Overview

The article presents an authoritative overview of enterprise credit risk management solutions specifically designed for financial institutions. It highlights key tools such as:

- Equabli's EQ Suite

- Oracle's advanced analytics

- FICO's automation tools

These solutions significantly enhance operational efficiency, improve borrower engagement, and reduce loan losses. By leveraging data-driven insights and advanced technologies, including AI and machine learning, they effectively address the complexities inherent in credit risk management, providing strategic advantages in a competitive landscape.

Introduction

The landscape of credit risk management is undergoing significant transformation, propelled by technological advancements and heightened regulatory demands. Financial institutions are now confronted with a multitude of innovative solutions aimed at refining their credit risk assessment and management processes. This article examines ten state-of-the-art enterprise credit risk management solutions that not only streamline operational workflows but also equip organizations with the insights necessary for informed lending decisions. As the stakes escalate, how can these tools assist financial institutions in navigating the intricate complexities of modern finance while ensuring compliance and optimizing performance?

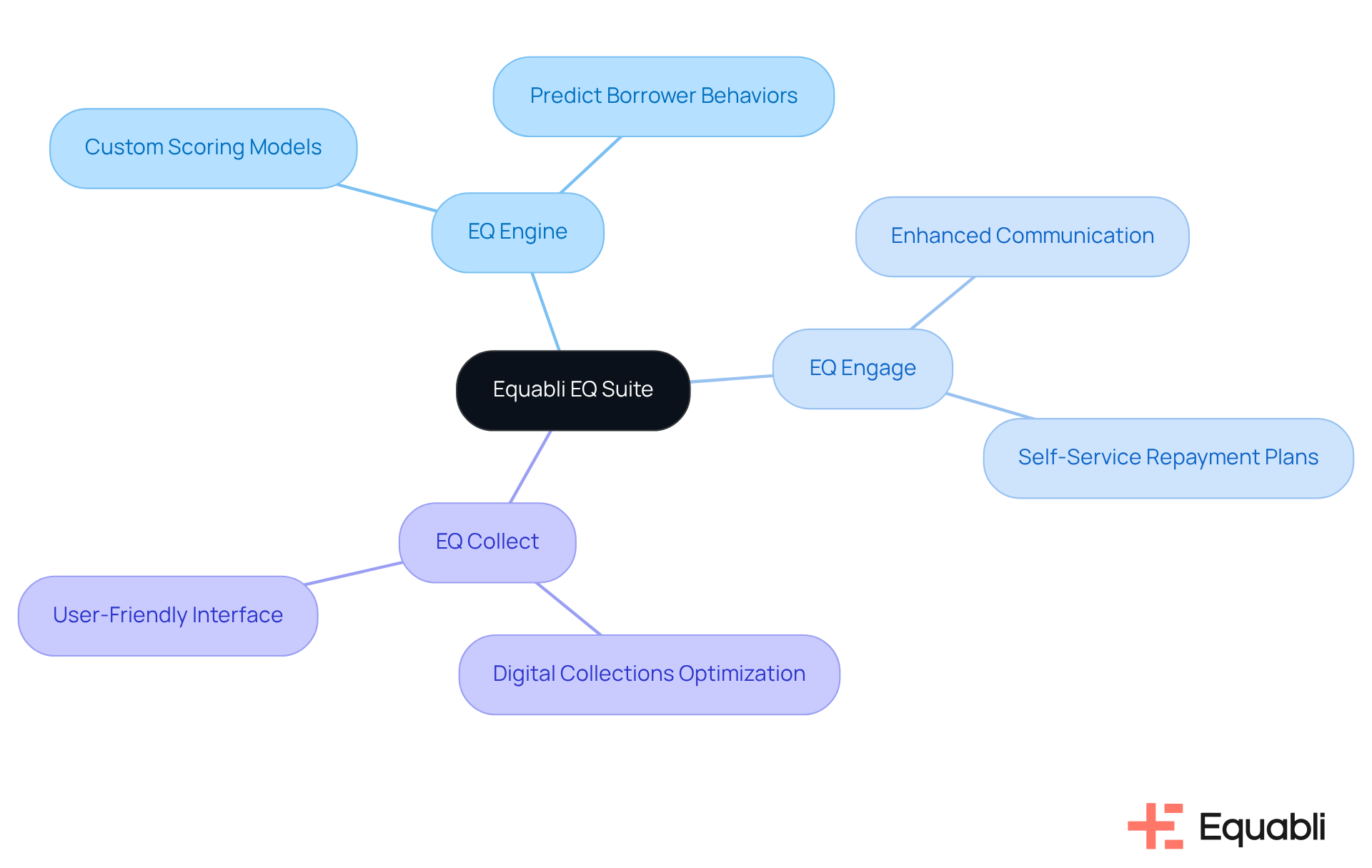

Equabli EQ Suite: Comprehensive Debt Collection Solutions for Financial Institutions

The EQ Suite by Equabli serves as a comprehensive toolkit tailored for monetary organizations, encompassing three fundamental components: EQ Engine, EQ Engage, and EQ Collect. The EQ Engine empowers the creation of custom scoring models, enabling organizations to accurately predict borrower repayment behaviors. EQ Engage significantly enhances communication with borrowers through their preferred channels, fostering improved engagement and responsiveness, while also allowing borrowers to self-service with customized repayment plans. Concurrently, EQ Collect optimizes digital collections via a user-friendly, scalable, cloud-native interface, facilitating self-service repayment plans that align with contemporary consumer preferences.

Collectively, these tools equip financial organizations to adopt data-driven strategies that markedly enhance operational efficiency and reduce costs associated with debt recovery. By harnessing advanced technology, including automated workflows and real-time reporting, the EQ Suite provides enterprise credit risk management platform solutions for financial institutions, effectively addressing the intricacies of credit risk management, ensuring adherence to evolving regulations while refining collection processes.

Recent innovations in debt collection technology, particularly in AI and machine learning, further augment the efficacy of the EQ Suite. These advancements enable organizations to analyze debtor behavior with greater precision and tailor their collection strategies accordingly, culminating in improved recovery rates. Successful deployments of the EQ Suite have demonstrated measurable improvements in collections, with certain organizations reporting a reduction in days of sales outstanding from 78 to 67 days within just two months of implementation.

As financial entities confront the complexities of modern debt collection, the EQ Suite stands out as one of the enterprise credit risk management platform solutions for financial institutions, driving digital transformation and enhancing overall lending management capabilities.

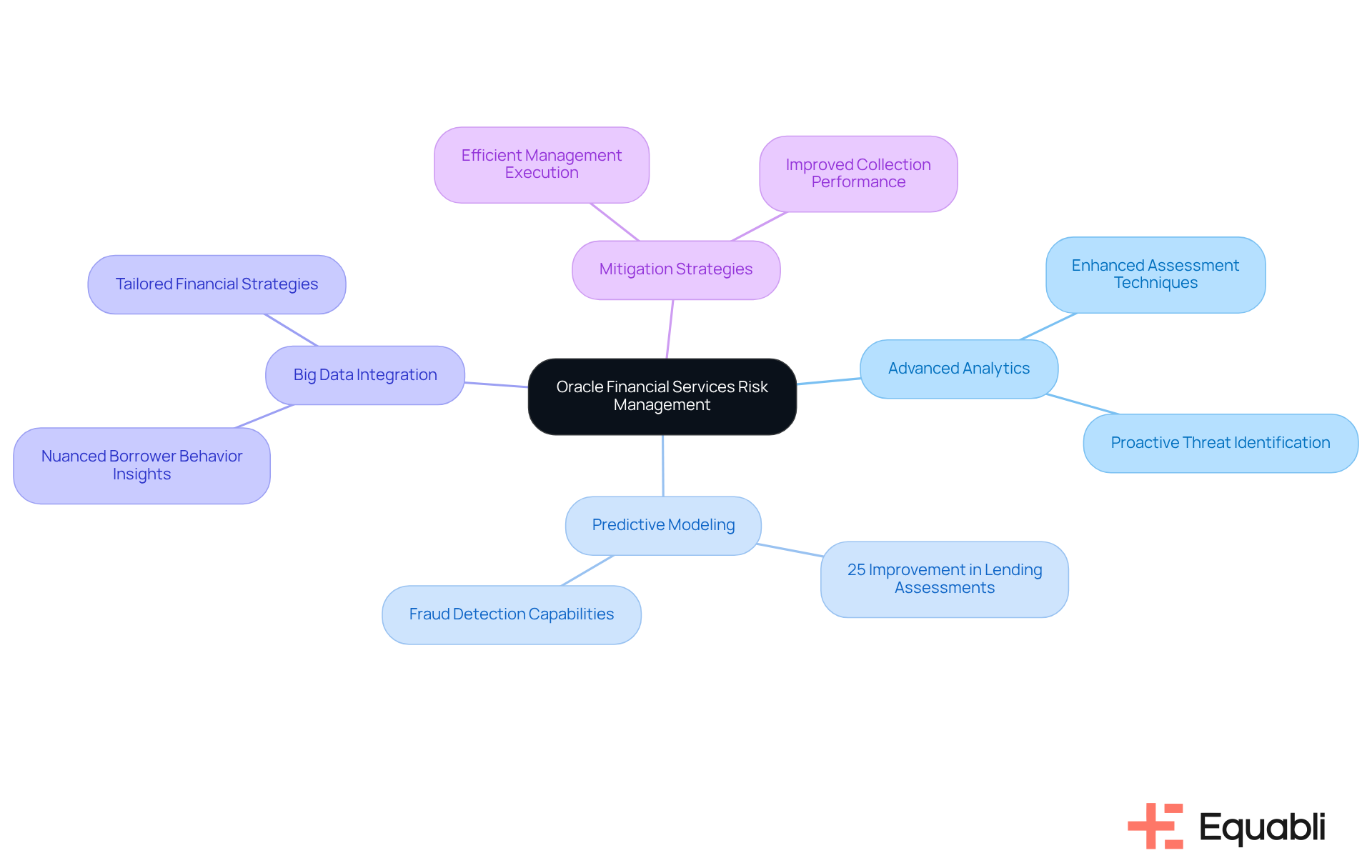

Oracle Financial Services Risk Management: Advanced Analytics for Credit Risk Assessment

Oracle Financial Services Risk Management utilizes advanced analytics as part of its enterprise credit risk management platform solutions for financial institutions to enhance the assessment of lending uncertainties. Evidence indicates that by employing extensive data and sophisticated forecasting modeling methods, organizations can identify potential threats early on. This proactive approach facilitates the execution of efficient management and mitigation strategies, significantly improving the overall financial exposure management framework.

Recent advancements in predictive modeling reveal that organizations utilizing these sophisticated analytics can enhance the precision of lending assessments by as much as 25%, leading to a notable reduction in default rates. Furthermore, the integration of big data provides a more nuanced understanding of borrower behavior, enabling financial institutions to tailor their strategies accordingly.

As the credit management landscape evolves, expert opinions increasingly underscore the necessity of leveraging big data through enterprise credit risk management platform solutions for financial institutions to navigate complexities and ensure robust mitigation. Equabli's EQ Engine exemplifies this shift by employing machine learning and automation to improve recovery rates and predict the likelihood of delinquency in active accounts. This strategic servicing approach not only enhances collection performance but also allows organizations to expand their operations without sacrificing effectiveness.

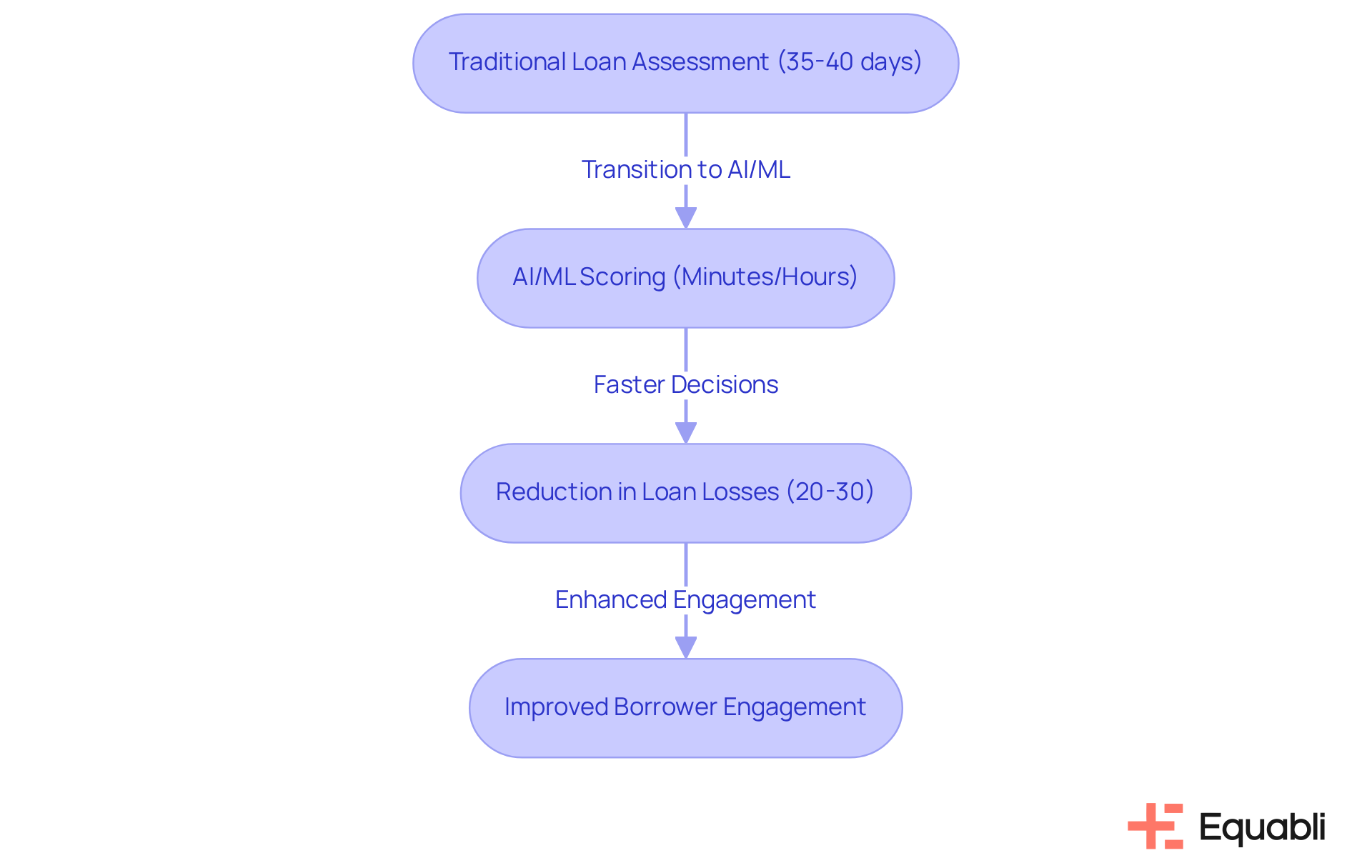

FICO Decision Management Suite: Automation Tools for Streamlined Credit Risk Decisions

The FICO Decision Management Suite provides enterprise credit risk management platform solutions for financial institutions, featuring advanced automation tools designed to enhance loan assessment decisions. By automating critical processes such as scoring and assessment, FICO significantly reduces manual errors and accelerates response times. This efficiency not only leads to improved management outcomes but also fosters better engagement with borrowers.

As Rajashree Goswami notes, 'AI loan evaluation is transforming how financial entities assess uncertainty, approve loans, and serve digital-first customers.'

With financial institutions increasingly adopting enterprise credit risk management platform solutions, they can expect a reduction in loan losses by 20-30%, achieved through more accurate evaluations and expedited decision-making processes. Traditional methods often require 35-40 days for a decision; in contrast, AI/ML-based scoring can yield results in mere minutes or hours, highlighting the essential shift needed in a competitive landscape where customer satisfaction relies on speed and precision in lending decisions.

Furthermore, the integration of alternative data sources in automated scoring processes is becoming crucial, enabling organizations to make more informed lending decisions.

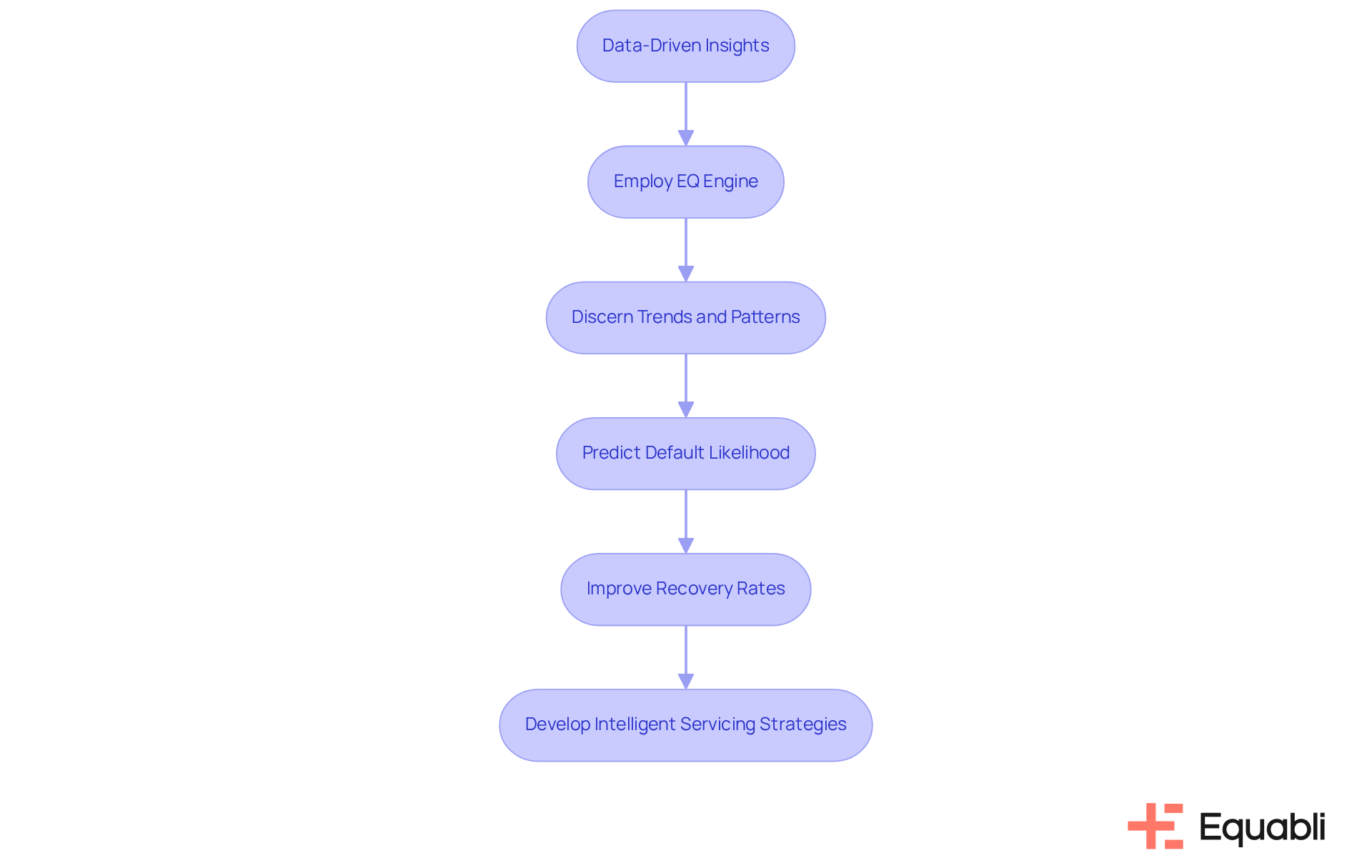

SAS Risk Management: Data-Driven Insights for Credit Risk Mitigation

Equabli's advanced enterprise credit risk management platform solutions for financial institutions deliver critical data-driven insights essential for effective credit mitigation. By employing the EQ Engine, financial organizations can harness machine learning and automation to discern trends and patterns in borrower behavior. This capability facilitates informed decision-making and proactive management strategies. The EQ Engine not only predicts the likelihood of default among active accounts but also improves recovery rates, enabling organizations to broaden their collections efforts without sacrificing performance. By developing intelligent servicing strategies, organizations can enhance collection performance and achieve greater operational efficiency.

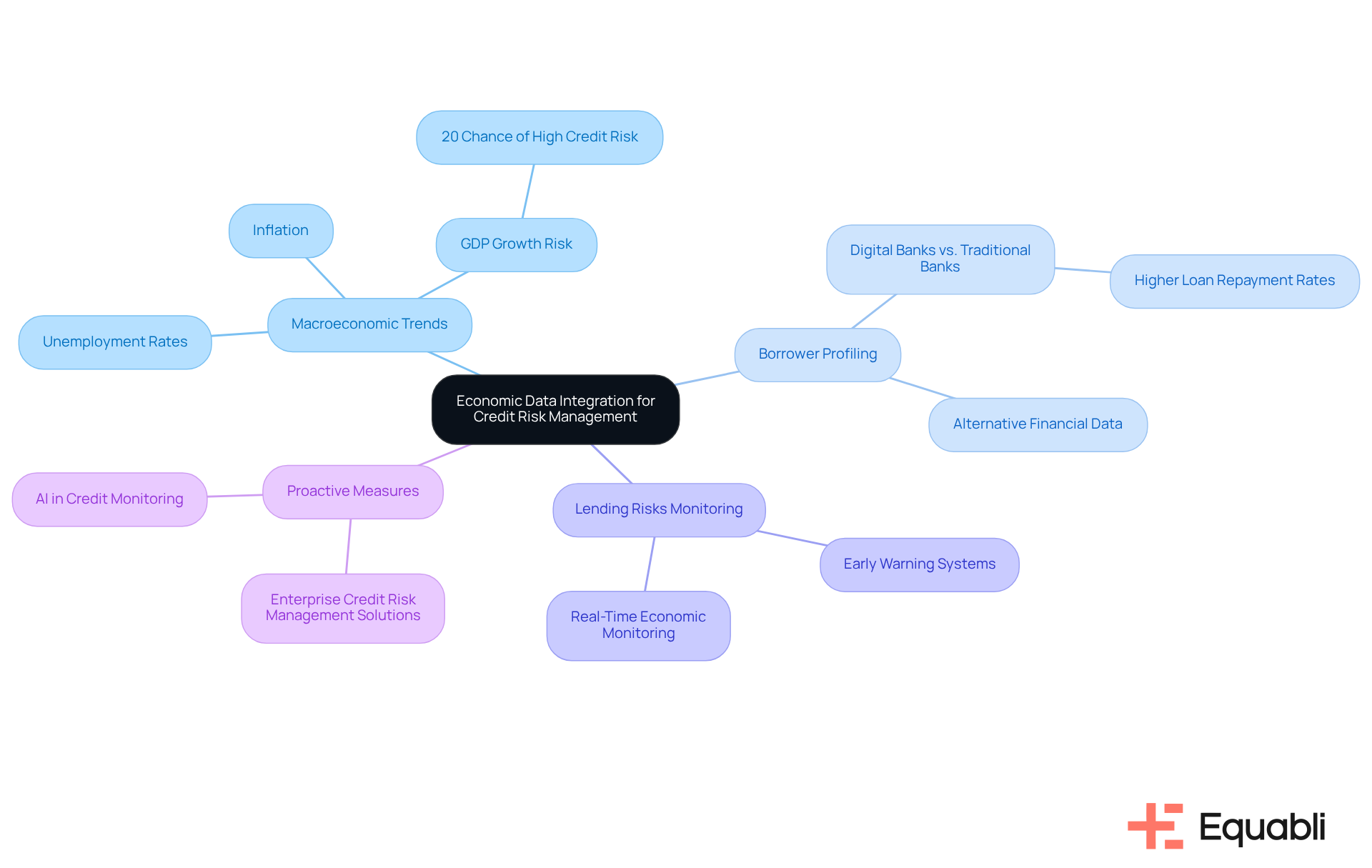

Moody's Analytics: Economic Data Integration for Effective Credit Risk Management

Moody's Analytics provides advanced tools that seamlessly integrate economic data into financial management processes. This capability enables financial entities to gain insights into macroeconomic trends, such as inflation and unemployment rates, thereby enhancing evaluations and refining strategies in response to current economic conditions. A recent study indicates a 20% likelihood of significant financial risk when quarterly GDP growth declines, underscoring the critical need for real-time economic monitoring.

Furthermore, the integration of alternative financial data has been shown to enhance borrower profiling, with digital banks outpacing traditional institutions in loan repayment rates for first-time borrowers. As financial organizations navigate the complexities of the 2025 economic landscape, leveraging enterprise credit risk management platform solutions for financial institutions will be essential for making informed lending decisions and mitigating uncertainties associated with macroeconomic fluctuations.

Additionally, the Bank of England has emphasized the importance of establishing early warning systems to monitor lending risks, further highlighting the proactive measures that must be undertaken in response to economic changes.

Experian Credit Risk Solutions: Scoring and Assessment Tools for Credit Portfolio Management

Experian Risk Solutions provides critical scoring and evaluation tools essential for effective portfolio management. By delivering detailed loan assessments and advanced scoring systems, Experian empowers lenders to accurately evaluate borrower vulnerability. This capability allows lenders to make informed decisions, significantly mitigating potential losses. The integration of comprehensive financial reports into the lending process not only enhances the assessment of uncertainties but also informs strategic planning, enabling organizations to adeptly navigate the complexities of borrower profiles. As financial institutions increasingly adopt innovative loan portfolio management strategies, the significance of Experian's enterprise credit risk management platform solutions for financial institutions escalates, fostering sustainable growth and ensuring compliance within lending practices.

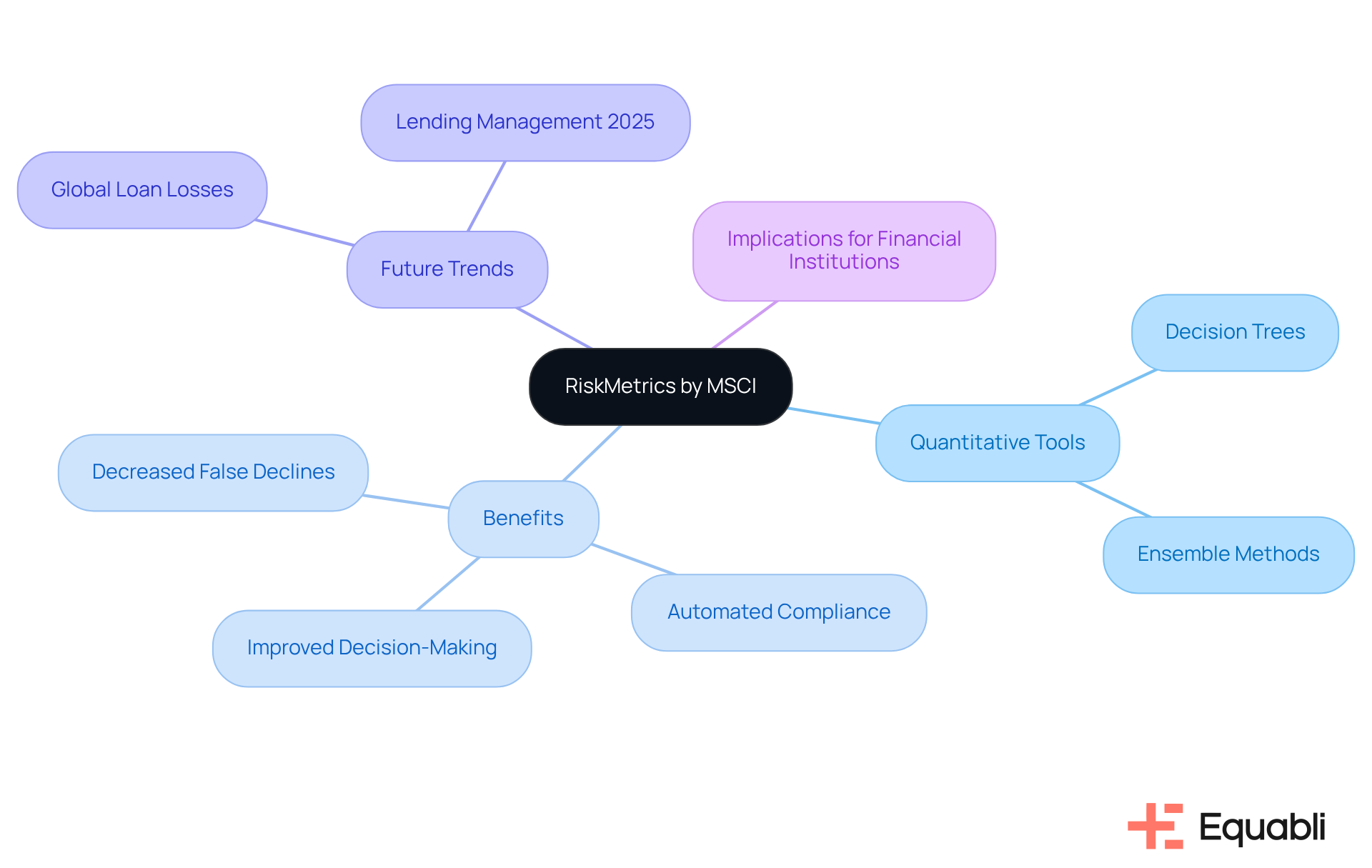

RiskMetrics by MSCI: Quantitative Tools for Evaluating Credit Risk Exposure

RiskMetrics by MSCI provides advanced quantitative tools that empower financial institutions to effectively assess enterprise credit risk management platform solutions for financial institutions. Utilizing sophisticated modeling techniques, including decision trees and ensemble methods, RiskMetrics enables organizations to evaluate potential losses accurately and develop robust strategies for loss prevention.

As noted by Tanya Share, 'Credit management tools decrease false declines by 20-30%, automate regulatory compliance, and handle thousands of concurrent applications.' This capability not only enhances the resilience of loan portfolios but also aligns with emerging trends in lending management for 2025, where global loan losses are projected to reach $814 billion.

Financial entities leveraging enterprise credit risk management platform solutions for financial institutions can expect improved decision-making capabilities, allowing for proactive adjustments to their lending strategies in response to evolving market conditions. Consequently, these tools are vital for ensuring compliance with regulatory standards while optimizing overall portfolio performance.

Zoot Enterprises: Efficient Credit Decisioning Solutions for Risk Management

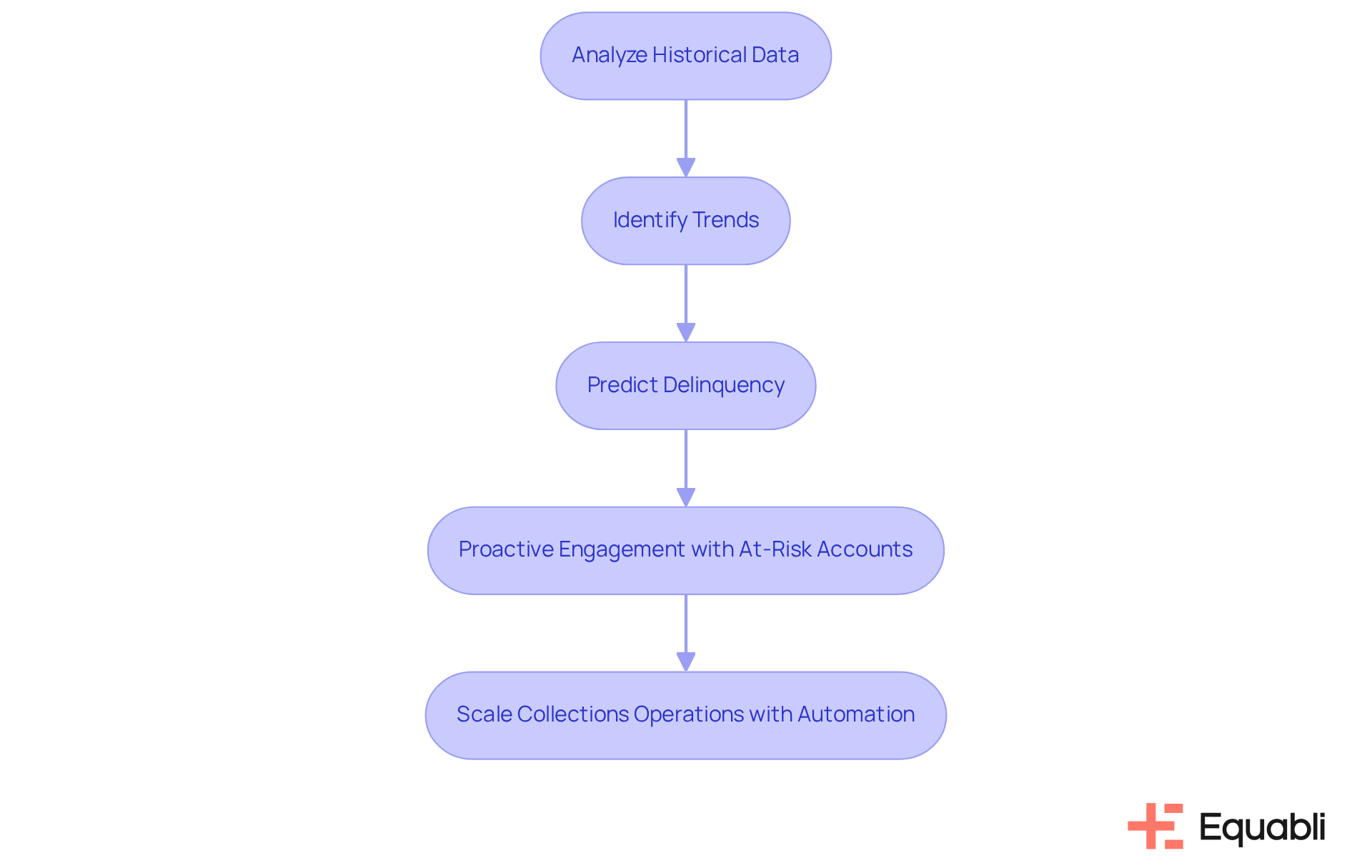

Equabli offers enterprise credit risk management platform solutions for financial institutions that enable them to operate more efficiently at every phase of debt recovery. By leveraging the EQ Engine, organizations can significantly enhance recovery rates through predictive threat evaluation and intelligent servicing strategies.

For instance, organizations can utilize the EQ Engine to analyze historical data and identify trends that predict delinquency, facilitating proactive engagement with at-risk accounts. Furthermore, Equabli's intelligent automation and machine learning solutions enable organizations to scale their collections operations without sacrificing performance, effectively forecasting the likelihood of delinquency in active accounts.

This transformation not only enhances collection performance but also optimizes the enterprise credit risk management platform solutions for financial institutions in managing financial exposure.

Kyriba: Treasury Management Solutions with Integrated Credit Risk Features

Kyriba provides advanced treasury management solutions that seamlessly integrate lending exposure features, empowering organizations to effectively manage liquidity and borrowing exposure. By offering real-time insights into cash flow and credit risk, Kyriba equips entities with critical tools for informed decision-making, thereby enhancing economic stability. This proactive approach not only deepens understanding of cash flow across complex operations but also bolsters strategic growth initiatives by enabling organizations to anticipate market changes and respond accordingly.

As Jean-Luc Robert, CEO of Kyriba, emphasizes, treasury management systems are vital for delivering insights that inform strategic economic decisions. Moreover, insights from the e-book 'Taking Treasury from Reactive to Proactive' underscore the imperative of transitioning to proactive treasury management, particularly in the face of regulatory changes and market volatility.

As financial organizations increasingly recognize the importance of real-time cash flow insights, Kyriba's enterprise credit risk management platform solutions for financial institutions become essential for optimizing credit exposure management and ensuring robust liquidity management practices.

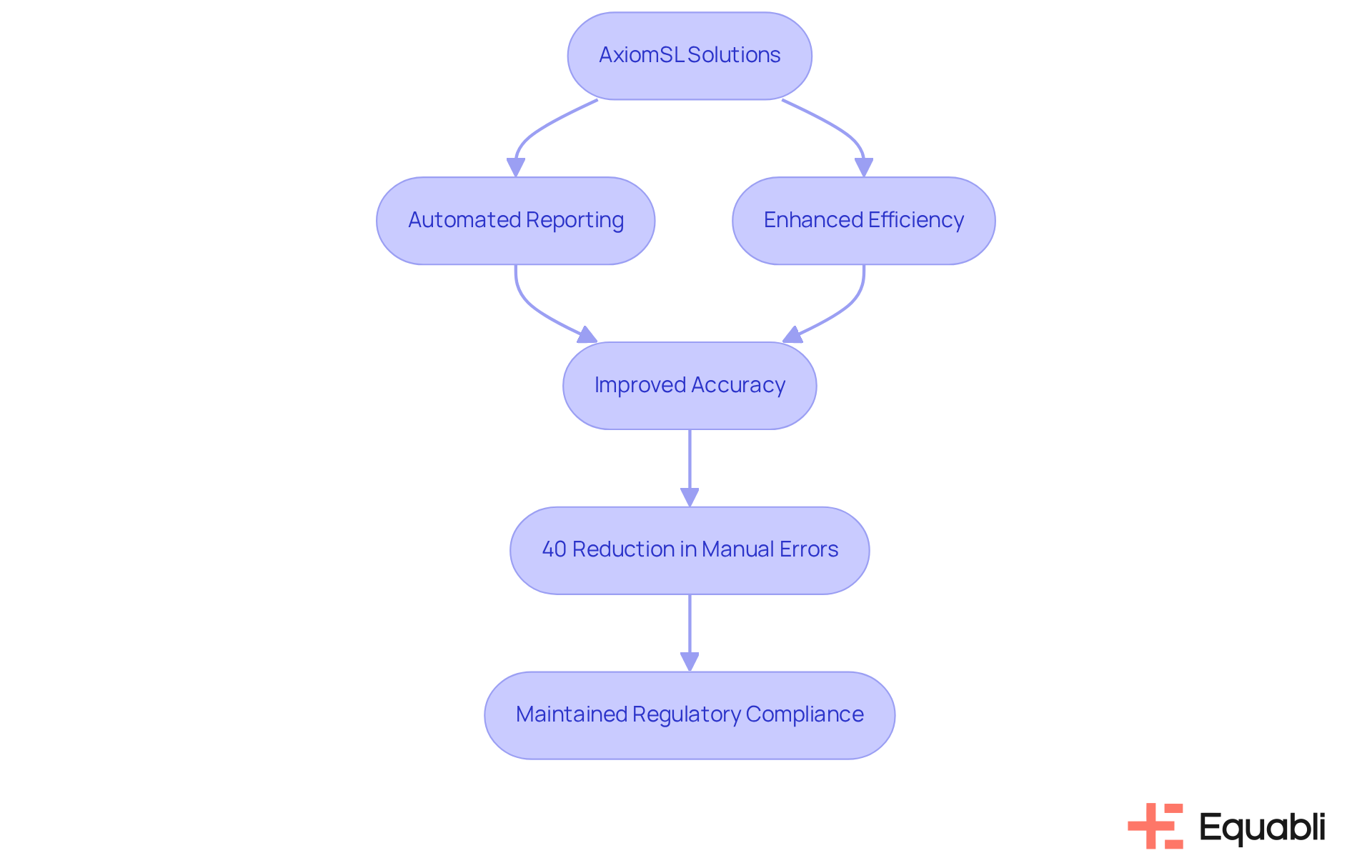

AxiomSL: Regulatory Reporting and Risk Management Solutions for Compliance

AxiomSL offers essential regulatory reporting and management solutions critical for compliance within the banking sector. By automating reporting processes, AxiomSL enables financial institutions to streamline operations while adhering to stringent regulatory standards. This automation not only enhances efficiency but also significantly impacts financial management by providing timely and accurate data, which is vital for informed decision-making.

For instance, a regional bank experienced a 40% reduction in manual errors within three months of implementing FIS for Basel III reporting, demonstrating the effectiveness of automation in enhancing accuracy and compliance.

As financial organizations confront the evolving landscape of compliance challenges in 2025, including adapting to new regulations and managing data complexity, leveraging AxiomSL's solutions will be crucial for maintaining regulatory compliance and effectively managing credit risk.

According to AxiomSL, "Our solutions provide scalable reporting tools tailored for banking and financial institutions, ensuring they meet compliance requirements efficiently.

Conclusion

In the rapidly evolving landscape of financial services, effective enterprise credit risk management solutions are crucial for institutions aiming to navigate complexities and mitigate potential losses. Innovative platforms such as Equabli's EQ Suite, Oracle Financial Services Risk Management, and FICO Decision Management Suite each offer unique features that enhance decision-making processes and improve borrower engagement. By leveraging advanced analytics, automation, and real-time data integration, these solutions empower financial organizations to refine their risk management strategies, ultimately achieving operational excellence.

Key insights reveal the importance of adopting data-driven approaches to credit risk management. Tools like SAS Risk Management and Moody's Analytics enable organizations to assess macroeconomic trends and borrower behavior, leading to more informed lending decisions. Furthermore, automation in regulatory reporting, as demonstrated by AxiomSL, illustrates how technology can streamline compliance processes while enhancing accuracy and efficiency.

As financial institutions prepare for future challenges, embracing these enterprise credit risk management solutions is not merely advantageous; it is essential. The integration of innovative technologies and data analytics will enable organizations to safeguard their assets while fostering sustainable growth in a competitive marketplace. By prioritizing these advancements, financial entities can ensure resilience and responsiveness to the ever-changing economic landscape, ultimately securing their position at the forefront of the industry.

Frequently Asked Questions

What is the EQ Suite by Equabli?

The EQ Suite by Equabli is a comprehensive toolkit designed for financial institutions, consisting of three main components: EQ Engine, EQ Engage, and EQ Collect, aimed at enhancing debt collection solutions.

How does the EQ Engine function?

The EQ Engine allows organizations to create custom scoring models that help predict borrower repayment behaviors accurately.

What features does EQ Engage provide?

EQ Engage enhances communication with borrowers through their preferred channels, improves engagement, and enables borrowers to self-service with customized repayment plans.

What is the purpose of EQ Collect?

EQ Collect optimizes digital collections through a user-friendly, scalable, cloud-native interface, facilitating self-service repayment plans that meet modern consumer preferences.

How does the EQ Suite improve operational efficiency for financial organizations?

The EQ Suite supports data-driven strategies that enhance operational efficiency and reduce debt recovery costs by utilizing automated workflows and real-time reporting.

What advancements in technology are utilized in the EQ Suite?

The EQ Suite incorporates advanced technologies such as AI and machine learning to analyze debtor behavior more precisely and tailor collection strategies, resulting in improved recovery rates.

What measurable improvements have organizations experienced after implementing the EQ Suite?

Some organizations have reported a reduction in days of sales outstanding from 78 to 67 days within just two months of implementing the EQ Suite.

What is the role of Oracle Financial Services Risk Management in credit risk assessment?

Oracle Financial Services Risk Management employs advanced analytics to enhance the assessment of lending uncertainties, allowing organizations to identify potential threats early and implement efficient management strategies.

How does predictive modeling impact lending assessments in financial institutions?

Predictive modeling can enhance the precision of lending assessments by up to 25%, leading to a significant reduction in default rates.

What does the FICO Decision Management Suite offer?

The FICO Decision Management Suite provides automation tools for financial institutions to enhance loan assessment decisions, reducing manual errors and accelerating response times.

How does AI impact loan evaluation in financial institutions?

AI transforms loan evaluation by enabling faster assessments, allowing decisions that traditionally took 35-40 days to be made in minutes or hours, thereby improving customer satisfaction.

What benefits can financial institutions expect from adopting enterprise credit risk management solutions?

Financial institutions can expect a reduction in loan losses by 20-30% through more accurate evaluations and expedited decision-making processes.