Overview

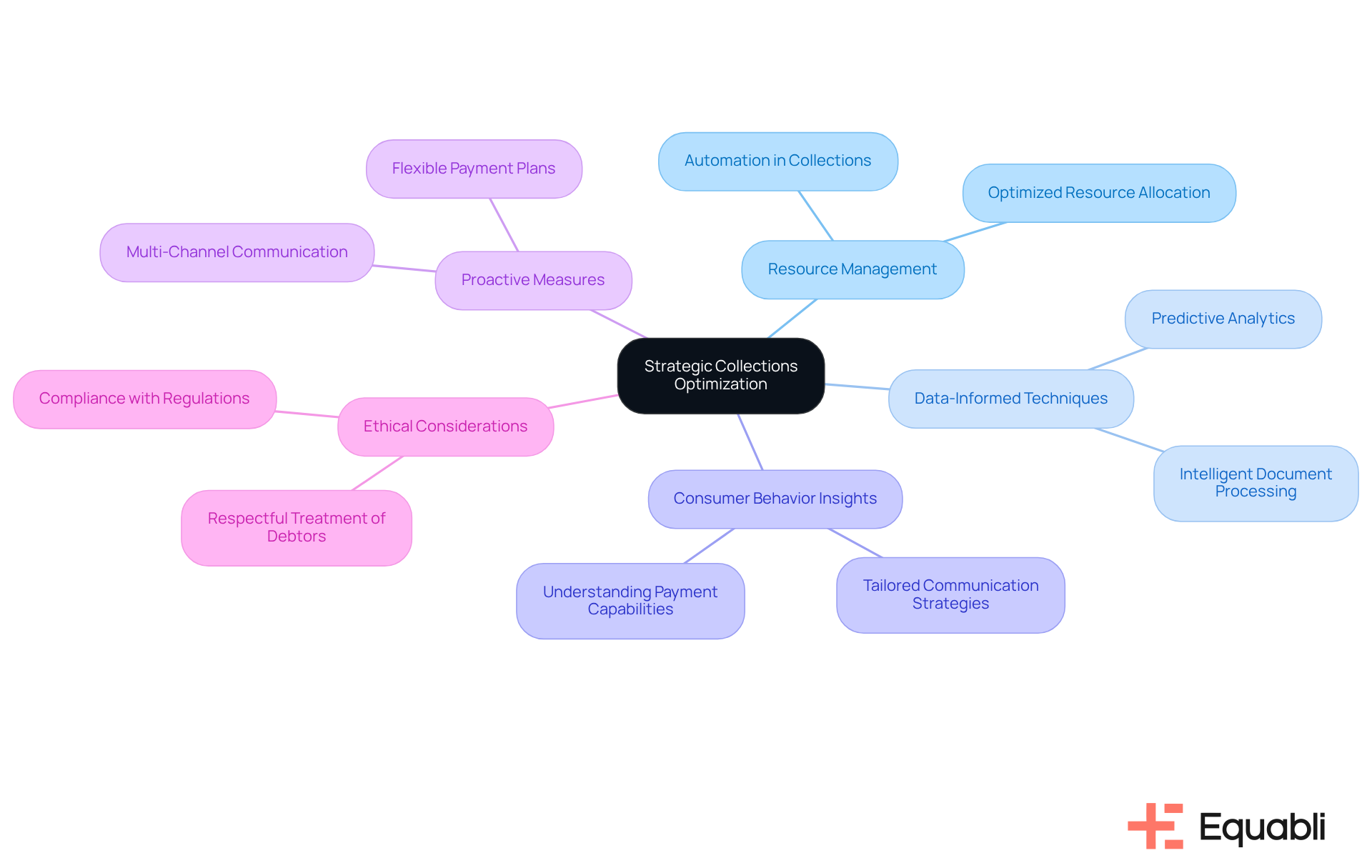

Strategic collections optimization is crucial for enterprise risk management, as it enhances debt recovery processes through data-informed techniques and advanced technologies. Organizations can leverage consumer insights and predictive analytics to improve recovery rates while maintaining positive customer relationships. This approach not only safeguards financial health but also mitigates risks associated with delinquent accounts, ultimately aligning with broader compliance and operational objectives.

Introduction

Strategic collections optimization has emerged as a critical component in enterprise risk management, particularly as organizations navigate the complexities of debt recovery within an increasingly data-driven landscape. By leveraging advanced technologies and insights into consumer behavior, businesses can significantly enhance their debt recovery processes. This not only leads to improved financial outcomes but also helps preserve customer relationships. However, the challenge lies in effectively implementing these strategies. How can organizations transition from traditional methods to a more proactive, data-informed approach that safeguards their financial health?

Define Strategic Collections Optimization

Optimizing systematic resource management through strategic collections optimization for enterprise financial risk management represents a structured method aimed at enhancing debt recovery procedures with the integration of data-informed techniques and advanced technologies. This methodology necessitates a thorough examination of current gathering practices to identify inefficiencies and implement tailored solutions that support strategic collections optimization for enterprise financial risk management objectives.

By leveraging insights into consumer behavior, interaction preferences, and payment capabilities, organizations can develop a more effective recovery plan that not only improves recovery rates but also nurtures positive customer relationships. Implementing strategic collections optimization for enterprise financial risk management is vital for maintaining financial health and mitigating risks associated with delinquent accounts.

The impact of data-informed strategies on debt recovery rates is substantial; they empower organizations to adopt proactive measures, such as predictive analytics and intelligent document processing, which significantly enhance retrieval effectiveness. Noteworthy examples of these methods include the adoption of multi-channel communication strategies and flexible payment plans, which have demonstrated their ability to improve recovery rates while adhering to ethical debt recovery standards.

As the debt recovery landscape evolves, the importance of employing data-informed approaches for strategic collections optimization for enterprise financial risk management cannot be overstated; they are essential for transforming the process from a reactive stance into a proactive engagement that safeguards both financial stability and customer relationships.

Identify Key Components of Financial Risk Management

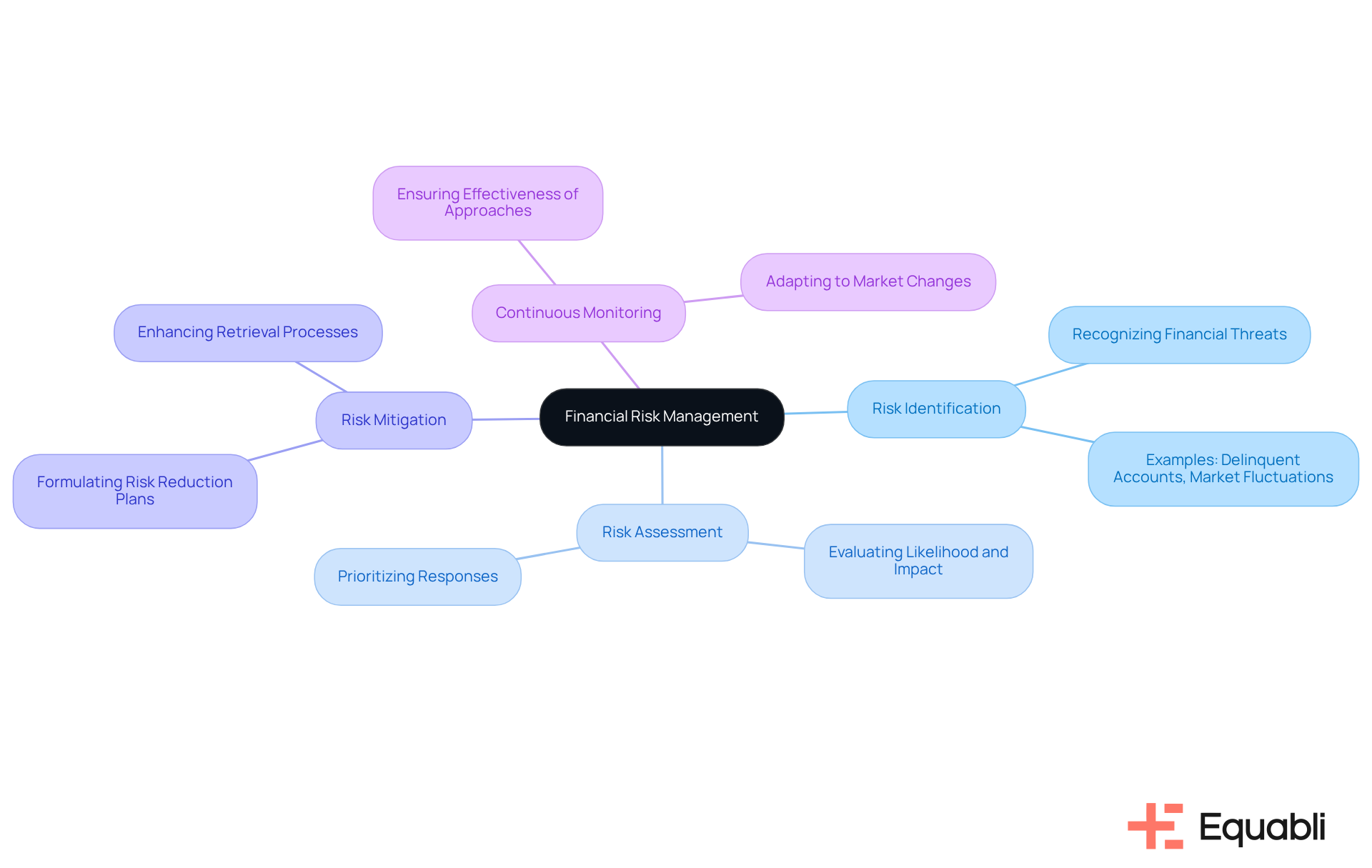

Key components of financial risk management encompass:

- Risk identification

- Risk assessment

- Risk mitigation

- Continuous monitoring

Risk identification entails recognizing potential financial threats, such as delinquent accounts or market fluctuations. Risk assessment evaluates the likelihood and impact of these threats, thereby enabling organizations to prioritize their responses effectively.

Subsequently, strategic collections optimization for enterprise financial risk management involves formulating risk reduction plans to mitigate possible losses, which may include enhancing retrieval processes.

Ultimately, ongoing observation ensures that risk management approaches remain effective and relevant, adapting to evolving market circumstances and organizational requirements. By comprehending these elements, entities can more effectively align their strategies with overarching risk management objectives.

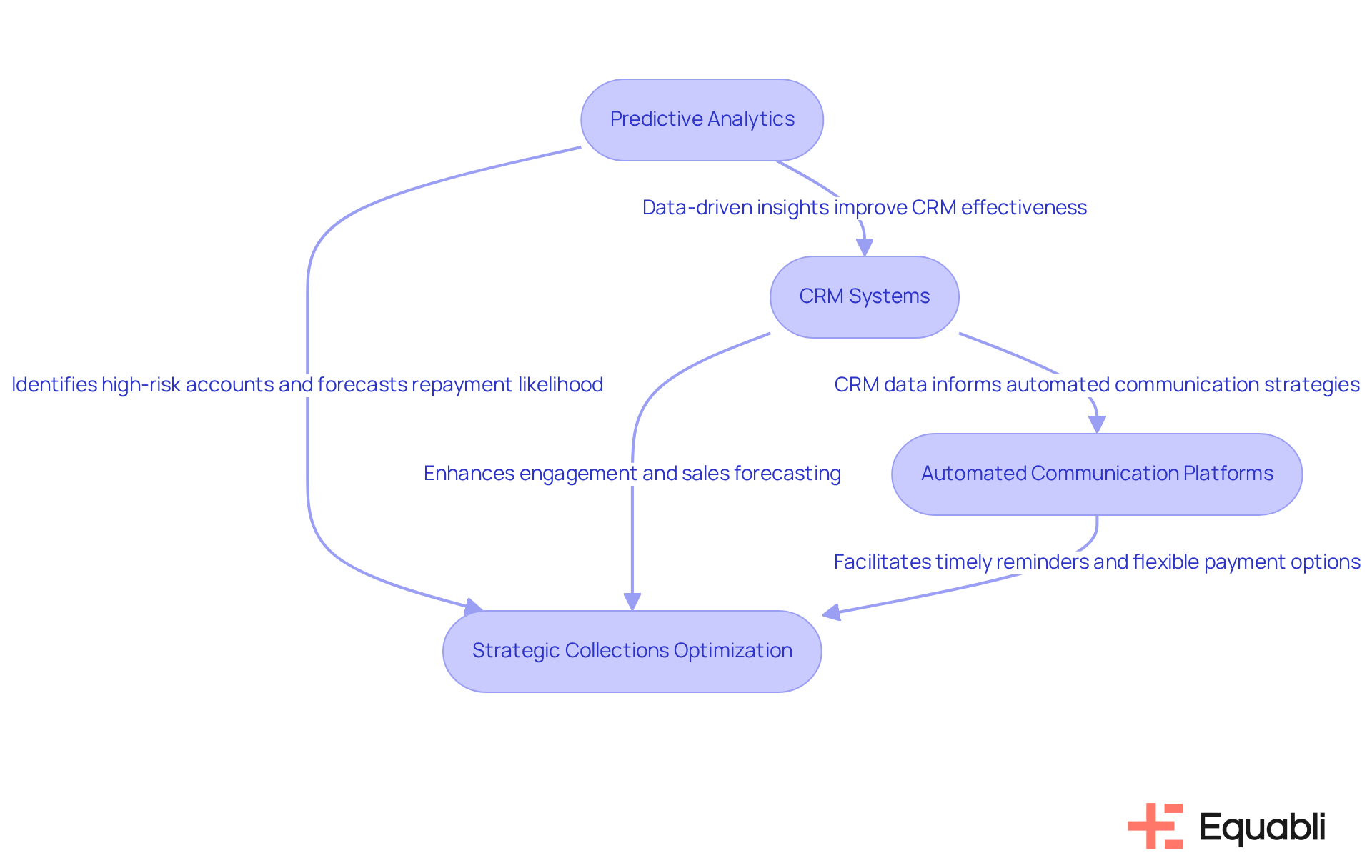

Utilize Advanced Tools for Data-Driven Decision Making

To enhance resource management through data-informed decision-making, entities must leverage advanced tools such as Equabli's EQ Engine and EQ Suite. These tools utilize predictive analytics, customer relationship management (CRM) systems, and automated communication platforms. Predictive analytics is pivotal in identifying high-risk accounts by analyzing historical payment behaviors alongside external factors, enabling collection teams to prioritize efforts effectively. For example, organizations that implement predictive models can refine their recovery strategies by forecasting repayment likelihood with increasing accuracy, thus allowing for tailored approaches to each account.

Equabli's EQ Suite further empowers entities by transforming traditional manual processes into intelligent, automated solutions. With features that encompass customizable repayment options and compliance management, organizations can engage with customers in a personalized manner, ensuring that communications resonate with borrowers. Data indicates that companies utilizing CRM technology achieve up to a 42% enhancement in sales forecasting precision, leading to improved engagement methods in receivables. Automated communication platforms complement these initiatives by facilitating timely reminders and offering flexible payment options, significantly enhancing borrower engagement.

By integrating predictive analytics and CRM systems into their debt management strategies, entities can achieve strategic collections optimization for enterprise financial risk management, allowing them to make informed decisions that enhance recovery rates and reduce operational expenses. This contemporary approach to debt recovery illustrates a shift from traditional, volume-oriented techniques to strategic collections optimization for enterprise financial risk management, ultimately leading to a more efficient and effective process for retrieving debts.

Implement Actionable Strategies for Effective Collections

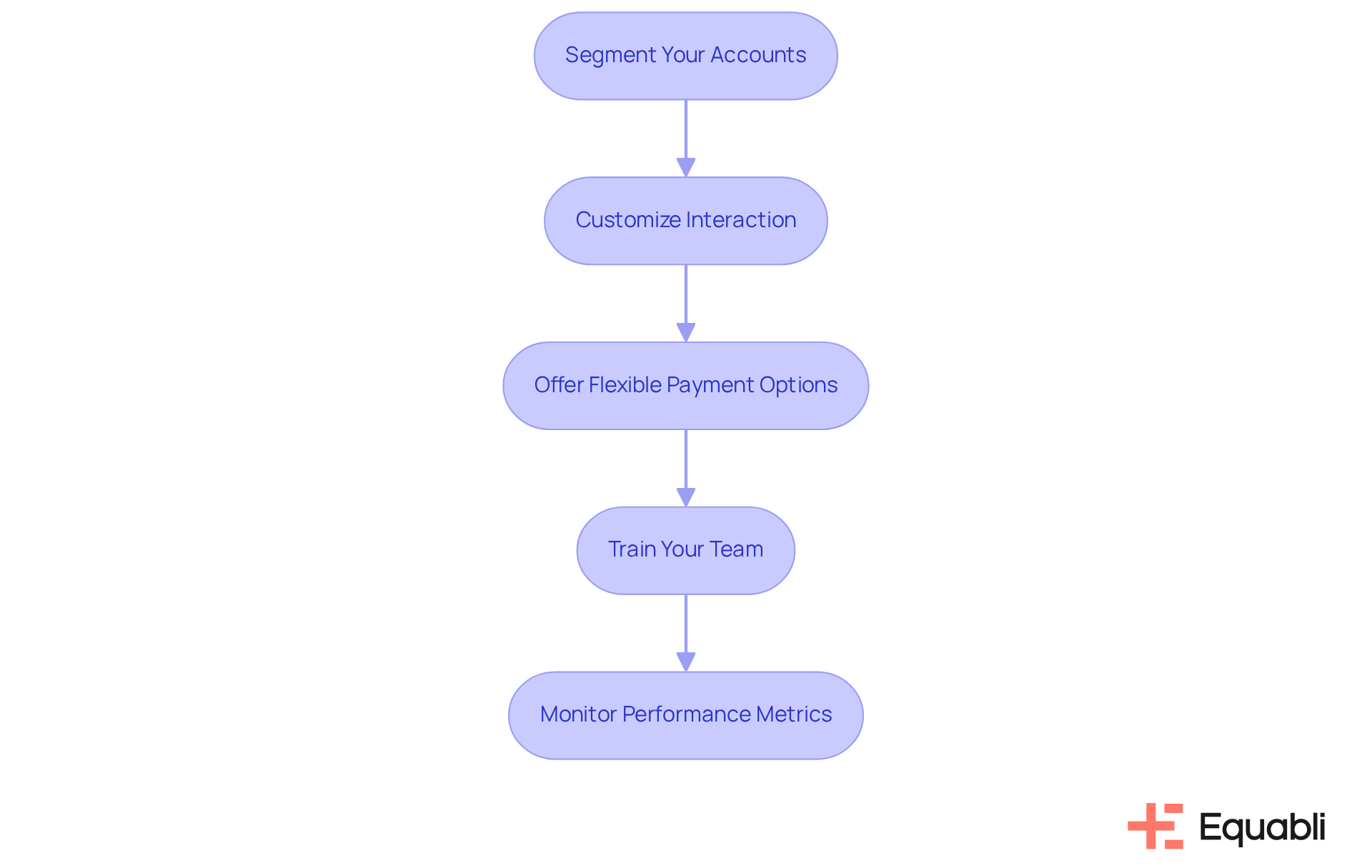

To implement actionable strategies for effective collections, organizations should consider the following steps:

-

Segment Your Accounts: Classifying accounts based on risk levels and payment history allows organizations to prioritize recovery efforts. This targeted approach not only enhances recovery outcomes but also facilitates more efficient resource allocation.

-

Customize Interaction: Leveraging data insights to tailor interaction strategies for various customer segments can significantly influence repayment rates. Notably, 91% of consumers are more likely to engage with brands that present relevant offers and recommendations. As emphasized by Bluechip Collections, effective debt recovery requires a systematic methodology that integrates clear policies and transparent dialogue.

-

Offer Flexible Payment Options: Providing a range of payment methods and plans accommodates diverse borrower needs. Flexible arrangements, such as installment plans, can assist clients facing cash flow challenges, thereby increasing the likelihood of repayment.

-

Train Your Team: Equipping the team responsible for accounts with the necessary skills and knowledge fosters empathetic engagement with borrowers. Training in effective communication cultivates positive relationships, which can lead to more amicable resolutions when accounts become overdue. Recognizing the emotional impact of debt enables collectors to approach conversations with the required sensitivity.

-

Monitor Performance Metrics: Regular assessment of key performance indicators (KPIs) such as recovery rates and customer satisfaction is essential. Ongoing monitoring allows organizations to refine their strategies and enhance overall efficiency in collections. Furthermore, implementing clear credit policies can mitigate late payments and bad debts by delineating terms and consequences.

By adhering to these steps, organizations can achieve strategic collections optimization for enterprise financial risk management, which enhances their retrieval efficiency and leads to superior financial results, ultimately contributing to a more robust cash flow and improved financial well-being.

Monitor and Adjust Strategies for Continuous Improvement

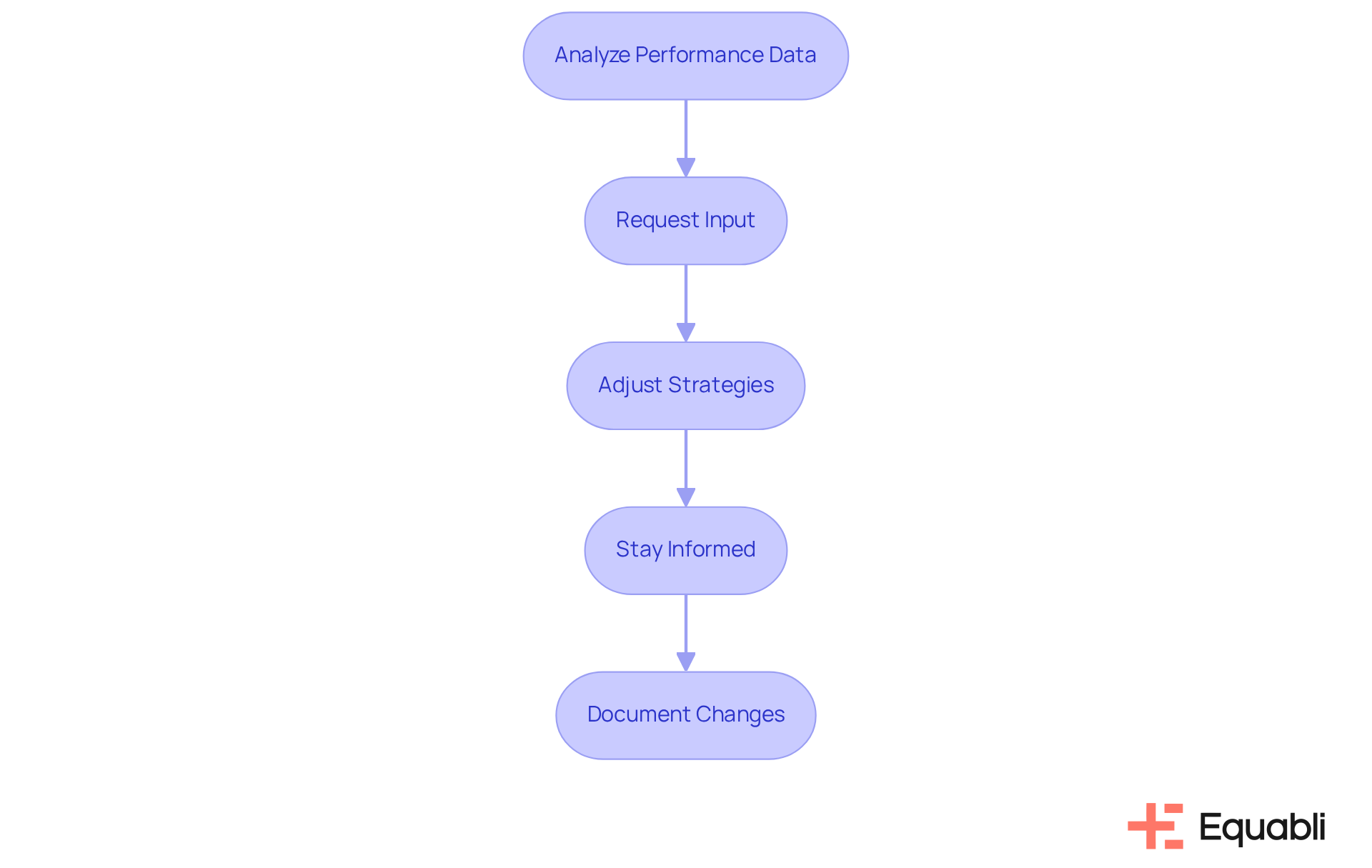

To promote ongoing enhancement in retrieval methods, organizations should establish a systematic review process that includes the following steps:

-

Analyze Performance Data: Regularly assess key performance indicators (KPIs) such as the Collection Effectiveness Index (CEI) and Days Sales Outstanding (DSO). This analysis helps identify trends and pinpoint areas needing enhancement, particularly given that 55% of all B2B invoiced sales in the US are overdue, underscoring the urgency for effective monitoring.

-

Request Input: Actively gather insights from staff and clients to evaluate the effectiveness of current approaches. This feedback is crucial, as 73% of UK businesses report negative consequences from late invoices, indicating a pressing need for responsive adjustments.

-

Adjust Strategies: Utilize the performance data and feedback to refine interaction methods, payment options, and team training. For instance, businesses employing multi-channel communication methods have observed improved retrieval outcomes, with 60% of successful recoveries involving at least two distinct communication channels.

-

Stay Informed: Remain updated on industry trends and technological advancements that could impact practices related to gathering. With 62% of companies planning to upgrade their accounts receivable technology in 2024, staying ahead of these changes is vital.

-

Document Changes: Maintain a thorough account of modifications implemented and their results to inform future planning. This documentation is essential for understanding the impact of changes, as businesses that automate accounts receivable tasks report increased savings and cash flow.

By adopting these practices, organizations can cultivate a dynamic collections strategy that leverages strategic collections optimization for enterprise financial risk management, adapting to evolving circumstances and consistently driving success.

Conclusion

Optimizing collections within the framework of enterprise risk management is crucial for enhancing financial stability and improving recovery processes. A structured approach to strategic collections optimization enables organizations to not only increase their debt recovery rates but also foster positive relationships with customers, ultimately contributing to a healthier financial environment.

Key components essential to this optimization process include:

- Data-informed strategies

- Advanced decision-making tools

- Actionable steps for effective collections

Identifying risks, assessing their impact, implementing flexible payment options, and continuous performance monitoring are critical in transforming collections from a reactive to a proactive endeavor.

In a rapidly evolving financial landscape, the significance of strategic collections optimization is paramount. Organizations are urged to adopt best practices and leverage advanced technologies to refine their approaches. By committing to ongoing improvement and adapting strategies based on performance metrics and feedback, businesses can achieve superior recovery outcomes and long-term financial resilience. Embracing this comprehensive methodology equips enterprises to navigate the complexities of financial risk management effectively.

Frequently Asked Questions

What is strategic collections optimization?

Strategic collections optimization is a structured method aimed at enhancing debt recovery procedures through systematic resource management, integrating data-informed techniques and advanced technologies to improve financial risk management.

Why is strategic collections optimization important for enterprise financial risk management?

It is vital for maintaining financial health and mitigating risks associated with delinquent accounts by improving recovery rates and nurturing positive customer relationships.

How does data-informed strategy impact debt recovery rates?

Data-informed strategies empower organizations to adopt proactive measures, such as predictive analytics and intelligent document processing, which significantly enhance retrieval effectiveness and improve recovery rates.

What are some examples of methods used in strategic collections optimization?

Examples include multi-channel communication strategies and flexible payment plans, which have shown to improve recovery rates while adhering to ethical debt recovery standards.

What are the key components of financial risk management?

The key components include risk identification, risk assessment, risk mitigation, and continuous monitoring.

What does risk identification involve?

Risk identification involves recognizing potential financial threats, such as delinquent accounts or market fluctuations.

How is risk assessment conducted in financial risk management?

Risk assessment evaluates the likelihood and impact of identified threats, enabling organizations to prioritize their responses effectively.

What is the purpose of continuous monitoring in financial risk management?

Continuous monitoring ensures that risk management approaches remain effective and relevant, adapting to evolving market circumstances and organizational requirements.