Overview

The article outlines four automated email strategies for payment reminders that significantly enhance debt recovery efforts. By tailoring communication, optimizing timing, crafting clear messages, and leveraging automation, these strategies are designed to improve financial outcomes. Evidence from case studies supports these approaches, demonstrating substantial increases in response rates and timely payments. This highlights the effectiveness of a data-driven and customer-centric methodology in enterprise-level debt collection, providing actionable insights for executives, lenders, and debt buyers.

Introduction

In the complex landscape of debt recovery, ensuring timely payments presents a significant challenge akin to navigating a labyrinth. However, organizations can enhance their approach to payment reminders and improve recovery rates through effective automated email strategies. This article delineates four key strategies that optimize communication while leveraging data-driven insights to create tailored and impactful reminders.

How can businesses achieve the delicate balance between persistence and respect for their clients' time, all while ensuring clarity and engagement in their messaging? The answers reside within these innovative approaches to automated communication.

Identify Your Audience for Tailored Communication

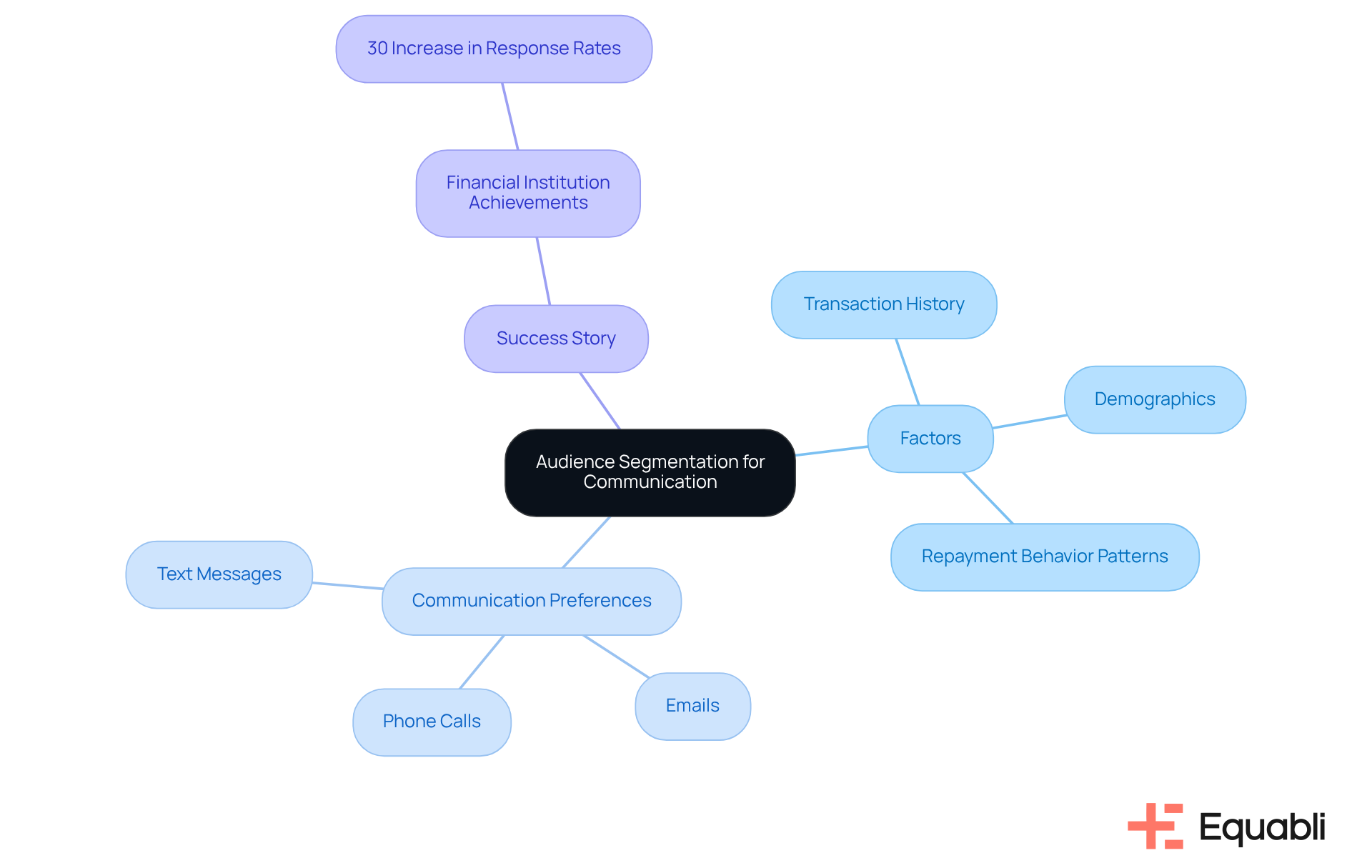

To effectively engage clients, it is essential to segment your audience based on factors such as transaction history, demographics, and communication preferences. Utilizing advanced data analytics tools facilitates the identification of repayment behavior patterns. For example, younger individuals tend to respond more favorably to text messages, whereas older clients may prefer emails or phone calls. By tailoring your communication strategy to meet the specific needs and preferences of each segment, you can significantly enhance engagement and increase the likelihood of timely repayments. Implementing a customer relationship management (CRM) system can streamline this process, allowing for the tracking of preferences and the automation of segmentation, thereby ensuring your messages resonate with the intended audience.

A notable success story involves a financial institution that segmented its audience according to transaction history. By sending customized messages addressing specific issues relevant to each individual's circumstances, the institution achieved a remarkable 30% increase in response rates. This case exemplifies the effectiveness of tailored communication in enhancing debt recovery outcomes.

Optimize Timing and Frequency of Payment Reminders

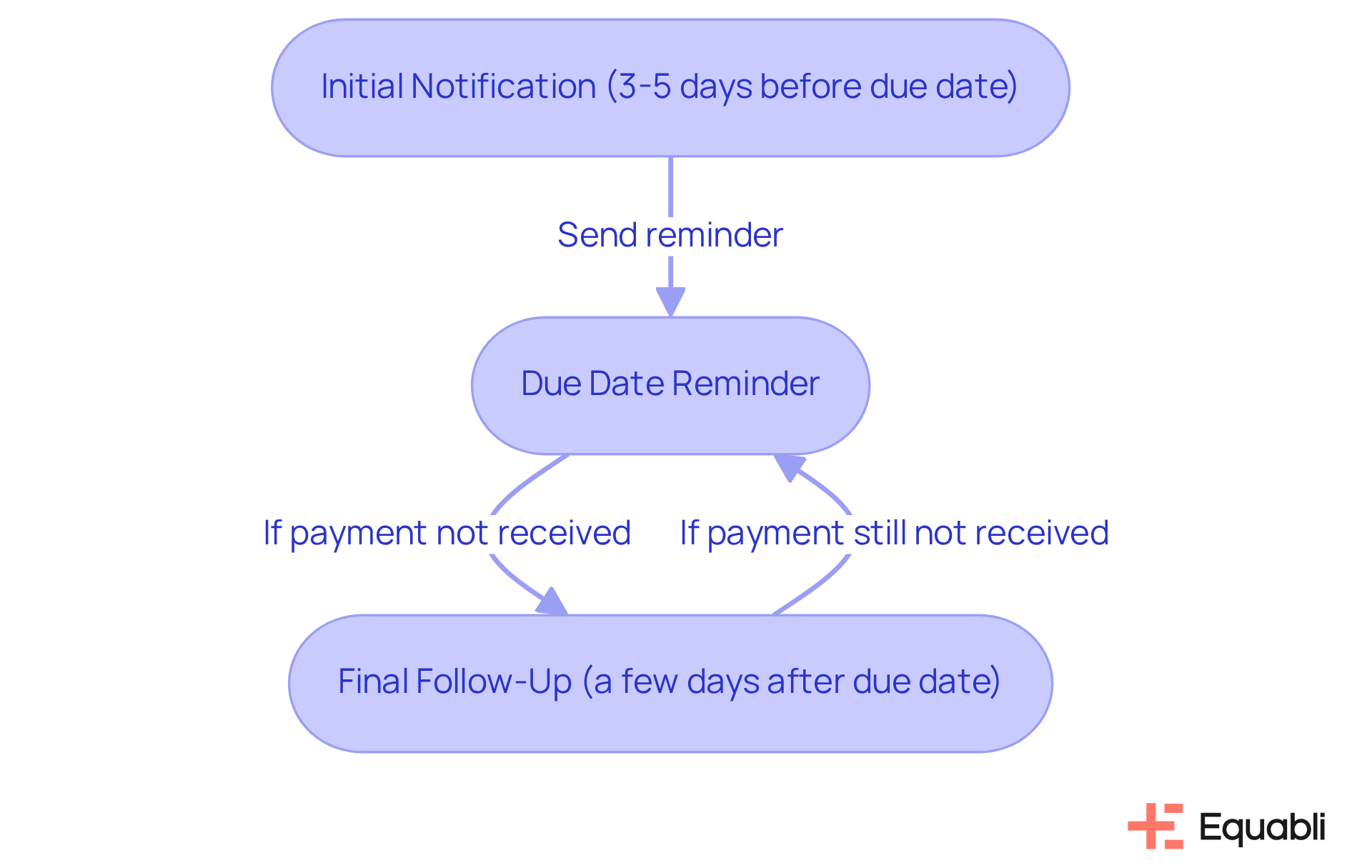

Timing is critical for effective automated email strategies for payment reminders in enterprise debt recovery, particularly within modern debt collection practices. Analyzing engagement data reveals when individuals are most receptive to emails, identifying specific days of the week or times of day. For instance, notifications sent at the beginning of the week often yield better results than those dispatched later, as individuals may be preoccupied with weekend activities. Notably, 55% of invoices in the US are settled post-due date, underscoring the need for effective automated email strategies for payment reminders in enterprise debt recovery that leverage data-driven insights.

Establishing a notification frequency that balances persistence with respect for the individual's time is essential. Best practices suggest utilizing automated email strategies for payment reminders in enterprise debt recovery by:

- Sending an initial notification 3-5 days before the due date

- Following up with a reminder on the due date itself

- Sending a final follow-up a few days after if payment remains outstanding

This structured method ensures consistent communication while avoiding overwhelming the borrower.

A pertinent case study involves a telecom company that optimized its notification schedule based on customer engagement data. By implementing a strategic timing approach, the firm achieved a remarkable 25% increase in timely transactions. This success was attributed to their targeted prompts, tailored to align with peak engagement periods identified through data analysis. Such strategies highlight the significant impact that well-timed notifications, including automated email strategies for payment reminders in enterprise debt recovery, can have on financial behavior, reinforcing the necessity of transitioning to Equabli's EQ Suite for a more intelligent and intuitive collections process.

Craft Clear and Concise Reminder Messages

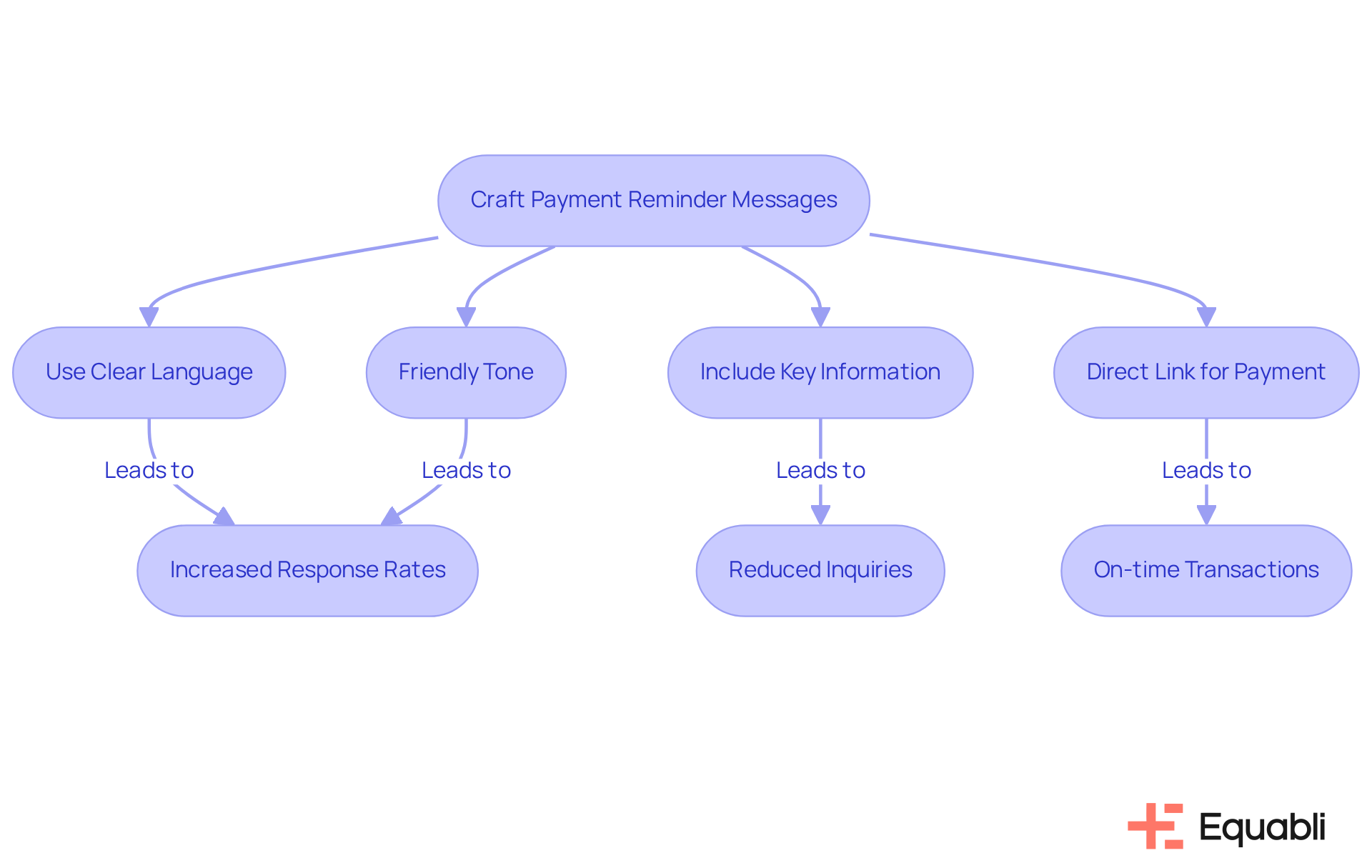

When crafting payment reminder messages, clarity is paramount in the context of automated email strategies for payment reminders in enterprise debt recovery. When implementing automated email strategies for payment reminders in enterprise debt recovery, it is important to utilize straightforward language and avoid jargon that may confuse borrowers. Begin with a clear subject line that conveys the purpose of the message, such as 'Payment Reminder: Due Date Approaching.' In the message, briefly mention the amount owed, the deadline, and include a direct link to complete the transaction.

Additionally, incorporating a friendly tone can foster a positive relationship. For instance, phrases like 'We appreciate your business and want to help you stay on track' can make the communication feel more personal. Personalized automated messages have been shown to increase response rates by 23%, reinforcing the value of a friendly approach. Always include contact information for borrowers who may have questions or need assistance.

A healthcare provider that streamlined its billing notification communications by utilizing straightforward language and direct links experienced a 40% decrease in questions regarding billing procedures. This suggests that clearer messaging resulted in improved comprehension and adherence, illustrating the effectiveness of simplified communication strategies.

Moreover, subject line clarity significantly influences open rates; messages with clear subject lines are more likely to be opened and responded to. In fact, 60% of clients settle their bills promptly when they receive a helpful notification, which underscores the effectiveness of automated email strategies for payment reminders in enterprise debt recovery as a means of enhancing efficient financial communication and ensuring on-time transactions.

To create effective billing notification emails, ensure they contain key information such as the invoice number, due date, and outstanding amount. This method not only assists in clarity but also promotes prompt remittances, ultimately fostering healthier cash flow.

Leverage Automation for Consistent Follow-Ups

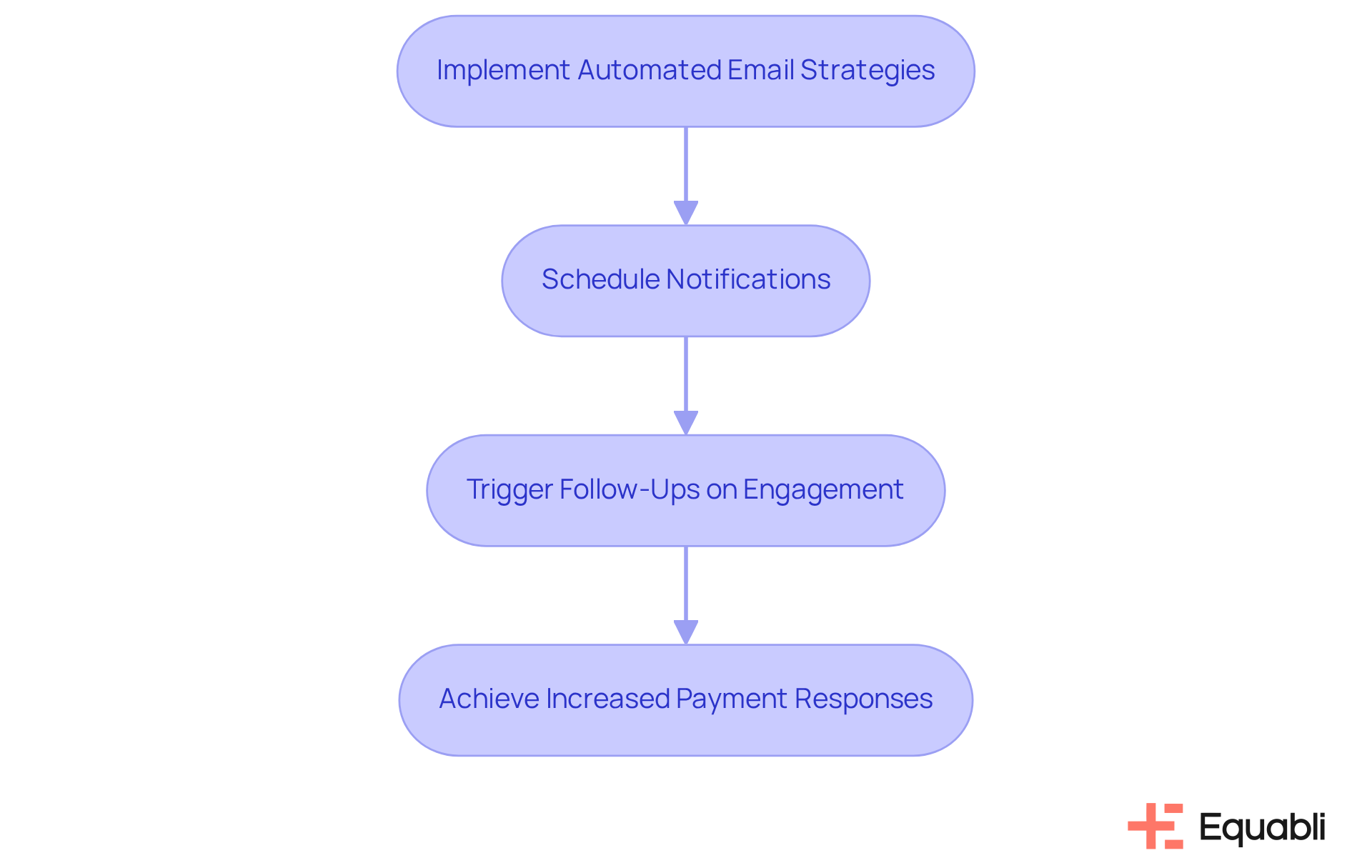

Utilizing automated email strategies for payment reminders in enterprise debt recovery significantly enhances your payment notification strategy, particularly through Equabli's intelligent EQ Suite. By implementing automated email strategies for payment reminders in enterprise debt recovery, organizations can schedule notifications in alignment with established timelines within their communication plan. This ensures that automated email strategies for payment reminders in enterprise debt recovery are dispatched consistently without manual intervention, allowing teams to concentrate on more complex tasks.

Equabli's EQ Collect empowers organizations to utilize automated email strategies for payment reminders in enterprise debt recovery by automating follow-ups based on the behavior of loan applicants. For instance, if an individual opens a reminder email but fails to complete a transaction, an automated follow-up can be triggered to offer additional assistance or information. This responsiveness not only improves engagement with prospective borrowers but also increases the likelihood of repayment.

A compelling case study involves a debt collection agency that implemented automated email strategies for payment reminders in enterprise debt recovery, resulting in a remarkable 50% increase in payment responses. This highlights the efficacy of automated email strategies for payment reminders in enterprise debt recovery, enhancing communication and recovery efforts, and ultimately contributing to improved financial outcomes. Furthermore, organizations utilizing automated email strategies for payment reminders in enterprise debt recovery, such as those employing the EQ Suite, have observed an average 25% reduction in days sales outstanding (DSO) and up to a 30% enhancement in collection efficiency, underscoring the trend of improved recovery rates through automation.

Moreover, it is essential to ensure that automated systems adhere to regulatory standards, as compliance is crucial for sustaining operational integrity. Industry experts emphasize that utilizing automated email strategies for payment reminders in enterprise debt recovery can significantly boost recovery rates, reduce manual workloads, and ensure compliance with regulations. Additionally, leveraging features like the EQ Engine for predictive analytics and EQ Engage for personalized borrower interactions can further refine collection strategies.

Conclusion

Implementing automated email strategies for payment reminders in debt recovery is essential for enhancing communication and improving recovery rates. By understanding the audience, optimizing timing, crafting clear messages, and leveraging automation, organizations can significantly increase engagement and prompt repayments. Tailored communication resonates more with clients and fosters a positive relationship, which is crucial in the debt recovery process.

Key insights from the article highlight the importance of:

- Segmenting the audience based on demographics and transaction history.

- Optimizing the timing and frequency of reminders.

- Ensuring clarity in messaging.

Successful case studies demonstrate that these strategies lead to substantial improvements in response rates and overall financial outcomes. For instance, organizations that adopted a structured approach to notifications experienced notable increases in timely payments, showcasing the effectiveness of data-driven insights.

The significance of these automated email strategies cannot be overstated. As the landscape of debt recovery evolves, embracing technology and personalization will be paramount for success. Organizations are encouraged to explore advanced tools and analytics to refine their communication strategies, ensuring compliance standards are met while enhancing client relationships. By prioritizing these best practices, businesses can foster healthier cash flow and improve their overall recovery rates, ultimately leading to a more sustainable financial future.

Frequently Asked Questions

Why is it important to identify your audience for communication?

Identifying your audience is essential for engaging clients effectively by segmenting them based on factors such as transaction history, demographics, and communication preferences.

What factors should be considered when segmenting an audience?

Factors to consider include transaction history, demographics, and communication preferences.

How can data analytics tools assist in identifying audience segments?

Advanced data analytics tools can help identify repayment behavior patterns, allowing for more tailored communication strategies.

What are some communication preferences of different age groups?

Younger individuals tend to respond better to text messages, while older clients may prefer emails or phone calls.

How can tailoring communication strategies enhance engagement?

By customizing communication to meet the specific needs and preferences of each audience segment, you can significantly improve engagement and increase the likelihood of timely repayments.

What role does a customer relationship management (CRM) system play in audience segmentation?

A CRM system can streamline the process of tracking preferences and automating segmentation, ensuring that messages resonate with the intended audience.

Can you provide an example of successful audience segmentation?

Yes, a financial institution segmented its audience based on transaction history and sent customized messages addressing specific issues, resulting in a 30% increase in response rates.