Overview

The article serves as a comprehensive guide on effectively crafting a credit collection dispute letter. It begins by emphasizing the letter's purpose, which is crucial for achieving a successful outcome. Essential steps are outlined, including:

- Gathering necessary documentation

- Incorporating key elements into the letter

- Ensuring proper formatting

- Sending it to the correct address

Following up is also highlighted as a vital action to secure a timely resolution. By adhering to these steps, individuals can significantly enhance their chances of contesting inaccuracies in their credit reports.

Introduction

Crafting an effective credit collection dispute letter is a crucial step in safeguarding one’s financial health. With nearly 20% of consumers successfully challenging inaccuracies in their credit reports, understanding how to navigate this process is essential. This guide offers a comprehensive look at the steps necessary to draft a compelling dispute letter, ensuring that individuals can assert their rights and rectify any errors impacting their creditworthiness.

What happens, however, when the response is unsatisfactory? How can one ensure that their voice is heard in the often-complex world of debt collection?

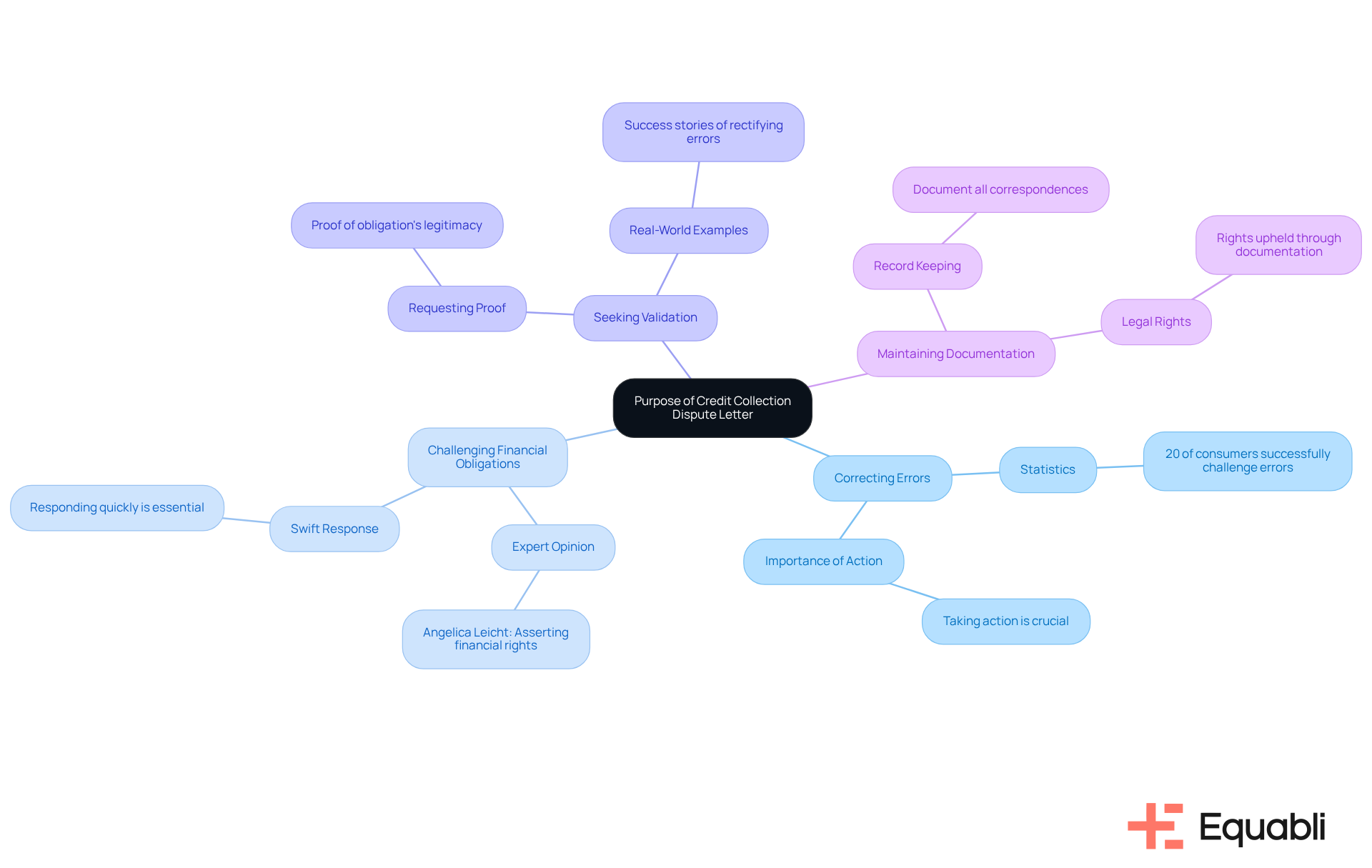

Understand the Purpose of a Credit Collection Dispute Letter

A debt collection challenge document is a formal instrument designed to contest the legitimacy of an obligation or rectify inaccuracies in your financial report. Understanding its purpose is vital for effective communication:

-

Correcting Errors: Identifying inaccuracies in your credit report? This credit collection dispute letter serves as your primary tool to request the necessary corrections. Data from the FTC indicates that approximately 20% of consumers successfully challenge errors in their financial reports, underscoring the importance of taking action.

-

Challenging Financial Obligations: Encountering a financial obligation that you do not recognize or believe is incorrect? This credit collection dispute letter empowers you to formally contest it. Financial experts, such as Angelica Leicht, emphasize that disputing erroneous obligations is not merely about enhancing your credit score; it is about asserting your financial rights. Swiftly responding and challenging inaccurate financial obligations through the appropriate channels is crucial.

-

Seeking Validation: The document can also be utilized to request that the creditor provide proof of the obligation's legitimacy and confirm your accountability for it. Real-world examples demonstrate that individuals have successfully rectified credit report errors through well-crafted credit collection dispute letters, reinforcing the significance of this process.

Moreover, maintaining documentation of all correspondences with collection agencies is essential, as these records can support your claim. Remember, upon sending a written challenge within 30 days of receiving notice, collectors are required to cease all collection activities until they furnish verification of the obligation. If you experience harassment from creditors, you have the option to file complaints with the CFPB or your state's attorney general.

By clearly defining your purpose, you can tailor your message to effectively communicate your concerns and desired outcomes, ensuring that your rights are upheld throughout the debt collection process.

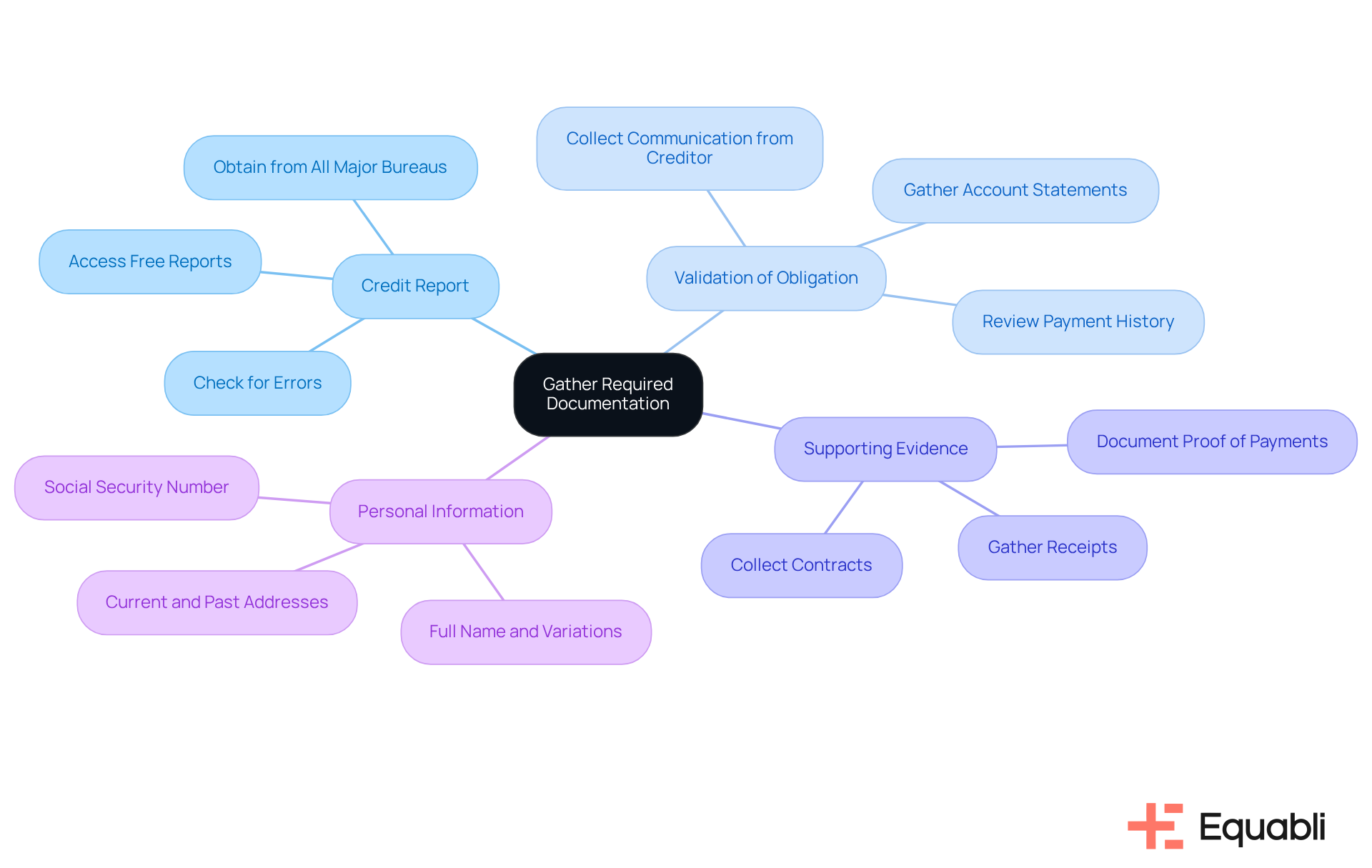

Gather Required Documentation and Information

Before drafting your dispute letter, it is essential to gather all relevant documentation and information to support your case effectively:

- Credit Report: Secure copies of your credit report from all three major credit bureaus—Equifax, Experian, and TransUnion. This step is critical, as mistakes can significantly impact your score and access to financing. You can access your credit reports for free through AnnualCreditReport.com.

- Validation of Obligation: Collect any communication from the creditor regarding the obligation, including account statements and payment history. This documentation is vital for validating the legitimacy of the debt in question.

- Supporting Evidence: If applicable, gather receipts, contracts, or any other documents that substantiate your claim. Effective documentation may include proof of payments or agreements that contradict the creditor's assertions.

- Personal Information: Ensure you have your personal details, such as your full name, address, and Social Security number, ready to include in the document. Accurate identification is essential, as errors in personal details can complicate the resolution process. Notably, 34% of participants found errors related to personal information, such as incorrect names or addresses.

Arranging this information not only simplifies the preparation of your credit collection dispute letter but also strengthens your position. Research indicates that 74% of consumer grievances to the Consumer Financial Protection Bureau arise from inaccurate data on financial reports. Furthermore, 25% of participants were unable to access their financial reports, highlighting potential obstacles in the resolution process. By being prepared, you can reference specific details that bolster your argument, aiding the reporting agency in addressing your concern effectively. Most conflicts are resolved within 10 to 14 days, establishing a reasonable expectation for the timeline of your issue. As Chris Horymski from Experian notes, even consumers with exceptional credit may not receive approval for significant purchases if other lender criteria are unmet, underscoring the necessity of promptly addressing any inaccuracies.

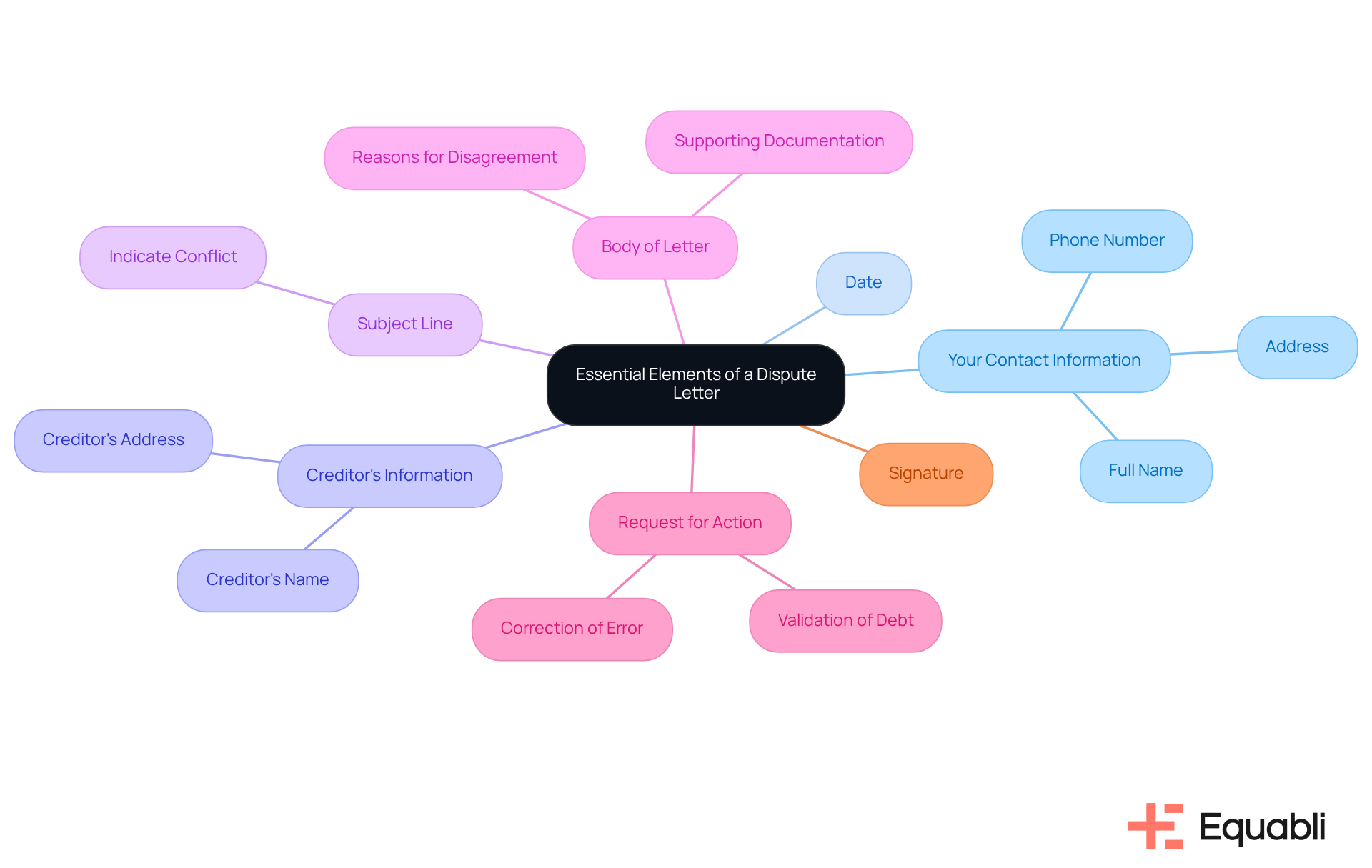

Include Essential Elements in Your Dispute Letter

A professional dispute letter must encompass several key elements to ensure clarity and effectiveness:

- Your Contact Information: Start with your full name, address, and phone number at the top of the letter. This allows the recipient to easily identify and respond to you.

- Date: Include the date you are sending the correspondence, which is essential for tracking the timeline of your issue.

- Creditor's Information: Direct the correspondence to the specific creditor or credit bureau, including their name and address, to ensure it reaches the correct party.

- Subject Line: Clearly indicate that this is a conflict letter, aiding in the appropriate categorization of the correspondence.

In the body of the credit collection dispute letter, explain the reasons for your disagreement by referencing specific inaccuracies or amounts owed. To substantiate your claims in the credit collection dispute letter, include supporting documentation, as this significantly impacts the success of your dispute.

- Request for Action: Clearly articulate what you want the creditor to do, whether it’s correcting the error or providing validation of the debt. This direct approach can facilitate a quicker resolution.

- Signature: Conclude with your signature at the bottom of the document, adding a personal touch and confirming the authenticity of your request.

Incorporating these elements not only enhances the professionalism of your correspondence but also increases the likelihood of a favorable outcome. Studies indicate that properly structured complaint letters can lead to greater success rates in addressing financial problems, making it crucial to follow these recommendations. According to Gayle Sato, "If your credit report displays incorrect or incomplete information, you have the right to submit a request for the credit reporting agency to examine the information in question." Furthermore, it is crucial to highlight that claims submitted online with Experian are typically resolved within 30 days, offering a clear timeline for resolution. Understanding your legal rights, including the obligation for debt collectors to provide written validation notices, can further empower you in the resolution process.

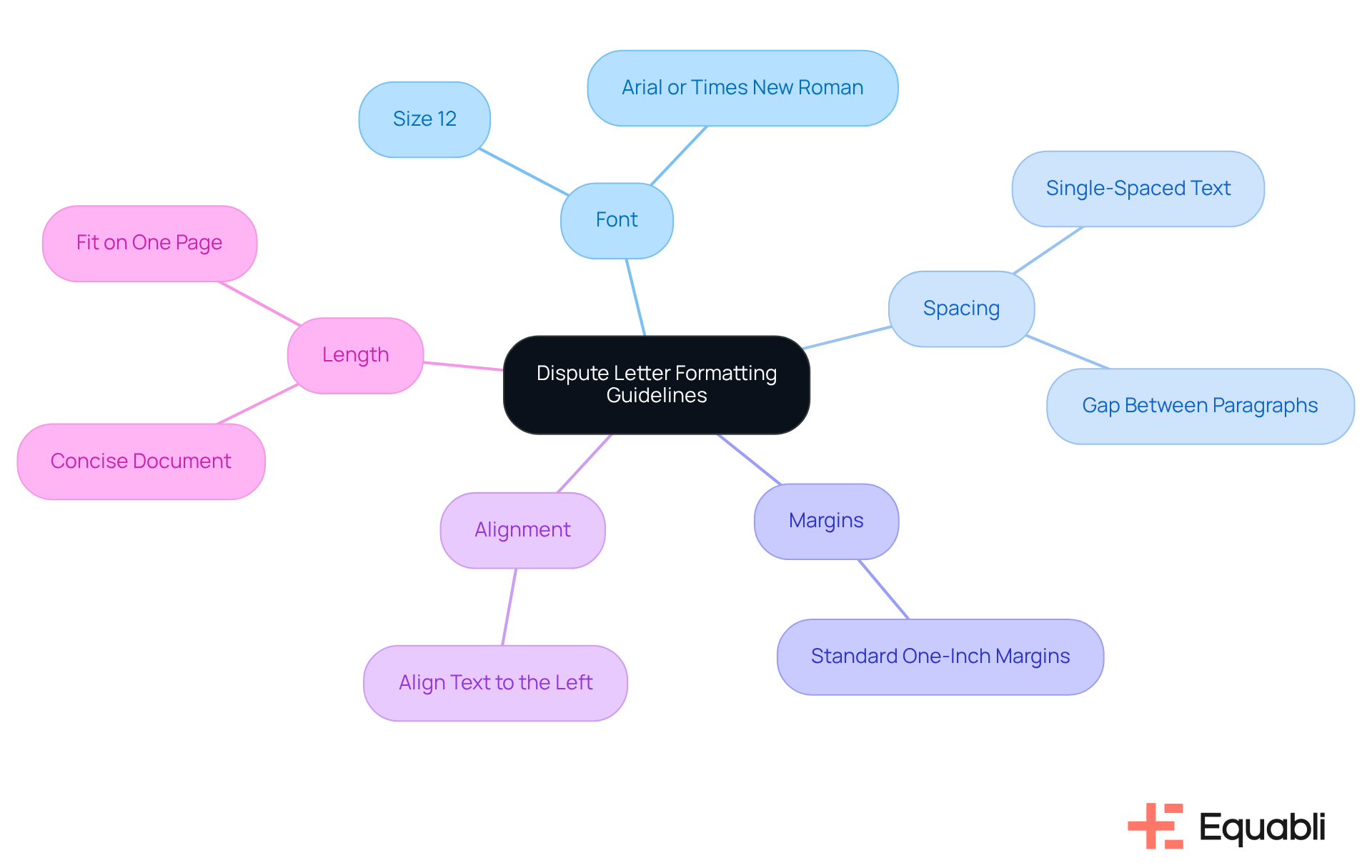

Format Your Dispute Letter Properly

To ensure your dispute letter is well-received, it is essential to adhere to these formatting guidelines:

- Use a Professional Font: Opt for a clear, professional font such as Arial or Times New Roman, size 12, to enhance readability.

- Single-Spaced Text: Maintain single-spacing throughout the document, with a gap between paragraphs to enhance clarity.

- Margins: Standard one-inch margins on all sides create a neat appearance.

- Alignment: Align your text to the left for a clean and organized look.

- Length: Aim for conciseness; ideally, the document should fit on one page, focusing on key points without unnecessary elaboration.

Proper formatting of the credit collection dispute letter not only improves readability but also demonstrates your seriousness in addressing the issue. According to communication experts, well-organized messages significantly enhance the chances of a positive reply, as they reflect professionalism and attention to detail. Additionally, using certified mail for sending complaint communications is advisable; it provides evidence of delivery and can heighten the urgency of your request. Statistics indicate that items sent via certified mail are 70% more likely to receive a timely response, ensuring your concerns are addressed swiftly. Furthermore, remember that reporting agencies are required to investigate disputes within 30 days, making proper formatting even more crucial in expediting your request.

Send Your Dispute Letter to the Correct Address

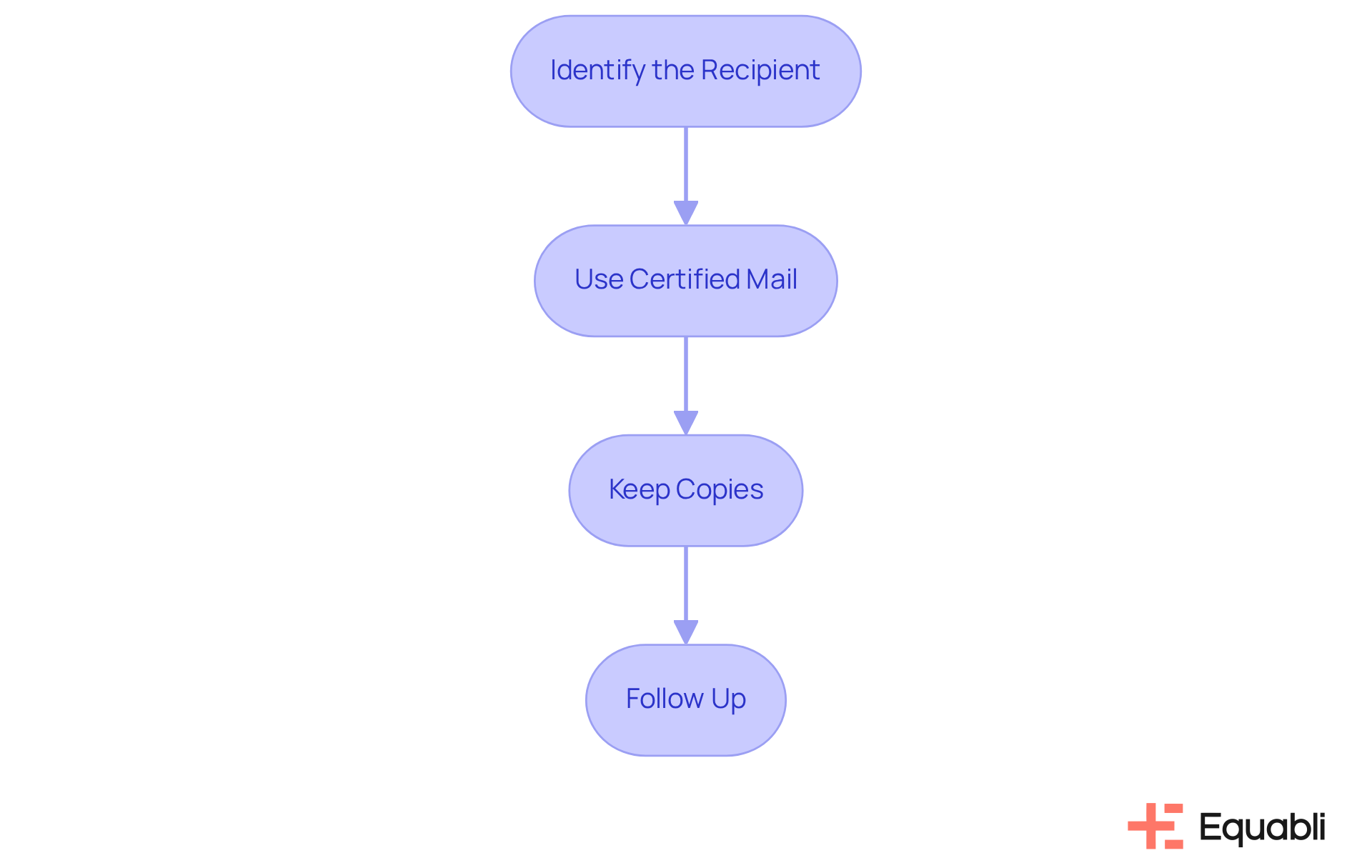

To ensure your dispute letter is processed efficiently, it is essential to adhere to the following best practices:

-

Identify the Recipient: Verify the correct department responsible for handling disputes by checking the creditor's website or your credit report. This initial step is crucial for directing your correspondence appropriately.

-

Use Certified Mail: Send your correspondence via certified mail with a return receipt requested. This method provides proof of delivery, which is vital for tracking your correspondence and ensuring accountability.

-

Keep Copies: Retain duplicates of the correspondence and any supporting documentation you send. This record will be invaluable for future reference, especially if further action is needed.

-

Follow Up: Mark the date you sent the correspondence and plan to follow up if you do not receive a response within 30 days. Creditors are typically expected to reply within this timeframe, and following up can help guarantee your issue is recognized.

As Leslie H. Tayne, Esq. states, "Almost any mistake or incorrect information you discover on your credit history should be tackled with a credit challenge correspondence." By correctly sending your credit collection dispute letter, you enhance the likelihood of it being received and processed by the appropriate party, thereby increasing your chances of a successful resolution. Furthermore, recognizing that lenders have 30 days to examine disagreements after obtaining your correspondence is vital for regulating your expectations throughout the procedure.

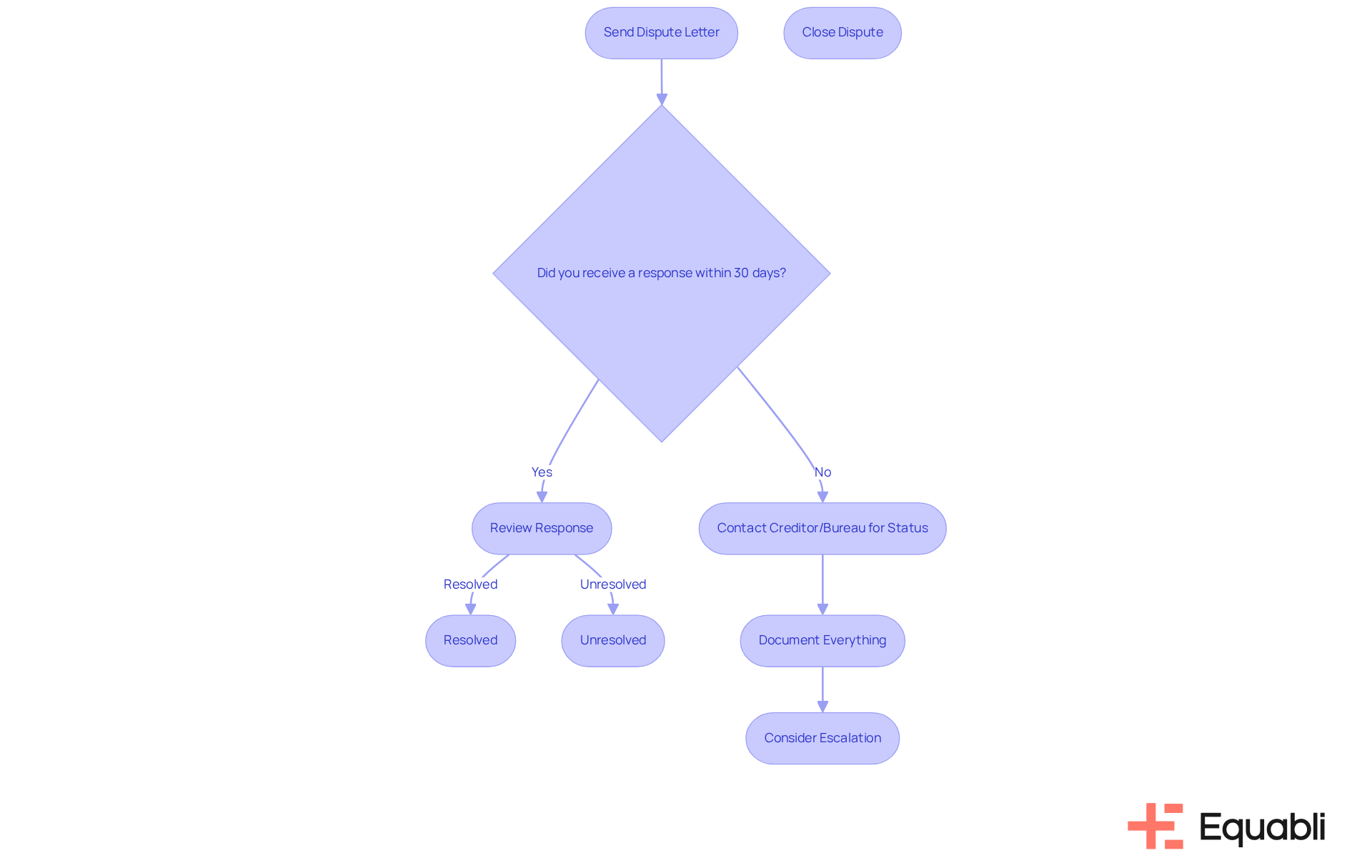

Follow Up on Your Dispute Letter

Following up on your credit collection dispute letter is crucial for ensuring a timely resolution. To effectively navigate this process, consider these key steps:

- Wait for a Response: Allow at least 30 days for the creditor or credit bureau to respond to your dispute. This timeframe is essential as it aligns with regulatory requirements for managing conflicts.

If you do not receive a response within this period, proactively reach out to the creditor or bureau to inquire about the status of your credit collection dispute letter. Many consumers find that direct communication can expedite the process.

Document everything in your credit collection dispute letter by maintaining meticulous records of all communications, including dates, times, and the names of representatives you speak with. This documentation can be invaluable if a credit collection dispute letter is required for further action.

If your conflict remains unresolved or unsatisfactorily addressed, consider sending a credit collection dispute letter to a regulatory agency or seeking legal advice. Consumer advocates emphasize that escalation can often lead to more serious attention to your case.

Research indicates that consumers who actively pursue their issues report higher satisfaction rates with the resolution process. A significant number express that diligent follow-up can significantly influence the outcome of their disputes. As noted by consumer advocate Wu, "Consumers should also file a complaint with the CFPB and their state attorney general's office." By demonstrating your commitment to resolving the issue, you increase the likelihood of achieving a favorable resolution.

Conclusion

Crafting an effective credit collection dispute letter is an essential step in asserting one's financial rights and ensuring the accuracy of credit reports. This process empowers individuals to challenge erroneous debts and serves as a crucial tool for correcting inaccuracies that can significantly impact financial health. By understanding the letter's purpose, gathering necessary documentation, and adhering to the proper format, consumers can enhance their chances of a successful resolution.

The article outlines several key steps to navigate the dispute process effectively:

- Understanding the essential elements that must be included in the letter.

- The importance of sending it to the correct address.

Each step plays a vital role in ensuring that the dispute is taken seriously by creditors and credit bureaus. Furthermore, the significance of following up on the dispute cannot be overstated; proactive communication can lead to quicker resolutions and better outcomes.

Ultimately, taking action to dispute inaccuracies transcends merely improving a credit score; it is about reclaiming financial control. Consumers are encouraged to utilize the provided guidelines, gather the necessary evidence, and remain diligent in their follow-up efforts. By doing so, they can rectify their credit reports and foster a deeper understanding of their financial rights and responsibilities.

Frequently Asked Questions

What is the purpose of a credit collection dispute letter?

A credit collection dispute letter is a formal document used to contest the legitimacy of a debt or correct inaccuracies in your credit report. It serves to request corrections, challenge unrecognized financial obligations, and seek validation from creditors regarding the legitimacy of the obligation.

How can a credit collection dispute letter help correct errors in my credit report?

The letter allows you to formally request corrections for inaccuracies found in your credit report. According to the FTC, about 20% of consumers successfully challenge errors in their reports, emphasizing the importance of taking action.

What should I do if I encounter a financial obligation I do not recognize?

You can use the credit collection dispute letter to formally contest the financial obligation that you believe is incorrect. This process is important for asserting your financial rights and ensuring accurate reporting.

What kind of validation can I request from creditors using the dispute letter?

You can request that the creditor provide proof of the obligation's legitimacy and confirm your responsibility for it. This documentation is crucial for validating the debt in question.

What documentation should I gather before drafting my dispute letter?

You should collect your credit reports from all three major credit bureaus, any communication from the creditor regarding the obligation, supporting evidence like receipts or contracts, and your personal information such as your full name, address, and Social Security number.

Why is it important to maintain documentation of correspondences with collection agencies?

Keeping records of all correspondences can support your claim and provide evidence if disputes arise. It is also essential for tracking the progress of your dispute.

What happens after I send a written challenge to a collector?

Once you send a written challenge within 30 days of receiving notice, collectors are required to cease all collection activities until they provide verification of the obligation.

What should I do if I experience harassment from creditors?

If you face harassment, you can file complaints with the Consumer Financial Protection Bureau (CFPB) or your state's attorney general.

How can I access my credit reports for free?

You can access your credit reports for free through AnnualCreditReport.com, which allows you to obtain copies from all three major credit bureaus.

What is the expected timeline for resolving disputes?

Most conflicts are resolved within 10 to 14 days, establishing a reasonable expectation for the timeline of your issue.