Overview

Enterprise-grade invoice collections software solutions are indispensable for financial institutions aiming to efficiently manage large-scale debt recovery while ensuring data security and compliance. These solutions incorporate features such as:

- Automated workflows

- Data-driven strategies

These features significantly enhance operational efficiency and borrower engagement. This, in turn, leads to improved debt recovery outcomes, underscoring the critical role such software plays in the financial services sector.

Introduction

Navigating the complexities of debt management in financial institutions necessitates robust solutions that streamline processes while safeguarding sensitive data. Enterprise-grade invoice collections software has emerged as a transformative tool, featuring automated workflows and multi-channel communication that enhance operational efficiency and borrower engagement. However, the implementation of such advanced systems presents hurdles; organizations frequently encounter employee resistance and integration challenges that can impede progress.

How can financial institutions effectively address these barriers to fully capitalize on the advantages of enterprise-grade invoice collections software and elevate their recovery efforts?

Understand Enterprise-Grade Invoice Collections Software

Enterprise-grade invoice collections software solutions for financial institutions are designed to efficiently manage the complexities of large-scale debt management while prioritizing data protection. Equabli's Privacy Policy underscores our commitment to safeguarding sensitive information, fostering trust among financial institutions in our solutions.

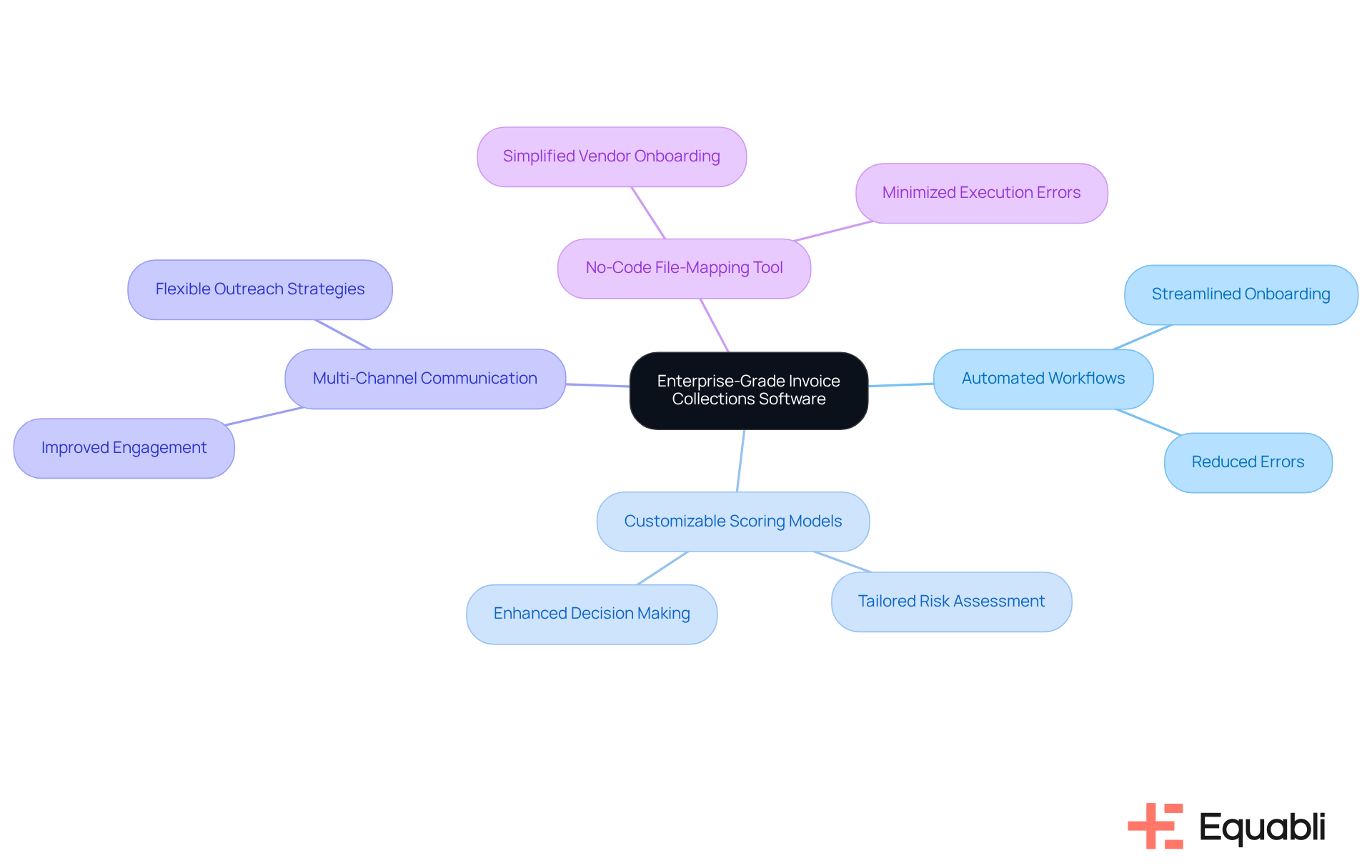

These software offerings include features such as:

- Automated workflows

- Customizable scoring models

- Multi-channel communication capabilities

- A no-code file-mapping tool that streamlines vendor onboarding and reduces execution errors

By leveraging cloud-based technology, organizations achieve real-time access to critical data, ensuring robust security for sensitive information. This technological shift not only simplifies the retrieval process but also significantly reduces operational costs and enhances borrower engagement through tailored communication methods.

For example, EQ Collect by Equabli illustrates how integrated functionalities, including data-driven strategies and automated monitoring, create a cohesive approach tailored to each client's unique needs. With stringent compliance oversight and immediate reporting, Equabli empowers financial organizations by offering enterprise-grade invoice collections software solutions for financial institutions to enhance their debt recovery efficiency and overall performance.

Identify Challenges in Implementing Invoice Collections Solutions

Implementing enterprise-grade invoice collections software solutions for financial institutions poses significant challenges for these organizations, particularly regarding employee resistance to change and integration with existing systems. Employees may exhibit hesitance in adopting new technologies, often stemming from concerns about their effects on established workflows. This resistance can disrupt operations and impede the successful implementation of new processes. Moreover, safeguarding data security and ensuring compliance with regulations is imperative; any lapse can result in substantial penalties.

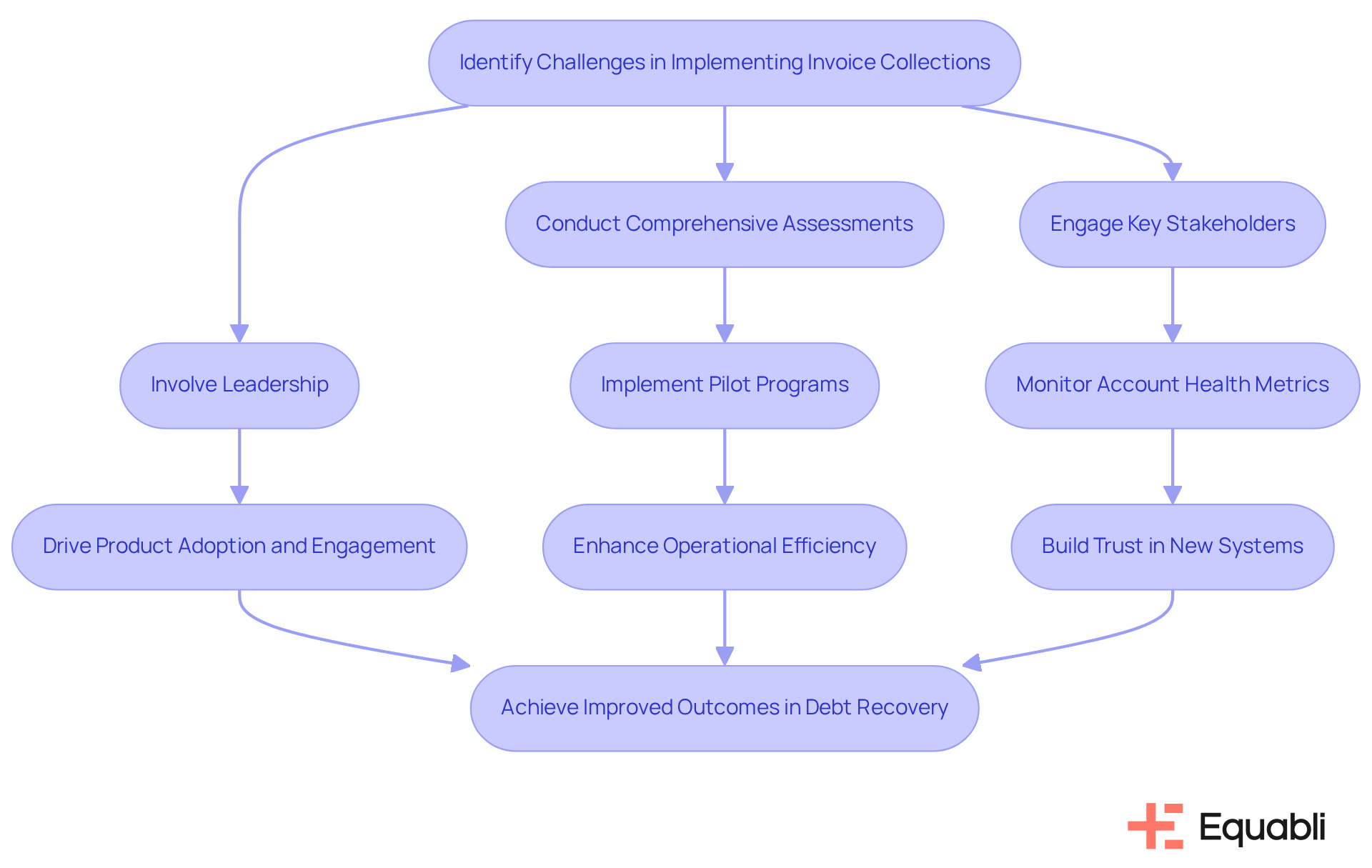

To effectively tackle these challenges, organizations should:

- Conduct comprehensive assessments of their current processes.

- Actively engage key stakeholders during the planning phase.

- Involve leadership, as their backing can cultivate a culture of acceptance and mitigate resistance among staff.

For example, implementing pilot programs enables institutions to identify potential integration issues early, allowing for necessary adjustments prior to full-scale deployment.

At Equabli, our Client Success Representatives are instrumental in this transition. They oversee the setup and implementation process during client onboarding, ensuring a seamless handoff from the sales team and a robust start to the client relationship. By comprehending the business objectives of our clients, they drive product adoption and engagement, guaranteeing that our platform meets those outcomes. They perform proactive check-ins and strategic business reviews, monitor account health metrics, and address customer issues with urgency and professionalism. This thorough approach not only enhances operational efficiency but also builds trust in the new systems among employees, ultimately resulting in a smoother transition and improved outcomes in debt recovery through enterprise-grade invoice collections software solutions for financial institutions.

Adopt Best Practices for Selecting and Integrating Software

When selecting enterprise-grade invoice collections software solutions for financial institutions, it is essential to prioritize scalability, user-friendliness, and robust analytics capabilities. Enterprise-grade invoice collections software solutions for financial institutions enable organizations to scale and adapt to increasing volumes of accounts and evolving business needs, ensuring long-term viability. User-friendly enterprise-grade invoice collections software solutions for financial institutions are essential as they minimize training time and enhance team productivity, allowing staff to focus on strategic tasks rather than navigating complex systems. Engaging with vendors who offer comprehensive support and training can significantly improve the integration process, fostering a smoother transition.

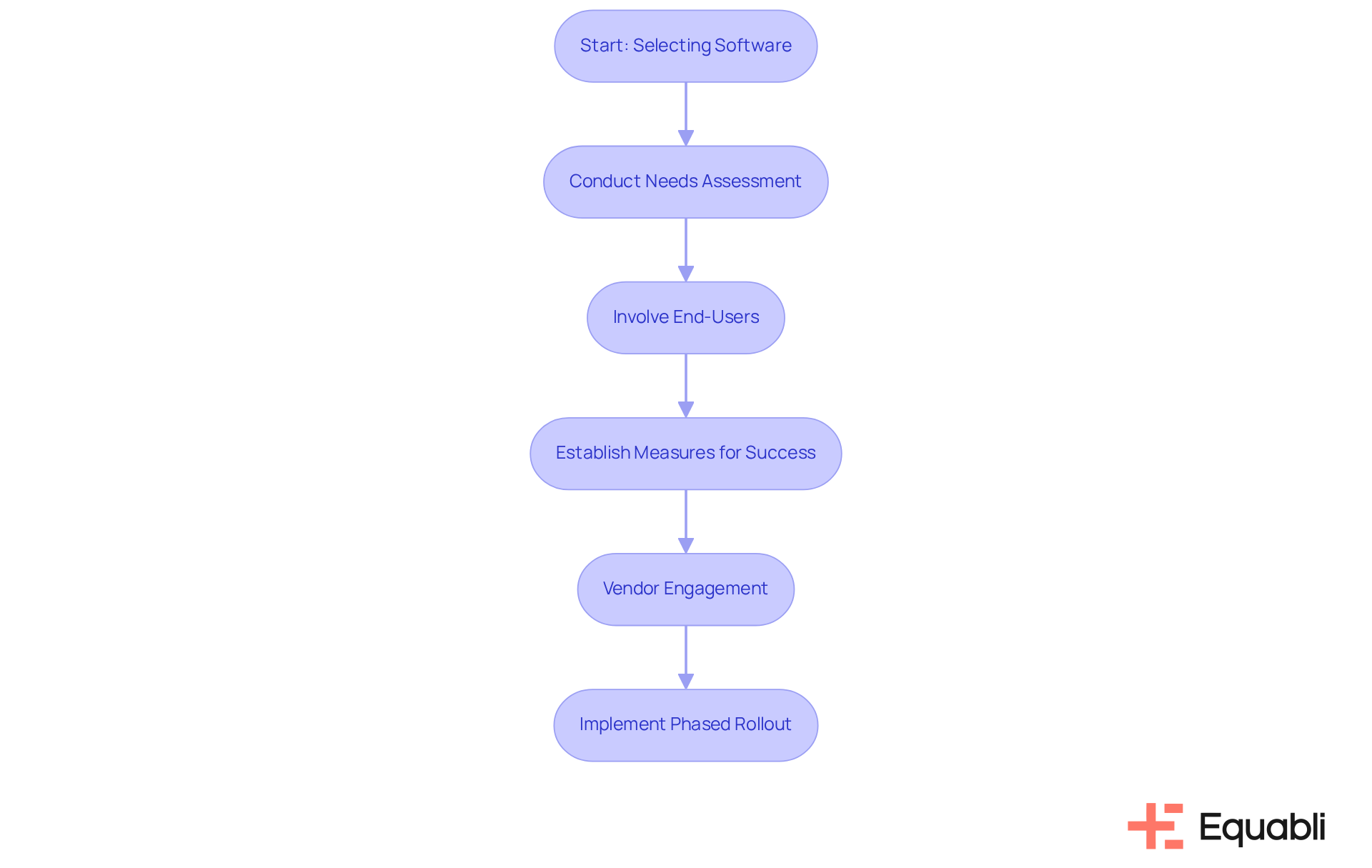

Best practices for selecting the right enterprise-grade invoice collections software solutions for financial institutions include:

- Conducting a thorough needs assessment to identify specific requirements.

- Involving end-users in the selection process to ensure that the software aligns with their workflows.

- Establishing distinct measures for success; organizations can monitor enhancements in operational efficiency and retrieval effectiveness over time.

For instance, Equabli's EQ Suite offers customizable features tailored to each organization's distinct approach, facilitating a better fit and smoother integration.

Additionally, implementing a phased rollout plan can effectively manage the transition, minimizing disruptions to ongoing operations. This approach allows teams to gradually adapt to new systems while maintaining focus on their core responsibilities. By prioritizing these optimal methods, financial organizations can enhance their retrieval processes, ultimately resulting in improved cash flow and stronger customer relationships with enterprise-grade invoice collections software solutions for financial institutions.

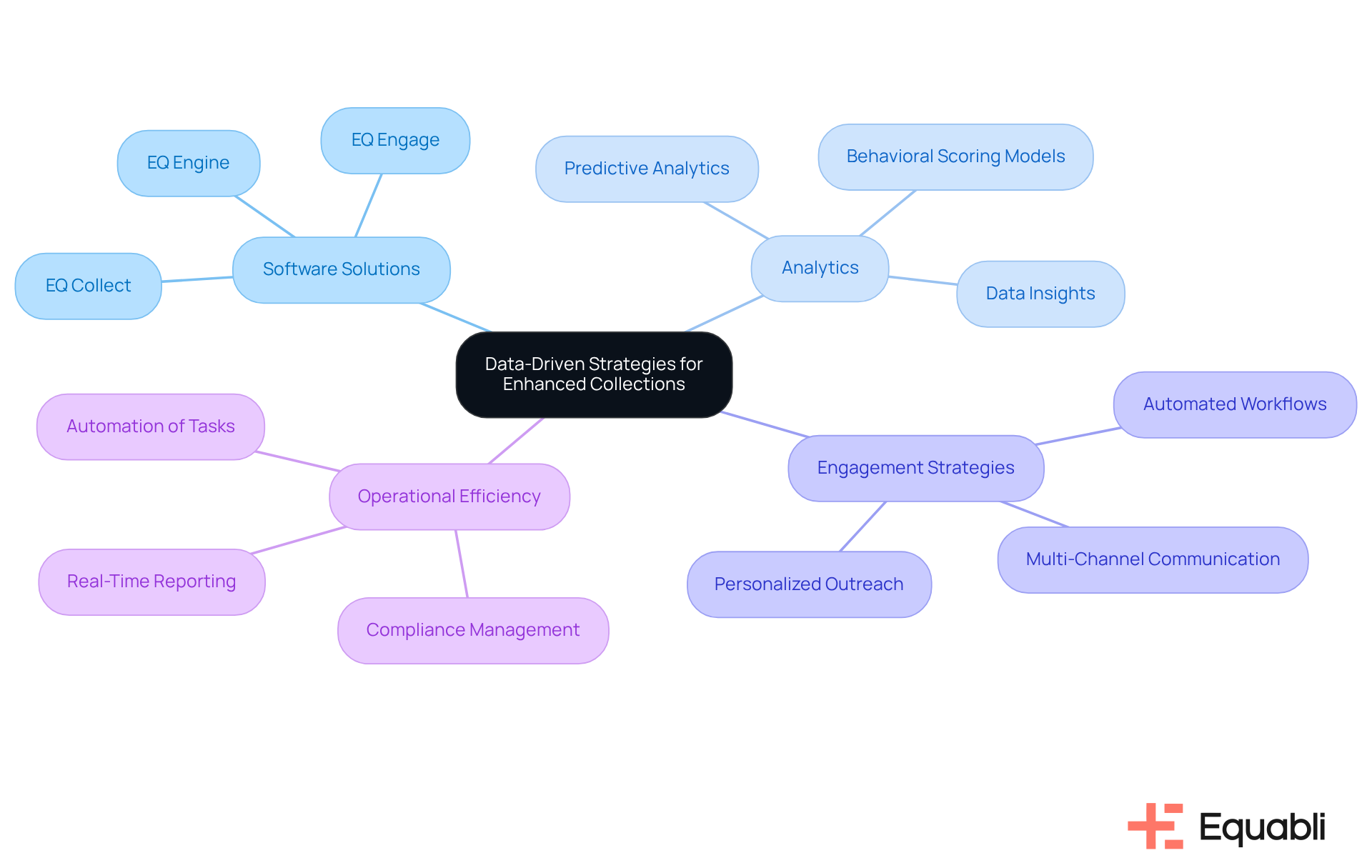

Leverage Data-Driven Strategies for Enhanced Collections

Data-informed approaches are essential for transforming procedures within financial organizations through the use of enterprise-grade invoice collections software solutions for financial institutions. By leveraging analytics, organizations can uncover valuable insights into borrower behaviors, preferences, and repayment patterns, which can enhance their enterprise-grade invoice collections software solutions for financial institutions. The development of enterprise-grade invoice collections software solutions for financial institutions, such as those provided by Equabli's EQ Engine, facilitates efficient forecasting of repayment probabilities and allows for the customization of collection strategies. For example, historical data analysis can identify trends that inform outreach efforts, thereby enhancing the precision of engagement tactics.

Moreover, implementing enterprise-grade invoice collections software solutions for financial institutions that utilize multi-channel communication strategies aligning with borrower preferences significantly boosts engagement and repayment rates. Equabli's EQ Engage empowers institutions to create, automate, and execute enterprise-grade invoice collections software solutions for financial institutions, ensuring that all borrower communication plans resonate with their brand voice and visual identity. Research indicates that targeted retrieval methods can elicit responses from up to 80% of delinquent accounts, underscoring the effectiveness of personalized approaches. Additionally, collection agencies that utilize enterprise-grade invoice collections software solutions for financial institutions report operational advancements occurring at eight times the usual pace, highlighting the efficiency gained through these methods.

With EQ Collect's no-code file-mapping tool, automated workflows, and real-time reporting capabilities, organizations can utilize enterprise-grade invoice collections software solutions for financial institutions to minimize execution errors and enhance transparency, allowing them to remain agile and responsive to evolving borrower needs. Regularly reviewing and refining strategies based on data insights is critical for improving recovery outcomes and operational efficiency. As Jack Mahoney observes, optimizing debt collection through analytics revolutionizes decision-making processes and risk management, making enterprise-grade invoice collections software solutions for financial institutions a vital component of contemporary financial operations.

Conclusion

Implementing enterprise-grade invoice collections software solutions is pivotal for enhancing the operational efficiency of financial institutions. These advanced systems adeptly navigate the complexities of debt management, enabling organizations to manage substantial volumes of accounts while ensuring stringent data security and compliance. By adopting these technologies, financial institutions can streamline their processes and enhance borrower engagement through personalized communication.

Key insights shared throughout the article highlight the features and benefits of these software solutions, including:

- Automated workflows

- Customizable scoring models

- Multi-channel communication capabilities

The discussion also addresses the challenges organizations encounter during implementation, such as:

- Employee resistance

- Integration with existing systems

Strategies for overcoming these hurdles, including:

- Stakeholder engagement

- Phased rollouts

are essential for a successful transition. Furthermore, the importance of adopting data-driven strategies to inform collection practices is underscored, demonstrating how analytics can lead to improved recovery rates and operational advancements.

Ultimately, the significance of enterprise-grade invoice collections software for financial institutions is paramount. As the landscape of debt management evolves, organizations must prioritize the adoption of these solutions to enhance their efficiency and effectiveness. By investing in the right tools and practices, financial institutions can bolster their collections processes and foster stronger relationships with their clients, paving the way for sustainable growth and success in the competitive financial sector.

Frequently Asked Questions

What is enterprise-grade invoice collections software?

Enterprise-grade invoice collections software is designed for financial institutions to manage large-scale debt management efficiently while prioritizing data protection.

What are the key features of this software?

Key features include automated workflows, customizable scoring models, multi-channel communication capabilities, and a no-code file-mapping tool for streamlined vendor onboarding.

How does cloud-based technology benefit organizations using this software?

Cloud-based technology provides real-time access to critical data, ensures robust security for sensitive information, simplifies the retrieval process, reduces operational costs, and enhances borrower engagement through tailored communication methods.

Can you provide an example of enterprise-grade invoice collections software?

EQ Collect by Equabli is an example, showcasing integrated functionalities like data-driven strategies and automated monitoring tailored to each client's unique needs.

How does Equabli ensure compliance and reporting in its software?

Equabli emphasizes stringent compliance oversight and immediate reporting to empower financial organizations in enhancing their debt recovery efficiency and overall performance.