Overview

This article examines effective strategies for implementing polite payment reminders within corporate accounts receivable management. It underscores the critical role of automation, professional communication, and legal compliance in enhancing collection efficiency. Evidence indicates that timely and respectful reminders can significantly boost payment rates and operational effectiveness.

From a compliance perspective, automating payment reminders not only streamlines processes but also ensures adherence to regulatory standards. Data shows that organizations employing automated systems experience a marked increase in collection rates, as these systems can send reminders promptly and consistently.

Moreover, professional communication is essential in maintaining positive relationships with clients. By crafting reminders that are both respectful and clear, companies can foster goodwill, which often translates into timely payments. Case studies reveal that businesses that prioritize professional communication see improved customer satisfaction alongside enhanced payment compliance.

In conclusion, integrating these strategies into accounts receivable practices is not merely beneficial but necessary for operational success. Executives must consider how these approaches can be operationalized to mitigate risks and enhance overall financial health.

Introduction

Polite payment reminders are essential for maintaining healthy cash flow in businesses. However, many organizations face challenges in implementing effective strategies that balance professionalism with assertiveness. This article presents ten innovative approaches to corporate accounts receivable management, providing teams with the necessary tools to enhance their collection processes.

How can companies navigate the delicate balance between reminding clients of their obligations and preserving strong relationships? This exploration reveals key techniques that not only improve collection rates but also foster positive communication within the realm of accounts receivable.

Equabli's EQ Suite: Automate Payment Reminders for Efficiency

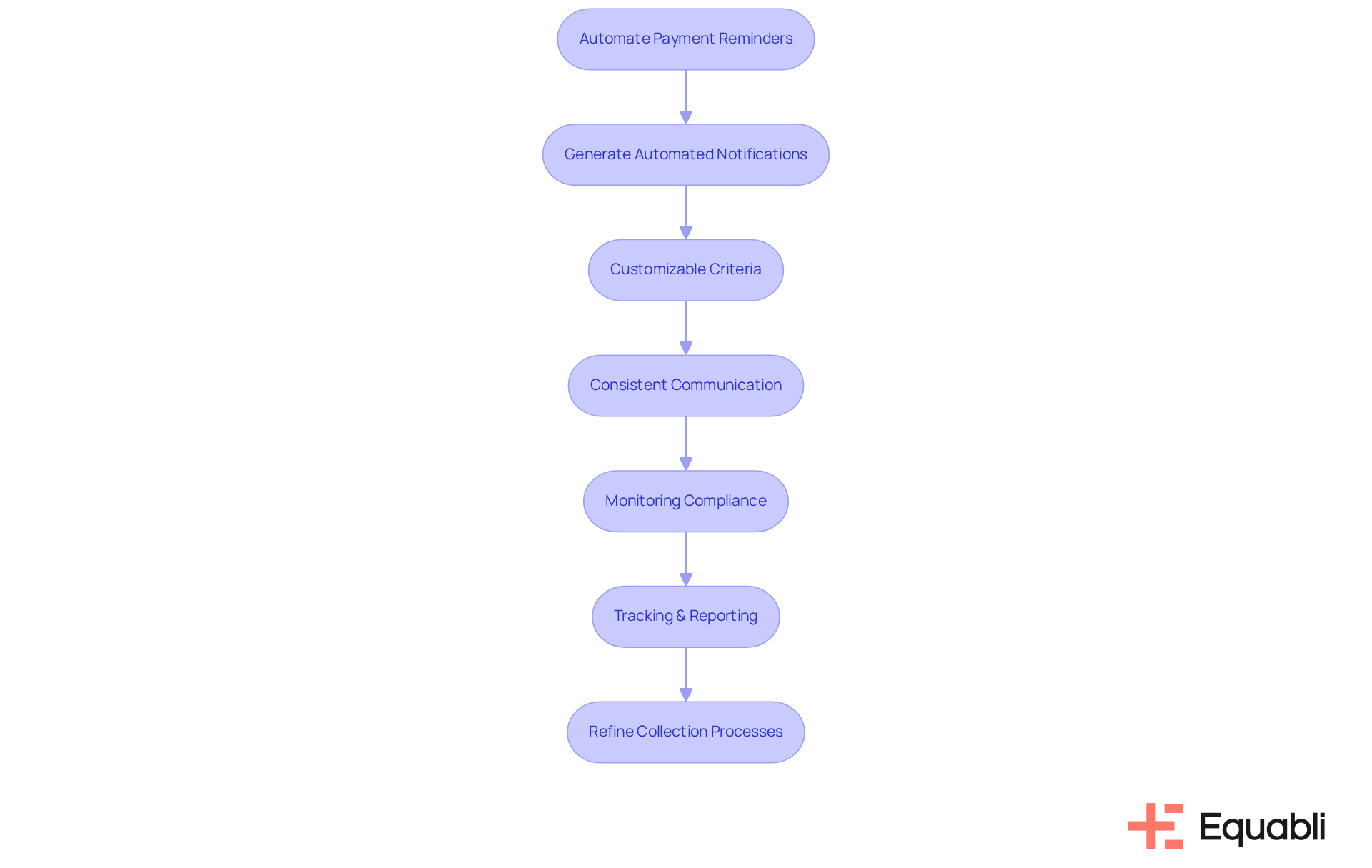

Equabli's EQ Suite provides a comprehensive set of tools designed to automate billing notifications, including polite payment reminder strategies for corporate accounts receivable management, enabling teams to concentrate on strategic initiatives. By utilizing the EQ Engine, organizations can generate automated notifications triggered by customizable criteria. This ensures consistent communication with clients, thereby increasing the likelihood of timely transactions.

This systematic approach not only enhances operational efficiency but also strengthens compliance oversight through automated monitoring, ensuring adherence to industry-leading standards. Furthermore, the automation capabilities facilitate thorough tracking and reporting, yielding valuable insights into the effectiveness of various polite payment reminder strategies for corporate accounts receivable management. Consequently, businesses can refine their collection processes, resulting in improved cash flow and reduced operational costs.

As Ashleigh Habgood, Director of New Zealand's largest dance school, remarked, "Much of our work has turned time-consuming manual processes into automated tasks," underscoring the significant impact of automation. Additionally, case studies, such as the one involving Todd's IT, illustrate that implementing automation can substantially improve cash flow, reducing the time to receive funds from 45 days to just 3 days. This evidence highlights the value of Equabli's solutions in optimizing collection processes and achieving superior financial outcomes.

ChaserHQ: Professional Email Templates for Payment Reminders

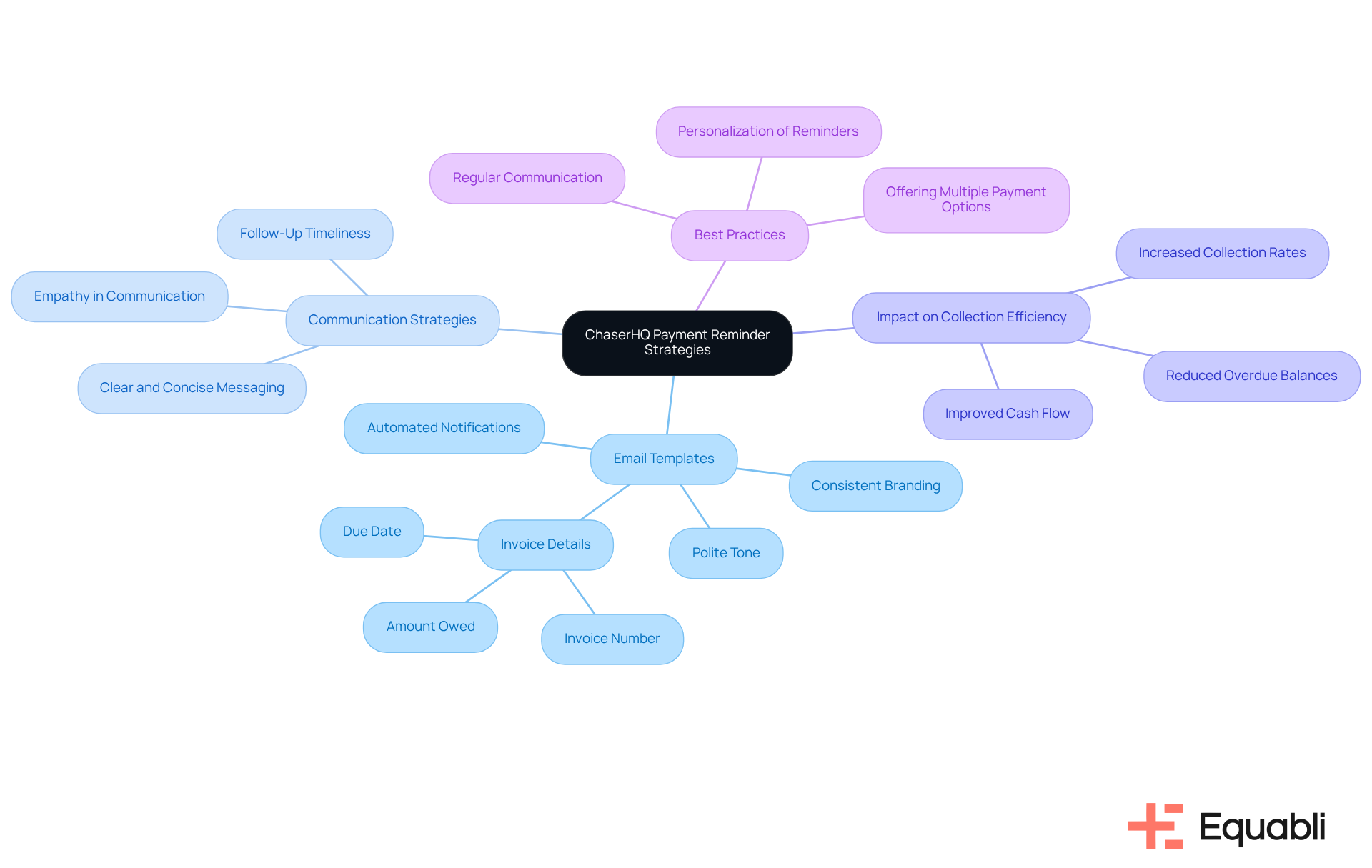

ChaserHQ provides a variety of professional email templates tailored for billing notifications, which incorporate polite payment reminder strategies for corporate accounts receivable management while emphasizing the importance of a polite yet assertive tone. This balance is crucial for sustaining robust customer relationships while effectively utilizing polite payment reminder strategies for corporate accounts receivable management. By utilizing these templates, accounts receivable teams can ensure their communications are consistent and professional, while also reflecting the company's branding, thereby enhancing the overall professionalism of their reminders. This approach minimizes misunderstandings and fosters constructive dialogue with customers, ultimately leading to improved collection rates.

Industry leaders advocate for clear and concise communication, which includes essential details such as invoice numbers, amounts owed, and due dates. This ensures that customers are well-informed and more likely to respond promptly. Recognizing the emotional strain that overdue accounts can impose on both contractors and clients is vital in addressing the challenges of manual debt collection. Implementing automated notifications can significantly enhance interactions and reduce overdue balances, modernizing accounts receivable processes and increasing collection efficiency.

Moreover, accounts receivable teams should consider offering various transaction options and direct links in their reminders, facilitating quicker settlements. The impact of such professional interaction strategies, particularly polite payment reminder strategies for corporate accounts receivable management, on revenue collection is substantial; organizations that embrace these practices frequently experience a marked increase in collection efficiency, underscoring the importance of organized and respectful communication. For optimal results, teams must continually assess and update their communication strategies to align with evolving customer needs.

Garfield Law: Master Timing and Tone in Payment Reminders

Garfield Law highlights the critical importance of mastering both timing and tone when making requests for funds. Sending notifications prematurely can frustrate customers, while excessive delays may lead to missed transactions. A balanced approach is recommended: notifications should be dispatched shortly after the due date by employing polite payment reminder strategies for corporate accounts receivable management while maintaining a friendly yet assertive tone. This strategy not only helps maintain a positive relationship with customers but also utilizes polite payment reminder strategies for corporate accounts receivable management to encourage timely payments. Furthermore, tailoring the tone based on an individual's payment history can significantly enhance the effectiveness of these notifications.

ResolvePay: Utilize Multiple Channels for Payment Reminders

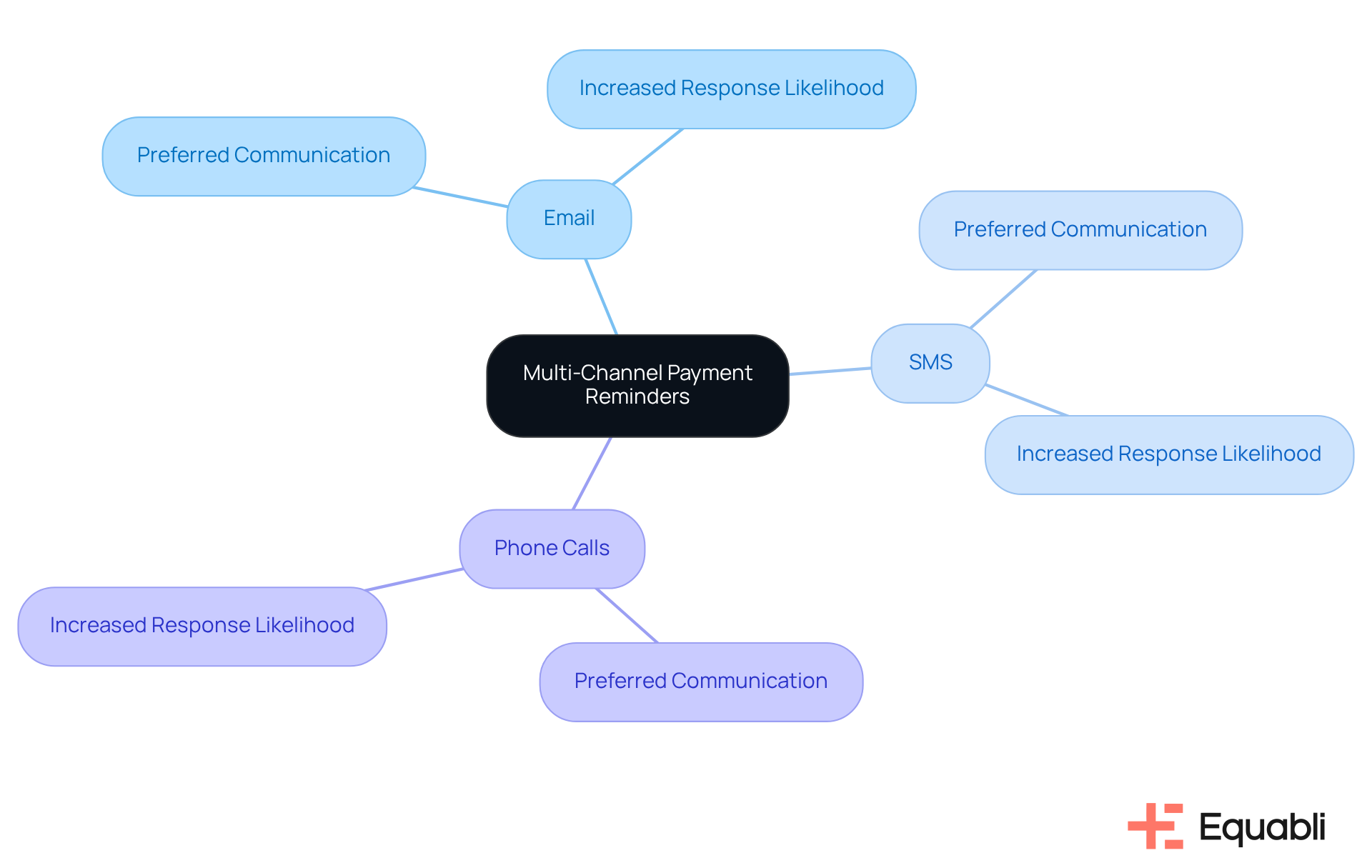

ResolvePay advocates for a multi-channel approach to billing notifications, utilizing email, SMS, and phone calls. This strategy not only ensures that customers receive notifications through their preferred communication method but also significantly increases the likelihood of prompt responses.

Evidence suggests that by accommodating diverse customer preferences, accounts receivable teams can enhance collection rates effectively. Furthermore, tracking responses across these platforms provides valuable insights that can refine future notification strategies, ultimately optimizing operational efficiency and compliance.

Square: Tips for Crafting Effective Payment Reminder Emails

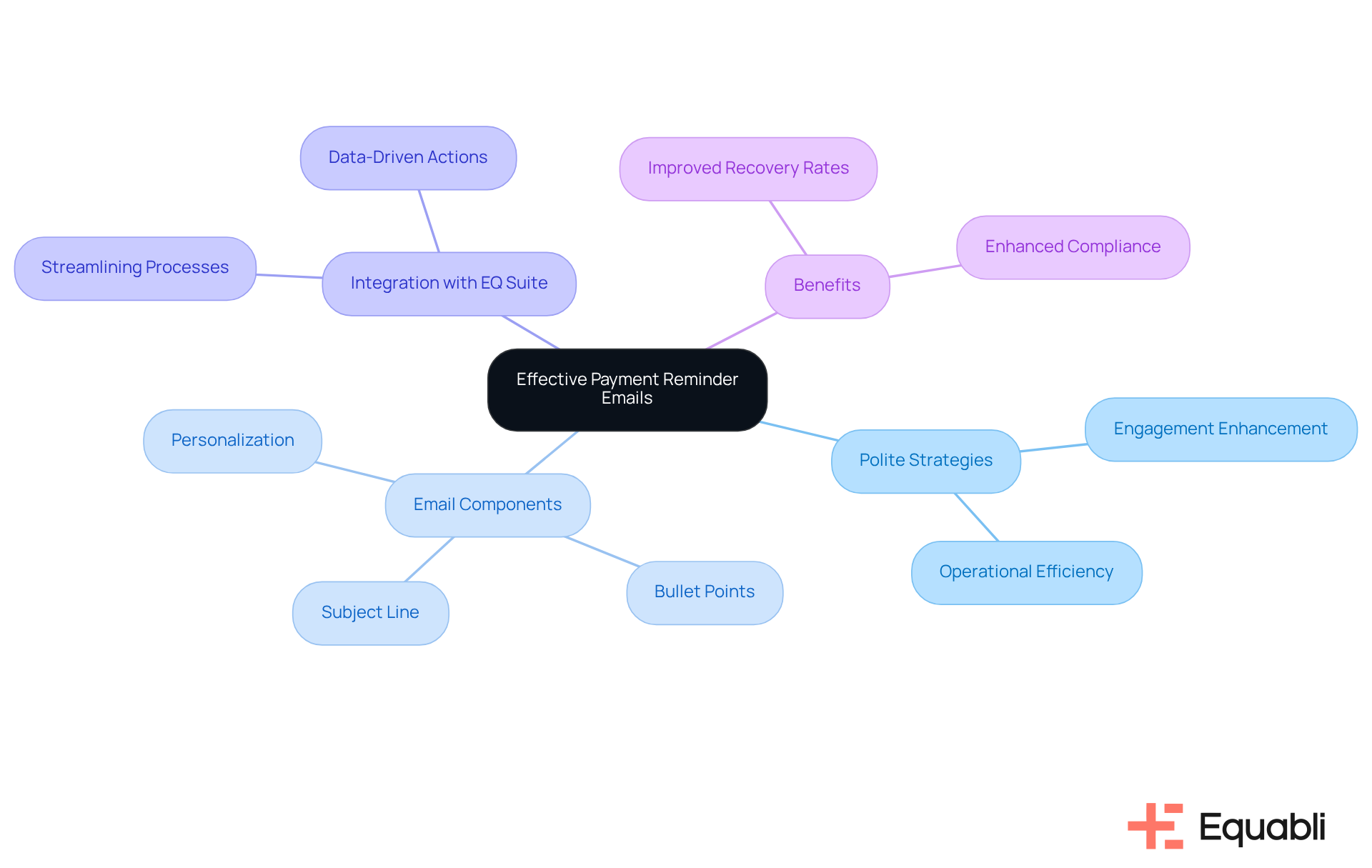

Creating effective billing notification emails requires the implementation of polite payment reminder strategies for corporate accounts receivable management and strategic engagement with customers to enhance efficiency. A clear and concise subject line is essential, along with bullet points to highlight important information and a direct call to action. Personalizing emails with the client’s name and specific invoice details significantly boosts engagement.

Addressing the challenges of manual debt collection is critical. Integrating these strategies with Equabli's EQ Suite can streamline accounts receivable processes, transforming manual tasks into intelligent, data-driven actions. By leveraging the EQ Suite, accounts receivable teams can utilize polite payment reminder strategies for corporate accounts receivable management that are not only informative but also prompt action, ultimately improving recovery rates and operational performance.

In summary, the implementation of polite payment reminder strategies for corporate accounts receivable management, supported by robust tools like the EQ Suite, positions organizations to enhance their billing communications effectively. This approach not only addresses operational challenges but also aligns with compliance requirements, ensuring that enterprises can navigate the complexities of debt collection with greater confidence.

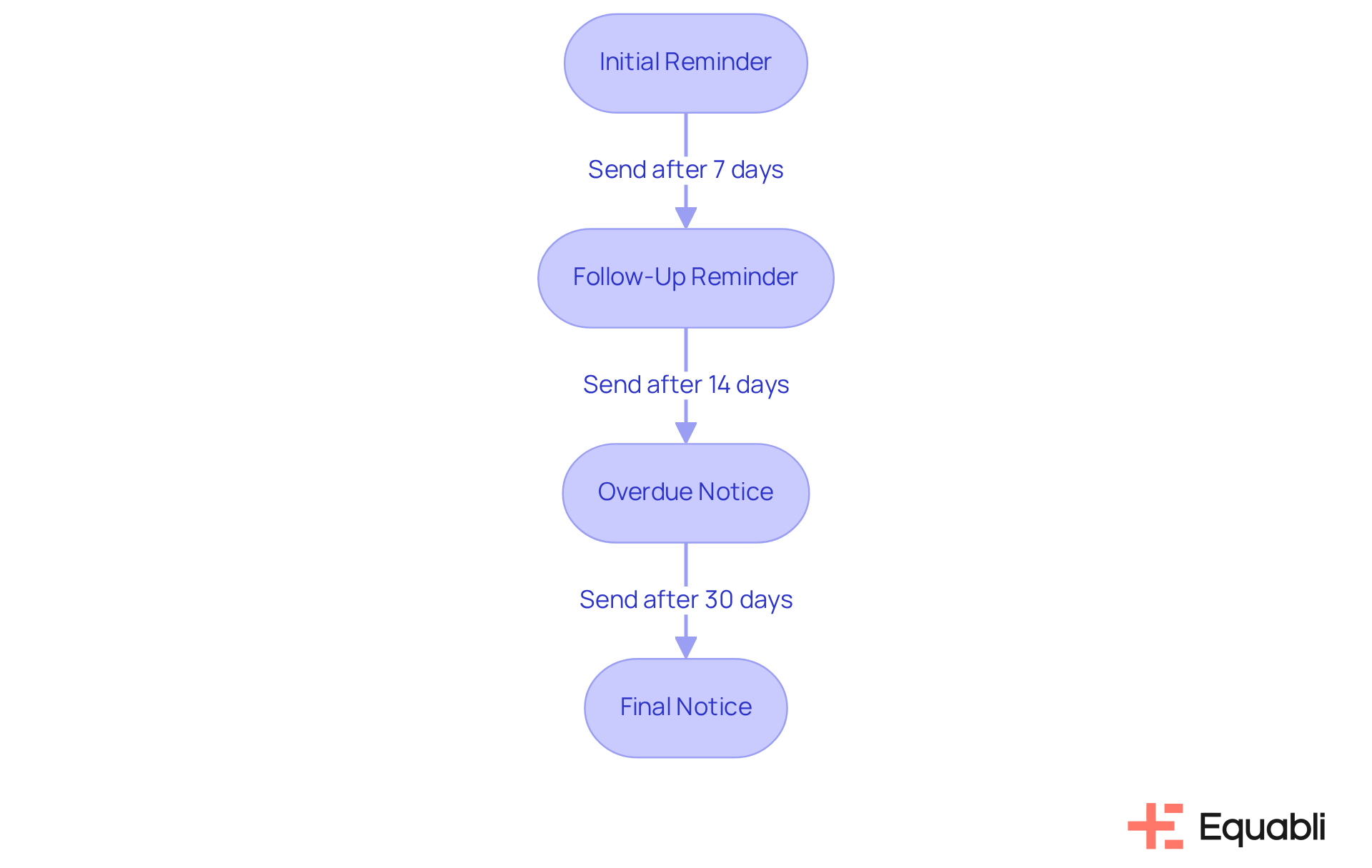

eTactics: Sample Emails for Every Stage of Payment Reminders

A well-crafted collection of sample emails is essential for utilizing polite payment reminder strategies for corporate accounts receivable management at every stage of the payment notification process. These templates serve as invaluable resources for accounts receivable teams by incorporating polite payment reminder strategies for corporate accounts receivable management, ranging from initial reminders to follow-ups for overdue accounts. By utilizing these organized emails, teams can apply polite payment reminder strategies for corporate accounts receivable management to ensure timely interactions that align with each stage of the collection process, significantly reducing the risk of client frustration. Customization options enable organizations to preserve their distinct tone and style, which can also enhance the effectiveness of polite payment reminder strategies for corporate accounts receivable management, promoting consistency in interactions.

Prompt interaction is crucial; research indicates that customers reached through their preferred channels pay 15% faster on average. Customized messaging strategies, especially through organized email templates, are effective polite payment reminder strategies for corporate accounts receivable management that enhance engagement and improve collection rates. In fact, personalized emails achieve a 20% higher engagement rate when they incorporate customer data. This approach not only simplifies the collection procedure but also fosters trust with debtors, ultimately leading to more successful recovery of overdue amounts.

As companies increasingly adopt digital formats for invoicing, the impact of organized email communication on collection efficiency cannot be overstated. Emails are not only faster and more cost-effective than traditional letters—costing 97% less to send—but they also allow for precise targeting based on customer demographics and preferences. By integrating polite payment reminder strategies for corporate accounts receivable management, accounts receivable teams can significantly enhance their collection efforts and improve overall cash flow.

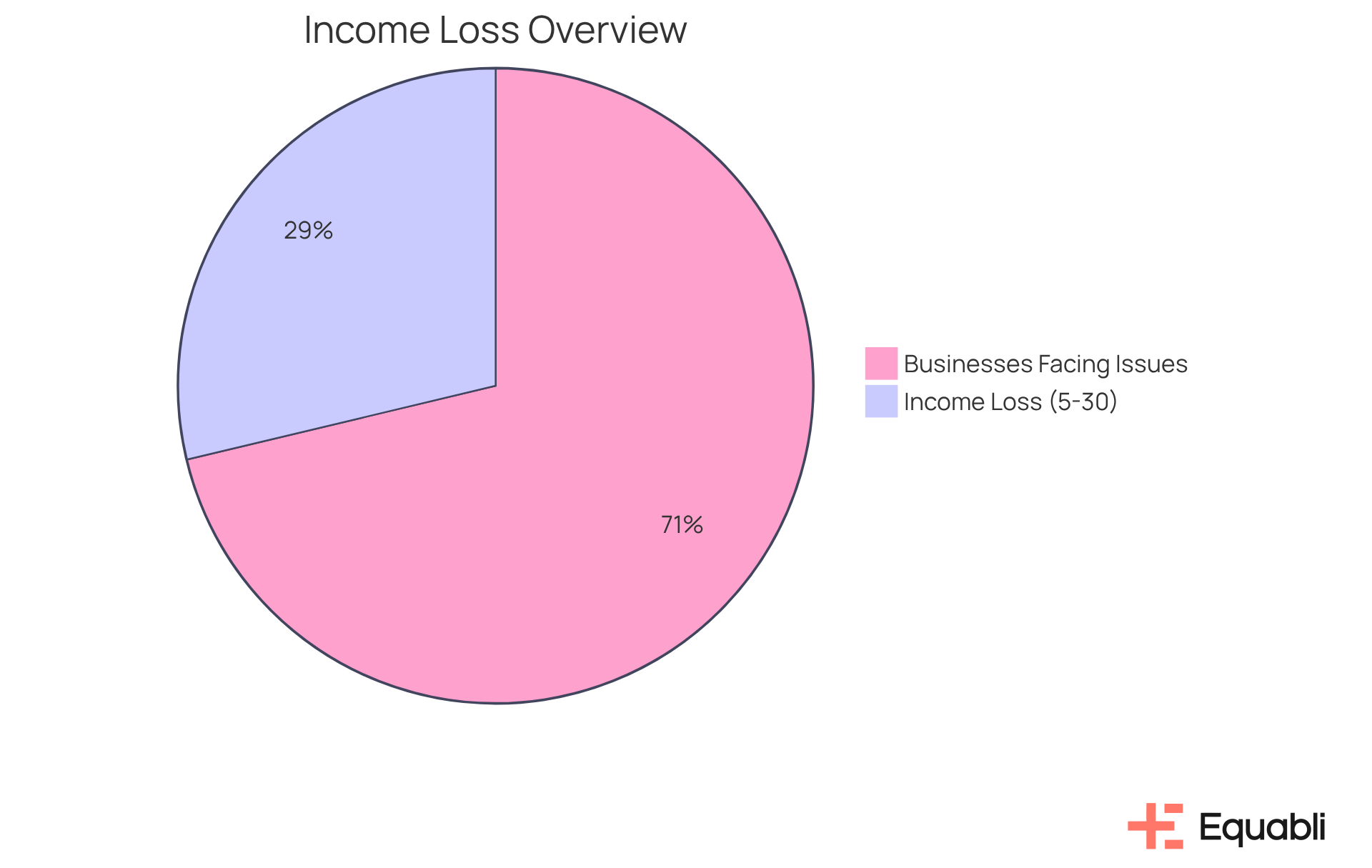

Payt Software: Understand the Costs of Payment Reminders

Understanding the costs associated with billing notifications is crucial for accounts receivable teams to effectively utilize polite payment reminder strategies for corporate accounts receivable management. This encompasses not only the direct expenses of sending reminders but also the significant financial repercussions of delayed transactions, which can severely impact revenue. In 2025, it is projected that over 62% of small businesses in the UK will face challenges due to late transactions, leading to cash flow issues that hinder operational capabilities and growth. Research indicates that companies lose between 5% and 30% of their annual income due to ineffective debt management, often stemming from these delays.

By conducting a thorough analysis of these costs, teams can make informed decisions about their polite payment reminder strategies for corporate accounts receivable management, ensuring optimal resource allocation. Recognizing the financial implications of postponed transactions can also justify investments in automation and advanced technologies. These enhancements not only streamline the notification process but also improve cash flow management, ultimately supporting the organization's financial health.

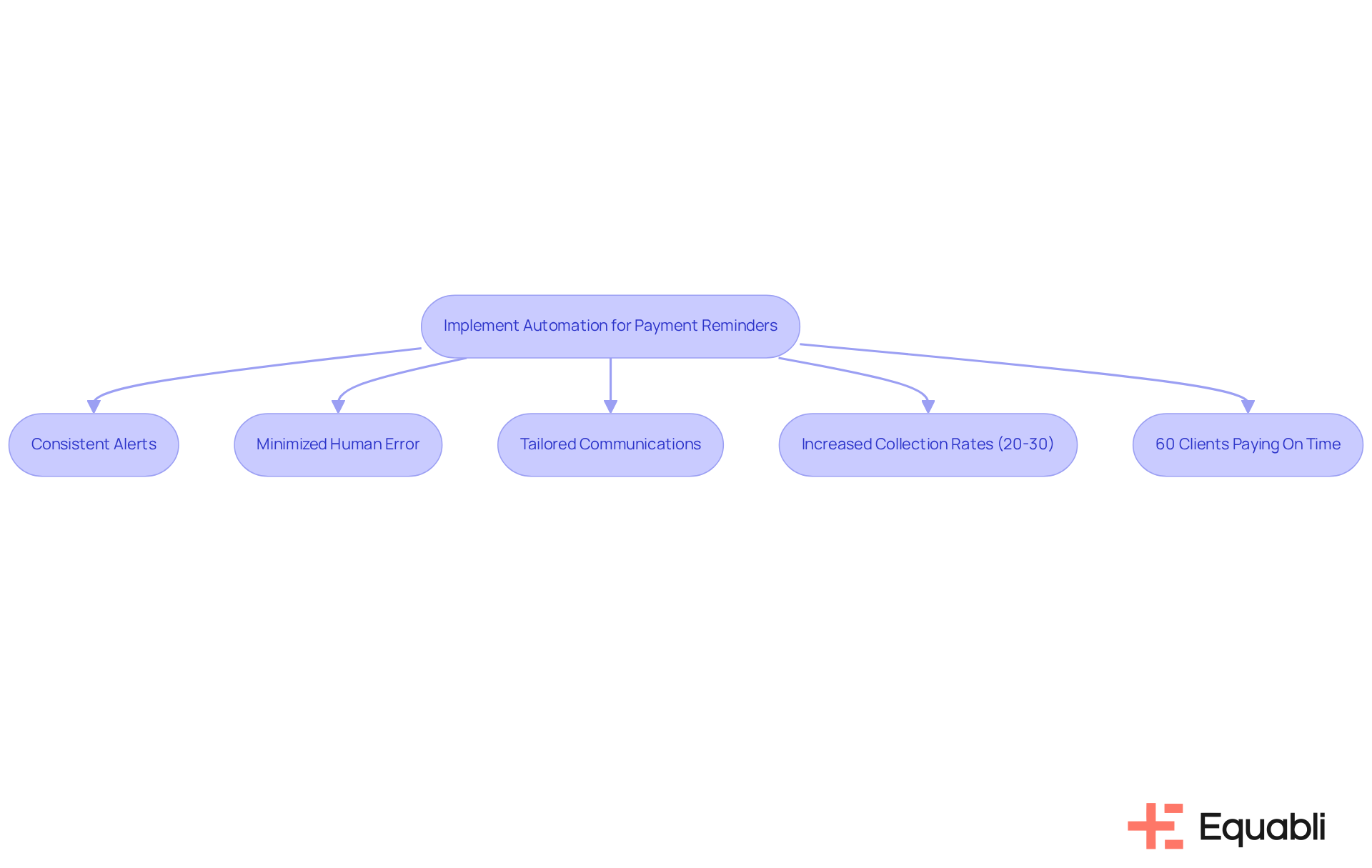

Medium: Leverage Automation for Streamlined Payment Reminders

Automation is pivotal in optimizing billing notifications, which supports accounts receivable teams in employing polite payment reminder strategies for corporate accounts receivable management, ensuring alerts are delivered consistently and punctually while minimizing human error. Evidence shows that organizations implementing polite payment reminder strategies for corporate accounts receivable management can tailor communications based on client behavior and payment history. This targeted strategy not only boosts notification efficiency but also utilizes polite payment reminder strategies for corporate accounts receivable management, enabling staff to concentrate on more complex collection tasks.

For instance, companies employing automated notifications have experienced a 20-30% increase in collection rates, underscoring the tangible benefits of this approach. Furthermore, the use of polite payment reminder strategies for corporate accounts receivable management through timely notifications leads to 60% of clients completing their transactions on time, illustrating the critical role of effective communication in managing accounts receivable. As advancements in billing notification automation progress, features like multi-channel delivery and AI-driven personalization are becoming essential for enhancing engagement and ensuring timely transactions.

Equabli's EQ Collect streamlines this process by shortening vendor onboarding timelines through a straightforward, no-code file-mapping tool. This improvement in efficiency is achieved via data-driven strategies, automated workflows, and real-time reporting. As Priya Thakar notes, "Automating payment alerts simplifies your process, enables you to receive payments more quickly, and liberates your team to concentrate on what is most important." This insight highlights the operational advantages of automation in the context of enterprise-level debt collection.

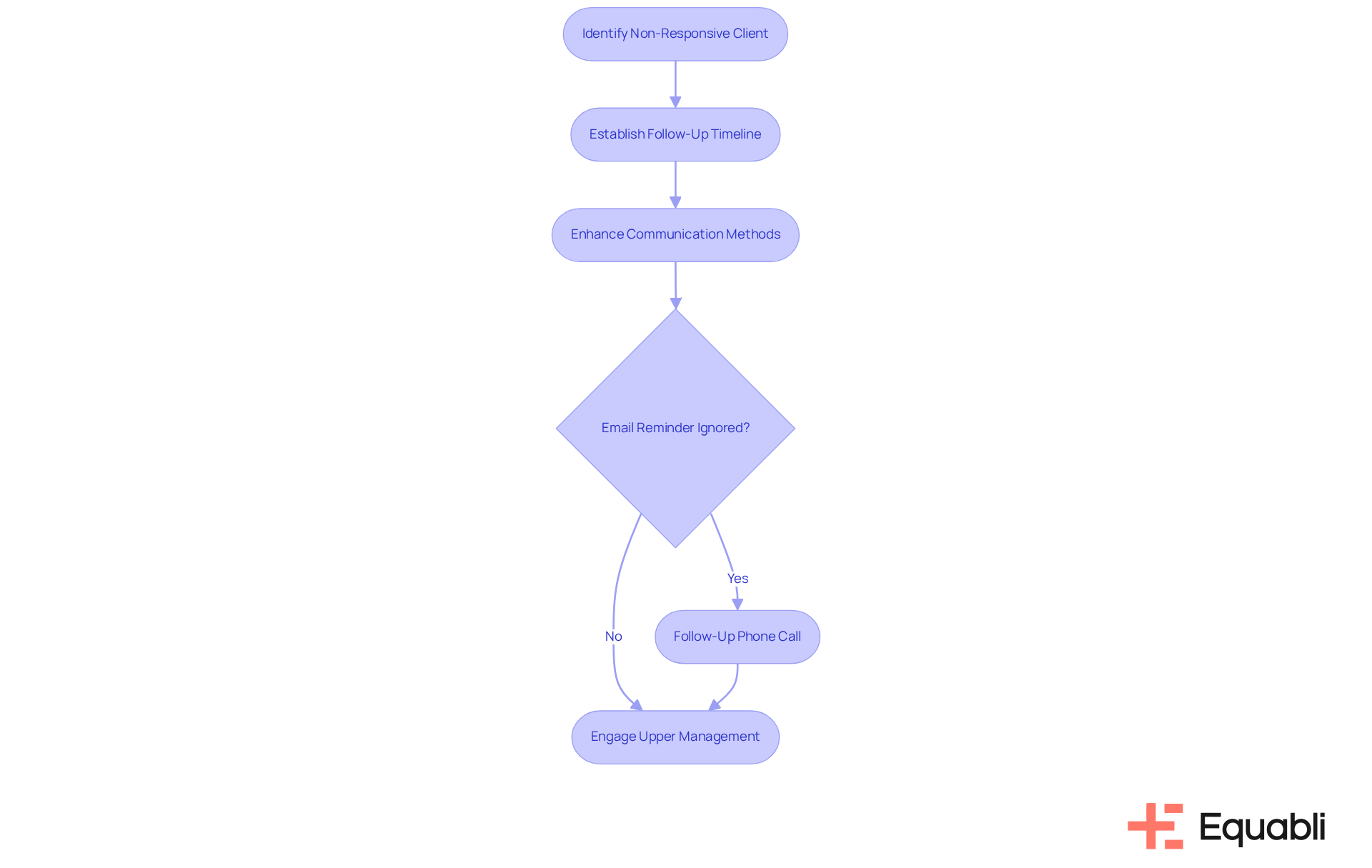

ResolvePay: Escalation Strategies for Non-Responsive Clients

Effective escalation strategies are crucial for managing non-responsive clients in debt collection. Establishing clear timelines for follow-up notifications is essential, as is enhancing communication methods when initial attempts fail. For example, if an email reminder is ignored, a follow-up phone call may yield better results. Engaging upper management in the escalation process can also underscore the seriousness of the situation to the customer, reinforcing the importance of timely payment.

By utilizing polite payment reminder strategies for corporate accounts receivable management, teams can significantly improve their chances of recovering overdue payments while preserving professional relationships. Empathy is a vital component in this process; understanding a customer's emotional state allows for tailored interactions that effectively address objections and foster a collaborative environment for debt resolution. As highlighted in the case study "The Importance of Empathy in Debt Collection," recognizing consumers' emotional states can lead to more productive discussions.

Incorporating empathetic language not only validates individuals' feelings but also enhances the overall communication experience. Benjamin Franklin's insight, "Many a man thinks he is buying pleasure, when he's really selling himself to it," serves as a reminder of the emotional complexities surrounding debt. By acknowledging these dynamics, accounts receivable teams can cultivate a more supportive environment that encourages clients to engage in resolving their debts.

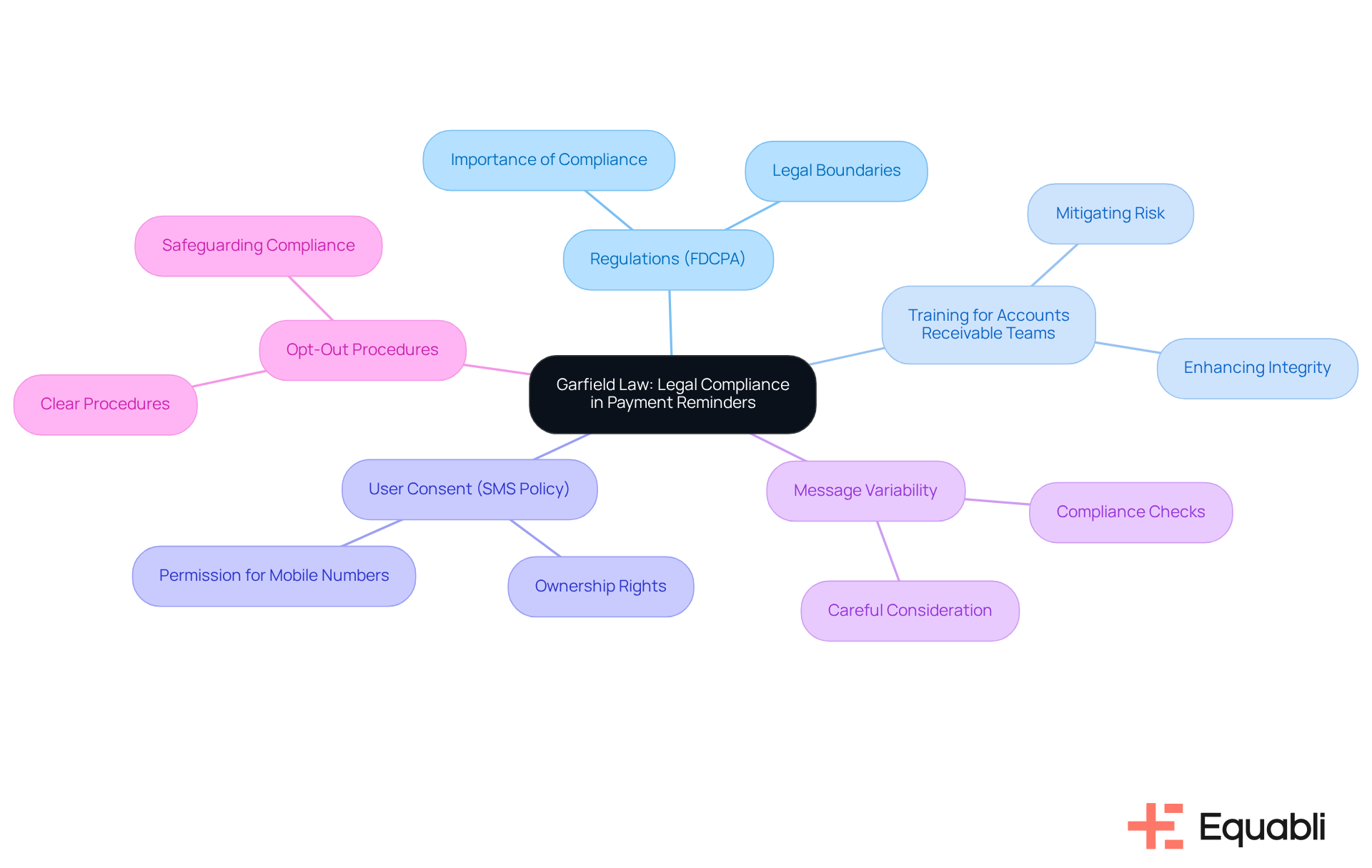

Garfield Law: Ensure Legal Compliance in Payment Reminders

Garfield Law underscores the critical importance of legal compliance in payment notifications. Adhering to regulations such as the Fair Debt Collection Practices Act (FDCPA) is essential for organizations. Evidence shows that accounts receivable teams must be well-trained on these regulations to prevent practices that could be perceived as harassing or misleading. This training not only mitigates risk but also enhances the integrity of the collections process.

Moreover, organizations must secure user consent for SMS communications, as stipulated in Equabli's SMS policy. This policy emphasizes the necessity of obtaining ownership rights or permission to utilize provided mobile numbers. The variability in the number of messages sent also requires careful consideration. By implementing compliance checks within their reminder processes, organizations can ensure they are operating within legal boundaries.

To further protect themselves from potential legal repercussions, organizations should establish clear opt-out procedures for recipients. This proactive approach not only safeguards against compliance violations but also upholds ethical standards in collections efforts. Ultimately, by prioritizing compliance and ethical practices, organizations can enhance their operational effectiveness while minimizing risk exposure.

Conclusion

Implementing polite payment reminder strategies for corporate accounts receivable is crucial for sustaining healthy cash flow and nurturing positive client relationships. Advanced tools and techniques can streamline collection processes, ensuring timely payments while alleviating the emotional strain often linked to overdue accounts.

The article highlights effective methods, such as automation through Equabli's EQ Suite and professional email templates from ChaserHQ. It underscores the significance of timing and tone in communication. Furthermore, it emphasizes the necessity of multi-channel approaches, personalized messaging, and legal compliance to enhance collection efficiency. Collectively, these strategies illustrate how a respectful and organized approach to payment reminders can markedly improve response rates and overall financial outcomes.

Organizations are encouraged to continually assess and refine their payment reminder practices. By embracing automation and adopting empathetic communication, businesses can alleviate the burden of manual debt collection, leading to enhanced client engagement and satisfaction. Prioritizing these strategies ensures a more effective accounts receivable process, ultimately contributing to long-term success and stability.

Frequently Asked Questions

What is Equabli's EQ Suite and what does it offer?

Equabli's EQ Suite is a comprehensive set of tools designed to automate billing notifications, including polite payment reminder strategies for corporate accounts receivable management. It helps teams focus on strategic initiatives by generating automated notifications based on customizable criteria, ensuring consistent communication with clients.

How does the automation in Equabli's EQ Suite improve operational efficiency?

The automation capabilities of Equabli's EQ Suite enhance operational efficiency by streamlining communication with clients, strengthening compliance oversight through automated monitoring, and facilitating thorough tracking and reporting. This leads to improved cash flow and reduced operational costs.

Can you provide an example of the impact of automation on cash flow?

Yes, a case study involving Todd's IT demonstrated that implementing automation reduced the time to receive funds from 45 days to just 3 days, significantly improving cash flow.

What does ChaserHQ offer for payment reminders?

ChaserHQ provides a variety of professional email templates tailored for billing notifications, which incorporate polite payment reminder strategies. These templates help ensure consistent and professional communication while reflecting the company's branding.

Why is the tone and timing important in payment reminders according to Garfield Law?

Garfield Law emphasizes that mastering timing and tone is critical when requesting payments. Sending notifications too early can frustrate customers, while delays may lead to missed transactions. A balanced approach is to send notifications shortly after the due date using a friendly yet assertive tone.

What strategies can enhance collection efficiency in accounts receivable management?

Strategies that enhance collection efficiency include using clear and concise communication with essential details like invoice numbers and due dates, offering various transaction options, and continually assessing and updating communication strategies to align with evolving customer needs.

How do polite payment reminder strategies impact customer relationships?

Polite payment reminder strategies help maintain robust customer relationships by fostering constructive dialogue and minimizing misunderstandings. This approach can lead to improved collection rates while ensuring that customers feel respected and informed.