Overview

The article primarily addresses the critical strategies for optimizing credit recovery within financial institutions. It details a range of methodologies, including:

- Predictive analytics

- Automated collection techniques

- Tailored communication strategies

These tools are essential for enhancing operational efficiency, improving recovery rates, and ensuring adherence to regulatory standards. Consequently, they play a pivotal role in maximizing the overall performance of financial institutions in managing delinquent accounts.

Introduction

In an increasingly competitive financial landscape, institutions confront the urgent challenge of optimizing credit recovery strategies to enhance their bottom line. The integration of innovative tools and methodologies has the potential to significantly elevate recovery rates while ensuring compliance and operational efficiency. Financial organizations must navigate the complexities of debt collection effectively, all while preserving strong borrower relationships and maximizing resource allocation. This article delineates ten essential strategies that empower institutions to streamline their credit recovery processes and adapt to the evolving market demands.

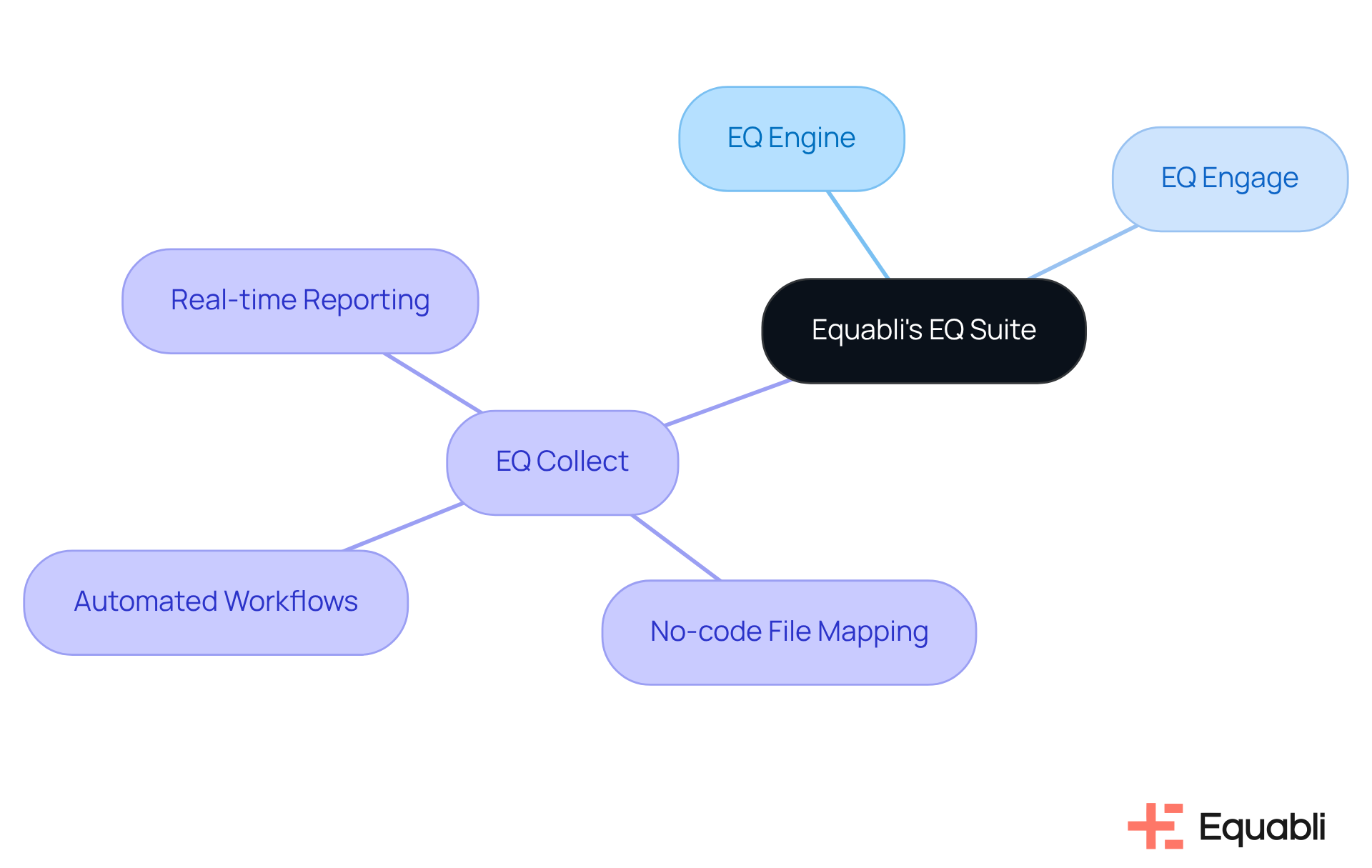

Equabli's EQ Suite: Comprehensive Tools for Credit Recovery Optimization

Equabli's EQ Suite provides a comprehensive set of tools aimed at implementing credit recovery optimization strategies for financial institutions. This suite features innovative solutions, including EQ Engine, EQ Engage, and EQ Collect, each tailored to improve efficiency and effectiveness in managing delinquent accounts.

For instance, EQ Collect allows institutions to minimize manual tasks and bolster their bottom line through key functionalities such as:

- A no-code file-mapping tool that streamlines vendor onboarding

- Automated workflows that reduce execution errors

- Real-time reporting that delivers unparalleled transparency and insights

By leveraging cloud-based technology, the EQ Suite enables lenders and agencies to adopt credit recovery optimization strategies for financial institutions that address their specific operational needs, ultimately maximizing recovery rates while minimizing costs.

Furthermore, Equabli is committed to protecting client information, ensuring compliance supervision, and maintaining the highest standards of data utilization within the consumer services sector.

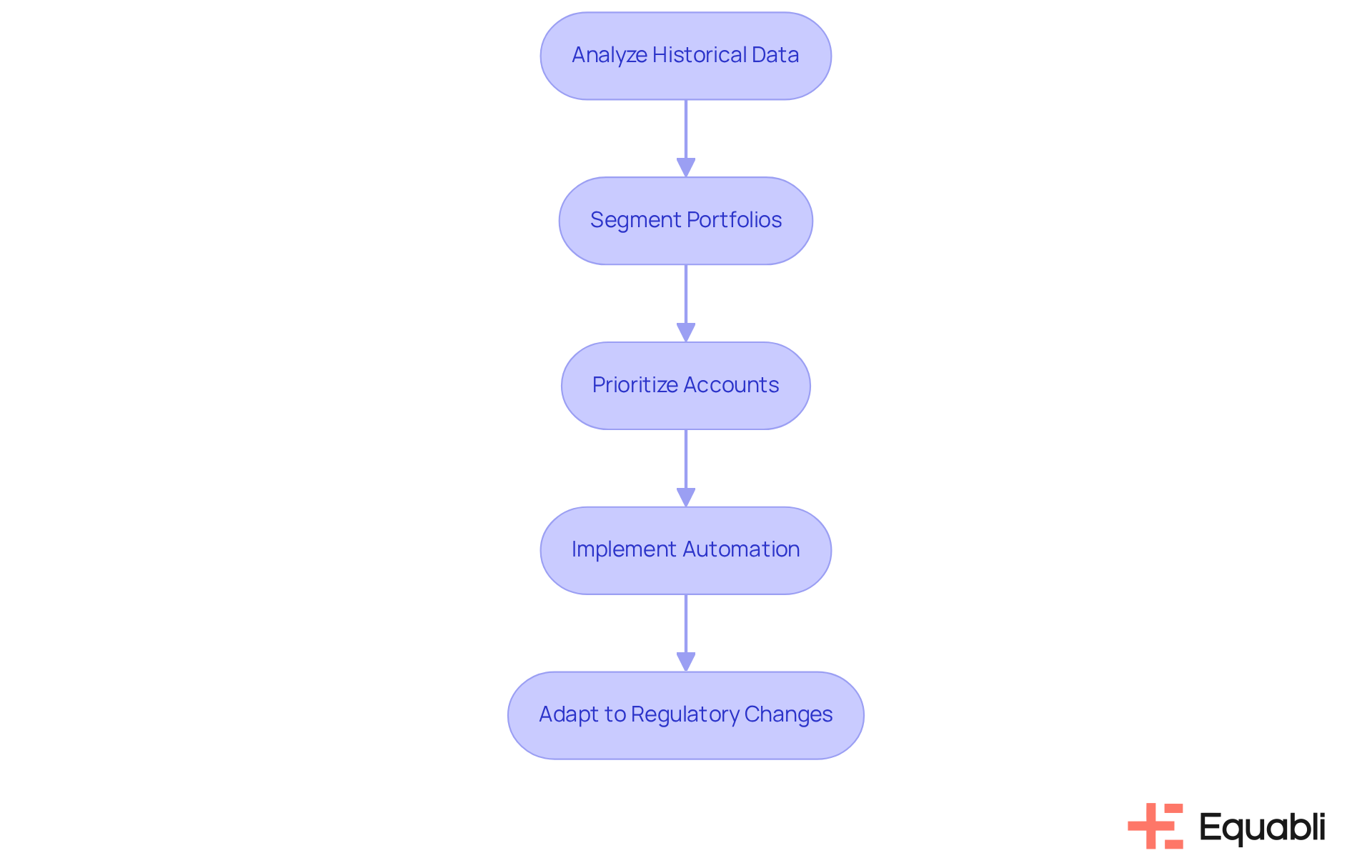

EQ Engine: Leverage Predictive Analytics for Enhanced Collection Strategies

The EQ Engine effectively harnesses predictive analytics to assess borrower behavior and forecast repayment likelihood. By meticulously analyzing historical data, organizations can segment their portfolios, prioritizing collection efforts on accounts with the highest recovery potential. This data-driven strategy enhances collection efficiency while significantly lowering operational costs by directing resources toward the most promising accounts. Notably, automation in debt collection can reduce operational costs by up to 30%.

As organizations increasingly adopt these advanced analytics, they position themselves to enhance their overall collection strategies, including credit recovery optimization strategies for financial institutions, and achieve better economic outcomes.

As Jack Mahoney, Chief Analytics Officer at National Credit Adjusters, states, 'Predictive analytics has emerged as a cornerstone of credit recovery optimization strategies for financial institutions in modern debt collection.'

Furthermore, in light of the evolving regulatory environment, monetary organizations must adapt their collection approaches to remain compliant while improving their operations.

EQ Engage: Boost Borrower Engagement for Better Payment Recovery

EQ Engage is designed to enhance client engagement through personalized communication strategies and intelligent outreach. By utilizing data-informed insights, financial institutions can tailor their outreach to align with the distinct preferences of individual clients. This customized strategy fosters a positive connection between lenders and clients, significantly increasing the probability of timely payments.

Research indicates that personalized communication can yield a 25% increase in recovery rates, emphasizing its critical role in credit recovery optimization strategies for financial institutions and enhancing overall payment recovery outcomes. Furthermore, EQ Engage supports self-service repayment options, enabling individuals to manage their repayment plans effectively.

By addressing the specific requirements and situations of borrowers while ensuring regulatory compliance, EQ Engage cultivates a supportive atmosphere that encourages repayment, ultimately enhancing economic performance for organizations through the implementation of credit recovery optimization strategies for financial institutions.

Moreover, the role of Client Success Representatives at Equabli is pivotal in enhancing client interaction and promoting product adoption, ensuring that organizations maximize the advantages of EQ Engage in their debt collection strategies.

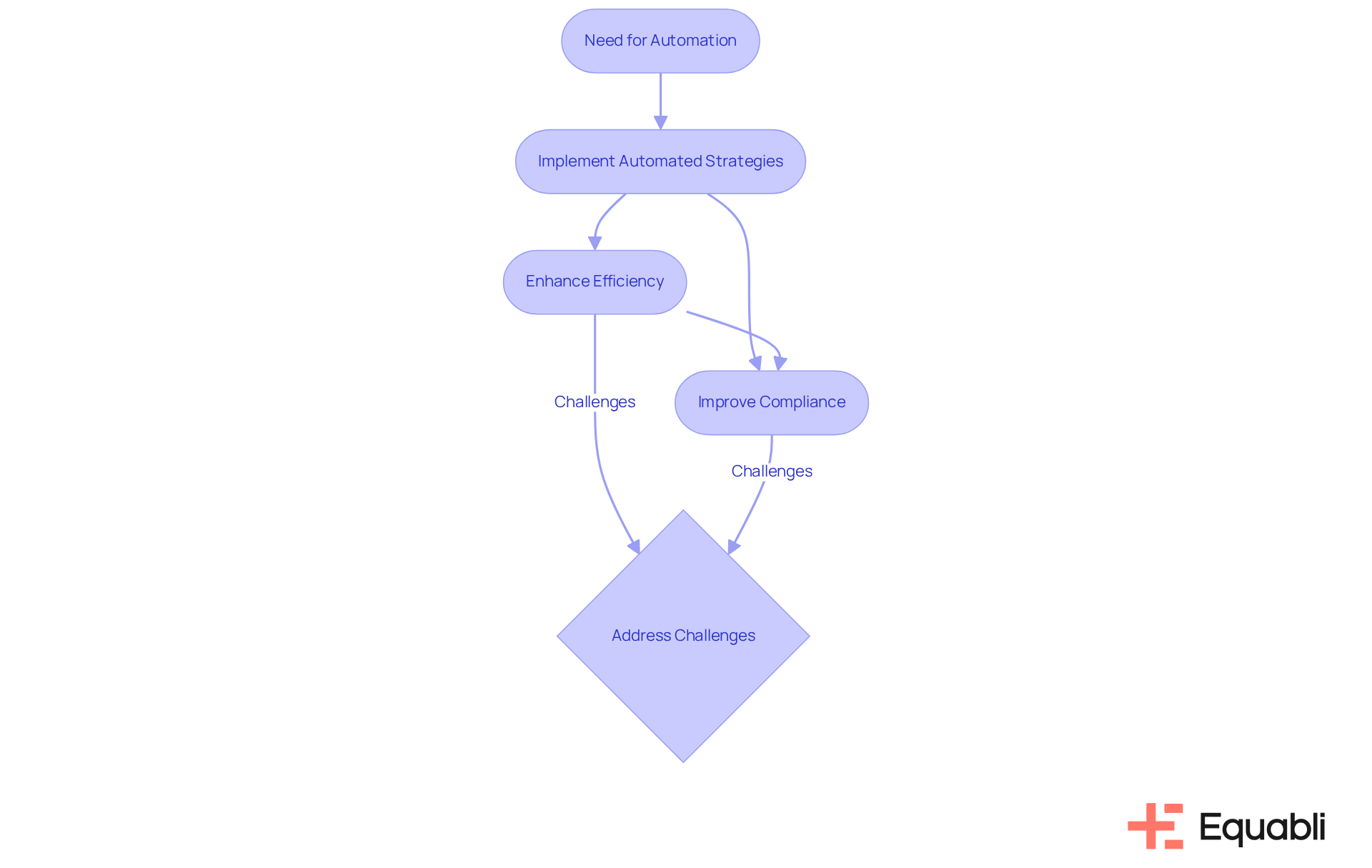

Automated Collection Strategies: Enhance Efficiency and Compliance

Automated collection strategies are indispensable for implementing credit recovery optimization strategies for financial institutions, enhancing operational efficiency and ensuring compliance with regulatory standards. By automating routine tasks such as payment reminders and follow-ups, financial institutions can significantly mitigate manual errors and utilize credit recovery optimization strategies for financial institutions to allocate resources more effectively to complex collection efforts. This transition not only improves collection efficiency but also supports adherence to evolving regulations.

For instance, agencies utilizing AI-powered omnichannel platforms have reported contact rate enhancements of up to 30%, showcasing the tangible benefits of automation. Furthermore, automated reminders have proven to elevate payment collection rates by ensuring timely communication with debtors, thereby reducing the likelihood of missed payments.

Compliance experts, including Manny Plasencia from TransUnion, assert that automation has transitioned from being an option to a necessity for agencies aiming to maintain a competitive edge, as it streamlines processes and bolsters regulatory compliance. However, organizations must also confront challenges such as ensuring data integrity prior to implementing AI solutions.

As the industry landscape evolves, organizations that adopt credit recovery optimization strategies for financial institutions will be better equipped to navigate the complexities of debt recovery while cultivating positive customer relationships.

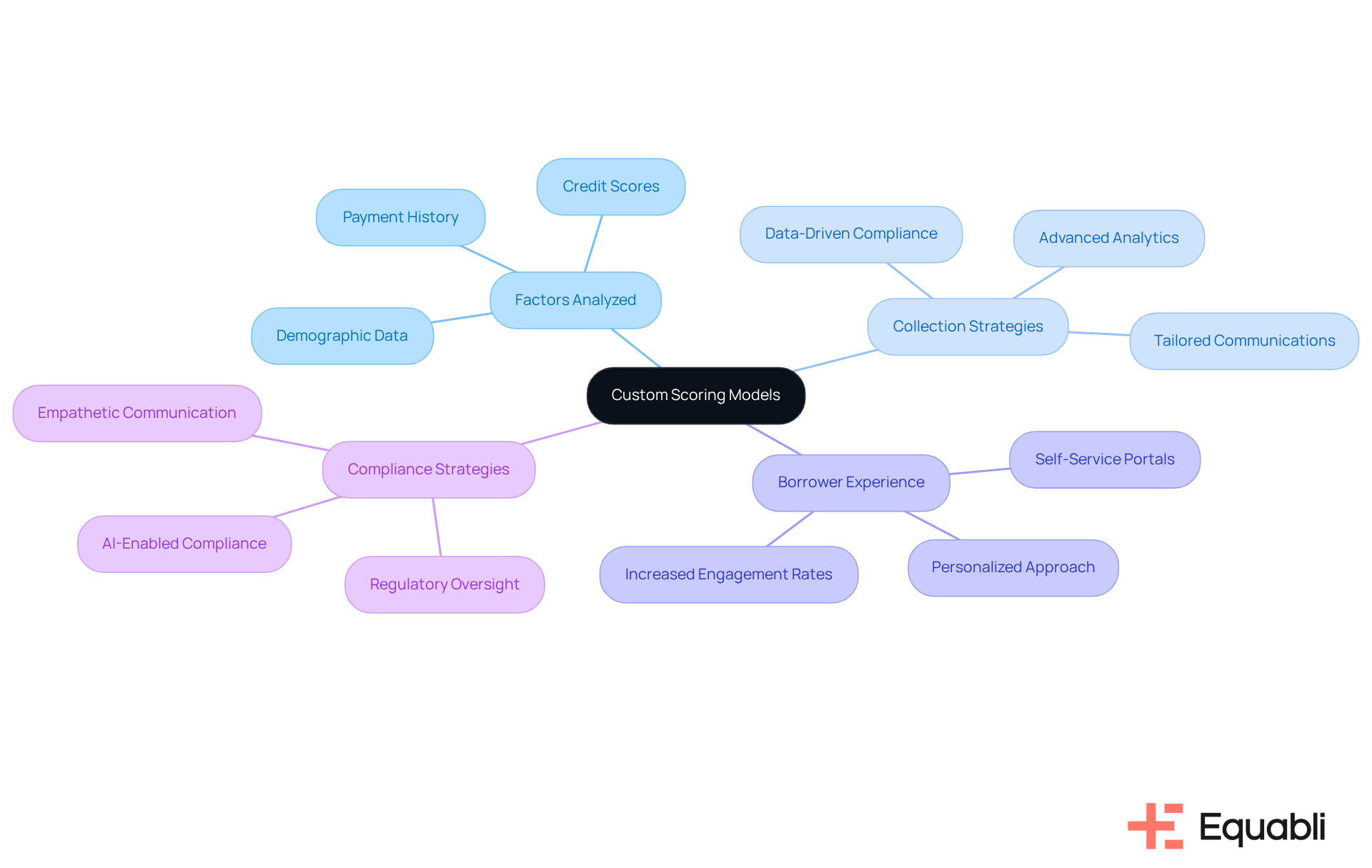

Custom Scoring Models: Tailor Collection Approaches to Borrower Behavior

Custom scoring models empower financial institutions to utilize credit recovery optimization strategies for financial institutions by aligning their collection strategies with the behaviors of individual loan recipients. By analyzing critical factors such as payment history, credit scores, and demographic data, lenders can develop credit recovery optimization strategies for financial institutions that effectively resonate with various client segments. This personalized approach not only increases the likelihood of successful collections but also significantly enhances the borrower experience.

Agencies that have implemented data-driven compliance strategies, for instance, report improved engagement rates, as they can tailor their communications to align with the preferences of diverse demographics. Furthermore, the integration of advanced analytics has shown a marked increase in recovery rates, demonstrating the effectiveness of credit recovery optimization strategies for financial institutions, with some organizations experiencing enhancements in collection results of up to 20%.

As the debt collection landscape evolves, leveraging these insights will be crucial for organizations aiming to navigate rising consumer debt levels and dynamic economic conditions effectively.

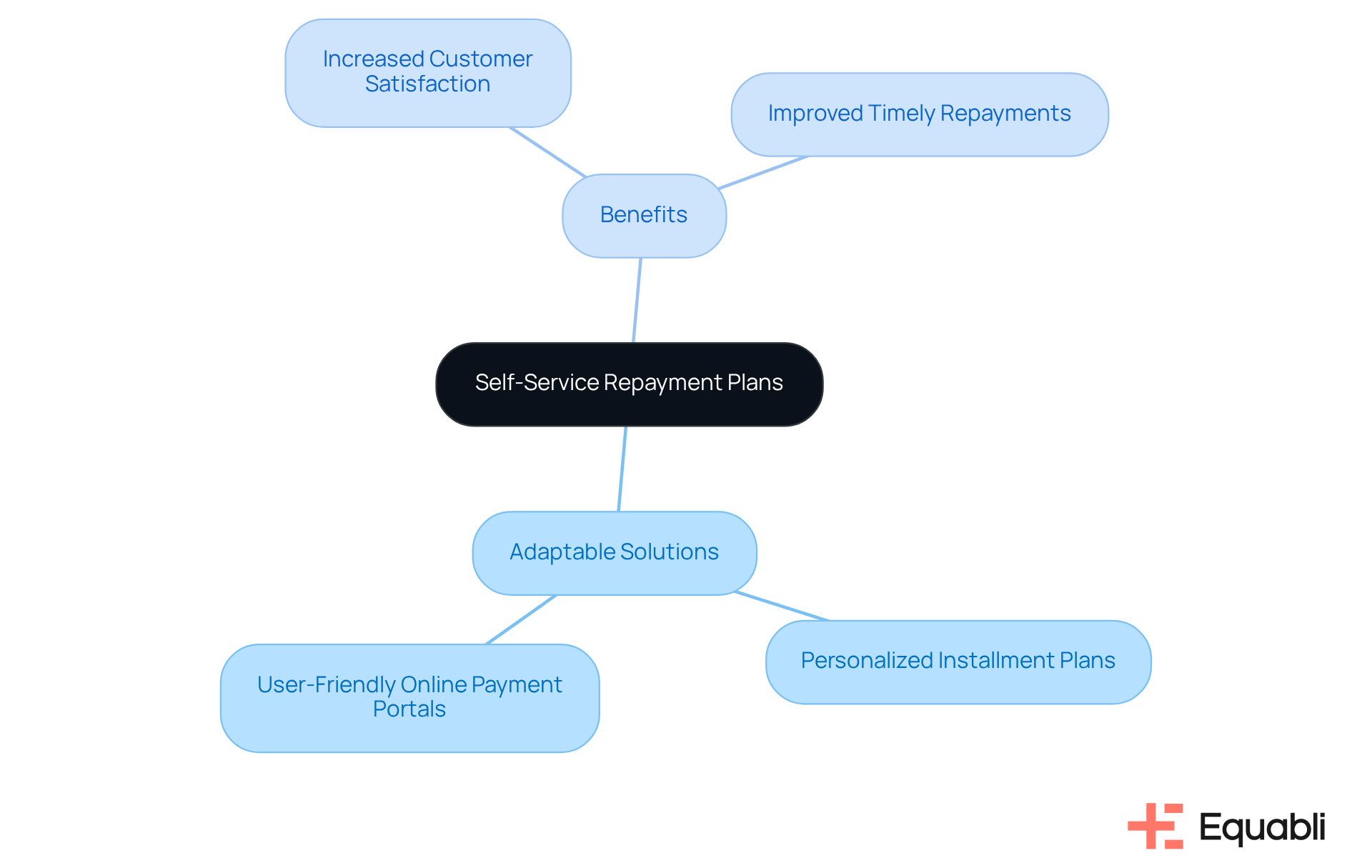

Self-Service Repayment Plans: Empower Borrowers to Pay on Their Terms

Self-service repayment plans are crucial for empowering individuals to manage their payments effectively. Evidence indicates that with EQ Engage, organizations can offer adaptable solutions such as:

- Personalized installment plans

- User-friendly online payment portals

This approach not only enhances customer satisfaction but also significantly increases the likelihood of timely repayments. By fostering customized communication pathways and tailored repayment options, financial organizations can enhance their credit recovery optimization strategies for financial institutions to improve recovery rates while instilling a sense of control and accountability among loan recipients.

Navigating the complexities of enterprise-level debt collection and compliance requires the implementation of credit recovery optimization strategies for financial institutions.

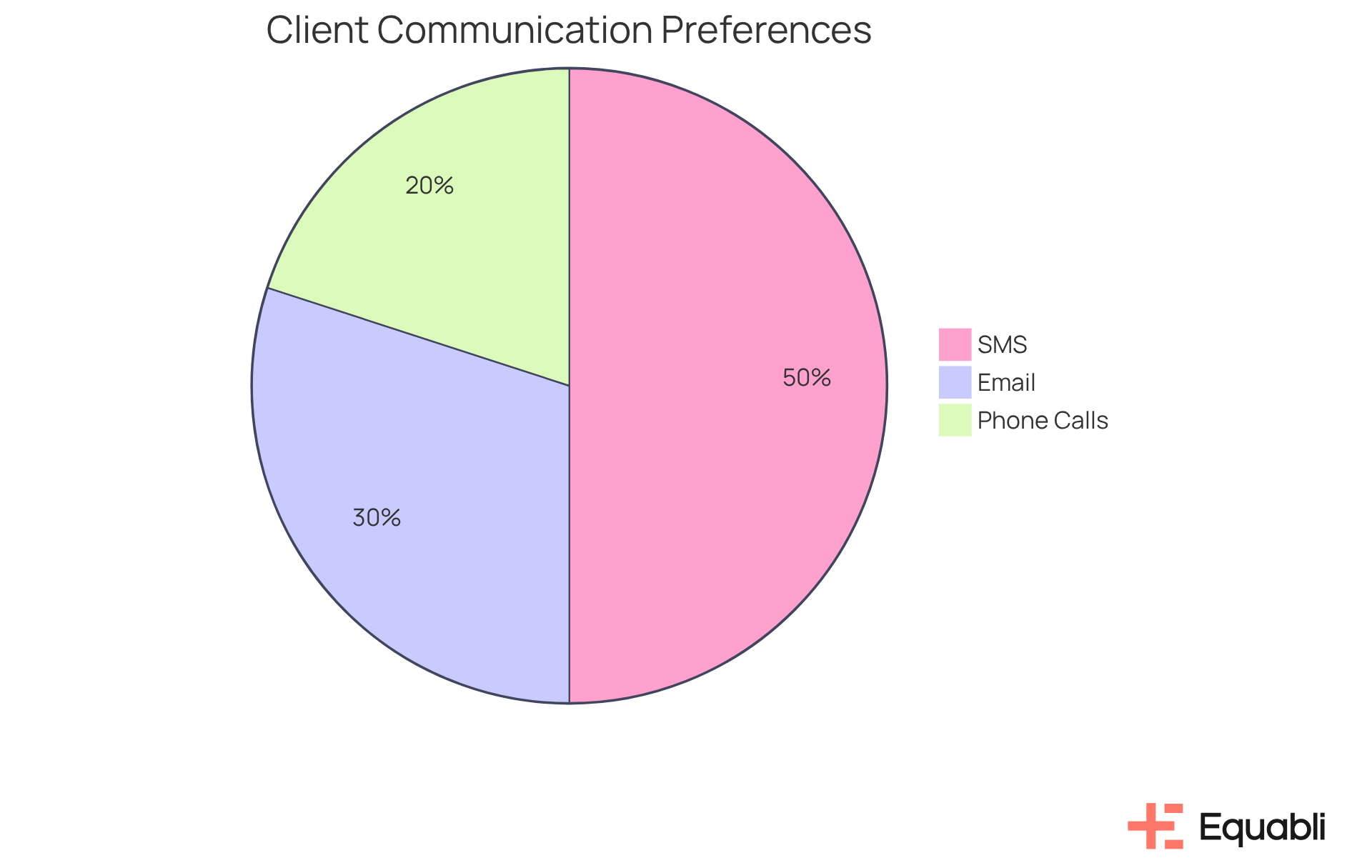

Preferred Communication Channels: Enhance Engagement for Better Recovery

Effective utilization of preferred communication channels is essential for enhancing participant engagement within financial institutions. Identifying and adopting the channels that resonate most with clients—be it email, SMS, or phone calls—can significantly elevate response rates. Evidence shows that personalized communication strategies tailored to client preferences foster stronger relationships and encourage more positive interactions. For instance, targeted messaging has been demonstrated to increase click-through rates by 41%, underscoring its effectiveness. Moreover, with 82% of text messages being read within five minutes, SMS stands out as a particularly effective channel for timely engagement.

To further bolster engagement, lending organizations should routinely assess client preferences regarding communication methods. Leveraging EQ Engage's capabilities, such as designing, automating, and implementing borrower contact strategies, can craft personalized communication paths while enabling borrowers with self-service repayment options. This strategic approach not only enhances credit recovery optimization strategies for financial institutions but also aligns with broader operational goals. Ultimately, understanding and applying these communication preferences can lead to improved outcomes for financial organizations, positioning them as leaders in enterprise-level debt collection and risk management.

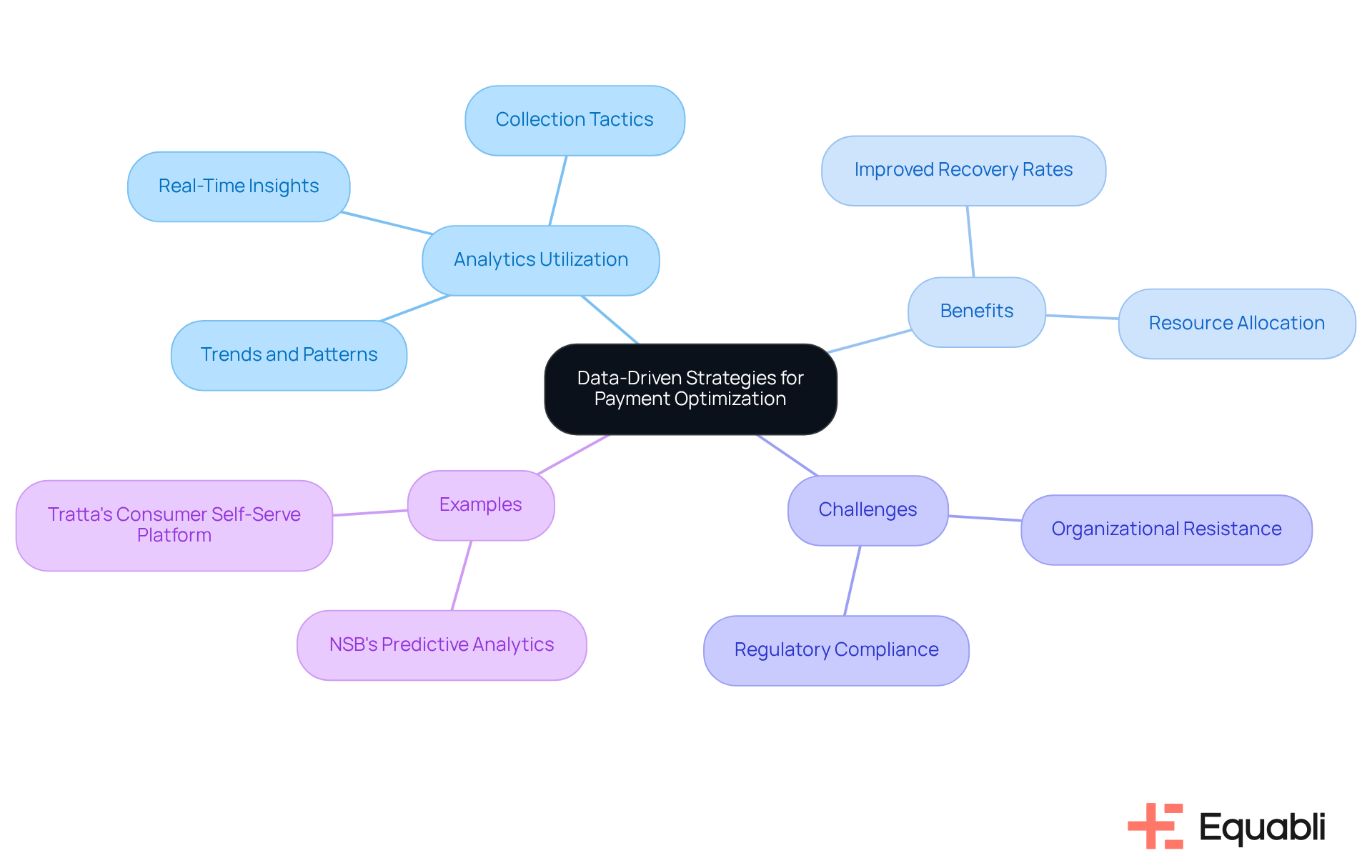

Data-Driven Strategies: Leverage Analytics for Payment Optimization

Data-driven strategies utilize analytics to enhance the effectiveness of credit recovery optimization strategies for financial institutions. By analyzing trends and patterns in borrower behavior, financial institutions can identify credit recovery optimization strategies for financial institutions and adjust their collection tactics accordingly. This analytical approach not only improves recovery rates but also incorporates credit recovery optimization strategies for financial institutions, enabling lenders to allocate resources more efficiently and maximize their overall impact.

For example, organizations like NSB have effectively utilized predictive analytics to prioritize high-risk cases, resulting in a significant increase in recovery rates. Moreover, real-time insights facilitate immediate adjustments in collection strategies, which are essential for implementing credit recovery optimization strategies for financial institutions, ensuring that lenders remain agile in response to shifting consumer behaviors.

However, the implementation of data-driven strategies may encounter obstacles, such as organizational resistance to change and the necessity for compliance with regulations like GDPR and CCPA. By focusing on high-return accounts and employing tailored communication methods, institutions can boost engagement and expedite debt settlements.

The integration of data analytics into debt collection processes is not merely a trend; it is vital for financial institutions to adopt credit recovery optimization strategies for financial institutions in an increasingly dynamic financial landscape.

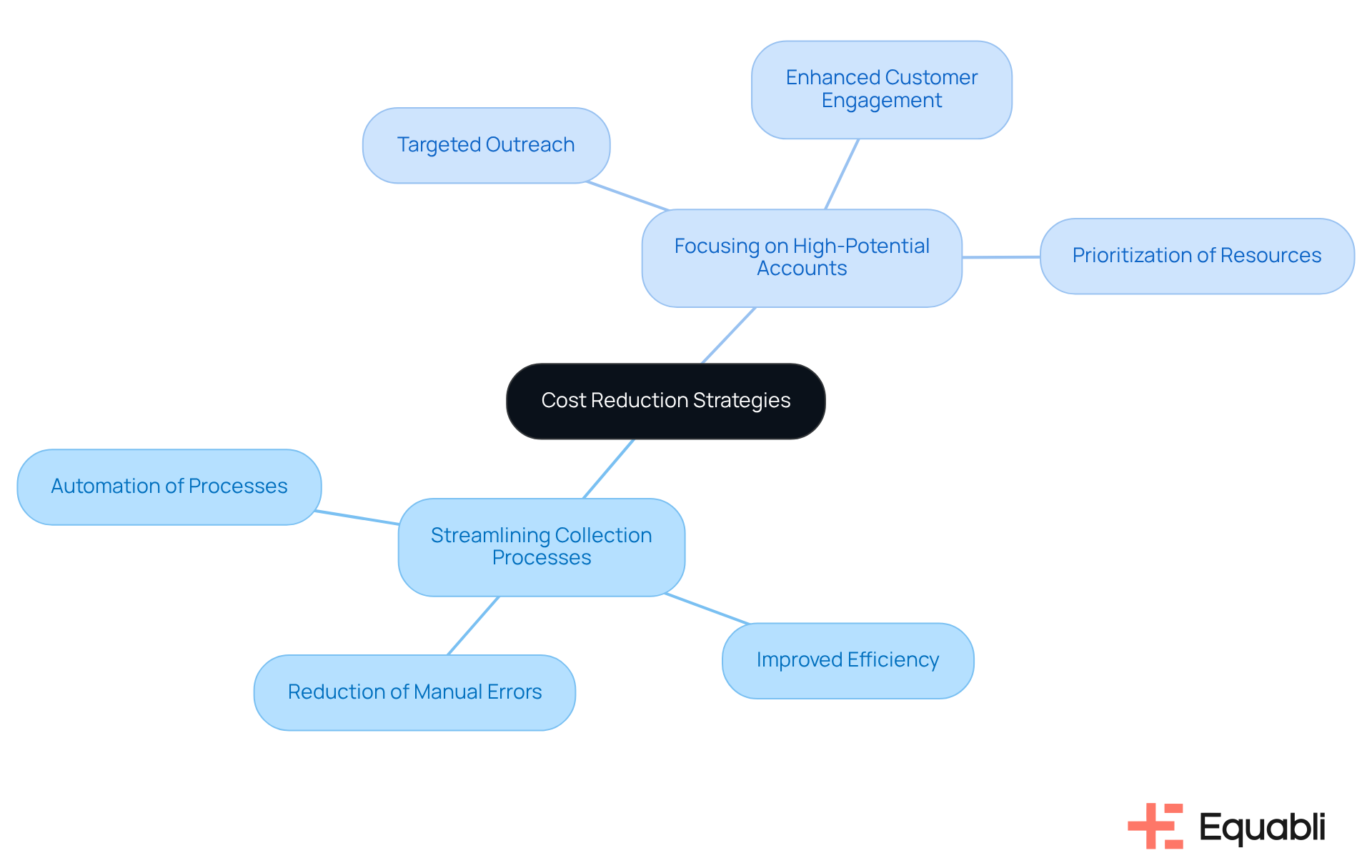

Cost Reduction Strategies: Maximize Recovery While Minimizing Expenses

Implementing cost reduction strategies is critical for maximizing returns and minimizing expenses within financial institutions. By utilizing credit recovery optimization strategies for financial institutions, such as:

- Streamlining collection processes

- Focusing on high-potential accounts through automation

organizations can significantly enhance their operational efficiency. Evidence suggests that reducing overhead costs directly correlates with improved recovery outcomes, thereby strengthening the bottom line. This strategic approach not only addresses immediate financial concerns but also employs credit recovery optimization strategies for financial institutions, enabling lenders to navigate the complexities of the debt collection landscape effectively.

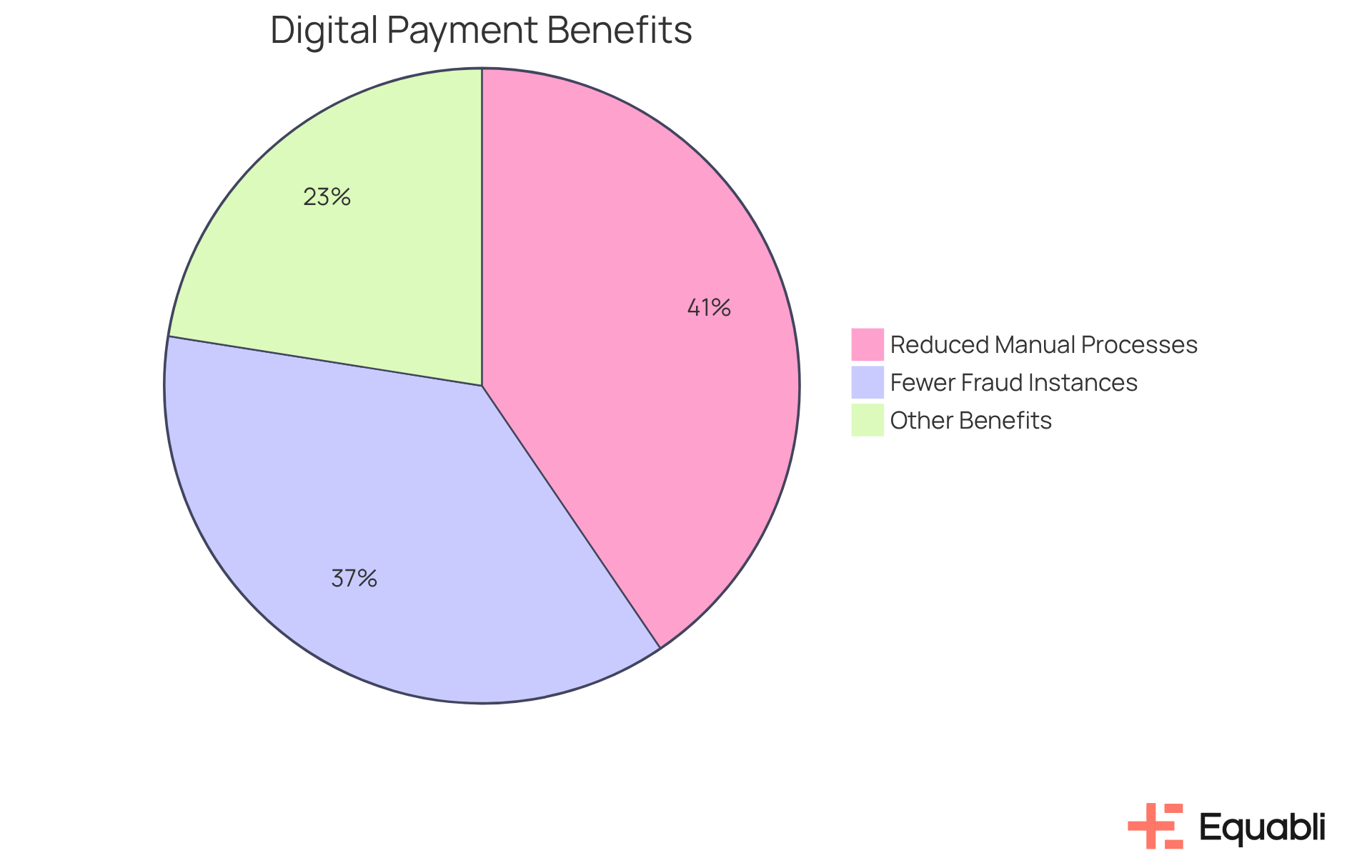

Digital Payment Solutions: Increase Flexibility for Borrowers

Digital payment solutions enhance flexibility in managing repayments for individuals. Evidence shows that options like mobile payments, online portals, and automated payment reminders allow financial institutions to effectively meet the diverse needs of their clients. This adaptability not only boosts borrower satisfaction but also increases the likelihood of timely payments.

Organizations that have embraced digital payment methods report a notable improvement in collection rates, with:

- 81% citing reduced manual processes

- 74% experiencing fewer instances of fraud and errors

As mobile payment adoption continues to rise—98% of Americans now own a mobile phone—integrating these solutions becomes essential for implementing credit recovery optimization strategies for financial institutions.

Conclusion

Implementing effective credit recovery optimization strategies is essential for financial institutions aiming to enhance operational efficiency and maximize recovery rates. Advanced tools and technologies, such as Equabli's EQ Suite, provide tailored solutions designed to meet the unique needs of lenders and agencies. By adopting these strategies, organizations can significantly improve their collection processes, ensuring compliance while fostering positive relationships with borrowers.

Key arguments highlight:

- The effective use of predictive analytics to assess borrower behavior

- The importance of personalized communication to boost engagement

- The necessity of automated collection strategies to streamline operations

Custom scoring models and self-service repayment options empower borrowers, ultimately leading to improved recovery outcomes. Furthermore, the integration of digital payment solutions enhances flexibility, allowing institutions to cater to the diverse needs of their clients.

As the financial landscape evolves, institutions must embrace these credit recovery optimization strategies to remain competitive. Prioritizing data-driven approaches and fostering meaningful borrower interactions enables organizations to navigate the complexities of debt recovery effectively. The path forward involves not only adopting innovative tools but also committing to continuous improvement and responsiveness to changing consumer behaviors, ensuring sustainable success in credit recovery efforts.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a comprehensive set of tools designed for credit recovery optimization strategies in financial institutions, featuring solutions like EQ Engine, EQ Engage, and EQ Collect to improve efficiency in managing delinquent accounts.

What functionalities does EQ Collect offer?

EQ Collect includes a no-code file-mapping tool for vendor onboarding, automated workflows to reduce execution errors, and real-time reporting for enhanced transparency and insights.

How does the EQ Suite help financial institutions?

The EQ Suite leverages cloud-based technology to enable lenders and agencies to adopt tailored credit recovery optimization strategies, maximizing recovery rates while minimizing costs.

What is the purpose of the EQ Engine?

The EQ Engine utilizes predictive analytics to assess borrower behavior and forecast repayment likelihood, allowing organizations to prioritize collection efforts on accounts with the highest recovery potential.

How can predictive analytics impact operational costs in debt collection?

Automation in debt collection, facilitated by predictive analytics, can reduce operational costs by up to 30% by directing resources toward the most promising accounts.

What role does EQ Engage play in credit recovery?

EQ Engage enhances borrower engagement through personalized communication strategies and intelligent outreach, increasing the likelihood of timely payments and supporting self-service repayment options.

What are the benefits of personalized communication in debt collection?

Personalized communication can lead to a 25% increase in recovery rates, highlighting its importance in credit recovery optimization strategies for financial institutions.

How does EQ Engage ensure compliance while improving repayment outcomes?

EQ Engage addresses borrowers' specific needs and situations while maintaining regulatory compliance, creating a supportive environment that encourages repayment.

What is the role of Client Success Representatives at Equabli?

Client Success Representatives enhance client interaction and promote product adoption, helping organizations maximize the benefits of EQ Engage in their debt collection strategies.