Overview

The article presents best practices in accounts receivable management (ARM) that are critical for mitigating financial risks faced by businesses. Establishing clear credit policies is essential; evidence suggests that organizations with defined credit guidelines experience fewer late payments.

Automating invoicing processes further enhances efficiency, as demonstrated by case studies showing reduced administrative costs and improved cash flow.

Leveraging technology, including data analytics and cloud-based solutions, not only minimizes the likelihood of late payments but also strengthens overall financial health.

These strategies collectively ensure a robust cash flow, positioning enterprises for sustained success.

Introduction

Effective accounts receivable management is not merely a financial necessity; it stands as a strategic imperative capable of significantly influencing a business's overall risk profile. By mastering the art of efficient payment collection and proactively managing credit risk, organizations can safeguard their cash flow and enhance financial stability. Data indicates that companies with robust accounts receivable practices report lower default rates and improved liquidity. However, many businesses encounter challenges in implementing best practices that not only streamline processes but also mitigate potential risks. This raises the question: what essential strategies can transform accounts receivable management into a robust shield against financial pitfalls?

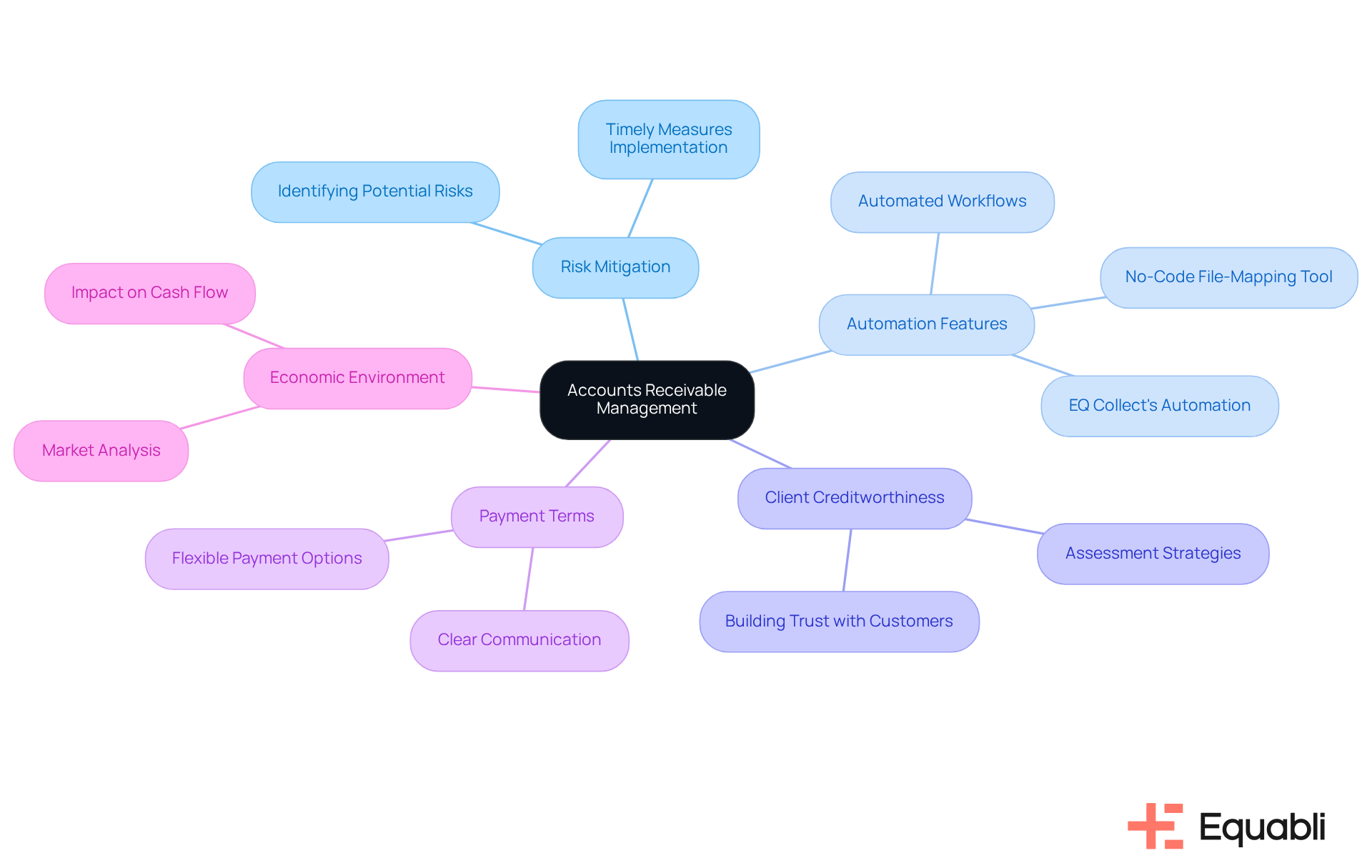

Understand Accounts Receivable Management and Its Role in Risk Mitigation

Accounts receivable management (ARM) is essential for businesses to efficiently collect payments owed by customers. Effective accounts receivable management financial solutions for enterprise risk mitigation are critical for maintaining healthy cash flow and minimizing financial risk.

By leveraging EQ Collect's automation features, including a no-code file-mapping tool and automated workflows, financial institutions can significantly reduce vendor onboarding timelines and enhance efficiency in receivables through data-driven strategies. This proactive approach enables organizations to identify potential risks early and implement timely measures, ensuring that their accounts receivable management financial solutions for enterprise risk mitigation are efficient and compliant with industry standards.

Recognizing the significance of client creditworthiness, payment terms, and the overall economic environment is crucial. A well-structured accounts receivable management financial solutions for enterprise risk mitigation strategy, enhanced by EQ Collect's intelligent automation and real-time reporting, safeguards against defaults while fostering clear communication and trust with customers.

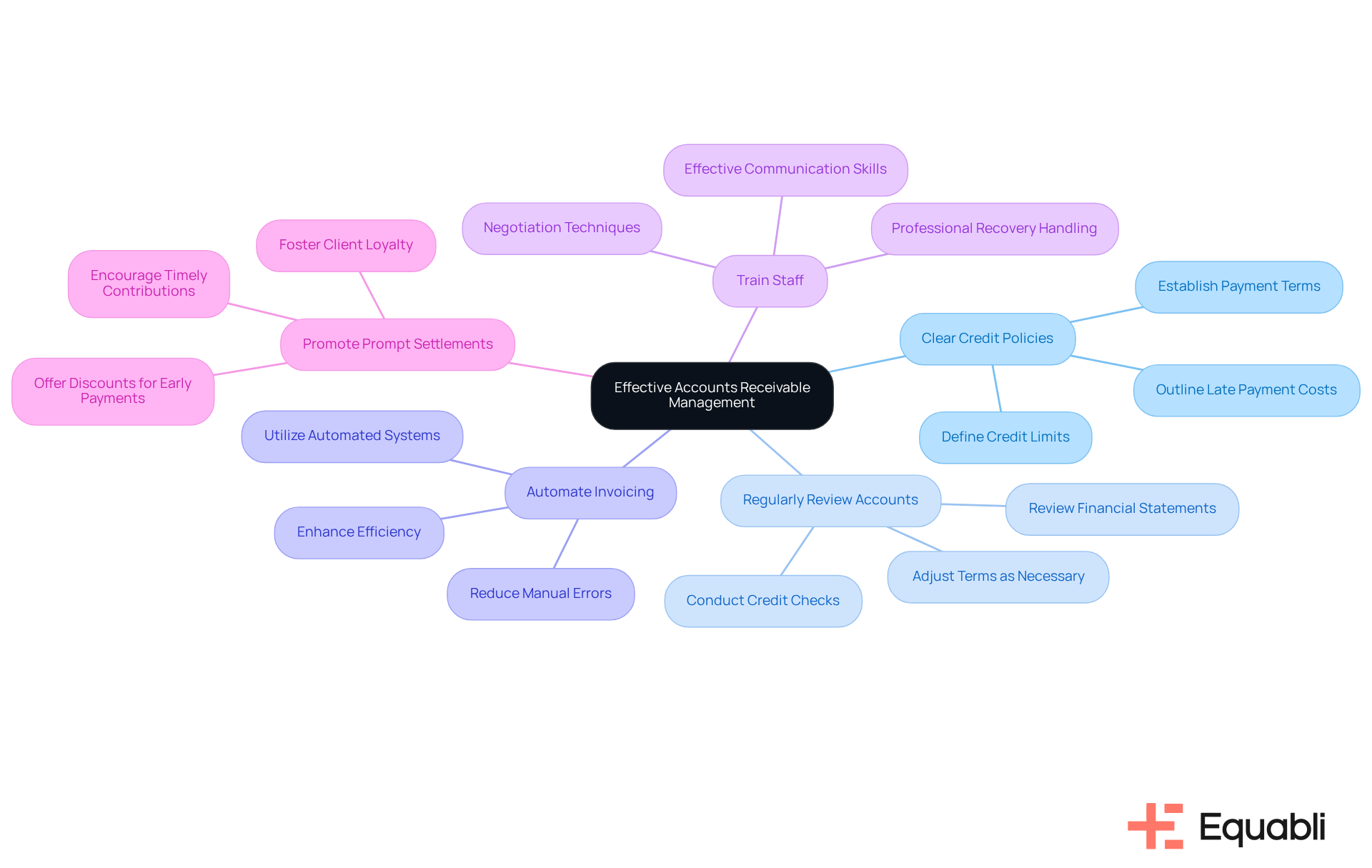

Implement Best Practices for Effective Accounts Receivable Management

To optimize accounts receivable management, organizations should adopt several best practices:

-

Establish Clear Credit Policies: Defining credit limits and terms is essential for minimizing risk exposure. A well-structured credit policy clarifies expectations and protects cash flow by ensuring that all credit-related processes are transparent and consistent. This includes guidelines on credit limits, payment terms, and late payment costs tailored to the specific needs of the business. The implementation of clear credit policies can significantly reduce the risk of late payments, thereby enhancing overall financial stability.

-

Regularly Review Accounts: Conducting periodic assessments of client creditworthiness is crucial. This involves running credit checks and reviewing financial statements to adjust terms as necessary, thereby reducing the likelihood of late or non-payments. By accurately assessing creditworthiness, businesses can make informed decisions about extending credit, which is vital for minimizing bad debt risk. This proactive approach not only safeguards cash flow but also strengthens client relationships through informed engagement.

-

Automate Invoicing and Follow-ups: Utilizing automated systems for invoicing and reminders ensures timely communication and reduces manual errors. Equabli's EQ Collect offers a no-code file-mapping tool that simplifies vendor onboarding and enhances efficiency through automated workflows. This streamlining enables organizations to concentrate on strategic decision-making instead of administrative tasks, ultimately enhancing performance in collections. The user-friendly, scalable, cloud-native interface further enhances the experience, facilitating adaptability and operational excellence.

-

Train Staff on Retrieval Techniques: Equipping your team with the skills to handle recoveries professionally and empathetically fosters positive customer interactions. Training in effective communication and negotiation techniques can significantly enhance collection outcomes. By investing in staff development, organizations can improve recovery rates and maintain strong customer relationships, which is essential in a competitive landscape.

-

Promote Prompt Settlements: Providing discounts or incentives for early settlements can enhance cash flow and decrease outstanding receivables. This proactive strategy not only encourages customers to settle their dues punctually but also enhances connections by showing gratitude for timely contributions. The implementation of such incentives can lead to improved cash flow management and foster loyalty among clients.

Incorporating these best practices, alongside the intelligent automation and real-time insights provided by Equabli's accounts receivable management financial solutions for enterprise risk mitigation, can lead to improved cash flow and reduced risk of bad debt. Case studies demonstrate that well-defined credit management policies help businesses maintain financial stability, underscoring the importance of strategic debt collection practices.

Leverage Technology for Enhanced Efficiency in Accounts Receivable Processes

Incorporating technology into accounts receivable management financial solutions for enterprise risk mitigation yields substantial improvements in efficiency and accuracy. Organizations should consider several strategic initiatives:

-

Cloud-Based Solutions: Implementing cloud-based accounts receivable software facilitates real-time tracking of invoices and payments, enhancing visibility and control over cash flow. This strategy not only streamlines processes but also reduces operational costs associated with manual tasks. Notably, cloud-based AR automation can unlock a 50% increase in invoice productivity, underscoring its efficiency gains. With EQ Collect, organizations can further shorten vendor onboarding timelines through a straightforward, no-code file-mapping tool, ensuring smarter orchestration and improved performance while minimizing execution errors.

-

Data Analytics: Employing data analysis tools provides significant insights into client transaction behaviors, enabling organizations to identify patterns that shape retrieval strategies. For instance, businesses leveraging data analytics have reported improvements in net recovery rates by up to 30%, demonstrating the power of informed decision-making. Furthermore, EQ Collect's data-driven approaches can enhance recoveries, amplifying the effect of automation alongside analytics.

-

Client Portals: Offering clients online portals allows convenient access to their accounts, enabling them to view invoices, complete transactions, and communicate directly with the collections team. Automated notifications and transaction confirmations keep clients updated, enhancing satisfaction and reducing the time spent on follow-ups. EQ Collect's user-friendly, scalable interface supports these functionalities, ensuring a seamless experience for both clients and enterprises.

-

Automated Reporting: Utilizing automated reporting tools generates insights on accounts receivable performance, aiding in the identification of areas for improvement. Regular performance monitoring ensures compliance with regulations and assists in recognizing potential issues before they escalate. Moreover, real-time visibility into payment status is crucial for swiftly addressing customer payment issues. With EQ Collect's unmatched clarity and insights, featuring automated monitoring and real-time reporting, organizations can uphold industry-leading compliance oversight both internally and externally.

By adopting these technological advancements, including the intelligent automation and machine learning solutions provided by EQ Collect, companies can significantly enhance their accounts receivable management financial solutions for enterprise risk mitigation, resulting in improved cash flow and operational efficiency.

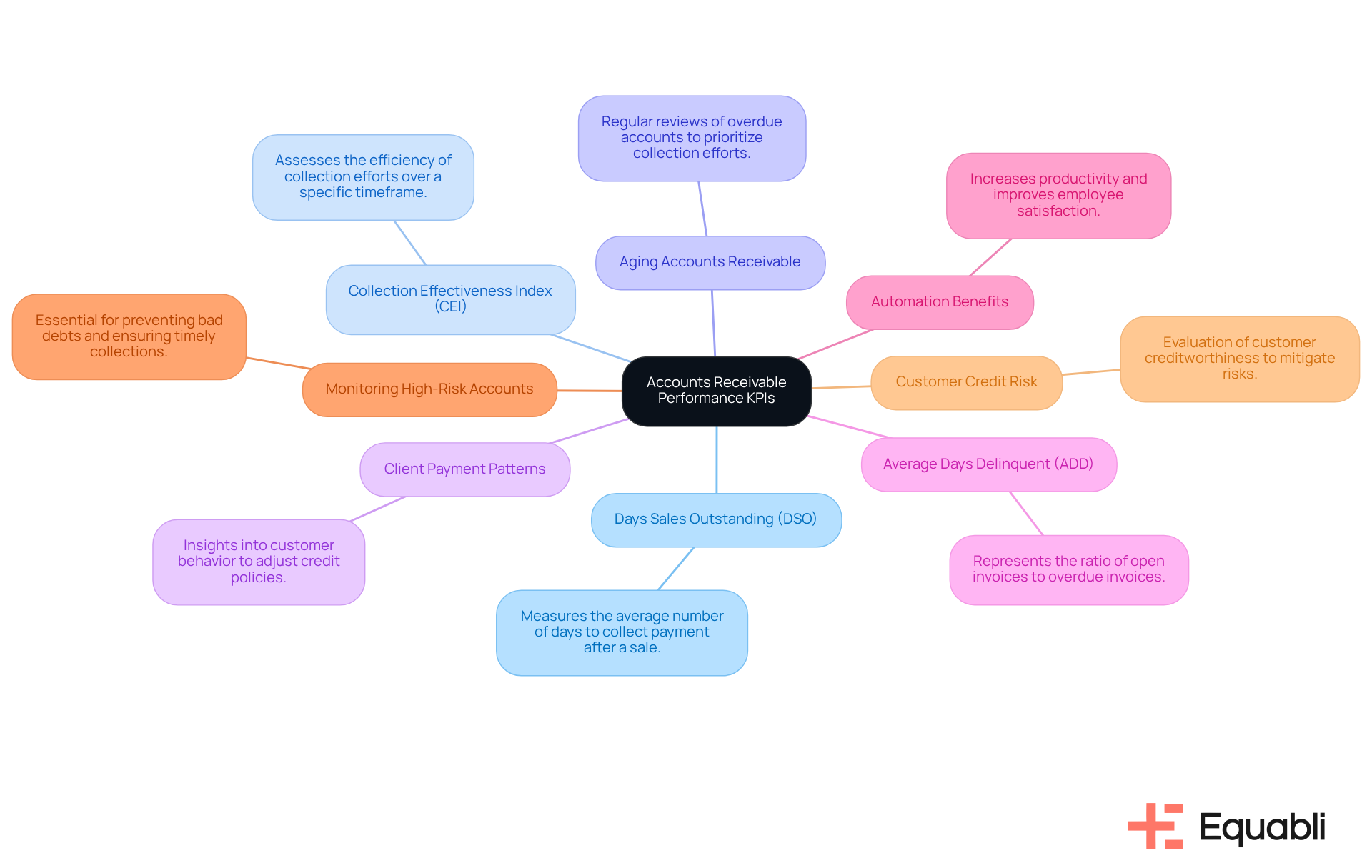

Utilize Key Performance Indicators to Measure and Improve Accounts Receivable Performance

To effectively measure accounts receivable performance, organizations should track several key performance indicators (KPIs).

-

Days Sales Outstanding (DSO) serves as a critical metric, measuring the average number of days required to collect payment post-sale. A lower DSO signifies effective receivables management and enhanced cash flow administration, directly impacting financial health.

-

Collection Effectiveness Index (CEI) assesses the efficiency of retrieval efforts over a defined timeframe. This KPI assists entities in recognizing trends and pinpointing areas for enhancement. A higher CEI indicates improved gathering practices, thereby reinforcing collection strategies.

-

Aging Accounts Receivable requires regular reviews of aging reports to identify overdue accounts. This practice enables organizations to prioritize retrieval efforts based on the age of receivables, ensuring prompt follow-ups on outstanding invoices, which is vital for maintaining cash flow.

-

Client Payment Patterns offer insights into customer behavior, allowing organizations to adjust credit policies and recovery strategies accordingly. Understanding these patterns is crucial for mitigating risks associated with slow-paying customers, enhancing overall operational efficiency.

-

Average Days Delinquent (ADD) is another KPI utilized by numerous firms, representing the ratio of open invoices to overdue invoices. This metric provides further context for evaluating recovery efficiency and informing strategic adjustments.

-

Automation Benefits in accounts receivable processes can significantly increase productivity and improve employee satisfaction, thereby enhancing overall efficiency. Automating repetitive tasks allows teams to focus on strategic initiatives rather than mundane processes.

-

Monitoring High-Risk Accounts is essential for preventing potential bad debts and ensuring timely collections. By identifying and managing high-risk accounts proactively, organizations can safeguard their financial interests.

-

Customer Credit Risk evaluation plays a significant role in influencing DSO and overall accounts receivable performance. A focused assessment of customer creditworthiness is necessary to mitigate risks and enhance collection effectiveness.

By consistently monitoring these KPIs, organizations can make informed decisions that enhance their accounts receivable management financial solutions for enterprise risk mitigation, ultimately reducing the risk of unpaid debts and improving overall financial health.

Conclusion

Effective accounts receivable management serves as a cornerstone for businesses seeking to mitigate financial risks while maintaining robust cash flow. By implementing best practices and leveraging technology, organizations can enhance their collection processes, ensuring timely payments and fostering stronger client relationships. The integration of intelligent automation, such as EQ Collect’s solutions, empowers businesses to proactively manage risks while remaining compliant with industry standards.

The article outlines several key strategies for optimizing accounts receivable management:

- Establishing clear credit policies

- Regularly reviewing client accounts

- Automating invoicing and follow-ups

- Training staff in retrieval techniques

- Promoting prompt settlements

These vital practices contribute to financial stability. Moreover, utilizing technology—like cloud-based solutions and data analytics—enables organizations to gain valuable insights and streamline operations, ultimately leading to improved performance in collections.

In conclusion, the significance of effective accounts receivable management cannot be overstated. By adopting these best practices and embracing technological advancements, businesses can not only mitigate risks but also enhance their overall financial health. It is imperative for organizations to prioritize these strategies and continuously monitor key performance indicators to adapt to changing market dynamics and foster enduring success. Taking action now will pave the way for a resilient financial future, ensuring that accounts receivable management remains a strategic asset in any business's risk mitigation framework.

Frequently Asked Questions

What is accounts receivable management (ARM)?

Accounts receivable management (ARM) is the process businesses use to efficiently collect payments owed by customers, which is essential for maintaining healthy cash flow and minimizing financial risk.

How does accounts receivable management contribute to risk mitigation?

Effective accounts receivable management helps businesses identify potential risks early, allowing them to implement timely measures that ensure compliance with industry standards and safeguard against defaults.

What tools does EQ Collect provide for accounts receivable management?

EQ Collect offers automation features such as a no-code file-mapping tool and automated workflows, which help financial institutions reduce vendor onboarding timelines and enhance efficiency in receivables management.

Why is client creditworthiness important in accounts receivable management?

Client creditworthiness is crucial because it helps businesses assess the likelihood of receiving payments, which is essential for developing effective strategies to mitigate financial risk.

How does EQ Collect enhance communication with customers?

EQ Collect's intelligent automation and real-time reporting foster clear communication and trust with customers, which is vital for effective accounts receivable management.

What role does the economic environment play in accounts receivable management?

The overall economic environment influences payment behaviors and customer creditworthiness, making it important for businesses to consider these factors when managing accounts receivable.