Overview

The article articulates the strategies that financial institutions can implement to cultivate comprehensive credit risk solutions, thereby enhancing their lending practices and minimizing defaults. It underscores the critical importance of understanding borrower risks and the utilization of advanced technologies such as machine learning and data analytics. Additionally, it advocates for the adoption of best practices in risk management, which collectively improve decision-making and operational efficiency. This approach is essential for ensuring financial stability and fostering growth in a competitive landscape.

Introduction

Understanding credit risk is paramount for financial institutions, as it shapes lending policies and risk management strategies. Comprehensive credit risk solution strategies not only enhance profitability but also safeguard against potential defaults. As the lending landscape becomes increasingly complex, institutions must navigate the challenges of credit risk management while leveraging technological advancements. This article explores best practices and innovative solutions that empower financial entities to thrive in a competitive environment.

Understand Credit Risk and Its Importance

Credit exposure signifies the likelihood that a borrower may default on their obligations as per the agreed terms. For financial institutions, comprehensive credit risk solution strategies for financial institutions are essential, as they directly impact lending policies, pricing strategies, and risk management frameworks. Institutions must diligently assess borrowers' creditworthiness to mitigate defaults and optimize their portfolios. This assessment typically involves analyzing financial scores, repayment histories, and prevailing economic conditions.

A profound understanding of lending vulnerabilities enables organizations to make informed decisions that enhance profitability and minimize exposure to bad debts. Entities that implement advanced loan evaluation frameworks frequently report significantly lower default rates and improved recovery outcomes, underscoring the critical role of financial acumen in the debt collection process.

The market for loan evaluation is projected to grow from USD 9.55 billion in 2025 to USD 31.46 billion by 2034, reflecting a compound annual growth rate (CAGR) of 14.17%. This expansion is driven by the increasing complexity of financial processes and the demand for integrated, real-time lending solutions. As financial entities adopt AI-driven analytics and real-time monitoring systems, they can enhance their lending profiles, leading to more accurate evaluations and better-informed borrowing decisions.

Equabli's EQ Engine significantly improves the credit risk assessment process by predicting the risk of delinquency in active accounts, thus facilitating tailored servicing strategies. It leverages predictive capabilities across various communication channels to create efficiencies and reduces roll rates, ultimately maximizing the net present value (NPV) in debt recovery efforts.

In practice, institutions such as Farm Credit Services of America (FCSAmerica) have effectively automated their document creation processes using solutions like ActiveDocs, generating between 50,000 and 300,000 compliance documents annually without human intervention. This automation streamlines processes and minimizes the risk of errors associated with manual data entry, further supporting efficient financial oversight.

Ultimately, a robust understanding of borrowing risks is not merely a regulatory requirement; it serves as a strategic advantage that can significantly influence comprehensive credit risk solution strategies for financial institutions, lending practices, and default rates, thereby ensuring financial stability and growth.

Establish a Comprehensive Credit Risk Management Framework

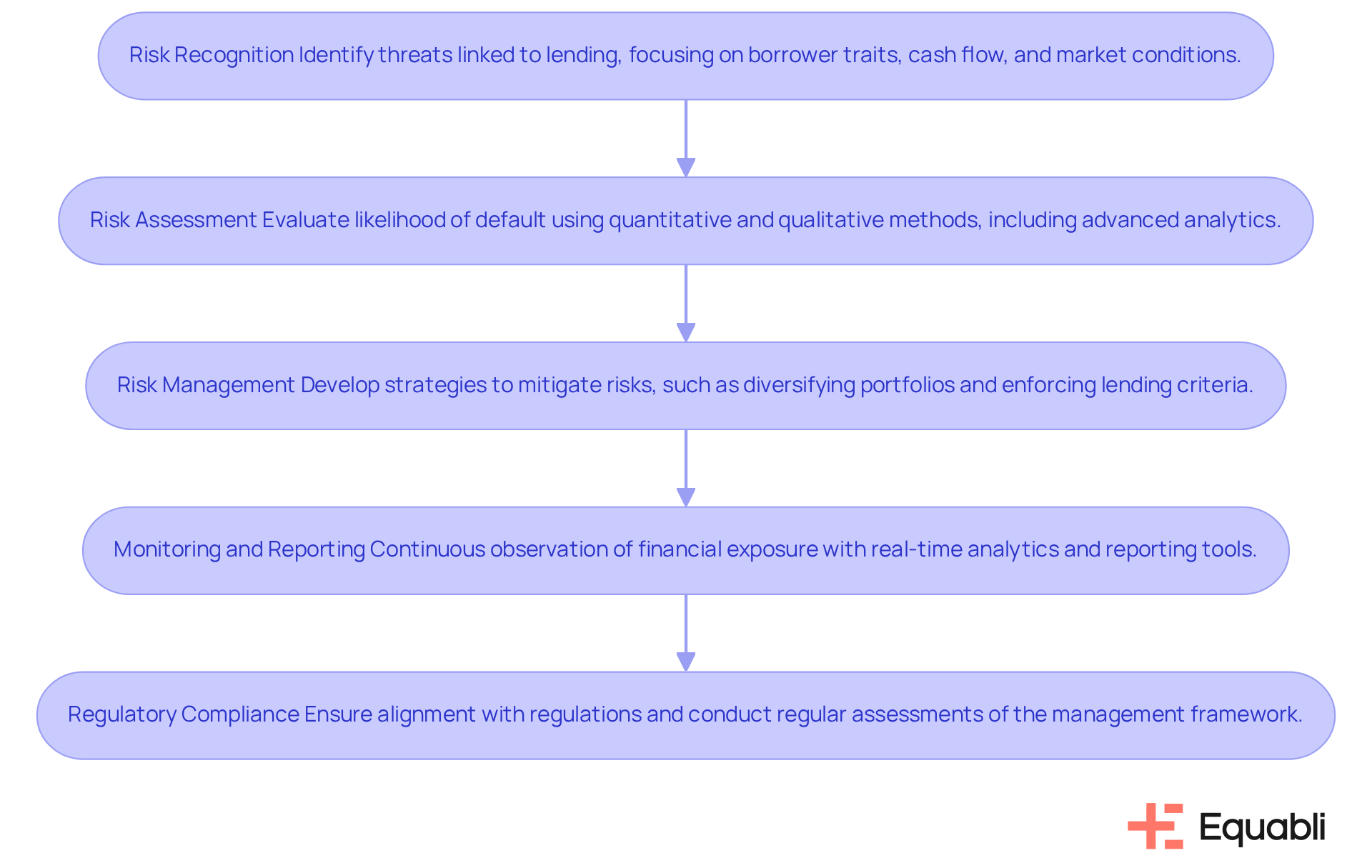

To establish a comprehensive credit risk management framework, financial institutions must adhere to several key steps:

-

Risk Recognition: It is essential to identify possible threats linked to lending, focusing on borrower traits, cash flow situations, and current market conditions. Effective identification is crucial; poor cash flow combined with existing debt obligations often signals potential repayment issues.

-

Risk Assessment: Institutions should employ both quantitative and qualitative methods to evaluate the likelihood of default and potential loss. Advanced analytics and machine learning models can significantly enhance predictive capabilities, allowing for the examination of extensive datasets for pattern recognition. Integrating conventional reports with contemporary monitoring tools is vital for a comprehensive assessment of financial reliability.

-

Risk Management: Developing strategies to mitigate identified threats is critical. This may include diversifying the loan portfolio to avoid concentration in high-risk sectors and enforcing stricter lending criteria. Financial covenants can act as early warning systems, helping to prevent borrowers from engaging in high-risk behaviors without lender approval.

-

Monitoring and Reporting: Continuous observation of financial exposure through real-time analytics and reporting tools is necessary. This ongoing supervision enables organizations to identify suspicious activities and identity theft before they escalate. Efficient early warning systems (EWS) require specific trigger thresholds that align with the organization's financial appetite, underscoring the importance of proactive monitoring as a cornerstone of a robust financial oversight framework.

-

Regulatory Compliance: Ensuring that the framework aligns with relevant regulations and industry standards, such as the Fair Credit Reporting Act (FCRA) and GDPR, is imperative. Regular assessments of the management framework are essential to adapt to evolving economic conditions and maintain compliance.

By implementing comprehensive credit risk solution strategies for financial institutions, organizations can foster a proactive approach to managing financial exposure, ultimately enhancing economic stability and minimizing losses. This comprehensive strategy not only protects the organization's interests but also builds trust with borrowers, positioning the entity for sustainable growth. As noted by the FDIC, "Proactive monitoring is the foundation of a strong financial oversight framework," highlighting the essential role of continuous supervision in today’s economic landscape. Furthermore, with over fifty percent of banking clients willing to switch banks due to unsatisfactory digital experiences, effective loan management is crucial for preserving the stability and profitability of financial institutions.

Leverage Technology for Enhanced Credit Risk Solutions

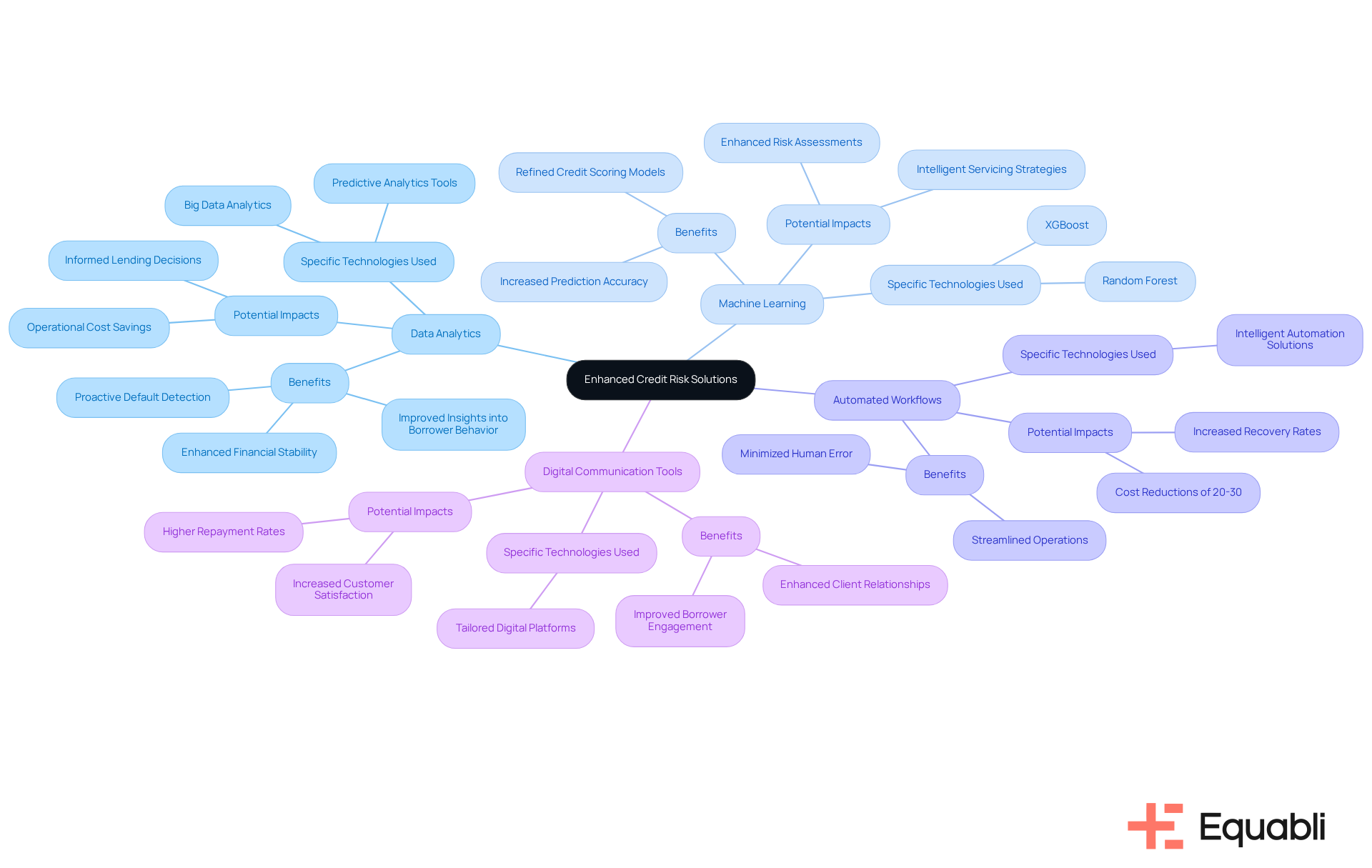

Enhancing comprehensive credit risk solution strategies for financial institutions necessitates a strategic integration of technology. Financial institutions should prioritize the following advancements:

-

Data Analytics: Leveraging big data analytics allows institutions to gain profound insights into borrower behavior, facilitating accurate predictions of repayment patterns. This approach not only enhances the evaluation of uncertainties but also enables proactive detection of potential defaults, significantly impacting overall financial stability.

-

Machine Learning: The adoption of machine learning algorithms is crucial for refining credit scoring models. Equabli's EQ Engine utilizes sophisticated machine learning techniques to forecast the likelihood of delinquency in active accounts, empowering organizations to develop intelligent servicing strategies. These algorithms enhance accuracy in risk assessments, with studies indicating that advanced models can achieve up to 94.3% accuracy in predicting loan defaults. Techniques such as Random Forest and XGBoost further bolster predictive capabilities, leading to more informed lending decisions.

-

Automated Workflows: Automating routine tasks, including data entry and reporting, streamlines operations while minimizing human error. Equabli's intelligent automation solutions can swiftly enhance recovery rates, enabling organizations to scale their collections operations without sacrificing performance. This efficiency not only reduces operational costs—reported savings can reach 20-30%—but also allows staff to concentrate on more strategic initiatives, ultimately improving service delivery.

-

Digital Communication Tools: Engaging borrowers through digital platforms tailored to their communication preferences can significantly improve repayment rates. By utilizing these tools, organizations can foster better relationships with clients, resulting in enhanced borrower engagement and satisfaction.

By adopting these technological innovations, particularly through Equabli's comprehensive credit risk solution strategies for financial institutions, financial entities can substantially refine their lending evaluation processes, leading to improved decision-making and greater operational efficiency. The synergy of data analytics and machine learning not only transforms evaluation processes but also equips organizations to navigate the complexities of contemporary lending environments adeptly.

Implement Best Practices for Effective Credit Risk Management

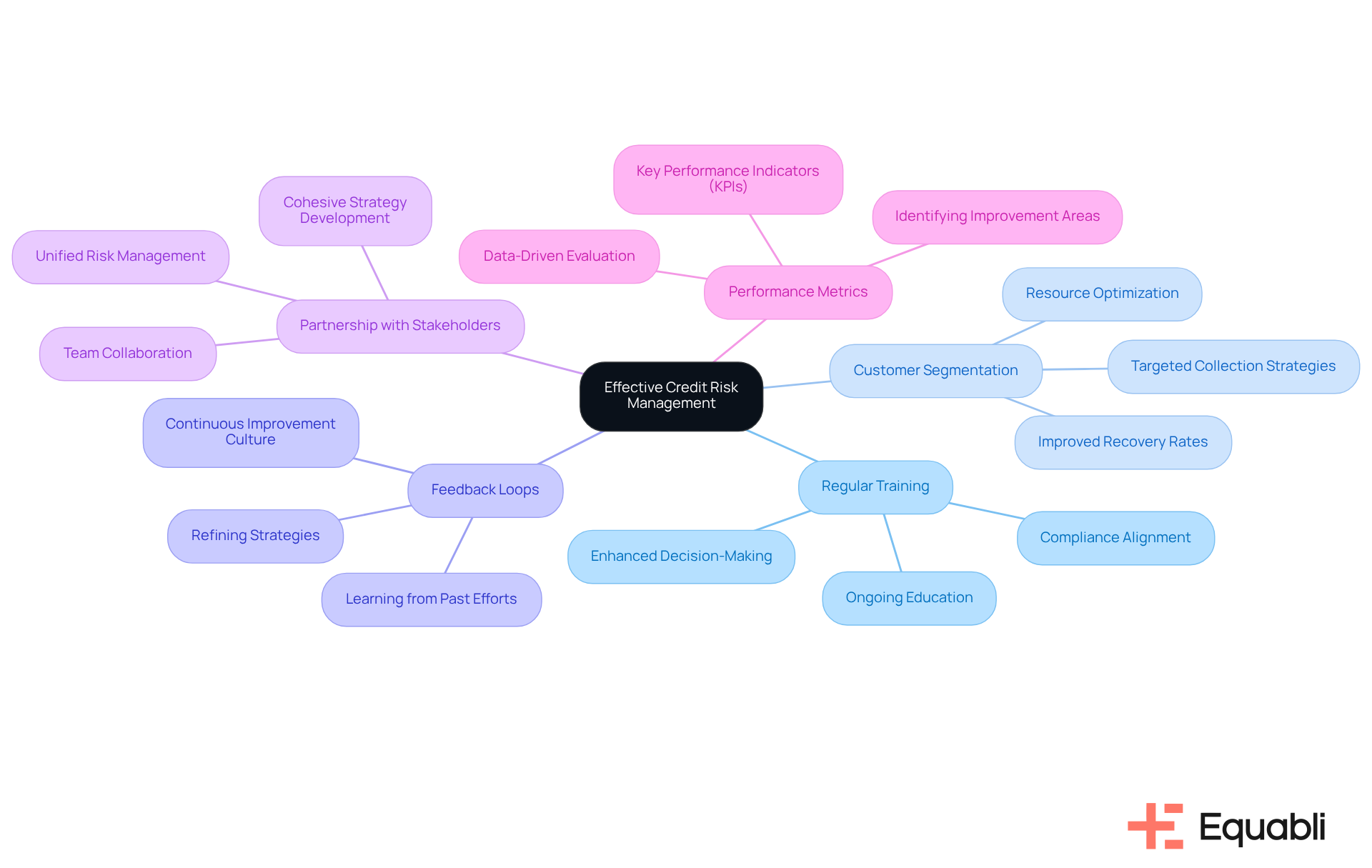

To implement best practices for effective credit risk management, financial institutions should prioritize the following strategies:

-

Regular Training: Ongoing education for personnel on financial assessment and management techniques is essential. This ensures that employees are well-versed in the latest methodologies and regulatory requirements, enhancing their ability to make informed decisions. As Prabhash Choudhary, CEO of Magistral Consulting, observes, 'Real-time integration of data, predictive analytics, and strong governance are essential elements of effective loan monitoring at banks.' This commitment to training not only fortifies decision-making capabilities but also aligns with compliance standards, ultimately reducing risk exposure.

-

Customer Segmentation: Efficient categorization of borrowers according to their profiles allows organizations to customize collection strategies. For instance, high-risk customers may require more proactive engagement, while low-risk borrowers can be approached with less urgency. This targeted approach can significantly improve collection success rates. The worldwide financial threat management software market is expected to expand from $1.4 billion in 2023 to $2.6 billion by 2028, highlighting the growing significance of efficient financial threat management. By leveraging segmentation, institutions can optimize resource allocation and enhance recovery outcomes.

-

Feedback Loops: Establishing feedback mechanisms is crucial for learning from past collection efforts. By analyzing what strategies worked or failed, institutions can refine their approaches, leading to more effective future collections. Prominent banks establish feedback loops to enhance lending models and adjust to new challenges and market changes through regular evaluations. This iterative process not only improves operational efficiency but also fosters a culture of continuous improvement.

-

Partnership with Stakeholders: Promoting teamwork among divisions, like risk assessment and collections, cultivates a cohesive strategy for financial vulnerability. This synergy ensures that all teams are aligned in their objectives and strategies, enhancing overall effectiveness. By fostering collaboration, organizations can create a unified front against potential risks, thereby strengthening their overall credit management framework.

-

Performance Metrics: Creating essential performance indicators (KPIs) to assess the effectiveness of financial exposure strategies is crucial. These metrics provide insights into recovery rates and help identify areas for improvement. Organizations should concentrate on creating KPIs that represent their particular goal-setting and operational aims. By focusing on data-driven performance evaluation, institutions can enhance their strategic initiatives and drive better financial outcomes.

By implementing these optimal methods, organizations can enhance their credit management abilities through comprehensive credit risk solution strategies for financial institutions, leading to better recovery rates and lower financial losses. Regular training and effective customer segmentation are particularly important, as they empower staff to make data-driven decisions that align with the institution's risk appetite and operational goals.

Conclusion

Understanding and managing credit risk is essential for financial institutions seeking to enhance lending practices and ensure long-term stability. By adopting comprehensive credit risk solution strategies, organizations can effectively navigate the complexities of borrower assessments, ultimately leading to improved profitability and reduced default rates.

Key insights throughout this article underscore the necessity of a structured approach to credit risk management. This includes:

- Recognizing potential risks

- Employing advanced analytics and machine learning for accurate assessments

- Continuously monitoring financial exposure

The integration of technology, such as automated workflows and data analytics, empowers institutions to make informed decisions that align with their risk appetite and operational goals.

As the financial services landscape evolves, the importance of robust credit risk management is paramount. Institutions are encouraged to adopt best practices and technological advancements to cultivate a proactive culture of risk management. By doing so, they not only safeguard their interests but also build trust with borrowers, positioning themselves for sustainable growth in an increasingly competitive market.

Frequently Asked Questions

What is credit exposure?

Credit exposure refers to the likelihood that a borrower may default on their obligations according to the agreed terms.

Why is understanding credit risk important for financial institutions?

Understanding credit risk is crucial for financial institutions as it impacts their lending policies, pricing strategies, and risk management frameworks, helping them mitigate defaults and optimize their portfolios.

How do institutions assess borrowers' creditworthiness?

Institutions assess borrowers' creditworthiness by analyzing financial scores, repayment histories, and prevailing economic conditions.

What benefits do organizations gain from understanding lending vulnerabilities?

Organizations that understand lending vulnerabilities can make informed decisions that enhance profitability and minimize exposure to bad debts.

What is the projected growth of the loan evaluation market?

The loan evaluation market is projected to grow from USD 9.55 billion in 2025 to USD 31.46 billion by 2034, with a compound annual growth rate (CAGR) of 14.17%.

What factors are driving the expansion of the loan evaluation market?

The expansion is driven by the increasing complexity of financial processes and the demand for integrated, real-time lending solutions.

How does Equabli's EQ Engine improve credit risk assessment?

Equabli's EQ Engine enhances credit risk assessment by predicting the risk of delinquency in active accounts and facilitating tailored servicing strategies.

What role does automation play in financial institutions' document processes?

Automation, such as that provided by ActiveDocs, allows institutions to generate compliance documents without human intervention, streamlining processes and reducing errors associated with manual data entry.

How can a robust understanding of borrowing risks influence financial stability?

A strong understanding of borrowing risks serves as a strategic advantage that influences credit risk solution strategies, lending practices, and default rates, thereby ensuring financial stability and growth.