Overview

Understanding the essential collection agency laws is crucial for every financial executive aiming to ensure compliance and avoid legal repercussions. Familiarizing oneself with regulations such as the Fair Debt Collection Practices Act (FDCPA), the Telephone Consumer Protection Act (TCPA), and state-specific laws is not just advisable; it is imperative. Implementing robust training and compliance management systems will empower executives to navigate the complexities of debt collection effectively. By doing so, organizations can mitigate risks and foster a culture of compliance that safeguards their reputation and financial standing.

Introduction

Navigating the intricate web of collection agency laws is paramount for financial executives in the complex landscape of debt recovery. With evolving regulations such as the Fair Debt Collection Practices Act (FDCPA) and the Telephone Consumer Protection Act (TCPA), organizations encounter both opportunities and challenges in maintaining compliance while optimizing operational efficiency. As the stakes rise, one critical question emerges: how can financial leaders effectively adapt to these changing laws to protect their organizations from legal pitfalls and enhance their reputations within the industry?

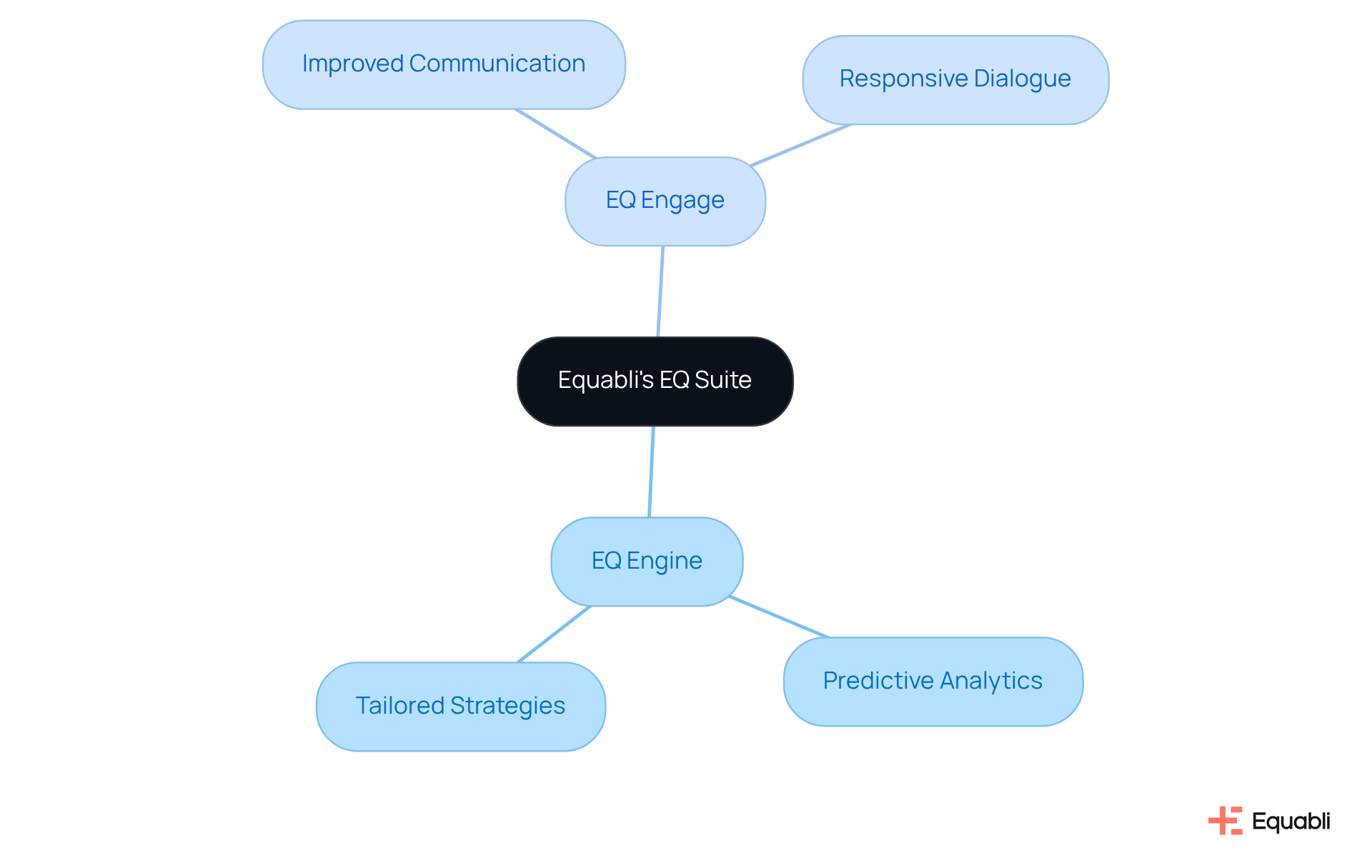

Equabli's EQ Suite: Modern Solutions for Debt Collection Compliance

Equabli's EQ Suite offers a comprehensive suite of tools designed to optimize debt collection processes while ensuring strict adherence to regulatory standards. At the core of this suite are the EQ Engine and EQ Engage. The EQ Engine employs predictive analytics to evaluate repayment behaviors, enabling organizations to tailor their strategies effectively. Simultaneously, EQ Engage improves communication with borrowers, fostering a more interactive and responsive dialogue.

These tools come with built-in compliance features that align with essential regulations, including collection agency laws, such as the Fair Debt Collection Practices Act (FDCPA) and the Telephone Consumer Protection Act (TCPA). This integration significantly reduces the risk of legal violations, thereby enhancing operational efficiency.

As the industry shifts towards digital-first strategies, organizations that adopt these advanced solutions are poised to experience improved compliance rates and reduced operational costs, positioning themselves advantageously in a competitive landscape.

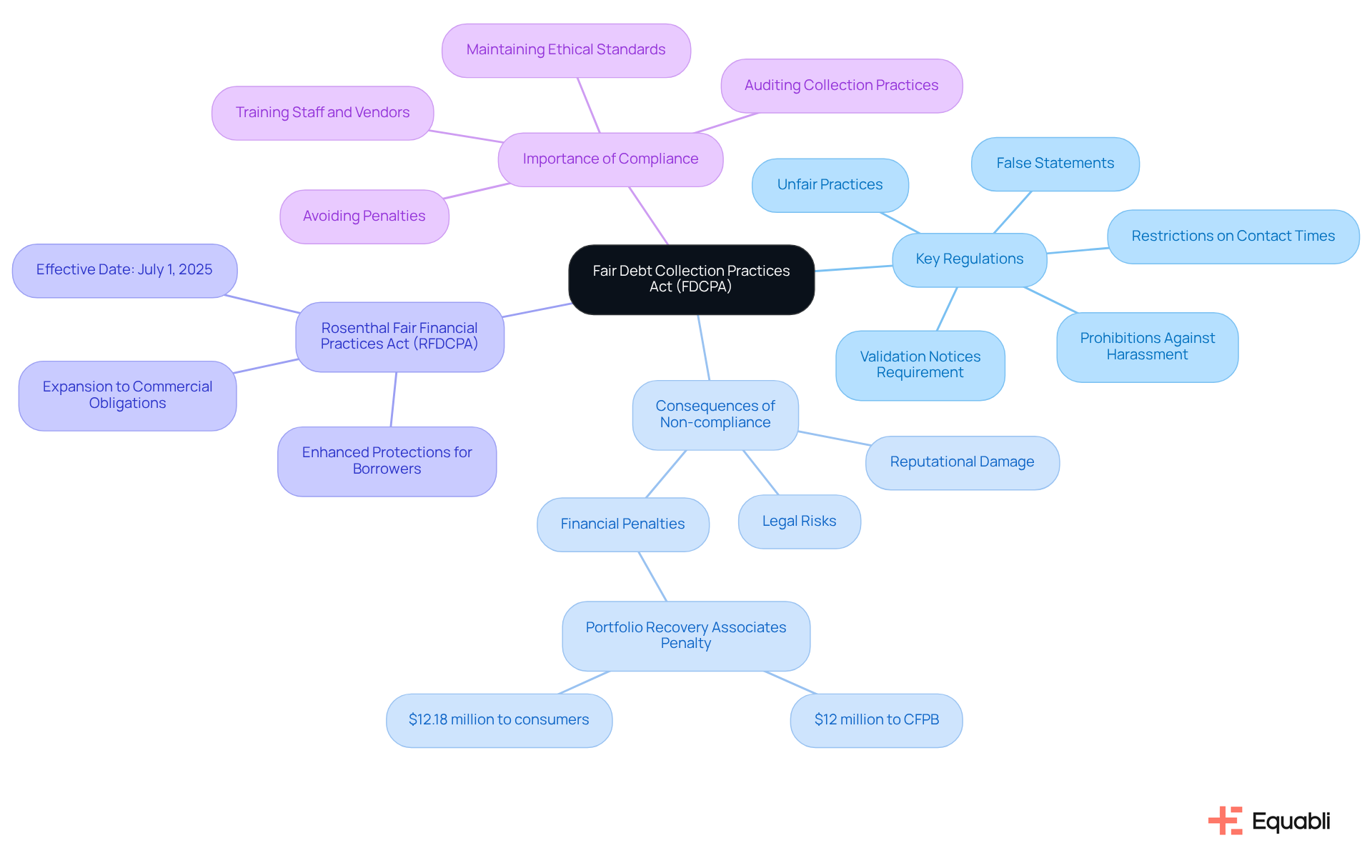

Fair Debt Collection Practices Act (FDCPA): Key Regulations for Agencies

The Fair Debt Collection Practices Act (FDCPA) establishes critical guidelines that debt collectors must adhere to in order to ensure fair treatment of consumers. Key provisions include prohibitions against harassment, false statements, and unfair practices. Agencies are required to provide consumers with validation notices and are restricted from contacting them at inconvenient times. Understanding collection agency laws is essential for organizations to avoid penalties and maintain ethical standards in their collection efforts.

Recent enforcement actions underscore the serious consequences of non-compliance. For example, Portfolio Recovery Associates faced a penalty exceeding $12 million due to violations of multiple consumer financial laws, highlighting the financial repercussions that can stem from failing to comply with FDCPA regulations. Such penalties not only affect the bottom line but also tarnish the reputation of the agencies involved.

Moreover, the expansion of the Rosenthal Fair Financial Practices Act (RFDCPA) in California, effective July 1, 2025, introduces additional legal exposure for creditors and recovery professionals, particularly concerning commercial obligations. This change mandates that commercial obligations will be subject to the same stringent recovery practices as consumer obligations, thereby enhancing protections for individual borrowers and personal guarantors against harassment and misleading practices.

Industry leaders emphasize the necessity of understanding collection agency laws to avert penalties and uphold ethical standards in recovery efforts. As the landscape of receivable retrieval evolves, it is imperative for organizations to remain informed about collection agency laws to operate efficiently and ethically in this domain. To ensure compliance, agencies should consider auditing their current collection practices in light of the forthcoming regulations.

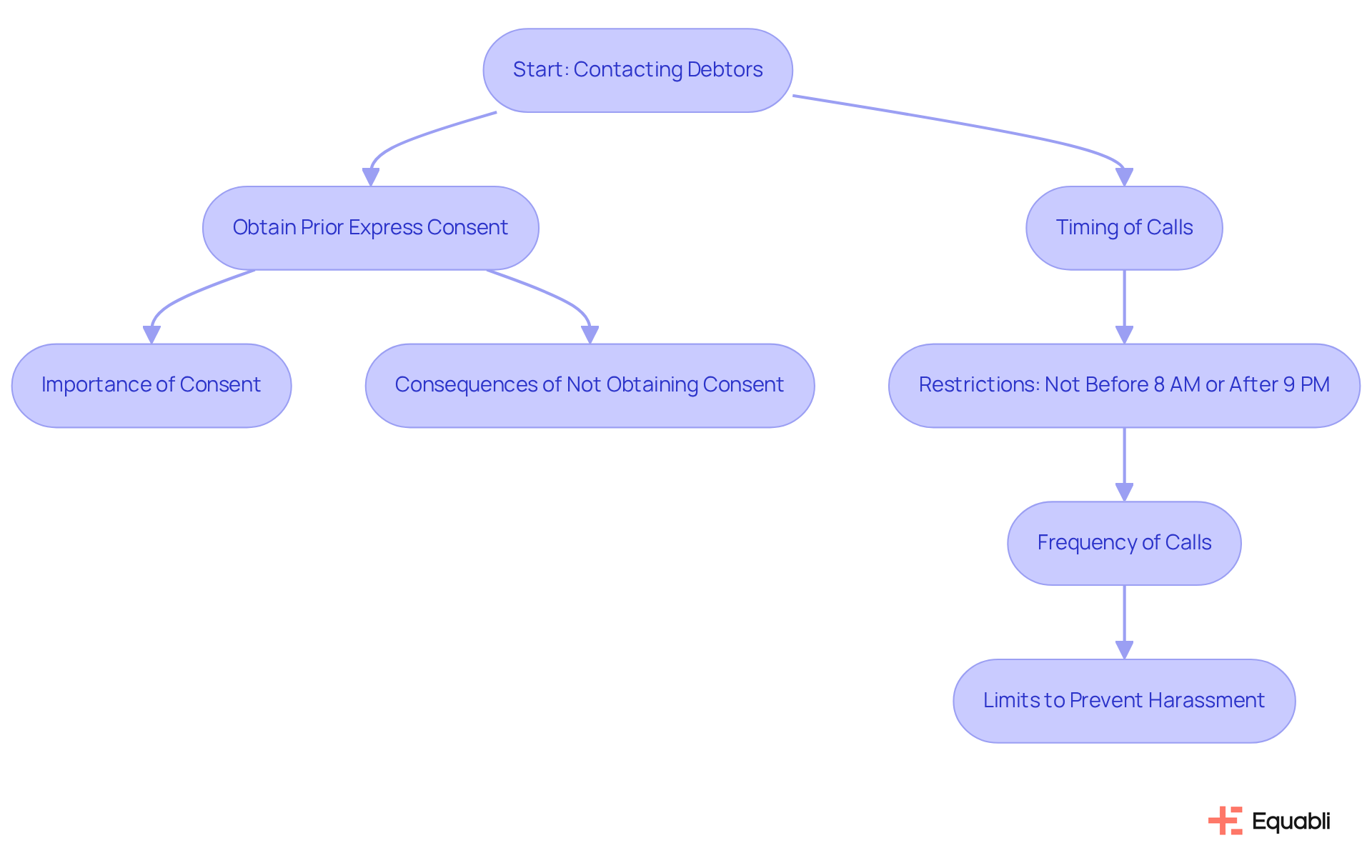

Telephone Consumer Protection Act (TCPA): Guidelines for Contacting Debtors

The Telephone Consumer Protection Act (TCPA) establishes stringent regulations governing how collectors engage with consumers, particularly through automated calls and text messages. A fundamental requirement is obtaining prior express consent before initiating such communications. This consent is not merely a formality; it is essential for compliance and helps mitigate the risk of costly penalties, which can reach up to $1,500 for intentional violations and up to $500 for basic violations.

Moreover, the TCPA imposes restrictions on the timing of calls, prohibiting contact before 8 a.m. and after 9 p.m. local time, and limits the frequency of calls to prevent harassment. These guidelines are intended to safeguard consumers and promote positive relationships between collectors and borrowers.

Legal specialists stress that comprehending and following these regulations is crucial for creditors. Noncompliance can lead to significant financial repercussions and damage to reputation. Recent trends indicate that consumers are increasingly aware of their rights regarding consent, with many opting out of unsolicited communications. This shift highlights the necessity for creditors to implement robust consent management strategies and stay updated on evolving regulations to ensure compliance and maintain trust with consumers.

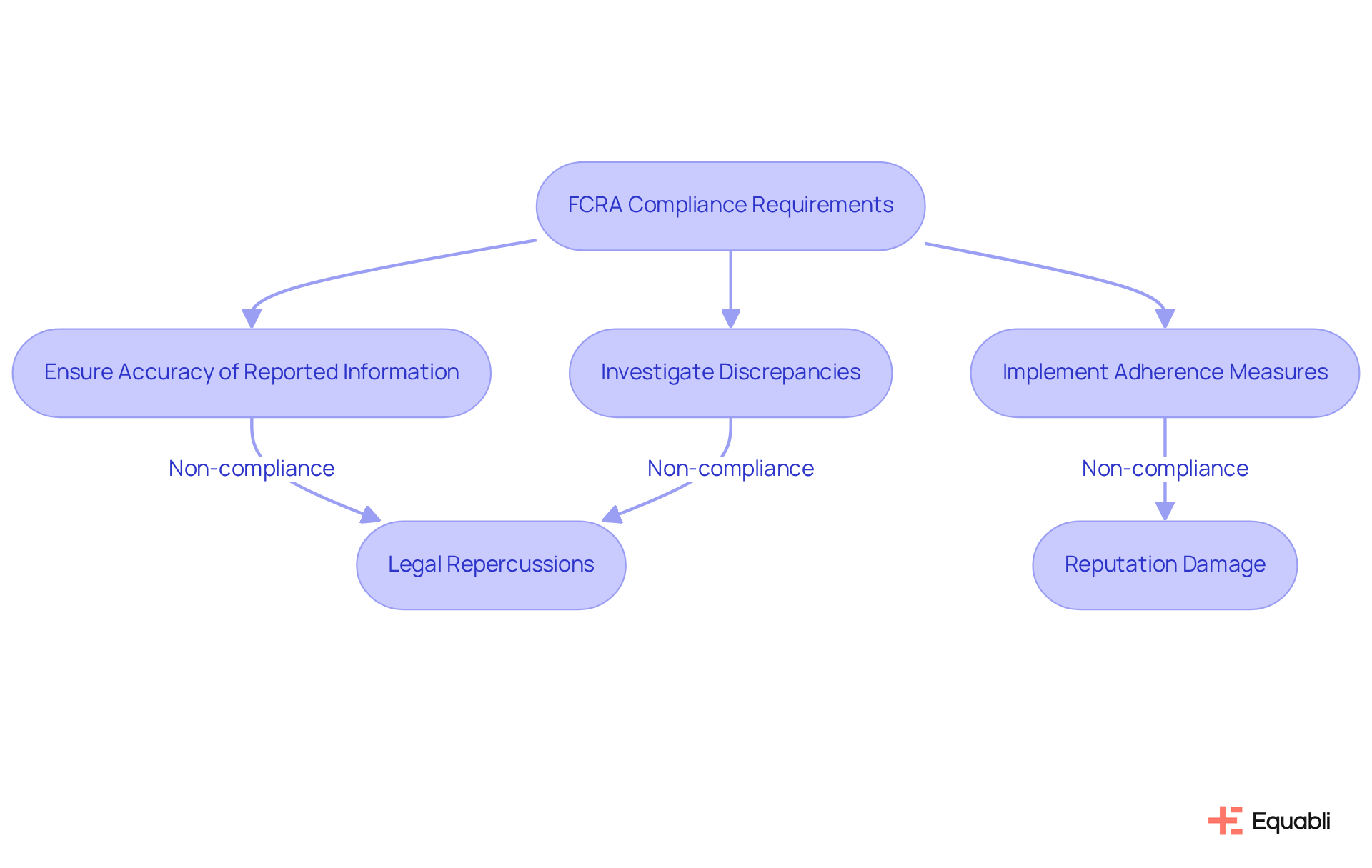

Fair Credit Reporting Act (FCRA): Reporting Standards for Collection Agencies

The Fair Credit Reporting Act (FCRA) establishes crucial standards for the collection, use, and reporting of consumer credit information. Collection firms must guarantee that the information they report is both precise and current. Furthermore, they are obligated to investigate any discrepancies related to reported financial obligations. Non-compliance with the FCRA can lead to significant legal repercussions and damage to the agency's reputation. Therefore, it is imperative for agencies to implement robust adherence measures to safeguard their integrity and operational success.

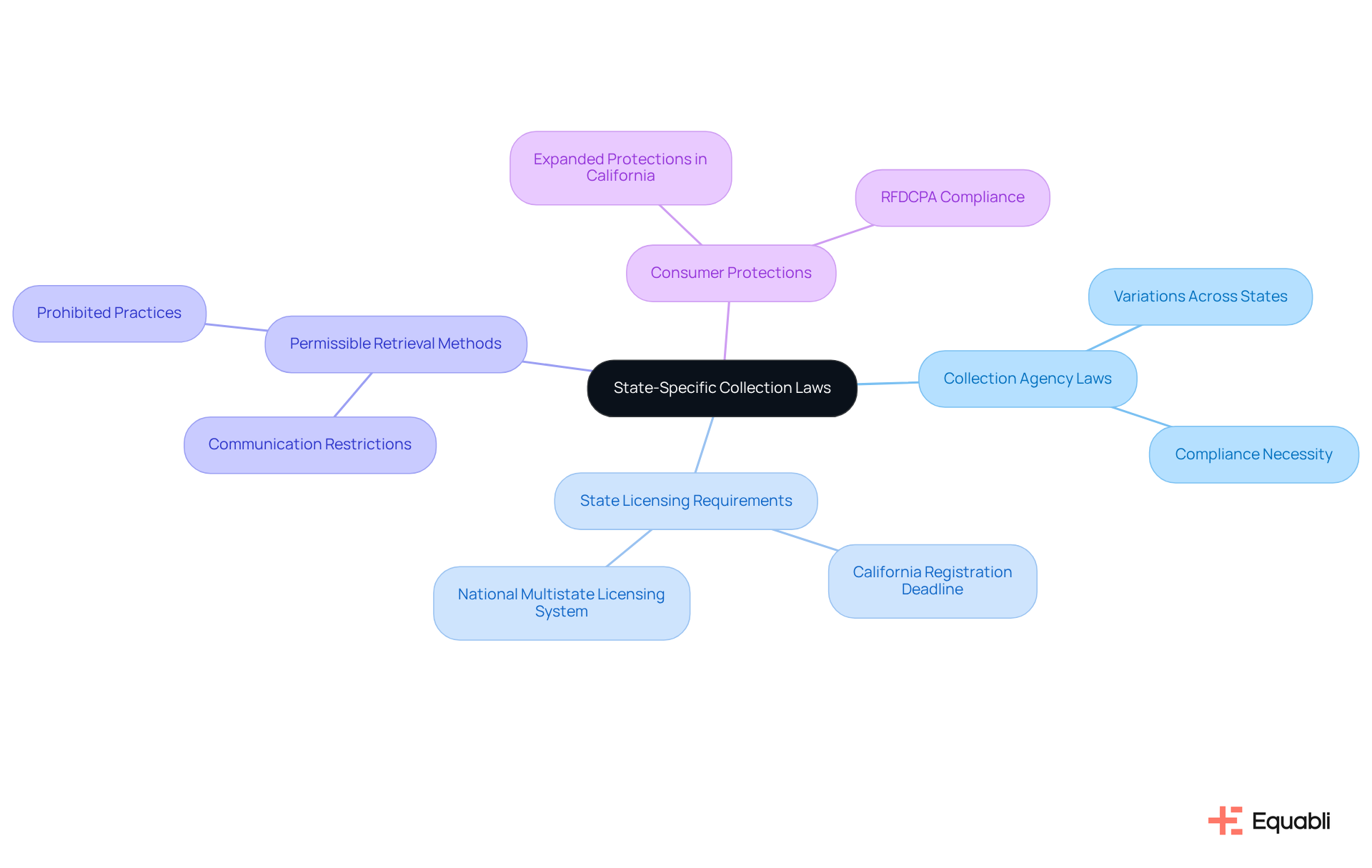

State-Specific Collection Laws: Navigating Local Regulations

Collection agency laws cause significant variation in debt recovery regulations across states, impacting communication methods and the types of debts eligible for recovery. It is crucial for financial executives to understand these variations to ensure compliance with collection agency laws and reduce legal risks. This entails understanding:

- Collection agency laws

- State licensing requirements

- Permissible retrieval methods

- Consumer protections that may surpass federal regulations

Regular training and updates on local laws are indispensable; research shows that organizations with robust adherence training programs experience fewer legal issues and demonstrate better compliance with state regulations. Legal experts assert that remaining informed about collection agency laws is not merely a best practice but a critical necessity for avoiding costly penalties. For example, financial institutions that proactively navigate these regulations often report enhanced operational efficiency and decreased compliance-related expenses.

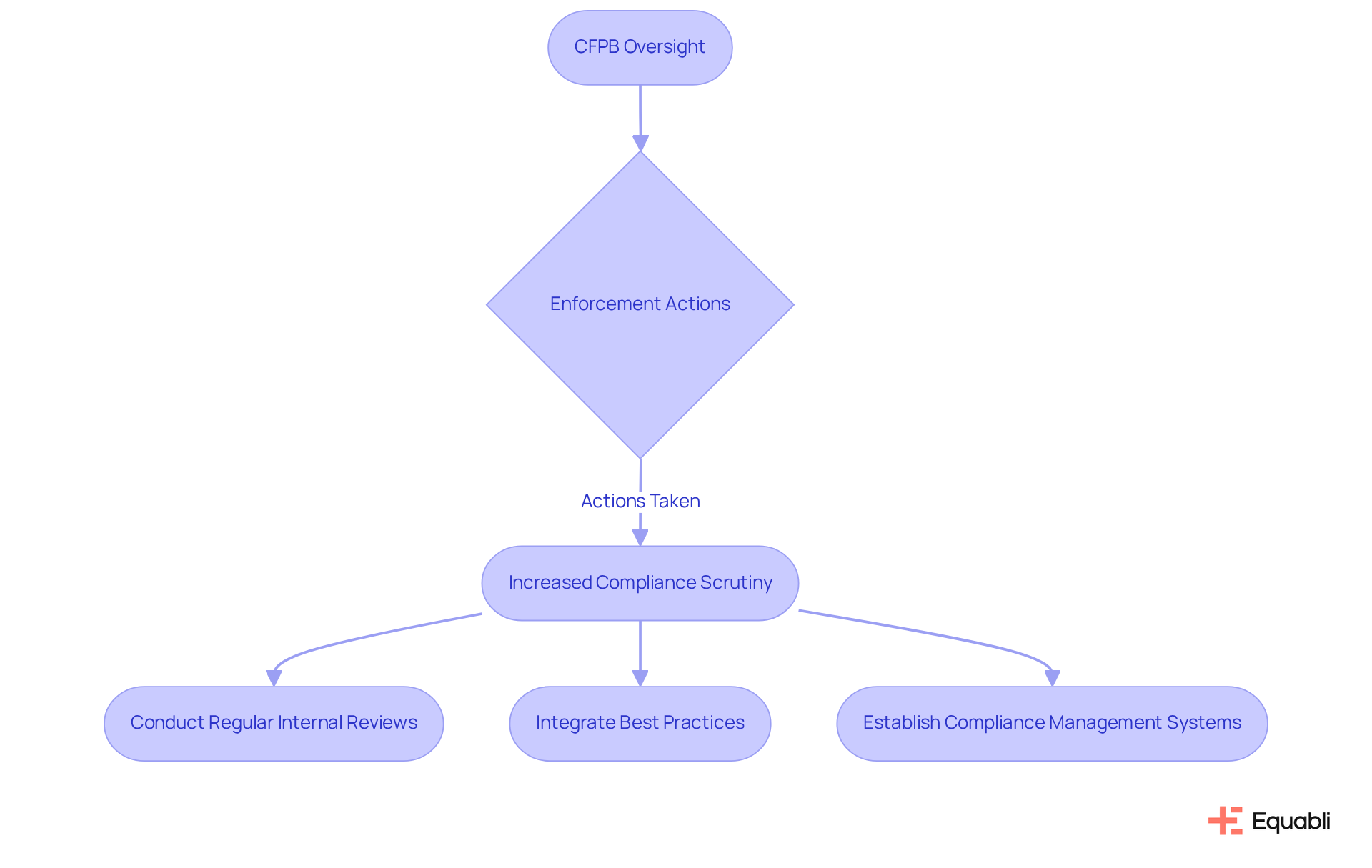

Consumer Financial Protection Bureau (CFPB): Oversight and Compliance Guidelines

The Consumer Financial Protection Bureau (CFPB) serves a pivotal function in regulating the credit recovery sector, ensuring that agencies adhere to collection agency laws as well as federal regulations such as the Fair Debt Recovery Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA). In 2023, the CFPB intensified its enforcement efforts, initiating 22 cases related to financial recovery—a notable increase from 16 actions in 2022. This surge signals a heightened scrutiny of compliance practices, compelling agencies to remain vigilant in following CFPB guidelines and integrating best practices into their operations. Failure to do so could result in severe penalties and reputational harm.

Recent enforcement actions highlight the critical nature of compliance. For instance, a financial technology firm faced substantial fines due to deceptive marketing tactics, underscoring the imperative for transparency in receivables management. Moreover, the CFPB's focus on medical debt collection practices emphasizes the need for organizations to align their strategies with consumer protection laws and collection agency laws, especially in recovering uncollectible work-related medical debt, which may violate the FDCPA.

To foster consumer trust and avert enforcement actions, organizations must establish comprehensive compliance management systems. This includes:

- Conducting regular internal reviews and audits to evaluate adherence to CFPB guidelines.

As the regulatory landscape continues to evolve, agencies that proactively adjust to these changes will not only minimize risks but also strengthen their operational integrity and enhance consumer relationships.

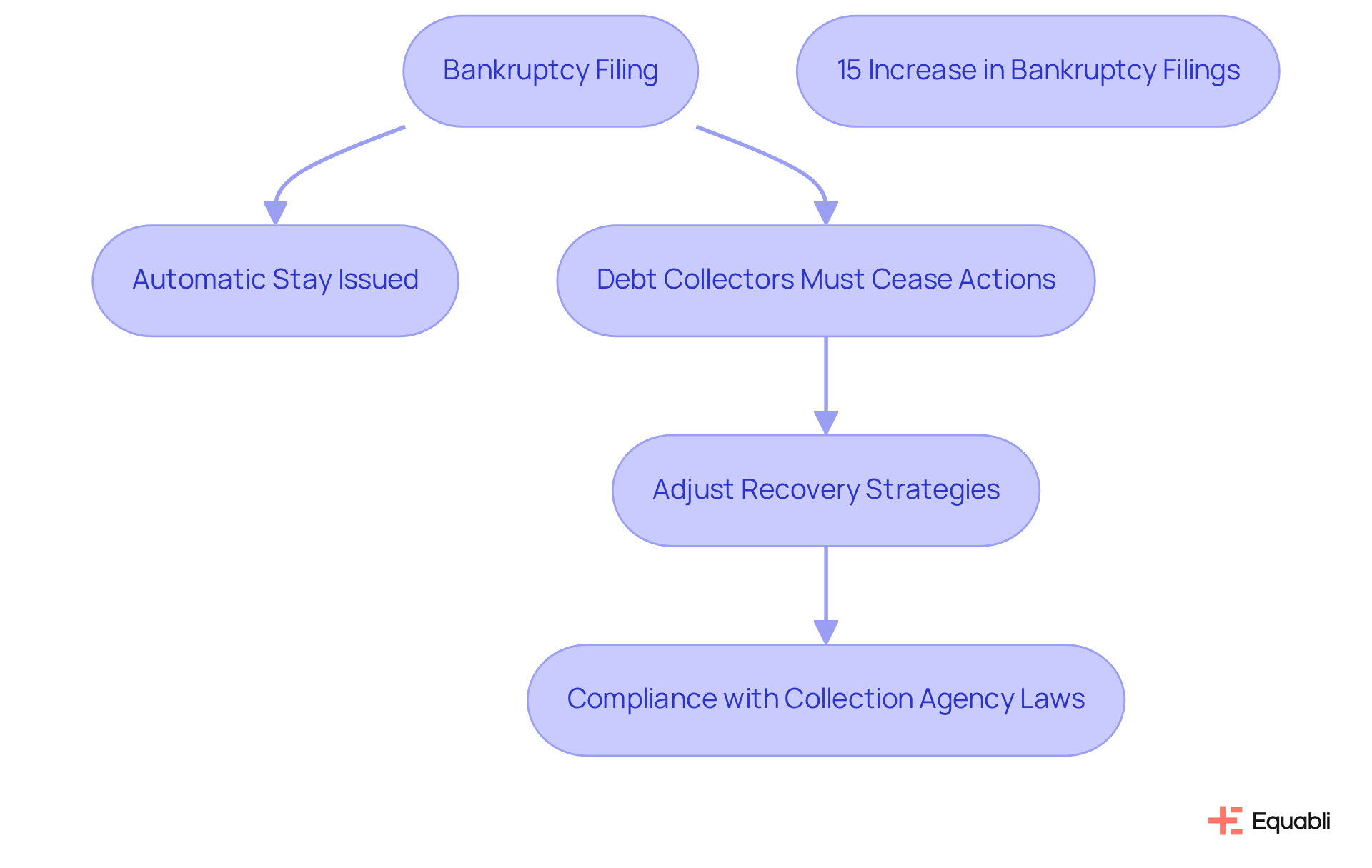

Bankruptcy Laws: Impact on Debt Collection Practices

Bankruptcy regulations offer vital protections for debtors, featuring an automatic stay that immediately halts all recovery actions upon the filing of a bankruptcy petition. This legal framework mandates that debt collectors cease all recovery activities and refrain from contacting debtors concerning discharged debts.

For debt recovery firms, a thorough understanding of collection agency laws is crucial to avoid compliance violations, which can lead to severe legal repercussions. Agencies must establish robust protocols to promptly identify bankruptcy filings and adjust their recovery strategies in compliance with collection agency laws.

Notably, recent trends reveal a 15% increase in bankruptcy filings, underscoring the necessity for organizations to remain vigilant and adaptable to these developments. By recalibrating their approaches in light of bankruptcy protections, organizations can enhance compliance and improve their overall efficacy in debt recovery.

Servicemembers Civil Relief Act (SCRA): Protections for Military Debtors

The Servicemembers Civil Relief Act (SCRA) offers essential protections for active-duty military personnel. Notably, it imposes a cap on interest rates at 6% for various loans and provides safeguards against eviction and foreclosure.

Debt collectors must recognize these protections outlined in collection agency laws to ensure compliance when interacting with military debtors. Non-compliance with SCRA provisions can result in severe legal consequences and tarnish an organization's reputation. Thus, training staff on SCRA requirements is crucial for upholding these laws.

Alarmingly, less than 10% of eligible service members currently benefit from the auto loan reductions they are entitled to under the SCRA, leading to over $10 million in lost savings annually. Furthermore, only 6% of individuals with personal loans from activated National Guard and Reserve are receiving the reductions they deserve, highlighting a significant gap in awareness and adherence that debt collectors must address.

The SCRA also permits active-duty service members to terminate an automobile lease without incurring early termination charges if the lease was signed prior to their activation. By implementing comprehensive training programs, organizations can better equip their teams to navigate the complexities of the SCRA and understand collection agency laws, ultimately fostering a more respectful and legally compliant approach to debt collection practices.

As Mac Warner, United States Assistant Attorney General for the Civil Rights Division, stated, 'We want all service members to devote their entire energy to defending the United States and not be distracted by financial concerns.

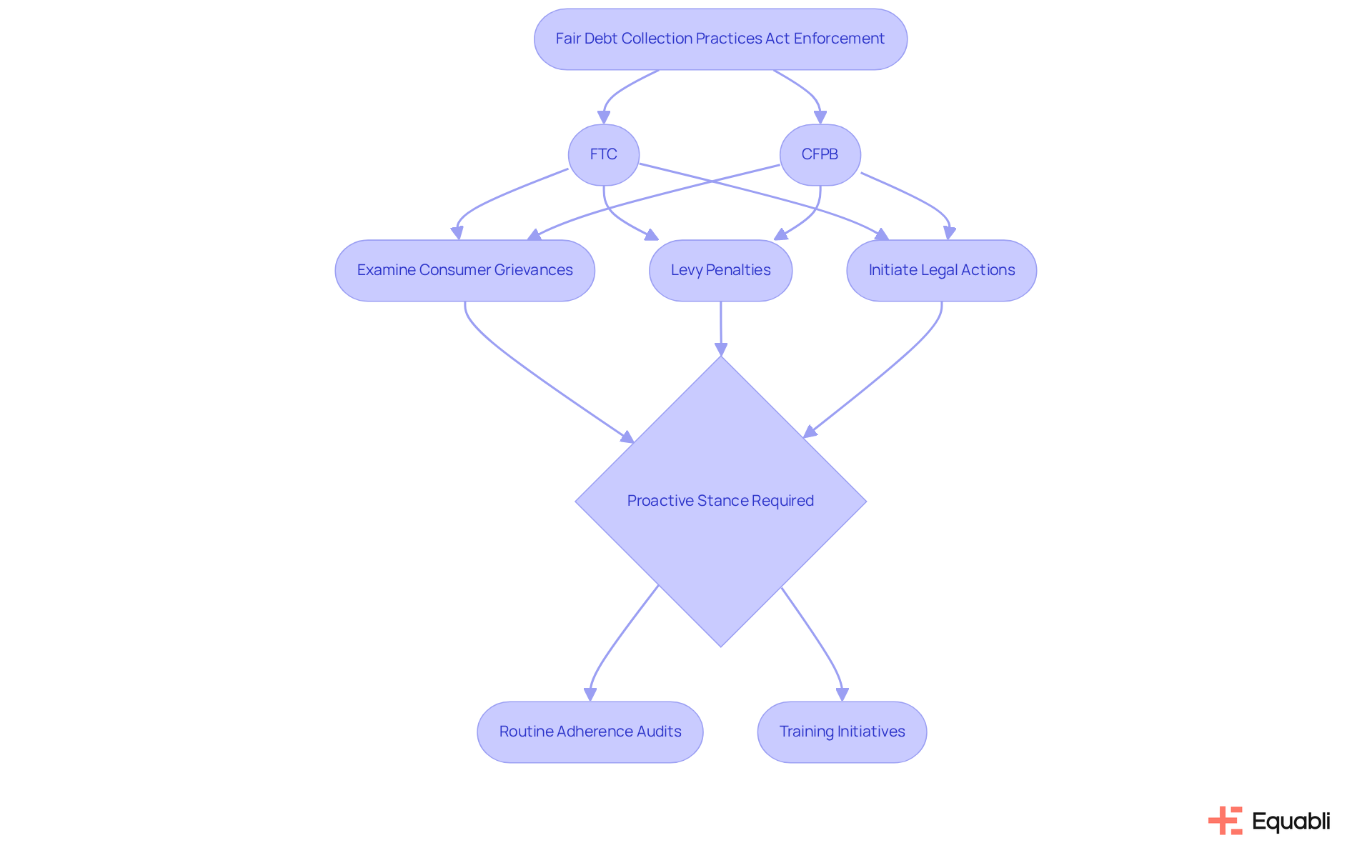

Enforcement Mechanisms of the Fair Debt Collection Practices Act

The enforcement of the Fair Debt Collection Practices Act (FDCPA) is primarily managed by the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB). These organizations wield the authority to:

- Examine consumer grievances

- Levy penalties

- Initiate legal actions against violators

Debt collection firms must adopt a proactive stance toward collection agency laws to prevent enforcement measures that can incur substantial penalties and tarnish their reputation. Routine adherence audits and training initiatives have proven effective in significantly reducing violations; studies indicate that organizations implementing such training report a marked decrease in infractions.

Recent actions by the FTC underscore the critical importance of compliance with collection agency laws. Notably, the FTC has taken decisive actions against numerous creditors for non-compliance, resulting in financial penalties and operational bans. FTC officials emphasize that strict adherence to collection agency laws is essential for protecting consumers and maintaining the integrity of the credit recovery sector.

By prioritizing compliance, organizations not only shield themselves from potential legal repercussions but also enhance their operational credibility in a highly regulated environment.

Recent Amendments to Collection Agency Laws: Staying Updated

Recent amendments to collection agency laws, particularly updates to the Fair Debt Collection Practices Act (FDCPA) and the Telephone Consumer Protection Act (TCPA), underscore the necessity for organizations to remain vigilant and responsive to regulatory changes. These updates not only introduce new communication restrictions but also enhance consumer protections and revise reporting requirements—factors that can significantly impact organizational operations.

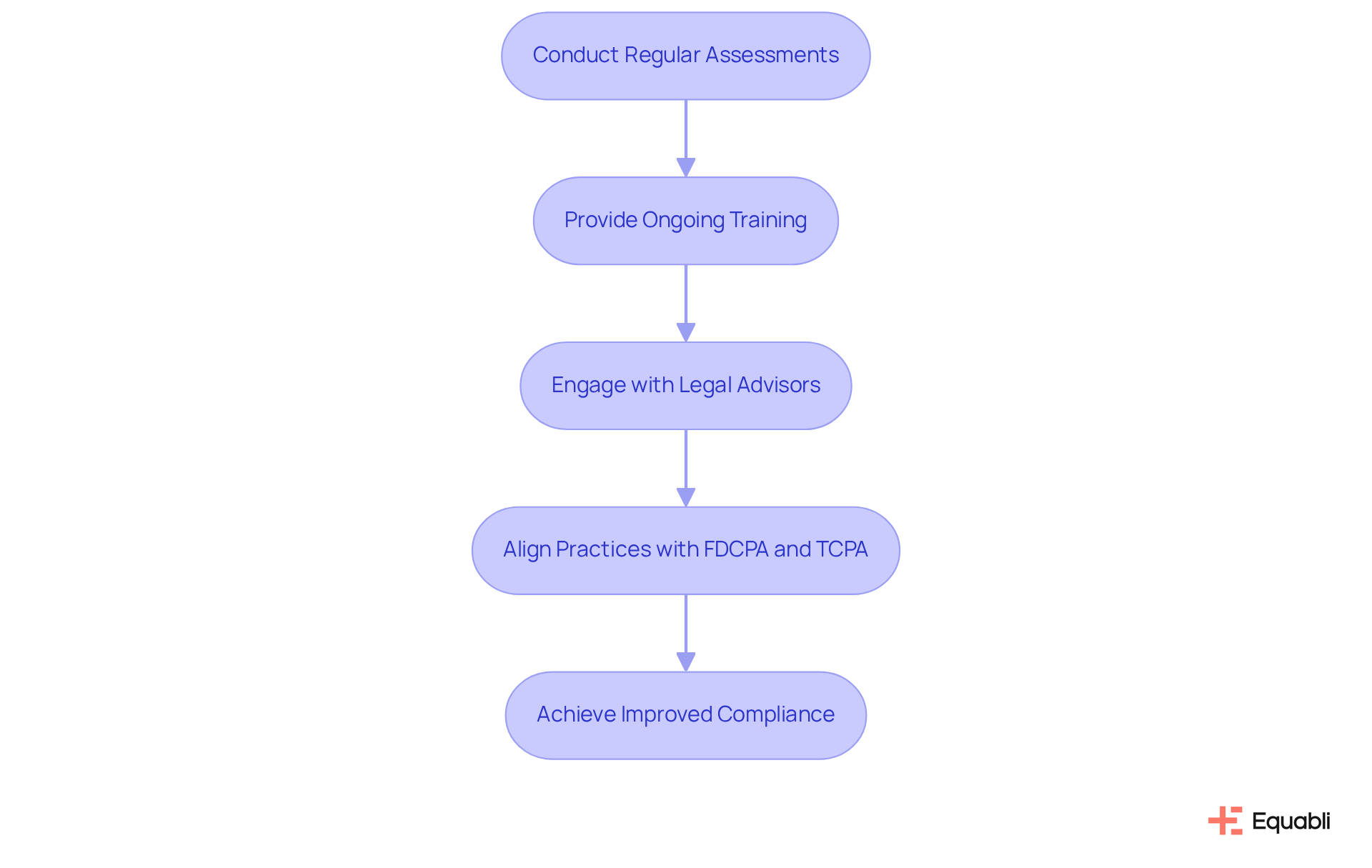

To remain compliant, organizations must:

- Conduct regular assessments of their protocols.

- Provide ongoing training for personnel, ensuring they are equipped to implement these changes effectively.

- Engage with legal advisors or regulatory specialists to navigate the complexities of collection agency laws.

For instance, agencies that have proactively aligned their practices with the new FDCPA and TCPA requirements have reported improved compliance rates and heightened consumer trust. Staying informed about these changes transcends regulatory obligation; it represents a strategic advantage that can lead to enhanced operational efficiency and stronger customer relations.

Conclusion

Understanding the intricacies of collection agency laws is essential for financial executives navigating the complex landscape of debt collection. Compliance with regulations such as the Fair Debt Collection Practices Act (FDCPA), the Telephone Consumer Protection Act (TCPA), and the Fair Credit Reporting Act (FCRA) is not merely a legal obligation; it is a strategic imperative. Adhering to these laws protects organizations from legal repercussions and fosters ethical practices that enhance consumer trust and operational efficiency.

Key insights emphasize the necessity of implementing robust compliance management systems and the importance of regular training on state-specific laws. Furthermore, proactive measures are required to adapt to recent amendments in regulations. As debt collection practices evolve, organizations prioritizing compliance and leveraging modern solutions like Equabli's EQ Suite are better positioned to navigate upcoming challenges, minimizing risks while maximizing operational integrity.

In light of ongoing changes in collection agency laws, it is imperative for financial executives to remain informed and agile. Embracing a culture of compliance and continuous improvement safeguards against potential penalties and contributes to a more respectful and effective debt recovery process. By making informed decisions and investing in compliance training and technology, organizations can build stronger relationships with consumers, ultimately enhancing their overall operational success.

Frequently Asked Questions

What is Equabli's EQ Suite and what does it offer?

Equabli's EQ Suite is a comprehensive set of tools designed to optimize debt collection processes while ensuring compliance with regulatory standards. It includes the EQ Engine, which utilizes predictive analytics to assess repayment behaviors, and EQ Engage, which enhances communication with borrowers.

How does the EQ Engine work?

The EQ Engine employs predictive analytics to evaluate repayment behaviors, allowing organizations to tailor their debt collection strategies effectively.

What is the purpose of EQ Engage?

EQ Engage aims to improve communication with borrowers, fostering a more interactive and responsive dialogue during the debt collection process.

What compliance features are included in Equabli's tools?

The tools come with built-in compliance features that align with regulations such as the Fair Debt Collection Practices Act (FDCPA) and the Telephone Consumer Protection Act (TCPA), helping to reduce the risk of legal violations.

Why is compliance important for debt collection agencies?

Compliance is crucial for debt collection agencies to avoid legal penalties, maintain ethical standards, and enhance operational efficiency.

What are the key regulations established by the Fair Debt Collection Practices Act (FDCPA)?

The FDCPA includes guidelines to ensure fair treatment of consumers, prohibiting harassment, false statements, and unfair practices, and requiring validation notices for consumers.

What are the consequences of non-compliance with FDCPA regulations?

Non-compliance can result in significant financial penalties, as demonstrated by Portfolio Recovery Associates, which faced over $12 million in penalties for violating consumer financial laws.

What is the Rosenthal Fair Financial Practices Act (RFDCPA)?

The RFDCPA, effective July 1, 2025, expands legal exposure for creditors and recovery professionals, subjecting commercial obligations to the same stringent recovery practices as consumer obligations.

What are the key requirements of the Telephone Consumer Protection Act (TCPA)?

The TCPA requires debt collectors to obtain prior express consent before making automated calls or sending text messages, restricts call timing to between 8 a.m. and 9 p.m. local time, and limits the frequency of calls.

What penalties can arise from violations of the TCPA?

Violations of the TCPA can lead to penalties of up to $1,500 for intentional violations and up to $500 for basic violations.

How are consumers becoming more aware of their rights under these regulations?

Consumers are increasingly aware of their rights regarding consent and are opting out of unsolicited communications, emphasizing the need for creditors to implement effective consent management strategies.