Overview

Crafting an effective collection dispute letter is essential for consumers seeking to protect their rights. It requires the inclusion of key elements such as:

- Personal information

- A clear statement of dispute

- A request for debt validation

All while adhering to a professional format. By integrating these components, not only does the clarity and professionalism of the letter improve, but consumers also empower themselves to assert their rights under the Fair Debt Collection Practices Act. This strategic approach significantly enhances the likelihood of receiving a favorable response from creditors.

Introduction

Crafting a collection dispute letter is an essential step for individuals aiming to challenge the accuracy of a debt claim. This letter serves not only as a formal communication tool but also empowers consumers to assert their rights under the Fair Debt Collection Practices Act. However, many individuals confront the daunting task of ensuring their letters are both effective and compliant with legal standards.

What are the essential elements that can transform a basic letter into a powerful instrument for financial protection? Understanding these components is crucial for safeguarding your financial interests.

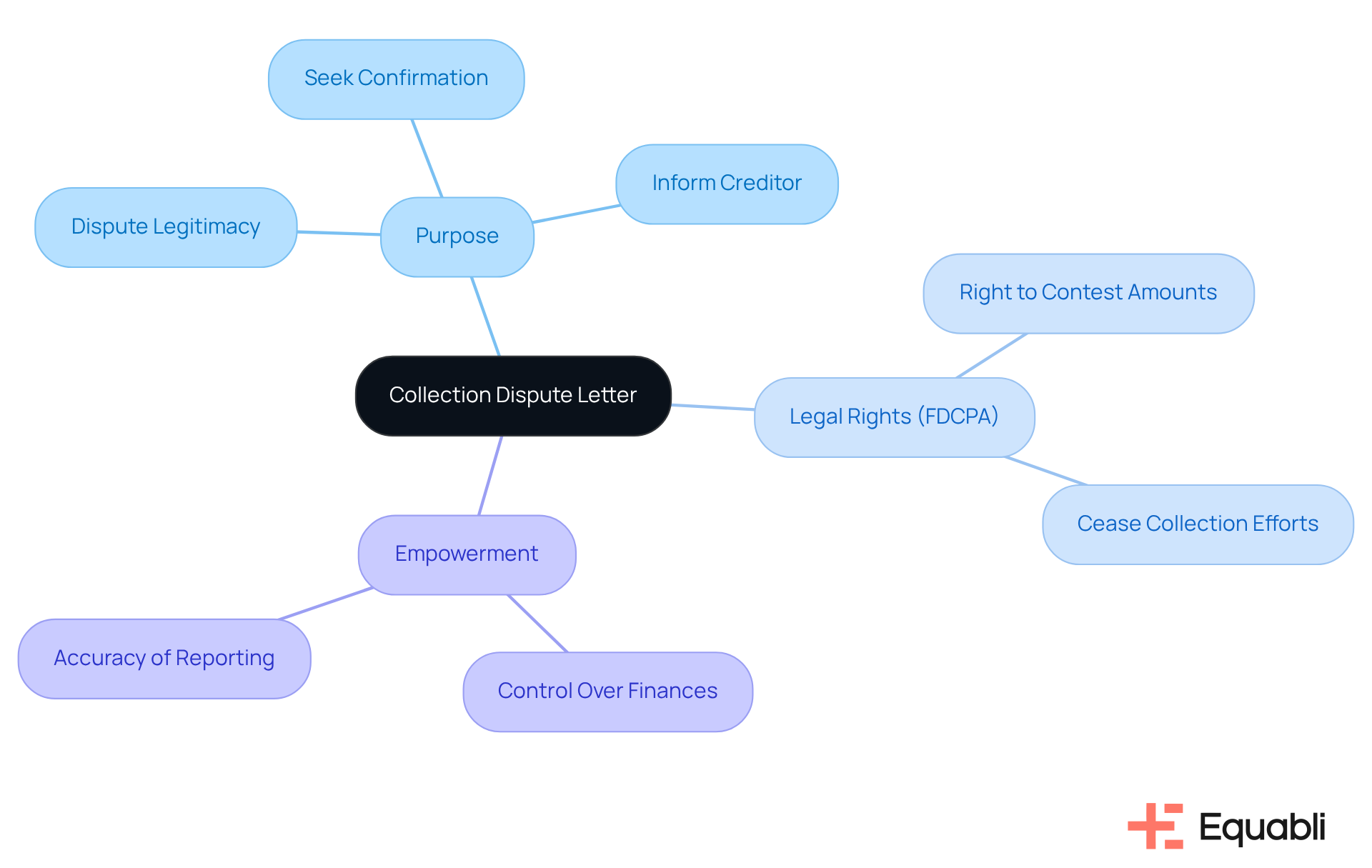

Understand the Purpose of a Collection Dispute Letter

A collection dispute letter serves as an official communication to a lender or collection agency, disputing the legitimacy or accuracy of a financial obligation assertion. The primary aim of this collection dispute letter is to inform the creditor that you dispute the amount owed and seek confirmation of its validity. This aspect is particularly significant under the Fair Debt Collection Practices Act (FDCPA), which grants consumers the right to contest amounts owed and requires collectors to cease collection efforts until the obligation is verified. By comprehending this purpose, you empower yourself to take control of your financial situation, ensuring you are not held accountable for debts that may not belong to you or that are inaccurately reported.

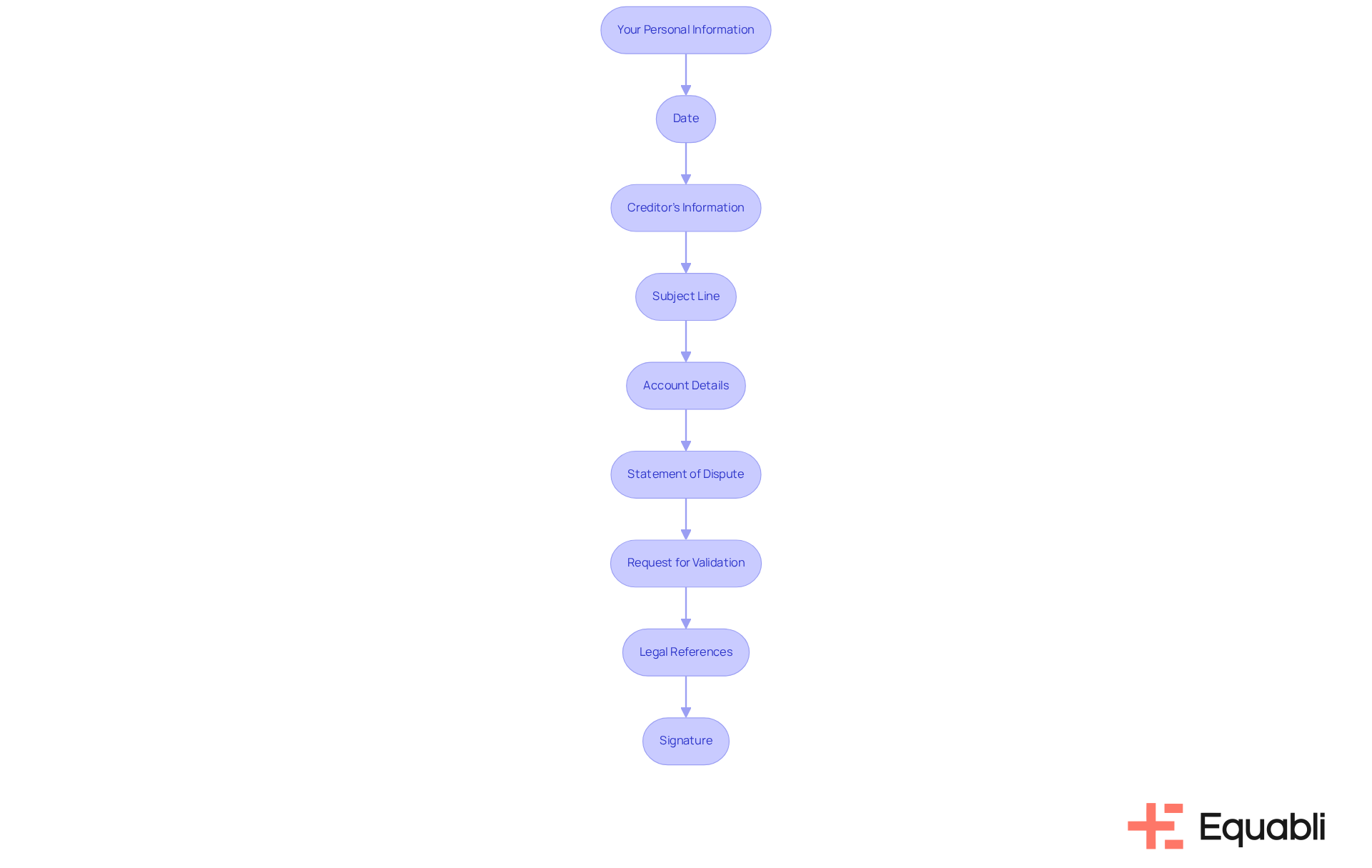

Include Key Elements in Your Dispute Letter

When crafting your collection dispute letter, it is crucial to include the following key elements:

-

Your Personal Information: Start with your complete name, address, and contact details at the top of the document. This enables the lender to recognize you effortlessly.

-

Date: Include the date of composing the correspondence. This is vital for record-keeping and establishing timelines.

-

Creditor's Information: Clearly state the name and address of the collection agency or creditor you are disputing.

-

Subject Line: Use a clear subject line, such as "Dispute of Debt - [Account Number]" to indicate the purpose of your letter.

-

Account Details: Reference the account number linked to the obligation in question, if known. This assists the lender in locating your account swiftly.

-

Statement of Dispute: Clearly articulate that you are contesting the amount owed. Use direct language to eliminate any ambiguity.

-

Request for Validation: Request that the lender provide validation of the debt, including details such as the original lender, the amount owed, and any supporting documentation.

-

Legal References: Mention your rights under the FDCPA, which mandates that the collector cease collection activities until they provide the requested validation.

-

Signature: Conclude the message with your signature and printed name. If sending a hard copy, consider using certified mail for tracking purposes.

By incorporating these components, you ensure that your complaint document is thorough, thereby enhancing the chances of a swift and positive response from the creditor.

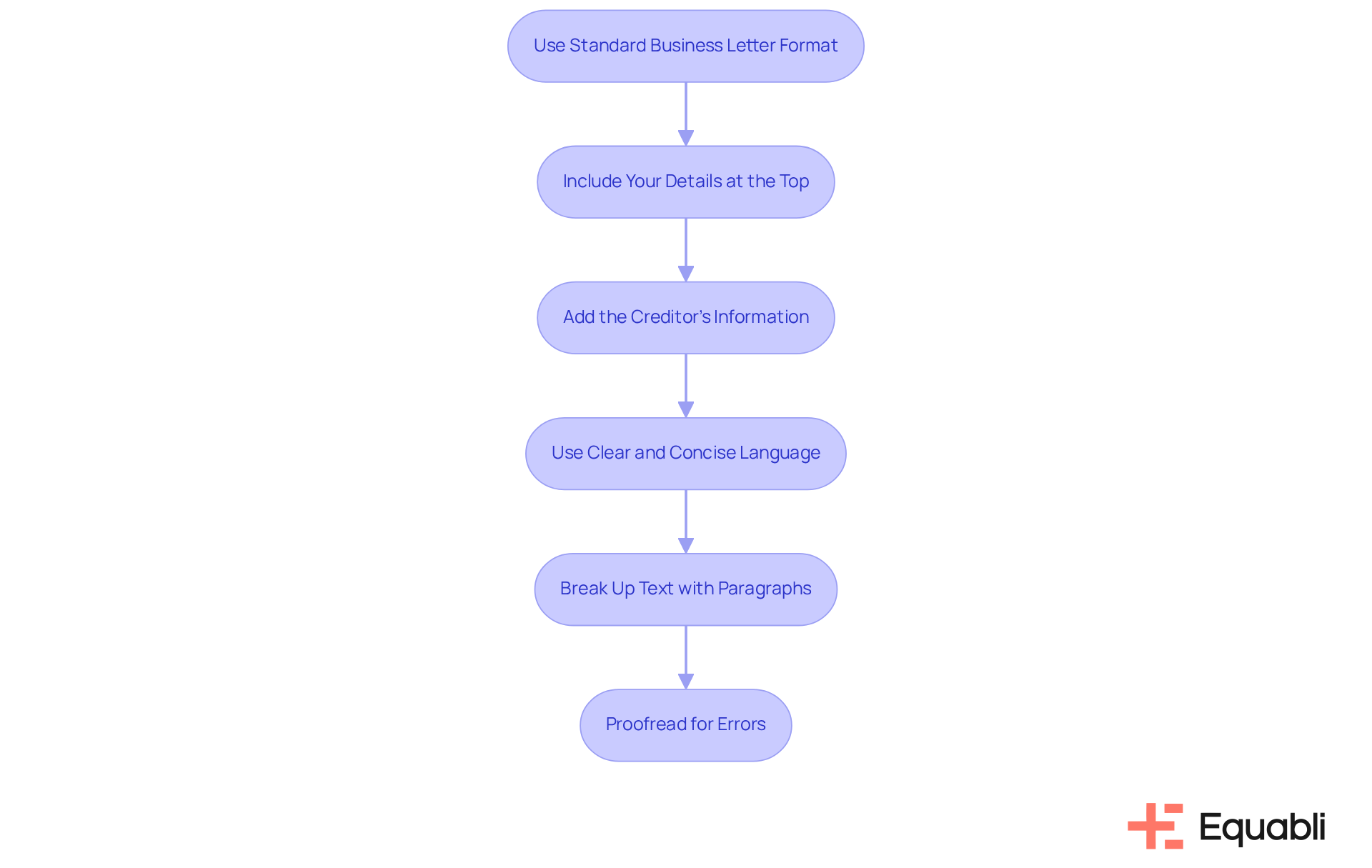

Choose the Right Format for Your Letter

To ensure your collection dispute letter is both professional and clear, it is crucial to adhere to specific formatting guidelines:

-

Use a Standard Business Letter Format: Align your text to the left and select a standard font such as Times New Roman or Arial in size 12. This choice significantly enhances readability.

-

Include Your Details at the Top: Begin with your name, address, and contact information, followed by the date. This establishes your identity and context immediately.

-

Add the Creditor's Information: Below your details, include the name and address of the creditor or collection agency. This ensures clarity in communication.

-

Use Clear and Concise Language: Steer clear of jargon and maintain straightforward sentences. This approach guarantees that your message is easily understood.

-

Break Up Text with Paragraphs: Utilize paragraphs to separate different points or sections of your message. This structure facilitates easier navigation through your argument.

-

Proofread for Errors: Prior to sending, meticulously proofread your document for spelling and grammatical errors. A well-composed message reflects your seriousness regarding the conflict.

By adhering to these formatting guidelines, you significantly enhance the professionalism of your collection dispute letter, thereby increasing the likelihood of it being taken seriously by the creditor.

Conclusion

Crafting an effective collection dispute letter is not just a task; it is a critical step in asserting one's rights and ensuring accuracy in financial obligations. This type of letter serves as a formal dispute and empowers individuals to challenge potentially erroneous claims made by creditors. By understanding its purpose, consumers can take proactive measures to safeguard their financial integrity.

Essential components must be incorporated into a collection dispute letter:

- Personal information

- A clear statement of dispute

- A request for validation of the debt

Proper formatting and straightforward language enhance the letter's effectiveness, ensuring that the message is both professional and easily understood. By adhering to these guidelines, individuals can significantly improve their chances of receiving a favorable response from creditors.

The importance of writing a collection dispute letter cannot be overstated. It is not merely a bureaucratic formality; it is a vital tool for consumers to protect themselves against inaccuracies and unjust collection practices. By taking the time to craft a well-structured and comprehensive letter, individuals assert their rights under the Fair Debt Collection Practices Act and pave the way for a more transparent and fair resolution of their financial disputes.

Frequently Asked Questions

What is the purpose of a collection dispute letter?

A collection dispute letter serves as an official communication to a lender or collection agency, disputing the legitimacy or accuracy of a financial obligation assertion.

Why is it important to send a collection dispute letter?

It is important to inform the creditor that you dispute the amount owed and seek confirmation of its validity, which helps ensure you are not held accountable for debts that may not belong to you or that are inaccurately reported.

What rights do consumers have under the Fair Debt Collection Practices Act (FDCPA) regarding collection disputes?

Under the FDCPA, consumers have the right to contest amounts owed, and collectors are required to cease collection efforts until the obligation is verified.

How does a collection dispute letter empower consumers?

By understanding the purpose of a collection dispute letter, consumers can take control of their financial situation and protect themselves from unjust debts.