Overview

The article presents effective strategies for optimizing payment notice letters, aimed at enhancing corporate debt recovery processes. It emphasizes the importance of automation, predictive analytics, and personalized communication as key approaches that collectively improve engagement and recovery rates. By making the debt collection process more efficient and responsive to borrower needs, these strategies not only streamline operations but also align with compliance requirements, ensuring that organizations can navigate the complexities of debt recovery effectively.

Incorporating automation into payment notice letters allows organizations to reduce manual errors and enhance operational efficiency. Predictive analytics further supports this by enabling lenders to identify high-risk accounts and tailor their communication strategies accordingly. Personalized communication fosters a stronger connection with borrowers, ultimately leading to improved recovery outcomes. These methods collectively represent a strategic shift towards a more data-driven and borrower-centric approach in debt collection.

To operationalize these strategies, organizations must invest in technology that supports automation and analytics. This investment not only enhances recovery rates but also mitigates compliance risks associated with debt collection practices. As regulatory scrutiny increases, adopting these advanced strategies positions organizations to remain compliant while effectively managing their debt recovery processes.

In conclusion, optimizing payment notice letters through automation, predictive analytics, and personalized communication is essential for enhancing corporate debt recovery. By implementing these strategies, organizations can improve engagement, streamline operations, and ensure compliance, ultimately driving better financial outcomes.

Introduction

In an increasingly competitive financial landscape, organizations are actively seeking ways to enhance their debt recovery processes. Payment notice letters are pivotal in this effort, serving as essential tools for communicating with borrowers and facilitating timely repayments. By exploring ten innovative strategies for optimizing these letters, companies can streamline operations and significantly improve recovery rates. However, the challenge remains: how can businesses effectively balance compliance, personalization, and automation to create a system that resonates with clients while ensuring regulatory adherence?

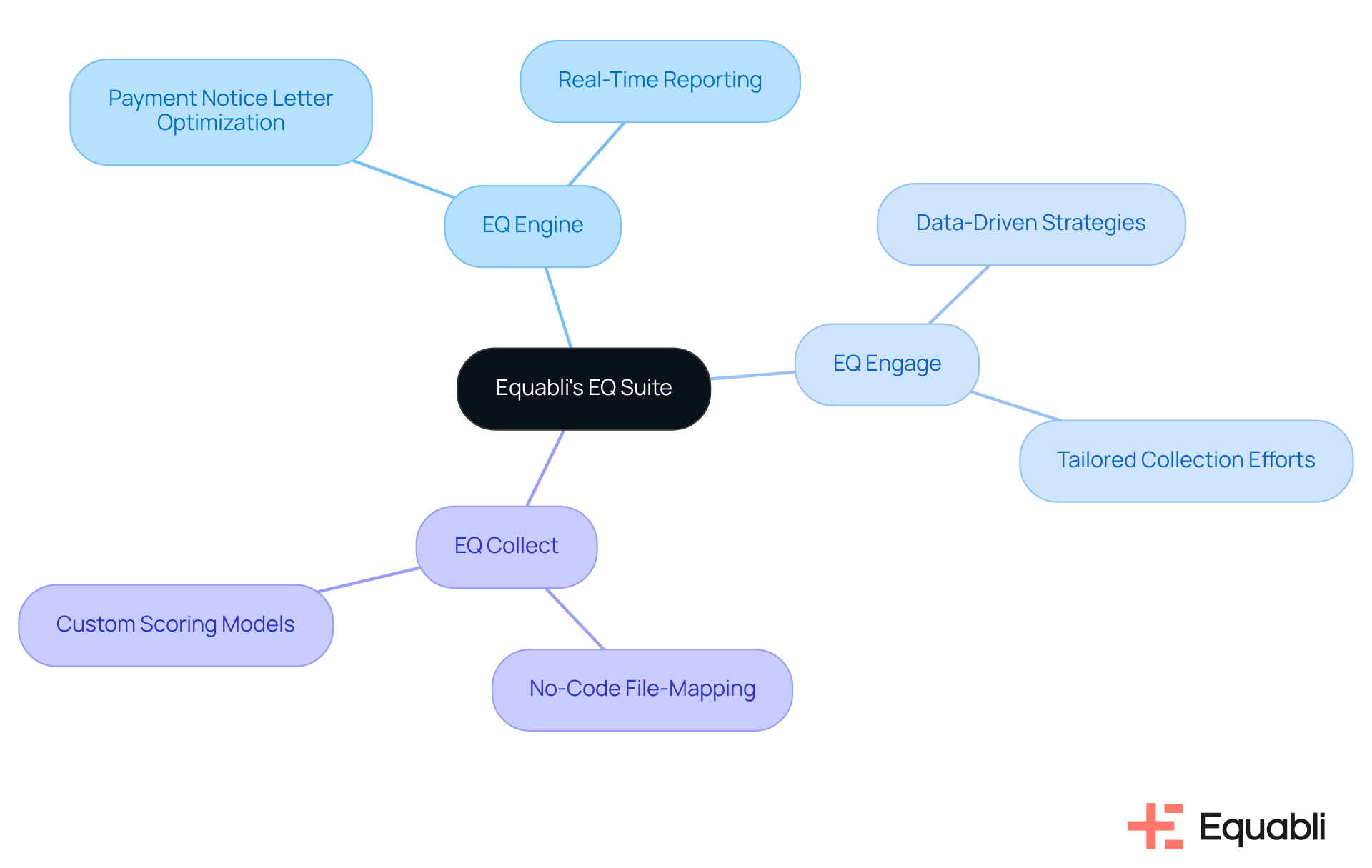

Equabli's EQ Suite: Streamline Debt Recovery with Intelligent Automation

Equabli's EQ Suite offers a robust set of tools designed to implement payment notice letter optimization strategies for corporate debt recovery processes, automating and streamlining them effectively. By utilizing intelligent automation through EQ Collect, organizations can effectively apply payment notice letter optimization strategies for corporate debt recovery processes, significantly reducing manual efforts and minimizing errors, thereby enhancing overall efficiency. For instance, the no-code file-mapping tool accelerates vendor onboarding, while data-informed strategies improve collection outcomes.

The collaboration between the EQ Engine, EQ Engage, and EQ Collect facilitates a seamless experience, allowing clients to implement payment notice letter optimization strategies for corporate debt recovery processes through custom scoring models that refine their collection strategies. This integration not only automates workflows but also offers real-time reporting, ensuring that collection efforts are data-driven and tailored to the unique needs of each client. Ultimately, this leads to improved recovery rates, demonstrating the strategic value of implementing payment notice letter optimization strategies for corporate debt recovery processes.

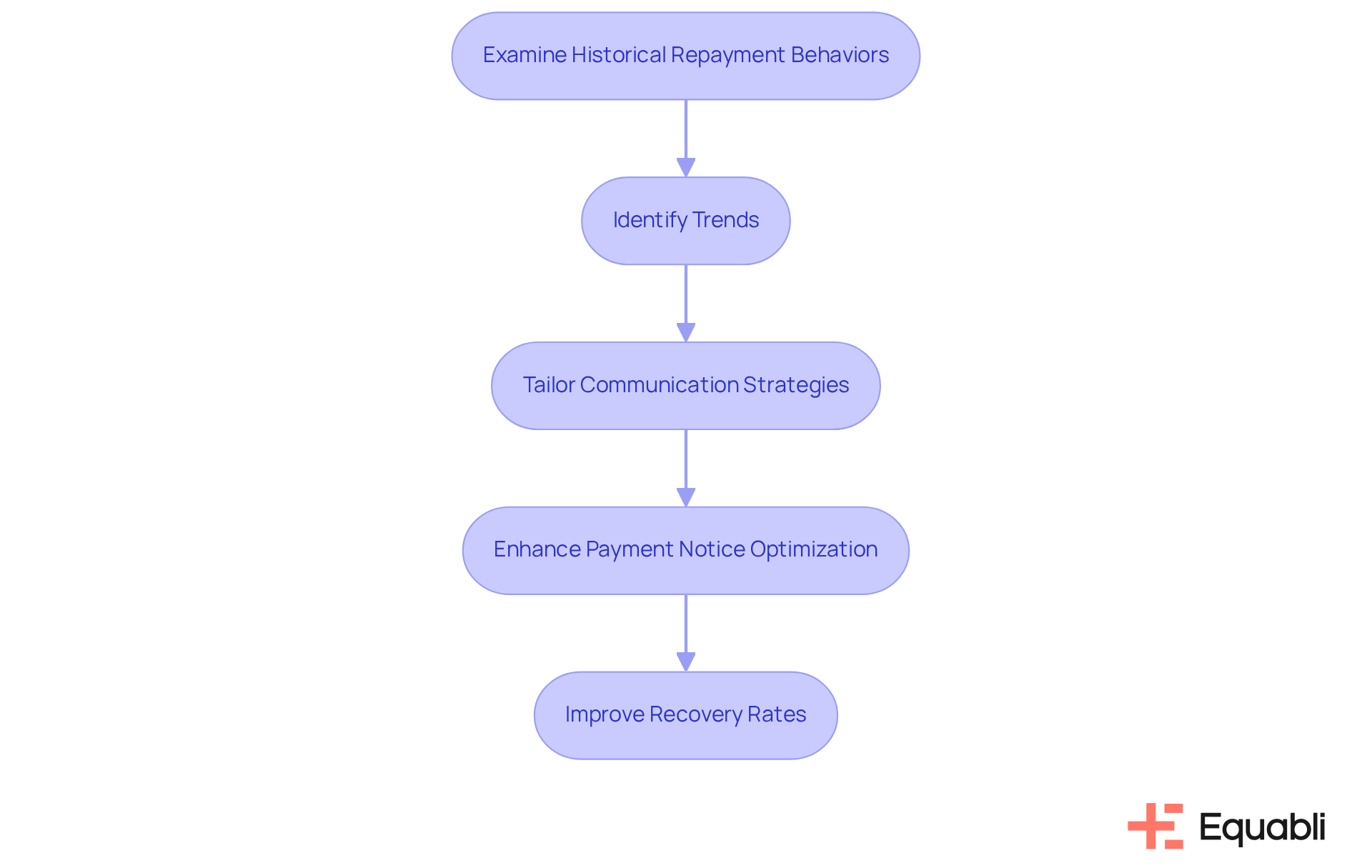

Predictive Analytics: Enhance Payment Notices with Data-Driven Insights

Employing predictive analytics is crucial for organizations aiming to enhance their payment notice letter optimization strategies for corporate debt recovery processes. By examining historical repayment behaviors, companies can identify trends that inform the development of these alerts. For instance, understanding which borrowers are more likely to respond positively to specific messages or formats allows organizations to tailor their communication strategies effectively.

This data-driven approach not only increases the relevance of billing alerts but also significantly enhances the payment notice letter optimization strategies for corporate debt recovery processes, improving the likelihood of timely reimbursements. As a result, recovery rates are enhanced, demonstrating the strategic value of incorporating payment notice letter optimization strategies for corporate debt recovery processes into debt collection practices. In an environment where compliance and operational efficiency are paramount, leveraging such insights positions organizations to navigate the complexities of enterprise-level debt management successfully.

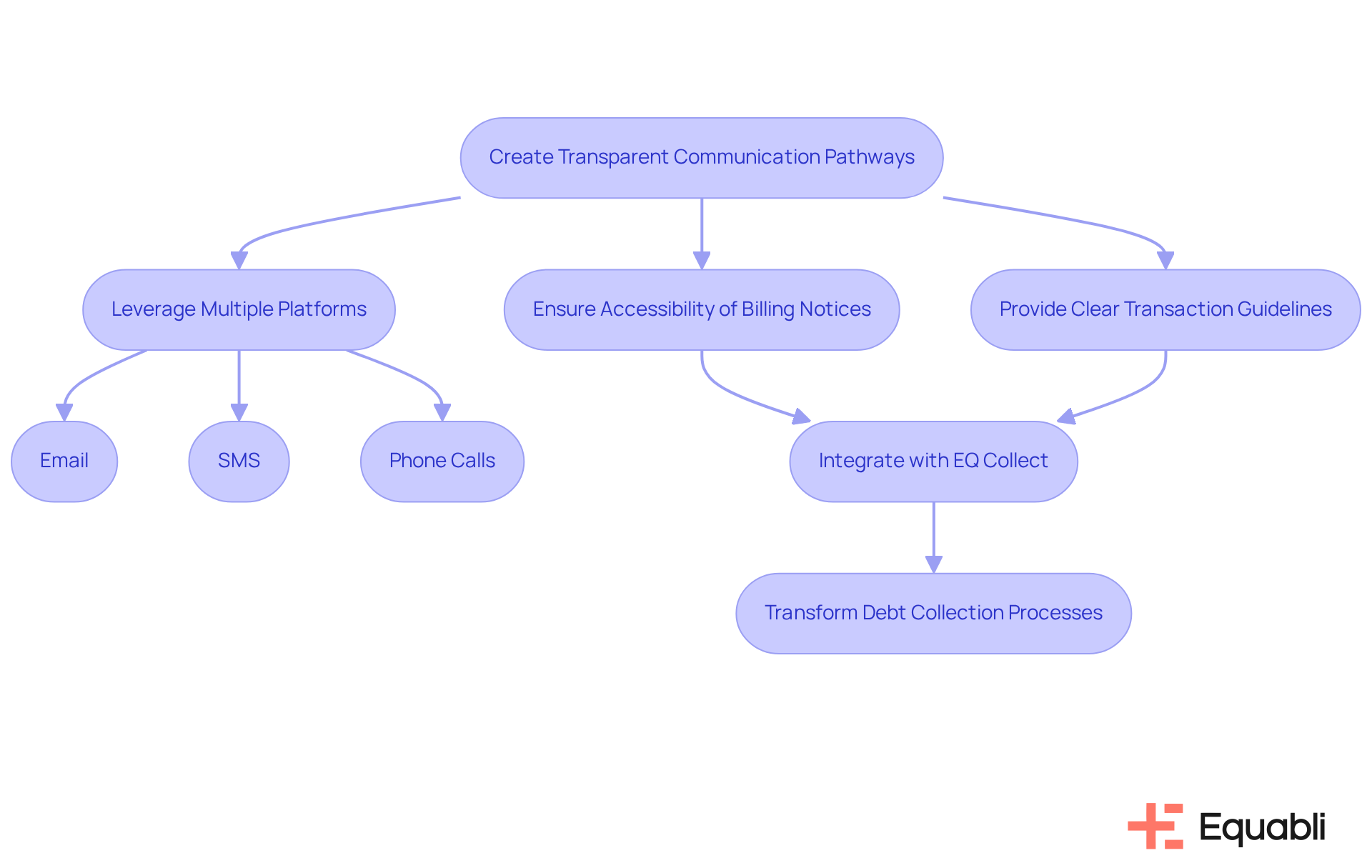

Clear Communication Channels: Improve Response Rates for Payment Notices

Creating transparent communication pathways is essential for improving response rates to billing alerts and addressing the challenges posed by disjointed systems. Organizations should leverage multiple platforms—such as email, SMS, and phone calls—to engage borrowers through their preferred communication methods. By ensuring that billing notices are accessible and comprehensible, companies can enhance engagement and promote timely responses.

Furthermore, providing clear guidelines on transaction processes can significantly improve the effectiveness of these communications. For instance, including a direct link to transaction methods in SMS reminders simplifies the process for borrowers. Integrating these payment notice letter optimization strategies for corporate debt recovery processes with Equabli's EQ Collect enables organizations to transition from inefficient to integrated systems, thereby streamlining operations and enhancing performance. This transition ultimately transforms debt collection processes, aligning them with best practices in compliance and operational efficiency.

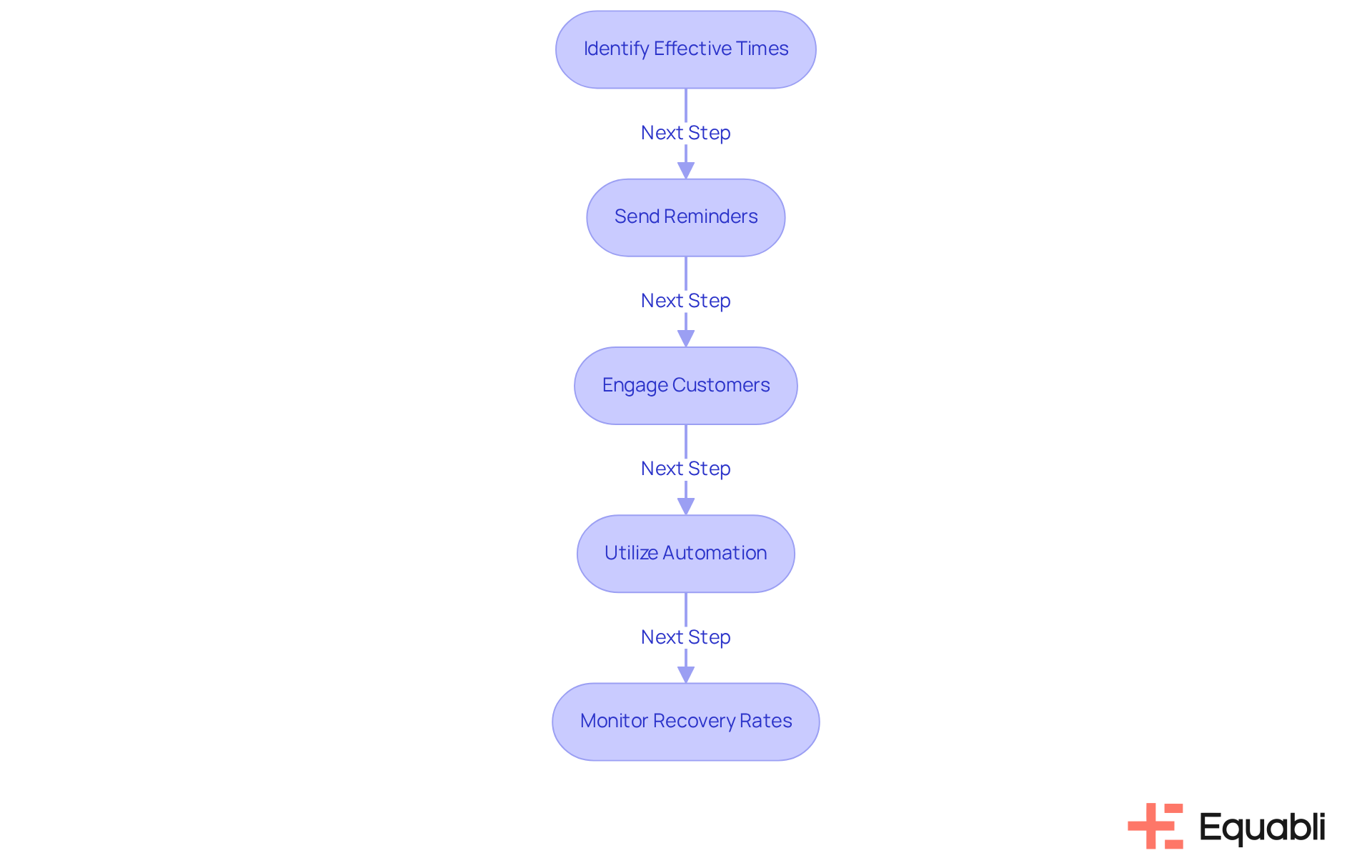

Systematic Follow-Up Schedule: Optimize Timing for Payment Notices

Creating a structured follow-up timetable is essential for implementing payment notice letter optimization strategies for corporate debt recovery processes. Organizations should leverage data analytics to identify the most effective times for sending reminders, considering user behavior and historical transaction patterns. By strategically timing follow-ups, companies can significantly boost engagement and encourage prompt repayment. Consistently planned alerts not only keep debt at the forefront of borrowers' minds but also reduce the risk of overlooked dues. Invoices should typically be paid within fourteen days, highlighting the urgency of timely reminders.

Moreover, contractors utilizing automatic billing reminders experience substantial savings in both time and finances, underscoring the efficiency gained through automation. Engaging customers through their preferred communication channels is critical for facilitating prompt transactions, fostering a more responsive relationship. Timely reminders can lead to a significant increase in recovery rates, reinforcing the obligation while maintaining a respectful and professional tone. As noted by Team SAP Signavio, the key steps in this process involve ensuring that reminders are sent consistently and effectively.

Implementing payment notice letter optimization strategies for corporate debt recovery processes can transform the debt recovery process, enhancing both efficiency and effectiveness.

Flexible Repayment Options: Increase Engagement with Payment Notices

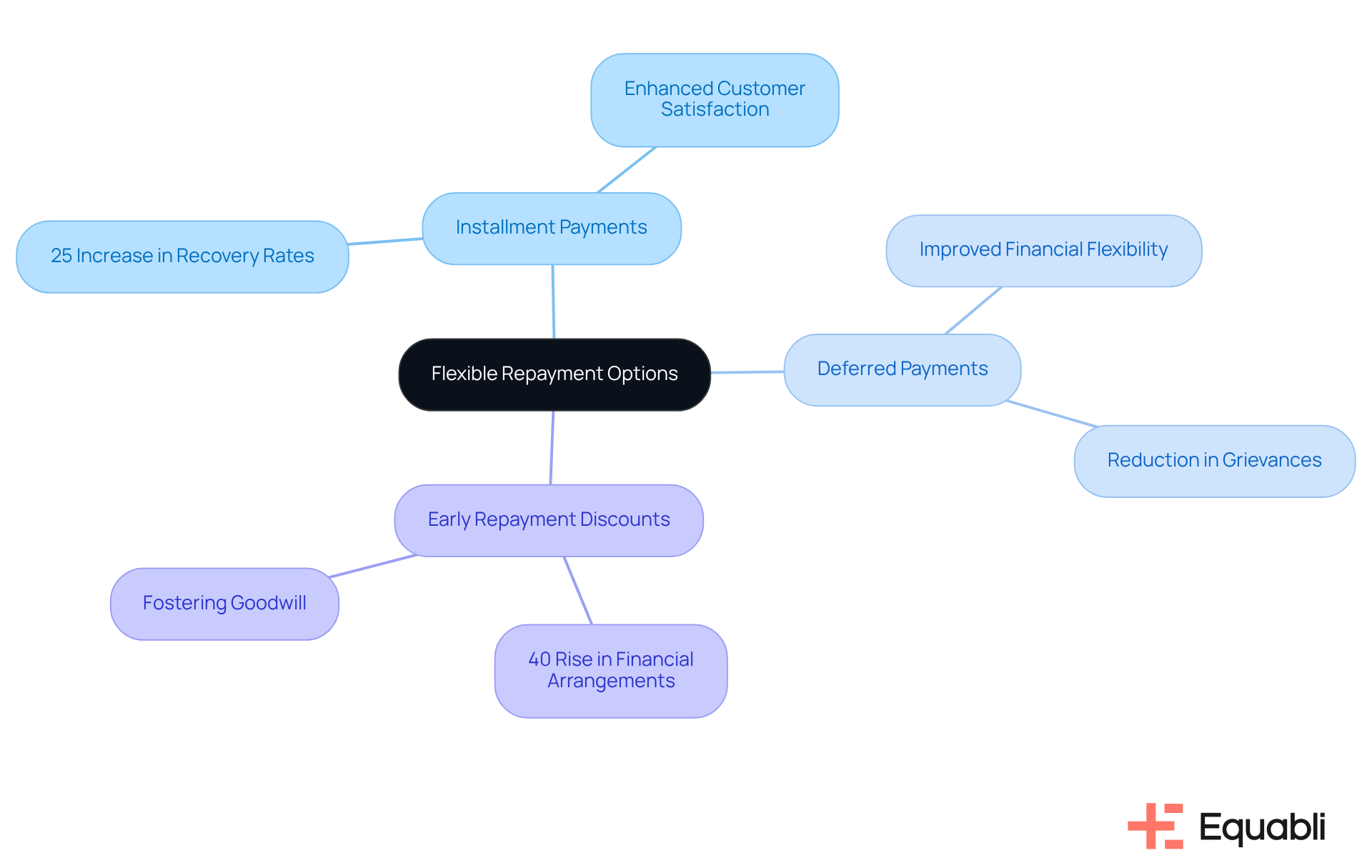

Implementing flexible repayment options significantly enhances engagement with payment notice letter optimization strategies for corporate debt recovery processes. By offering a variety of payment plans—such as installment payments, deferred payments, or discounts for early repayment—organizations can implement payment notice letter optimization strategies for corporate debt recovery processes to effectively address individual financial circumstances. This adaptability simplifies the repayment process for borrowers and cultivates goodwill, fostering a positive relationship between lenders and clients.

Research from The Kaplan Group indicates that personalized collection approaches can lead to a 25% increase in recovery rates. This underscores the impact of flexibility on borrower engagement. Moreover, businesses utilizing a multichannel digital strategy have reported a 40% rise in financial arrangements, demonstrating that payment notice letter optimization strategies for corporate debt recovery processes resonate effectively with clients.

By centering collections strategies around people, as highlighted in case studies on empathy and customer care, organizations can utilize payment notice letter optimization strategies for corporate debt recovery processes to improve engagement rates and enhance debt recovery outcomes. Additionally, with only 11% of debt collection companies currently utilizing AI in their operations, there exists significant potential for improvement through technology and real-time data, which are essential for effective personalization.

Personalized Communication: Tailor Payment Notices for Better Engagement

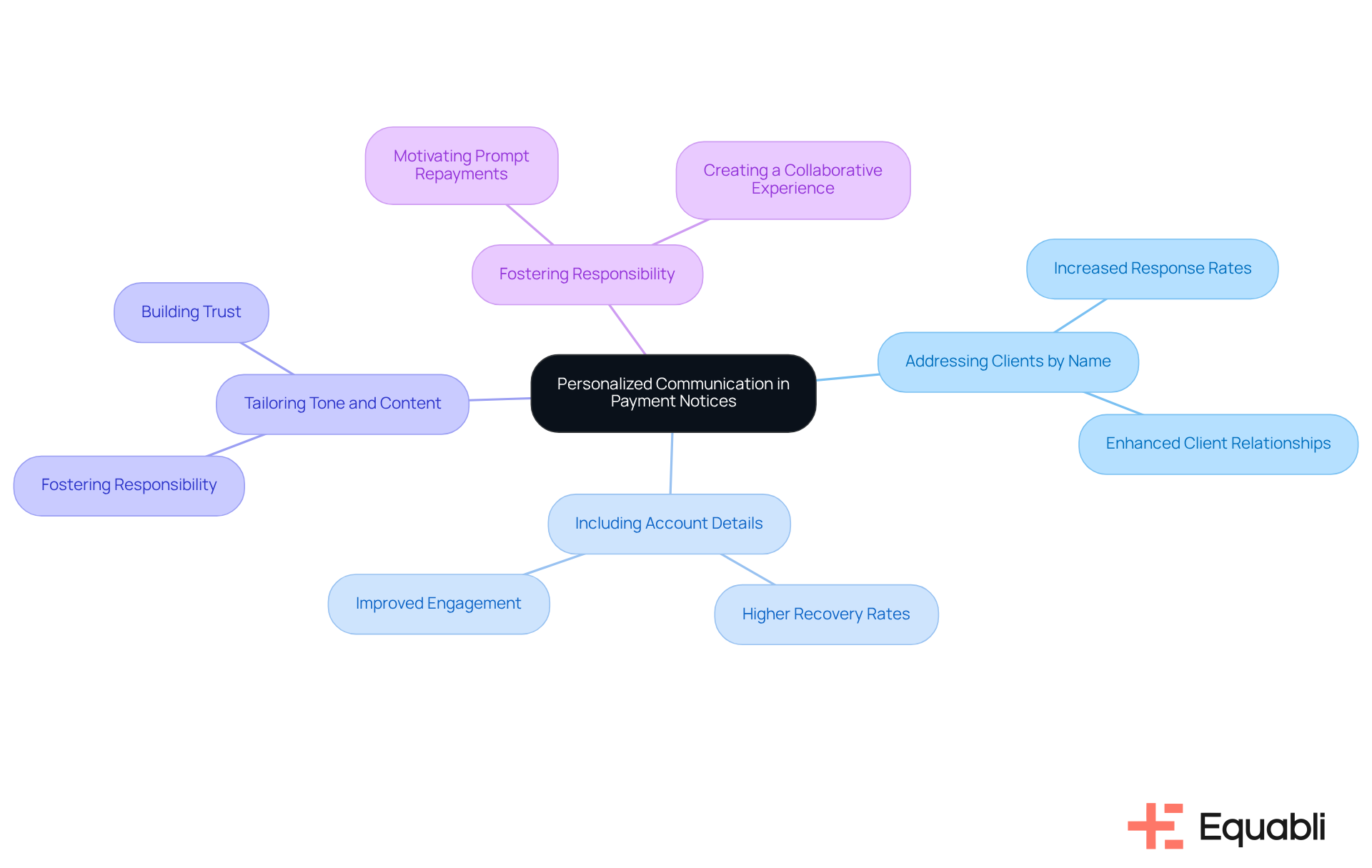

The use of payment notice letter optimization strategies for corporate debt recovery processes significantly enhances engagement and response rates. By addressing clients by name and including specific account details, organizations enhance their payment notice letter optimization strategies for corporate debt recovery processes, creating messages that resonate on a personal level. Evidence shows that implementing payment notice letter optimization strategies for corporate debt recovery processes, which tailor the tone and content to align with an individual’s history and preferences, not only increases the likelihood of a positive response but also demonstrates that lenders value their clients as individuals. This approach fosters a sense of responsibility, motivating prompt repayments. Research indicates that payment notice letter optimization strategies for corporate debt recovery processes can lead to a 25% increase in recovery rates, underscoring the effectiveness of this strategy.

As the collections landscape evolves, adopting a conversational tone rather than a confrontational one is essential. This shift can transform the borrower experience, making it more collaborative and less transactional. By positioning individuals at the core of their communication strategies, organizations can significantly enhance their collection results and foster enduring connections with their clients. This approach not only aligns with compliance frameworks but also addresses the operational challenges faced by executives in debt collection, ultimately driving better outcomes.

Incentives for Prompt Payment: Encourage Quick Responses to Notices

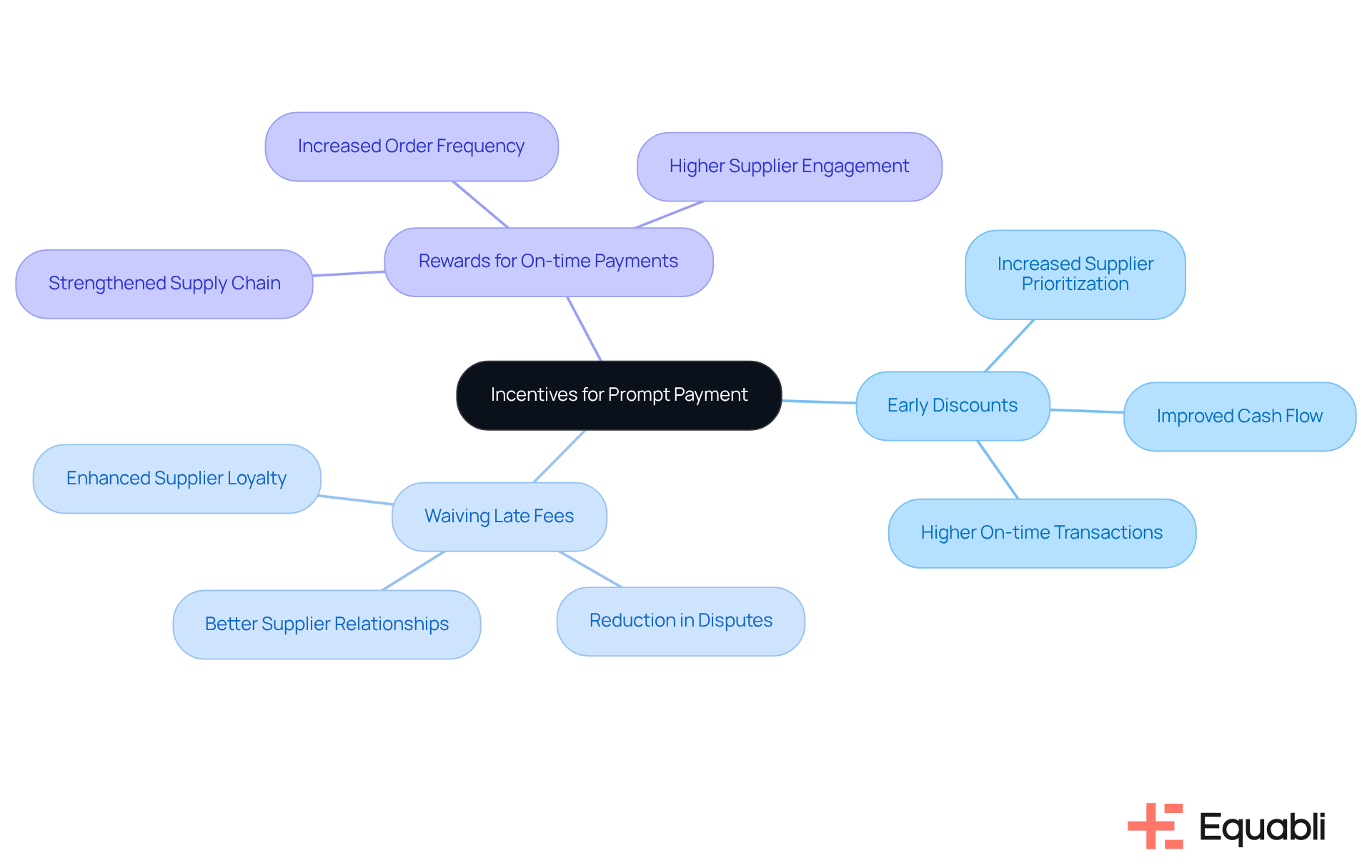

Encouraging timely remittance serves as a pivotal strategy within payment notice letter optimization strategies for corporate debt recovery processes. Organizations can adopt measures such as:

- Offering early discounts

- Waiving late fees

- Providing rewards for consistent on-time payments

These payment notice letter optimization strategies for corporate debt recovery processes not only prompt borrowers to act swiftly but also foster loyalty and appreciation, ultimately leading to significantly improved recovery outcomes.

Research indicates that companies implementing early settlement options witness a 35% increase in supplier prioritization during shortages. This statistic underscores the effectiveness of these strategies in cultivating stronger relationships within the supply chain. Furthermore, organizations that establish early settlement discount programs consistently report an average ROI of 10-20% annually, driven by enhanced cash flow and a reduction in disputes.

As Janine Sabo, Corporate Credit Manager, notes, "These discounts enhance cash flow because as receipts arrive faster, it potentially can lower the expense of borrowing." This creates a mutually beneficial scenario where borrowers gain from financial incentives while organizations experience improved recovery rates.

For instance, a mid-sized manufacturing firm that introduced an early settlement discount program observed a 15% increase in on-time transactions within three months. This case exemplifies the tangible benefits of payment notice letter optimization strategies for corporate debt recovery processes, reinforcing the notion that strategic financial incentives can transform the debt collection landscape.

Automated Reminders: Maintain Consistency in Payment Notice Follow-Ups

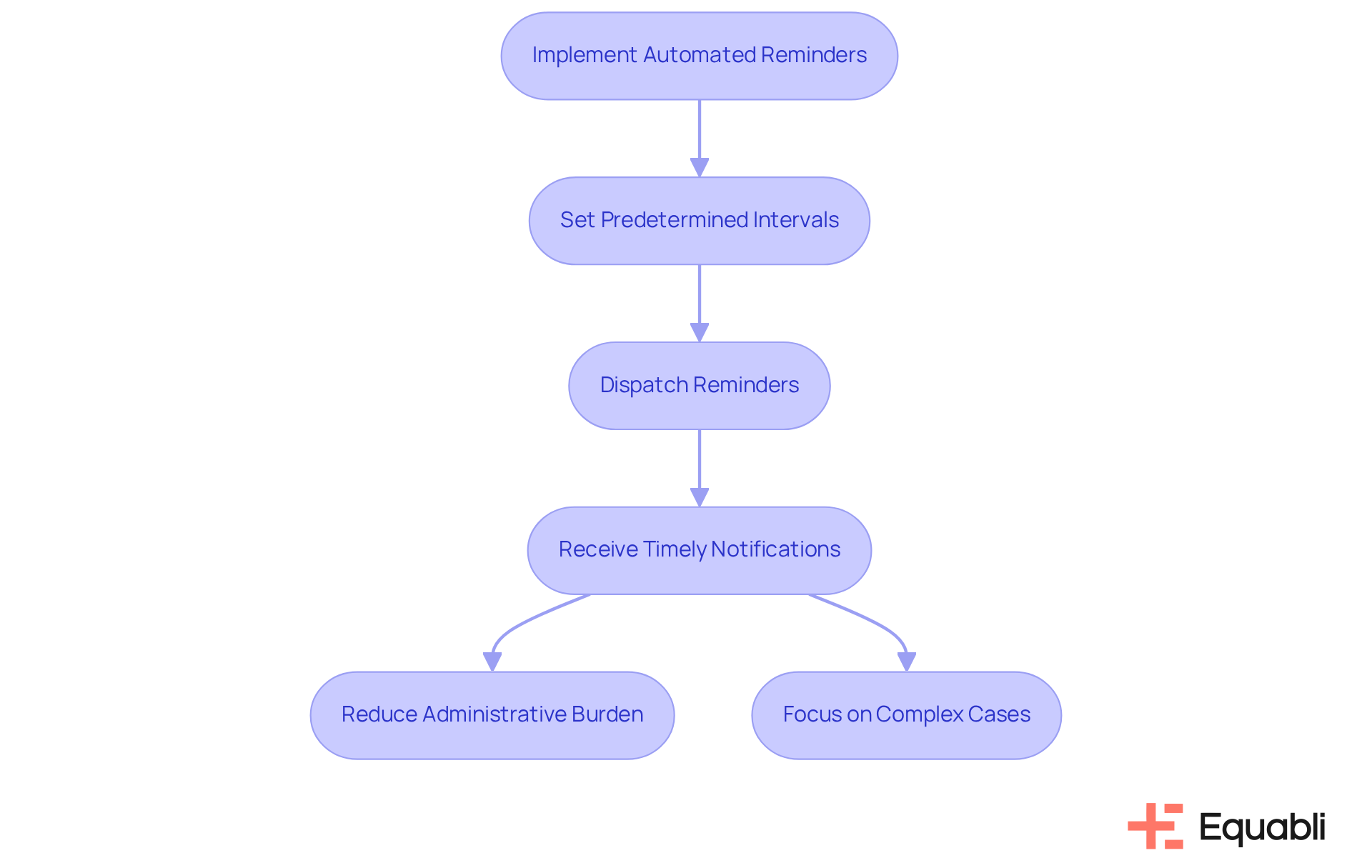

Automated reminders are essential for implementing payment notice letter optimization strategies for corporate debt recovery processes to ensure consistency in follow-ups. Utilizing Equabli's EQ Suite, organizations can implement automated systems that dispatch reminders at predetermined intervals. This approach guarantees that individuals receive timely notifications without the need for manual intervention. Such consistency not only keeps the debt visible to clients but also significantly alleviates the administrative burden on collection teams by implementing payment notice letter optimization strategies for corporate debt recovery processes. Consequently, teams can concentrate on more complex cases, thereby enhancing overall efficiency and recovery performance.

Documentation of Interactions: Enhance Future Payment Notice Strategies

Recording engagements with borrowers is crucial for enhancing future payment notice letter optimization strategies for corporate debt recovery processes. By maintaining comprehensive records of communications, responses, and financial behaviors, organizations can analyze effective practices and pinpoint areas for improvement related to payment notice letter optimization strategies for corporate debt recovery processes. This data-driven methodology not only refines payment notice letter optimization strategies for corporate debt recovery processes based on actual outcomes but also bolsters compliance with regulatory standards, ensuring a clear history in the event of disputes.

Effective record-keeping is essential for implementing payment notice letter optimization strategies for corporate debt recovery processes. It enables businesses to adapt their communication methods and implement payment notice letter optimization strategies for corporate debt recovery processes to meet evolving consumer expectations. As the debt collection landscape shifts towards more personalized and respectful practices, the implementation of payment notice letter optimization strategies for corporate debt recovery processes emerges as a vital asset in securing successful outcomes. This approach not only enhances operational efficiency but also aligns with compliance frameworks, ultimately supporting sustainable business practices.

Legal Compliance: Ensure Payment Notices Meet Regulatory Standards

Ensuring that billing alerts comply with legal standards is essential for organizations engaged in debt recovery. This compliance encompasses regulations regarding the content, timing, and distribution of notifications. Regular reviews of practices are vital to align with current laws, thereby mitigating the risk of legal challenges. By prioritizing compliance, companies not only protect themselves against potential penalties but also bolster their reputation within the industry.

Recent legislative changes, such as those proposed in New York, highlight the urgency for organizations to adapt their billing strategies. These changes include penalties of $250 for the first violation and up to $500 for each subsequent infraction related to declining cash transactions. Furthermore, Connecticut's proposed legislation SB 1396, which limits charges for earned wage access services, underscores the importance of understanding how such regulations can impact the effectiveness of fee communication. These modifications can significantly enhance the resonance of financial alerts with recipients while ensuring adherence to legal requirements.

As noted by the Head of Legal & Compliance at Truevo, "Using Vixio PaymentsCompliance gives us a comprehensive view of the critical changes in regulation in our key markets, and reduces our business resource requirement which saves us on average £100k per annum." This perspective illustrates the financial advantages of maintaining compliance. To implement effective compliance strategies, organizations should:

- Conduct regular audits of their payment notice letter optimization strategies for corporate debt recovery processes

- Remain vigilant about legislative changes that may influence their operations

Conclusion

Optimizing payment notice letters is essential for improving corporate debt recovery processes. By implementing intelligent automation, predictive analytics, clear communication, and personalized engagement, organizations can enhance recovery rates and streamline operations. These strategies not only strengthen relationships with borrowers but also ensure that the debt collection process remains efficient, compliant, and responsive to client needs.

Key strategies highlighted include:

- The utilization of Equabli's EQ Suite for automation

- Employing data-driven insights for tailored communications

- Establishing flexible repayment options

Each approach contributes to a more effective debt recovery framework, underscoring the necessity of adapting to borrower preferences and behaviors. Furthermore, integrating systematic follow-ups and automated reminders fosters consistency, while thorough documentation of interactions refines future strategies and ensures compliance with legal standards.

In summary, the importance of optimizing payment notice letters cannot be overstated. Organizations are urged to adopt these strategies to enhance debt recovery outcomes while cultivating a respectful and empathetic approach to collections. By prioritizing effective communication and leveraging technology, businesses can navigate the complexities of debt recovery more successfully, ultimately leading to improved financial health and stronger client relationships.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a set of tools designed to automate and streamline corporate debt recovery processes through payment notice letter optimization strategies, utilizing intelligent automation to enhance efficiency and reduce manual efforts.

How does EQ Collect contribute to debt recovery?

EQ Collect helps organizations apply payment notice letter optimization strategies effectively, significantly reducing manual efforts and minimizing errors, which leads to improved overall efficiency in debt recovery.

What features does the EQ Suite offer for improving debt recovery?

The EQ Suite includes a no-code file-mapping tool for faster vendor onboarding, custom scoring models for refining collection strategies, real-time reporting for data-driven collection efforts, and seamless integration between the EQ Engine, EQ Engage, and EQ Collect.

How does predictive analytics enhance payment notice strategies?

Predictive analytics helps organizations analyze historical repayment behaviors to identify trends, allowing them to tailor communication strategies and improve the relevance of billing alerts, ultimately enhancing recovery rates.

Why are clear communication channels important for payment notices?

Clear communication channels improve response rates to billing alerts by allowing organizations to engage borrowers through their preferred methods, such as email, SMS, and phone calls, ensuring that notices are accessible and comprehensible.

How can organizations improve the effectiveness of their billing communications?

Organizations can improve billing communications by providing clear guidelines on transaction processes, such as including direct links to payment methods in SMS reminders, which simplifies the process for borrowers.

What is the strategic value of implementing payment notice letter optimization strategies?

Implementing these strategies enhances recovery rates, ensures compliance, and improves operational efficiency, positioning organizations to better navigate the complexities of enterprise-level debt management.