Overview

This article examines various accounts receivable management solutions specifically designed for enterprise financial services, underscoring the critical role of automation and predictive analytics in improving debt collection efficiency. Evidence shows that by leveraging advanced technologies, such as the EQ Suite and similar platforms, organizations can achieve significant improvements in recovery rates, streamline operations, and optimize cash flow management. These enhancements are essential for addressing the evolving challenges faced in financial operations, thereby offering strategic insights for executives navigating the complexities of debt collection and compliance.

Introduction

The financial landscape is evolving rapidly, underscoring the critical importance of effective accounts receivable management for organizations. As enterprises seek to enhance cash flow and streamline debt collection processes, innovative solutions leveraging automation and predictive analytics are emerging. This article examines seven cutting-edge accounts receivable management tools designed to optimize financial operations. However, the pressing question remains: which of these solutions will best equip businesses to navigate the complexities of debt recovery in an ever-changing environment?

Equabli EQ Suite: Intelligent Solutions for Streamlined Debt Collection

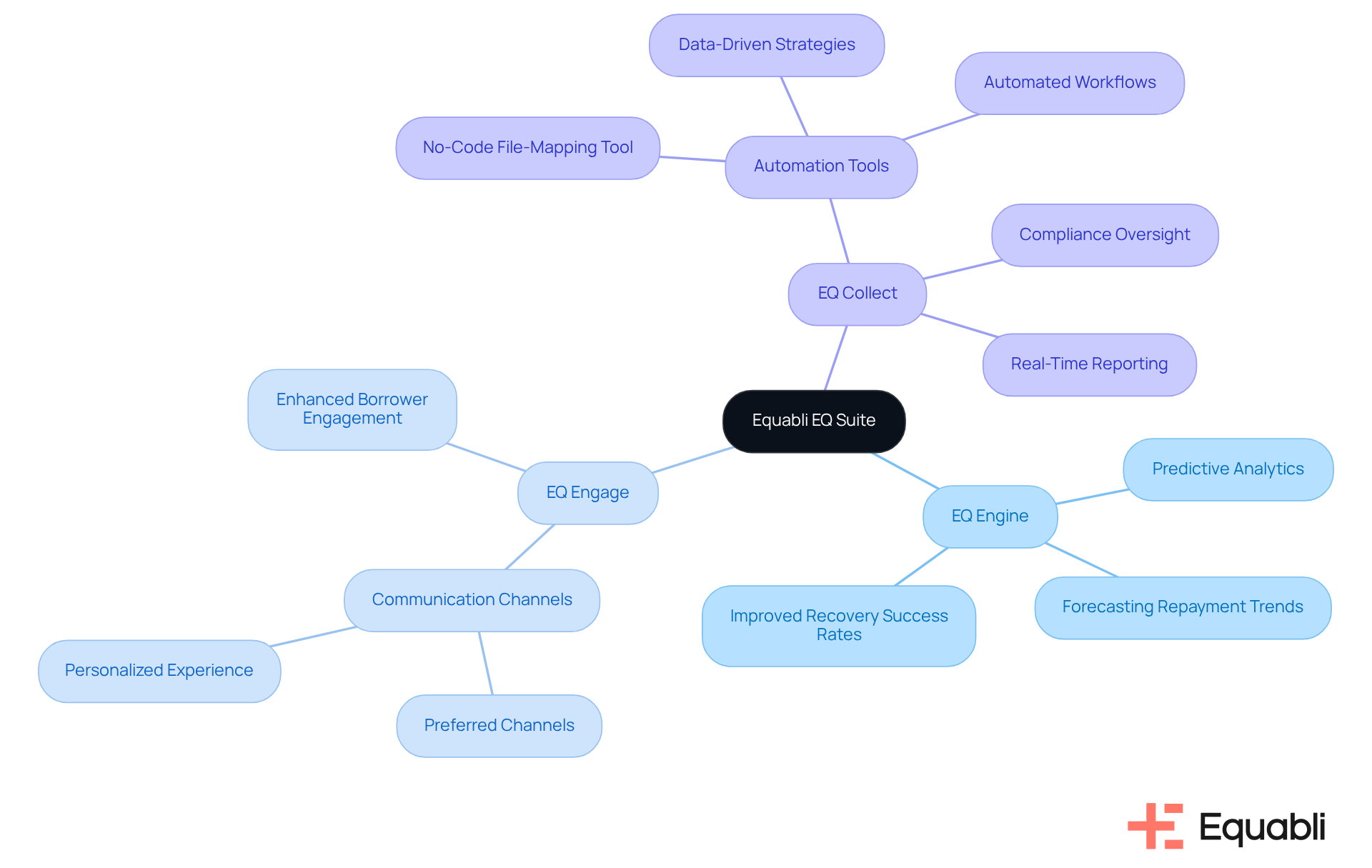

The Equabli EQ Suite serves as a comprehensive platform aimed at enhancing debt recovery processes for lenders and agencies. Comprising three critical components—EQ Engine, EQ Engage, and EQ Collect—this suite leverages advanced predictive analytics to evaluate repayment behaviors, enabling organizations to customize their recovery strategies effectively. The EQ Engine's ability to forecast repayment trends significantly improves recovery success rates; reports indicate that businesses utilizing such predictive tools can experience recovery rates soaring by up to 80% compared to traditional methods.

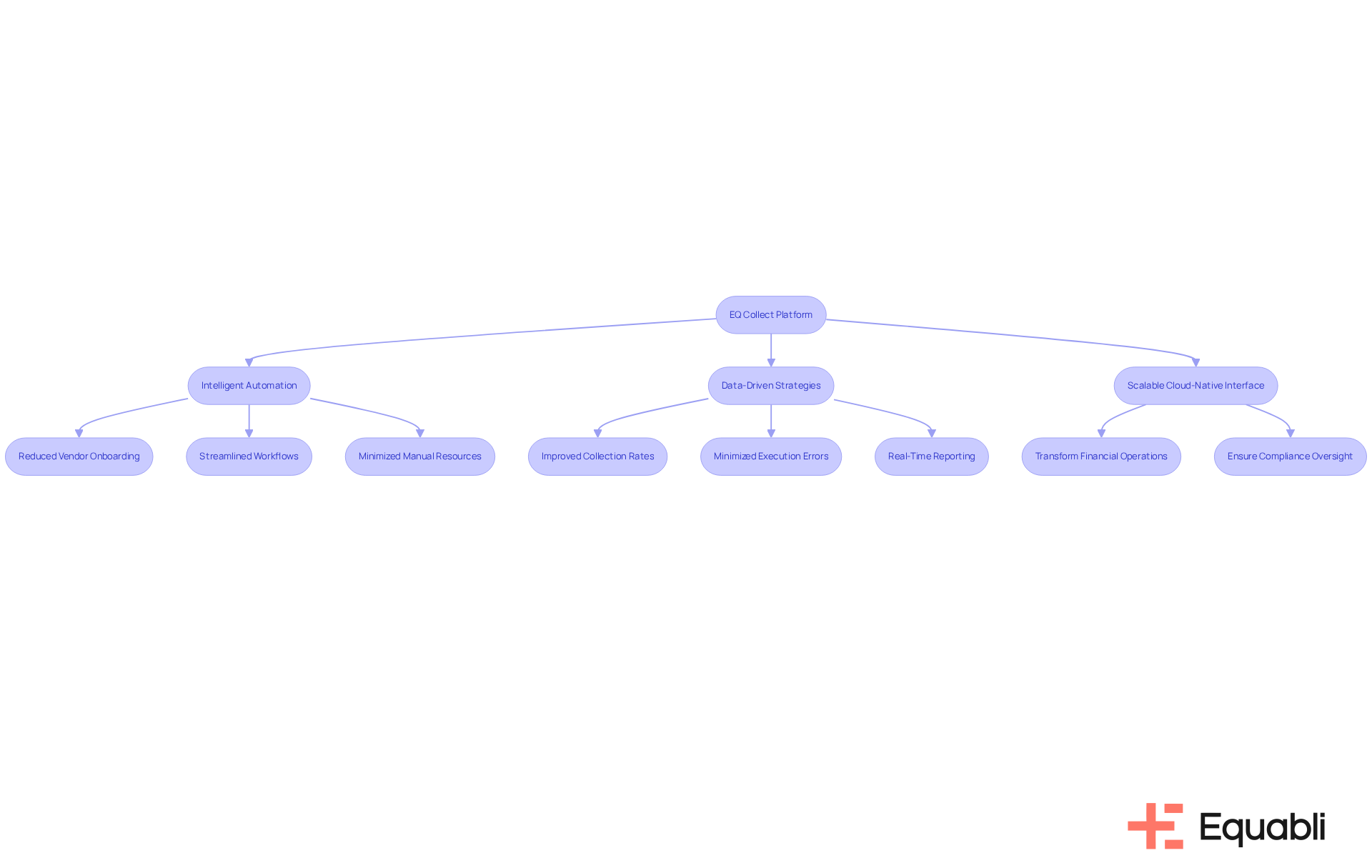

EQ Engage promotes efficient communication with borrowers through their preferred channels, thereby fostering a more personalized experience. In parallel, EQ Collect automates the collection process, ensuring compliance and operational efficiency. Notable features of EQ Collect include:

- A no-code file-mapping tool that accelerates vendor onboarding

- Data-driven strategies that optimize retrievals

- Automated workflows that minimize execution errors

Furthermore, it offers real-time reporting for unparalleled transparency and insights, coupled with industry-leading compliance oversight. The user-friendly, scalable, cloud-native interface further enhances the experience, facilitating financial institutions' adaptation to evolving needs.

This technological integration not only curtails operational costs but also boosts borrower engagement, positioning the EQ Suite as an indispensable asset for modern financial institutions navigating the complexities of accounts receivable management debt collection solutions for enterprise financial services. Equabli is dedicated to safeguarding private information, ensuring that all data handling within the EQ Suite complies with rigorous data protection standards, which is vital in today’s regulatory landscape.

As the debt recovery landscape progresses, particularly in 2025, the emphasis on technology-driven solutions becomes increasingly important. Industry leaders highlight the significance of predictive analytics in formulating effective debt recovery strategies, underscoring the EQ Suite's pivotal role in transforming how financial institutions manage delinquency and recover outstanding debts.

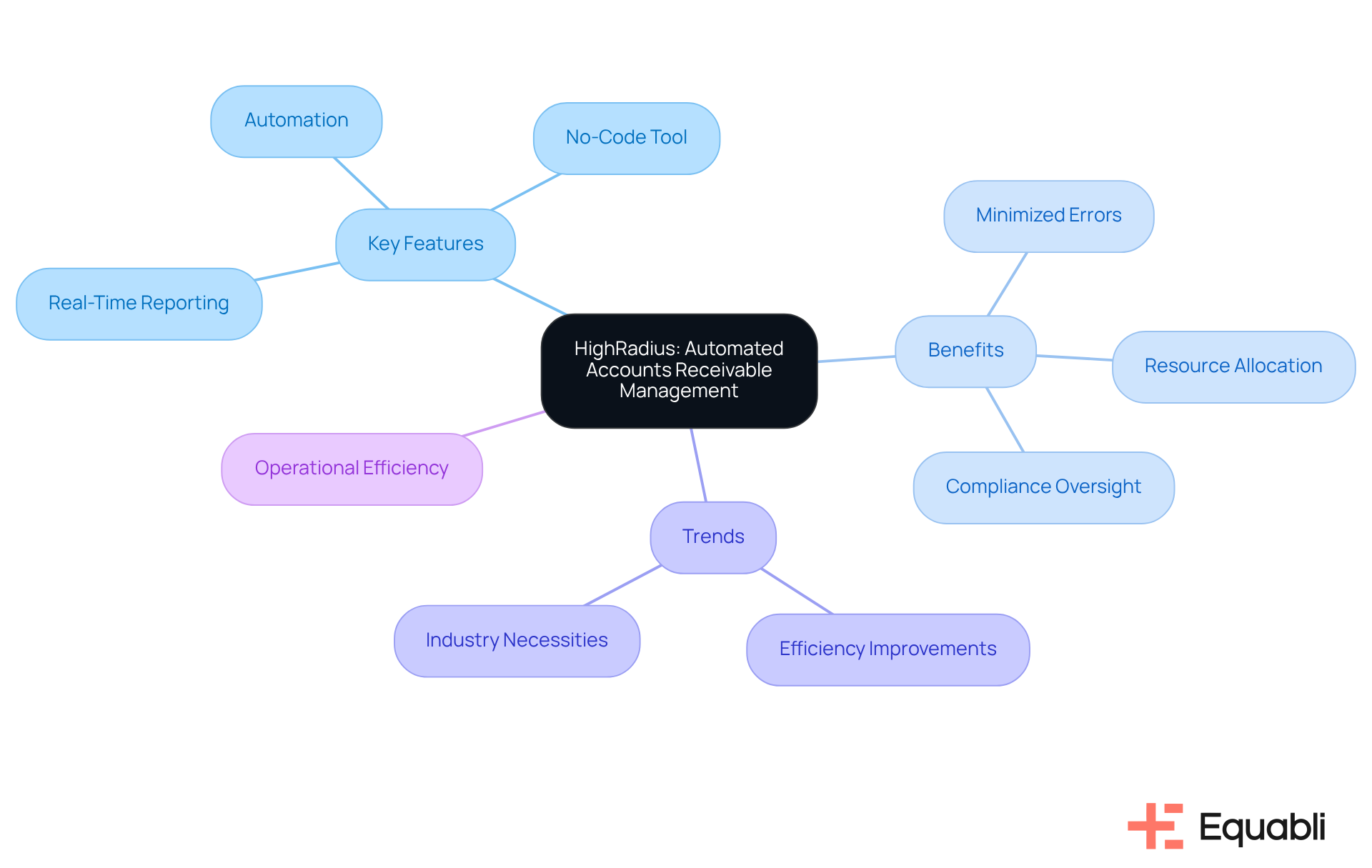

HighRadius: Automated Accounts Receivable Management Software

Equabli delivers a robust suite of accounts receivable management debt collection solutions for enterprise financial services, strategically designed to optimize cash flow processes. By automating essential functions such as vendor onboarding, payment collection, and reporting, EQ Collect significantly minimizes manual effort and reduces errors. The platform's intuitive, no-code file-mapping tool streamlines vendor onboarding timelines, while data-driven strategies enhance operational efficiency and increase collections. Consequently, organizations can minimize execution errors and allocate resources more effectively.

Leveraging advanced automation and real-time reporting, Equabli ensures unmatched transparency and insights, providing industry-leading compliance oversight both internally and externally. This capability enables organizations to transition their focus from administrative tasks to strategic initiatives, ultimately driving improved operational efficiency and cash flow optimization.

Recent trends indicate that automation is transforming cash application processes, allowing organizations to achieve substantial efficiency improvements. Industry leaders stress the necessity of adopting these technologies to maintain competitiveness in the evolving financial landscape. As organizations increasingly recognize the significance of accounts receivable management debt collection solutions for enterprise financial services, they can enhance their operational capabilities and realize meaningful advancements in cash flow management.

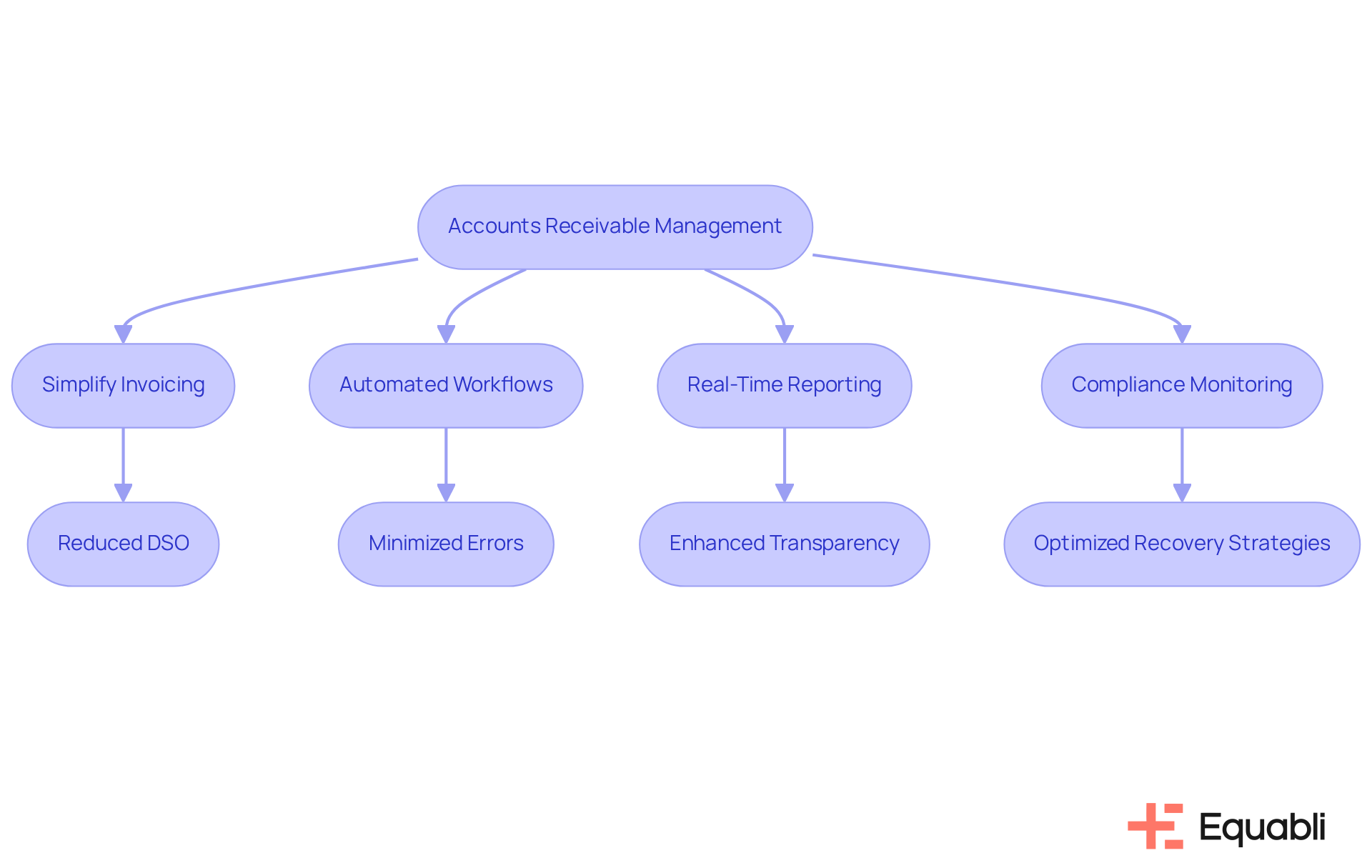

Gaviti: Cash Flow Optimization through Accounts Receivable Management

Equabli offers innovative accounts receivable management debt collection solutions for enterprise financial services, strategically focused on enhancing cash flow for enterprises. The EQ Collect platform simplifies invoicing and payment reminders, ensuring timely receipts and reducing Days Sales Outstanding (DSO). This efficiency is achieved through a no-code file-mapping tool that accelerates vendor onboarding and employs data-driven strategies.

Automated workflows within the platform minimize execution errors and reduce reliance on manual resources, while real-time reporting delivers unparalleled transparency and insights. By leveraging intelligent automation and machine learning, Equabli delivers accounts receivable management debt collection solutions for enterprise financial services, enabling financial institutions to refine their debt recovery processes and optimize recovery strategies through NPV optimization and account-level lifetime value analysis.

This methodology reduces manual processes and improves cash flow visibility, allowing organizations to sustain robust financial operations. Furthermore, EQ Collect includes automated compliance monitoring and features a user-friendly, scalable, cloud-native interface, significantly enhancing its value proposition.

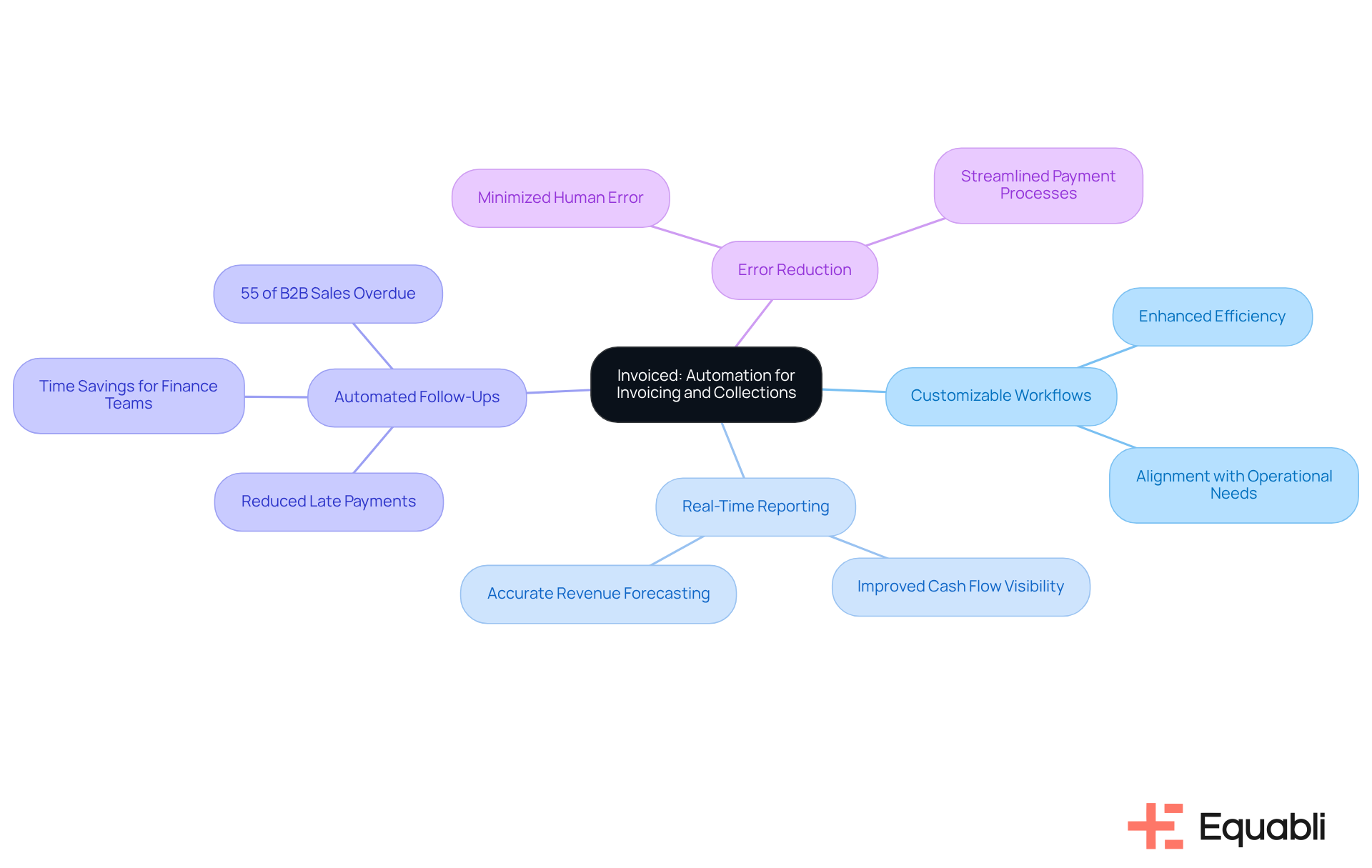

Invoiced: Automation for Invoicing and Collections

Invoiced serves as a robust billing automation platform designed to streamline the invoicing and payment collection process for businesses. This platform empowers users to create, send, and manage invoices with ease, while also automating follow-up reminders for overdue payments. The customizable workflows offered by Invoiced allow organizations to tailor their invoicing processes, thereby enhancing efficiency and ensuring alignment with operational needs.

The platform’s real-time reporting features significantly enhance visibility into cash flow, enabling finance teams to monitor outstanding payments and forecast revenue with greater accuracy. This level of automation not only conserves valuable time but also mitigates the risk of human error, establishing Invoiced as an essential tool for finance professionals aiming to improve their financial oversight. Given that 55% of all B2B invoiced sales are overdue and 81% of businesses have reported an increase in delayed payments, the demand for accounts receivable management debt collection solutions for enterprise financial services is more pressing than ever.

As highlighted by finance professionals, "60% of smaller middle-market firms report significant challenges in managing payments due to manual processes," underscoring the critical role of automation in overcoming these hurdles. Furthermore, integrating accounts receivable management debt collection solutions for enterprise financial services like EQ Collect can enhance debt recovery efficiency through features such as automated workflows, real-time insights, and stringent compliance oversight. This ensures that financial institutions are better equipped to navigate the complexities of financial oversight with increased effectiveness.

Paystand: Digital Payment Solutions for Efficient Collections

Equabli offers accounts receivable management debt collection solutions for enterprise financial services through EQ Collect, specifically designed for enterprise financial institutions. This platform provides accounts receivable management debt collection solutions for enterprise financial services by enhancing debt recovery efficiency through intelligent automation and machine learning, which significantly reduces vendor onboarding timelines with a user-friendly, no-code file-mapping tool.

By leveraging data-driven strategies, EQ Collect not only improves collection rates but also minimizes execution errors and the need for manual resources through streamlined automated workflows. Financial institutions benefit from unparalleled transparency and insights with real-time reporting, ensuring compliance oversight both internally and externally through automated monitoring.

With a scalable, cloud-native interface, EQ Collect empowers organizations to transform their financial operations into a more efficient and effective process.

Versapay: Collaborative Solutions for Accounts Receivable

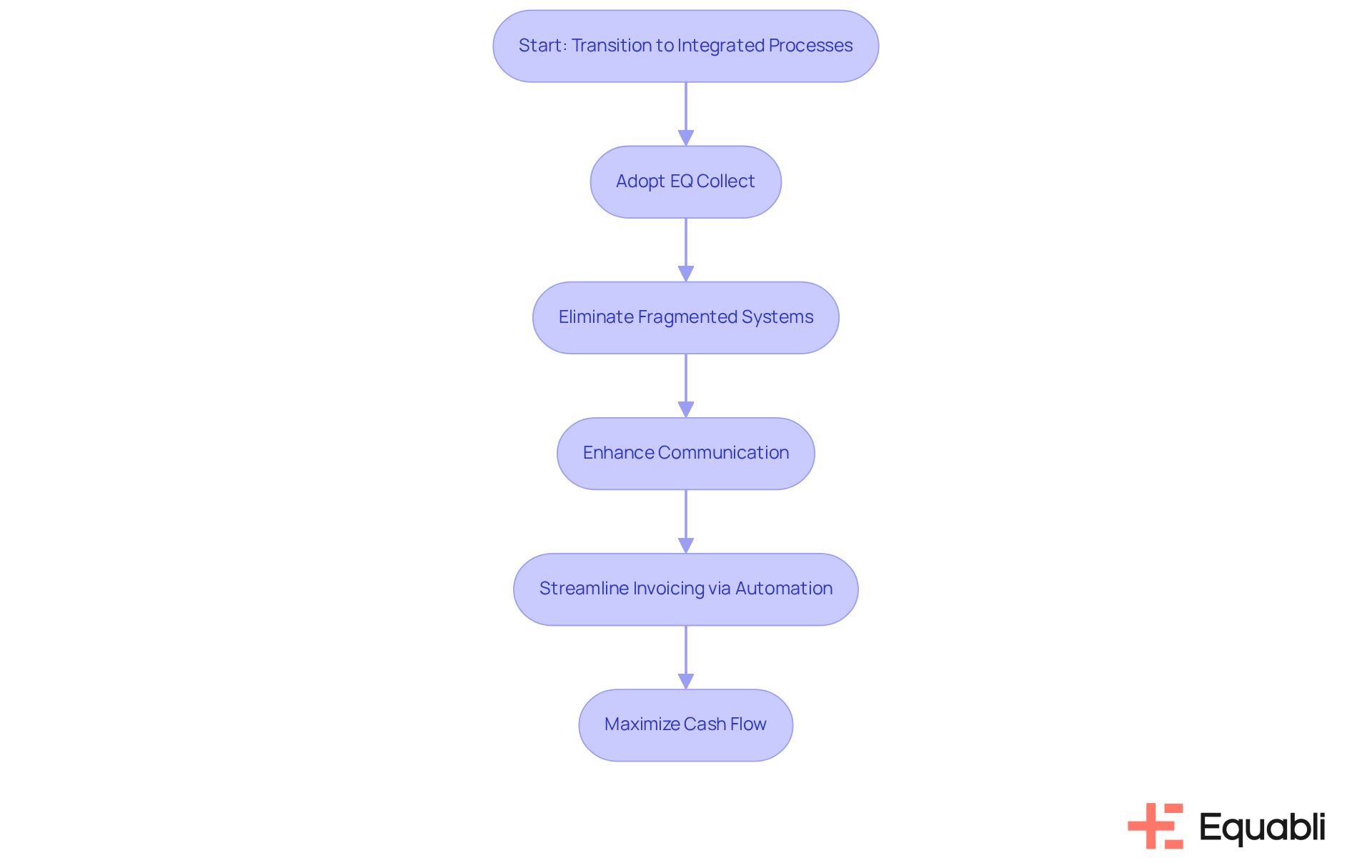

Equabli delivers innovative accounts receivable management debt collection solutions for enterprise financial services, significantly enhancing communication between financial organizations and their clients. The transition from inefficient to integrated processes begins now. By utilizing EQ Collect, organizations can eliminate the disorder of fragmented systems, ensuring smarter orchestration, improved performance, and timely reporting. This integrated strategy empowers clients to swiftly and effectively resolve issues, reducing disputes and accelerating payment cycles, ultimately enhancing cash flow.

Notably, organizations that adopted accounts receivable management debt collection solutions for enterprise financial services for over 50% of their operations observed a 32% reduction in Days Sales Outstanding (DSO), highlighting the effectiveness of such solutions. Moreover, the incorporation of automation within the invoicing process streamlines operations, enabling finance teams to leverage accounts receivable management debt collection solutions for enterprise financial services, thus managing collections more efficiently while fostering robust customer relationships.

As financial specialists emphasize, effective communication is vital in debt collection, especially in 2025, as technological advancements and customer expectations increasingly shape the landscape. The significance of real-time collaboration in accelerating payment cycles cannot be overstated, as it cultivates transparency and trust, benefiting both businesses and their clients.

To effectively leverage Equabli's solutions, organizations should prioritize training staff to adapt to these innovative tools, ensuring a seamless transition and maximizing the advantages of enhanced communication.

Schedule a call to explore how EQ Collect can transform your accounts receivable oversight.

Shepherd Outsourcing Collections: Expert Debt Collection Services

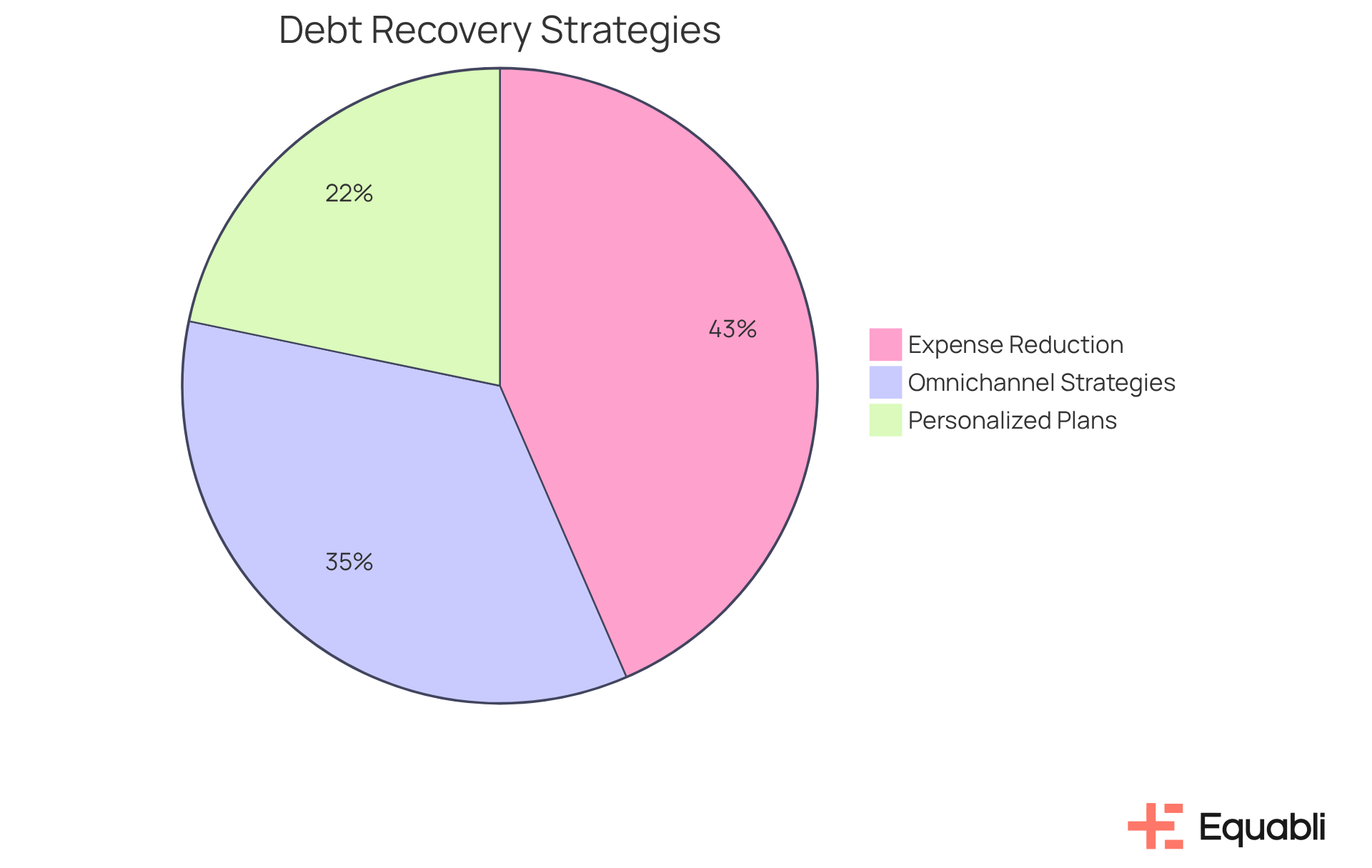

Shepherd Outsourcing Services provides expert accounts receivable management debt collection solutions for enterprise financial services that are tailored to the unique needs of businesses managing outstanding debts. By emphasizing ethical practices and compliance, the company employs seasoned professionals who utilize proven strategies to enhance recovery rates. Evidence suggests that personalized debt management plans, which consider individual debtor circumstances, not only improve success in collections but also foster long-term partnerships with clients. Industry leaders note that such tailored strategies can lead to a significant 25% increase in recovery rates, underscoring the effectiveness of Shepherd Outsourcing's approach.

Furthermore, the implementation of omnichannel strategies can achieve a 40% rise in payment arrangements and a 50% reduction in recovery expenses, reinforcing the efficiency of their services. By leveraging analytics for debt portfolios, Shepherd Outsourcing identifies high-risk clients and customizes strategies accordingly, ensuring a more effective recovery process. By collaborating with Shepherd Outsourcing, companies can utilize accounts receivable management debt collection solutions for enterprise financial services to alleviate the pressures of receivables, enabling them to concentrate on core business functions while ensuring that their debt recovery processes are managed with integrity and professionalism.

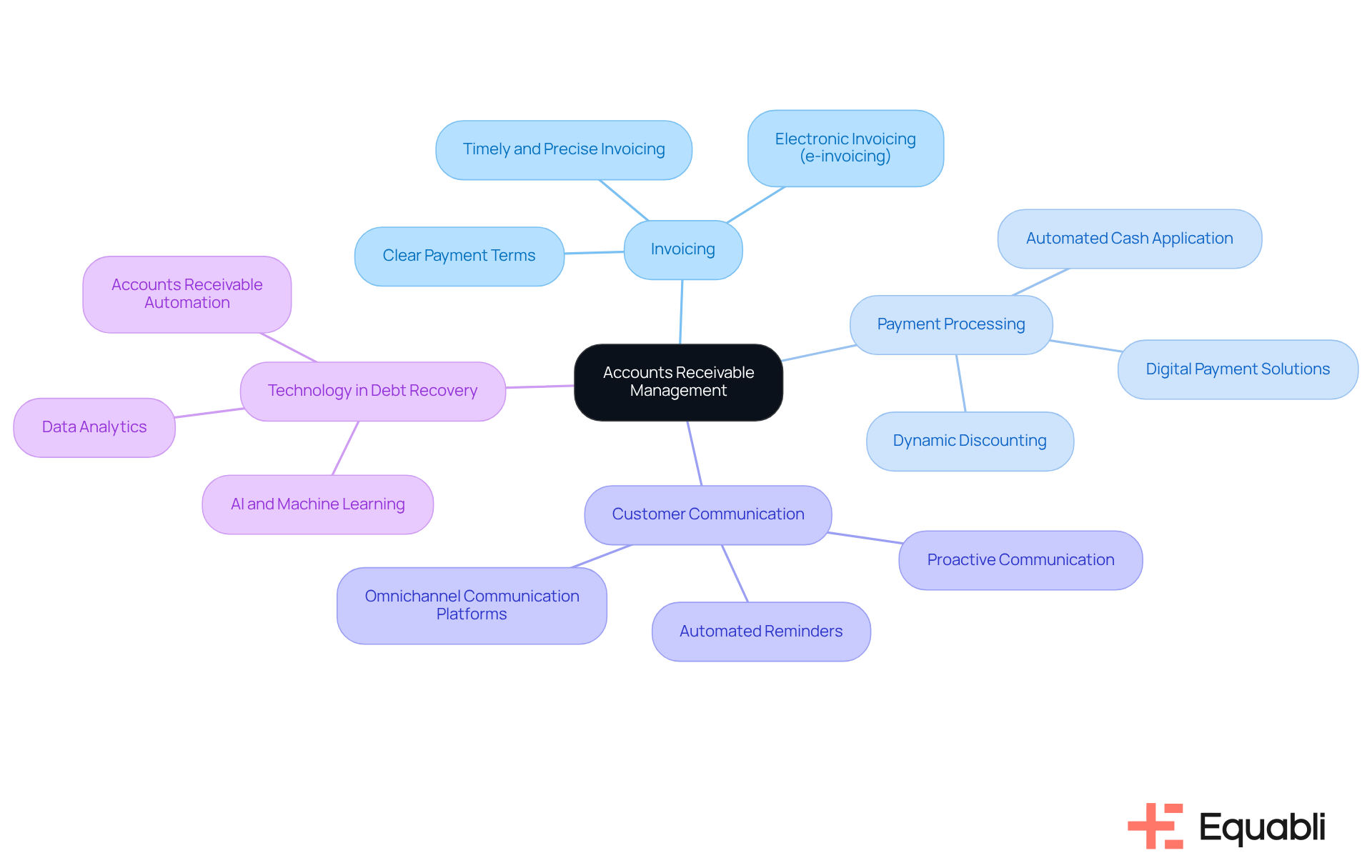

Retrievables: Comprehensive Guide to Accounts Receivable Management

Retrievables serves as a critical asset for managing outstanding debts, offering extensive insights into best practices, strategies, and tools designed to enhance recovery efforts. The platform addresses essential aspects such as invoicing, payment processing, and customer communication, thereby empowering businesses to develop effective accounts receivable management debt collection solutions for enterprise financial services. By leveraging the insights provided by Retrievables, organizations can significantly enhance their accounts receivable management debt collection solutions for enterprise financial services, leading to improved cash flow management.

Effective invoicing strategies are fundamental to cash flow management; timely and precise invoicing accelerates payment cycles and reduces disputes. Proactive communication with customers, which includes reminders and clearly defined payment terms, fosters stronger relationships and promotes prompt payments.

Retrievables also presents success stories that illustrate how businesses have successfully optimized their retrieval strategies. For example, companies that adopted automated reminders and dynamic discounting experienced significant improvements in recovery rates and overall cash flow.

As we look toward 2025, organizations are encouraged to adopt advanced data analytics and AI-driven tools to enhance their accounts receivable management debt collection solutions for enterprise financial services and refine their retrieval processes. Financial experts assert that harnessing these technologies will enhance operational efficiency and provide tailored solutions to meet diverse customer needs. As one expert remarked, 'Harnessing the power of data analytics is game-changing.' By implementing these strategies, companies can navigate the evolving landscape of credit control with confidence.

ChaserHQ: Best Practices for Accounts Receivable Management

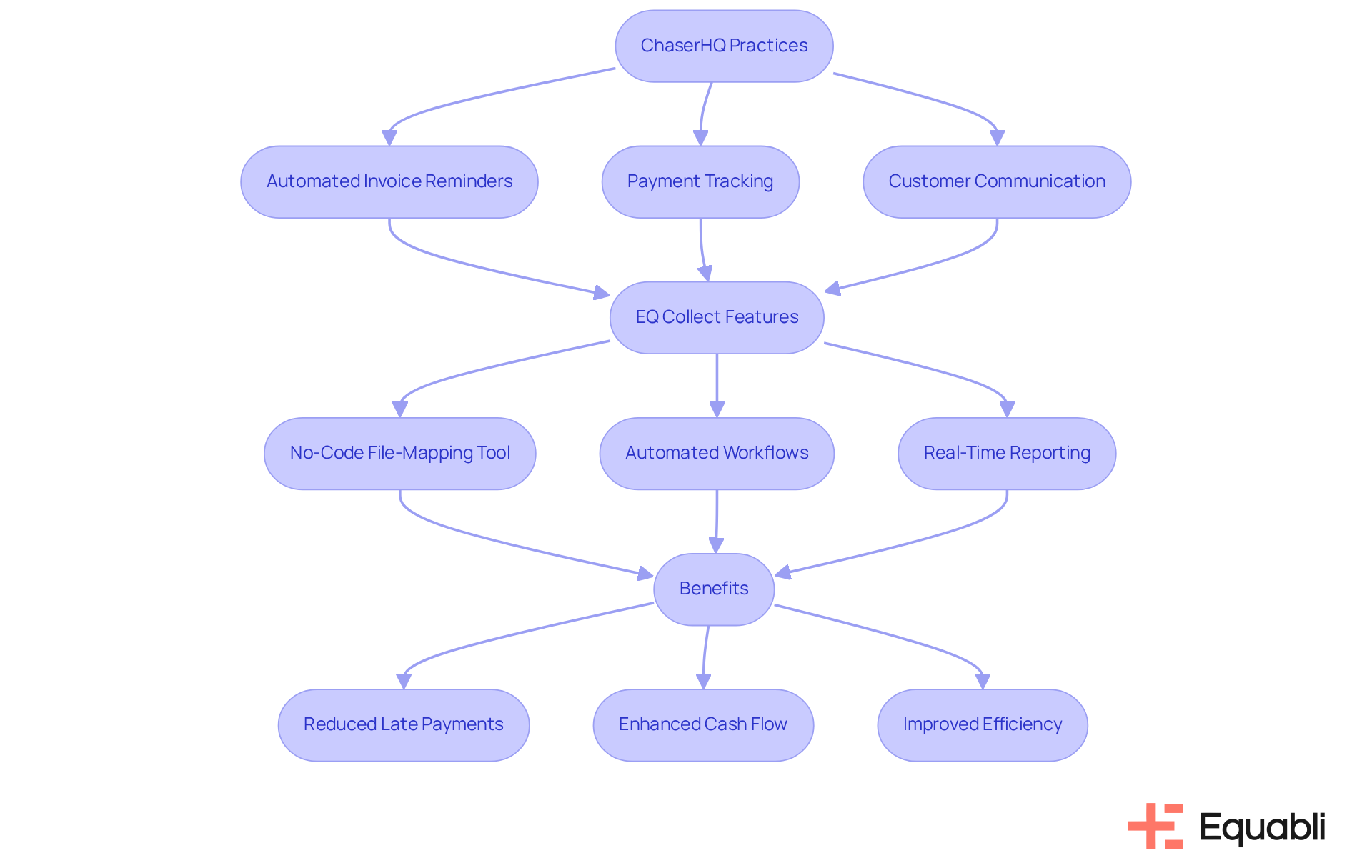

ChaserHQ is dedicated to establishing best practices in financial management, thereby assisting businesses in optimizing their recovery processes. The platform provides tools that automate invoice reminders, track payments, and manage customer communications. By integrating ChaserHQ's best practices with Equabli's EQ Collect features, organizations can significantly enhance their collection efficiency.

Evidence shows that EQ Collect reduces vendor onboarding timelines through a straightforward, no-code file-mapping tool, while improving operational efficiency with data-driven strategies. Its automated workflows minimize execution errors and reduce reliance on manual resources, while real-time reporting delivers unparalleled transparency and insights.

Furthermore, EQ Collect ensures industry-leading compliance oversight and features a user-friendly, scalable, cloud-native interface. By leveraging these advanced capabilities, businesses can mitigate late payments, enhance cash flow, and improve overall efficiency in their accounts receivable management debt collection solutions for enterprise financial services. The emphasis on proactive communication and automation positions organizations to excel in managing their receivables.

JPMorgan: Insights into Automated Receivables Management

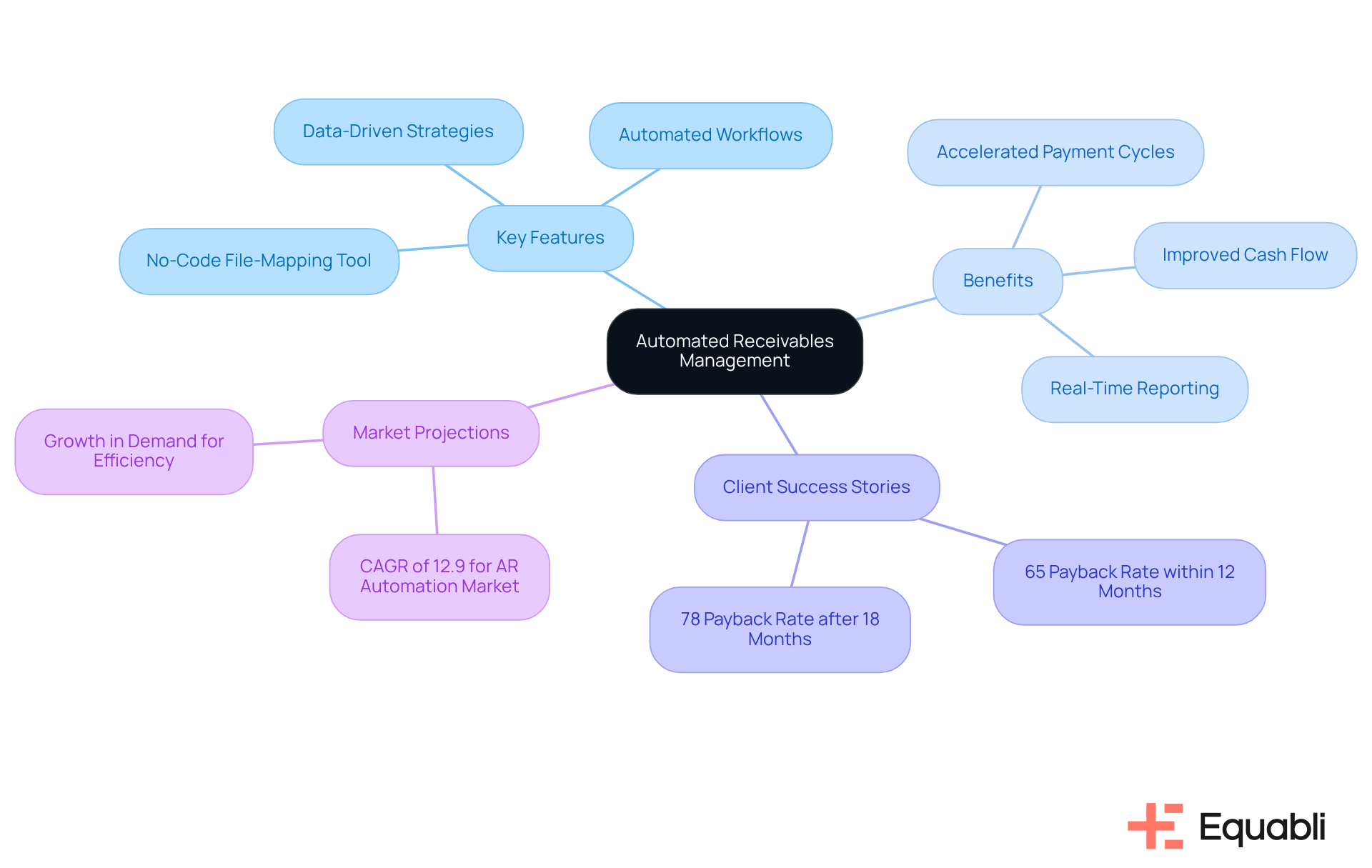

Equabli provides accounts receivable management debt collection solutions for enterprise financial services, which are automated to enhance operational efficiency and improve cash flow for businesses. By leveraging cutting-edge technologies such as intelligent automation and machine learning, their EQ Collect platform streamlines invoicing and payment processing. Key features include:

- A no-code file-mapping tool that significantly reduces vendor onboarding timelines

- Data-driven strategies that enhance efficiency and boost revenue

- Automated workflows that minimize execution errors and reliance on manual resources

This automation not only accelerates payment cycles, enabling organizations to optimize their cash flow, but also provides unparalleled transparency and insights through real-time reporting. Notably, 91% of mid-sized companies utilizing automated billing systems report enhanced cash flow, underscoring the effectiveness of Equabli's innovative solutions. Client success stories indicate that the implementation of these technologies has resulted in a 65% payback rate within 12 months, with 78% of organizations achieving a payback rate after 18 months of deploying digital accounts receivable systems, illustrating the tangible benefits of automation in improving financial performance.

As a leader in managing outstanding payments, Equabli continues to set the standard for the integration of AI into invoicing and collections, ensuring that businesses can effectively navigate the complexities of modern financial operations with increased ease and efficiency. Furthermore, with the accounts receivable management debt collection solutions for enterprise financial services market projected to grow at a CAGR of 12.9%, Equabli's innovations are well-positioned to meet the evolving demands of the industry. Paul Legan emphasizes the necessity of tailored solutions in today's financial landscape, stating, "Every business that manages receivables faces its own unique obstacles; however, there are some universal complications," highlighting how EQ Collect effectively addresses these challenges.

Conclusion

The landscape of accounts receivable management is evolving rapidly, necessitating innovative solutions that enhance efficiency and boost cash flow for enterprises. Cutting-edge platforms—including Equabli EQ Suite, HighRadius, Gaviti, Invoiced, Paystand, Versapay, Shepherd Outsourcing, Retrievables, ChaserHQ, and JPMorgan—provide powerful tools to streamline debt collection processes and improve financial oversight. Each solution emphasizes the importance of automation, predictive analytics, and tailored strategies to meet the unique challenges faced by organizations in managing receivables.

Leveraging technology minimizes manual errors and accelerates payment cycles, enhances compliance, and fosters better communication between businesses and their clients. The highlighted platforms offer a range of features, from intelligent automation and real-time reporting to personalized debt management strategies, all aimed at optimizing recovery rates and improving overall cash flow management. As businesses prepare for the future, adopting these advanced solutions will be crucial in navigating the complexities of accounts receivable management effectively.

In conclusion, the imperative for organizations is clear: embracing innovative accounts receivable management solutions is essential for sustaining competitiveness in a rapidly changing financial environment. By investing in these technologies, enterprises can enhance their operational capabilities, reduce Days Sales Outstanding (DSO), and ultimately foster stronger financial health. The future of accounts receivable management lies in the hands of those willing to adapt and leverage the power of automation and data-driven insights, ensuring a more efficient, transparent, and effective approach to debt collection.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a comprehensive platform designed to enhance debt recovery processes for lenders and agencies. It consists of three main components: EQ Engine, EQ Engage, and EQ Collect, which utilize advanced predictive analytics to evaluate repayment behaviors and customize recovery strategies.

How does the EQ Engine improve debt recovery?

The EQ Engine forecasts repayment trends, significantly improving recovery success rates. Reports indicate that businesses using predictive tools can see recovery rates increase by up to 80% compared to traditional methods.

What features does EQ Engage offer?

EQ Engage promotes efficient communication with borrowers through their preferred channels, fostering a more personalized experience during the debt recovery process.

What are the key features of EQ Collect?

EQ Collect automates the collection process and includes features such as a no-code file-mapping tool for faster vendor onboarding, data-driven strategies to optimize retrievals, automated workflows to minimize errors, and real-time reporting for transparency and insights.

How does the EQ Suite ensure compliance and data protection?

The EQ Suite includes industry-leading compliance oversight and adheres to rigorous data protection standards, ensuring that all data handling complies with the current regulatory landscape.

What advantages does the EQ Suite provide for financial institutions?

The EQ Suite reduces operational costs, boosts borrower engagement, and enhances the ability of financial institutions to adapt to evolving needs in accounts receivable management and debt collection.

Why is predictive analytics important in debt recovery?

Predictive analytics is crucial as it helps formulate effective debt recovery strategies, allowing financial institutions to manage delinquency and recover outstanding debts more efficiently.

How does automation impact accounts receivable management?

Automation improves cash application processes, minimizes manual effort, reduces errors, and allows organizations to focus on strategic initiatives, ultimately driving operational efficiency and optimizing cash flow.

What is the significance of real-time reporting in the EQ Suite?

Real-time reporting provides unmatched transparency and insights, enabling organizations to monitor their operations closely and make informed decisions regarding their debt recovery strategies.

How does EQ Collect enhance cash flow for enterprises?

EQ Collect simplifies invoicing and payment reminders, ensuring timely receipts and reducing Days Sales Outstanding (DSO), while leveraging intelligent automation to optimize recovery strategies and improve cash flow visibility.