Overview

The article emphasizes the critical role of invoice text message templates in B2B payment reminders, underscoring their significance in enhancing communication and mitigating late payments within financial services. Evidence suggests that customizable templates and automated workflows can significantly enhance client engagement and recovery rates. This, in turn, leads to more efficient debt collection processes, providing a strategic advantage in managing enterprise-level operations.

Introduction

In the fast-paced realm of B2B transactions, timely payment reminders are critical to sustaining a business's cash flow. The advent of digital communication presents companies with an opportunity to leverage innovative text message templates that can enhance their payment collection strategies. This article explores ten effective invoice text message templates specifically designed for B2B payment reminders. These templates not only streamline processes but also foster healthy client relationships.

How can these templates prompt timely payments while simultaneously cultivating goodwill and compliance in an environment where financial expectations often lack clarity?

Equabli EQ Suite: Automate Payment Reminders for Enhanced Efficiency

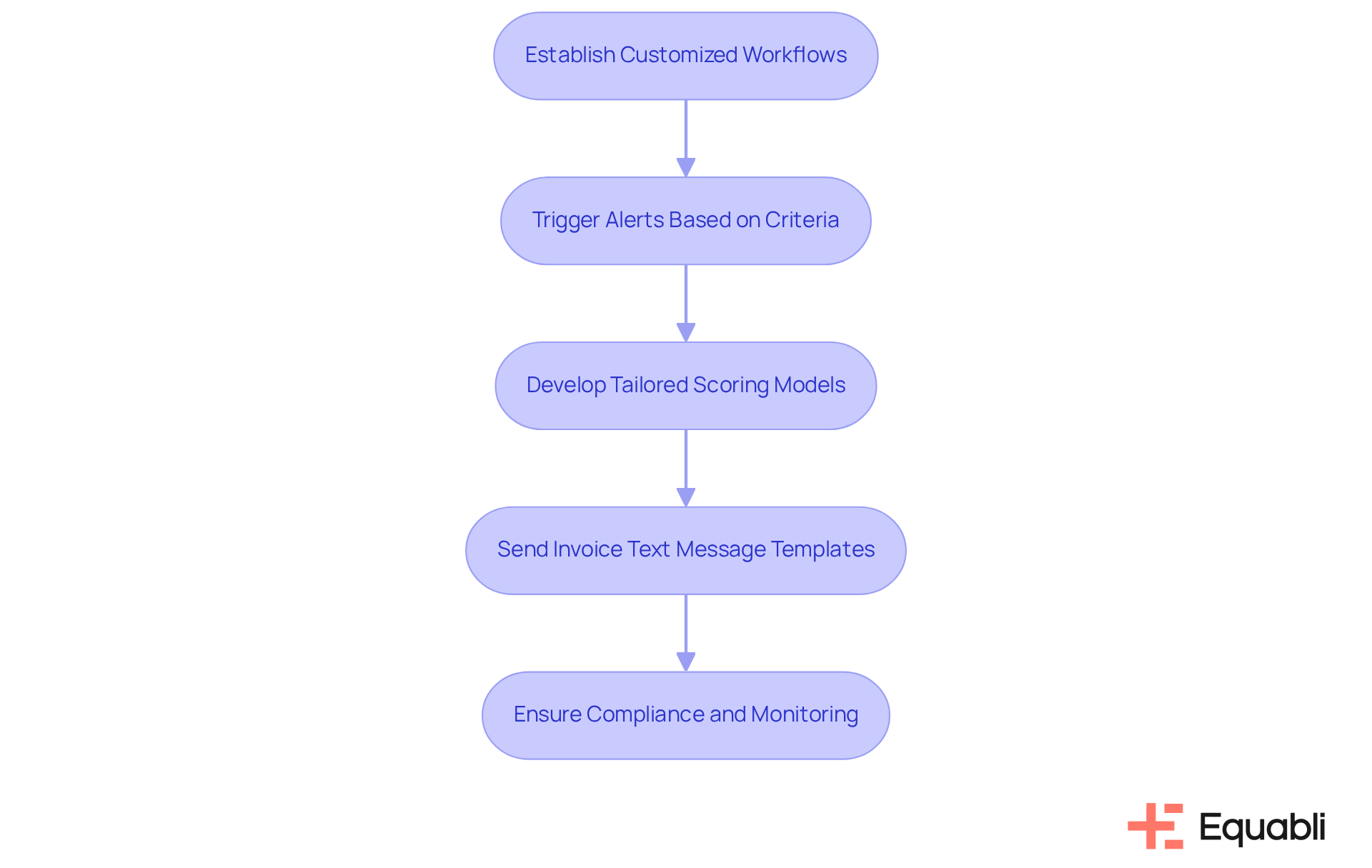

The Equabli EQ Suite offers a comprehensive solution that includes invoice text message templates for B2B payment reminders in financial services, allowing businesses to establish customized workflows that trigger alerts based on specific criteria. By implementing data-driven strategies, organizations can enhance timely communication with clients using invoice text message templates for B2B payment reminders in financial services, thereby minimizing the risk of late payments.

The EQ Engine, an integral component of the suite, empowers users to develop tailored scoring models that forecast repayment behaviors. This ensures that invoice text message templates for B2B payment reminders in financial services are sent at the optimal moment for maximum effectiveness. Such automation not only conserves valuable time but also enhances borrower engagement through preferred communication channels, ultimately leading to improved recovery rates.

Moreover, with industry-leading compliance oversight and automated monitoring, Equabli guarantees that all data handling adheres to stringent privacy standards. This commitment provides financial institutions with peace of mind as they navigate the complexities associated with debt collection, reinforcing the importance of compliance in operational strategies.

Chaser: Friendly Late Payment Reminder Email Templates

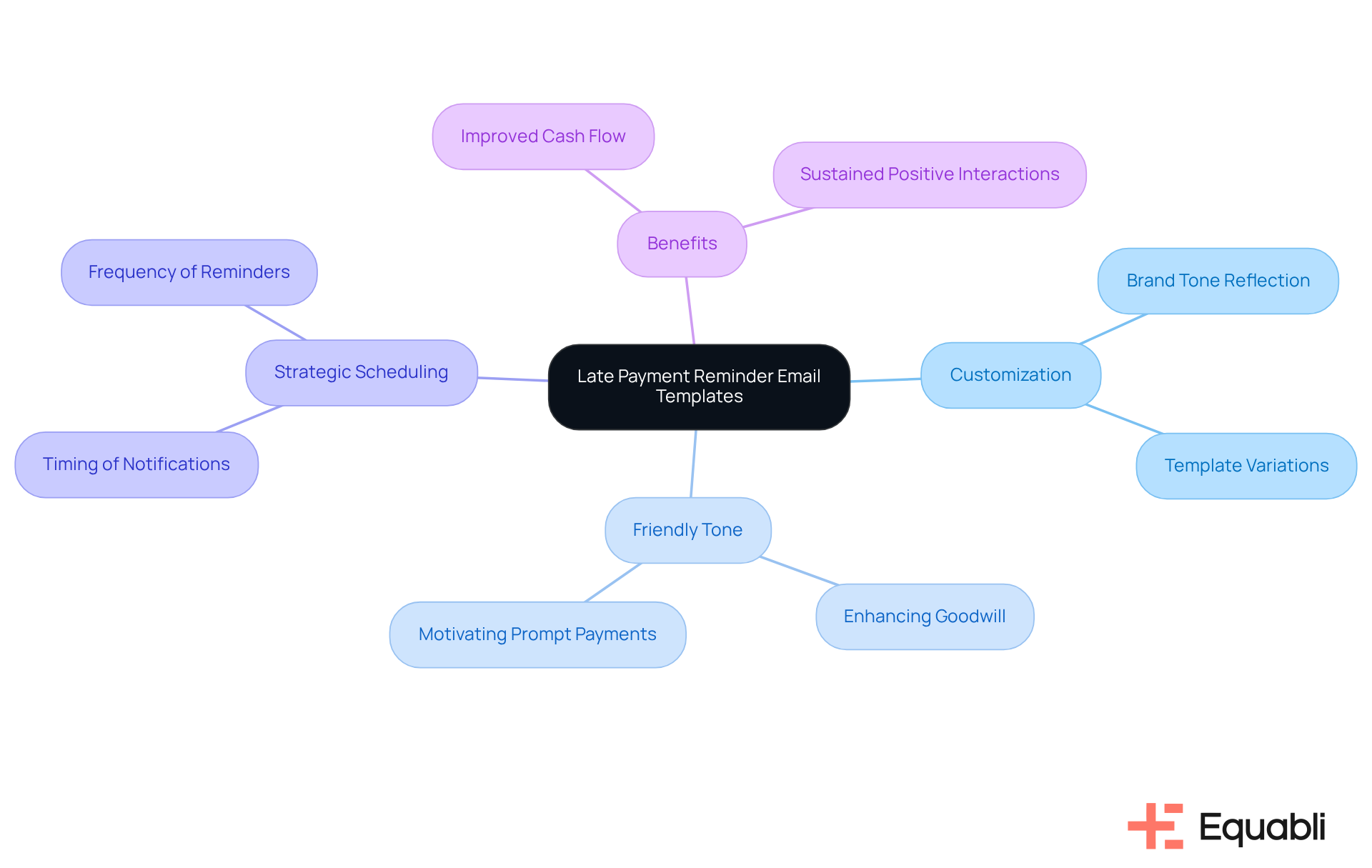

Chaser offers a suite of late fee notification email formats designed to promote timely settlements while preserving client relationships. These formats can be customized to reflect the brand's tone and programmed to send notifications at strategic intervals. By adopting a friendly tone, businesses can enhance goodwill and motivate clients to settle their accounts promptly. This approach not only improves cash flow but also sustains positive interactions, which is essential for effective enterprise-level debt management.

Peakflo: Customizable Payment Reminder Templates for Every Stage

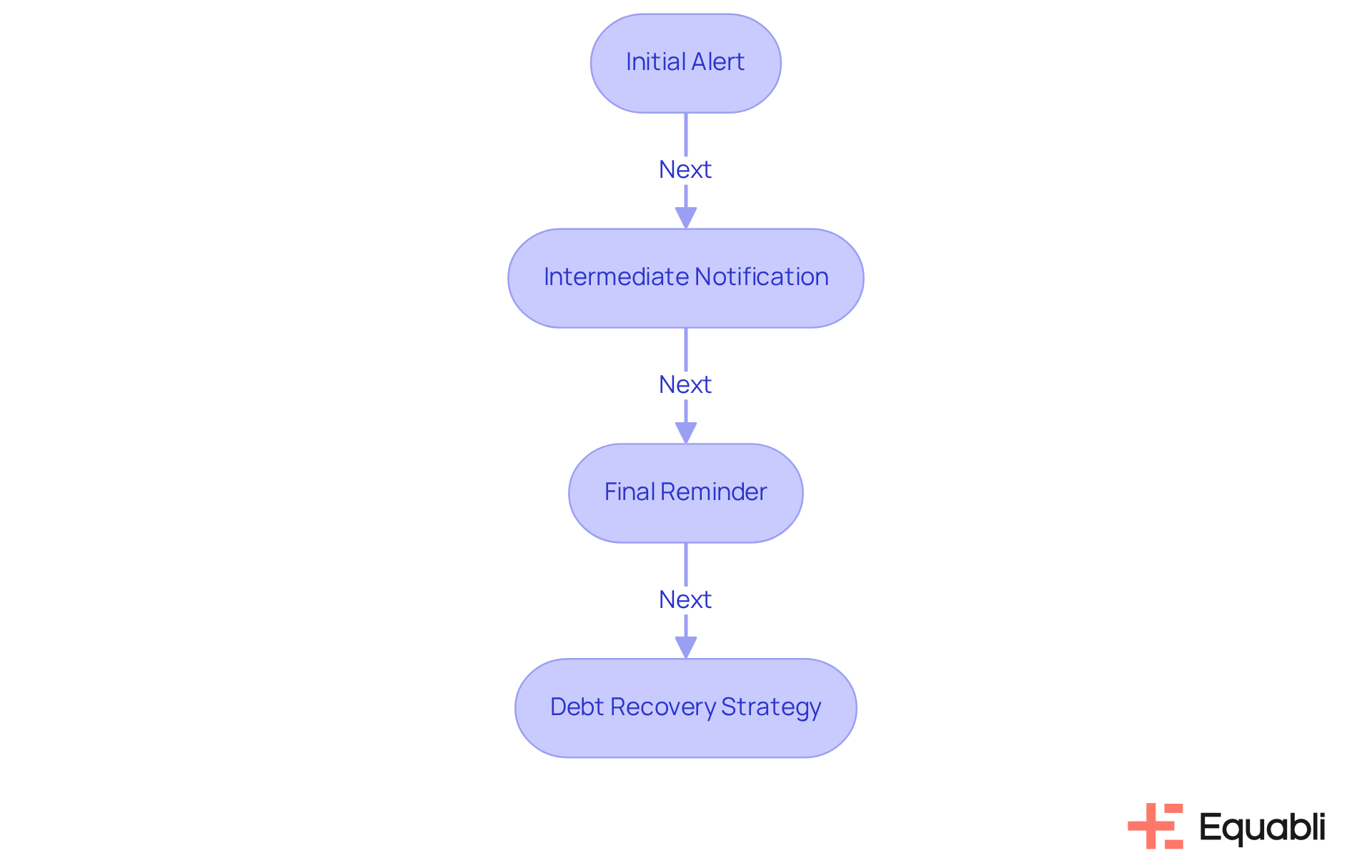

Equabli provides adaptable notification designs tailored to each phase of the transaction process, ranging from initial alerts to final notices. This flexibility allows businesses to customize their communications based on the client's transaction history and relationship status. By integrating these frameworks with Equabli's EQ Suite, organizations can ensure that their notifications are not only timely and relevant but also supported by a contemporary, data-informed strategy for debt recovery. Such integration significantly enhances the likelihood of timely fund recovery, streamlining operations and improving overall performance in the recovery lifecycle.

Messente: SMS Payment Reminder Templates for Timely Collections

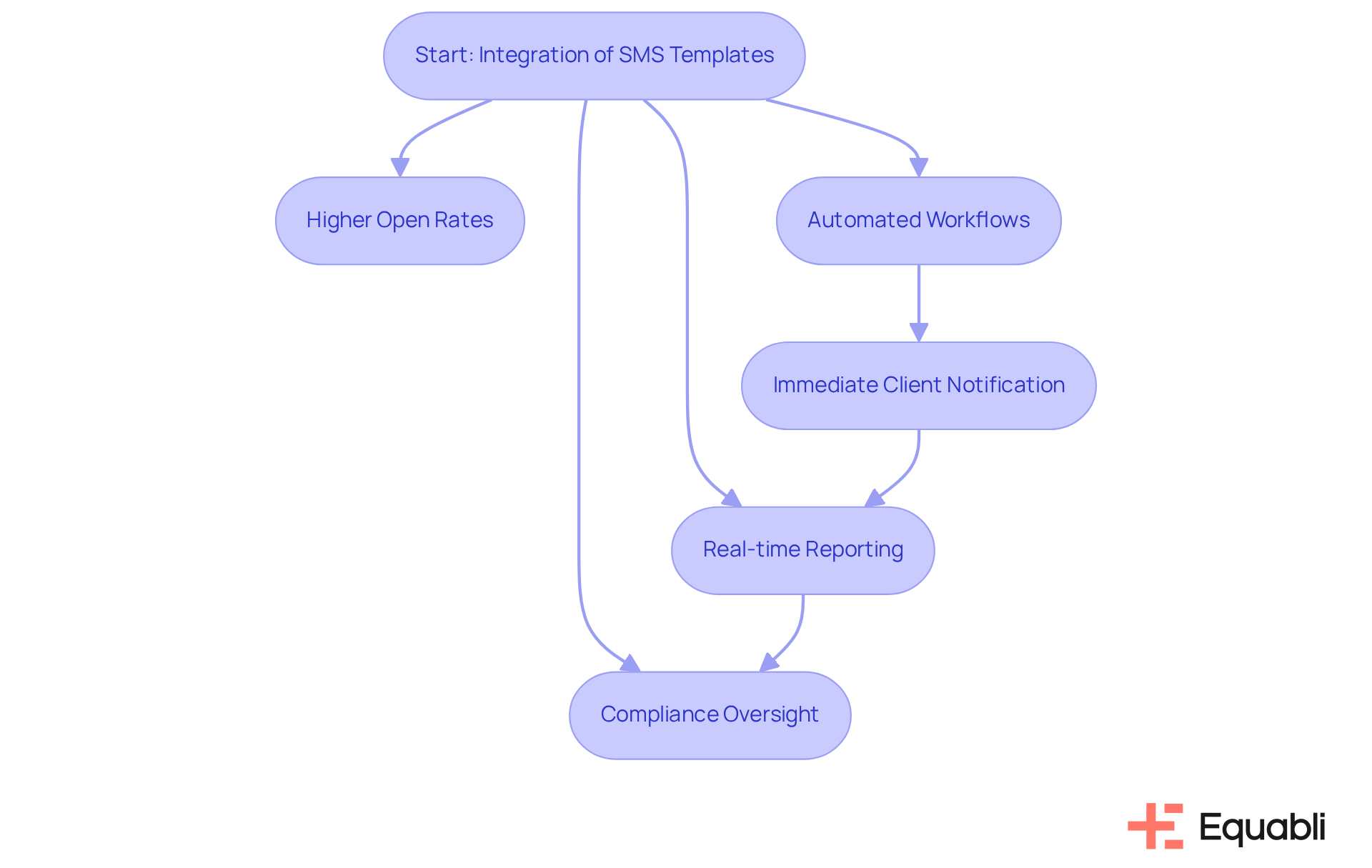

Integrating SMS notification formats provided by Messente with the functionalities of EQ Collect significantly enhances debt recovery efficiency. Invoice text message templates for b2b payment reminders in financial services boast a higher open rate than emails, establishing them as a critical tool for ensuring timely payments. By leveraging invoice text message templates for b2b payment reminders in financial services alongside EQ Collect's data-centric strategies, automated workflows, and no-code file-mapping tool, organizations can promptly inform clients of upcoming charges or overdue accounts. This proactive approach encourages immediate action, thereby reducing the risk of prolonged delinquency. Moreover, EQ Collect's real-time reporting, automated monitoring, and compliance oversight not only streamline the collection process but also ensure adherence to industry standards.

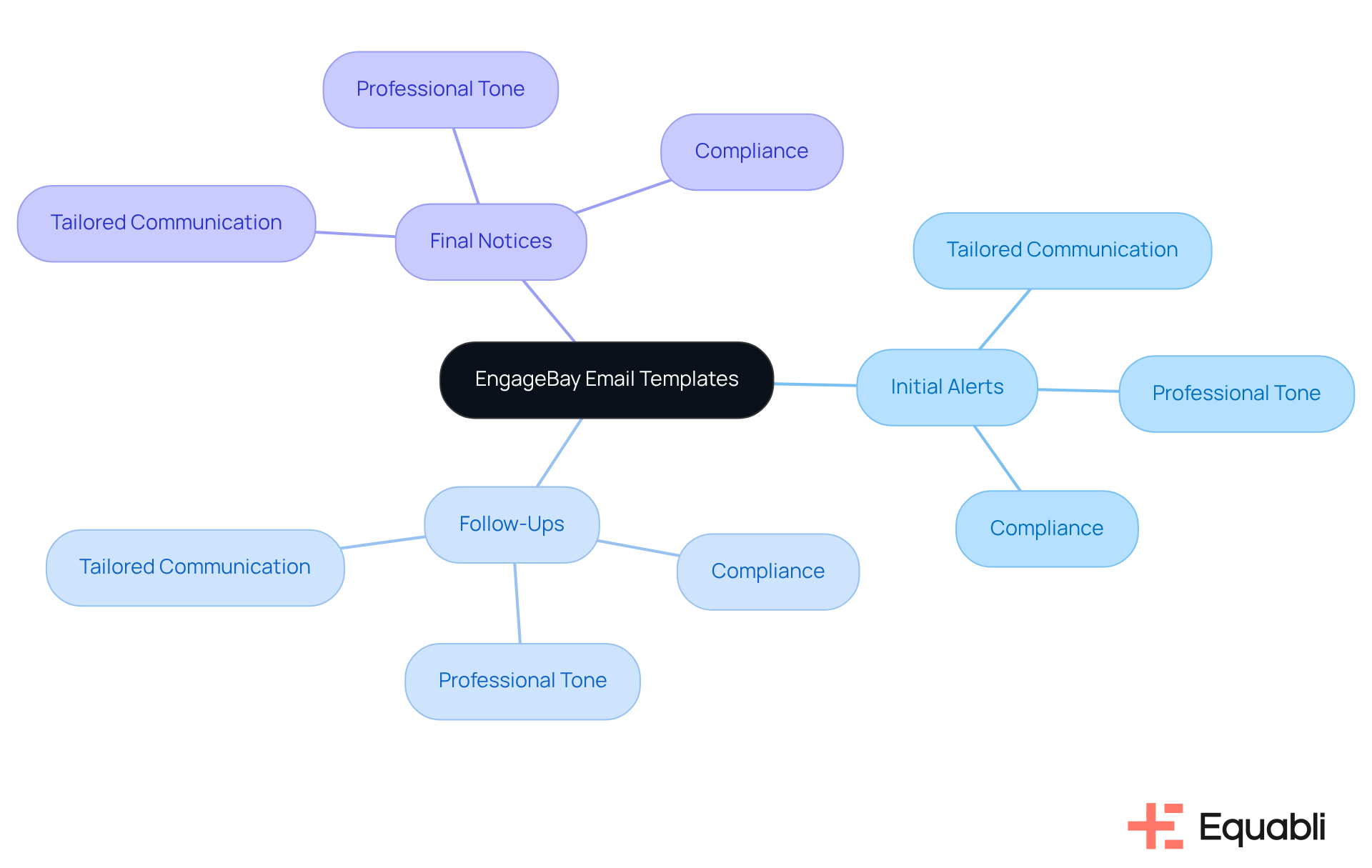

EngageBay: Versatile Payment Reminder Email Templates for Various Scenarios

EngageBay provides a range of adaptable email formats for notifications, suitable for various scenarios such as initial alerts, follow-ups, and final notices. This adaptability allows businesses to tailor their communication based on clients' financial behaviors, ensuring that reminders remain relevant and impactful. By leveraging these models, organizations can maintain a professional tone when addressing financial matters, which ultimately enhances collection outcomes.

From a compliance perspective, utilizing these customizable email formats not only aligns with industry standards but also reinforces the importance of effective communication in debt collection processes. The strategic application of these tools can lead to improved engagement with clients, fostering a more responsive and responsible approach to financial management.

To operationalize this strategy, businesses must consider how these adaptable formats can be integrated into their existing communication workflows. By doing so, they can ensure that their outreach is not only timely but also resonates with the specific circumstances of each client, thereby increasing the likelihood of successful collections.

In conclusion, the flexibility offered by EngageBay's email formats serves as a critical asset for organizations aiming to enhance their financial communication strategies. By adopting these tools, businesses can navigate the complexities of debt collection while upholding a professional image and achieving better results.

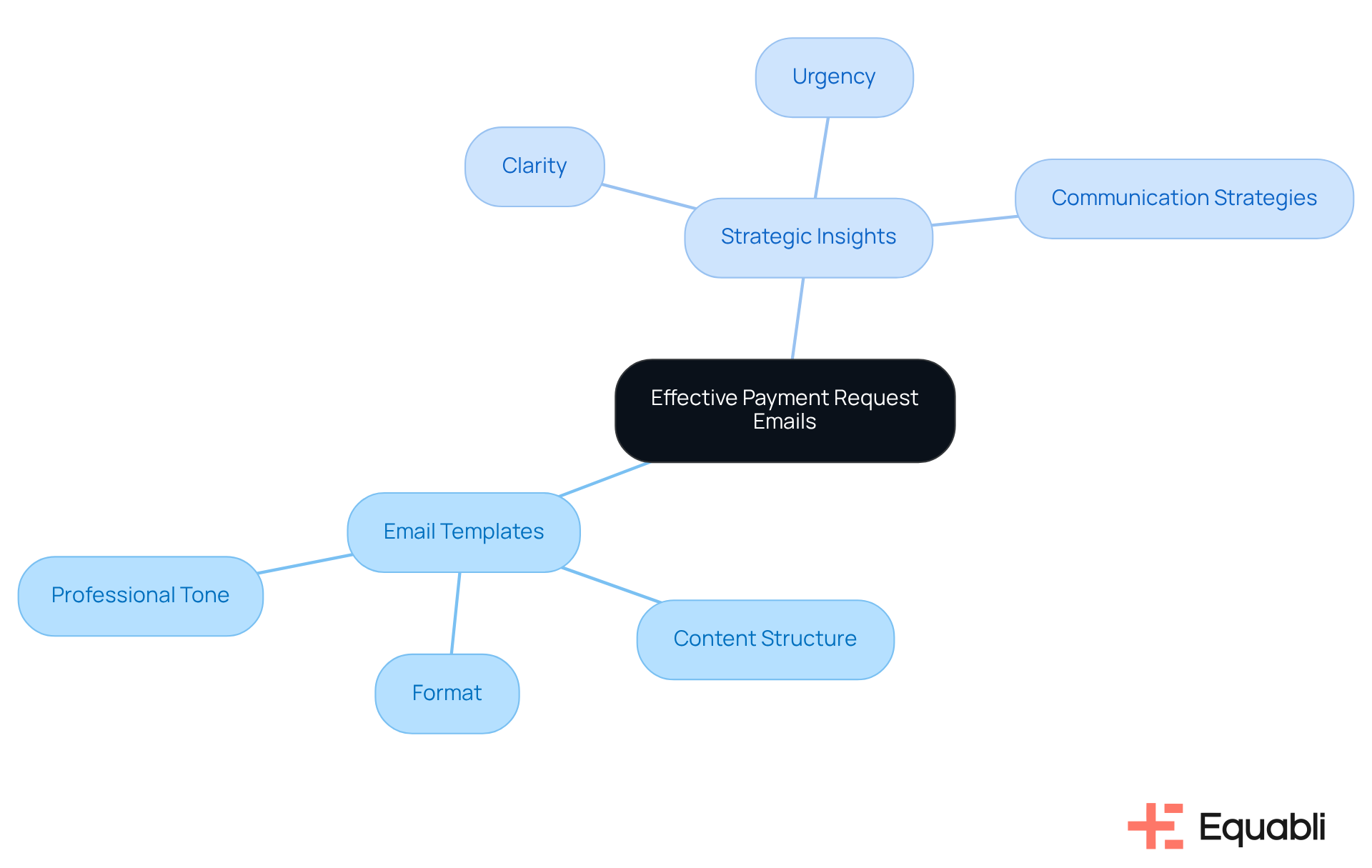

EasyStaff: Effective Payment Request Email Templates and Tips

EasyStaff delivers efficient invoice request email formats, accompanied by strategic insights for crafting persuasive communications. These templates are meticulously designed to articulate financial expectations with clarity while upholding a professional tone. The accompanying recommendations underscore the critical importance of clarity and urgency in request communications, aiding businesses in articulating their needs effectively. By leveraging these resources, organizations can enhance their communication strategies, thereby increasing the likelihood of timely fund receipt.

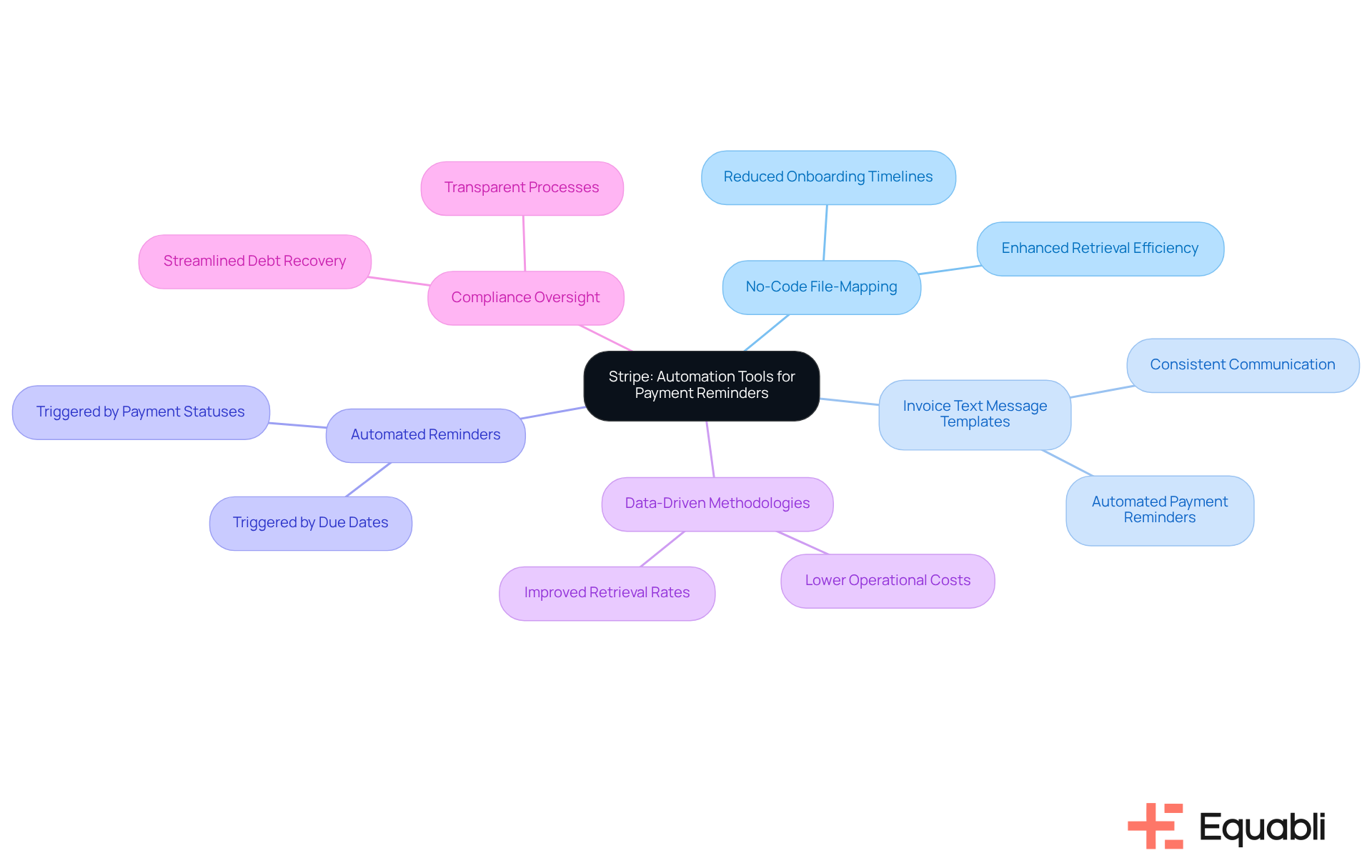

Stripe: Automation Tools for Streamlined Payment Reminders

Equabli offers a suite of automation tools through EQ Collect, enabling financial organizations to optimize their billing notification processes. The platform features a no-code file-mapping tool, which significantly reduces vendor onboarding timelines and enhances retrieval efficiency. By utilizing invoice text message templates for b2b payment reminders in financial services, organizations can automate reminders based on specific triggers—such as due dates or payment statuses—minimizing manual efforts and ensuring consistent communication with clients.

Utilizing data-driven methodologies and providing immediate reporting capabilities, businesses can improve retrieval rates while simultaneously lowering operational costs. With robust compliance oversight and a user-friendly, scalable interface, EQ Collect transforms debt recovery into a streamlined, transparent process, positioning organizations to navigate the complexities of financial compliance effectively.

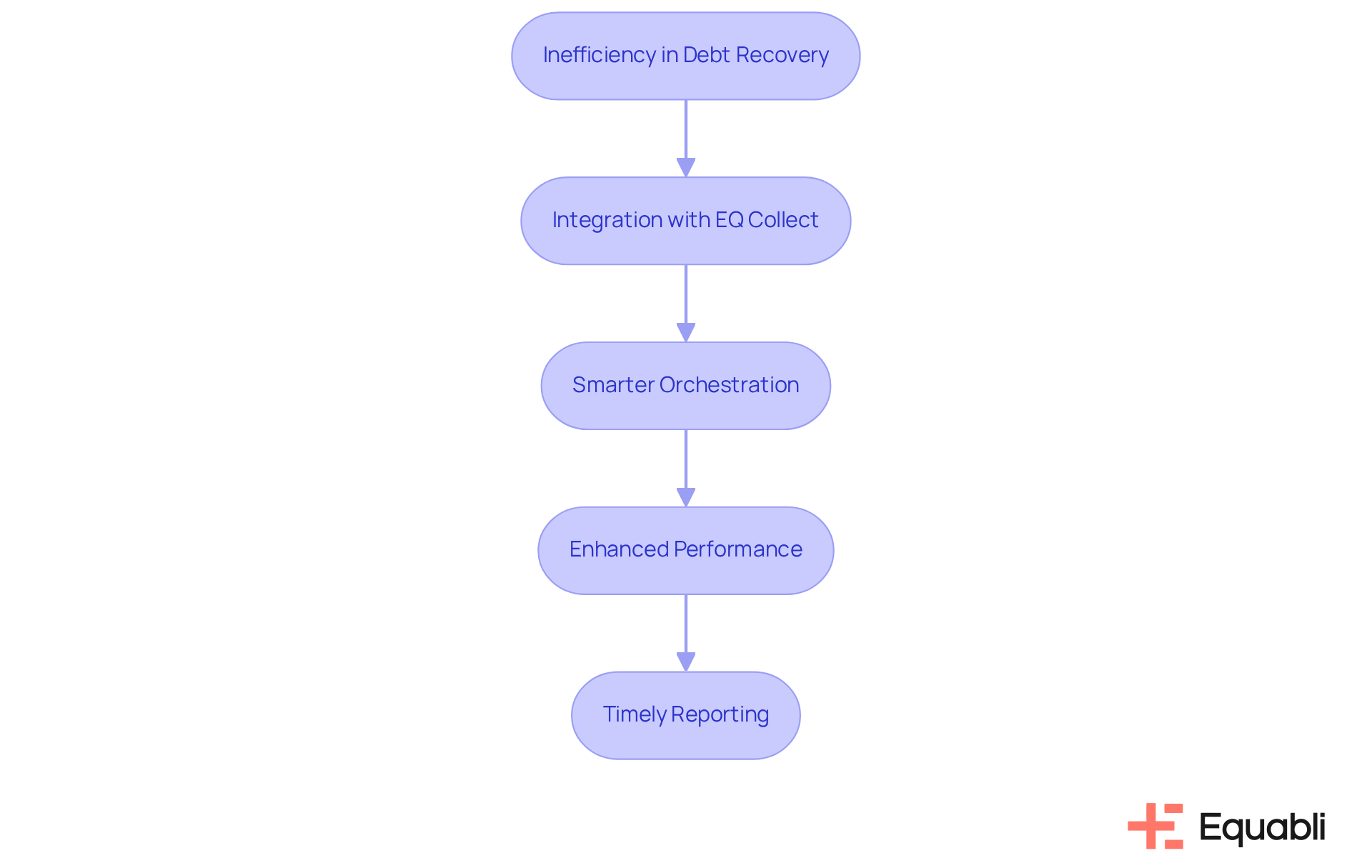

OpenPhone: Customizable Text Message Templates for Payment Reminders

Equabli's EQ Collect delivers innovative solutions for financial institutions focused on streamlining debt recovery processes. The transition from inefficiency to integration commences with EQ Collect, which synchronizes operations and facilitates smarter orchestration, thereby enhancing performance and ensuring timely reporting.

Customizable invoice text message templates for b2b payment reminders in financial services serve as a foundation for effective communication; however, EQ Collect further empowers institutions by enabling tailored repayment options and robust compliance management features. This comprehensive approach not only increases the likelihood of prompt remittances but also fosters stronger borrower relationships, ultimately transforming the debt recovery landscape.

ResolvePay: Strategies for Setting Clear Payment Expectations and Automating Reminders

Establishing clear financial expectations from the outset is crucial for effective debt collection. By clearly communicating payment terms and deadlines, businesses can significantly reduce confusion and encourage timely payments. Evidence shows that when clients are informed of their obligations, compliance improves, leading to better collection outcomes.

Furthermore, ResolvePay utilizes invoice text message templates for b2b payment reminders in financial services to ensure clients are consistently aware of their financial commitments. This proactive approach not only enhances collection outcomes but also improves overall cash flow, positioning businesses for greater financial stability.

Versapay: Tips for Creating Effective Payment Reminders to Boost Cash Flow

Versapay offers critical insights for developing efficient billing alerts that can significantly improve cash flow. Personalizing reminders, utilizing clear and concise language, and strategically timing reminders to align with clients' payment behaviors are essential practices. Implementing these best practices not only enhances communication strategies but also leads to improved collection rates and healthier cash flow. By adopting these approaches, businesses can better navigate the complexities of debt collection and optimize their financial operations.

Conclusion

Implementing effective payment reminder strategies is crucial for businesses aiming to enhance cash flow and uphold robust client relationships. By leveraging customizable invoice text message templates and automated workflows, organizations can facilitate timely communication with clients, thereby reducing the risk of late payments. The article delineates various tools and methodologies, including the Equabli EQ Suite, Chaser, and Messente, which enable businesses to customize their reminders according to specific client needs and behaviors, ultimately resulting in improved recovery rates.

Key insights from the article underscore the significance of personalization, clarity, and timing in payment reminders. Friendly email templates that maintain client goodwill and SMS notifications with higher open rates exemplify methods that reinforce the necessity of clear financial communication. By integrating these strategies into their operations, businesses can not only refine their debt collection processes but also cultivate a more responsive and responsible approach to financial management.

In light of the insights presented, organizations are urged to adopt a proactive approach to payment reminders. By utilizing the tools and best practices discussed, businesses can navigate the complexities of debt recovery more effectively, ensuring not only enhanced cash flow but also fortified relationships with their clients. Embracing these strategies positions companies for long-term financial stability and success.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a comprehensive solution that provides invoice text message templates for B2B payment reminders in financial services, allowing businesses to create customized workflows that trigger alerts based on specific criteria.

How does the EQ Engine benefit users?

The EQ Engine allows users to develop tailored scoring models that predict repayment behaviors, ensuring that payment reminders are sent at the optimal time for maximum effectiveness.

What advantages does automation provide in the payment reminder process?

Automation conserves valuable time, enhances borrower engagement through preferred communication channels, and ultimately leads to improved recovery rates.

How does Equabli ensure compliance with data handling?

Equabli guarantees that all data handling adheres to stringent privacy standards through industry-leading compliance oversight and automated monitoring.

What is the purpose of Chaser's late payment reminder email templates?

Chaser offers late fee notification email formats designed to promote timely settlements while maintaining positive client relationships, improving cash flow and sustaining goodwill.

How can Chaser's templates be customized?

The templates can be customized to reflect the brand's tone and programmed to send notifications at strategic intervals.

What kind of notification designs does Equabli provide?

Equabli provides adaptable notification designs tailored to each phase of the transaction process, from initial alerts to final notices.

How does integrating Equabli's notification frameworks with the EQ Suite help businesses?

Integration ensures that notifications are timely, relevant, and supported by a data-informed strategy for debt recovery, significantly enhancing the likelihood of timely fund recovery.