Overview

The article emphasizes the critical role of automated payment reminder text message templates tailored for financial institutions, aiming to enhance communication and improve repayment rates. Evidence shows that SMS notifications achieve high open and response rates, making them an effective tool in debt collection strategies. Furthermore, personalized, timely, and empathetic messaging is essential in cultivating positive relationships with clients, ultimately encouraging timely payments. This approach not only supports operational efficiency but also aligns with compliance standards, reinforcing the importance of strategic communication in financial services.

Introduction

In the dynamic landscape of finance, effective communication is crucial for maintaining robust relationships between financial institutions and their clients. Automated payment reminder text message templates have emerged as essential tools for enhancing client engagement and ensuring timely payments. These templates provide organizations with a streamlined approach to their billing processes, ultimately improving operational efficiency.

However, with a plethora of options available, how can institutions craft messages that not only inform but also resonate with borrowers? This article explores ten innovative templates designed to optimize payment reminders, addressing the challenges of engagement and compliance while fostering a more responsive relationship with clients.

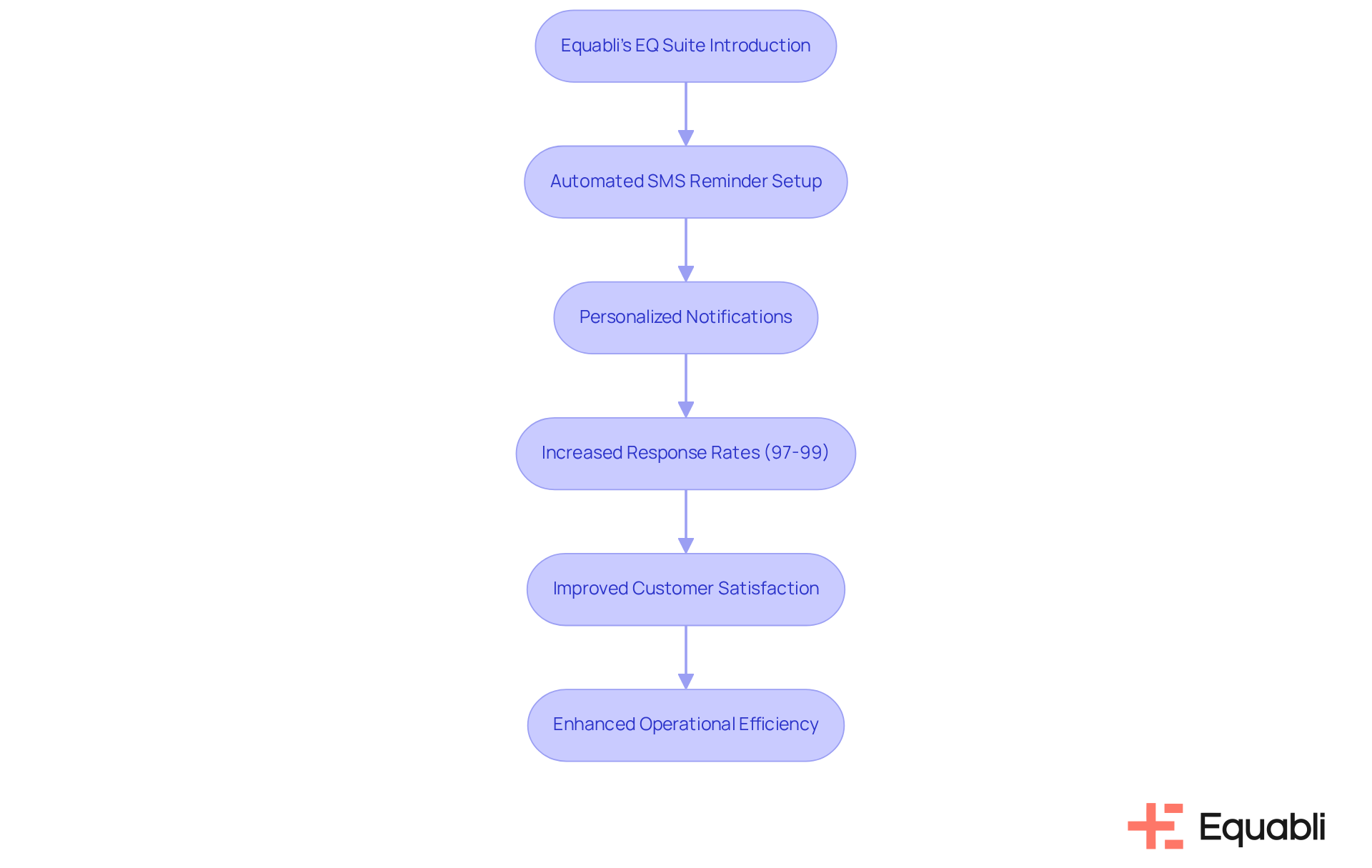

Equabli's EQ Suite: Automated Payment Reminders for Financial Institutions

Equabli's EQ Suite provides a strategic solution for financial entities aiming to enhance their billing notification processes using automated payment reminder text message templates for financial institutions. By leveraging automation, the EQ Suite enables organizations to utilize automated payment reminder text message templates for financial institutions to deliver timely and personalized SMS payment notifications, ensuring users remain informed of their obligations. This method not only increases repayment rates but also improves customer satisfaction through a streamlined communication experience.

Research indicates that SMS notifications achieve response rates between 97% and 99%, significantly surpassing traditional phone calls, which typically yield only 30% to 60% replies. The integration of data-driven insights allows organizations to customize notifications based on user behavior, thereby enhancing their effectiveness and relevance. Financial experts emphasize that efficient communication strategies, including automated payment reminder text message templates for financial institutions, are crucial for fostering borrower engagement and encouraging positive repayment behaviors.

By adopting these innovative practices, financial organizations can enhance their operational efficiency and achieve superior financial outcomes. This approach not only aligns with compliance requirements but also positions organizations to better manage risk and improve overall performance in debt collection.

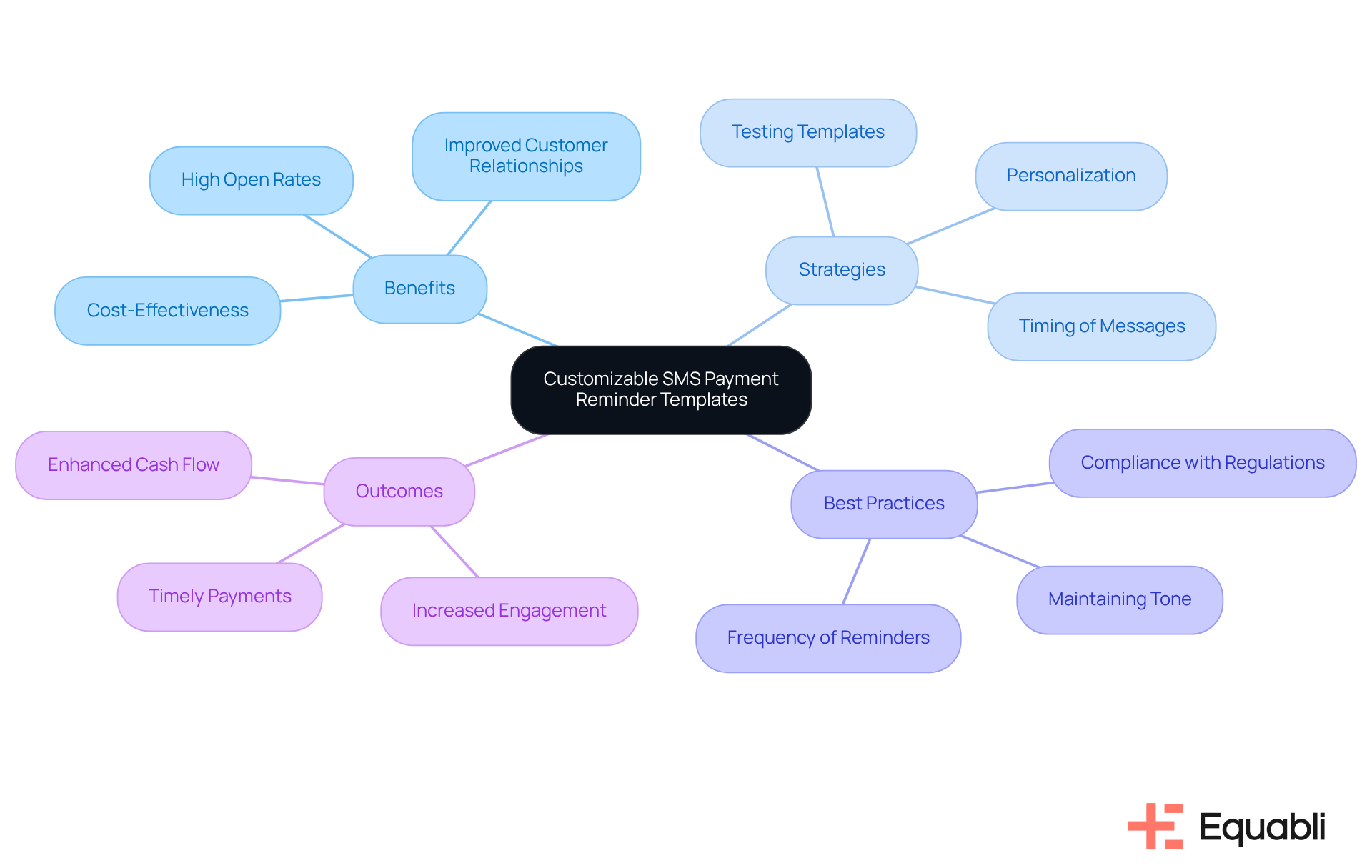

Chaser: Customizable SMS Payment Reminder Templates

EQ Engage provides financial organizations with a suite of creative features designed to enhance communication strategies using automated payment reminder text message templates for financial institutions. By tailoring the tone, content, and timing of these notifications, organizations can better align their messaging with the distinct preferences of their borrowers. Research shows that customized notifications significantly boost engagement, with SMS messages achieving an impressive 98% open rate compared to just 42.35% for emails. This heightened visibility not only increases the likelihood of timely reimbursements but also cultivates a positive relationship between the organization and its clients.

Financial institutions can leverage EQ Engage to develop, automate, and implement borrower contact strategies. By testing various automated payment reminder text message templates for financial institutions—ranging from gentle reminders for upcoming due dates to more urgent alerts for overdue payments—organizations can identify the most effective approaches for their audience. Maintaining a courteous tone in all communications is crucial, as is ensuring compliance by obtaining consent from recipients prior to sending SMS notifications. Institutions should adhere to best practices, such as limiting notifications to no more than one per week, to optimize their communication efforts.

By capturing consumer preferences and employing these tailored strategies through EQ Engage, organizations can effectively enhance transaction rates and improve overall customer satisfaction. This approach not only addresses operational challenges but also positions financial organizations as responsive partners in the debt collection process.

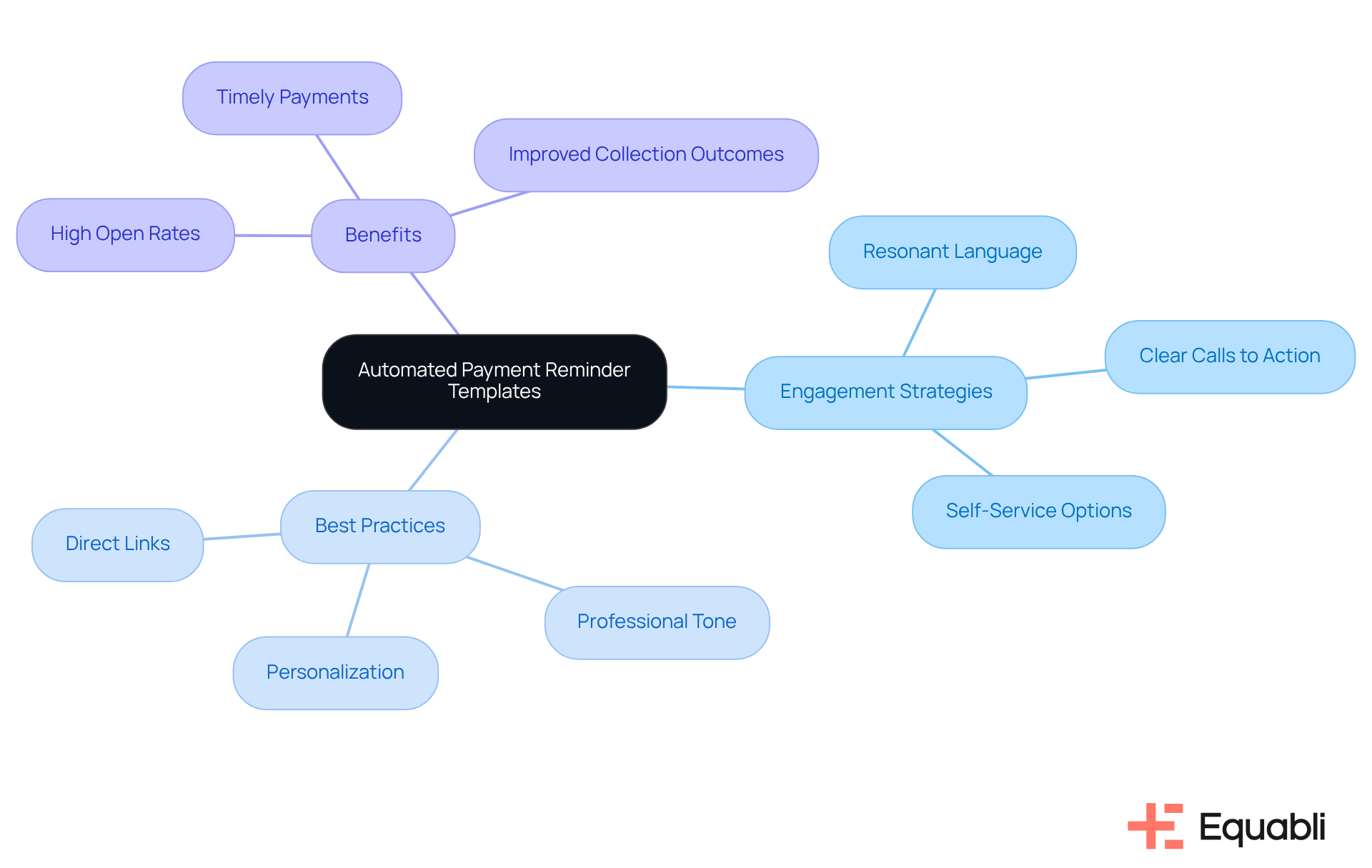

Curogram: Proven Payment Reminder Message Templates

Equabli provides automated payment reminder text message templates for financial institutions, which effectively engage debtors and promote timely payments. These templates utilize language that resonates with recipients, featuring clear calls to action that encourage immediate responses. Financial organizations can leverage automated payment reminder text message templates for financial institutions to ensure their reminders are not only informative but also compelling enough to drive action.

With SMS messages achieving an impressive 98% open rate and 81% of consumers checking their texts within five minutes, Equabli's templates are strategically designed to enhance borrower engagement. By employing EQ Engage's tailored communication pathways and self-service repayment options, organizations can significantly improve their communication strategies and collection outcomes.

Adhering to best practices for billing notifications—such as maintaining a professional tone, personalizing messages, and including a direct transaction link—empowers institutions to streamline operations and boost performance in debt recovery. This approach not only addresses compliance requirements but also positions organizations to navigate the complexities of enterprise-level debt collection effectively.

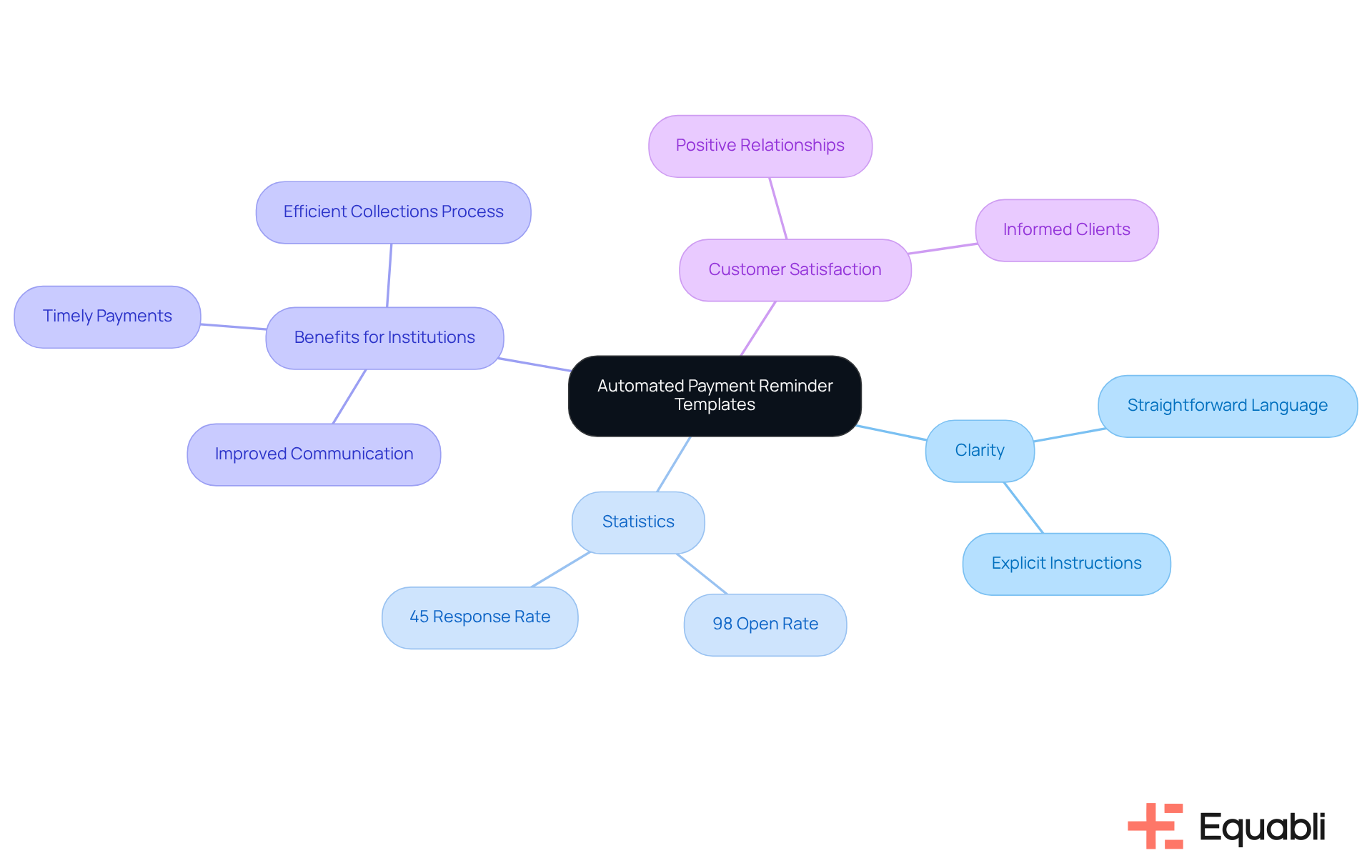

Textedly: Effective Payment Reminder Message Templates

Textedly provides a robust collection of automated payment reminder text message templates for financial institutions, focusing on clarity and directness. These templates are crafted to deliver essential information succinctly, ensuring that individuals comprehend their payment responsibilities without ambiguity. By utilizing straightforward language and providing explicit instructions, Textedly's automated payment reminder text message templates for financial institutions greatly enhance communication between these institutions and their clients.

The effectiveness of this approach is underscored by compelling statistics: text messages boast a 98% open rate and a 45% response rate. This not only heightens the likelihood of timely payments but also enhances the overall experience for loan recipients. As communication experts emphasize, clarity in messaging is crucial for fostering positive relationships, ensuring clients feel informed and valued throughout the transaction process.

By incorporating automated payment reminder text message templates for financial institutions into financial notifications, we can achieve improved customer satisfaction and a more efficient collections process. By focusing on clear communication, organizations can navigate the complexities of debt collection while reinforcing compliance and operational effectiveness.

TextRequest: SMS Payment Reminder Templates for Overdue Payments

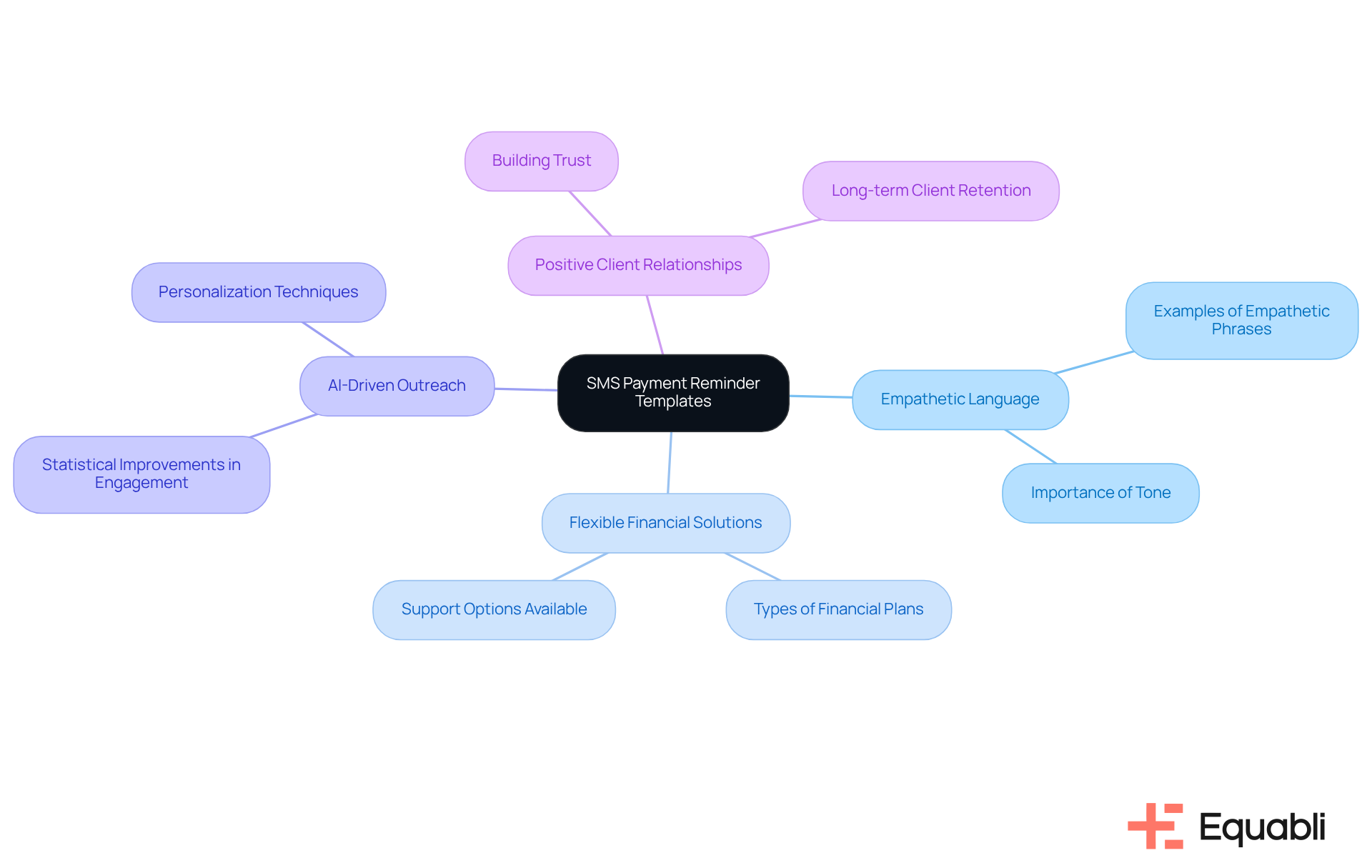

TextRequest provides automated payment reminder text message templates for financial institutions that are specifically designed to address overdue accounts with a focus on sensitivity and empathy. These templates utilize empathetic language to encourage individuals to take action while providing feasible solutions, such as flexible financial plans or support options. This compassionate approach not only aids in recovering overdue payments but also utilizes automated payment reminder text message templates for financial institutions to foster a positive relationship between them and their clients.

Research shows that hyper-personalized communication can significantly boost engagement, with AI-driven outreach improving response rates by five times. Organizations that prioritize compassionate communication in their notifications often see enhanced outcomes, as clients feel recognized and supported during challenging financial times. By adopting these strategies, financial organizations can effectively manage the complexities of collections while upholding respect and dignity for their clients.

Upflow: Guide to Writing Effective SMS Payment Reminder Messages

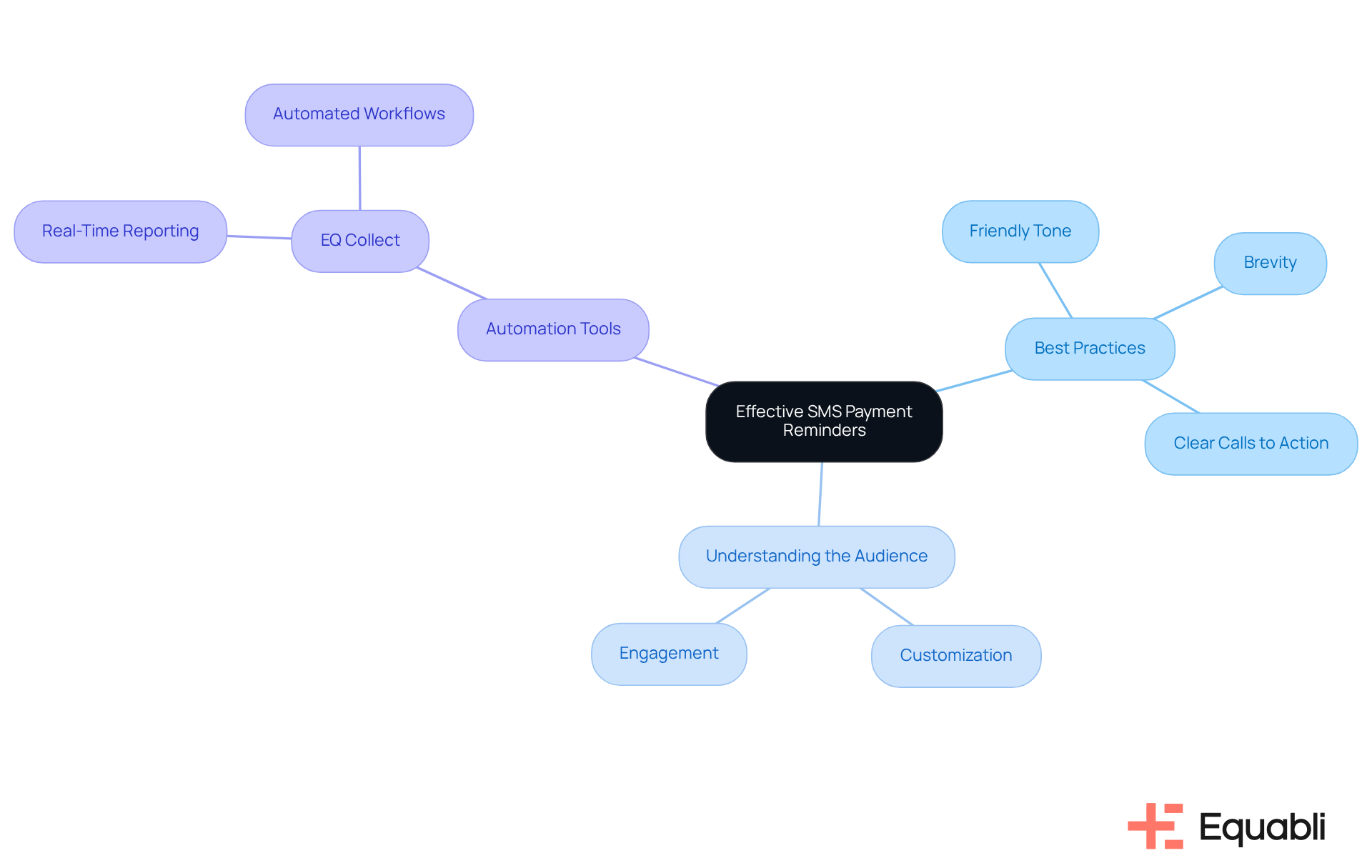

Upflow provides a comprehensive guide on crafting effective automated payment reminder text message templates for financial institutions specifically designed for loan recipients. A key best practice is to adopt a friendly tone while maintaining brevity and incorporating clear calls to action. By adhering to these principles, financial organizations can utilize automated payment reminder text message templates for financial institutions to develop notifications that not only convey essential information but also encourage clients to act promptly.

Understanding the audience is crucial; messages should be customized to resonate with individual needs, significantly enhancing repayment rates. Communication experts assert that a friendly approach in reminders fosters a more positive response from borrowers, thereby improving engagement and trust.

Moreover, utilizing automation tools such as Equabli's EQ Collect and automated payment reminder text message templates for financial institutions can streamline these processes, minimizing manual tasks and boosting overall efficiency. With features like real-time reporting and automated workflows, EQ Collect empowers financial organizations to refine their communication strategies, ultimately leading to enhanced collection outcomes within the financial sector.

DanaConnect: Text Message Templates for Collection Strategies

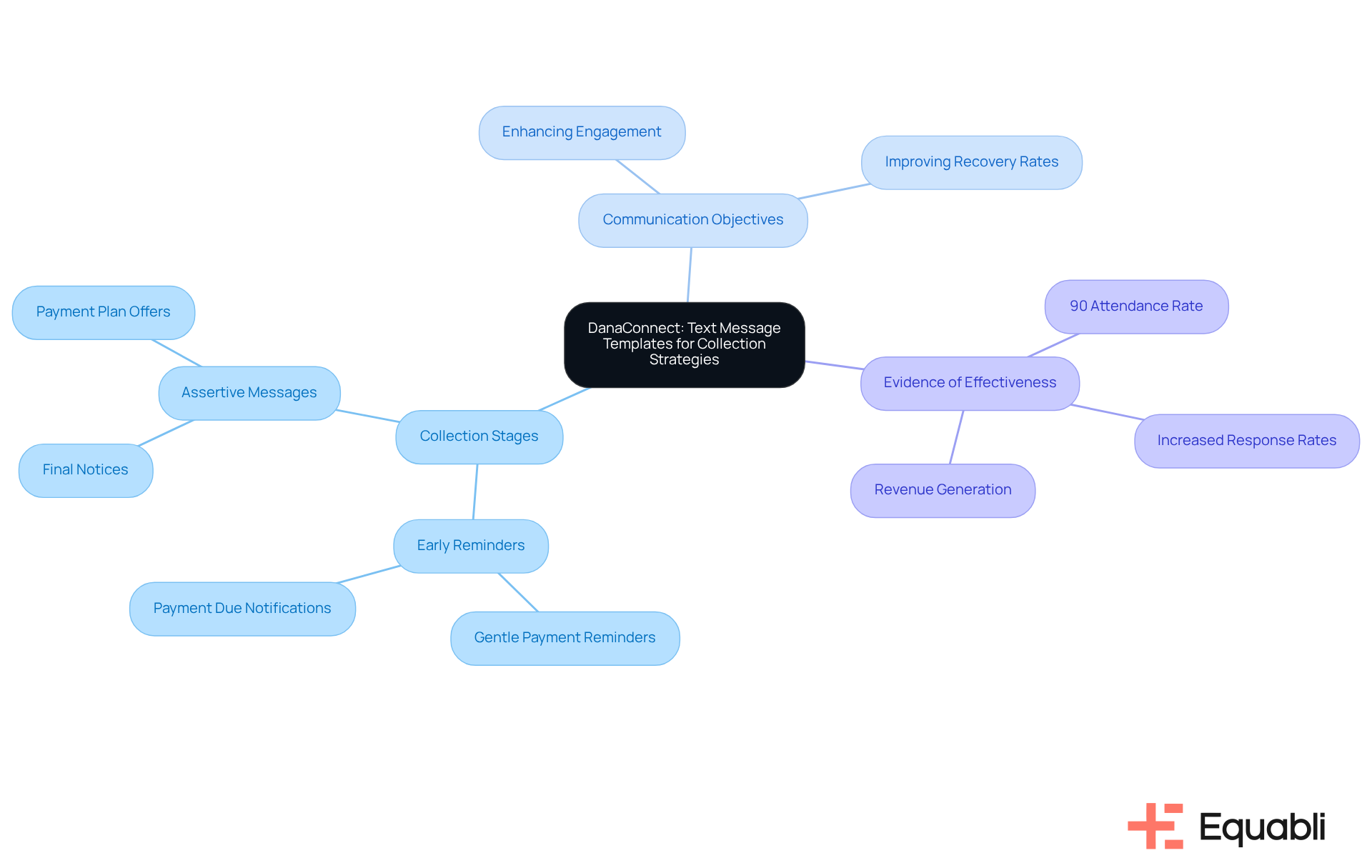

DanaConnect offers automated payment reminder text message templates for financial institutions, tailored for various collection methods and enabling organizations to align their communications with specific collection objectives. These templates address different stages of delinquency, ranging from gentle reminders for early-stage delinquencies to more assertive messages for accounts that are significantly overdue. By leveraging automated payment reminder text message templates for financial institutions, organizations can maintain consistency in their messaging, which is crucial for enhancing engagement and improving collection outcomes.

Evidence from financial organizations underscores the effectiveness of these templates. For instance, organizations that implemented targeted SMS notifications experienced a notable increase in participant responses, with attendance rates for events soaring to as high as 90% following SMS reminders. This illustrates the impact of strategically crafted messaging in fostering engagement and compliance.

As we approach 2025, it is essential to align messaging with collection goals by utilizing automated payment reminder text message templates for financial institutions. Data indicates that individuals respond more positively to customized and timely communications, highlighting the need for financial entities to adopt strategies that resonate with their clients. By utilizing DanaConnect's templates, institutions can streamline their collection processes while cultivating stronger relationships with loan recipients, ultimately enhancing recovery rates.

Textedly: Tips for Effective Payment Reminder Messages

Textedly provides essential strategies for crafting automated payment reminder text message templates for financial institutions that resonate with borrowers. Tailoring each message to reflect the recipient's information is crucial, as is ensuring notifications are sent at optimal times—specifically one week before the due date—to maximize engagement. Research indicates that timely notifications can significantly boost response rates, with SMS messages achieving an impressive open rate of 98% within minutes of delivery. This immediacy underscores the importance of timing in financial communications.

Moreover, maintaining a friendly yet professional tone is vital. A well-structured reminder not only delivers necessary information but also nurtures a positive relationship with clients. Personalization, such as including the client's name and specific invoice details, can further increase the likelihood of prompt payments. Additionally, offering grace periods encourages clients to settle their dues without penalties, thereby strengthening client relationships.

By leveraging automated payment reminder text message templates for financial institutions through platforms like EQ Engage, they can reduce no-shows by 29%, thereby enhancing overall efficiency and client engagement. EQ Engage enables the design and automation of client contact strategies, ensuring communications are tailored to individual preferences while adhering to compliance standards. Furthermore, the self-service repayment options provided by EQ Engage allow borrowers to manage their payments effectively, while capturing consumer preferences enhances the personalization of communication.

By implementing these strategies, financial institutions can refine their communication efforts through automated payment reminder text message templates for financial institutions, ultimately leading to improved cash flow and stronger client relationships.

Curogram: Anatomy of a Perfect Payment Reminder

Curogram identifies key components of an effective payment notification, underscoring the importance of:

- A clear subject line

- Concise messaging

- A friendly tone

- A compelling call to action

These elements are vital for prompting timely responses from individuals. A well-crafted notification not only delivers essential information but also nurtures positive borrower relationships by adhering to communication best practices.

Research shows that subject lines significantly impact open rates, making them a critical aspect of SMS notifications. By integrating features from EQ Engage—such as:

- Customized communication paths

- Personalized repayment strategies

- Compliance oversight

- Segmentation

financial organizations can enhance the effectiveness of their notifications. This comprehensive strategy not only improves collection outcomes but also empowers clients to self-service, thereby fostering a more engaging and compliant communication framework.

Equabli's EQ Suite: Data-Driven Insights for Optimizing Collections

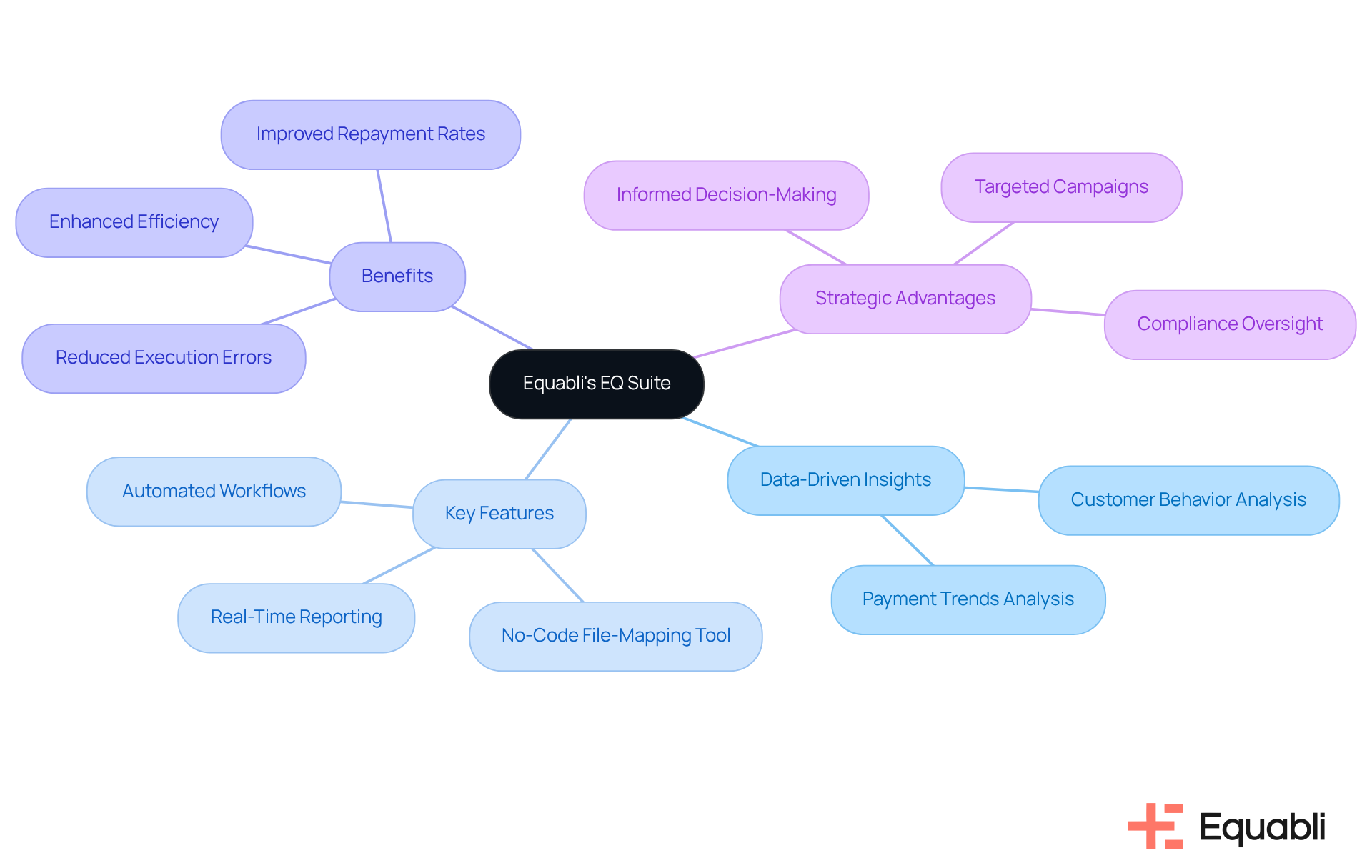

Equabli's EQ Suite delivers critical data-driven insights essential for optimizing collections. By analyzing customer behavior and payment trends, the EQ Suite empowers financial entities to refine their payment notification strategies through automated payment reminder text message templates for financial institutions. Key features, including automated workflows, a no-code file-mapping tool, and real-time reporting, significantly reduce execution errors and enhance efficiency. This enables organizations to identify the most effective messaging techniques and timing for using automated payment reminder text message templates for financial institutions, ultimately leading to improved repayment rates.

Leveraging data-driven strategies, industry-leading compliance oversight, and the capability to segment borrowers for targeted campaigns allows institutions to make informed decisions. This approach not only enhances overall collection efforts but also drives better outcomes in enterprise-level debt management. By adopting such analytical methodologies, organizations can navigate the complexities of compliance and operational challenges, positioning themselves for sustained success in the financial landscape.

Conclusion

Automated payment reminder text message templates offer a significant opportunity for financial institutions aiming to enhance their communication strategies and improve repayment rates. By implementing these innovative tools, organizations can deliver timely and personalized notifications that resonate with borrowers, fostering a more engaged and satisfied customer base.

The article discusses various platforms, including Equabli's EQ Suite, Chaser, and Textedly, which provide tailored SMS templates designed to boost the effectiveness of payment reminders. Key insights emphasize the importance of clarity, empathy, and customization in messaging, alongside the substantial benefits of employing data-driven strategies to optimize communication efforts. These approaches not only streamline operations but also ensure compliance with regulatory requirements, ultimately leading to improved financial outcomes.

As financial institutions navigate the complexities of debt collection, adopting automated payment reminder text message templates is essential. By prioritizing effective communication strategies, organizations can strengthen their relationships with borrowers, encourage timely repayments, and achieve greater operational efficiency. Investing in these technologies is not merely a tactical decision; it signifies a strategic commitment to enhancing borrower experiences and driving long-term success in the financial sector.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a strategic solution designed for financial institutions to enhance their billing notification processes through automated payment reminder text message templates. It allows organizations to deliver timely and personalized SMS payment notifications to keep users informed of their obligations.

How do automated payment reminders improve repayment rates?

Automated payment reminders using SMS notifications significantly increase repayment rates, achieving response rates between 97% and 99%, compared to traditional phone calls which only yield 30% to 60% replies. This timely communication helps ensure users are aware of their payment obligations.

What benefits do customized SMS payment reminder templates provide?

Customized SMS payment reminder templates enhance engagement by aligning messaging with borrowers' preferences. Research shows that SMS messages have a 98% open rate, which increases the likelihood of timely reimbursements and fosters better relationships between organizations and clients.

What features does EQ Engage offer for financial organizations?

EQ Engage provides features that allow financial organizations to develop, automate, and implement borrower contact strategies. It enables testing of various automated payment reminder text message templates, helping identify the most effective approaches for engaging their audience.

What best practices should institutions follow when sending SMS notifications?

Institutions should maintain a courteous tone, obtain consent from recipients, limit notifications to no more than one per week, and ensure messages are personalized and professional. Including a direct transaction link in reminders is also recommended to streamline operations.

How do Equabli's payment reminder templates drive borrower engagement?

Equabli's payment reminder templates use resonant language and clear calls to action, encouraging immediate responses. The templates are designed to be informative and compelling, significantly improving communication strategies and collection outcomes for financial organizations.

What is the importance of compliance in sending payment reminders?

Compliance is crucial for financial organizations to navigate the complexities of debt collection effectively. Adhering to best practices and obtaining consent ensures that organizations meet legal requirements while improving their operational efficiency and performance in debt recovery.