Overview

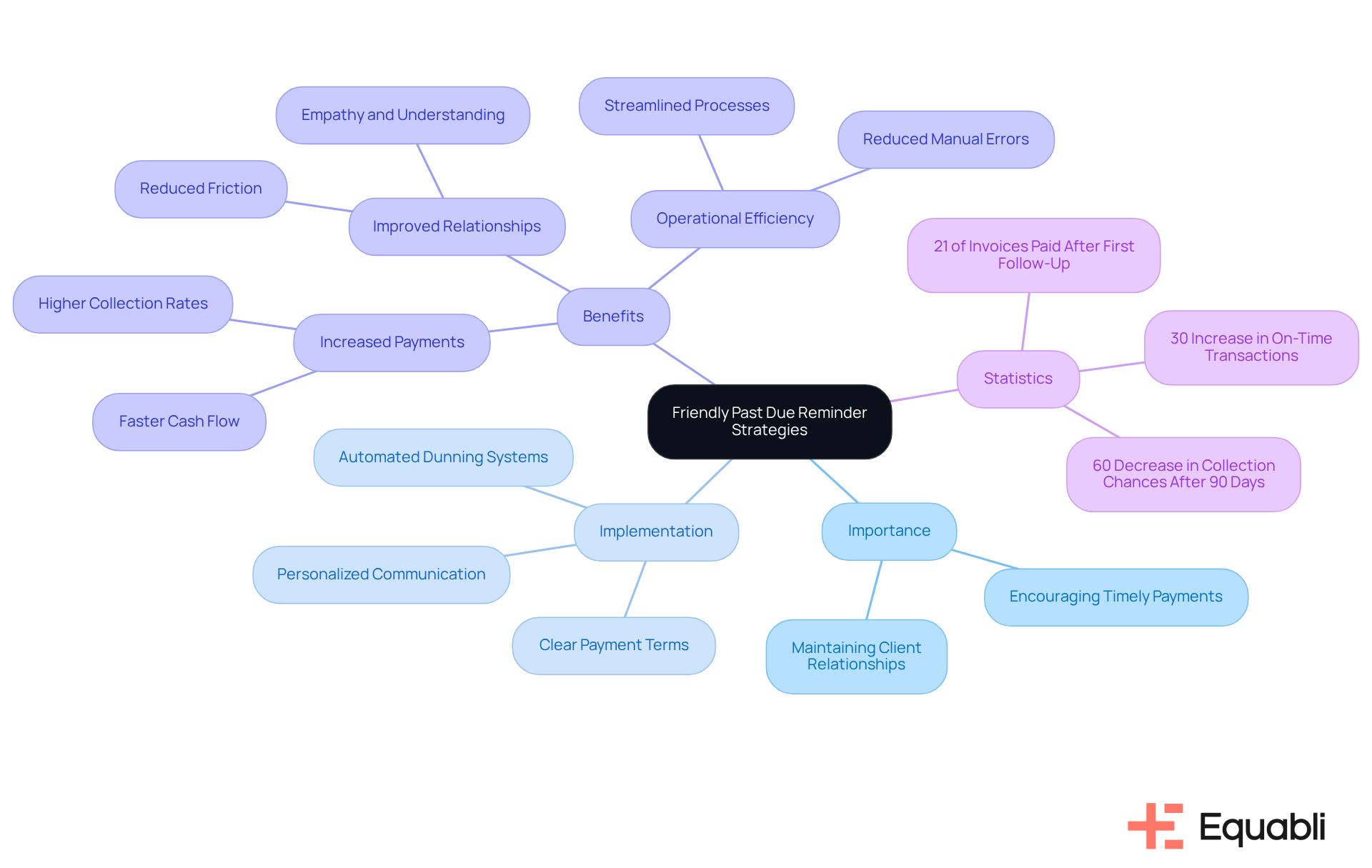

The article underscores the critical role of friendly past due reminder strategies in accounts receivable management. These strategies not only foster positive client relationships but also ensure timely payments, which are essential for maintaining healthy cash flow.

Evidence supporting this assertion includes effective communication techniques such as personalization and clear messaging. Statistics reveal that implementing these strategies can significantly enhance collection rates, demonstrating their value in enterprise-level operations. For instance, organizations that adopt a personalized approach often see improved client engagement and payment compliance.

The impact of these strategies extends beyond immediate financial benefits; they also contribute to long-term client loyalty and trust. By prioritizing clear communication, businesses can mitigate misunderstandings and reinforce their commitment to client satisfaction.

In conclusion, adopting friendly past due reminder strategies is not merely a best practice but a strategic imperative for organizations aiming to optimize their accounts receivable processes. Executives should consider integrating these techniques into their operational frameworks to enhance both collection efficiency and client relationships.

Introduction

In accounts receivable management, effective communication is pivotal to influencing financial outcomes. Friendly past due reminders not only act as gentle nudges for clients but also play a vital role in sustaining positive business relationships. As organizations pursue timely payments, they face the challenge of crafting reminders that are both effective and considerate.

How can businesses navigate the necessity of collecting payments while fostering goodwill among their clients?

Understand the Importance of Friendly Past Due Reminders

Welcoming friendly past due reminder strategies for enterprise accounts receivable management serve as essential prompts that keep individuals aware of their financial responsibilities without inducing tension. Implementing friendly past due reminder strategies for enterprise accounts receivable management helps sustain a positive relationship, which is crucial for long-term business success. By conveying empathy and understanding, friendly past due reminder strategies for enterprise accounts receivable management can mitigate potential friction and encourage timely payments. Research indicates that clients are more likely to respond favorably to friendly past due reminder strategies for enterprise accounts receivable management, highlighting the importance of polite and considerate communication in this context. Furthermore, pleasant notifications can prevent late charges and additional collection measures, ultimately benefiting both lenders and borrowers.

Establishing a robust accounts receivable (AR) process with clear credit policies and defined terms is vital for efficient management of accounts receivable. Businesses that implement automated dunning systems report significant enhancements in collection rates, with some experiencing immediate improvements in cash flow. For instance, a case study revealed that a company utilizing a courteous notification strategy saw a 30% increase in on-time transactions, demonstrating how a thoughtful approach can effectively influence customer behavior.

Moreover, statistics reveal that only 21% of invoices are settled after the initial follow-up, highlighting the necessity of sending multiple notifications. By maintaining transparent communication regarding payment expectations and deadlines, organizations can strengthen client relationships while ensuring financial stability. Ultimately, the strategic use of friendly past due reminder strategies for enterprise accounts receivable management not only facilitates effective management but also contributes to healthier cash flow and reduced operational risks.

Develop Effective Strategies for Friendly Reminder Emails

To craft effective friendly reminder emails, financial institutions should consider the following strategies:

-

Personalize Your Message: Incorporating the recipient's name and referencing specific details about their account or previous interactions can significantly enhance engagement. Personalization has been shown to increase response rates by up to 23%, fostering a sense of value and understanding among clients.

-

Be Clear and Concise: Clearly stating the purpose of the email is crucial. This includes specifying the amount due, the due date, and any relevant invoice numbers. Avoiding jargon and using straightforward language ensures that key information is easily digestible, which is essential for effective communication.

-

Use a Friendly Tone: Initiating the email with a warm greeting and expressing appreciation for the client's business sets a positive tone. Phrases such as 'We hope you're doing well' can foster goodwill, encouraging timely responses and reinforcing client relationships.

-

Include Financial Options: Simplifying the transaction process is vital. Including links to payment methods or providing clear instructions on how to settle their account can significantly improve the likelihood of timely payments. Offering convenient financing alternatives further enhances this process.

-

Establish a Notification Schedule: Organizing alerts thoughtfully is key. Sending an initial notification 7 days prior to the due date, a second on the due date, and a follow-up 3 days later if the payment is overdue maintains consistent communication. This structured approach not only enhances cash flow but also decreases Days Sales Outstanding (DSO), which is critical for sustaining healthy financial operations.

By implementing friendly past due reminder strategies for enterprise accounts receivable management, financial institutions can enhance their accounts receivable management while maintaining positive relationships with clients.

Implement a Step-by-Step Process for Sending Reminders

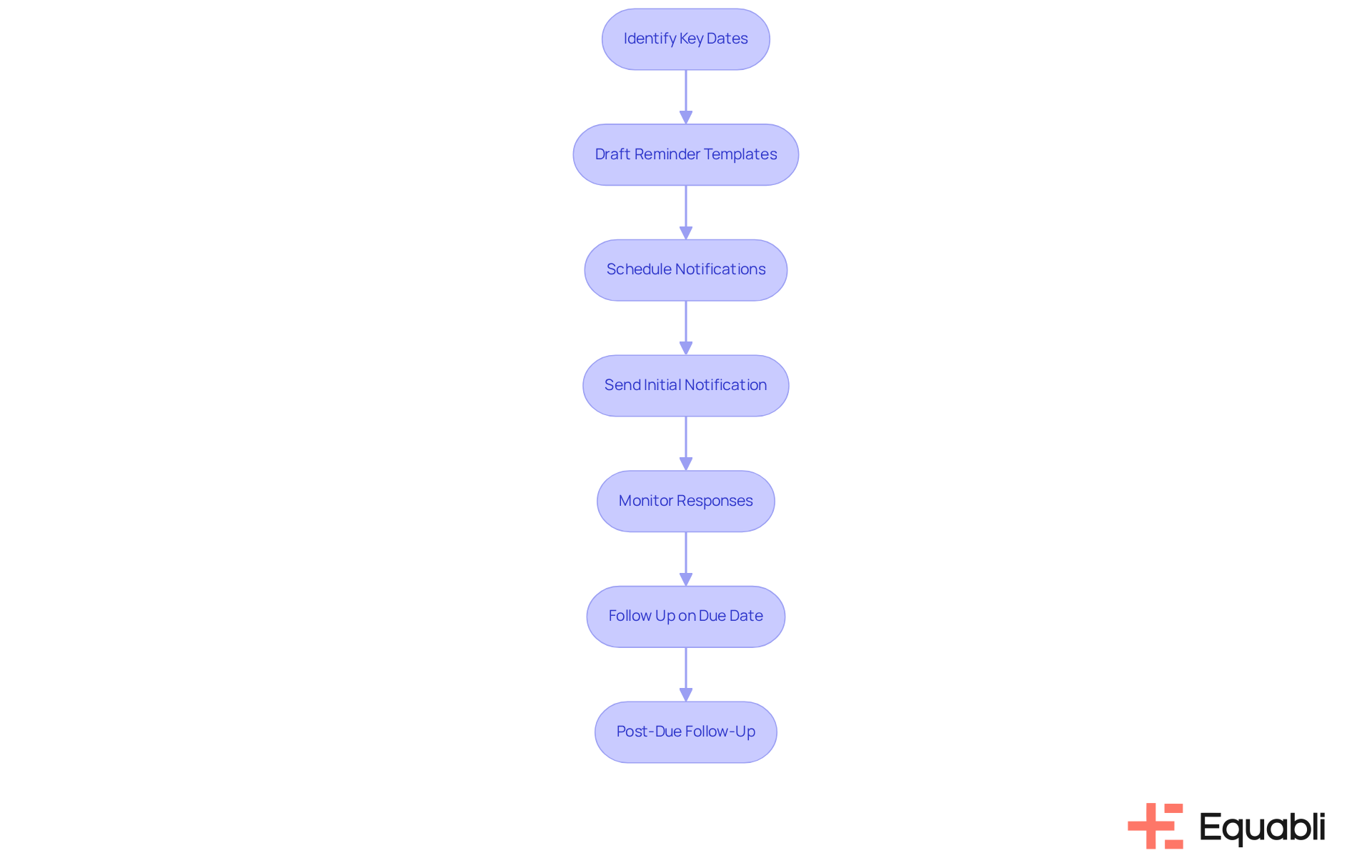

To establish an effective friendly reminder process for accounts receivable management, consider the following structured approach:

-

Identify Key Dates: Begin by determining the due dates for all outstanding invoices and marking them on your calendar to ensure timely follow-ups. As Betsy Francoeur points out, "Ideally, the first payment notification should be sent within a week of the invoice being due." This proactive measure not only aids in maintaining cash flow but also reinforces the importance of timely communication in financial operations.

-

Draft Reminder Templates: Create templates tailored for different stages of reminders—pre-due, on due date, and post-due. This strategy saves time and ensures consistency in communication, which is crucial for maintaining professional relationships and operational efficiency.

-

Schedule Notifications: Utilize a calendar or alert tool to organize when each notification will be dispatched. Aim to send the first notice one week prior to the due date to provide clients with ample warning. Establishing clear policies about notification timing is essential for adopting friendly past due reminder strategies for enterprise accounts receivable management.

-

Send the Initial Notification: One week before the due date, dispatch your first friendly notification email. Include all essential information such as the invoice number, amount owed, and a clear prompt for settlement. Notably, '60% of customers pay on time when they receive a helpful notice,' underscoring the effectiveness of timely communication in enhancing payment rates.

-

Monitor Responses: Track customer replies and transactions diligently. If a client interacts with your notice, address their concerns promptly to maintain a positive relationship. This responsiveness not only fosters goodwill but also mitigates potential disputes.

-

Follow Up on Due Date: On the due date, send a second notice that reiterates the financial details and expresses gratitude for their attention to the matter. This reinforces the significance of prompt settlement and demonstrates professionalism in your operations.

-

Post-Due Follow-Up: If payment has not been received, send a follow-up notification a few days after the due date. Maintain a friendly tone by implementing friendly past due reminder strategies for enterprise accounts receivable management, emphasizing the importance of settling the account to encourage prompt action. Consider utilizing AI tools from Equabli's EQ Suite to automate notifications, streamlining the process and enhancing efficiency while still adding a personal touch.

Utilize Technology and Tools for Enhanced Reminder Efficiency

To enhance the efficiency of your reminder process, consider implementing the following tools and technologies:

-

Automated Email Systems: Utilizing platforms like Mailchimp or SendinBlue can automate notification emails based on due dates. This method not only saves time but also boosts engagement, as automated emails can achieve response rates of 97% to 99%, significantly surpassing traditional methods. By streamlining communication, organizations can ensure the use of friendly past due reminder strategies for enterprise accounts receivable management that enhance customer interaction.

-

Customer Relationship Management (CRM) Software: Implementing a CRM system such as Salesforce or HubSpot allows for the monitoring of customer interactions and automates notifications based on billing schedules. Businesses have reported a 40-60% increase in response rates when alerts are tailored to individual customer behaviors. This customization fosters stronger relationships and improves overall notification efficiency.

-

Transaction Management Solutions: Platforms like PayPal or Stripe offer automated notifications that inform customers directly when dues are approaching. This integration not only streamlines the payment process but also leads to quicker collections, as friendly past due reminder strategies for enterprise accounts receivable management typically result in a 5% increase in collection rates. Such solutions are vital for maintaining cash flow and operational efficiency.

-

Task Management Apps: Tools such as Trello or Asana can help organize your schedule, ensuring that no customer is overlooked. By effectively managing tasks, these applications enhance operational efficiency and allow staff to concentrate on high-value interactions, ultimately improving service delivery.

-

SMS Alert Services: Services like Twilio enable the dispatch of text notifications, which are often more immediate and effective for clients who prefer mobile communication. Text messages boast a delivery rate of 98% within three minutes, making them an essential resource for timely notifications. This immediacy can significantly enhance friendly past due reminder strategies for enterprise accounts receivable management.

-

Voice Automation: Implementing voice automation can greatly improve your notification strategy. Organizations utilizing this technology have reported a 60% increase in completed scheduled repayment notifications and a 42% decrease in repayment delays throughout the credit cycle. This dynamic approach ensures timely and relevant communication by utilizing friendly past due reminder strategies for enterprise accounts receivable management, adapting to borrower behavior.

-

Analytics Tools: Leveraging analytics to monitor the effectiveness of your notifications allows for real-time adjustments based on client responses and payment behaviors. This data-driven approach can enhance the overall efficiency of accounts receivable management through friendly past due reminder strategies for enterprise accounts receivable management, ensuring that notifications are both timely and relevant. Additionally, sending the first follow-up reminder 2-3 days after the due date can further improve response rates and collection outcomes.

Conclusion

Implementing friendly past due reminder strategies is essential for effective accounts receivable management. These strategies not only promote timely payments but also cultivate positive relationships between businesses and their clients. By emphasizing empathy and clear communication, organizations can significantly enhance their collection processes while preserving goodwill.

The importance of personalization in reminder emails is paramount. Evidence shows that tailored communications yield higher engagement rates. Additionally, a structured notification schedule can streamline the reminder process, ensuring consistency and reliability. Utilizing technology, such as automated email systems and CRM software, can further improve response rates and collection efficiency, demonstrating the tangible benefits of a strategic approach to reminders.

Ultimately, adopting friendly past due reminder strategies aids in managing accounts receivable and contributes to healthier cash flow and reduced operational risks. As businesses pursue financial stability, embracing these practices can lead to stronger customer relationships and a more sustainable financial management approach. Taking action on these insights can transform how organizations handle reminders, ensuring prompt payments and lasting client satisfaction.

Frequently Asked Questions

What is the purpose of friendly past due reminders in accounts receivable management?

Friendly past due reminders serve as essential prompts to keep individuals aware of their financial responsibilities without inducing tension, helping to sustain positive relationships and encouraging timely payments.

How do friendly past due reminders impact client relationships?

By conveying empathy and understanding, friendly past due reminders can mitigate potential friction and foster a positive relationship, which is crucial for long-term business success.

What benefits do polite and considerate communication provide in accounts receivable management?

Polite communication can prevent late charges and additional collection measures, benefiting both lenders and borrowers by encouraging favorable responses from clients.

Why is it important to have a robust accounts receivable process?

A robust accounts receivable process with clear credit policies and defined terms is vital for efficient management, leading to improved collection rates and cash flow.

What improvements can automated dunning systems bring to accounts receivable management?

Businesses that implement automated dunning systems often report significant enhancements in collection rates and can experience immediate improvements in cash flow.

How effective are friendly notification strategies in influencing customer behavior?

A case study indicated that a company using a courteous notification strategy experienced a 30% increase in on-time transactions, demonstrating the effectiveness of a thoughtful approach.

What statistics highlight the need for multiple payment reminders?

Statistics show that only 21% of invoices are settled after the initial follow-up, emphasizing the necessity of sending multiple notifications to ensure timely payments.

How can transparent communication regarding payment expectations benefit organizations?

Maintaining transparent communication about payment expectations and deadlines can strengthen client relationships while ensuring financial stability for the organization.