Overview

The article identifies ten strategic solutions for financial institutions to manage compliance with the Fair Debt Collection Practices Act (FDCPA). It presents evidence through various tools and platforms, including the Equabli EQ Suite and Compliance.ai, which facilitate regulatory adherence via automation, real-time monitoring, and data-driven insights. This approach enables organizations to effectively navigate the complexities of compliance, thereby minimizing risks and reducing operational costs. These insights are critical for executives seeking to enhance their compliance frameworks and operational strategies.

Introduction

In an increasingly complex regulatory landscape, financial institutions encounter heightened pressure to comply with the Fair Debt Collection Practices Act (FDCPA). The implications of non-compliance are substantial, as they can lead to significant financial penalties and reputational harm.

This article explores ten innovative FDCPA compliance management solutions that empower financial organizations, streamline operations, and enhance adherence strategies.

As institutions navigate these regulatory challenges, the critical question arises: which tools will not only ensure compliance but also foster operational efficiency in an ever-evolving legal environment?

Equabli EQ Suite: Comprehensive Compliance Management for Financial Institutions

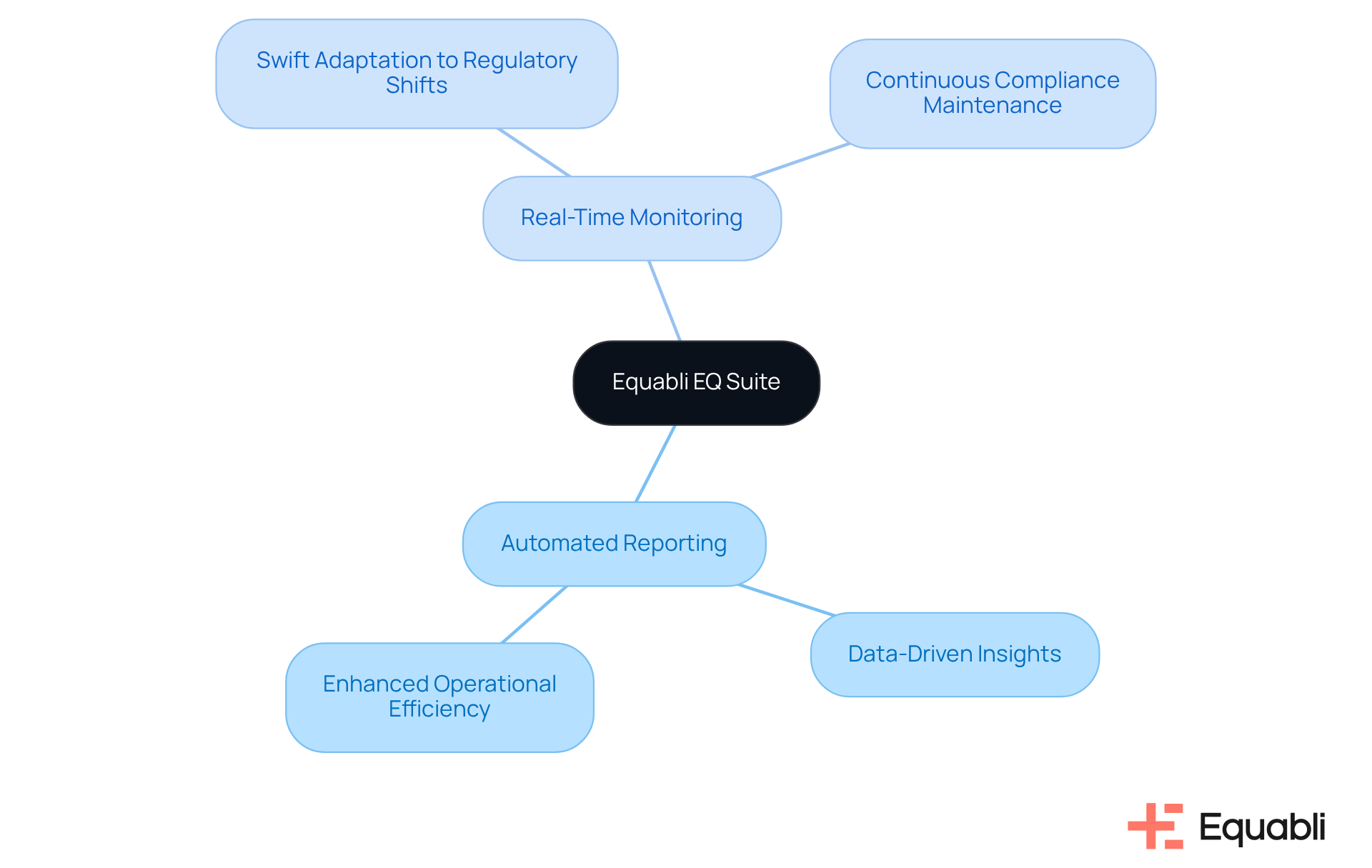

The Equabli EQ Suite provides for financial institutions, offering a robust suite of tools tailored to effectively navigate compliance with the Fair Debt Collection Practices Act (FDCPA). Key features of FDCPA compliance management solutions for financial institutions include:

- Real-time monitoring

These features enable organizations to swiftly adapt to regulatory shifts and maintain continuous compliance. Its facilitates seamless integration with existing systems, empowering organizations to refine their while ensuring adherence. By harnessing , the EQ Suite equips organizations with FDCPA compliance management solutions for financial institutions to make informed decisions that not only improve regulatory compliance but also enhance operational efficiency. This comprehensive approach allows banks to proactively tackle in an evolving legal landscape.

Compliance.ai: Real-Time Regulatory Updates for FDCPA Compliance

Compliance.ai serves as a robust platform delivering tailored specifically for financial institutions. By leveraging , it continuously monitors , including those relevant to the Fair Debt Collection Practices Act (FDCPA). This proactive strategy ensures organizations remain informed about the latest regulatory requirements, enabling to their practices.

Additionally, Compliance.ai oversees communications to ensure conformity with FDCPA standards by implementing , providing comprehensive . This approach simplifies the implementation of necessary changes, significantly reducing the risk of potential violations, including civil penalties of up to $10,000 per day for non-compliance.

Through these features, monetary organizations can by implementing [FDCPA compliance management solutions for financial institutions](https://equabli.com/solutions), ensuring compliance with regulatory standards while maintaining operational efficiency. Furthermore, with AI by as much as 40%, Compliance.ai not only supports regulatory adherence but also improves cost-effectiveness in operations.

FICO: Advanced Analytics for Risk Assessment and Compliance

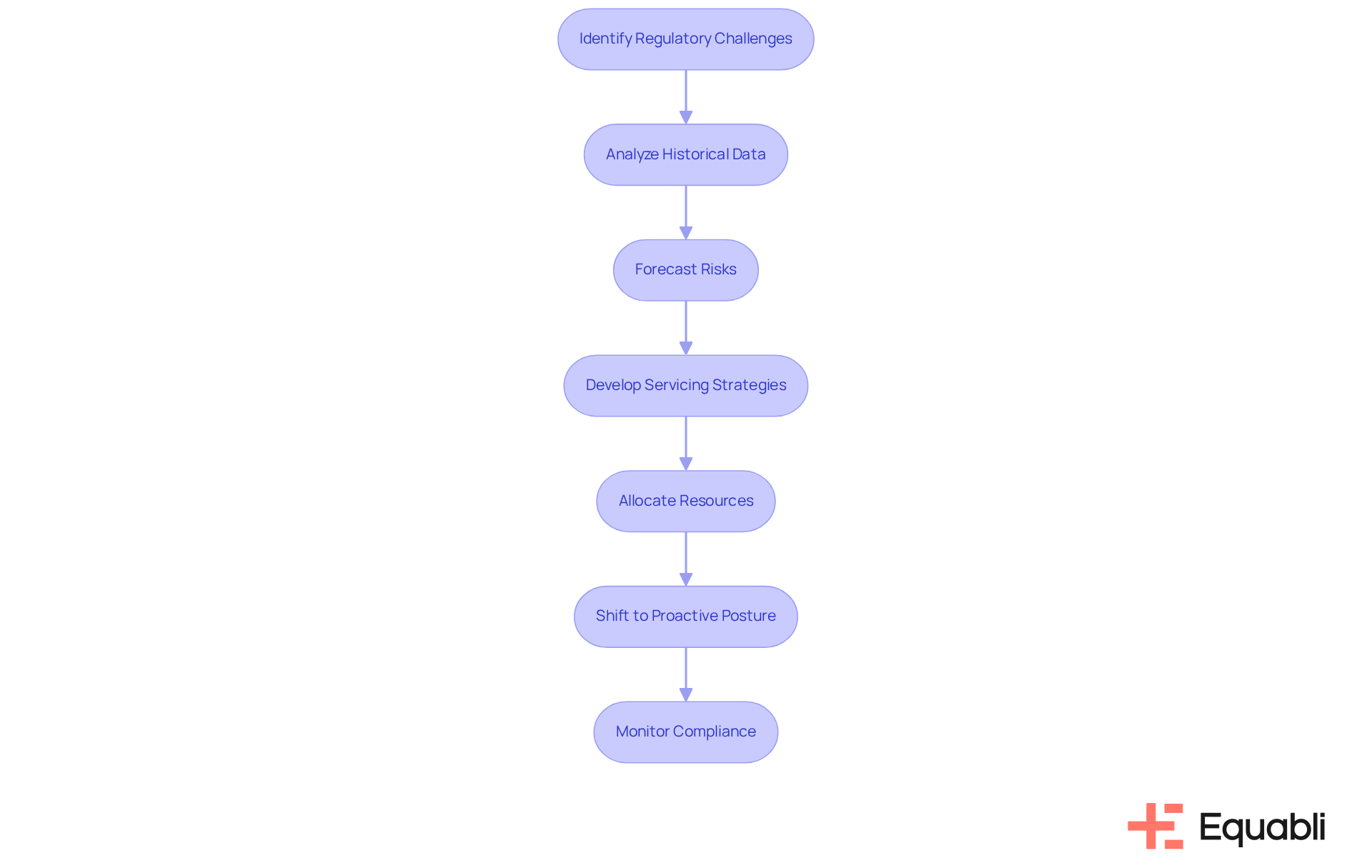

Equabli delivers that empower them to thoroughly assess risk and ensure . Leveraging the predictive capabilities of the , organizations can proactively identify potential regulatory challenges and assess the risk of delinquency for active accounts across various communication channels. This forward-thinking approach not only assists in meeting but also enhances overall operational efficiency.

For instance, the EQ Engine's predictive analytics can analyze historical data patterns to forecast . This enables organizations to allocate resources more effectively and concentrate on high-risk areas. Consequently, organizations can , promoting accountability and continuous improvement.

By integrating Equabli's analytics into existing regulatory frameworks, institutions can leverage FDCPA compliance management solutions for financial institutions to gain a and compliance status, leading to improved decision-making and reduced penalties associated with non-compliance. Notably, it is crucial to acknowledge that only 20% of analytics insights yield business results, highlighting the .

As Dov Goldman asserts, "Occasional or one-off assessments are simply inadequate in a fast-changing risk environment," underscoring the necessity for . Furthermore, the potential repercussions of non-compliance—such as —emphasize the critical need for robust adherence strategies.

LexisNexis Risk Solutions: Data Insights for Enhanced Compliance Management

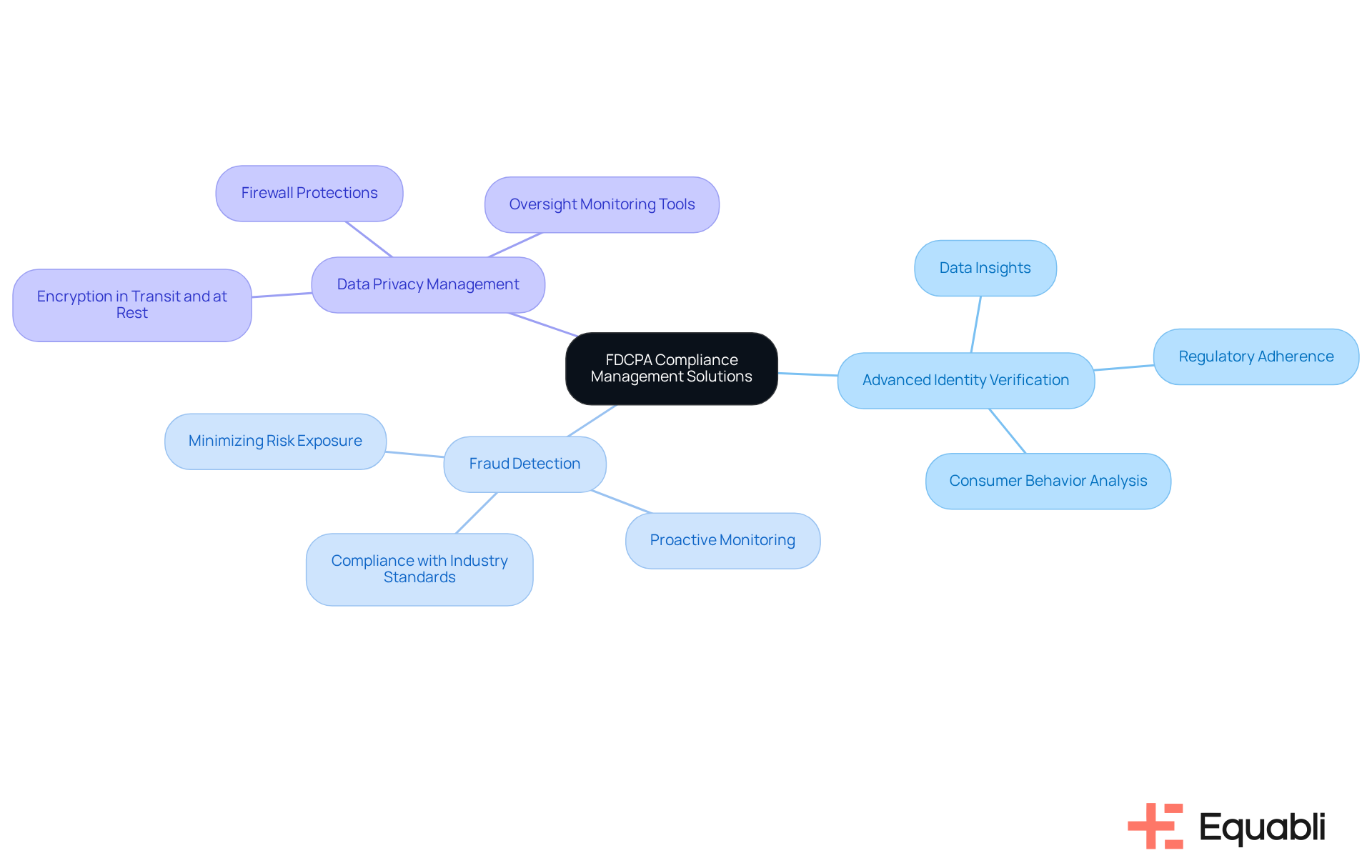

Equabli provides an extensive array of that significantly enhance . With having tripled between 2013 and 2022, the necessity for has reached unprecedented levels. These FDCPA compliance management solutions for financial institutions provide essential insights into , credit risk, and evolving compliance landscapes, enabling organizations to make informed decisions that align with the Fair Debt Collection Practices Act (FDCPA) requirements. Key offerings include:

- Advanced identity verification

- Fraud detection capabilities

These are crucial for maintaining .

Furthermore, guarantees that customer data is protected against unauthorized access, use, or disclosure through methods such as encryption in transit and at rest, along with firewall protections. The integration of to proactively address potential regulatory challenges, ensuring alignment with industry standards. As financial organizations increasingly rely on data insights, the ability to in fostering adherence to FDCPA compliance management solutions for financial institutions, ultimately leading to improved compliance outcomes and reduced operational risks.

As Mark Sangster, VP at Adlumin, emphasizes, " than it is now," underscoring the urgency for organizations to prioritize adherence. To remain proactive, organizations should regularly evaluate their regulatory tools in light of the evolving data privacy laws, especially with the anticipated increased enforcement from the Federal Trade Commission (FTC) in 2024. Equabli's stringent policies against sharing personal information with third parties further reinforce its dedication to safeguarding customer information throughout the debt collection process.

Zoot Enterprises: Automated Decisioning for Streamlined Compliance

Zoot Enterprises provides that significantly enhance . By , Zoot effectively reduces the risk of non-compliance associated with human error. Their platform seamlessly integrates with existing systems, facilitating real-time adherence checks and automated reporting. This strategy not only enhances but also enables institutions to quickly adapt to regulatory changes, thereby ensuring .

The implementation of FDCPA compliance management solutions for financial institutions can lead to substantial , fostering a . Industry experts emphasize that can optimize resource allocation and decrease compliance-related expenses, further highlighting the value of Zoot's solutions.

Additionally, Zoot's recognition as at the 2023 Credit & Collections Technology Awards underscores their commitment to excellence in management.

SAS: Analytics and Reporting Tools for Compliance Monitoring

Equabli offers a robust suite of features designed to enhance and . With , organizations can significantly reduce through a straightforward, no-code file-mapping tool, thereby improving . This solution empowers organizations to implement that enhance collections while minimizing execution errors and manual labor through automated workflows. Furthermore, EQ Collect features a user-friendly, scalable, cloud-native interface that optimizes operational processes.

Recent industry insights reveal that:

- 70% of corporate risk and regulatory professionals have observed a shift towards more strategic regulatory approaches in recent years, highlighting the growing importance of data-driven decision-making in management.

- By leveraging the functionalities of EQ Collect, organizations can attain unparalleled clarity and insight through , ensuring compliance with FDCPA compliance management solutions for financial institutions and maintaining .

As organizations increasingly rely on reporting tools, statistics indicate that:

- 38% of regulatory leaders cite inefficient or manual processes as their primary concern.

- EQ Collect directly addresses these inefficiencies by automating and reporting, enabling organizations to streamline their processes and focus on strategic regulatory initiatives.

Numerous financial organizations have successfully utilized EQ Collect in conjunction with SAS solutions as FDCPA compliance management solutions for financial institutions, demonstrating measurable improvements in their management frameworks. As we approach 2025, the trend of employing advanced reporting tools for regulatory tracking is expected to continue, with a strong emphasis on enhancing operational efficiency and mitigating regulatory risks. Financial organizations should consider implementing Equabli's solutions not only to meet regulatory obligations but also to .

CuraDebt: Specialized Services for Compliance Management

CuraDebt demonstrates exceptional proficiency in delivering , tailored specifically to their needs. Their adept team navigates the complexities of the Fair Debt Collection Practices Act (FDCPA) by equipping organizations with FDCPA compliance management solutions for financial institutions. Key offerings include:

- Customized training programs

These are essential for maintaining legal standards and enhancing . As financial organizations face increased scrutiny, the importance of robust has escalated, with 57% of leaders underscoring the necessity of to ensure staff are well-versed in , including FDCPA compliance management solutions for financial institutions.

Looking ahead to 2025, adherence evaluations will become critical, as 61% of financial organizations prioritize FDCPA compliance management solutions for financial institutions to effectively manage escalating within their (ERM) programs. These audits not only but also identify opportunities for improvement, fostering a culture of conformity within the organization.

In light of the evolving debt collection landscape, to providing FDCPA compliance management solutions for financial institutions positions them as a vital partner for organizations seeking to strengthen their regulatory efforts.

ComplianceLine: Training and Reporting Solutions for FDCPA Compliance

ComplianceLine offers a comprehensive suite of training and reporting solutions designed for financial institutions that prioritize . Their training programs encompass , ensuring that staff are well-informed and equipped to meet industry standards. In conjunction with this educational initiative, facilitate meticulous , enabling organizations to pinpoint areas necessitating improvement. This integrated approach not only enhances overall but also significantly mitigates the risk of legal violations by utilizing FDCPA solutions for financial institutions.

In 2025, towards that support . Industry experts assert that such tools are critical for fostering transparency and accountability within organizations. By leveraging these innovative reporting solutions, financial institutions can utilize FDCPA compliance management solutions for financial institutions to adeptly navigate the complexities of regulatory requirements, ensuring alignment with evolving legislative mandates.

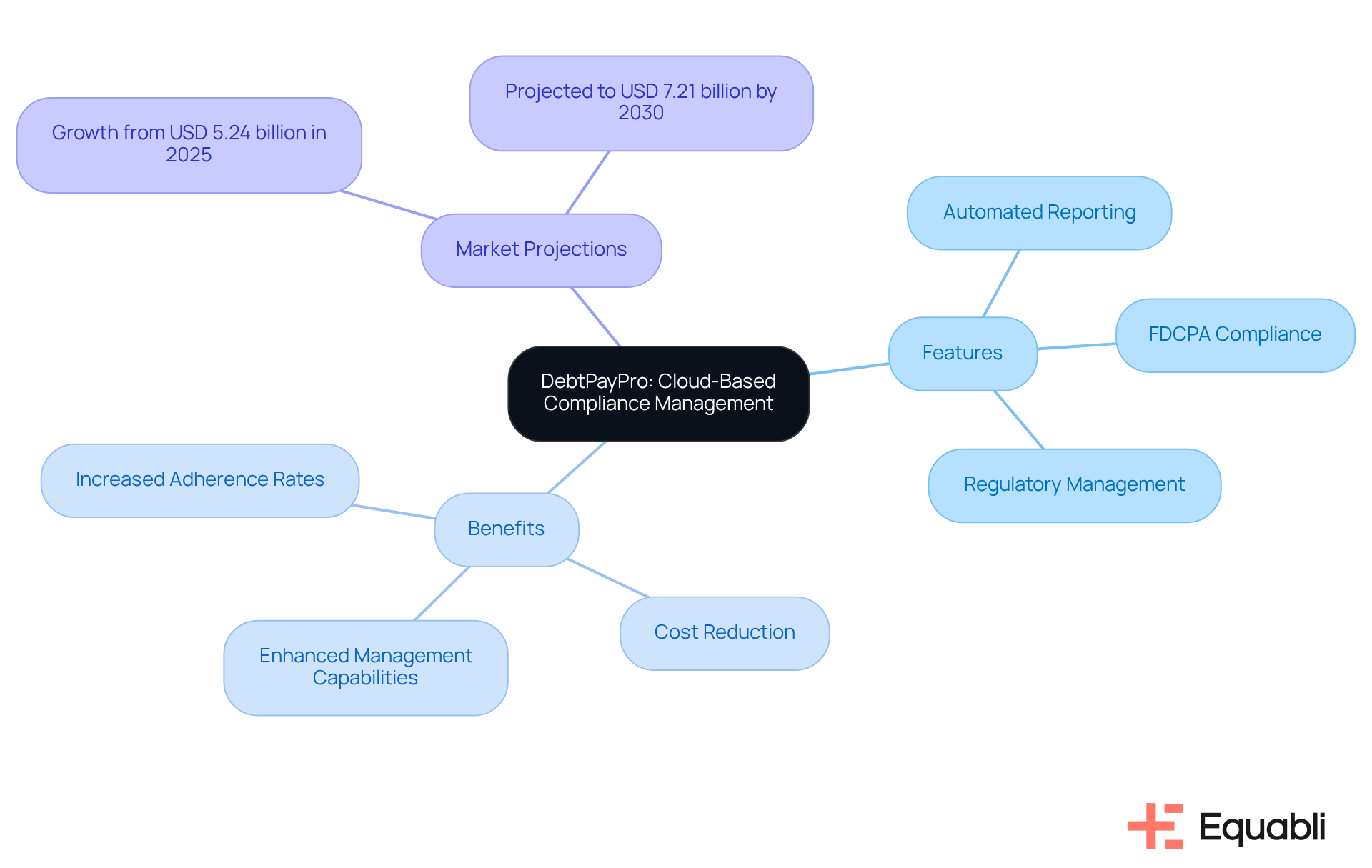

DebtPayPro: Cloud-Based Compliance Management for Debt Collection

DebtPayPro provides a robust tailored for debt collection agencies, equipped with as . This platform , thereby . Evidence suggests that the integration of automated reporting could by as much as 60%, as agencies increasingly leverage technology to . This transition not only but also , enabling agencies to concentrate on core collection activities while ensuring the implementation of FDCPA compliance management solutions for financial institutions. As the is projected to grow from USD 5.24 billion in 2025 to USD 7.21 billion by 2030, the importance of FDCPA compliance management solutions for financial institutions becomes increasingly critical.

Proven Compliance Solutions: Consulting for Effective FDCPA Strategies

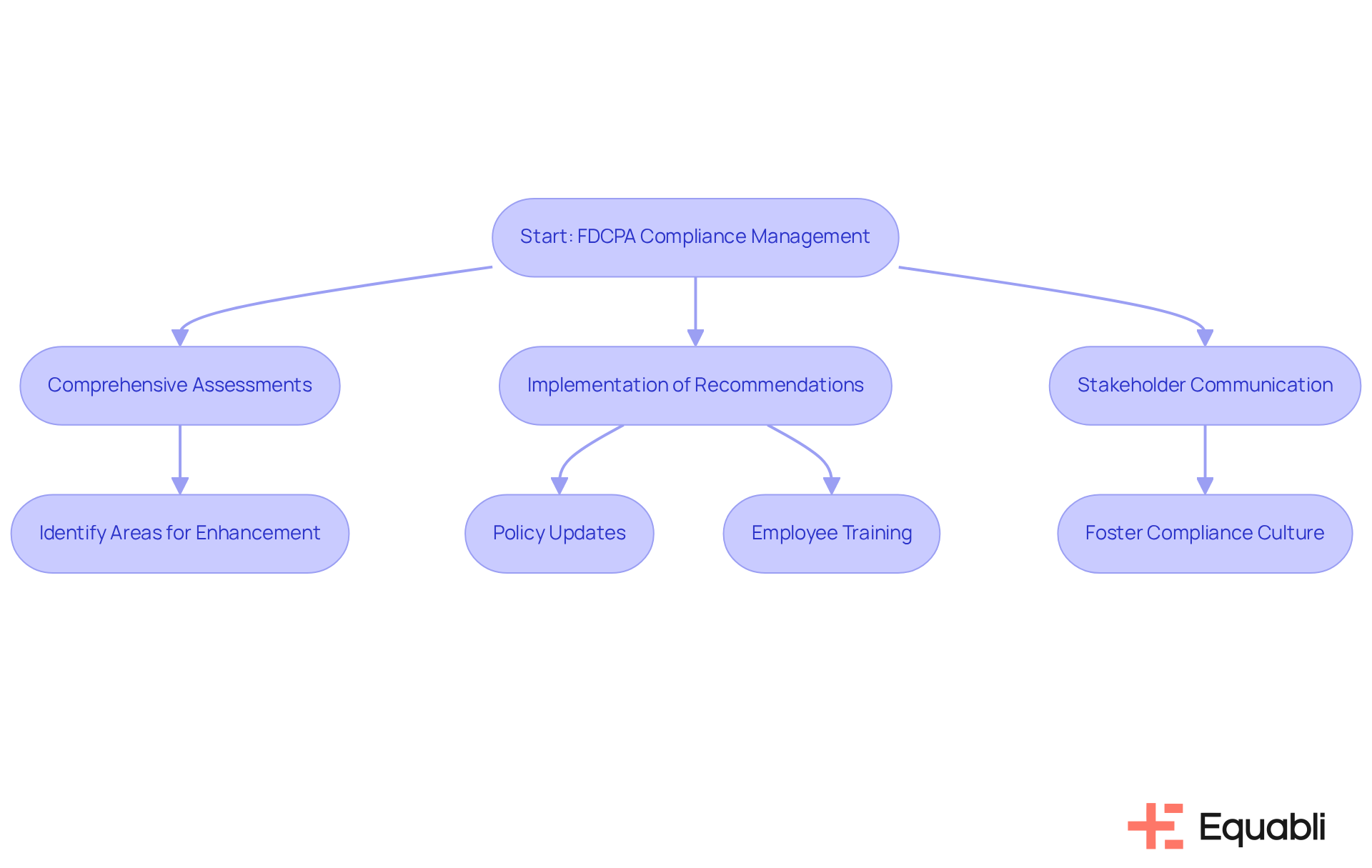

Proven Compliance Solutions specializes in consulting services that offer for to develop to the Fair Debt Collection Practices Act (FDCPA). Their experienced team conducts , pinpointing specific areas requiring enhancement. By leveraging these insights, organizations can implement practical recommendations, such as policy updates and employee training programs, that not only comply with but also effectively mitigate risks.

This proactive approach is essential in today's , where financial entities must navigate intricate legal obligations while maintaining operational efficiency. Furthermore, regarding is crucial for fostering a culture of compliance within organizations. Proven Compliance Solutions has successfully transformed regulatory frameworks, empowering institutions to attain sustainable growth and preserve their industry standing.

The significant legal and financial repercussions of non-compliance highlight the urgency of . Regular assessments and updates of risk management practices are also vital to adapt to evolving regulations. By partnering with Proven Compliance Solutions, organizations can management solutions for financial institutions, ensuring they meet regulatory demands and effectively reduce risks.

Conclusion

The imperative for robust FDCPA compliance management solutions in financial institutions cannot be overstated. As the regulatory landscape evolves, organizations must prioritize innovative tools and strategies that facilitate regulatory adherence while enhancing operational efficiency. The evidence presented through solutions such as the Equabli EQ Suite, Compliance.ai, and Zoot Enterprises illustrates their unique contributions to compliance management, emphasizing the critical role of real-time monitoring, automated reporting, and advanced analytics. These features empower organizations to proactively tackle regulatory challenges, thereby minimizing risk exposure.

Moreover, specialized services from CuraDebt and Proven Compliance Solutions highlight the necessity of tailored training and consulting, fostering a culture of compliance within financial institutions. By embracing these advancements, institutions are not only mitigating the risk of legal violations but also positioning themselves for sustainable growth in an increasingly competitive environment. Therefore, taking proactive steps toward compliance today is essential for establishing a resilient and efficient operational framework for the future.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a comprehensive compliance management solution designed for financial institutions to navigate compliance with the Fair Debt Collection Practices Act (FDCPA). It offers a suite of tools that include automated reporting and real-time monitoring.

How does the Equabli EQ Suite help with FDCPA compliance?

The EQ Suite helps organizations maintain continuous compliance by enabling them to swiftly adapt to regulatory shifts and refine their collection strategies through data-driven insights.

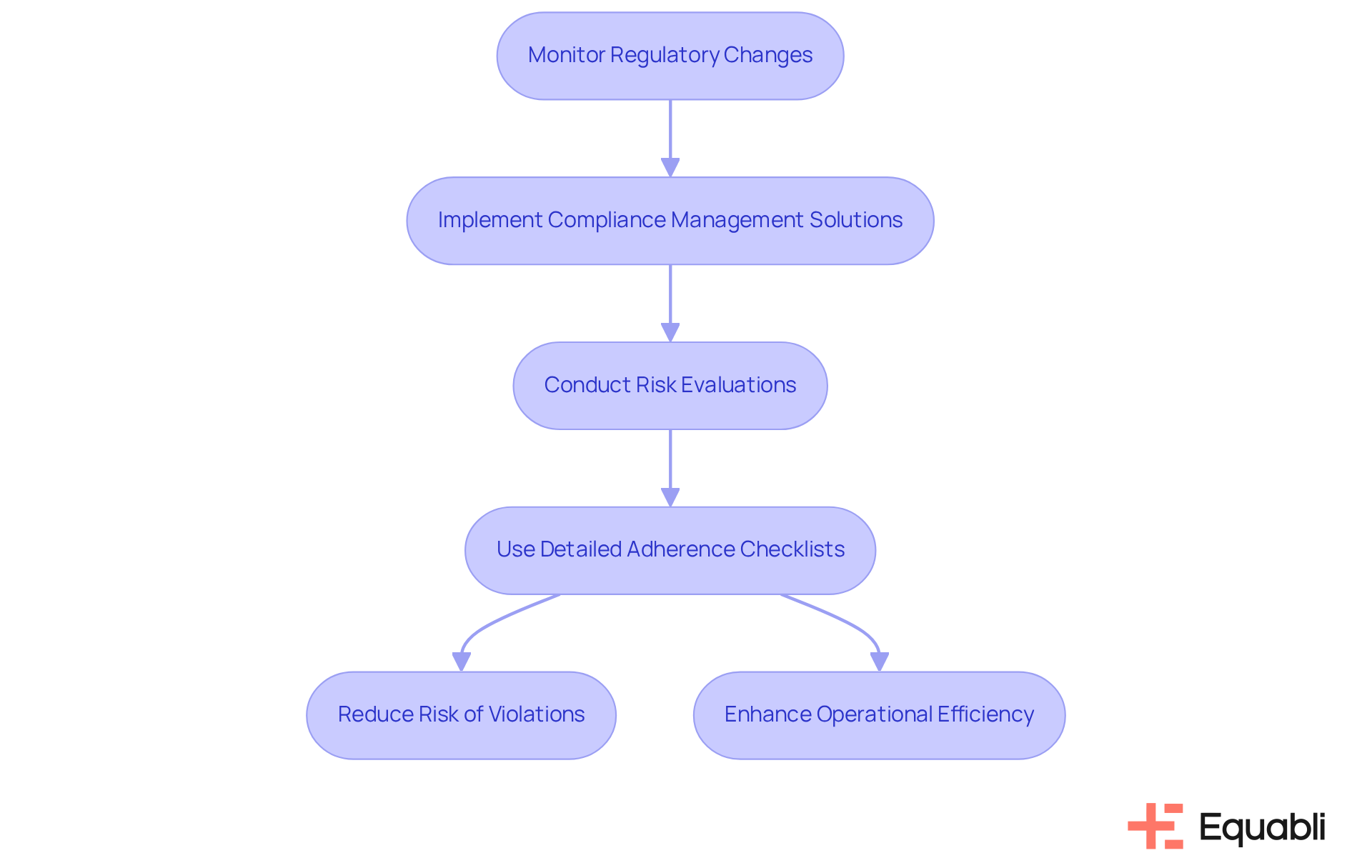

What are the key features of Compliance.ai?

Compliance.ai provides real-time regulatory updates, monitors changes in laws and regulations related to FDCPA, oversees communications for conformity with FDCPA standards, and offers comprehensive risk evaluations and adherence checklists.

How does Compliance.ai reduce compliance risks?

By continuously monitoring regulatory changes and providing detailed adherence checklists, Compliance.ai simplifies the implementation of necessary changes, significantly reducing the risk of potential violations and associated civil penalties.

What role does FICO play in compliance management?

FICO delivers advanced analytics solutions that allow financial institutions to assess risk and ensure FDCPA compliance. Its EQ Engine uses predictive analytics to identify potential regulatory challenges and assess delinquency risk.

Why is ongoing monitoring important for compliance?

Ongoing monitoring is crucial because it allows organizations to shift from a reactive to a proactive regulatory posture, promoting accountability and continuous improvement in compliance efforts.

What are the consequences of non-compliance with FDCPA?

Non-compliance with FDCPA can lead to financial penalties, legal consequences, and reputational damage, emphasizing the need for robust compliance strategies.

How can organizations enhance their adherence strategies using these solutions?

Organizations can enhance their adherence strategies by implementing FDCPA compliance management solutions that leverage real-time updates, predictive analytics, and comprehensive risk evaluations to ensure compliance while maintaining operational efficiency.