Overview

The article examines effective strategies for leveraging payment reminder emails to enhance client engagement within the financial services sector. It underscores the critical role of:

- Audience segmentation

- Optimal timing

- Clarity in communication

- Automation

Evidence suggests that tailored and well-timed reminders can significantly elevate customer response rates and fortify relationships, ultimately leading to improved payment outcomes.

From a compliance perspective, understanding the nuances of audience segmentation allows financial institutions to craft messages that resonate with specific client demographics. This targeted approach not only increases engagement but also aligns with regulatory expectations, ensuring that communications are both effective and compliant.

To operationalize this strategy, organizations should implement automated systems that facilitate timely reminders. Automation not only streamlines the process but also ensures that reminders are sent at optimal intervals, thereby maximizing the likelihood of a positive response.

In conclusion, the strategic use of payment reminder emails, when executed with precision and clarity, can transform client engagement efforts. Financial services firms that prioritize these strategies will likely see enhanced relationships and better payment outcomes.

Introduction

In today's competitive financial landscape, effective communication with clients is essential, particularly regarding payment reminders. Tailored strategies that resonate with various customer segments can significantly enhance engagement and compliance. However, the challenge lies in understanding how to craft these reminders to not only inform but also motivate clients to take action.

What key elements transform a simple reminder into a compelling call to action that clients will respond to? This inquiry is critical for executives seeking to optimize their debt collection processes and ensure compliance in an evolving regulatory environment.

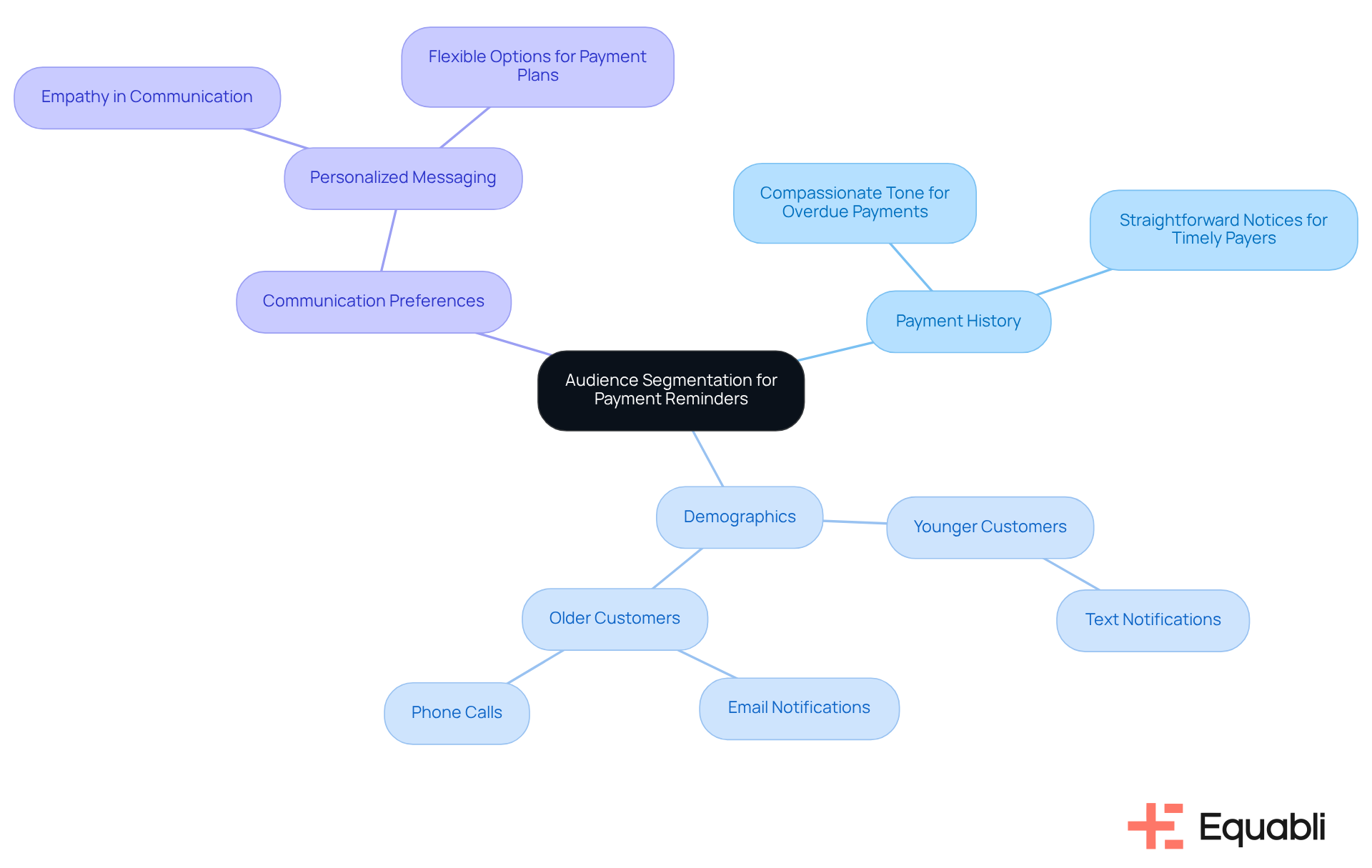

Identify Your Audience for Tailored Payment Reminders

To effectively engage customers, it is essential to segment your audience based on critical factors such as:

- Payment history

- Demographics

- Communication preferences

Utilizing payment reminder email strategies for client engagement in financial services is crucial. For example, younger customers often respond more favorably to text notifications, while older patrons may prefer emails or phone calls. Utilizing data analytics tools can reveal patterns in repayment behaviors, enabling tailored messaging that resonates with each segment.

Customizing notifications to address specific concerns or motivations significantly enhances the effectiveness of payment reminder email strategies for client engagement in financial services. For instance, an individual who has overlooked several dues may respond better to a compassionate tone, whereas a consistently timely individual might appreciate a straightforward notice regarding their upcoming due date. This targeted approach, including payment reminder email strategies for client engagement in financial services, not only improves engagement but also fosters a sense of understanding and support from your organization, ultimately strengthening connections with customers.

From a compliance perspective, this method aligns with best practices in customer communication, ensuring that outreach is both effective and respectful. By leveraging insights from customer data, organizations can operationalize strategies that enhance customer relationships while mitigating risks associated with debt collection. This strategic focus on customer engagement is vital for maintaining a competitive edge in the financial services landscape.

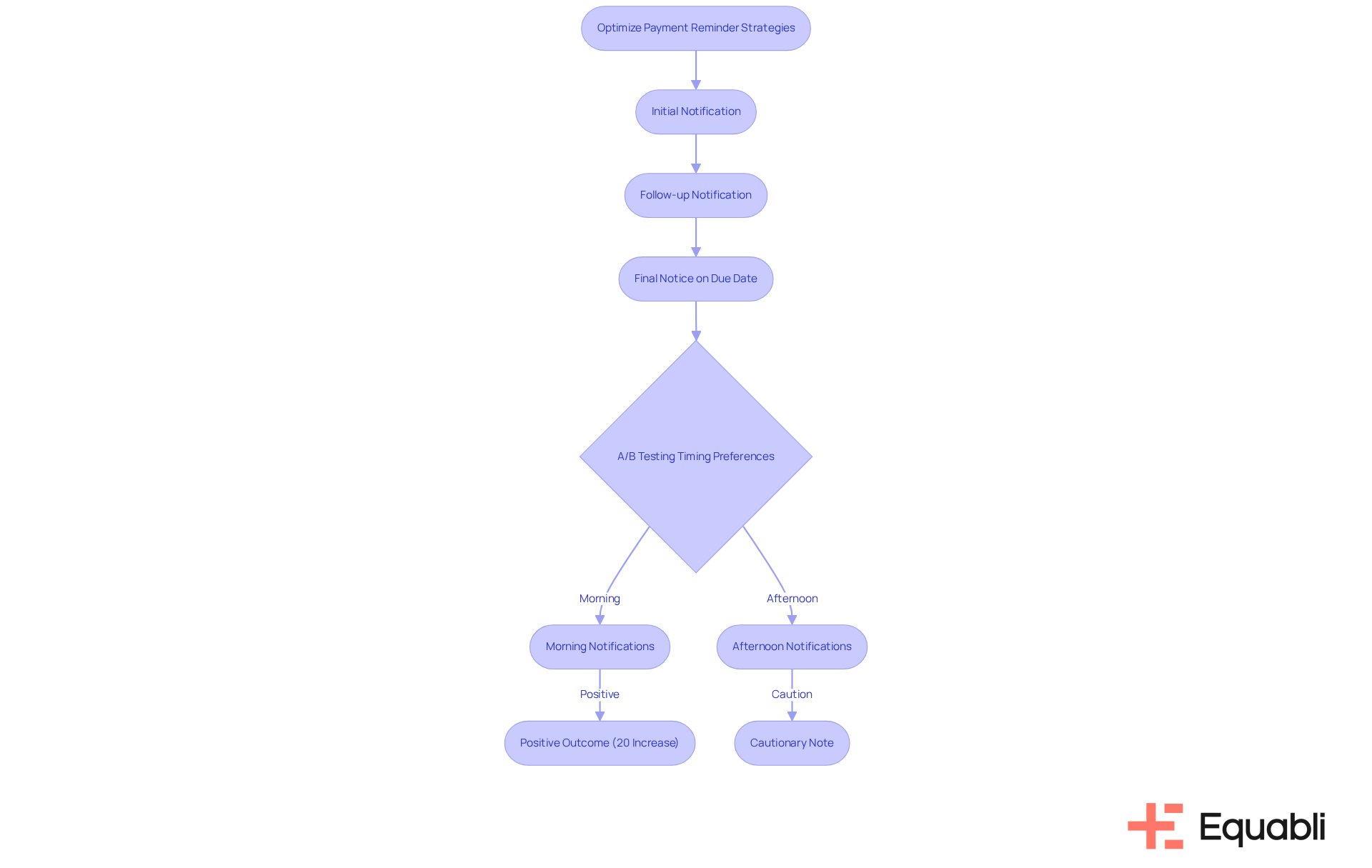

Optimize Timing and Frequency of Payment Reminders

Creating a well-timed plan for implementing payment reminder email strategies for client engagement in financial services is crucial for aligning with customers' billing cycles. Effective payment reminder email strategies for client engagement in financial services involve sending notifications a few days prior to the due date, which act as prompts to encourage timely payments without overwhelming customers. For instance, a structured approach involves:

- Sending an initial notification

- A follow-up a few days before the due date

- A final notice on the due date itself

However, it is vital to avoid inundating customers with excessive messages, as this can lead to disengagement.

Implementing payment reminder email strategies for client engagement in financial services through A/B testing for different timings and frequencies can help uncover optimal strategies tailored to your audience. Evidence from a financial organization indicates that customers responded more favorably to notifications dispatched in the early morning rather than late afternoon, resulting in a 20% increase in timely contributions. This data underscores the significance of timing in enhancing customer engagement through payment reminder email strategies for client engagement in financial services and ensuring financial stability.

From a compliance perspective, understanding customer preferences in notification timing not only improves payment rates but also is essential for implementing effective payment reminder email strategies for client engagement in financial services. To operationalize this strategy, organizations should consider integrating customer feedback mechanisms to refine their notification processes continually. This approach not only aligns with best practices in customer engagement but also mitigates risks associated with late payments.

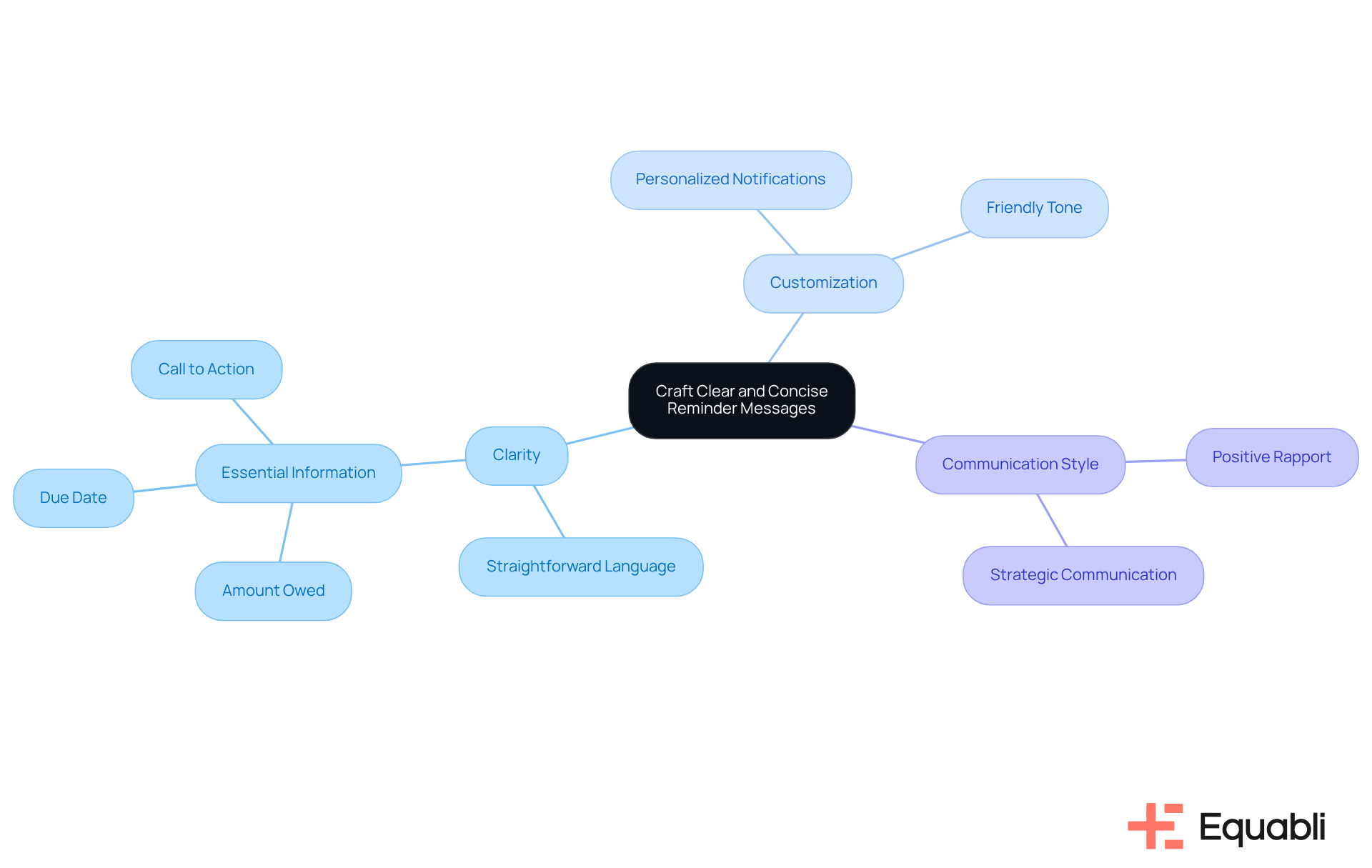

Craft Clear and Concise Reminder Messages

Clarity is paramount when developing payment reminder email strategies for client engagement in financial services.

- Point: Utilizing straightforward language is essential to avoid confusion among clients.

- Evidence: A clear subject line, such as 'Payment Reminder: Due Date Approaching,' succinctly conveys the email's purpose.

- Explanation: In the body, it is critical to include essential information, such as the amount owed, the due date, and a clear call to action, like 'Click here to complete your transaction.'

- Link: Data indicates that 87% of companies encounter challenges with delayed invoiced collections, underscoring the importance of efficient notifications.

Customizing automated billing notifications is one of the effective payment reminder email strategies for client engagement in financial services that can significantly enhance response rates.

- Evidence indicates that payment reminder email strategies for client engagement in financial services can enhance engagement by 23%.

- Explanation: A pleasant tone can also foster better customer relationships; for instance, instead of a strict notification, consider a friendly approach, such as, 'We hope you're doing well!' This simple gesture, as part of payment reminder email strategies for client engagement in financial services, can make a substantial difference.

As Amaya Woods observes, 'A cheerful, amicable notice acts as a gentle prompt, alerting customers of their outstanding invoices and motivating them to make timely transactions.' This approach incorporates payment reminder email strategies for client engagement in financial services, which not only conveys essential information but also helps maintain a positive rapport with clients.

- Evidence shows that using payment reminder email strategies for client engagement in financial services can greatly influence communication in billing notifications.

- By adopting a strategic communication style, organizations can utilize payment reminder email strategies for client engagement in financial services to encourage timely transactions.

- Link: Ultimately, this fosters a more effective debt collection process, aligning with broader operational goals.

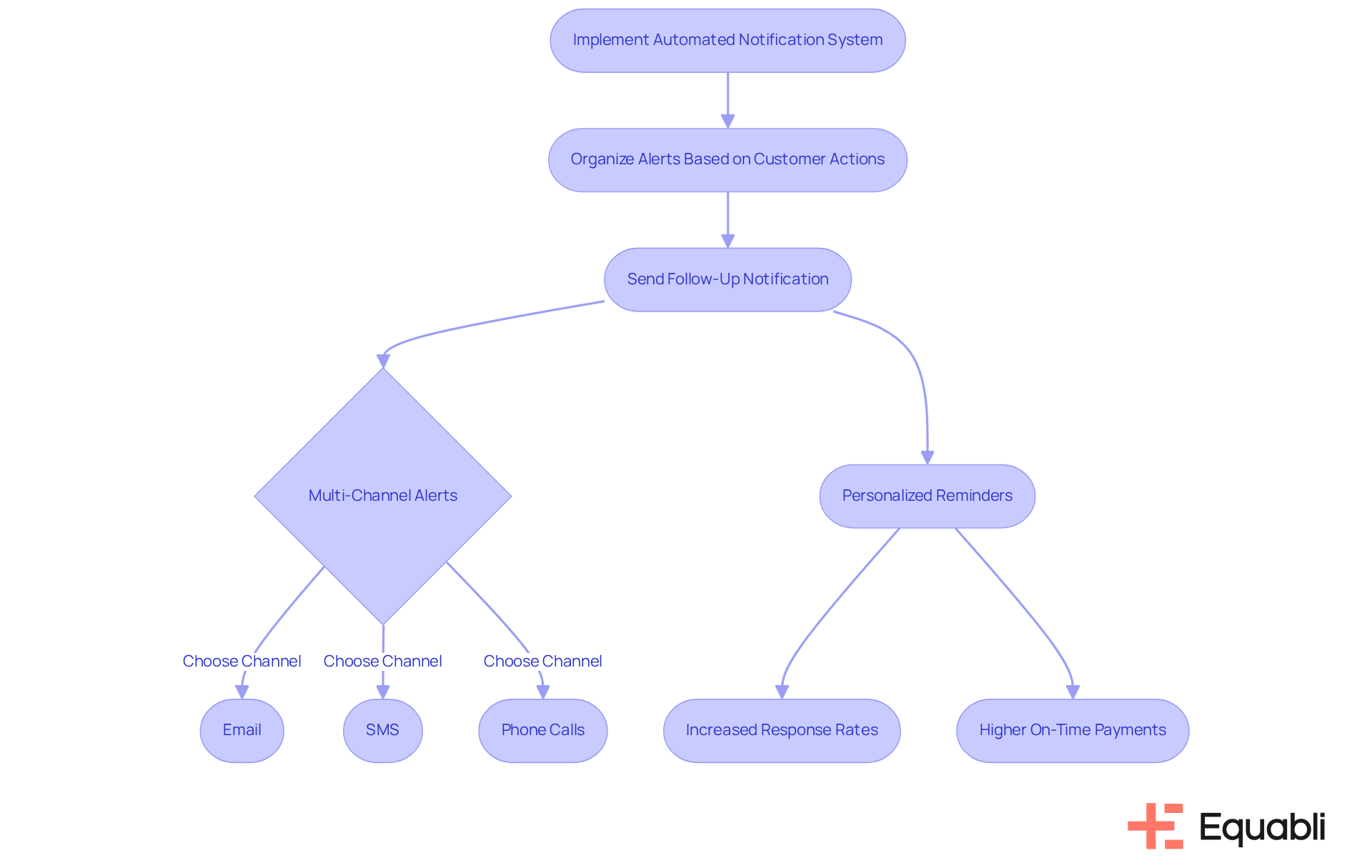

Leverage Automation for Consistent Follow-Ups

Implementing an automated notification system significantly enhances collection efforts by ensuring timely follow-ups and reducing manual workload. By employing instruments that organize alerts based on customer actions and transaction history, organizations can streamline their processes. For instance, when a customer fails to meet a financial obligation, the system can automatically dispatch a follow-up notification within a designated period, such as three days after the due date. This approach ensures that no customer is neglected, allowing teams to focus on more complex cases requiring personal attention.

A multi-channel strategy for alerts is essential, delivering notifications through email, SMS, or phone calls according to user preferences. Research indicates that companies utilizing multiple communication channels can experience response rates increase by 200-300%. A case study from a prominent collection agency demonstrated that automating their notification process led to a 30% rise in on-time payments, underscoring the effectiveness of this strategy. Furthermore, personalized reminders achieve 20% greater engagement rates than generic messaging, highlighting the importance of customizing communications to meet individual requirements. By leveraging automation, financial institutions can enhance client engagement through payment reminder email strategies for client engagement in financial services, improve collection rates, and ultimately drive better financial outcomes while ensuring compliance with consumer protection laws.

Conclusion

Implementing effective payment reminder email strategies is crucial for enhancing client engagement and ensuring timely payments within the financial services sector. By concentrating on audience segmentation, optimizing timing, crafting clear messages, and leveraging automation, organizations can develop a tailored approach that meets diverse customer needs. This strategic focus not only strengthens customer relationships but also drives improved financial outcomes.

Key insights emphasize the necessity of identifying customer segments based on payment history and communication preferences. Additionally, optimizing the timing and frequency of reminders, while maintaining clarity in messaging, is essential. The role of automation in streamlining follow-ups and enhancing engagement through multi-channel notifications underscores the importance of a comprehensive approach to payment reminders. Collectively, these strategies contribute to a more effective debt collection process and foster supportive client relationships.

As financial institutions navigate the complexities of customer engagement, adopting these payment reminder email strategies can lead to significant enhancements in collection rates and customer satisfaction. By prioritizing personalized communication and utilizing data-driven insights, organizations can mitigate risks associated with late payments and enhance their competitive edge in the evolving financial landscape. Embracing these practices is not merely a recommendation; it is a vital step toward achieving long-term success and maintaining a loyal customer base.

Frequently Asked Questions

Why is it important to identify your audience for payment reminders?

Identifying your audience is crucial to effectively engage customers by segmenting them based on factors such as payment history, demographics, and communication preferences.

How can payment history influence customer engagement?

Payment history can reveal patterns in repayment behaviors, allowing for tailored messaging that resonates with different customer segments.

What are some preferred communication methods for different demographics?

Younger customers often respond better to text notifications, while older customers may prefer emails or phone calls.

How can customizing notifications improve payment reminder strategies?

Customizing notifications to address specific concerns or motivations enhances effectiveness; for instance, a compassionate tone may work better for someone who has missed payments, while a straightforward notice may suit a consistently timely payer.

What benefits does a targeted approach to payment reminders provide?

A targeted approach improves engagement, fosters understanding and support, and strengthens connections with customers.

How does this method align with compliance best practices?

This method ensures that customer outreach is effective and respectful, adhering to best practices in customer communication.

What role does customer data play in enhancing payment reminder strategies?

Leveraging insights from customer data allows organizations to operationalize strategies that enhance relationships while mitigating risks associated with debt collection.

Why is customer engagement important in the financial services landscape?

A strategic focus on customer engagement is vital for maintaining a competitive edge in the financial services industry.