Overview

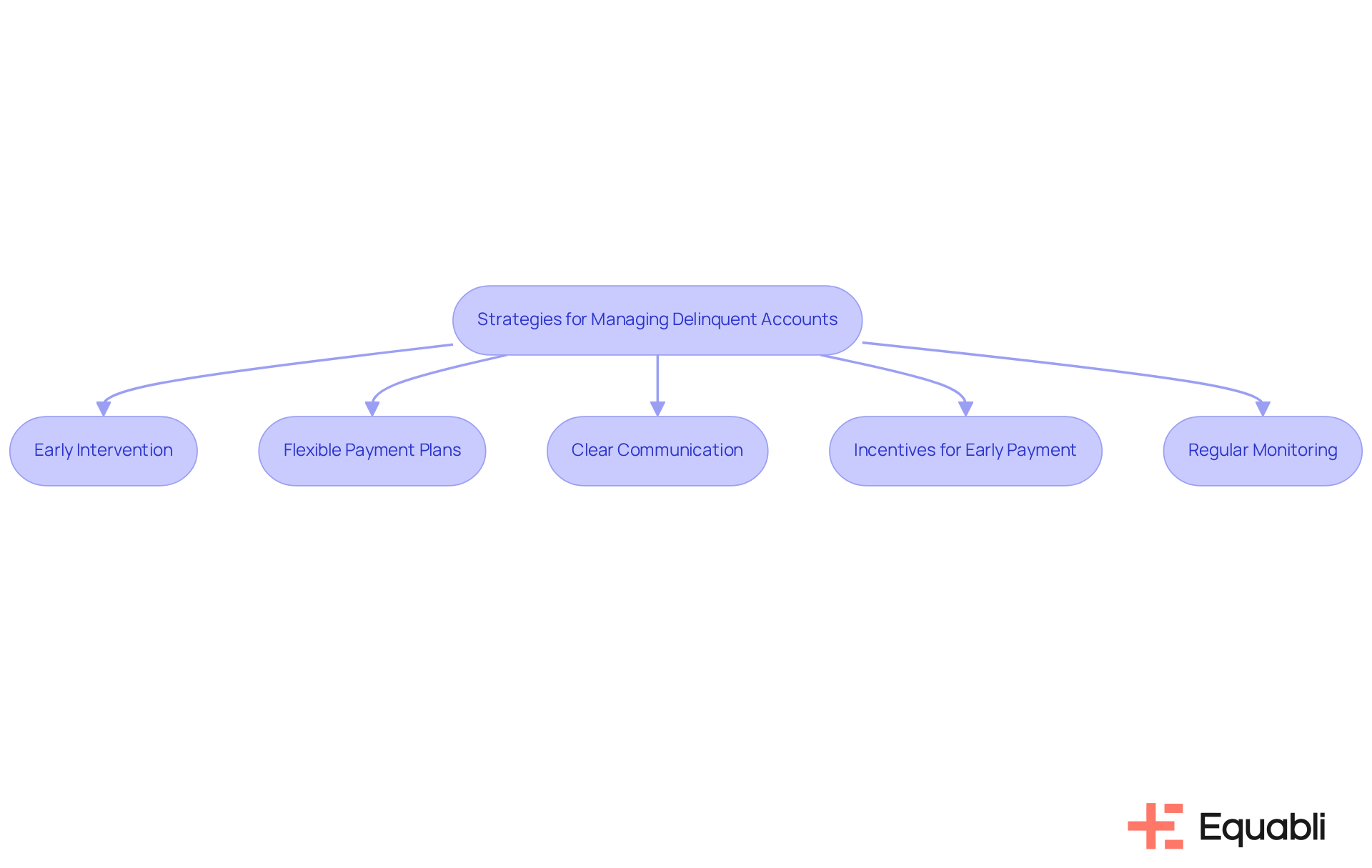

The article delineates four effective steps for managing delinquent accounts:

- Early intervention

- Flexible payment plans

- Clear communication

- Regular monitoring

These strategies are underpinned by compelling evidence indicating that proactive outreach and customized repayment options can significantly boost collection rates. Consequently, this not only enhances a company's financial health but also mitigates the risks associated with overdue payments. By implementing these steps, organizations can foster a more robust approach to delinquency management, ultimately leading to improved financial outcomes.

Introduction

Delinquent accounts represent a formidable challenge for businesses, with a staggering percentage of B2B sales in the U.S. remaining unpaid past their due dates. The repercussions of these unpaid debts extend far beyond immediate cash flow issues; they adversely affect credit ratings, investor confidence, and overall profitability. As organizations navigate the complexities of managing these accounts, the real challenge lies in understanding the root causes of delinquency and implementing effective strategies to mitigate its impact.

What proactive measures can businesses adopt to revolutionize their delinquency management approach and protect their financial health?

Define Delinquent Accounts and Their Impact on Financial Health

Delinquent balances are classified as a delinquency account, representing debts that remain unpaid past their due date, typically categorized as overdue by 30 days or more. These records pose a significant risk to a company's financial health, as they can severely diminish cash flow and escalate operational expenses associated with collection efforts. In fact, a staggering 55% of all B2B invoiced sales in the U.S. are overdue, underscoring the pervasive nature of this challenge. If not addressed promptly, balances in a delinquency account can lead to substantial write-offs, adversely affecting credit ratings, investor confidence, and overall profitability.

The ramifications of a delinquency account go beyond immediate cash flow issues. For example, 73% of UK businesses report facing negative consequences due to late invoices, which can impede their capacity to meet payroll and invest in growth initiatives. Furthermore, bad debts accounted for an average of 9% of all credit-based B2B sales in the U.S. in 2023, highlighting the urgent need for effective management strategies.

Real-world examples illustrate the impact of delinquent payments on businesses. Small business owners, on average, dedicate 10% of their workday to pursuing unpaid invoices, diverting attention from other critical tasks. This inefficiency not only strains resources but also constrains growth potential. As companies navigate the intricacies of delinquency account management, grasping its implications is essential for formulating robust collection strategies that mitigate financial risks and bolster overall stability.

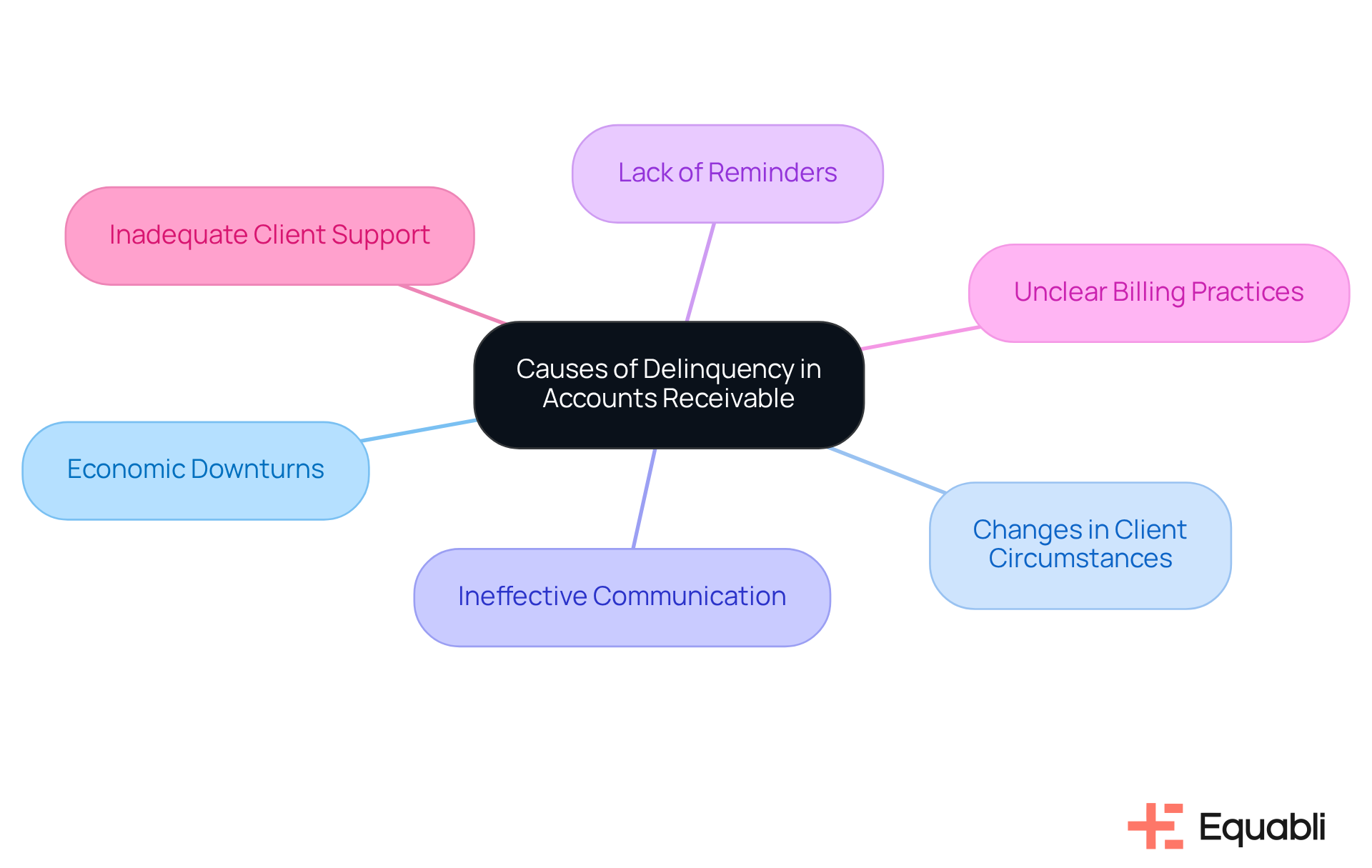

Identify Common Causes of Delinquency in Accounts Receivable

Delinquency accounts in receivables often stem from several key factors:

- Economic downturns

- Changes in client circumstances—such as job loss or reduced income

- Ineffective communication regarding settlement terms

- A lack of reminders for outstanding dues

- Unclear billing practices

- Inadequate client support

Recognizing these issues is crucial for organizations aiming to mitigate overdue balances. By enhancing client communication and offering flexible billing options, companies can proactively address these challenges and foster stronger financial relationships.

Implement Effective Strategies for Managing Delinquent Accounts

To manage delinquency accounts effectively, organizations must adopt a multi-faceted approach that addresses the challenges of manual debt collection, including:

-

Early Intervention: Proactively reach out to clients immediately after a missed transaction. This timely outreach can increase the likelihood of full repayment by up to 30% compared to delayed actions. Simple reminders sent via email, text, or mail can encourage timely payments and prevent escalation into disputes. By utilizing Equabli's EQ Suite, organizations can automate these reminders, ensuring no client is overlooked.

-

Flexible Payment Plans: Customize repayment options that take into account the financial situations of delinquent customers. Research shows that implementing flexible plans can lead to a 25% increase in repayment rates, fostering goodwill and collaboration. With EQ Engage, organizations can provide tailored repayment solutions that enhance borrower engagement and compliance management.

-

Clear Communication: Ensure that all communication regarding financial terms and consequences is straightforward and transparent. Consistent and clear communication reinforces the seriousness of financial expectations, encouraging better habits among clients. The EQ Suite facilitates clear communication through its intuitive interface, making it easier to convey important information.

-

Incentives for Early Payment: Offering discounts or rewards for clients who settle their debts early can be an effective strategy. This approach not only encourages timely transactions but also strengthens customer relationships.

-

Regular Monitoring: Continuously track receivables to identify potential delinquencies before they escalate. By monitoring payment trends, organizations can intervene early, significantly enhancing recovery rates and minimizing financial risks. Moreover, maintaining meticulous documentation of all transactions and interactions with debtors is essential for potential legal proceedings.

By applying these strategies, supported by Equabli's groundbreaking tools, organizations can improve their collection efforts, effectively reduce the occurrence of delinquent payments, and better manage their delinquency account while transitioning from outdated manual processes to a more efficient, data-informed approach.

Utilize Technology and Automation to Enhance Delinquency Management

To effectively manage delinquent accounts, organizations must leverage technology and automation tools, including:

-

Automated Reminders: Implement software solutions that send automated billing reminders via email or SMS. This proactive communication keeps clients consistently informed about their financial obligations, significantly enhancing collection rates. Research indicates that organizations employing automated reminders can experience a notable increase in prompt settlements, thereby improving overall cash flow.

-

Data Analytics: Utilize advanced analytics tools to assess repayment behaviors and identify emerging trends. By analyzing historical data, lenders gain insights into borrower patterns, facilitating informed decision-making and tailored collection strategies. Financial institutions adopting data-driven approaches have reported reductions in operating expenses by 15-20%, highlighting the importance of analytics in optimizing delinquency management.

-

Self-Service Portals: Offer individuals online access to their accounts through self-service portals. This empowers borrowers to view their balances, make payments, and establish repayment plans at their convenience, fostering a sense of control and engagement. Enhanced borrower engagement through preferred communication channels has been shown to significantly improve repayment rates.

-

Integration with CRM Systems: Ensure delinquency management tools seamlessly integrate with existing client relationship management (CRM) systems. This integration maintains comprehensive customer profiles, allowing companies to tailor their communication and collection strategies effectively. By leveraging these technologies, organizations can streamline their delinquency management processes, enhance borrower engagement, and ultimately improve collection rates.

Conclusion

Managing delinquent accounts is paramount for safeguarding a company's financial health and ensuring long-term stability. The implications of overdue balances must be recognized as the first step toward effective management. Delinquent accounts not only impede cash flow but can also lead to substantial operational challenges, including increased collection costs and potential write-offs that jeopardize credit ratings and investor confidence.

This article delineates several key strategies for effectively managing delinquent accounts.

- Early intervention through timely reminders

- Implementation of flexible payment plans

- Clear communication of financial terms

- Provision of incentives for early payment

Furthermore, leveraging technology and automation—such as automated reminders and data analytics—can enhance collection efforts and streamline processes, ultimately resulting in improved recovery rates.

In conclusion, addressing delinquent accounts transcends merely chasing payments; it necessitates a comprehensive approach that integrates proactive communication, strategic flexibility, and modern technology. By adopting these best practices, organizations can not only mitigate the incidence of delinquency but also cultivate stronger relationships with clients, thereby ensuring a healthier financial future. Taking decisive action now is crucial to safeguarding against the broader consequences of delinquent accounts and paving the way for sustainable growth.

Frequently Asked Questions

What are delinquent accounts?

Delinquent accounts are debts that remain unpaid past their due date, typically categorized as overdue by 30 days or more.

How do delinquent accounts affect a company's financial health?

Delinquent accounts pose a significant risk to financial health by diminishing cash flow and increasing operational expenses related to collection efforts, potentially leading to substantial write-offs and negatively impacting credit ratings and profitability.

What percentage of B2B invoiced sales in the U.S. are overdue?

Approximately 55% of all B2B invoiced sales in the U.S. are overdue.

What are the broader implications of delinquent accounts for businesses?

Beyond cash flow issues, delinquent accounts can hinder a business's ability to meet payroll and invest in growth initiatives, with 73% of UK businesses reporting negative consequences due to late invoices.

What percentage of credit-based B2B sales in the U.S. were attributed to bad debts in 2023?

Bad debts accounted for an average of 9% of all credit-based B2B sales in the U.S. in 2023.

How much time do small business owners spend on pursuing unpaid invoices?

Small business owners, on average, dedicate 10% of their workday to pursuing unpaid invoices, which can divert attention from other critical tasks.

Why is it important for companies to manage delinquent accounts effectively?

Effective management of delinquent accounts is essential to mitigate financial risks, improve cash flow, and support overall business stability and growth potential.