Overview

This article outlines the essential criteria that financial institutions must consider when selecting a debt recovery firm. It highlights the significance of evaluating:

- Compliance expertise

- Technology integration

- Client engagement

- Performance metrics

These factors collectively enhance operational efficiency and underpin effective debt recovery strategies, ensuring that institutions can navigate the complexities of financial risk management with confidence.

Introduction

Selecting the right debt recovery firm is a critical decision for financial institutions navigating a complex landscape of compliance, borrower expectations, and operational efficiency. Understanding the key criteria for this selection process enhances debt collection strategies and improves recovery rates. However, with numerous firms claiming to offer optimal solutions, it is essential to identify what truly differentiates them. Institutions must ensure they choose a partner that aligns with their unique needs and regulatory requirements.

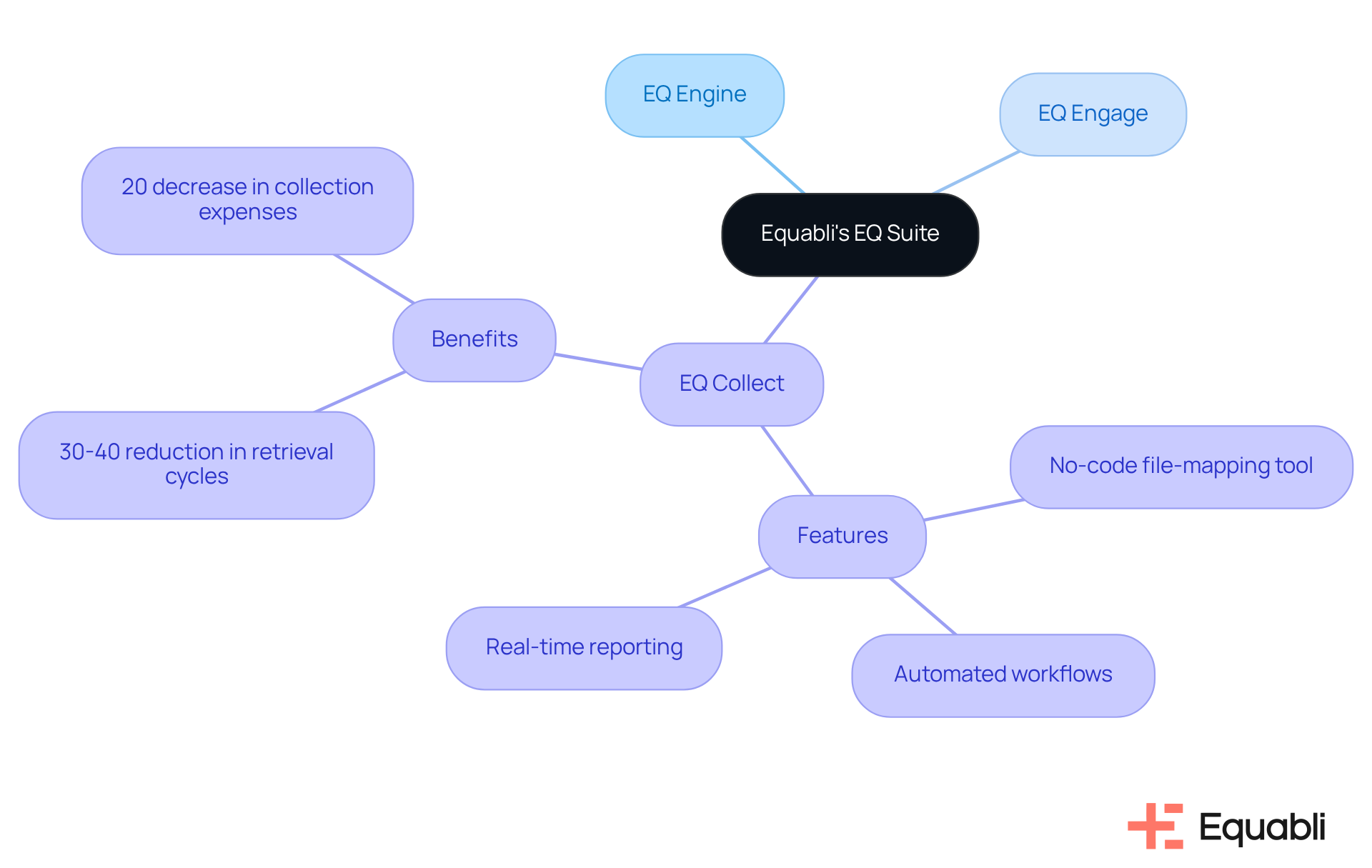

Equabli's EQ Suite: Comprehensive Debt Recovery Solutions

Equabli's EQ Suite serves as a comprehensive solution that aligns with the debt recovery firm selection criteria for financial institutions, enhancing their collection processes. Comprising the EQ Engine, EQ Engage, and EQ Collect, this suite enables organizations to implement a holistic strategy for managing delinquent accounts. By leveraging these tools, financial institutions can develop custom scoring models that accurately predict repayment behaviors, refine collection strategies, and facilitate digital collections through self-service repayment plans.

The EQ Collect's no-code file-mapping tool significantly reduces vendor onboarding timelines, thereby improving operational efficiency. This enhancement leads to more effective collections through data-driven strategies, including automated monitoring and streamlined workflows. Furthermore, the integration of automated workflows minimizes execution errors and reduces the reliance on manual resources. Real-time reporting capabilities provide unparalleled transparency and actionable insights, which are critical for informed decision-making.

The intuitive, scalable, cloud-based interface of the EQ Suite not only lowers collection costs but also enhances borrower interactions. Organizations utilizing this suite report a 30-40% reduction in financial retrieval cycles and a 20% decrease in collection expenses. Industry leaders recognize the EQ Suite as an essential solution for modernizing financial collections, emphasizing its alignment with the debt recovery firm selection criteria for financial institutions, thereby enhancing efficiency and ensuring compliance in an increasingly digital landscape.

In conclusion, the EQ Suite stands out as a strategic asset for financial institutions aiming to optimize their collection processes while navigating the complexities of compliance and operational efficiency.

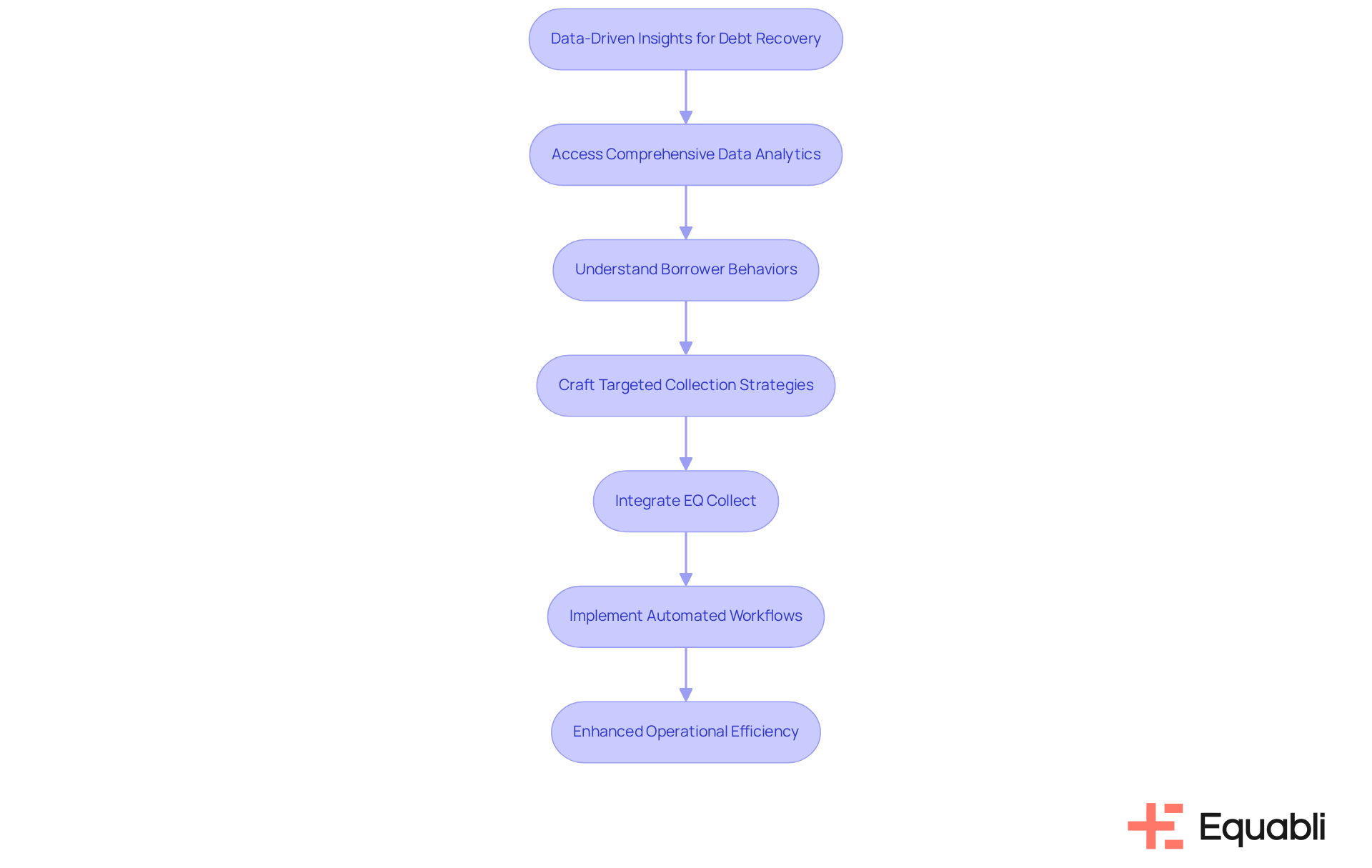

LexisNexis RiskView: Data-Driven Insights for Debt Recovery

LexisNexis RiskView serves as a critical asset for financial institutions, providing access to comprehensive data analytics that empower informed decision-making in debt collection. By leveraging insights from RiskView, organizations can attain a nuanced understanding of borrower behaviors and risk profiles, which is essential for crafting targeted and effective collection strategies. This data-centric methodology not only bolsters success rates but also significantly mitigates the risk of regulatory non-compliance. As the landscape of financial collections evolves, the adoption of such analytics becomes imperative for adapting to shifting borrower expectations and optimizing recovery efforts.

To enhance operational efficiency, the integration of EQ Collect can markedly decrease vendor onboarding timelines through its no-code file-mapping tool, while simultaneously improving collections via data-driven methodologies. This integration reduces execution errors and reliance on manual resources through automated workflows, ensuring more intelligent orchestration and superior performance. Financial institutions are advised to consider the incorporation of data analytics into their credit collection frameworks, particularly in relation to the debt recovery firm selection criteria for financial institutions, starting with a comprehensive assessment of their current data management practices. This approach will not only improve outcomes but also foster a culture of data-driven decision-making.

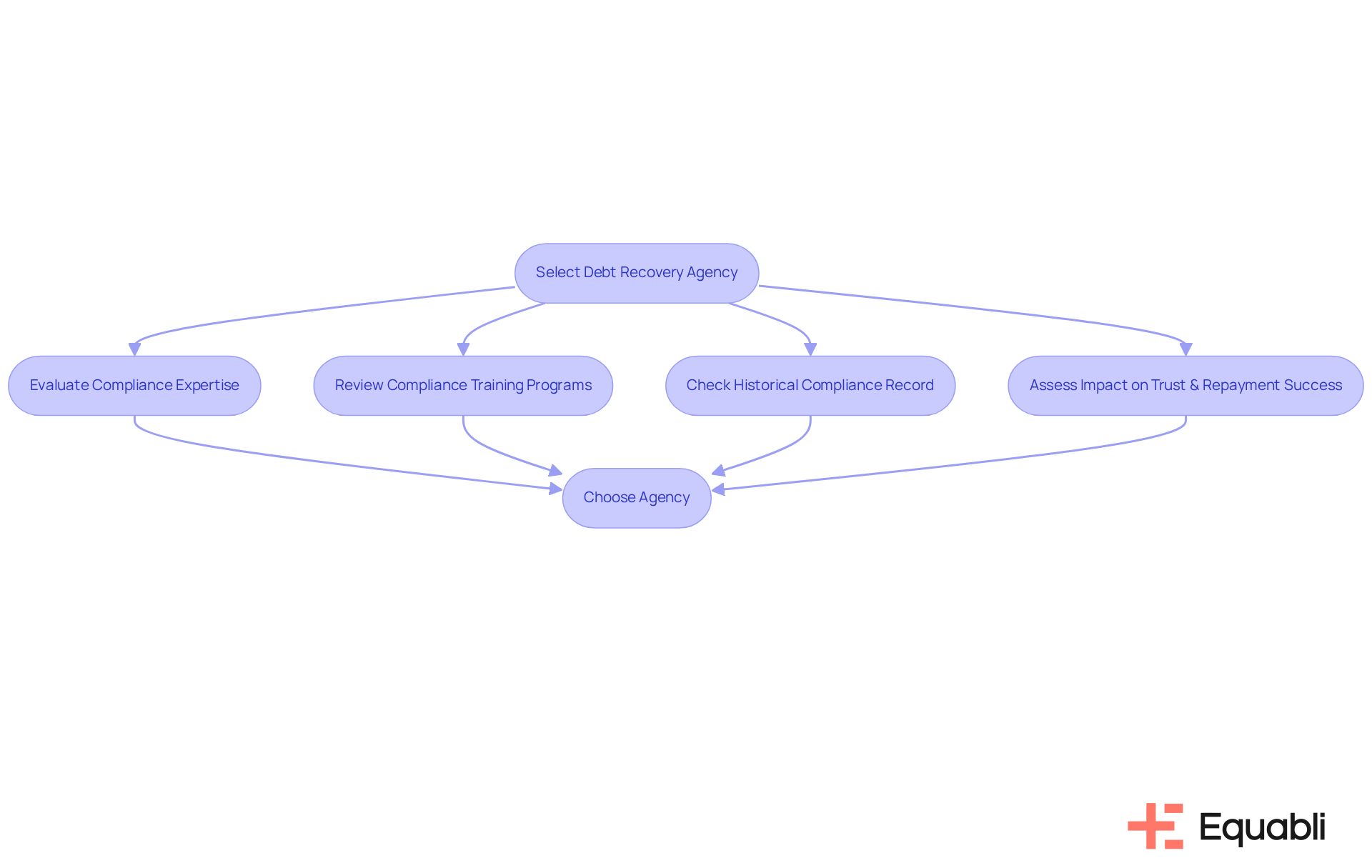

Compliance Expertise: Ensuring Regulatory Adherence in Debt Recovery

The debt recovery firm selection criteria for financial institutions necessitate a comprehensive evaluation of the agency's compliance expertise. Agencies must demonstrate a robust understanding of essential regulations, particularly the Fair Debt Collection Practices Act (FDCPA) alongside relevant local laws. A solid compliance framework not only shields financial institutions from potential legal challenges but also cultivates trust with borrowers, a critical element for effective collection strategies.

Institutions are advised to inquire about the agency's compliance training programs and their historical compliance record. Compliance serves as a distinguishing factor in the debt recovery firm selection criteria for financial institutions within a competitive landscape, making it a central consideration in the selection process.

Recent amendments to FDCPA regulations highlight the imperative for agencies to remain informed, as non-compliance can result in substantial penalties, fines, and legal repercussions, thereby tarnishing their reputation. Furthermore, adherence to these regulations has been shown to enhance repayment success rates; notably, 56% of agencies are currently employing self-service portals to improve borrower interaction.

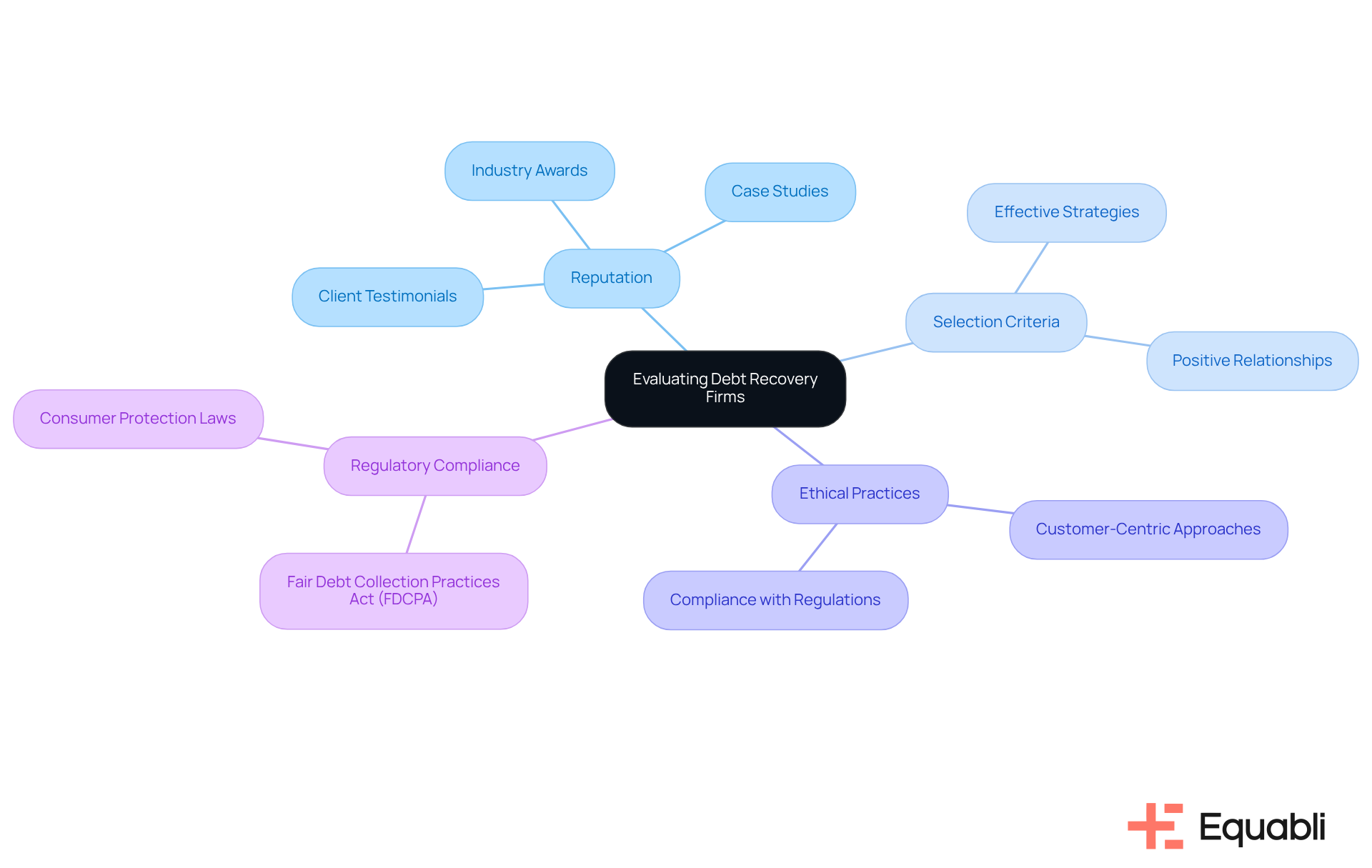

Industry Reputation: Evaluating Track Records of Debt Recovery Firms

The reputation of a debt collection agency is critical for financial organizations when considering the debt recovery firm selection criteria for financial institutions. Comprehensive research on potential collaborators is essential; this includes examining client testimonials, case studies, and industry awards. An organization with a strong reputation typically demonstrates effective reinstatement strategies and fosters positive relationships with borrowers, significantly enhancing reinstatement outcomes. Furthermore, financial organizations should reference industry reports and rankings to evaluate a company's standing within the financial collection sector.

Given the substantial amounts of non-performing loans (NPLs) that financial organizations frequently encounter, understanding the debt recovery firm selection criteria for financial institutions is of utmost importance. Agencies that adopt ethical and customer-centric collection strategies are poised to gain a competitive edge. This reinforces the necessity of aligning with firms that prioritize ethical practices and customer satisfaction.

Additionally, it is vital for financial organizations to consider the potential negative impacts of financial settlements on credit scores, alongside the necessity for compliance with regulations such as the Fair Debt Collection Practices Act (FDCPA). Staying informed about emerging trends in the collections sector, including the integration of AI and automation, can equip financial organizations with innovative solutions for efficient monetary retrieval.

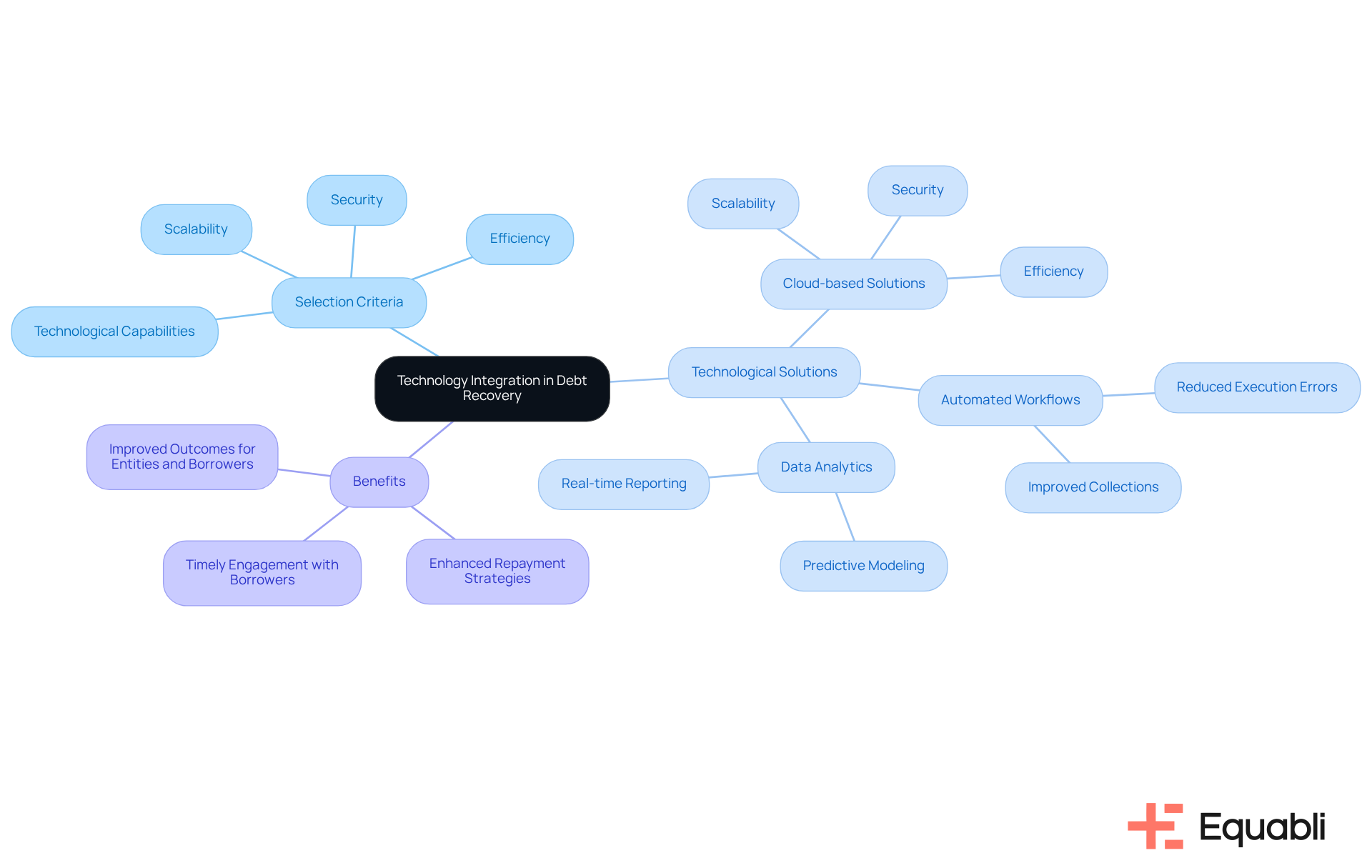

Technology Integration: Adapting to Digital Debt Recovery Solutions

In the current digital landscape, integrating technology into debt collection processes is imperative for financial institutions. It is crucial to evaluate potential partners using the debt recovery firm selection criteria for financial institutions, focusing on their technological capabilities that enhance restoration efforts.

For instance, the use of cloud-based solutions like EQ Collect significantly boosts scalability, security, and efficiency, while simultaneously minimizing human errors. Automated workflows represent a key feature that reduces execution errors and improves collections through data-driven strategies, ensuring timely and effective engagement with borrowers.

Additionally, advanced data analytics platforms empower organizations to employ predictive modeling for enhanced repayment strategies, supported by real-time reporting that provides unparalleled transparency and insights. By embracing these technologies, organizations can develop more efficient and effective restoration strategies, which align with the debt recovery firm selection criteria for financial institutions, ultimately yielding improved outcomes for both the entity and its borrowers.

As Scott McNealy observed, we are entering a participation age where active engagement and technological integration are essential for success.

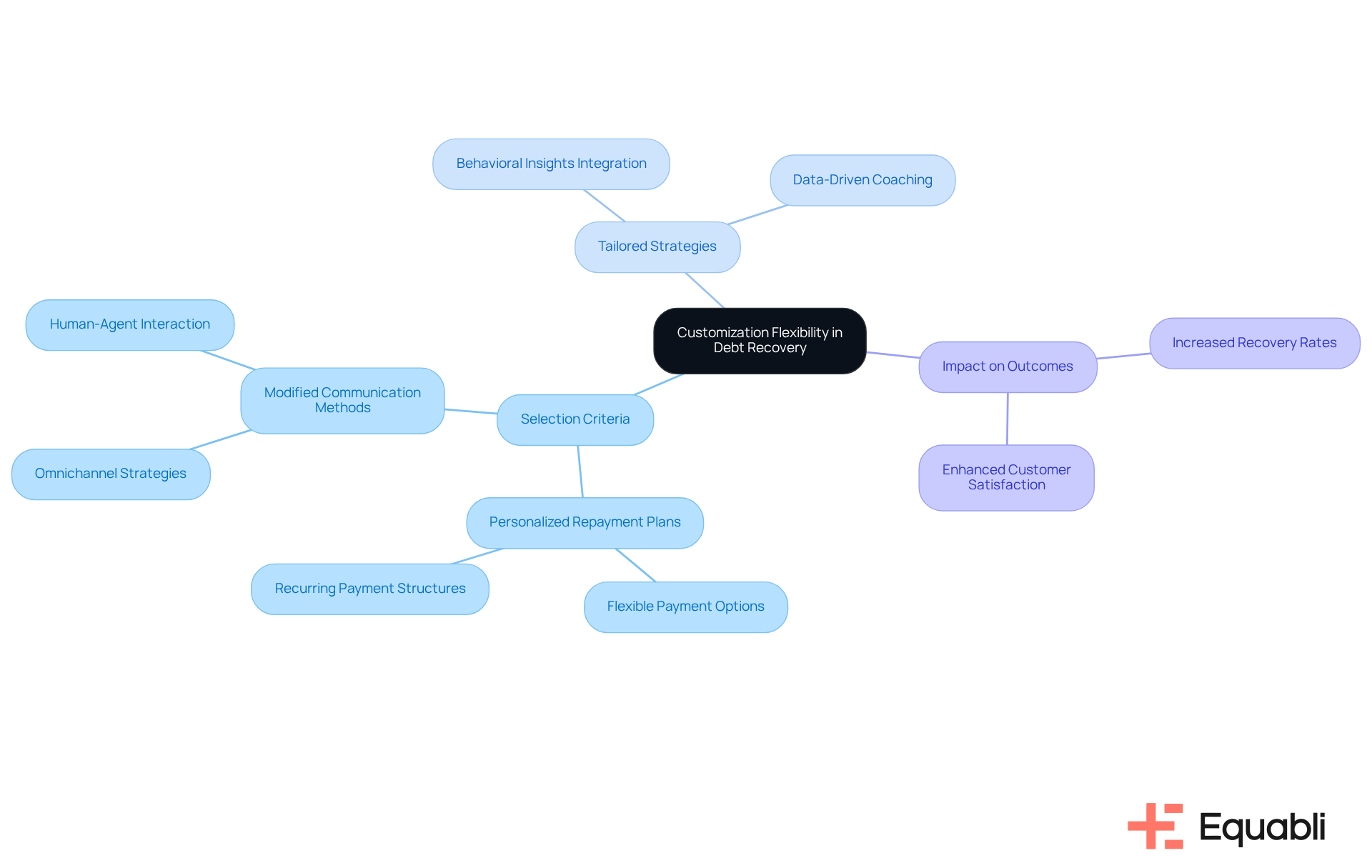

Customization Flexibility: Tailoring Debt Recovery Strategies

Organizations should consider the debt recovery firm selection criteria for financial institutions, prioritizing those that offer customization flexibility when selecting a debt collection agency. Each financial institution faces distinct challenges and borrower demographics, making a one-size-fits-all approach less effective. Agencies that tailor their strategies—such as developing personalized repayment plans or modifying communication methods—are positioned to achieve superior outcomes.

Institutions must evaluate the agency's ability to customize services and understand the processes involved, as these factors are key components of the debt recovery firm selection criteria for financial institutions, which directly influence operational success and compliance adherence.

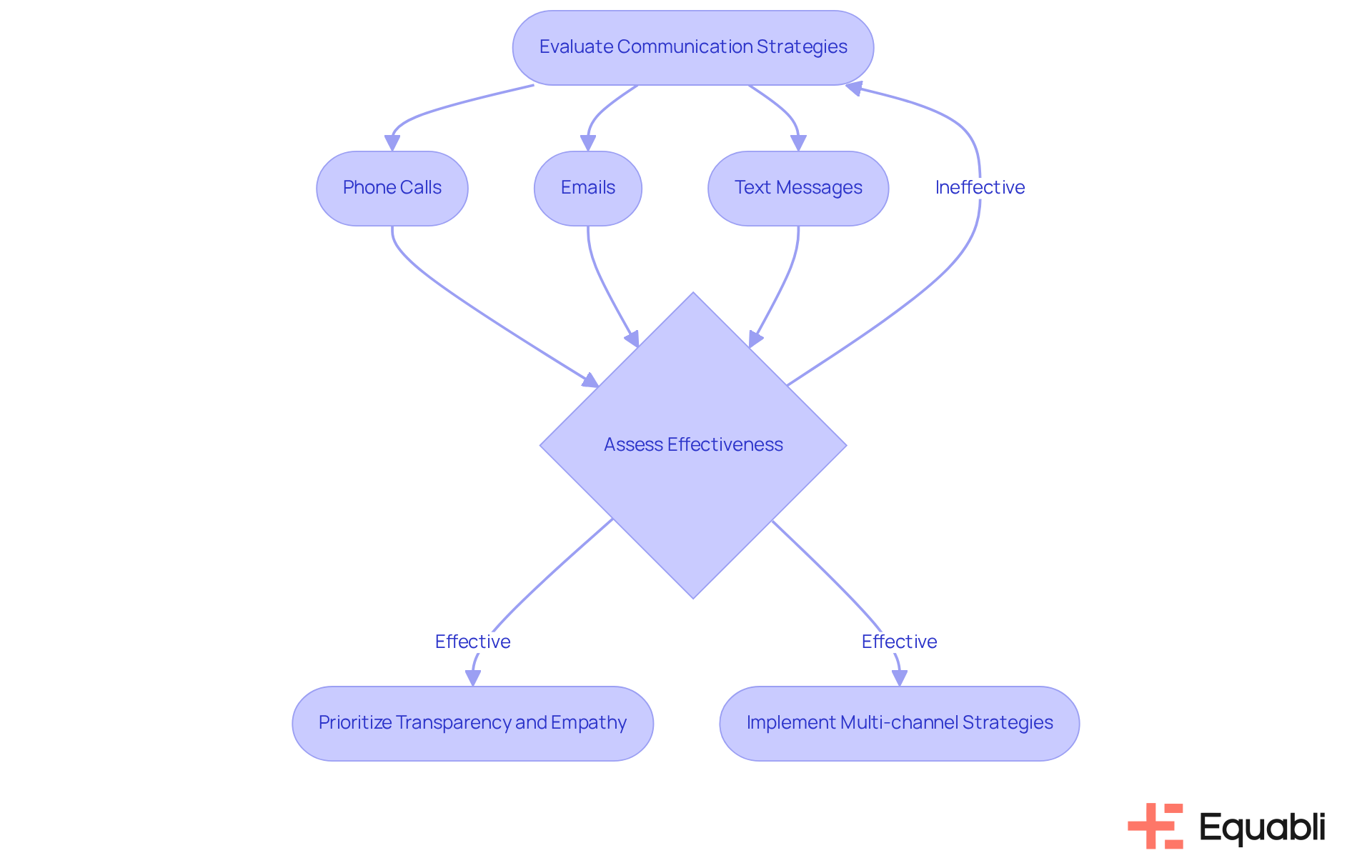

Client Engagement: Effective Communication Strategies in Debt Recovery

Client involvement is essential in the debt collection process, significantly influencing collection rates. Financial institutions must evaluate potential partners according to the debt recovery firm selection criteria for financial institutions, which emphasizes the importance of engaging with borrowers through diverse communication channels, including phone calls, emails, and text messages.

Companies that prioritize transparency and empathy in their interactions are more likely to cultivate positive relationships with borrowers, leading to improved repayment outcomes. Organizations should scrutinize the communication strategies employed by these companies and assess their effectiveness in engaging clients, as these factors are critical for successful financial recovery and align with the debt recovery firm selection criteria for financial institutions.

Notably, organizations that implement multi-channel communication strategies have reported response rates that are 200-300% higher than those relying on single-channel approaches. This underscores the necessity for adaptability in engagement techniques, highlighting the strategic imperative for financial institutions to enhance their communication frameworks.

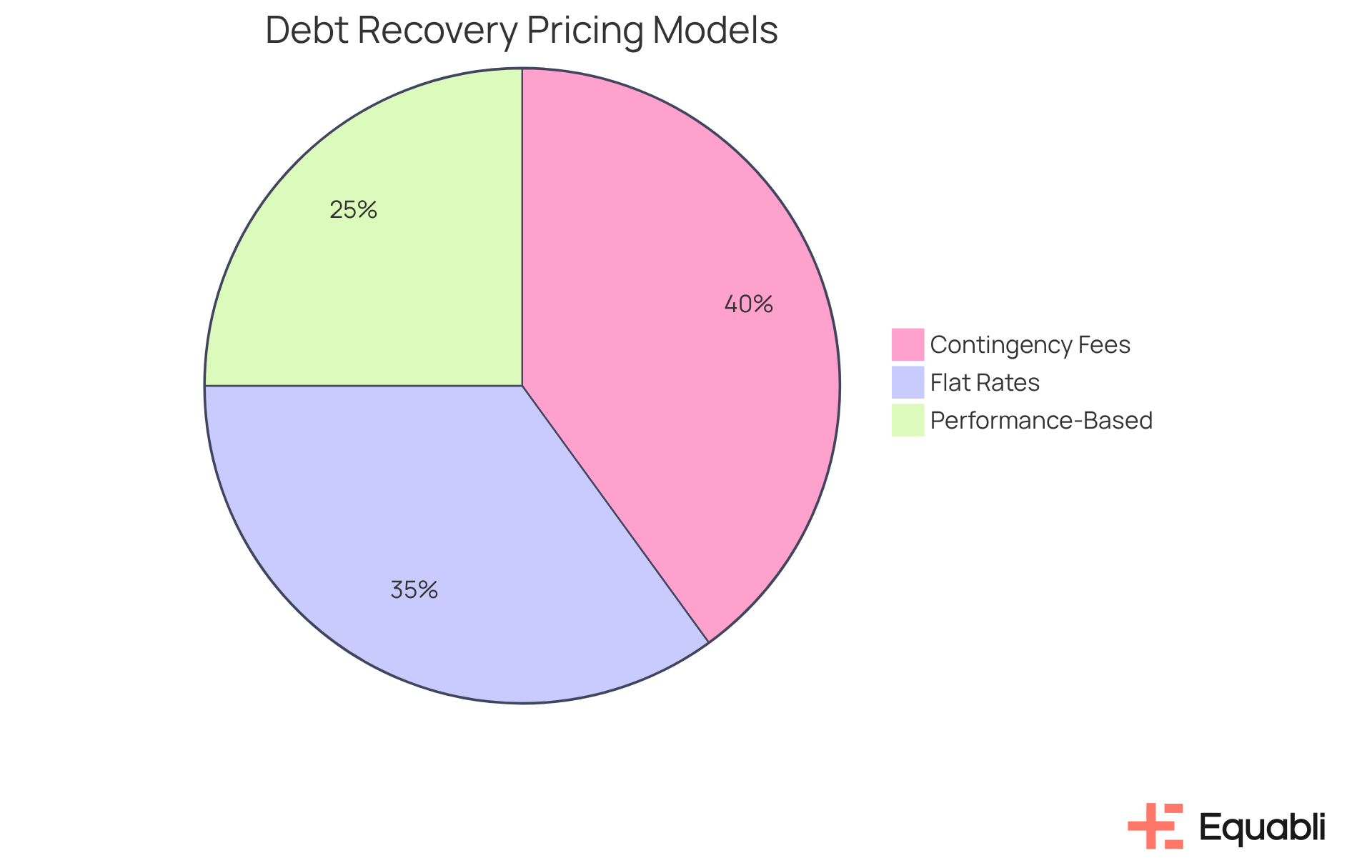

Cost-Effectiveness: Evaluating Pricing Models of Debt Recovery Firms

Cost-effectiveness represents a pivotal consideration in the selection of a debt collection firm. Financial organizations must evaluate the debt recovery firm selection criteria for financial institutions, which includes assessing pricing strategies such as:

- Contingency fees

- Flat rates

- Performance-based pricing

Understanding the services encompassed within the pricing structure, alongside the identification of any hidden costs, is essential. A transparent pricing framework that aligns with the organization’s budgetary constraints and financial objectives fosters a more productive partnership.

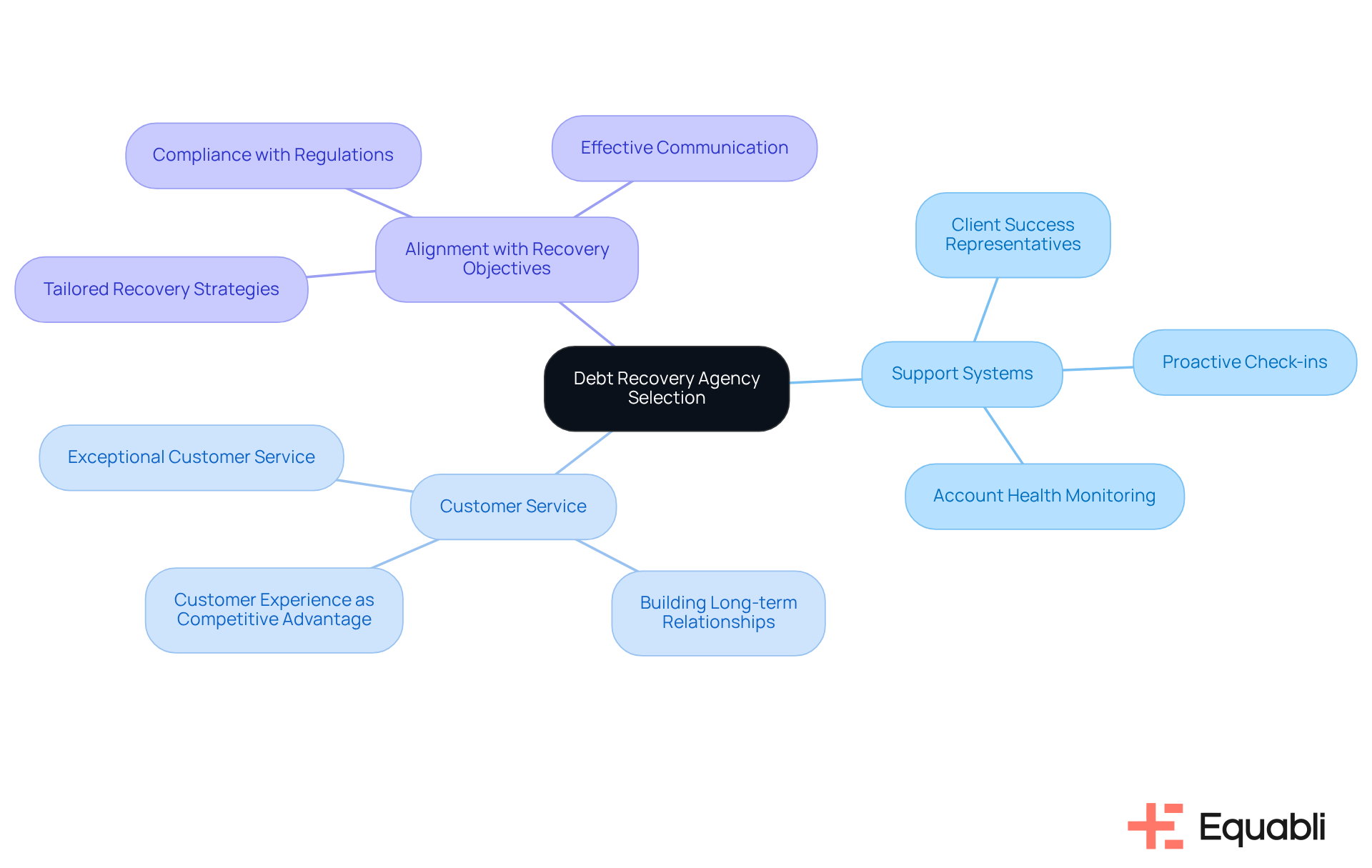

Support and Resources: Assessing Availability for Debt Recovery

When selecting a debt collection agency, financial organizations must prioritize the evaluation of available assistance and resources according to the debt recovery firm selection criteria for financial institutions. This involves a thorough assessment of the agency's customer service capabilities, training programs, and supplementary resources that facilitate the recovery process. A firm equipped with strong support systems—such as dedicated Client Success Representatives who conduct proactive check-ins and monitor account health—can significantly aid institutions in navigating challenges and refining their improvement strategies. Organizations should actively seek information regarding the extent of support offered and the resources at their disposal to bolster their financial collection efforts.

Exceptional customer service is crucial; it has the potential to transform a single interaction into a long-term relationship, ultimately enhancing outcomes. With the collections sector projected to grow by 10.3% over the next five years, driven by advancements in technology and customer service methodologies, it is imperative to choose a partner that prioritizes these elements. Consequently, when evaluating potential partners, financial entities must ensure that the agency fulfills the debt recovery firm selection criteria for financial institutions by providing substantial assistance and aligning with their specific recovery objectives.

Performance Metrics: Evaluating Reporting Capabilities in Debt Recovery

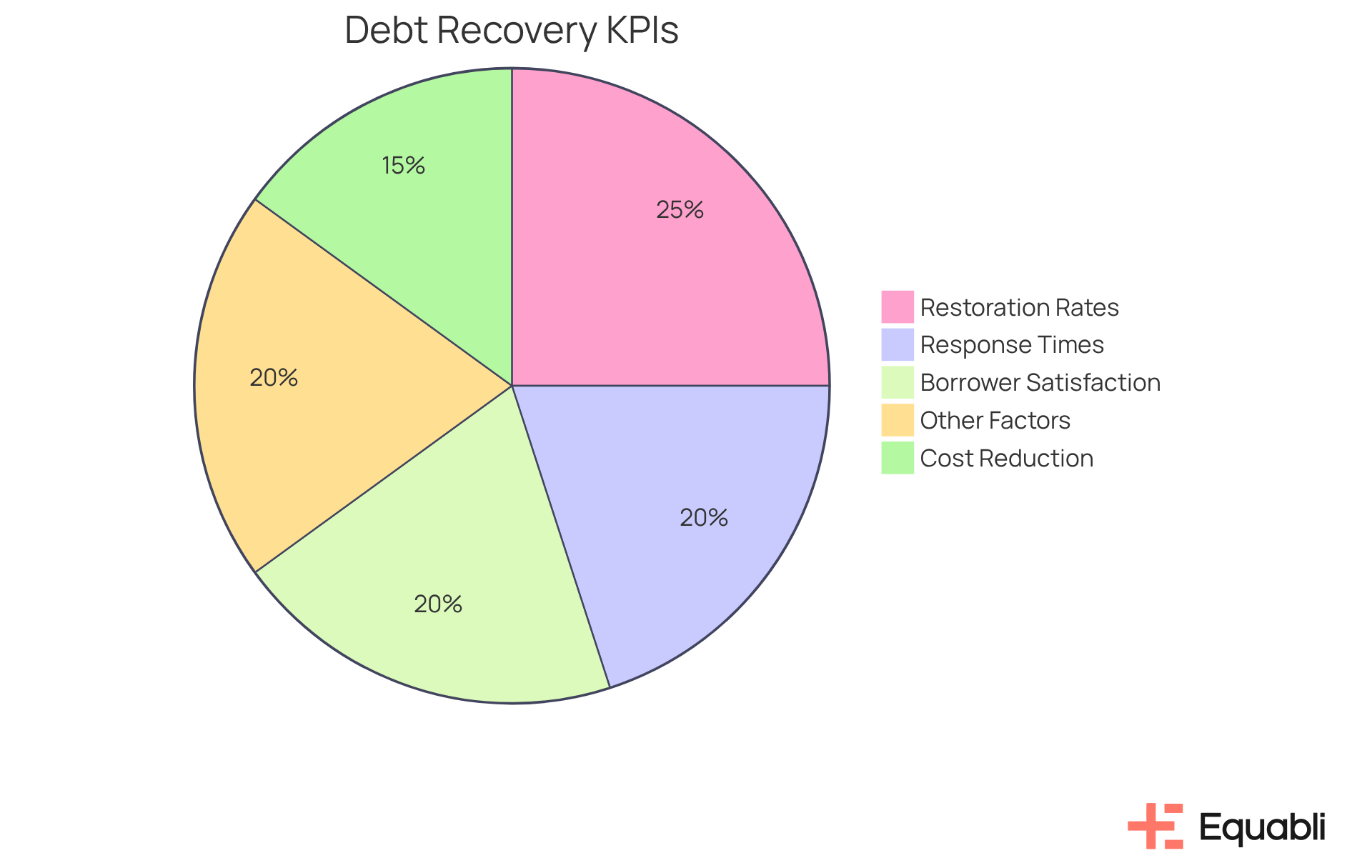

Performance metrics are critical for evaluating the effectiveness of the debt recovery firm selection criteria for financial institutions. Monetary organizations must prioritize the debt recovery firm selection criteria for financial institutions by focusing on the reporting capabilities of potential partners, including specific metrics monitored and the frequency of reporting.

Key performance indicators (KPIs) such as restoration rates have shown a 15-25% increase for companies employing AI-driven solutions, alongside response times and borrower satisfaction, which are fundamental components of a robust reporting framework. Furthermore, agencies adopting digital-first approaches have reported a 15% reduction in collection costs, underscoring the advantages of contemporary reporting capabilities.

A company that delivers comprehensive and transparent reporting aids organizations in assessing their debt recovery firm selection criteria for financial institutions, empowering them to make informed, data-driven decisions that enhance overall performance. Additionally, organizations that implement effective KPI tracking can achieve up to a 90% reduction in manual efforts, while those employing data protection measures experience a similar 90% decrease in manual tasks, thus streamlining operations and bolstering compliance.

By leveraging these insights, including the fact that 73% of customers in late delinquency responded positively when engaged through digital channels, financial institutions can navigate the complexities of financial collection more effectively and refine their strategies for success. As Tratta emphasizes, real-time metrics are the "lifeblood" of debt recovery efforts, highlighting the significance of effective reporting capabilities in ensuring compliance and improving operational efficiency.

Conclusion

Selecting the appropriate debt recovery firm is essential for financial institutions seeking to optimize their collection processes and ensure compliance. Organizations should consider critical criteria, including:

- Technology integration

- Customization flexibility

- Compliance expertise

- Performance metrics

Adhering to these selection criteria enables financial institutions to enhance operational efficiency and cultivate positive relationships with borrowers.

Insights from the discussion underscore the significance of leveraging data-driven solutions, such as Equabli's EQ Suite and LexisNexis RiskView, to improve recovery outcomes. The emphasis on compliance and industry reputation illustrates the necessity for financial institutions to partner with agencies that prioritize ethical practices and customer satisfaction. Moreover, effective communication strategies and robust support resources are vital components that can substantially influence the success of debt recovery efforts.

In the context of the evolving debt recovery landscape, financial institutions are advised to adopt a proactive approach when evaluating potential partners. By concentrating on the outlined criteria and embracing innovative solutions, organizations can navigate the complexities of debt collection more effectively. This strategic alignment not only enhances recovery rates but also fosters trust with borrowers, ultimately contributing to a more sustainable financial ecosystem.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a comprehensive debt recovery solution designed for financial institutions, consisting of the EQ Engine, EQ Engage, and EQ Collect. It helps organizations manage delinquent accounts and optimize their collection processes.

How does the EQ Suite improve debt recovery for financial institutions?

The EQ Suite allows financial institutions to develop custom scoring models, refine collection strategies, and facilitate digital collections through self-service repayment plans, leading to more effective debt recovery.

What features of EQ Collect enhance operational efficiency?

The EQ Collect's no-code file-mapping tool reduces vendor onboarding timelines, while automated workflows minimize execution errors and reliance on manual resources, thereby improving operational efficiency.

What are the benefits of using the EQ Suite?

Organizations using the EQ Suite report a 30-40% reduction in financial retrieval cycles and a 20% decrease in collection expenses, alongside enhanced borrower interactions and lower collection costs.

What role does LexisNexis RiskView play in debt recovery?

LexisNexis RiskView provides comprehensive data analytics that help financial institutions understand borrower behaviors and risk profiles, enabling them to create targeted and effective collection strategies.

How does data analytics impact debt recovery success?

Utilizing data analytics, financial institutions can bolster success rates in debt collection and mitigate the risk of regulatory non-compliance, adapting to evolving borrower expectations.

What is the importance of compliance expertise in debt recovery?

Compliance expertise is essential for debt recovery firms as it ensures adherence to regulations like the Fair Debt Collection Practices Act (FDCPA), protecting financial institutions from legal challenges and fostering borrower trust.

What should financial institutions consider regarding compliance when selecting a debt recovery agency?

Institutions should evaluate the agency's compliance training programs, historical compliance record, and their ability to stay informed about regulatory changes to ensure effective debt recovery practices.

How does compliance affect repayment success rates?

Adhering to compliance regulations has been shown to enhance repayment success rates, with many agencies employing self-service portals to improve borrower interactions.