Overview

The article presents effective strategies for managing payment overdue reminders within the context of credit risk management. Clear communication, timely notifications, and a friendly tone are essential to enhance collection rates while preserving professional relationships. Evidence indicates that structured reminder systems can significantly improve payment compliance and customer engagement.

From a compliance perspective, implementing a systematic approach to reminders not only fosters better relationships with clients but also aligns with regulatory expectations. Data shows that organizations employing structured reminder systems experience higher compliance rates, which directly impacts their bottom line.

To operationalize this strategy, organizations should consider integrating automated reminder systems that allow for timely notifications. This approach not only streamlines the collection process but also enhances customer engagement by providing a consistent and professional touchpoint.

In conclusion, adopting effective payment overdue reminder strategies is crucial for organizations aiming to mitigate credit risk. By prioritizing clear communication and structured systems, businesses can improve compliance and maintain strong relationships with their clients.

Introduction

In the finance sector, managing overdue payments is not merely a necessity; it is a critical component that can significantly impact client relationships. The global debt recovery software market is experiencing notable growth, prompting organizations to adopt innovative strategies that integrate technology with effective communication. This article explores ten powerful strategies for payment overdue reminder letters that not only streamline the collection process but also cultivate goodwill and trust between businesses and their clients.

How can companies effectively balance the urgency of collecting overdue payments with the imperative to maintain positive relationships? The following strategies provide a structured approach to navigating this delicate balance.

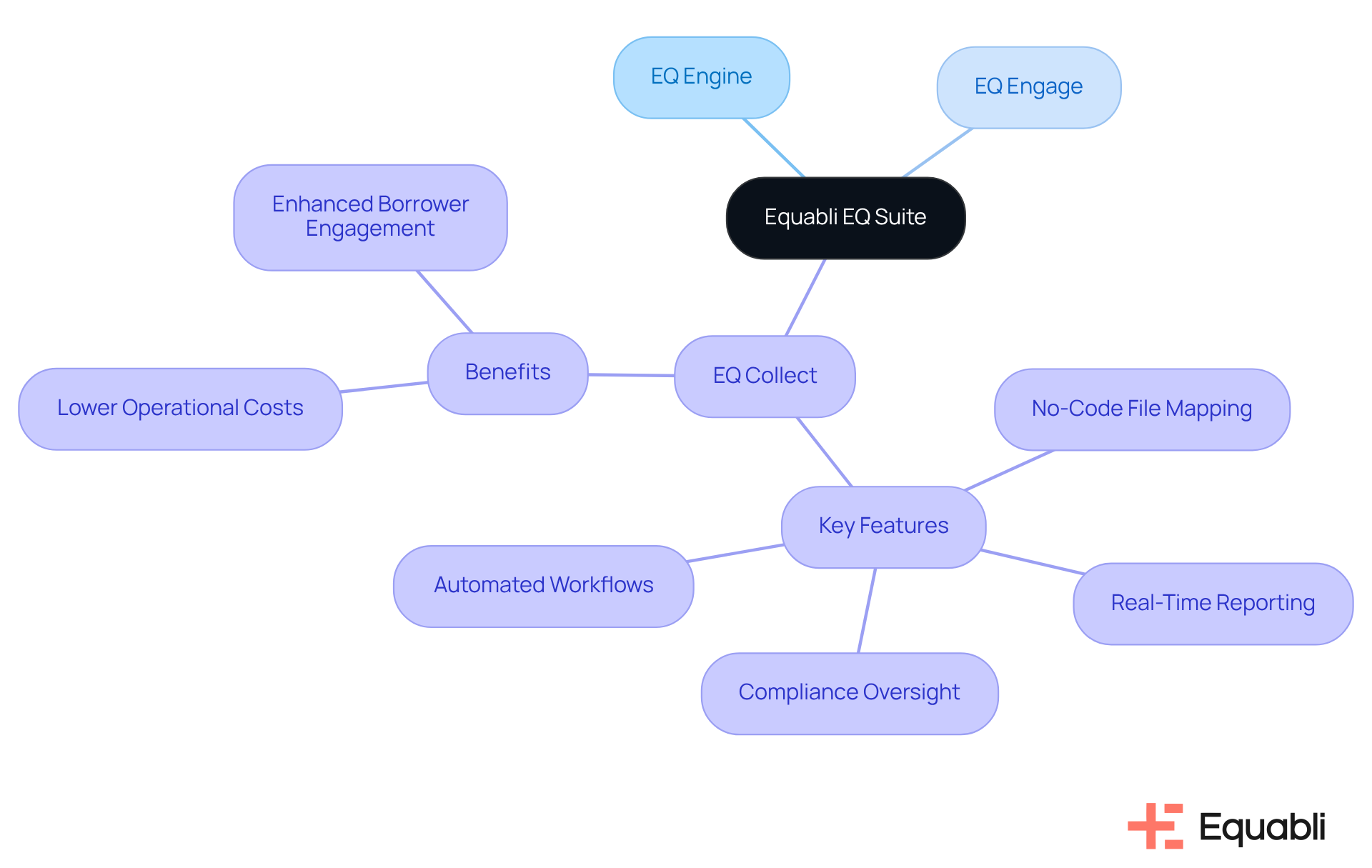

Equabli: Intelligent EQ Suite for Streamlined Payment Reminders

Equabli's EQ Suite revolutionizes the payment notification process through a robust suite of tools designed for automation and efficiency. This suite encompasses the EQ Engine, EQ Engage, and EQ Collect, enabling organizations to implement tailored scoring models that accurately forecast repayment behaviors. By refining retrieval strategies and facilitating digital assets via self-service repayment plans, this intelligent suite can significantly lower operational costs—by as much as 30%—while simultaneously enhancing borrower engagement.

Key features of EQ Collect, including:

- A no-code file-mapping tool

- Automated workflows

- Real-time reporting

- Compliance oversight

minimize execution errors and streamline vendor onboarding. This ensures smarter orchestration and improved performance. Clients benefit from the ability to communicate through their preferred channels, which is vital for implementing payment overdue reminder letter strategies for corporate credit risk management and ensuring timely reminders and follow-ups essential for effective credit risk management.

As the global debt recovery software market is projected to reach $6.8 billion by 2030, expanding at an annual rate of 9.3%, the adoption of such digital tools is increasingly critical for organizations aiming to boost recovery rates and enhance customer satisfaction. Successful implementations of these digital debt recovery tools have demonstrated that businesses leveraging technology-integrated solutions can achieve recovery rate improvements of up to 80%. This underscores the importance of embracing digital transformation within debt recovery strategies.

The integration of advanced technology in collections not only streamlines processes but also cultivates a more empathetic approach to customer interactions, which is essential in today’s financial landscape. From a compliance perspective, organizations must prioritize these innovations to navigate the complexities of debt recovery effectively.

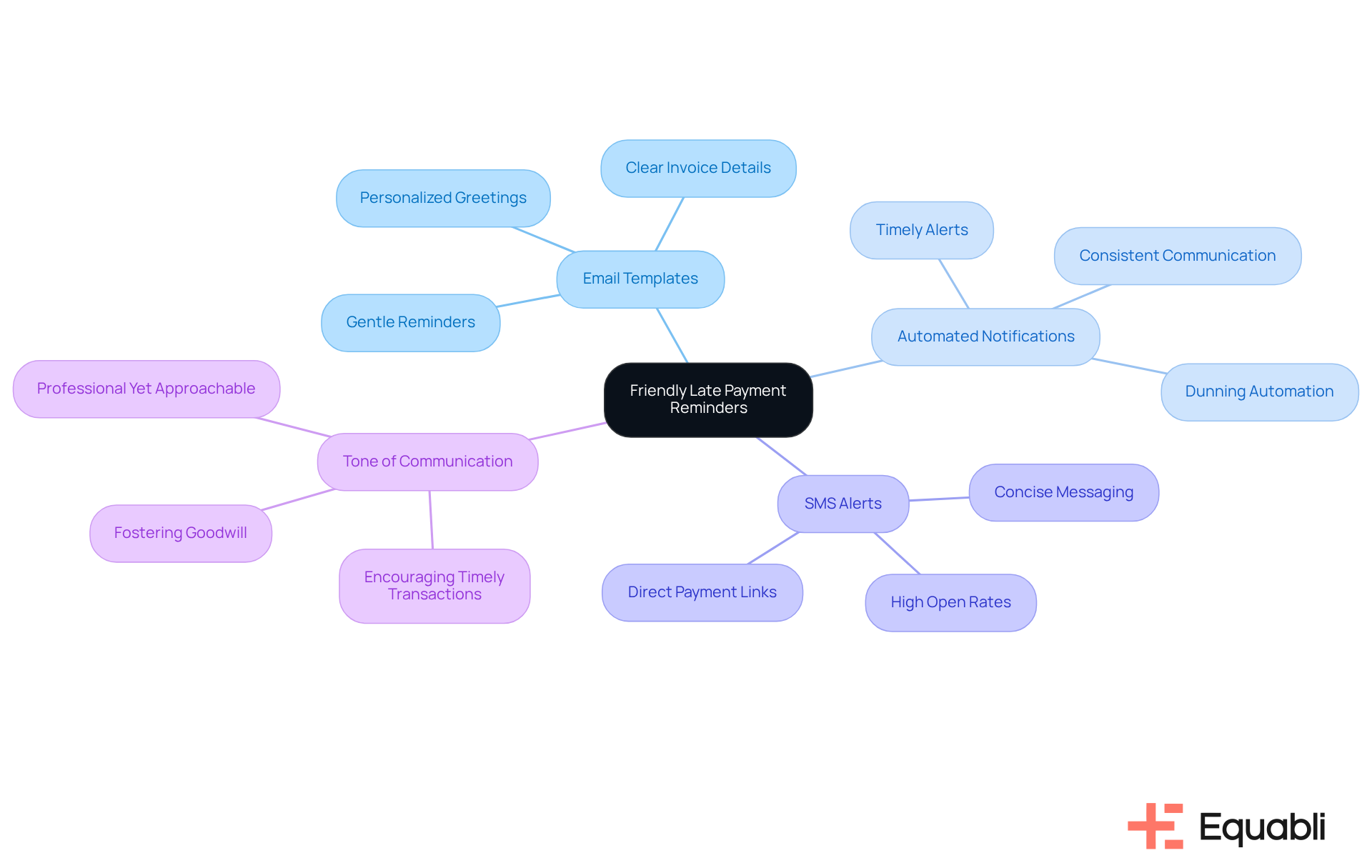

ChaserHQ: Email Templates for Friendly Late Payment Reminders

ChaserHQ offers a suite of email templates designed specifically for friendly late fee reminders. These templates adopt a courteous tone, facilitating businesses in following up on overdue invoices while preserving client relationships. By integrating elements such as personalized greetings, clear invoice details, and gentle reminders for settlement, these templates enable businesses to uphold professionalism and effectively manage their accounts receivable.

In addition to email notifications, automated systems enhance the consistency and professionalism of communication, ensuring alerts are dispatched promptly and without manual intervention. SMS notifications, known for their higher open and response rates, serve as an efficient modern method for financial alerts, further engaging customers.

To sustain customer relationships during billing notifications, a professional yet approachable tone is essential. This strategy not only encourages timely transactions but also fosters goodwill, making customers feel valued rather than pressured. Optimal practices include:

- Sending notifications well in advance of the due date, positioning them as a supportive service rather than a collection effort.

- Offering incentives for prompt payments, motivating customers to prioritize their obligations.

- Incorporating direct transaction links in notifications to significantly reduce barriers in the settlement process, streamlining account resolution for customers.

The impact of tone in overdue notices is critical; a courteous message can enhance customer engagement and mitigate potential conflicts. By framing reminders as friendly nudges, businesses can effectively implement payment overdue reminder letter strategies for corporate credit risk management while managing their accounts receivable and nurturing strong customer relationships. This balance is vital for long-term success in credit risk management and is often achieved through effective payment overdue reminder letter strategies for corporate credit risk management.

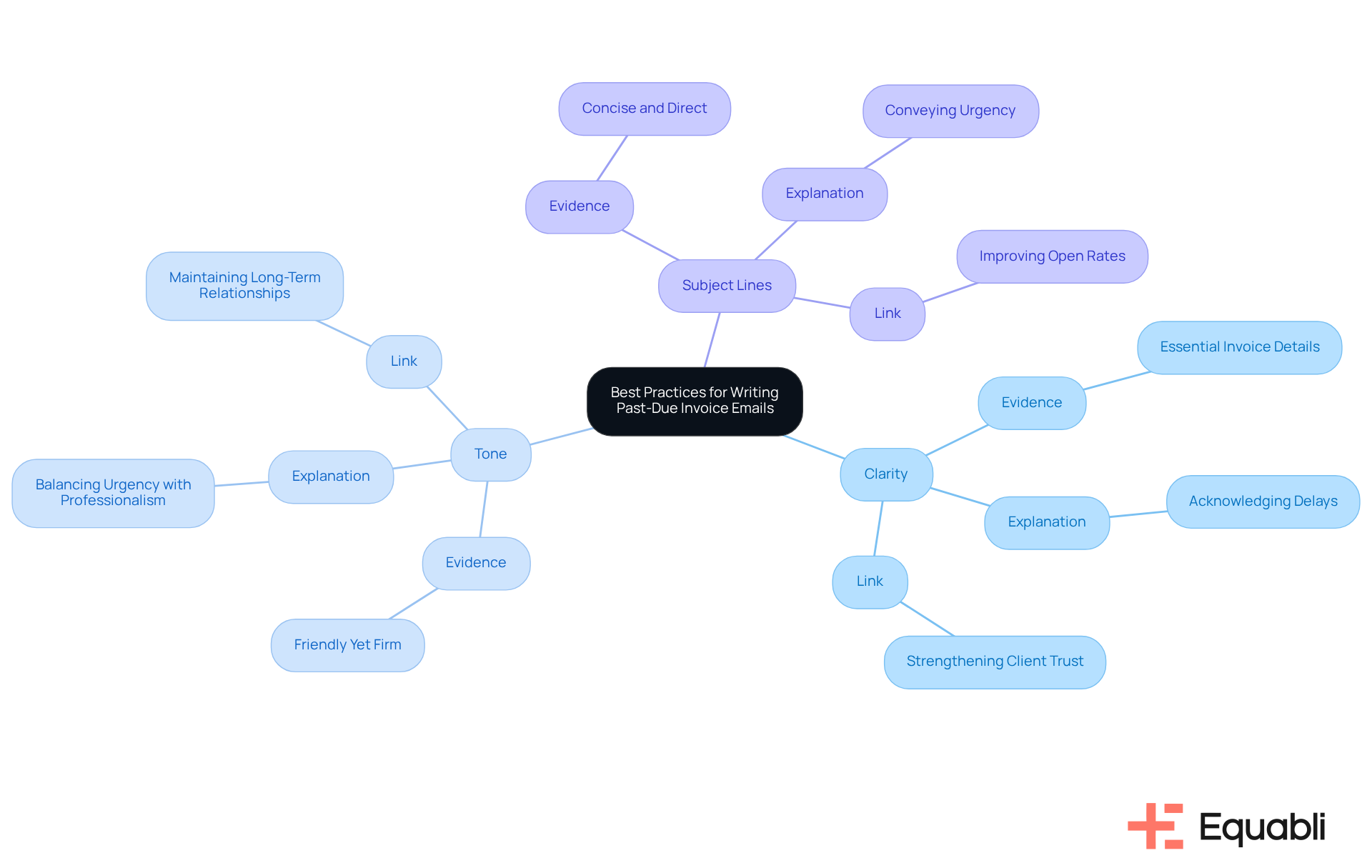

Invoiced.com: Best Practices for Writing Past-Due Invoice Emails

Effective communication in overdue invoice emails is crucial for applying payment overdue reminder letter strategies for corporate credit risk management, which enhances collection rates and maintains professional relationships.

- Point: Clarity must be prioritized, beginning with a polite greeting and a clear statement of the email's purpose.

- Evidence: Including essential invoice details—such as the amount due, due date, and invoice number—ensures clients have all necessary information readily available.

- Explanation: Acknowledging potential delays in transactions can foster goodwill, while establishing clear expectations for timelines reinforces accountability.

- Link: This approach not only improves communication but also strengthens client trust.

Financial specialists assert that clear communication plays a crucial role in transaction behavior, particularly when implementing payment overdue reminder letter strategies for corporate credit risk management.

- Evidence shows that employing payment overdue reminder letter strategies for corporate credit risk management, such as a well-organized email, can enhance the likelihood of prompt payments by providing customers with a straightforward method to settle their accounts.

- Explanation: Incorporating a friendly yet firm tone balances urgency with professionalism, encouraging prompt action without alienating customers.

- Link: This balance is essential for maintaining long-term relationships.

Successful email strategies, including payment overdue reminder letter strategies for corporate credit risk management, involve using concise subject lines that convey urgency, such as 'Payment Due Reminder: Invoice #12345'.

- Evidence indicates that the body of the email should be direct, detailing the overdue balance and any applicable late fees, while also utilizing payment overdue reminder letter strategies for corporate credit risk management to offer support for individuals facing challenges.

- Explanation: Providing various transaction methods and incorporating direct links for processing can simplify the procedure, making it easier for customers to fulfill their obligations.

- Link: By implementing these best practices, businesses can enhance cash flow management and strengthen customer relationships.

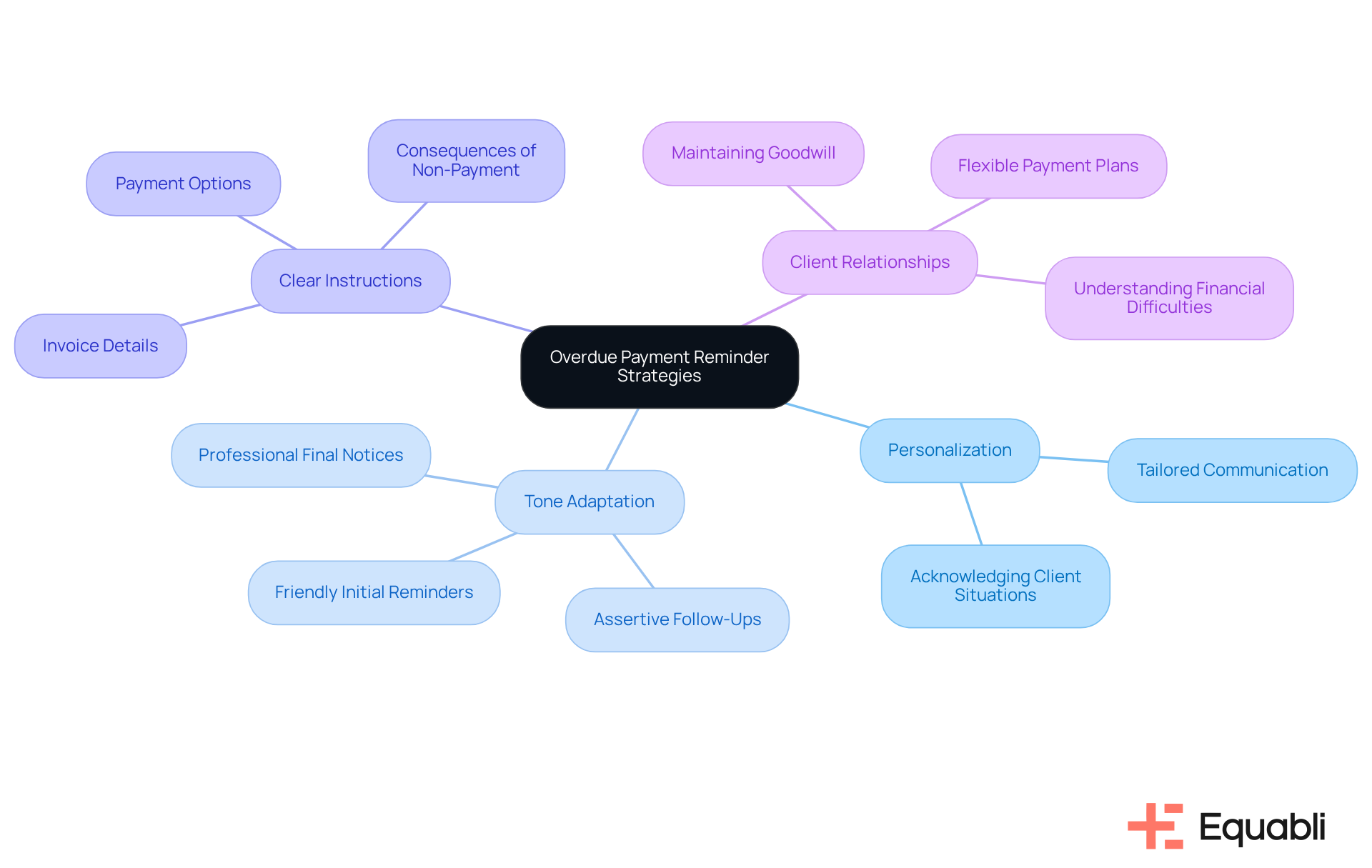

InvoiceFly: Versatile Overdue Payment Reminder Email Templates

Equabli offers a suite of adaptable overdue reminder email templates that utilize payment overdue reminder letter strategies for corporate credit risk management to enhance customer engagement and streamline the retrieval process. These templates enable businesses to tailor their tone and content, ensuring that communication remains both professional and approachable. By incorporating clear billing instructions and essential details—such as invoice numbers, due dates, and outstanding balances—these templates facilitate timely responses from customers, supporting effective payment overdue reminder letter strategies for corporate credit risk management.

Research indicates that personalized communication is one of the key payment overdue reminder letter strategies for corporate credit risk management, as it significantly boosts payment collection rates; customers are more likely to respond positively to messages that acknowledge their unique situations. For instance, a friendly reminder after one week of non-payment can help maintain goodwill, while a more assertive follow-up after two weeks underscores urgency without sacrificing professionalism. This strategic approach incorporates payment overdue reminder letter strategies for corporate credit risk management, which not only enhances cash flow but also cultivates stronger client relationships, demonstrating a commitment to understanding and addressing their needs.

eTactics: Sample Emails for Timely Payment Reminders

eTactics provides a series of example emails designed for prompt invoice notifications. These examples illustrate how to organize notifications effectively, incorporating essential elements such as a clear subject line, a courteous introduction, and a straightforward request for payment. By following these examples, companies can ensure their notifications are both professional and efficient, thereby increasing the likelihood of timely settlements.

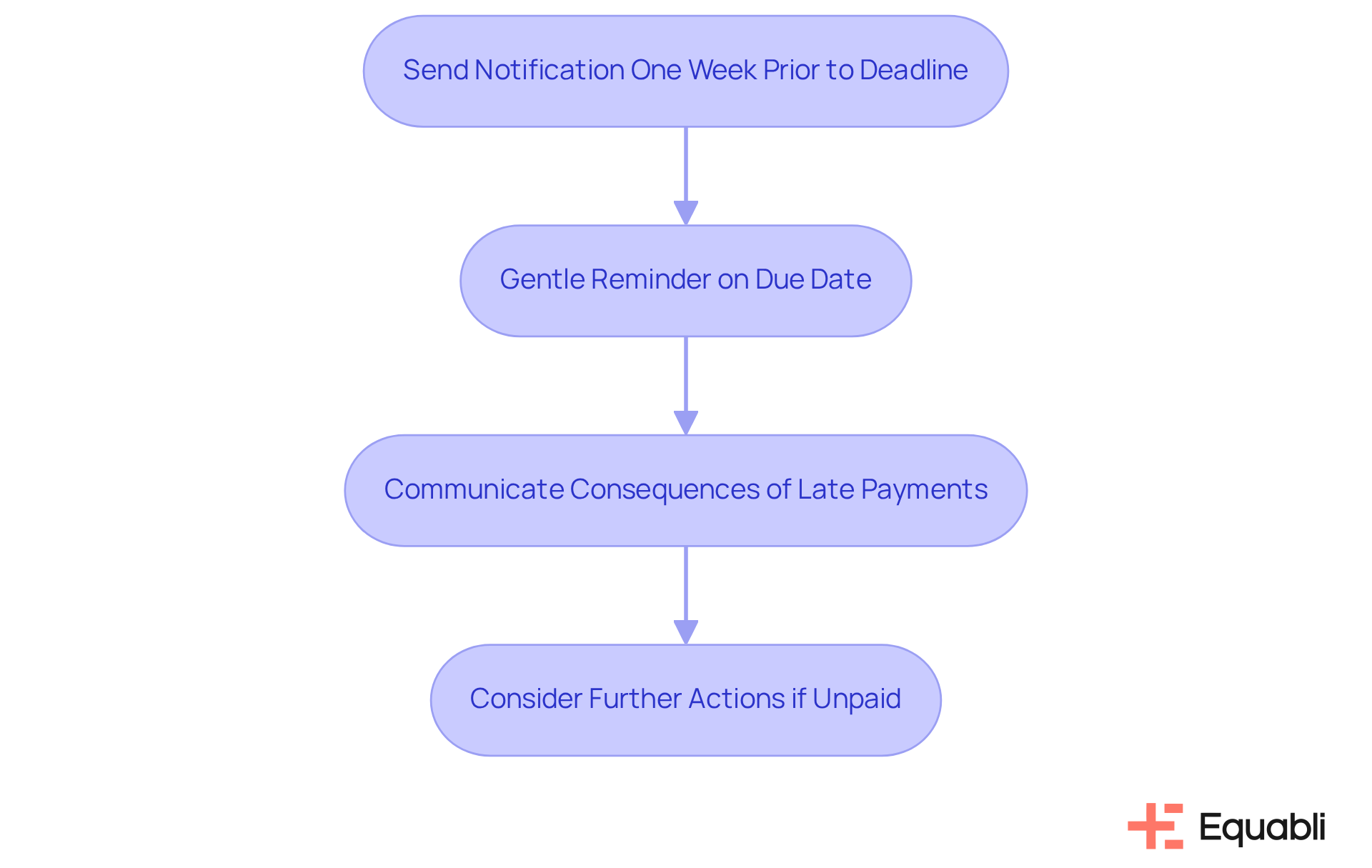

Sending notifications one week prior to the deadline serves as a proactive measure, assisting customers in preparing for transactions. This approach underscores the importance of organized alerts. Research indicates that pre-due notifications are perceived as a valuable service, significantly reducing the incidence of late payments. Furthermore, acknowledging potential reasons for non-payment and offering assistance can enhance client relationships, fostering a more collaborative environment.

It is prudent to send a gentle reminder on the day the invoice is due, as this can further encourage prompt payment. Additionally, clearly communicating the potential consequences of late payments, such as late fees, is crucial in promoting timely settlements. By integrating payment overdue reminder letter strategies for corporate credit risk management, companies can refine their billing notification practices and enhance their overall cash flow.

PaidNice: Proven Overdue Payment Reminder Email Templates

PaidNice offers a suite of effective overdue reminder email templates that significantly enhance collection efforts. These templates are designed to be straightforward, incorporating all essential details such as the invoice number, amount due, and transaction link. By gradually shifting the tone from friendly to more assertive as payments become increasingly overdue, businesses can convey urgency while upholding professionalism.

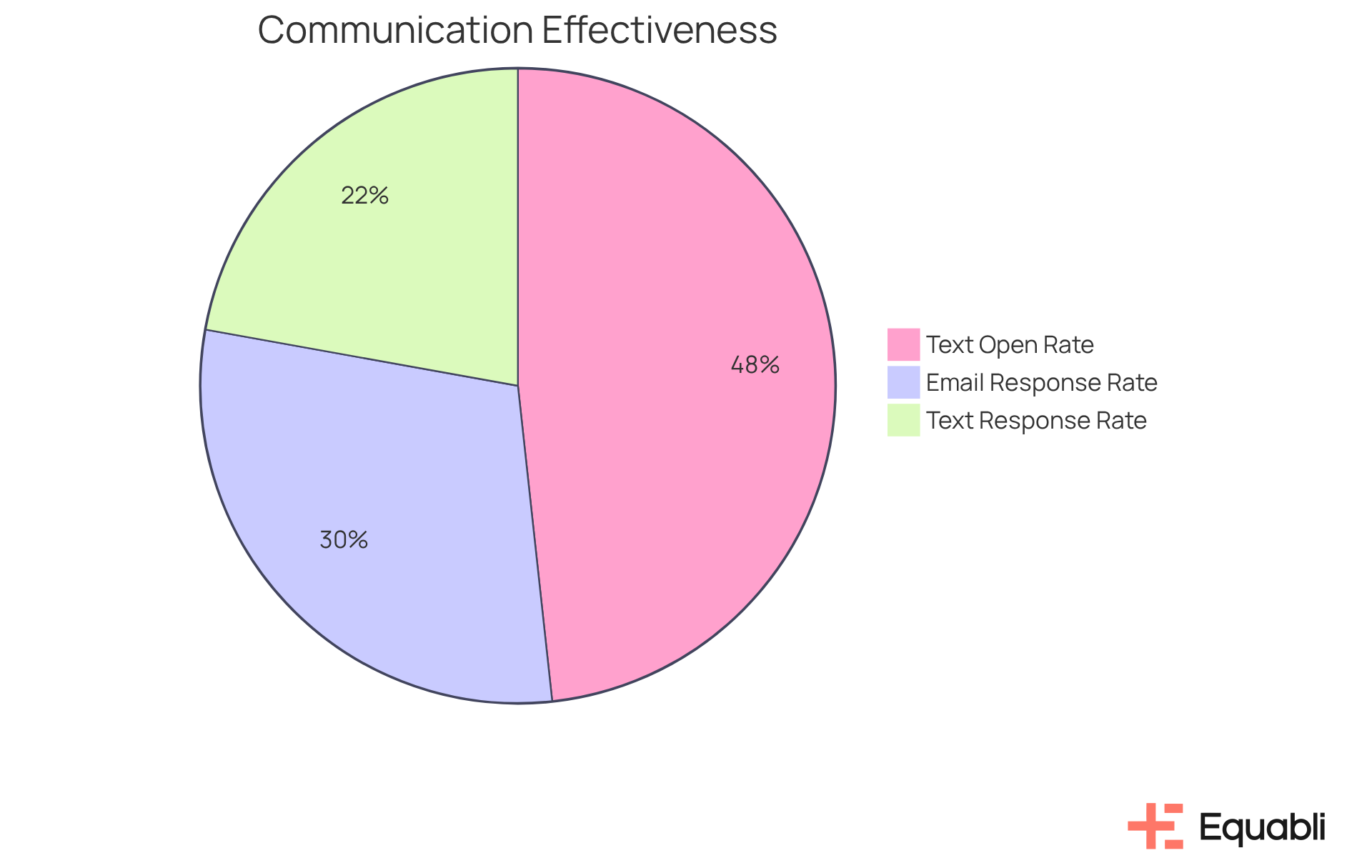

For example, companies that implement a structured notification system report that 60% of customers pay on time when they receive timely prompts. This statistic underscores the importance of effective communication. Furthermore, text messages achieve an impressive 98% open rate within five minutes, illustrating how urgency can be communicated effectively. Notably, text messages yield a 45% higher response rate than emails in collections, reinforcing their value in this context.

Striking a balance between urgency and professionalism is essential; notifications must be firm yet courteous, ensuring that individuals feel valued while being reminded of their obligations. This approach fosters a culture of responsibility and encourages prompt settlements, ultimately leading to healthier cash flow and stronger client relationships. As highlighted, the payment overdue reminder letter strategies for corporate credit risk management can transform your accounts receivable from a constant worry into a smooth, predictable process. Therefore, integrating multiple communication channels, such as text and email, is advisable to enhance retrieval rates.

Upflow.io: Tips and Templates for Effective Past Due Notices

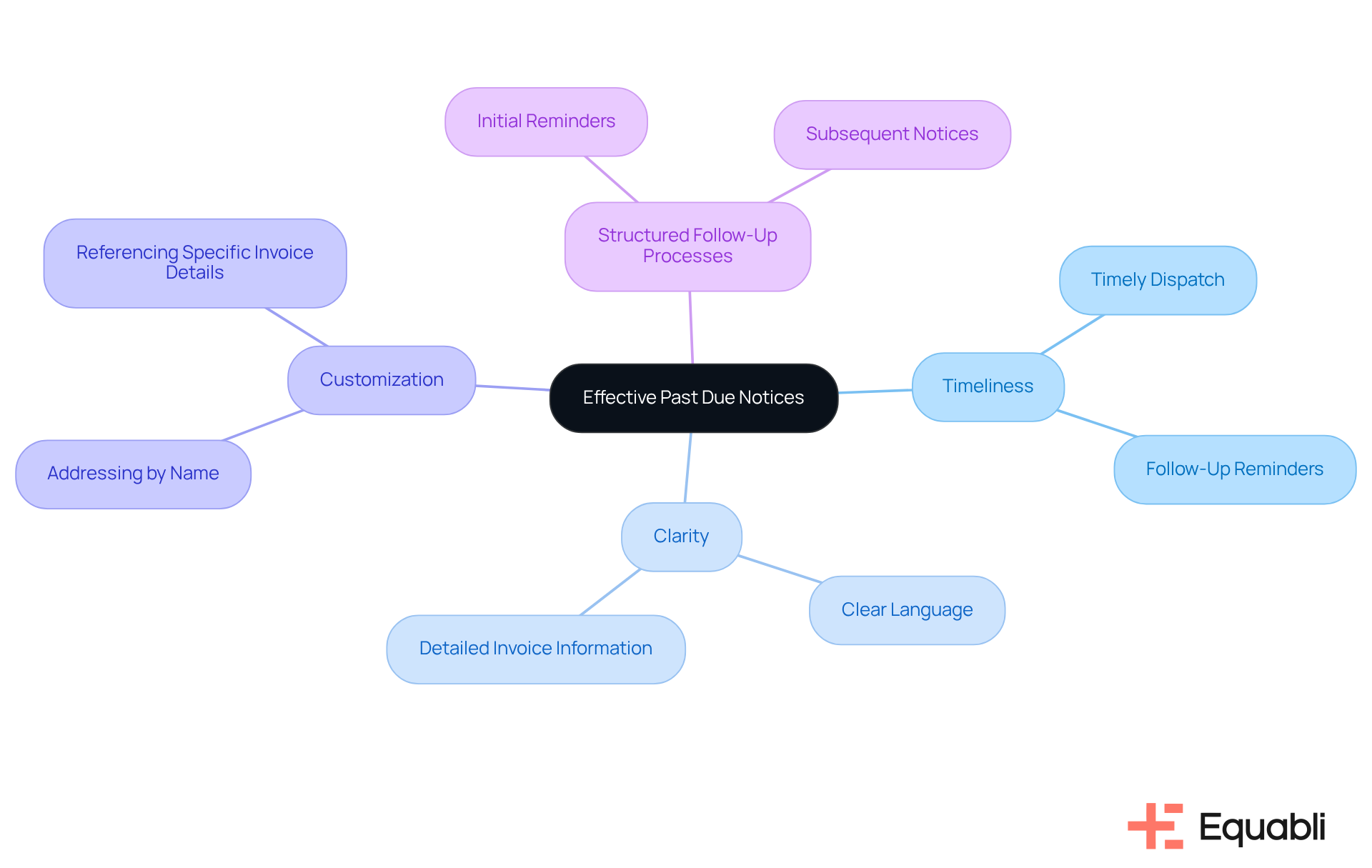

Effective past due notices are essential for implementing payment overdue reminder letter strategies for corporate credit risk management, which enhances collection rates and maintains positive client relationships. Timely dispatch of payment overdue reminder letter strategies for corporate credit risk management post-due date is vital; research indicates that the likelihood of recovering funds diminishes significantly over time. Clear and straightforward language is imperative, ensuring all relevant invoice details are included, such as the amount owed, due date, and options for settling the bill. This clarity not only aids understanding but also underscores the seriousness of the situation.

Successful businesses illustrate that timely communication can lead to improved collection rates. By leveraging Equabli's EQ Collect, organizations can streamline operations, ensuring smarter orchestration and enhanced performance in their debt recovery processes. Companies that implement structured follow-up processes, including initial reminders and subsequent notices, frequently observe a marked increase in payment compliance, highlighting the importance of payment overdue reminder letter strategies for corporate credit risk management. Financial experts assert that implementing payment overdue reminder letter strategies for corporate credit risk management can motivate debtors to prioritize their outstanding balances, ultimately improving cash flow.

Furthermore, customizing communication—addressing customers by name and referencing specific invoice details—can significantly influence engagement levels. This approach fosters trust and encourages cooperation, particularly with long-term customers. By adopting these strategies and utilizing Equabli's integrated solutions, organizations can effectively navigate the complexities of debt recovery while preserving valuable client relationships.

Invoiced.com: Strategies to Reduce Late Payments Altogether

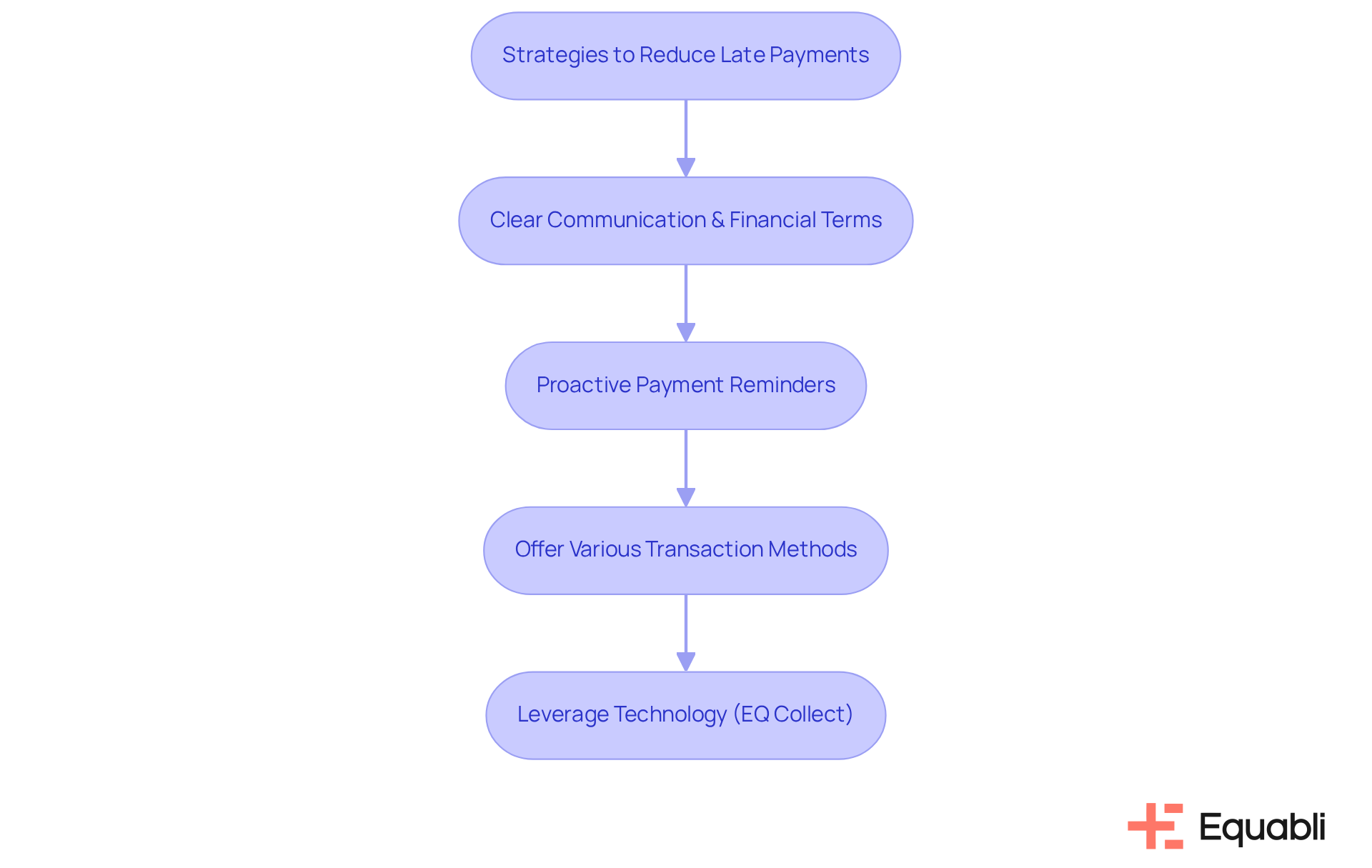

Successful debt recovery hinges on clear communication and the implementation of payment overdue reminder letter strategies for corporate credit risk management to minimize delays in settling accounts. Establishing explicit financial terms from the outset is crucial; this includes defining due dates, accepted transaction methods, and penalties for late payments. Such clarity not only sets expectations but also fosters accountability among clients. Data indicates that over half (51%) of suppliers report delays in receiving funds, highlighting the necessity for payment overdue reminder letter strategies for corporate credit risk management to effectively address this challenge.

Proactive communication is essential in the payment overdue reminder letter strategies for corporate credit risk management. Implementing payment overdue reminder letter strategies for corporate credit risk management by sending notifications well in advance of due dates can significantly enhance the timeliness of transactions. For example, businesses that implement payment overdue reminder letter strategies for corporate credit risk management often experience a notable reduction in overdue invoices. Successful practices include freelancers who request deposits before commencing work, thereby safeguarding against delayed payments and ensuring a more efficient cash flow.

Moreover, offering various transaction methods can facilitate prompt exchanges. By accommodating clients' preferences, businesses can reduce friction in the transaction process, ultimately leading to improved cash flow. The Fair Compensation Code, introduced in December 2024, aims to recognize companies with sound financial practices, further highlighting the importance of maintaining transparent and equitable terms.

To further bolster these strategies, leveraging the features of EQ Collect can markedly enhance debt collection efficiency. Its no-code file-mapping tool allows businesses to shorten vendor onboarding timelines and improve operational efficiency through data-driven strategies. Automated workflows reduce execution errors and reliance on manual resources, while real-time reporting offers unparalleled transparency and insights. Additionally, EQ Collect ensures industry-leading compliance oversight, both internally and externally, through automated monitoring, aligning with the principles of the Fair Payment Code.

In conclusion, clear financial terms and proactive communication are vital strategies for implementing payment overdue reminder letter strategies for corporate credit risk management, which helps mitigate late transactions and enhance overall financial health. By adopting these methods and utilizing the smart automation and machine learning solutions offered by EQ Collect, companies can not only improve their cash flow but also foster stronger relationships with customers, promoting a culture of timely transactions.

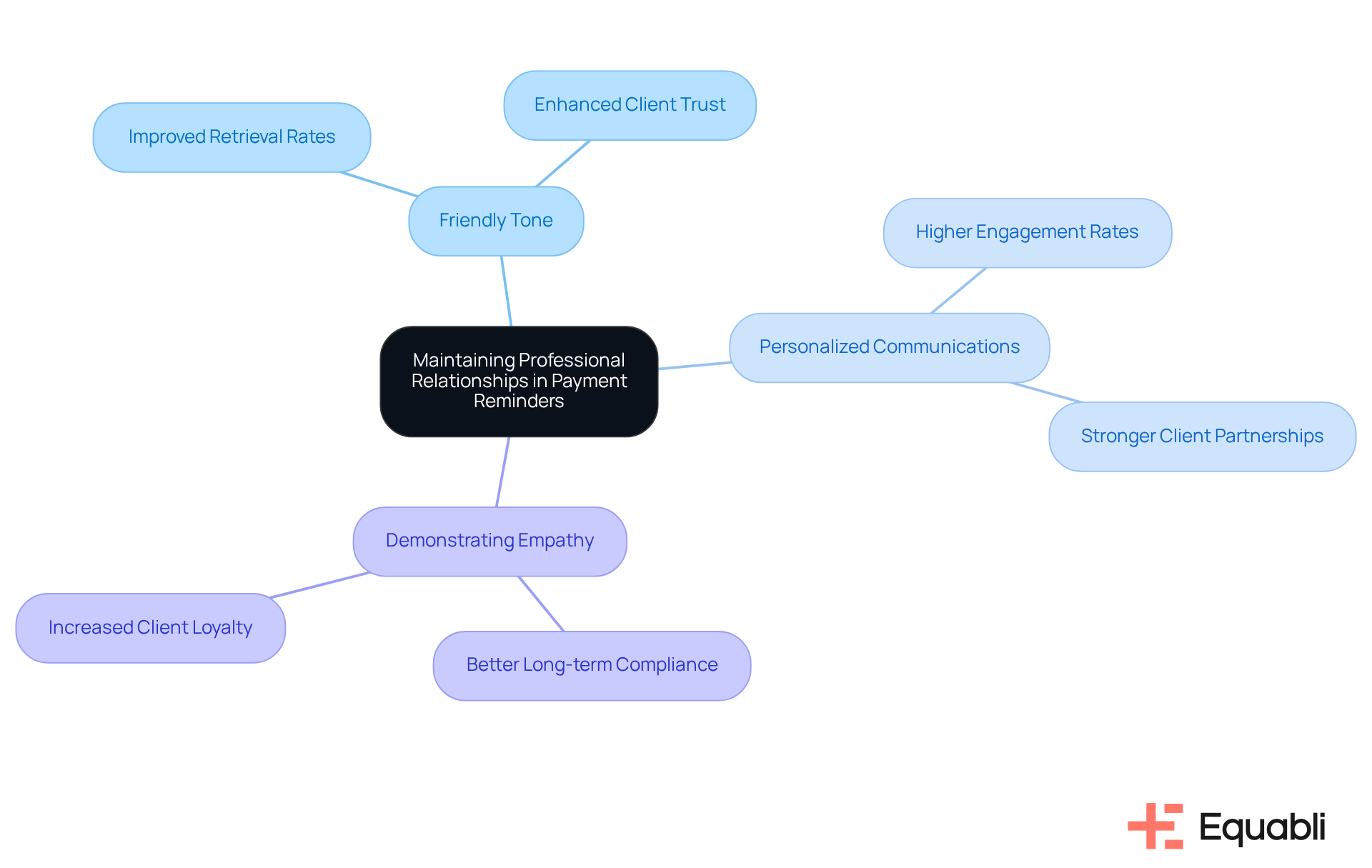

ChaserHQ: Maintaining Professional Relationships in Payment Reminders

ChaserHQ underscores the critical importance of fostering professional relationships during the reminder process. By adopting a friendly tone, personalizing communications, and demonstrating empathy towards clients' circumstances, businesses can significantly enhance their collection efforts. This relationship-building approach not only facilitates prompt reimbursements but also cultivates loyalty and trust—key components for long-term success in receivables management.

Industry leaders assert that effective communication, characterized by understanding and personalization, plays a pivotal role in influencing payment retrieval outcomes. For instance, organizations that prioritize these strategies often experience improved retrieval rates and stronger client partnerships. This, in turn, contributes to enhanced overall financial stability, positioning businesses to navigate the complexities of debt collection more effectively.

To operationalize these insights, businesses should integrate relationship-focused strategies into their collection processes. By doing so, they can address the operational and compliance challenges inherent in the industry, ultimately fostering a more resilient financial framework.

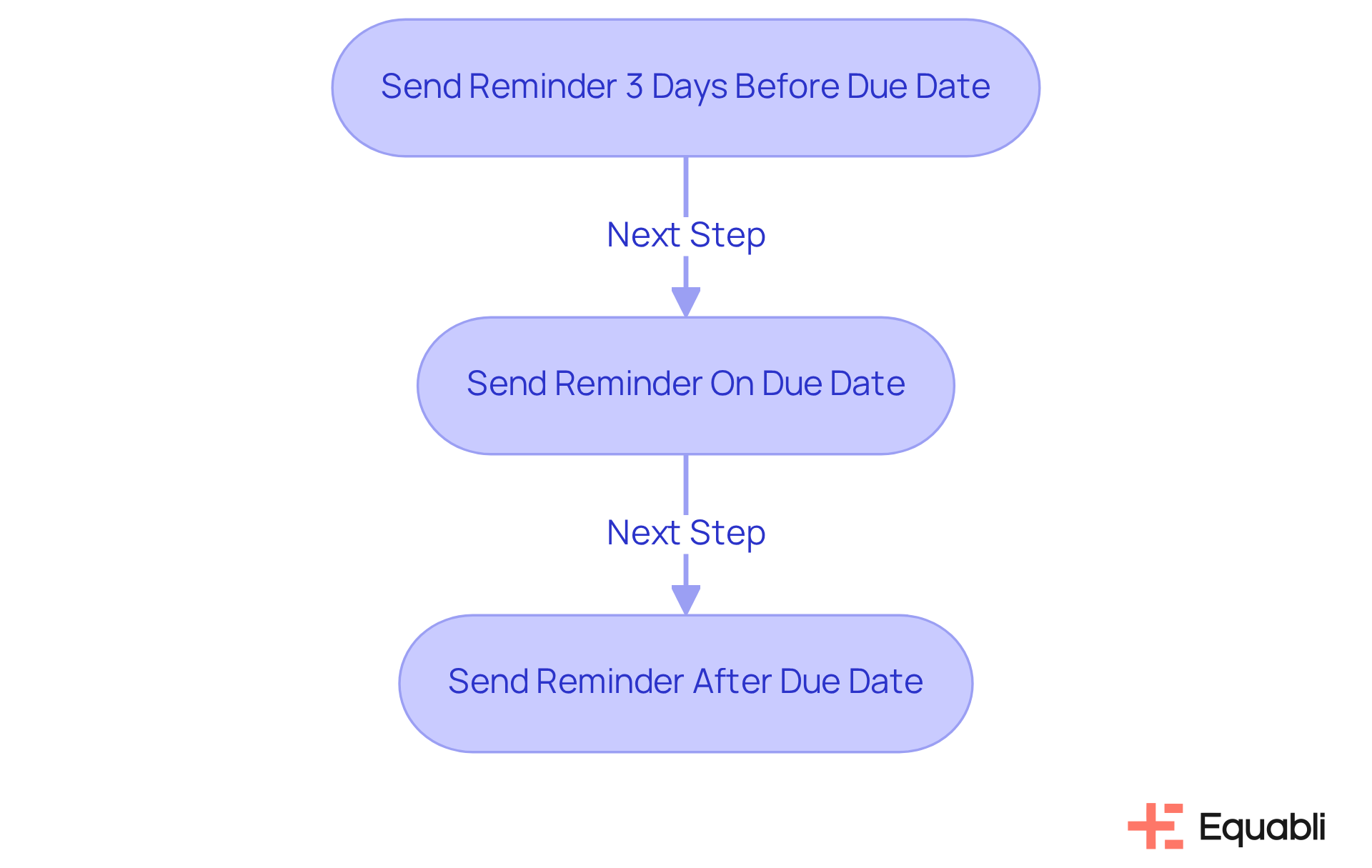

InvoiceFly: Timing Your Overdue Payment Reminders Effectively

Equabli's EQ Suite presents a strategic solution for debt collection, enabling financial institutions to optimize their operations and enhance overall performance. By integrating intelligent, data-driven tools, businesses can optimize their payment overdue reminder letter strategies for corporate credit risk management.

Evidence suggests that payment overdue reminder letter strategies for corporate credit risk management, which involve sending reminders a few days before the due date, on the due date, and shortly after the amount becomes overdue, significantly increase the likelihood of prompt payments. This structured approach, bolstered by Equabli's innovative features, ensures that payment overdue reminder letter strategies for corporate credit risk management are implemented in a timely and relevant manner.

The suite offers customizable repayment options and robust borrower engagement strategies, empowering institutions to modernize their debt recovery processes effectively. From a compliance perspective, these enhancements not only streamline operations but also align with regulatory expectations, mitigating risk exposure.

By adopting such advanced solutions, financial institutions can position themselves as leaders in the evolving landscape of debt collection, ultimately driving better outcomes for both lenders and borrowers.

Conclusion

Implementing effective payment overdue reminder letter strategies is essential for organizations aiming to enhance credit risk management and optimize cash flow. By leveraging innovative tools such as Equabli's EQ Suite and adopting a customer-centric approach, businesses can streamline communication processes. This ensures timely reminders while preserving positive client relationships. Such a dual focus not only improves recovery rates but also fosters trust and loyalty, which are critical for long-term success.

Various strategies have been discussed, including:

- The use of friendly email templates from ChaserHQ

- The importance of clear communication in past-due invoices

- The effectiveness of timely reminders

Each element contributes to a comprehensive approach that balances professionalism with empathy, ultimately leading to improved payment compliance and stronger client connections. Insights from these practices underscore the significant impact that well-structured reminder systems can have on an organization’s financial health.

In a landscape where customer relationships and financial stability are paramount, adopting these payment overdue reminder strategies is not merely beneficial but essential. By prioritizing clear communication, timely follow-ups, and personalized interactions, organizations can navigate the complexities of debt recovery more effectively. Embracing these techniques will enhance cash flow and cultivate a culture of responsibility and respect, paving the way for sustainable business growth.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a set of tools designed to automate and streamline the payment notification process, which includes the EQ Engine, EQ Engage, and EQ Collect. It helps organizations implement tailored scoring models to forecast repayment behaviors and improve borrower engagement.

How does the EQ Suite benefit organizations?

The EQ Suite can lower operational costs by up to 30% while enhancing borrower engagement through refined retrieval strategies and self-service repayment plans.

What are the key features of EQ Collect?

Key features of EQ Collect include a no-code file-mapping tool, automated workflows, real-time reporting, and compliance oversight, all aimed at minimizing execution errors and streamlining vendor onboarding.

Why is communication important in payment reminders?

Effective communication allows organizations to connect with clients through their preferred channels, which is crucial for managing corporate credit risk and ensuring timely reminders and follow-ups.

What is the projected growth of the global debt recovery software market?

The global debt recovery software market is projected to reach $6.8 billion by 2030, with an annual growth rate of 9.3%.

How can digital debt recovery tools improve recovery rates?

Successful implementations of digital debt recovery tools can lead to recovery rate improvements of up to 80%, highlighting the importance of technology in debt recovery strategies.

What approach does ChaserHQ take for late payment reminders?

ChaserHQ provides email templates for friendly late payment reminders that maintain a courteous tone, helping businesses follow up on overdue invoices while preserving client relationships.

What are some optimal practices for sending payment reminders?

Optimal practices include sending notifications well in advance of the due date, offering incentives for prompt payments, and incorporating direct transaction links in notifications to facilitate the settlement process.

Why is tone important in overdue notices?

A courteous tone in overdue notices can enhance customer engagement and reduce conflicts, making reminders feel like friendly nudges rather than pressure tactics.

What are best practices for writing past-due invoice emails?

Best practices include prioritizing clarity with polite greetings, providing essential invoice details, acknowledging potential delays, and maintaining a friendly yet firm tone to encourage prompt payments while preserving relationships.