Overview

This article presents effective strategies for optimizing payment reminder letters, crucial for enhancing corporate credit management. Implementing automated, personalized notifications and utilizing multi-channel communication can significantly improve collection rates and cash flow. Evidence from various case studies illustrates the positive impacts of these strategies on businesses' financial health.

From a compliance perspective, the integration of automated systems not only streamlines communication but also ensures adherence to regulatory standards. For instance, companies that have adopted these practices report a marked increase in their collection efficiency, demonstrating the tangible benefits of such innovations.

To operationalize this strategy, organizations should consider investing in technology that supports personalized outreach. This approach not only fosters better relationships with clients but also enhances the overall effectiveness of credit management efforts. The implications for financial health are profound, as improved collection rates directly contribute to stronger cash flow and reduced risk exposure.

In conclusion, the strategic implementation of optimized payment reminder letters is essential for corporate credit management. By leveraging automation and multi-channel communication, businesses can enhance their collection processes, ultimately leading to improved financial outcomes.

Introduction

In the competitive landscape of corporate credit management, effective payment reminder strategies are essential for maintaining cash flow and ensuring timely payments. Organizations are increasingly adopting innovative solutions that automate notifications while optimizing their content and delivery for maximum impact. These strategies not only enhance collection efforts but also align with compliance requirements, reinforcing the importance of structured approaches in debt management.

Given the multitude of options available, how can businesses pinpoint the most effective methods to engage customers and improve their collection rates?

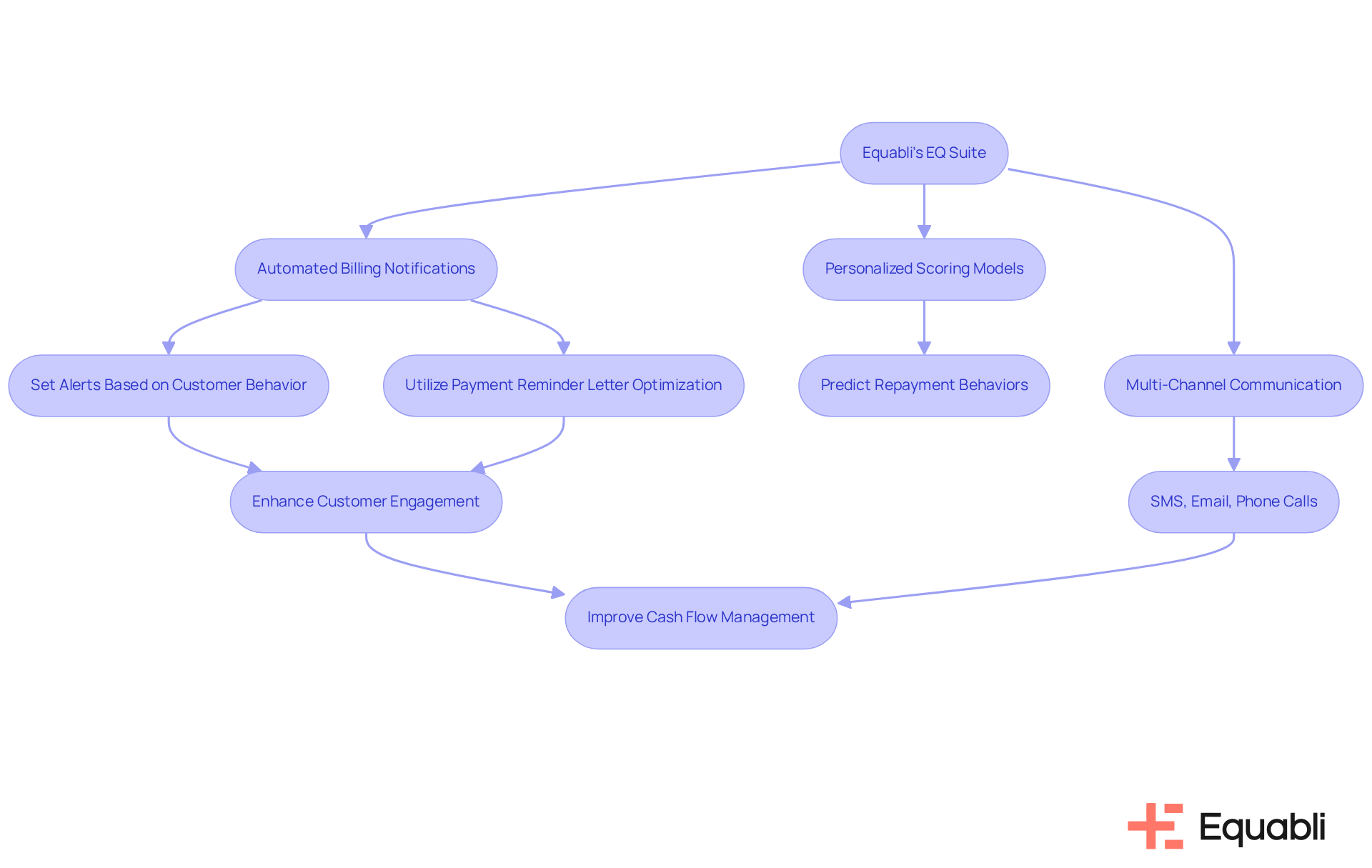

Equabli's EQ Suite: Streamline Payment Reminders with Intelligent Automation

Equabli's EQ Suite offers a comprehensive set of tools designed to automate billing notifications, utilizing payment reminder letter optimization strategies for corporate credit management with efficiency. By leveraging intelligent automation, organizations can utilize payment reminder letter optimization strategies for corporate credit management, setting alerts based on customer behavior and payment history. This ensures timely notifications that enhance customer engagement by utilizing payment reminder letter optimization strategies for corporate credit management. The EQ Engine, a key component of the suite, supports the creation of personalized scoring models that predict repayment behaviors. This capability supports payment reminder letter optimization strategies for corporate credit management, allowing for tailored notifications that resonate with borrowers and simplifying the notification process while significantly reducing the manual workload on staff. Consequently, teams can focus on more strategic initiatives.

Moreover, the EQ Engage feature facilitates communication through preferred channels, including SMS, email, or phone calls. This guarantees that notifications reach customers in the most effective manner possible. Implementing payment reminder letter optimization strategies for corporate credit management through a multi-channel approach not only increases the likelihood of prompt transactions but also improves overall cash flow management. By adopting these advanced tools, organizations can enhance their operational efficiency and compliance posture in the competitive landscape of debt collection.

Gaviti: Enhance Cash Flow with Effective B2B Payment Reminders

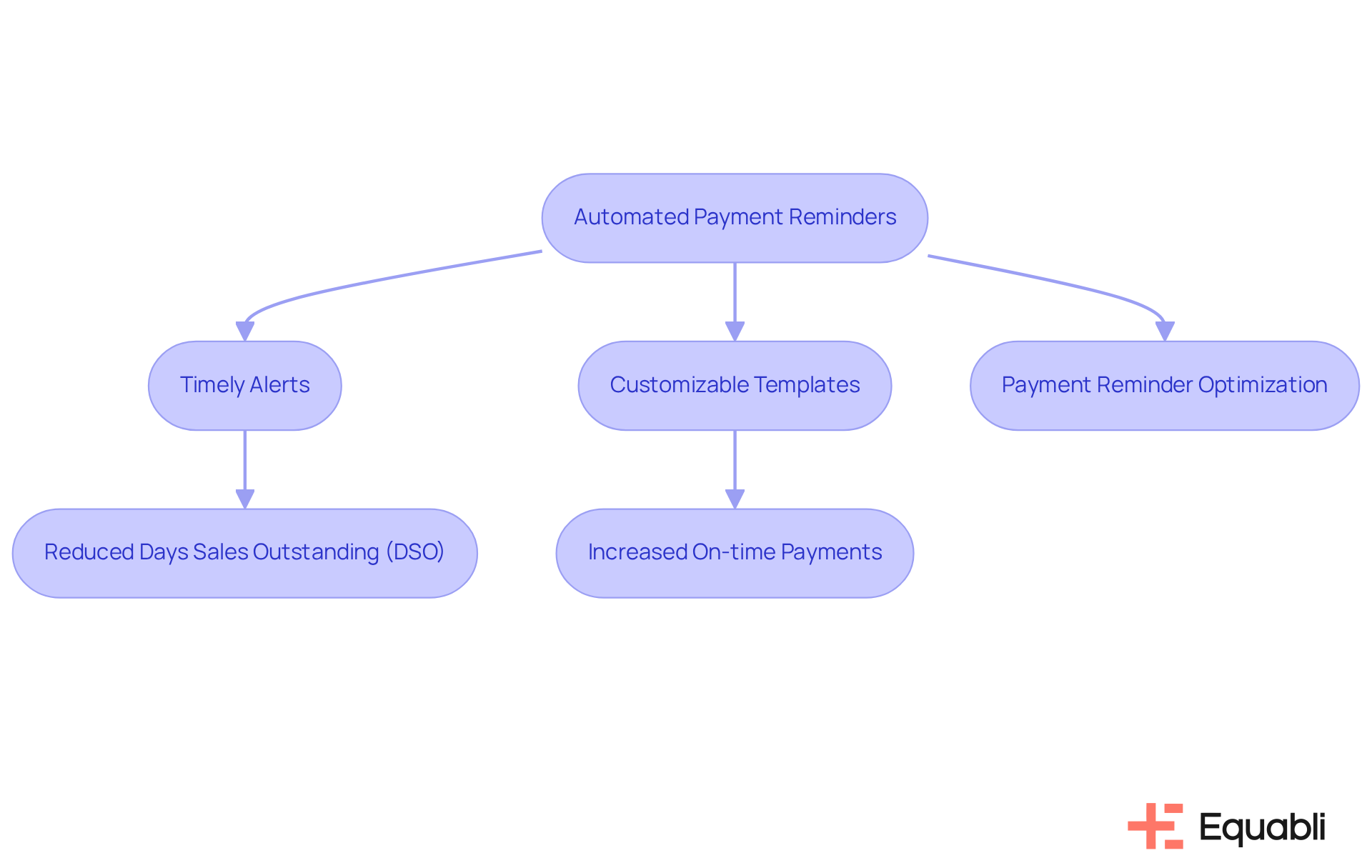

Gaviti specializes in B2B billing alerts that significantly enhance cash flow for companies. By automating the notification process, Gaviti enables businesses to send timely alerts regarding upcoming and overdue dues. This proactive strategy minimizes the risk of overdue transactions, thereby supporting a robust cash flow.

The platform offers customizable templates tailored to meet the unique needs of various clients, ensuring that notifications are not only timely but also relevant. By analyzing historical payment patterns, Gaviti employs payment reminder letter optimization strategies for corporate credit management to enhance the timing and frequency of notifications, which further increases the likelihood of on-time payments. This strategic approach is essential for businesses looking to enhance their overall financial health through payment reminder letter optimization strategies for corporate credit management and streamline their accounts receivable processes.

Real-world examples underscore the effectiveness of automated notifications in enhancing cash flow. Businesses utilizing Gaviti's solutions report a notable reduction in Days Sales Outstanding (DSO), illustrating how timely notifications can improve cash flow management. As Michael Dell emphasized, 'Cash flow is crucial' for business sustainability, underscoring the importance of prompt billing notifications. Furthermore, a case study of Malt reveals that by implementing automated notifications, they successfully reduced their DSO by 58%, highlighting the tangible benefits of such solutions. As companies increasingly recognize the importance of timely financial notifications, adopting automated solutions becomes vital for maintaining operational efficiency and growth.

Automated Payment Reminders: Transform Your Collection Strategy

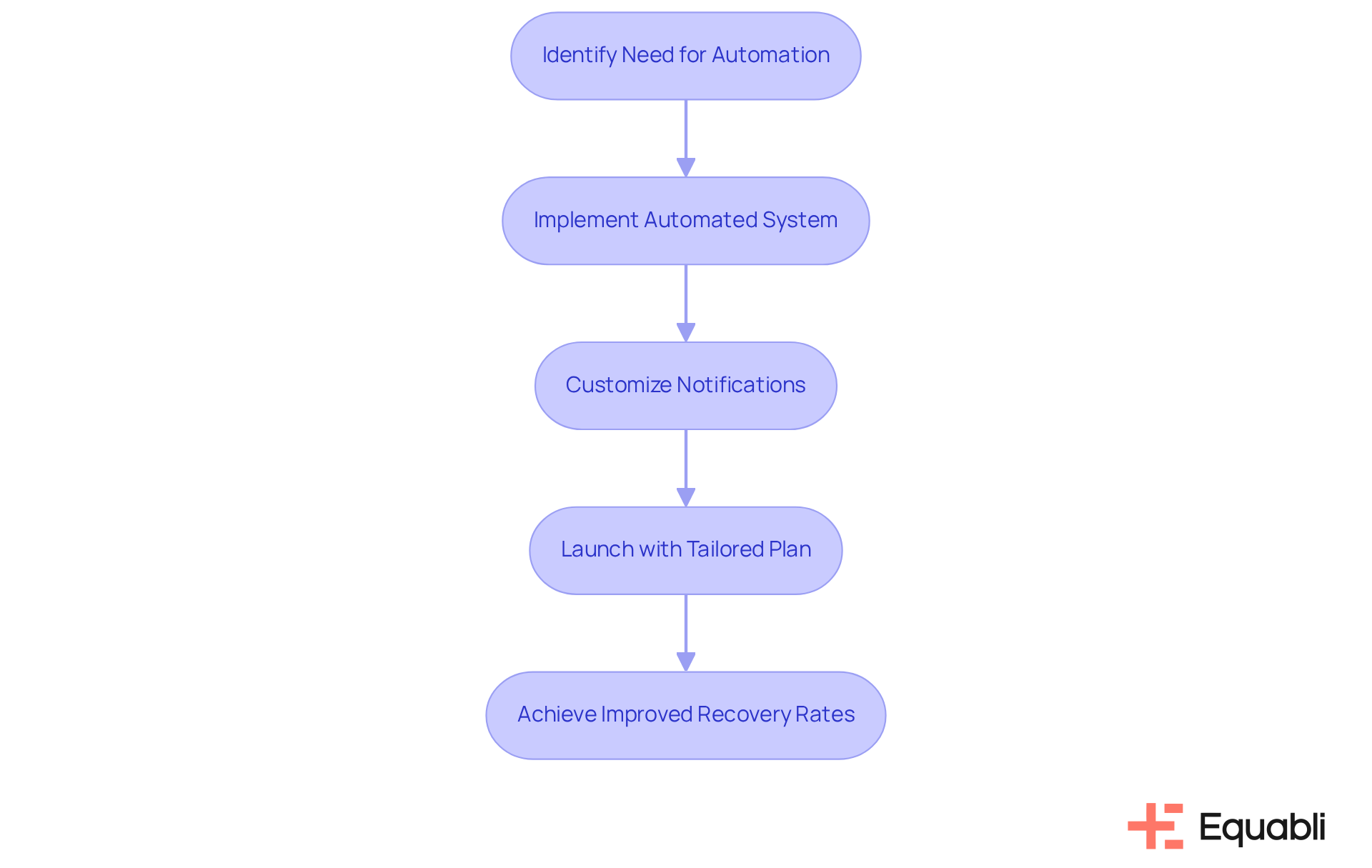

Automated billing notifications are revolutionizing collection strategies across various sectors. By implementing automated systems, organizations can ensure that notifications are dispatched consistently and at optimal intervals, significantly reducing the risk of missed payments. This automation alleviates the manual burden of tracking due dates and sending reminders, enabling staff to concentrate on higher-value tasks. The inefficiencies and missed opportunities associated with manual debt collection can be effectively mitigated through this transition.

Equabli's EQ Suite serves as a prime example of this transformation, providing cloud-based solutions that modernize debt collection processes. With features designed to enhance efficiency and recovery, organizations can seamlessly shift from manual methods to intelligent, data-driven strategies. Furthermore, automated notifications can be customized using customer information, which enhances engagement and response rates. For instance, notifications can be tailored to reflect a client's transaction history, making them more relevant and impactful. This level of personalization not only boosts collection rates but also cultivates stronger relationships with customers, as they feel recognized and valued.

Equabli's expert team assists organizations with a tailored launch plan, ensuring a smooth transition to the EQ Suite. Industries such as fintech, healthcare, and telecom have reported significant improvements in recovery rates, with financial institutions experiencing increases of up to 30% after adopting automated solutions like EQ Collect. A mid-sized marketing firm, for example, implemented automated alerts to notify clients of outstanding dues, leading to improved revenue management and operational efficiency. By integrating payment reminder letter optimization strategies for corporate credit management, organizations can optimize their collection processes and achieve sustainable growth.

Monograph: Tailored Payment Reminder Templates for A&E Firms

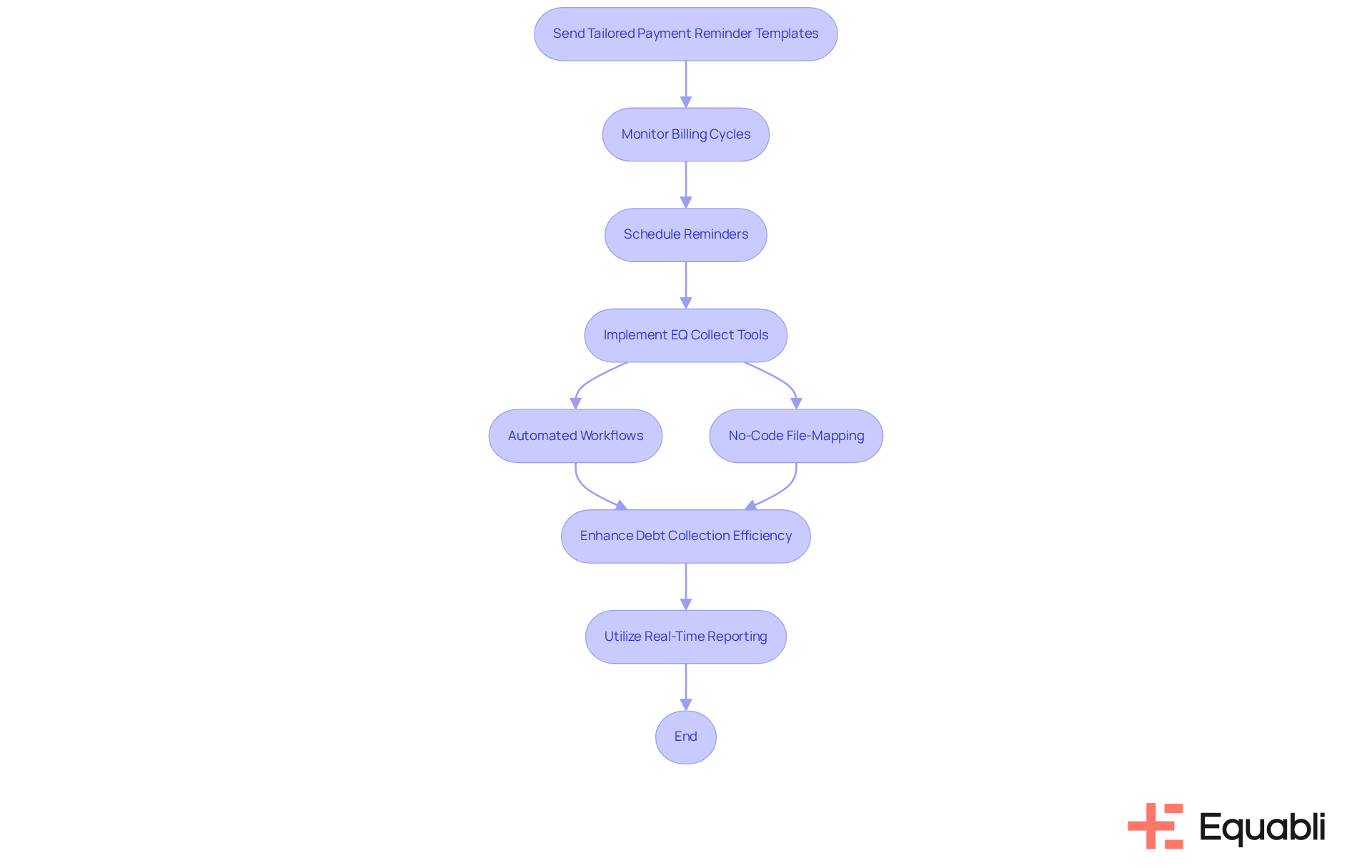

Monograph offers tailored billing notification templates specifically designed for architecture and engineering (A&E) firms. These templates account for the unique billing cycles and project-oriented nature of A&E work, ensuring notifications are both relevant and timely. By implementing a systematic approach, Monograph empowers firms to adopt payment reminder letter optimization strategies for corporate credit management, allowing them to send reminders at strategic intervals, such as one week before the due date and immediately after a transaction becomes overdue.

In collaboration with EQ Collect, firms can significantly enhance their debt collection efficiency. EQ Collect's no-code file-mapping tool streamlines vendor onboarding timelines, while its automated workflows reduce execution errors and the need for manual resources. The platform's data-driven strategies not only improve operational efficiency but also increase collections, enabling A&E firms to manage their accounts receivable more effectively.

The five-touch system provided by Monograph substantially reduces collection time by automating follow-ups. This not only simplifies the transaction process but also fosters improved client relationships through clear and consistent communication. With EQ Collect's real-time reporting and compliance oversight, A&E firms gain unparalleled transparency and insights, facilitating better cash flow management. By leveraging these customized templates alongside EQ Collect's features, firms can utilize payment reminder letter optimization strategies for corporate credit management to ensure timely transaction receipt, ultimately maximizing their net present value in debt recovery.

Paystand: Modernize Payment Reminders with AR Automation

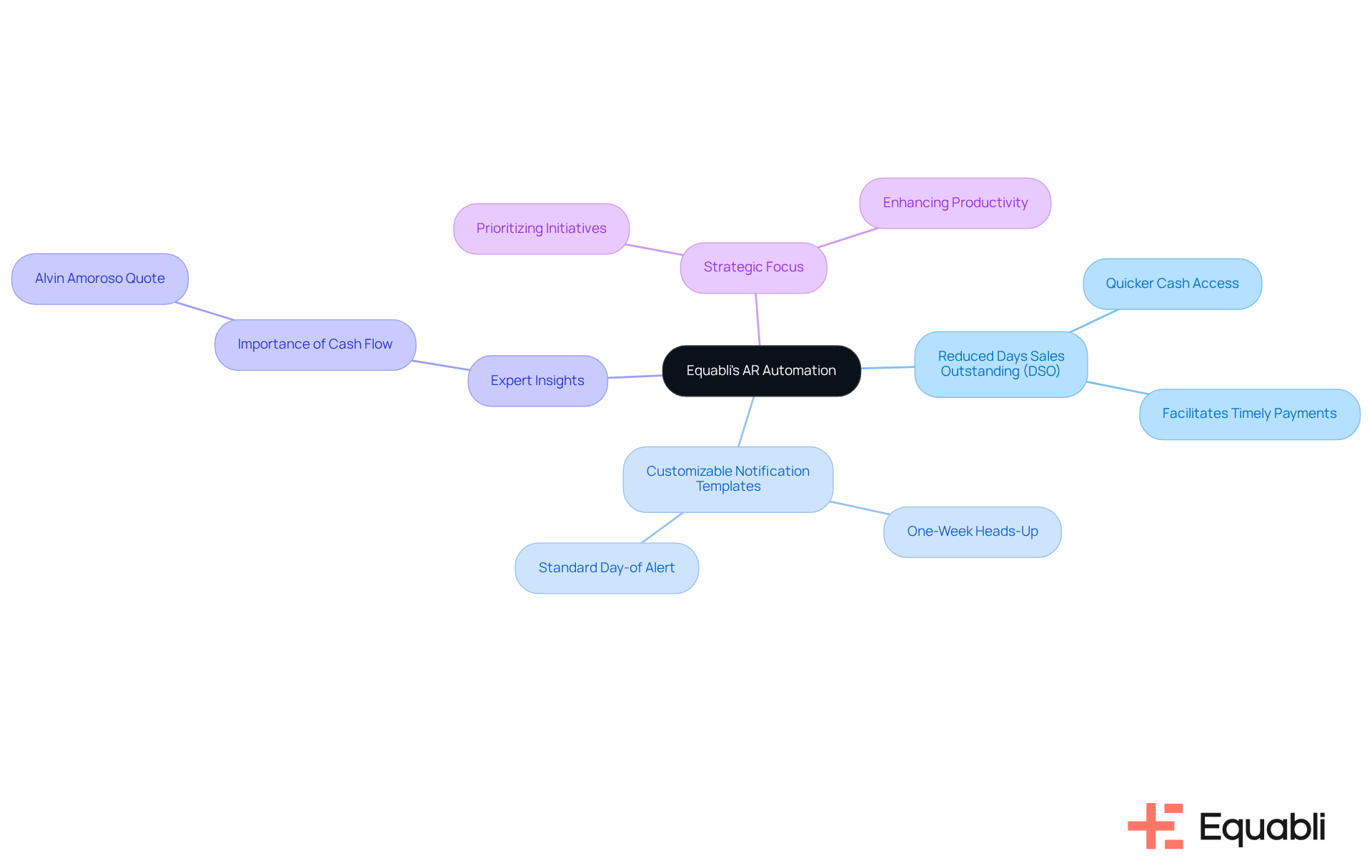

Equabli stands at the forefront of enhancing billing notifications through accounts receivable (AR) automation. By utilizing payment reminder letter optimization strategies for corporate credit management, Equabli empowers companies to send timely alerts to customers, significantly reducing the likelihood of overdue invoices. The platform integrates seamlessly with existing financial systems, facilitating real-time monitoring of invoices and transactions.

With Equabli's AR automation, businesses can develop customizable notifications tailored to their specific billing conditions and customer preferences. This level of customization is a key component of payment reminder letter optimization strategies for corporate credit management, ensuring that reminders are not only timely but also relevant, thereby increasing the chances of prompt payment. Moreover, automating AR processes alleviates the administrative burden on finance teams, enabling them to focus on strategic initiatives rather than manual follow-ups. This transition not only enhances operational efficiency but also nurtures stronger client relationships through consistent and professional communication.

Key Benefits of Equabli's AR Automation:

- Reduced Days Sales Outstanding (DSO): A lower DSO translates to quicker access to cash, facilitating timely bill payments and investments in growth.

- Customizable Notification Templates: Leverage templates such as the 'one-week heads-up' and 'standard day-of alert' to ensure effective communication.

- Expert Insights: As Alvin Amoroso states, "Cash flow is the lifeblood of any business, from solo freelancers to burgeoning enterprises." This underscores the importance of efficient billing notifications in maintaining financial health.

- Strategic Focus: By automating notifications, finance teams can prioritize strategic initiatives over manual follow-ups, thereby enhancing overall productivity.

Tratta: Boost Collection Rates with Automated Payment Reminders

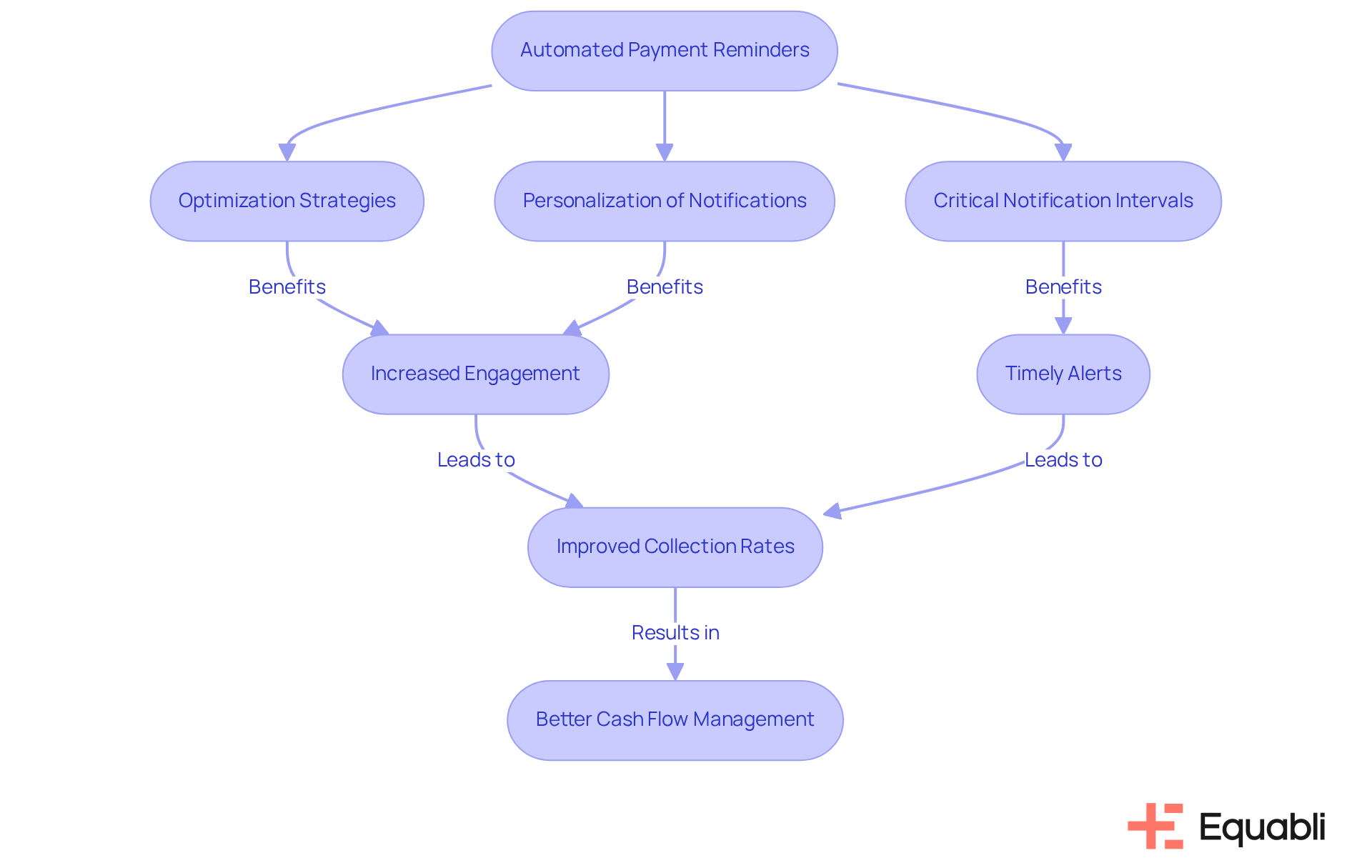

Equabli significantly enhances collection rates through automated billing notifications. By utilizing Equabli's advanced solutions, organizations can adopt payment reminder letter optimization strategies for corporate credit management, ensuring customers receive timely alerts for upcoming and overdue payments. This automation minimizes the risk of overlooked transactions and improves overall collection effectiveness, particularly through payment reminder letter optimization strategies for corporate credit management, especially considering that the average mid-market company generates 2,433 invoices monthly, making manual notifications impractical.

The platform also allows for the personalization of notification messages, enabling businesses to tailor their communications based on customer preferences and transaction history. This customized approach not only increases engagement but also strengthens relationships with customers, ultimately leading to improved collection rates. Research indicates that personalizing automated notifications can elevate response rates by 23%, underscoring the importance of message customization in enhancing customer engagement.

Furthermore, utilizing payment reminder letter optimization strategies for corporate credit management by sending notifications at critical intervals—such as one, 15, 30, 45, 60, and 90 days overdue—ensures clients remain informed and accountable, thereby increasing the likelihood of timely payments. This proactive strategy fosters a positive customer experience, which is vital in the accounts receivable process and can be enhanced by implementing payment reminder letter optimization strategies for corporate credit management, ultimately contributing to better cash flow management. A case study from RPT Realty illustrates the financial benefits of implementing automated notifications, revealing annual savings of $64,200 on cash application and invoicing. By leveraging automation, organizations can significantly reduce the time and resources allocated to manual follow-ups, resulting in a more efficient and effective collections process.

Best Practices for Sending Effective Payment Reminders

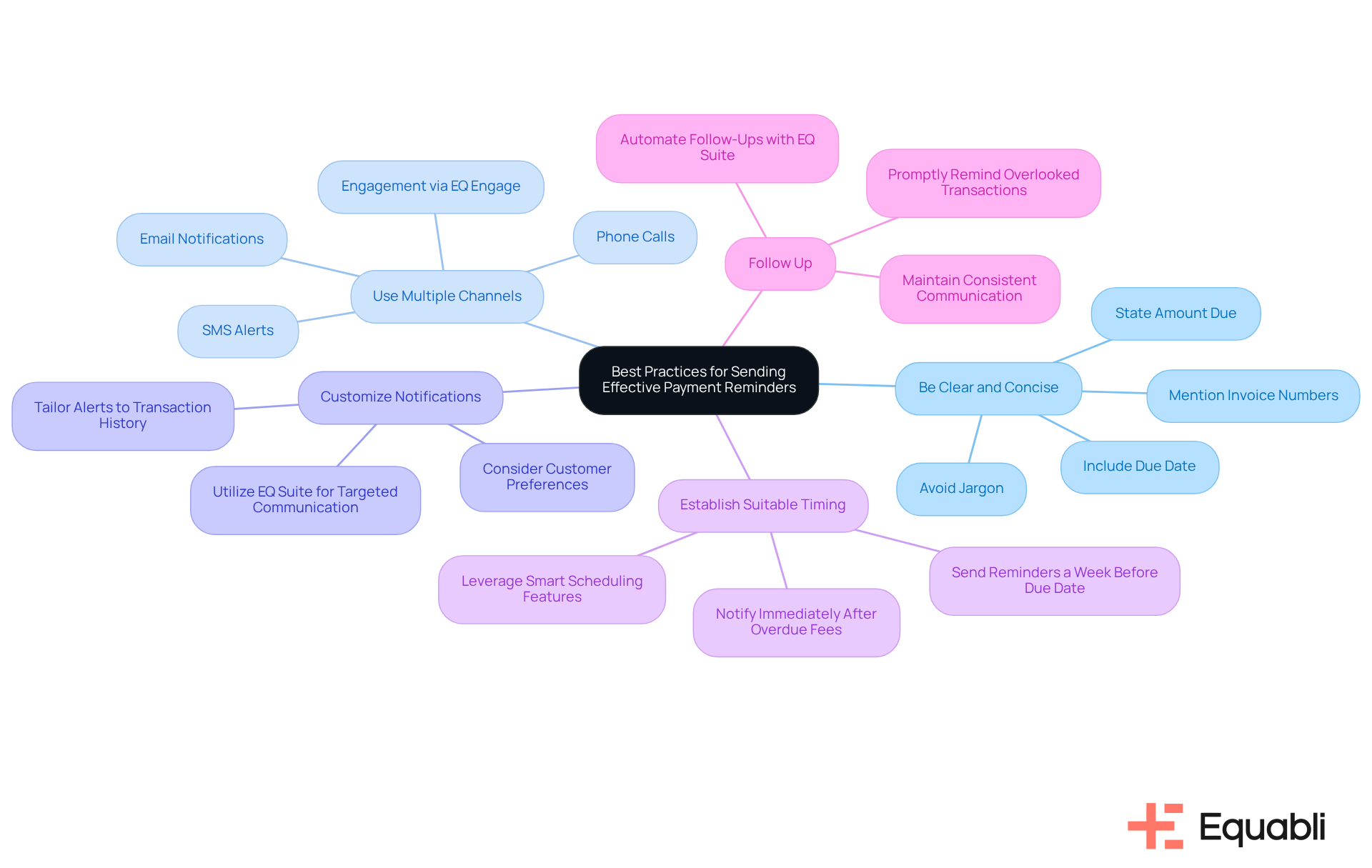

To ensure the effectiveness of payment reminder letter optimization strategies for corporate credit management, organizations must adhere to several best practices, particularly when utilizing modern solutions like Equabli's EQ Suite, which effectively addresses the challenges of manual debt collection.

-

Be Clear and Concise: Notifications should clearly state the amount due, the due date, and any relevant invoice numbers. Avoiding jargon and maintaining straightforward language enhances understanding and compliance.

-

Use Multiple Channels: Employ various communication channels, such as email, SMS, and phone calls, to engage customers where they are most responsive. Equabli's EQ Engage facilitates this multi-channel approach, significantly enhancing borrower engagement and response rates by implementing payment reminder letter optimization strategies for corporate credit management.

-

Customize Notifications: Tailor alerts based on the customer's transaction history and preferences. Personalization is crucial for improving engagement, and the EQ Suite offers payment reminder letter optimization strategies for corporate credit management, which facilitates targeted communication strategies.

-

Establish Suitable Timing: Schedule notifications thoughtfully, such as a week before the due date and immediately after a fee becomes overdue. This proactive strategy helps maintain awareness of transactions and is supported by the smart scheduling features of Equabli's solutions.

-

Follow Up: If a transaction is overlooked, promptly follow up with a courteous reminder. Consistent communication is essential for maintaining cash flow, and with the EQ Suite's payment reminder letter optimization strategies for corporate credit management, organizations can automate follow-ups to ensure that no client is neglected.

Timing and Frequency: Key Factors for Effective Payment Reminders

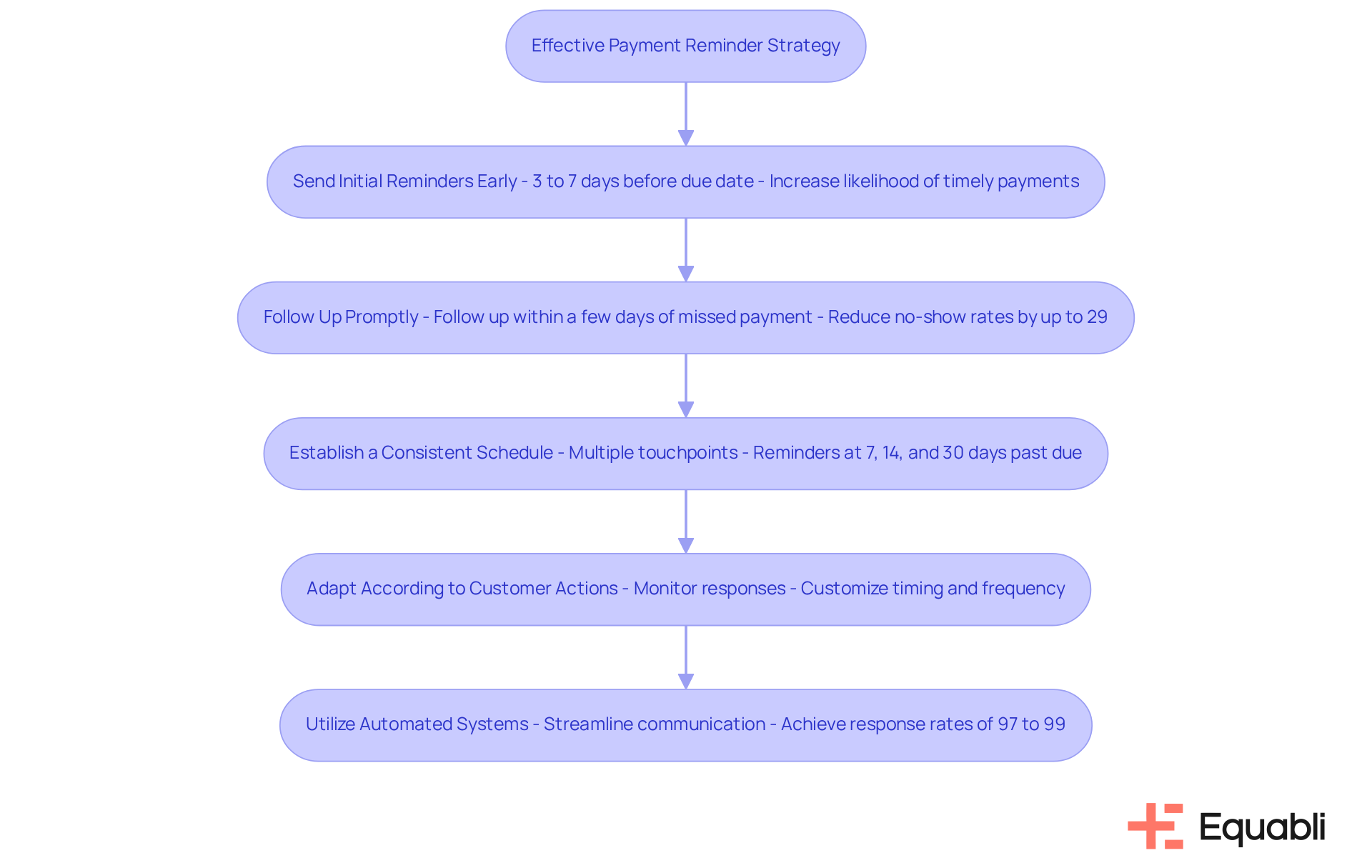

Timing and frequency are critical components in crafting an effective billing notification strategy. Research shows that notifications sent at inappropriate times can significantly diminish response rates. Here are essential guidelines to optimize your approach:

- Send Initial Reminders Early: Dispatch the first reminder 3 to 7 days before the payment due date. This timeframe allows clients to adequately prepare for their obligations, thereby increasing the likelihood of timely payments.

- Follow Up Promptly: If a payment is missed, follow up within a few days. A gentle reminder can often prompt immediate action, as timely notifications can reduce no-show rates by up to 29%.

- Establish a Consistent Schedule: Develop a structured notification schedule that incorporates multiple touchpoints. For instance, notifications can be sent on the due date, followed by additional reminders at regular intervals—such as 7, 14, and 30 days past due—to sustain engagement and encourage compliance.

- Adapt According to Customer Actions: Monitor customer responses to your notifications and be prepared to adjust the timing and frequency as necessary. Some clients may respond better to frequent prompts, while others may prefer a more subdued approach. Customization can enhance engagement, with studies indicating that personalized alerts can boost response rates by 40-60% when aligned with individual schedules.

- Utilize Automated Systems: Implementing automated notification systems can streamline communication efforts. These systems can efficiently manage campaigns, ensuring consistent messaging across various channels, such as SMS and email, which achieve response rates of 97% to 99%, far exceeding traditional phone calls.

By adhering to payment reminder letter optimization strategies for corporate credit management, organizations can markedly enhance their collection processes, ensuring timely responses and improved cash flow.

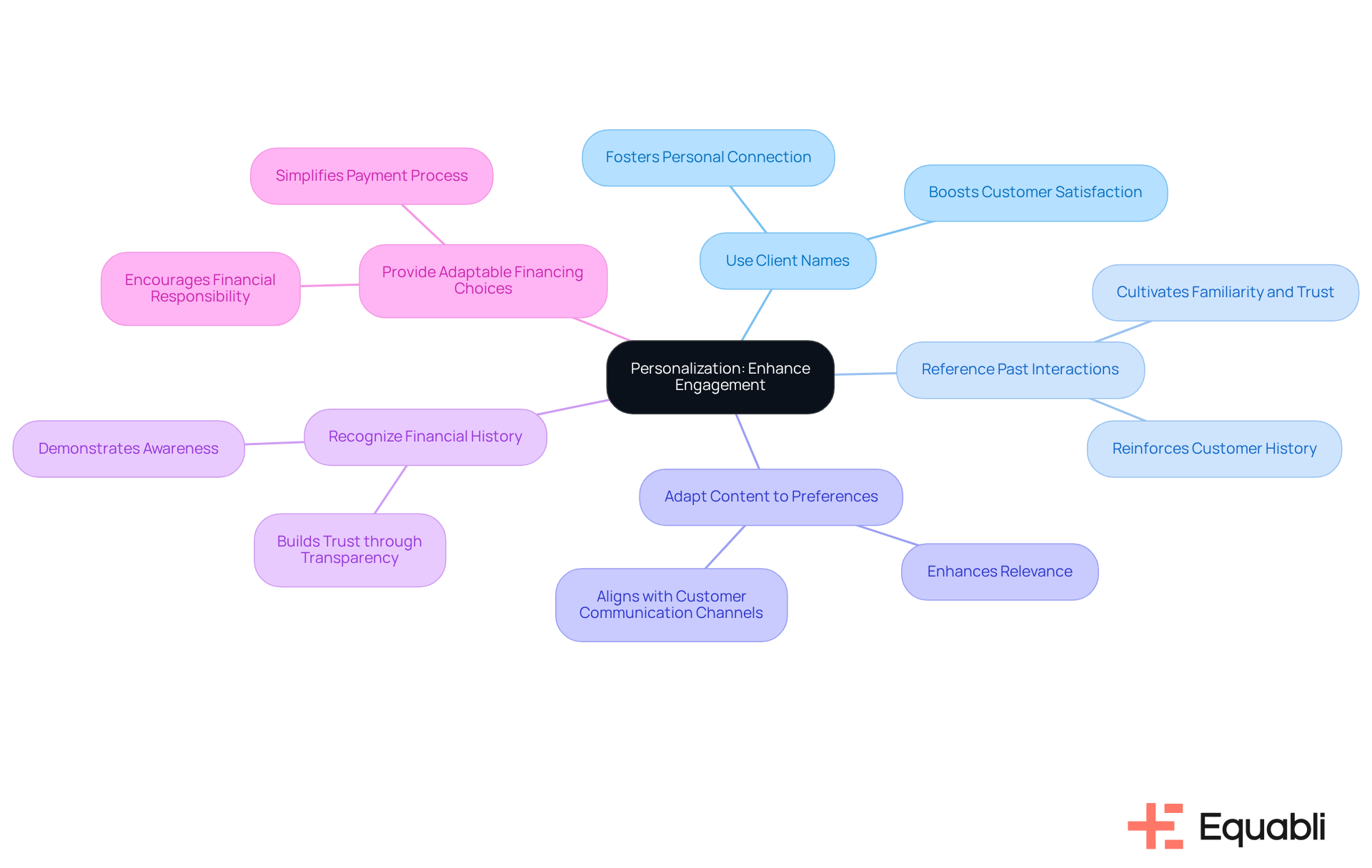

Personalization: Enhance Engagement with Customized Payment Reminders

Personalization serves as a critical strategy for enhancing engagement with payment notifications. By tailoring alerts based on consumer data, organizations can craft messages that resonate more deeply with recipients. Here are several strategies for effective personalization:

-

Use Client Names: Addressing clients by their names in reminders fosters a personal connection. Demonstrating courtesy and appreciation can significantly boost customer satisfaction and loyalty.

-

Reference Past Interactions: Highlighting previous transactions or engagements reinforces individuals' history with your organization, cultivating familiarity and trust.

-

Adapt Content to Preferences: Tailoring notification content to align with customer preferences—such as preferred communication channels and transaction methods—enhances relevance.

-

Recognize Financial History: Acknowledging a customer's history of delayed transactions respectfully in reminders demonstrates awareness of their situation and a willingness to collaborate. Transparency in communication is essential for building trust and sustaining long-term relationships.

-

Provide Adaptable Financing Choices: Emphasizing available flexible financing options simplifies the process for customers to meet their obligations.

By utilizing payment reminder letter optimization strategies for corporate credit management, organizations can create a more engaging and supportive environment for customers, ultimately improving adherence to financial responsibilities and fostering long-term relationships. As noted by Defuse, "Customer service etiquette is a powerful tool for creating meaningful, impactful customer interactions.

Performance Tracking: Measure the Effectiveness of Payment Reminders

To enhance payment reminder letter optimization strategies for corporate credit management, organizations must monitor performance metrics that signify effectiveness, particularly in the context of modernizing debt collection processes.

Response Rates: Organizations should measure the percentage of clients who respond to reminders. This metric assists in determining which types of notifications are most effective, especially when utilizing Equabli's EQ Suite, which enhances communication by implementing payment reminder letter optimization strategies for corporate credit management. By analyzing response rates, companies can refine their strategies for payment reminder letter optimization for corporate credit management to improve engagement.

Payment Timeliness: It is crucial to monitor how swiftly payments are processed after notifications are issued. This metric provides insights into the effectiveness of timing and frequency, enhanced by the intuitive features of EQ Collect. Understanding payment timeliness can lead to the development of payment reminder letter optimization strategies for corporate credit management that align with client behavior.

Client Feedback: Collecting input from clients regarding the notification process is essential. Understanding their experiences can refine strategies, particularly when leveraging data-driven insights from the EQ Suite. This feedback loop not only improves client satisfaction but also enhances overall collection effectiveness by implementing payment reminder letter optimization strategies for corporate credit management.

Collection Rates: Monitoring overall collection rates is vital to evaluate the impact of notifications on cash flow. A rise in collections following the introduction of notifications signifies success, highlighting the effectiveness of payment reminder letter optimization strategies for corporate credit management. This metric serves as a direct indicator of the financial health of the organization.

Cost-Effectiveness: Assessing the expenses linked to sending notifications versus the income generated from prompt payments is critical. This analysis helps determine the ROI of payment reminder letter optimization strategies for corporate credit management, especially when moving from manual processes to Equabli's automated solutions. Understanding cost-effectiveness ensures that organizations can allocate resources efficiently while maximizing returns.

![]()

Conclusion

Implementing effective payment reminder letter optimization strategies is crucial for enhancing corporate credit management. Organizations can leverage advanced tools and automation to streamline their billing notifications, ensuring reminders are timely, relevant, and personalized. By adopting these strategies, businesses can significantly improve their collection rates and overall cash flow management.

Automation plays a pivotal role in reducing manual workloads, allowing teams to concentrate on strategic initiatives. Solutions such as Equabli's EQ Suite and Gaviti's B2B billing alerts exemplify how intelligent automation can transform collection processes. Best practices include:

- Utilizing multiple communication channels

- Customizing notifications

- Adhering to optimal timing

These lead to improved engagement and responsiveness from clients.

The significance of payment reminder letter optimization strategies cannot be overstated. Organizations prioritizing these approaches not only enhance operational efficiency but also foster stronger relationships with customers. Embracing automation and personalization in payment reminders paves the way for improved financial health and sustainable growth in an increasingly competitive landscape.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a comprehensive set of tools designed to automate billing notifications and optimize payment reminder letters for corporate credit management, enhancing efficiency and customer engagement.

How does the EQ Engine work?

The EQ Engine supports the creation of personalized scoring models that predict repayment behaviors, allowing for tailored notifications that resonate with borrowers and simplify the notification process.

What is the purpose of the EQ Engage feature?

The EQ Engage feature facilitates communication through preferred channels such as SMS, email, or phone calls, ensuring that notifications reach customers effectively.

How does Gaviti enhance cash flow for businesses?

Gaviti enhances cash flow by automating B2B billing alerts, sending timely notifications about upcoming and overdue dues, which minimizes the risk of overdue transactions.

What are the benefits of using customizable templates in Gaviti?

Customizable templates ensure that notifications are timely and relevant, tailored to meet the unique needs of various clients, thereby increasing the likelihood of on-time payments.

What impact do automated notifications have on Days Sales Outstanding (DSO)?

Automated notifications have been shown to significantly reduce Days Sales Outstanding (DSO), improving cash flow management and financial health for businesses.

How do automated billing notifications transform collection strategies?

Automated billing notifications ensure consistent dispatch of reminders at optimal intervals, reducing the risk of missed payments and allowing staff to focus on higher-value tasks.

What industries have benefited from using automated solutions like Equabli's EQ Suite?

Industries such as fintech, healthcare, and telecom have reported significant improvements in recovery rates after adopting automated solutions.

How does personalization in notifications enhance customer engagement?

Personalization makes notifications more relevant and impactful by reflecting a client's transaction history, which boosts collection rates and fosters stronger customer relationships.

What support does Equabli provide for organizations transitioning to the EQ Suite?

Equabli offers a tailored launch plan to assist organizations in smoothly transitioning to the EQ Suite, ensuring effective implementation of automated solutions.