Overview

The article examines advanced debt recovery methodologies for corporate creditors, highlighting the critical role of predictive analytics, behavioral science, and omnichannel communication in enhancing collection rates. It substantiates this by illustrating how data-driven strategies, personalized communication, and technological tools can improve creditor-borrower interactions, ultimately resulting in more effective debt recovery processes.

Introduction

Navigating the complexities of debt recovery presents significant challenges for corporate creditors in today's dynamic financial environment. Advanced methodologies, underpinned by data analytics and behavioral insights, offer lenders a strategic opportunity to refine their collection strategies and cultivate stronger relationships with borrowers.

However, the pressing question remains: how can creditors adeptly implement these sophisticated techniques to enhance recovery rates while ensuring a seamless experience for debtors?

This guide explores innovative approaches and technologies poised to transform debt recovery into a more efficient and successful endeavor.

Understand Advanced Debt Recovery Methodologies

The collection process is optimized through advanced debt recovery methodologies for corporate creditors, which encompass a variety of strategies. Predictive analytics emerges as a crucial tool in this context. By utilizing data to predict repayment behaviors, lenders can tailor their strategies according to borrower profiles, significantly improving collection rates. For instance, Equabli's EQ Engine employs machine learning to forecast the risk of delinquency in active accounts, enabling lenders to develop intelligent servicing strategies that proactively engage high-risk accounts. This data-driven approach allows lenders to identify high-risk accounts and customize communication accordingly, ultimately enhancing recovery rates and operational efficiency.

In addition to predictive analytics, behavioral science plays a vital role in understanding the psychological factors influencing borrower decisions. By applying insights from behavioral science, lenders can create more effective communication and engagement strategies, fostering a sense of accountability among borrowers. This approach not only improves borrower interactions but also aligns with compliance frameworks that emphasize responsible lending practices.

Omnichannel communication represents another key methodology, allowing creditors to engage individuals through various channels such as SMS, email, and phone calls. This multi-faceted approach increases the likelihood of repayment by meeting borrowers where they are most comfortable, thus enhancing overall engagement and responsiveness.

Moreover, the incorporation of digital payment solutions provides flexible options that address borrower preferences, thereby improving the likelihood of successful collections. By offering convenient access to payment options, lenders can facilitate prompt repayments and enhance overall collection results, aligning with best practices in financial services.

Mastering advanced debt recovery methodologies for corporate creditors not only enhances rehabilitation rates but also assists corporate lenders in establishing stronger connections with borrowers. Ultimately, this contributes to improved financial well-being and stability, positioning lenders as trusted partners in the debt collection process.

Leverage Technology and Tools for Effective Recovery

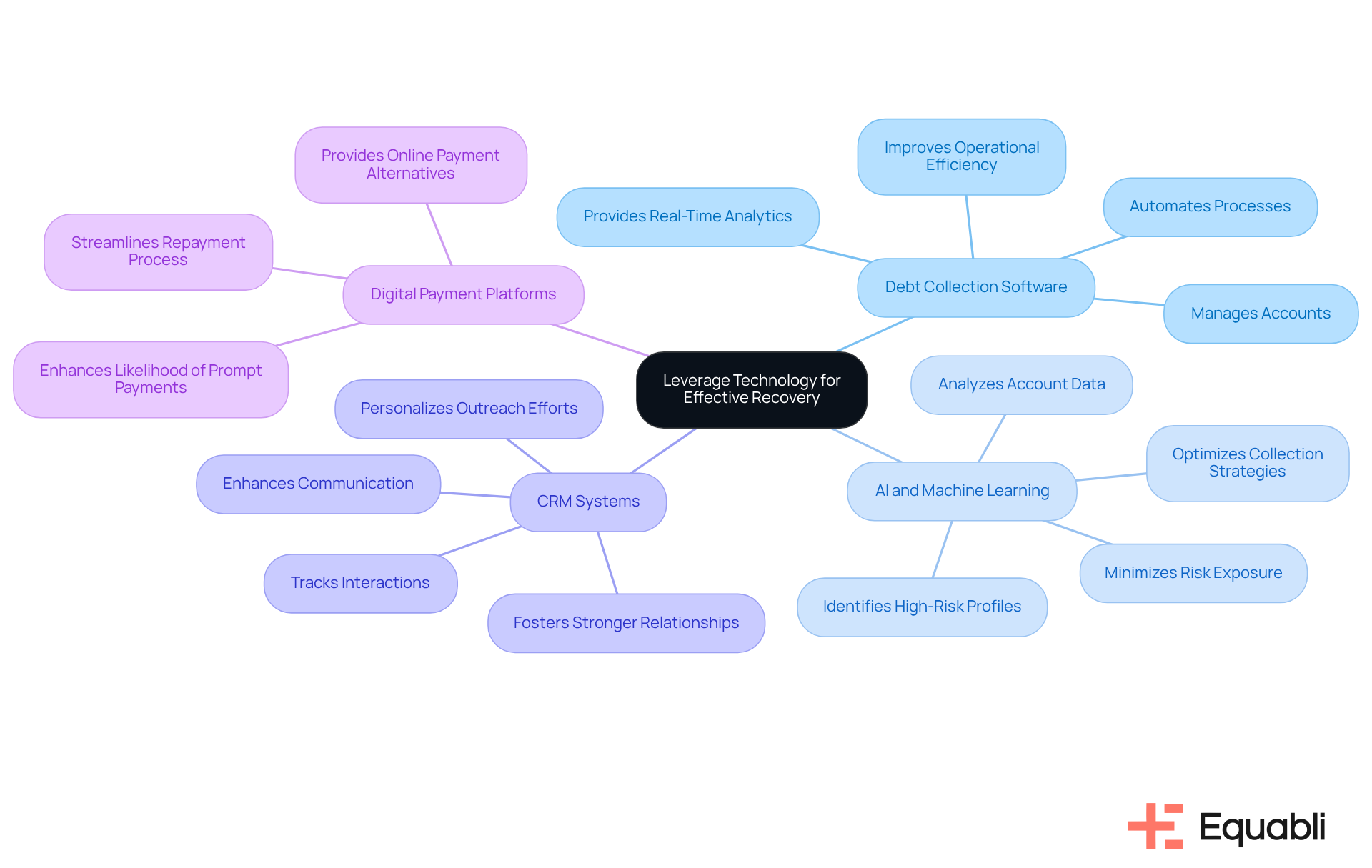

To enhance debt recovery efforts, corporate creditors should consider several advanced technologies and tools:

-

Debt Collection Software: Implementing cloud-based solutions, such as Equabli's EQ Suite, automates processes, manages accounts, and provides real-time analytics, thereby improving operational efficiency.

-

AI and Machine Learning: Utilizing AI to analyze account data enables the identification of high-risk profiles and the optimization of collection strategies based on predictive models, which is crucial for minimizing risk exposure.

-

Customer Relationship Management (CRM) Systems: Integrating CRM systems enhances communication with clients, tracks interactions, and personalizes outreach efforts, thus fostering stronger relationships and increasing recovery rates.

-

Digital Payment Platforms: Providing online payment alternatives streamlines the repayment process for individuals with debt, significantly enhancing the likelihood of prompt payments.

By adopting these technologies, creditors can leverage advanced debt recovery methodologies for corporate creditors to not only improve collection rates but also enhance the overall debtor experience, positioning themselves strategically in the evolving landscape of debt management.

Implement Step-by-Step Strategies for Debt Recovery

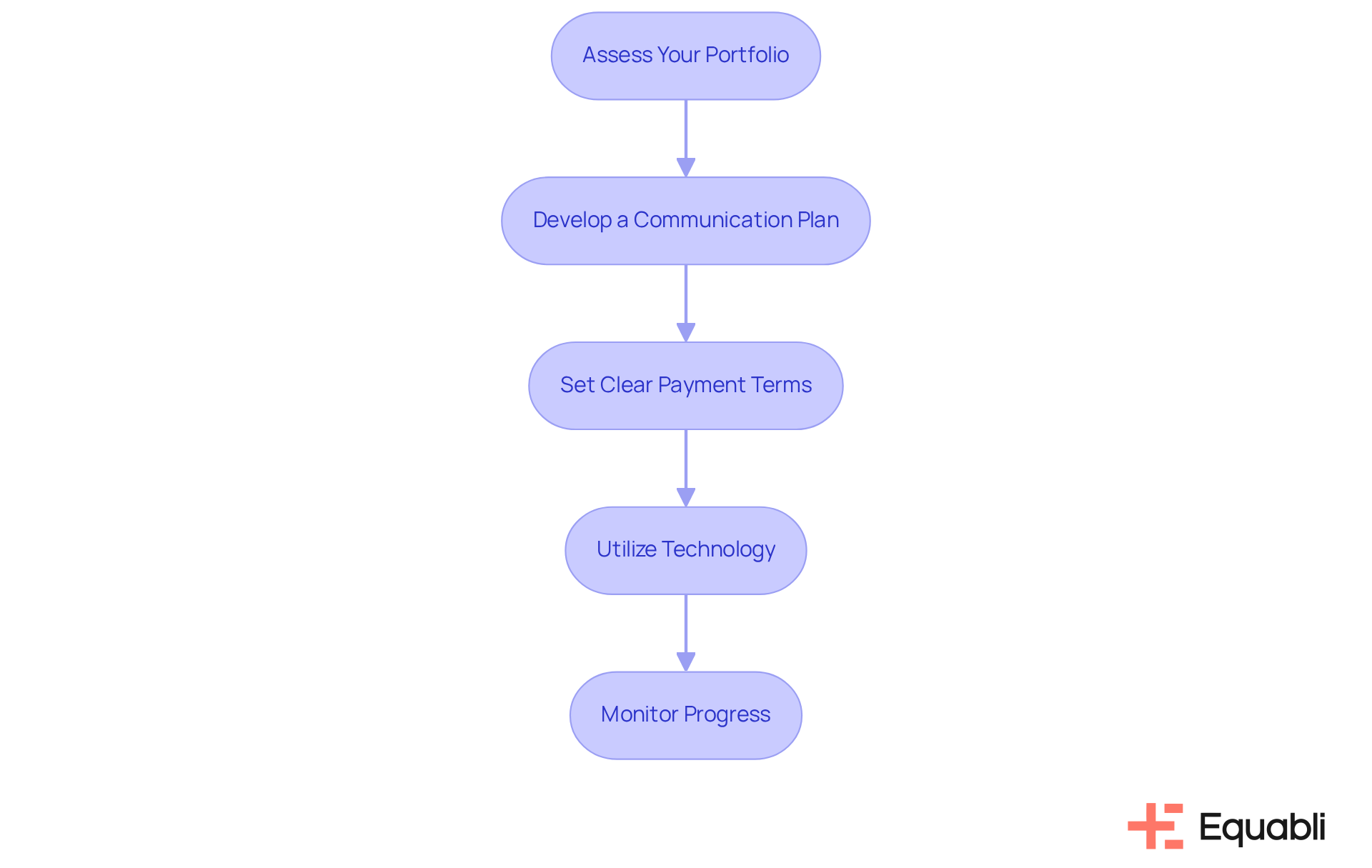

To implement effective debt recovery strategies, corporate lenders should adhere to the following structured steps:

-

Assess Your Portfolio: Begin by examining accounts receivable to identify high-risk amounts owed. Prioritize these accounts for recovery efforts, ensuring a focused approach to debt management.

-

Develop a Communication Plan: Establish a structured outreach plan that encompasses initial contact, follow-ups, and reminders. Utilize various communication channels, and leverage Equabli's EQ Engage for personalized communication, enhancing borrower engagement and addressing the challenges inherent in manual outreach.

-

Set Clear Payment Terms: Clearly articulate payment terms and options to clients, ensuring they comprehend their obligations and the solutions available to them. Employ customizable repayment options offered by EQ Suite to accommodate diverse borrower needs.

-

Utilize Technology: Harness collection software and AI tools, such as those available in the EQ Suite, to automate reminders and track borrower interactions. This approach ensures timely follow-ups and enhances operational efficiency, which is critical in today's competitive landscape.

-

Monitor Progress: Regularly review restoration efforts and adjust strategies based on performance metrics, including response rates and payment timelines. Insights derived from Equabli's data-driven tools facilitate the refinement of approaches, leading to improved outcomes.

By adhering to these steps and integrating Equabli's innovative solutions, corporate lenders can establish a robust framework for efficient financial collection, utilizing advanced debt recovery methodologies for corporate creditors to effectively address the limitations of manual processes.

Monitor Performance and Adapt Strategies for Continuous Improvement

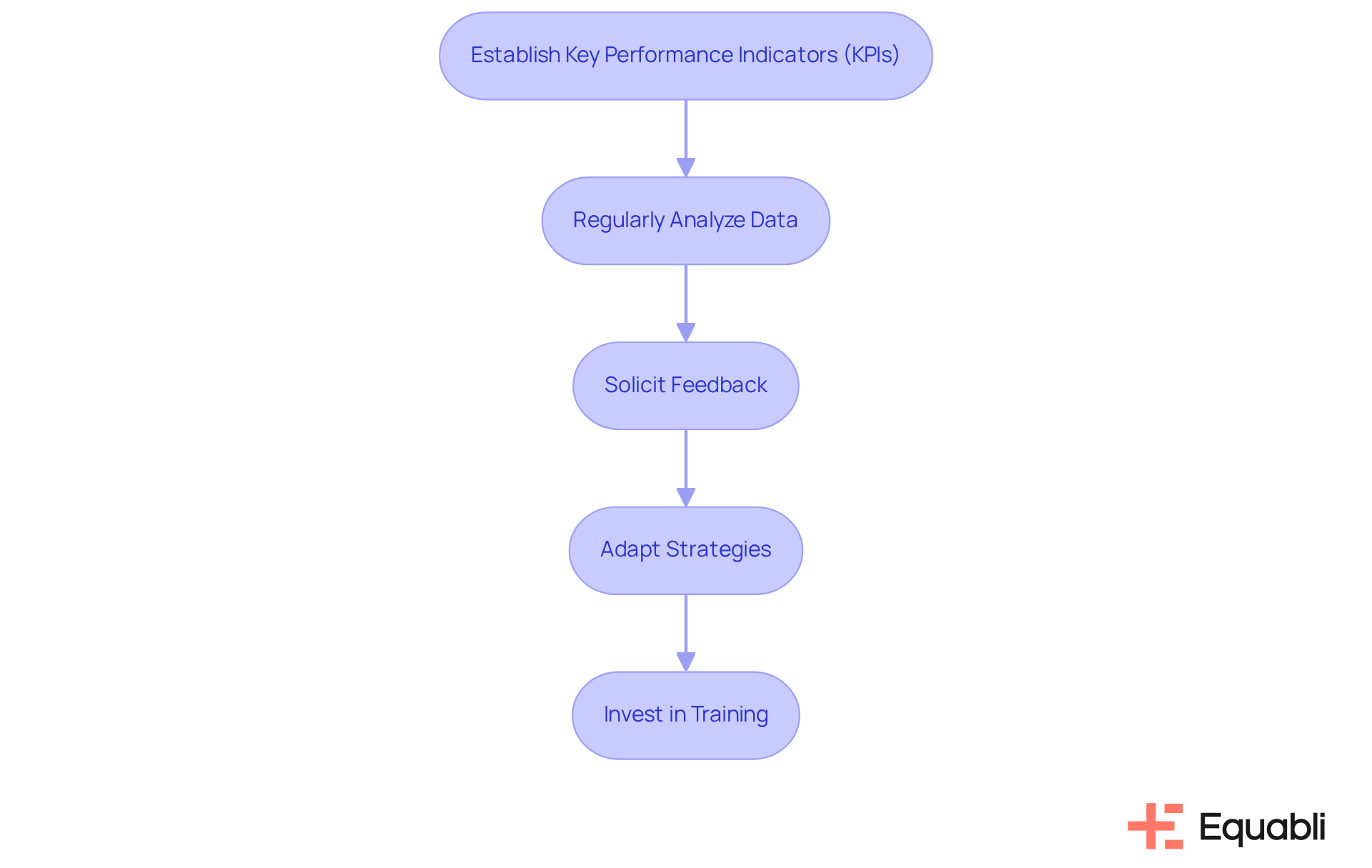

To ensure continuous improvement in debt recovery efforts, corporate creditors should adopt the following practices:

-

Establish Key Performance Indicators (KPIs): Defining KPIs such as collection rates, average days to collect, and client engagement levels is crucial for measuring success. These metrics provide a clear framework for assessing performance and identifying areas for enhancement.

-

Regularly Analyze Data: Utilizing analytics tools to assess performance against KPIs allows creditors to identify trends and pinpoint areas requiring attention. This data-driven approach fosters informed decision-making and strategic adjustments.

-

Solicit Feedback: Gathering feedback from team members and debtors is essential for understanding pain points in the collection process. This insight can lead to targeted improvements that enhance overall effectiveness.

-

Adapt Strategies: Based on performance data and feedback, creditors should adjust their collection strategies to improve outcomes. This may involve refining communication methods or integrating new technologies to streamline processes.

-

Invest in Training: Continuous training for staff on best practices and emerging technologies ensures they remain informed and effective in their roles. This investment not only enhances individual performance but also contributes to the organization’s overall debt recovery success.

By implementing these practices, corporate creditors can cultivate a culture of continuous improvement, which is vital for achieving sustained success in debt recovery.

Conclusion

Mastering advanced debt recovery methodologies is essential for corporate creditors seeking to enhance collection efforts and build stronger relationships with borrowers. By leveraging innovative strategies such as predictive analytics, behavioral science, and omnichannel communication, lenders can optimize their approaches to debt recovery, ultimately improving repayment rates and operational efficiency.

The significance of technology in automating processes, the importance of personalized communication, and the necessity of continuous performance monitoring were explored throughout the article. Implementing structured strategies, such as assessing portfolios and utilizing advanced tools like AI and cloud-based software, empowers creditors to navigate the complexities of debt recovery more effectively. Regular analysis and adaptation of strategies ensure that lenders remain responsive to changing borrower behaviors and market dynamics.

The insights shared underscore the critical role that advanced debt recovery methodologies play in fostering financial well-being and stability. As corporate creditors embrace these best practices and innovative technologies, they position themselves not only as effective debt collectors but also as trusted partners in the financial journey of their borrowers. Engaging with these methodologies transcends mere collection strategies; it embodies a commitment to creating a more responsible and responsive lending environment.

Frequently Asked Questions

What are advanced debt recovery methodologies?

Advanced debt recovery methodologies are optimized strategies used by corporate creditors to improve the collection process, incorporating various techniques such as predictive analytics, behavioral science, omnichannel communication, and digital payment solutions.

How does predictive analytics contribute to debt recovery?

Predictive analytics uses data to forecast repayment behaviors, allowing lenders to tailor their strategies to borrower profiles. This significantly improves collection rates by enabling lenders to proactively engage high-risk accounts.

What is Equabli's EQ Engine?

Equabli's EQ Engine is a tool that employs machine learning to predict the risk of delinquency in active accounts, helping lenders develop intelligent servicing strategies that enhance recovery rates.

How does behavioral science influence debt recovery strategies?

Behavioral science provides insights into the psychological factors that affect borrower decisions, allowing lenders to create effective communication and engagement strategies that foster accountability among borrowers.

What role does omnichannel communication play in debt recovery?

Omnichannel communication allows creditors to engage borrowers through various channels like SMS, email, and phone calls, increasing the likelihood of repayment by reaching borrowers through their preferred communication methods.

How do digital payment solutions improve debt recovery?

Digital payment solutions offer flexible options that cater to borrower preferences, facilitating prompt repayments and enhancing overall collection results by providing convenient access to payment methods.

What are the overall benefits of mastering advanced debt recovery methodologies?

Mastering these methodologies enhances rehabilitation rates, helps corporate lenders establish stronger connections with borrowers, and contributes to improved financial well-being and stability, positioning lenders as trusted partners in the debt collection process.