Overview

The article presents effective strategies for utilizing payment reminder letters to enhance debt recovery processes. Implementing structured reminder strategies can significantly reduce overdue payments and improve cash flow. Evidence indicates a potential 50% reduction in overdue dues, highlighting the impact of personalized and automated communication on engagement.

From a compliance perspective, these strategies not only streamline operations but also align with best practices in debt collection. By adopting a systematic approach, organizations can mitigate risks associated with overdue accounts, ensuring a more robust financial standing.

To operationalize this strategy, enterprises should consider integrating automated systems that facilitate timely reminders. This not only enhances communication but also fosters a proactive approach to debt management, ultimately leading to improved recovery rates.

In conclusion, leveraging structured payment reminder letters is a strategic imperative for organizations aiming to optimize their debt recovery processes. By focusing on data-driven insights and compliance awareness, businesses can navigate the complexities of debt collection while enhancing their overall cash flow.

Introduction

Managing corporate debt recovery effectively hinges on timely communication, making payment reminders an essential tool for financial institutions. Implementing effective payment reminder letter strategies can significantly enhance cash flow and reduce overdue accounts. Studies indicate that organizations can achieve reductions in late payments by as much as 50%. However, the challenge remains: how can businesses craft these reminders to not only inform but also engage clients, ensuring that payments are prioritized without straining relationships?

Understand the Importance of Payment Reminders in Debt Recovery

Payment reminder letter strategies for corporate debt recovery processes play a pivotal role in the debt recovery process. They not only inform clients of their responsibilities but also underscore the importance of timely settlements using payment reminder letter strategies for corporate debt recovery processes. Evidence suggests that regular reminders can reduce overdue dues by as much as 50%, significantly improving cash flow and minimizing operational disruptions. Companies that implement payment reminder letter strategies for corporate debt recovery processes often experience a marked decrease in late accounts, demonstrating the effectiveness of this approach in enhancing overall recovery rates.

Incorporating payment reminder letter strategies for corporate debt recovery processes into your collection strategy facilitates the early identification of potential issues, allowing for timely interventions that can avert larger debt problems. With EQ Collect's automated workflows, no-code file-mapping tool, and data-driven strategies, financial institutions can adopt a proactive stance by pinpointing accounts at risk of delayed settlement ahead of due dates. This capability is essential for maintaining financial stability and building trust with clients. By committing to transparent communication through automated notifications, organizations can fortify their relationships with clients, ultimately fostering better financial habits and a stronger bottom line. As noted by Gaviti, "Digital notifications can shorten the collection cycle from weeks or months to days, enhancing your cash flow." Furthermore, the real-time reporting and industry-leading compliance oversight offered by EQ Collect empower organizations to manage their collections with efficiency and effectiveness.

Craft Effective Payment Reminder Messages: Key Components

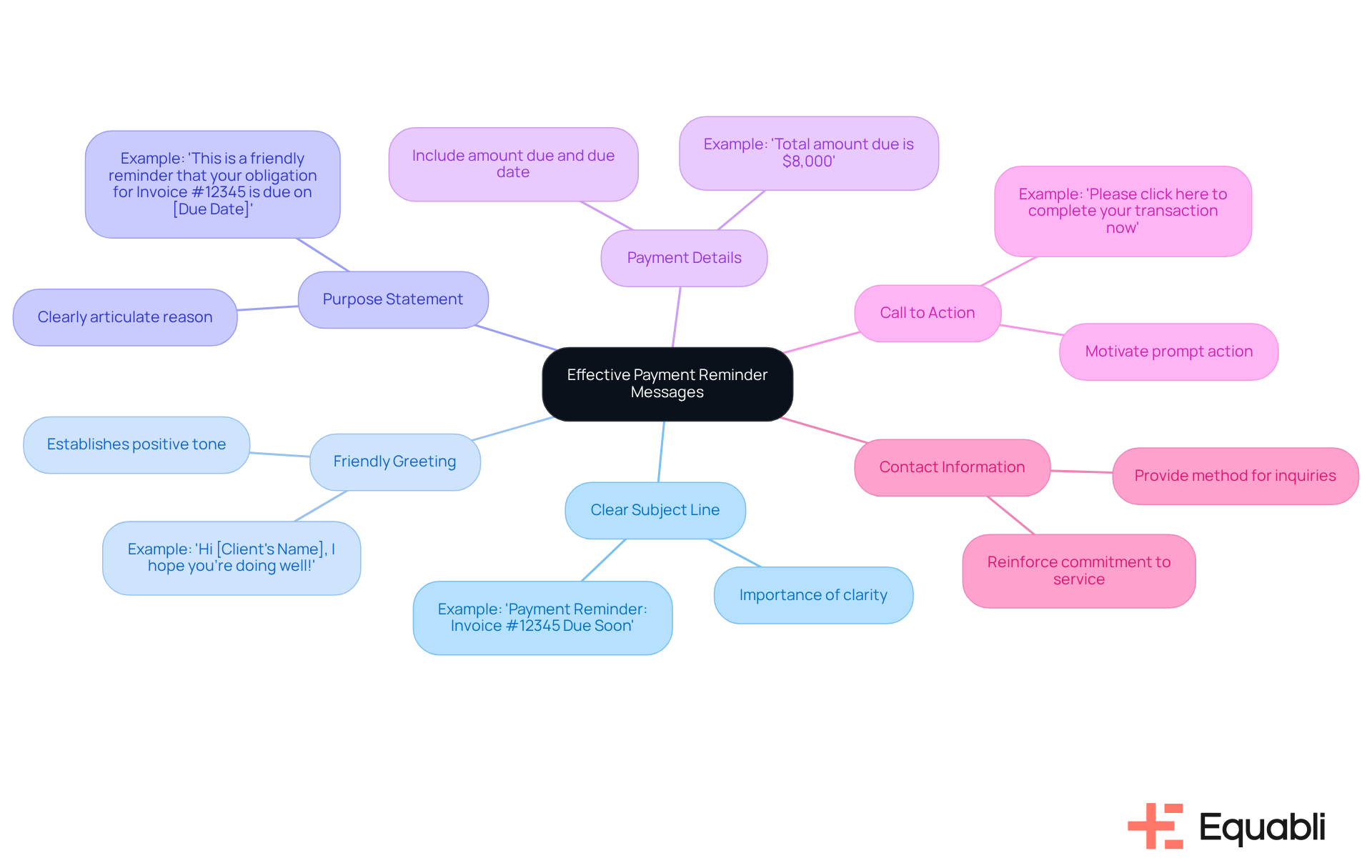

An effective payment reminder message must encompass several key components to maximize engagement and prompt action:

- Clear Subject Line: The subject line should immediately convey the email's purpose, such as "Payment Reminder: Invoice #12345 Due Soon."

- Friendly Greeting: Begin with a warm greeting to establish a positive tone, e.g., "Hi [Client's Name], I hope you're doing well!"

- Purpose Statement: Clearly articulate the reason for the message, such as, "This is a friendly reminder that your obligation for Invoice #12345 is due on [Due Date]."

- Payment Details: Include specific information about the amount due, the original due date, and any relevant invoice numbers. For instance, if the total amount due is $8,000, clearly state this to avoid confusion.

- Call to Action: Motivate the customer to act promptly, for example, "Please click here to complete your transaction now." Offering a direct financial link can significantly accelerate processing times.

- Contact Information: Provide a method for customers to reach out with questions or concerns, reinforcing your commitment to customer service.

Integrating these components not only educates customers but also involves them, enhancing the chances of timely transactions. Customized automated notifications can enhance response rates by 23%, making it crucial to adjust messages for individual clients. Furthermore, sending notifications through SMS can boost engagement, considering that text messages have a 98% open rate and a 45% response rate, especially for billing alerts. By implementing payment reminder letter strategies for corporate debt recovery processes, organizations can foster positive relationships while effectively managing their accounts receivable.

It's also important to send the first notification one week before the due date and follow up with additional notices if the invoice remains unpaid. Moreover, explicitly outlining possible repercussions for delayed transactions, such as a 10% late charge, can encourage customers to prioritize their dues. Sustaining an optimistic tone during the notifications is essential for maintaining client connections while promoting prompt settlements.

Leverage Automation for Efficient Payment Reminder Strategies

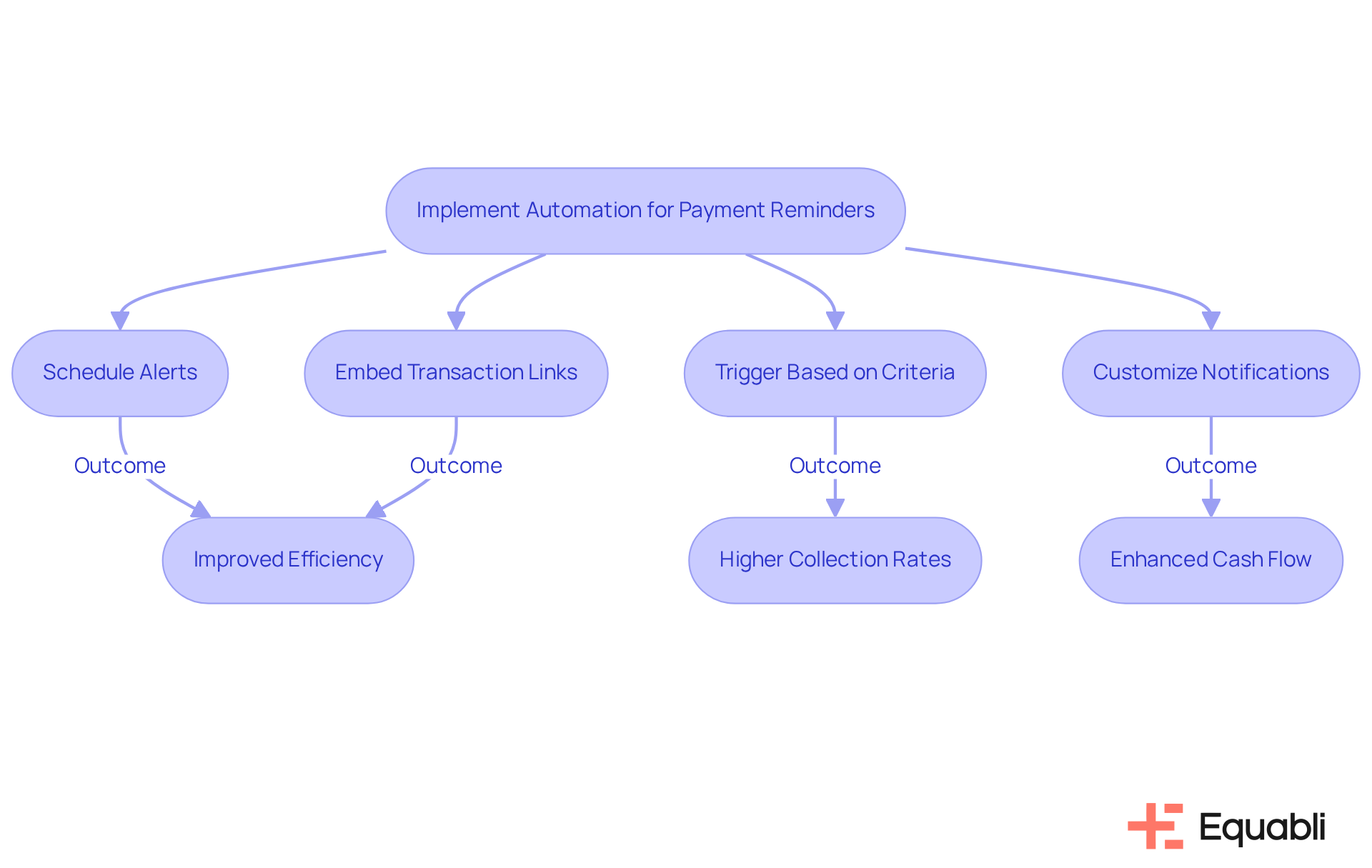

Automation revolutionizes billing notifications by enabling organizations to schedule alerts at optimal times—before, on, and after the due date—ensuring timely communication without manual intervention. This strategy reduces the risk of human error and significantly boosts operational efficiency, particularly when utilizing Equabli's intelligent EQ Suite.

Automated systems can trigger alerts based on specific criteria, such as due dates or the number of days overdue, facilitating a customized approach that aligns with Equabli's data-driven recovery methods. For instance, notifications can escalate in tone or frequency based on a customer's billing history, ensuring that communication remains relevant and impactful. Furthermore, embedding transaction links directly within notifications promotes prompt action, streamlining the settlement process for clients.

Research indicates that organizations leveraging digital transaction technology typically see a 5% increase in collection rates. In contrast, companies employing automated billing notifications often report enhancements of up to 20% within the first year. This increase in efficiency not only improves cash flow but also allows staff to focus on more complex collection strategies, ultimately enhancing overall performance. Additionally, automated systems maintain comprehensive records of interactions, providing an audit trail that safeguards lenders against litigation.

The integration of real-time analytic dashboards within the EQ Suite empowers lenders to monitor key metrics such as debt recovery rates and overdue loans. Thus, automation in notifications is not merely a trend but a strategic necessity for organizations that utilize payment reminder letter strategies for corporate debt recovery processes to refine their operations.

Key Features of Equabli's EQ Suite:

- EQ Engine: Customizable strategies for payment reminders based on client behavior.

- EQ Engage: Empowering borrowers with self-service repayment options.

- Real-Time Analytics: Effectively monitoring and optimizing collection efforts.

Personalize Communication to Enhance Client Engagement

Personalization is crucial for effective communication in debt recovery. By tailoring billing notifications to specific customers, organizations can significantly enhance engagement and increase the likelihood of timely transactions through effective payment reminder letter strategies for corporate debt recovery processes. This can be accomplished by incorporating specific details such as the client's name, the amount due, and references to prior interactions. For example, a notification stating, "Hi [Client's Name], we noted your contribution last month—thank you! Just a quick reminder that your next payment of [Amount] is due on [Due Date]," fosters a personal connection.

Utilizing data analysis to understand customer behavior and preferences optimizes the timing and method of communication in payment reminder letter strategies for corporate debt recovery processes, ensuring notifications are sent when individuals are most likely to respond. Equabli's EQ Engage platform empowers organizations to develop, automate, and implement borrower contact strategies that resonate with customers. Research indicates that payment reminder letter strategies for corporate debt recovery processes, including personalized notifications, can lead to a substantial increase in repayment rates; individuals feel more connected to the organization and are more inclined to respond to prompts that acknowledge their unique circumstances. For instance, an auto loan financing company reported over 60% response rates after transitioning to hyper-personalized payment reminders.

Investing in payment reminder letter strategies for corporate debt recovery processes not only enhances collection rates but also fosters enduring relationships with clients. By leveraging tools like EQ Engage to craft tailored communication journeys and manage borrower preferences, businesses can transform their debt recovery processes into more effective and empathetic engagements.

Conclusion

Implementing effective payment reminder letter strategies is essential for enhancing debt recovery processes. These reminders serve as crucial notifications for clients and significantly improve cash flow by reducing overdue accounts. By adopting a structured approach to payment reminders, organizations can foster positive relationships with clients while ensuring timely settlements.

Key strategies for crafting effective payment reminders include:

- Clear communication

- Automation integration

- Message personalization

Evidence shows that these components drive higher engagement rates and prompt action from clients. Utilizing tools like automated workflows and data analysis allows organizations to streamline their processes, making it easier to manage accounts receivable and enhance overall recovery rates.

The significance of implementing robust payment reminder strategies cannot be overstated. Organizations should embrace these practices not merely as a means of collecting debts but as a way to build trust and rapport with clients. By prioritizing timely, personalized communication, businesses can transform their debt recovery efforts into a more effective and empathetic process, leading to long-term success and stronger financial health.

Frequently Asked Questions

What is the role of payment reminders in debt recovery?

Payment reminders play a crucial role in debt recovery by informing clients of their responsibilities and emphasizing the importance of timely settlements. They can reduce overdue dues by up to 50%, improving cash flow and minimizing operational disruptions.

How do payment reminder strategies affect late accounts?

Companies that implement payment reminder strategies often see a significant decrease in late accounts, demonstrating the effectiveness of this approach in enhancing overall recovery rates.

What benefits do automated payment reminders provide?

Automated payment reminders help identify potential issues early, allowing for timely interventions that can prevent larger debt problems. They also facilitate transparent communication with clients, which can strengthen relationships and promote better financial habits.

How can EQ Collect assist in debt recovery?

EQ Collect offers automated workflows, a no-code file-mapping tool, and data-driven strategies that enable financial institutions to proactively identify accounts at risk of delayed settlement before due dates, thus maintaining financial stability.

What impact do digital notifications have on the collection cycle?

Digital notifications can significantly shorten the collection cycle from weeks or months to just days, enhancing cash flow for organizations.

What additional features does EQ Collect provide for managing collections?

EQ Collect provides real-time reporting and industry-leading compliance oversight, allowing organizations to manage their collections with greater efficiency and effectiveness.