Overview

The article presents a robust framework for disputing debt collectors, highlighting the critical importance of understanding your rights under the Fair Debt Collection Practices Act (FDCPA). It details essential rights to debt validation, outlines the specific steps to initiate a dispute, and provides guidance on crafting an effective dispute letter. This structured approach not only empowers consumers to assert their rights but also equips them to navigate potential outcomes in debt disputes with confidence and clarity.

Introduction

Navigating the complexities of debt collection can indeed be daunting, particularly when confronted by aggressive collectors. The stakes are high; many consumers remain unaware of their rights under the Fair Debt Collection Practices Act, rendering them vulnerable to unfair practices. This guide not only delineates the essential steps for disputing a debt but also empowers readers with the knowledge necessary to navigate this challenging process with confidence.

What occurs when a collector's claim is questionable? How can individuals effectively assert their rights to secure a favorable resolution?

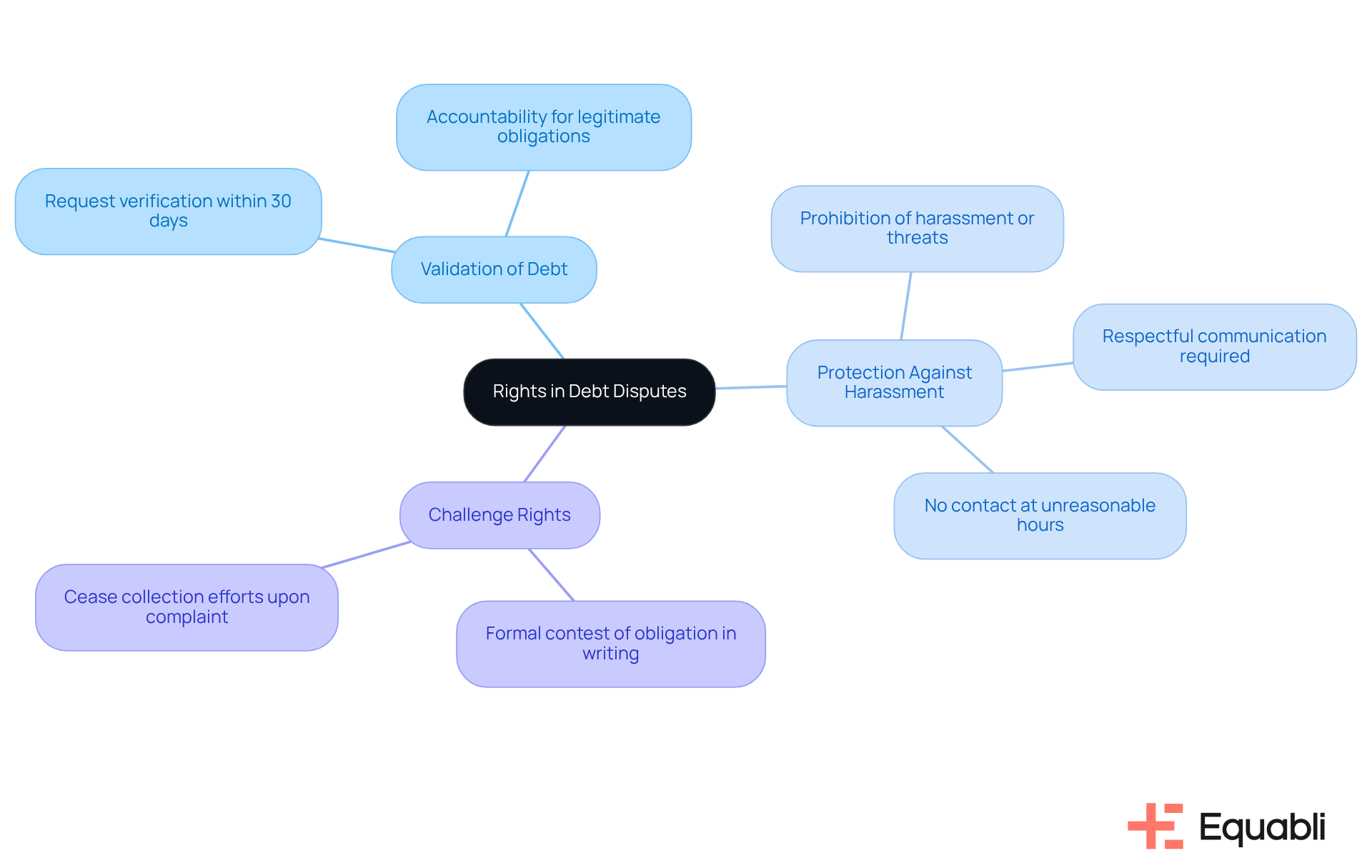

Understand Your Rights in Debt Disputes

Before understanding how to dispute debt collector actions, it is imperative to know your entitlements under the Fair Debt Collection Practices Act (FDCPA). Key rights include:

- Validation of Debt: You have the right to request verification of the debt within 30 days of the initial contact from the collector. This ensures that you are only held accountable for legitimate obligations.

- Protection Against Harassment: Collectors are prohibited from harassing or threatening you. They must communicate respectfully and avoid contacting you at unreasonable hours, thus safeguarding your peace of mind.

- Challenge Rights: You can formally contest the obligation in writing. Upon receiving your complaint, the collector must cease collection efforts until they provide validation, which is essential for understanding how to dispute debt collector inaccuracies.

Understanding how to dispute debt collector entitlements is crucial, as research indicates that only a small fraction of consumers fully comprehend their rights in debt conflicts. For instance, a recent statistic reveals that merely 25% of consumers are aware of their entitlements under the FDCPA. By familiarizing yourself with these protections, you can navigate the conflict process more effectively and assertively. As Nathan W. Morris aptly states, "Every time you borrow money, you’re robbing your future self," underscoring the importance of knowing your rights to avoid potential pitfalls. Furthermore, employing compassionate language during conflicts can enhance communication and understanding, ultimately leading to more effective solutions.

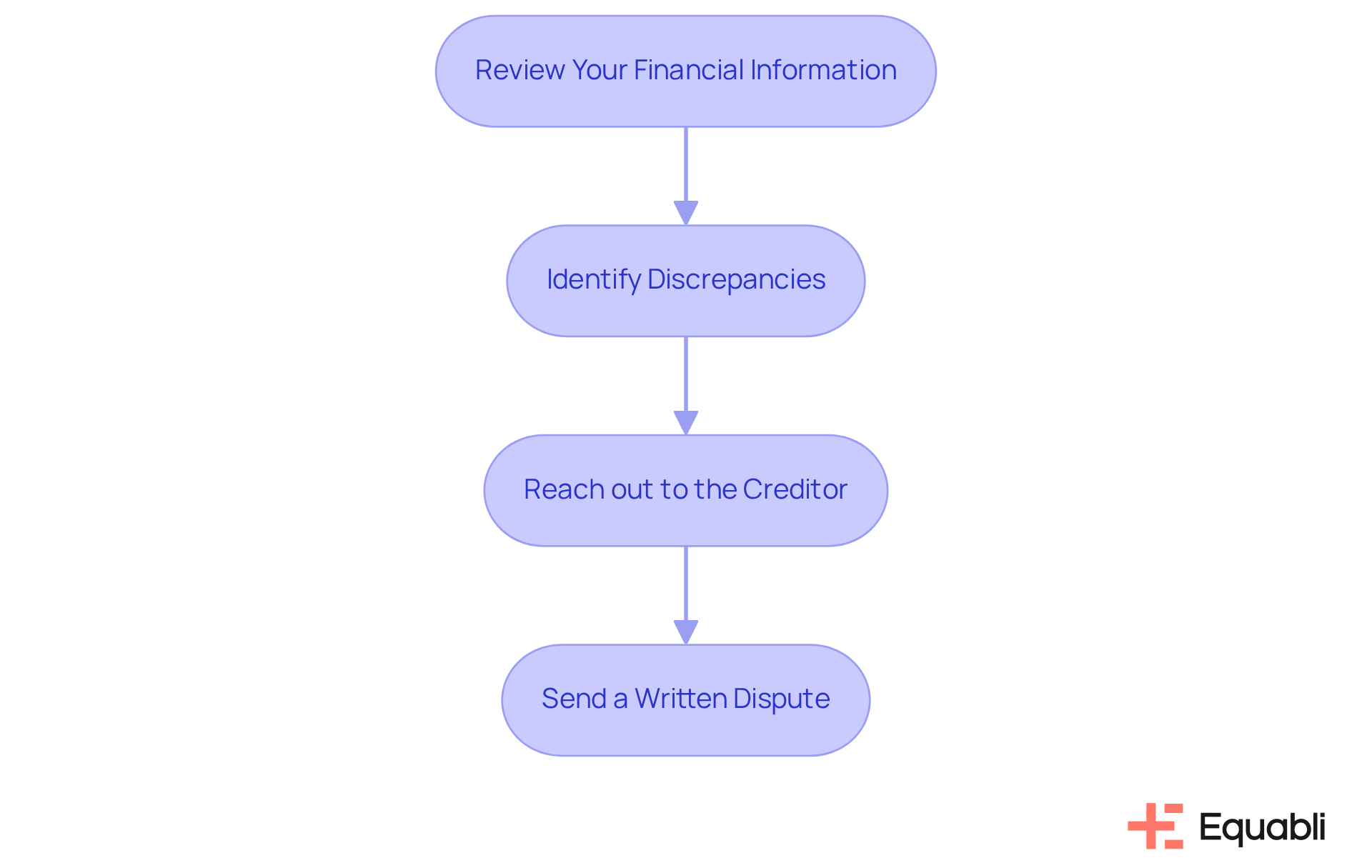

Initiate the Debt Dispute Process

To effectively initiate the debt dispute process, it is crucial to follow these essential steps:

-

Review Your Financial Information: Begin by gathering all relevant documents, including the collector's notice, account statements, and any previous correspondence. This foundational step ensures you possess a comprehensive understanding of the situation.

-

Identify Discrepancies: Scrutinize the details for inaccuracies, such as the amount owed, the creditor's name, or the authenticity of the obligation itself. Identifying these inconsistencies is vital for achieving a successful resolution.

-

Reach out to the Creditor: Inform the creditor of your intention to challenge the obligation. This can be accomplished via phone or email; however, it is essential to follow up with a formal written notice to establish a clear record of your communication.

-

Send a Written Dispute: Within 30 days of your initial contact, dispatch a written dispute letter to the creditor. Clearly articulate your reasons for contesting the amount and retain a copy for your records. This formal documentation is crucial for protecting your rights.

Recent insights reveal that consumers typically take an average of 30 days to commence a financial contention process after receiving a notice, underscoring the importance of timely action. Moreover, industry experts emphasize the necessity of maintaining clear communication and documentation throughout the conflict process to facilitate resolution. By following these steps, you can effectively understand how to dispute debt collector claims and work towards a favorable outcome.

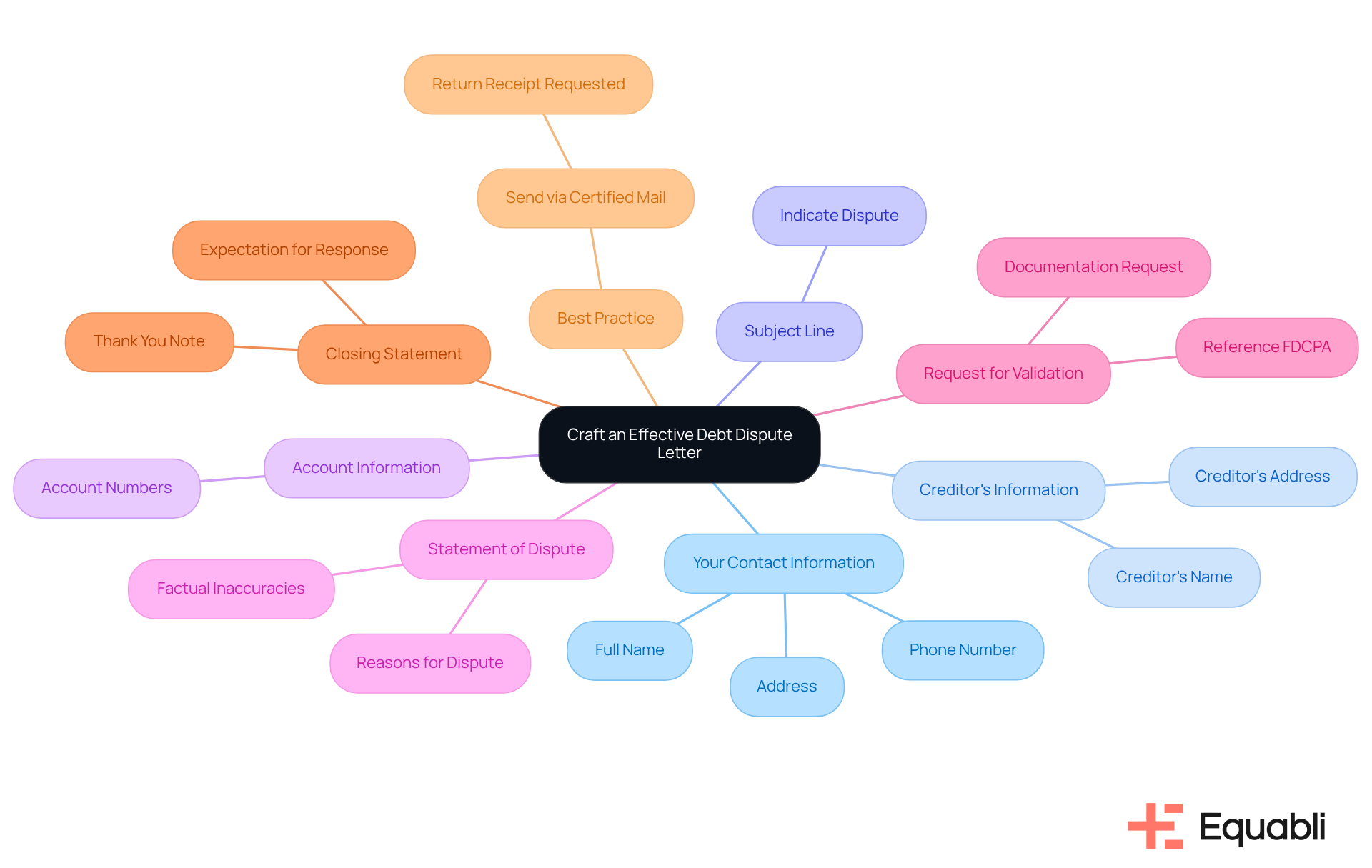

Craft an Effective Debt Dispute Letter

When crafting your debt dispute letter, it is essential to include the following critical elements:

- Your Contact Information: Clearly state your full name, address, and phone number to facilitate communication.

- Creditor's Information: Address the letter to the specific creditor, including their name and address for proper identification.

- Subject Line: Clearly indicate that this letter serves as a dispute regarding a particular obligation.

- Account Information: Include any pertinent account numbers linked to the obligation to assist the agent in finding your file.

- Statement of Dispute: Articulate your reasons for contesting the financial obligation clearly and concisely, focusing on factual inaccuracies.

- Request for Validation: Formally ask that the agency provide documentation confirming the obligation's validity, as mandated by the Fair Debt Collection Practices Act (FDCPA). According to the FDCPA, debtors have the right to know how to dispute debt collector claims within 30 days, making timely action crucial.

- Closing Statement: Thank the collector for their attention and express your expectation for a prompt response.

Best Practice: It is advised to send the objection letter via certified mail with a return receipt requested for proof of delivery.

Sample Template:

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Date]

[Debt Collector's Name]

[Debt Collector's Address]

[City, State, Zip Code]

Subject: Dispute of Debt

Dear [Debt Collector's Name],

I am writing to formally dispute the validity of the debt referenced in your notice dated [insert date]. I believe that the amount you claim I owe is inaccurate. Please provide me with documentation that verifies this debt.

Thank you for your attention to this matter. I look forward to your prompt response.

Sincerely,

[Your Name]

Statistics indicate that written dispute letters can significantly enhance the resolution process, with effective communication leading to faster outcomes. Conflicts can be settled 20% quicker with HighRadius' automated management system. Legal experts stress that understanding how to dispute debt collector conflicts through a well-organized letter is crucial for asserting your rights and ensuring adherence from creditors. As Rick Munster states, "Acting quickly is key—disputes carry the most weight within 30 days of the first notice." By adhering to this template and incorporating all essential information, you can enhance your stance and promote a more effective resolution to your financial conflict.

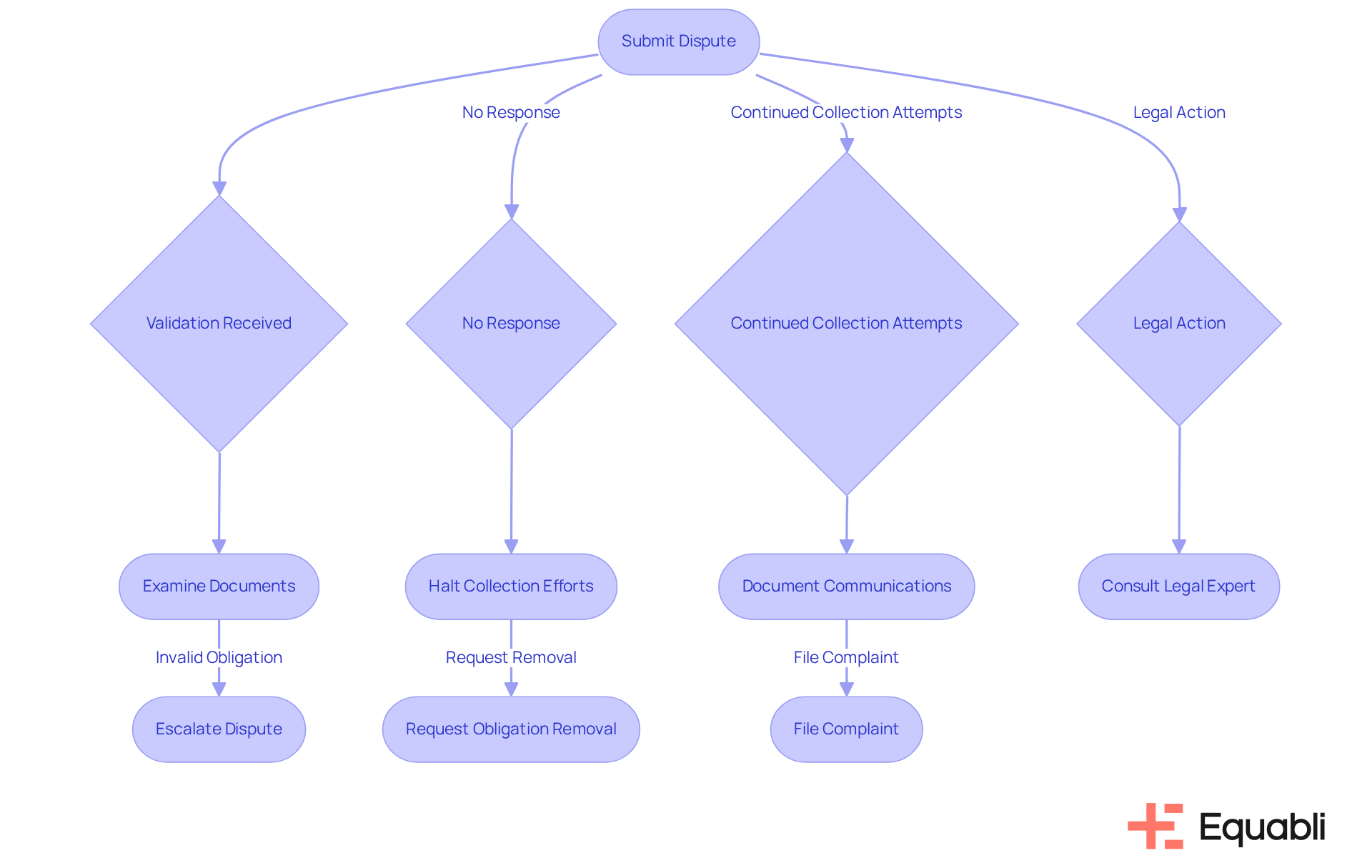

Navigate Outcomes and Next Steps After Disputing

After submitting your dispute, you may encounter several potential outcomes:

- Validation Received: If the creditor provides verification, examine the documents carefully. Should you still believe the obligation is invalid, you have the option to escalate the dispute further.

- No Response: If the agency does not reply within 30 days, they are required to halt all collection efforts. At this stage, you can request the removal of the obligation from your credit report.

- Continued Collection Attempts: If the collector persists in pursuing the debt without providing validation, it is crucial to document all communications. Consider filing a complaint with the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general to address the issue.

- Legal Action: If the conflict escalates to legal proceedings, it is advisable to consult with a legal expert to fully comprehend your entitlements and available options.

Being prepared for these outcomes allows you to understand how to dispute debt collector actions more effectively, ensuring that your rights are protected. Importantly, recent statistics indicate that a significant percentage of consumers—around 30%—receive confirmation from creditors, underscoring the importance of understanding the validation process. Furthermore, consumer protection organizations emphasize the necessity for prompt and precise replies from creditors, highlighting the need for diligence in these interactions. Additionally, insights from case studies, such as the significance of empathy in debt collection, can enhance your approach to resolving disputes and foster improved communication with collectors.

Conclusion

Understanding the intricacies of disputing debt collectors is essential for consumers seeking to protect their rights and achieve favorable outcomes. Familiarizing oneself with the Fair Debt Collection Practices Act (FDCPA) and the necessary steps to initiate a dispute empowers individuals to navigate the often-overwhelming debt collection landscape with confidence and clarity.

Key points discussed emphasize the importance of:

- Knowing your rights

- The systematic approach to initiating a dispute

- The critical components of an effective debt dispute letter

Each step, from gathering relevant documentation to articulating clear reasons for contesting a debt, plays a crucial role in ensuring that consumers are treated fairly and that their disputes are taken seriously. Moreover, understanding potential outcomes after submitting a dispute equips individuals with the knowledge to respond appropriately and assertively.

Ultimately, the ability to dispute a debt collector's claims transcends financial management; it embodies a fundamental consumer right. By taking proactive steps and employing effective communication strategies, individuals can safeguard their financial future and navigate disputes with greater ease. Embracing this knowledge empowers consumers to stand up against unfair practices and reinforces the importance of being informed in an ever-evolving financial landscape.

Frequently Asked Questions

What is the Fair Debt Collection Practices Act (FDCPA)?

The Fair Debt Collection Practices Act (FDCPA) is a federal law that outlines the rights of consumers in debt disputes and regulates the behavior of debt collectors to prevent abusive practices.

What rights do I have under the FDCPA regarding debt validation?

You have the right to request verification of the debt within 30 days of the initial contact from the collector. This ensures that you are only held accountable for legitimate obligations.

Are debt collectors allowed to harass me?

No, debt collectors are prohibited from harassing or threatening you. They must communicate respectfully and avoid contacting you at unreasonable hours.

How can I formally contest a debt?

You can formally contest the obligation in writing. Once the collector receives your complaint, they must cease collection efforts until they provide validation of the debt.

What percentage of consumers are aware of their rights under the FDCPA?

Research indicates that only a small fraction of consumers, specifically about 25%, are aware of their entitlements under the FDCPA.

Why is it important to know my rights in debt disputes?

Knowing your rights is crucial for navigating the conflict process effectively and assertively, helping you avoid potential pitfalls in debt disputes.

How can communication during debt disputes be improved?

Employing compassionate language during conflicts can enhance communication and understanding, leading to more effective solutions.