Overview

This article identifies ten automated debt collection software solutions that significantly enhance financial risk management for enterprises. These solutions incorporate features such as:

- Predictive analytics

- Automation

- Real-time reporting

These features collectively improve operational efficiency, compliance, and recovery rates. By leveraging these advanced tools, organizations are better positioned to navigate the complexities of debt recovery effectively, ensuring they meet regulatory requirements while optimizing their financial operations.

Introduction

The landscape of financial risk management is experiencing a notable transformation, primarily driven by the pressing need for efficient and effective debt recovery solutions. As organizations confront escalating operational costs and regulatory challenges, automated debt collection software has become an essential tool for enhancing recovery rates and streamlining processes. This article examines ten leading automated debt collection software solutions that not only aim to improve operational efficiency but also raise critical questions regarding compliance, data security, and the integration of advanced technologies.

How can businesses strategically leverage these tools to navigate the complexities of debt collection while ensuring competitiveness in an evolving market?

Equabli EQ Suite: Comprehensive Automated Debt Collection Solution

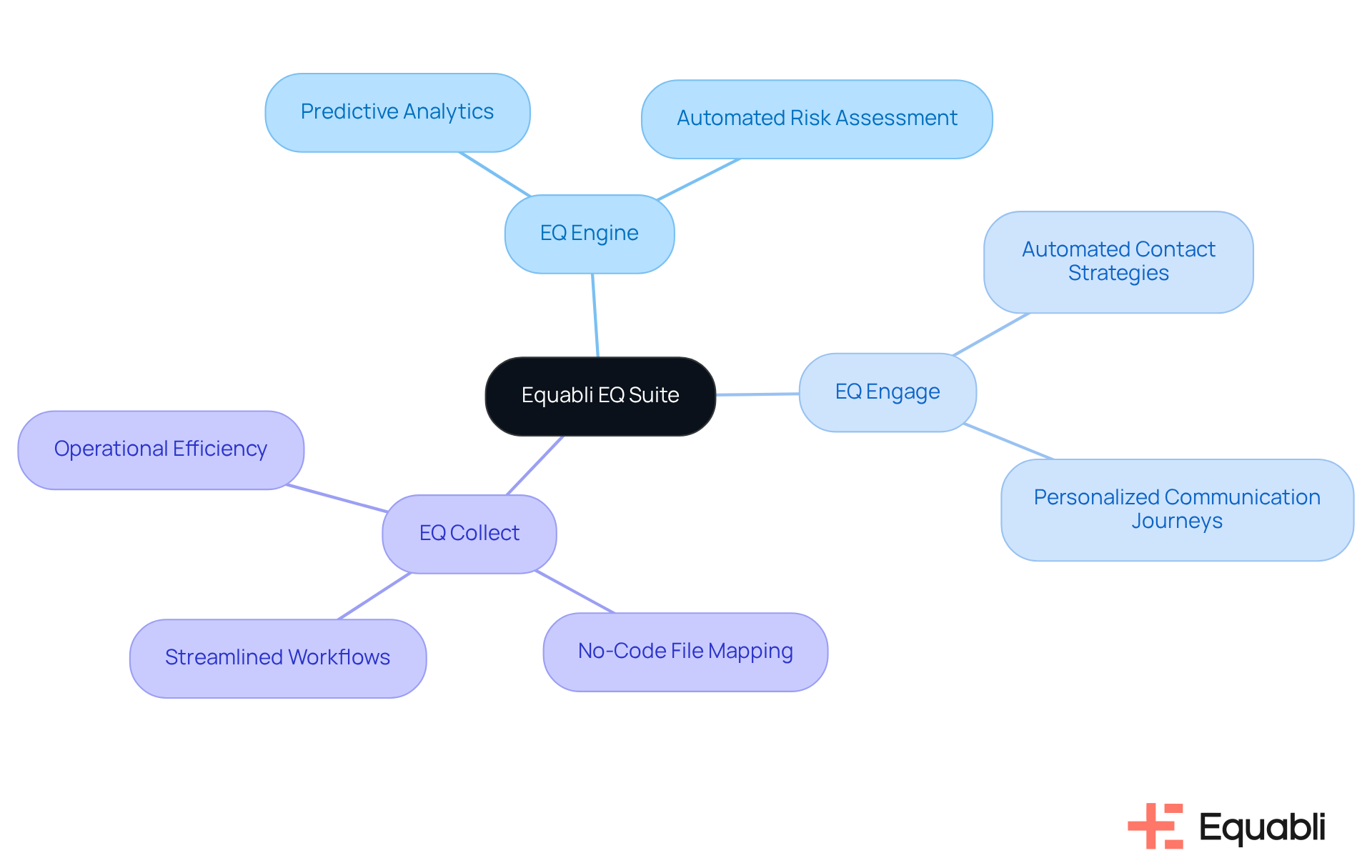

The EQ Suite represents a pivotal advancement in automated debt collection software solutions for enterprise financial risk management, benefiting lenders and agencies. This comprehensive platform integrates tools such as EQ Engine, EQ Engage, and EQ Collect, which utilize automated debt collection software solutions for enterprise financial risk management, alongside predictive analytics and automation to refine repayment strategies. For instance, the no-code file-mapping tool and streamlined workflows within EQ Collect significantly reduce manual tasks and execution errors, thereby enhancing operational efficiency and compliance oversight.

Moreover, EQ Engage empowers organizations to craft and automate borrower contact strategies, which are part of automated debt collection software solutions for enterprise financial risk management, ensuring that communication journeys are personalized and aligned with brand identity. By leveraging custom scoring models, the EQ Suite enables organizations to anticipate borrower behaviors, enhance engagement through preferred communication channels, and utilize automated debt collection software solutions for enterprise financial risk management. This strategic approach not only reduces operational costs but also improves recovery rates.

Equabli's unwavering commitment to data protection is crucial, as detailed in our Privacy Policy. This commitment ensures that all data usage adheres to industry standards and meets client needs, reinforcing the importance of compliance in today’s regulatory landscape.

CR Software: Advanced Automated Debt Collection Software for Enterprises

CR Software has introduced a state-of-the-art system for managing receivables, specifically designed for businesses. The Debt Manager platform offers comprehensive oversight of the recovery process, utilizing automated debt collection software solutions for enterprise financial risk management, featuring:

- Automated workflows that streamline operations

- Real-time reporting for improved decision-making

- Robust compliance tracking to meet regulatory standards

This software significantly enhances operational efficiency, enabling organizations to manage large volumes of accounts while prioritizing customer engagement and satisfaction.

As the financial recovery landscape evolves, businesses aiming to refine their retrieval strategies and enhance overall performance find that the integration of automated debt collection software solutions for enterprise financial risk management becomes essential. By adopting the Debt Manager platform, organizations can not only improve their recovery processes but also align with compliance requirements, thereby mitigating risks associated with debt collection.

Convin.ai: AI-Powered Debt Collection Automation for Enterprises

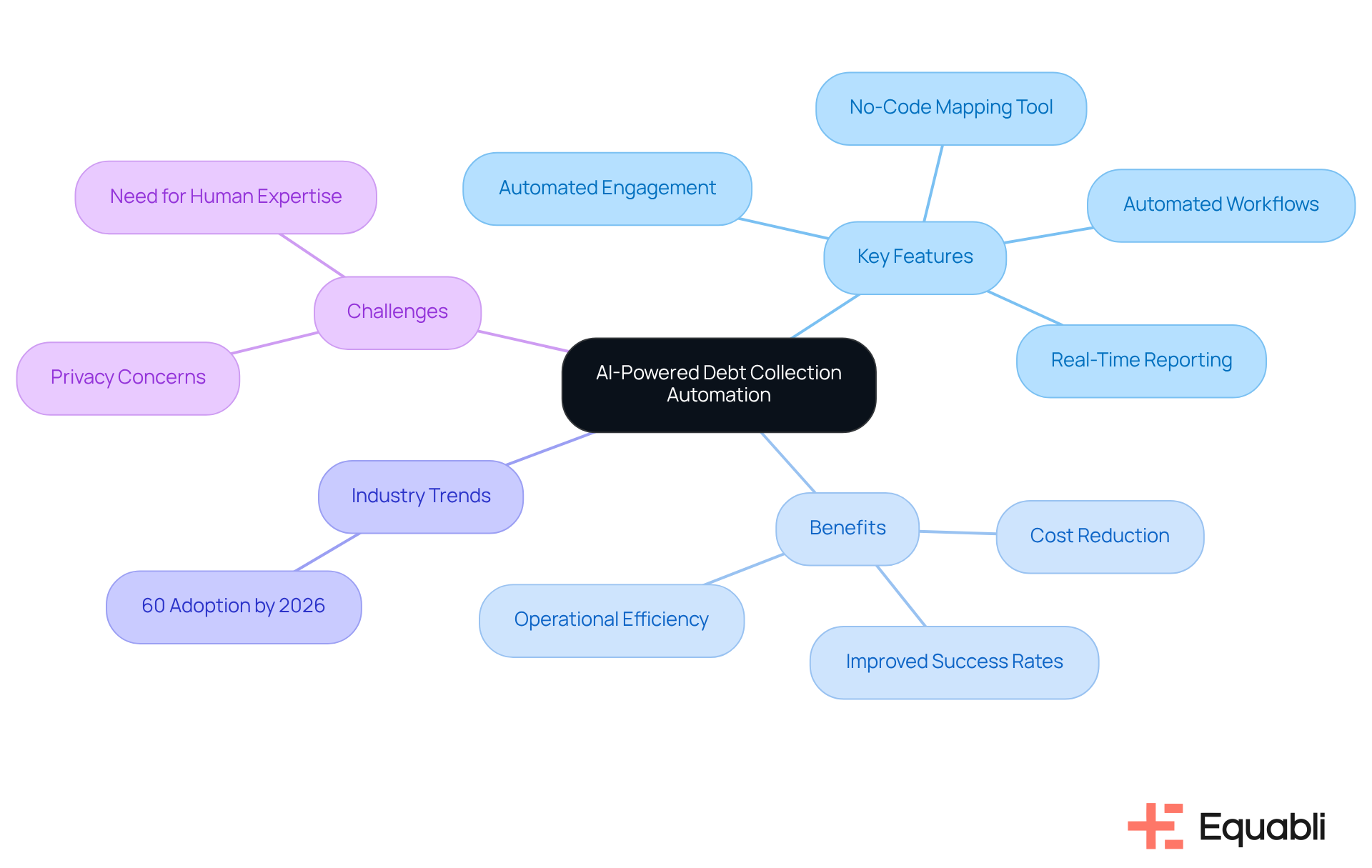

Equabli leverages artificial intelligence to revolutionize debt retrieval processes by offering automated debt collection software solutions for enterprise financial risk management that enhance recovery efforts. The EQ Collect platform automates customer engagement through calls and messages, ensuring timely follow-ups and personalized communication that aligns with individual debtor needs. By employing advanced analytics on customer data and behavior, EQ Collect refines retrieval strategies, resulting in notable improvements in operational efficiency and cost reduction.

Key features, such as a no-code file-mapping tool, facilitate streamlined vendor onboarding, while automated workflows reduce execution errors and reliance on manual resources. Furthermore, real-time reporting provides unparalleled clarity and insights into collection efforts. According to McKinsey, automation can decrease collection costs by up to 40% and boost success rates by 25%, underscoring the benefits of AI-driven solutions like EQ Collect.

As the industry shifts toward AI-driven automation, with projections indicating that over 60% of collection agencies will adopt such technologies by 2026, EQ Collect exemplifies how automated debt collection software solutions for enterprise financial risk management can optimize workflows, enhance compliance, and ultimately yield better recovery outcomes. Additionally, our company places a high priority on data protection, ensuring that client information is handled with the utmost care in accordance with our Privacy Policy.

However, it is crucial to acknowledge the challenges associated with AI integration, including privacy and compliance concerns. This necessitates a balanced approach that combines AI capabilities with human expertise to achieve optimal results.

HES FinTech: Predictive Analytics in Automated Debt Collection

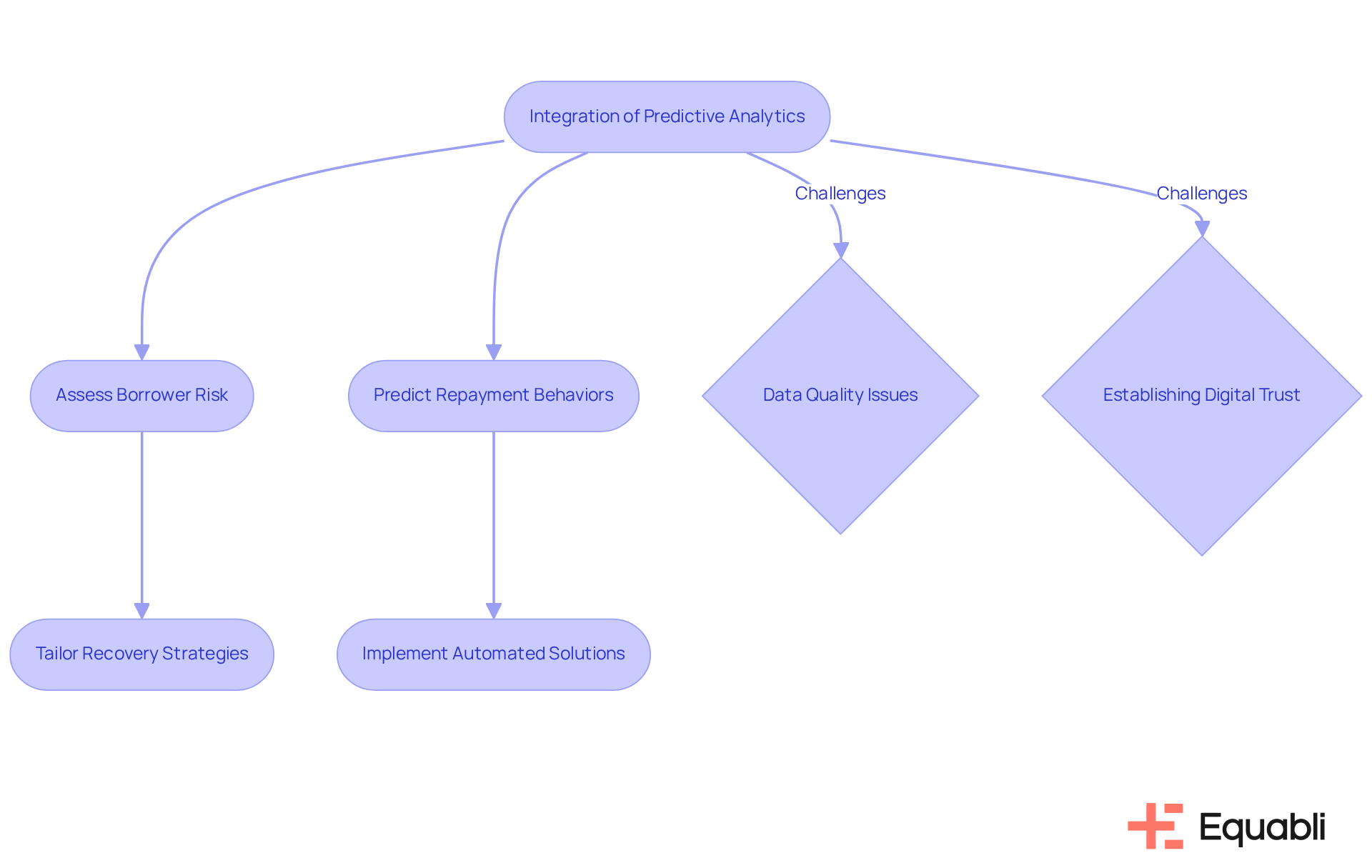

The integration of predictive analytics within automated debt collection software solutions for enterprise financial risk management represents a critical advancement for financial organizations. By leveraging machine learning algorithms, companies can effectively assess borrower risk and use automated debt collection software solutions for enterprise financial risk management to predict repayment behaviors. This capability allows organizations to utilize automated debt collection software solutions for enterprise financial risk management, tailoring their recovery strategies to enhance recovery rates while reducing costs typically associated with manual retrieval efforts.

The EQ Engine exemplifies this innovation, enabling financial institutions to anticipate the risk of delinquency in active accounts. This foresight aids in developing intelligent servicing strategies that significantly improve recovery performance. Industry insights indicate that AI-driven platforms enhance right-party contact (RPC) rates, further validating the effectiveness of this approach.

However, organizations face challenges such as data quality and integration issues when implementing AI technologies. Establishing digital trust is also paramount, particularly among younger generations who prioritize transparency and ethical practices in financial recovery. Addressing these challenges is essential for organizations aiming to streamline operations and remain competitive in a rapidly evolving economic landscape.

In conclusion, adopting a comprehensive strategy that incorporates advanced analytics and automated debt collection software solutions for enterprise financial risk management not only aligns with industry trends but also positions organizations to navigate the complexities of debt recovery effectively. By focusing on data-driven insights and compliance awareness, financial institutions can enhance their operational efficiency and strategic decision-making.

BillingPlatform: Centralized Debt Management and Collections System

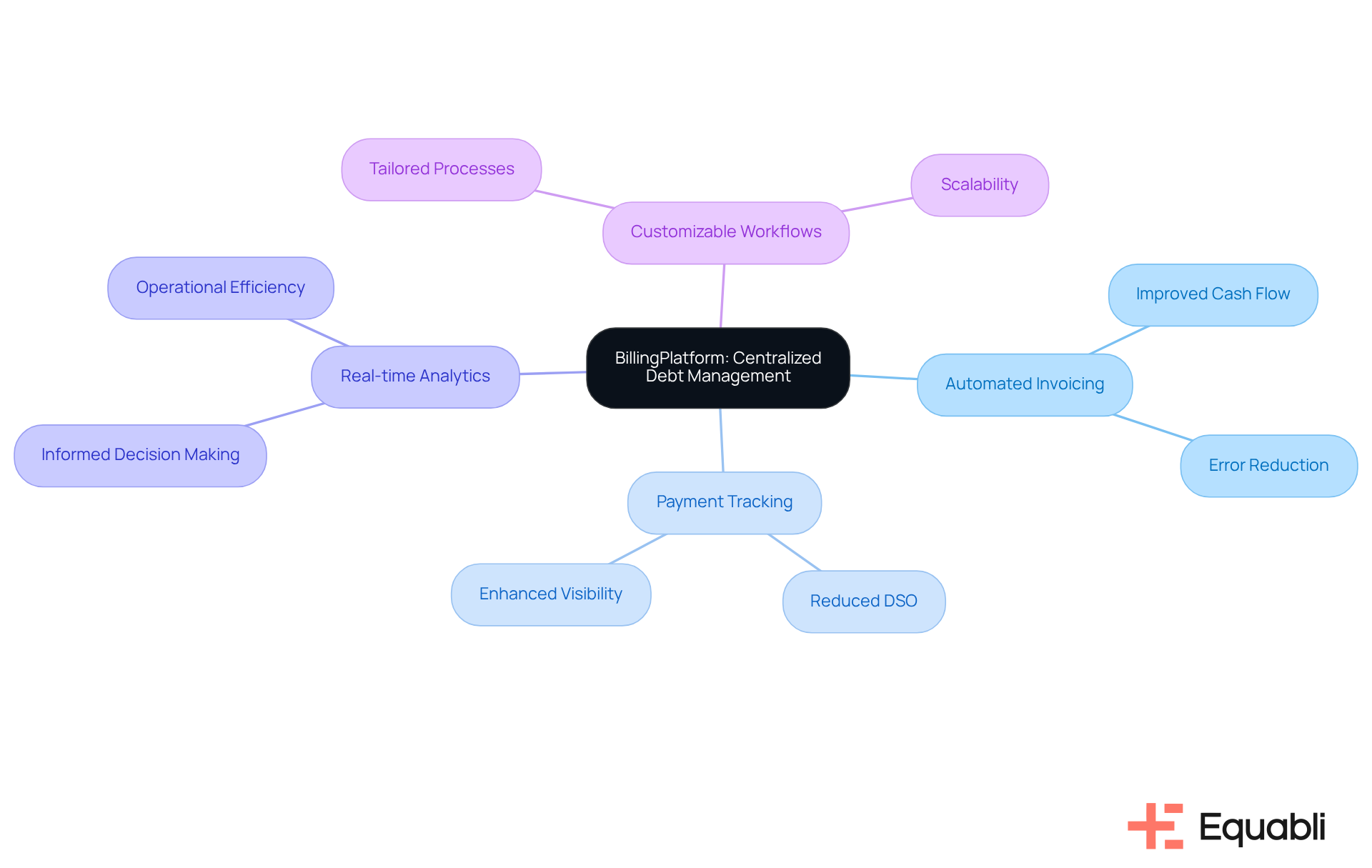

BillingPlatform offers a robust debt management and recovery system that enhances financial operations for businesses. The platform facilitates efficient management of accounts receivable by automating invoicing, payment tracking, and receivables processes through automated debt collection software solutions for enterprise financial risk management. Key features, including customizable workflows and real-time analytics, provide organizations with improved visibility into cash flow, effectively reducing days sales outstanding (DSO).

As we look towards 2025, the shift towards automated debt collection software solutions for enterprise financial risk management and receipt management is expected to accelerate, driven by the increasing demand for operational efficiency and enhanced cash flow management. Automated debt collection software solutions for enterprise financial risk management not only streamline processes but also reduce manual errors, enabling finance teams to concentrate on strategic initiatives rather than routine tasks.

Success stories from organizations utilizing BillingPlatform underscore significant improvements in financial operations, demonstrating the impactful role of technology-driven solutions in existing workflows. As enterprises increasingly recognize the necessity of automation, the adoption of automated debt collection software solutions for enterprise financial risk management becomes crucial for leveraging real-time data to make informed decisions, sustain growth, and optimize revenue.

IBS Home: Automated Debt Collection for Banks and Credit Unions

Equabli provides advanced solutions for receivable recovery specifically designed for banks and credit unions, with its leading software, EQ Collect, at the forefront. This platform streamlines the gathering process by automating routine tasks through features like a no-code file-mapping tool and optimized workflows. As a result, institutions can focus on more complex interactions that require human insight. By integrating sophisticated communication tools and data-driven strategies, EQ Collect significantly enhances borrower engagement, allowing financial institutions to maintain robust relationships with their clients while effectively managing delinquent accounts.

The emphasis on compliance is paramount, especially as financial institutions encounter increasing regulatory scrutiny. EQ Collect not only automates compliance processes but also markedly improves recovery rates. Organizations that adopt automated debt collection software solutions for enterprise financial risk management have reported recovery rate enhancements of up to 25%, underscoring the efficiency of technology in modern financial recovery strategies.

Success stories from credit unions highlight the substantial impact of EQ Collect. By adopting this technology, institutions have improved their operational efficiency, reduced dependence on manual processes, and achieved higher member retention rates. Furthermore, effective receivable recovery in credit unions requires a balance between assertive retrieval and member-focused principles, which EQ Collect facilitates through customized communication and flexible payment options. As the landscape of financial recovery evolves, leveraging automated debt collection software solutions for enterprise financial risk management, such as EQ Collect, positions banks and credit unions to meet the demands of 2025 and beyond, ensuring they remain competitive and customer-centric in their strategies.

To fully leverage the benefits of EQ Collect, institutions should routinely evaluate their compliance procedures and utilize real-time reporting features to gain insights into their performance. This proactive approach will enable them to adapt to changing regulations and enhance overall efficiency.

Matellio: Automated Debt Collection Solutions for Enhanced Efficiency

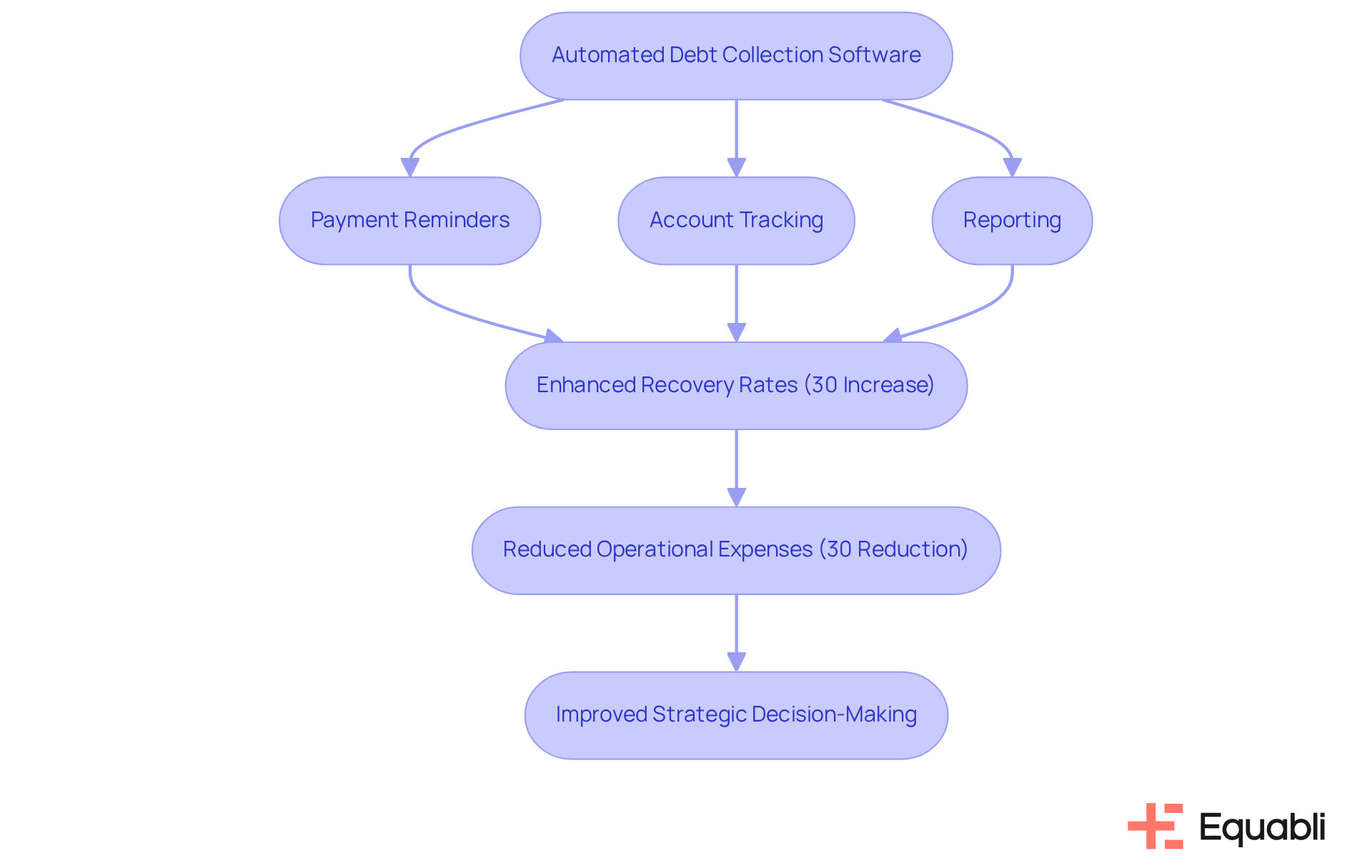

The company offers automated debt collection software solutions for enterprise financial risk management that streamline debt recovery while prioritizing operational efficiency for businesses. Their automated debt collection software solutions for enterprise financial risk management automate essential processes, including payment reminders, account tracking, and reporting. This automation, specifically using automated debt collection software solutions for enterprise financial risk management, enables organizations to concentrate on strategic decision-making rather than manual tasks.

Evidence of effectiveness is compelling: programmed payment reminders can enhance recovery rates by as much as 30%. This statistic underscores the critical role of prompt communication in the debt recovery process. Additionally, the implementation of automated debt collection software solutions for enterprise financial risk management has led to notable efficiency gains, with organizations reporting reductions in operational expenses by up to 30%. A McKinsey report further emphasizes the effectiveness of data-driven strategies in achieving these results.

Equabli's offerings include an intuitive, scalable, cloud-native interface and a no-code file-mapping tool that significantly shortens vendor onboarding timelines. These features assist clients in refining their strategies and improving overall recovery rates. Furthermore, with streamlined processes and real-time reporting, the company ensures unmatched clarity and compliance monitoring—essential elements for financial organizations utilizing automated debt collection software solutions for enterprise financial risk management while navigating the complexities of loan recovery efficiently.

ScienceSoft: Versatile Automated Debt Collection Software Solutions

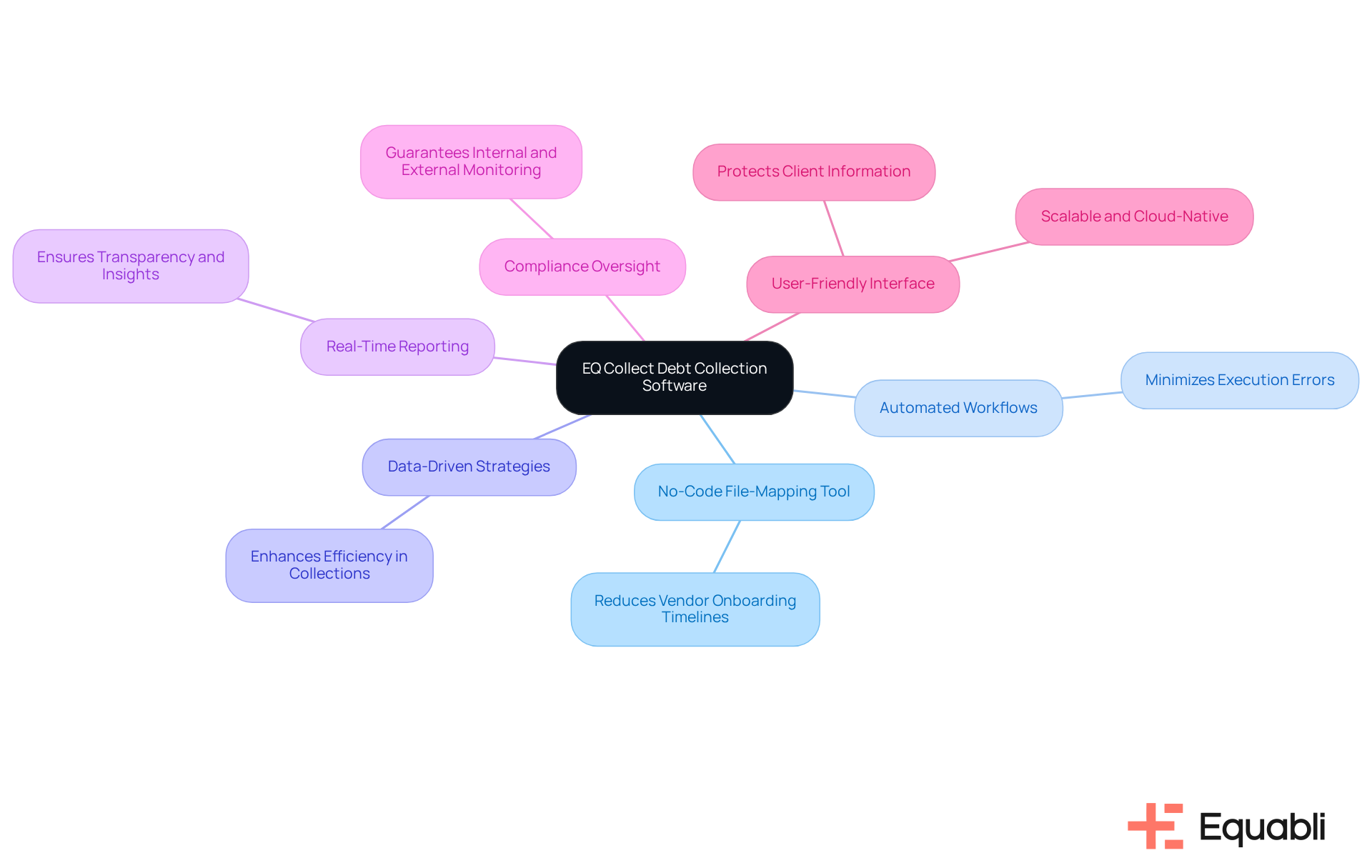

This company offers automated debt collection software solutions for enterprise financial risk management that are adaptable and tailored specifically for large financial organizations. The EQ Collect platform provides automated debt collection software solutions for enterprise financial risk management, featuring:

- A no-code file-mapping tool that significantly reduces vendor onboarding timelines

- Automated workflows that minimize execution errors

- Data-driven strategies that enhance efficiency in collections

With real-time reporting, clients benefit from unparalleled transparency and insights, while industry-leading compliance oversight guarantees rigorous internal and external monitoring.

Moreover, the company prioritizes the protection of client information, addressing the critical concerns of financial institutions. By offering a user-friendly, scalable, cloud-native interface, the platform empowers organizations to streamline their processes, ultimately enhancing overall efficiency and effectiveness through automated debt collection software solutions for enterprise financial risk management. This strategic approach not only meets compliance requirements but also positions clients to adapt to evolving regulatory landscapes.

Recovery.com: Smarter Automated Debt Collection Solutions for Enterprises

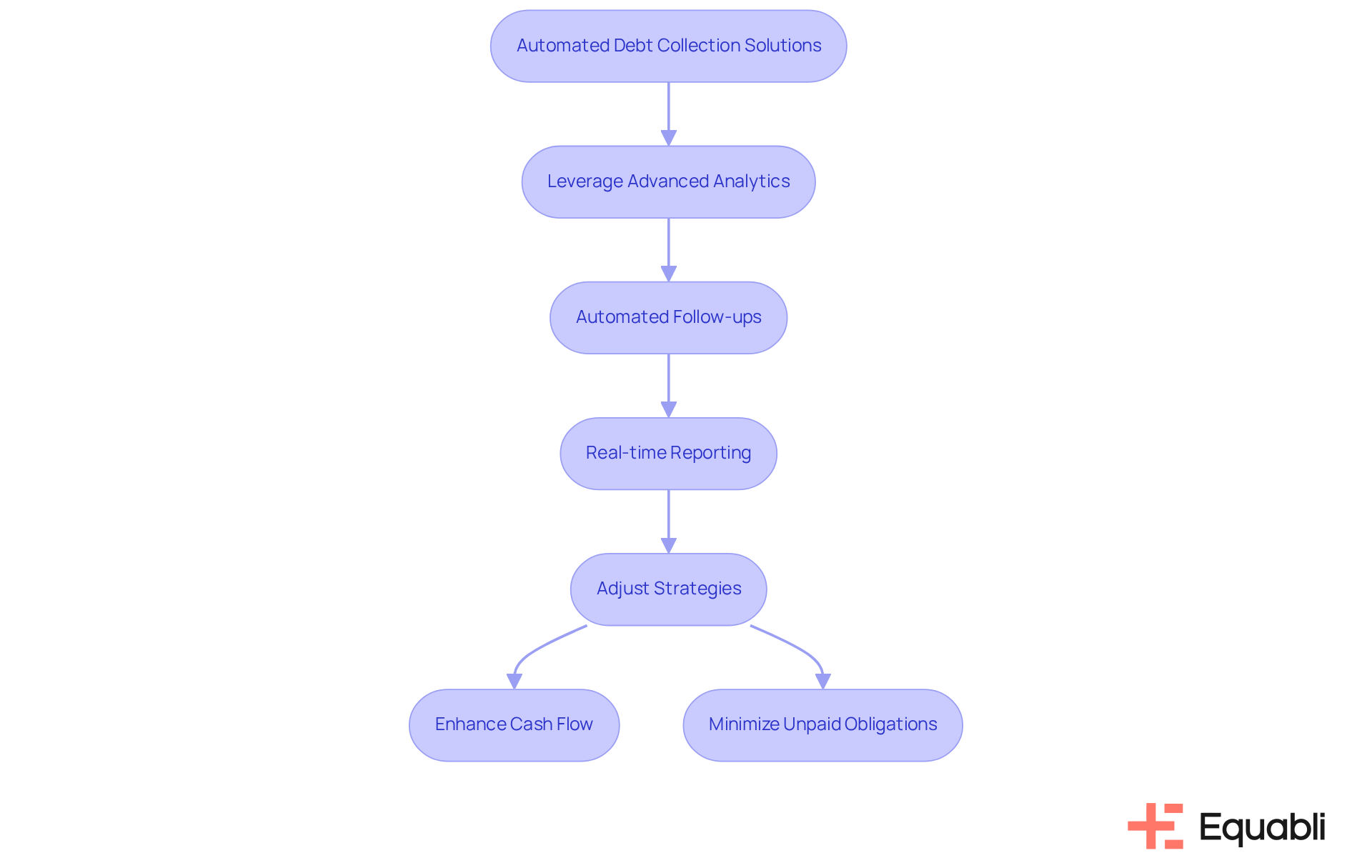

Innovative automated debt collection software solutions for enterprise financial risk management are essential for businesses aiming to enhance their recuperation efforts. By leveraging advanced analytics and machine learning, Equabli enhances collection strategies through automated debt collection software solutions for enterprise financial risk management, enabling organizations to manage their accounts receivable more effectively. Automated follow-ups facilitated by automated debt collection software solutions for enterprise financial risk management ensure timely communication with debtors, thereby enhancing engagement and cooperation.

Real-time reporting features enable clients to track performance indicators and adjust strategies flexibly. This adaptability ultimately enhances cash flow and minimizes unpaid obligations. As the sector evolves, the integration of automated debt collection software solutions for enterprise financial risk management becomes crucial for financial institutions to maintain competitiveness and comply with regulations in the ever-changing landscape of financial recovery.

The CFO Club: Expert Guidance on Automated Debt Collection Software Selection

The CFO Club offers essential insights for selecting automated debt collection software solutions for enterprise financial risk management, helping organizations navigate the complex software landscape. Their resources include:

- Thorough comparisons

- Feature analyses

- Implementation best practices

By focusing on current trends and emerging technologies, The CFO Club empowers financial leaders to make informed decisions that align with their strategic objectives, ultimately enhancing operational processes. As John Sanders, Managing Partner and CEO, asserts, "Digital adoption is no longer optional—it’s a competitive necessity." This guidance is vital as the debt collection landscape shifts, with automated debt collection software solutions for enterprise financial risk management becoming essential for operational efficiency and improved recovery rates.

Conclusion

The landscape of financial risk management is undergoing significant transformation, with automated debt collection software solutions leading the charge. These sophisticated tools not only streamline recovery processes but also bolster operational efficiency and compliance, making them indispensable for organizations looking to enhance their financial strategies. By integrating predictive analytics, AI-driven automation, and real-time reporting, businesses can markedly improve their debt recovery rates while reducing costs tied to manual processes.

Highlighted throughout this article are various software solutions, including Equabli EQ Suite, CR Software, and Convin.ai, each showcasing unique features and capabilities. These platforms empower organizations to automate workflows, tailor borrower communications, and utilize data-driven insights to refine their recovery strategies. The focus on compliance and data protection is critical, particularly in an era of heightened regulatory scrutiny. Success stories from financial institutions that have embraced these technologies illustrate tangible benefits, such as improved recovery rates and enhanced customer engagement.

As the debt collection sector evolves, adopting automated solutions has transitioned from an option to a necessity for maintaining competitiveness. Organizations must proactively evaluate their existing systems, investigate the latest advancements in automated debt collection software, and prioritize the integration of these tools into their operations. This strategic approach not only enhances financial performance but also aligns with the demands of a rapidly changing market, equipping them to navigate the complexities of debt recovery in the years ahead.

Frequently Asked Questions

What is the EQ Suite and what does it offer?

The EQ Suite is an automated debt collection software solution designed for enterprise financial risk management. It includes tools like EQ Engine, EQ Engage, and EQ Collect, which utilize predictive analytics and automation to improve repayment strategies and operational efficiency.

How does EQ Collect enhance operational efficiency?

EQ Collect features a no-code file-mapping tool and streamlined workflows that significantly reduce manual tasks and execution errors, leading to improved operational efficiency and compliance oversight.

What role does EQ Engage play in debt collection?

EQ Engage allows organizations to create and automate borrower contact strategies, ensuring personalized communication journeys that align with the brand identity while enhancing engagement through preferred communication channels.

How does the EQ Suite improve recovery rates?

By leveraging custom scoring models and predictive analytics, the EQ Suite anticipates borrower behaviors, which helps enhance engagement and ultimately improves recovery rates.

What is the focus of Equabli regarding data protection?

Equabli is committed to data protection, ensuring that all data usage complies with industry standards and meets client needs, as outlined in their Privacy Policy.

What features does the CR Software Debt Manager platform provide?

The Debt Manager platform offers automated workflows, real-time reporting, and robust compliance tracking, which together enhance operational efficiency and customer satisfaction in managing receivables.

How does CR Software help businesses in debt recovery?

By adopting the Debt Manager platform, organizations can refine retrieval strategies, enhance overall performance, and align with compliance requirements, thus mitigating risks associated with debt collection.

What advantages does the EQ Collect platform offer through AI?

EQ Collect automates customer engagement via calls and messages, ensuring timely follow-ups and personalized communication. It uses advanced analytics to refine retrieval strategies, improving operational efficiency and reducing costs.

What are the projected benefits of AI-driven debt collection solutions like EQ Collect?

According to McKinsey, automation can reduce collection costs by up to 40% and increase success rates by 25%, highlighting the benefits of AI-driven solutions in debt collection.

What challenges are associated with AI integration in debt collection?

Challenges include privacy and compliance concerns, necessitating a balanced approach that combines AI capabilities with human expertise for optimal results.