Overview

This article outlines the essential steps for crafting an effective payment reminder email template aimed at debt recovery. Clear communication and timely follow-ups are critical in this process. Incorporating key elements such as invoice details, payment guidelines, and maintaining a professional tone significantly enhances client engagement. Evidence suggests that these practices not only reduce overdue payments but also support healthier cash flow for businesses.

From a compliance perspective, ensuring that payment reminders are structured and clear can mitigate risks associated with debt recovery. By adhering to established guidelines, businesses can foster trust and transparency with clients, which is vital in maintaining long-term relationships.

To operationalize this strategy, organizations should consider integrating automated systems that facilitate timely reminders while ensuring compliance with relevant regulations. This approach not only streamlines the process but also reinforces the importance of timely payments in sustaining business operations.

In conclusion, the strategic implementation of a well-crafted payment reminder email template is essential for effective debt recovery. By focusing on clarity, professionalism, and compliance, businesses can enhance their cash flow and reduce the incidence of overdue payments.

Introduction

Crafting effective payment reminder emails is a critical competency for businesses focused on sustaining healthy cash flow and nurturing positive client relationships. These communications function not merely as reminders; they are essential tools that can significantly mitigate overdue accounts and improve engagement rates. However, what challenges must be navigated to ensure these reminders are both impactful and received with professionalism? This article explores five key steps to develop a compelling payment reminder email template that not only encourages timely payments but also fortifies the relationship between businesses and their clients.

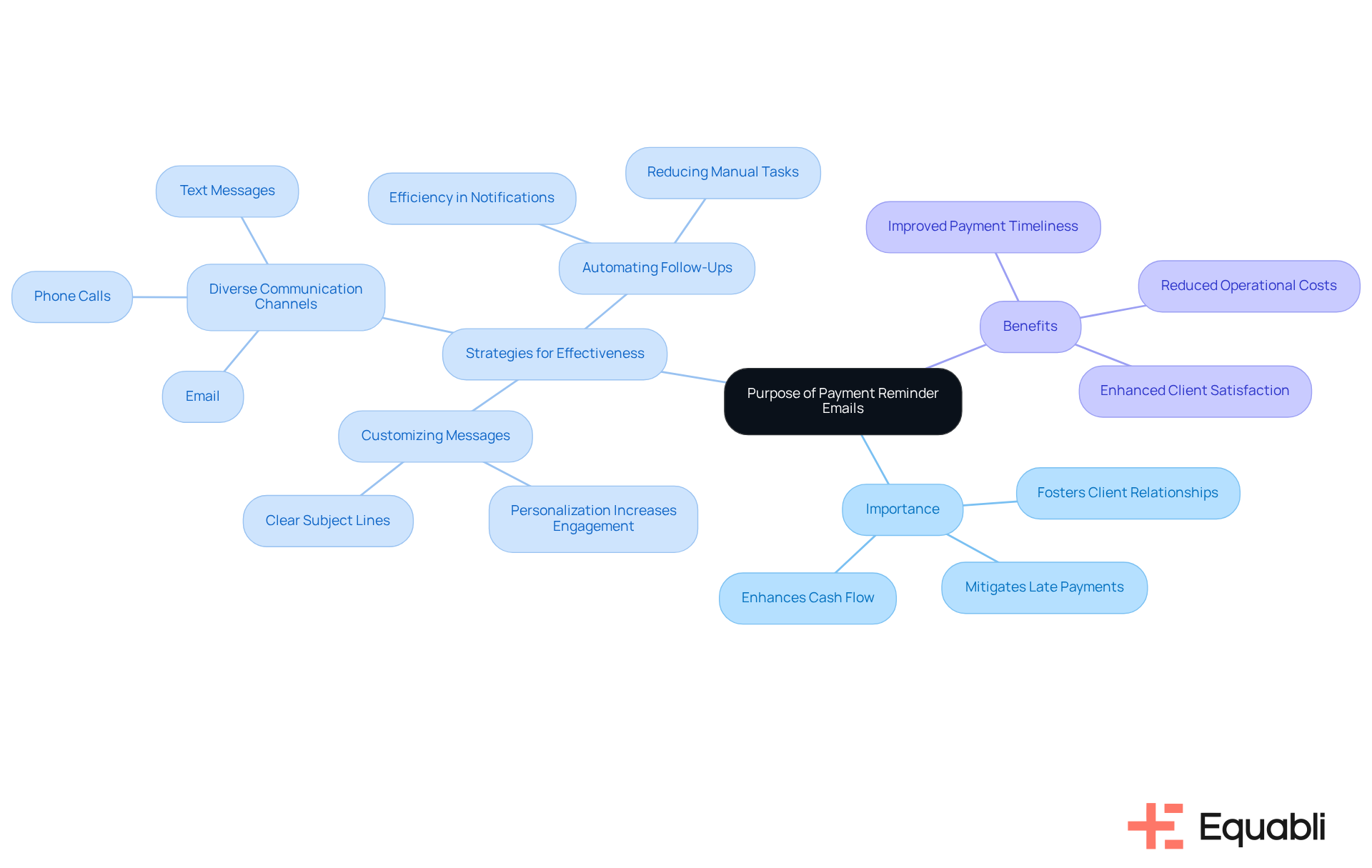

Understand the Purpose of Payment Reminder Emails

Invoicing alerts via email serve as essential tools in the debt collection process, utilizing a payment reminder email template for corporate debt recovery strategies to act as gentle reminders to clients regarding impending or overdue payments. These communications significantly mitigate the risk of late payments, which is vital for sustaining healthy cash flow. Companies that implement effective notification strategies often experience a notable decrease in overdue accounts; studies indicate that personalized emails yield a 20% higher engagement rate.

Timely reminders also contribute to fostering positive client relationships by demonstrating professionalism and courtesy. By clearly articulating financial terms and deadlines, the payment reminder email template for corporate debt recovery strategies not only prompts action but also underscores the importance of timely remittances. Financial experts emphasize that transparent communication is critical in reducing late payments, with omni-channel approaches enhancing collection success rates by up to 25%.

To optimize the effectiveness of billing notifications, financial organizations should adopt successful strategies such as:

- Customizing messages

- Utilizing diverse communication channels

- Automating follow-ups through platforms like EQ Collect

The automated workflows of this platform minimize manual tasks, ensuring notifications are dispatched promptly and efficiently, thereby enhancing client satisfaction and ultimately leading to improved cash flow and reduced operational costs.

It is also important to note that standard late fees typically range from 1-2% monthly, highlighting the financial repercussions of delayed transactions. Best practices recommend using a payment reminder email template for corporate debt recovery strategies by issuing notifications about dues three days prior to the deadline to encourage proactive engagement. Including a clickable transaction link or QR code in these notifications can facilitate easier transactions for clients, further enhancing the effectiveness of the communication.

Identify Key Elements to Include in Your Template

When crafting a payment reminder email template, it is essential to incorporate several key elements that enhance professionalism and ensure clarity in communication.

-

Subject Line: A clear and concise subject line is crucial. It should indicate the email's purpose, such as "Payment Reminder: Invoice #[Invoice Number] Due Soon." This sets the tone for the recipient's expectations.

-

Greeting: Begin with a personalized greeting that addresses the recipient by name. This fosters a friendly and approachable tone, which is vital in maintaining positive relationships.

-

Invoice Details: Clearly present the invoice number, amount due, and due date. This information should be prominently displayed for easy reference, ensuring that the recipient can quickly identify the key details.

-

Payment Guidelines: Provide explicit instructions on how to complete the transaction. Include direct links to transaction portals when relevant, facilitating a seamless payment process.

-

Contact Information: Include your contact details for any questions or clarifications. This reinforces your commitment to assist the recipient and enhances trust in your communication.

-

Closing Statement: Conclude with a courteous ending that expresses appreciation for their attention. Encourage prompt settlement, emphasizing the significance of timely financial interactions.

-

Email Disclaimers: Incorporate essential disclaimers to safeguard sensitive information and ensure legal compliance. This enhances the professionalism of your correspondence and protects both parties.

-

Consequences of Non-Remittance: Clearly state potential repercussions for tardy remittances, such as late fees or account suspension. This emphasizes the urgency of timely contributions and the importance of maintaining financial obligations.

Integrating these components not only elevates the professionalism of your communication but also increases the likelihood of prompt transactions when you use a payment reminder email template for corporate debt recovery strategies. Ultimately, this approach fosters healthier cash flow and strengthens customer relationships.

Determine the Appropriate Tone and Timing for Reminders

It is essential to select the appropriate tone and timing for a payment reminder email template for corporate debt recovery strategies to maximize their effectiveness.

-

Point: A friendly yet professional demeanor is crucial in communication.

-

Evidence: Starting with a warm welcome and expressing appreciation for the customer's business fosters goodwill.

-

Explanation: Avoiding confrontational language is vital; instead, a supportive and understanding approach encourages positive responses from clients. This tone not only enhances the customer experience but also strengthens the relationship.

-

Link: By cultivating a positive atmosphere, organizations can significantly improve client engagement and response rates.

-

Point: Strategic timing for notifications is equally important.

-

Evidence: Sending the first notice approximately seven days before the due date, followed by a reminder on the due date, is a recommended practice.

-

Explanation: If payment remains pending, a final notice should be dispatched shortly thereafter. This organized approach ensures that the transaction remains top-of-mind for customers by using a payment reminder email template for corporate debt recovery strategies, without overwhelming them with constant reminders.

-

Link: Such timing strategies can enhance the likelihood of prompt payments, thereby supporting cash flow management.

-

Point: Integrating EQ Collect into operations can streamline processes.

-

Evidence: This system eliminates the chaos of disjointed systems, ensuring timely reporting and improved coordination for notifications.

-

Explanation: A consistent communication method significantly increases the chances of timely transactions, which is crucial for maintaining healthy cash flow and client relationships.

-

Link: To explore how EQ Collect can enhance your debt collection process, consider booking a call today.

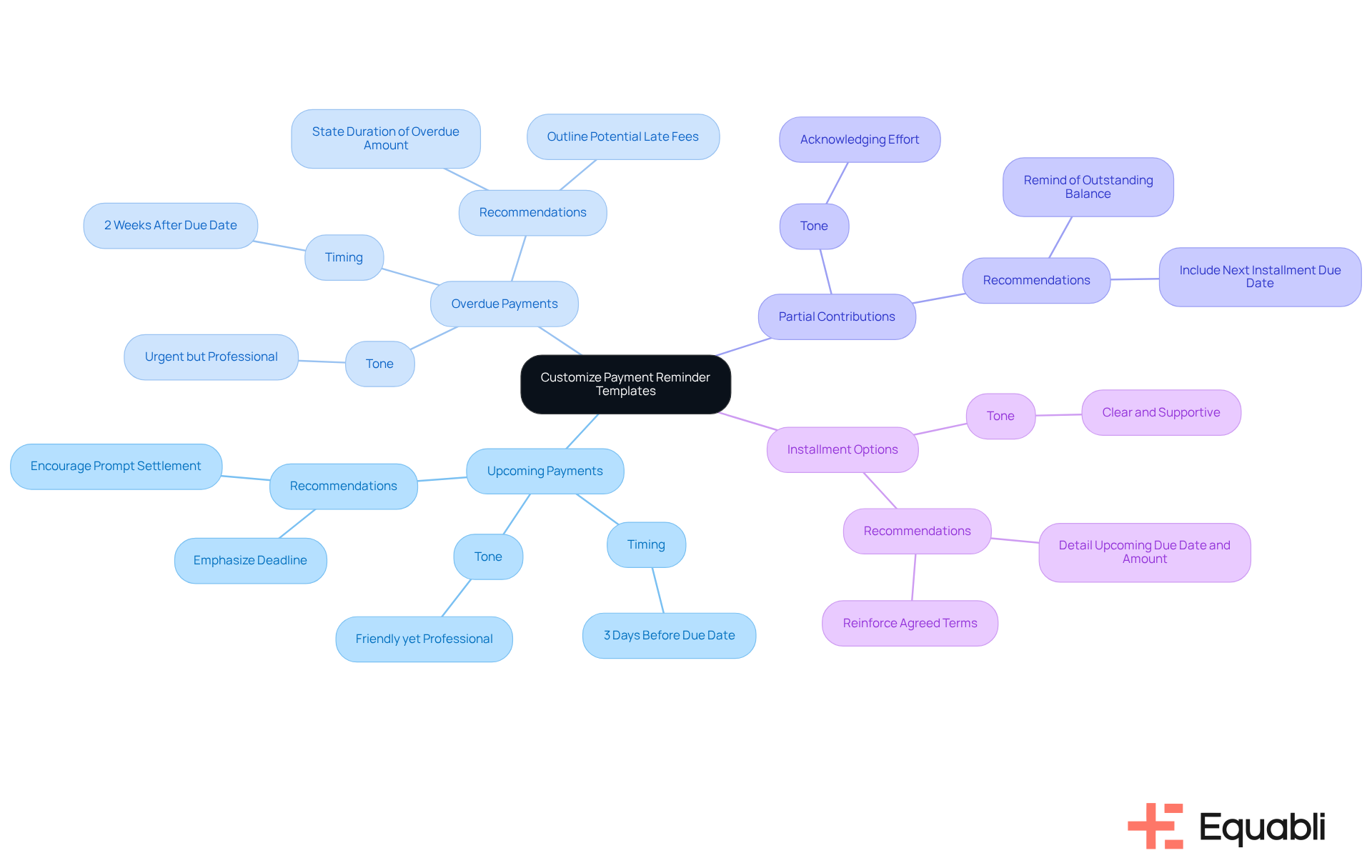

Customize Your Template for Various Payment Scenarios

To maximize the effectiveness of payment reminder emails, it is essential to customize templates based on specific payment scenarios:

-

Upcoming Payments: For invoices approaching their due date, adopt a friendly yet professional tone. Emphasize the impending deadline and encourage prompt settlement to avoid late charges. Evidence suggests that sending notifications three days prior to the due date significantly increases the likelihood of timely payments.

-

Overdue Payments: In the case of overdue invoices, it is crucial to adopt a more urgent tone while maintaining professionalism. Clearly state the duration of the overdue amount and outline any potential late fees. A reminder dispatched two weeks after the due date can effectively prompt action, particularly if it features a clear subject line that conveys urgency.

-

Partial Contributions: When a client has made a partial payment, acknowledge their effort while reminding them of the outstanding balance. Include the due date for the next installment to reinforce the importance of settling the account promptly. This approach fosters goodwill and encourages timely payment of dues.

-

Installment Options: For customers on an installment plan, send notifications detailing the upcoming due date and amount. Reinforce the agreed-upon terms to ensure clarity and compliance. This not only supports adherence to the payment schedule but also strengthens the relationship with the customer by demonstrating attentiveness to their commitments.

By tailoring your communication to these specific scenarios, including the use of a payment reminder email template for corporate debt recovery strategies, you can enhance client engagement and improve the overall efficiency of your debt recovery efforts.

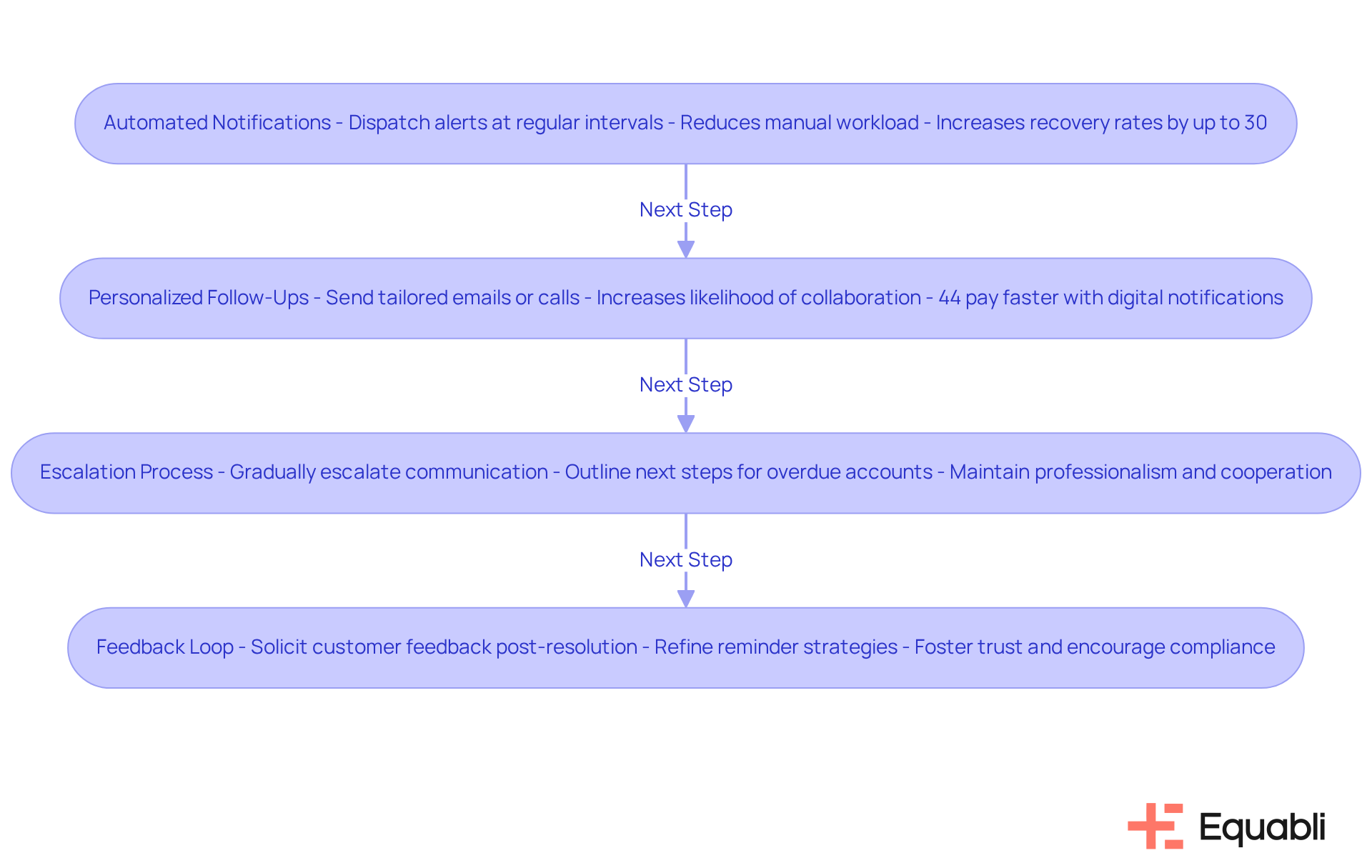

Implement Follow-Up Strategies for Effective Debt Recovery

Implementing effective follow-up strategies, including a payment reminder email template for corporate debt recovery strategies, is crucial for enhancing debt recovery efforts in financial institutions. Automated Notifications serve as a foundational approach. By utilizing a payment reminder email template for corporate debt recovery strategies, institutions can dispatch alerts at regular intervals, ensuring consistency in communication while significantly reducing manual workload. This allows staff to concentrate on more complex tasks. Financial institutions that have adopted automated solutions have reported recovery rate increases of up to 30%. Moreover, implementing a payment reminder email template for corporate debt recovery strategies can decrease the collection cycle from weeks or months to days, thereby enhancing cash flow and overall efficiency.

Personalized Follow-Ups are essential for individuals who do not respond to initial reminders. Sending a personalized follow-up email or making a direct phone call can be highly effective. Customizing interactions based on personal financial history and preferences increases the likelihood of collaboration, as nearly 70% of clients would consider switching for a superior financial experience. Furthermore, 44% of patients pay faster when they receive digital notifications, highlighting the importance of timely and personalized communication.

Establishing a clear escalation process using a payment reminder email template for corporate debt recovery strategies for overdue accounts is another critical strategy. If payments remain unmade after several reminders, using a payment reminder email template for corporate debt recovery strategies to outline the next steps—such as involving a collections agency or pursuing legal action—upholds professionalism and ensures that customers understand the seriousness of their obligations. Gradually escalating communication helps maintain positive debtor relationships while encouraging cooperation.

Finally, creating a Feedback Loop after resolving a payment issue is vital. Soliciting feedback from customers regarding their experience not only provides valuable insights for refining reminder strategies but also fosters trust and encourages future compliance. This practice can reveal areas for improvement and enhance the overall customer experience.

By integrating these strategies, financial institutions can optimize their debt recovery processes, enhance client engagement, and ultimately improve collection rates.

Conclusion

Crafting effective payment reminder emails is crucial for enhancing debt recovery processes and maintaining healthy cash flow. These communications serve not only to prompt timely payments but also to foster positive relationships with clients, ensuring that financial obligations are met with professionalism and courtesy. By understanding their purpose and adopting the right tone and timing, organizations can significantly improve their communication strategies.

Various strategies underscore the importance of:

- Customization based on specific payment scenarios

- The benefits of automated notifications

- The necessity of follow-up strategies

Personalized communication leads to higher engagement rates and improved collection success. Implementing these best practices can result in a reduction of overdue accounts and an increase in overall efficiency, ultimately benefiting the organization.

The significance of payment reminder emails extends beyond mere debt recovery; they are vital for maintaining trust and transparency in client relationships. Organizations should prioritize developing tailored communication strategies that resonate with clients, ensuring reminders are effective yet respectful. Adopting these practices can streamline the debt recovery process, enhancing both organizational performance and client satisfaction.

Frequently Asked Questions

What is the purpose of payment reminder emails?

Payment reminder emails serve as essential tools in the debt collection process, acting as gentle reminders to clients about impending or overdue payments, which helps mitigate the risk of late payments and sustain healthy cash flow.

How do personalized payment reminder emails impact client engagement?

Personalized emails yield a 20% higher engagement rate compared to standard messages, leading to a notable decrease in overdue accounts.

What are some strategies to optimize payment reminder emails?

Successful strategies include customizing messages, utilizing diverse communication channels, and automating follow-ups through platforms like EQ Collect.

What are the financial repercussions of delayed transactions?

Standard late fees typically range from 1-2% monthly, highlighting the financial impact of delayed payments.

What key elements should be included in a payment reminder email template?

Key elements include a clear subject line, personalized greeting, invoice details, payment guidelines, contact information, a courteous closing statement, email disclaimers, and consequences of non-remittance.

How should the subject line of a payment reminder email be structured?

The subject line should be clear and concise, indicating the email's purpose, such as 'Payment Reminder: Invoice #[Invoice Number] Due Soon.'

Why is it important to include invoice details in a payment reminder email?

Clearly presenting the invoice number, amount due, and due date ensures that the recipient can quickly identify key details for prompt payment.

What should be included in the payment guidelines of a reminder email?

Payment guidelines should provide explicit instructions on how to complete the transaction, including direct links to transaction portals when relevant.

How can including contact information in the email enhance communication?

Including contact details reinforces your commitment to assist the recipient and enhances trust in your communication.

What should the closing statement of a payment reminder email convey?

The closing statement should express appreciation for the recipient's attention and encourage prompt settlement, emphasizing the significance of timely financial interactions.