Overview

The article presents an authoritative examination of automated overdue payment reminder systems available for enterprises, underscoring their critical role in optimizing accounts receivable management. These systems, including the EQ Suite, are evidenced to enhance operational efficiency, mitigate manual errors, and substantially elevate recovery rates. This effectiveness illustrates their pivotal function in modernizing debt collection strategies, thereby aligning with best practices in financial risk management.

Introduction

Automated overdue payment reminders have become essential for enterprises facing the challenges of cash flow management and customer engagement. As organizations increasingly leverage technology to streamline their accounts receivable processes, the benefits of implementing these systems are becoming evident—ranging from improved recovery rates to enhanced compliance oversight. However, with a multitude of options available, how can businesses discern which automated payment reminder solutions are genuinely effective in transforming their debt recovery strategies? This article explores ten standout systems that not only promise efficiency but also deliver measurable results in managing overdue payments.

Equabli EQ Suite: Comprehensive Automated Payment Reminder Solutions

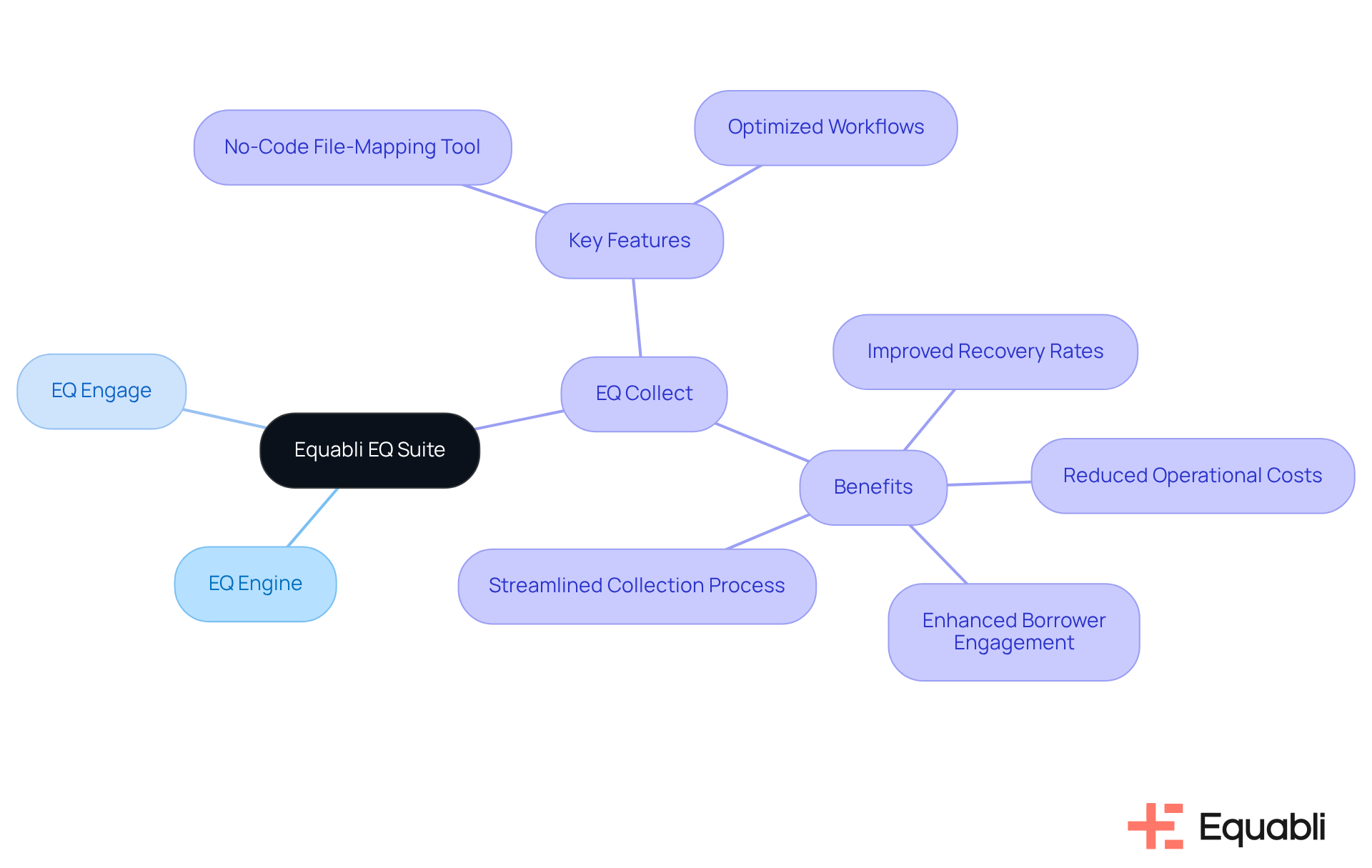

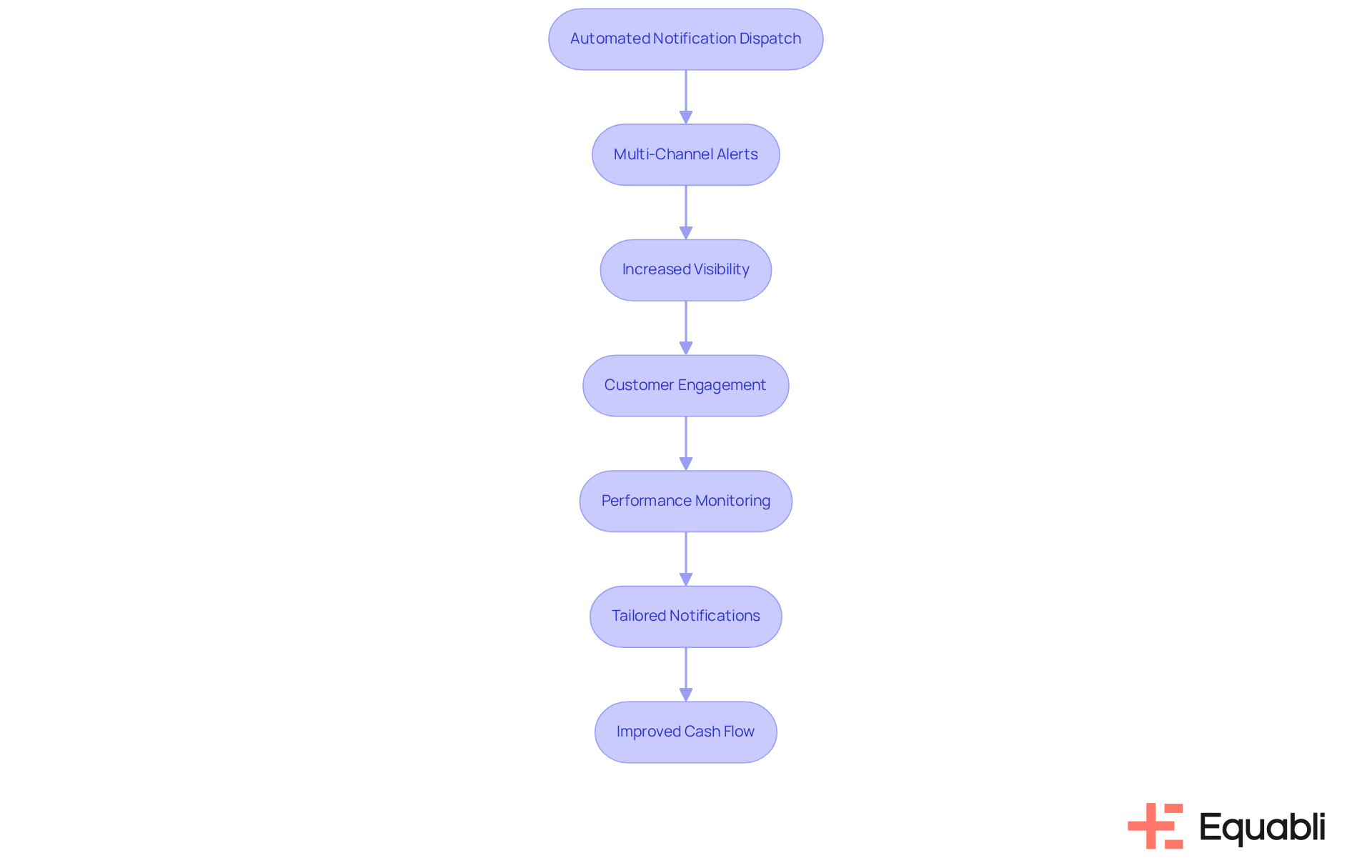

The Equabli EQ Suite provides a comprehensive array of tools designed to support automated overdue payment reminder systems for enterprise accounts receivable management with precision. Central to this suite are the EQ Engine, EQ Engage, and EQ Collect, which empower businesses to customize their reminder strategies through predictive analytics and insights into borrower behavior. By implementing these cloud-based solutions, organizations can markedly improve operational efficiency while ensuring adherence to regulatory standards.

Key features of EQ Collect include:

- A no-code file-mapping tool

- Optimized workflows

These features significantly reduce execution errors and shorten vendor onboarding timelines. Additionally, the suite incorporates secure, top-tier compliance supervision and automated tracking, which streamline the collection process. Businesses utilizing automated billing notification systems have reported recovery rate improvements of up to 80% when compared to traditional methods. Furthermore, the EQ Suite enhances borrower engagement by facilitating communication through preferred channels, ultimately leading to a reduction in operational costs.

As delayed remittances continue to pose challenges for organizations, the EQ Suite, featuring automated overdue payment reminder systems for enterprise accounts receivable management, stands out as an indispensable tool for enterprises aiming to modernize their debt recovery strategies.

Gaviti: Automated Payment Reminders for Enhanced Collection Efficiency

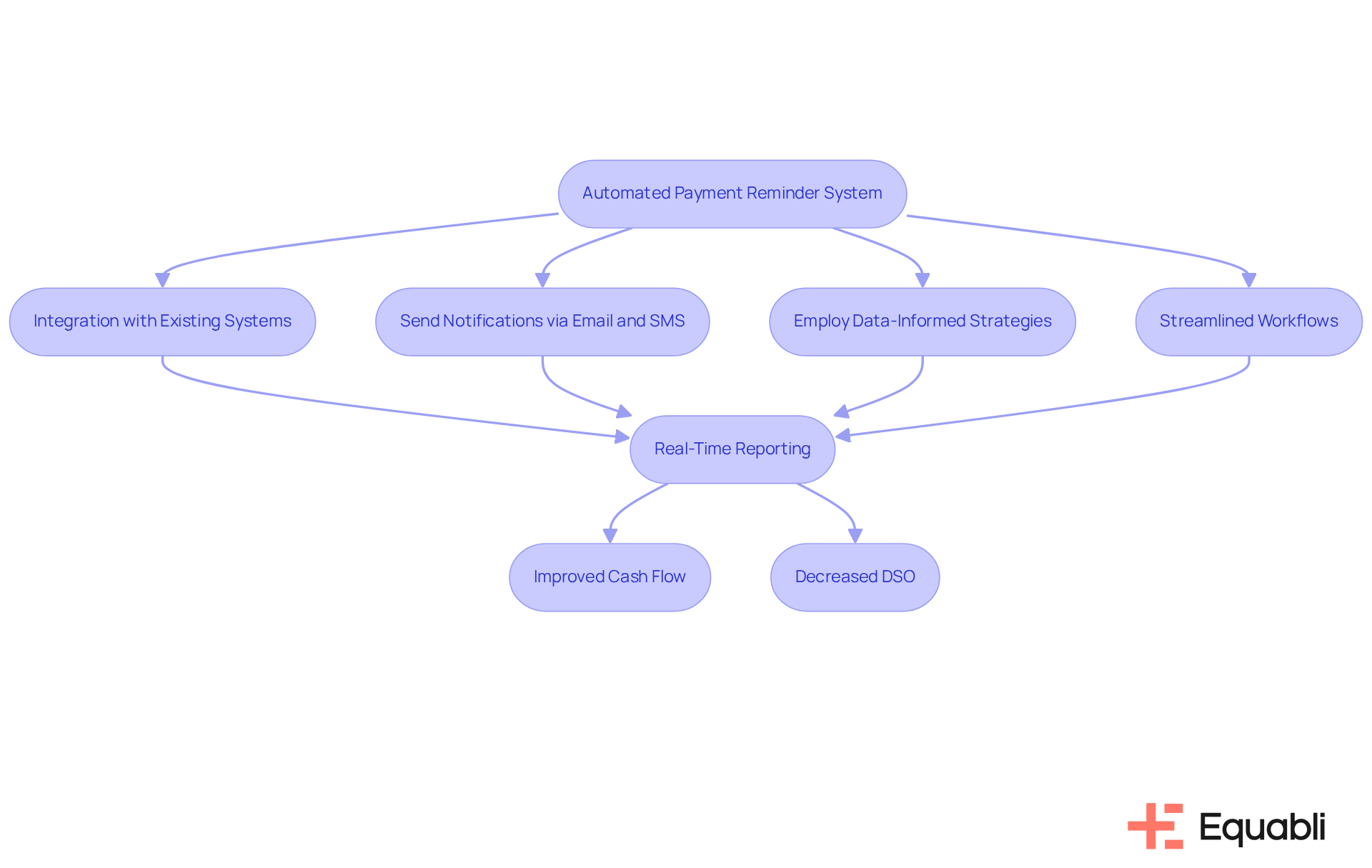

Equabli utilizes automated overdue payment reminder systems for enterprise accounts receivable management to enhance invoice notification and retrieval efficiency through its EQ Collect platform. This solution seamlessly integrates with existing systems, allowing businesses to implement automated overdue payment reminder systems for enterprise accounts receivable management to send timely notifications via email and SMS. By employing data-informed strategies, including streamlined workflows and a no-code file-mapping tool, Equabli significantly enhances retrieval processes. The reduction of manual tasks and execution errors leads to improved cash flow and decreased Days Sales Outstanding (DSO).

Real-time reporting provides insights into customer transaction behaviors, enabling organizations to effectively implement automated overdue payment reminder systems for enterprise accounts receivable management. With a focus on secure, industry-leading compliance oversight and a user-friendly, scalable, cloud-native interface, Equabli positions financial institutions to optimize operations and improve performance in debt recovery.

Convin: Streamlined Automated Debt Collection Software

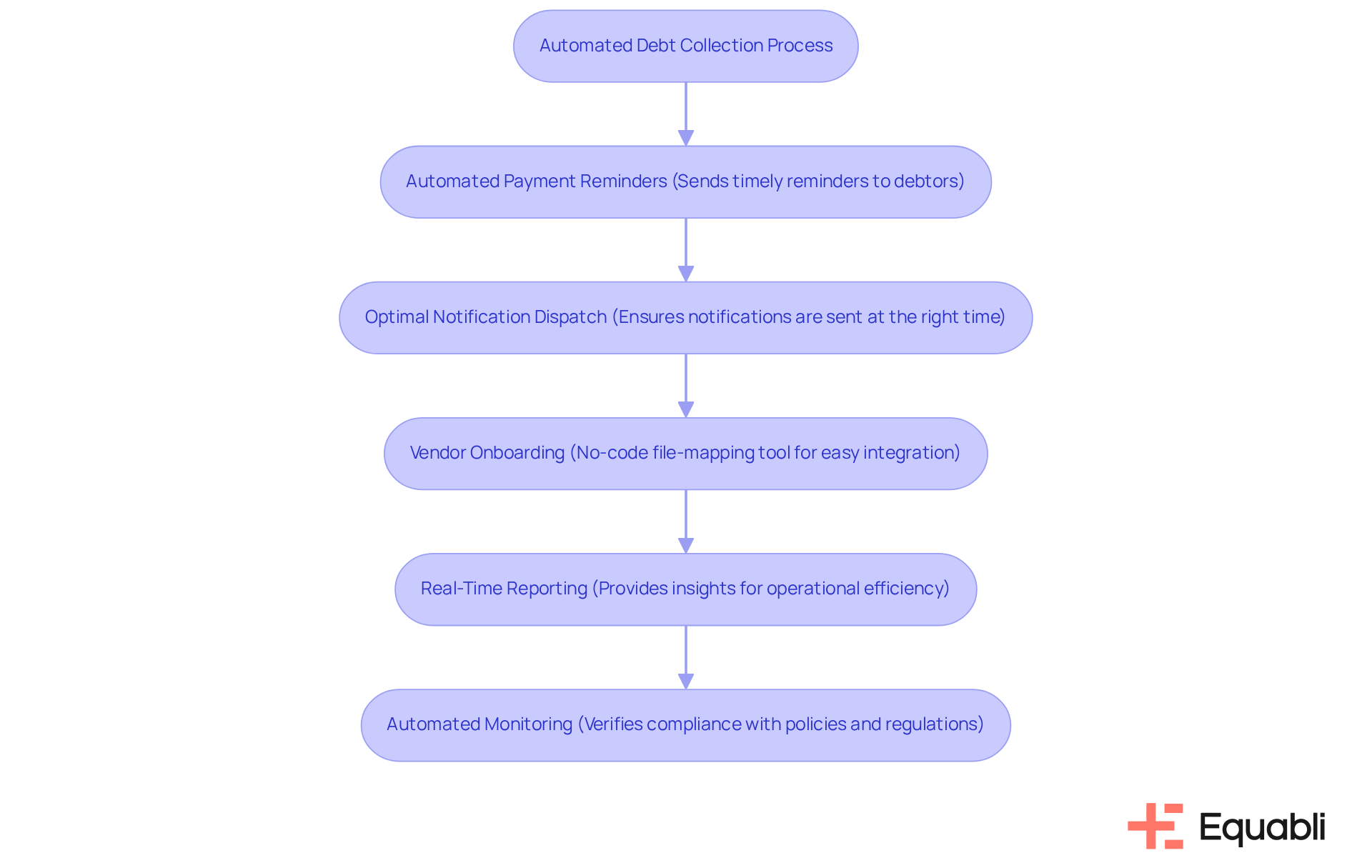

Equabli provides an advanced application that utilizes automated overdue payment reminder systems for enterprise accounts receivable management, significantly enhancing the effectiveness of billing notifications. By leveraging intelligent automation and data-informed strategies, EQ Collect utilizes automated overdue payment reminder systems for enterprise accounts receivable management to ensure notifications are dispatched at optimal times, thereby increasing the likelihood of timely payments. This capability not only minimizes execution errors but also streamlines vendor onboarding through a no-code file-mapping tool, which allows for the continuous refinement of communication strategies. As a result, businesses can manage overdue accounts more effectively through automated overdue payment reminder systems for enterprise accounts receivable management.

Furthermore, EQ Collect delivers unparalleled transparency and insights through real-time reporting, which bolsters operational efficiency and compliance with regulatory standards. Automated monitoring verifies debt collection actions against internal policies and legal regulations, directly contributing to a positive customer experience. Organizations utilizing EQ Collect report improved customer satisfaction, as amiable and prompt notifications enhance satisfaction levels. This dual effect underscores the platform's impact on both operational efficiency and client relations.

Tratta: Automation Tools for Effective Payment Reminders

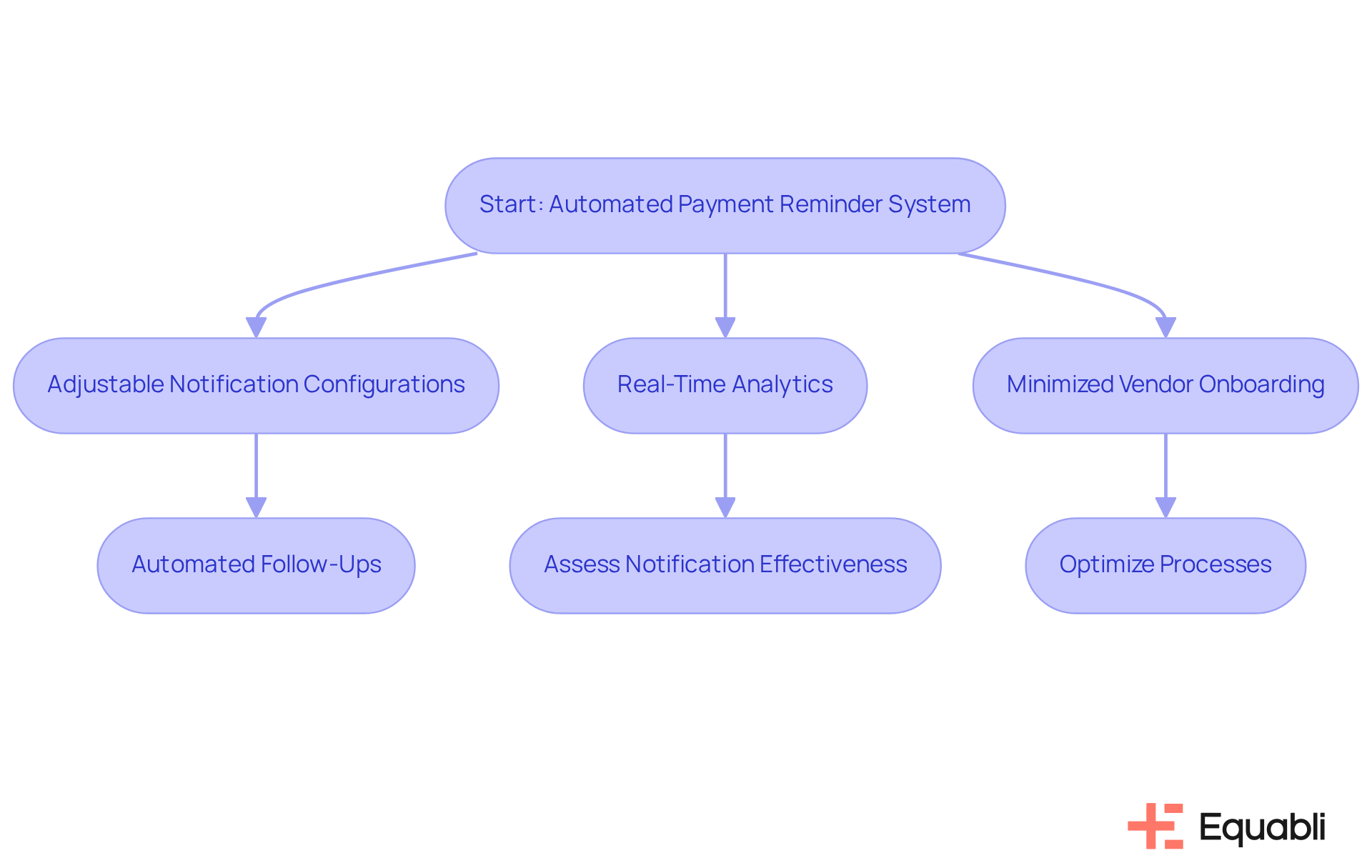

Equabli provides a suite of automated overdue payment reminder systems for enterprise accounts receivable management, specifically designed for efficient billing notifications through its EQ Collect platform. Companies can leverage adjustable notification configurations to automate follow-ups based on client actions and transaction history. Notably, 68% of enterprises adopted automated overdue payment reminder systems for enterprise accounts receivable management post-pandemic, underscoring a significant shift towards automation in collections.

EQ Collect improves operational efficiency by minimizing vendor onboarding timelines with a straightforward, no-code file-mapping tool, enabling organizations to optimize their processes. The platform also incorporates real-time analytics and automated workflows, allowing organizations to continuously assess the effectiveness of their notification strategies while reducing execution errors and reliance on manual resources. This capability empowers teams to make timely adjustments based on data insights, thereby enhancing the efficiency of notifications.

By automating these processes, Equabli utilizes automated overdue payment reminder systems for enterprise accounts receivable management, alleviating the manual workload on retrieval teams and enabling them to focus on more complex cases while ensuring that notifications are sent reliably and on time.

As Equabli states, "EQ Collect provides unrivaled transparency and insights with real-time reporting," which addresses the reality that 71% of past-due customers feel overwhelmed by unclear outreach. The integration of real-time analytics and industry-leading compliance oversight not only boosts operational efficiency but also promotes a proactive approach to debt recovery, ultimately leading to improved financial outcomes.

Invoiced: Advanced Solutions for Managing Past Due Invoices

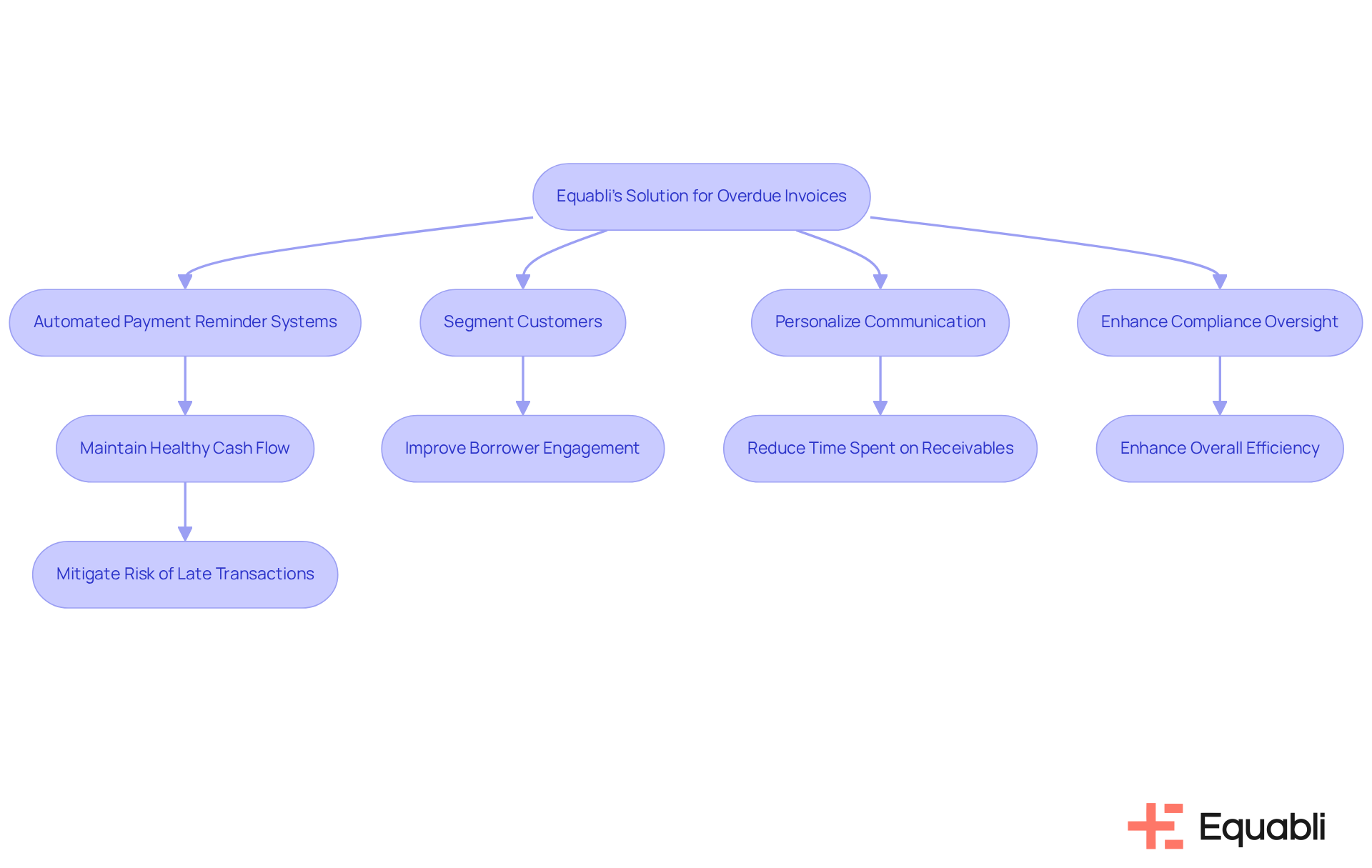

Equabli provides sophisticated solutions for managing overdue invoices by utilizing automated overdue payment reminder systems for enterprise accounts receivable management within its EQ Suite. This cloud-based platform enables businesses to implement automated overdue payment reminder systems for enterprise accounts receivable management, which are tailored to the invoice due date and customer preferences, thereby transforming traditional debt recovery methods. Many financial organizations encounter difficulties with manual debt recovery processes, which can lead to inefficiencies, missed dues, and strained borrower relationships.

With its user-friendly interface, Equabli streamlines the invoicing process, enabling financial institutions to maintain healthy cash flow while mitigating the risk of late transactions. Equabli helps organizations reduce the time spent on receivables and enhance overall efficiency by using automated overdue payment reminder systems for enterprise accounts receivable management, while simultaneously improving borrower engagement and compliance oversight. To optimize collections, organizations can implement strategies such as:

- Segmenting customers based on their financial behavior

- Personalizing communication to increase engagement

Tabs: Essential Accounts Receivable Management Tools

Tabs offers critical accounts receivable management tools that enhance the payment notification process. By integrating scheduled notifications and monitoring for overdue invoices, Tabs empowers businesses to maintain robust control over their cash flow. Automation alleviates the administrative burden on finance teams and enhances overall collection efficiency.

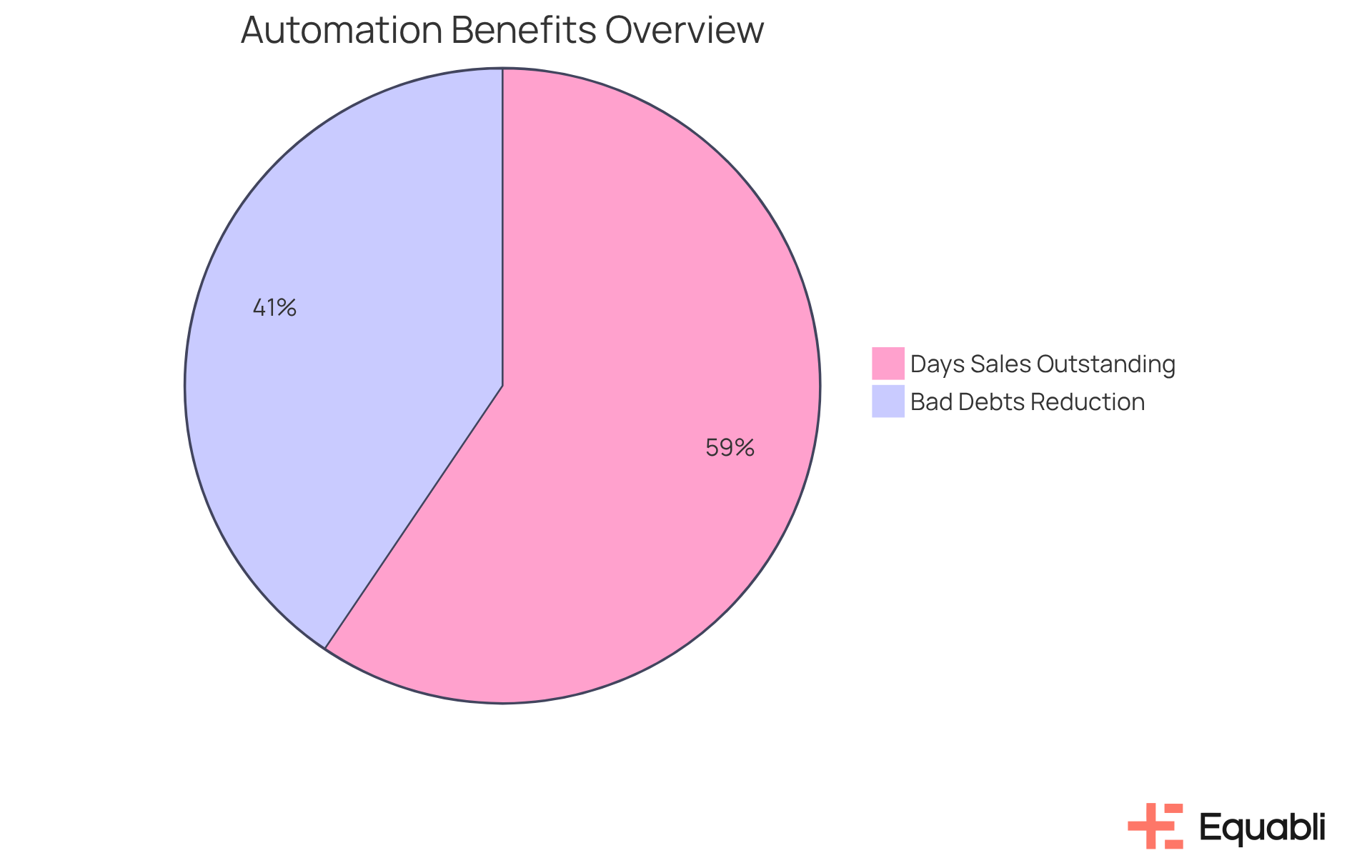

Evidence indicates that firms utilizing automated overdue payment reminder systems for enterprise accounts receivable management have experienced:

- A 15% reduction in bad debts

- A 22% decrease in days sales outstanding

This underscores the tangible benefits of these automated systems. Furthermore, Tabs' seamless integration with existing financial systems facilitates the implementation of effective notification strategies, enabling organizations to swiftly adapt to changing transaction patterns and improve cash flow management.

Practical examples demonstrate that companies using automated overdue payment reminder systems for enterprise accounts receivable management achieve faster revenue recovery, with alerts sent at critical intervals—such as three days post-due date and subsequent follow-ups—leading to enhanced monitoring of overdue invoices and improved recovery rates. Additionally, the unparalleled transparency and insights provided by real-time reporting ensure that organizations uphold industry-leading compliance oversight, both internally and externally.

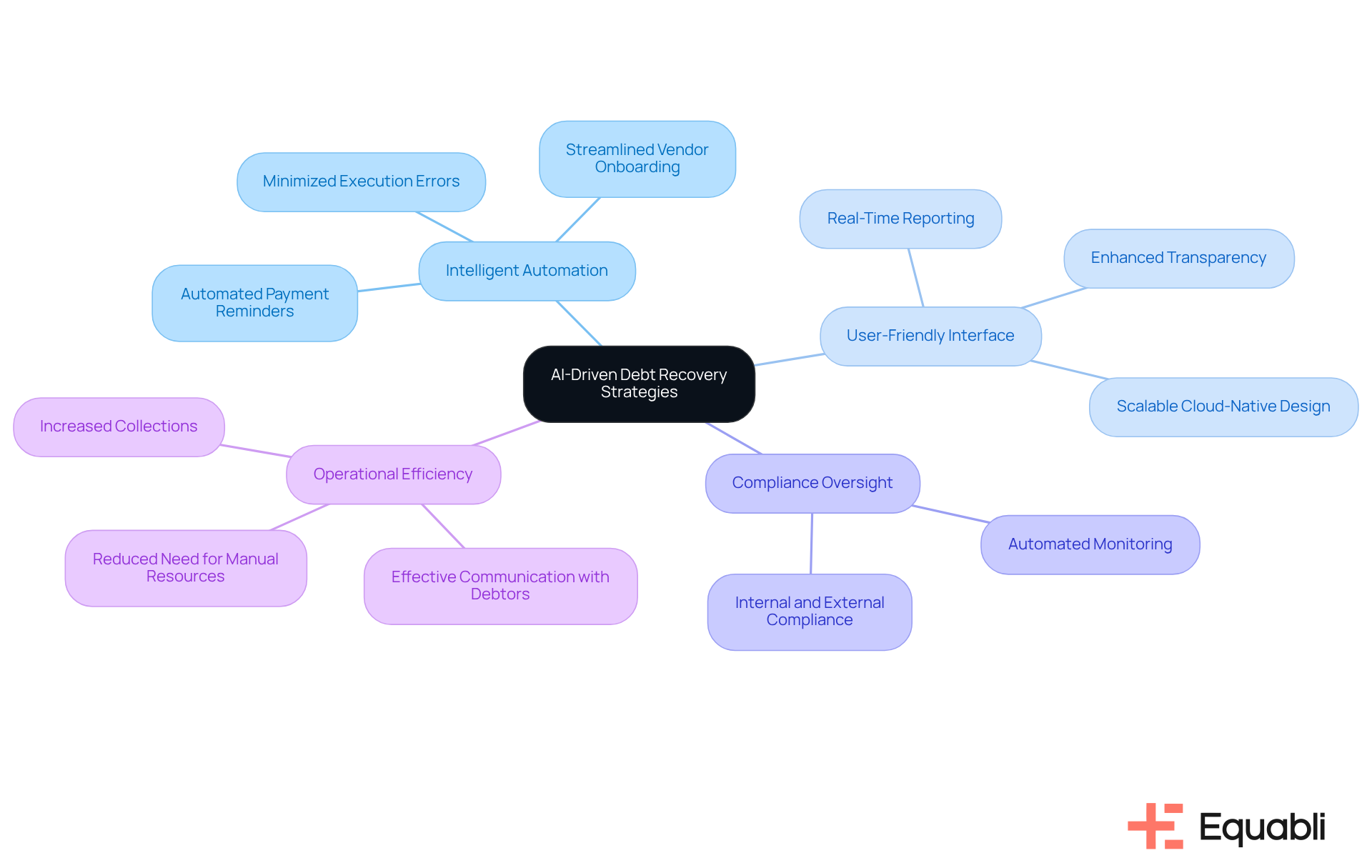

CallMiner: AI-Driven Debt Recovery Strategies

Equabli's intelligent automation and machine learning solutions significantly enhance the efficiency of automated overdue payment reminder systems for enterprise accounts receivable management in the debt recovery process. By leveraging EQ Collect, organizations can streamline vendor onboarding timelines through a no-code file-mapping tool. This improvement not only boosts operational efficiency but also increases collections through the implementation of automated overdue payment reminder systems for enterprise accounts receivable management. The platform minimizes execution errors and reduces the need for manual resources by employing streamlined processes that ensure effective communication with debtors.

Moreover, EQ Collect features a user-friendly, scalable, cloud-native interface that provides unparalleled transparency and insights via real-time reporting. This capability empowers financial institutions to refine the timing and content of their notifications using automated overdue payment reminder systems for enterprise accounts receivable management. Additionally, by implementing robust compliance oversight—both internally and externally—through automated monitoring, Equabli's solutions, including automated overdue payment reminder systems for enterprise accounts receivable management, enable organizations to navigate the complexities of debt recovery. This approach not only enhances operational efficiency but also improves customer experience through personalized communication, positioning Equabli as a strategic partner in addressing the challenges of enterprise-level debt collection.

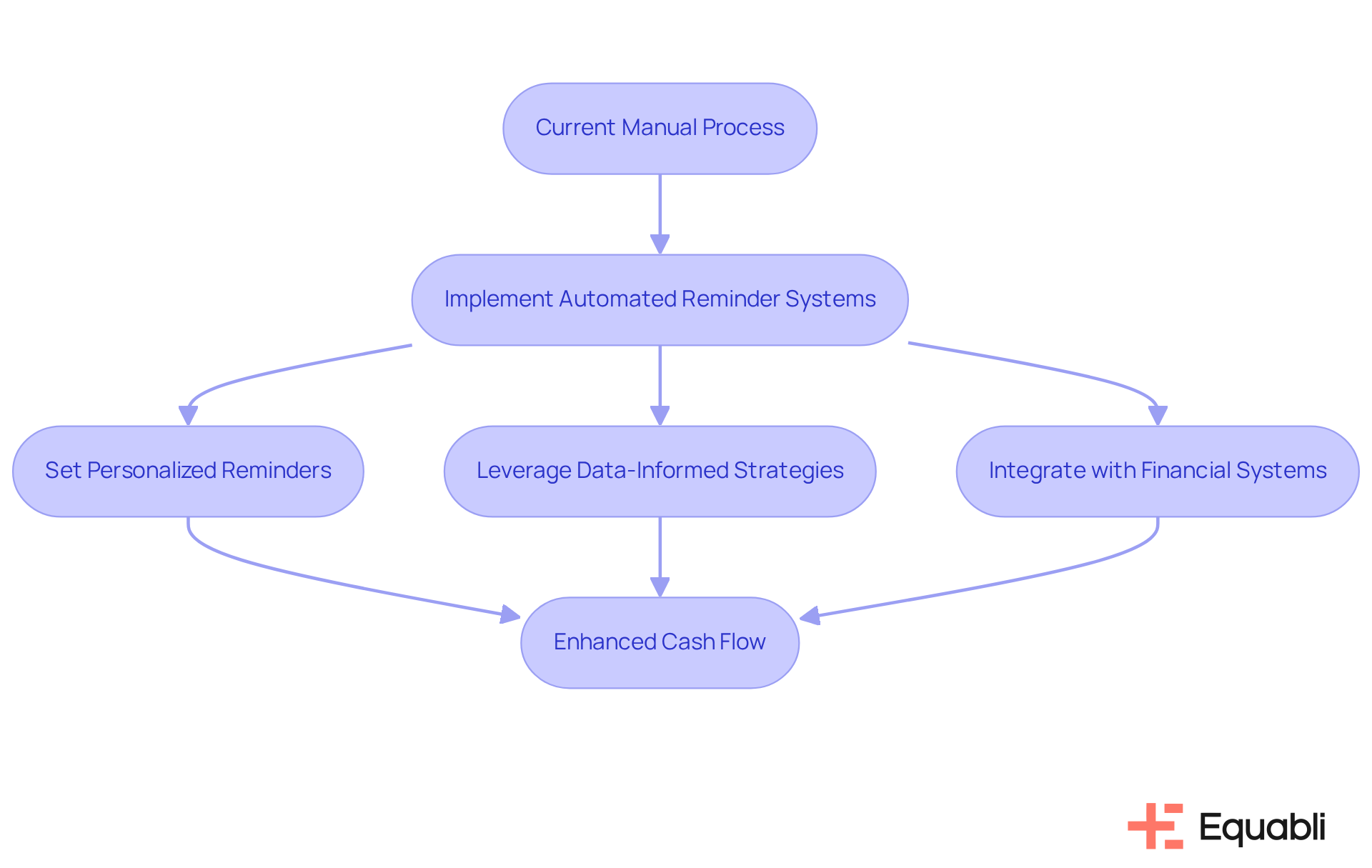

FlexPoint: Solutions for Managing Late Payments

Equabli offers tailored solutions for managing overdue transactions by implementing automated overdue payment reminder systems for enterprise accounts receivable management through its EQ Collect platform. This platform offers advanced features that allow companies to set personalized reminders triggered by specific criteria, such as transaction history or invoice due dates.

The transition from manual processes to automated overdue payment reminder systems for enterprise accounts receivable management significantly enhances efficiency and minimizes the chances of late payments. By leveraging data-informed strategies and real-time reporting, EQ Collect empowers organizations to maintain oversight of their retrieval processes.

Its seamless integration with existing financial systems ensures a smooth workflow, while automated overdue payment reminder systems for enterprise accounts receivable management provide systematic alerts that bolster compliance oversight and enhance overall cash flow, thereby transforming debt recovery into a more efficient and strategic endeavor.

Gestion Credit Expert: Transformative Automated Payment Reminder Solutions

Gestion Credit Expert offers advanced automated overdue payment reminder systems for enterprise accounts receivable management that significantly enhance the recovery process. By leveraging cutting-edge technology, the platform efficiently dispatches alerts through multiple channels, including email and SMS. This multi-channel approach not only increases the visibility of overdue billing notifications but also improves customer engagement, as studies indicate that diversified communication methods lead to quicker responses from clients.

The analytical capabilities of Gestion Credit Expert allow organizations to monitor the effectiveness of their notification strategies, fostering continuous improvement in recovery efforts. Companies can analyze response rates and payment behaviors, tailoring notifications to individual customer preferences. This data-driven methodology is essential in a landscape where 57% of debt recovery agencies are now utilizing AI for predictive analytics and account segmentation, marking a significant shift towards more intelligent and responsive recovery practices.

Through the automation of notifications and the integration of comprehensive analytics, Gestion Credit Expert enhances operational efficiency by utilizing automated overdue payment reminder systems for enterprise accounts receivable management while fostering positive customer relationships. This ultimately leads to improved cash flow and a reduction in overdue invoices.

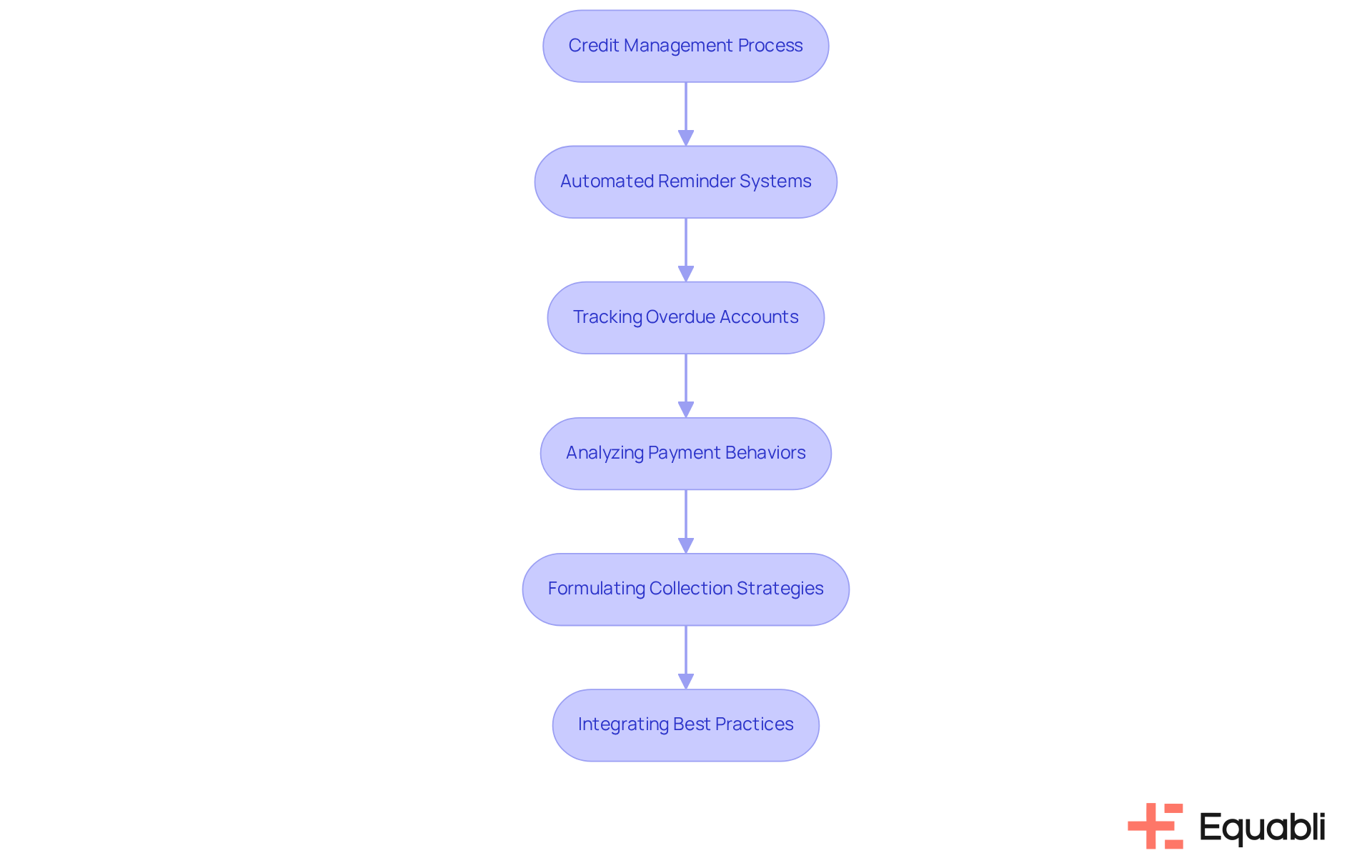

Credit Management Source: Insights and Tools for Effective Collections

Credit Management Source provides a comprehensive suite of insights and tools aimed at enhancing receivables management. Their platform supports automated overdue payment reminder systems for enterprise accounts receivable management, enabling businesses to efficiently track overdue accounts and analyze customer payment behaviors. By leveraging these resources, organizations can formulate customized collection strategies that align with their specific operational requirements.

The emphasis on education and optimal practices not only empowers businesses to refine their retrieval processes but also significantly enhances their overall financial health. For example, companies using automated overdue payment reminder systems for enterprise accounts receivable management report a notable reduction in overdue accounts, illustrating the effectiveness of these systems in maintaining cash flow and minimizing delinquency rates.

Moreover, effective collections are vital in credit risk management, aiding organizations in mitigating potential losses and bolstering their financial stability. This strategic approach underscores the importance of integrating robust collection practices within the broader context of enterprise risk management.

Conclusion

Automated overdue payment reminder systems are revolutionizing enterprise accounts receivable management. By leveraging advanced technology, businesses can enhance their debt recovery strategies, streamline operations, and significantly improve cash flow. The insights provided throughout this article underscore the necessity of adopting these systems to tackle the persistent challenges posed by delayed payments and inefficient manual processes.

This article details various solutions, including the Equabli EQ Suite, Gaviti, Convin, and others, each offering unique features tailored to the diverse needs of enterprises. Key benefits such as improved recovery rates, enhanced borrower engagement, and compliance oversight are emphasized, demonstrating how automation minimizes execution errors while fostering positive customer relationships. The statistics presented, including an 80% improvement in recovery rates and substantial reductions in Days Sales Outstanding, highlight the tangible advantages of these automated systems.

As organizations continue to navigate the complexities of debt collection, embracing automated overdue payment reminder systems is not merely a strategic choice but a vital necessity. By investing in these innovative solutions, enterprises can position themselves for sustained financial health, ensuring they remain competitive in an ever-evolving marketplace. Adopting these systems represents a proactive step toward modernizing debt recovery processes and achieving greater operational efficiency.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a comprehensive set of tools designed for automated overdue payment reminder systems aimed at improving enterprise accounts receivable management with precision.

What are the main components of the EQ Suite?

The main components of the EQ Suite include the EQ Engine, EQ Engage, and EQ Collect, which allow businesses to customize their reminder strategies using predictive analytics and insights into borrower behavior.

How does the EQ Suite improve operational efficiency?

By implementing cloud-based solutions, the EQ Suite enhances operational efficiency, reduces execution errors, and shortens vendor onboarding timelines, while ensuring compliance with regulatory standards.

What are the key features of EQ Collect?

Key features of EQ Collect include a no-code file-mapping tool and optimized workflows, which significantly reduce execution errors and improve vendor onboarding processes.

What benefits do businesses experience by using automated billing notification systems?

Businesses report recovery rate improvements of up to 80% compared to traditional methods, enhanced borrower engagement through preferred communication channels, and a reduction in operational costs.

How does Equabli utilize automated overdue payment reminder systems?

Equabli uses automated overdue payment reminder systems to enhance invoice notification and retrieval efficiency, allowing businesses to send timely notifications via email and SMS.

What impact does the EQ Collect platform have on cash flow?

The EQ Collect platform reduces manual tasks and execution errors, leading to improved cash flow and decreased Days Sales Outstanding (DSO).

What reporting capabilities does the EQ Suite offer?

The EQ Suite provides real-time reporting that offers insights into customer transaction behaviors, enabling organizations to implement effective automated overdue payment reminder systems.

How does the EQ Collect enhance customer satisfaction?

The EQ Collect enhances customer satisfaction by providing amiable and prompt notifications, which improve client relations and operational efficiency.

What compliance features does the EQ Suite include?

The EQ Suite includes secure, industry-leading compliance oversight and automated monitoring to verify debt collection actions against internal policies and legal regulations.