Overview

The article outlines four effective strategies for finance executives to implement automated invoice payment reminder email systems, which are crucial for maintaining cash flow and minimizing overdue accounts. It underscores the significance of:

- Timing

- Clarity

- Personalization

- Leveraging technology

These strategies not only enhance communication efficiency but also improve collection rates through timely and tailored reminders. By adopting these practices, executives can ensure a more streamlined approach to debt collection, ultimately fostering better financial management and compliance.

Introduction

The financial landscape increasingly relies on technology, making the efficiency of cash flow management more critical than ever. For finance executives, mastering automated invoice payment reminder email strategies presents an invaluable opportunity to enhance operational efficiency and foster positive client relationships.

However, the challenge remains: how can these automated systems be optimized to ensure timely payments without overwhelming customers?

Exploring effective strategies for crafting these reminders can lead to improved collection rates and a healthier bottom line.

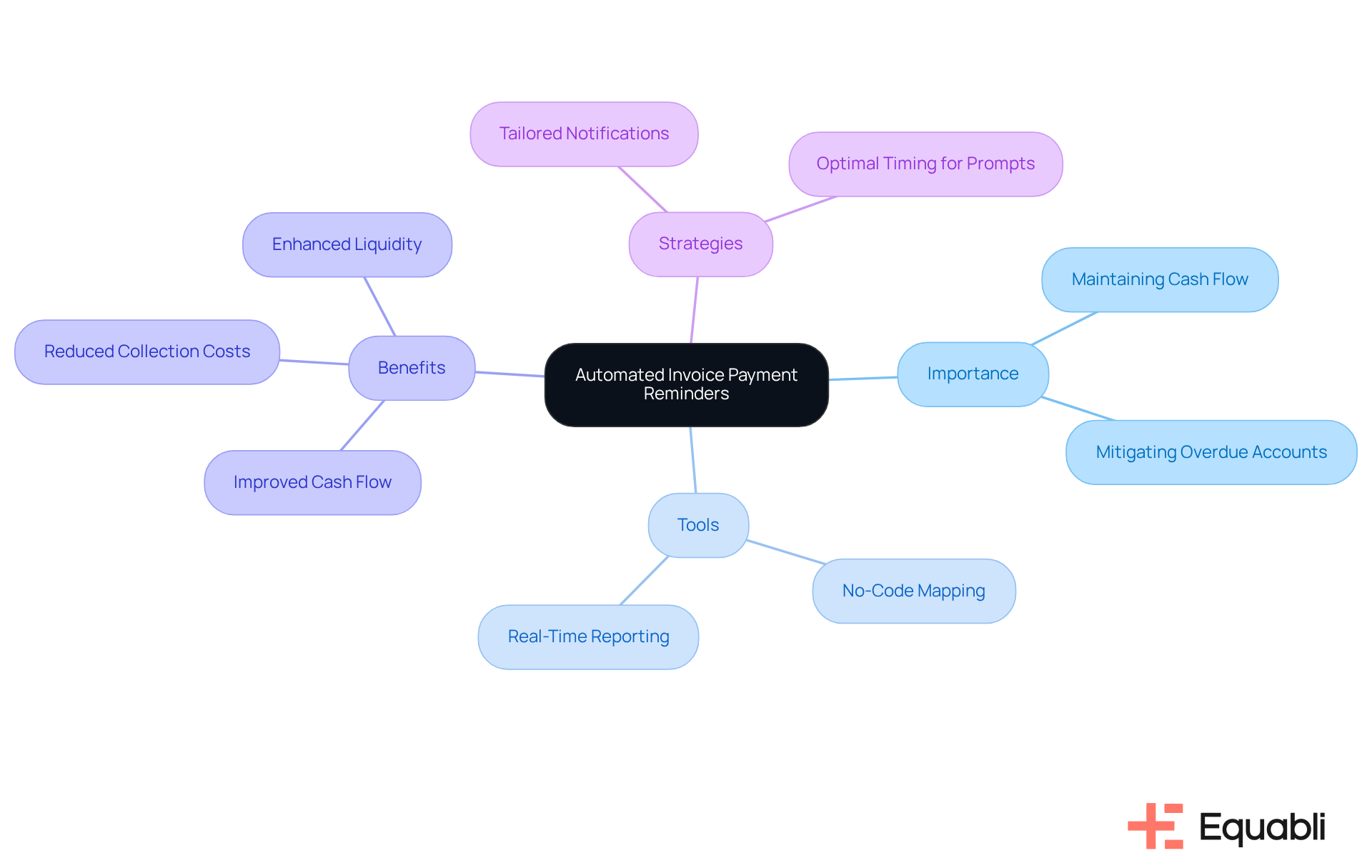

Understand the Importance of Automated Invoice Payment Reminders

The use of automated invoice payment reminder email strategies for corporate finance departments is critical for maintaining robust cash flow and mitigating overdue accounts. They serve as proactive communication tools that align with automated invoice payment reminder email strategies for corporate finance departments, informing customers of upcoming or overdue payments and thereby reducing the likelihood of missed payments.

By leveraging EQ Collect's capabilities, such as the no-code file-mapping tool and real-time reporting, finance executives can utilize automated invoice payment reminder email strategies for corporate finance departments to streamline this process. This ensures consistent messaging that enhances operational efficiency and fosters a positive relationship with customers.

Data-driven strategies and automated workflows through EQ Collect minimize execution errors and manual resource allocation, facilitating smarter orchestration and improved performance. Research indicates that timely notifications can significantly decrease the average days sales outstanding (DSO), leading to enhanced liquidity for organizations.

Furthermore, using automated invoice payment reminder email strategies for corporate finance departments can be tailored for different stages of the billing cycle, ensuring clients receive appropriate prompts at optimal times, which ultimately improves repayment behaviors and reduces collection costs.

Implement Effective Strategies for Payment Reminder Emails

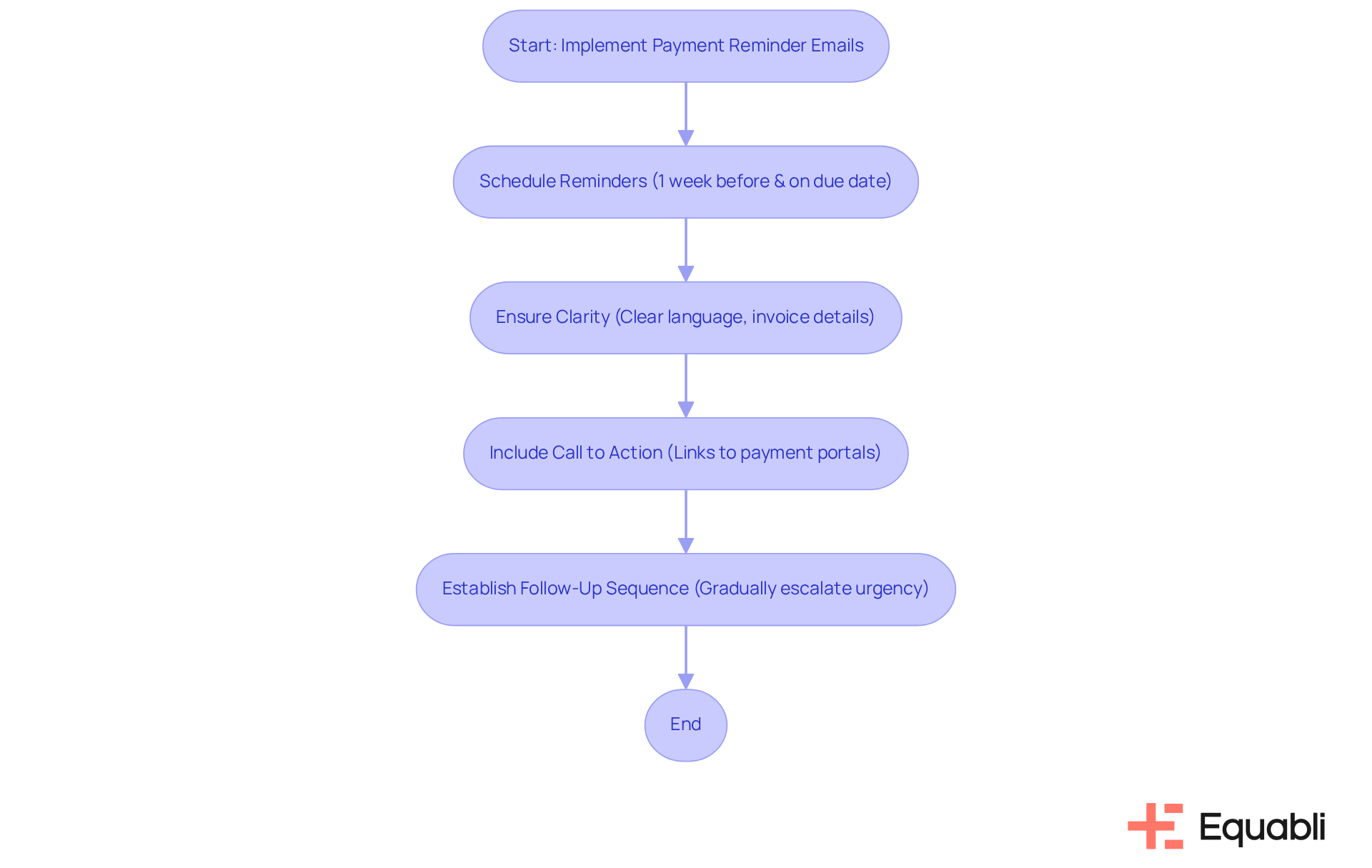

To implement automated invoice payment reminder email strategies for corporate finance departments, finance executives should adopt several best practices.

- First, timing is crucial; reminders should be scheduled strategically, such as one week before the due date and again on the due date. This approach ensures that customers are aware of their obligations without feeling overwhelmed.

- Second, clarity is essential. Use clear and concise language in both the subject line and body of the message, including vital details such as the invoice number, amount due, and due date.

- Third, a compelling call to action should be included, urging customers to complete transactions directly through the email. This may involve links to payment portals or instructions for alternative payment methods.

- Finally, it is important to establish a follow-up sequence for individuals who do not respond to initial prompts, gradually escalating the urgency of the communication.

By employing automated invoice payment reminder email strategies for corporate finance departments, finance leaders can enhance the efficiency of their follow-up messages, ultimately leading to improved collection rates.

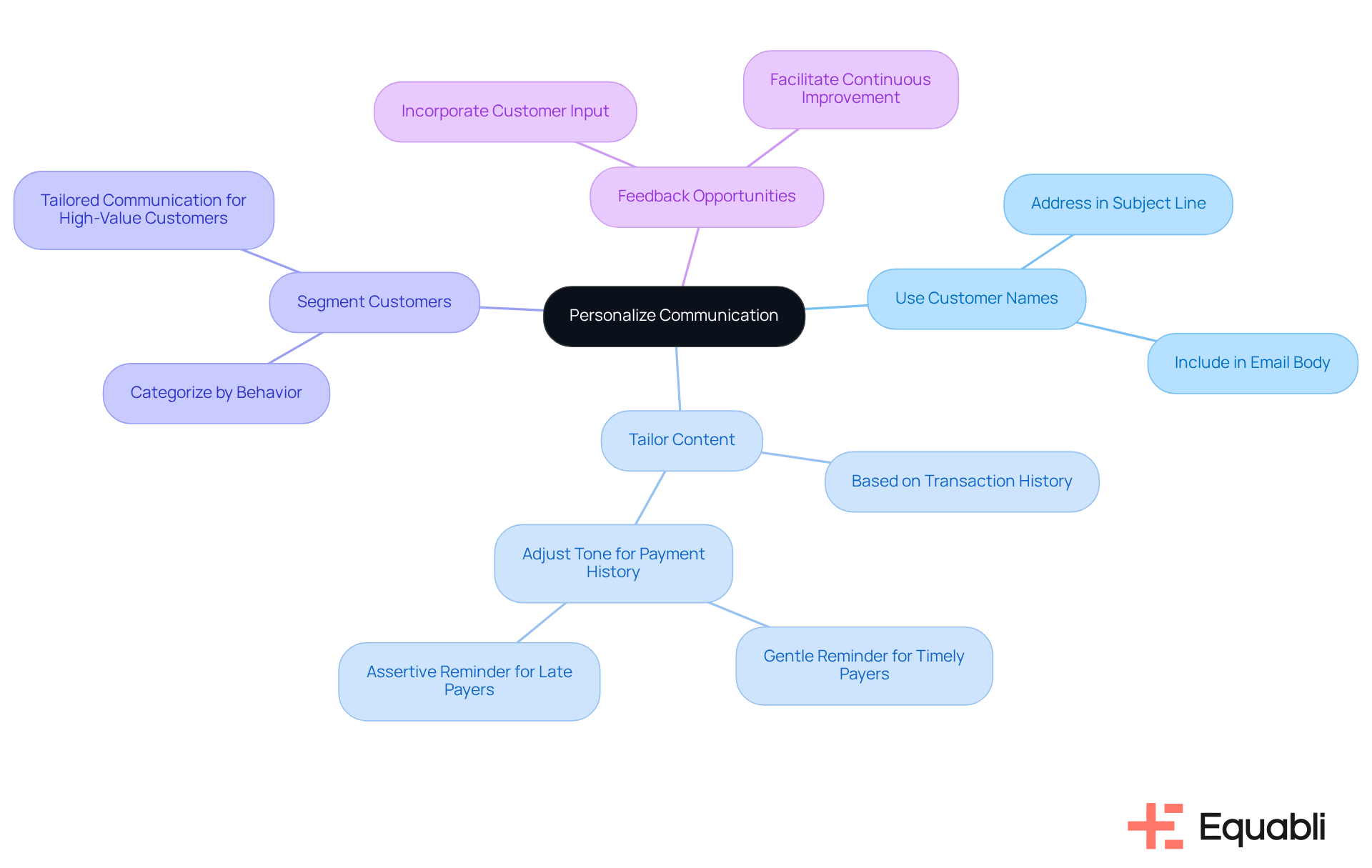

Personalize Communication to Enhance Client Engagement

Customizing reminder messages can significantly enhance customer engagement and response rates. Finance executives should consider the following approaches:

- Use Customer Names: Address individuals by their names in both the subject line and body of the email to create a more personal touch.

- Tailor Content: Personalize the material according to the customer's transaction history and preferences. For instance, if a customer typically settles invoices punctually, a gentle reminder may suffice; conversely, a customer with a history of delayed payments may require a more assertive approach.

- Segment Customers: Categorize customers based on their behaviors and customize notifications accordingly. High-value customers, for example, may warrant more tailored communication than lower-value accounts.

- Feedback Opportunities: Incorporate options for customers to provide input on the notification process, facilitating continuous improvement.

By implementing automated invoice payment reminder email strategies for corporate finance departments, finance leaders can foster stronger relationships with clients, ultimately resulting in improved financial behaviors.

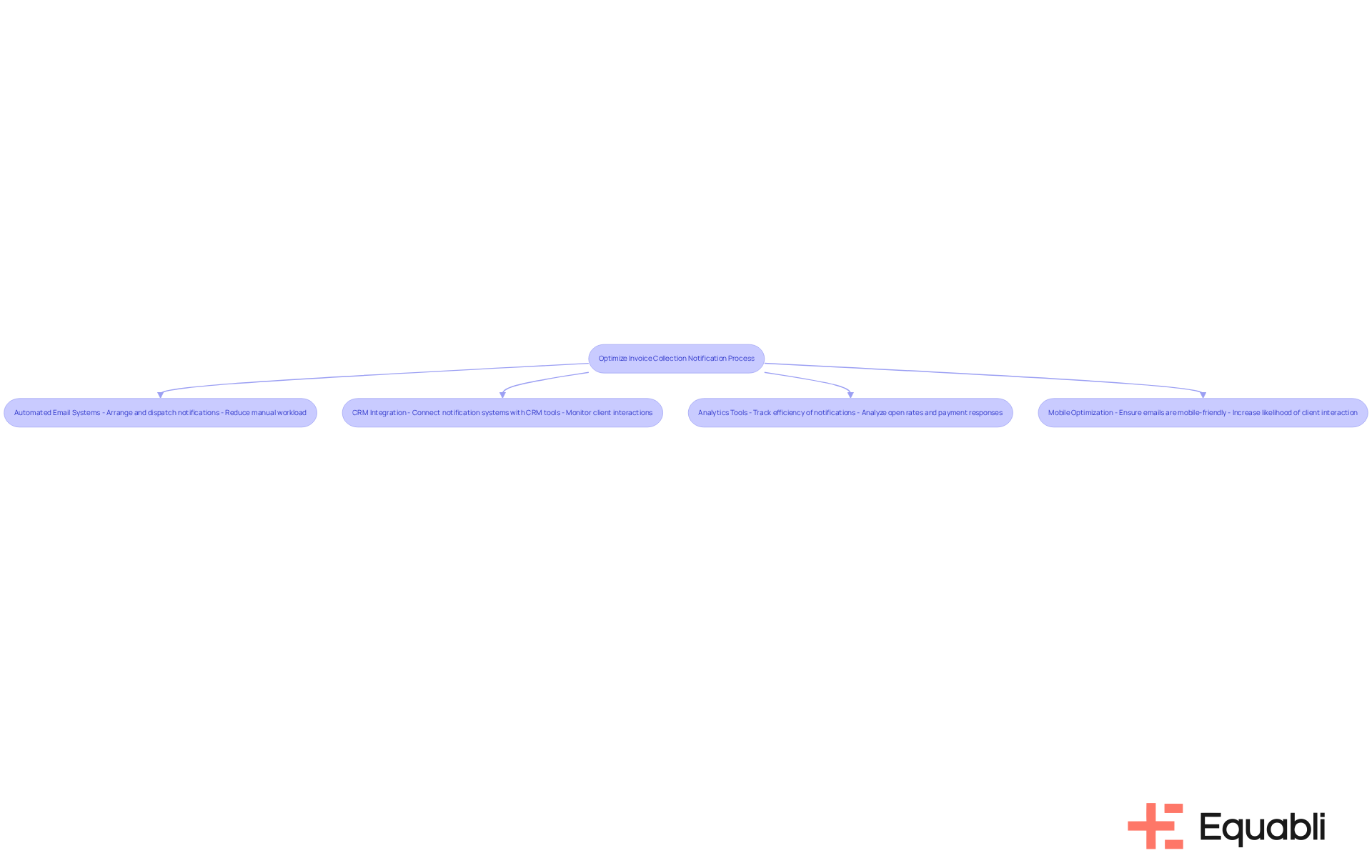

Leverage Technology for Streamlined Reminder Processes

To optimize the invoice collection notification process, finance executives must implement automated invoice payment reminder email strategies for corporate finance departments effectively. Automated Email Systems are essential; implementing automated invoice payment reminder email strategies for corporate finance departments can arrange and dispatch notifications based on established criteria, such as due dates and transaction history. This approach not only reduces manual workload but also ensures timely communication, aligning with EQ Collect's automated workflows that minimize execution errors.

-

CRM Integration further enhances this process by connecting notification systems with Customer Relationship Management (CRM) tools. This integration allows for the monitoring of client interactions and financial behaviors, guiding tailored and effective notification strategies that enhance the efficiency of collections, as evidenced by EQ Collect's data-driven methods.

-

Analytics Tools should also be utilized to track the efficiency of notification messages. By analyzing open rates, click-through rates, and payment responses, finance executives can make informed modifications. With EQ Collect's real-time reporting, unparalleled clarity and insights into notification processes are attainable.

-

Finally, Mobile Optimization is crucial; ensuring that notification emails are mobile-friendly significantly increases the likelihood of client interaction, as many users access their emails via mobile devices.

By strategically leveraging these technologies, finance executives can enhance their reminder processes and improve collections using automated invoice payment reminder email strategies for corporate finance departments.

Conclusion

Automated invoice payment reminder email strategies are crucial for finance executives seeking to optimize cash flow management and mitigate overdue accounts. Implementing these automated systems facilitates timely communication with clients, thereby enhancing the efficiency of the billing process and ultimately improving repayment behaviors.

Key strategies discussed throughout the article include the significance of timing, clarity, and personalization in reminder emails. By strategically scheduling reminders, utilizing clear language, and customizing messages to reflect individual customer behaviors, finance leaders can substantially boost engagement and response rates. Furthermore, leveraging technology—such as CRM integration and analytics tools—enables a more streamlined and data-driven approach to managing invoice collections.

Incorporating these automated invoice payment reminder strategies not only enhances operational efficiency but also fortifies client relationships. By adopting these practices, finance executives can foster a more proactive approach to collections, leading to improved liquidity and financial stability. The importance of these strategies is paramount; they represent a vital step toward optimizing cash flow and securing the long-term success of corporate finance departments.

Frequently Asked Questions

Why are automated invoice payment reminders important for corporate finance departments?

Automated invoice payment reminders are critical for maintaining robust cash flow and mitigating overdue accounts by proactively informing customers of upcoming or overdue payments, thereby reducing the likelihood of missed payments.

How can EQ Collect enhance the use of automated invoice payment reminders?

EQ Collect provides capabilities such as a no-code file-mapping tool and real-time reporting, allowing finance executives to streamline the automated invoice payment reminder process, ensuring consistent messaging and enhancing operational efficiency.

What benefits do data-driven strategies and automated workflows provide in invoice management?

Data-driven strategies and automated workflows minimize execution errors and manual resource allocation, facilitating smarter orchestration and improved performance in invoice management.

How do timely notifications impact days sales outstanding (DSO)?

Research indicates that timely notifications can significantly decrease the average days sales outstanding (DSO), leading to enhanced liquidity for organizations.

Can automated invoice payment reminders be customized for different billing stages?

Yes, automated invoice payment reminders can be tailored for different stages of the billing cycle, ensuring clients receive appropriate prompts at optimal times, which improves repayment behaviors and reduces collection costs.