Overview

This article presents ten corporate debt recovery solutions specifically designed for financial institutions, underscoring the critical role of technology and personalized strategies in enhancing recovery rates. It highlights the Equabli EQ Suite, which employs predictive analytics, automated workflows, and borrower engagement strategies to optimize the debt recovery process and bolster operational efficiency. Ultimately, these innovations position financial organizations for success within a competitive landscape.

Introduction

The landscape of corporate debt recovery is undergoing significant transformation, propelled by technological advancements and evolving borrower expectations. Financial institutions now have a distinct opportunity to refine their recovery strategies through innovative solutions that not only streamline processes but also cultivate stronger relationships with borrowers. As the demand for efficient and effective debt recovery solutions intensifies, organizations must navigate the complexities of compliance, engagement, and operational efficiency to ensure success. This article examines ten cutting-edge corporate debt recovery solutions that empower financial institutions to excel in a competitive environment.

Equabli EQ Suite: Comprehensive Debt Recovery Solutions

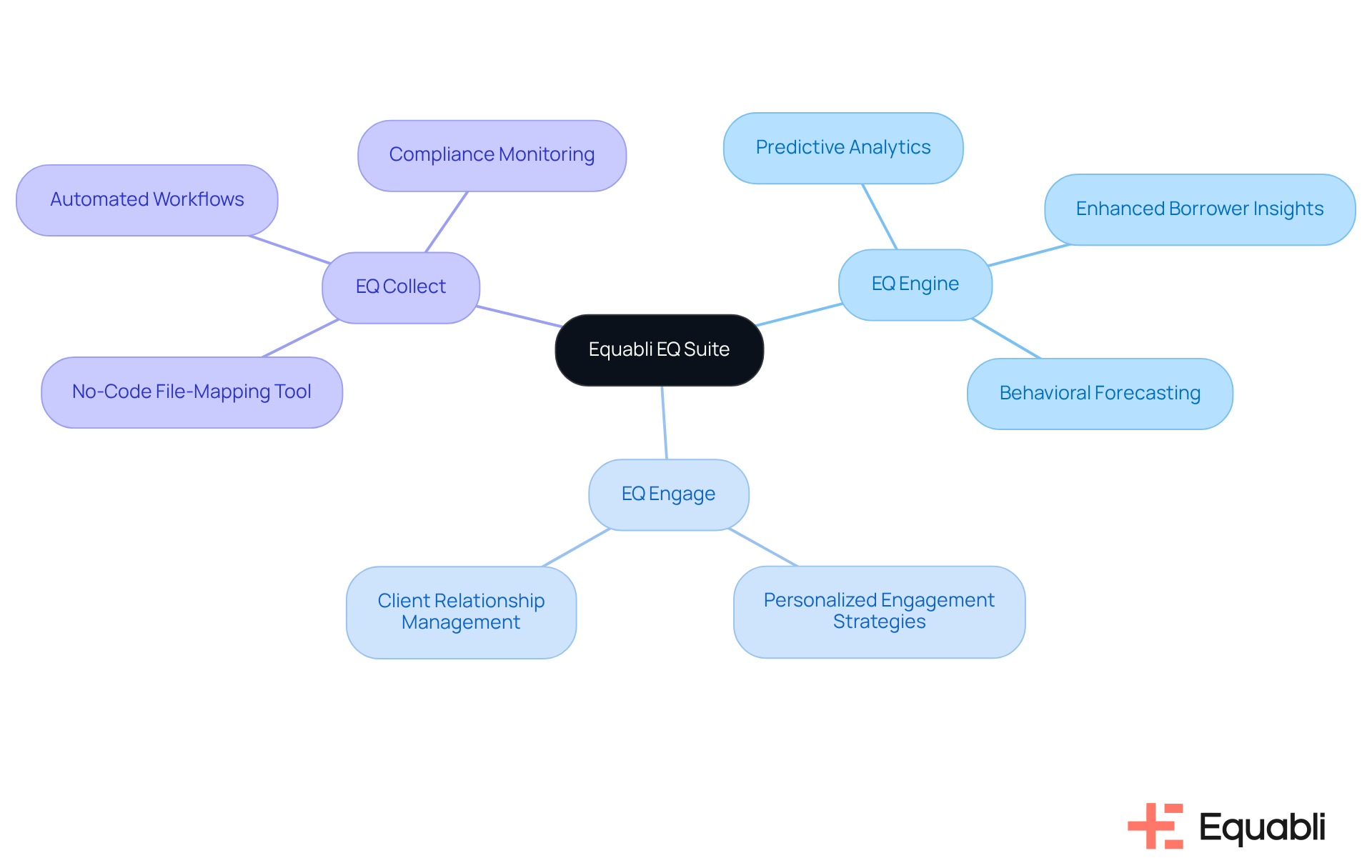

The Equabli EQ Suite serves as a robust platform aimed at providing corporate debt recovery solutions for financial institutions. This suite includes tools such as EQ Engine, EQ Engage, and EQ Collect, which significantly improve retrieval efficiency. By leveraging predictive analytics, lenders can anticipate borrower behaviors, while personalized engagement strategies foster stronger client relationships. Furthermore, automated digital resources streamline the repayment process, enabling organizations to effectively manage delinquency and boost retrieval rates.

Key features of EQ Collect, including a no-code file-mapping tool and automated workflows, minimize manual tasks and enhance operational efficiency. This ensures compliance with industry standards through automated monitoring. Such a comprehensive solution, specifically designed as corporate debt recovery solutions for financial institutions, is particularly beneficial across various sectors, including fintech, healthcare, and telecom, addressing their specific challenges while ensuring adaptability in the rapidly evolving landscape of financial recovery.

As the global debt retrieval software market is projected to grow by USD 2.31 billion from 2024 to 2028, the EQ Suite positions financial organizations to capitalize on this trend. By enhancing operational efficiency and compliance adherence, it supports their corporate debt recovery solutions for financial institutions in a competitive environment.

Equabli EQ Engine: Predictive Scoring for Enhanced Recovery

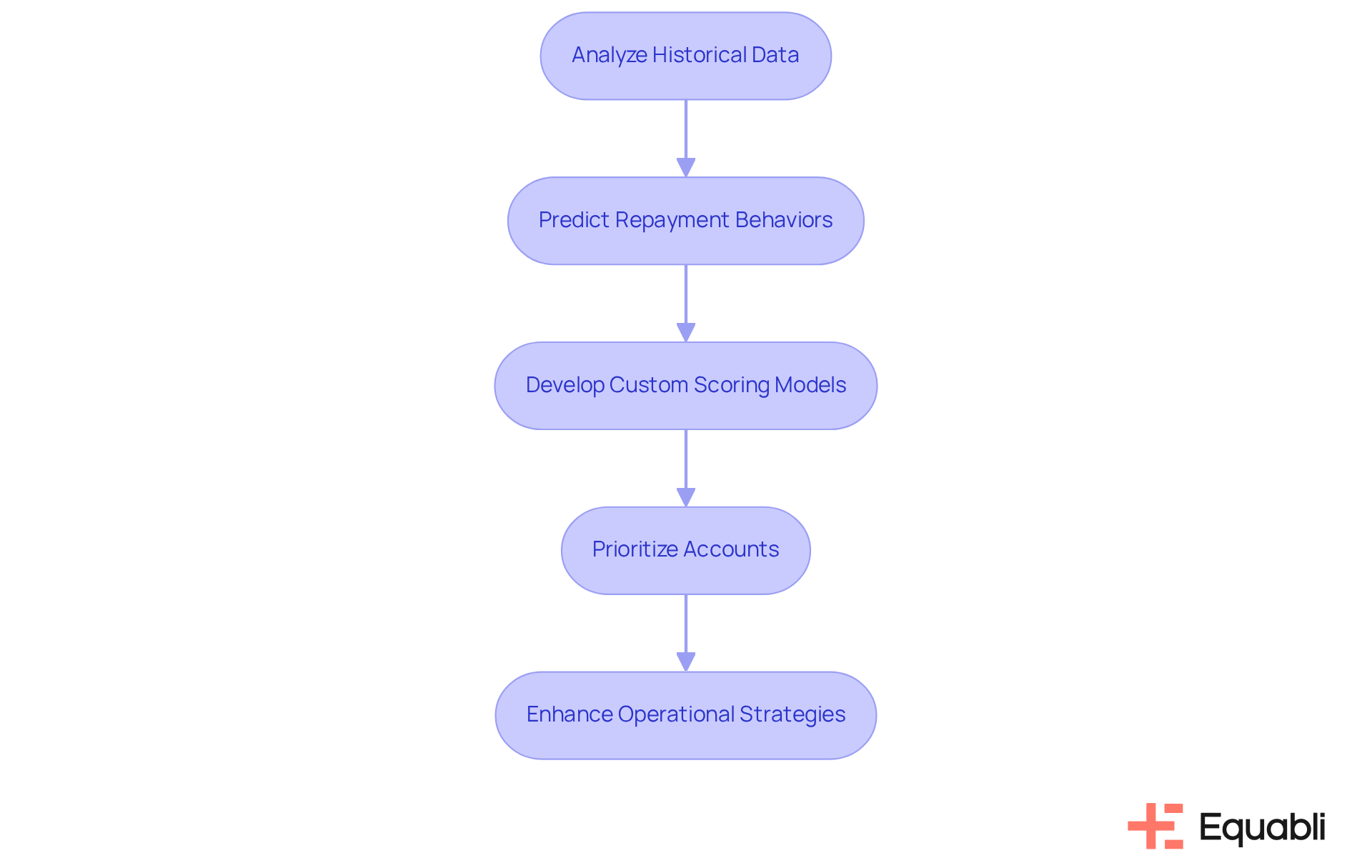

The EQ Engine exemplifies the critical role of advanced machine learning algorithms in the financial sector, enabling organizations to analyze historical data meticulously. This capability allows lenders to predict repayment behaviors with exceptional accuracy, thereby enhancing their operational strategies.

By developing custom scoring models, financial institutions can prioritize accounts based on their likelihood to repay, which significantly enhances corporate debt recovery solutions for financial institutions. Furthermore, this predictive scoring facilitates strategic resource allocation, ultimately lowering operational expenses and enhancing overall efficiency in the retrieval process.

The integration of such intelligent systems is increasingly recognized as essential for improving success rates and adapting to the evolving landscape of corporate debt recovery solutions for financial institutions.

Equabli EQ Engage: Boosting Borrower Engagement

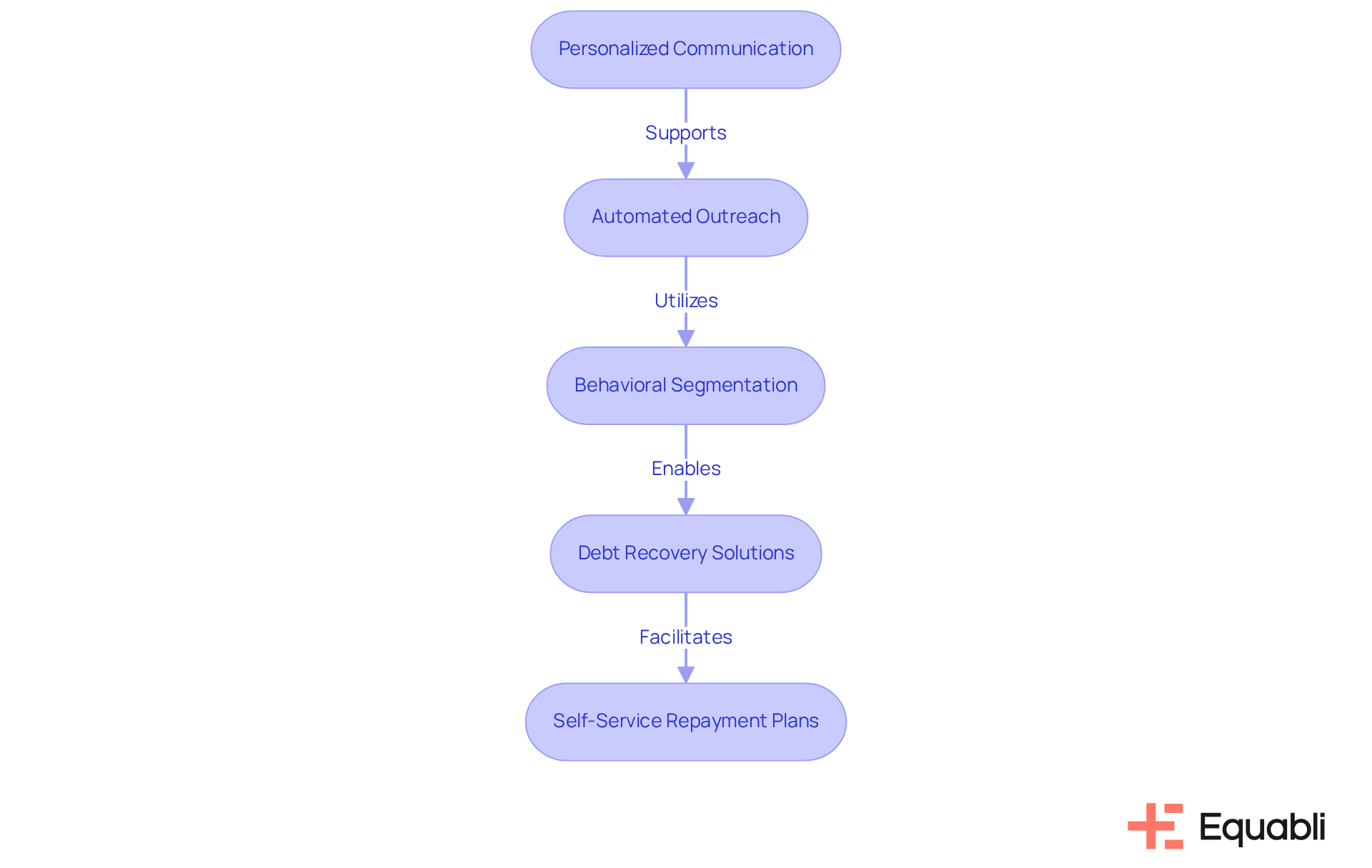

EQ Engage serves as a robust solution aimed at enhancing borrower engagement through personalized communication strategies. By automating outreach and utilizing preferred communication channels, lenders can create a more tailored experience for their borrowers. This platform enables the segmentation of borrowers based on their behaviors and preferences, allowing financial institutions to implement corporate debt recovery solutions for financial institutions that deliver timely and relevant messages promoting repayment while also cultivating customer loyalty.

Evidence shows that improved engagement through customized communication can significantly enhance recovery rates. As industry experts highlight, effective communication campaigns are essential for educating consumers about their obligations while ensuring compliance with servicing regulations. By focusing on personalized interactions, lenders can transform their recovery processes into collaborative partnerships with borrowers, ultimately leading to improved financial outcomes through corporate debt recovery solutions for financial institutions.

Furthermore, EQ Collect enhances these efforts with features such as automated workflows, real-time reporting, and compliance oversight, ensuring that lenders can manage their recoveries efficiently. Moreover, with 57% of recovery agencies utilizing AI for account segmentation and predictive analytics, technology is pivotal in facilitating these customized communication initiatives. EQ Engage also empowers borrowers to self-service with tailored repayment plans, ensuring that communication aligns with their preferences while maintaining regulatory compliance.

As TJ Mitchell notes, securing timely payments from consumers necessitates a strategic approach rooted in empathy, clarity, and convenience.

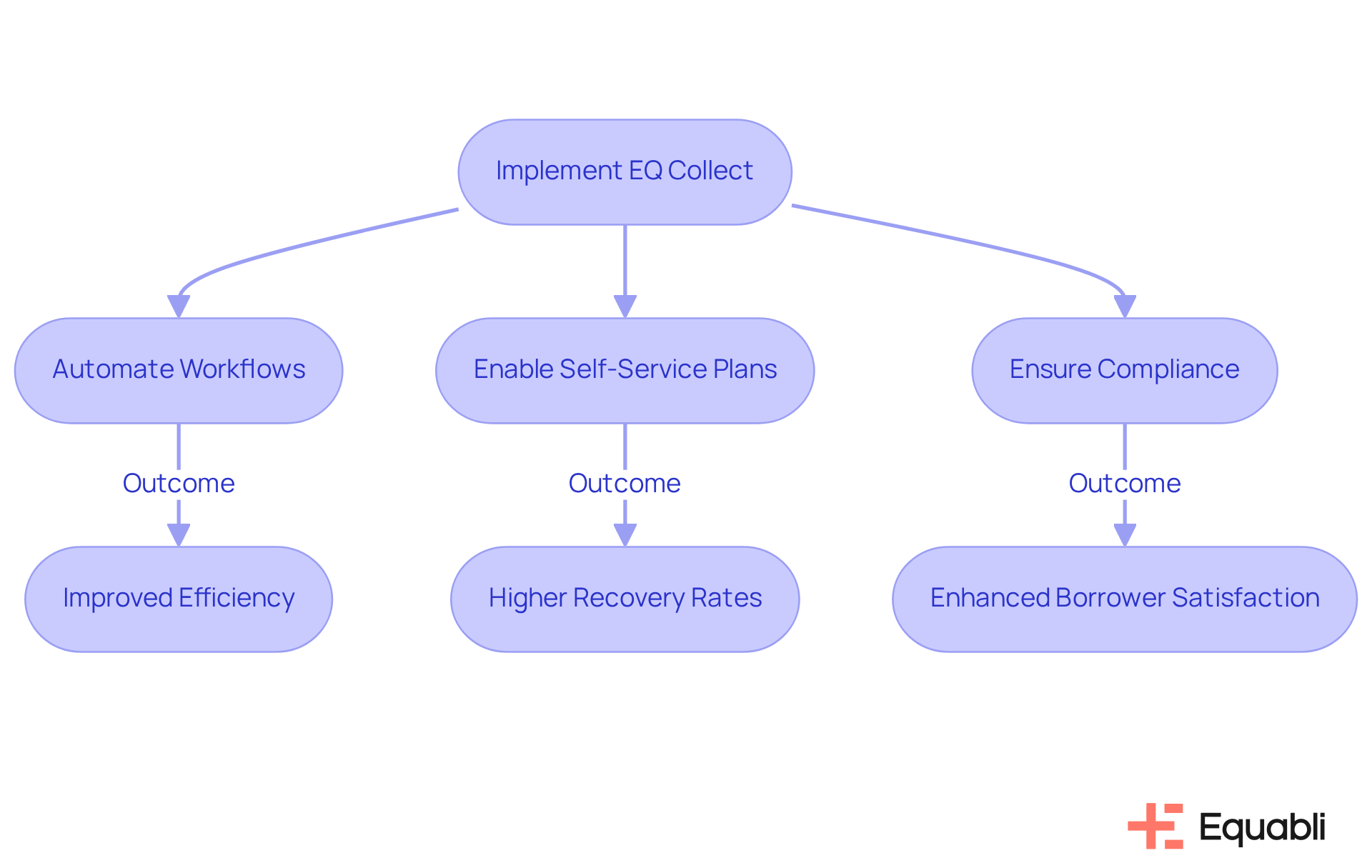

Equabli EQ Collect: Streamlined Digital Collections

EQ Collect transforms the debt recovery landscape by offering streamlined digital solutions that empower borrowers to manage their repayment plans independently. This innovative tool mitigates the friction typically associated with conventional retrieval techniques, thereby facilitating a more user-friendly experience.

By automating workflows, employing a no-code file-mapping tool, and ensuring compliance through automated monitoring, EQ Collect enhances operational efficiency while significantly improving borrower satisfaction. Financial organizations adopting this digital-first strategy can effectively meet the evolving demands of consumers, as evidenced by the statistic that 73% of clients in late delinquency made payments when contacted through digital channels.

The implementation of self-service repayment plans has proven to enhance recovery rates, positioning EQ Collect as an essential resource for organizations aiming to modernize their debt management strategies.

FICO Debt Manager: Efficient Debt Recovery Management

FICO Debt Manager serves as a pivotal corporate debt recovery solution for financial institutions that are seeking to enhance their debt recovery management. This tool integrates automated workflows that significantly streamline the collections process by facilitating timely follow-ups and consistent communication with customers. Its compliance management features empower institutions to navigate regulatory requirements effectively, thereby mitigating the risk of violations.

By leveraging predictive analytics, FICO Debt Manager identifies high-risk accounts, enabling organizations to prioritize their collection efforts with precision. This strategic focus on corporate debt recovery solutions for financial institutions not only improves recuperation rates but also lowers operational expenses, making it an indispensable resource in the competitive landscape of financial collection. Organizations employing FICO Debt Manager can anticipate a streamlined methodology that boosts both efficiency and compliance, ultimately driving improved financial outcomes.

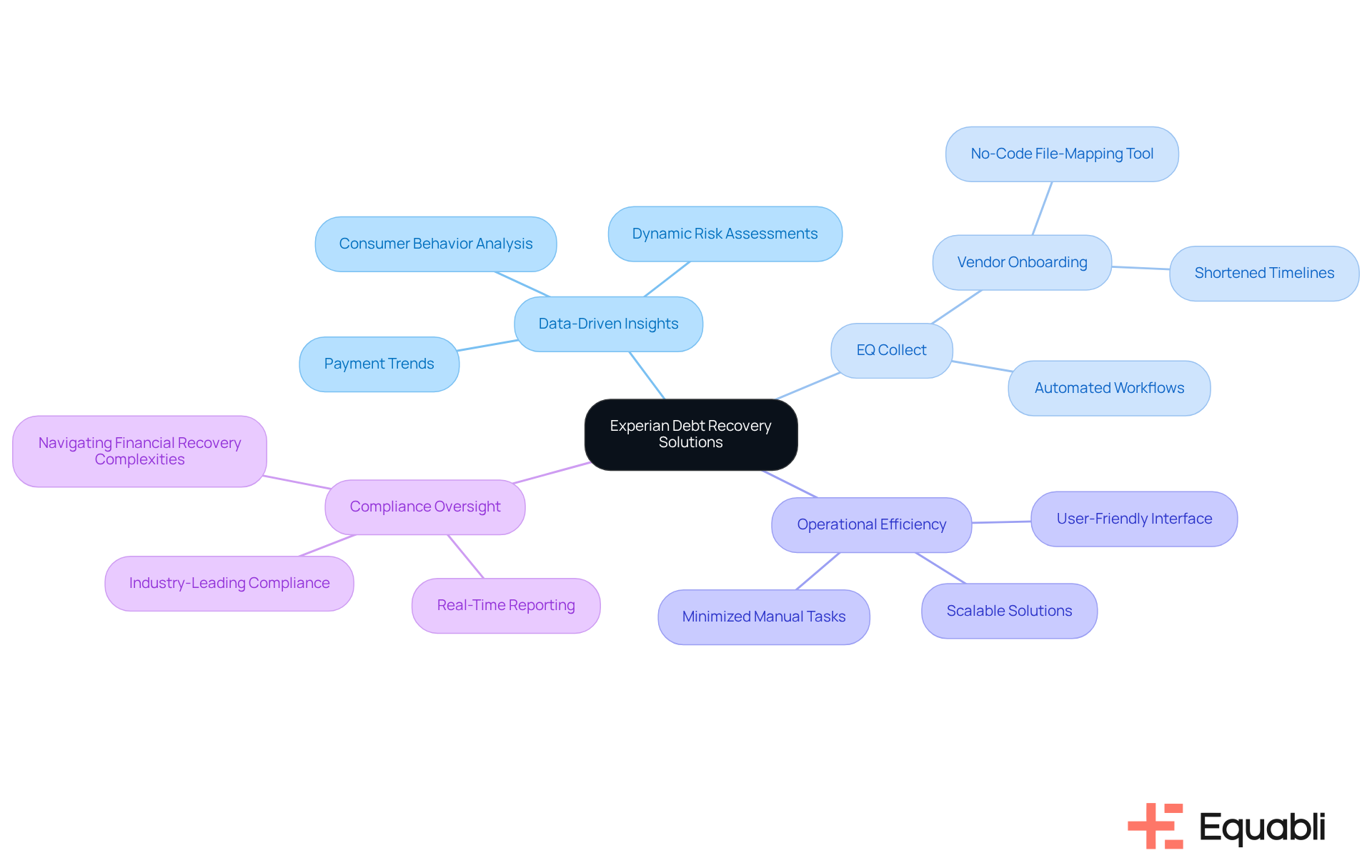

Experian Debt Recovery Solutions: Data-Driven Insights

Equabli provides a comprehensive suite of debt recovery solutions that leverage data-driven insights to refine collection strategies. By thoroughly examining consumer behavior and payment trends, Equabli enables financial organizations to identify the most effective strategies for engaging borrowers. This strategic approach allows organizations to prioritize accounts based on dynamic risk assessments and repayment likelihood, ensuring optimal resource allocation.

With EQ Collect, financial organizations can significantly shorten vendor onboarding timelines through a simple, no-code file-mapping tool. This enhancement in efficiency is complemented by data-driven strategies that reduce execution errors via automated workflows. Furthermore, the user-friendly, scalable, cloud-native interface of EQ Collect enhances operational efficiency, minimizes manual tasks, and improves the bottom line.

Access to real-time reporting and industry-leading compliance oversight further empowers financial institutions to navigate the complexities of financial recovery. By integrating these capabilities, organizations not only enhance their operational effectiveness but also strengthen their compliance frameworks, positioning themselves for sustainable success in the evolving landscape of debt recovery.

CollectAI: Automated Debt Collection Services

CollectAI leverages artificial intelligence to revolutionize collection services, automating critical tasks such as payment reminders and follow-ups. This automation enables collectors to concentrate on strategic initiatives, significantly enhancing operational efficiency. By ensuring timely and relevant communication, AI improves the overall customer experience, resulting in heightened engagement and satisfaction.

Financial institutions can enhance their loan collection processes by implementing AI, which will lead to improved corporate debt recovery solutions for financial institutions, resulting in increased collection rates and reduced operational expenses. Agencies adopting AI-driven solutions report a notable rise in liquidation results, with 56% utilizing self-service portals and a 9% increase in email and SMS engagement.

Equabli's EQ Collect further optimizes this landscape by:

- Shortening vendor onboarding timelines through a no-code file-mapping tool

- Enhancing efficiency via data-driven strategies

- Minimizing execution errors through automated workflows

With real-time reporting and robust compliance oversight, organizations can achieve smarter orchestration and enhanced performance in their recovery efforts. As the financial obligation management landscape evolves, the integration of AI and automation becomes imperative for organizations aiming to enhance their corporate debt recovery solutions for financial institutions and elevate their retrieval capabilities.

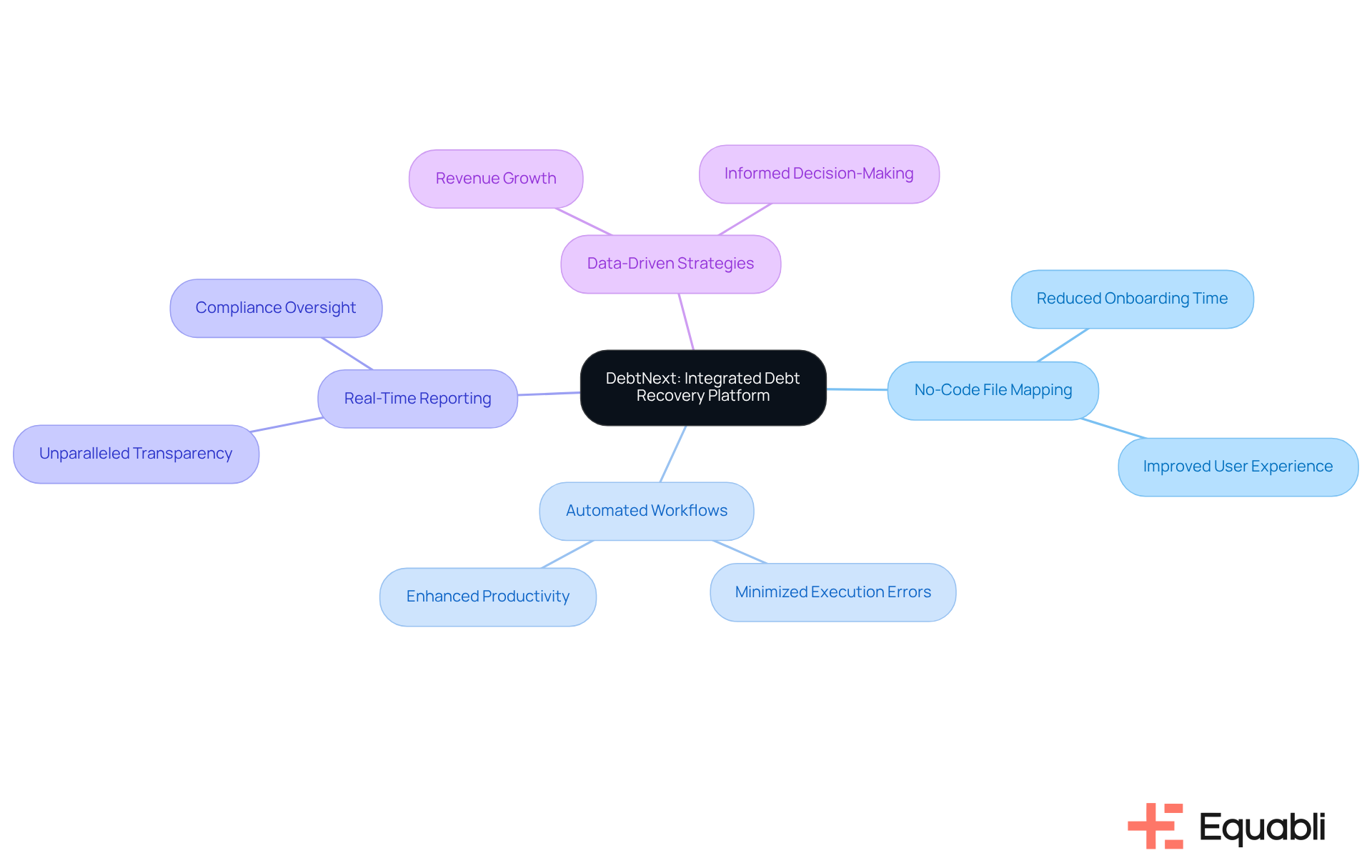

DebtNext: Integrated Debt Recovery Platform

EQ Collect serves as a robust resource for enhancing debt retrieval efficiency, offering corporate debt recovery solutions for financial institutions that streamline the debt recovery process. The platform's no-code file-mapping tool significantly reduces vendor onboarding timelines, thereby improving operational efficiency. Data-driven strategies not only enhance productivity but also drive revenue growth, while automated workflows minimize execution errors.

Furthermore, EQ Collect offers unparalleled transparency through real-time reporting, ensuring compliance oversight remains industry-leading with automated monitoring. By integrating these functionalities into a single, user-friendly interface, EQ Collect empowers financial institutions to optimize operations and make informed, data-driven decisions, enabling swift adaptation to evolving market dynamics.

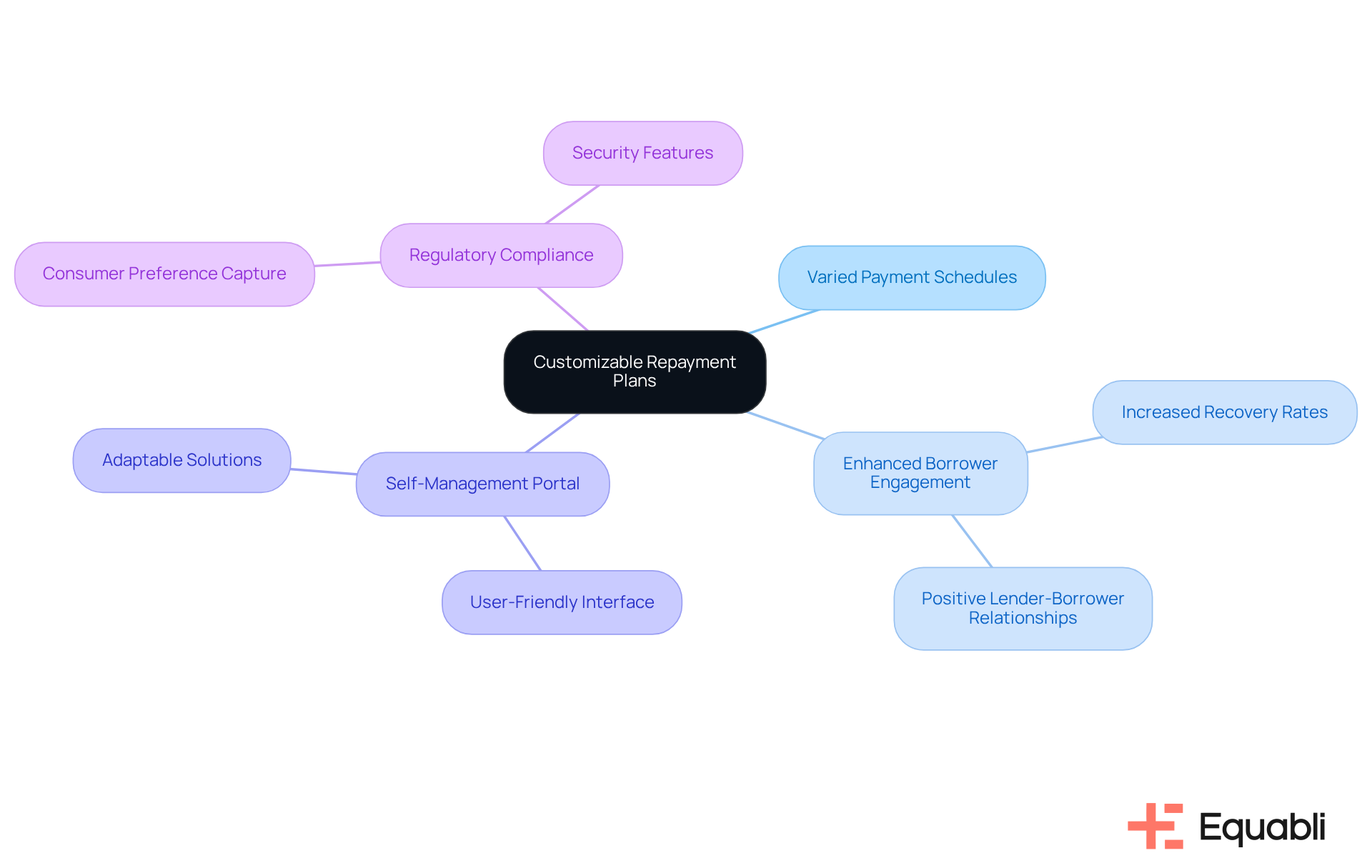

ZimpleMoney: Customizable Repayment Plans

Equabli provides customizable repayment plans via its EQ Engage platform, enabling lenders to tailor their collections strategies to meet the specific needs of individual borrowers. This flexibility is evidenced by options such as varied payment schedules and amounts, which enhance borrower engagement and subsequently increase the likelihood of repayment. Such a tailored approach not only improves recovery rates but also fosters positive relationships between lenders and borrowers.

Furthermore, EQ Engage empowers borrowers to self-manage their repayment plans through a user-friendly, white-labeled portal, ensuring that solutions are adaptable to diverse financial situations. The platform also captures consumer preferences and maintains regulatory compliance, both of which are critical for effective financial collection in today’s multifaceted lending landscape.

TrueAccord: Machine Learning for Optimized Recovery

TrueAccord leverages machine learning to refine debt recovery strategies through meticulous analysis of borrower behavior and prediction of repayment likelihood. This advanced technology empowers financial institutions to customize their communication and retrieval strategies based on individual debtor profiles. By utilizing data-driven insights, TrueAccord enhances the efficiency of recovery processes while ensuring compliance with regulatory standards.

The integration of machine learning not only improves recovery rates but also fosters a customer-centric approach, promoting positive debtor experiences that encourage timely payments. Automated communication tools, for example, analyze debtor responses to identify the optimal time and channel for engagement, resulting in increased successful payment rates. This strategic focus on borrower behavior analysis is essential for developing effective corporate debt recovery solutions for financial institutions, ultimately yielding improved outcomes for these organizations.

Additionally, Equabli's EQ Collect offers a suite of features designed to enhance collection efficiency. With a no-code file-mapping tool, financial organizations can streamline vendor onboarding timelines and boost operational efficiency. Automated workflows reduce execution errors and reliance on manual resources, while real-time reporting delivers unparalleled transparency and insights. The platform also guarantees industry-leading compliance oversight through automated monitoring, positioning it as an invaluable asset for institutions seeking corporate debt recovery solutions for financial institutions to optimize their debt recovery processes.

Conclusion

The landscape of corporate debt recovery is evolving rapidly, necessitating innovative solutions to enhance efficiency and borrower engagement. Financial institutions can leverage advanced platforms like the Equabli EQ Suite, which integrates predictive analytics, automated workflows, and personalized communication strategies to optimize debt recovery processes. By adopting these comprehensive tools, organizations can improve retrieval rates while fostering stronger relationships with their clients.

Key solutions such as EQ Engine's predictive scoring, EQ Engage's tailored communication, and the streamlined capabilities of EQ Collect are essential components in modernizing debt recovery efforts. These technologies empower institutions to make data-driven decisions, prioritize accounts effectively, and enhance borrower satisfaction, ultimately leading to improved financial outcomes. Furthermore, platforms like FICO Debt Manager, CollectAI, and TrueAccord illustrate the critical role of automation and machine learning in refining recovery strategies.

As the corporate debt recovery sector continues to advance, embracing these cutting-edge solutions is vital for financial institutions seeking to remain competitive. By prioritizing technology-driven approaches and focusing on borrower engagement, organizations can navigate the complexities of debt recovery and position themselves for sustainable success in a rapidly changing environment. The future of debt recovery is here; now is the time for financial institutions to harness these innovations for optimal results.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a comprehensive platform designed to provide corporate debt recovery solutions for financial institutions, featuring tools such as EQ Engine, EQ Engage, and EQ Collect to improve retrieval efficiency.

How does the EQ Suite improve debt recovery efficiency?

The EQ Suite enhances debt recovery efficiency by leveraging predictive analytics to anticipate borrower behaviors and employing personalized engagement strategies to strengthen client relationships. It also streamlines the repayment process through automated digital resources.

What are the key features of EQ Collect?

Key features of EQ Collect include a no-code file-mapping tool and automated workflows that reduce manual tasks, enhance operational efficiency, and ensure compliance with industry standards through automated monitoring.

Which sectors can benefit from the EQ Suite?

The EQ Suite is particularly beneficial for various sectors, including fintech, healthcare, and telecom, as it addresses their specific challenges in corporate debt recovery.

What is the market outlook for debt retrieval software?

The global debt retrieval software market is projected to grow by USD 2.31 billion from 2024 to 2028, positioning the EQ Suite as a valuable tool for financial organizations to capitalize on this trend.

What role does the EQ Engine play in debt recovery?

The EQ Engine uses advanced machine learning algorithms to analyze historical data, enabling lenders to predict repayment behaviors accurately and develop custom scoring models that prioritize accounts based on their likelihood to repay.

How does EQ Engage enhance borrower engagement?

EQ Engage enhances borrower engagement by automating outreach and utilizing preferred communication channels, allowing lenders to create personalized experiences and segment borrowers based on their behaviors and preferences.

What impact does improved borrower engagement have on recovery rates?

Improved engagement through customized communication has been shown to significantly enhance recovery rates by educating consumers about their obligations and fostering collaborative partnerships between lenders and borrowers.

What additional features does EQ Collect provide to support recovery efforts?

EQ Collect supports recovery efforts with features such as automated workflows, real-time reporting, and compliance oversight, enabling lenders to manage recoveries efficiently.

How does technology play a role in customized communication initiatives?

Technology is pivotal in facilitating customized communication initiatives, with 57% of recovery agencies utilizing AI for account segmentation and predictive analytics to enhance engagement strategies.