Overview

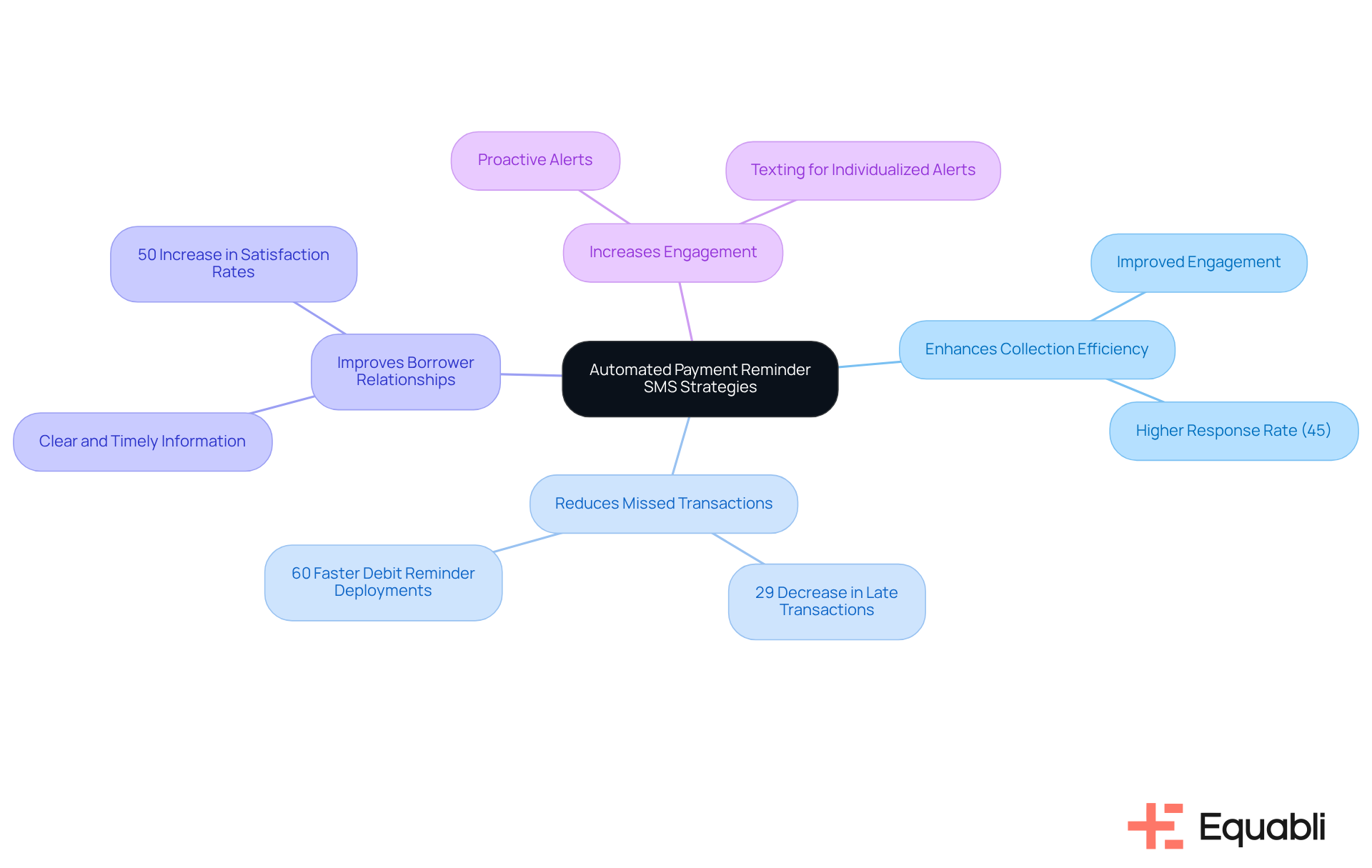

Automated payment reminder SMS strategies are essential for financial institutions aiming to enhance collection efficiency and strengthen borrower relationships. Evidence shows that these strategies significantly reduce late transactions and boost engagement, as SMS alerts enjoy high open rates. This effectiveness not only aids in managing financial obligations but also contributes to improved cash flow.

From a compliance perspective, implementing these SMS strategies aligns with regulatory expectations, ensuring that institutions maintain robust communication with borrowers. The ability to send timely reminders fosters a proactive approach to debt management, ultimately minimizing risk exposure.

To operationalize this strategy, financial institutions should consider integrating SMS reminders into their existing workflows. This integration can streamline processes and enhance the overall borrower experience, positioning institutions as partners in financial responsibility.

In conclusion, adopting automated SMS reminders is not merely a tactical move; it represents a strategic imperative for financial institutions. By leveraging this technology, organizations can improve their collection rates while fostering positive relationships with borrowers.

Introduction

The financial landscape is evolving, prompting institutions to adapt their methods for maintaining healthy cash flow and fostering customer relationships. Automated payment reminder SMS strategies have emerged as a pivotal tool, enabling financial organizations to enhance collection efficiency while minimizing the risk of missed transactions. With an impressive open rate, these timely SMS alerts underscore their potential impact.

However, how can institutions effectively implement these strategies to boost payment rates and deepen customer engagement? By exploring the nuances of automated reminders, organizations can uncover pathways to operational success and improved financial management.

Understand the Importance of Automated Payment Reminders in Financial Institutions

Automated payment reminder SMS strategies for financial institutions serve as a critical asset, significantly enhancing collection efficiency for financial organizations. Evidence shows that by utilizing automated payment reminder SMS strategies for financial institutions, sending timely SMS alerts can help institutions reduce the risk of missed transactions, which directly benefits cash flow. With an impressive open rate, SMS alerts are a key component of automated payment reminder SMS strategies for financial institutions, ensuring that messages are promptly seen and acted upon, and reinforcing the importance of proactive communication in financial management.

This strategy not only improves collections but also fosters positive borrower relationships by using automated payment reminder SMS strategies for financial institutions to provide clear and timely information about financial obligations. For instance, organizations that implemented automated notifications experienced a notable 29% decrease in late transactions compared to those relying solely on manual follow-ups. This data underscores the effectiveness of SMS alerts in driving operational success and compliance.

Moreover, the integration of automated payment reminder SMS strategies for financial institutions has significantly enhanced overall payment collection rates, with financial entities reporting increased engagement and responsiveness from borrowers. As executives recognize the value of SMS notifications in debt collection, they increasingly view automated payment reminder SMS strategies for financial institutions as essential tools for promoting customer loyalty and improving operational efficiency. This shift highlights the need for organizations to adapt their strategies to leverage technology effectively in managing financial relationships.

Implement Effective SMS Reminder Strategies for Timely Payments

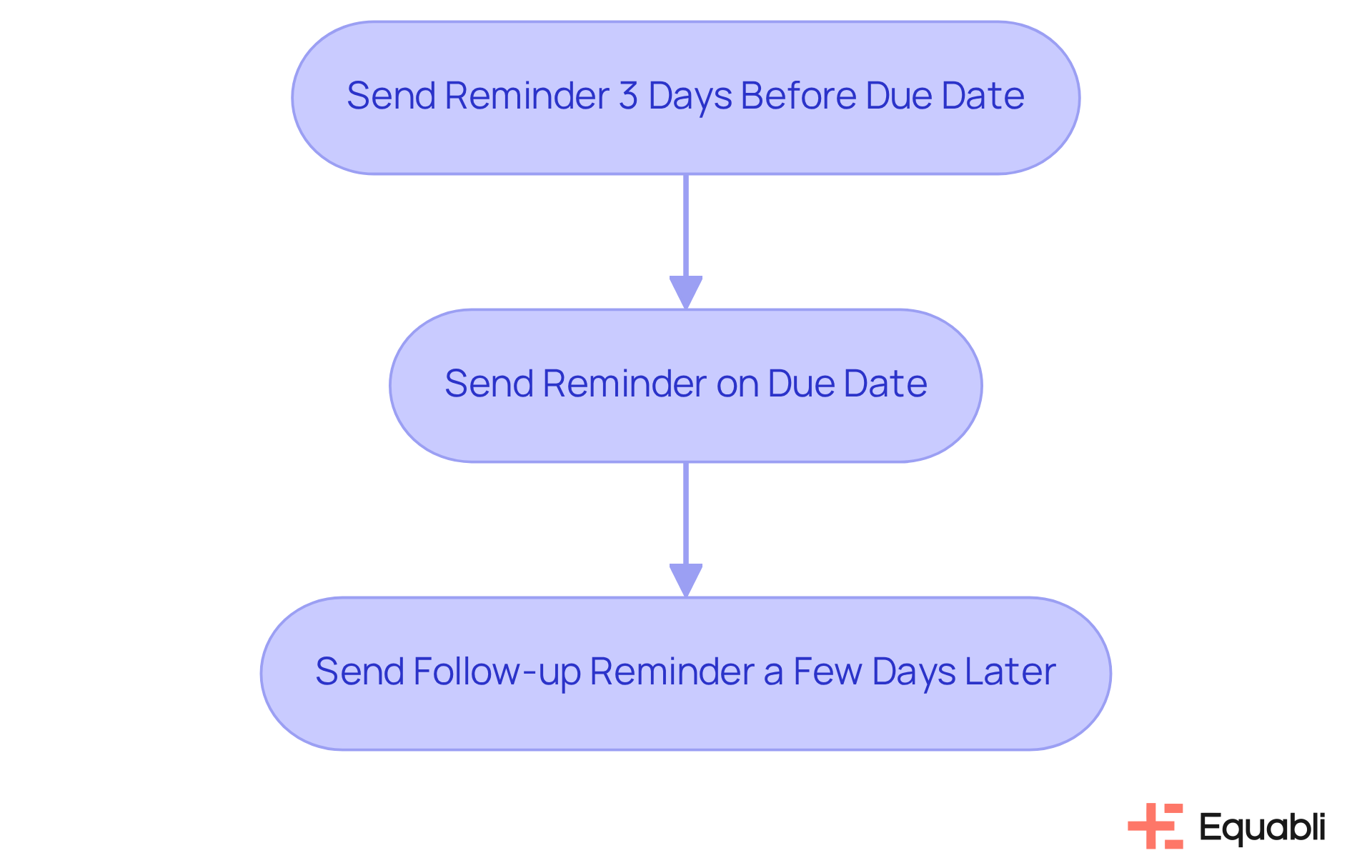

To implement automated payment reminder SMS strategies for financial institutions, a tiered messaging approach should be adopted. This strategy involves sending notifications at strategic intervals:

- A few days before the due date

- On the due date

- A follow-up notification a few days later

Each message must be concise and direct, containing essential information such as the amount owed, due date, and a direct link for transactions. For instance, a notice might state:

"Hi [Customer Name], this is a friendly notification that your fee of [$Amount] is due on [Due Date]. Click here to pay now: [Payment Link]."

Data indicates that automated payment reminder SMS strategies for financial institutions can significantly enhance payment response rates, with SMS alerts achieving open rates of 98%. Institutions should also monitor response levels and adjust their messaging strategies based on customer feedback and engagement metrics. This continuous refinement ensures that notifications resonate with clients, ultimately improving collection efficiency and enhancing cash flow through the use of automated payment reminder SMS strategies for financial institutions.

Personalize SMS Messages to Enhance Customer Engagement

Customizing SMS messages significantly enhances customer interaction and response rates, particularly when financial entities utilize automated payment reminder SMS strategies for financial institutions while prioritizing data security in accordance with Equabli's privacy policy. By incorporating the customer's name and relevant account details into notifications, institutions can foster a deeper connection. For instance, instead of a generic message, a tailored reminder could read: "Hello [Customer Name], just a reminder that your fee of [$Amount] is due on [Due Date]." This approach not only personalizes communication but also encourages prompt contributions.

Moreover, responsibly utilizing customer data to tailor messages based on payment history or preferences can further boost engagement with automated payment reminder SMS strategies for financial institutions. Equabli's commitment to data protection ensures that these practices comply with privacy standards, allowing organizations to build trust while enhancing communication. Research shows that automated payment reminder SMS strategies for financial institutions can enhance response rates by up to 15%, making this a strategic approach for organizations aiming to improve their collection efforts while adhering to data protection regulations.

Leverage Automation Tools for Streamlined Payment Reminder Processes

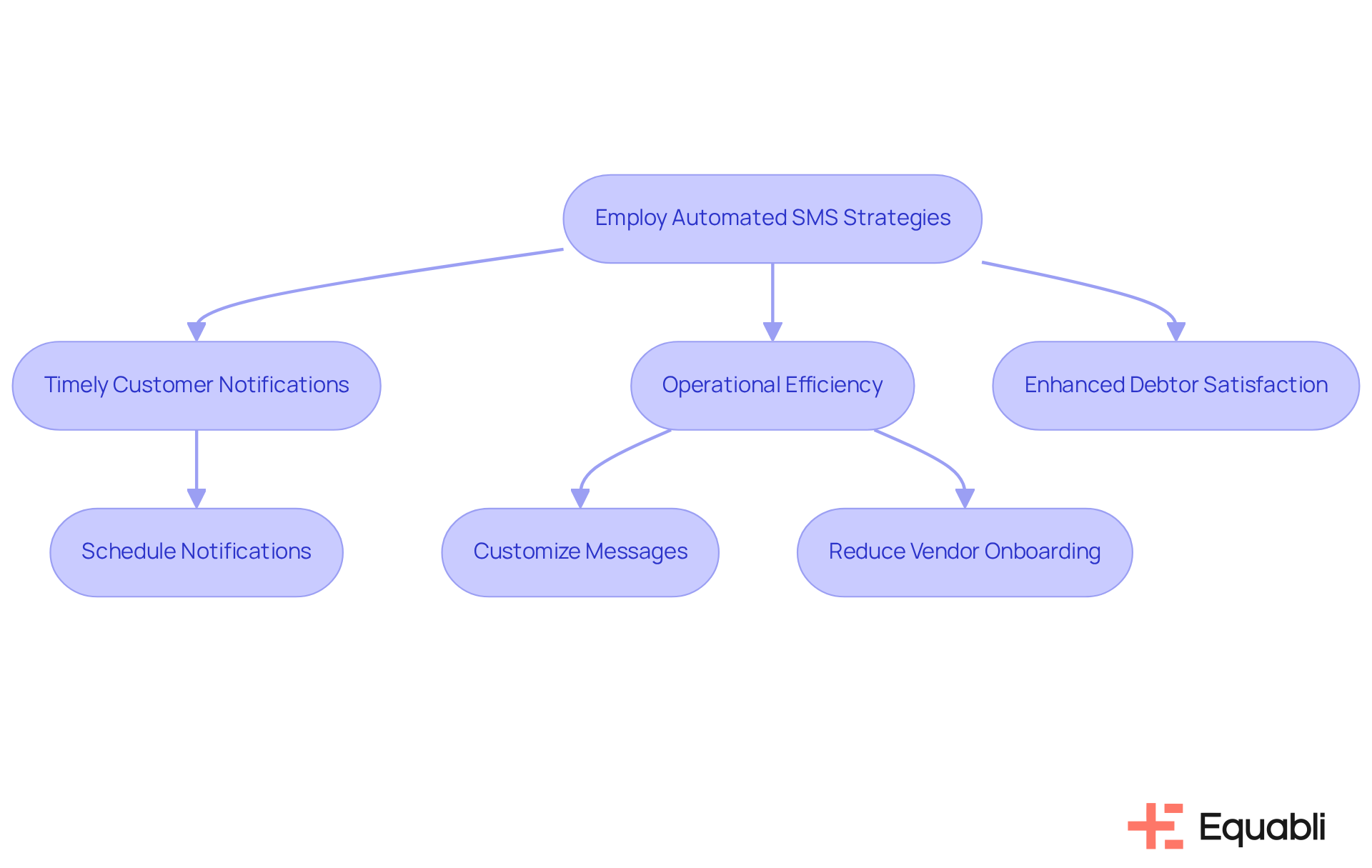

Employing automated payment reminder SMS strategies for financial institutions is essential for enhancing payment notification processes. Automated SMS platforms utilize automated payment reminder SMS strategies for financial institutions to facilitate the scheduling and sending of notifications without manual intervention, ensuring timely communication with customers. These solutions should provide customization options for messages and scheduling based on customer behavior, thereby enhancing engagement. For instance, Equabli's EQ Collect automates the entire notification workflow, from initial alerts to follow-ups, enabling staff to concentrate on more complex collection tasks.

With features such as a no-code file-mapping tool and automated workflows, organizations can significantly reduce vendor onboarding timelines and minimize execution errors, leading to substantial operational efficiency improvements. Furthermore, implementing automated payment reminder SMS strategies for financial institutions can enhance collection levels by ensuring that notifications are dispatched consistently and at optimal intervals, ultimately lowering expenses and improving cash flow management. As financial institutions increasingly adopt these technologies, they can anticipate a notable increase in debtor satisfaction and recovery rates.

According to Equabli, organizations implementing automated due payment reminder systems report a 10-15% reduction in bad debt write-offs. This statistic underscores the financial advantages of timely reminders, highlighting the critical role of automated payment reminder SMS strategies for financial institutions in modern debt collection strategies.

Conclusion

Automated payment reminder SMS strategies are essential for enhancing the operational efficiency of financial institutions. By leveraging timely and effective SMS notifications, organizations can significantly mitigate the risk of missed payments, thereby improving cash flow and fostering stronger relationships with borrowers. Evidence indicates that these strategies not only enhance collection rates but also facilitate proactive communication, which is vital for managing financial obligations.

The article outlines several key approaches for implementing these strategies effectively:

- It underscores the importance of a tiered messaging system.

- Personalized communication.

- The utilization of automation tools to streamline processes.

By adopting a structured approach to reminders and customizing messages based on customer data, financial institutions can achieve higher engagement and response rates. The statistics presented demonstrate the tangible benefits of these practices, including a marked reduction in late transactions and enhanced customer satisfaction.

In summary, the importance of automated payment reminder SMS strategies is paramount. As financial institutions increasingly adopt technology, integrating these strategies will be crucial for bolstering collection efforts and maintaining customer loyalty. Organizations are urged to implement these best practices and continuously refine their approaches to not only meet but exceed customer expectations. By doing so, they will enhance their operational efficiency and cultivate a more positive financial environment for both the institution and its clients.

Frequently Asked Questions

What are automated payment reminder SMS strategies?

Automated payment reminder SMS strategies are systems used by financial institutions to send timely SMS alerts to borrowers, reminding them of their financial obligations and helping to enhance collection efficiency.

How do automated payment reminders benefit financial institutions?

They reduce the risk of missed transactions, improve cash flow, enhance overall payment collection rates, and foster positive relationships with borrowers by providing clear and timely information.

What impact do SMS alerts have on transaction timeliness?

Organizations that implemented automated notifications experienced a 29% decrease in late transactions compared to those relying solely on manual follow-ups, indicating that SMS alerts significantly improve transaction timeliness.

Why are SMS alerts considered effective in financial management?

SMS alerts have an impressive open rate, ensuring that messages are promptly seen and acted upon, which reinforces proactive communication in managing financial obligations.

How do automated payment reminder SMS strategies influence customer relationships?

They promote positive borrower relationships by delivering timely information about financial obligations, which can lead to increased engagement and responsiveness from borrowers.

What is the perception of executives regarding automated payment reminder SMS strategies?

Executives increasingly view these strategies as essential tools for promoting customer loyalty and improving operational efficiency in debt collection.