Overview

The article highlights nine essential examples of collection letters vital for effective debt recovery. It asserts that well-crafted letters—including initial reminders, past due notices, and final demand letters—are crucial for enhancing communication with debtors. These letters improve recovery rates by clearly outlining the amount owed and encouraging timely payment. By understanding the role of these letters, organizations can significantly boost their debt recovery efforts.

Introduction

Debt collection often resembles navigating a minefield, where the balance between professionalism and empathy is paramount. In this context, mastering the art of crafting effective collection letters becomes an essential skill for organizations striving to recover owed funds while preserving positive relationships with debtors. This article delves into nine critical examples of collection letters that not only improve recovery rates but also cultivate goodwill and cooperation.

How can businesses effectively encourage timely payments without alienating their clients? The answer lies in grasping the nuances of each letter type and employing strategic communication techniques.

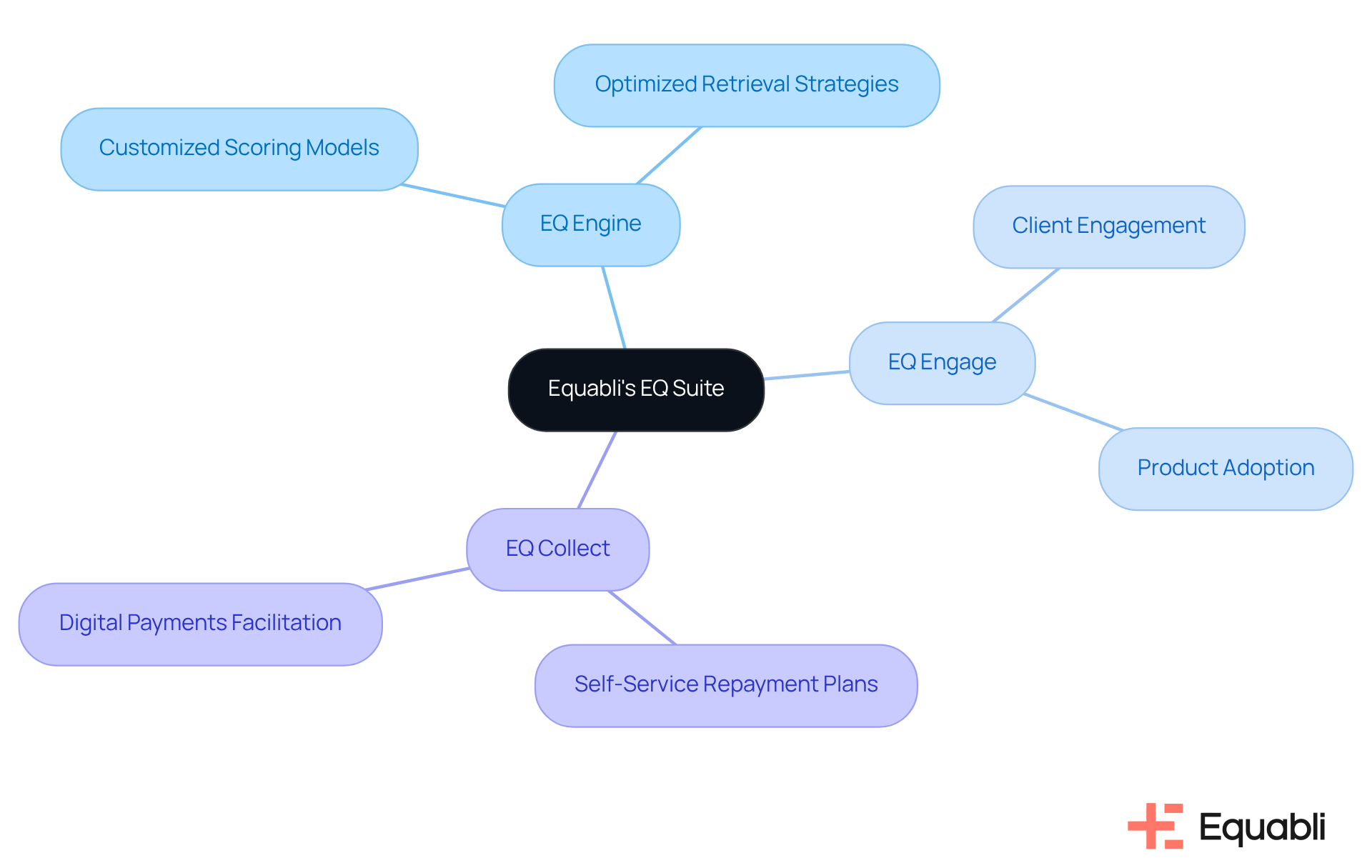

Equabli's EQ Suite: Transforming Debt Collection with Intelligent Solutions

Equabli's EQ Suite stands as a transformative platform in debt retrieval, prioritizing data protection and privacy. This comprehensive solution encompasses the EQ Engine, EQ Engage, and EQ Collect, all designed to leverage data-driven strategies that enhance operational efficiency while strictly adhering to our privacy policy.

With these tools, clients can:

- Implement customized scoring models

- Optimize retrieval strategies

- Facilitate digital payments through self-service repayment plans, ensuring the safeguarding of personal information

Furthermore, our client success representatives are instrumental in fostering client engagement and driving effective product adoption. By harnessing advanced technology, organizations can significantly reduce collection costs and enhance borrower engagement, establishing the EQ Suite as an indispensable asset for lenders and agencies alike.

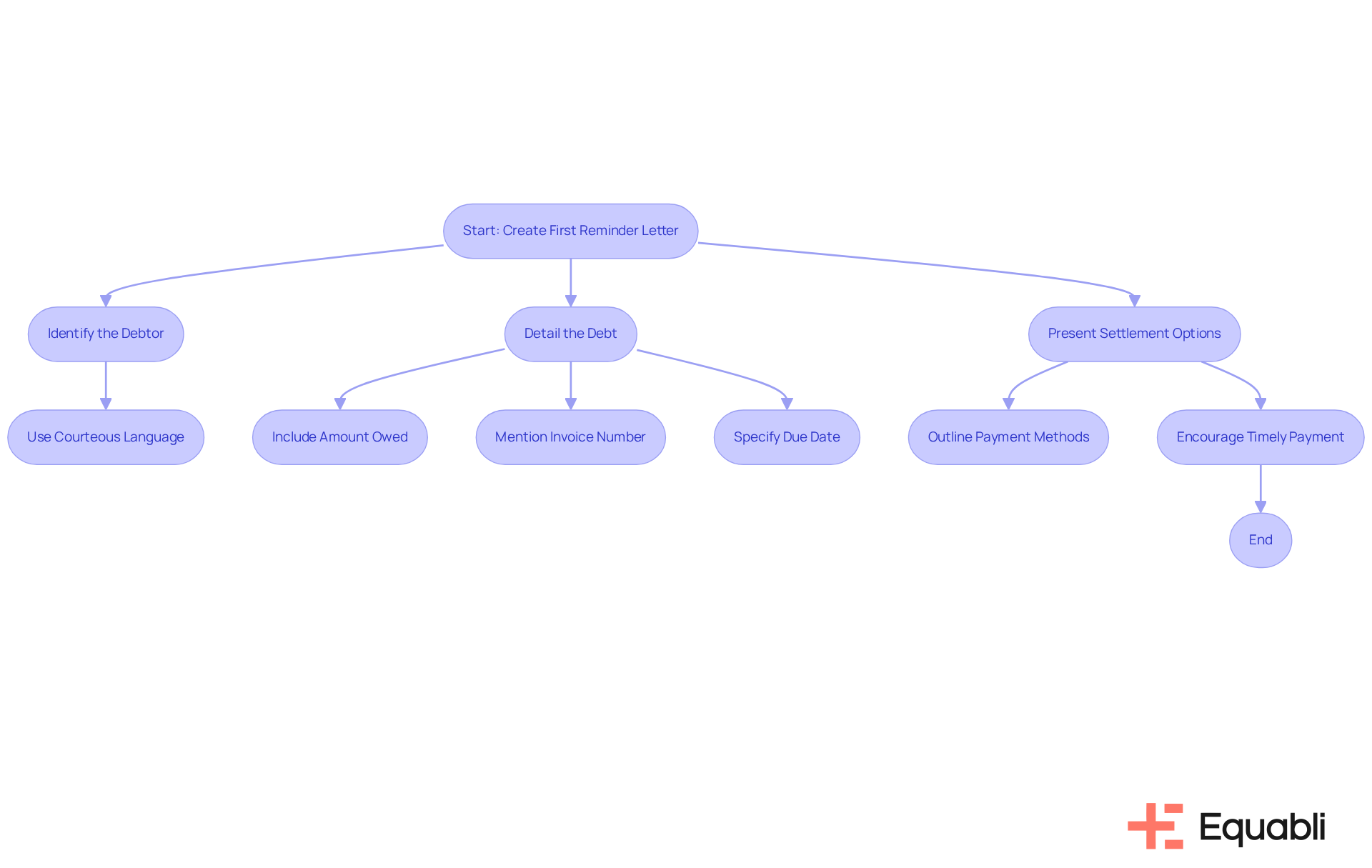

First Reminder Letter: A Friendly Approach to Prompt Payment

The initial reminder letter acts as a crucial prompt for debtors, highlighting their outstanding balance. It should be both courteous and concise, detailing the amount owed, invoice number, and settlement conditions. A thoughtfully composed first reminder not only fosters goodwill but also encourages timely payment, making it an indispensable tool in the recovery process.

Consider this: 68% of firms that receive more than half of their funds post-due date encounter cash flow challenges. This statistic underscores the importance of effective invoice retrieval emails, which can significantly boost recovery rates. Current trends indicate that the tone of a notice profoundly influences the debtor's response, reinforcing the need for a professional and respectful approach in these communications.

An effective debt recovery message, exemplified by a letter of collection example, should include:

- Clear identification of the debtor

- Specific details about the debt

- Available settlement options

All of which are vital for clarity and impact. By adopting a friendly demeanor and utilizing Equabli's EQ Suite, organizations can refine their collection strategies, enhance borrower engagement through customizable repayment options, and ultimately improve cash flow.

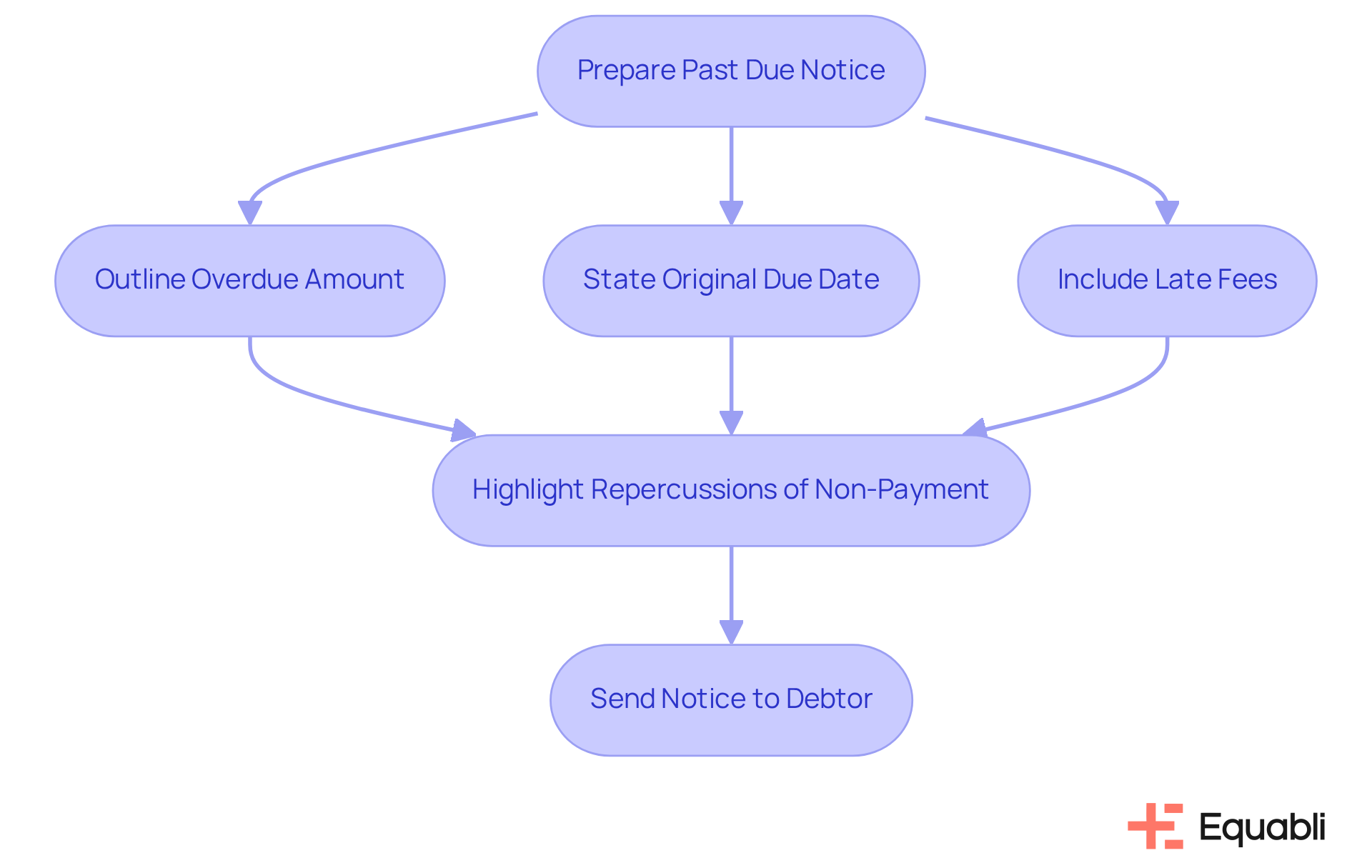

Past Due Notice: Reinforcing Urgency in Debt Recovery

A past due notice serves as a crucial communication tool that underscores the urgency of repayment. It must explicitly outline the overdue amount, the original due date, and any incurred late fees. By highlighting the repercussions of continued non-payment, this notice effectively motivates debtors to prioritize settling their accounts, thereby enhancing recovery rates.

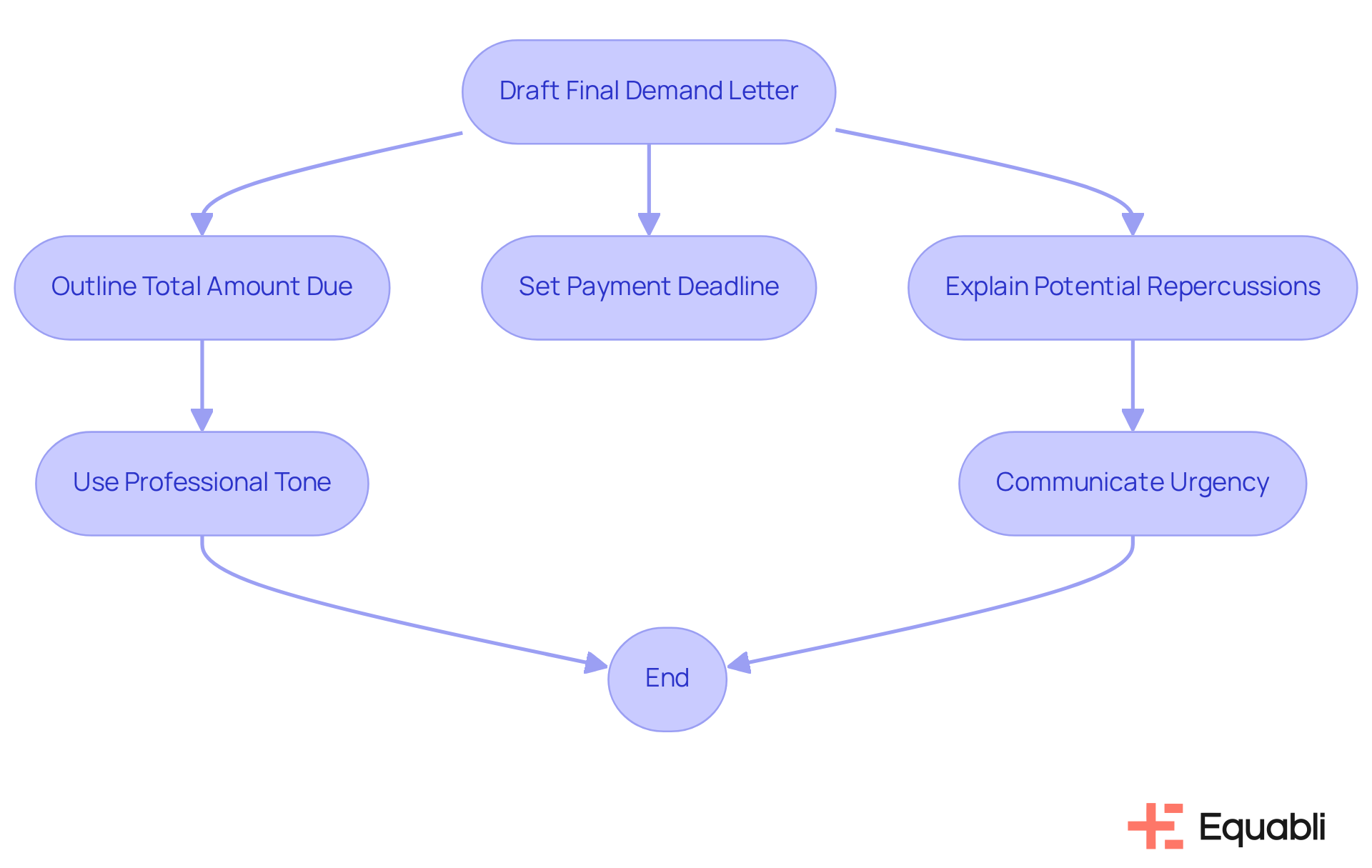

Final Demand Letter: Last Call for Payment Before Escalation

The final demand notice serves as a critical last call for settlement before further measures are enacted. It must convey a firm yet professional tone, clearly outlining the total amount due, the payment deadline, and the potential repercussions of non-payment, including legal action, as seen in a letter of collection example.

This document is a vital letter of collection example for establishing a definitive record of communication and underscoring the seriousness of the situation. By presenting this information effectively, businesses can foster a sense of urgency and encourage prompt action from the recipient.

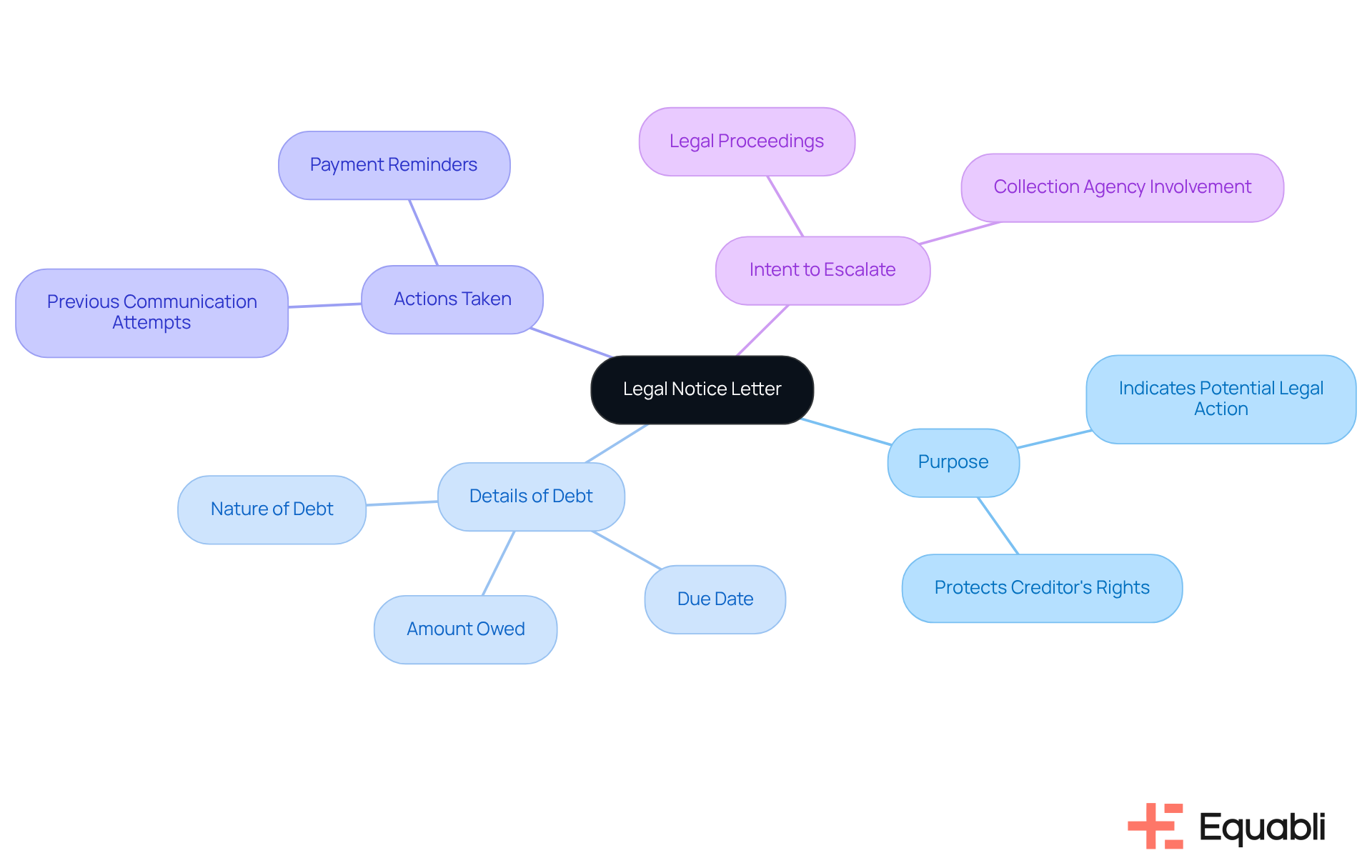

Legal Notice Letter: Preparing for Potential Legal Action

A legal notice is a formal communication that indicates the potential for legal action should the debt remain unpaid. This document must detail the specifics of the debt, outline the actions taken to collect it, and present a clear intent to escalate the matter legally. By serving this purpose, the legal notice not only protects the rights of the creditor but also ensures adherence to legal requirements. Understanding its significance is crucial for any creditor aiming to safeguard their interests and navigate the complexities of debt collection effectively.

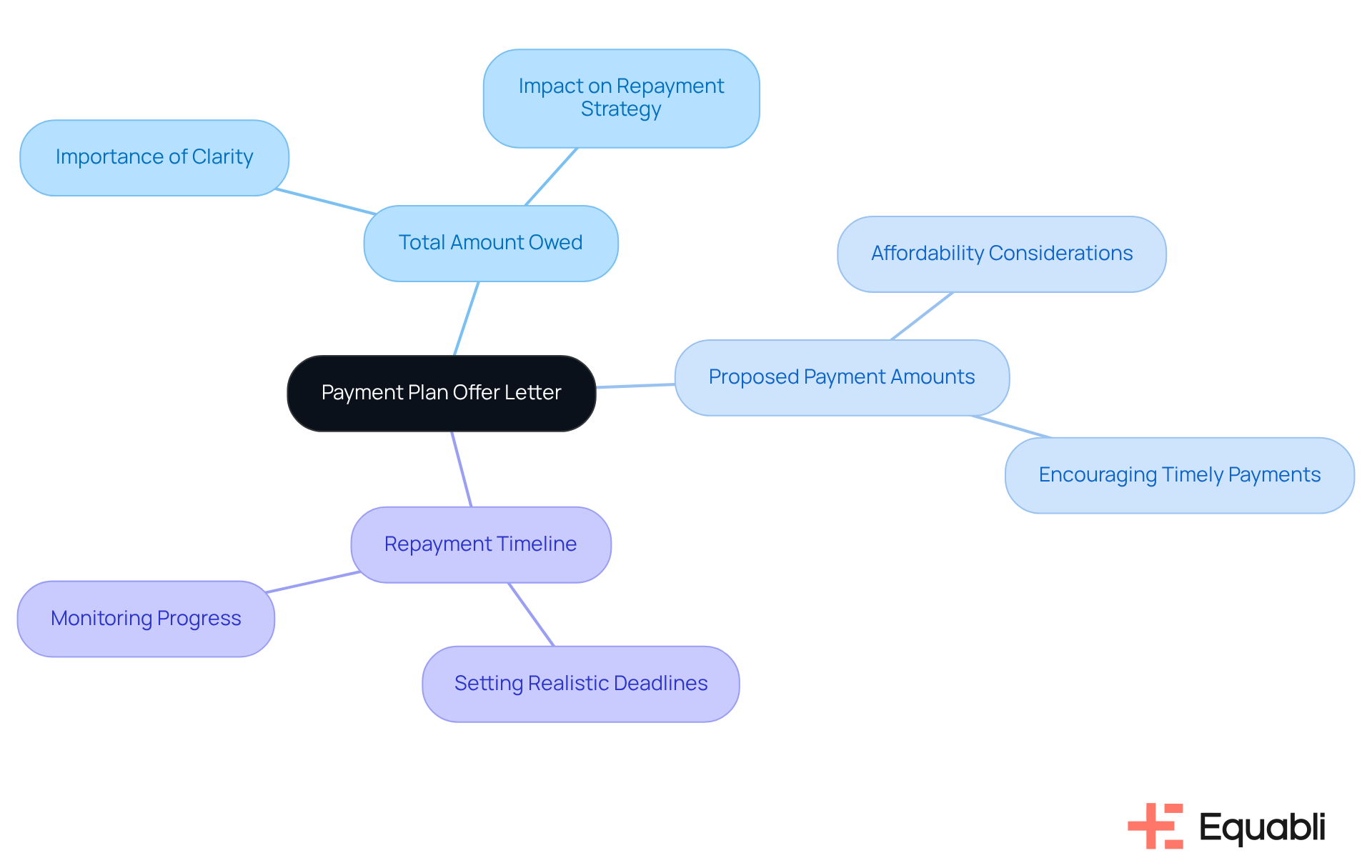

Payment Plan Offer Letter: Encouraging Debtor Cooperation

A financial plan offer letter is crucial in establishing a suggested repayment timeline that takes into account the debtor's economic circumstances. It meticulously outlines the total amount owed, the proposed payment amounts, and the timeline for repayment. By offering a structured plan, creditors not only foster cooperation but also significantly increase the likelihood of recovering the owed amount. Such a strategic approach not only aids in clarity but also builds a partnership between creditors and debtors, paving the way for successful financial resolutions.

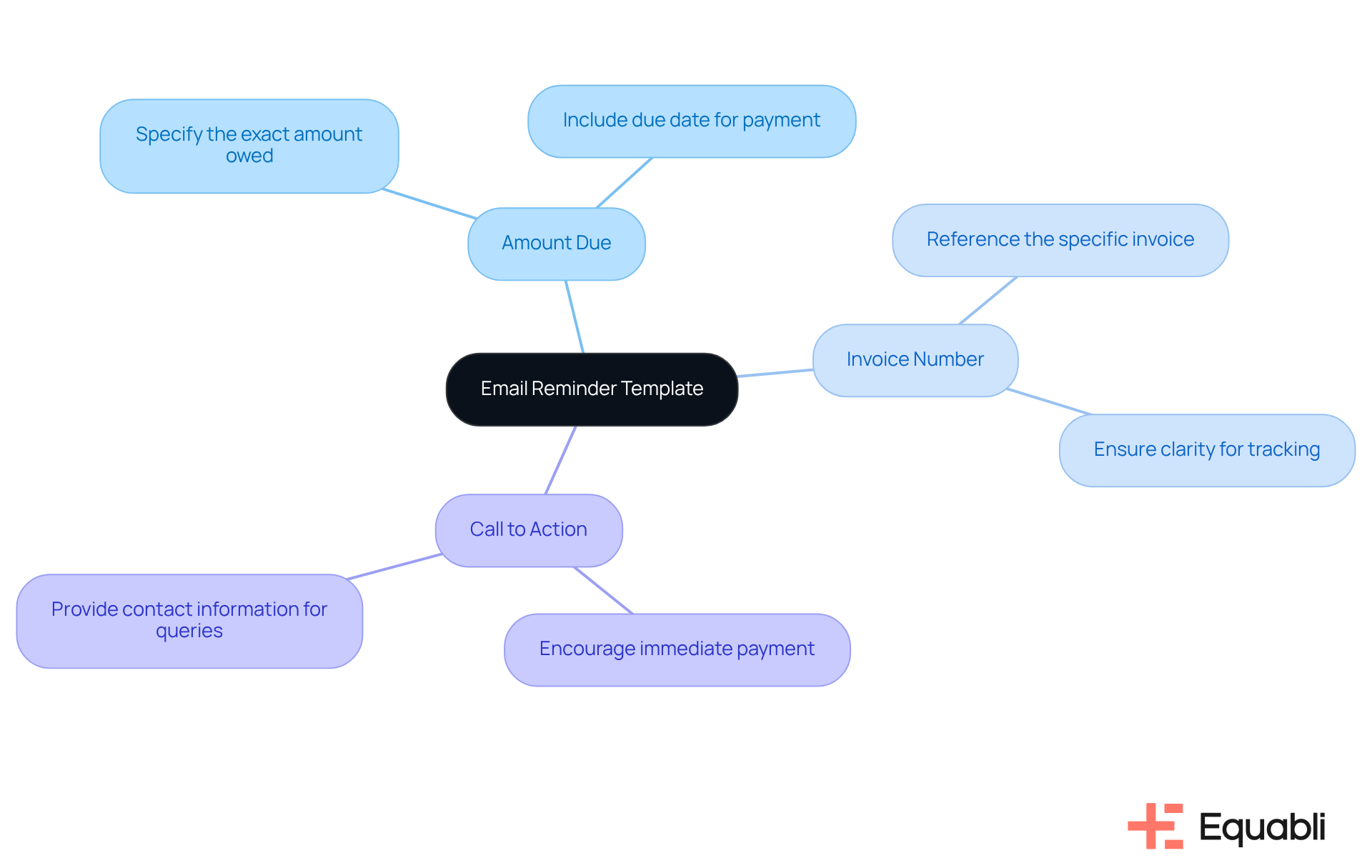

Email Reminder Template: Streamlining Digital Communication

An email reminder template serves as a vital tool for automating communication with debtors, particularly in overcoming the challenges posed by manual recovery processes. When integrated with Equabli's EQ Suite, this template empowers organizations to streamline operations and enhance performance in financial recovery.

It is imperative to include key information such as:

- The amount due

- Invoice number

- A definitive call to action

By leveraging email reminders through the EQ Suite, organizations can maintain consistent communication and significantly increase the likelihood of prompt payments, ultimately revolutionizing their recovery strategies.

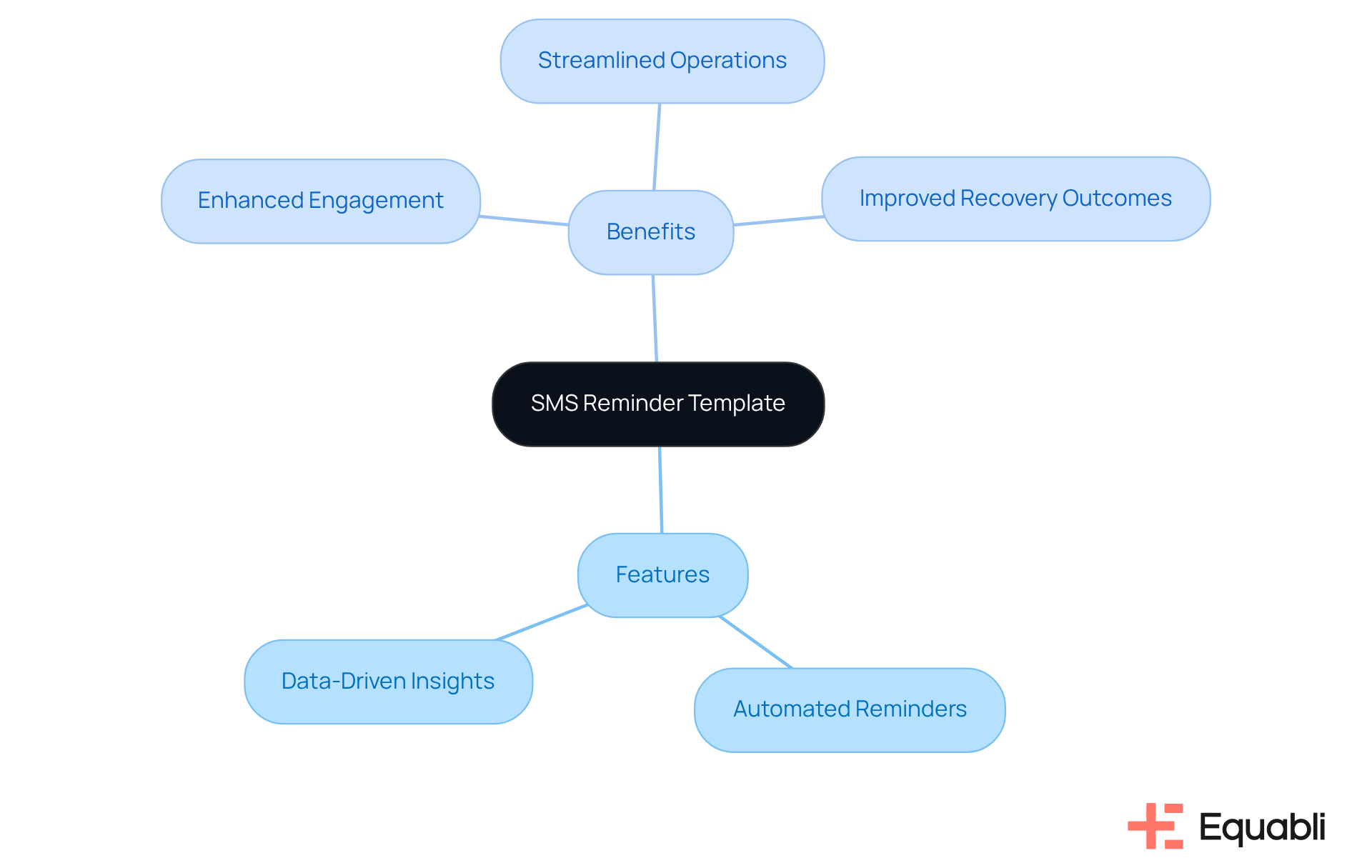

SMS Reminder Template: Engaging Debtors via Mobile

An SMS reminder template empowers organizations to swiftly and efficiently engage with debtors. This concise message should include the amount due along with a link for payment. By leveraging Equabli's EQ Suite, which addresses the complexities of manual debt management, SMS reminders can significantly enhance engagement by providing a convenient avenue for debtors to respond. The EQ Suite's features, such as:

- Automated reminders

- Data-driven insights

streamline operations and improve recovery outcomes, enabling financial institutions to adeptly manage the recovery lifecycle.

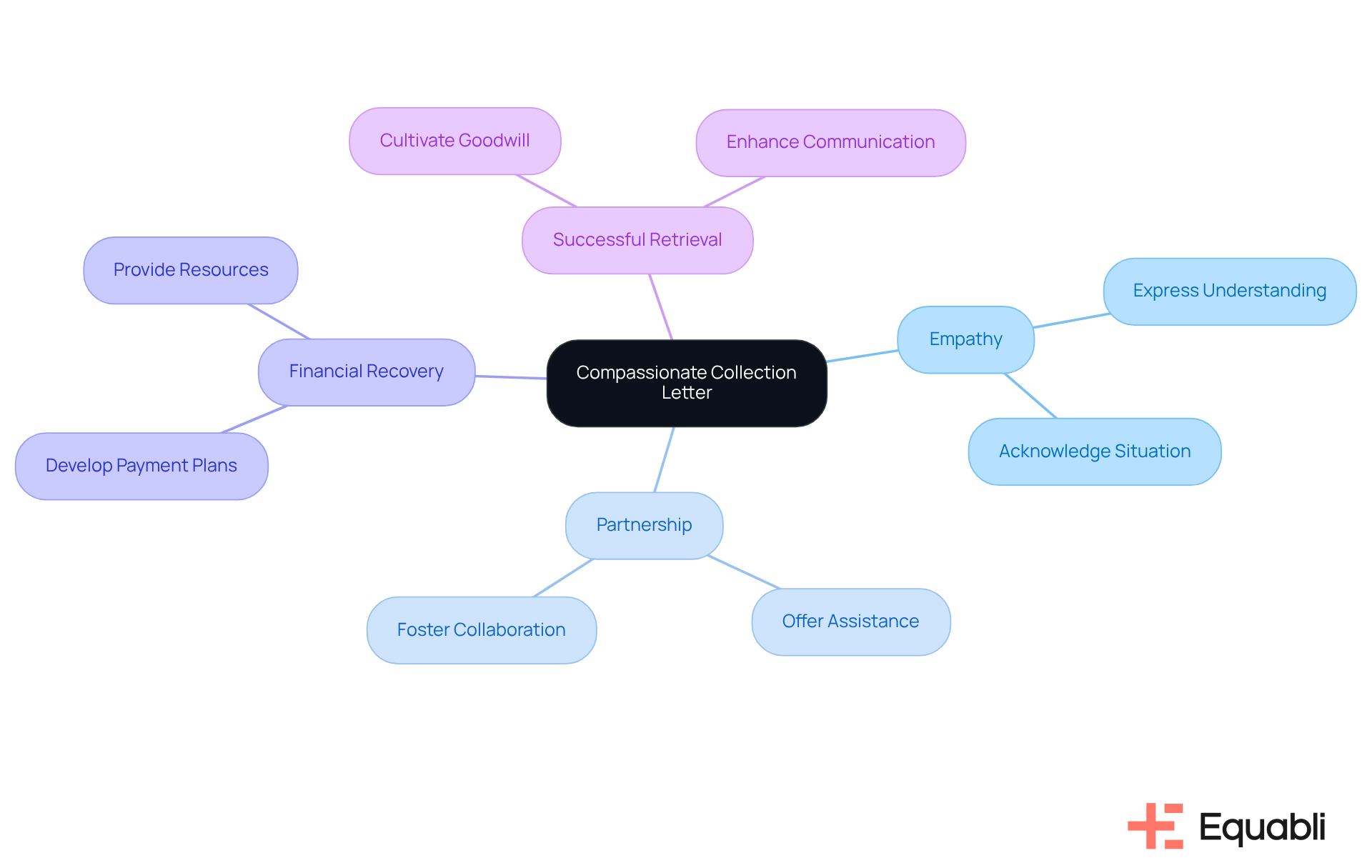

Compassionate Collection Letter: Building Positive Debtor Relationships

A compassionate reminder letter serves as a crucial tool in acknowledging the debtor's situation while still requesting payment. It is essential to express understanding and offer assistance in finding a resolution. By addressing financial recovery with empathy, organizations not only cultivate goodwill but also significantly enhance their chances of successful retrieval. This approach fosters a partnership with the debtor, paving the way for a more collaborative resolution.

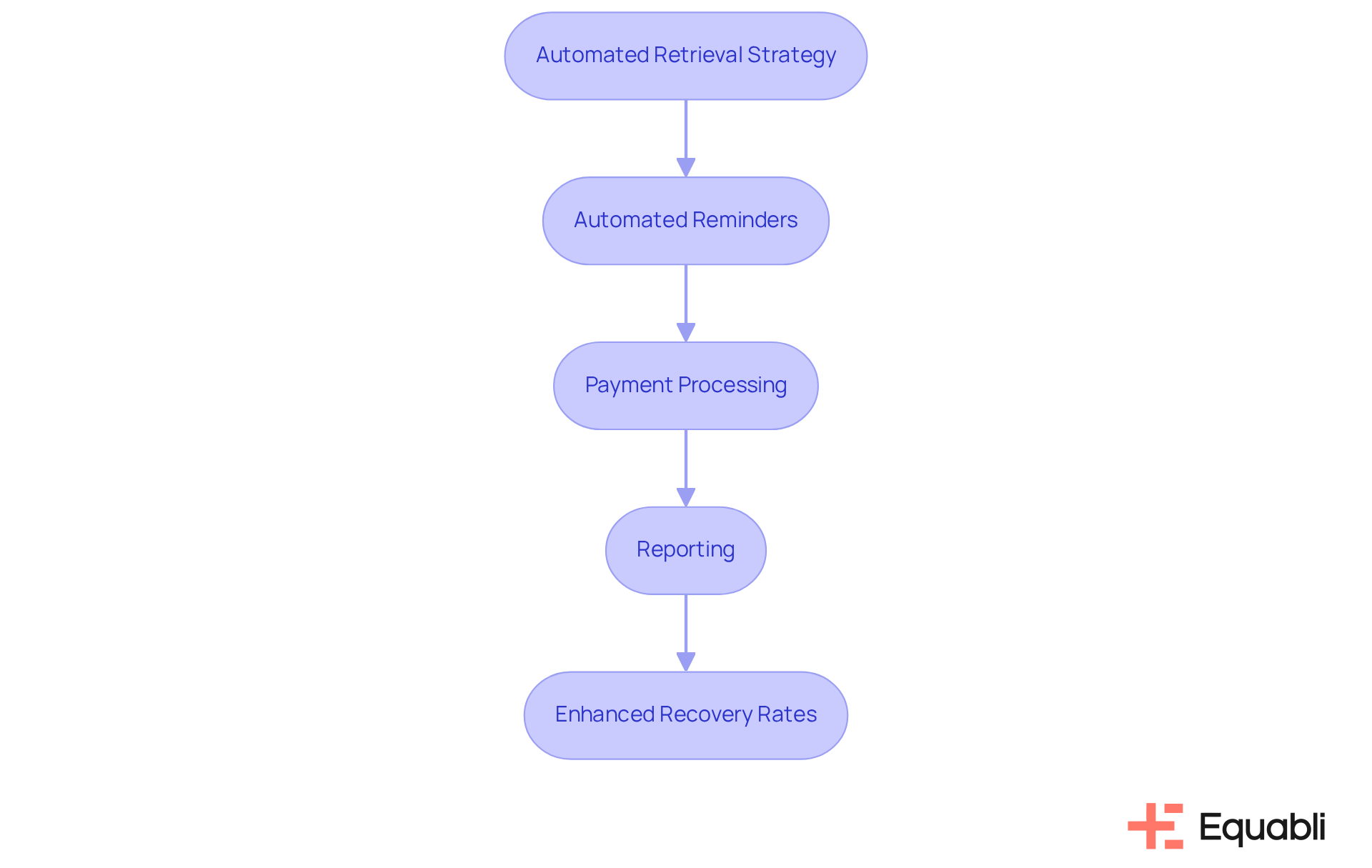

Automated Collection Strategy: Enhancing Efficiency in Recovery

An automated retrieval strategy revolutionizes the debt recovery process by leveraging advanced technology. This encompasses automated reminders, payment processing, and comprehensive reporting, all facilitated by the user-friendly, scalable, cloud-native interface of Equabli's EQ Collect.

By utilizing a straightforward, no-code file-mapping tool, organizations can significantly reduce vendor onboarding timelines while enhancing efficiency in collections through data-driven methodologies.

Automation not only minimizes execution errors and reliance on manual resources but also ensures compliance with regulations through rigorous automated monitoring and industry-leading oversight.

Furthermore, access to real-time reporting delivers unparalleled transparency and insights, ultimately culminating in enhanced recovery rates.

Conclusion

The effectiveness of debt collection is fundamentally rooted in strategic communication. Tailored letters can significantly enhance recovery efforts, as evidenced by various approaches—from friendly reminders to legal notices—that organizations can employ. These strategies not only foster positive relationships with debtors but also ensure that outstanding balances are addressed promptly. The integration of Equabli's EQ Suite further amplifies these efforts, providing tools that streamline processes and enhance engagement.

Key arguments throughout this discussion emphasize the critical importance of clarity, urgency, and empathy in communication. Each letter serves a distinct purpose, whether to remind, demand, or propose a solution, and should be crafted with the debtor's perspective in mind. By utilizing automated strategies and data-driven insights, organizations can improve recovery rates while maintaining compliance and transparency.

In conclusion, adopting a thoughtful and systematic approach to debt collection is essential for success. Leveraging effective letter templates and innovative solutions like the EQ Suite allows organizations to transform their debt recovery processes. Embracing these best practices not only enhances cash flow but also cultivates a collaborative environment that benefits both creditors and debtors. Taking decisive action now to refine collection strategies will lead to more successful outcomes and stronger financial relationships in the future.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a transformative platform for debt retrieval that focuses on data protection and privacy. It includes tools such as the EQ Engine, EQ Engage, and EQ Collect, which utilize data-driven strategies to enhance operational efficiency.

What features does the EQ Suite offer to clients?

The EQ Suite allows clients to implement customized scoring models, optimize retrieval strategies, and facilitate digital payments through self-service repayment plans, all while safeguarding personal information.

How does Equabli support client engagement and product adoption?

Equabli provides client success representatives who help foster client engagement and drive effective product adoption, ensuring that organizations can maximize the benefits of the EQ Suite.

What are the benefits of using the EQ Suite for debt collection?

By using the EQ Suite, organizations can significantly reduce collection costs, enhance borrower engagement, and establish a more efficient debt collection process.

What is the purpose of the first reminder letter in debt collection?

The first reminder letter serves as a courteous prompt for debtors, highlighting their outstanding balance and encouraging timely payment by detailing the amount owed, invoice number, and settlement conditions.

Why is the tone of a reminder letter important?

The tone of a reminder letter can significantly influence the debtor's response, making it essential to adopt a professional and respectful approach to foster goodwill and encourage prompt payment.

What key elements should be included in an effective debt recovery message?

An effective debt recovery message should include clear identification of the debtor, specific details about the debt, and available settlement options to ensure clarity and impact.

What is the role of a past due notice in debt recovery?

A past due notice reinforces the urgency of repayment by explicitly outlining the overdue amount, the original due date, and any incurred late fees, motivating debtors to prioritize settling their accounts.