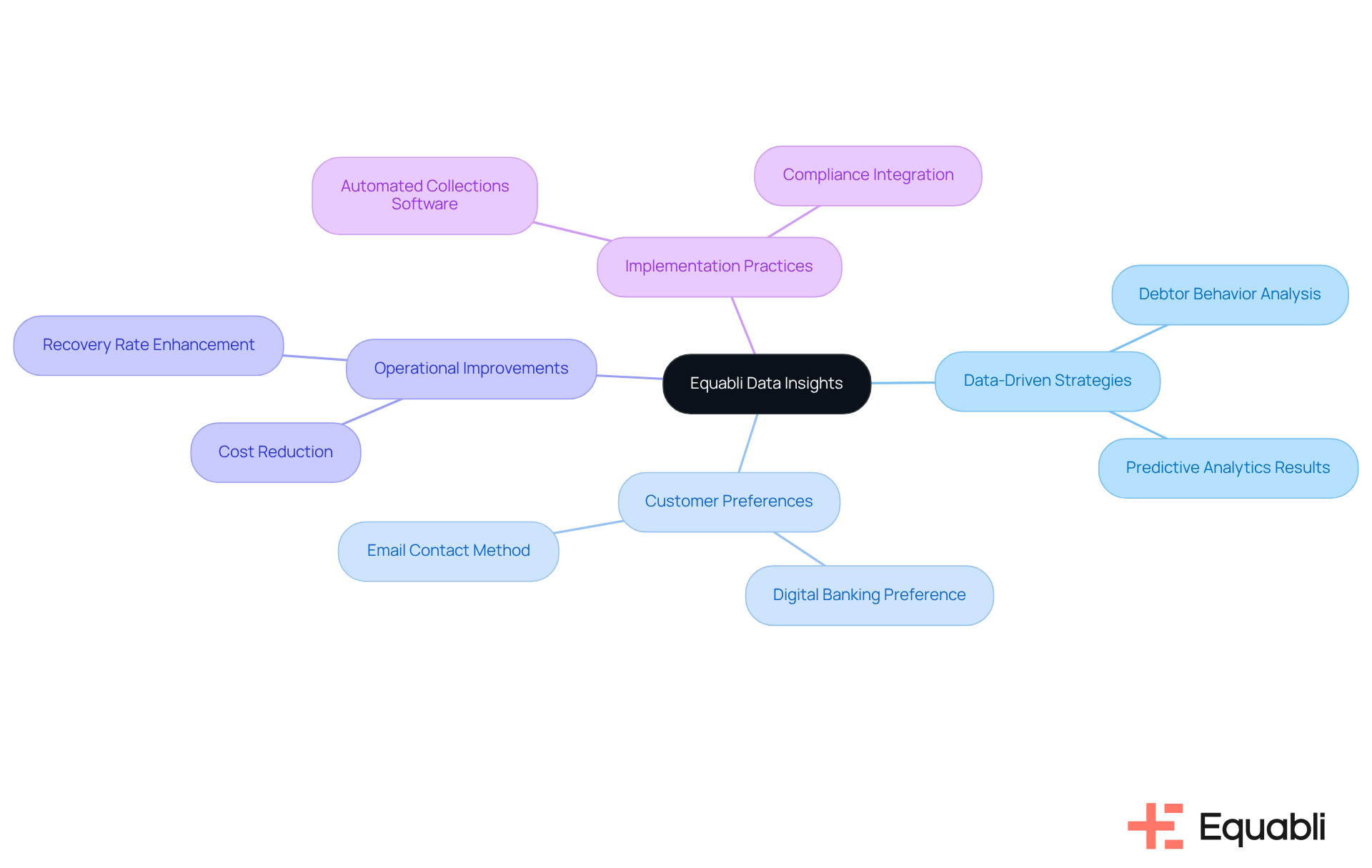

Equabli Data Insights: Transforming Information into Actionable Strategies

Equabli leverages advanced data analytics to convert raw information into actionable strategies for fund recovery. By analyzing debtor behavior and repayment patterns, organizations can make informed decisions that significantly enhance their recovery efforts. This data-driven approach not only improves recovery rates but also aids in strategic planning and optimal resource allocation. For example, agencies utilizing predictive analytics have reported recovery rate enhancements of 15-25%, underscoring the effectiveness of data insights.

Moreover, with 71% of consumers preferring digital banking and 59.5% opting for email as their primary contact method for debt recovery, understanding customer preferences is crucial for tailoring communication and payment options. As Chris Hopkins notes, "Companies utilizing advanced AI capabilities in debt recovery see remarkable outcomes: a 40% decrease in operational costs, a 10% enhancement in recoveries, and a 30% rise in customer satisfaction ratings." By transforming borrower behavior data into practical insights, Equabli empowers organizations to proactively engage with debtors, leading to improved recovery outcomes.

To implement these data-informed strategies, financial organizations should focus on integrating automated collections software solutions for enterprise financial risk management into their data collection processes. This approach not only aligns with compliance requirements but also positions organizations to navigate the complexities of enterprise-level debt collection effectively.

Equabli Automation: Enhancing Efficiency Through Automated Strategy Execution

Equabli's automated collections software solutions for enterprise financial risk management significantly enhance the implementation of gathering strategies, thereby reducing manual involvement and improving operational efficiency. For instance, the no-code file-mapping tool and automated workflows enable organizations to streamline routine tasks such as follow-ups and payment reminders. This allows teams to allocate their resources toward more complex cases that require personalized attention. Consequently, this shift accelerates the gathering process and boosts overall productivity.

Financial organizations that utilize automated collections software solutions for enterprise financial risk management have reported notable improvements in retrieval efficiency, with some experiencing recovery rate increases of up to 30%. The reduction of manual tasks empowers teams to concentrate on strategic initiatives, fostering a proactive approach to collections management. As a result, businesses can maintain stronger customer relationships while ensuring timely payments, ultimately enhancing cash flow and financial health.

Moreover, the role of Client Success Representatives at Equabli further strengthens client engagement and product adoption. This ensures that financial institutions maximize the benefits of automated collections software solutions for enterprise financial risk management, effectively positioning them to navigate the complexities of enterprise-level debt collection.

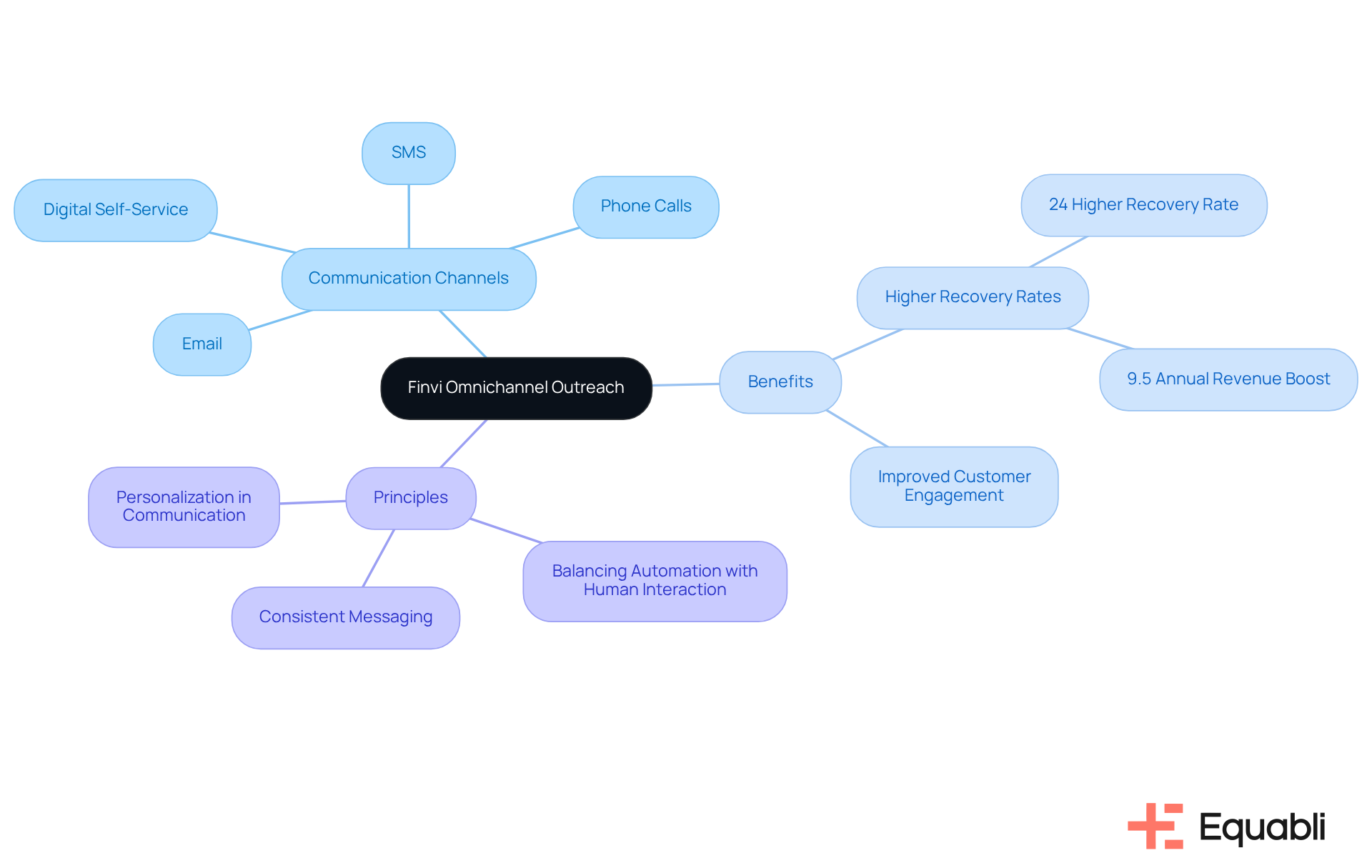

Finvi Omnichannel Outreach: Effective Communication for Debt Recovery

Finvi employs a robust omnichannel outreach strategy that facilitates effective communication with loan recipients across various platforms. This approach integrates channels such as email, SMS, and phone calls, significantly enhancing the likelihood of successful contact and repayment. Evidence shows that organizations utilizing omnichannel strategies report a 24% higher recovery rate compared to those relying solely on single-channel methods. As consumer preferences evolve, engaging borrowers through their preferred communication channels becomes essential for building trust and improving repayment outcomes.

However, balancing automation with human interaction is crucial, particularly in complex cases that necessitate a personal touch. Consistent messaging across all channels further amplifies the effectiveness of this strategy. As Bill Gosling articulated, "Omnichannel engagement means integrating voice, text, email, and digital self-service in a coordinated, compliant strategy." This comprehensive approach not only transforms the debt recovery process into a more respectful interaction but also aligns with the increasing demand for convenience and flexibility in debt resolution.

Equabli Security Standards: Protecting Sensitive Data in Debt Collection

Equabli prioritizes data security by implementing rigorous high-security standards across its suite of tools. This commitment not only ensures compliance with evolving regulations but also builds trust among clients and borrowers. Our Privacy Policy outlines how we collect and use data, reflecting our dedication to safeguarding private information. By emphasizing data protection, Equabli allows organizations to concentrate on efficient retrievals without compromising security.

In an environment where the cost of data breaches continues to escalate, adopting advanced security measures is crucial. For instance, organizations that implement comprehensive cybersecurity protocols can expect a significant enhancement in recovery efficiency—up to 40% more effective than traditional third-party unsecured consumer retrieval services. As the debt collection landscape evolves, integrating privacy-preserving AI techniques and zero-trust architecture will become standard practice, ensuring that every transaction and access point undergoes continuous verification.

This layered security approach not only protects sensitive data but also boosts overall operational efficiency, ultimately fostering improved borrower engagement and trust. From a compliance perspective, it is essential for enterprises to stay ahead of regulatory changes while enhancing their data protection strategies.

Conclusion

The landscape of debt collection is undergoing significant transformation, making the adoption of automated collections software solutions essential for enterprises focused on enhancing their financial risk management. Tools such as the Equabli EQ Suite and Finvi's offerings not only streamline the debt recovery process but also emphasize compliance and data security. By leveraging advanced technologies and predictive analytics, organizations can markedly improve their recovery rates while fostering strong relationships with borrowers.

Key insights from this discussion highlight the critical role of automation, tailored communication, and robust compliance features in contemporary debt collection strategies. For example, predictive scoring enables organizations to customize their approaches based on borrower behavior, while omnichannel outreach facilitates effective engagement across preferred communication platforms. Additionally, prioritizing data security protects sensitive information, thereby building trust and enhancing overall operational efficiency.

As the industry adapts to emerging challenges and opportunities, embracing these automated solutions is not merely advantageous but imperative for financial institutions. Organizations are urged to explore and implement these innovative tools, positioning themselves to adeptly navigate the complexities of debt collection and bolster their financial health in the years ahead.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a comprehensive platform designed for businesses engaged in debt recovery, offering advanced tools for custom scoring models, optimized retrieval strategies, and digital acquisitions.

How does the EQ Suite enhance debt collection processes?

The EQ Suite enhances debt collection processes by leveraging cloud-based technology to improve efficiency and effectiveness in managing delinquent accounts, featuring automated workflows, real-time reporting, and strict compliance oversight.

What are the key features of the EQ Suite?

Key features of the EQ Suite include automated workflows, real-time reporting, stringent compliance oversight, and a commitment to data protection, all aimed at streamlining financial recovery.

How does the EQ Suite ensure compliance and data protection?

The EQ Suite incorporates robust security measures and operational efficiencies, prioritizing data protection while ensuring transparency and adherence to regulatory standards throughout the recovery process.

What is EQ Collect and how does it differ from competitors like Finvi?

EQ Collect is an automated collections software solution specifically designed for enterprise financial risk management, featuring a user-friendly interface and no-code file-mapping tool. It is data-centric and offers comprehensive features that enhance operational efficiency, setting it apart from competitors like Finvi.

What role does the EQ Engine play in debt collection?

The EQ Engine utilizes advanced predictive scoring models to assess repayment behaviors, helping organizations identify high-risk accounts and customize recovery strategies based on historical data and loan applicant profiles.

How does predictive analytics improve debt recovery efforts?

Predictive analytics improves debt recovery efforts by enabling organizations to make informed decisions based on repayment behavior analysis, which enhances recovery rates and fosters stronger relationships with borrowers.

Why is compliance important in debt collection?

Compliance is crucial in debt collection to mitigate risks associated with regulatory adherence and to ensure that organizations operate within legal frameworks while effectively managing their recovery processes.