Overview

Automated reminder systems for effective payment management are essential tools that enable organizations to sustain timely communication with borrowers. This proactive approach significantly reduces missed payments and enhances cash flow. The article delineates a step-by-step process for implementing these systems, underscoring the critical importance of:

- Customization

- Audience segmentation

- Compliance

Such elements not only enhance engagement but also improve operational efficiency, thereby positioning organizations to navigate the complexities of debt collection with greater effectiveness.

Introduction

Automated reminder systems have emerged as pivotal tools in corporate finance, revolutionizing how organizations manage outstanding payments. These systems streamline communication and reduce the likelihood of missed deadlines, enhancing cash flow while fostering stronger relationships with borrowers.

However, implementing such systems presents challenges—how can businesses effectively tailor these reminders to maximize engagement and ensure timely payments?

This article explores the intricacies of automated reminder systems, offering a comprehensive guide on their setup, message personalization, and troubleshooting common issues to elevate payment management strategies.

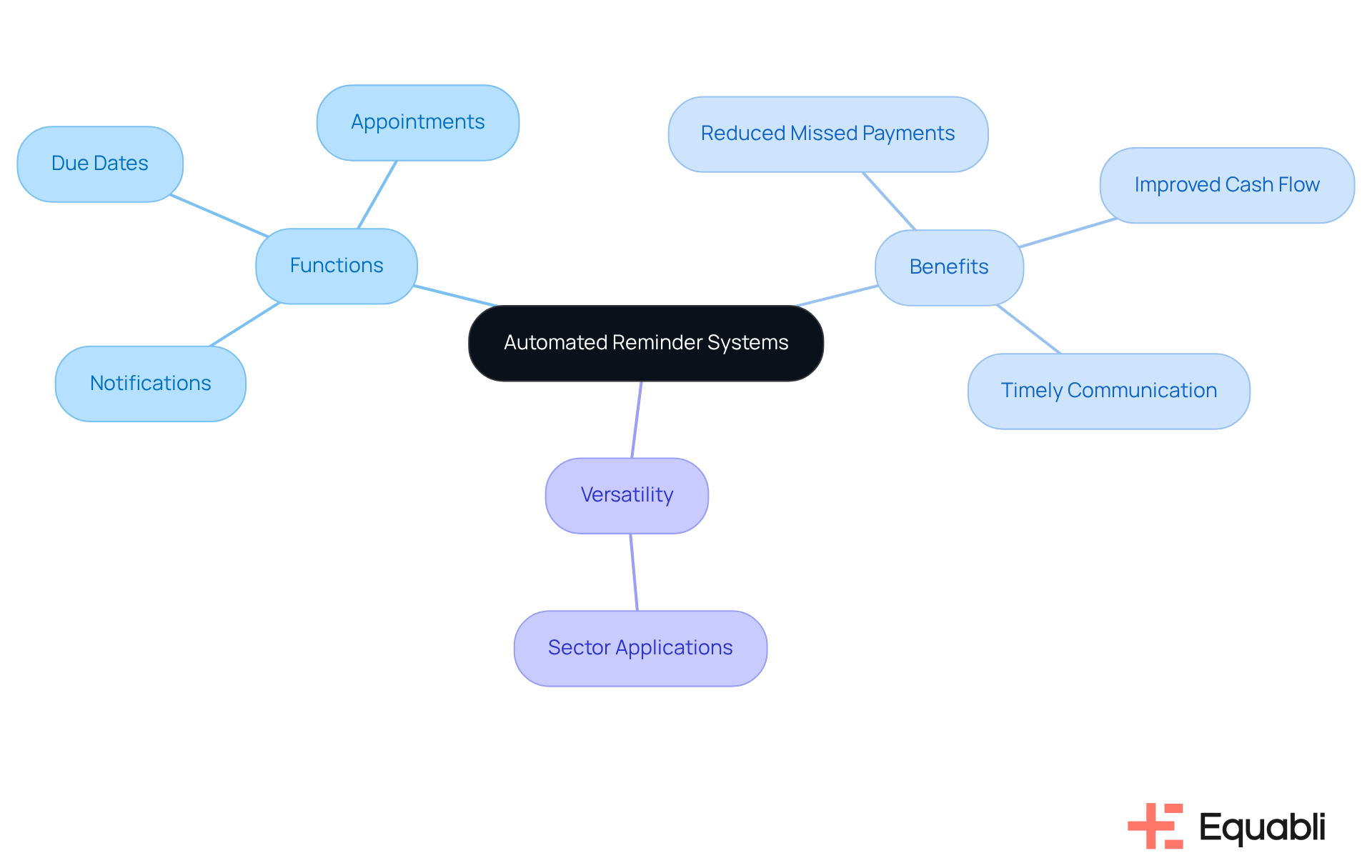

Understand Automated Reminder Systems and Their Importance

Automated reminder systems for outstanding payment management in corporate finance serve as essential digital tools designed to dispatch notifications regarding due dates, appointments, or other significant tasks without requiring manual intervention. These frameworks are essential in the debt collection industry as they utilize automated reminder systems for outstanding payment management in corporate finance, helping to reduce missed payments and improve overall cash flow.

By utilizing automated reminder systems for outstanding payment management in corporate finance, organizations can ensure timely communication with borrowers, which is a vital factor for maintaining engagement and encouraging repayment. Furthermore, these frameworks can be tailored to meet the specific needs of various sectors, making them versatile instruments in modern debt recovery strategies.

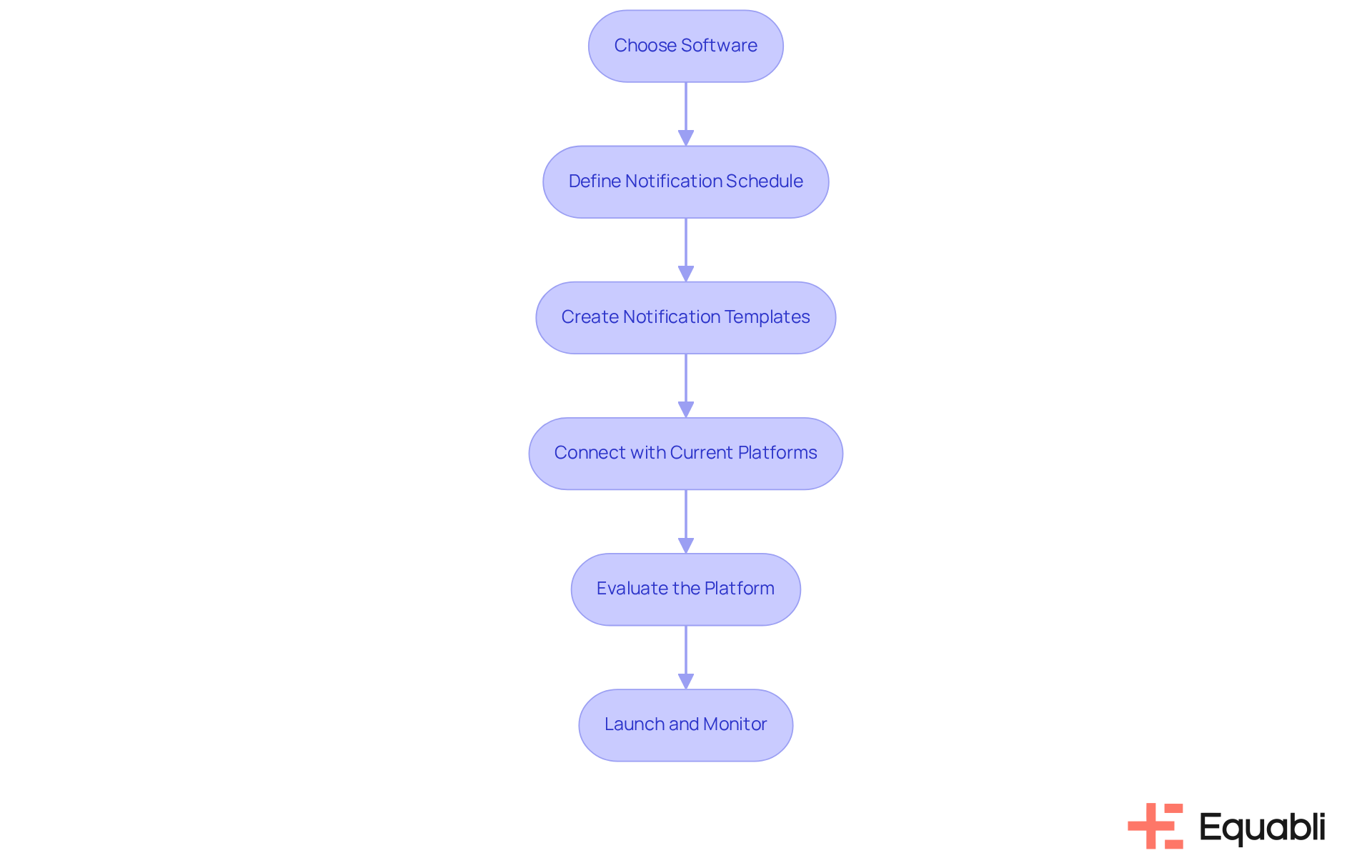

Set Up Your Automated Reminder System: Step-by-Step Process

-

Choosing the right software means selecting automated reminder systems for outstanding payment management in corporate finance that align with your specific business needs. Features such as customization options, seamless integration with existing systems, and an intuitive user interface enhance usability and operational efficiency.

-

Define Your Notification Schedule: Establishing a strategic timeline for sending alerts is essential. Consider scheduling notifications a few days prior to the due date, on the due date itself, and a follow-up message shortly thereafter if payment remains pending. This proactive approach supports timely collections by utilizing automated reminder systems for outstanding payment management in corporate finance.

-

Create Notification Templates: Crafting clear and concise message templates for your alerts fosters positive engagement with borrowers. Maintaining a professional yet approachable tone encourages timely payments, enhancing overall collection effectiveness.

-

Connect with Your Current Platforms: Ensuring that the automated reminder systems for outstanding payment management in corporate finance are integrated with your existing customer relationship management (CRM) or billing software is vital. This integration streamlines data flow, improving accuracy in tracking payments and enhancing operational performance.

-

Evaluate the Platform: Conducting comprehensive testing prior to launching the platform verifies that notifications are sent accurately and that all features function as designed. Utilizing feedback from these tests allows for necessary adjustments, ensuring optimal performance.

-

Launch and Monitor: Following a successful setup, the next step is to activate your automated reminder systems for outstanding payment management in corporate finance. Regularly monitoring its performance is critical to identifying areas for enhancement and ensuring alignment with your collection objectives.

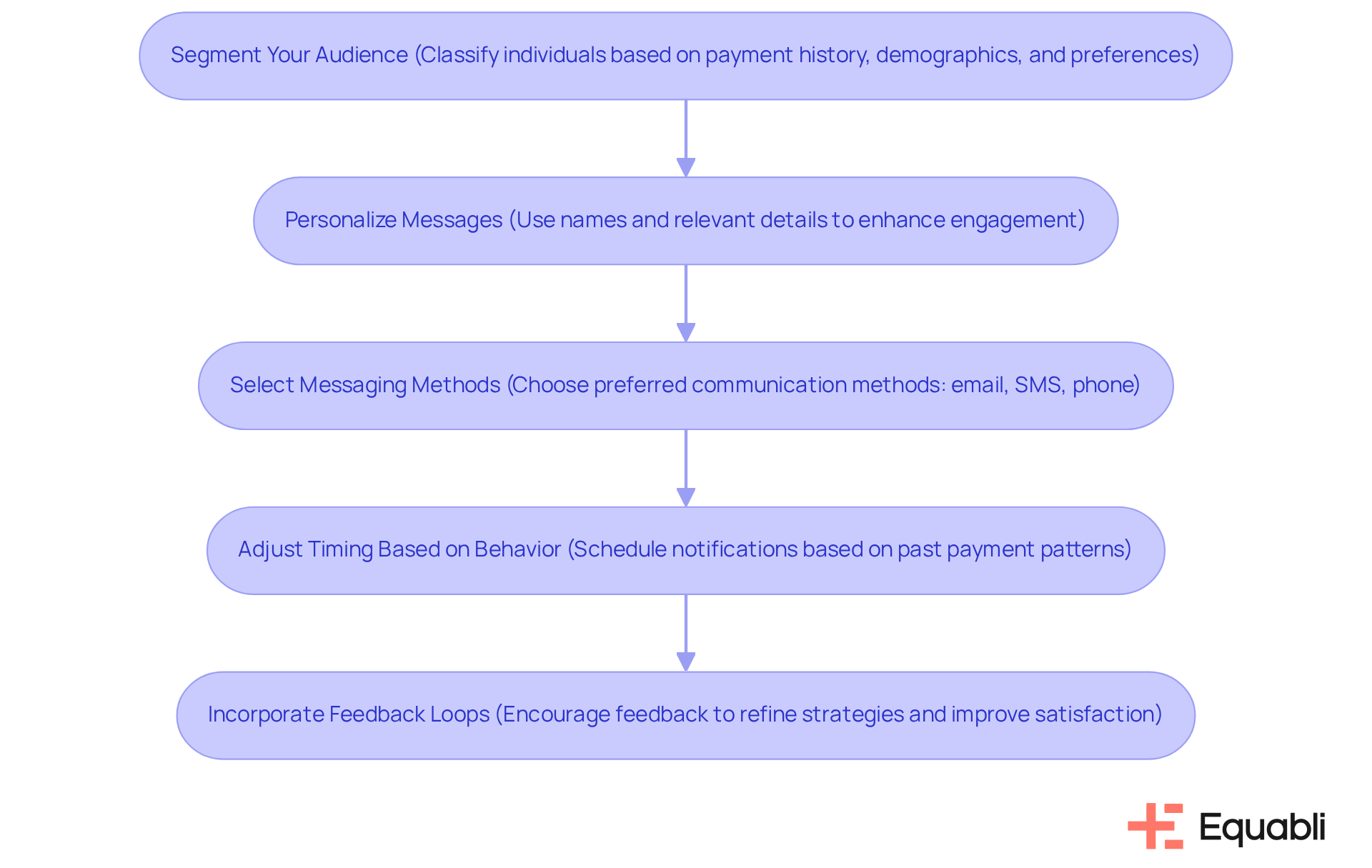

Customize Your Reminder Strategy for Optimal Engagement

-

Segment Your Audience: Classifying individuals into distinct segments based on factors such as payment history, demographics, and interaction preferences enhances targeted messaging. This approach enables effective communication tailored to each group's unique characteristics. Recent data indicates that over 1.7 million reviews have been enabled for businesses, underscoring the necessity of understanding customer segments to foster better engagement.

-

Personalize Messages: Incorporating the individual's name and relevant details in reminders significantly elevates engagement probability. Tailored messages resonate more profoundly with recipients. As David Newman articulates, "Email has an ability many channels don’t: creating valuable, personal touches—at scale."

-

Select Messaging Methods Carefully: Recognizing and employing clients' preferred communication methods—whether email, SMS, or phone calls—can lead to enhanced engagement rates. Providing multiple options increases the likelihood of responses through favored mediums. The achievement of a 4.9 Google review rating by businesses exemplifies the effectiveness of personalized communication strategies.

-

Adjust Timing Based on Behavior: Analyzing past payment patterns is crucial for determining optimal moments to dispatch notifications. For instance, if data suggests individuals are more receptive in the mornings, scheduling notifications accordingly can enhance their effectiveness.

-

Incorporate Feedback Loops: Incorporating feedback loops is essential, as it encourages borrowers to share their thoughts on the notification process, which can be enhanced by automated reminder systems for outstanding payment management in corporate finance. Utilizing this feedback facilitates continuous refinement of your strategy, ultimately improving engagement and satisfaction over time. A case study titled "Empathy in Customer Service" illustrates how attentive listening to customers can strengthen relationships and satisfaction, reinforcing the value of feedback in your reminder strategy.

Troubleshoot Common Issues in Automated Reminder Implementation

-

Low Engagement Rates: Low engagement rates necessitate a reassessment of message content and timing. Implementing A/B testing can identify which messages resonate effectively with your audience, leading to improved interaction rates. For example, Cleveland Clinic achieved a 20% reduction in no-show rates through automated text messaging, illustrating the impact of effective communication strategies. Leveraging Equabli's EQ Collect can further streamline operations, ensuring smarter orchestration and enhanced performance in your engagement efforts.

-

Technical Glitches: To minimize disruptions, it is essential to conduct routine checks for software updates and ensure seamless integration with other platforms. In the event of technical issues, utilizing the software's support resources can significantly enhance system reliability. Key features such as real-time synchronization and automated data flow are critical for effective integration, and EQ Collect is specifically designed to facilitate these processes.

-

Flawed Information: Maintaining precise borrower data is vital for efficient notification delivery. Regular audits of your database should be conducted to eliminate duplicates and rectify errors, ensuring that notifications reach intended recipients without issues. By implementing automated reminder systems for outstanding payment management in corporate finance, practices can save up to $5,000 per employee annually by minimizing administrative tasks related to appointment alerts. With EQ Collect, you can ensure that your data management is integrated and efficient, further enhancing operational performance.

-

Unsubscribes or Complaints: An increase in unsubscribes or complaints may indicate a need to reevaluate your messaging strategy. It is crucial to ensure that notifications are considerate and not overly frequent, as excessive messages can lead to client irritation and disengagement. According to the American Medical Informatics Association, alerts and reminders can foster shared accountability and enhance patient autonomy in their healthcare management. Utilizing EQ Collect can assist in customizing interactions, thereby enhancing client engagement and minimizing grievances.

-

Compliance Issues: Staying informed about regulations governing interaction with borrowers is essential. Ensure that your automated reminder systems for outstanding payment management in corporate finance comply with relevant laws, such as HIPAA, to mitigate potential legal risks and maintain client trust. EQ Collect is designed to support compliance, ensuring that your communication strategies align with legal requirements.

Conclusion

Automated reminder systems represent a strategic necessity in enhancing payment management by facilitating timely communication and minimizing missed payments. Evidence suggests that these systems not only streamline the notification process but also enhance engagement with borrowers, which is essential for sustaining cash flow and bolstering overall financial health.

This article outlined key strategies for implementing and optimizing automated reminder systems:

- Selecting appropriate software

- Defining notification schedules

- Customizing messages

- Addressing common issues

Each step is integral to an effective payment management strategy. The emphasis on personalization, audience segmentation, and feedback loops illustrates how tailored communication can significantly improve engagement rates.

Incorporating automated reminder systems transcends mere technological advancement; it is a crucial strategy for organizations aiming to enhance their financial operations. By adopting these systems, businesses can achieve more consistent cash flow and cultivate stronger client relationships. The imperative is clear—now is the time to evaluate existing payment management processes and consider the implementation of automated reminders to drive efficiency and effectiveness in financial management.

Frequently Asked Questions

What are automated reminder systems?

Automated reminder systems are digital tools designed to send notifications about due dates, appointments, or significant tasks without manual intervention.

Why are automated reminder systems important in corporate finance?

They are essential for managing outstanding payments, helping to reduce missed payments and improve overall cash flow.

How do automated reminder systems benefit debt collection?

They facilitate timely communication with borrowers, which is crucial for maintaining engagement and encouraging repayment.

Can automated reminder systems be customized?

Yes, these systems can be tailored to meet the specific needs of various sectors, making them versatile tools in debt recovery strategies.