Overview

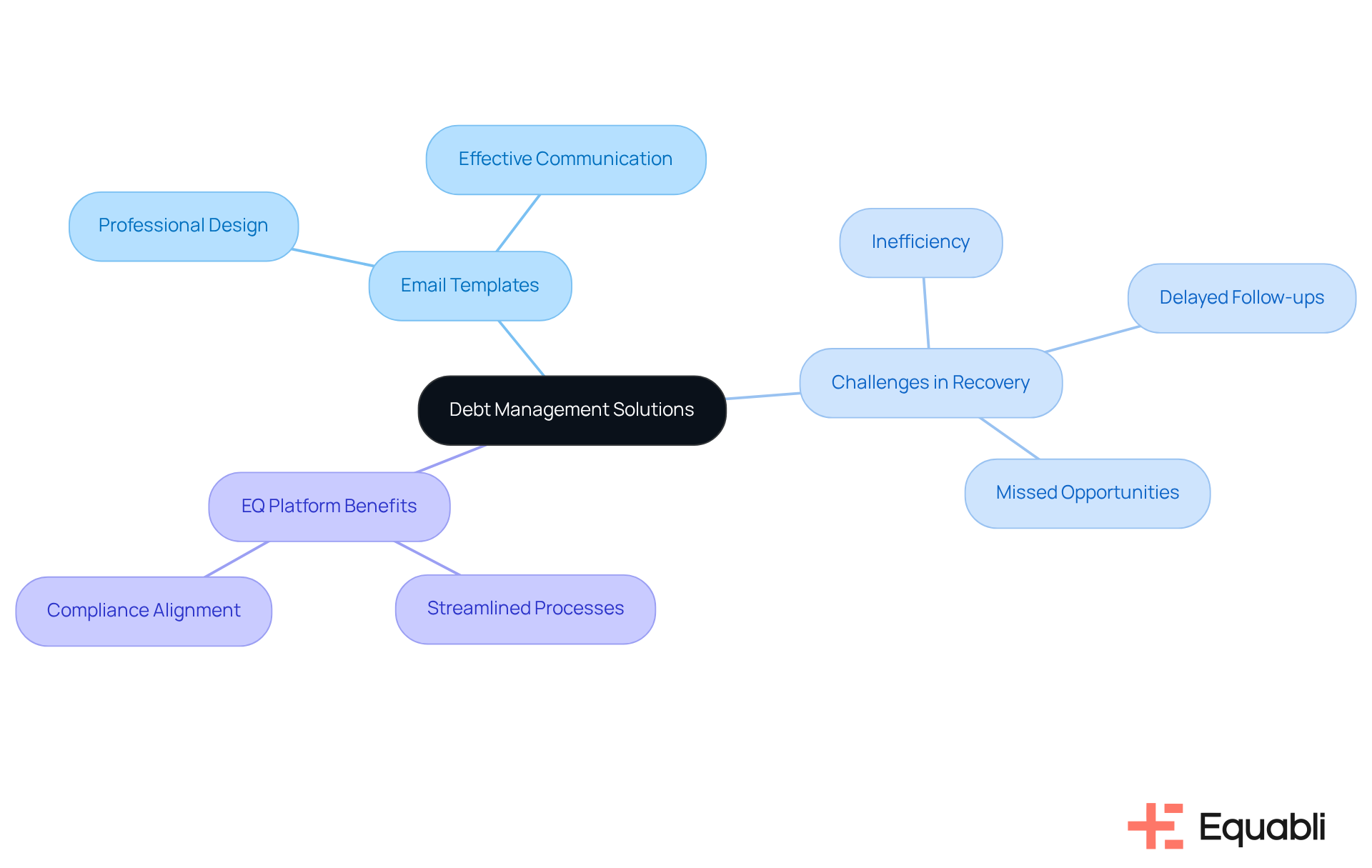

The article provides a comprehensive overview of professional email templates designed for overdue payment reminders within corporate finance. These templates are crucial for enhancing communication and improving recovery efforts. By integrating these templates with advanced management systems, such as Equabli's EQ Suite, organizations can streamline their debt collection processes and enhance operational efficiency. This integration not only reduces overdue payments but also fosters stronger client relationships, ultimately contributing to a more effective financial management strategy.

Introduction

In the fast-paced finance sector, managing overdue payments presents a significant challenge for businesses. Delayed payments not only disrupt cash flow but also jeopardize client relationships, creating a ripple effect that can hinder operational efficiency. This article presents ten professional email templates tailored for overdue payment reminders, equipping organizations with essential tools to enhance communication and recovery efforts. Given the multitude of strategies available, how can businesses adopt the most effective approaches to prompt timely payments while upholding professionalism?

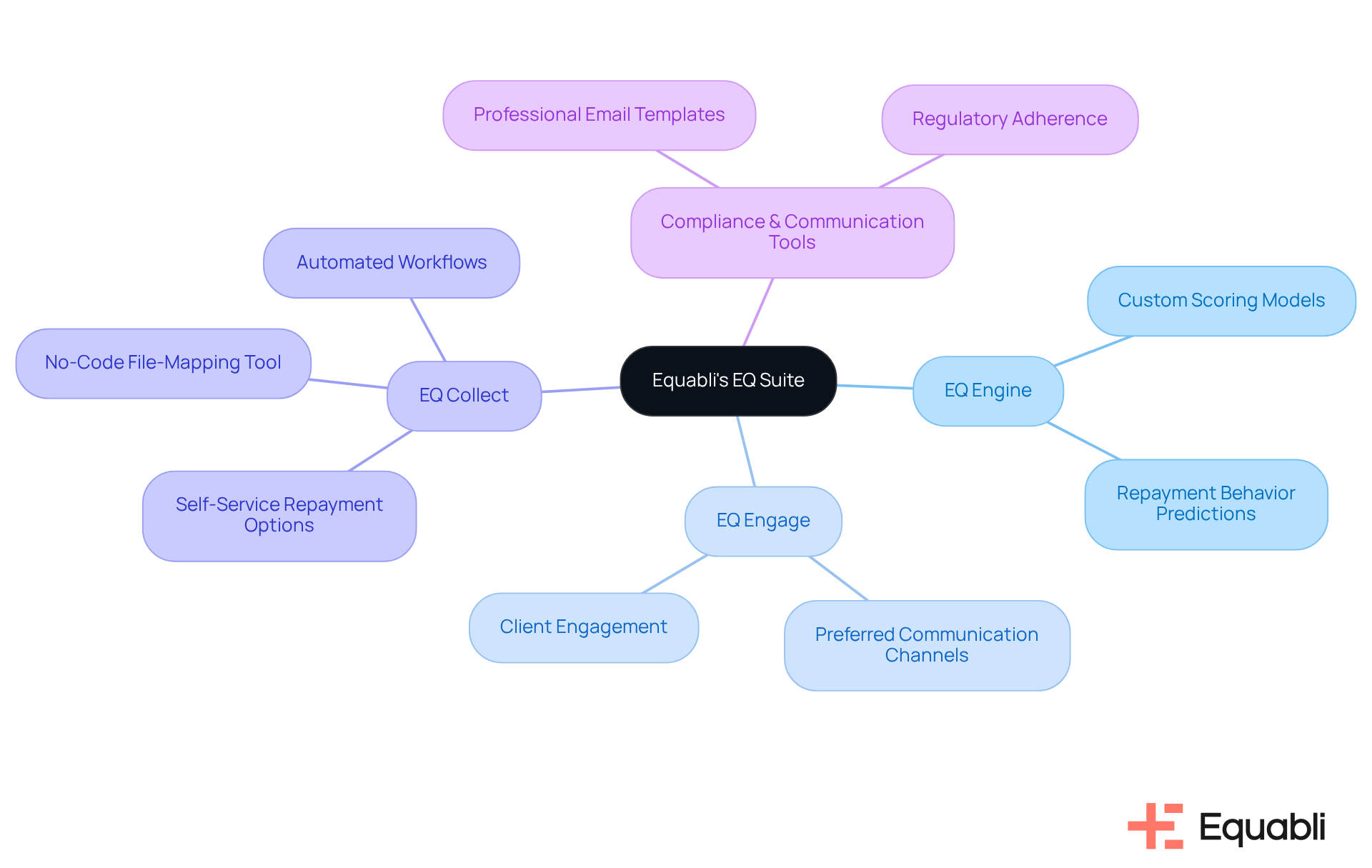

Equabli's EQ Suite: Streamlined Overdue Payment Management

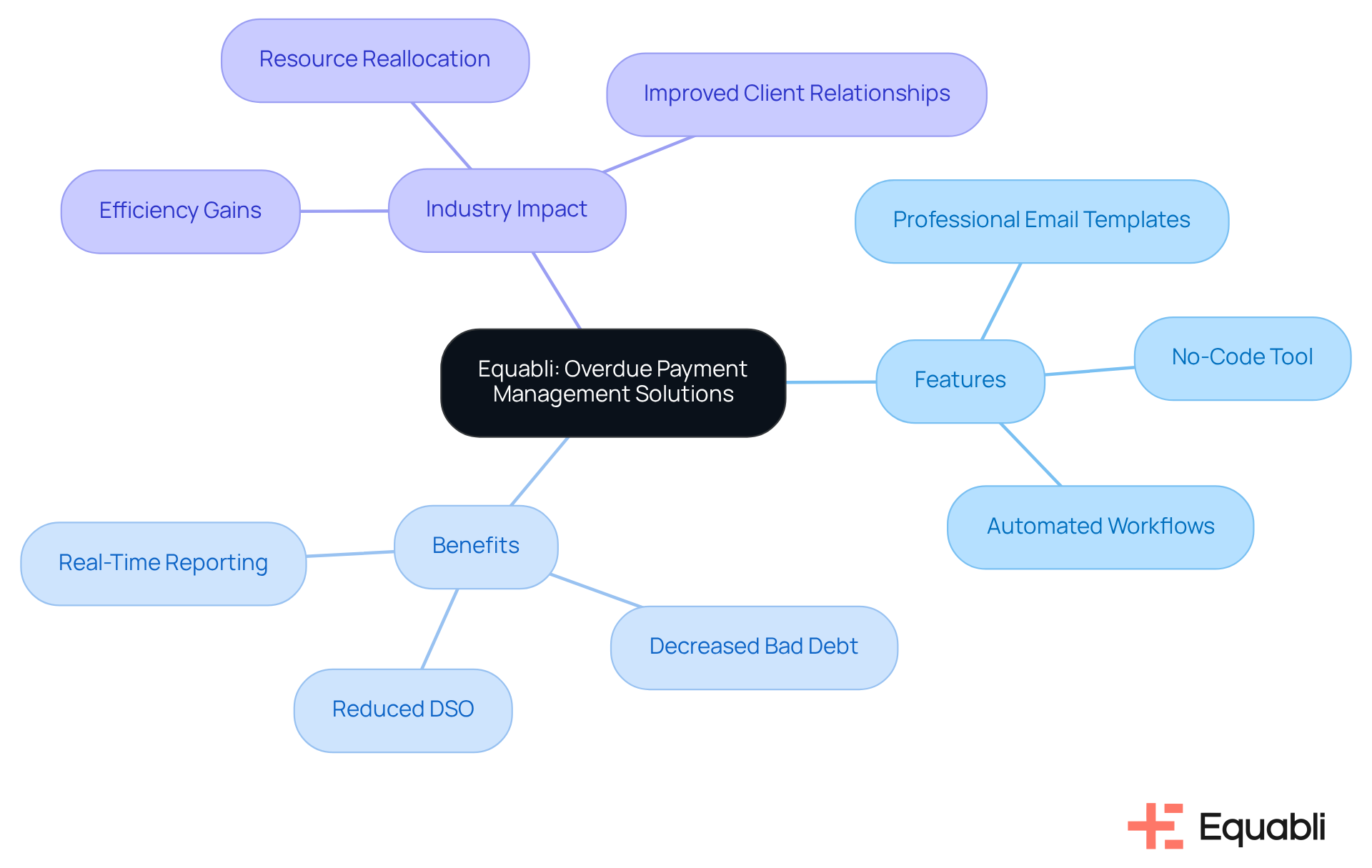

Equabli's EQ Suite provides a robust framework for managing overdue accounts, leveraging innovative tools designed to enhance recovery efficiency. The EQ Engine utilizes custom scoring models that accurately predict repayment behaviors, enabling lenders to effectively tailor their strategies. Furthermore, EQ Engage enhances borrower communication by utilizing preferred channels, ensuring clients remain informed and engaged throughout the repayment process.

In addition, EQ Collect simplifies the management of digital assets by offering self-service repayment options, allowing borrowers to take control of their debts. Key features of EQ Collect, including a no-code file-mapping tool and automated workflows, significantly reduce vendor onboarding timelines and minimize execution errors. This enhancement leads to improved operational efficiency, which is critical in today’s competitive landscape.

This comprehensive suite not only streamlines the collection process and bolsters compliance but also includes professional email templates for overdue payment reminders in corporate finance, making it an indispensable resource for lenders and agencies navigating the complexities of overdue account management. By integrating these advanced tools, organizations can better address the challenges associated with debt recovery while ensuring adherence to regulatory standards.

ChaserHQ: Tailored Email Templates for Payment Reminders

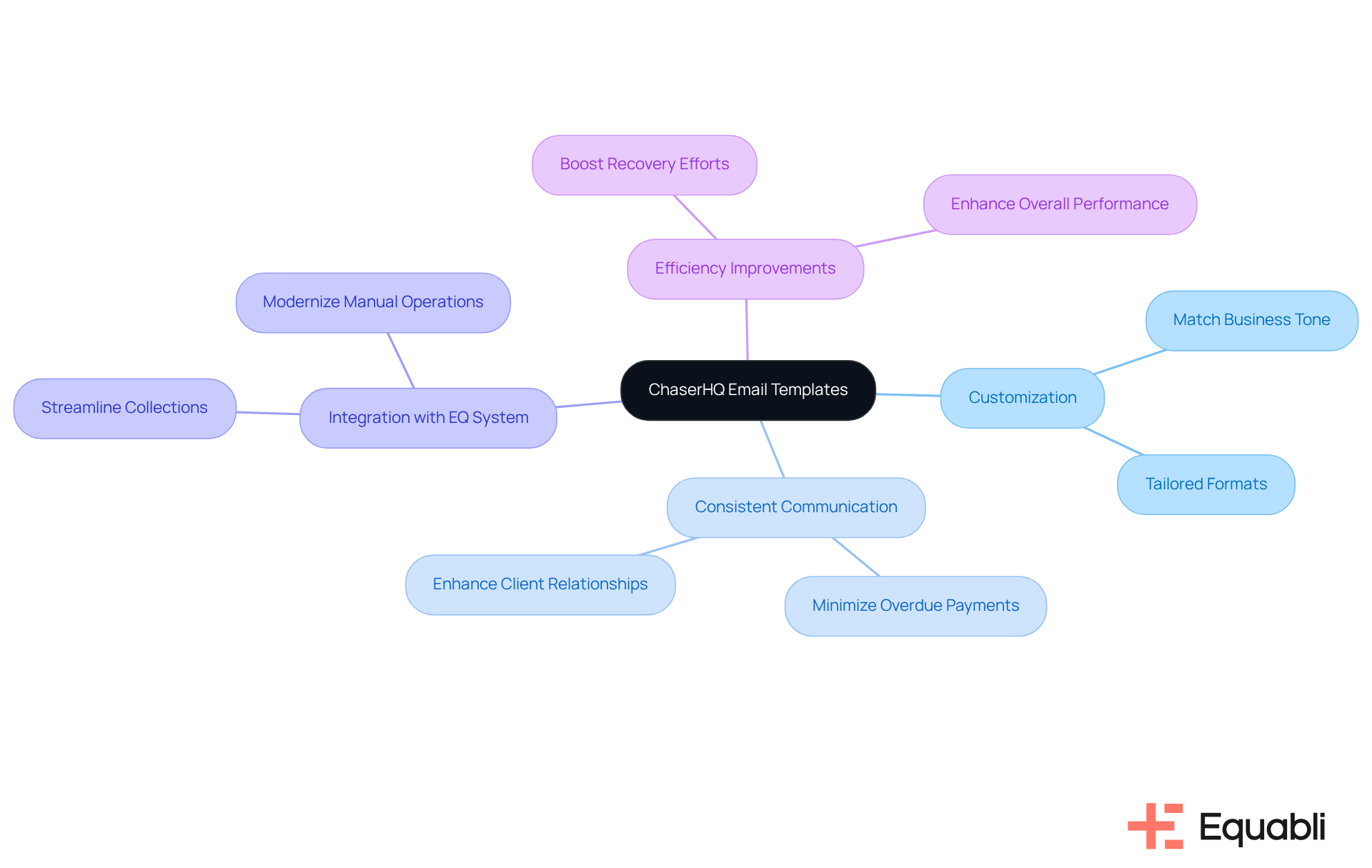

ChaserHQ provides professional email templates for overdue payment reminders in corporate finance, offering a range of customized email formats specifically designed for reminder notifications. These professional email templates for overdue payment reminders in corporate finance can be customized to match your business's tone and style, ensuring that reminders are both professional and effective. By utilizing professional email templates for overdue payment reminders in corporate finance, organizations can sustain consistent communication with clients, thereby minimizing the risk of overdue payments and enhancing client relationships.

Moreover, integrating these email strategies with Equabli's EQ system can significantly transform your debt retrieval process. The EQ Suite modernizes manual operations, streamlining collections to be more efficient and intuitive. This modernization ultimately enhances recovery efforts and boosts overall performance, positioning your organization for greater success in debt management.

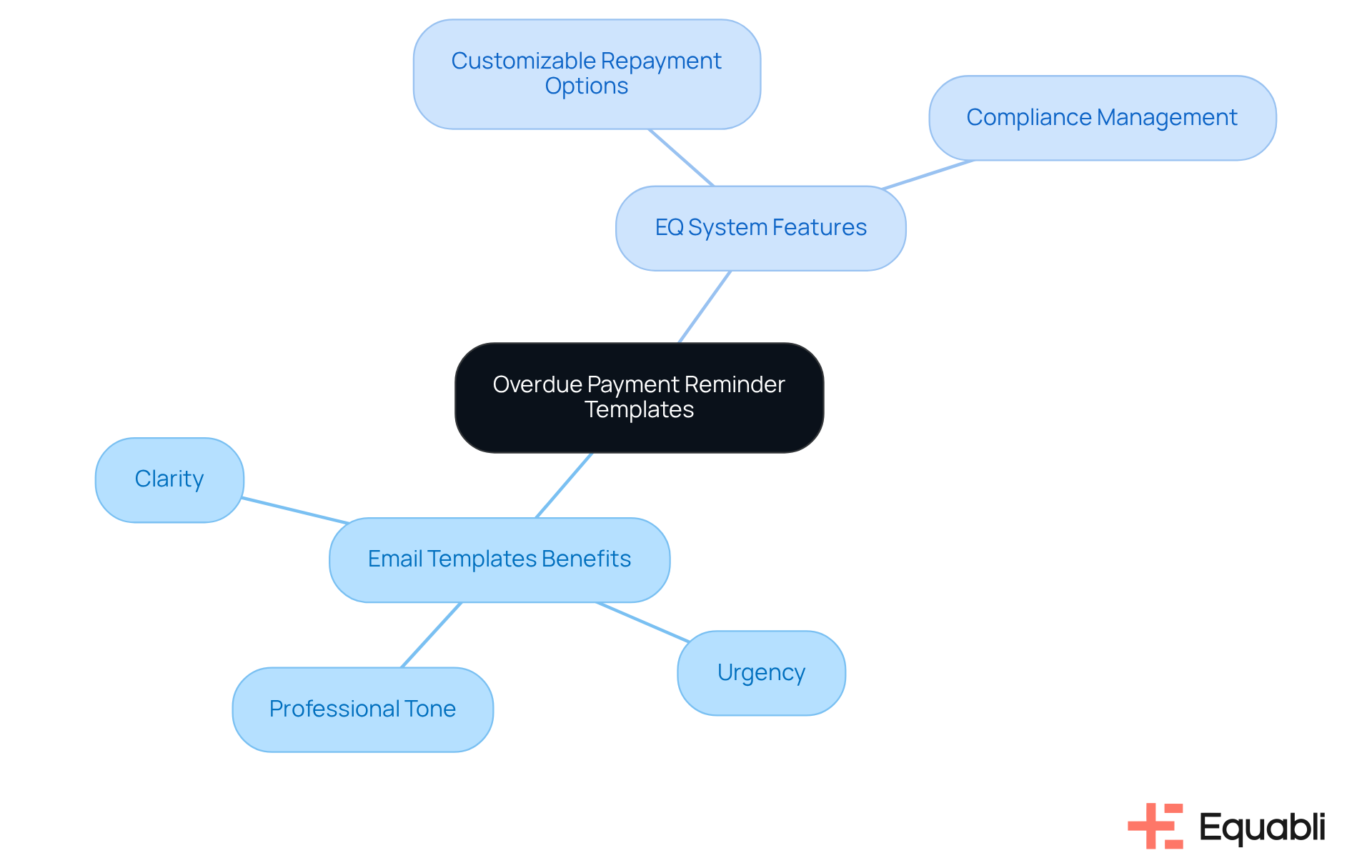

GetJobber: Effective Overdue Payment Reminder Templates

Equabli offers professional email templates for overdue payment reminders in corporate finance that are efficient and straightforward to implement. These frameworks emphasize clarity and urgency, ensuring clients understand the importance of settling their accounts. By leveraging professional email templates for overdue payment reminders in corporate finance, businesses can enhance their recovery efforts while upholding a professional tone, which is crucial for maintaining client relationships.

Despite these advancements, many financial institutions continue to grapple with manual debt recovery processes, resulting in inefficiencies and lost opportunities. Equabli's EQ system enables organizations to modernize their debt management practices, shifting from manual tasks to a more efficient, data-informed approach. The EQ Suite includes features such as:

- Customizable repayment options

- Compliance management

These features not only streamline operations but also boost borrower engagement, ultimately leading to improved recovery rates.

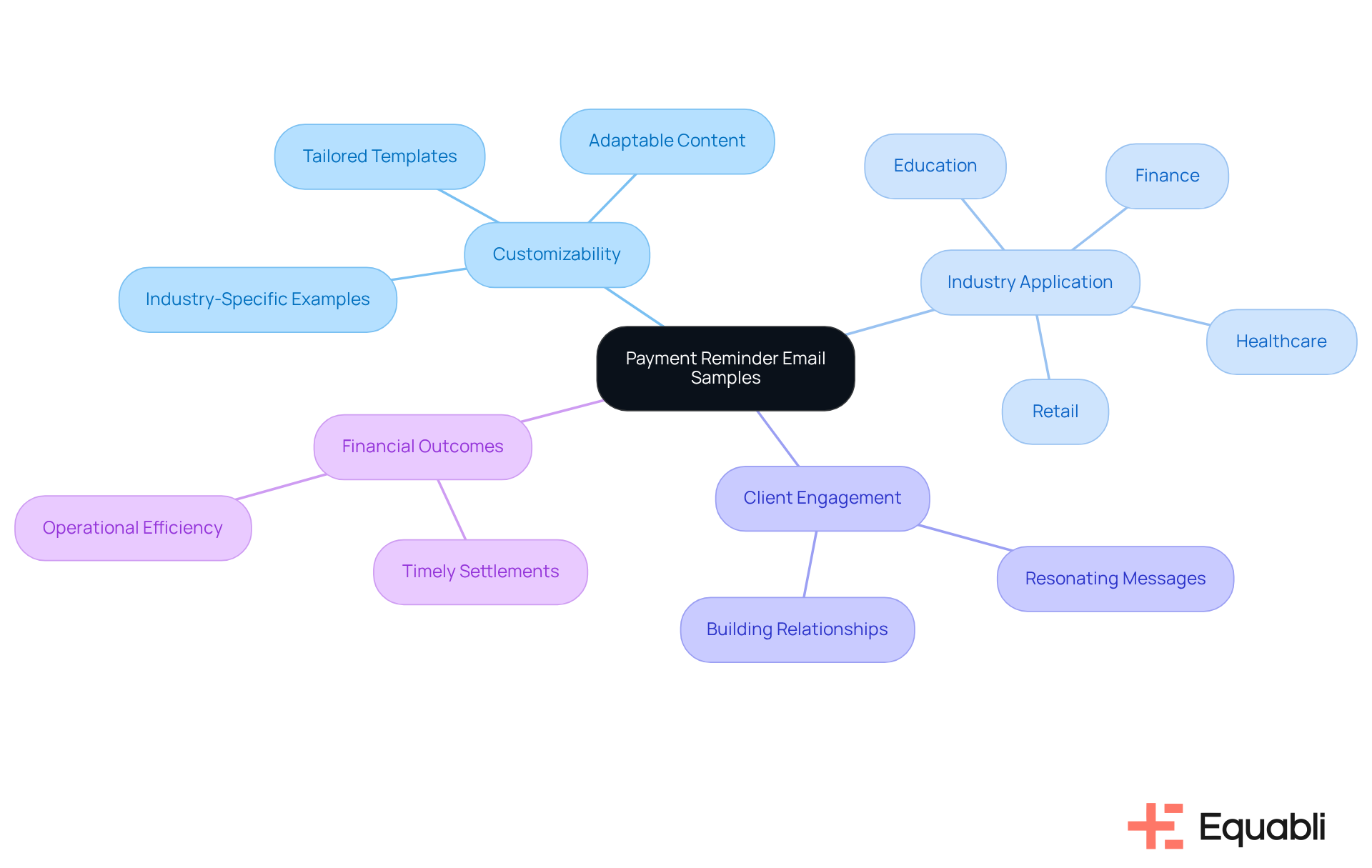

eTactics: Versatile Payment Reminder Email Samples

eTactics provides a suite of adaptable reminder email samples tailored for diverse industries and client scenarios. These samples can be easily customized to meet specific requirements, serving as a valuable asset for businesses aiming to refine their communication strategies. By leveraging these flexible models, organizations can ensure their reminders resonate with clients, thereby increasing the likelihood of timely settlements. This approach not only enhances operational efficiency but also aligns with best practices in client engagement, ultimately supporting improved financial outcomes.

Invoiced.com: Past Due Invoice Email Templates

Invoiced.com offers professional email templates for overdue payment reminders in corporate finance that effectively communicate overdue balances to clients. These professional email templates for overdue payment reminders in corporate finance highlight the importance of timely payments and provide all necessary information to facilitate the reimbursement process. However, manual debt retrieval often results in inefficiencies, missed opportunities, and an increase in overdue payments.

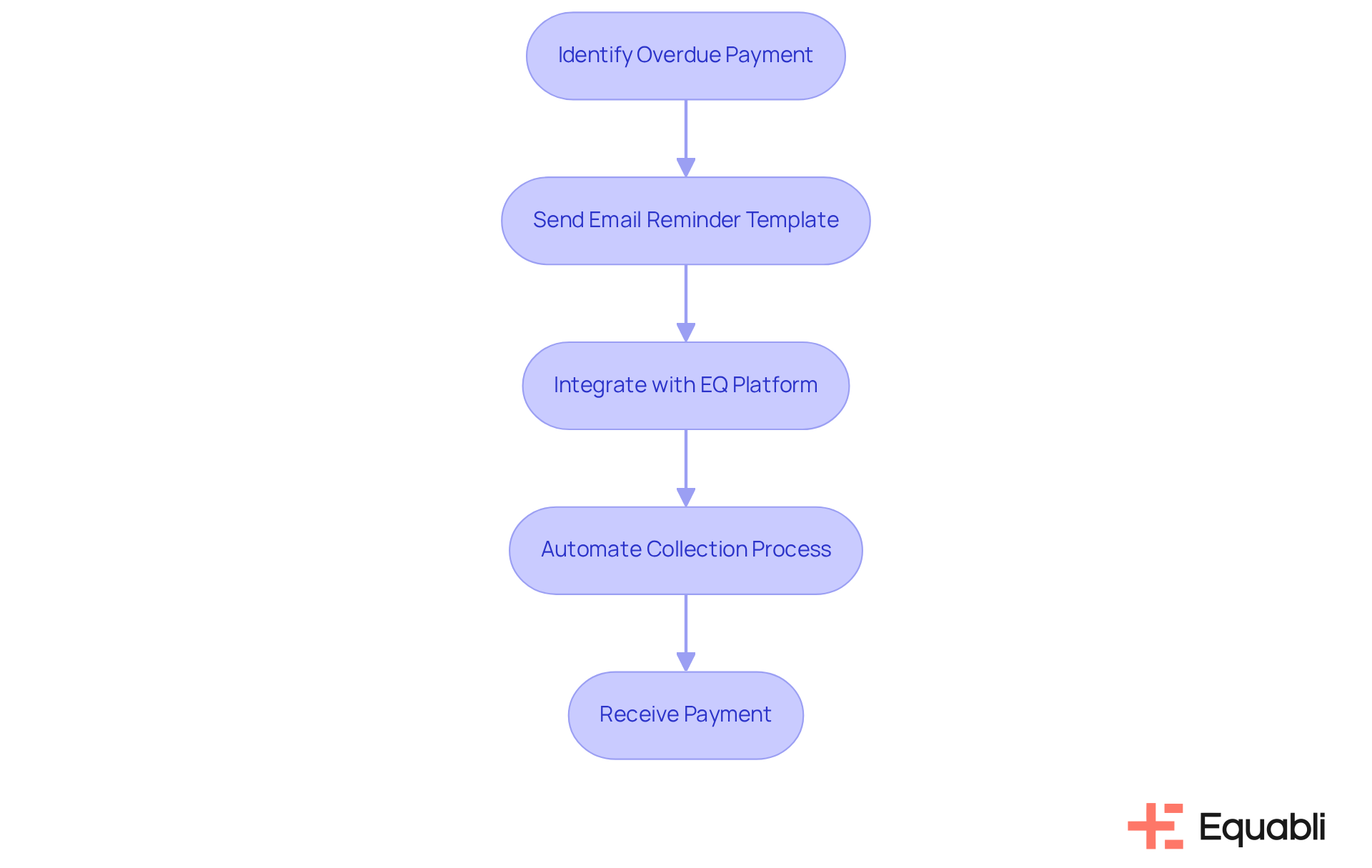

By integrating these templates with Equabli's EQ platform, financial institutions can modernize their debt collection processes. The EQ Suite addresses the challenges associated with manual tasks by automating and streamlining operations, transforming them into efficient, data-driven workflows. This integration not only aids companies in managing their accounts receivable effectively but also enhances performance by significantly reducing the frequency of overdue invoices.

SquareUp: Tips for Writing Effective Payment Reminder Emails

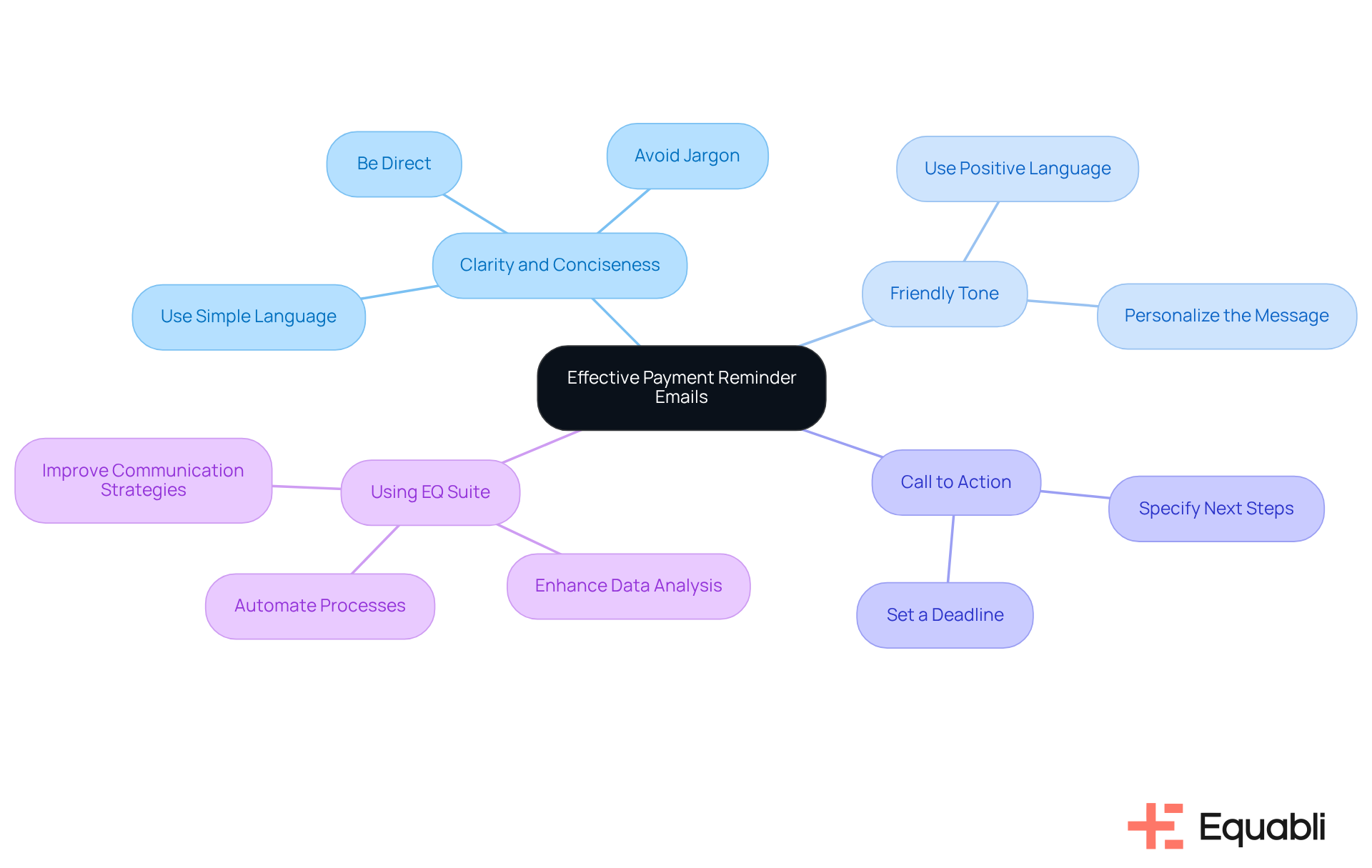

SquareUp provides essential guidance for crafting effective professional email templates for overdue payment reminders in corporate finance related to transactions. First, clarity and conciseness are paramount; emails should communicate the necessary information without ambiguity. Evidence suggests that a friendly tone can foster better client relationships, while a clear call to action encourages prompt responses. By implementing these strategies, organizations can utilize professional email templates for overdue payment reminders in corporate finance to create notifications that not only inform clients of overdue payments but also drive timely action, thereby improving recovery rates.

To further bolster these initiatives, financial institutions can utilize Equabli's EQ Suite. This suite modernizes manual processes and enhances operational efficiency. By integrating intelligent, data-driven tools into their collections strategy, businesses can refine their email communications and significantly elevate overall recovery performance. This approach not only streamlines operations but also positions organizations to better navigate the complexities of enterprise-level debt collection.

PaidNice: Specialized Overdue Payment Reminder Templates

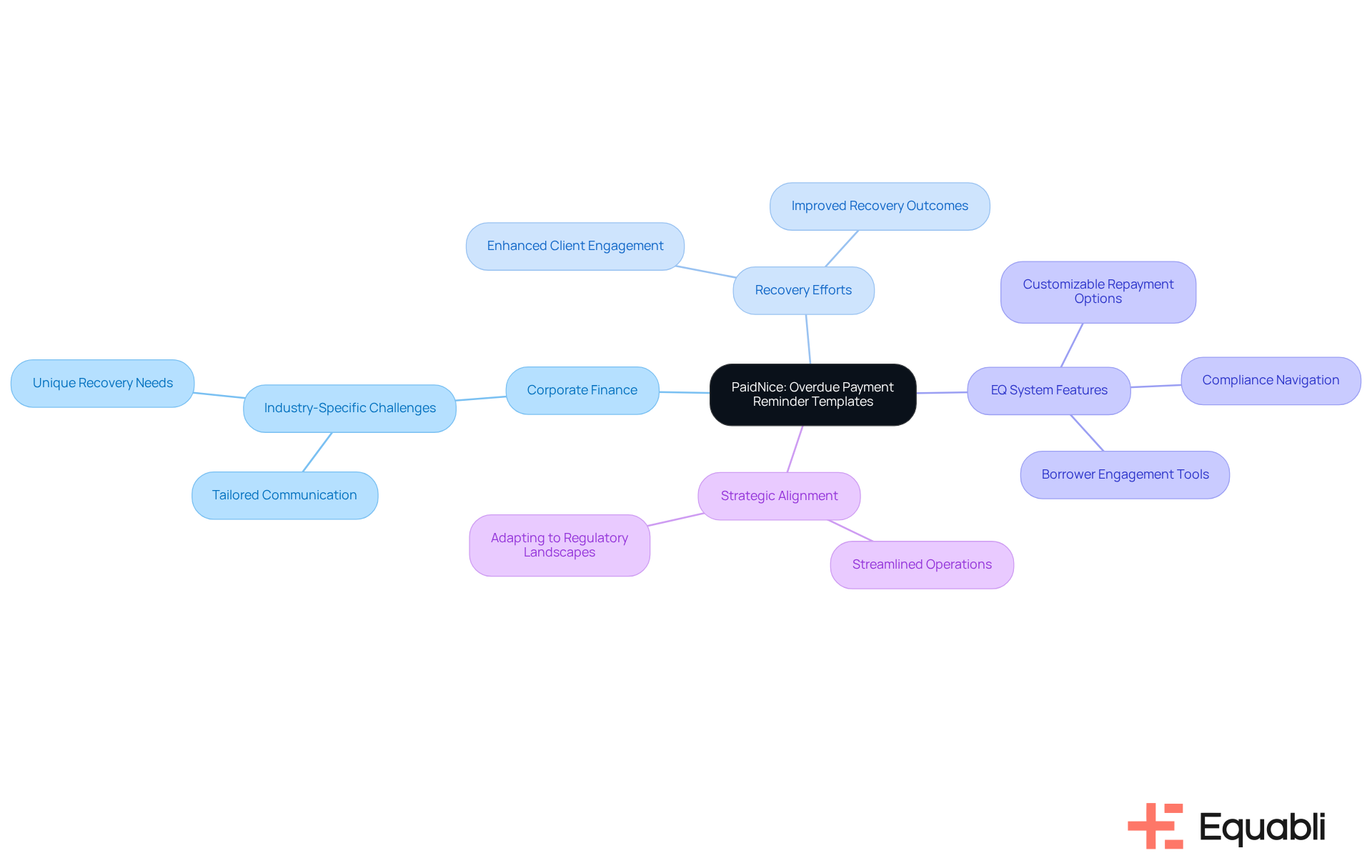

Equabli provides professional email templates for overdue payment reminders in corporate finance, tailored for various sectors. These models address the unique challenges faced by different industries, ensuring that communication remains relevant and effective. By utilizing these specific frameworks, businesses can enhance their recovery efforts and improve client engagement. The EQ system effectively addresses common issues in manual debt retrieval, such as inefficiency and missed opportunities, by transforming traditional processes into a modern, data-driven approach.

With innovative features like customizable repayment options and borrower engagement tools, financial institutions can navigate compliance requirements while optimizing recovery outcomes. This strategic alignment not only streamlines operations but also reinforces the importance of adapting to evolving regulatory landscapes. To further enhance your collection strategy, consider integrating these models with the EQ Suite, providing a comprehensive approach to debt recovery that aligns with enterprise-level objectives.

Monograph: Payment Reminder Templates for A&E Firms

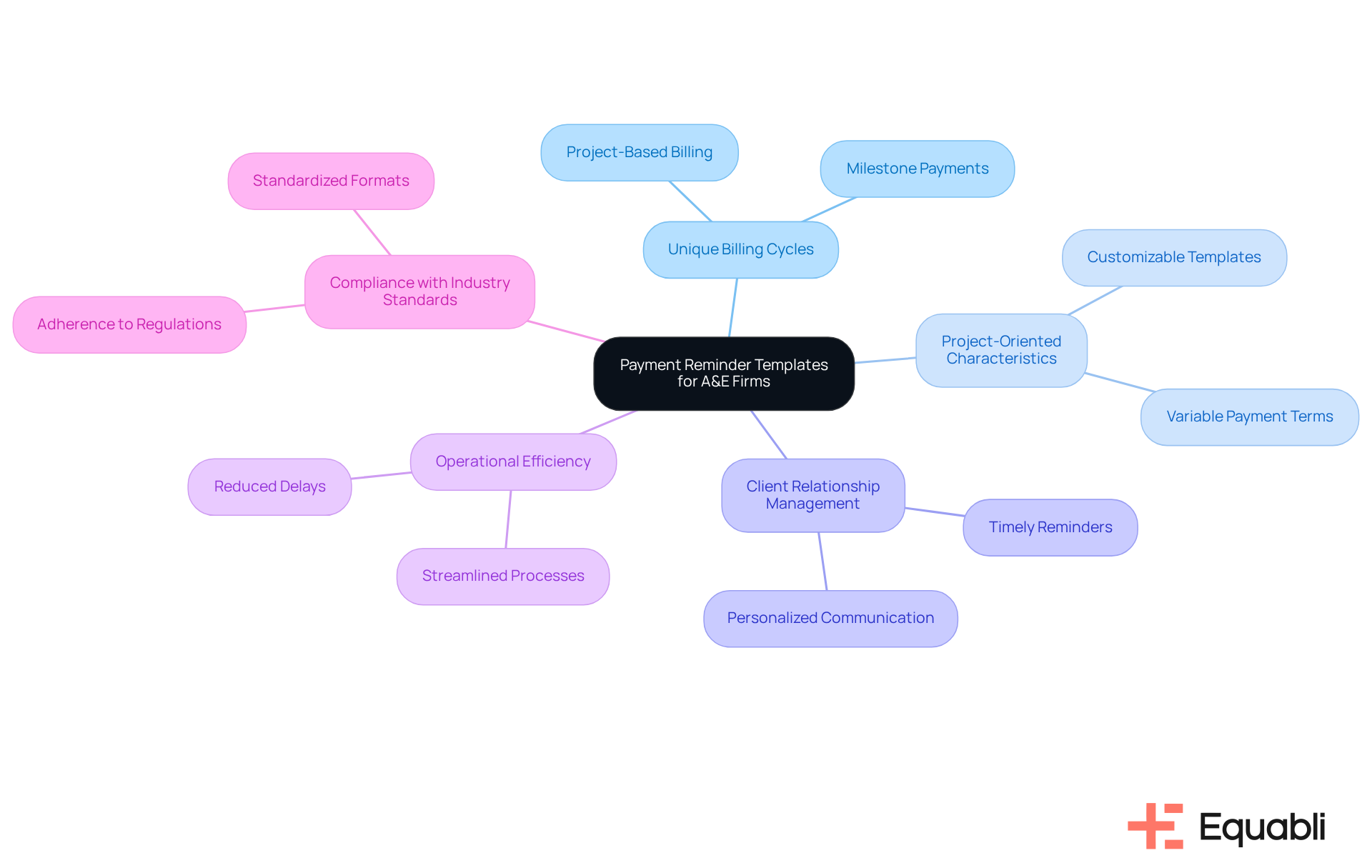

Monograph offers payment reminder formats specifically designed for architecture and engineering firms. These models take into account the unique billing cycles and project-oriented characteristics inherent in these sectors. By utilizing these tailored formats, companies can effectively manage their accounts receivable, thereby sustaining robust client relationships. This strategic approach not only enhances operational efficiency but also reinforces compliance with industry standards.

Upflow: Past Due Notice Templates and Tips

Equabli offers professional email templates for overdue payment reminders in corporate finance, along with practical advice for effective communication. These professional email templates for overdue payment reminders in corporate finance are designed to clearly convey overdue balances, while the accompanying tips enhance the effectiveness of these notices. Companies often struggle with manual debt recovery methods, facing challenges such as inefficiency, delayed follow-ups, and missed opportunities for timely settlements. By utilizing Equabli's resources, including the advanced functionalities of the EQ platform, financial institutions can refine their retrieval processes and encourage prompt remittances from clients.

The EQ Platform represents a significant shift from traditional manual debt management to a modern, data-driven approach, optimizing operations and enhancing performance throughout the recovery lifecycle. This transition not only streamlines processes but also aligns with compliance requirements, ensuring that institutions can navigate the complexities of debt collection effectively. As the landscape of financial services evolves, leveraging such innovative solutions becomes imperative for maintaining competitive advantage and operational efficiency.

Equabli: Modern Solutions for Overdue Payment Management

Equabli is at the forefront of contemporary overdue payment management solutions, incorporating professional email templates for overdue payment reminders in corporate finance, and leveraging advanced technology and data-driven strategies to transform retrieval processes. The EQ Suite not only enhances communication with clients but also significantly improves efficiency in managing overdue accounts through the use of professional email templates for overdue payment reminders in corporate finance. For instance, features like a no-code file-mapping tool and automated workflows streamline vendor onboarding timelines and reduce execution errors, enabling organizations to optimize their operations effectively.

Implementing Equabli's innovative tools can significantly enhance the effectiveness of professional email templates for overdue payment reminders in corporate finance. Studies indicate that automation can reduce days sales outstanding (DSO) by as much as 22%, while businesses typically experience a 10-15% decrease in bad debt write-offs. Furthermore, the platform offers real-time reporting and industry-leading compliance oversight, ensuring organizations maintain transparency and adhere to regulatory standards. This commitment to compliance not only strengthens client relationships through timely and effective communication but also empowers Client Success Representatives to enhance product adoption and engagement.

Industry leaders acknowledge the significance of these data-driven strategies, with many noting, "Many companies see efficiency gains that allow them to reassign employees to more important projects." This shift not only supports sustainable growth but also positions organizations favorably within a competitive landscape. By embracing Equabli's solutions, businesses can navigate the complexities of debt collection and compliance with greater confidence.

Conclusion

Equabli's innovative solutions for managing overdue payments underscore the critical role of effective communication and streamlined processes in corporate finance. By integrating professional email templates with advanced technology, organizations can significantly enhance their debt recovery efforts while preserving strong client relationships. The EQ Suite not only simplifies the management of overdue accounts but also empowers businesses to adopt a more data-driven approach to collections.

Various tools and strategies have been explored, including:

- Customizable email templates from ChaserHQ

- Adaptable samples from eTactics

- Specialized formats from Monograph

Each resource is tailored to address unique challenges in overdue payment management, ensuring effective communication with clients. The emphasis on clarity, urgency, and professionalism in these templates is vital for fostering timely payments and minimizing overdue accounts.

As the financial services landscape evolves, leveraging comprehensive solutions becomes essential for maintaining operational efficiency and compliance. Organizations are encouraged to embrace these modern tools and strategies to enhance their collection processes and strengthen client relationships. By prioritizing effective communication and adopting innovative technologies, businesses can navigate the complexities of overdue payment management with confidence and success.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a comprehensive framework designed for managing overdue accounts, featuring innovative tools that enhance recovery efficiency, including custom scoring models and improved borrower communication.

How does the EQ Engine work?

The EQ Engine utilizes custom scoring models to accurately predict repayment behaviors, allowing lenders to tailor their strategies effectively.

What features does EQ Engage offer?

EQ Engage enhances borrower communication by utilizing preferred channels to keep clients informed and engaged throughout the repayment process.

What functionalities does EQ Collect provide?

EQ Collect simplifies digital asset management with self-service repayment options, a no-code file-mapping tool, and automated workflows, which help reduce vendor onboarding timelines and minimize execution errors.

How does the EQ Suite improve operational efficiency?

By streamlining the collection process, bolstering compliance, and providing professional email templates for overdue payment reminders, the EQ Suite enhances operational efficiency critical for competitive performance.

What are the benefits of using ChaserHQ in conjunction with Equabli's EQ system?

ChaserHQ offers tailored email templates for overdue payment reminders that can be customized to match a business's tone, enhancing communication and minimizing overdue payments while integrating seamlessly with the EQ system for improved debt retrieval.

What are the key features of Equabli's email templates for overdue payment reminders?

The email templates are professional, customizable, emphasize clarity and urgency, and are designed to maintain effective communication with clients to enhance recovery efforts.

What challenges do financial institutions face regarding debt recovery?

Many financial institutions struggle with manual debt recovery processes, leading to inefficiencies and lost opportunities, which can be addressed by modernizing their practices with Equabli's EQ system.

What are some features included in Equabli's EQ system?

The EQ system includes customizable repayment options, compliance management, and tools that streamline operations while boosting borrower engagement for improved recovery rates.