Overview

Collection agencies play a pivotal role in enhancing compliance and effectiveness in debt recovery through the implementation of tailored strategies that leverage advanced technology and strict adherence to legal regulations. These agencies not only support creditors in retrieving overdue payments but also place a significant emphasis on ethical practices and compliance with essential laws such as the Fair Debt Collection Practices Act (FDCPA). This commitment fosters trust among stakeholders and improves recovery rates by facilitating personalized communication and offering flexible payment options. By prioritizing these elements, collection agencies position themselves as reliable partners in the debt recovery process.

Introduction

Collecting agencies serve as pivotal intermediaries within the financial ecosystem, crucial for enabling creditors to recover overdue payments and sustain healthy cash flow.

With the number of Americans facing outstanding debts on the rise, the reliance on these agencies has reached unprecedented levels. This situation underscores the urgent need for effective strategies that ensure compliance and operational efficiency.

Yet, amid increasing regulatory scrutiny and evolving economic challenges, how can these agencies adeptly navigate the complexities of debt collection? It is essential to foster trust while striving for optimal recovery rates.

Define Collection Agencies and Their Purpose

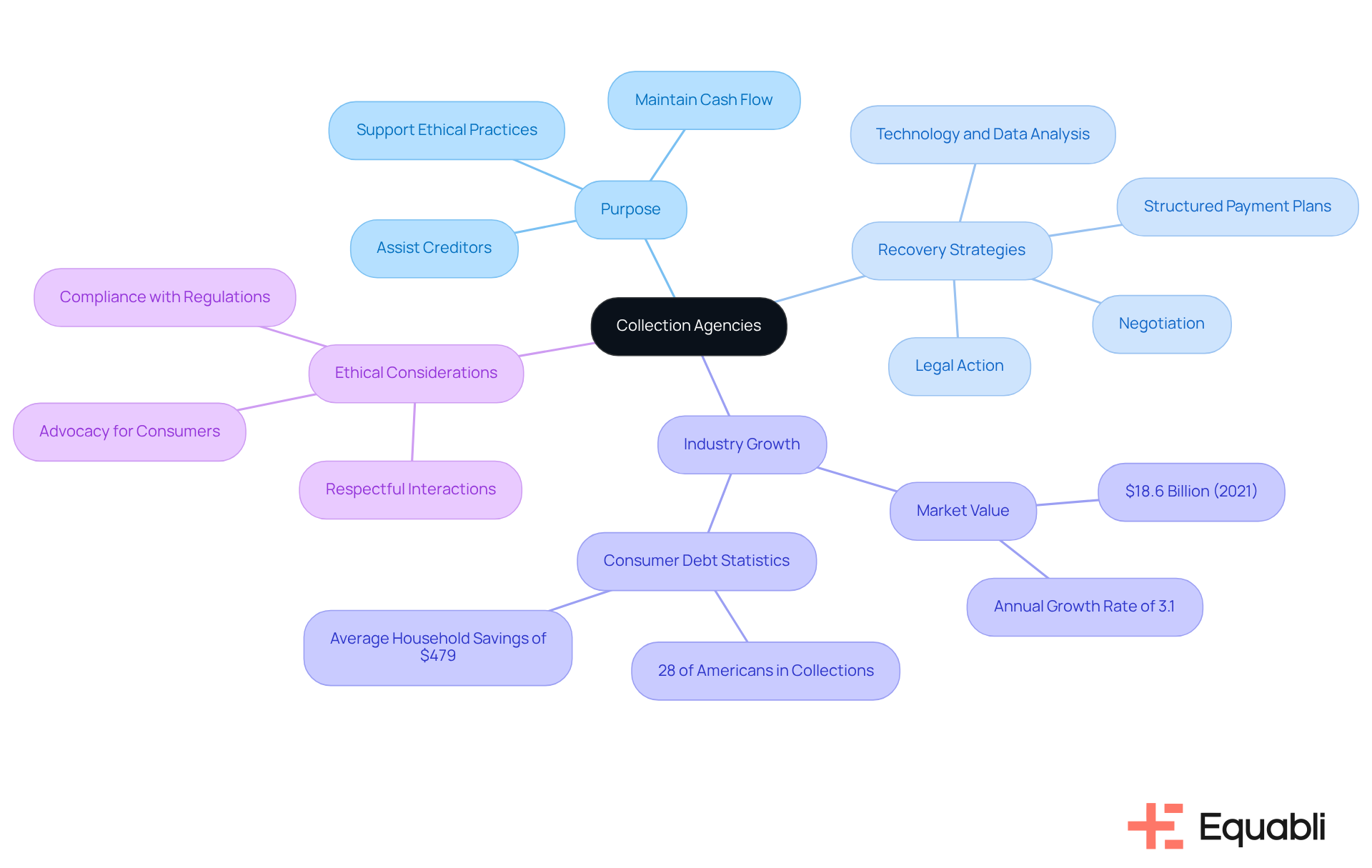

Collecting agencies serve as specialized organizations that play a crucial role in assisting creditors with the recovery of overdue payments. Acting as intermediaries between creditors and debtors, collecting agencies employ a variety of strategies to facilitate repayment, including negotiation, structured payment plans, and, when necessary, legal action. By outsourcing financial recovery, creditors can concentrate on their core business activities while benefiting from the expertise of professionals skilled in retrieval strategies. This collaboration not only helps maintain cash flow—essential for operational sustainability—but also enables creditors to recover overdue funds more efficiently.

The receivables recovery sector has witnessed significant growth, with approximately 28% of Americans holding at least one outstanding amount in recovery. This statistic underscores the increasing reliance on collecting agencies, as numerous lenders recognize the importance of delegating these responsibilities. In fact, a substantial proportion of lenders are currently outsourcing their receivable management processes to collecting agencies, which has become a strategic decision aimed at enhancing retrieval rates and alleviating operational burdens.

Effective credit collection methods employed by collection firms often involve leveraging advanced technology and data analysis to tailor tactics for specific borrowers. This approach not only improves recovery rates but also fosters better relationships between collectors and consumers, leading to more respectful and productive interactions. Financial specialists emphasize the importance of collecting agencies, highlighting that they not only support clients facing cash flow challenges but also advocate for ethical practices in financial recovery. As David Greenwood, a field specialist, asserts, "The top recovery firms not only assist clients facing cash flow issues and overdue payments, but they also support what is just."

In conclusion, collecting agencies are indispensable allies for creditors, enhancing their ability to retrieve debts while ensuring compliance with regulations and maintaining positive cash flow.

Examine Legal Regulations and Compliance Requirements

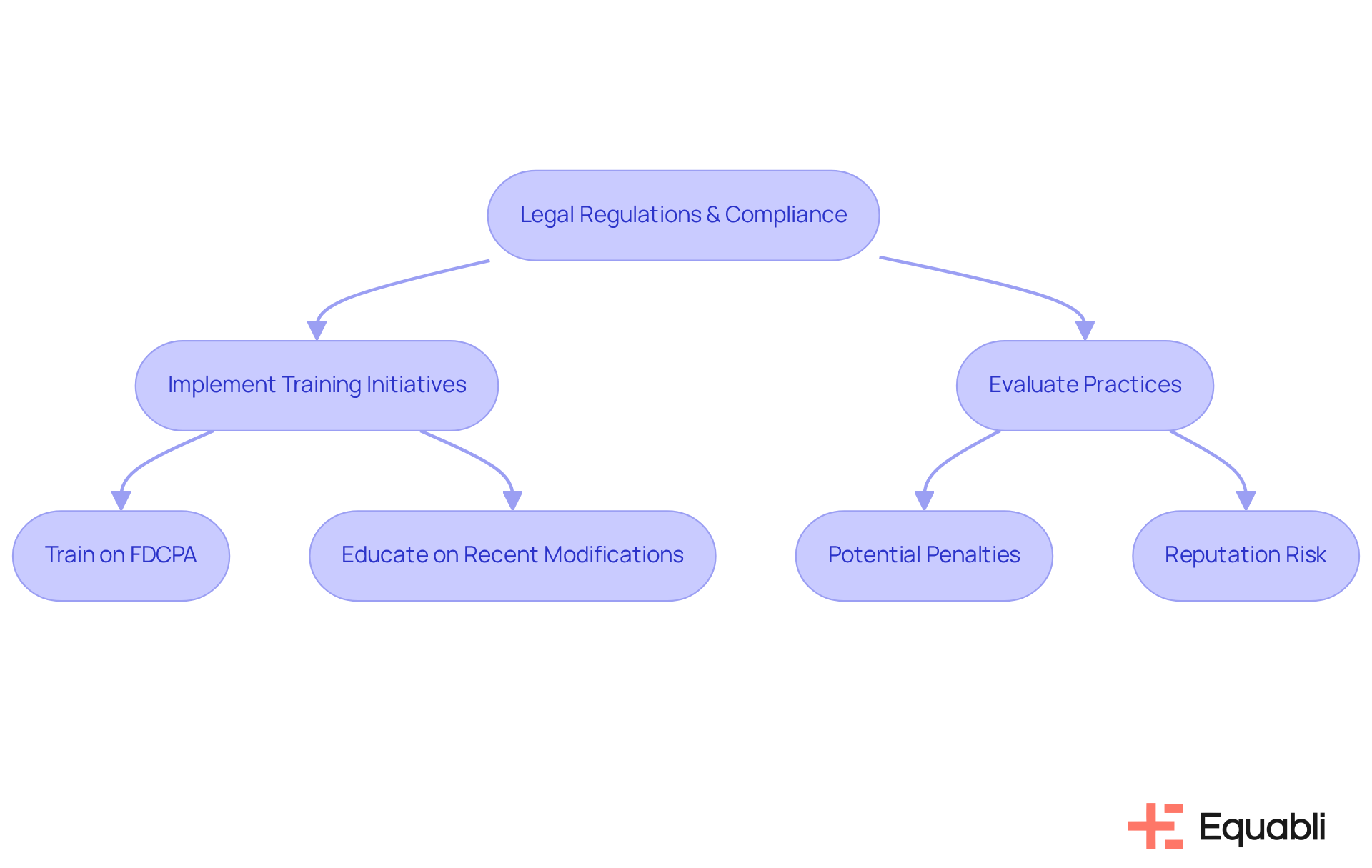

Collecting agencies operate within a complex framework of legal regulations, prominently featuring the Fair Debt Collection Practices Act (FDCPA) alongside various state laws. These regulations dictate communication methods with debtors, the frequency of contact, and acceptable collection practices. Compliance is not merely a legal obligation; it is essential for fostering trust with consumers and maintaining a positive reputation in the industry. To ensure adherence to these regulations, organizations must implement robust training initiatives for their personnel, emphasizing the intricacies of the FDCPA and any recent modifications, such as California's Senate Bill 1286, which expands consumer protections to commercial obligations of $500,000 or less, effective July 1, 2025.

Failing to comply with these regulations can lead to significant penalties, including fines and lawsuits, which may severely disrupt an organization's operations. The recent actions taken by the FTC against Blackstone Legal underscore the serious repercussions of misleading practices, resulting in a proposed court order that would indefinitely bar the company from the debt recovery sector and impose a financial judgment exceeding $8 million. These instances highlight the critical need for organizations to regularly evaluate and adapt their practices in response to evolving laws.

Furthermore, legal experts stress the importance of training programs that inform staff about prohibited behaviors, such as harassment and deceptive communications. By prioritizing compliance and cultivating a culture of accountability, collecting agencies can mitigate the risks associated with non-compliance and enhance their operational effectiveness.

Analyze Collection Strategies and Their Effectiveness

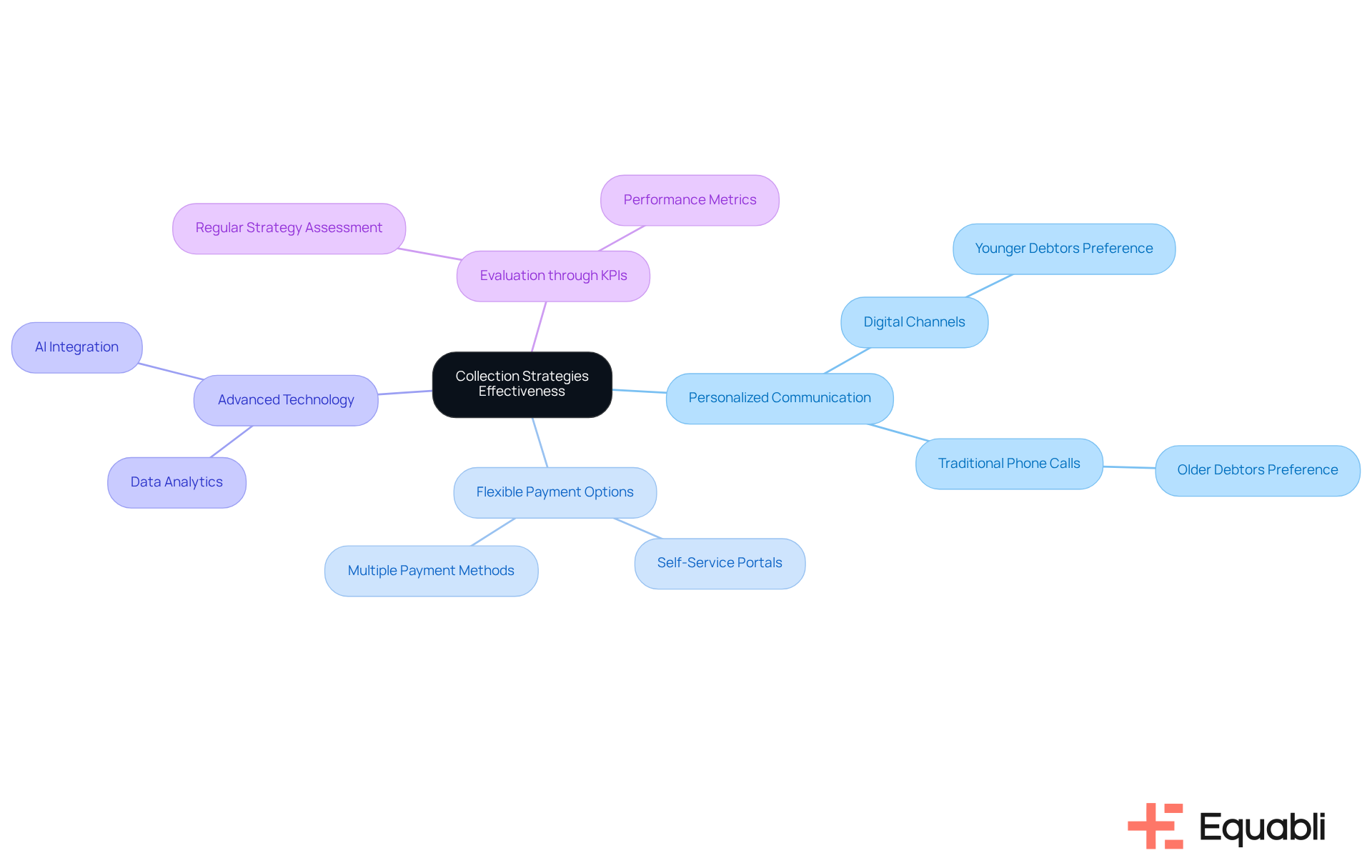

Effective collection strategies utilized by collecting agencies integrate personalized communication, flexible payment options, and advanced technology. Agencies can leverage data analytics to discern optimal approaches for various debtor profiles, customizing their communication methods accordingly. For instance, younger debtors often engage more with digital channels, while older consumers may prefer traditional phone calls.

The rise of digital communication has been significant, with a 9% increase in email and SMS engagement, underscoring the shift towards these preferred methods. Furthermore, implementing self-service payment options not only enhances debtor engagement but also boosts recovery rates.

Regular evaluation of these strategies through key performance indicators (KPIs) is essential, enabling collecting agencies to adapt and refine their methods continuously. As Jack Mahoney, Chief Analytics Officer, observes, organizations that recognize data as a strategic asset will thrive in the evolving landscape of financial recovery, making data-driven choices essential for success.

Identify Challenges in Debt Collection for Financial Institutions

Financial institutions face considerable challenges in debt recovery, primarily due to rising delinquency rates and regulatory compliance pressures. Economic factors, such as inflation and job market instability, have been linked to increased defaults, complicating recovery efforts. For instance, the transition into serious delinquency for credit cards rose from 6.36% in Q4 2023 to 7.18% in Q4 2024, while the overall transition into serious delinquency increased from 1.42% in Q4 2023 to 1.70% in Q4 2024. This data underscores the urgency of addressing these issues. Furthermore, the evolving regulatory landscape necessitates that institutions remain vigilant about compliance requirements, particularly with the potential for increased enforcement actions by state regulators due to decreased CFPB enforcement, which can strain operational resources.

To effectively navigate these challenges, financial institutions must invest in advanced technology solutions that streamline recovery processes and enhance their collaboration with collecting agencies. Equabli's groundbreaking financial recovery solutions, particularly the EQ Suite, empower lenders and organizations by offering tools that facilitate smooth onboarding and proactive client interaction. By aligning with their business goals, Equabli ensures that its platform delivers on desired outcomes, driving product adoption and client satisfaction. Proactive check-ins and strategic business reviews are integral to this process, providing insights into product usage trends and opportunities for expansion.

The integration of AI and machine learning, currently utilized by 57% of collecting agencies, can significantly enhance recovery rates by enabling predictive analytics to identify at-risk accounts earlier. Additionally, implementing robust training programs for retrieval personnel is essential. Such training not only improves their ability to manage complex situations but also fosters constructive relationships with debtors, ultimately leading to improved recovery outcomes.

As the financial recovery environment evolves, entities that prioritize technology and personnel development, along with collaborating with collecting agencies, will be better equipped to adapt to economic shifts and regulatory demands, ensuring sustainable recovery strategies. Moreover, the unique challenges posed by Buy Now Pay Later (BNPL) debt necessitate specialized management approaches, further highlighting the need for a modernized strategy in collections.

Conclusion

Collecting agencies are indispensable players in the financial ecosystem, acting as essential partners for creditors in recovering overdue payments. By serving as intermediaries, these agencies enhance cash flow for businesses and ensure that debt recovery is executed ethically and in accordance with legal standards. Their specialized expertise and strategic methodologies empower creditors to concentrate on their core business functions while adeptly managing outstanding debts.

Key insights shared throughout this article illuminate the operational strategies of collecting agencies, emphasizing the significance of adhering to regulations such as the Fair Debt Collection Practices Act. The challenges faced by financial institutions in today’s economic landscape are also addressed. The discussion underscores how leveraging advanced technology, personalized communication, and comprehensive training programs can markedly improve recovery rates and cultivate stronger relationships with debtors. Moreover, the necessity for continuous adaptation to shifting legal requirements and the economic environment is highlighted as vital for sustaining operational effectiveness.

As the debt collection landscape evolves, it is crucial for both collecting agencies and financial institutions to prioritize compliance alongside innovative strategies. By embracing technology and fostering a culture of accountability, organizations can adeptly navigate the complexities of debt recovery. This proactive approach not only mitigates the risks associated with non-compliance but also ensures preparedness to tackle the challenges presented by changing economic conditions and regulatory demands.

Frequently Asked Questions

What are collection agencies and what is their purpose?

Collection agencies are specialized organizations that assist creditors in recovering overdue payments by acting as intermediaries between creditors and debtors. They employ various strategies, including negotiation, structured payment plans, and legal action, to facilitate repayment.

How do collection agencies benefit creditors?

By outsourcing financial recovery to collection agencies, creditors can focus on their core business activities while leveraging the expertise of professionals skilled in retrieval strategies. This collaboration helps maintain cash flow and enables more efficient recovery of overdue funds.

What is the current state of the receivables recovery sector in the U.S.?

The receivables recovery sector has experienced significant growth, with approximately 28% of Americans holding at least one outstanding amount in recovery. Many lenders are outsourcing their receivable management processes to collecting agencies to enhance retrieval rates and reduce operational burdens.

What methods do collection agencies use to improve recovery rates?

Collection agencies often leverage advanced technology and data analysis to tailor their tactics for specific borrowers. This approach not only improves recovery rates but also fosters better relationships between collectors and consumers.

How do collection agencies promote ethical practices in financial recovery?

Collection agencies advocate for ethical practices in financial recovery by ensuring compliance with regulations and promoting respectful interactions between collectors and consumers. They aim to support clients facing cash flow challenges while maintaining just practices in the recovery process.

Why are collection agencies considered indispensable allies for creditors?

Collection agencies enhance creditors' ability to retrieve debts effectively while ensuring compliance with regulations and maintaining positive cash flow, making them essential partners in financial recovery efforts.