Overview

The three foremost automation solutions for achieving success in enterprise debt collection are:

- AI-driven analytics

- Multi-channel communication capabilities

- Compliance management functionalities

These elements collectively enhance operational efficiency and improve recovery rates. Organizations that implement these automation tools, such as EQ Collect, have been reported to significantly reduce operational costs and enhance collection outcomes, with some indicating recovery rate improvements of up to 80%. This underscores the critical role that technology plays in modern debt collection practices, highlighting the necessity for enterprises to adopt such solutions to remain competitive and compliant.

Introduction

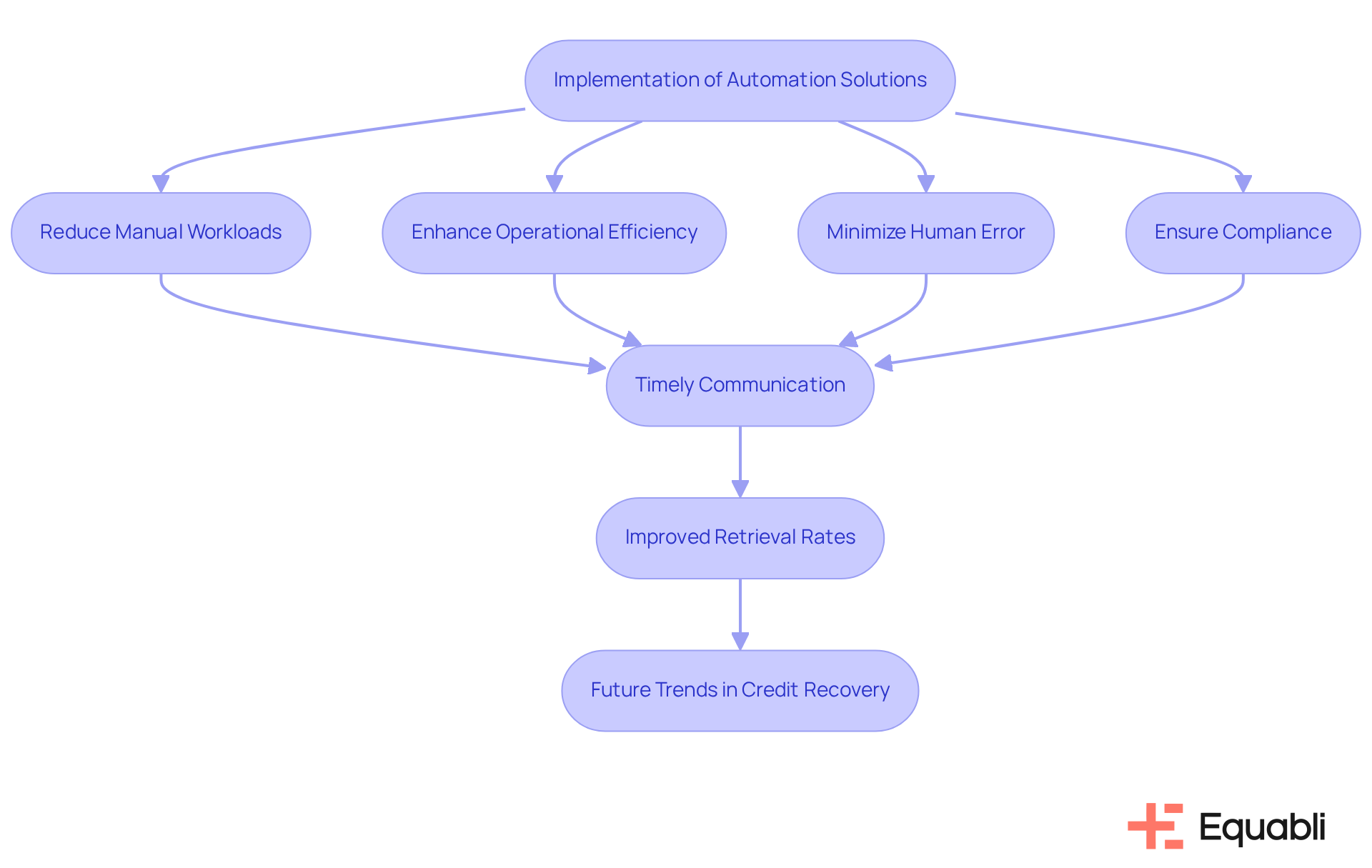

The landscape of debt collection is undergoing a significant transformation, propelled by the integration of automation technologies that are set to redefine how enterprises recover overdue payments. As organizations focus on enhancing operational efficiency and compliance, the capacity to automate routine tasks has become a pivotal factor, markedly reducing manual workloads and diminishing human error.

However, with a plethora of automation solutions on the market, how can businesses effectively select tools that not only streamline their processes but also enhance engagement and recovery rates?

An exploration of the most effective automation solutions for enterprise debt collection provides critical insights into optimizing recovery efforts and achieving sustainable success in an increasingly competitive landscape.

Understand the Role of Automation in Debt Collection

The implementation of automation solutions for enterprise debt collection processes serves as a pivotal mechanism to enhance the recovery of overdue payments through technology. By utilizing automation solutions for enterprise debt collection processes, organizations can significantly reduce manual workloads and bolster operational efficiency through automating routine tasks such as sending reminders, processing payments, and managing communications. This transition minimizes the risk of human error and ensures consistent compliance with regulations, as automated systems enforce rules accurately and uniformly.

Moreover, mechanization fosters borrower engagement by facilitating timely and relevant communication through preferred channels, which is essential in today’s digital-first environment. Organizations that have implemented automation solutions for enterprise debt collection processes report significant improvements in retrieval rates, with reductions in Days Sales Outstanding (DSO) ranging from 10% to 20%. For example, debt collection agencies utilizing AI-driven analytics and robotic tools have achieved recovery rate enhancements of up to 80% compared to traditional methods.

Industry leaders emphasize that integrating automation solutions for enterprise debt collection processes has become vital for maintaining competitiveness. As one specialist noted, "Agencies that adopt mechanization and data-focused strategies are establishing a new industry standard — one that emphasizes efficiency, empathy, and transparency." This perspective reflects a broader trend in the credit recovery sector, where the focus is shifting from confrontation to collaboration, propelled by technological advancements.

Looking ahead to 2025, the impact of mechanization on credit recovery efficiency is expected to become even more pronounced, as organizations increasingly rely on predictive analytics to prioritize accounts and tailor communication strategies. The ongoing evolution of the credit collection landscape underscores the necessity for financial institutions to embrace these innovative solutions to enhance their operational capabilities and improve overall recovery outcomes.

Select and Integrate the Right Automation Tools

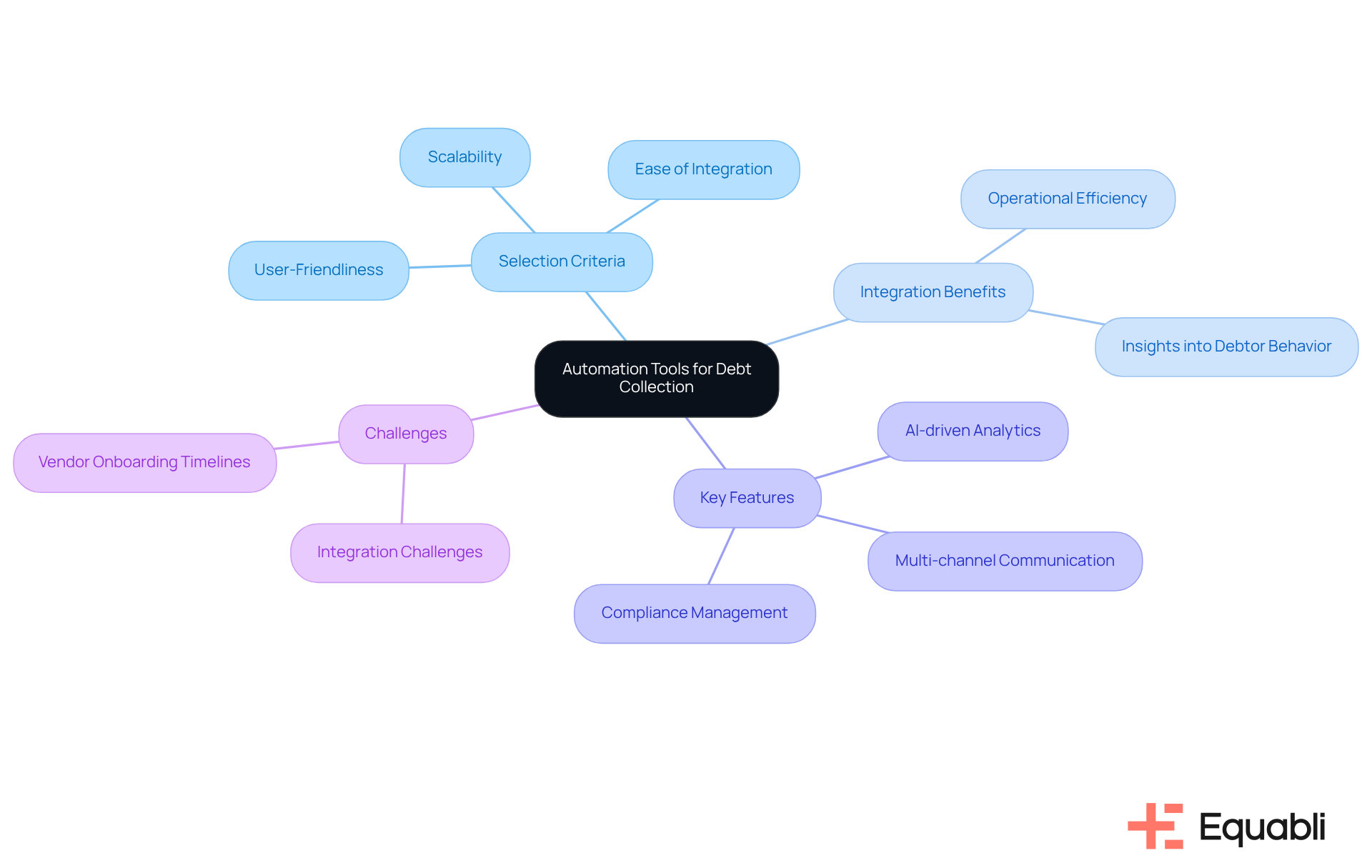

When selecting automation solutions for enterprise debt collection processes, companies must prioritize scalability, ease of integration, and user-friendliness. For instance, the EQ Collect from Equabli offers customizable options tailored to specific business needs, including a straightforward, no-code file-mapping tool that significantly reduces vendor onboarding timelines. Seamless integration with existing systems, such as Customer Relationship Management (CRM) software and payment processors, is essential for maximizing the effectiveness of these tools. Key features to evaluate include:

- AI-driven analytics

- Multi-channel communication capabilities

- Compliance management functionalities

All of which are enhanced by EQ Collect's automated workflows and real-time reporting.

Mechanization can reduce operational expenses by as much as 30% in debt recovery processes, making it an attractive choice for enterprises. Successful integration examples, such as Kolleno's ability to assist clients in reducing overdue balances by 71% within the first 3 to 6 months, highlight the potential advantages of utilizing these advanced tools. Organizations should also be cognizant of potential integration challenges and seek expert insights to navigate these hurdles effectively. A well-integrated automation solution for enterprise debt collection processes not only enhances operational efficiency but also provides valuable insights into debtor behavior, enabling more effective collection strategies.

Furthermore, with 89% of consumers preferring communication via text messaging, the integration of multi-channel communication features is crucial for improving engagement and response rates. By leveraging EQ Collect, organizations can ensure smarter orchestration, enhanced performance, and integrated operations.

Evaluate and Optimize Automated Debt Collection Processes

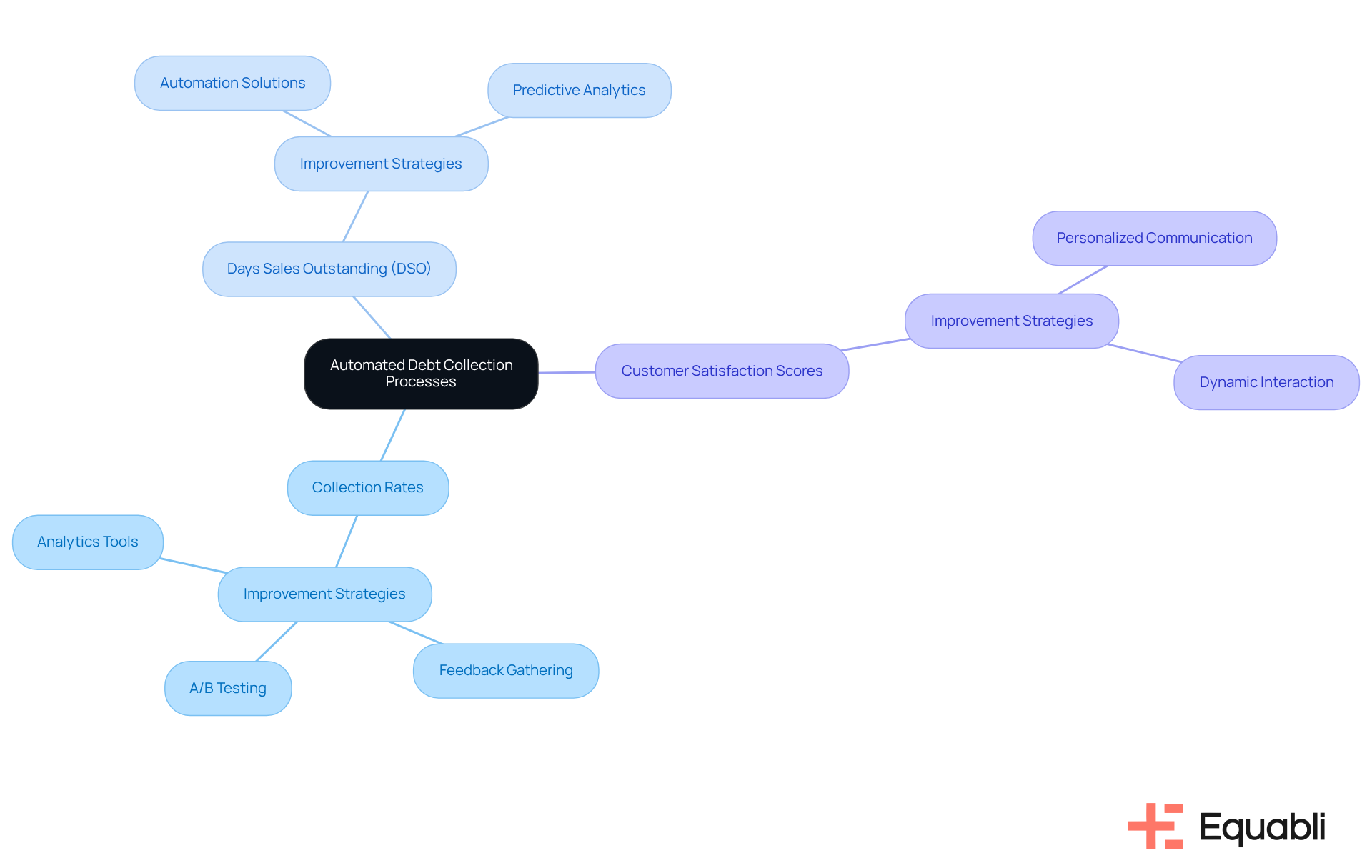

To effectively evaluate and enhance automation solutions for enterprise debt collection processes, organizations must regularly assess key performance indicators (KPIs) such as:

- Collection rates

- Days sales outstanding (DSO)

- Customer satisfaction scores

Analytics tools are instrumental in identifying areas for improvement, including the frequency of communication and the effectiveness of various channels. Gathering feedback from both staff and customers is essential to assess the impact of automation on their experiences.

Utilizing A/B testing for different communication strategies can reveal which methods yield the highest engagement and restoration rates. Statistics indicate that financial institutions that utilize automation solutions for enterprise debt collection processes have observed recovery rates increase by up to 30%. Continuous enhancement of these processes ensures they remain efficient and adaptable to the ever-evolving landscape of financial recovery.

Organizations should define measurable KPIs to track performance improvements, such as:

- Reducing compliance violations

- Increasing liquidation rates

By aligning automation strategies with these objectives, businesses can strengthen their overall debt recovery efforts and utilize automation solutions for enterprise debt collection processes to achieve sustainable growth.

Conclusion

The transformative power of automation in enterprise debt collection is undeniable. By leveraging advanced technologies, organizations can significantly improve their recovery rates, streamline operations, and enhance borrower engagement. The integration of automation solutions not only reduces manual workloads but also minimizes errors and ensures compliance, ultimately leading to a more efficient and effective debt collection process.

Key insights throughout the article underscore the importance of selecting the right automation tools, such as those that offer scalability, multi-channel communication, and AI-driven analytics. Successful case studies illustrate how businesses have achieved remarkable results, including substantial reductions in overdue balances and operational costs. Furthermore, continuous evaluation of automated processes through performance metrics enables organizations to adapt and optimize their strategies in line with evolving market demands.

Embracing automation in debt collection is not merely a trend; it is a strategic necessity for organizations aiming to thrive in a competitive landscape. As the industry progresses toward 2025 and beyond, the emphasis on efficiency, empathy, and transparency will only grow stronger. Organizations are encouraged to take proactive steps in selecting and implementing the right automation solutions to enhance their debt recovery efforts and achieve sustainable growth.

Frequently Asked Questions

What is the role of automation in debt collection?

Automation in debt collection enhances the recovery of overdue payments by reducing manual workloads and improving operational efficiency through the automation of routine tasks such as sending reminders, processing payments, and managing communications.

How does automation affect operational efficiency in debt collection?

Automation minimizes the risk of human error and ensures consistent compliance with regulations, as automated systems enforce rules accurately and uniformly, leading to improved operational efficiency.

What are the benefits of using automation for borrower engagement?

Automation facilitates timely and relevant communication through preferred channels, which enhances borrower engagement and is essential in today’s digital-first environment.

What improvements have organizations reported after implementing automation in debt collection?

Organizations have reported significant improvements in retrieval rates, with reductions in Days Sales Outstanding (DSO) ranging from 10% to 20%, and some debt collection agencies have achieved recovery rate enhancements of up to 80% compared to traditional methods.

Why is integrating automation solutions becoming vital for competitiveness in debt collection?

Industry leaders emphasize that adopting mechanization and data-focused strategies establishes a new industry standard that emphasizes efficiency, empathy, and transparency, which are crucial for maintaining competitiveness.

What is the expected future impact of automation on credit recovery efficiency by 2025?

By 2025, the impact of mechanization on credit recovery efficiency is expected to become more pronounced as organizations increasingly rely on predictive analytics to prioritize accounts and tailor communication strategies.

What broader trend is reflected in the credit recovery sector due to technological advancements?

The focus in the credit recovery sector is shifting from confrontation to collaboration, driven by technological advancements and the adoption of innovative solutions.