Overview

The article presents a critical overview of various automated due payment reminder systems that enhance financial operations for enterprises. These systems, including offerings from Equabli, Gaviti, and Invoiced, significantly improve cash flow management and reduce overdue invoices. Evidence suggests that they enhance customer engagement through timely and personalized notifications. Consequently, this streamlining of the debt recovery process not only mitigates financial risk but also fosters stronger client relationships, underscoring their value in enterprise-level debt collection strategies.

Introduction

Automated payment reminder systems are rapidly transforming the landscape of financial operations, providing financial institutions with innovative solutions to enhance their debt recovery processes. These systems streamline communication and significantly improve cash flow management, establishing themselves as indispensable tools for modern enterprises.

As organizations navigate the complexities of integrating these technologies, critical questions emerge:

- How can businesses ensure they are selecting the right automated solutions?

- What specific benefits can they anticipate from implementing these systems?

This article delves into ten leading automated due payment reminder systems, exploring their features, benefits, and the tangible impacts they have on financial operations.

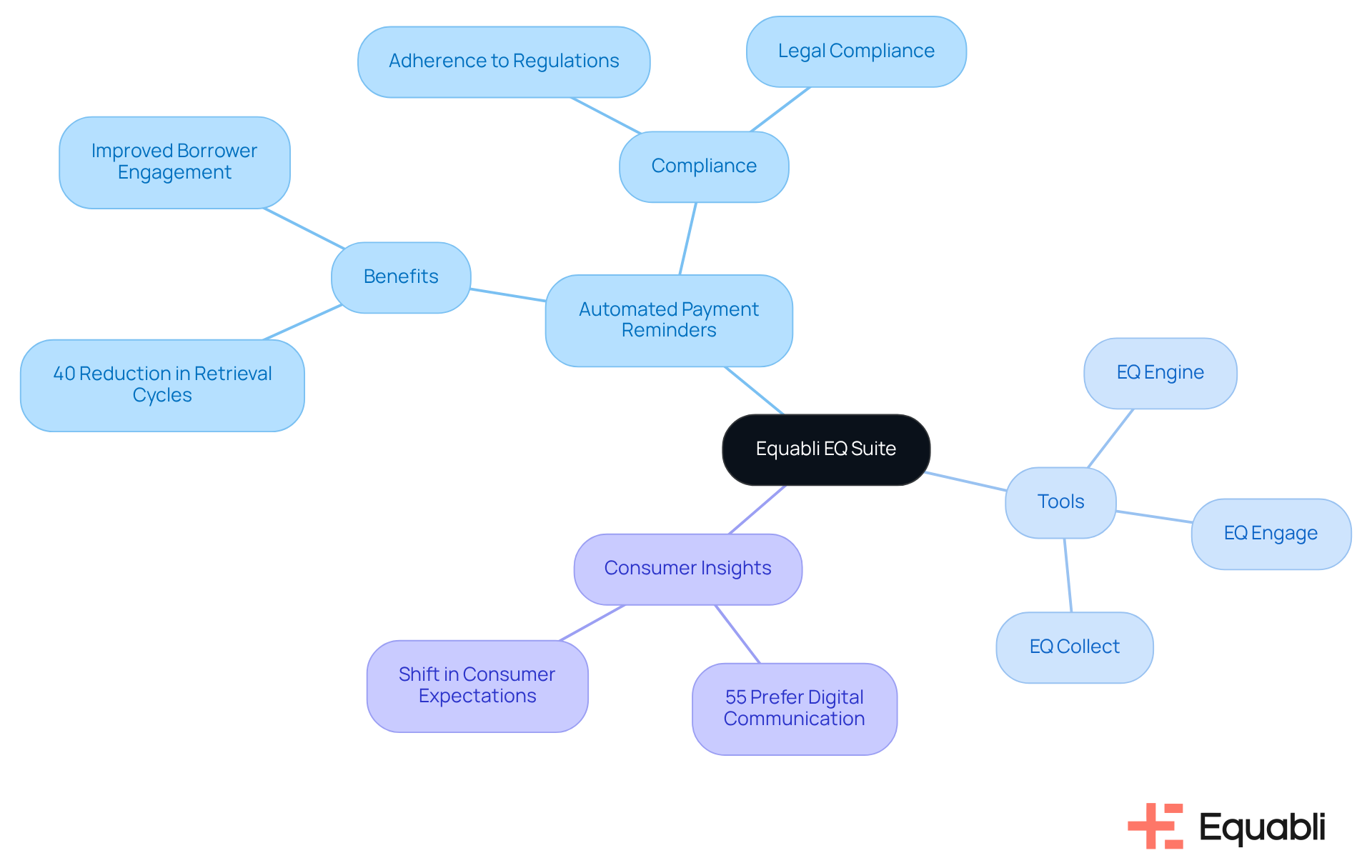

Equabli EQ Suite: Comprehensive Automated Payment Reminder Solutions

The Equabli EQ Suite offers a comprehensive array of automated due payment reminder systems for enterprise financial operations, significantly enhancing retrieval efficiency for financial institutions. This suite encompasses tools such as EQ Engine, EQ Engage, and EQ Collect, enabling users to develop custom scoring models, refine retrieval strategies, and facilitate digital resources through self-service repayment options. By automating notifications, the EQ Suite not only ensures adherence to evolving regulations but also promotes improved borrower engagement via preferred communication channels.

A critical insight into consumer preferences reveals that 55% of consumers now favor digital communication over traditional methods, highlighting the imperative for financial institutions to modernize their approaches. Furthermore, organizations that implement automated due payment reminder systems for enterprise financial operations report a 40% reduction in average retrieval cycles, demonstrating the tangible benefits of integrating such technology into debt recovery processes.

As the landscape of debt recovery evolves, the EQ Suite emerges as an essential tool for maximizing operational efficiency and fostering sustainable growth.

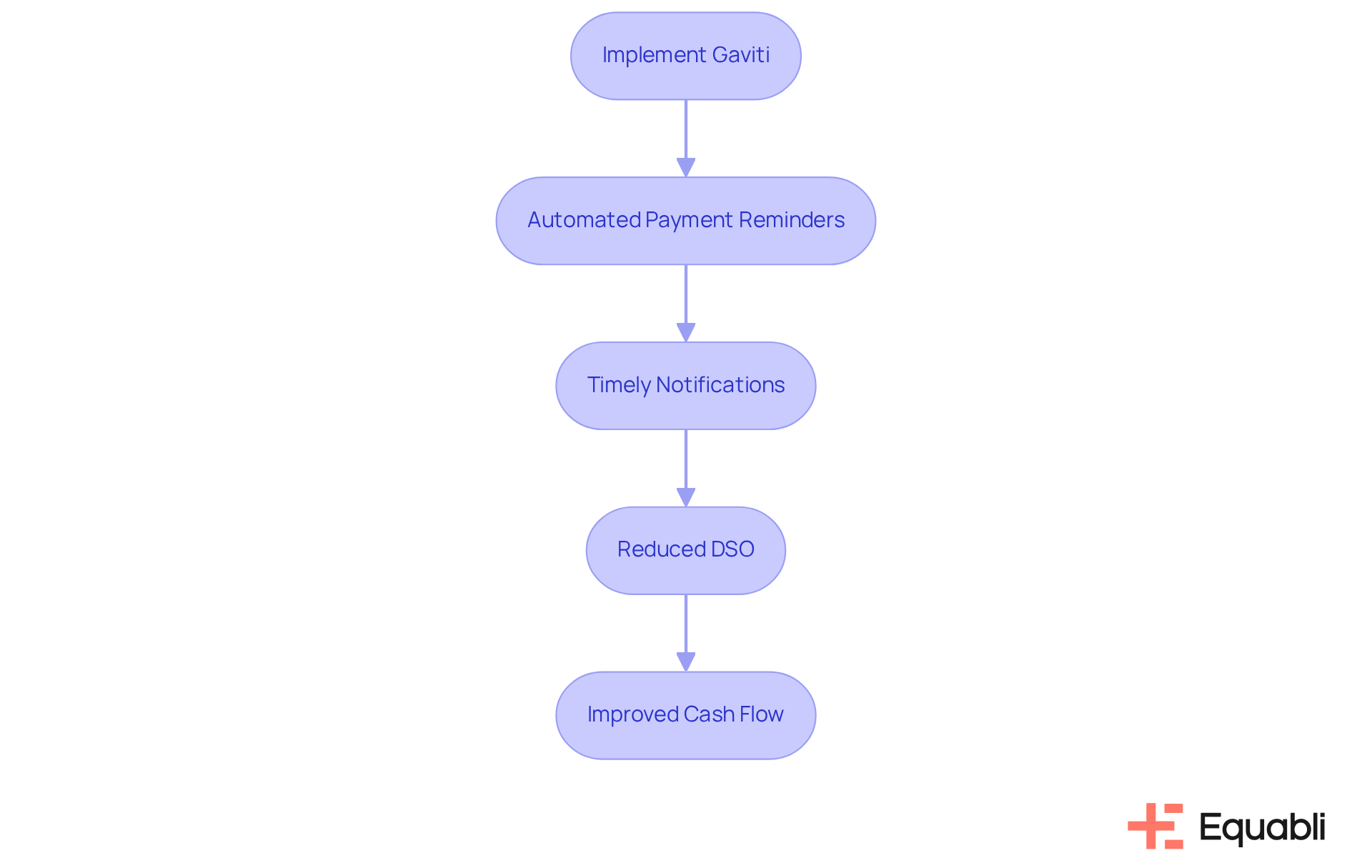

Gaviti: Automated Payment Reminders for Enhanced Collection Efficiency

Gaviti's electronic collection notifications are instrumental in enhancing collection efficiency within accounts receivable management. By leveraging advanced AI technology, Gaviti streamlines the invoicing process, leading to a significant reduction in Days Sales Outstanding (DSO) and improved cash flow management. Evidence indicates that businesses utilizing Gaviti have experienced a DSO reduction of up to 30% or more within a six-month period, underscoring the platform's effectiveness. The system utilizes automated due payment reminder systems for enterprise financial operations, automating alerts and follow-ups to ensure that clients receive timely notifications regarding overdue payments. This proactive approach not only sustains a healthy cash flow but also mitigates late transactions, resulting in a 15% decrease in bad debts attributable to invoicing technology alone.

As industry leaders recognize, the integration of automated due payment reminder systems for enterprise financial operations is vital for enhancing cash flow and promoting overall financial stability. Furthermore, with 94% of companies either utilizing or experimenting with AI in accounts receivable, the relevance of Gaviti's solutions becomes increasingly pronounced. Improving DSO not only enhances liquidity but also fortifies customer relationships through consistent communication. To maximize these advantages, it is advisable to assess your current accounts receivable processes to identify opportunities where automated due payment reminder systems for enterprise financial operations can enhance efficiency and reduce DSO.

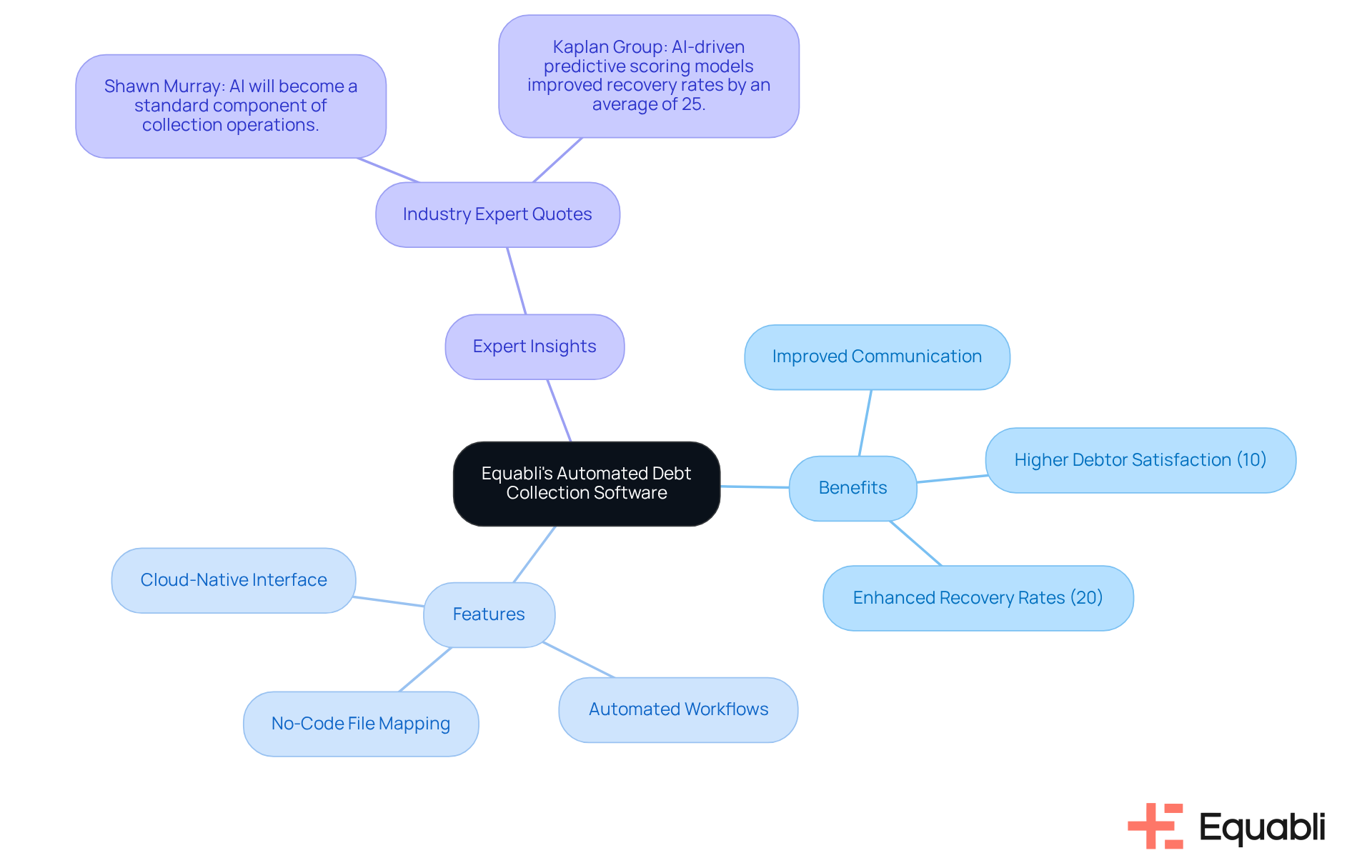

Convin: Streamlined Automated Debt Collection Software

Equabli's automated due payment reminder systems for enterprise financial operations revolutionize payment notification systems by leveraging AI capabilities to enhance communication processes. This technology ensures that reminders are dispatched at optimal times, resulting in significantly improved retrieval rates. By delivering timely and relevant notifications, Equabli not only streamlines the retrieval process but also elevates the overall customer experience.

Financial institutions employing AI-driven communication workflows have documented a 10% increase in debtor satisfaction compared to traditional methods. Moreover, predictive AI models can enhance recovery rates by as much as 20%.

With features such as a no-code file-mapping tool, automated workflows, and a user-friendly, scalable, cloud-native interface, Equabli's EQ Collect minimizes execution errors and manual resource demands, ensuring smarter orchestration and enhanced performance.

As industry expert Shawn Murray notes, 'By all indications, AI will become a standard element of retrieval operations across the industry.' This underscores the tangible benefits of integrating automated due payment reminder systems for enterprise financial operations into debt retrieval strategies, fundamentally transforming the debt recovery landscape.

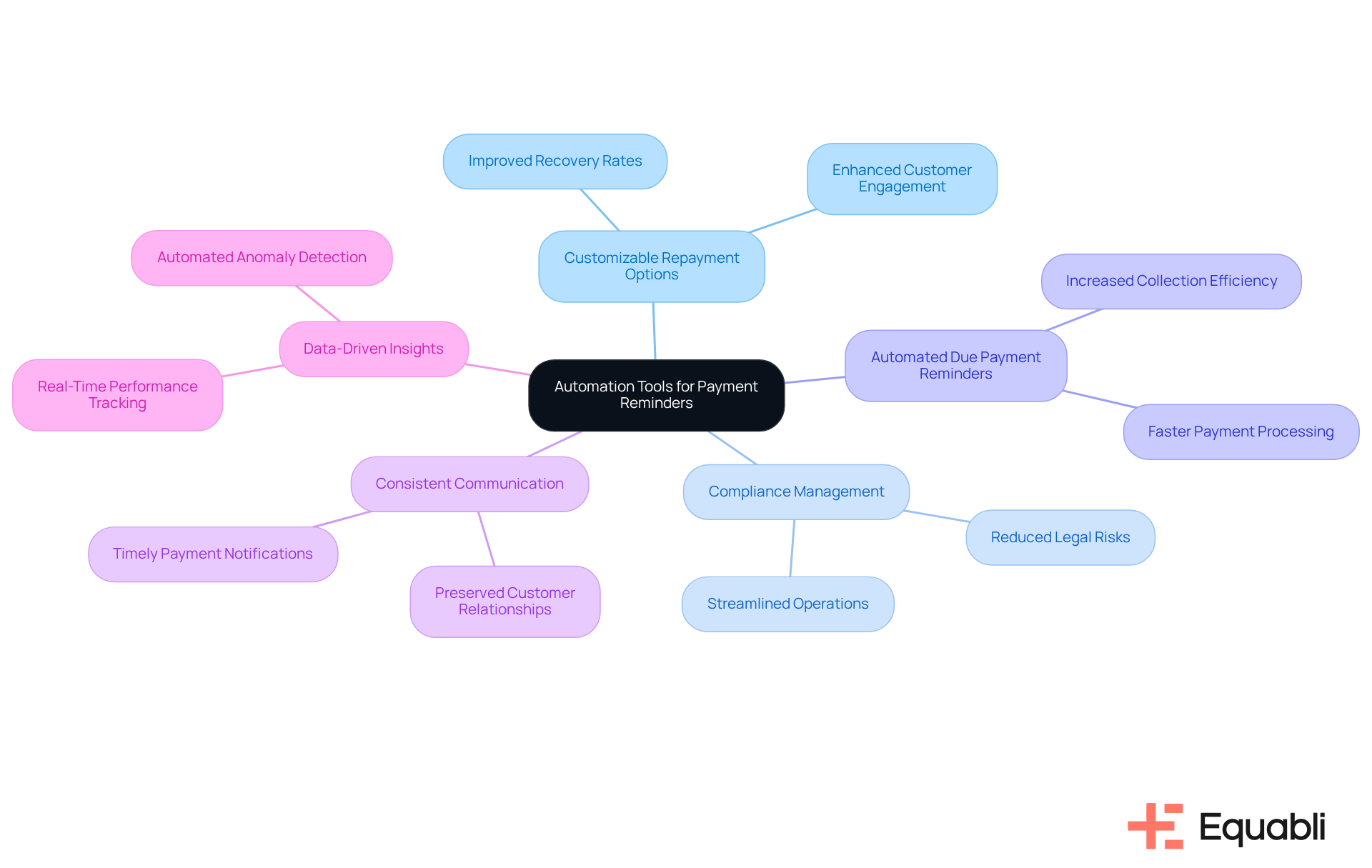

Tratta: Automation Tools for Effective Payment Reminders

Equabli provides advanced automation tools designed to enhance payment notifications, leveraging automated due payment reminder systems for enterprise financial operations to address the challenges faced by organizations reliant on manual debt recovery processes. The EQ Suite facilitates the automation of invoicing, reminders, and follow-ups through automated due payment reminder systems for enterprise financial operations, significantly reducing the manual workload associated with receivables. By fostering consistent communication with debtors, Equabli empowers organizations to improve their recovery rates while preserving positive customer relationships.

Key features of the EQ Suite encompass customizable repayment options and compliance management, both of which streamline operations and enhance overall performance. This evolution in the debt recovery landscape enables financial institutions to implement automated due payment reminder systems for enterprise financial operations, which enhances their efficiency and effectiveness, ultimately driving better outcomes in debt collection and risk management.

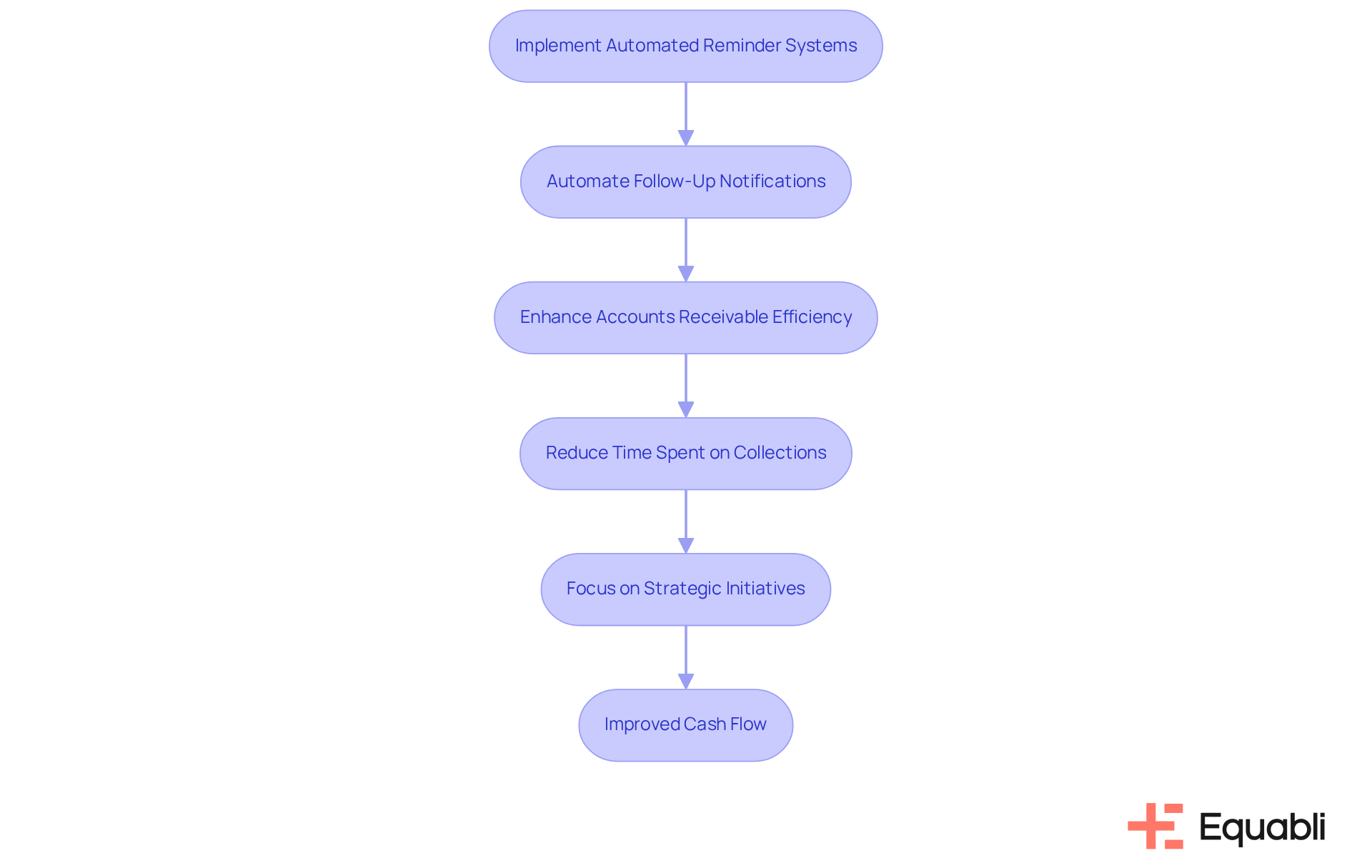

Invoiced: Advanced Solutions for Managing Past Due Invoices

Invoiced provides advanced solutions for managing overdue invoices, including its automated due payment reminder systems for enterprise financial operations, exemplified by the Smart Chasing Engine, which automates follow-up notifications and significantly enhances accounts receivable efficiency. Implementing automated due payment reminder systems for enterprise financial operations to automate follow-ups for overdue invoices allows companies to markedly reduce the time spent on collections, enabling personnel to focus on strategic initiatives. This automation enhances the notification process and improves cash flow by utilizing automated due payment reminder systems for enterprise financial operations, ensuring timely receipt of funds.

Evidence indicates that systematic late fee applications can lead to a substantial decrease in past-due invoices, with 86% of businesses reporting that up to 30% of their monthly invoiced sales are overdue. Organizations leveraging Invoiced's platform have observed a significant reduction in processing delays, directly contributing to improved cash flow management.

Financial experts emphasize the necessity of automated due payment reminder systems for enterprise financial operations, asserting that consistent communication regarding financial obligations can significantly influence customer behavior. R.J. Ancona, Vice President at American Express, notes that the time and cost associated with automation are often less daunting than anticipated, yielding both short-term and long-term advantages. By utilizing automated due payment reminder systems for enterprise financial operations, organizations can establish clear expectations and foster timely transactions, ultimately enhancing overall financial health. Invoiced's strategy for automating these processes through automated due payment reminder systems for enterprise financial operations not only boosts operational efficiency but also equips businesses to excel in a competitive environment. To further capitalize on the benefits of system notifications, consider personalizing late fee schedules and implementing grace periods to accommodate diverse customer needs.

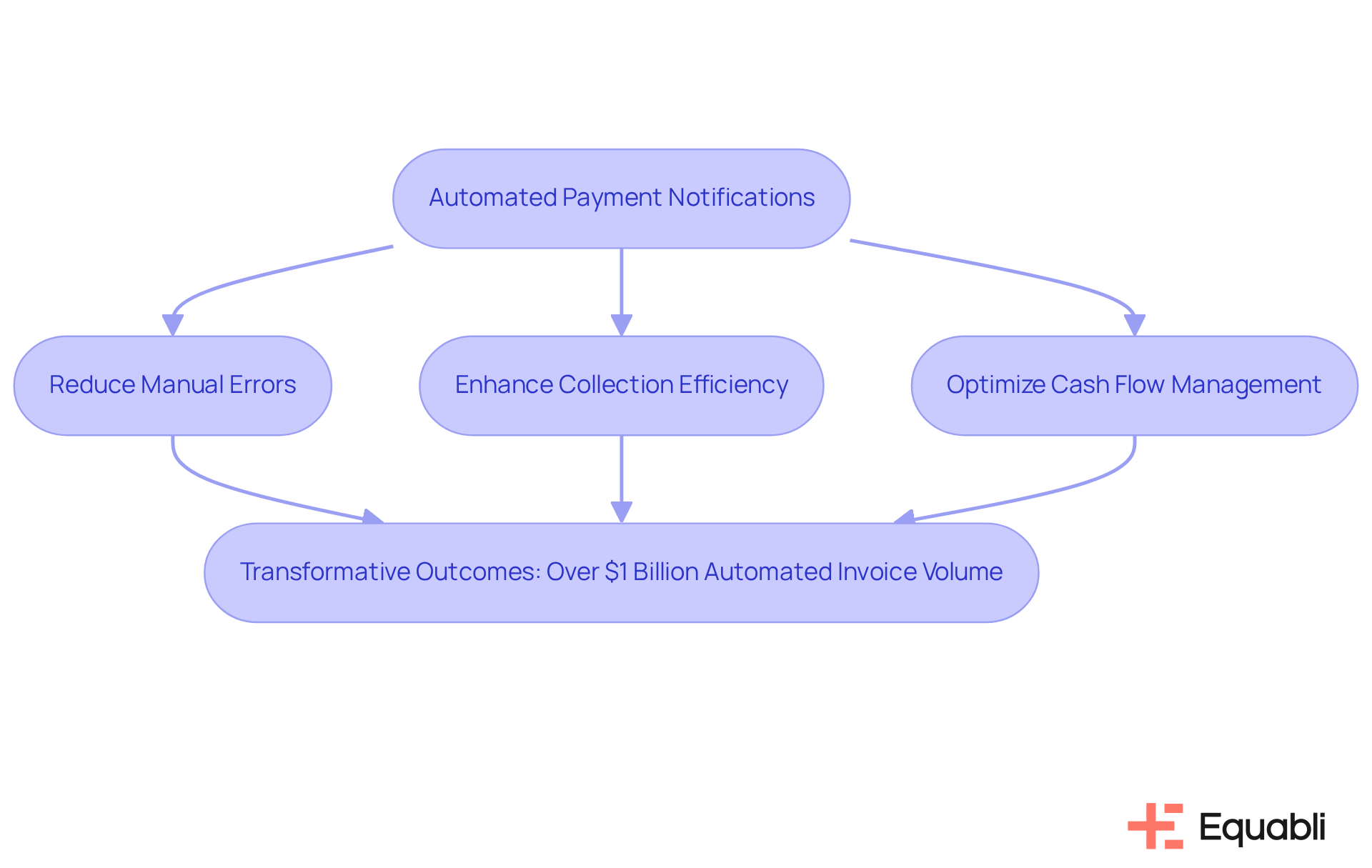

Tabs: Essential Accounts Receivable Management Tools

Tabs provides essential accounts receivable management tools, particularly through automated payment notifications that streamline the invoicing process. Evidence shows that by ensuring prompt and effective notifications, Tabs significantly reduces manual errors, a frequent source of inefficiency in traditional systems. This automation not only enhances collection efficiency but also optimizes cash flow management.

For instance, companies leveraging Tabs have reported transformative outcomes, automating over $1 billion in invoice volume, which has led to a marked decrease in Days Sales Outstanding (DSO). Industry leaders assert that automated due payment reminder systems for enterprise financial operations are vital for contemporary financial operations, enabling teams to concentrate on strategic initiatives rather than being hindered by manual processes.

The integration of automated due payment reminder systems for enterprise financial operations into the invoicing workflow illustrates how technology can improve financial management, ensuring compliance and accuracy while fostering better client relationships through proactive communication. This strategic shift not only addresses operational challenges but also positions organizations to navigate the complexities of enterprise-level debt collection effectively.

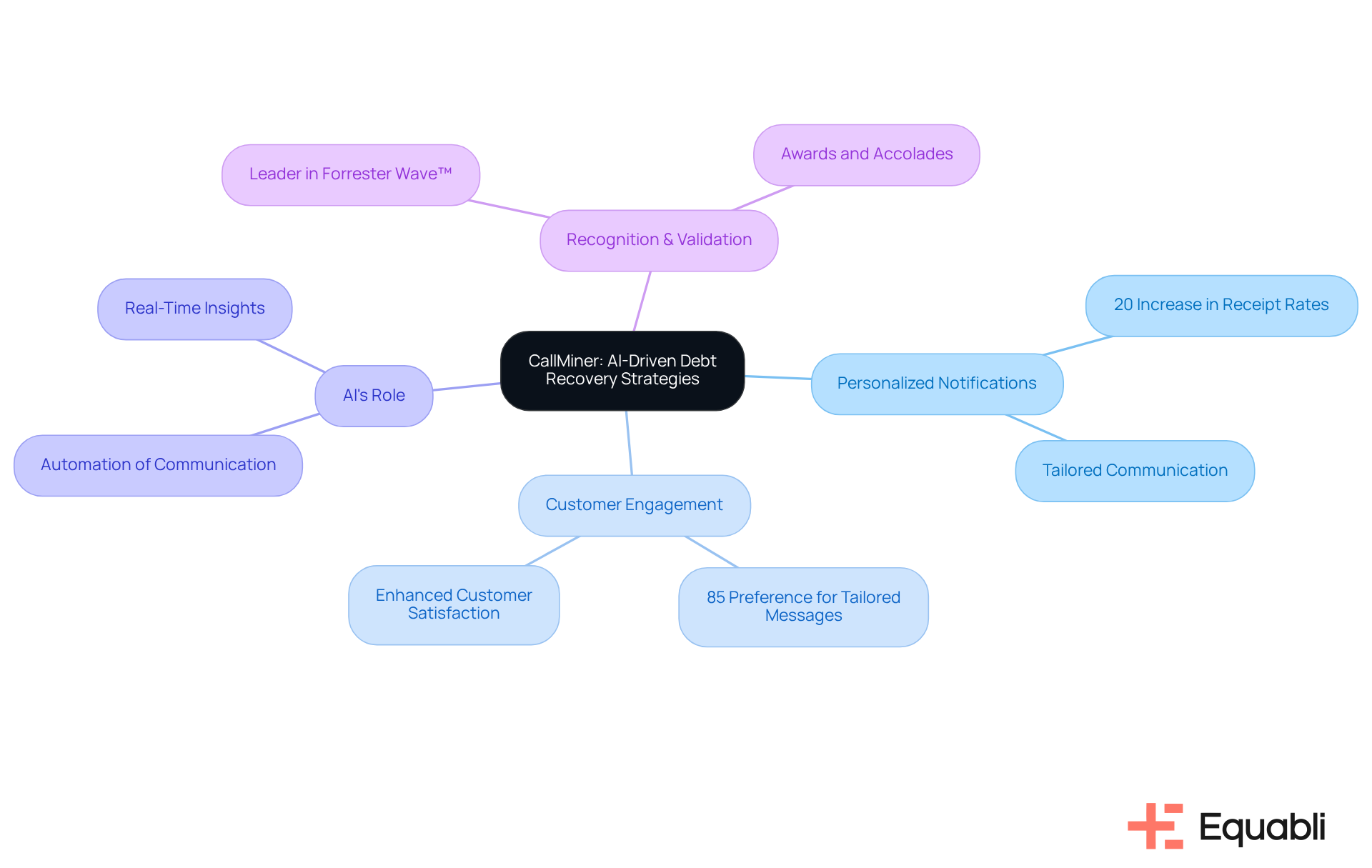

CallMiner: AI-Driven Debt Recovery Strategies

CallMiner employs AI-driven debt recovery techniques that significantly enhance the efficiency of collection notices. By meticulously analyzing customer interactions and behaviors, CallMiner's platform personalizes notifications for individual debtors. This data-driven strategy has been shown to improve the likelihood of prompt settlements, thereby boosting recovery rates and elevating customer satisfaction through tailored communication. Research indicates that customized communication in debt recovery can lead to a 20% increase in receipt rates, underscoring the critical role of personalized interactions.

Moreover, organizations utilizing CallMiner's insights report heightened engagement, with 85% of customers preferring tailored notifications over generic messages. Bruce McMahon, VP of Product Management, asserts that "AI is crucial in enhancing customer experience and ensuring that communication is relevant and timely." This strategic emphasis on individual debtor needs illustrates how automated due payment reminder systems for enterprise financial operations can enhance traditional debt recovery methods into more effective, customer-centric solutions.

Furthermore, CallMiner's recognition as a leader in The Forrester Wave™: Conversation Intelligence Solutions for Contact Centers, Q2 2025, validates its effectiveness in improving customer interactions. By leveraging these insights, enterprises can not only enhance their debt recovery processes through automated due payment reminder systems for enterprise financial operations but also foster stronger relationships with their customers, ultimately leading to improved operational outcomes.

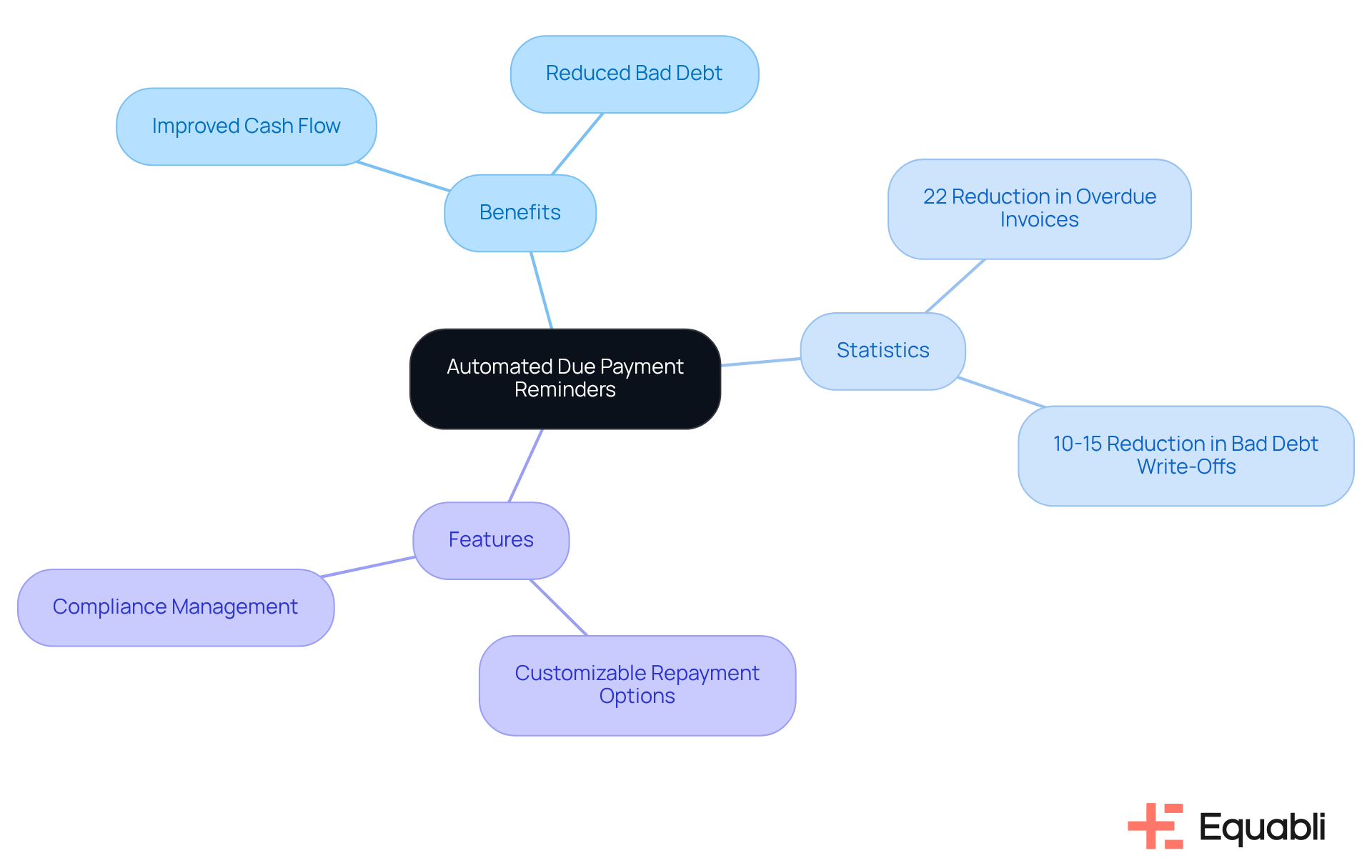

FlexPoint: Solutions for Managing Late Payments

Equabli offers a robust suite of solutions for managing overdue invoices, incorporating automated due payment reminder systems for enterprise financial operations that enhance the collection process. By implementing automated due payment reminder systems for enterprise financial operations, Equabli ensures clients receive timely notifications regarding overdue charges, effectively mitigating the risk of delays that can adversely affect cash flow. Evidence indicates that organizations utilizing automated accounts receivable systems can reduce overdue invoices by as much as 22%. Furthermore, those that adopt these automation tools typically see a 10-15% reduction in bad debt write-offs, highlighting the financial advantages of timely reminders.

Financial experts assert that automated due payment reminder systems for enterprise financial operations are essential for sustaining healthy cash flow, empowering businesses to proactively tackle overdue accounts. Equabli's EQ Suite not only streamlines operations but also allows organizations to focus on strategic growth initiatives, ultimately transforming overdue amounts into manageable financial assets. With innovative features such as customizable repayment options and compliance management, Equabli's solutions modernize the debt recovery process, thereby enhancing efficiency and borrower engagement.

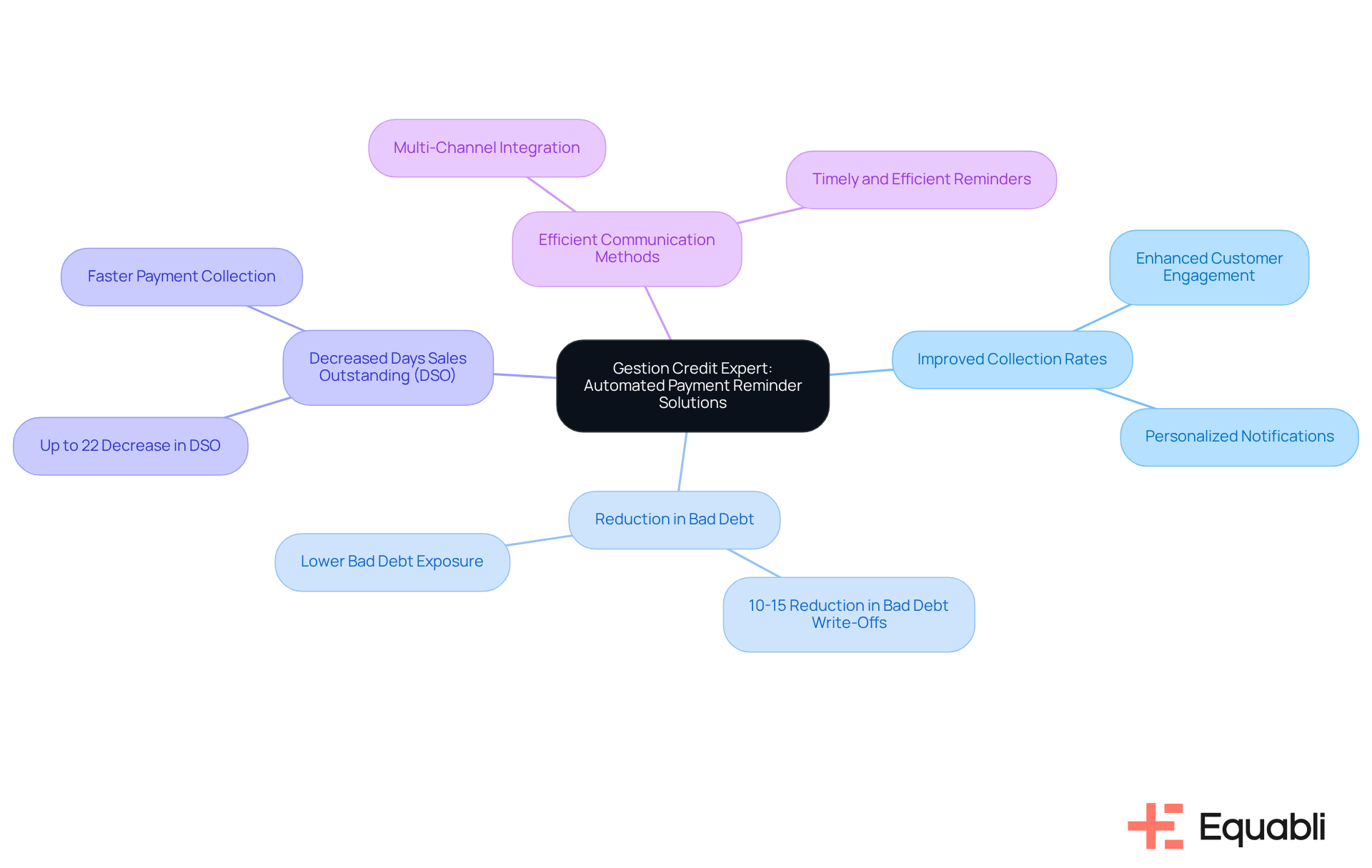

Gestion Credit Expert: Transformative Automated Payment Reminder Solutions

Gestion Credit Expert offers automated due payment reminder systems for enterprise financial operations that significantly enhance recovery processes. The platform utilizes automated due payment reminder systems for enterprise financial operations to ensure that clients are consistently informed about their payment obligations. This proactive strategy not only improves collection rates but also strengthens customer relationships by implementing automated due payment reminder systems for enterprise financial operations, as personalized notifications tailored to individual preferences foster greater engagement.

Evidence indicates that companies utilizing automated due payment reminder systems for enterprise financial operations can achieve a reduction in bad debt write-offs by 10-15%. Additionally, firms that utilize automated due payment reminder systems for enterprise financial operations often experience a decrease in days sales outstanding (DSO) by as much as 22%. For instance, the implementation of automated due payment reminder systems for enterprise financial operations at Vanquis Bank has led to a 60% reduction in the need for agent resources, allowing teams to focus on more valuable customer interactions.

By integrating various communication methods, including SMS and email, Gestion Credit Expert ensures the implementation of automated due payment reminder systems for enterprise financial operations that are timely and efficient. This approach enhances the likelihood of swift transactions and contributes to a positive customer experience, ultimately positioning enterprises to navigate the complexities of debt collection more effectively with automated due payment reminder systems for enterprise financial operations.

Stripe: Tools for Automating Payment Reminders

Equabli provides robust tools for implementing automated due payment reminder systems for enterprise financial operations, which significantly enhances debt recovery efficiency for financial institutions. The platform features a no-code file-mapping tool that reduces vendor onboarding timelines and workflows designed to minimize execution errors. This simplification of the entire process is crucial for operational efficiency.

The integration of data-driven strategies, real-time reporting, and industry-leading compliance oversight ensures unparalleled insights and transparency throughout operations. By transforming manual processes into intelligent, automated due payment reminder systems for enterprise financial operations, Equabli enables businesses to manage their invoicing and collections more effectively. This transformation is essential for improving cash flow management in today's competitive landscape.

To explore how Equabli can enhance your debt recovery processes, consider booking a demo today. This proactive step could lead to significant improvements in your operational efficiency and compliance posture.

Conclusion

Automated due payment reminder systems have become indispensable for financial operations, fundamentally reshaping how organizations approach debt recovery. By leveraging advanced technology, these systems not only improve operational efficiency but also facilitate enhanced engagement with borrowers, ultimately resulting in better cash flow and fewer overdue payments.

The discussion highlights platforms such as Equabli EQ Suite, Gaviti, and Invoiced, each offering distinct features that optimize communication and automate follow-up processes. Key insights indicate that businesses implementing these automated solutions can achieve substantial reductions in Days Sales Outstanding (DSO) and bad debt write-offs, while also enjoying improved customer satisfaction through tailored notifications.

As the financial landscape evolves, adopting automated due payment reminder systems is vital for organizations striving to maintain a competitive advantage. By investing in these technologies, companies can refine their operational strategies, ensuring timely transactions and robust financial management. The future of debt recovery is rooted in process automation, making it imperative for organizations to embrace these innovative solutions to foster sustainable growth and operational efficiency.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a comprehensive array of automated due payment reminder systems designed to enhance retrieval efficiency for financial institutions. It includes tools like EQ Engine, EQ Engage, and EQ Collect, allowing users to create custom scoring models and refine retrieval strategies.

How does the EQ Suite improve borrower engagement?

The EQ Suite promotes improved borrower engagement by automating notifications and allowing communication through preferred channels, aligning with consumer preferences for digital communication.

What are the benefits of using automated due payment reminder systems?

Organizations implementing automated due payment reminder systems report a 40% reduction in average retrieval cycles and improved operational efficiency, which fosters sustainable growth.

What is Gaviti and how does it enhance collection efficiency?

Gaviti is a platform that uses electronic collection notifications and advanced AI technology to enhance collection efficiency in accounts receivable management, leading to a significant reduction in Days Sales Outstanding (DSO) and improved cash flow management.

What results have businesses seen from using Gaviti?

Businesses using Gaviti have experienced a DSO reduction of up to 30% or more within six months and a 15% decrease in bad debts due to its invoicing technology.

Why is AI integration important in accounts receivable?

The integration of AI in accounts receivable is vital for enhancing cash flow and promoting financial stability, as evidenced by 94% of companies either utilizing or experimenting with AI in this area.

How does Equabli's automated debt collection software work?

Equabli's software leverages AI to enhance communication processes by ensuring reminders are sent at optimal times, improving retrieval rates and overall customer experience.

What impact does AI-driven communication have on debtor satisfaction?

Financial institutions using AI-driven communication workflows have reported a 10% increase in debtor satisfaction compared to traditional methods.

What features does Equabli's EQ Collect offer?

EQ Collect features a no-code file-mapping tool, automated workflows, and a user-friendly, scalable cloud-native interface that minimizes execution errors and manual resource demands.

What is the future of AI in debt retrieval operations?

Industry experts predict that AI will become a standard element in retrieval operations, significantly transforming the debt recovery landscape.