Overview

Automated past due payment reminder systems are crucial for enterprise risk management, as they significantly enhance collection efficiency and reduce overdue payments. Evidence indicates that organizations employing such systems have reported increased retrieval rates and improved compliance. This effectiveness not only optimizes financial operations but also minimizes bad debt, demonstrating the strategic value of these systems in managing enterprise-level financial risks.

Introduction

In an era where financial efficiency is paramount, organizations are increasingly adopting automated past due payment reminder systems as a strategic solution for enterprise risk management. These innovative tools streamline the collection process, enhance cash flow, and reduce operational costs, thereby becoming indispensable for businesses seeking to optimize their receivables.

However, a critical challenge persists: how can companies effectively implement these systems to maximize recovery rates while maintaining robust customer relationships?

This article explores ten cutting-edge automated solutions that promise to transform debt recovery practices, offering actionable insights for businesses navigating the complexities of overdue payments.

Equabli EQ Suite: Comprehensive Automated Payment Collection Solutions

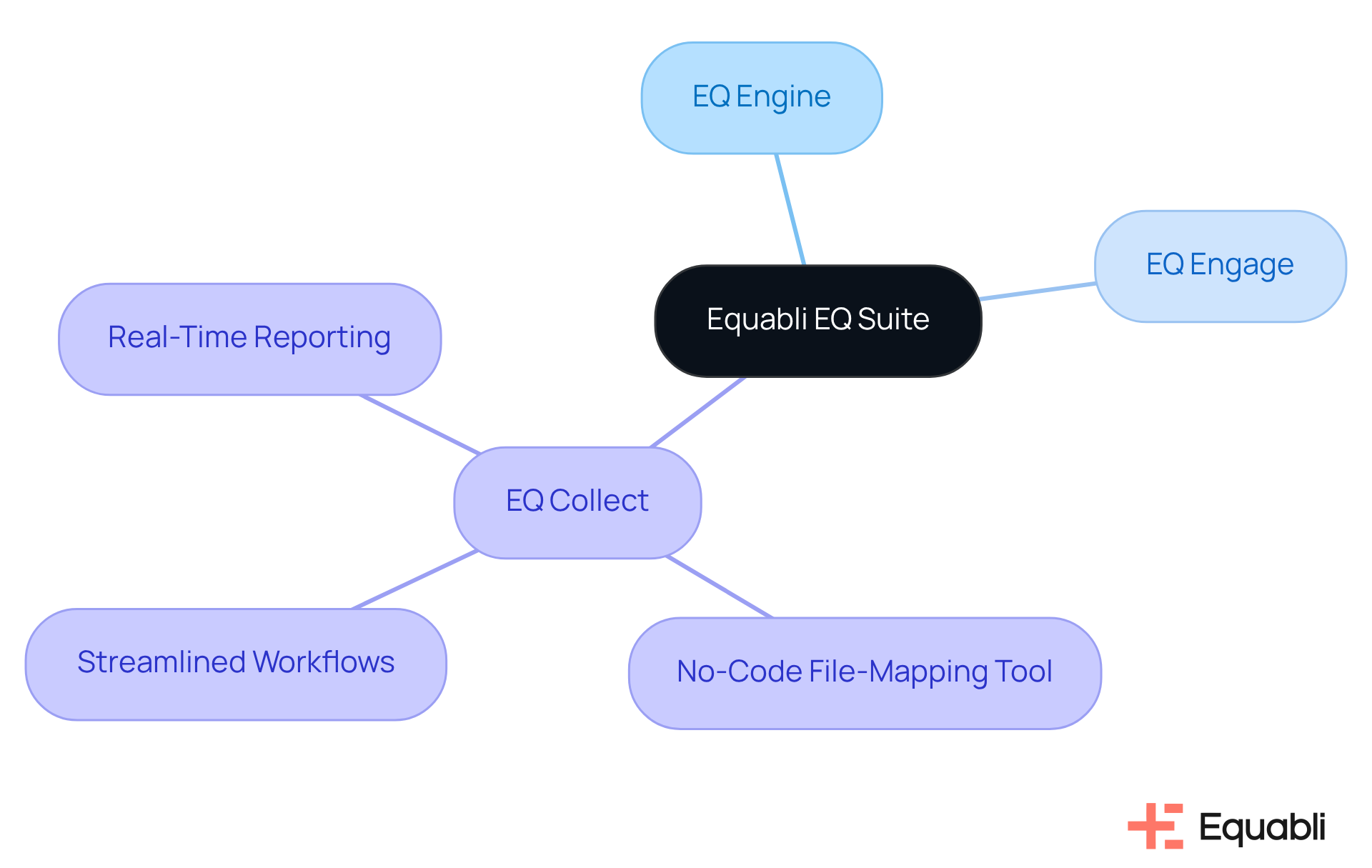

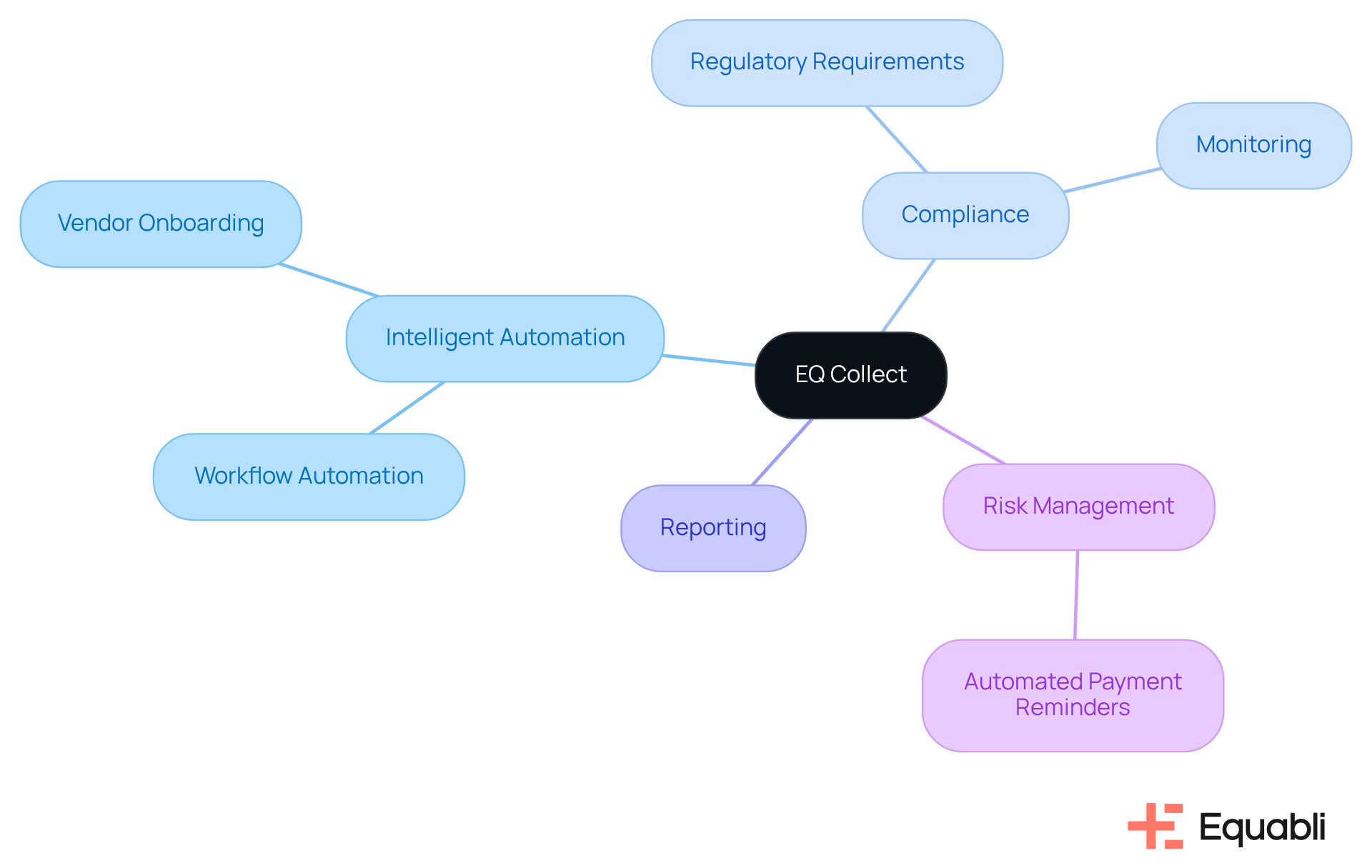

The Equabli EQ Suite provides a robust suite of tools designed to efficiently implement automated past due payment reminder systems for enterprise risk management. This includes components such as the EQ Engine, EQ Engage, and EQ Collect, enabling organizations to develop customized scoring models that predict repayment behaviors, refine retrieval strategies, and facilitate digital repayments via self-service repayment plans.

Key features of EQ Collect, such as a no-code file-mapping tool, streamlined workflows, and real-time reporting, significantly shorten vendor onboarding timelines and reduce execution errors, thereby enhancing productivity and compliance. By leveraging data-driven insights, the EQ Suite markedly boosts borrower engagement, which is critical for businesses aiming to optimize their recovery processes.

Notably, organizations utilizing automated past due payment reminder systems for enterprise risk management have experienced a 15-25% increase in retrieval rates, illustrating the effectiveness of these systems in lowering operational costs while improving recovery efficiency. Moreover, companies with robust compliance strategies report a 100% adherence rate in their collection efforts, highlighting the EQ Suite's essential role in modern debt recovery management.

Gaviti: Automated Payment Reminders for Enhanced Collection Efficiency

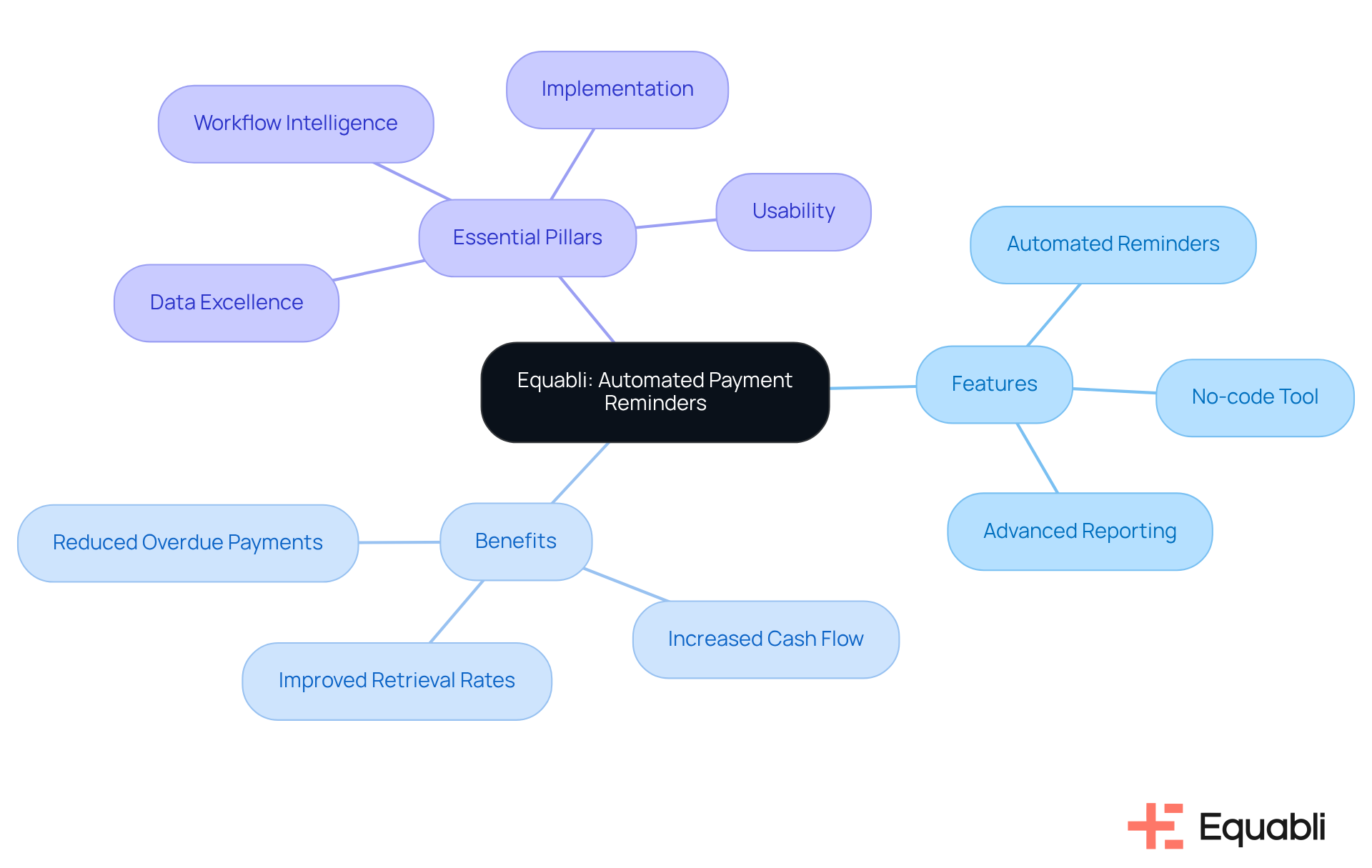

Equabli utilizes automated past due payment reminder systems for enterprise risk management to automate billing reminders, enabling companies to manage their accounts receivable more efficiently. Evidence shows that Equabli significantly reduces the likelihood of overdue payments and enhances cash flow by using automated past due payment reminder systems for enterprise risk management. The platform's user-friendly, cloud-native interface allows organizations to customize reminder schedules and messages, aligning communications with customer preferences, which ultimately results in improved retrieval rates.

Furthermore, Equabli incorporates a no-code file-mapping tool and automated workflows, which minimize execution errors and reduce the need for manual resources. This greatly enhances productivity and increases retrieval rates through data-driven strategies. User experiences indicate a 50% increase in cash flow and a 30% decrease in Days Sales Outstanding (DSO), underscoring the platform's effectiveness in improving collection performance.

Current trends in accounts receivable automation highlight the significance of four essential pillars:

- Data Excellence

- Workflow Intelligence

- Implementation

- Usability

These can be enhanced by automated past due payment reminder systems for enterprise risk management. Equabli's advanced reporting tools deliver valuable insights into payment trends and debtor behavior, assisting businesses in strategic planning and cash flow optimization. Additionally, the platform integrates seamlessly with existing accounting software, thereby improving operational performance and streamlining accounts receivable processes.

Convin: Streamlined Automated Debt Collection Software

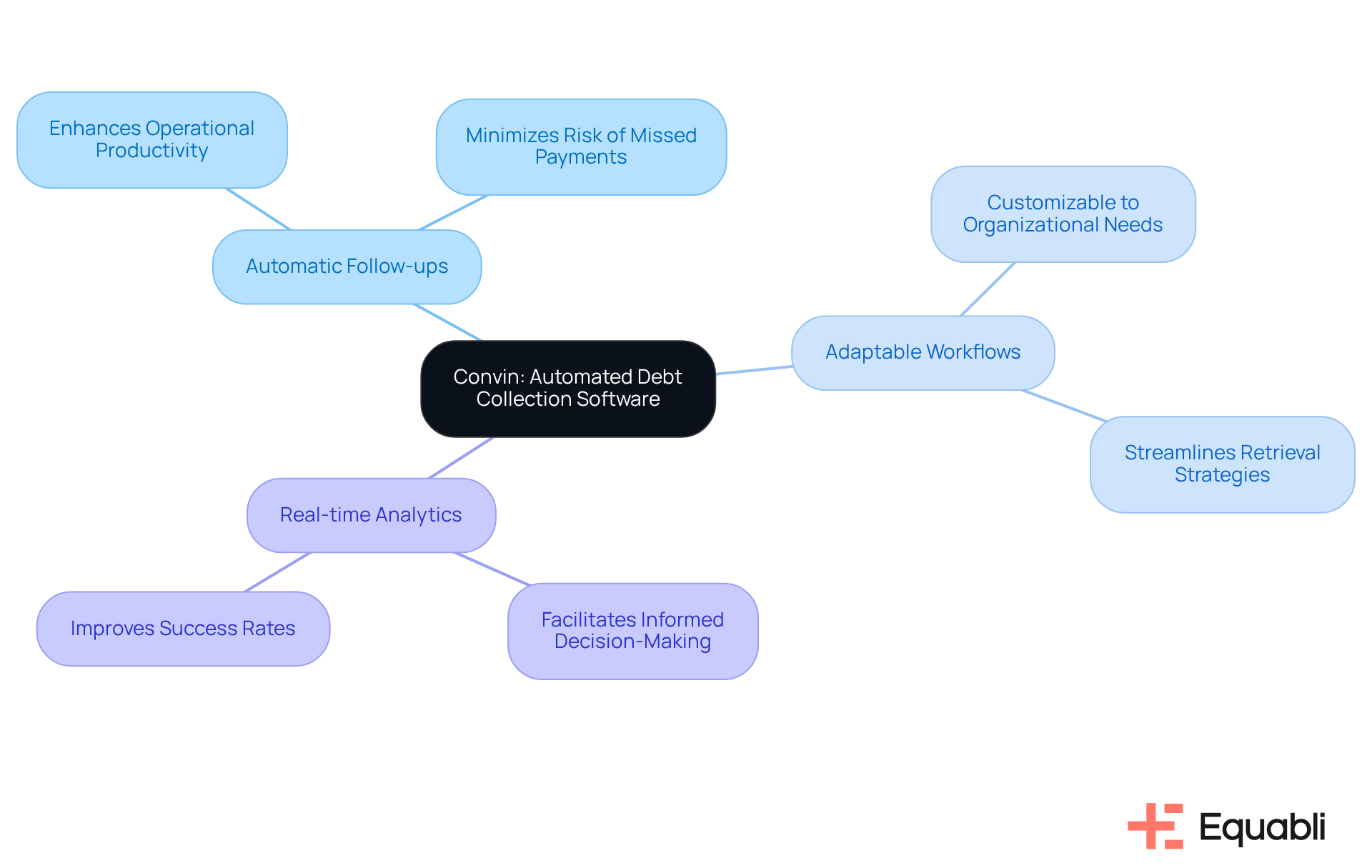

Convin provides an advanced software solution for debt recovery that integrates seamlessly with existing systems, thereby enhancing operational productivity. Key features include:

- Automatic follow-ups

- Adaptable workflows

- Real-time analytics

These features empower organizations to monitor their retrieval efforts closely. By automating routine tasks, Convin allows teams to concentrate on high-value interactions, significantly boosting efficiency and minimizing the risk of missed payments. The adoption of automated past due payment reminder systems for enterprise risk management not only streamlines processes but also leverages real-time analytics to facilitate informed decision-making, ultimately leading to improved success rates in debt recovery.

Industry leaders recognize that customizable workflows are essential for adapting to the unique requirements of each organization, thereby enhancing the effectiveness of retrieval strategies. Organizations utilizing Convin have reported substantial increases in productivity, underscoring the transformative impact of integrating advanced technology into debt recovery practices. Additionally, with EQ Collect, organizations can:

- Expedite vendor onboarding through a no-code file-mapping tool

- Optimize collections with data-driven strategies

- Ensure compliance with monitored processes

Firms that embraced real-time analytics have experienced a fourfold increase in productivity, enabling them to manage rapid business growth without the need for additional recruitment.

Invoiced: Advanced Solutions for Managing Past Due Invoices

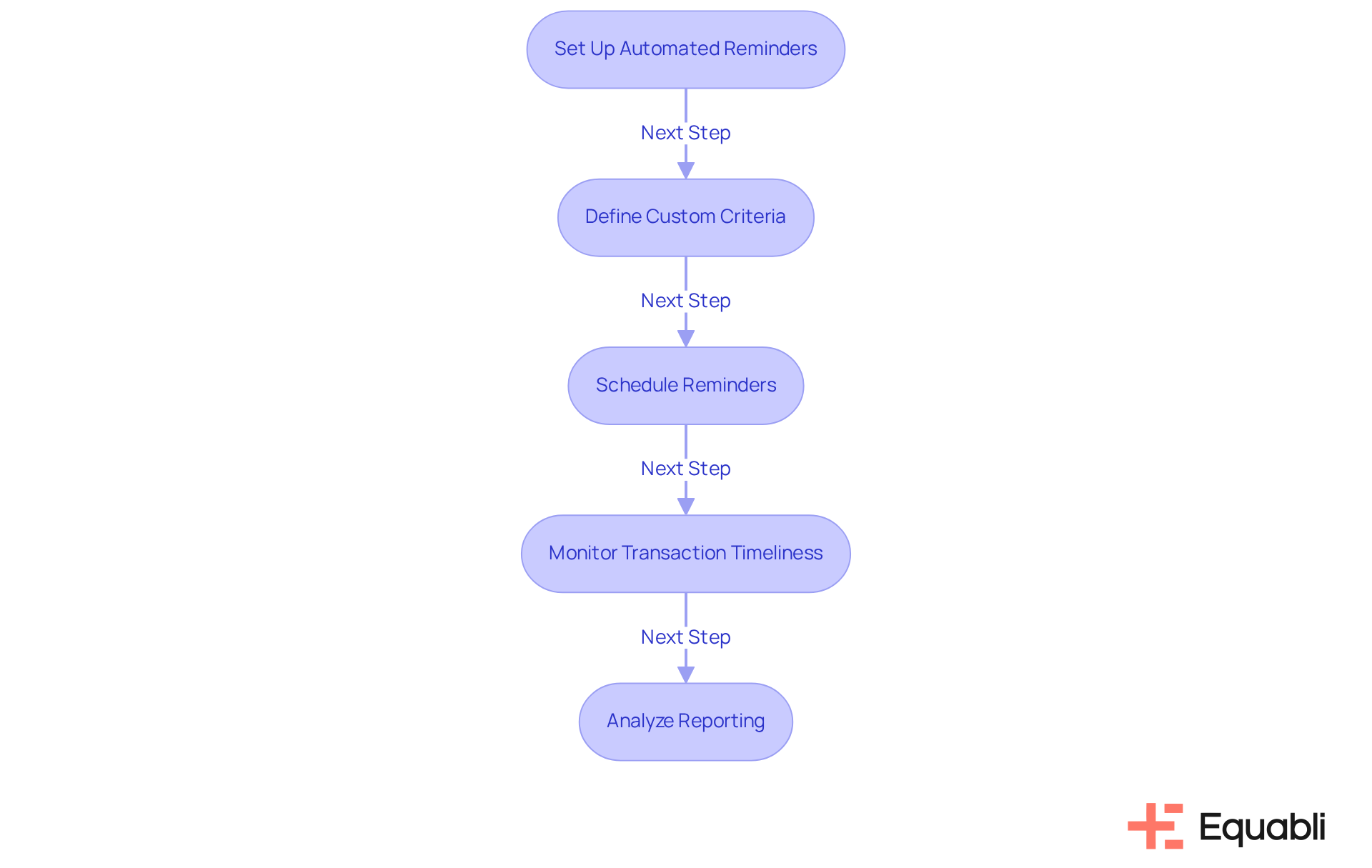

Equabli offers advanced solutions for the efficient management of overdue invoices, which include automated past due payment reminder systems for enterprise risk management, scheduled reminders, and flexible financing options through EQ Collect. This platform empowers businesses to create customizable workflows that trigger reminders based on defined criteria, ensuring timely and relevant communication with customers. For instance, a no-code file-mapping tool significantly reduces vendor onboarding timelines, while data-driven strategies enhance operational efficiency and boost collections.

Moreover, EQ Collect offers real-time reporting and compliance oversight, which enhances transparency and guarantees adherence to industry standards. Research indicates that companies utilizing automated past due payment reminder systems for enterprise risk management experience a marked improvement in transaction timeliness, with 42% of automated invoices settled punctually compared to only 25% of manual invoices. Additionally, the ability to customize workflows allows organizations to refine their communication strategies, addressing the distinct needs of each client.

By implementing automated past due payment reminder systems for enterprise risk management, Equabli enables businesses to mitigate the risks associated with overdue invoices, thereby reducing the likelihood of bad debt and fostering healthier financial operations. As Jamerlyn Brown highlights, "Businesses using AR automation typically see a 10-15% drop in bad debt write-offs," underscoring the financial advantages of adopting such technologies. Given that 47% of small businesses have invoices overdue by more than 30 days, the demand for effective solutions like those provided by Equabli is increasingly critical.

Tabs: Essential Accounts Receivable Management Tools

Equabli provides essential accounts receivable management tools, incorporating automated past due payment reminder systems for enterprise risk management within its EQ Collect platform. This platform features a user-friendly, scalable, cloud-native interface and a no-code file-mapping tool for vendor onboarding, complemented by automated workflows that mitigate execution errors. These capabilities empower businesses to optimize their receivables effectively through automated past due payment reminder systems for enterprise risk management.

The platform's analytics functionalities provide critical insights into transaction trends, enabling organizations to proactively adjust their strategies and minimize the risk of overdue accounts. Furthermore, real-time reporting and industry-leading compliance oversight equip financial institutions to achieve smarter orchestration and enhance performance in their debt recovery efforts.

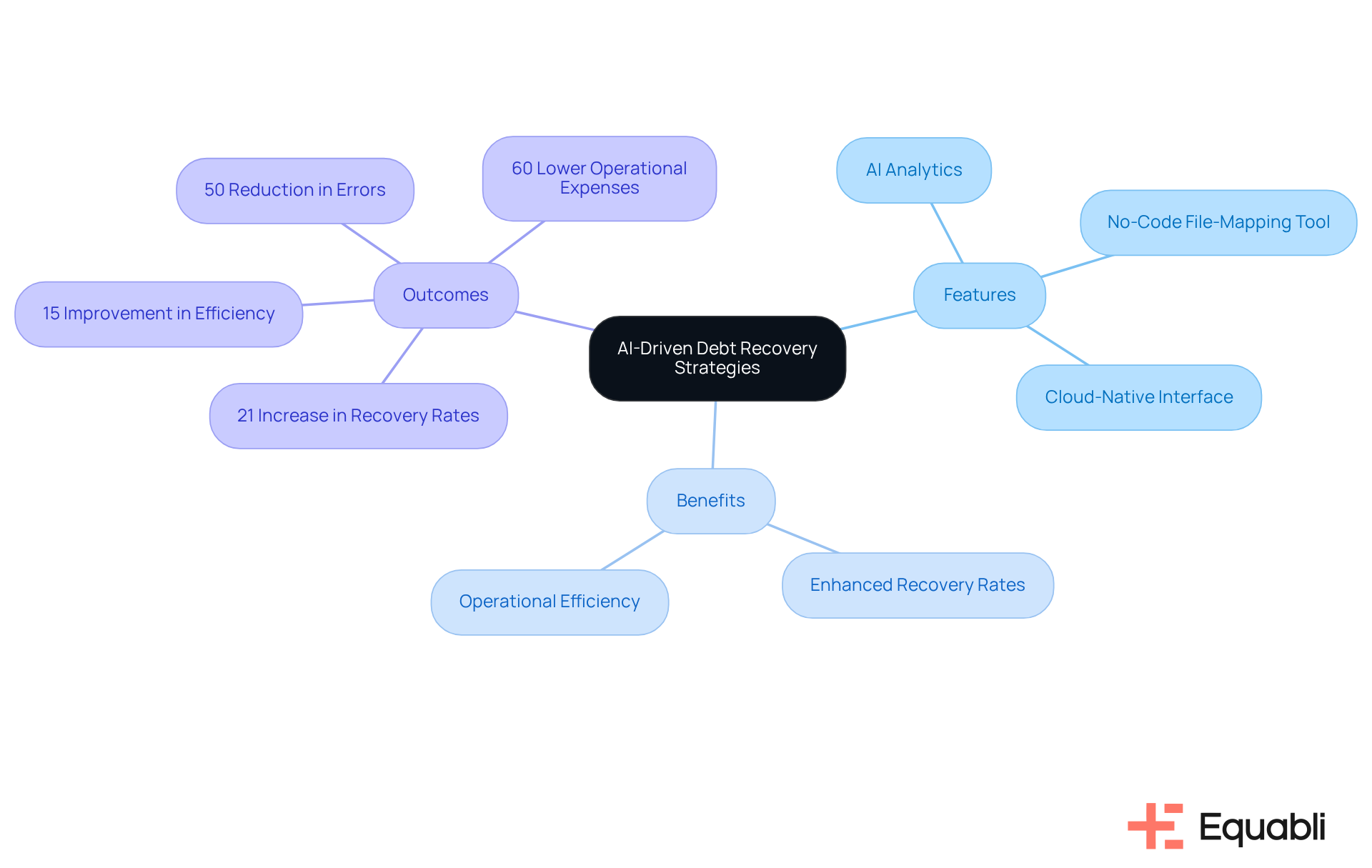

CallMiner: AI-Driven Debt Recovery Strategies

CallMiner leverages AI-driven analytics to significantly enhance debt recovery strategies. By meticulously analyzing customer interactions and payment behaviors, the platform delivers actionable insights that empower organizations to refine their retrieval efforts. This predictive capability allows businesses to evaluate the likelihood of repayment, enabling effective prioritization of outreach initiatives. As a result, resources are allocated more strategically, minimizing the risk of non-payment and bolstering overall retrieval effectiveness.

Organizations utilizing EQ Collect's AI analytics have reported a 21% increase in recovery rates alongside a 15% improvement in overall operational efficiency. Features such as a no-code file-mapping tool and a cloud-native interface further streamline the retrieval process, optimizing operations while ensuring compliance with regulations like the Fair Debt Practices Act (FDCPA). These advancements underscore the transformative role of AI and intelligent automation in modern debt collection processes, positioning them as essential tools for contemporary financial institutions.

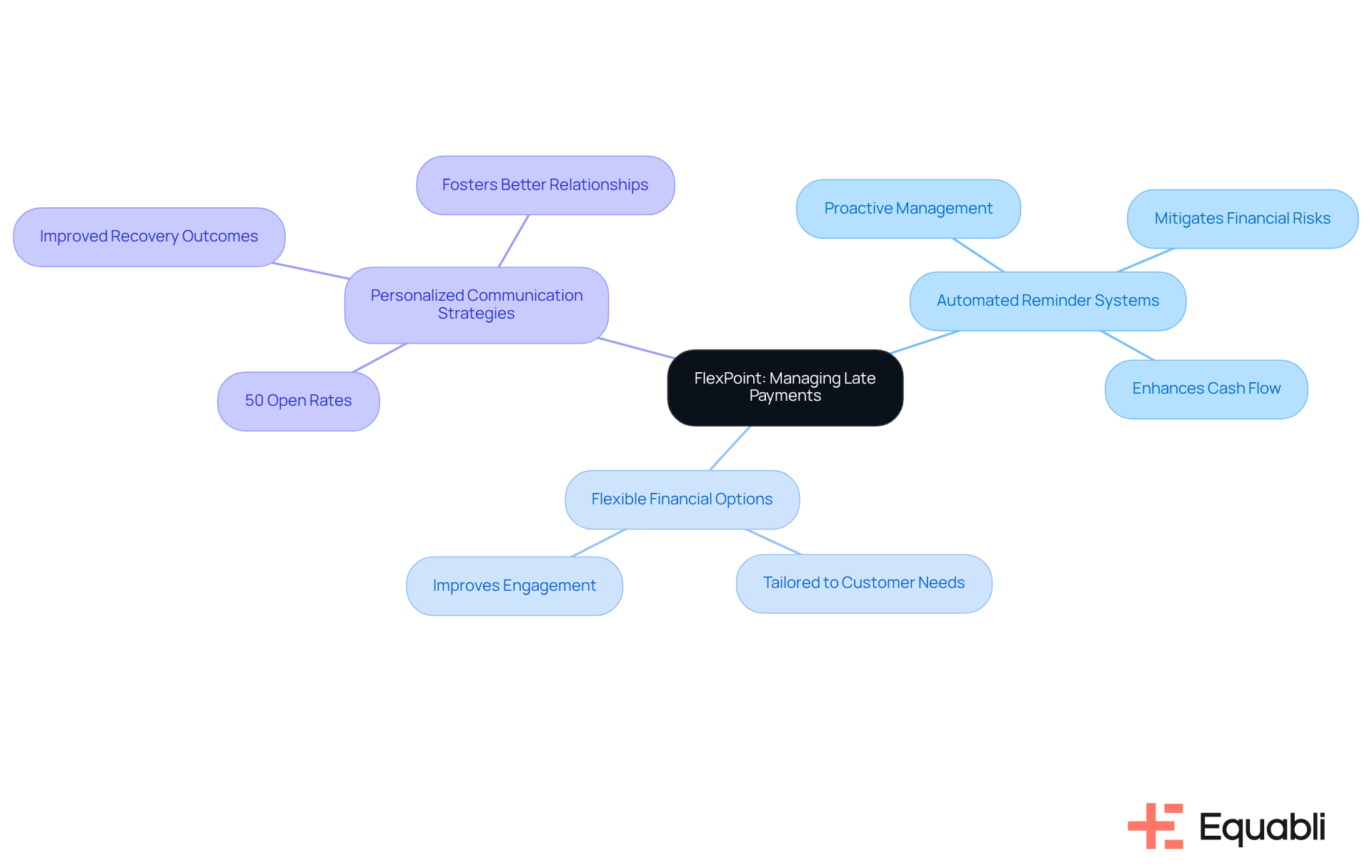

FlexPoint: Solutions for Managing Late Payments

FlexPoint provides customized solutions for managing overdue accounts, which include automated past due payment reminder systems for enterprise risk management and flexible financial options tailored to diverse customer needs. This approach significantly enhances the likelihood of prompt transactions by enabling companies to develop personalized communication strategies.

The use of automated past due payment reminder systems for enterprise risk management allows for proactive management of overdue accounts, which mitigates financial risks and fosters healthy cash flow. Industry leaders assert that personalized communication can yield improved recovery outcomes, with digital communications achieving open rates of 50% or more.

Successful implementations of these tailored strategies demonstrate their effectiveness in debt retrieval, underscoring the critical role of adaptability and customization in optimizing recovery efforts.

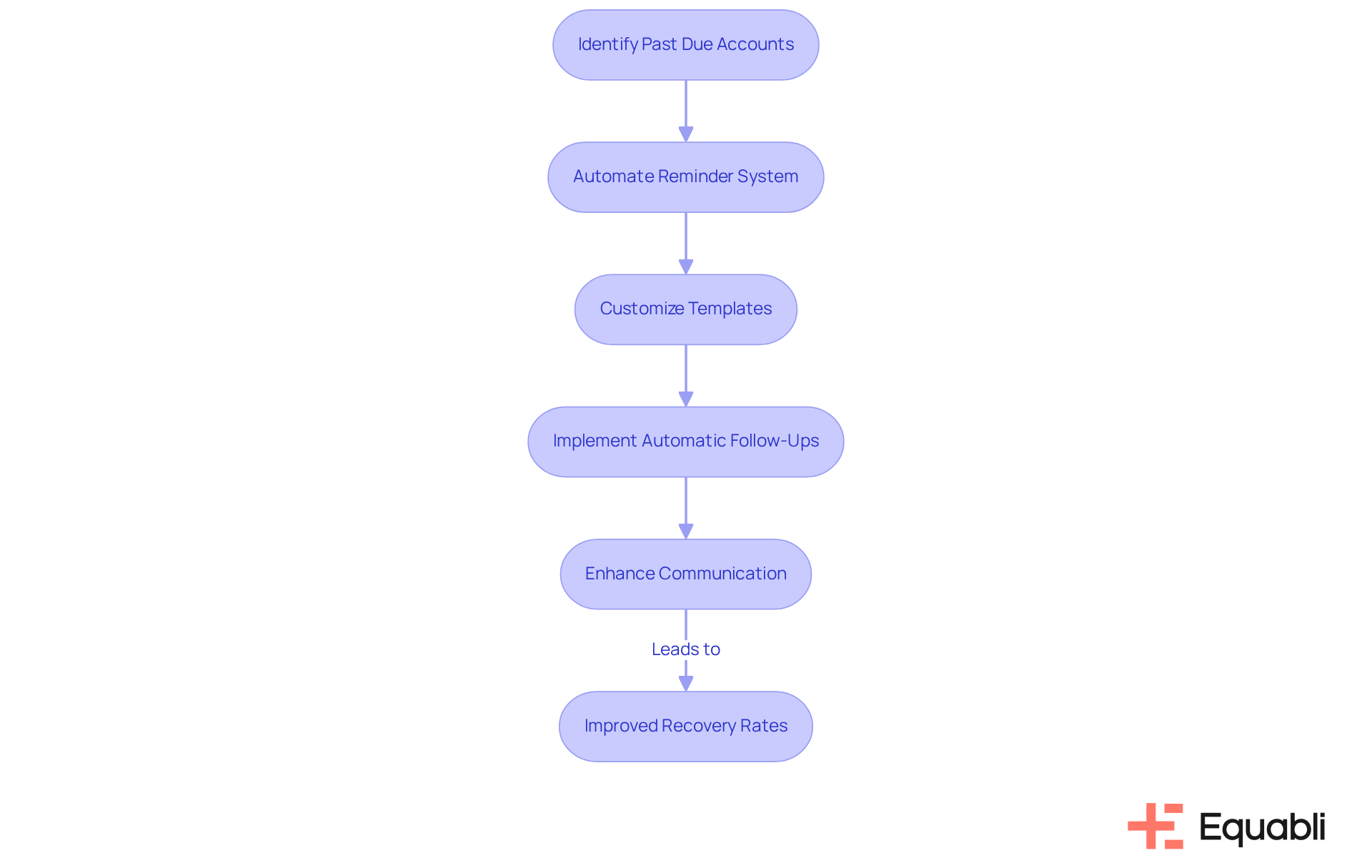

Gestion Credit Expert: Transformative Automated Payment Reminder Solutions

Gestion Credit Expert offers innovative solutions through automated past due payment reminder systems for enterprise risk management that significantly enhance the retrieval process. Evidence indicates that integrating features such as automatic follow-ups and customizable reminder templates enables organizations to maintain consistent and effective communication with their customers. This automation not only minimizes the time spent on manual follow-ups but also enhances overall retrieval effectiveness through automated past due payment reminder systems for enterprise risk management. Financial experts assert that the use of automated past due payment reminder systems for enterprise risk management can lead to recovery rates improving by up to 80% compared to traditional methods, underscoring the efficacy of these systems.

Moreover, the capacity to tailor reminder templates allows businesses to personalize their communication, which is essential for cultivating positive borrower relationships and increasing repayment rates. As the debt recovery landscape evolves, leveraging automated past due payment reminder systems for enterprise risk management becomes critical for organizations aiming to enhance their receivables management and elevate operational productivity, particularly with innovations offered by Gestion Credit Expert.

Emagia: AI-Powered Invoice Reminders and Optimization Techniques

Equabli's EQ Collect exemplifies a strategic advancement in retrieval efforts through the integration of intelligent automation and machine learning solutions. This platform notably reduces vendor onboarding periods via a user-friendly, no-code file-mapping tool, empowering organizations to enhance productivity and drive revenue through data-driven strategies. Evidence suggests that EQ Collect effectively automates workflows, which minimizes execution errors and reliance on manual resources, thereby ensuring timely and effective communications.

From a compliance perspective, the platform offers a scalable, cloud-native interface coupled with real-time reporting, enabling financial institutions to access critical insights that bolster financial health and incorporate automated past due payment reminder systems for enterprise risk management to mitigate the risk of overdue accounts. Furthermore, EQ Collect stands out for its industry-leading compliance oversight, which guarantees robust monitoring both internally and externally. This feature not only addresses regulatory requirements but also enables organizations to proactively manage risk in an increasingly complex financial landscape by utilizing automated past due payment reminder systems for enterprise risk management.

Conclusion: The Future of Automated Payment Reminders in Debt Collection

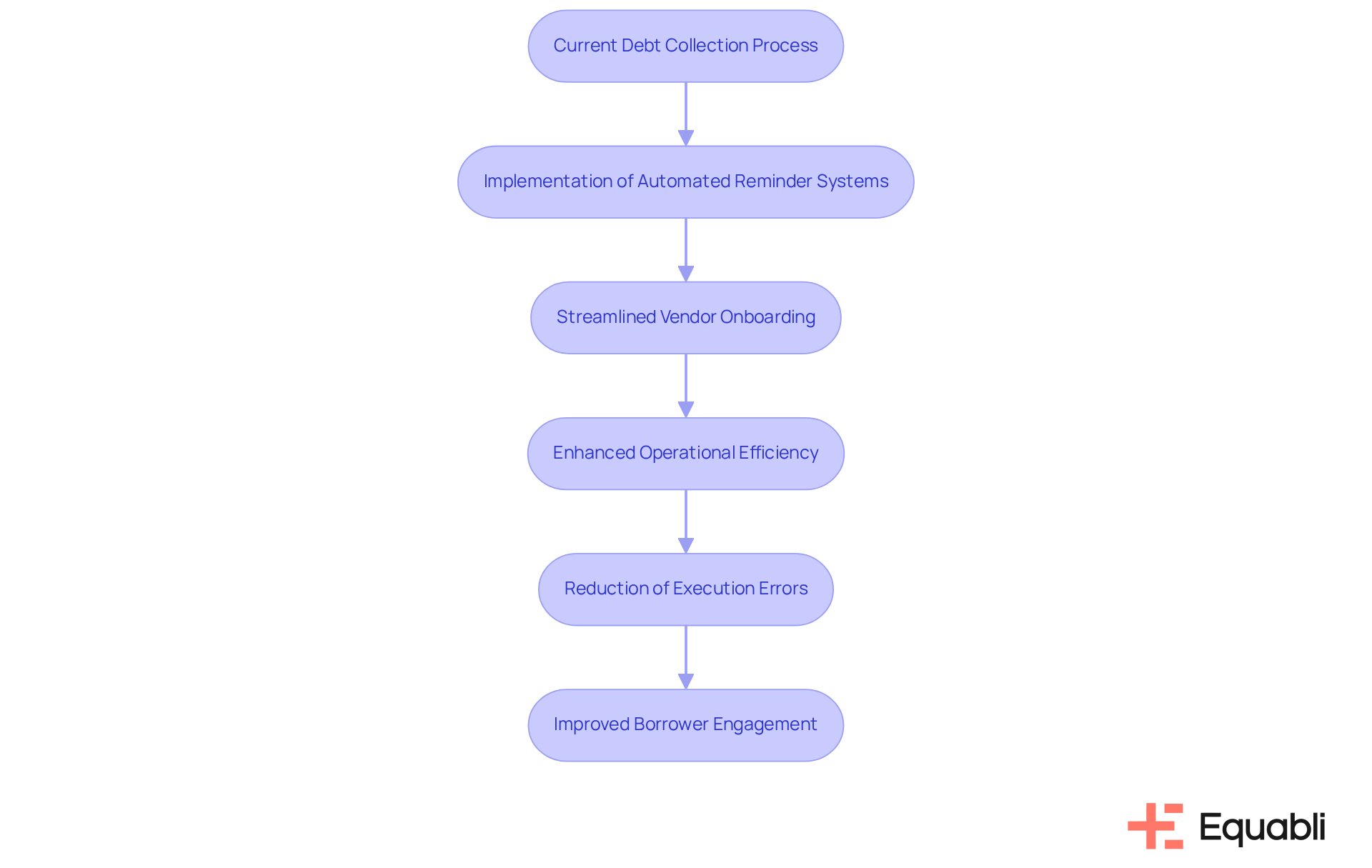

In the evolving landscape of debt recovery, automated past due payment reminder systems for enterprise risk management are becoming indispensable. Leveraging advanced technologies such as EQ Collect enables organizations to streamline vendor onboarding processes through a straightforward, no-code file-mapping tool. This innovation not only enhances operational efficiency via data-driven strategies but also significantly reduces execution errors through automated workflows. The result is improved borrower engagement and superior financial outcomes.

The future of debt recovery is increasingly reliant on automated past due payment reminder systems for enterprise risk management that integrate automation and intelligence. EQ Collect exemplifies this trend with its real-time reporting capabilities, industry-leading compliance oversight, and a user-friendly, scalable, cloud-native interface. Financial institution executives are strongly encouraged to schedule a demo to explore how EQ Collect can fundamentally transform their collection processes. This proactive approach not only addresses current operational challenges but also positions organizations for sustainable success in a competitive market.

Conclusion

Automated past due payment reminder systems are essential for enhancing enterprise risk management, equipping organizations with the necessary tools to improve their debt recovery processes. By leveraging advanced technologies such as the EQ Collect platform, businesses can optimize their operations, reduce manual errors, and significantly boost borrower engagement. This shift not only results in improved financial outcomes but also enables companies to excel in a competitive market.

Key insights throughout this article underscore the effectiveness of various automated solutions, including those provided by Equabli, Gaviti, and Convin. These systems have demonstrated marked improvements in cash flow, a reduction in Days Sales Outstanding (DSO), and enhanced compliance with industry regulations. The integration of data-driven strategies and customizable workflows is crucial for optimizing collection efforts and mitigating risks associated with overdue payments.

As the financial landscape evolves, adopting automated past due payment reminder systems is not merely advantageous but vital for sustainable success. Organizations must explore these innovative solutions to enhance their accounts receivable management. By embracing automation and intelligence in their collection processes, businesses can effectively tackle current challenges while ensuring long-term resilience and growth in an ever-changing market.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a comprehensive set of tools designed to automate past due payment reminder systems for enterprise risk management, featuring components like the EQ Engine, EQ Engage, and EQ Collect.

What are the key features of EQ Collect?

Key features of EQ Collect include a no-code file-mapping tool, streamlined workflows, and real-time reporting, which help shorten vendor onboarding timelines and reduce execution errors.

How does the EQ Suite improve borrower engagement?

The EQ Suite enhances borrower engagement by leveraging data-driven insights, which is crucial for optimizing recovery processes.

What impact do automated payment reminder systems have on retrieval rates?

Organizations using automated payment reminder systems have experienced a 15-25% increase in retrieval rates, demonstrating their effectiveness in improving recovery efficiency and lowering operational costs.

What are the benefits of using Gaviti for automated payment reminders?

Gaviti automates billing reminders, reduces the likelihood of overdue payments, enhances cash flow, and allows organizations to customize reminder schedules and messages to align with customer preferences.

How does Equabli's platform enhance productivity?

Equabli's platform enhances productivity by incorporating a no-code file-mapping tool and automated workflows, which minimize execution errors and reduce the need for manual resources.

What are the current trends in accounts receivable automation?

Current trends highlight four essential pillars: Data Excellence, Workflow Intelligence, Implementation, and Usability, which can be enhanced by automated past due payment reminder systems.

How does Convin improve debt recovery processes?

Convin improves debt recovery by providing automatic follow-ups, adaptable workflows, and real-time analytics, allowing organizations to monitor retrieval efforts and automate routine tasks.

What are the advantages of using real-time analytics in debt recovery?

Organizations that use real-time analytics have reported a fourfold increase in productivity, enabling them to manage business growth without additional recruitment.

How does the EQ Suite ensure compliance in collection efforts?

The EQ Suite ensures compliance through monitored processes, which help organizations achieve a 100% adherence rate in their collection efforts.