Overview

The article presents seven enterprise receivables collection management solutions specifically designed for financial institutions, underscoring the imperative for modernized debt management processes. It provides evidence of the integration of advanced technology, predictive analytics, and enhanced borrower engagement strategies. These elements collectively contribute to improved operational efficiency and recovery rates for these institutions, illustrating the strategic value of adopting such solutions.

Introduction

Financial institutions are currently navigating an increasingly complex landscape of debt management, where traditional methods are swiftly becoming outdated. As organizations pursue innovative solutions to enhance their receivables collection processes, the integration of advanced technology and data-driven strategies presents a vital opportunity.

However, with a plethora of options available, how can these institutions pinpoint the most effective enterprise receivables collection management solutions that not only streamline operations but also cultivate stronger borrower relationships?

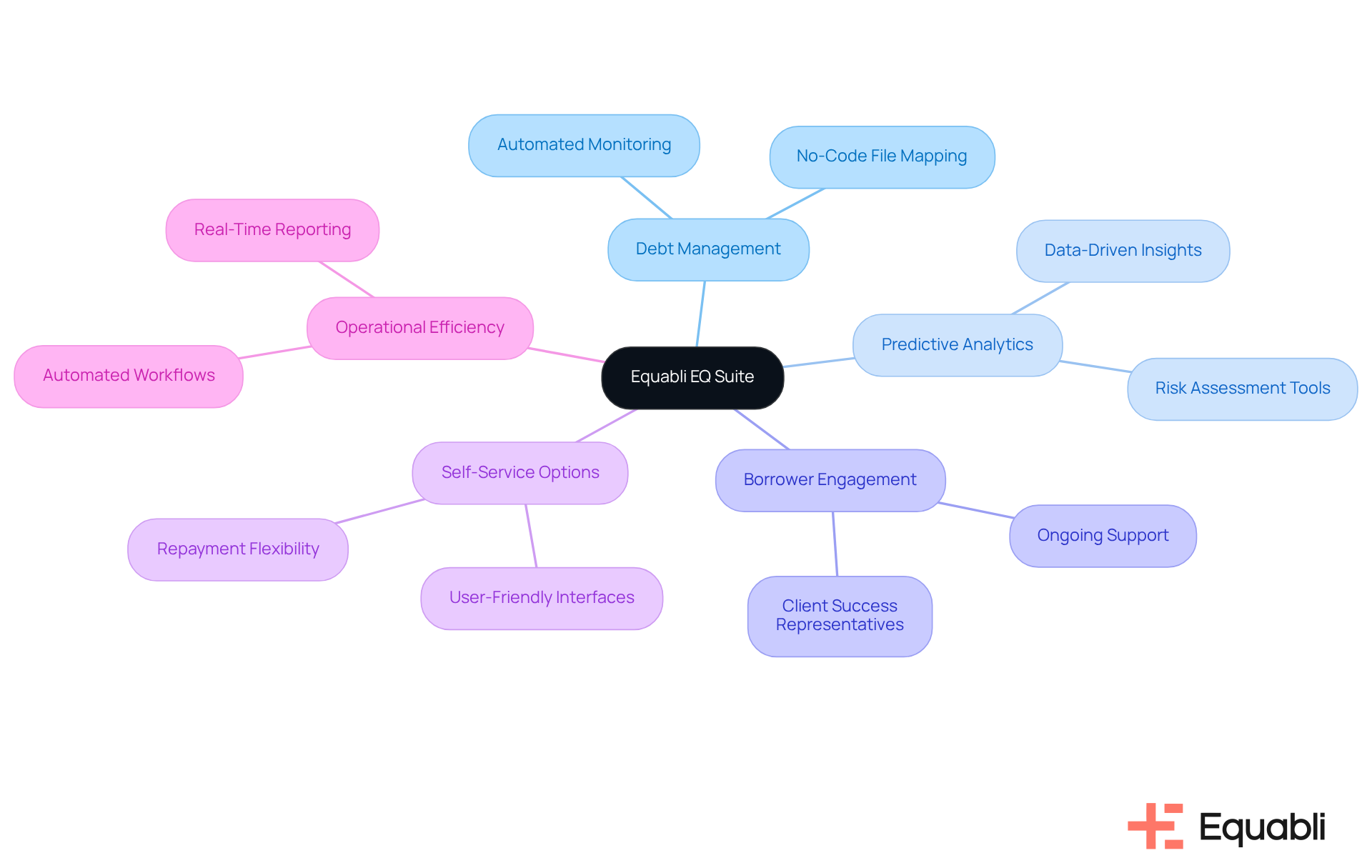

Equabli EQ Suite: Comprehensive Debt Collection Solutions for Financial Institutions

The Equabli EQ Suite represents a robust platform tailored for financial organizations seeking enterprise receivables collection management solutions for financial institutions to modernize their debt management processes. By integrating advanced technology with user-friendly interfaces, it enables lenders and agencies to utilize enterprise receivables collection management solutions for financial institutions to manage delinquency with greater effectiveness. This suite encompasses tools that facilitate predictive analytics, borrower engagement, and self-service repayment options, all aimed at enhancing recovery efficiency and minimizing operational expenses with enterprise receivables collection management solutions for financial institutions.

Key features, including the no-code file-mapping tool and automated monitoring, significantly reduce manual tasks while improving the bottom line. By leveraging the EQ Suite, organizations can customize their strategies to meet the unique requirements of their clients, thereby ensuring a more efficient retrieval process in the context of enterprise receivables collection management solutions for financial institutions. Additionally, Equabli's Client Success Representatives play a pivotal role in fostering client engagement and driving product adoption. They oversee the onboarding process, ensuring a seamless transition for clients while providing ongoing support to optimize product usage and address any challenges.

Furthermore, the EQ Collect features, which include enterprise receivables collection management solutions for financial institutions, automated workflows, and real-time reporting, enhance operational efficiency, allowing organizations to decrease manual tasks and improve their financial outcomes. By integrating these components, Equabli ensures that organizations can achieve their debt recovery objectives by utilizing enterprise receivables collection management solutions for financial institutions with improved efficiency and understanding. This strategic approach not only addresses immediate operational needs but also positions organizations for long-term success in a competitive landscape.

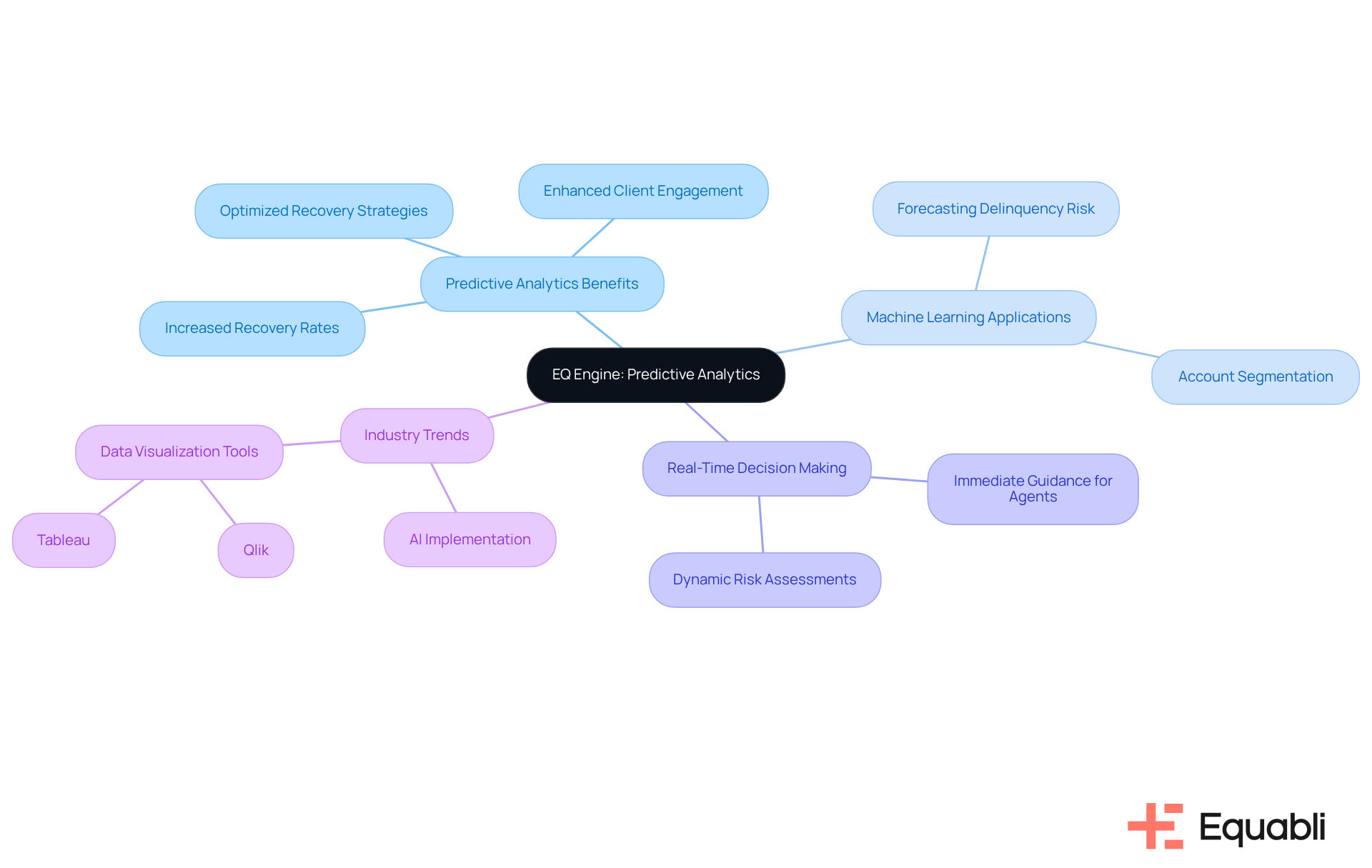

EQ Engine: Predictive Analytics for Optimizing Collection Strategies

The EQ Engine leverages predictive analytics and intelligent automation to assess repayment behaviors and optimize recovery strategies. By analyzing historical data and borrower profiles, it empowers financial institutions to identify the most effective enterprise receivables collection management solutions for financial institutions that are tailored to individual borrowers. This precision-driven approach not only increases the likelihood of successful recoveries but also minimizes the time and resources allocated to less effective methods. Institutions can utilize these insights to continually refine their acquisition strategies, resulting in a more streamlined and effective recovery process.

Evidence shows that agencies employing predictive analytics have achieved a notable 25% increase in recovery rates, underscoring the significant impact of data-driven methodologies on retrieval efforts. Furthermore, with 57% of debt recovery agencies already implementing AI for account segmentation and predictive analytics, the shift towards analytics-driven debt recovery, particularly through enterprise receivables collection management solutions for financial institutions, is clearly reshaping the landscape, enabling organizations to enhance operational efficiency and improve client engagement.

The EQ Engine also supports the application of machine learning to forecast the risk of delinquency in active accounts, facilitating the development of intelligent servicing strategies. Additionally, the integration of real-time decision-making during consumer interactions is becoming increasingly critical, allowing agents to receive immediate guidance in live conversations. The utilization of data visualization tools such as Qlik or Tableau is essential for consolidating disparate data sources, delivering real-time visibility into key performance indicators, and further optimizing collection strategies.

EQ Engage: Enhance Borrower Engagement with Preferred Communication Channels

EQ Engage is strategically designed to enhance client interaction by enabling financial organizations to connect through preferred communication methods, including SMS, email, and phone calls. This adaptability ensures that individuals receive reminders and updates in a manner that resonates with them, significantly increasing the likelihood of timely repayments.

Research indicates that 73% of customers in late delinquency made a payment when contacted through digital channels, underscoring the effectiveness of modern communication methods facilitated by EQ Engage. By promoting transparent and responsive communication, institutions can cultivate trust and rapport with clients, which is essential for improving collection rates and overall customer satisfaction.

Best practices for client communication in 2025 emphasize the necessity for empathy and personalization, crucial elements in navigating the emotional landscape of debt. As Benjamin Franklin aptly noted, 'Creditors have better memories than debtors,' highlighting how consistent communication can help individuals remain aware of their obligations.

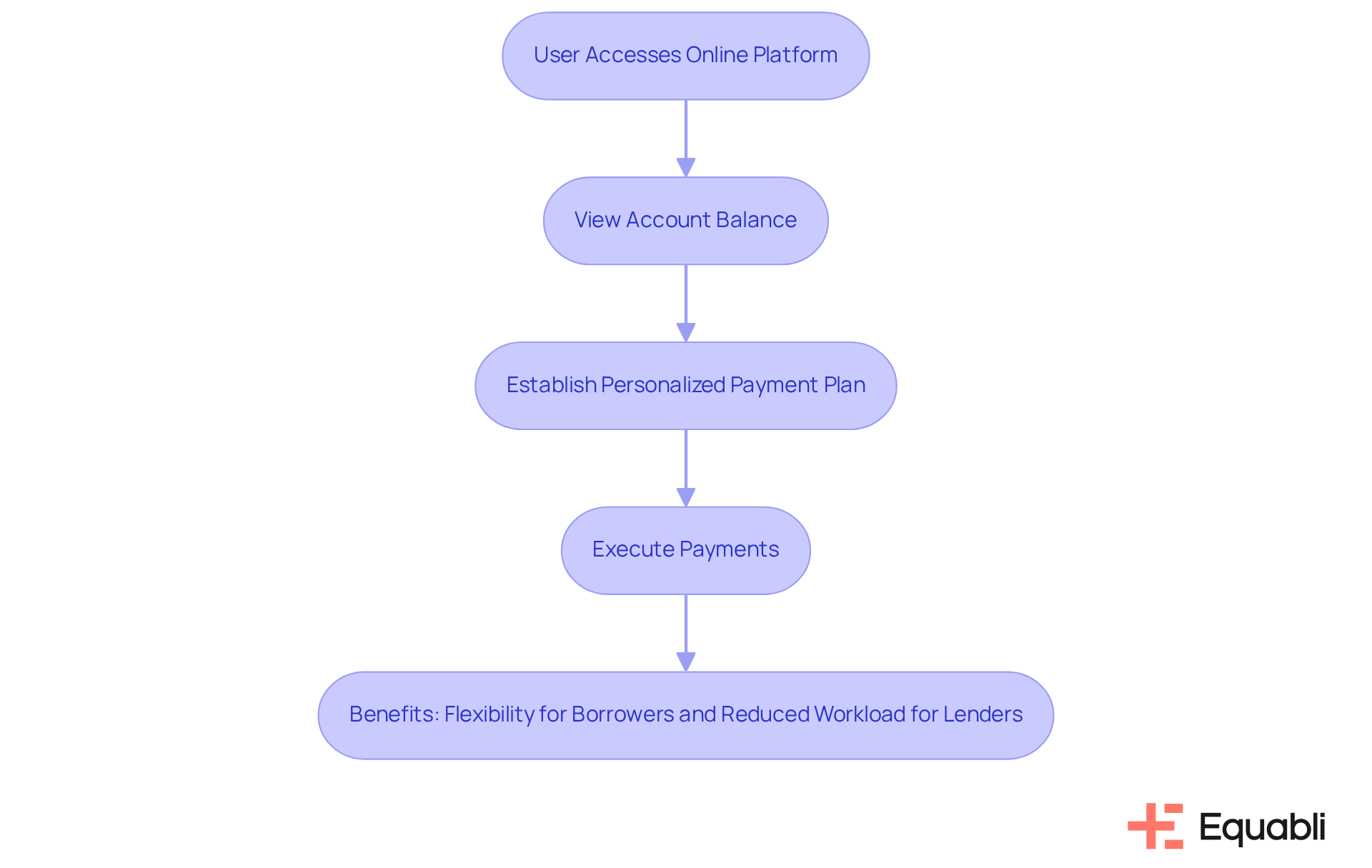

EQ Collect: Streamlined Self-Service Repayment Plans for Efficient Collections

EQ Collect revolutionizes debt management by offering efficient self-service repayment options, empowering individuals to assume control of their financial responsibilities. Evidence shows that through an intuitive online platform, users can effortlessly access account balances, establish personalized payment plans, and execute payments at their convenience. This digital approach alleviates the workload on collection teams, significantly enhancing operational efficiency by implementing enterprise receivables collection management solutions for financial institutions.

Consequently, these institutions experience reduced administrative burdens, while borrowers benefit from flexibility and control over their repayment schedules, fostering a more positive relationship with lenders. Ultimately, the implementation of EQ Collect is likely to improve repayment behaviors, as individuals are more inclined to engage with a system that prioritizes their needs and preferences.

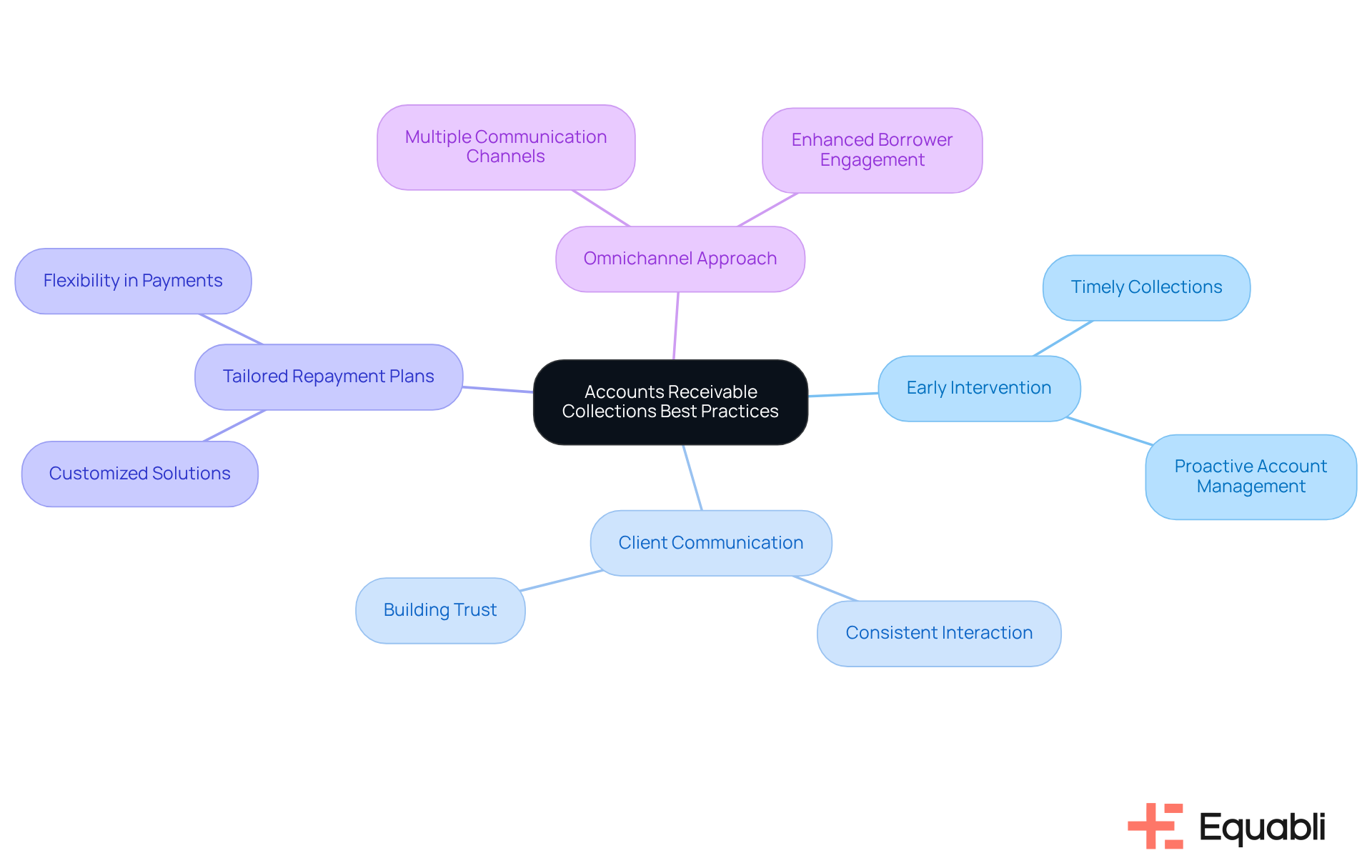

First Business Bank: Best Practices for Accounts Receivable Collections

First Business Bank exemplifies best practices in enterprise receivables collection management solutions for financial institutions by employing a proactive strategy for managing delinquent accounts. By integrating early intervention tactics, consistent client communication, and tailored repayment plans, the bank leverages enterprise receivables collection management solutions for financial institutions to ensure timely collections.

As noted by Jasna Hadzi-Tosev, "By adopting these 'must-haves,' you can achieve an effective balance between recovering overdue payments and maintaining trust with clients." This relationship-focused approach not only enhances client engagement but also significantly mitigates delinquency rates.

A case study highlights that effective and consistent interaction with clients is crucial for retrieving payments and understanding their circumstances. By prioritizing relationship-building and addressing issues before they escalate, First Business Bank has successfully utilized enterprise receivables collection management solutions for financial institutions to reduce delinquency rates and improve overall collection efficiency.

Furthermore, the adoption of an omnichannel approach enables the bank to engage with borrowers in a manner that fosters trust and transparency.

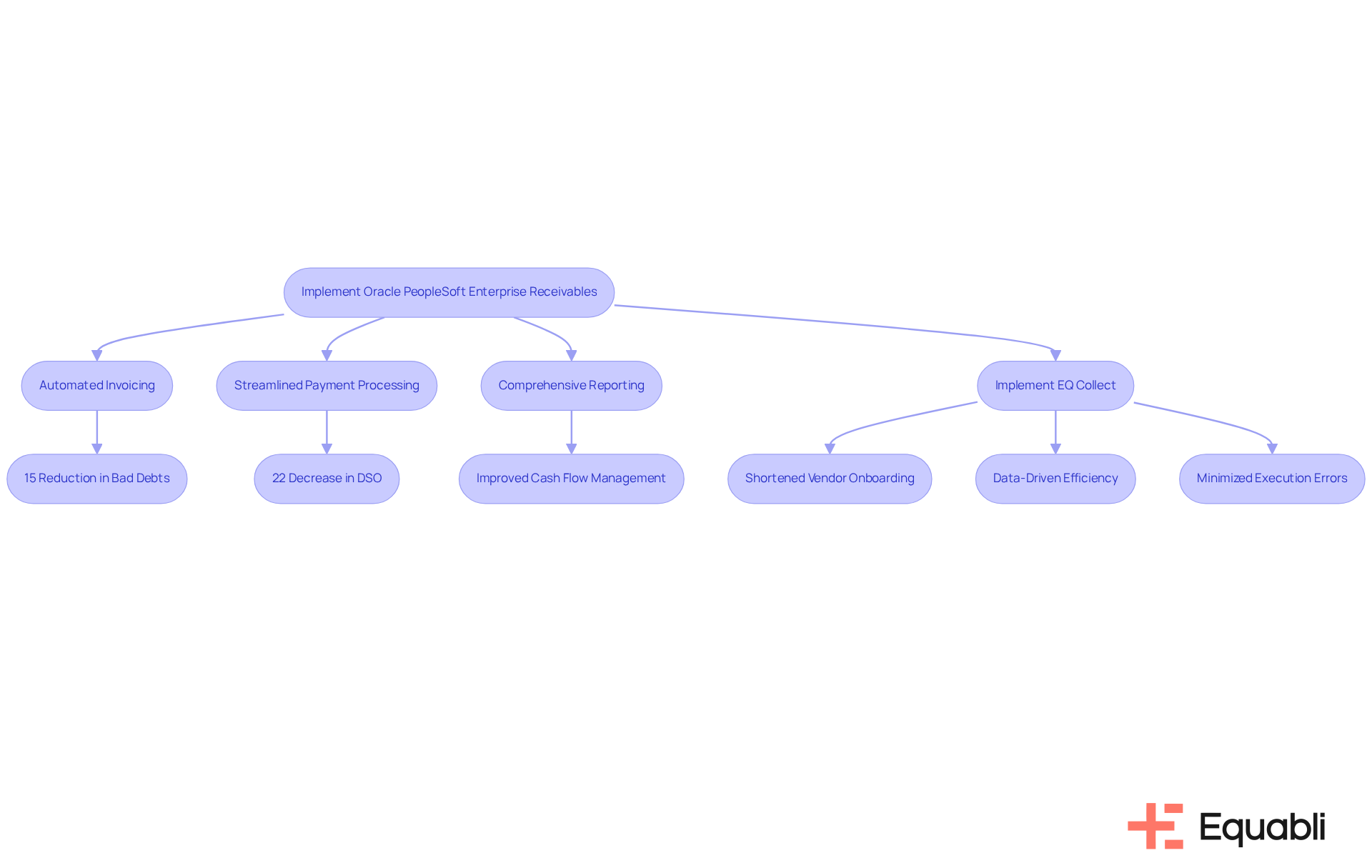

Oracle PeopleSoft Enterprise Receivables: Robust Financial Management Tools

Oracle PeopleSoft Enterprise Receivables provides a suite of advanced enterprise receivables collection management solutions for financial institutions, designed to optimize the accounts receivable process. Automated invoicing and streamlined payment processing significantly enhance operational efficiency. Organizations leveraging comprehensive reporting features and real-time insights can achieve improved visibility into their receivables, facilitating informed decision-making that leads to better recovery outcomes.

The benefits of automated invoicing are particularly significant; businesses implementing these solutions have reported a 15% reduction in bad debts, while automation can decrease days sales outstanding (DSO) by as much as 22%. Furthermore, integrating PeopleSoft with existing retrieval strategies allows organizations to proactively manage accounts, reducing the time spent on manual tasks and enabling quicker responses to overdue payments. This strategic methodology not only enhances efficiency in collections but also utilizes enterprise receivables collection management solutions for financial institutions to transform receivables into vital financial assets, ultimately supporting better cash flow management and organizational growth.

Additionally, utilizing EQ Collect can further strengthen these initiatives by:

- Shortening vendor onboarding timelines through a no-code file-mapping tool

- Enhancing efficiency via data-driven strategies

- Minimizing execution errors through automated workflows

This integration ensures smarter orchestration, improved performance, and cohesive operations, ultimately revolutionizing debt recovery processes.

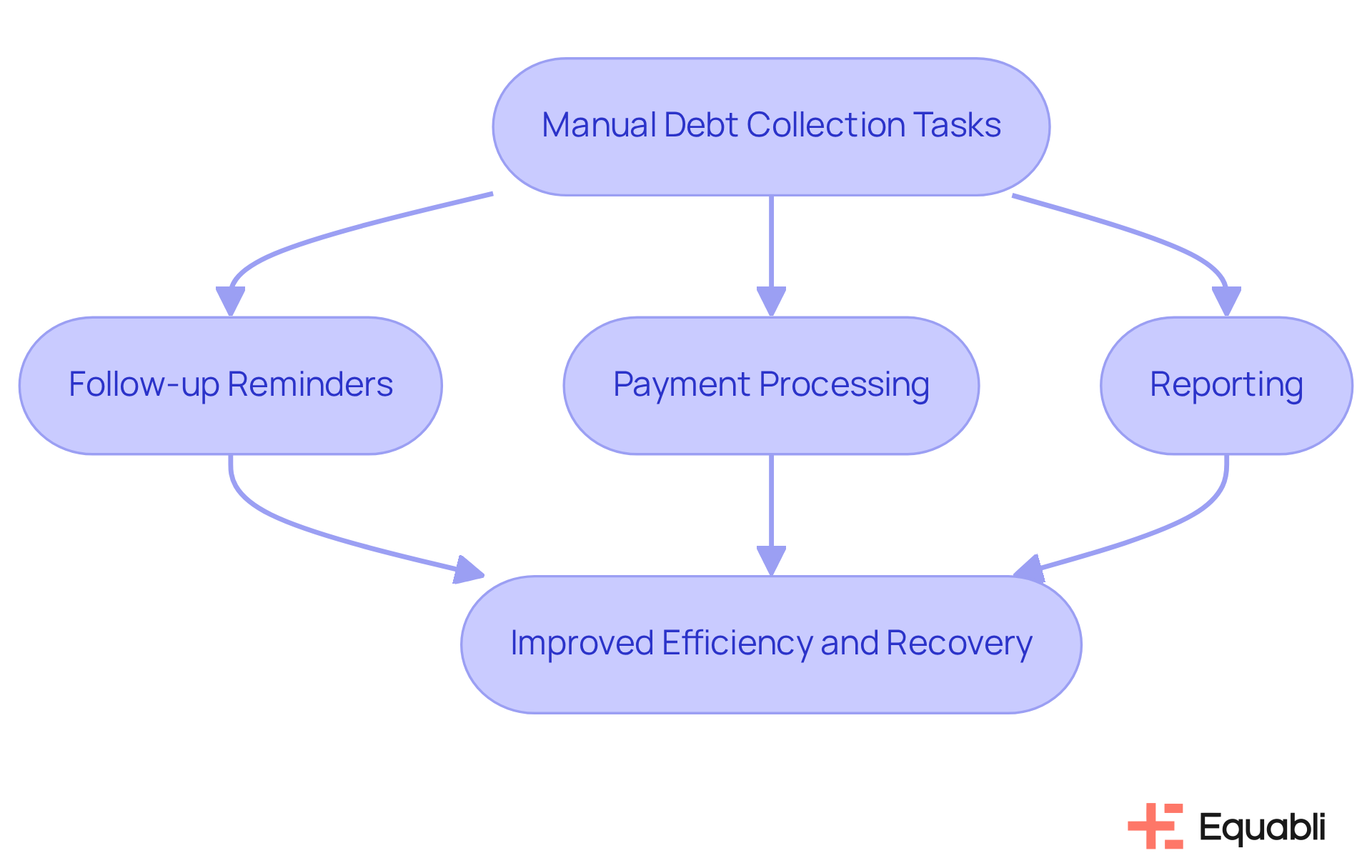

Debt Collection Management Software: Automate and Streamline Collection Processes

Debt recovery management software is essential for automating and streamlining retrieval processes. Utilizing Equabli's EQ Suite allows organizations to transition from burdensome manual tasks to intelligent, cloud-based solutions that enhance efficiency and recovery.

Automating tasks such as:

- Follow-up reminders

- Payment processing

- Reporting

significantly reduces the time spent on manual processes while improving accuracy. This shift enables teams to focus on more strategic activities, ultimately leading to improved retrieval rates and reduced operational expenses.

With the support of Equabli's experienced team and tailored launch strategies, lending organizations can overcome the challenges posed by traditional debt collection methods and embrace a modern approach that empowers creditors to achieve their objectives.

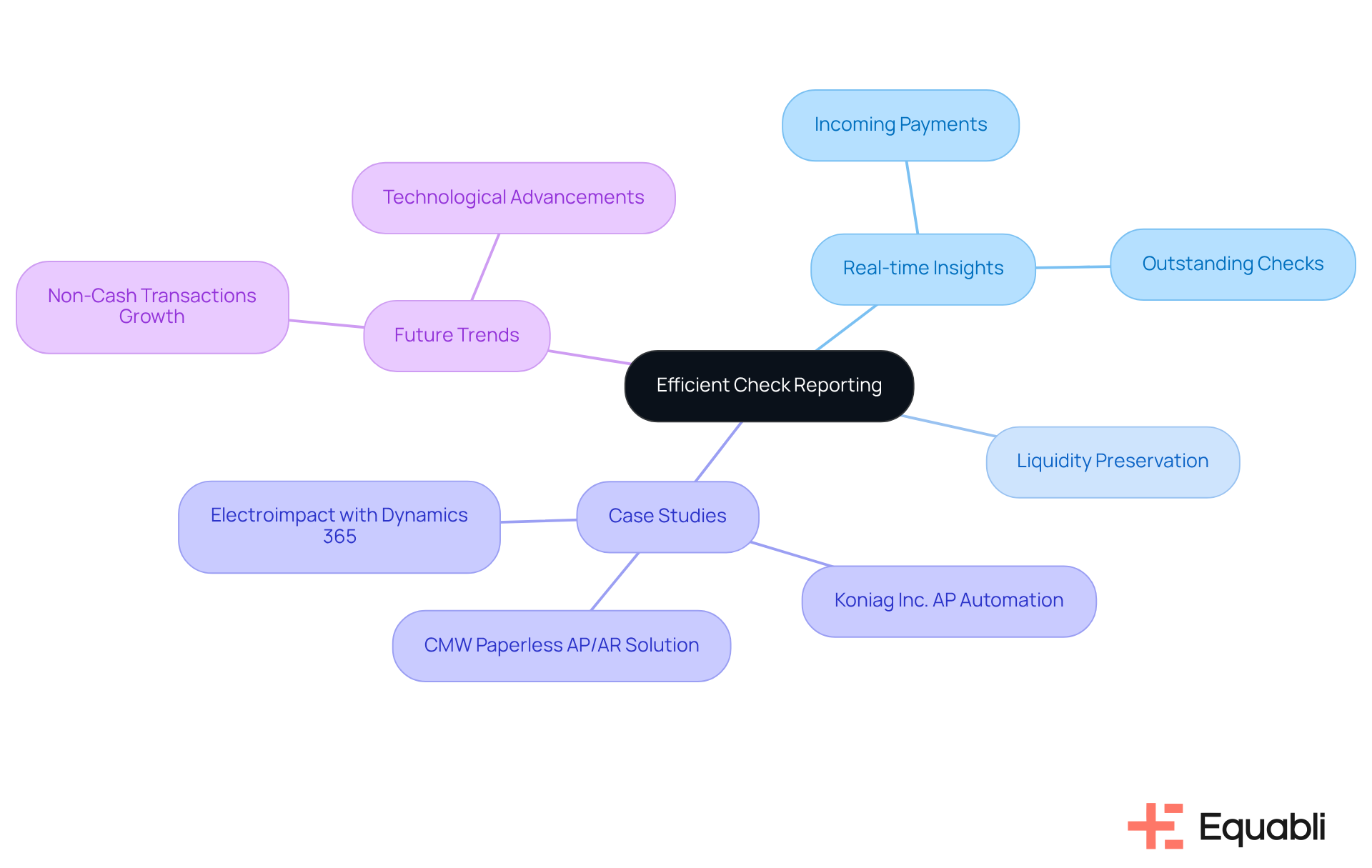

Efficient Check Reporting: Improve Cash Flow Management

Effective check reporting is essential for enhancing enterprise receivables collection management solutions for financial institutions to improve cash flow management. By implementing enterprise receivables collection management solutions for financial institutions that provide real-time insights into incoming payments and outstanding checks, organizations can improve cash flow and make informed economic decisions. This proactive approach not only supports liquidity preservation but also enables organizations to utilize enterprise receivables collection management solutions for financial institutions to promptly address any economic challenges that may arise.

As Takis Georgakopoulos, Global Head of Payments at J.P. Morgan, asserts, "It’s time to think beyond pay-in and pay-out capabilities. Payments can and should do more for businesses - and their customers." This perspective underscores the necessity of enterprise receivables collection management solutions for financial institutions within today's dynamic economic landscape.

Furthermore, case studies, such as that of Koniag Inc., which enhanced accuracy through their AP Automation solution, exemplify the tangible benefits of efficient check reporting. As trends in cash flow management evolve, leveraging enterprise receivables collection management solutions for financial institutions becomes imperative for organizations aiming to improve operational efficiency and strategic decision-making.

With non-cash transactions projected to increase by 13% year-over-year by 2025, the urgency of adapting to these changes cannot be overstated.

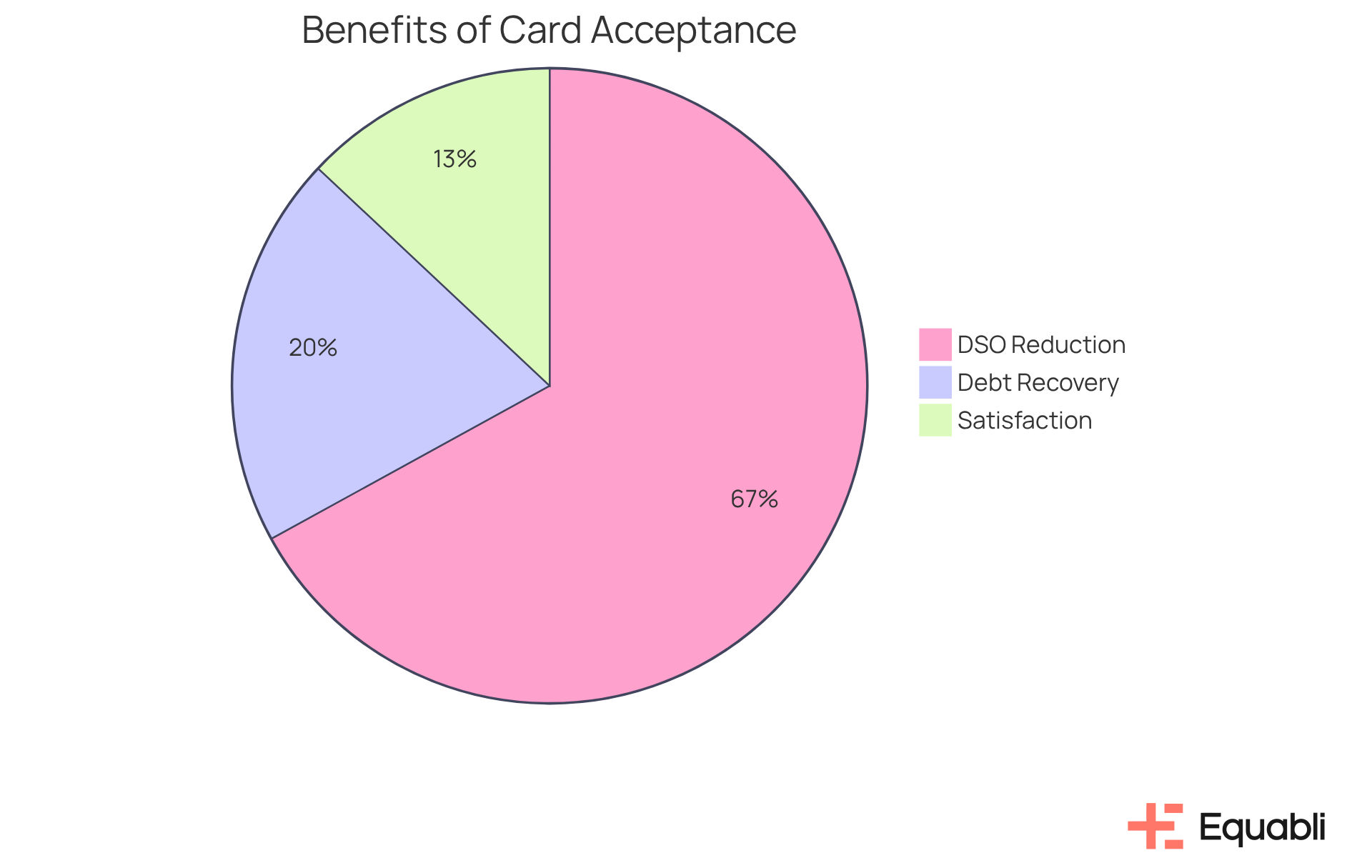

Accepting Credit Cards: Enhance Payment Flexibility in Receivables Management

Incorporating credit card payments into enterprise receivables collection management solutions for financial institutions significantly enhances payment flexibility for users. Evidence from the Forrester study indicates that organizations adopting commercial cards have reduced Days Sales Outstanding (DSO) from 45 days to just 15 days, underscoring the efficiency of this payment method. This flexibility not only improves satisfaction for loan recipients but also mitigates the risk of delinquency, as individuals are more inclined to fulfill their obligations when presented with convenient payment options.

Furthermore, the Forrester study revealed that suppliers experienced a 20% increase in debt recovery rates due to the prompt retrieval of overdue payments facilitated by card acceptance. As 75% of finance leaders report that accounts receivable has become more strategic in the past 12-24 months, integrating enterprise receivables collection management solutions for financial institutions, including credit card payments, emerges as a vital strategy to enhance cash flow and cultivate positive borrower relationships.

As Abhishek, VP and Global Head of B2B Acceptance at Visa Commercial Solutions, remarked, 'Buying organizations are increasingly choosing to pay with commercial cards because they are easy to use, secure, offer opportunities to monetize their payments, help increase cash flow and improve working capital management.

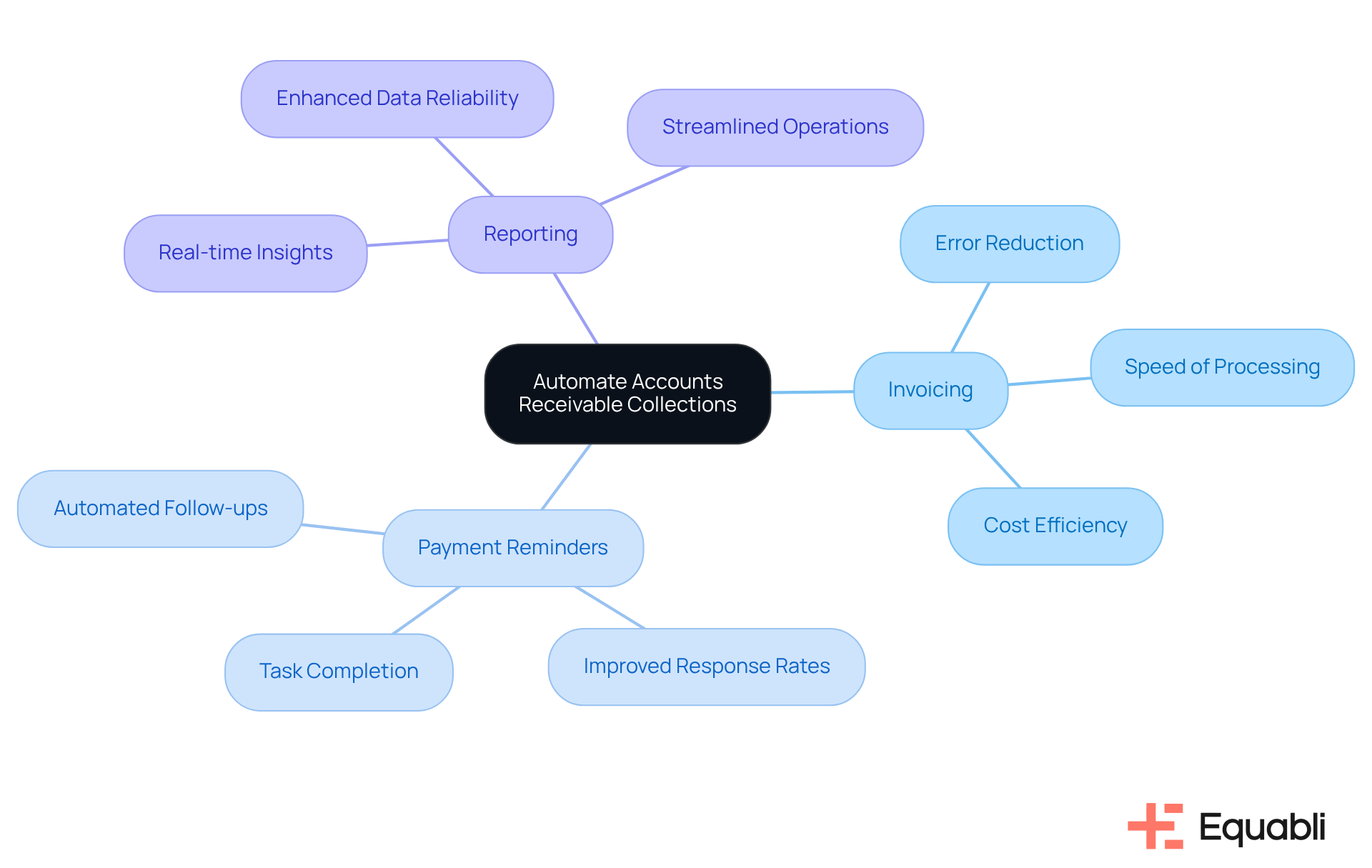

Automate Accounts Receivable Collections: Improve Processes and Reduce Errors

Automating accounts receivable management is crucial for optimizing processes and minimizing errors. By implementing automated systems for:

- Invoicing

- Payment reminders

- Reporting

institutions can significantly reduce the risk of human error while utilizing enterprise receivables collection management solutions for financial institutions to ensure effective management of receivables.

Equabli's EQ Suite offers intelligent, cloud-based solutions that modernize traditional debt management practices, enhancing recovery efforts. This transformation not only streamlines operations but also improves the overall efficacy of enterprise receivables collection management solutions for financial institutions, ultimately leading to higher recovery rates and enhanced financial performance.

Conclusion

The landscape of enterprise receivables collection management solutions for financial institutions is rapidly evolving, driven by technological advancements and a focus on enhancing operational efficiency. Financial organizations can modernize their debt management processes, streamline operations, and ultimately improve recovery rates by adopting comprehensive tools like the Equabli EQ Suite. The integration of predictive analytics, borrower engagement strategies, and self-service repayment options represents a significant shift towards more effective debt collection practices that prioritize both efficiency and client relationships.

Key insights from the article underscore the importance of leveraging data-driven methodologies to optimize collection strategies. Solutions such as the EQ Engine illustrate how predictive analytics can enhance recovery efforts by tailoring approaches to individual borrower profiles. Furthermore, fostering effective communication through preferred channels significantly boosts client engagement, while automation reduces manual tasks and errors, leading to a more efficient accounts receivable management process.

In light of these advancements, it is crucial for financial institutions to embrace modern debt collection solutions that not only address current operational challenges but also position them for future success. By investing in innovative technologies and best practices, organizations can enhance their cash flow management, improve borrower satisfaction, and ultimately transform their receivables into valuable financial assets. The time to act is now; adopting these strategies will ensure that financial institutions remain competitive and responsive in an ever-changing economic landscape.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a comprehensive platform designed for financial institutions to modernize their debt management processes through enterprise receivables collection management solutions. It integrates advanced technology with user-friendly interfaces to enhance delinquency management.

What key features does the EQ Suite offer?

The EQ Suite includes tools for predictive analytics, borrower engagement, self-service repayment options, a no-code file-mapping tool, and automated monitoring, all aimed at improving recovery efficiency and minimizing operational expenses.

How does the EQ Suite benefit financial organizations?

By utilizing the EQ Suite, organizations can customize their debt collection strategies, reduce manual tasks, and enhance operational efficiency, ultimately improving their financial outcomes and recovery objectives.

What role do Client Success Representatives play in the EQ Suite?

Equabli's Client Success Representatives help foster client engagement and drive product adoption by overseeing the onboarding process and providing ongoing support to optimize product usage and address challenges.

What is the EQ Engine and its purpose?

The EQ Engine leverages predictive analytics and intelligent automation to assess repayment behaviors and optimize recovery strategies for financial institutions, helping them identify effective collection methods tailored to individual borrowers.

How does predictive analytics impact debt recovery?

Agencies using predictive analytics have seen a 25% increase in recovery rates, highlighting the effectiveness of data-driven methodologies in enhancing retrieval efforts and operational efficiency.

What communication methods does EQ Engage utilize?

EQ Engage allows financial organizations to connect with clients through preferred communication channels such as SMS, email, and phone calls, increasing the likelihood of timely repayments.

What are the best practices for client communication emphasized by EQ Engage?

Best practices include empathy and personalization in communication, which are essential for navigating the emotional aspects of debt and improving collection rates and customer satisfaction.

How does EQ Engage improve borrower engagement?

By promoting transparent and responsive communication through preferred channels, EQ Engage cultivates trust and rapport with clients, thereby enhancing collection rates.