Overview

This article provides an authoritative overview of effective payment reminder text message templates tailored for financial institutions. It underscores the critical role of customization and automation in enhancing communication strategies within the debt collection landscape. By leveraging Equabli's EQ Suite, organizations can create tailored notifications that significantly improve borrower engagement and ensure compliance with regulatory standards.

The integration of these tools not only streamlines communication but also leads to more favorable debt collection outcomes. As financial institutions navigate the complexities of compliance and operational efficiency, adopting such innovative solutions becomes imperative. This strategic approach not only addresses immediate operational challenges but also positions organizations for long-term success in debt recovery.

Introduction

In the dynamic landscape of finance, effective communication is pivotal in shaping a financial institution's relationship with its clients. The increasing prevalence of digital interactions underscores the necessity for timely and personalized payment reminders via SMS, which are essential for enhancing collection rates and fostering borrower engagement. This article presents ten customizable payment reminder text message templates tailored specifically for financial institutions, equipping organizations with the tools to refine their communication strategies.

How can these templates not only streamline operations but also redefine the way institutions engage with their clients, ultimately driving improved financial outcomes?

Equabli's EQ Suite: Customizable Payment Reminder Solutions

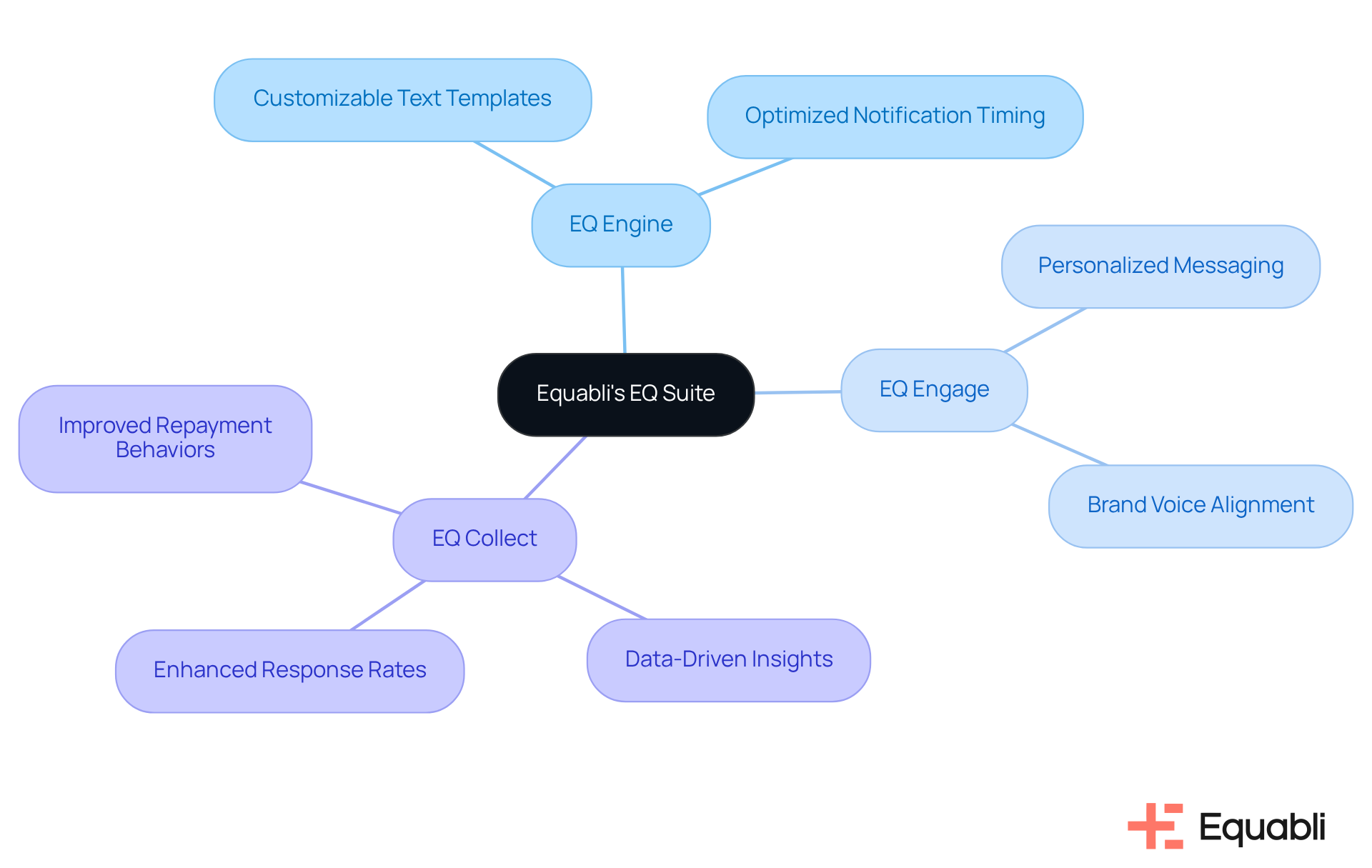

Equabli's EQ Suite provides financial entities with effective payment reminder text message templates for financial institutions, offering customizable payment notification solutions tailored to their operational needs. The suite includes tools such as EQ Engine, EQ Engage, and EQ Collect, which enable organizations to create effective payment reminder text message templates for financial institutions and craft personalized messaging strategies that resonate with their borrowers. This adaptability ensures that notifications are impactful and aligned with the organization's brand voice and customer engagement objectives.

By leveraging data-driven insights, these notifications can be optimized for both timing and content. This optimization significantly enhances response rates and repayment behaviors, ultimately supporting improved financial outcomes. In an industry where compliance and customer engagement are paramount, Equabli's solutions include effective payment reminder text message templates for financial institutions, making them a strategic asset for organizations aiming to refine their debt collection processes.

ChaserHQ: SMS Payment Reminder Templates for Businesses

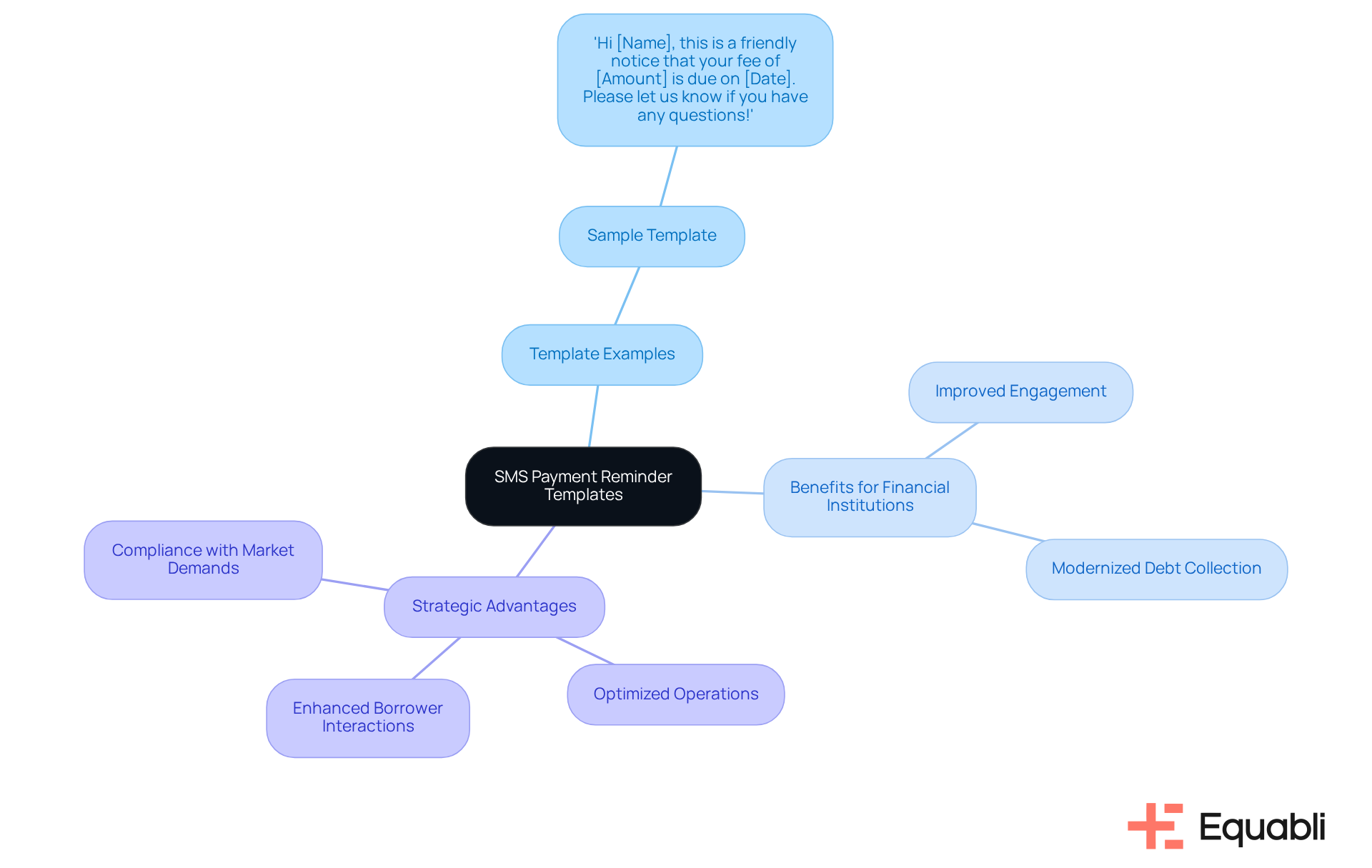

Equabli provides effective payment reminder text message templates for financial institutions and B2B services. These templates are designed to be concise and direct, ensuring clarity and actionable communication. For instance, a template might read: 'Hi [Name], this is a friendly notice that your fee of [Amount] is due on [Date]. Please let us know if you have any questions!' Such templates not only uphold professionalism but also facilitate prompt transactions.

Incorporating effective payment reminder text message templates for financial institutions with Equabli's EQ Suite allows financial organizations to modernize their debt collection strategies. By optimizing operations and enhancing borrower interactions through tailored communication and self-service repayment options, institutions can significantly improve their engagement with clients. This strategic approach not only addresses compliance requirements but also positions organizations to respond effectively to evolving market demands.

Curogram: Proven Payment Reminder Message Templates

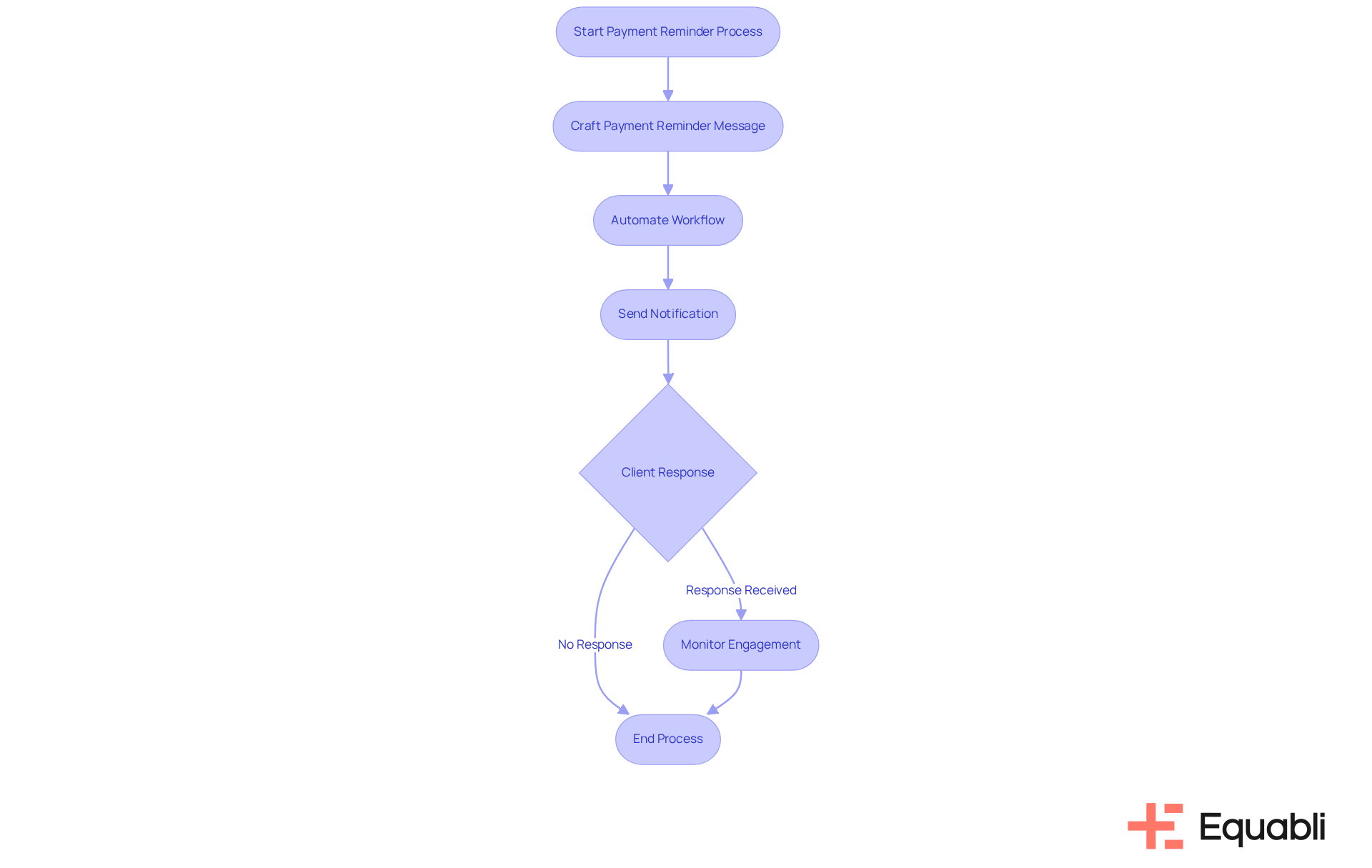

Equabli offers effective payment reminder text message templates for financial institutions, which can be enhanced through the capabilities of EQ Collect, addressing the challenges posed by disjointed systems. By integrating automated workflows and real-time reporting, financial institutions can optimize their communication processes, leading to smarter orchestration.

For example, a message might state:

'Dear [Name], your payment of [Amount] is due soon. Please ensure it is settled by [Date] to avoid any late fees.'

This direct approach, combined with effective payment reminder text message templates for financial institutions and EQ Collect's data-driven strategies, not only informs clients but also prompts timely action, which is crucial for maintaining cash flow.

With EQ Collect, organizations can reduce manual tasks, minimize execution errors, and enhance overall efficiency. This ensures timely notifications that significantly boost borrower engagement. From a compliance perspective, leveraging such automated solutions can mitigate risks associated with manual processes, ultimately fostering a more reliable debt collection framework.

Textedly: Effective Payment Reminder Message Templates

Equabli specializes in enhancing debt collection efficiency through effective communication strategies. By implementing EQ Collect, financial organizations can automate billing notifications using effective payment reminder text message templates for financial institutions, ensuring timely and customized messages. For instance, a reminder might read:

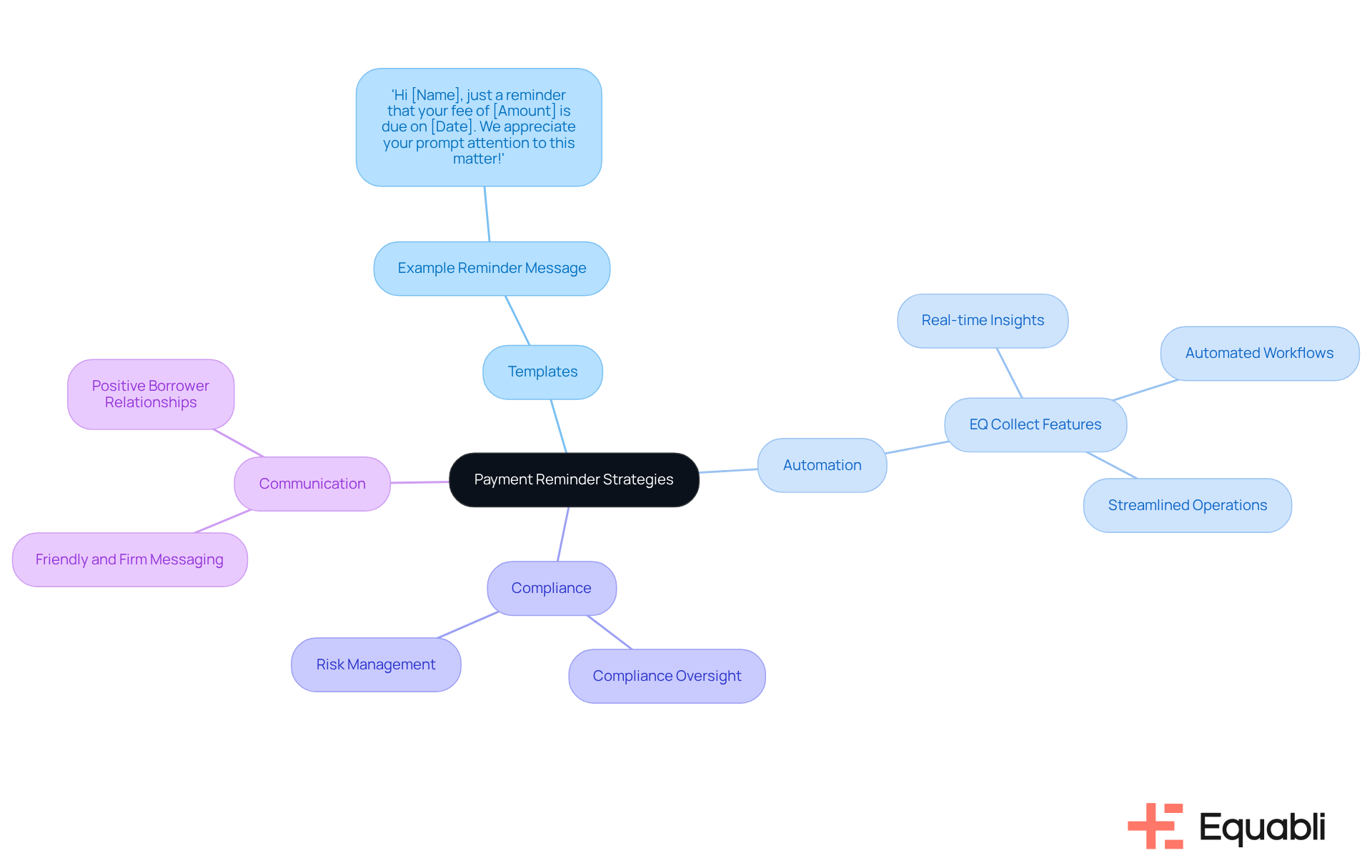

- 'Hi [Name], just a reminder that your fee of [Amount] is due on [Date]. We appreciate your prompt attention to this matter!'

Such messages, which incorporate effective payment reminder text message templates for financial institutions, are driven by EQ Collect's real-time insights and automated workflows, designed to be both friendly and firm, promoting timely transactions while maintaining a positive relationship with borrowers.

The advanced features of EQ Collect, including compliance oversight and streamlined operations as detailed in the user manual, significantly enhance performance in debt recovery. By leveraging these capabilities, institutions can navigate the complexities of debt collection more effectively. This strategic approach not only improves operational efficiency but also aligns with compliance requirements, ensuring that organizations remain vigilant in their risk management efforts.

In summary, Equabli's solutions provide effective payment reminder text message templates for financial institutions aiming to optimize their debt collection processes. By focusing on automation and effective communication, institutions can enhance their recovery rates while fostering positive borrower relationships.

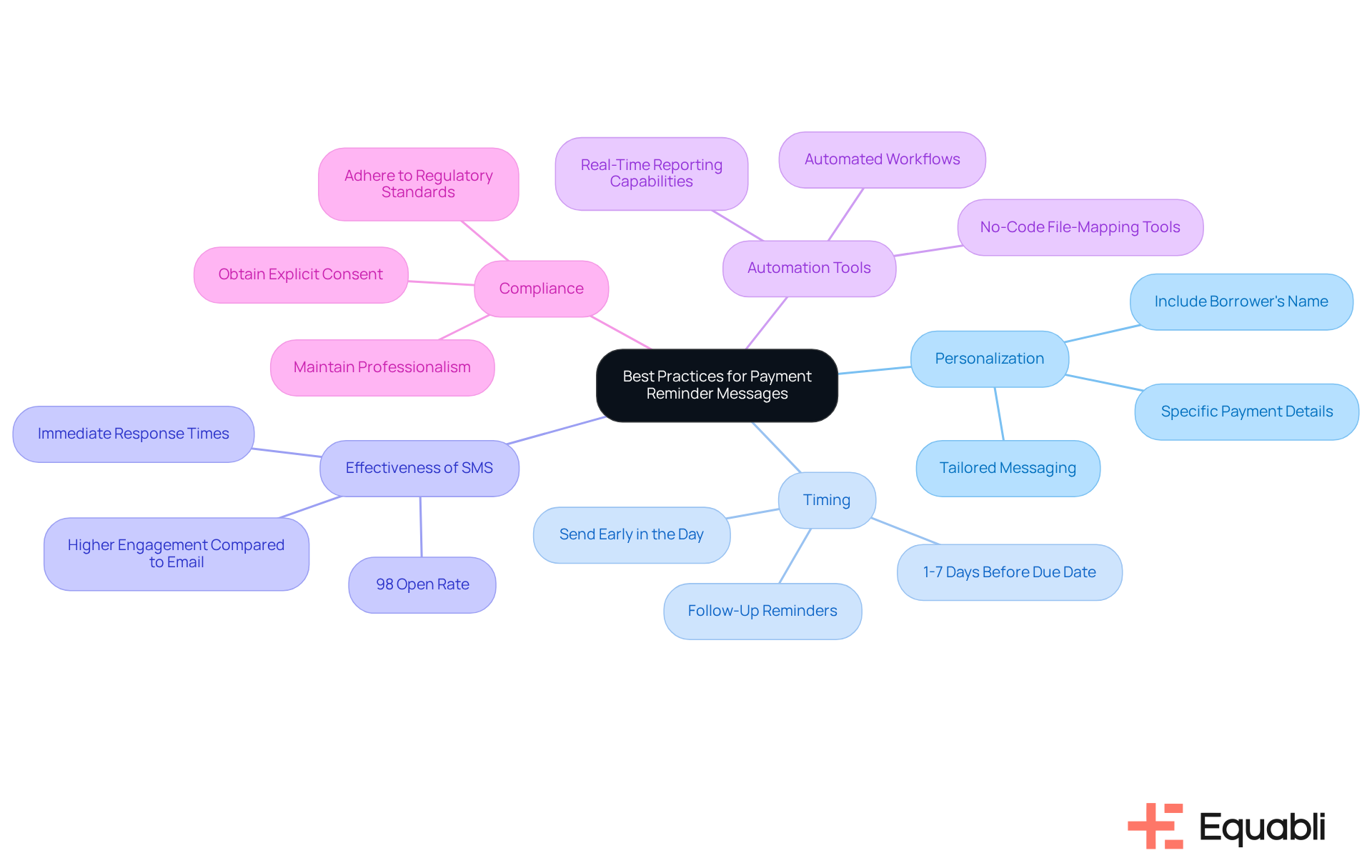

Messente: Best Practices for Payment Reminder Messages

Optimal approaches for creating notifications emphasize the critical role of personalization and timing in enhancing borrower engagement, particularly through the use of effective payment reminder text message templates for financial institutions. Including the borrower's name along with specific payment details in effective payment reminder text message templates for financial institutions cultivates a sense of urgency, making the communication more relevant and direct. Evidence shows that SMS notifications achieve an impressive 98% open rate, significantly surpassing email, which averages around 42.35%. This data highlights the effectiveness of timely notifications, particularly when sent early in the day or just before the due date, thereby increasing the likelihood of repayment.

Utilizing EQ Collect's no-code file-mapping tool and automated workflows allows financial organizations to streamline the creation of effective payment reminder text message templates for financial institutions. This not only boosts collection rates but also enhances borrower satisfaction. Furthermore, the platform's real-time reporting capabilities offer valuable insights that can refine messaging strategies. Compliance oversight is another critical feature, ensuring that all communications adhere to regulatory standards.

It is essential for organizations to obtain explicit consent from customers prior to sending SMS notifications. This practice aligns with EQ Collect's commitment to maintaining professionalism and compliance in all communications, thereby reinforcing trust and transparency in borrower interactions.

OpenPhone: Professional Payment Reminder Text Message Templates

Equabli offers effective payment reminder text message templates for financial institutions, enhancing communication efficiency. For instance, a template may state:

'Dear [Name], this is a reminder that your payment of [Amount] is due on [Date]. Please reach out if you have any questions or need assistance.'

This approach not only conveys essential information but also fosters dialogue, thereby nurturing a supportive relationship with clients by utilizing effective payment reminder text message templates for financial institutions.

By integrating EQ Collect, financial institutions can streamline operations, minimize manual tasks, and boost performance through automated workflows and real-time reporting. This integration ensures that notifications are timely and part of a cohesive strategy, which mitigates execution errors and enhances participant engagement.

From a compliance perspective, utilizing structured communication methods like these can significantly reduce risks associated with client interactions. Financial institutions that adopt such practices position themselves to better navigate regulatory landscapes while maintaining operational efficiency.

To operationalize this strategy, institutions should consider implementing comprehensive training for staff on the effective payment reminder text message templates for financial institutions and the EQ Collect system. This will not only enhance compliance but also improve overall client satisfaction and retention.

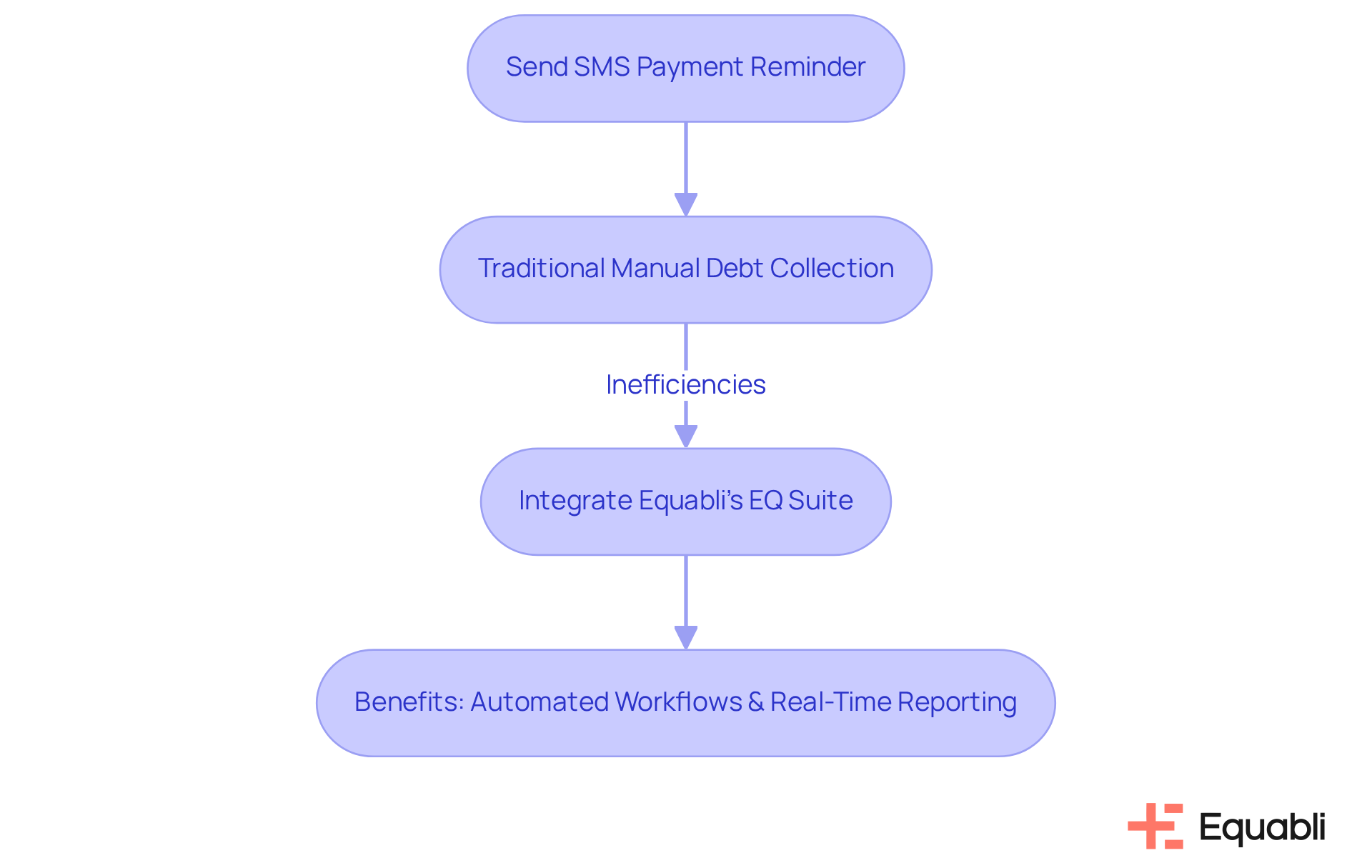

ContactMonkey: Leveraging SMS for Payment Reminders in Banking

ContactMonkey underscores the critical role of SMS in delivering financial notifications within the banking sector. By leveraging SMS, institutions can effectively use effective payment reminder text message templates for financial institutions to communicate with borrowers instantly. For instance, a message such as: Hi [Name], just a brief notice that your due amount of [Amount] is on [Date]. Thank you for your attention! ensures timely receipt of notifications, thereby increasing the likelihood of on-time payments.

However, traditional manual debt collection processes often result in inefficiencies, including delayed communications and heightened operational costs. Integrating Equabli's EQ Suite allows financial institutions to modernize their debt collection strategies. This solution employs automated workflows and real-time reporting, enhancing borrower engagement and streamlining communication.

The combination of SMS alerts and effective payment reminder text message templates for financial institutions not only enhances recovery rates but also increases operational efficiency. As the financial landscape evolves, adopting such innovative approaches is essential for institutions aiming to optimize their debt collection processes and mitigate compliance risks.

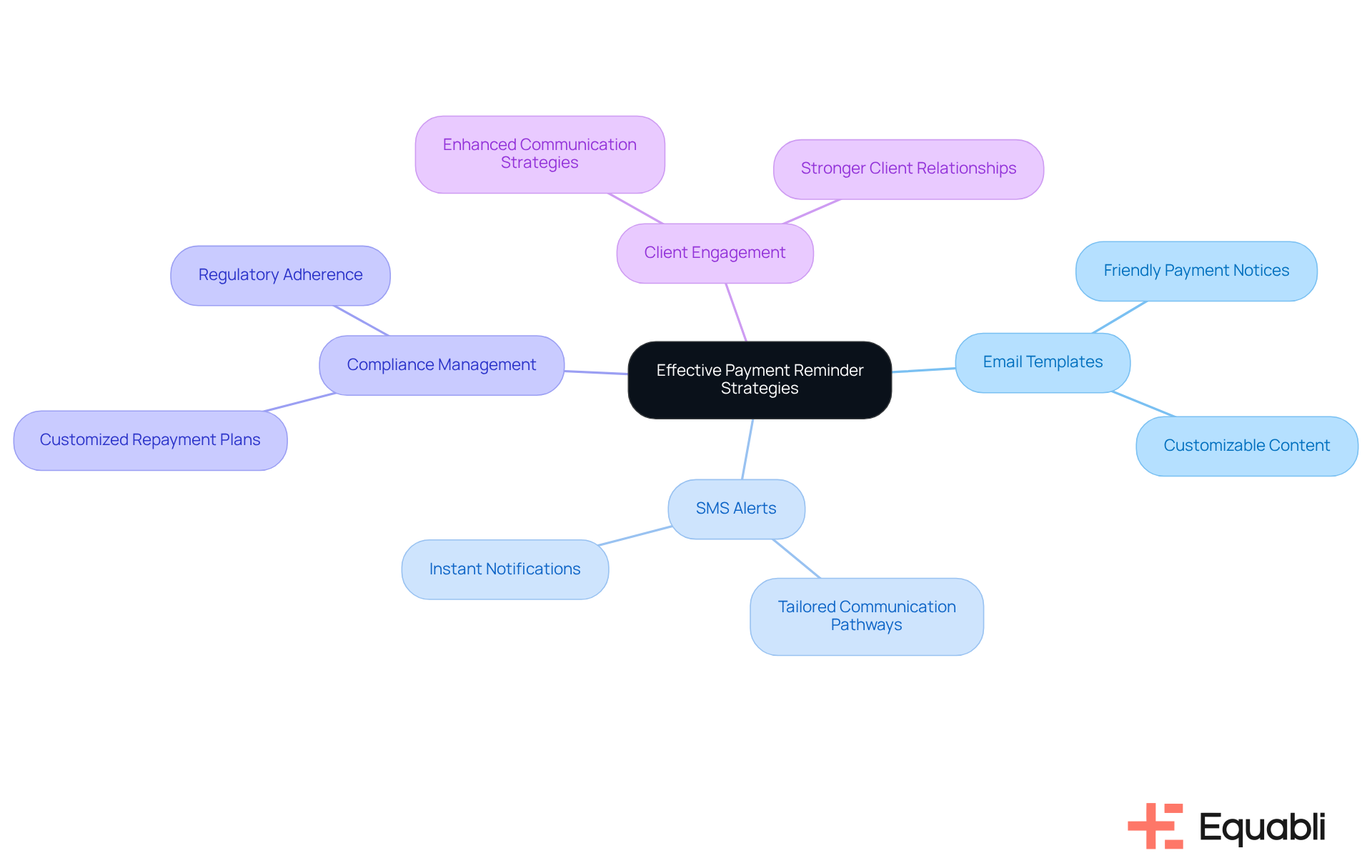

Square: Effective Payment Reminder Email Templates

Equabli provides efficient billing notification email templates that can be integrated with SMS alerts, leveraging the innovative features of EQ Engage. For instance, an email might state:

'Dear [Name], this is a friendly notice that your payment of [Amount] is due on [Date]. We appreciate your prompt attention to this matter. If you have any questions, please do not hesitate to contact us.'

By utilizing EQ Engage's tailored communication pathways, financial organizations can create effective payment reminder text message templates for financial institutions to ensure that clients receive notifications through their preferred communication method.

Furthermore, EQ Engage equips clients with customized repayment plans and facilitates compliance management. This significantly enhances overall engagement and user experience, addressing the operational and compliance challenges that executives face in the financial sector. By adopting effective payment reminder text message templates for financial institutions, organizations can enhance their communication strategies, ultimately fostering stronger client relationships and ensuring adherence to regulatory standards.

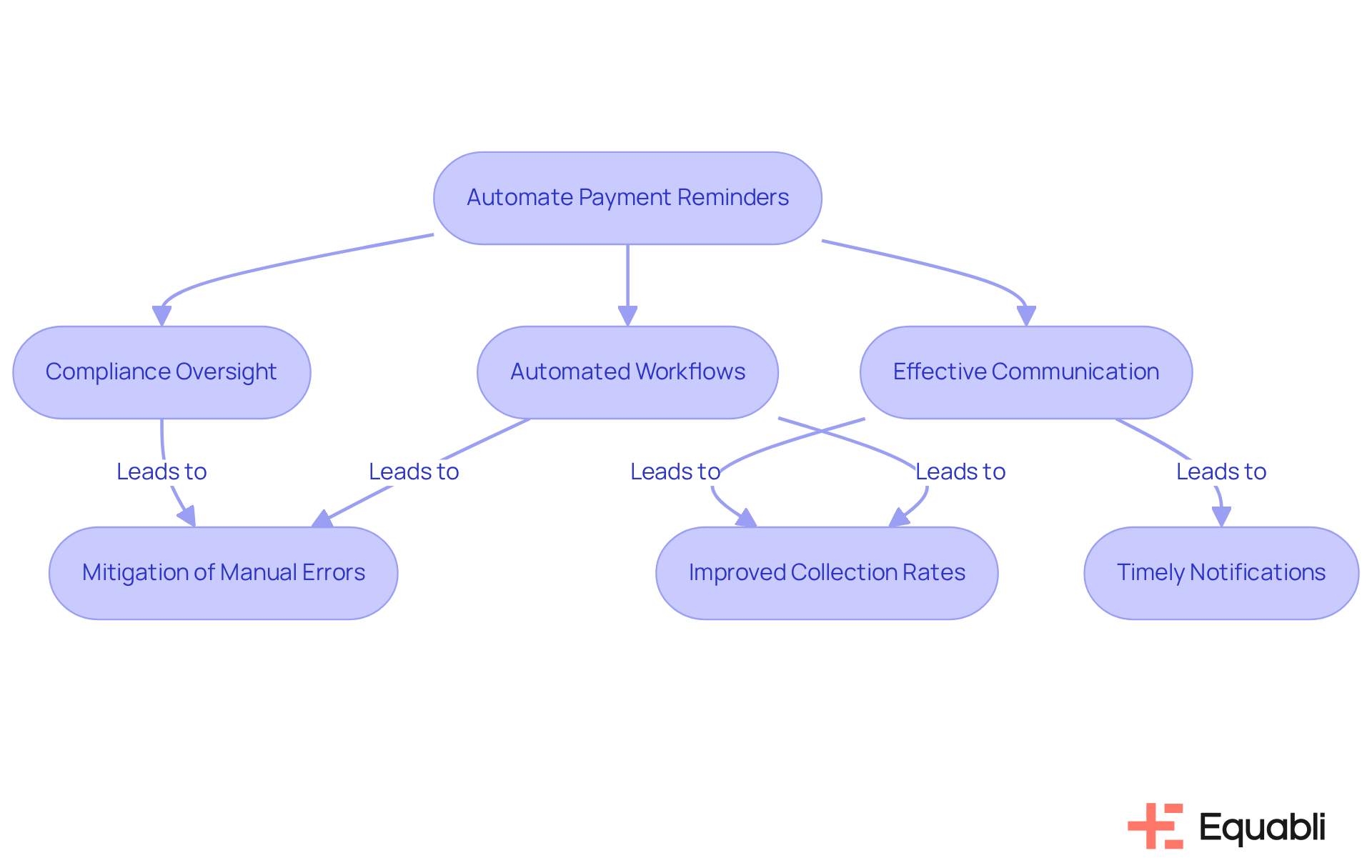

Tratta: Automating Payment Reminders for Better Collection Rates

Equabli automates billing notifications, significantly enhancing collection rates for financial organizations. By leveraging the EQ Collect platform, institutions can utilize effective payment reminder text message templates for financial institutions, ensuring timely notifications reach recipients without manual intervention. For example, an automated message could state: Hi [Name], your fee of [Amount] is due tomorrow. Thank you for your attention! This consistent communication, supported by EQ Collect's data-driven strategies and real-time reporting, incorporates effective payment reminder text message templates for financial institutions to foster client awareness and encourage timely remittances.

The platform's features, including automated workflows and compliance oversight, not only improve communication but also streamline operations, which can be enhanced by using effective payment reminder text message templates for financial institutions to boost collection performance. From a compliance perspective, these automated systems help organizations adhere to regulatory requirements while optimizing their debt collection processes. By integrating such solutions, financial institutions can mitigate risks associated with manual errors and delays, ultimately driving better financial outcomes.

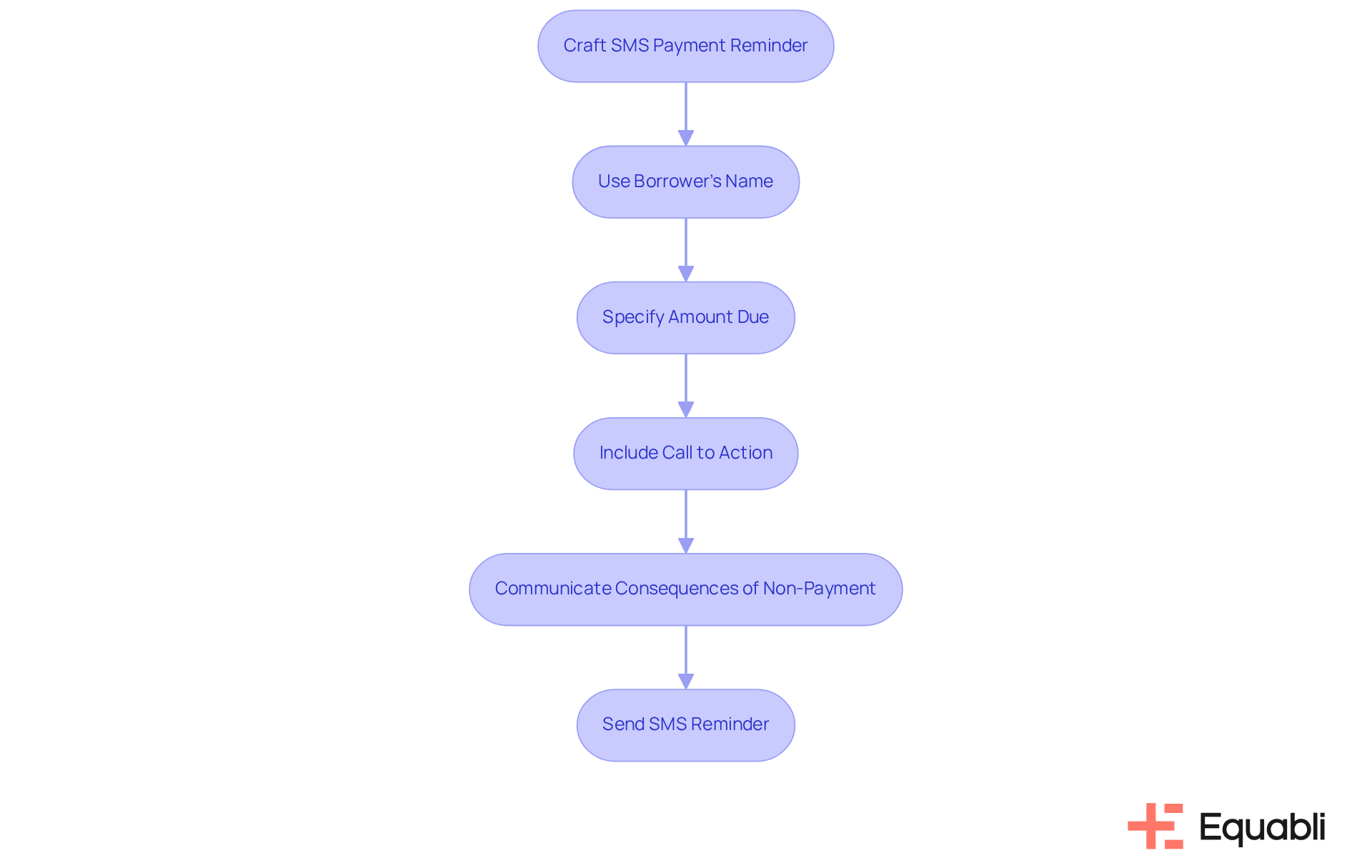

Upflow: Guide to Writing Effective SMS Payment Reminder Messages

Equabli provides a comprehensive guide for crafting effective payment reminder text message templates for financial institutions, highlighting the importance of clarity, brevity, and personalization. Utilizing the borrower's name, specifying the amount due, and including a clear call to action—such as, "Please make your payment of $[Amount] by [Date] to avoid late fees"—are essential strategies. SMS messages boast an impressive 98% open rate, significantly outpacing the average email open rate of 20-25%. This statistic underscores their potential as a vital communication tool for financial organizations.

By adhering to these guidelines and ensuring compliance with relevant regulations, financial institutions can enhance their communication strategies and improve repayment rates by utilizing effective payment reminder text message templates for financial institutions. Integrating SMS reminders into a cohesive system, such as Equabli's EQ Collect, streamlines operations and boosts performance by automating reminders and tracking responses. This integration ultimately fosters greater client engagement.

It is crucial to communicate the potential consequences of non-payment to underscore the urgency of timely payments. To maximize effectiveness, financial institutions should leverage EQ Collect's features to schedule and personalize effective payment reminder text message templates for financial institutions, ensuring these reminders resonate with borrowers. This strategic approach not only enhances compliance but also positions lenders to mitigate risk exposure effectively.

Conclusion

Equabli's EQ Suite represents a critical solution for financial institutions seeking to enhance their payment reminder strategies through effective text message templates. By focusing on customizable and data-driven approaches, organizations can significantly improve communication with borrowers, ensuring that reminders are not only timely but also resonate with the intended audience.

The article has explored various platforms and best practices, underscoring the importance of clarity, personalization, and automation in crafting payment reminder messages. From Equabli's comprehensive suite to the innovative templates offered by ChaserHQ and Curogram, the consistent theme is the optimization of engagement and compliance. The impressive open rates of SMS notifications further highlight the effectiveness of this communication method in encouraging timely payments.

Adopting these effective payment reminder text message templates transcends merely improving collection rates; it fosters stronger relationships with clients and enhances overall satisfaction. Financial institutions are encouraged to leverage these insights and tools to refine their communication strategies, ensuring agility and responsiveness in an ever-evolving landscape. By doing so, organizations position themselves for greater success in managing repayments while maintaining trust and transparency with their borrowers.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a set of customizable payment reminder solutions designed for financial institutions, providing effective text message templates and tools to enhance borrower engagement and optimize debt collection processes.

What tools are included in the EQ Suite?

The EQ Suite includes tools such as EQ Engine, EQ Engage, and EQ Collect, which help organizations create personalized payment reminder messages and strategies that align with their brand voice.

How do Equabli's payment reminder templates improve financial outcomes?

By leveraging data-driven insights, these templates can be optimized for timing and content, significantly enhancing response rates and repayment behaviors, which support improved financial outcomes.

What types of businesses can benefit from Equabli's payment reminder templates?

Equabli provides effective payment reminder text message templates for both financial institutions and B2B services, helping them to modernize their debt collection strategies.

Can you provide an example of a payment reminder message template?

An example of a payment reminder message might be: "Hi [Name], this is a friendly notice that your fee of [Amount] is due on [Date]. Please let us know if you have any questions!"

How does EQ Collect enhance payment reminder processes?

EQ Collect integrates automated workflows and real-time reporting, optimizing communication processes, reducing manual tasks, and improving overall efficiency in notifying clients about payments.

What compliance benefits do Equabli's solutions offer?

By utilizing automated solutions like EQ Collect, organizations can mitigate risks associated with manual processes, ensuring compliance and fostering a more reliable debt collection framework.