Overview

The article outlines four effective strategies for implementing friendly payment reminders within enterprise accounts receivable management, aimed at improving payment compliance and enhancing customer relationships.

-

Proactive notifications serve as a crucial tool in reminding clients of upcoming payments, thereby minimizing the risk of overdue invoices. Evidence suggests that businesses employing this strategy have reported significant increases in timely transactions.

-

Automation streamlines the reminder process, ensuring that communications are sent consistently and efficiently. This not only reduces the administrative burden but also fosters a more reliable payment schedule, which is essential for maintaining cash flow.

-

Personalized communication enhances the customer experience, allowing businesses to tailor reminders based on individual client preferences and behaviors. This approach has been linked to higher customer engagement rates, reinforcing the importance of relationship management in debt collection.

-

Adopting a multi-channel approach ensures that reminders reach clients through their preferred communication methods, whether via email, SMS, or phone calls. This flexibility can significantly improve response rates and overall compliance.

In conclusion, by integrating these strategies, enterprises can effectively reduce overdue invoices while fostering stronger connections with clients, ultimately leading to improved financial performance and customer satisfaction.

Introduction

Implementing effective payment reminder strategies is essential for enterprises focused on maintaining robust cash flow and fostering strong customer relationships. Evidence shows that by adopting friendly and proactive approaches, organizations can significantly reduce late payments and enhance overall client satisfaction. This is particularly crucial in today’s complex accounts receivable landscape.

How can businesses ensure their reminders are not only effective but also well-received by clients? This article explores four innovative strategies that leverage automation, personalization, and multi-channel communication to transform payment reminders into a seamless and engaging experience for enterprise accounts receivable.

Adopt Proactive Payment Reminder Strategies

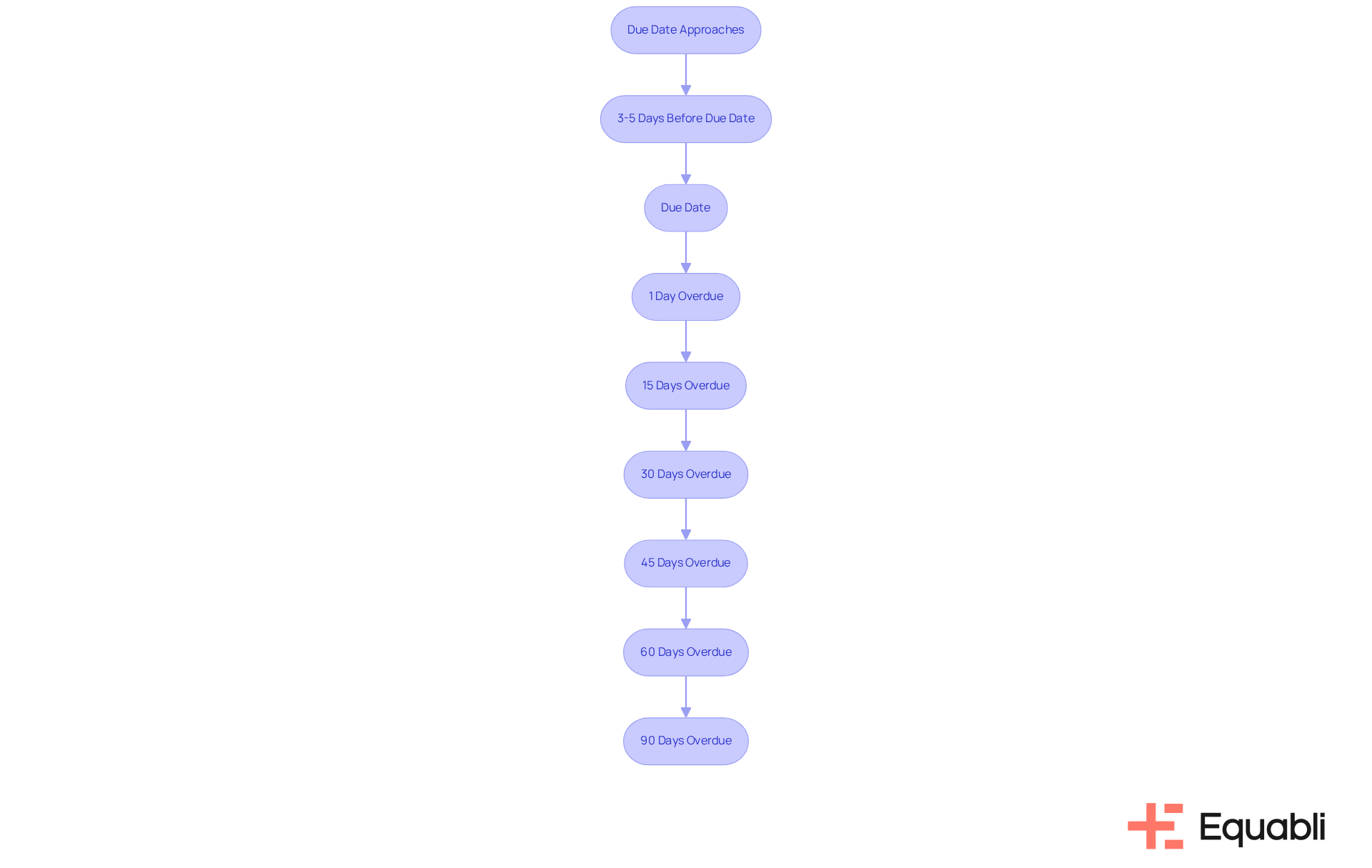

Implementing friendly payment reminder strategies for enterprise accounts receivable management is essential for minimizing late transactions, especially when leveraging advanced tools like Equabli's EQ Suite. Utilizing friendly payment reminder strategies for enterprise accounts receivable management, like sending notifications well in advance of deadlines—such as a courteous email 3 to 5 days before the due date followed by a text message on the due date—can significantly enhance payment compliance. Evidence shows that companies adopting this tiered reminder approach experience reductions in overdue invoices by as much as 30%. This strategy not only highlights friendly payment reminder strategies for enterprise accounts receivable management by keeping payments at the forefront for clients but also underscores a commitment to customer service, which 95% of respondents deem crucial in the accounts receivable experience.

By integrating friendly payment reminder strategies for enterprise accounts receivable management into their processes and utilizing CRM tools for streamlined communication, businesses can improve cash flow and elevate customer satisfaction. Furthermore, notifications should be sent at intervals of:

- One day overdue

- 15 days overdue

- 30 days overdue

- 45 days overdue

- 60 days overdue

- 90 days overdue

to ensure consistent follow-up and mitigate potential pitfalls in the notification process. With the EQ Suite, financial institutions can refine their debt collection practices, enhancing efficiency and borrower engagement, ultimately leading to improved recovery outcomes.

Leverage Automation for Efficient Reminder Management

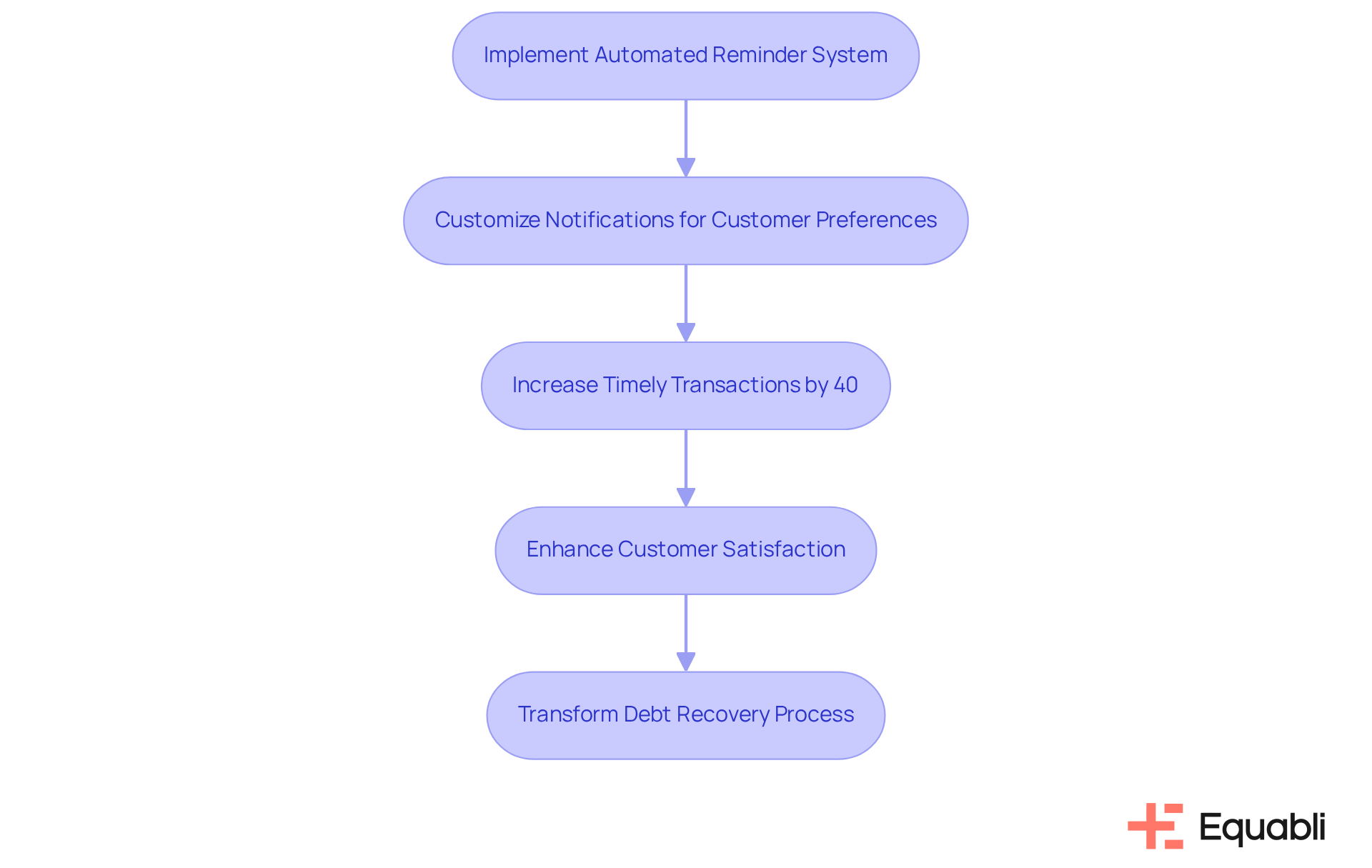

The effectiveness of invoice follow-up management can be significantly enhanced by implementing friendly payment reminder strategies for enterprise accounts receivable management. Evidence shows that software solutions like Equabli's EQ Suite, which features automated notifications and a no-code file-mapping tool, can help organizations avoid missing transactions. These notifications can be customized to align with customer preferences, incorporating friendly payment reminder strategies for enterprise accounts receivable management, fostering consistent communication and minimizing execution errors and resource expenditure.

Firms that have adopted automated systems report a 40% increase in timely transactions, thanks to friendly payment reminder strategies for enterprise accounts receivable management, as customers receive prompt notifications without the burden of manual follow-ups. This improvement not only streamlines operations but also enhances customer satisfaction by implementing friendly payment reminder strategies for enterprise accounts receivable management. Furthermore, Equabli's solutions offer real-time reporting and robust compliance oversight, delivering unparalleled transparency and insights. This transforms debt recovery into a more efficient and effective process, positioning organizations to better navigate the complexities of enterprise-level debt collection.

Personalize Communication to Enhance Engagement

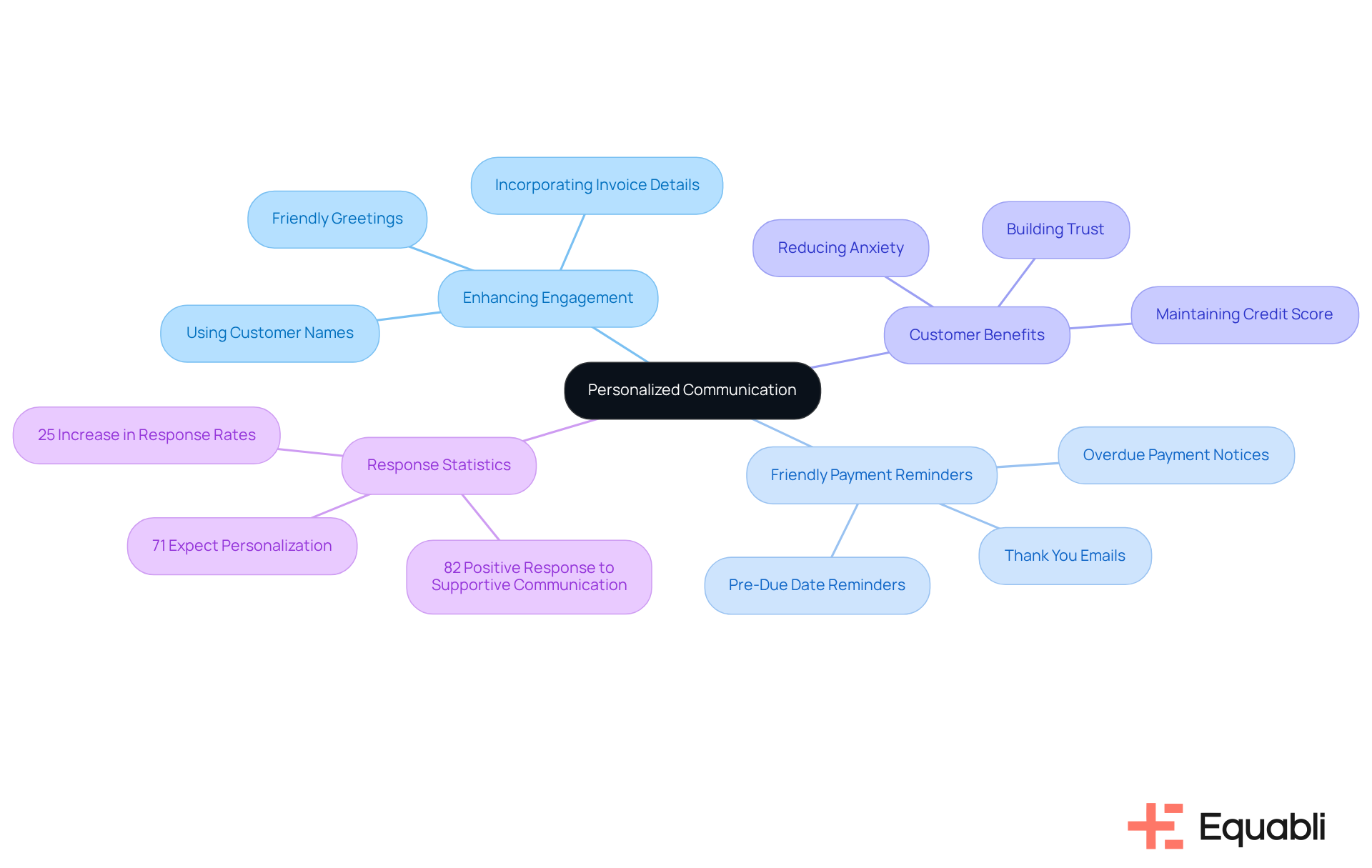

Customizing billing notifications serves as a strategic approach to enhance customer engagement and apply friendly payment reminder strategies for enterprise accounts receivable management to facilitate timely transactions. By addressing customers by name and incorporating specific account details—such as the invoice number and total amount owed—businesses can elevate a standard notification into a more impactful communication through friendly payment reminder strategies for enterprise accounts receivable management. For example, a message stating, 'Hi [Client Name], just a friendly reminder that your fee of [Amount] is due on [Date],' not only personalizes the interaction but also underscores the importance of the payment.

Moreover, highlighting the benefits of timely payments, such as maintaining a favorable credit score, aligns with friendly payment reminder strategies for enterprise accounts receivable management and can provide an additional incentive for customers to respond promptly. Research indicates that 82% of customers respond more positively to encouraging communication. Firms that implement tailored communication strategies have experienced a significant 25% increase in response rates, thereby accelerating transaction timelines. This approach not only fosters a stronger connection with customers but also utilizes friendly payment reminder strategies for enterprise accounts receivable management to enhance overall collection efficiency.

As emphasized by the Symend Research Team, supportive communication is crucial for building trust and improving customer relationships. Personalization emerges as a fundamental component of effective billing notifications, which aligns with friendly payment reminder strategies for enterprise accounts receivable management and best practices in compliance management.

Utilize Multi-Channel Approaches for Effective Reminders

Implementing a multi-channel strategy for payment notifications can significantly enhance their effectiveness, particularly when supported by Equabli's EQ Suite. This approach employs various communication methods—such as email, SMS, and phone calls—to ensure clients receive notifications in their preferred format. For instance, a company might initiate communication with an email notification, followed by a text message on the due date, thereby maximizing engagement opportunities. Research indicates that organizations utilizing multi-channel notifications achieve engagement rates up to 50% higher than those relying solely on a single channel. By aligning with customer preferences and leveraging the intelligent tools of the EQ Suite, businesses can enhance accounts receivable outcomes by implementing friendly payment reminder strategies for enterprise accounts receivable management, ultimately improving their overall collection rates and cultivating stronger relationships.

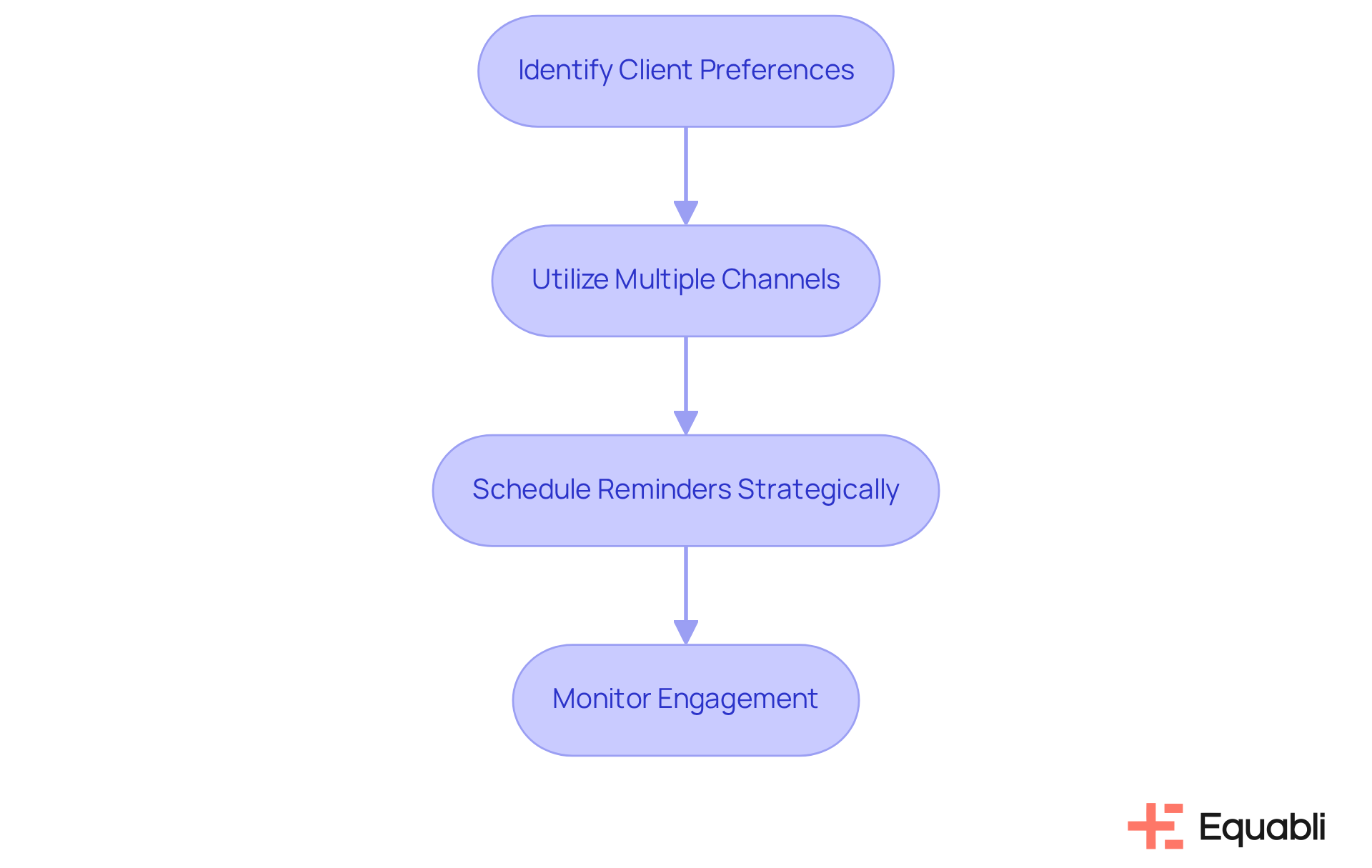

To effectively implement a multi-channel strategy for payment reminders, consider the following steps:

- Identify Client Preferences: Utilize surveys or data analytics to ascertain how clients prefer to receive reminders.

- Utilize Multiple Channels: Combine email, SMS, and phone calls to engage customers through their preferred methods, harnessing the capabilities of EQ Engage for personalized communication.

- Schedule Reminders Strategically: Dispatch reminders at optimal times, aligning with individual customer schedules, which can boost response rates by 40-60%.

- Monitor Engagement: Assess the effectiveness of each channel and adjust your strategy based on customer responses, utilizing insights from the EQ Suite to refine your approach.

As noted by industry experts, the necessity of a responsive multi-channel approach is paramount. By catering to client preferences and employing friendly payment reminder strategies for enterprise accounts receivable management through Equabli's solutions, organizations can enhance their overall collection rates and strengthen client relationships.

Conclusion

Implementing friendly payment reminder strategies for enterprise accounts receivable is essential for enhancing payment compliance and strengthening customer relationships. Proactive notifications through various channels and personalized communication can significantly reduce overdue invoices, creating a more positive accounts receivable experience.

Key strategies include:

- Tiered reminder notifications

- Automation of follow-ups

- Personalized messages

- A multi-channel approach

These methods streamline the payment process and reflect a commitment to customer service, which is vital for maintaining robust business relationships. Companies adopting these practices often experience substantial improvements in cash flow and customer satisfaction.

The importance of friendly payment reminder strategies cannot be overstated. By prioritizing proactive communication and utilizing advanced tools like Equabli's EQ Suite, businesses can enhance their accounts receivable management. This ensures timely payments while fostering trust and loyalty with clients. Embracing these strategies transcends mere collection improvements; it cultivates a more engaging and supportive environment for customers, paving the way for long-term success.

Frequently Asked Questions

What are proactive payment reminder strategies?

Proactive payment reminder strategies involve sending notifications to clients in advance of payment deadlines to enhance payment compliance. This can include emails and text messages to remind clients about upcoming due dates.

How can friendly payment reminders affect overdue invoices?

Companies that adopt friendly payment reminder strategies can reduce overdue invoices by as much as 30%, as these reminders keep payments at the forefront for clients and demonstrate a commitment to customer service.

What is the recommended timing for sending payment reminders?

It is recommended to send payment reminders at the following intervals: 3 to 5 days before the due date, one day overdue, 15 days overdue, 30 days overdue, 45 days overdue, 60 days overdue, and 90 days overdue.

How does the EQ Suite assist in accounts receivable management?

The EQ Suite helps financial institutions refine their debt collection practices, enhance efficiency, improve borrower engagement, and ultimately lead to better recovery outcomes.

Why is customer service important in accounts receivable management?

Customer service is deemed crucial in the accounts receivable experience, with 95% of respondents recognizing its importance. Friendly payment reminders contribute to a positive customer service experience.

What tools can be integrated for effective payment reminder strategies?

Businesses can integrate CRM tools to streamline communication and improve the effectiveness of their friendly payment reminder strategies in accounts receivable management.