Overview

This article identifies ten automated debt recovery solutions tailored for financial institutions, aimed at enhancing debt collection processes. Notably, solutions like Equabli's EQ Suite and various AI-powered platforms demonstrate significant improvements in operational efficiency, borrower engagement, and compliance. These advancements are pivotal in transforming traditional debt recovery practices into more effective, customer-centric approaches.

From a compliance perspective, the integration of these technologies not only streamlines operations but also ensures adherence to regulatory standards, thereby mitigating risk. The evidence suggests that financial institutions leveraging these solutions can expect a marked increase in recovery rates while fostering better relationships with borrowers.

To operationalize this strategy, institutions must evaluate their current debt collection frameworks and consider the implementation of these automated solutions. By doing so, they can position themselves at the forefront of industry best practices, ultimately enhancing their competitive edge in the market.

Introduction

As financial institutions confront the complexities of debt recovery, the integration of automated solutions stands out as a pivotal strategy. Advanced technologies enable organizations to streamline processes, enhance borrower engagement, and significantly reduce operational costs. However, a pressing challenge persists: how can these institutions effectively leverage automation to improve recovery rates while ensuring compliance and nurturing positive customer relationships? This article explores ten innovative automated debt recovery solutions that are set to reshape the financial landscape, providing insights into their features, benefits, and the essential role they play in modern debt management.

Equabli EQ Suite: Comprehensive Automated Debt Recovery Solutions

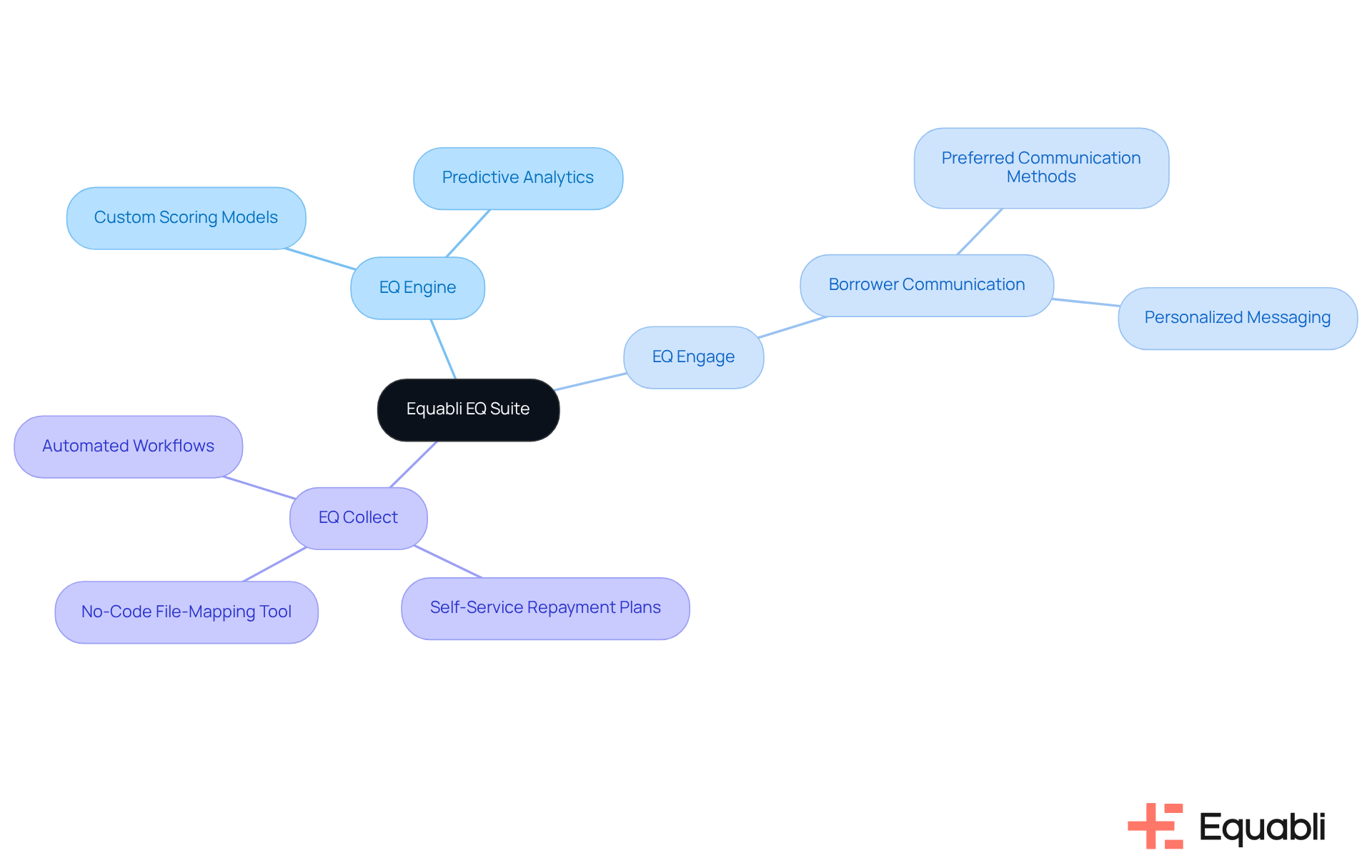

The EQ Suite by Equabli represents a strategic advancement for financial institutions aiming to modernize their debt recovery processes with automated debt recovery solutions for enterprise financial operations while ensuring robust data protection. This platform features essential tools such as EQ Engine, EQ Engage, and EQ Collect, which facilitate the implementation of custom scoring models, enhanced retrieval strategies, and digital self-service repayment plans. By prioritizing compliance with industry standards and regulations, Equabli underscores its commitment to safeguarding client data.

Utilizing these tools allows organizations to significantly reduce retrieval expenses while improving borrower engagement through preferred communication methods. The suite's capabilities, including automated workflows, a no-code file-mapping tool, and a user-friendly interface, contribute to enhanced operational efficiency. Furthermore, real-time reporting features bolster compliance efforts, ultimately transforming the financial landscape for organizations.

In summary, the EQ Suite not only streamlines debt recovery but also provides automated debt recovery solutions for enterprise financial operations while aligning with compliance requirements. As the industry evolves, leveraging such advanced tools will be crucial for maintaining competitive advantage and ensuring effective risk management.

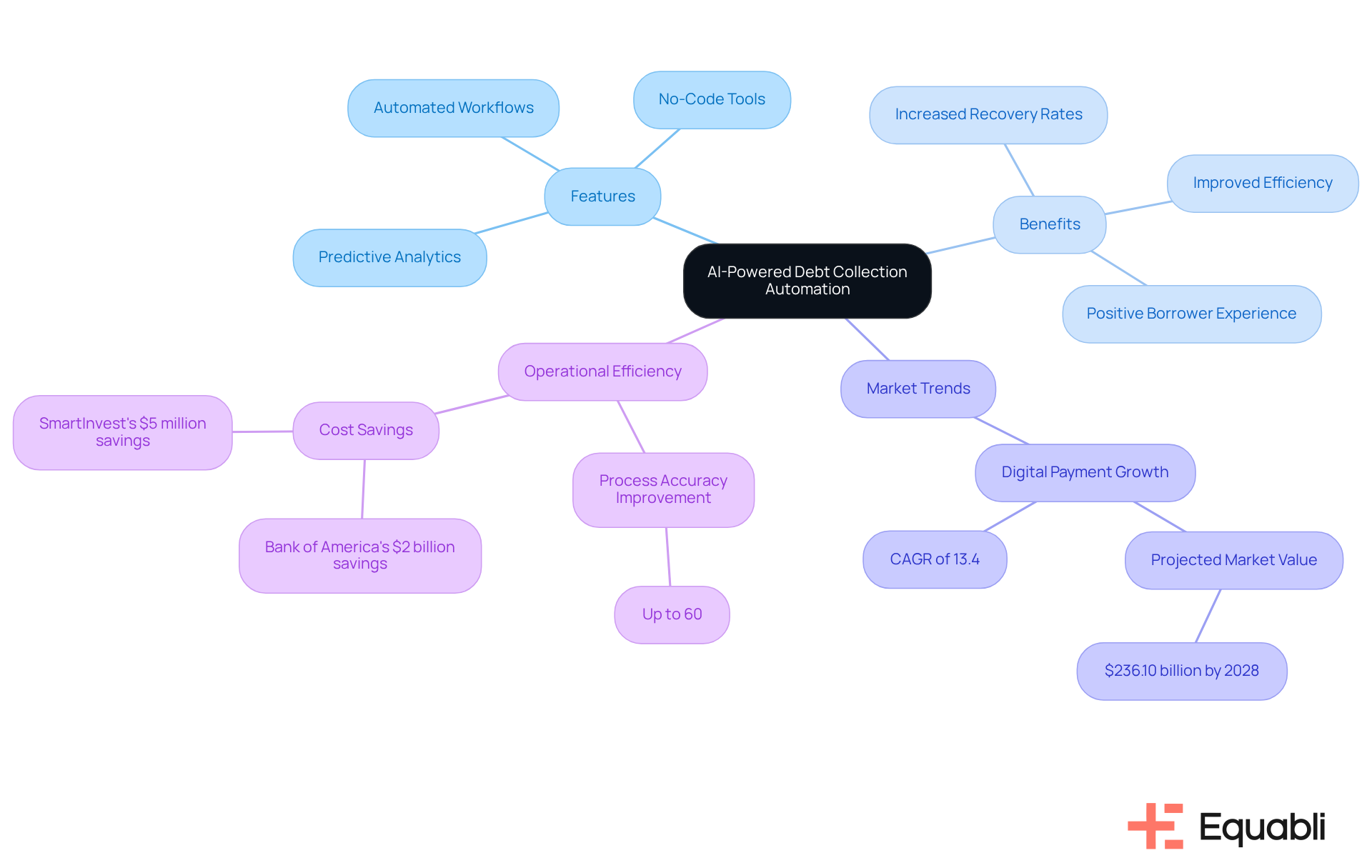

Convin.ai: AI-Powered Debt Collection Automation

Equabli presents a cutting-edge AI-powered platform that revolutionizes fund recovery through automated debt recovery solutions for enterprise financial operations. Financial organizations can leverage advanced analytics to scrutinize customer data and behavior patterns, enabling them to tailor their collection strategies with precision. The platform's predictive analytics capabilities identify optimal times and methods for engaging borrowers, significantly increasing the likelihood of successful repayments. According to an EY report, financial organizations employing automated debt recovery solutions for enterprise financial operations can achieve process precision improvements of up to 60%, highlighting the effectiveness of automation in debt recovery.

As the global digital payment sector is projected to reach $236.10 billion by 2028, the imperative for financial organizations to adopt AI technologies becomes increasingly clear. With EQ Collect, organizations can expedite vendor onboarding through a user-friendly, no-code file-mapping tool, enhance operational efficiency, and boost recoveries with data-driven strategies while minimizing execution errors through automated workflows. This level of automation not only streamlines operations but also enhances the borrower experience, fostering more positive interactions with financial institutions.

As AI continues to reshape the financial recovery landscape, organizations striving to improve efficiency and effectiveness in their retrieval efforts find that automated debt recovery solutions for enterprise financial operations, like EQ Collect, are essential.

Firstsource: Automation Solutions for FinTech Debt Collection

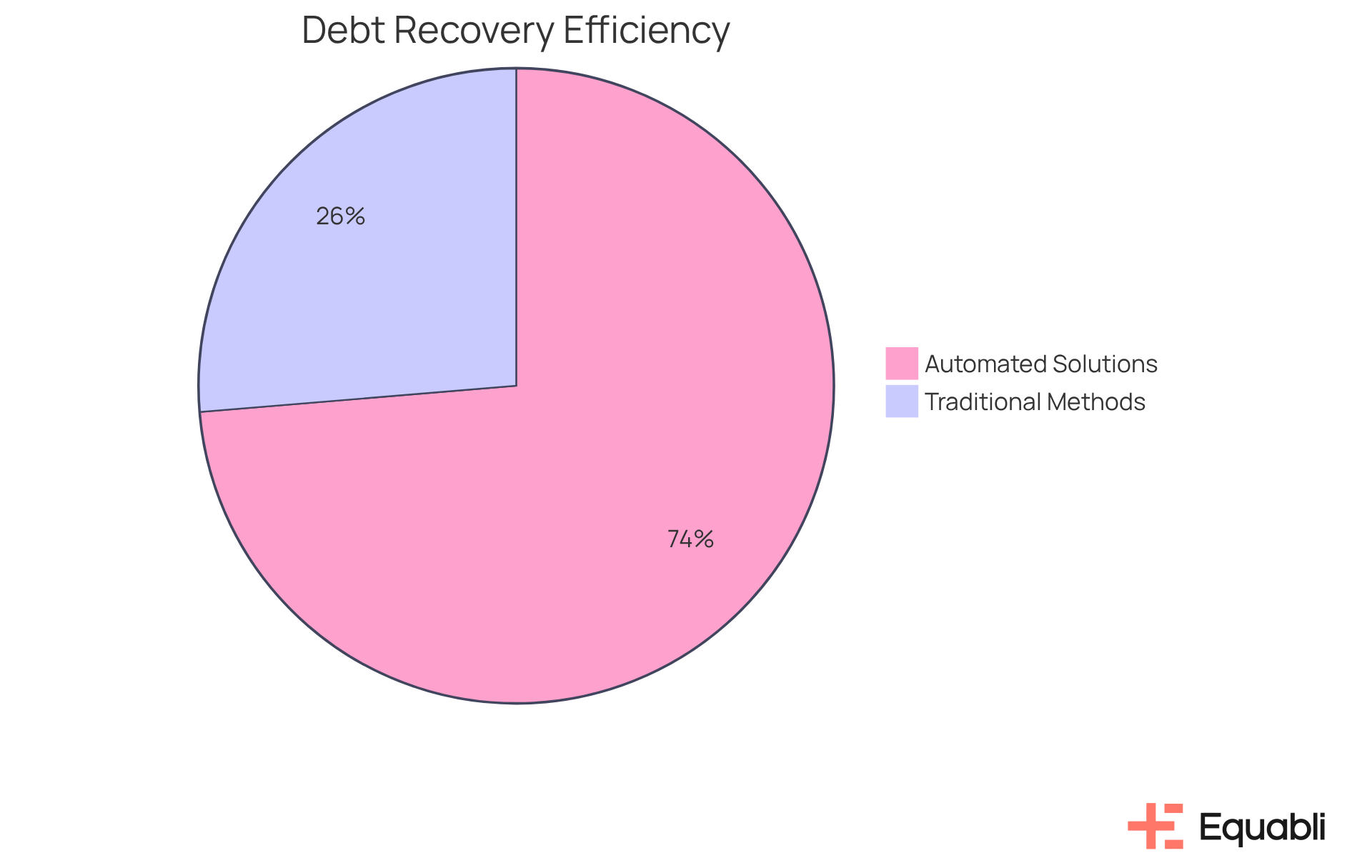

Firstsource provides automated debt recovery solutions for enterprise financial operations through a comprehensive suite of automation tools specifically designed for fintech firms involved in receivables management. This platform integrates seamlessly with existing systems, facilitating streamlined operations and improved data management. By implementing automated debt recovery solutions for enterprise financial operations, Firstsource empowers recovery teams to concentrate on more complex cases, thereby significantly enhancing recovery rates and operational efficiency.

Evidence of this effectiveness is compelling: Firstsource has reported a remarkable 70% reduction in overall cost to collect, highlighting the efficiency gains achieved through their automated solutions. In contrast, traditional loan recovery methods yield recovery rates of only 20-25%, underscoring the advantages of adopting a digital-first strategy. As the receivables landscape evolves, organizations that utilize automated debt recovery solutions for enterprise financial operations are poised to achieve superior results, transforming receivables into a more efficient and customer-centric process.

Moreover, with the embedded finance market anticipated to expand significantly, the integration of automated debt recovery solutions for enterprise financial operations is increasingly vital for fintech firms aiming to enhance customer engagement and satisfaction. This strategic shift not only addresses operational challenges but also positions firms to thrive in a competitive environment.

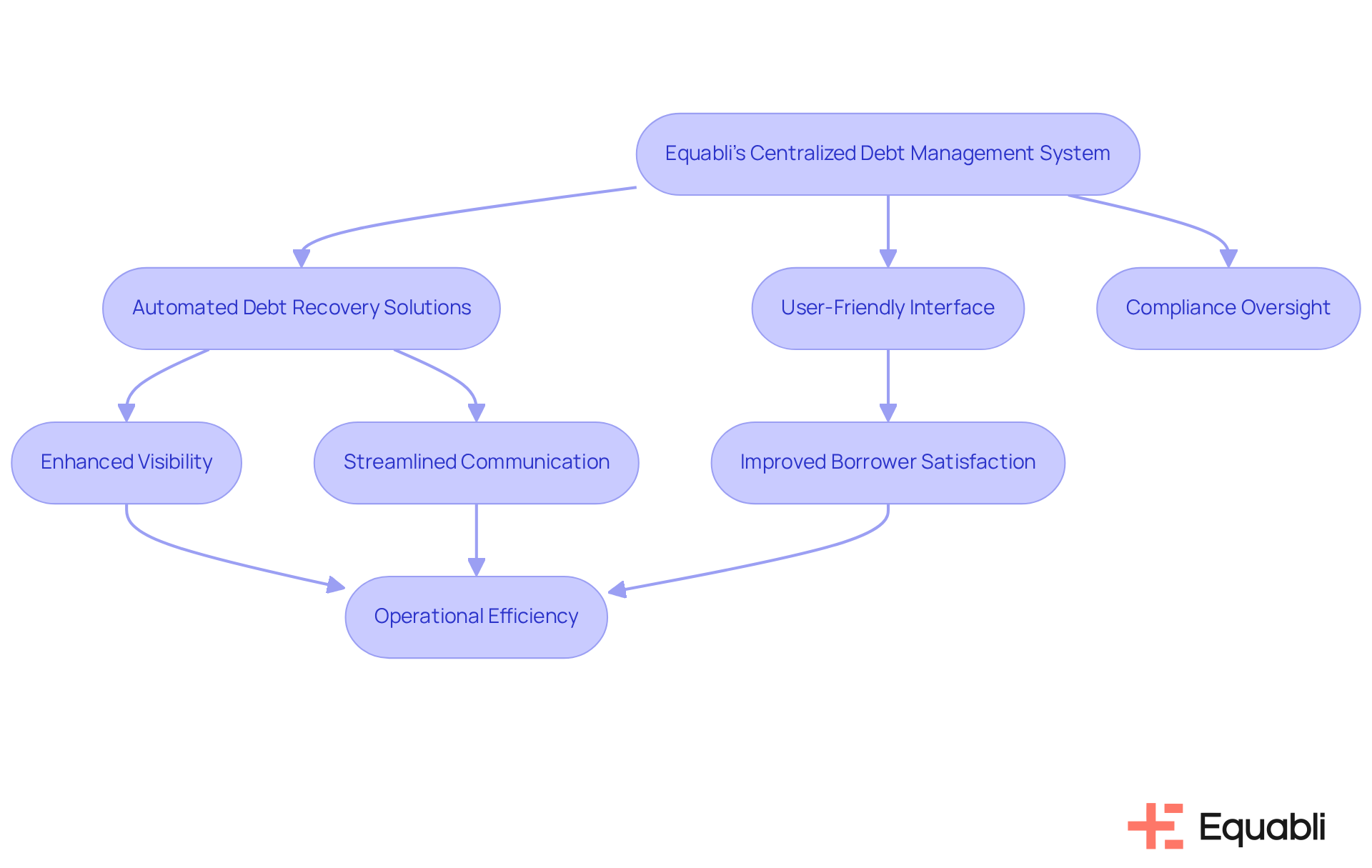

BillingPlatform: Centralized Debt Management and Collections System

Equabli offers a robust centralized debt management and recovery system that includes automated debt recovery solutions for enterprise financial operations, empowering financial institutions to optimize their retrieval processes. By consolidating all debt-related activities onto a single platform, organizations can implement automated debt recovery solutions for enterprise financial operations, which enhances visibility into their accounts, streamlines communication with borrowers, and automates payment processing. This integration not only minimizes execution errors and reduces reliance on manual resources but also significantly boosts operational efficiency through automated debt recovery solutions for enterprise financial operations, along with features like a user-friendly, scalable, cloud-native interface and a no-code file-mapping tool.

The impact of this comprehensive approach extends beyond operational efficiency; it enhances the customer experience and drives performance through data-driven strategies and real-time reporting. Organizations utilizing automated debt recovery solutions for enterprise financial operations have reported notable decreases in retrieval times and improved borrower satisfaction, underscoring the tangible benefits of adopting such innovative tools. Furthermore, the ability to manage and oversee assets from a unified interface allows institutions to respond swiftly to changing circumstances, ensuring they remain agile in a competitive landscape.

Equabli's commitment to industry-leading compliance oversight further solidifies its authority in the sector, ensuring adherence to both internal and external standards. This focus on compliance is crucial for executives navigating the complexities of debt collection and risk management. Potential users can explore Equabli's features through tailored demonstrations, providing them with firsthand insight into the significant advantages of intelligent automation in financial recovery.

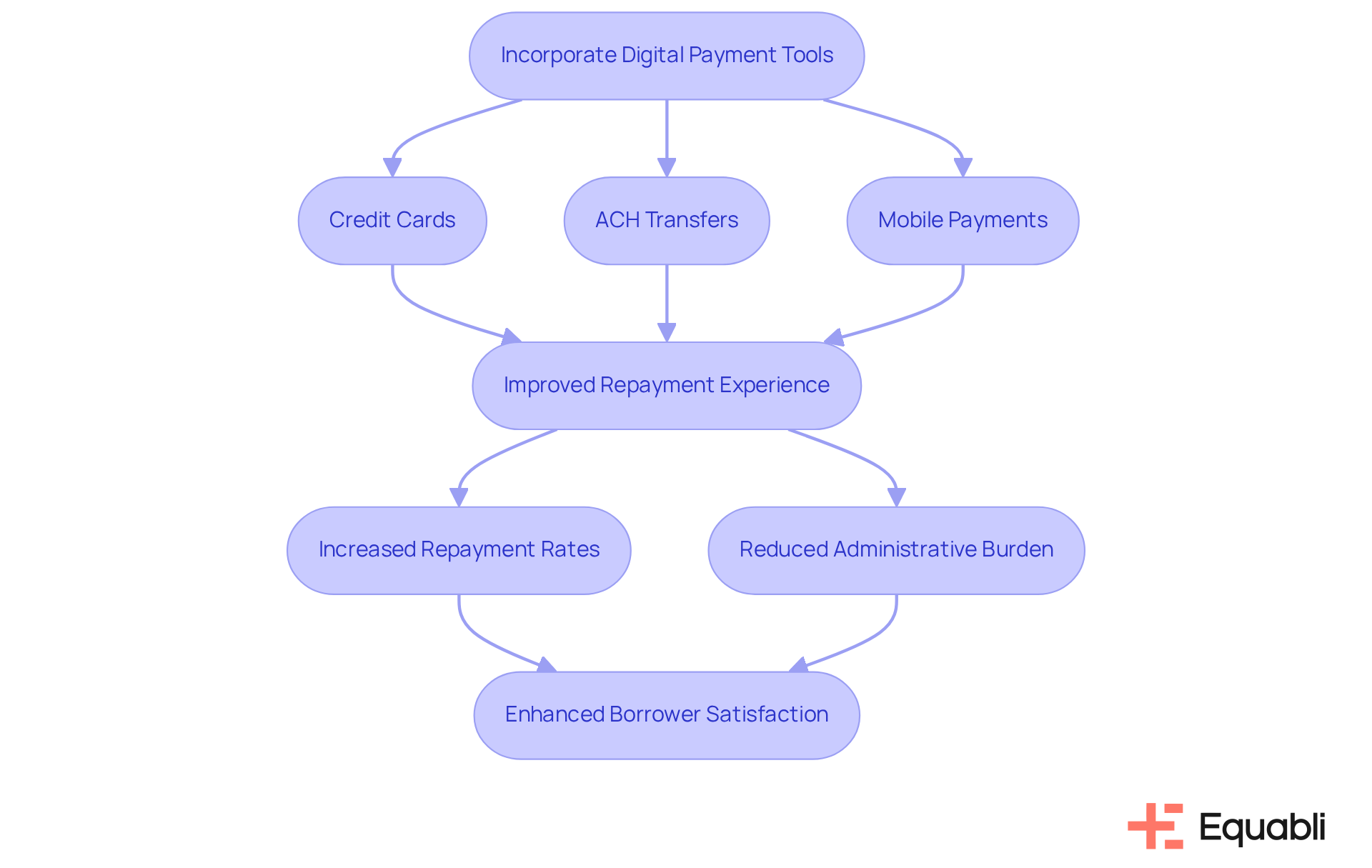

Digital Payment Integration Tools: Streamlining Debt Collection

Incorporating digital payment tools is essential for enhancing debt retrieval processes. By offering borrowers a range of payment options—such as credit cards, ACH transfers, and mobile payments—financial institutions can significantly improve the repayment experience. These automated debt recovery solutions for enterprise financial operations not only expedite payment processing but also alleviate the administrative burden on retrieval teams, allowing them to focus on more strategic initiatives.

Evidence shows that implementing multiple payment methods enhances repayment rates, with over 92% of customers opting for self-service payments when available. This shift to digital payments is crucial, especially as American consumer liabilities reached $17.29 trillion by the third quarter of 2023, highlighting the growing demand for effective retrieval methods.

Successful case studies illustrate that agencies leveraging these digital solutions, including EQ Collect, have experienced revenue increases of up to 16% and a notable reduction in the cost of fund recovery, as detailed in the case study 'Enhancing Digital Engagement in Collection.' Moreover, personalized communication through these platforms has resulted in improved engagement, with 73% of customers in late delinquency making payments when contacted via digital channels.

Integrating EQ Collect into the automated debt recovery solutions for enterprise financial operations further enhances efficiency. Its user-friendly, scalable, cloud-native interface and no-code file-mapping tool allow financial organizations to shorten vendor onboarding timelines and boost revenue through data-driven strategies. Automated workflows reduce execution errors and manual resource requirements, while real-time reporting offers unparalleled transparency and insights.

As the debt collection landscape evolves, the integration of automated debt recovery solutions for enterprise financial operations alongside EQ Collect will be pivotal in enhancing borrower satisfaction and driving recovery success in 2025 and beyond. Additionally, providing real-time updates on account balances will further align with customer expectations and improve overall repayment experiences.

Automated Payment Reminder Systems: Enhancing Communication in Collections

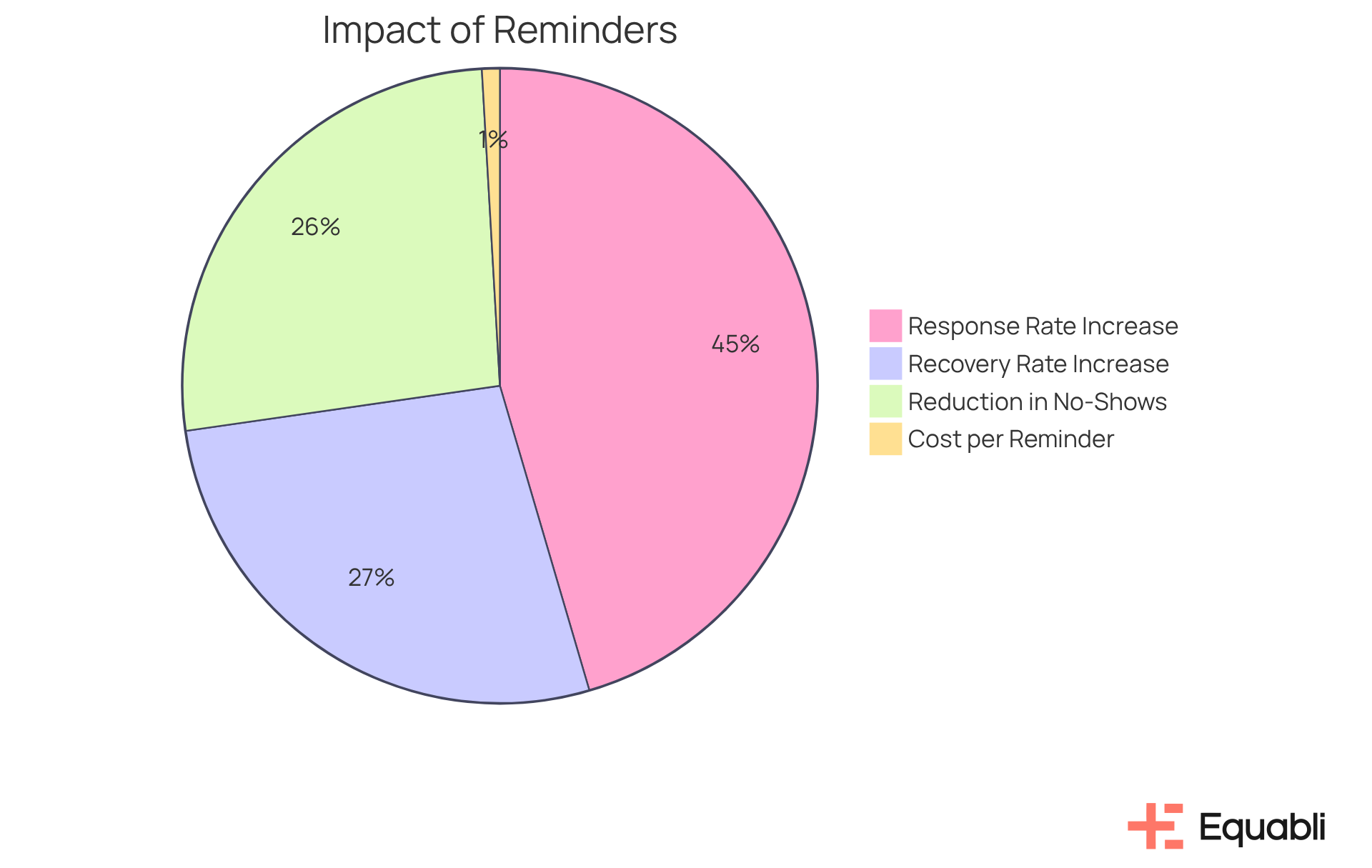

Automated payment reminder systems play a vital role in enhancing communication between financial entities and borrowers. By delivering timely reminders through preferred channels—such as SMS, email, or app notifications—these systems ensure borrowers are well-informed about upcoming payments. This proactive approach not only increases the likelihood of on-time repayments but also cultivates a positive relationship between lenders and borrowers.

Financial organizations utilizing Equabli's EQ Suite have reported recovery rate increases of up to 30%, attributed to the intelligent and intuitive features designed to optimize operations. Evidence shows that automated reminders can reduce no-shows by 29%, underscoring the effectiveness of timely communication. Furthermore, research indicates that 44% of borrowers respond more swiftly to digital alerts, while firms experience a 40-60% increase in response rates when reminders align with individual customer timelines. This highlights the critical role of technology in implementing automated debt recovery solutions for enterprise financial operations.

Moreover, the cost-effectiveness of automated reminders is notable, averaging €0.41 each, making them an economical tool for financial organizations. By enhancing communication through options like EQ Engage, which offers tailored messaging and self-service repayment alternatives, automated reminders significantly influence repayment rates. This positions them as an essential resource for financial entities aiming to enhance their recovery processes with automated debt recovery solutions for enterprise financial operations.

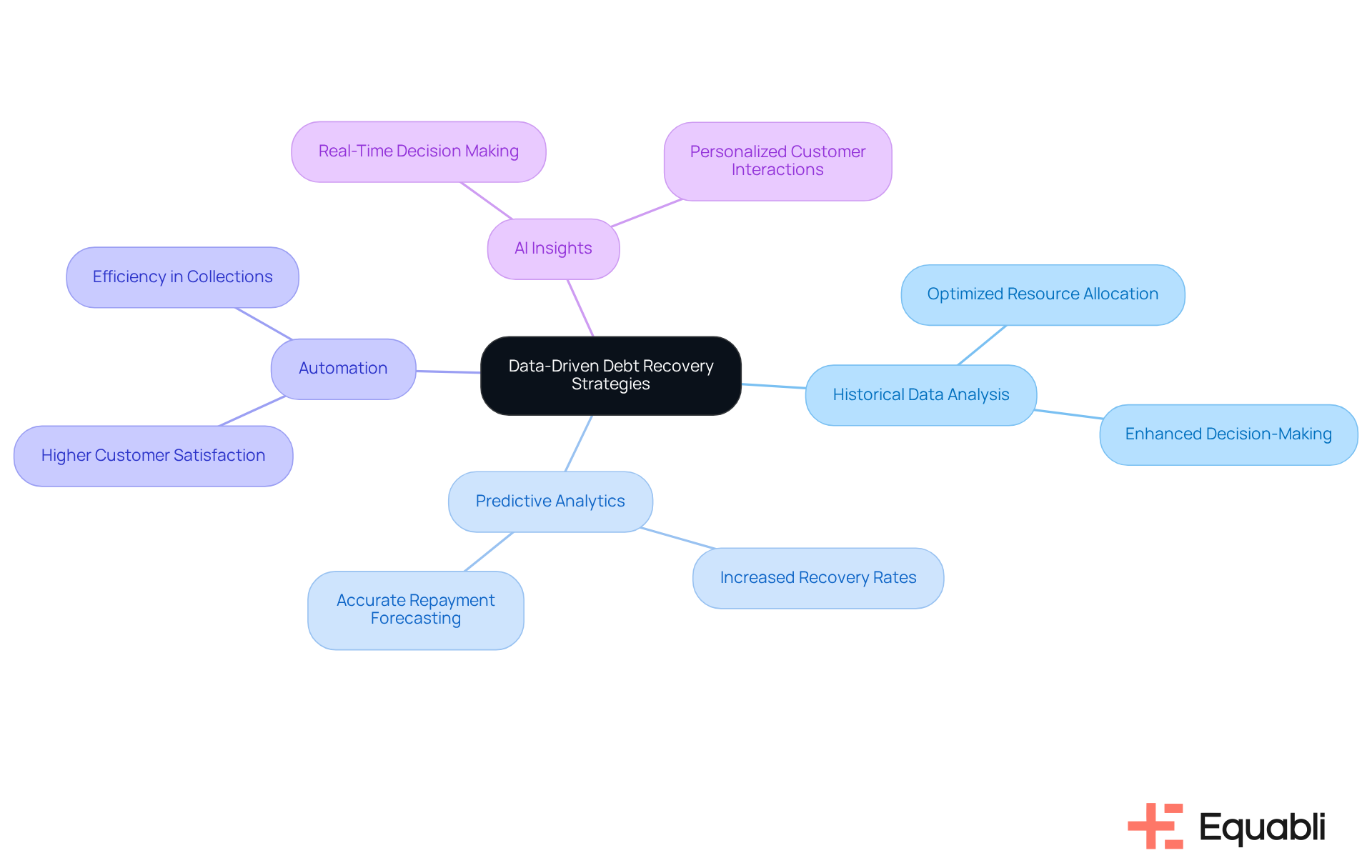

Data-Driven Collection Strategies: Optimizing Debt Recovery Efforts

Data-driven approaches are essential for enhancing debt recovery efforts in 2025. By leveraging historical repayment data and analyzing borrower behavior, financial institutions can develop targeted strategies that cater to the unique needs of different borrower segments. This method not only optimizes resource allocation but also significantly boosts the likelihood of successful recoveries, ultimately improving financial performance.

For instance, organizations that adopt predictive analytics have reported recovery goals surpassing 103% within the first three months, with further increases to 105% by the sixth month. Moreover, companies utilizing automation and AI-driven insights can achieve up to a 30% rise in customer satisfaction ratings during the retrieval process. These advancements underscore the importance of embracing a data-centric approach to redefine financial recovery as a strategic function that aligns with brand values and fosters long-term customer engagement.

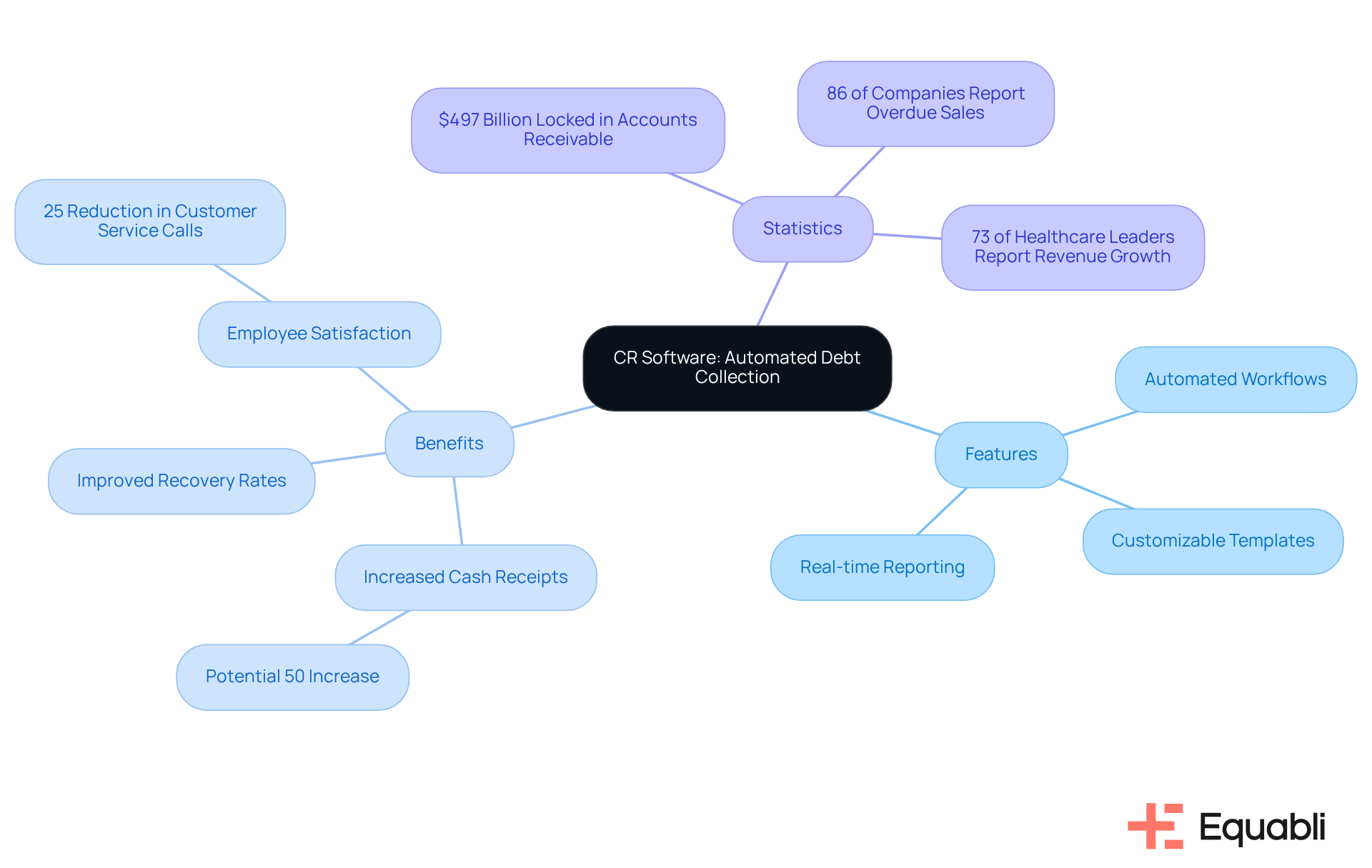

CR Software: Advanced Automated Debt Collection Software

CR Software provides innovative automated debt recovery solutions for enterprise financial operations that streamline the retrieval process for financial institutions. By integrating features such as automated workflows, customizable communication templates, and real-time reporting, organizations can significantly enhance their operational efficiency. Evidence suggests that automation of repetitive tasks allows teams to concentrate on high-priority accounts, leading to improved recovery rates. For instance, companies that have embraced automation report a potential increase in cash receipts by nearly 50% when RCM is outsourced, highlighting the tangible benefits of these advanced solutions.

Moreover, a compelling case study indicates that the implementation of customer service chatbots has led to a 25% reduction in calls to customer service centers. This shift not only frees up resources for addressing more complex issues but also boosts employee satisfaction. With 86% of companies acknowledging that up to 30% of their monthly invoiced sales are overdue, it becomes imperative to enhance operational efficiency in receivables management.

As we approach 2025, the latest innovations in automated debt recovery solutions for enterprise financial operations are poised to revolutionize operational methodologies. Automation is evolving from a mere option to a necessity for financial organizations aiming to thrive in a competitive landscape through the adoption of automated debt recovery solutions for enterprise financial operations. Financial leaders must critically assess their current processes to identify automation opportunities, ensuring they remain at the forefront of industry advancements.

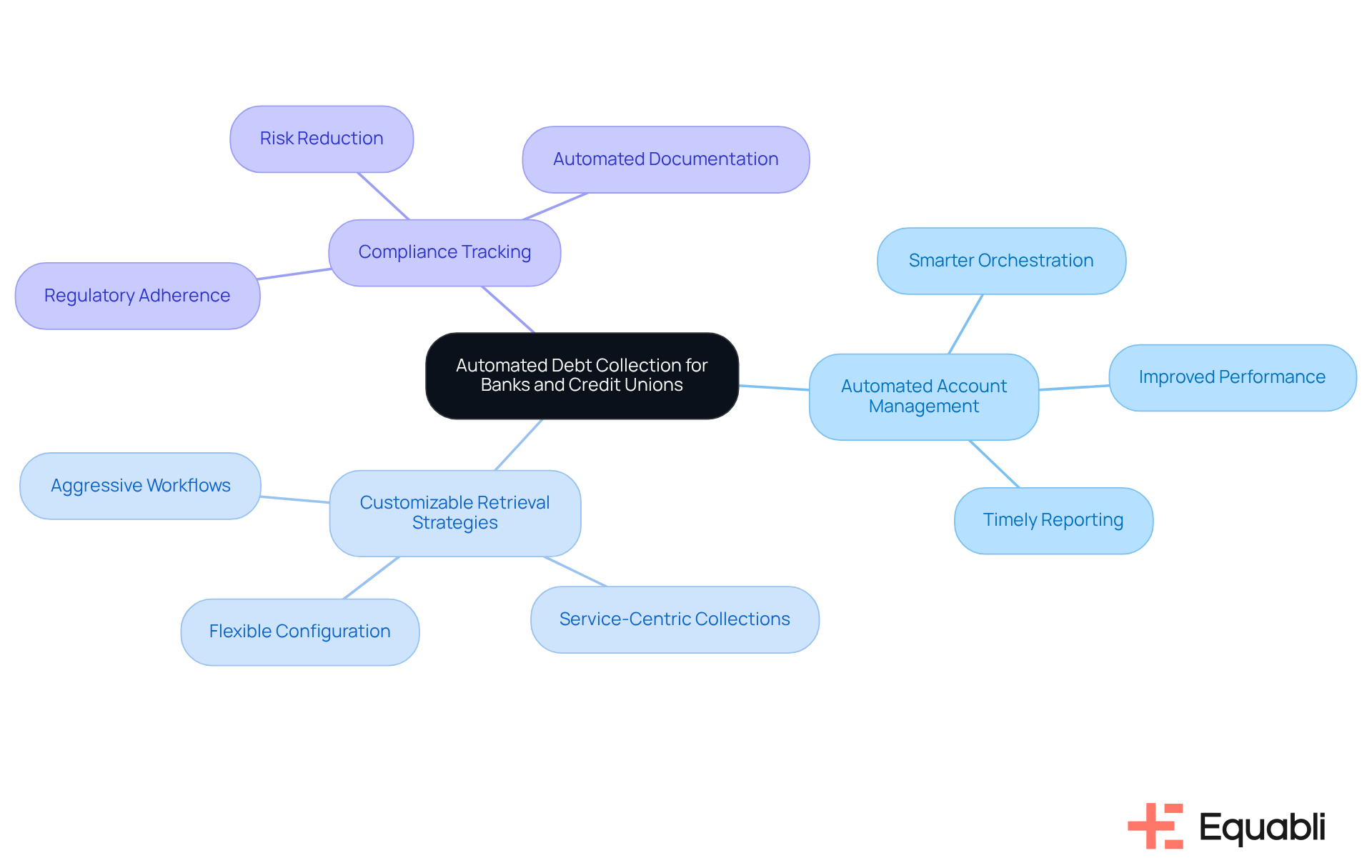

IBS Home: Automated Debt Collection for Banks and Credit Unions

Equabli offers automated debt recovery solutions for enterprise financial operations specifically designed for banks and credit unions. Powered by EQ Collect, this platform features automated account management, customizable retrieval strategies, and compliance tracking. These capabilities address the unique challenges faced by financial institutions, enabling them to enhance their retrieval processes through automated debt recovery solutions for enterprise financial operations while adhering to regulatory requirements.

The transition from inefficient practices to integrated solutions begins today. This shift allows for smarter orchestration, improved performance, and timely reporting. By leveraging Equabli's tools, institutions can utilize automated debt recovery solutions for enterprise financial operations to optimize their debt collection strategies, ensuring compliance and operational efficiency.

To explore how Equabli can enhance your debt collection processes, consider booking a call today. Additionally, EQ Engage offers innovative features for customizable repayment options, borrower engagement, and compliance management, further supporting your institution's strategic goals.

Conclusion

The evolution of automated debt recovery solutions for financial institutions signifies a pivotal shift towards enhanced efficiency and borrower engagement. Various platforms, including Equabli's EQ Suite and Convin.ai, offer robust tools that streamline operations while ensuring compliance with industry standards. By leveraging advanced technologies, financial organizations can optimize their retrieval processes and cultivate stronger relationships with borrowers, ultimately leading to improved recovery rates.

Key insights indicate that automation can significantly reduce collection costs and enhance operational efficiency. For example, Firstsource's automation tools have demonstrated notable success in improving recovery rates while minimizing manual resource requirements. Moreover, the integration of digital payment solutions and automated reminder systems has proven essential in enhancing the repayment experience, with evidence suggesting that these strategies substantially boost borrower engagement and satisfaction.

As the financial landscape evolves, adopting automated debt recovery solutions is not merely an option but a necessity for institutions striving to maintain a competitive edge. Organizations should assess their current processes and explore innovative technologies that can transform their debt collection strategies. This proactive approach ensures compliance and efficiency while fostering a more customer-centric approach to debt recovery, paving the way for sustainable growth in the future.

Frequently Asked Questions

What is the EQ Suite by Equabli?

The EQ Suite by Equabli is an automated debt recovery solution designed for financial institutions to modernize their debt recovery processes. It includes tools such as EQ Engine, EQ Engage, and EQ Collect, focusing on custom scoring models, enhanced retrieval strategies, and digital self-service repayment plans.

How does the EQ Suite ensure data protection?

The EQ Suite prioritizes compliance with industry standards and regulations, demonstrating Equabli's commitment to safeguarding client data throughout the debt recovery process.

What benefits does the EQ Suite provide to organizations?

The EQ Suite helps organizations reduce retrieval expenses, improve borrower engagement, enhance operational efficiency through automated workflows, and provide real-time reporting for compliance efforts.

What is Convin.ai and how does it enhance debt collection?

Convin.ai is an AI-powered platform by Equabli that automates fund recovery. It utilizes advanced analytics to analyze customer data and behavior, allowing organizations to tailor their collection strategies effectively and increase the likelihood of successful repayments.

What impact does automation have on debt recovery processes according to the article?

Automation can improve process precision by up to 60%, reduce overall costs, and enhance borrower experiences, making it essential for financial organizations aiming to improve efficiency and effectiveness in their retrieval efforts.

What is Firstsource's role in automated debt recovery?

Firstsource provides a suite of automation tools specifically for fintech firms involved in receivables management, allowing for streamlined operations and improved data management. Their solutions enable recovery teams to focus on complex cases, enhancing recovery rates and operational efficiency.

What are the reported efficiency gains from using Firstsource's automated solutions?

Firstsource has reported a 70% reduction in overall cost to collect, significantly improving recovery rates compared to traditional methods, which yield only 20-25%.

Why is adopting automated debt recovery solutions increasingly vital for fintech firms?

As the embedded finance market expands, fintech firms need to integrate automated debt recovery solutions to enhance customer engagement and satisfaction, address operational challenges, and maintain competitiveness in the evolving receivables landscape.