Overview

The article provides an authoritative overview of automated email payment reminder systems, which are strategically designed to enhance enterprise debt recovery. These systems utilize advanced technology, including artificial intelligence and customizable notifications, to significantly improve communication and increase recovery rates. By streamlining the collections process, they foster better client relationships and enhance operational efficiency, ultimately positioning enterprises for greater success in managing debt recovery.

Introduction

Automated email payment reminder systems are fundamentally transforming enterprise debt recovery, providing businesses with innovative solutions that streamline collection processes. By leveraging advanced technology, organizations can significantly enhance cash flow, minimize overdue payments, and preserve positive relationships with clients. However, as these systems gain traction, it is crucial to assess their effectiveness and identify best practices for implementation.

How can enterprises effectively utilize these tools not only to recover debts but also to cultivate customer loyalty in an increasingly competitive landscape?

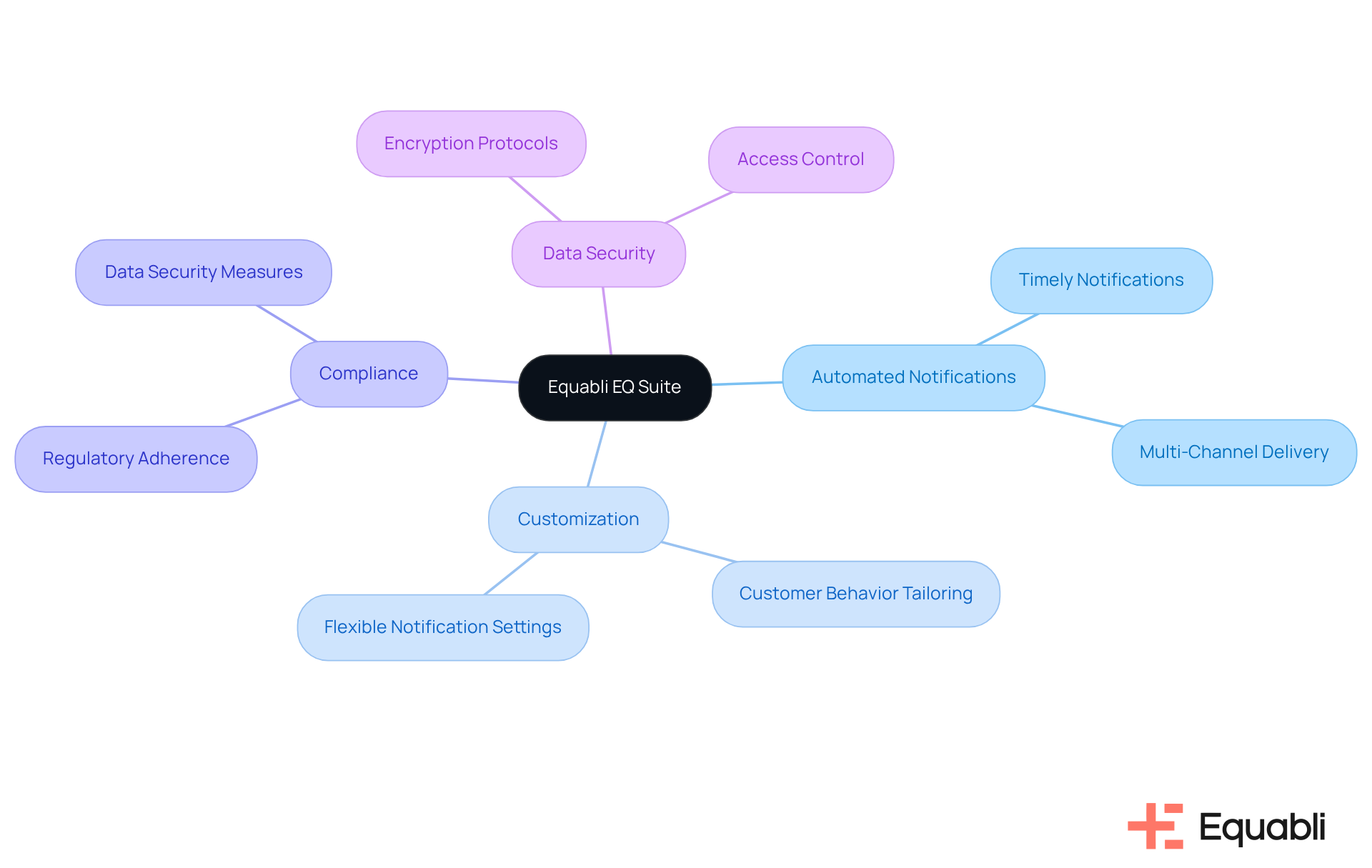

Equabli EQ Suite: Comprehensive Automated Payment Reminder Solution

The Equabli EQ Suite represents a robust automated billing notification solution that seamlessly integrates with existing systems, ensuring compliance and data security throughout the billing process. Utilizing sophisticated algorithms, it delivers timely notifications via email and SMS, thereby preventing clients from missing payment deadlines.

With a focus on data-driven methodologies, the EQ Suite's flexible features allow businesses to tailor notifications based on customer behavior, which not only boosts engagement but also enhances retrieval rates. This comprehensive strategy streamlines the collection process while fostering improved relationships with borrowers by providing preferred communication channels.

Importantly, this solution maintains industry-leading compliance oversight, positioning it as a critical tool for enterprises navigating the complexities of debt collection and risk management through automated email payment reminder systems for enterprise debt recovery.

Convin AI: Intelligent Debt Collection Software for Automated Reminders

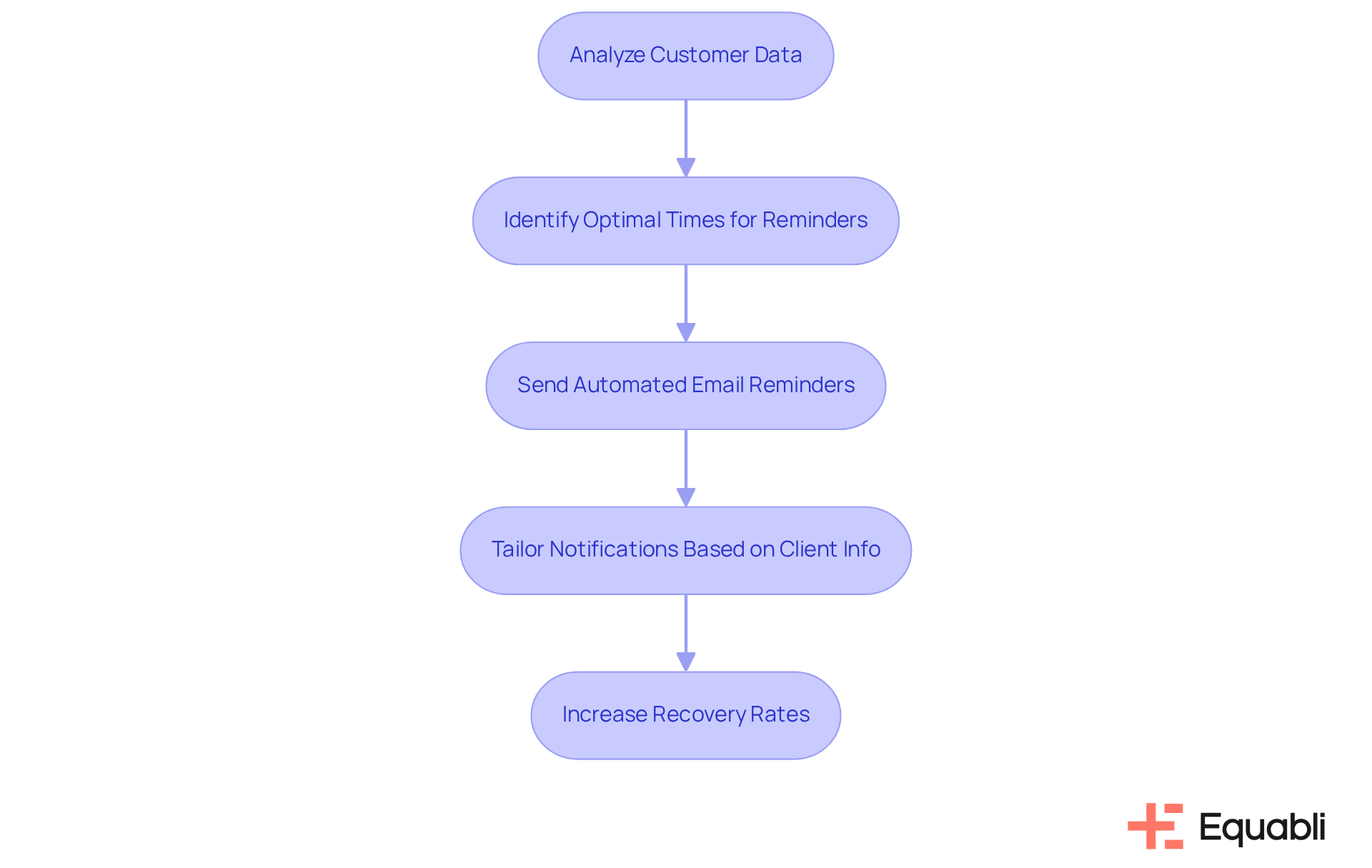

Convin AI leverages artificial intelligence to revolutionize debt retrieval, particularly through its automated email payment reminder systems for enterprise debt recovery. By analyzing customer data, the software identifies optimal times and channels for sending reminders, significantly increasing the likelihood of timely transactions. Businesses implementing AI in their retrieval strategies have reported a notable 21% increase in recovery rates, underscoring the technology's effectiveness in enhancing retrieval processes.

Automating these communications with automated email payment reminder systems for enterprise debt recovery not only reduces the burden on collection teams but also streamlines the overall debt recovery workflow. With AI operating continuously, notifications can be sent reliably and promptly, ensuring that no bill is overlooked. This capability is crucial, as automated email payment reminder systems for enterprise debt recovery have been shown to elevate payment completion rates by 21%, while simultaneously reducing operational costs associated with manual follow-ups.

Moreover, tailoring notification scripts based on individual client information fosters improved engagement, rendering interactions more conversational and empathetic. Customized notifications can yield response rates that are 40-60% higher when aligned with individual customer schedules, thereby enhancing recovery rates as clients are more inclined to respond positively to personalized communications. As the debt collection landscape evolves, the integration of intelligent software like Convin AI is becoming indispensable for organizations seeking to optimize their recovery strategies and achieve sustainable growth.

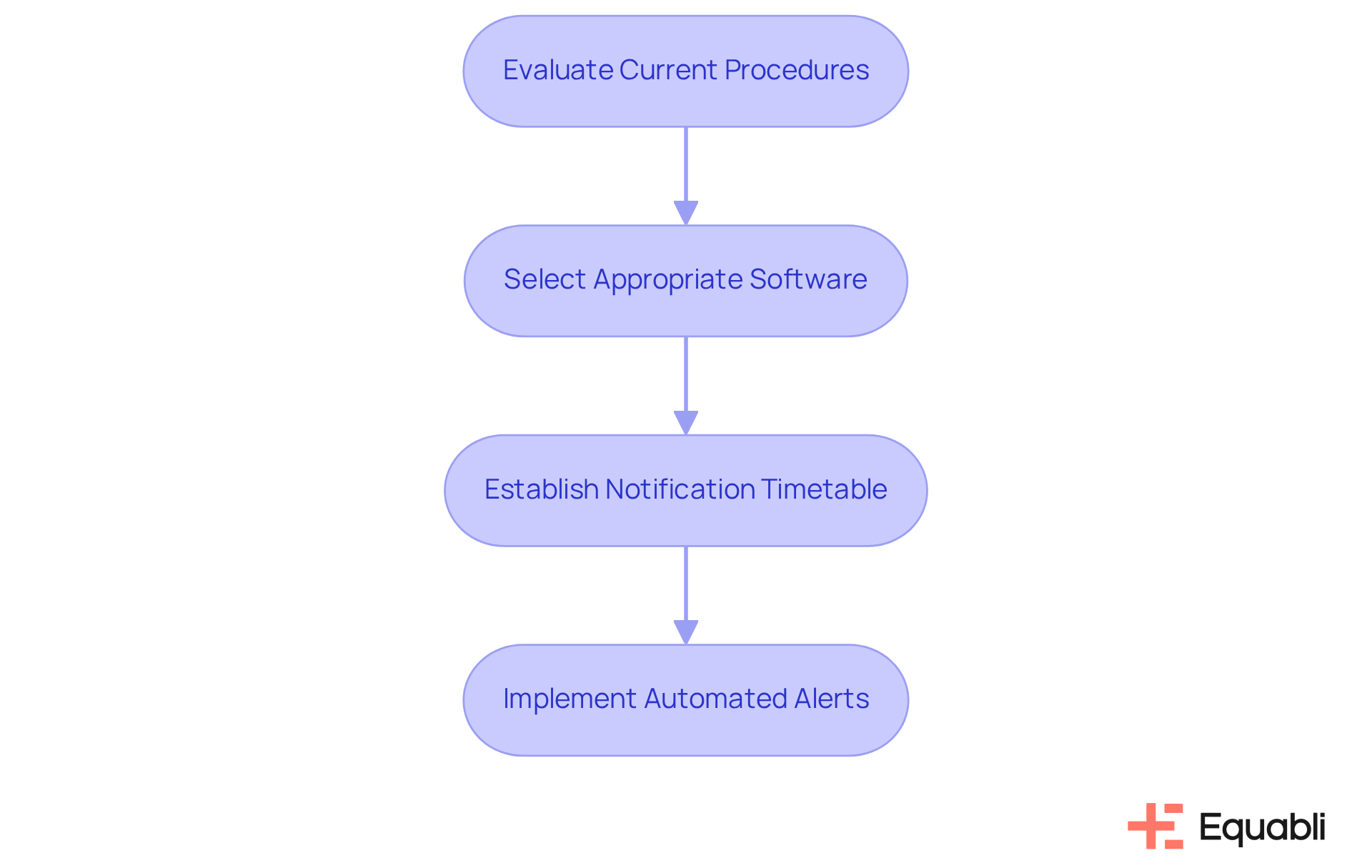

Gestion Credit Expert: Automated Payment Reminders for Improved Cash Flow

Gestion Credit Expert provides automated alerts that significantly enhance cash flow for organizations. This system strategically arranges notifications to ensure prompt transactions, effectively mitigating instances of late fees. Evidence indicates that firms implementing automated notifications experience a notable decline in overdue bills; financial analysts report that regular alerts can reduce late fees by as much as 30%.

Furthermore, incorporating automated billing alerts into existing systems requires:

- A thorough evaluation of current procedures

- The selection of appropriate software options

- The establishment of a notification timetable

As enterprises confront the complexities of cash flow management in 2025, sustaining a healthy cash flow becomes vital for both sustainability and growth. Automated email payment reminder systems for enterprise debt recovery are emerging as a crucial tool for maintaining operational efficiency and fostering positive client relationships.

Manny Gagliardi, VP of Contingent Talent Management at symplr, emphasizes this point, stating, "Incorporating advanced invoicing, collections, and reconciliation into the CTM ecosystem improves both agency and client workflows, enhancing the overall value we’re dedicated to providing to our clients.

Calfrenzy: Effective Payment Reminder Strategies for Enterprises

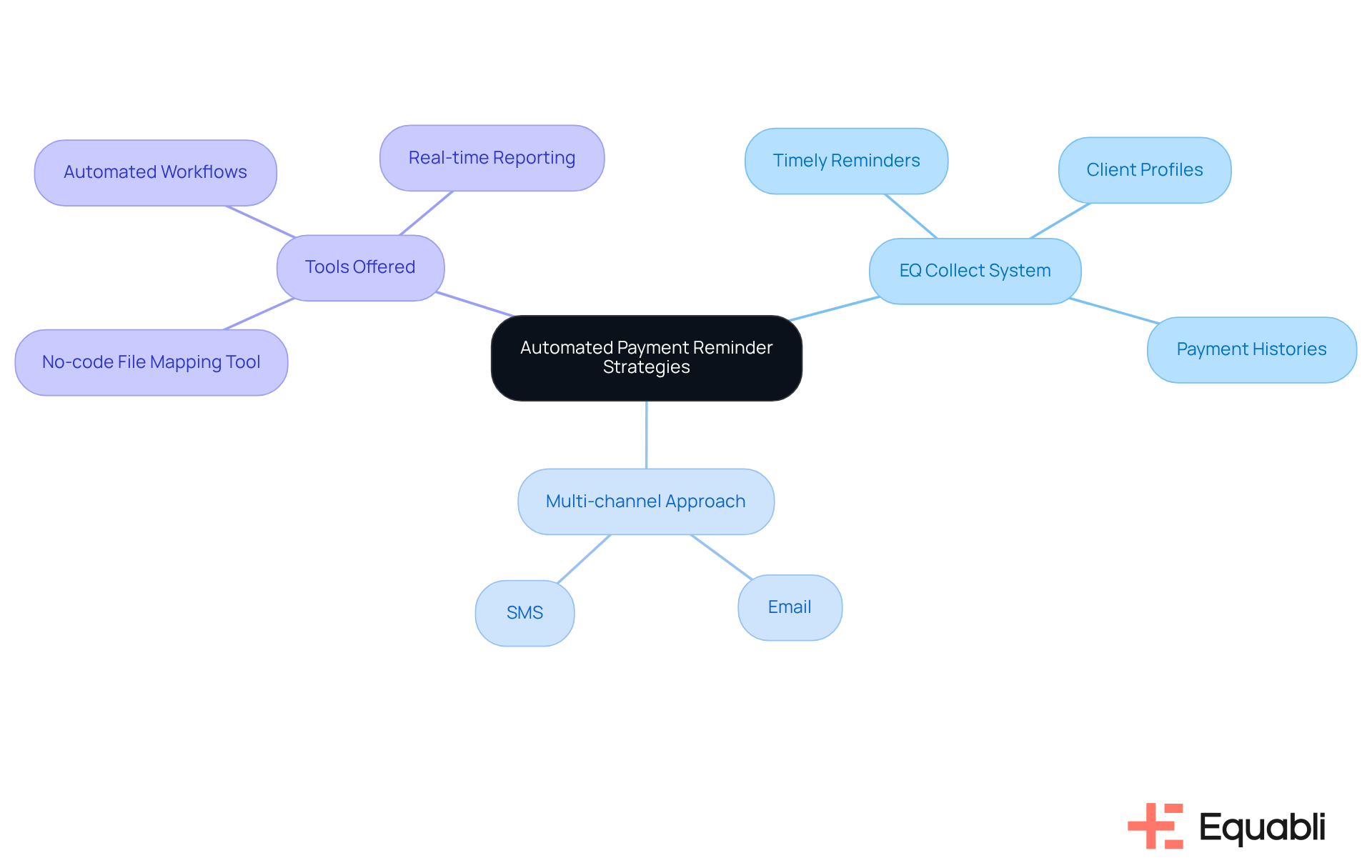

Equabli specializes in developing automated email payment reminder systems for enterprise debt recovery that are tailored for businesses. Their EQ Collect system empowers organizations to dispatch timely reminders based on client profiles and payment histories, ensuring communications are relevant and effective. By adopting a multi-channel approach that includes both email and SMS, Equabli significantly enhances the likelihood of successful recoveries through automated email payment reminder systems for enterprise debt recovery while fostering positive customer relationships.

Equabli's offerings include:

- A no-code file-mapping tool

- Automated workflows

- Real-time reporting

These collectively transform traditional debt recovery methods by incorporating automated email payment reminder systems for enterprise debt recovery into intelligent, data-driven strategies. This shift not only improves efficiency but also ensures compliance and elevates overall performance. The EQ Suite further simplifies the transition from manual to automated processes, facilitating user adoption of these advanced tools.

In summary, Equabli's innovative solutions, particularly automated email payment reminder systems for enterprise debt recovery, present a strategic advantage for enterprises navigating the complexities of debt collection. By leveraging technology to enhance communication and operational efficiency, businesses can significantly improve their recovery outcomes while maintaining compliance and strengthening customer relationships.

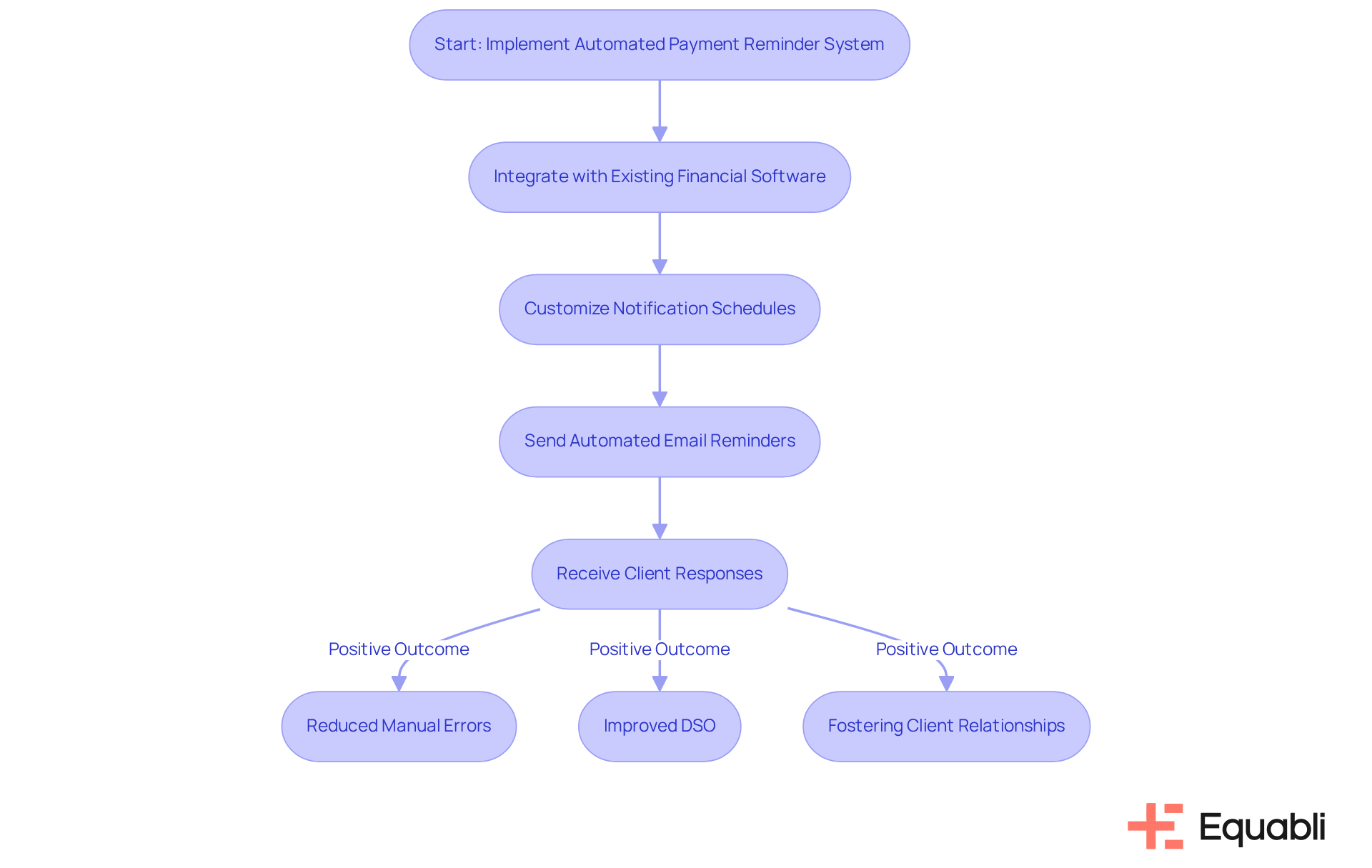

iMakeable: Streamlined Collections Automation for Payment Reminders

iMakeable provides an advanced automation platform for managing invoices that incorporates automated email payment reminder systems for enterprise debt recovery, significantly enhancing the efficiency of sending notifications about dues. By seamlessly integrating with existing financial software, the system fosters smooth communication with clients, which notably reduces manual errors and conserves valuable time. This automation accelerates revenue collections by utilizing automated email payment reminder systems for enterprise debt recovery while simultaneously improving overall operational efficiency. Companies that utilize automated email payment reminder systems for enterprise debt recovery frequently report enhancements in Days Sales Outstanding (DSO) within just one to two billing cycles; prompt notifications lead to quicker responses and diminished overdue balances.

Statistically, approximately 70% of companies that provide detailed transaction instructions on their invoices experience improved processing times. Furthermore, the implementation of automated email payment reminder systems for enterprise debt recovery allows for the customization of notification schedules based on client actions, ensuring that communications remain both efficient and considerate, thereby fostering improved relationships and encouraging timely settlements. As Michał Kłak articulates, "The practical solution is a respectful, data-driven system: billing notice scheduling that adjusts to behavior, late fee risk assessment that informs priorities, omnichannel outreach with SMS/email, and strong consent management." This underscores the importance of compliance, as automated systems must validate consent and respect preferences to avert potential complications.

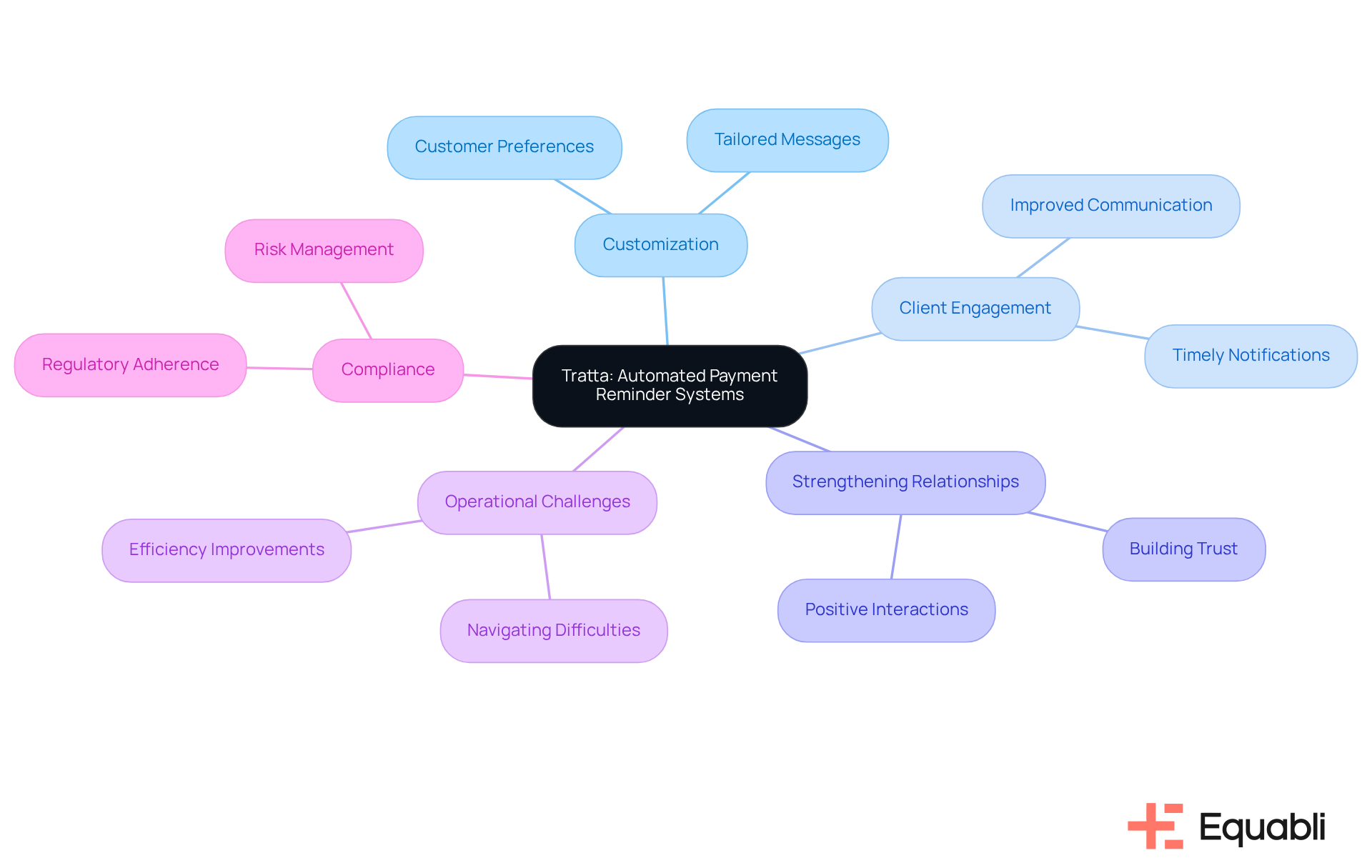

Tratta: Automated Payment Reminder Systems for Enhanced Communication

Tratta offers automated email payment reminder systems for enterprise debt recovery that improve communication with clients, which is a crucial factor in managing enterprise-level debt. Their platform allows organizations to customize messages based on customer preferences, ensuring notifications are both timely and relevant. This tailored approach not only improves client engagement but also strengthens business relationships, facilitating effective collections. By prioritizing communication, Tratta positions businesses to navigate operational challenges while maintaining compliance and fostering positive client interactions.

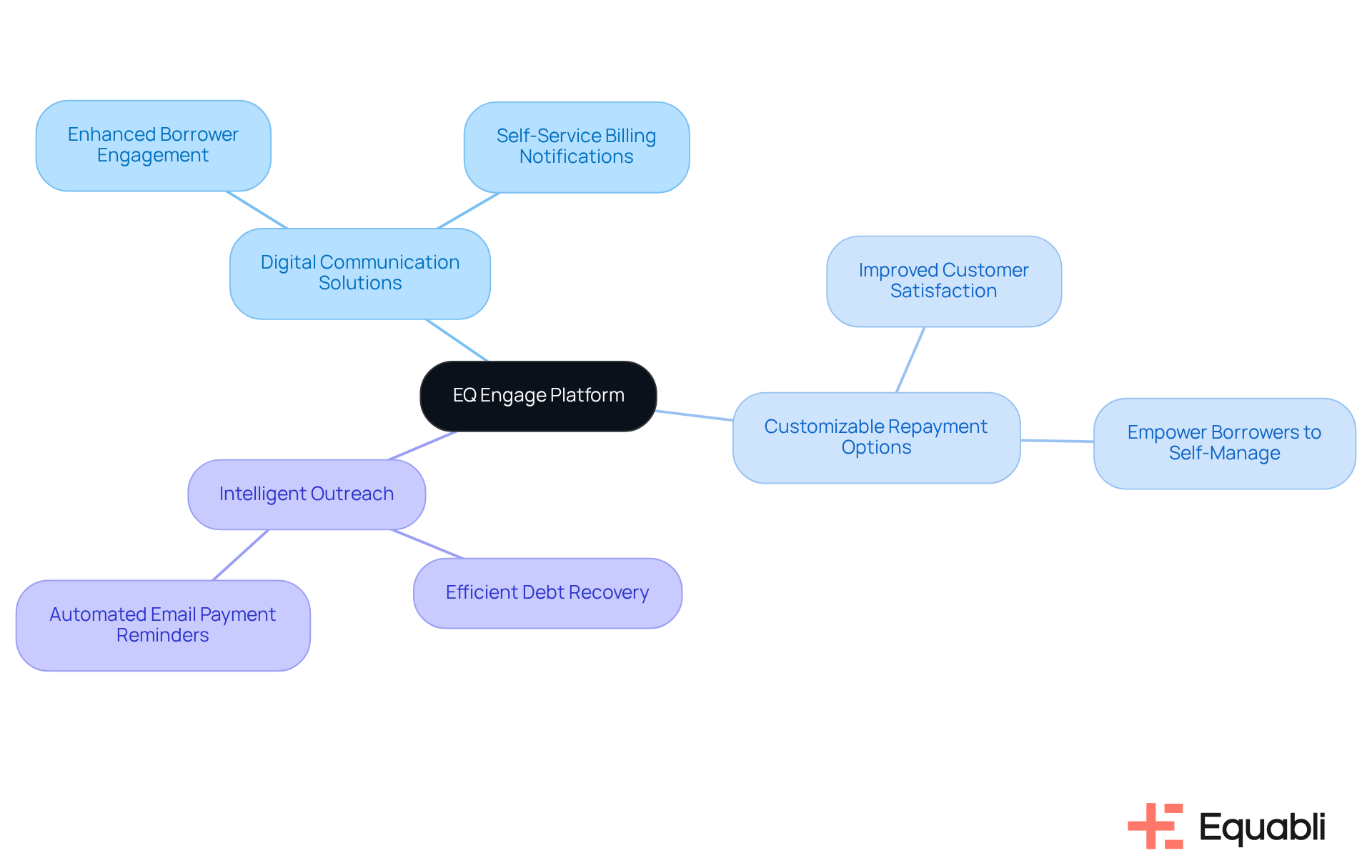

Grapevine Group: Digital Communication Solutions for Self-Service Payment Reminders

Equabli focuses on digital communication solutions that enable self-service billing notifications through its EQ Engage platform. This innovative system allows users to manage their payment schedules and receive reminders via their preferred channels, thereby enhancing borrower engagement.

- Intelligent outreach and customizable repayment options not only improve customer satisfaction but also empower borrowers to self-manage their repayment plans.

- This self-service approach alleviates the burden on collection teams, leading to more efficient debt recovery processes by utilizing automated email payment reminder systems for enterprise debt recovery, while capturing consumer preferences and ensuring compliance with regulatory standards.

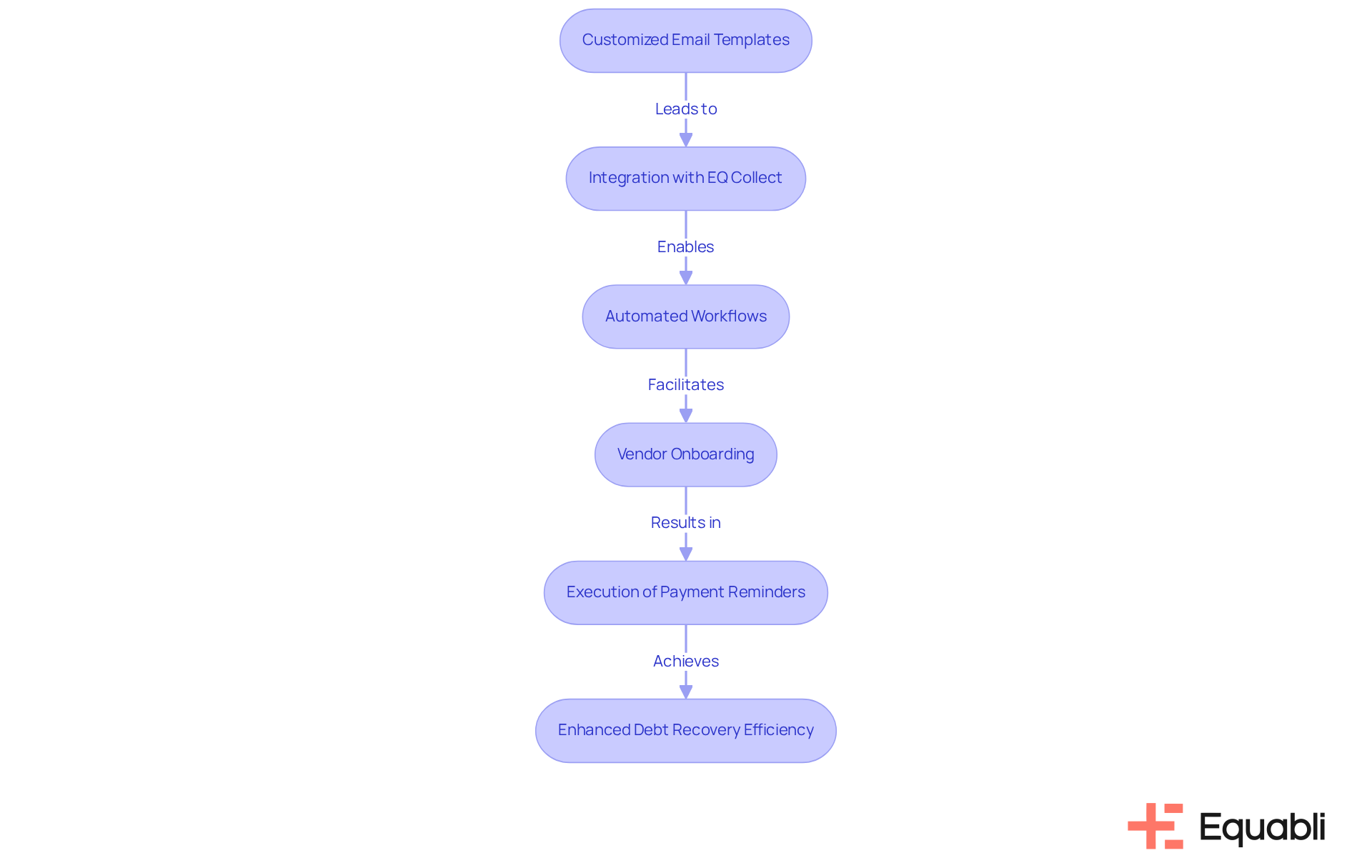

Monograph: Tailored Email Templates for Automated Payment Reminders

Monograph provides customized email templates that are specifically designed for automated email payment reminder systems for enterprise debt recovery. These templates are fully customizable, enabling businesses to tailor their communications based on client relationships and payment histories. By integrating these templates with the robust features of EQ Collect, organizations can significantly enhance their debt recovery efficiency through automated email payment reminder systems for enterprise debt recovery.

EQ Collect's no-code file-mapping tool effectively shortens vendor onboarding timelines, while its automated workflows minimize execution errors. This ensures that notifications are not only professional and clear but also timely and effective. The integration of automated email payment reminder systems for enterprise debt recovery ultimately leads to higher response rates and improved collections, thereby transforming the debt recovery process.

In summary, leveraging customized email templates alongside EQ Collect's features and automated email payment reminder systems for enterprise debt recovery enables organizations to navigate the complexities of debt recovery with greater efficacy. This strategic approach not only addresses operational challenges but also aligns with compliance requirements, ensuring a comprehensive solution for enterprise-level debt collection.

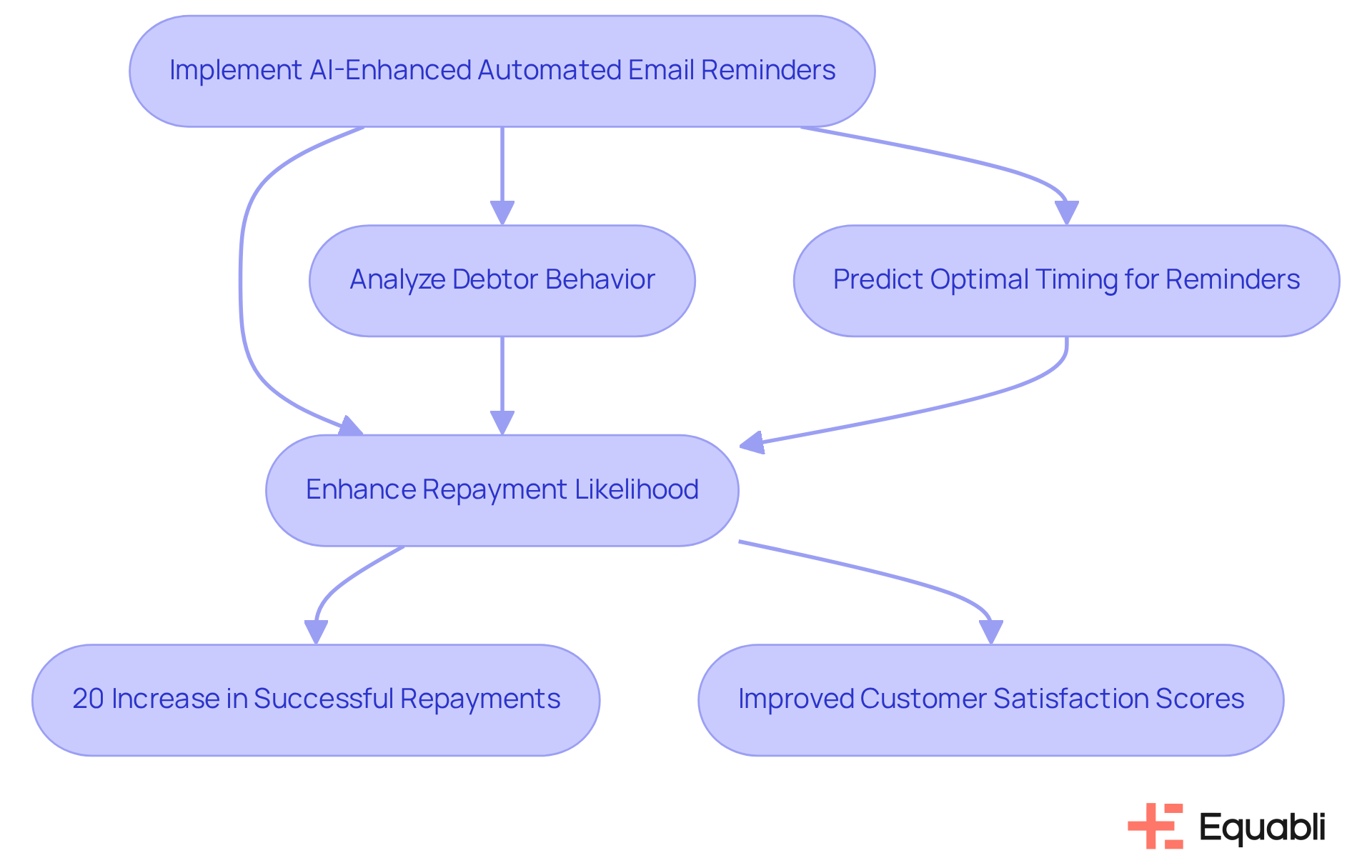

ResearchGate: AI-Enhanced Automated Debt Recovery Systems

ResearchGate utilizes automated email payment reminder systems for enterprise debt recovery that are driven by AI and leverage machine learning algorithms to optimize payment notifications. Evidence indicates that these systems analyze debtor behavior and predict optimal timing for reminders, which significantly enhances repayment likelihood. By integrating AI into the collections process, organizations can improve recovery rates while reducing operational costs. According to industry statistics, entities utilizing these AI solutions have experienced a 20% increase in successful repayments compared to traditional methods. Furthermore, elevated customer satisfaction scores (CSAT) indicate that personalized communication strategies foster improved engagement and response rates.

From a compliance perspective, specialists in technology emphasize that advancements in machine learning will further enhance billing notifications, enabling companies to retrieve debts more efficiently while cultivating stronger client relationships. This transition towards data-driven strategies is crucial for organizations seeking to modernize their collections and achieve sustainable growth. By adopting such innovative approaches, businesses can effectively navigate the complexities of enterprise-level debt collection through automated email payment reminder systems for enterprise debt recovery.

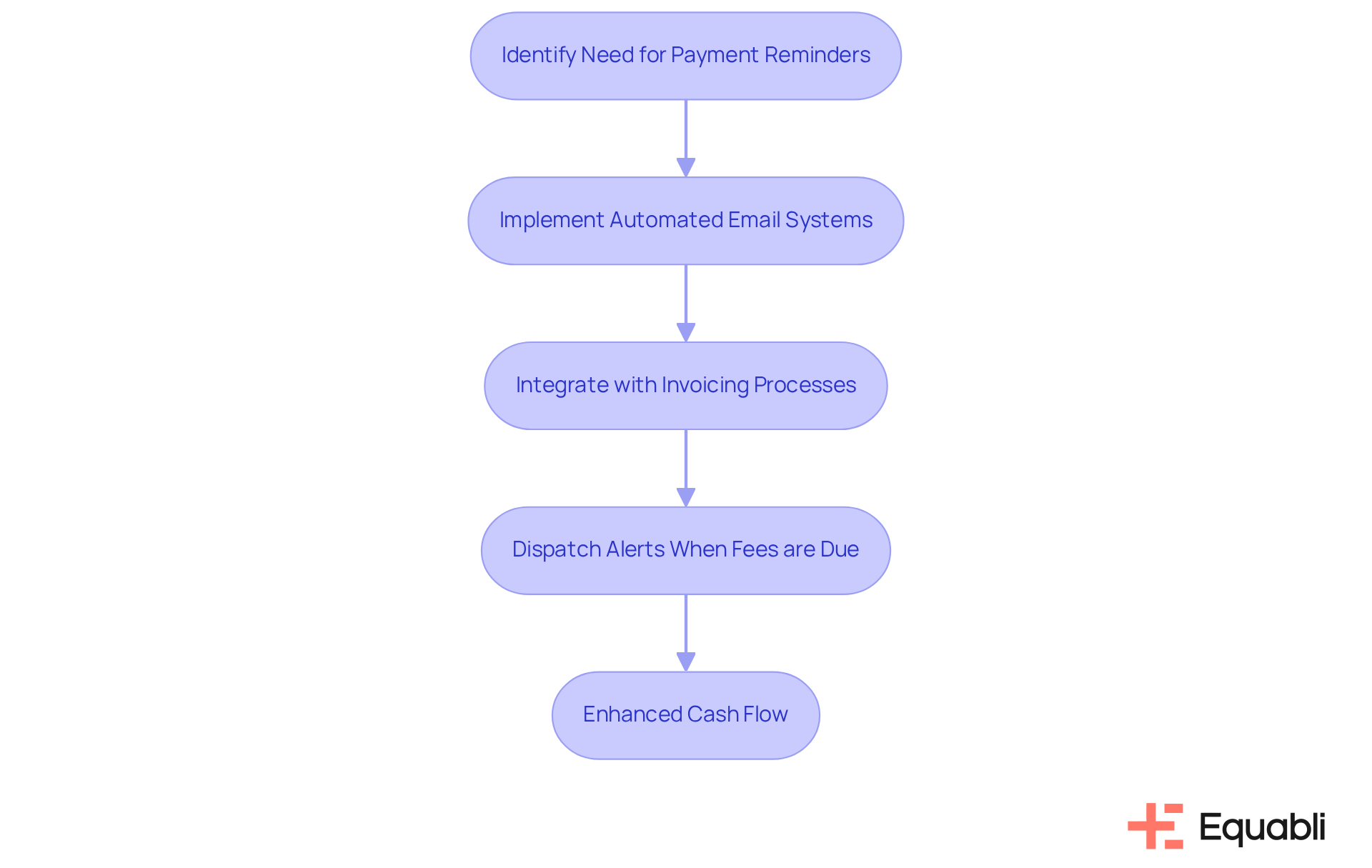

Calfrenzy: Automating Payment Reminders at the Source

Calfrenzy underscores the critical importance of automating reminder notifications at the source through automated email payment reminder systems for enterprise debt recovery, ensuring alerts are dispatched immediately when a fee is due. This proactive strategy significantly reduces the likelihood of missed payments by utilizing automated email payment reminder systems for enterprise debt recovery, thereby enhancing cash flow for businesses. By seamlessly integrating their system with invoicing processes, Calfrenzy facilitates effective communication with clients. This integration not only leads to improved collections but also enhances financial outcomes for enterprises by utilizing automated email payment reminder systems for enterprise debt recovery.

Conclusion

Automated email payment reminder systems are revolutionizing enterprise debt recovery by providing businesses with innovative solutions that enhance their collection strategies. Leveraging advanced technologies such as artificial intelligence and customizable communication tools allows organizations to significantly improve cash flow while strengthening client relationships. The integration of these systems streamlines the recovery process, ensures compliance, and fosters a more empathetic approach to client communications.

The article highlights various solutions, including Equabli EQ Suite, Convin AI, and Gestion Credit Expert, for their effectiveness in automating payment reminders. Each system offers unique features tailored to the specific needs of enterprises, ranging from data-driven methodologies to intelligent scheduling of notifications. The benefits of these automated systems are substantial, with statistics indicating increased recovery rates, reduced late fees, and improved operational efficiency. By adopting a proactive approach to payment reminders, businesses can mitigate overdue balances and enhance their overall financial health.

As the debt recovery landscape evolves, embracing automated email payment reminder systems is increasingly vital for organizations pursuing sustainable growth. Companies are encouraged to explore these innovative solutions, assess their unique requirements, and implement best practices that align with their operational goals. In doing so, they can navigate the complexities of debt collection while building stronger, more positive relationships with their clients, ultimately leading to a healthier bottom line.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is an automated billing notification solution that integrates with existing systems to ensure compliance and data security while delivering timely payment reminders via email and SMS.

How does the Equabli EQ Suite enhance customer engagement?

The EQ Suite allows businesses to tailor notifications based on customer behavior, which boosts engagement and improves retrieval rates by providing preferred communication channels.

What compliance features does the Equabli EQ Suite offer?

The EQ Suite maintains industry-leading compliance oversight, making it a critical tool for enterprises involved in debt collection and risk management.

What is Convin AI and how does it improve debt retrieval?

Convin AI is intelligent debt collection software that uses artificial intelligence to automate email payment reminders, analyze customer data, and identify optimal times and channels for sending reminders, significantly increasing recovery rates.

What impact does Convin AI have on recovery rates?

Businesses using Convin AI have reported a 21% increase in recovery rates due to its automated reminders and tailored communication strategies.

How does Convin AI enhance communication with clients?

Convin AI allows for the customization of notification scripts based on individual client information, leading to more conversational and empathetic interactions, which can result in response rates that are 40-60% higher.

What is Gestion Credit Expert and what benefits does it provide?

Gestion Credit Expert offers automated alerts that improve cash flow for organizations by strategically arranging notifications to ensure prompt transactions and reducing late fees by up to 30%.

What steps are necessary to incorporate automated billing alerts into existing systems?

To incorporate automated billing alerts, organizations need to evaluate current procedures, select appropriate software options, and establish a notification timetable.

Why is maintaining healthy cash flow important for enterprises?

Sustaining a healthy cash flow is vital for both sustainability and growth, especially as enterprises face complexities in cash flow management in 2025. Automated payment reminder systems are crucial for operational efficiency and positive client relationships.